TODAY bestsellers: Reviewer-loved and editor-approved picks from $7

- Share this —

- Watch Full Episodes

- Read With Jenna

- Inspirational

- Relationships

- TODAY Table

- Newsletters

- Start TODAY

- Shop TODAY Awards

- Citi Concert Series

- Listen All Day

Follow today

More Brands

- On The Show

- TODAY Plaza

Tina Knowles praises Beyoncé and Taylor Swift for boosting the economy. See how much their tours have made

Tina Knowles is celebrating two of 2023’s hottest tickets — Beyoncé’s “Renaissance Tour” and Taylor Swift’s “Eras Tour.”

On Instagram , Knowles shared a screenshot of a Facebook post from New York Times , which linked out to an article that detailed the economic and cultural impact of her daughter Beyoncé’s tour.

In the caption of her post, Knowles wrote, “This is so awesome ! To b able to stimulate the economy is no small feat! @beyonce.”

Knowles also gave a sweet nod to Swift in her caption, adding, “And ! @taylorswift ! Just being young women and being able to say this , is so awesome!!! Proud of them both !”

Beyoncé and Swift’s tours overlapped in the United States during the summer. Both were a pop culture sensation, with social media platforms inundated by various trends coming out of each tour.

For Swift’s “Eras Tour,” friendship bracelets and DIY themed costumes became the norm while Beyoncé’s “Renaissance” world tour birthed the “mute” challenge and had concertgoers following her request for a silver theme in celebration of Virgo season.

With Beyoncé’s tour wrapping up on Oct. 1 and Swift’s on-going tour resuming Nov. 9 in Argentina, both tours have already generated millions of dollars along the way.

Read on to learn more about each tour's economic impact.

How much has the “Renaissance Tour” made?

Beyoncé’s “Renaissance Tour” kicked off May 10 in Sweden and will conclude Oct. 1 in Kansas City. Before the tour kicked off, Forbes estimated that Beyoncé would earn nearly $2.1 billion from her tour.

The “Cuff It” singer’s tour set multiple records over the summer, including back-to-back records for the highest one-month gross in history in both July and August, according to a Sept. report by Billboard .

In July, she grossed $127.6 million and in August, that number increased to $179 million. The outlet also reported the “Renaissance Tour” became the highest grossing tour by a female artist, surpassing Madonna's “Sticky & Sweet Tour” with $461.3 million.

During the “Renaissance Tour,” Beyoncé also gave back $2 million to students and small business through her charity foundation, BeyGOOD. Half of the donations went to entrepreneurs, with luncheons hosted by BeyGOOD the day before each show for a chance to win a $100 thousand grant. The other portion of the $2 million donation was allocated to the Renaissance Scholarship Fund.

Beyoncé’s tour spawned several special moments over the course of its run, including a special tribute to the late Tina Turner , a birthday surprise from Diana Ross , as well as numerous performances alongside her eldest daughter, Blue Ivy.

It was also a hotspot for celebrities including Leonardo DiCaprio, Vanessa Bryant, Prince Harry and Meghan Markle, Kim and Khloe Kardashian, and more.

How much has the “Eras Tour” made?

Swift’s “Eras Tour” originally ran from March 17 through August 9. Throughout the year, Swift added on additional dates including several international dates in 2023 and 2024 as well as additional 2024 dates in the United States and internationally.

While Swift’s tour still has 13 months to go, so far it’s been estimated she's earned $1 billion in sales , with Pollstar estimating the singer will exceed $1.4 billion in the new year .

Swift's economic impact far has exceeded solely ticket sales, too. The tour also increased revenue for hotels across the country, with fans flocking to each city to experience her career-sprawling performances.

It was also reported Swift made several donations with her tour’s earnings, including donating to local food banks at each stop and gifting $100,000 bonus checks to her truck drivers at the end of the U.S. leg of the tour.

The singer’s tour is also set to hit the big screen in the United States, and now internationally. In a press release, AMC said that it took less than 24 hours for the film to “shatter AMC’s U.S. record for the highest ticket-sales revenue during a single day in AMC’s 103-year history.”

Swift’s “Eras Tour” was not without its faults though.

The singer spoke out against Ticketmaster after fans struggled to obtain tickets to the tour due to “historically unprecedented demand” causing the website to crash. The debacle sparked public scrutiny, including questions from senators , and elicited changes from the company before Beyoncé’s “Renaissance Tour” tickets went on sale.

Francesca Gariano is a New York City-based freelance journalist reporting on culture, entertainment, beauty, lifestyle and wellness. She is a freelance contributor to TODAY.com, where she covers pop culture and breaking news.

Taylor Swift may have just revealed she's the godmother of Blake Lively and Ryan Reynolds' kids

Pop culture.

Brittany Mahomes shares new pics with Taylor Swift and Travis Kelce overseas

Taylor Swift plays ‘Clara Bow’ with ‘hero’ Stevie Nicks in the audience

Taylor swift's feud with scooter braun is the subject of a new docuseries. a detailed timeline of what happened.

Taylor Swift snaps selfies with Prince William and Travis Kelce backstage at London ‘Eras Tour’

Taylor swift and joe alwyn’s relationship timeline, in their own words.

Celine Dion recalls being 'nervous' awarding Taylor Swift her Grammy amid ongoing health battle

Taylor Swift's cats: What she's said about Meredith Grey, Olivia Benson and Benjamin Button

From the Super Bowl to ‘So High School’: A timeline of Taylor Swift and Travis Kelce’s relationship

Taylor Swift kicks off her European leg of 'Eras Tour.' Here's the full list of show dates

Taylor Swift’s Eras Tour breaks record as highest-grossing music tour ever

Taylor Swift's Eras Tour is officially the highest-grossing music tour ever, becoming the first to surpass $1 billion dollars in revenue.

The tour, which began in March 2023 and is set to conclude in December 2024 after a total of 151 shows worldwide, has earned $1.04 billion (£840 million) to date, according to Pollstar.

This breaks the record set by Elton John’s five-year farewell tour which ended earlier this year, bringing in $939 million (£749 million) over 328 shows.

Swift’s sixth concert tour is in fact so popular that it has earned more than this year’s next two highest-grossing tours (Beyoncé’s and Bruce Springsteen’s) combined.

Beyoncé’s 56-date Renaissance World Tour broke Madonna’s 14-year-old record for the highest-grossing music tour by a female artist , earning $579 million (£468 million) between May and October, before The Eras Tour subsequently took the title.

Described by Swift as a journey through all her musical “eras”, each show is over 3.5 hours long with a set list of 44 songs divided into 10 acts.

It has received immensely positive reviews from critics, who have heaped praise on the production’s concept and quality, as well as Swift’s performances.

Her devoted fanbase, the Swifties, have turned out in full force to see their idol, crashing ticketing sites, selling out hotels, and even causing earthquake-like seismic activity at certain shows, as happened in Seattle in July.

With roughly 72,000 people in attendance at each concert, and tickets averaging around $238, the tour is grossing over $17 million per show.

According to Pollstar, 4.3 million tickets have been sold to date, and at this trajectory, the tour could realistically rake in over $2 billion dollars if all the remaining scheduled shows are played.

Merchandise has also proven to be a lucrative source of revenue, with estimates that it has brought in around $200 million so far.

The Eras Tour is just one of Swift’s many successes in 2023. In addition to recently being named Time ’s Person of the Year, and the re-recording of her decade-old 1989 being the best-selling album of the year, she has broken multiple world records.

In June, she was awarded the record for the most simultaneous albums on the US Billboard 200 for a living artist, with 10 of her albums charting at the same time.

She then broke several more records in July :

- Most US No.1 albums by a female artist – 12

- Most US singles chart entries (female) – 212

- Most Top 10 debuts on the US Hot 100 (female) – 31

- Most simultaneous new entries on the Hot 100 (female) – 26

- Most cumulative weeks at No.1 on US albums charts (solo female) – 63

And in August, she made history with the most monthly listeners on Spotify (female) , becoming the first female artist to amass 100 million.

With plans to release more music and continue on her record-breaking tour, we’ve no doubt that Taylor Swift will achieve many more Guinness World Records titles in 2024!

Want more? Follow us on Google News and across our social media channels to stay up-to-date with all things Guinness World Records! You can find us on Facebook , Twitter/X , Instagram , Threads , TikTok , LinkedIn , and Snapchat Discover . Don't forget to check out our videos on YouTube and become part of our group chat by following the Guinness World Records WhatsApp channel . Still not had enough? Click here to buy our latest book, filled to the brim with stories about our amazing record breakers.

- Entertainment

The Staggering Economic Impact of Taylor Swift’s Eras Tour

Y ou don’t have to be a Swiftie to have been touched in some way by Taylor Swift’s Eras Tour, a stadium arena experience that kicked off in March. The tour, which pays homage to every era of the artist’s illustrious 17-year career , is set to become the biggest tour of all time only a third of the way through its run.

If you live in one of the 20 locales Swift, 33, performed at in the last five months, your city has likely seen a boost in revenue from the hundreds of thousands of attendees who traveled from near and far. If you don’t—or simply couldn’t snag tickets due to the cost or the now infamous Ticketmaster snafu—chances are you’ve seen clips of the three-and-a-half hour show from celebrities’ Instagram stories.

While there’s much to say about the music, costumes, and production, the impact of the Eras Tour is starkly reflected in the numbers: a projected gross of $2.2 billion in North American ticket sales alone, and hundreds of millions of streams, reaching a nearly 80% spike in those listening to her music catalog in the weeks after the tour kicked off.

After 53 shows, the first U.S. leg of the tour came to a close on Aug. 9. Swift originally announced 27 shows and has since extended the tour, adding new dates in cities like New Orleans, Indianapolis, and Toronto, which are all now anticipating a local economic boost. Eras is set to go international this month, starting with four shows in Mexico City, continuing its five-continent run through November 2024.

Swift’s tour is in a league of its own, even among legendary groups like the Rolling Stones who have been touring for decades, other major touring artists like Harry Styles and Beyoncé and contemporaries like Adele with sold-out Las Vegas residencies, as the singer-songwriter brings her mega tour directly to her dedicated fans in various cities for multiple nights.

The reasons behind the Eras Tour's unmatched success are many. Nora Princiotti, staff writer at The Ringer and co-host of the podcast of Every Single Album: Taylor Swift, attributes part of the tour’s success to the sheer depth and popularity of Swift’s music catalog. “I don't know that anybody envisioned a tour of this scale ever happening. She can go three and a half hours and just hit after hit after hit,” says Princiotti.

There’s also the timing: The tour has become the perfect outing for concert-goers itching for a post-pandemic live music immersive experience. “We are in an experience economy where people crave going out and participating in social events,” says Alice Enders, a music industry analyst at Enders Analysis and a former senior economist at the World Trade Organization. “It's no surprise that people are flocking to this Eras Tour experience in what is increasingly an otherwise digital environment we live in.”

And fans are acutely aware of Swift being connected to her body of work in a way that few artists are—she writes all her songs, has been protective of her music in the streaming boom, and is now releasing re-recordings of her discography to reclaim their master rights. It all adds up to a music industry enterprise the likes of which the world has never seen.

Read more: Why You Can't Remember That Taylor Swift Concert All Too Well

The economic and cultural impact of the Eras Tour

Analysts estimate that the Eras Tour will likely surpass the $1 Billion mark next March, while Swift is touring internationally. If this projection holds true, she will achieve the milestone of the biggest tour in music history, surpassing Elton John's multi-year farewell tour, which wrapped up earlier this summer and holds the current record of $939 million. The Eras Tour would then continue for another seven months before concluding in November of 2024 in Toronto—that is, unless rumors that Swift will release more dates come to fruition.

But the money goes far deeper than just net profits. The Eras Tour is projected to generate close to $5 billion in consumer spending in the United States alone. “If Taylor Swift were an economy, she’d be bigger than 50 countries,” said Dan Fleetwood, President of QuestionPro Research and Insights, in a story for GlobalNewsWire . On the opening night in Glendale, Ariz., the concert brought in more revenue for local businesses than Super Bowl LVII , which was held back in February in the same stadium. To use that event as a comparison, Swift has been performing the equivalent of two to three Super Bowls every weekend for the past five months (and six of seven nights at her last round of shows in Los Angeles).

Typically, every $100 spent on live performances generates an estimated $300 in ancillary local spending on things like hotels, food and transportation. But for the Eras Tour, Swifties are taking this to the next level, dropping an estimated $1,300-$1,500 on things like outfits and costumes, merchandise, dining, and travel—boosting local economies by hundreds of millions of dollars in one weekend.

The Illinois governor credited the musician with reviving the state’s tourism industry after her three nights in Chicago. She was even mentioned in a report by the Fed , crediting her with fueling the national tourism industry.

The enthusiasm is so great that cities along her tour have experienced supply shortages. For one example: Swift mentions “friendship bracelets” in the song You’re on Your Own, Kid , off her most recent album Midnights . Swifties have taken this and run with it. Every concert is filled with tens of thousands of fans wearing and exchanging beaded bracelets spelling out the names of Swift songs and colloquialisms all the way up their arms. While this bracelet economy has brought new revenue to local businesses, businesses have also reported bead and sequin shortages .

This enthusiasm comes despite broader economic challenges. “There’s a cost of living crisis and people are still forking out thousands of dollars to see Taylor Swift,” says Enders. Despite this, a national study of concertgoers shows that even with an average of more than $1,300 spent per event, 91% said they would go again.

Not only is the Eras Tour an economic boon, but it has also become a cultural phenomenon. Every city Swift has visited over the course of the tour so far has pulled out all of the stops for her : Minneapolis was renamed “Swiftie-apolis;” Santa Clara, Calif., made her the honorary mayor; the New Jersey governor named the state sandwich of New Jersey after her. Now world leaders like the Chilean President, the mayor of Budapest, and Canadian Prime Minister Justin Trudeau are asking her to bring the tour to their countries. The FBI tweeted out a Taylor Swift pun in July.

Princiotti says that in her role as a fan, it’s been both exciting and strange to see such a global embrace of Swift. “For as big as she has been for so long, even if this is a new peak, I think a lot of fans feel like they've spent their entire lives defending their love of her,” she says. “And there's something very strange in seeing the U.S. government, or all of these various municipalities, just desperate to get a little sliver of the clout that comes from just being somewhat associated with Taylor Swift.”

Justice is better than revenge. You may not be Superman, but you can help the #FBI protect the country. If you have information about a federal crime, speak now. Call 1-800-225-5324 or visit https://t.co/t8G7LO4hxu to submit a tip. pic.twitter.com/kn9QhlNhGx — FBI Washington Field (@FBIWFO) July 10, 2023

Read more: Here’s Why Taylor Swift Is Re-Releasing Her Old Albums

Beyond the concert tickets

Donning beaded bracelets and drawings of the figure “13” (Swift’s favorite number) on their hands, many Swifties attending her shows are just as eager to secure exclusive tour merchandise. Thousands of them line up for hours in advance to snag the coveted merch of $75 hoodies, $55 long-sleeve shirts and $45 T-shirts.

Fans are even clamoring to get their hands on physical copies of Swift’s music. “Streaming has taken over the purchase of the physical album product, but Taylor Swift is among the artists that still makes money from vinyl and CDs because they’ve become collector's items for her fans,” says Enders.

Swift creates different editions, reissues, and extras that make fans want to collect more and more copies of her albums in different forms. For her Midnights album, four of the five different album covers fit together to form a clock face, while another comes with bonus tracks, making buying different versions of the album a necessity for true fans. And some diehards admit they’ve purchased the vinyl versions without even owning a record player.

Midnights was the top-selling vinyl record in 2022, with 945,000 copies sold, making it the best-selling physical album since 1991. One out of every 25 vinyl records sold last year was a Taylor Swift album, and she is the first artist in history to simultaneously occupy at least seven of the top 10 spots on the Vinyl Albums chart. For her newest re-recorded album set to come out in October, 1989 (Taylor’s Version) , Swift has already released multiple vinyl and special edition deluxe CDs for pre-order on her website , each with different cover art and unique additions.

View this post on Instagram A post shared by Taylor Swift (@taylorswift)

The success of Swift’s re-recording project

Swift’s mega tour isn’t the only thing she’s dominated. Her streaming and chart success from her constant release of new and re-recorded music (six going on seven albums in the last three years) adds to the vast project that is Swift’s domination of the global music industry.

“This moment for her is like an excellent HBO miniseries that’s not just a primary narrative, but also a B plot and a C plot where the main narrative is the tour, but underneath that we have the album re-recordings,” said Charlie Harding, music journalist and co-host of the podcast @SwitchedOnPop .

Swift’s “Taylor’s Version” re-recording project is an effort she started in 2019, when music mogul Scooter Braun bought record masters for her entire discography from her prior music label Big Machine Records. So far, Swift has released three re-recorded albums: Fearless (Taylor’s Version) , Red (Taylor’s Version), and Speak Now (Taylor’s Version), with the re-recorded editions all including additional “vault songs” that didn’t make it to the final versions of their original albums.

Read more: Why Music Manager Scooter Braun Is at the Center of a Media Storm

Fans have embraced Swift’s attempt to claim her music back, opting to stream the re-recordings more than the original versions, thus dethroning the catalog once owned by Braun. (He sold the rights to Shamrock Holdings in November 2020.)

Swift’s project has broken several music records in the wake of the album re-releases. Her latest re-recorded album, Speak Now (Taylor’s Version) , a recording of her 2010 studio album, made history when it went straight to the top of the charts as her 12th no. 1—making her the woman with the most no. 1 albums and the first person with five albums simultaneously on Spotify’s Top Ten Albums Global chart.

And Swift’s Eras tour is directly linked to the success of her streaming. “The live music performance is actually a driver to the streaming platforms,” says Enders. “When you go to see an Eras show you’re rediscovering Taylor Swift and you go back to listen to her music when you get home and in the days after.”

So far, Swift is halfway through her re-recording project, with three albums still to come. Swift announced on Aug. 9, when closing out her six-show residency at Los Angeles’ So-Fi Stadium, that her next re-recorded album will be her synth pop 1989 album, due Oct. 27.

Surprise!! 1989 (Taylor’s Version) is on its way to you 🔜! The 1989 album changed my life in countless ways, and it fills me with such excitement to announce that my version of it will be out October 27th. To be perfectly honest, this is my most FAVORITE re-record I’ve ever done… pic.twitter.com/JFYOWhBxhj — Taylor Swift (@taylorswift13) August 10, 2023

“It's kind of like the Marvel Cinematic Universe,” says Harding, using another onscreen metaphor. “We're in the Taylor Swift cinematic universe at any given moment. There's endless amounts of discussion to be had at every level of this world that she's created, and each one I think serves a different audience.”

With more tour stops on the horizon and three more albums to re-release, Swift isn’t slowing down any time soon. The music sensation has even exceeded her own expectations. On the last night of the first U.S. leg of the tour, Swift told the crowd, “I figured it would be fun, but I did not know it would be like this.”

Harding says it’s not just a recipe for financial success, but for spectacular longevity. “Taylor Swift has the capacity to be around for a whole lifetime,” he says. “I think the big question I have is: where do you go from here?”

Correction, Aug. 24

The original version of this story stated that Scooter Braun still owns the master rights to Swift's first six albums. Braun sold the rights to Shamrock Holdings in November 2020.

More Must-Reads from TIME

- Why Biden Dropped Out

- Ukraine’s Plan to Survive Trump

- The Rise of a New Kind of Parenting Guru

- The Chaos and Commotion of the RNC in Photos

- Why We All Have a Stake in Twisters’ Success

- 8 Eating Habits That Actually Improve Your Sleep

- Welcome to the Noah Lyles Olympics

- Get Our Paris Olympics Newsletter in Your Inbox

Write to Mariah Espada at [email protected]

The Economy (Taylor’s Version)

See how much money Taylor Swift’s Eras Tour actually made

Call it a gold rush: Taylor Swift is adding billions to the U.S. economy.

Swift’s record-shattering Eras Tour is set to be the most lucrative concert run in American history. But the massive production not only provided a jolt of money to sold-out stadiums — it also infused the American economy with a trickle-down flow of cash.

Now, as the show heads to movie theaters this weekend, millions more will experience — and shell out cold, hard cash for — a moment with Swift.

As she hits the silver screen, here’s a look at The Economy (Taylor’s Version).

The biggest windfall is headed straight to Swift, who stands to make as much as $4.1 billion from the Eras Tour, according to estimates from Peter Cohan, an associate professor of management at Babson College.

That’s assuming the pop star ends up keeping the standard artist’s share of roughly 85 percent of her tour’s revenue, with average ticket prices of $456. Swift’s earnings would be the most from a single tour for any musical act to date — and more than the yearly economic output of 42 countries , including Liberia, which has more than 5 million people.

But the impact of the Eras Tour extends far beyond what Swift takes home. In one of the few efforts to assess spending by concertgoers, software company QuestionPro quizzed 592 Swifties who responded to an opt-in online survey. Based on their answers and average concert attendance, the company estimates that Swift’s fans spent about $93 million per show — yes, on tickets, but also on merchandise, travel, hotels, food and outfits.

Add all that up, and by the end of the U.S. tour, you’ve got a $5.7 billion boost to the country’s economy. That’s enough to give $440 to each person in Swift’s home state of Pennsylvania. Or almost enough to send every American a $20 bill.

The mania began months before the March kickoff of the Eras Tour. Presale tickets went on sale in November — sending millions of fans into a frenzy and causing Ticketmaster to crash. A class-action lawsuit and a congressional inquiry followed, as did the ire of many Swifties.

Tickets, which started at $49, sold for many multiples of their face value on resale sites like SeatGeek.

That burst of spending has revived the entertainment industry after a years-long pandemic slump.

“Swift and her ‘Eras’ tour have redefined entertainment economics,” said Chris Leyden, director of growth marketing at SeatGeek.

The tour’s economic boost spread far past the walls of Swift’s stadium venues, as fans traveled from near and far to any show they could get their hands on. The Federal Reserve Bank of Philadelphia even put the Swift effect in a report — saying concertgoers provided a sizable boost to hotel revenue in May.

Hotels, restaurants and shops around the country felt the upswing, with millions of dollars flowing into the 20 U.S. cities Swift visited this summer. Cincinnati estimated that it would see about $48 million in additional economic impact, according to Visit Cincy and the Cincinnati Regional Chamber’s Center for Research and Data.

In Los Angeles, where Swift performed six shows, the California Center for Jobs and the Economy predicted a $320 million boost to the county. Kansas City tourism organization Visit KC said the region got an estimated $48 million impact from the tour’s July stop. The Common Sense Institute, which studies the state of Colorado’s economy, predicted the boom from Swift’s Denver performances would add up to $140 million statewide.

“The [Eras Tour] was a shot in the arm to a part of the regional economy that’s really been lagging,” said Mike Kahoe, chief economist for the California center. “It brought some much-needed dollars to the tourism industry.”

Hotel analytics group STR calculated tour cities produced a $208 million bump in hotel room revenue, over and above normal seasonal levels.

In Seattle, Swift set a record for single-day revenue for downtown hotels — notching $7.4 million, about $2 million more than the record set during a Major League Baseball All-Star Game earlier the same month, according to Visit Seattle and STR.

“To put the impact into context, $208 million is basically the combined room revenue generated in New York City and Philadelphia in one week,” STR senior research analyst M. Brian Riley wrote. And that’s just for the actual nights of the tour, not including fans who arrived early or stayed longer.

Swift’s fans want to embody their favorite Era — and that means splurging on elaborate outfits and costumes.

“Is there anyone here who put a lot of work, thought and preparation into lyric memorization and/or what you were going to wear?” Swift asked the crowd to loud cheers at a Los Angeles show in August.

A core accessory for any Swiftie is a few — or a few dozen — friendship bracelets to grace their wrists and to trade at shows. The jewelry, inspired by a lyric in Swift’s song “You’re On Your Own Kid,” is often handmade or bought online and boasts popular Swift lyrics.

One Etsy seller, Kara White, started making the bracelets with her mom earlier this year, when the tour began. They got orders for 1,500 bracelets in a single day as fans prepared for the Los Angeles shows. White and her mom have made about $15,000 this year selling bracelets.

“It just shows how much she makes her fans go crazy,” White said.

Coveted tour merchandise that were hard to nab had fans turning to internet resale sites. One of the most popular items: a $65 blue crewneck with the Eras Tour logo.

At the venues, merch lines were long — inside and at trucks parked outside. Justin Paul, a DJ, producer and creative director who teaches music business courses at UCLA Extension, came up with a conservative estimate — $864,000 for each show — for Swift’s merch sales inside venues by using the number of people at each show and an average of how much concertgoers typically spend on merch. Still, Swift is a special case.

“You look at how much consumers are spending to see Taylor Swift, and it is quite an astonishing amount,” said Dan Fleetwood, president of research and insights at QuestionPro. “And not only are they spending this money, but in a lot of cases, they’re saying they would gladly do it again.”

Judging by the QuestionPro survey respondents, the average fan spent nearly $1,300 on outfits, travel, tickets and extras for the concert.

All of that Swiftie spending meant restaurants, shops and security firms had to keep up. One solution: hiring temporary workers while the tour is in town.

“When Taylor Swift comes to town, she brings a surge of economic activity,” said Daniel Altman, chief economist at Instawork, which allows businesses to employ workers by the hour.

Not only are there more jobs in and around Eras stadiums, but they pay better, too: The average hourly rate offered on Instawork within a five-mile radius of Swift’s May 13 show in Philadelphia was $20.57, $2 higher than usual.

There have been longer-term lifts in employment, too. In Los Angeles, Swift’s six-day stop was estimated to generate enough revenue to fund 3,300 new jobs, according to the California Center for Jobs and the Economy. That would be enough to staff every bookstore and news stand in the L.A. area.

Swift also passed on some of that karma — and cash — to her employees.

She gave every truck driver on the tour an extra $100,000 this summer, and she gifted bonuses to sound technicians, caterers, dancers and other staff, People magazine reported in August .

Swift may have been the main event, but fans shelled out for days of related festivities, with plenty of small businesses happy to bask in her afterglow. There were tour-inspired ice cream flavors in Pennsylvania , bonbons in Colorado and lattes in New Hampshire .

In Washington state, Neko Cat Cafe hosted feline-friendly “Taylor listening parties” at its two locations to commemorate the tour’s arrival. The small business made over $3,000 from the event, with ticket sales at its Bellingham location — almost 90 miles north of Seattle — 140 percent higher than on a typical Friday night.

Forty cats, all available for adoption, wore Swift-themed bandanas while humans drank glittery wine and ate “Lover”-themed cookies. Tickets, at $40 a pop, promptly sold out.

That Midas touch extended around the country: In California, Susie Cakes sold $50,000 worth of Swift-themed cupcakes. Seattle’s Japonessa Sushi Cocina dished out $10,000 in “Reputation” sushi rolls and glitter-filled cocktails. And in Kansas City, Donutology filled orders for 20,000 Eras-themed donuts, which became a staple at “Tayl-gating” parties in the parking lot before Swift hit the stage.

In Minneapolis, Inbound Brew Co. racked up twice as much money than on a normal weekend when it hosted three nights of Eras-related festivities this summer, including trivia games, live-band karaoke and a dance party, according to general manager Emily Elmer.

“This was bigger for us than when the Super Bowl came to town in 2018,” she said.

The first leg of her North American tour may be over, but Swift can’t stop, won’t stop moving … this time into movie theaters and football stadiums (when athletes are actually on the field). She has become a recognizable figure at Kansas City Chiefs games to watch her rumored paramour, tight end Travis Kelce. Her appearances have caused sales of Kelce’s jersey to jump and, in at least one case, NFL ticket prices to rise after rumors Swift would be in attendance, according to NPR.

Eras, too, is onto its next phase. In November, the pop star will take her 146-show tour international, with stops in South America, Asia, Australia and Europe. But first, Swift heads to the movies — where global pre-sales have already surpassed $100 million, according to AMC. Fans, the movie chain said, are turning up “from the largest cities to the smallest towns.”

Long story short: Swift’s economic dominance is about to begin again.

About this story:

The following songs are referenced in this story:

Abha Bhattarai became a Swiftie during the pandemic, when she listened to “Evermore” and “Folklore” on repeat.

Rachel Lerman managed to get tickets for Swift’s Munich show, where she will be embracing her “1989” era.

Emily Sabens became a Swiftie at age 10 while performing songs from the debut album in her basement with her cousin. She was blessed with “Haunted” as a surprise song at the Eras Tour in Detroit.

Editing by Karly Domb Sadof (who is still trying to get her Eras Tour tickets), Betty Chavarria (who has a song named after her), Jennifer Liberto (mom of a Swiftie), Mike Madden (who is not a Swiftie — yet), Paola Ruano (who is going to the Eras Tour for a second time in London) and Haley Hamblin (who promises to finally listen to 1989 soon).

By The Barricade

How Much Money Bands Make on Tour: The Breakdown

There are always plenty of myths about how much money bands make on tour. If you ask megastars, then they’ll easily say millions. Yet, you might find a different answer from a much smaller act.

The true figures about how much money bands make on tour depend on their schedule, crew, attendance of the show, and the amount of merchandise sold each night.

What may seem like a lucrative part of the industry can be particularly misleading, and amounts will vary from act to act.

The music industry’s costs and potential earnings from touring can vary heavily. So just how much money do bands make on tour, and is it worth all the effort?

4 Ways Bands Make Money While On Tour

Considering the money bands make on tour, it’s about getting bodies in the venue.

The more people attend a show, the more money you make. What gives the band revenue streams are factors such as:

- Promoters rate

- Ticket price

- Merch sales

So let’s see how these can earn bands money when playing on tour, as they are all slightly different in how they bring in money.

1. Flat Promoter Fees

Bands first receive a flat amount for playing a tour or show from the promoter .

This fee will vary depending on the band’s place on the card and the type of event they are playing. For example, headliners of a month-long tour will be paid more than an opening act who appears at only a set number of shows.

Agents and venues will take a small amount of this fee, but most of the money will go directly to the act.

A flat fee guarantees you get something from every show you play. The guarantee often will be a minimum of $500-$800 per show, so bands playing ten shows may receive a flat fee of $5000.

2. Show Guarantees

Guarantees are a deal you can make with the venue to bring in X sales if they cut their cost by Y. If you are an established band, you might get away with this. But for those that are starting, you will need to prove that you can make this mark with your social media presence.

For example, if 8 out of 10 shows sell out, a band might receive an $800 bonus for selling out a set number of venues.

Speaking of social media – if you are signed on with a label, this is an expense that you will not have to cover yourself. Typically, most labels will do all of your promotion and social media marketing for you because this is how they make money off of you. So get them to leverage this as much as they can!

It is easy to see why the term “starving artist” exists with all of this information. The cost to initially go on tour is costly, and there are not a lot of guarantees that you can make money. Many bands will lose money before they start to make money from touring . However, you can make traveling a career with persistence and a keen budgetary eye. ALWAYS make sure you do your research.

These sorts of fees entice bands to hit the road in the first place. And it is how the big bands earn big bucks from sponsors and promoters looking to fill big venues after someone’s profile reaches new heights.

Total minimum income from promoter fees (guarantees and flat payouts): $5000-$8000

3. Ticket Sales & Gate Receipts

The other big income driver is selling the people into the venue itself. And your income from this is easy to work out. The more people at a show, the more money you earn.

Don’t get excited, though, thinking that you are going to 100% of the sales from a sold-out venue. The figure currently sits at around 75-80% of the amount.

After all, promoters, venues, and agents will take their slice of the money before you receive the income from those entering the venue.

So how much might you earn? Well, most average gig venues have a capacity of around 350 people. According to FinanceBuzz, the average price for a ticket sits at $63.54 for shows in the USA. Going by this estimate, a sold-out show would generate a base revenue of $22,239. Removing the fees from agents leaves $16,679 for acts to take.

When dividing these figures amongst the artists playing, a headliner looks to take around 60% of these figures, while support acts may receive 20%.

So going by these figures, headliners would get $10,007 from a sold-out show while two support acts would receive $3335. That is before the money is then split between individual members.

If you play in a four-piece, headlining band members would receive $2,501 per show, and those on the support bill would receive $833 each.

It shows how vital selling out venues is for everyone on the card, regardless if they are a headlining act or first on the support bill.

Total minimum income from sales/show: $800-$2500

4. Merchandise

The other big money generator is by selling merchandise. Merchandising is a big way to boost potential income, mainly if a venue is sold out.

Fans will always want to grab something from a show, and even just having a t-shirt for sale makes a big difference to your worth.

You must know you won’t get all the profits some bands get. Depending on different factors, the venue will look to recoup a decent slice of the sales numbers, which might range from 20-35%.

With that in mind, you need to set prices that are not extortionate but also allow you to recoup what it costs to make them. It’s why most bands set a minimum of $10-$20 for shirts at a stall.

Some merchandising companies will jack prices up higher if they are representing a headliner, and that’s when fees will hit $40-$50 per shirt.

If you can sell shirts to a minimum of 60% of a 350-person venue, you are looking at generally an average minimum of $3,150 in shirt sales per show.

After deducting external fees, you would receive $2,205 to share among band members. This would break down to an average of $551.25 per show for each member of a four-piece band .

It could allow members to earn at least $5510 each if they were to repeat this on a 10-show tour where each show had sold out.

Total minimum income in Merch sales: $5500-22,200

Who Gets The Most Money on Tour? Bands or Everyone Else?

Touring is a relentless beast for any act. However, it’s also a necessity. Playing show after show for weeks on end is a grueling effort, but it is the best way to boost your profile and sales of CDs.

You often see tours touted as the money maker for best-selling artists; to a degree, they aren’t wrong.

According to to live revenue aggregator Pollstar, The Rolling Stones have amassed $2.17bn through touring throughout their career, with U2 having also grossed $2.13bn over past decades.

Surely, musicians should all be touring as much as possible, right? However, that’s not quite the case.

Many major acts who perform at stadiums and arenas will have others funding much of their set. This could be through primary sponsors, promoters, and even record labels.

For bands or musicians touring in a van from town to town, it’s a much different scenario. It’s here where every little item makes a difference to the end figure you receive.

Costs to think about when on tour

When battling profits and losses, everything will impact just what you will make. This all includes:

- Travel & Accommodation

- Overall Attendance

- Third-Party Deals

- Merchandising

It’s a lot to take in, but you need to know how each of these may see you finish making a profit or sucking on a loss.

You will find that the only concrete money that comes into your pocket will be whatever the promoter pays you to complete the tour .

From there, everything else is potentially fluid. Your primary sources of income will come from the gate of each show.

The more people who attend, the better chances of making a profit. It’ll also directly drive how much you make from merch sales.

From there, the costs then start to add up. Logistics aren’t cheap, even if you stay at budget hotels and use a second-hand van for riding show to show.

That doesn’t cover paying for those with you on tour. Costs can include paying crew members for technical support and selling merch for you.

Furthermore, there are also third-party costs that may need to be factored in too. Venues often take some share of merch sales and gate receipts as well. This may not be much, but 10% over several weeks soon adds up.

When considering pure travel or rest days, everything runs closer to the break-even point (where revenue equals costs). So is it all worth it?

The 6 Highest Costs of Touring as a Band You Need To Know

Touring is very much part of the industry. It’s what drives sales and boosts star power. However, to make money, you do genuinely have to spend money.

Spending is what it might feel like your band is doing non-stop when on tour. Everything costs, and it’s not cheap to do even a month’s tour in the current climate.

Let’s take some time to break down just what you might be spending on the road.

1. Travel & Accommodation

It would be best if you worked out everything regarding logistics. Even a domestic tour of the US isn’t going to be cheap.

Just in logistics, you will frequently be spending high amounts of money on:

- Accommodation

- Means of transportation

When it comes to transportation, driving is by far the cheapest method. Yet, it doesn’t make it particularly affordable. You would be lucky to hire a van and trailer for anything less than $10000 for the tour.

Then, just fuel will drive your costs even higher. The EIA showed that the cost per gallon has skyrocketed from $1.50 in 2000 to over $5 in the 2020s.

With fuel prices rising at an average annual rate of 4%, it’s a brutal price to pay just from getting from show to show. This would mean that you may spend a minimum of $5,000-$10,000 on a month’s tour in fuel. These fuel costs significantly impact where bands must tour , so their potential earnings are worth the effort.

Then there’s accommodation. You will need to find somewhere to sleep, and you can’t spend every night sleeping in a van. You will find that most cheap hotels will set you back an average of $50 a night per person. That is a minimum of $300-$500 a night for your traveling party. If you set that back over a month-long tour, it’s another $8000 in expenses.

Total Minimum Logistics Cost: approx. $20000-25000

2. Personnel Costs (Staffing)

Another considerable expense will be paying for having any team members with you on tour. This will be an amount that varies depending on your act as a whole.

If you are a solo artist or a band, you might get away with having a manager with you on tour and a roadie to work lights/sound engineering.

The costs will expand even further for acts with an additional crew, such as merch sellers and extra musicians. But everyone still has to be paid for.

Some acts have been straightforward about these costs. Indie pop duo Pomplamoose revealed in 2014 that for their tour, they paid six tour members $8794 for a week on the road. That included four touring musicians and two sound staff. That equated to over $43,000 during that 5-week tour.

While crew costs may be smaller than what Pomplamoose paid for that tour, you will still need to pay the crew what they are worth for tours. That will be $10,000 for two or three crew members over a month.

Total Minimum Crew Costs:$10,000

3. Insurance

You can’t be on tour without being insured when on stage. This covers both yourself or injury and potential incidents with fans on stage.

You never know when a set piece might spontaneously collapse, or a stage dive might go wrong. Most policies can be split into two areas:

- Annual amount

For those playing intermittently, prices by the event may only hit around $50-$60, but tour-wide policies can stretch into the thousands.

Annual fees can be cheaper; these cover artists year-round regardless of how much they perform. With these policies starting at around $200 per performer, it can work out more affordable for those performing all-year round.

What makes insurance “expensive” is deciding not to pay for it. Getting sued because someone gets injured at your show is a reality.

Total Minimum Insurance Cost: $50-$800

4. Production Cost

Production costs are never going to be cheap. Even though you own all your instruments, you must determine what lighting and sound equipment you may need to rent.

None of this equipment is particularly cheap, especially lighting rigs and other heavy items requiring much power. This, on its own, will likely set you back several thousand to get what you need.

Throw in a couple more thousand for trailers to haul everything along, and you will likely find that production costs will reach a minimum of $5,000-$10,000.

Thankfully, it’s a far cry from what an established tour manager revealed to the English newspaper The Guardian that they spent over $750,000 daily for a significant headlining stadium tour.

Total Minimum Production Cost: $5,000-$10,000

5. Merchandise

Before earning the benefit of merch sales figures, you need to physically create the shirts and hats and make enough of them to sell at the show.

Making merchandise isn’t cheap, and there are plenty of loopholes to negotiate before you can sell it.

You need to think carefully about the average size of your venues and the type of people at those shows. This lets you determine how much you need to create and what kind of items you want to sell.

Production costs will generally start in the hundreds if you sell one t-shirt style for your act, and then it’s just a matter of the quantity.

So if you manufactured one shirt at a base cost of $3, getting 500 for a week’s worth of shows would cost you $150. It would expand to $600 if you did this for a month-long tour.

Should you expand your product line, then that will drive costs higher. For example, creating an embroidered hat would start at $12. The 500 items for a week would cost $6000 to sell alongside a t-shirt.

Thankfully, you can recoup these costs back through sales, but it still needs to be counted up when adding total expenses.

Total Minimum Merchandising Costs: $500-$3000

Food is the energy that gives your team the power to rock. Choose whole-grain sources for sustained energy. Nobody shreds like a guitarist fueled by shredded wheat.

In all seriousness, it doesn’t hurt to prioritize healthy and economical foods when you’re on the road. The temptation for gas station junk food is hard to resist, but they don’t provide the best value in terms of nutrition. A sugar crash halfway through a set isn’t ideal.

Non-perishable staples, including canned goods you can warm up in a hotel microwave, are among the most cost-effective foods for road trips. Ultimately, getting most of your food from a grocery store rather than a drive-through will save your band a great deal. Except to spend about $10 a day (give or take) per person this way.

Also, free hotel breakfasts can come in extraordinarily hand

Total Minimum Food Costs: $300

7. Fees That Come Outside of the Tours and Shows

When working out costs, you also need to consider any cuts external parties may take from overall figures. This is something you should consider a general expense.

First, you need to consider who is taking what shares from the potential income you may receive.

These amounts generally won’t change, and figures will be spread between promoters, third-party agents, and the venue. Those figures include:

- Promoters: 10% of gate receipts

- Booking Agents : 5-10% of playing fee, gate receipts

- Venue: 20-30% Merchandise sales, 20% Gate Receipts

With everyone looking to get a slice of the action, it can genuinely affect how much money bands make on tour. And your overall net income will drop as more people become involved.

Merchandise sales are hotly contested, with many venues slowly looking to get an increased share of what is sold in their venues. For example, venues in the UK increased their take to 30% in 2022 as venues themselves looked to find ways to stay profitable.

Consider carefully what you may lose in add-on figures for an entire tour. You may need to be aware of the cut everyone else is looking to take.

Total Minimum Add-On Costs: 20-30% of all incoming figures

How Much Money Bands Make On Tour – Comparing Expenses and Profits With an Example

There are often fine margins when working out how much money bands make on tour. These margins are often dictated by how many people attend a show.

It’s a big risk to take especially considering how much bands have to fork out to go on the road in the first place. As we can see from the following breakdown:

Final Breakdowns

Total Minimum costs:

- Logistics: $20000-25000

- Crew: $10000-$30000

- Insurance: $200-$8000

- Production: $8000-$10000

- Merchandise: $2400-$21000

Minimum Tour Cost: $40,600

To have to spend $40,600 just for a potential four-week tour is a massive amount for any band to commit to. And it’s a commitment with no guarantee of success.

It’s why acts hope that they can sell out shows and try to bring in as much money as possible. A successful tour can be profitable, though, as our breakdown shows.

Minimum Income (headlining act):

- Promoter Fees: $5000-$8000

- Ticket Sales: $25000

- Merchandise: $22,000

Total Income: $52,000

For a headlining act, an income of $52,000 from a tour means the band just about comes out profitable, posting a margin of $11,600. Each band member would walk away with $13,000 from a tour.

By this estimate, bands must repeat that cycle for several months to earn a decent annual salary.

With the US Bureau of Statistics averaging the annual average salary at $54,132, bands would need to tour for four months a year for each member to hit that milestone.

That is still dependent on the shows being completely sold out. If attendances are only half or 75% full, bands risk being left in the red.

It’s why touring is not quite as glamorous as it might seem, and a lot of hard work is required to showcase just how much money bands make on tour and make it a successful venture.

Your Free eBook is Waiting

Share your email below to receive an eBook with $100,000 worth of information that will kick start your music career.

You have Successfully Subscribed!

You're signing up to receive emails from By The Barricade

Similar Posts

Are Guitar Strap Locks Necessary?

Imagine this, and you just left your favorite guitar shop. You purchased a fantastic guitar, and now your wallet is much lighter. If I just spent a large amount on a guitar, I would want to protect my investment. So, are guitar strap locks necessary? Yes. Locking guitar straps help protect your investment. Anytime you spend…

What Is Skacore? – A Look Into What Makes It Awesome

Whether it was the heyday of the late 1990s or a raving cult favorite, trying to define what skacore is can be tricky for many casual listeners. So, what is skacore? Skacore is a cross-blend of many genres blending bouncy ska riffs with metal-inspired drumming with vocals delivered in a coarse, rough style akin to…

The Band’s Guide to Getting Paid at Music Venues

A band is like any other business, except with drums. Like it or not, all bands gotta pay the bills. Performing gigs for venues is the best way to do this. But how do music venues pay bands? Venue owners have complete discretion on how they pay performers. Some may divide earnings after the night…

Plugging a Bass into a Guitar Amp

The bass guitar is a crucial instrument that lays the rhythmic foundation of a song. It is not surprising that many people gravitate toward it. However, an electric bass is nearly silent without an amp. Bass amps can be costly. What if you already own a guitar amp? Is plugging a bass into a guitar…

The Five Best Earplugs for Concerts

Listening to live music can be an energizing, exciting, fulfilling, and phenomenal experience for many people. This is especially true for those who can attend the concert of an artist or group they are interested in. Luckily, there are ways to listen to the show and protect your hearing. Earplugs have various features, materials, fits,…

How Do Bagpipes Work?

For anyone who wants to know how bagpipes work, it opens up a portal into one of the oldest and most formal instruments found anywhere on the planet. Bagpipes produce sounds by moderating the airflow in the instrument’s bag via the pipes or reeds the piper blows into. This vibration can be modulated with the…

Start Booking Better Shows

Sign up for a free e-book detailing how to ptich venues and agents for shows, get featured on music sites, and take your career to the next level

Success, your eBook will arrive in your inbox shortly.

Taylor Swift’s Eras Tour Is the Highest-Grossing of All Time and First-Ever to Hit $1 Billion

By Ethan Millman

Ethan Millman

Taylor Swift ‘s Eras Tour is the highest-grossing concert tour of all time, according to data from live music trade publication Pollstar , with the tour becoming the first ever to gross at least $1 billion. Swift dethrones Elton John’s years-long Farewell Yellow Brick Road tour for the top spot.

In a monumental, near-unprecedented year for a pop star, the all-time touring record is just one of the major accomplishments Swift has achieved in 2023, and perhaps her most significant financially as concert tours have become the biggest moneymaker for musicians. The Eras Tour was by far the biggest concert tour in the world this year, earning more than the next two highest-ranked tours (Beyonce and Bruce Springsteen) combined, as Pollstar data reflects.

Harris Taunts Trump After He Backs Out of Debates

So ... what's with this rumor that j.d. vance had sex with a couch, the inside story of the 'grooming' allegations against ava kris tyson, elon musk's daughter fires back after he says she was 'killed' by 'woke mind virus'.

By the time the shows actually started, each tour date became a major social media moment, and the cities she played celebrated her with honorary mayorships and temporary city name changes . A world leader even implored Swift to set aside dates in their country.

Swift’s dominance has been evident in every aspect of the music business, from concert gross and merchandise to her album sales and streams, and even in the movie theaters, where her Eras Tour film has become one of the top-grossing concert movies of all time . Spotify crowned Swift the most streamed artist of 2023 last month with over 26.1 billion global streams, which amounts to $100 million in earnings . Those streams don’t take into account the other streaming services like Apple Music and Amazon Music, or her over 5 million traditional album sales just in the U.S.

Céline Dion Is 'So Full of Joy' After Comeback Olympics Performance

- She's Back

- By Tomás Mier

Britney Spears Says ‘I Love Halsey,’ Takes Back ‘Upset’ Comment About ‘Lucky’ Video

- Deleted Post

PnB Rock's Alleged Shooter Still Lacks 'Competency' to Stand Trial, Court Rules

- Murder Case

- By Nancy Dillon

Céline Dion Makes Grand Return at Olympics Opening Ceremony

- By Larisha Paul

Post Malone's ‘F-1 Trillion' May Feature Jelly Roll, Dolly Parton, Chris Stapleton, and More

- Killer Collabs

Most Popular

Ryan reynolds met madonna in person to ask if 'deadpool & wolverine' could use 'like a prayer,' and she had one 'great note' after watching the scene, netflix's reed hastings backs kamala harris with $7m donation, dutch chemists finally work out how rembrandt achieved the golden lustre in his 'the night watch' painting, jennifer lopez’s super-rare outing with her son max shows how he’s dad marc anthony’s twin, you might also like, ‘the penguin’ comic-con activation evacuated after fire breaks out on roof, all the fashion at the paris olympics 2024 opening ceremony, the best yoga mats for any practice, according to instructors, ‘in a violent nature’ is getting a sequel from ifc films and shudder, ncaa settlement lawyers can seek cut of athlete revenue.

Rolling Stone is a part of Penske Media Corporation. © 2024 Rolling Stone, LLC. All rights reserved.

Beyoncé’s Renaissance World Tour Earns $579 Million

By Steven J. Horowitz

Steven J. Horowitz

Senior Music Writer

- Beyoncé Introduces Team U.S.A. in Promo for Paris 2024 Olympics: ‘Get a Look at America, Y’All’ 32 mins ago

- Queens of the Stone Age Cancel Additional European Tour Dates Following Josh Homme’s Emergency Surgery 12 hours ago

- Ice Spice Drills Down on Debut Full-Length ‘Y2K!,’ Leaving Little Room for Versatility: Album Review 13 hours ago

The Renaissance World Tour may have come to an end this past Sunday in Kansas City, but it’s safe to call it a smashing success for Beyoncé.

Related Stories

Data protection key as m&e explores ai capabilities in cloud storage, nicolas cage is 'terrified' of ai and got digitally scanned for spider-man noir: 'i don’t want you to do anything' with my face and body 'when i'm dead', popular on variety.

The trailer shows footage of her daughter (and consistent tour guest star) Blue Ivy Carter rehearsing, as well as her and Jay-Z’s twins, Rumi and Sir. Insiders claim that the movie will feature highlights from the Renaissance World Tour and footage recording the album, as well as the long-awaited music videos for songs from the project.

Beyoncé initially released “Renaissance” in July 2022 and teased the tour three months later. The Renaissance World Tour kicked off on May 10 in Stockholm, Sweden, continuing on through Europe before landing in Toronto on July 8. Throughout its duration, Beyoncé led a team of more than 300 touring crew members, bringing out guests including Kendrick Lamar, Megan Thee Stallion and Diana Ross .

More from Variety

‘we live in time’ trailer: florence pugh falls in love with andrew garfield, and hits him with a car, in a24 romance drama, youtube and tubi are giving netflix, disney a run for their money, harry styles and stevie nicks duet in tribute to christine mcvie at bst hyde park concert, what neon’s ‘longlegs,’ a24’s ‘civil war’ demonstrate about indie distribution power, more from our brands, céline dion is ‘so full of joy’ after comeback olympics performance, woodford reserve just dropped a box of chocolates inspired by its bourbon, ncaa settlement lawyers can seek cut of athlete revenue, the best loofahs and body scrubbers, according to dermatologists, will the boys’ prequel spinoff give us first herogasm ‘we’d be crazy not to,’ says eric kripke — watch.

Drake’s ‘It’s All A Blur Tour’ Reported Earnings Are Just As Massive As The Bras He Receives Onstage

When he’s not dodging random items tossed at him on stage, Drake is being buried with massive bras at each stop of the It’s All A Blur Tour . Despite the tour’s rough start, including accusations by fans that Ticketmaster price gouged tickets and reported logistical issues that caused the Memphis date to be canceled , it’s one of the most sought-after tickets for a rap performance.

According to Touring Data, of the nine shows reported, the tour has brought in $41,195,428 in revenue — or, on average, $4,577,270 per show. The tour has 55 concert dates across North America. Ticket prices range, but the outlet shared that the medium cost is just above $284.

IT'S ALL A BLUR, @Drake $41,195,428 Revenue ($4,577,270 avg.) 145,035 Tickets Sold (16,115 avg.) $284.04 Average Price 9/55 Reported Shows #Update — Touring Data (@touringdata) August 19, 2023

After the tour’s Brooklyn, New York, stops between July 17 and 21, Touring Data revealed Drake broke a grossing record. “Drake earns the highest grossing boxscore report by a rapper in history, with $18.02 million from 64,747 tickets sold at Barclays Center in New York as part of the ‘It’s All a Blur Tour’ (4 shows),” wrote the company on social media.

. @Drake earns the highest grossing boxscore report by a rapper in history, with $18.02 million from 64,747 tickets sold at Barclays Center in New York as part of the "It's All a Blur Tour" (4 shows). — Touring Data (@touringdata) August 19, 2023

Although Drake has a long way to catch up with Beyoncé’s Renaissance World Tour or Taylor Swift’s The Eras Tour , Drake is undoubtedly leading the way for rap acts—the perfect way to commemorate the genre’s 50th anniversary.

RENAISSANCE, @Beyonce $295,676,504 Revenue ($8,959,894 avg.) 1,600,155 Tickets Sold (48,490 avg.) $184.78 Average Price 33/56 Reported Shows #Update — Touring Data (@touringdata) August 8, 2023

THE ERAS TOUR by @taylorswift13 starts today at State Farm Stadium in Glendale. Her last concert earned $345.7 million from 2.888 million tickets sold in 53 shows (2018). — Touring Data (@touringdata) March 17, 2023

Mechanics • 20 min read

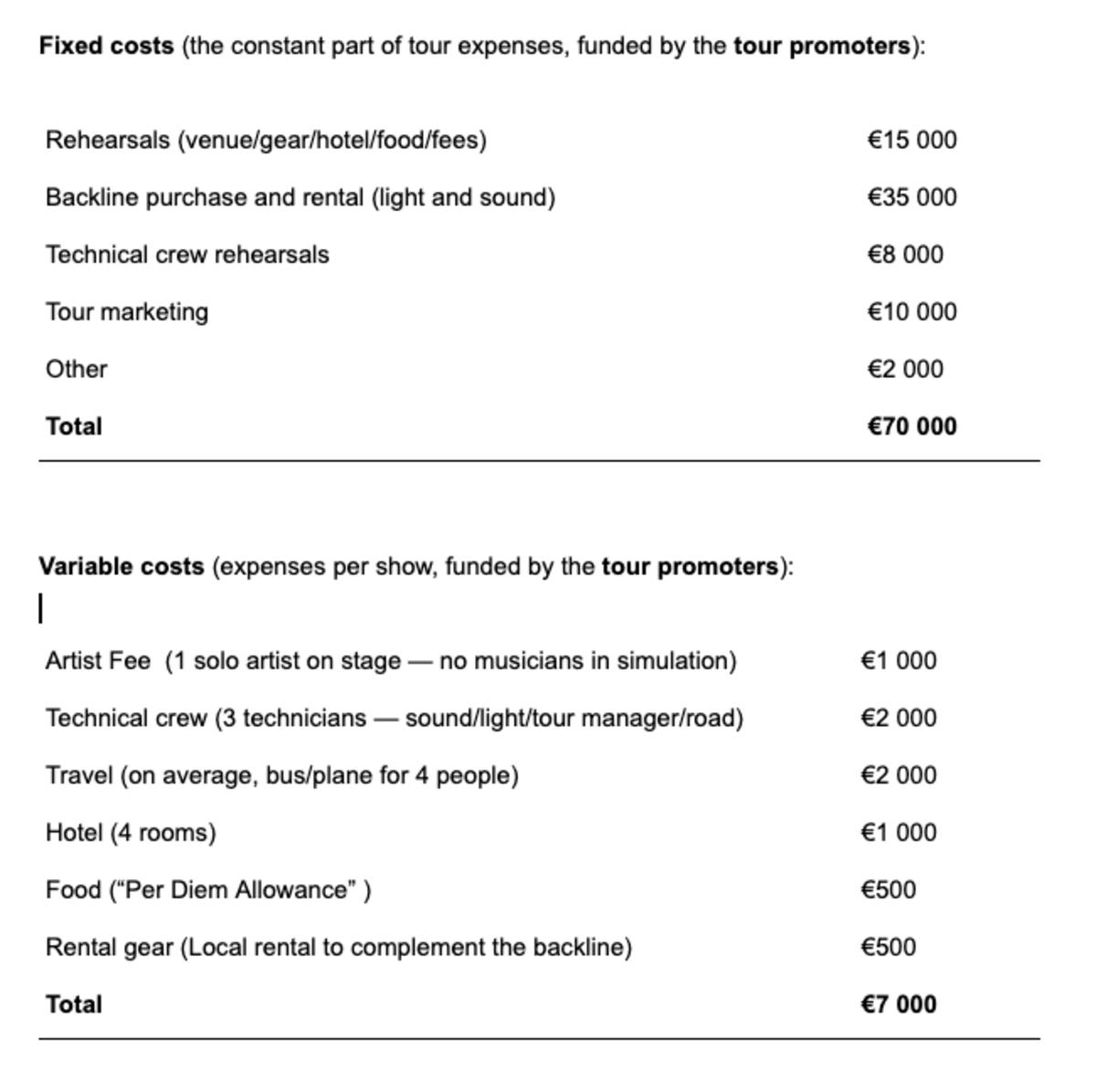

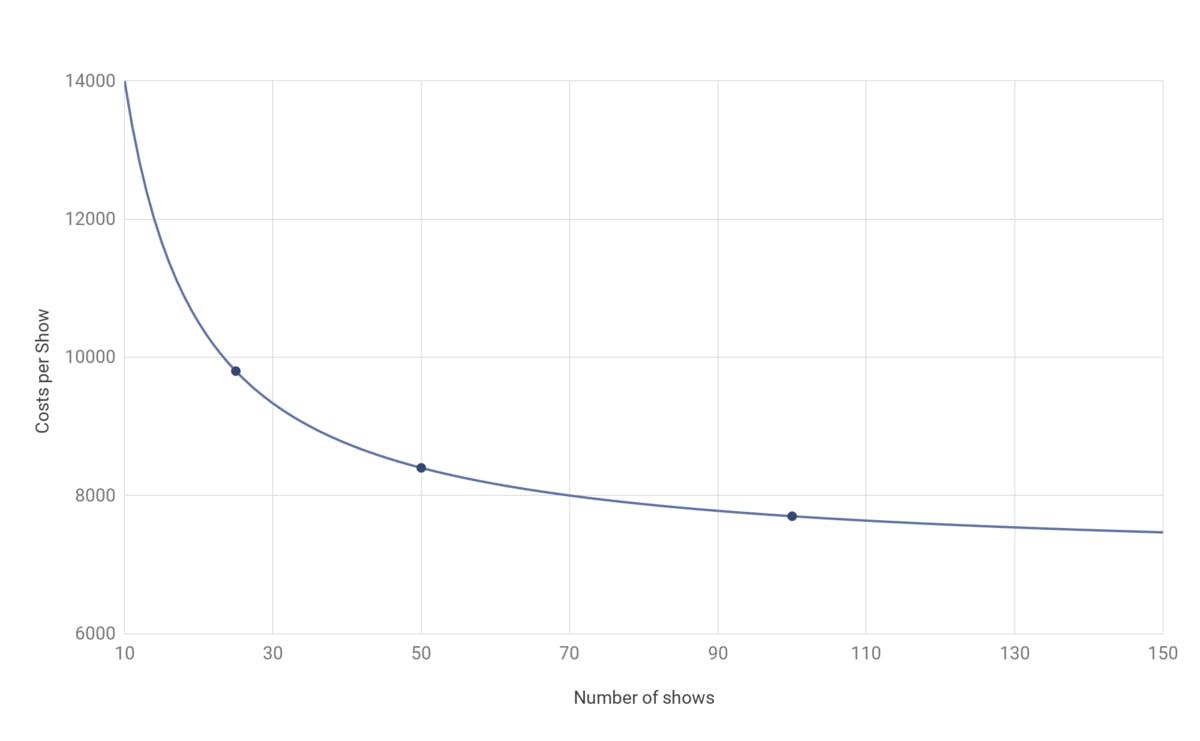

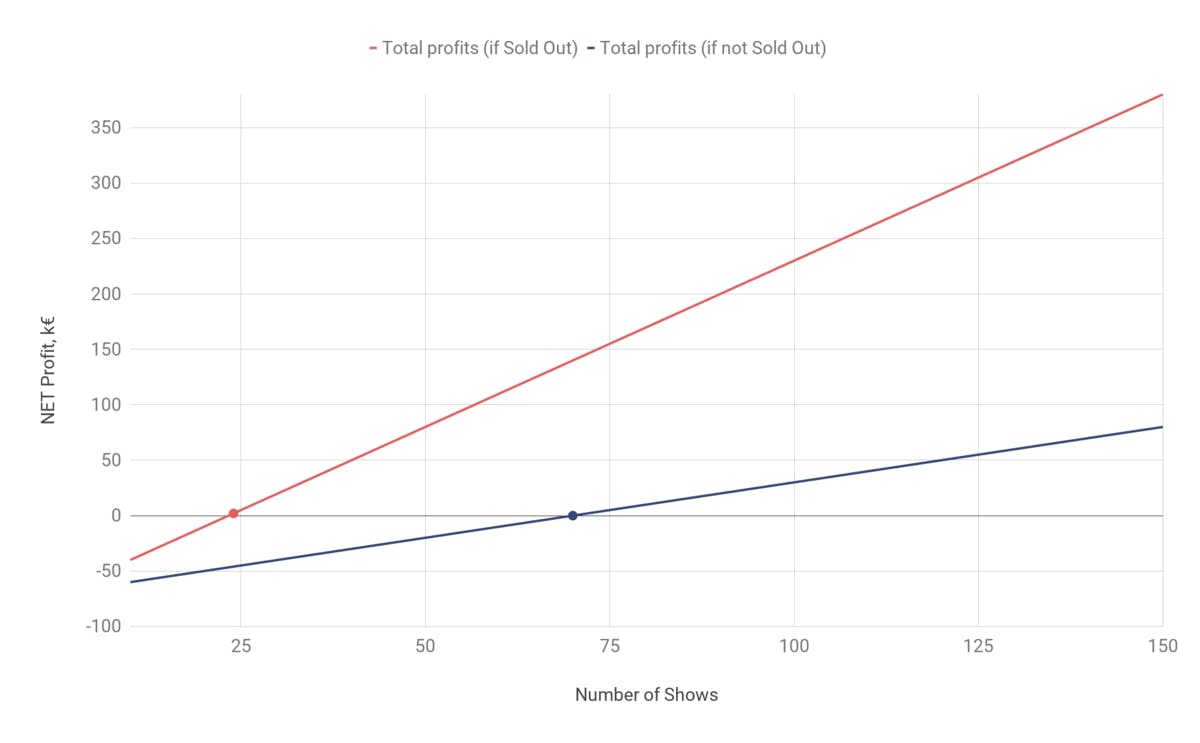

The Mechanics of Touring: How the Live Music Industry Works

By Dmitry Pastukhov

Published April 28, 2019

The Live Music Industry: An Overview

Key players in the touring industry, artists and managers, booking agents, tour managers and technicians, festivals & venues, label & publisher, the touring cycle, 1. finding the talent, 2. building the tour strategy and producing the show, 3. booking the tour, 4. selling the tickets, 5. preparations, 6. the day x, 7. the show, tour simulation, tour gross revenue.

Touring makes up a huge portion of an artist’s life and the lion’s share of the industry’s revenues. At the same time, it is the only part of the music career that remains 99% “physical” in what is otherwise the digital-first industry. While some of the artists can easily reach millions of fans via streaming, putting together an international tour for the same crowd is an extremely complicated process.

Despite the rise of digital streaming platforms, make no mistake, live music is still the cash cow of the industry. Even though streaming revenue is expected to grow to $23 billion by 2022, by that same year the live music industry is projected to reach a whopping $31 billion in global value. Global live music revenue continues to increase (with the substantial portion of this growth attributed to the worldwide explosion of EDM festivals, which we've traced in our analyses of Chinese and Indian markets). At the same time, if we take a look at the well-established music economies, a recent Nielsen study found that 52% of Americans attend live shows at least once a year.

Nevertheless, the touring industry’s decentralized and network-based system remains a complex landscape to navigate: artists often work with dozens of local promoters, booking agents and venues in the course of a single tour. So, let’s start with the basics and identify all of the parties that are usually involved in a mid-sized tour:

Artists and their managers are the crucial elements of the live business. As we’ve laid out in our Mechanics of Management , manager’s role is to build and coordinate the artist’s team on all sides of the music industry, and that, of course, includes the concert business. The artist’s management usually takes part in the initial route planning, helps the artist pick the touring team, and serves as a bridge between the live entertainment and all other sides of the artist’s career.

The job of the booking agent itself is very easy to define: the agent represents the artist across the live industry. Their goal is to book the tour and sell the shows to the local talent buyers, finding the venue and negotiating the price. The booking deal is usually pretty straightforward: “an artist A, represented by the agent B, commits to play an N-minute show in the venue C on the day X for a $Y. ” A good agent is the one who’s able to get all those As, Bs and Cs right — so that the venue is sold out, but there are no fans left without a ticket; the artist gets paid well, but the promoter doesn’t feel cheated, and so on. While the deal is relatively simple, it’s hard to nail all the details — especially given the fact that the show are usually booked from 8 to 24 months in advance, depending on the scope of the venue.

Promoters are the side of the live business that funds the tour and buys the shows. The landscape of concert promotion is complex, and promoters themselves come in various shapes and sizes. To make it a bit simpler, imagine that promoter is a middle-man, connecting the concert space and the artist to put together a show. You can start building that bridge from either side, however.

Tour promoters set out from the artist side, contracting musicians to perform a series of concerts, paying for rehearsals, audiovisual production, covering the travel expenses and so on. Once the show is ready, tour promoters, working closely with the artist’s booking agent, either rent venues themselves or subcontract (read: sell) the shows to the local promoters (or a mixture of both).

Local promoters, in their turn, embark from a concert space. Affiliated, or at least connected with local venues and performance spaces, they buy gigs from the agents and/or tour promoters to own the ticket sales. An art-director of a small club, a local group of party promoters, a team of the major US festival — all those event promoters of different scope would fall into that category.

In that context, the role of the agent becomes clear. If promoters are the middle-men on the side of an artist or a concert space, the agent is the middle-man between the middle-men, who builds up the network of promoters (on both fronts) and artists, serving as a liaison between all sides.

However, some of the biggest tours today can be put together without the agent’s involvement. One of the main shifts in the live business is the consolidation of tour and local promoters under the umbrella of entertainment conglomerates, with the most notable examples of Live Nation and AEG .

Essentially, these companies have grown their operation to the point where they can build the bridge from both sides, internalizing all the processes. They both produce the concert tours and own (or, at least, establish partnerships with) a vast network of clubs and arenas, providing venues for the tour. Live Nation, AEG and alike can now create centralized international tours, offering artists 360° deals. However, touring under such exclusive promotion remains reserved for the artists of the top echelon — so most of the shows out there are still put together in collaboration between the tour promoters, booking agents and local partners.

Tour managers that stay on the road with the artist's crew are the oil that makes the wheels of the tour spin. Even a nationwide tour involves extremely complex logistics, and it becomes exponentially harder to manage the travel as the tour passes onto an international level. For the first-tier acts, staying on the road with the artist crew, technicians and 30 trucks worth of equipment can cost up to $750k per day . The goal of the tour manager is to make sure that the money doesn't go down the drain when the artist’s bus breaks down in Nowhere, Oklahoma . Getting the band from point A to point B seems to be a pretty straightforward job, but in fact, the routine of the tour manager is dealing with unexpected and solving a dozen of new problems each day — all while keeping the artists happy and ready to perform. To give you a taste of an international tour route, here's an approximate map of the Lizzo's tour in support of "Cuz I Love You" release, stretching over 64 locations and 74,575 km — and that is just the straight routs, not accounting for the actual roadways.

"Cuz I Love You" tour route, 30.04.2019 — 28.10.2019 (interactive version available here )

Tour managers also run the technician crew, and, while the technical support of the tour is often overlooked, the fact is that behind every show there’s a team that turns the performance into an audiovisual experience that the audience has paid to see. It takes hard work and expertise to assemble the stage, set up the lights and the sound system, etc. The live industry relies on the tech crew to make the show actually happen.

Festivals and venues are at the very core of the live business, providing the space and (usually) the base infrastructure for the show. As we've already mentioned, there’s often a great deal of vested interest between local promoters and performance spaces. That means that there’s usually a local promoter “attached” to the venue, and same goes for music festivals.

Outdoor events are a distinct part of the live performance landscape. Operated by promotion groups, prominent festivals can introduce artists to new audiences, both in terms of fans and music industry executives — all while offering a fat pay-check. A major festival performance puts the artist on the map, and the promotional effect of the show itself has to be considered. It can become even more important than the immediate monetary gain — especially for independent, up-and-coming artists. That’s why the tour routing will often be structured around a couple of big music festivals — and then filled up with solo concerts along the way. A good example is Coachella: as the event takes place over two separate weekends, most of the Coachella artists also book “side-gigs” around the area during the in-between week.

Although recording and publishing industries are not directly engaged in the live business, we have to remember that the music industry is built on collaboration . By convention, most music tours follow the release of an album, and each artist has to report his set after the show to PROs so that the proper songwriters get paid. The music industry is made up of separate companies and people working on the different parts of the artist career — and, while not completely aligned, they are always interconnected.

The six key parties described above work together to bring the live show to the concert-goers. However, it’s important to mention that they won’t always be represented by separate entities. Often some of the roles will be internalized by the different sides of the touring chain: independent artists and their management might produce the tour themselves, internalizing the job of the tour promoter; conglomerate promoters, as we’ve mentioned, can now offer exclusive touring deals; and so on. That said, in the next section we will go through the tour cycle step by step to showcase how all these players interact to create the tour. As it usually is in the music industry, it all starts with the artist.

On the first step, agents and tour promoters find and sign the performer. This process is not much different from the scouting of recording or publishing A&Rs, although the criteria might differ. For some types of artists (like DJs, for example) touring can be relatively huge, while the recording revenues might stay almost non-existent. Agents and A&Rs look for different things in the artist, but the essence of scouting remains the same across the board — identify and sign the promising acts before anyone else does.

There’s another twist to talent hunting in the live industry that is probably worth mentioning. As an average show has to be booked 9-10 months in advance, tour deals are usually signed around a year prior to the actual performance. At the same time, the vast majority of concert tours follow the recording releases to build up the momentum and ride the promotion wave. That has one unavoidable implication: tour promoters and agents sign the artist to perform the material which is not written yet, which can be quite risky.

That is especially true when it comes to the debut artists, that might not even have a 40-minute set or any solid live performance skills when they get their first touring deal. There is a lot of gut feeling that goes into scouting on the live industry side — more than in the recording business at least, where licensing deals allowed labels to mediate the risks of the creative stage.

Once the artist is on board, it’s time to produce the show and define the tour strategy and routing. At this step, the tour promoter starts the preparations: building the light show and live visual materials, booking rehearsal sessions to perfect the live performance, and so on. Meanwhile, the artist, manager, agent and tour promoter work out a general timeframe and draft an approximate route of the future tour. The initial tour planning is usually done around priority shows, like major city performances or music festivals, while the rest of the route is defined in broad strokes. Unless we’re talking about the top-tier, established artists, the tour will always follow a recording release. Once the initial planning is over, the tour strategy will be defined in terms of “The artist will play a priority city/music festival in a specific area N weeks after the release”.

Ones the initial route is set out, the agent goes on to book the tour, pitching the show to local promoters and festivals. Starting with the priority shows and then filling in the details, the tour route gradually takes its final form. The agent negotiates with local promoters to pick out an optimal venue (in terms of volume, style, conditions, etc.) to host the show. As Tom Windish, a senior executive of Paradigm Talent Agency mentioned in our recent interview , picking the right venue is perhaps the hardest part of booking a tour: the material is not out yet, and there’s no way to predict the reception of the release that’s almost a year ahead. Go for a small but safe venue — and you risk losing potential ticket sales and disappointing the fans; go big, and you might end up in a half-empty room, losing on the investment and leaving every side of the deal disappointed. The agent has to make risky decisions in a situation of uncertainty, and given the venue landscape in some of the regions, sometimes that means choosing between a venue capacity of 500 and 2000 for what is reasonably a 1000-ticket show.

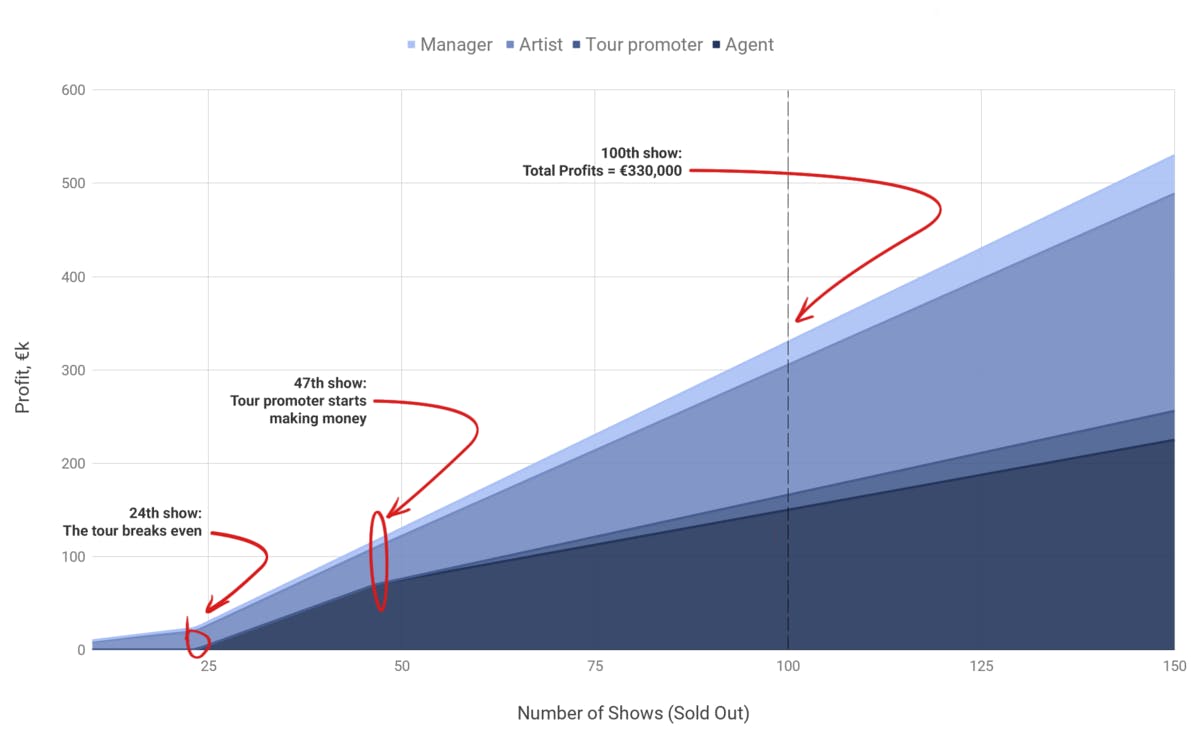

As for the conditions and splits of the booking contract, generally local promoters, tour promoters, and artists will split the net profits of the show. Artists might also get a flat fee to ensure they'll make some money even if all other parties do their job poorly. Usually, the more the flat fee, the less the artist’s share of the net profits (and vice versa). In that sense, the structure of the contract splits often reflects the artist's risk appetite: some artists self-produce the tour, sacrifice the flat fees and end up getting almost 100% of the net. Others might ask for a higher "safety" fee, lowering both the profits of the tour and their own stake in it. Booking agents, in their turn, earn a flat percentage on the revenues ‘on top’ (though they might put their share back in the pot if the tour doesn’t turn out a profit). That might be a lot to take in, but don't worry, we will get back to the splits and give you a clear example with a tour simulation you can find below .

Once the tour is booked, it’s the time to promote it and sell the tickets. On paper, the ball is in the promoter’s court here, but in reality the marketing of the tour is carried out in close collaboration between all the sides — from managers and booking agents to the artists' record labels. Concert marketing is a topic worthy of a separate article, but if we were to simplify things, it could be separated into two main parts.

First is the overarching tour marketing, implemented by the tour promoter and synchronized with the record release. The tour marketing campaign utilizes wide communication channels to promote the tour in general rather than a particular show. Second is the regional marketing owned by the local promoters, which aims to boost the sales of a specific show, focusing on narrow communication channels, like radio, OOH and locally targeted digital advertising.