- Search Search Please fill out this field.

- Business Essentials

Voyage Policy: What it Means, How it Works

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

What Is a Voyage Policy?

A voyage policy is marine insurance coverage for risks to a ship's cargo during a specific voyage. Unlike most insurance policies it is not time-based but expires when the ship arrives at its destination. It covers only the cargo, not the ship that carries it.

A voyage policy is also known as marine cargo insurance.

Key Takeaways

- A voyage policy, or marine cargo insurance, covers losses incurred to a ship's contents during a journey.

- A voyage policy is used mainly by exporters who need to ship only occasionally or only in small amounts of cargo.

- Exporters who ship routinely generally use open cover marine insurance.

Understanding a Voyage Policy

Voyage policies are commonly used by exporters who need marine shipping only occasionally or for relatively small amounts of cargo. Large exporters who ship by sea routinely tend to prefer open cover marine insurance, which covers all cargo shipped by the policyholder for a specified time period.

A voyage policy covers unforeseen risks but not preventable risks. For a voyage policy to be valid, the vessel transporting the cargo must be in good condition and capable of making the journey, and the vessel's crew must be competent.

A voyage policy is in effect only while the ship is at sea; additional insurance is needed to cover losses during loading and unloading of cargo.

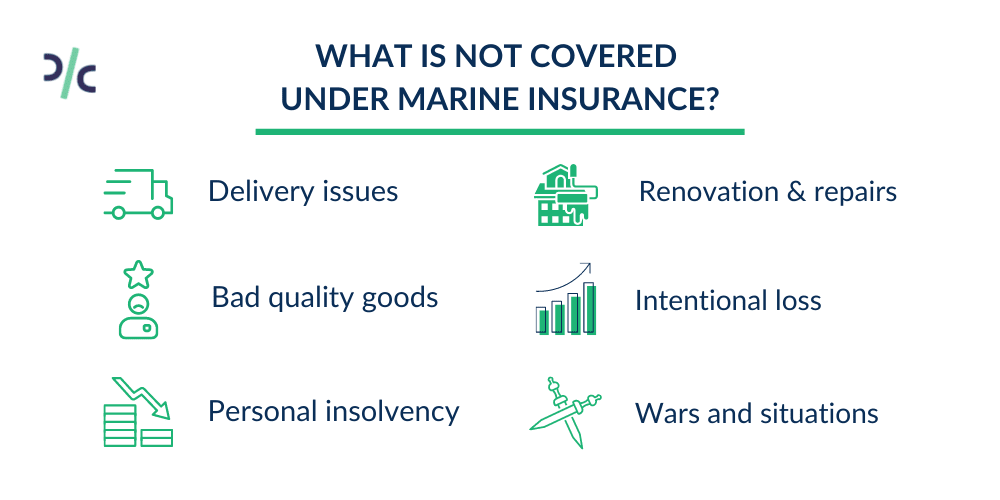

Voyage policies generally cover accidental damage and collisions as well as natural disasters. Losses due to delays may be covered as well. Voyage policies may specifically exclude losses caused by willful misconduct, ordinary leakage, ordinary wear and tear, improper or inadequate packaging, and labor strikes. Acts of war and terrorist activity also are usually excluded.

The policyholder may need to purchase additional insurance to cover the cargo during the entire transport process as voyage policies typically exclude losses that occur during the loading and unloading of the cargo.

The policy is in place for the duration of the voyage, however long it takes. If there are unanticipated delays en route, the coverage remains in place. This allows for factors such as inclement weather at sea or a shortage of docking at the destination port.

Because each policy is specific to a particular cargo and voyage, all details of both are recorded in the policy contract.

:max_bytes(150000):strip_icc():format(webp)/carriage-paid-cpt.asp-final-1f5aad52797e4f43b8e9e2fd06e99145.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

What is a voyage policy? Definition and examples

The term ‘cargo’ refers to goods or produce that are transported by sea, land, or air.

Voyage policies, which protect just the goods in transit and not the vessel, are important for businesses involved in international trade. International trade includes the exportation and importation of goods.

Investopedia has the following definition of the term :

“A voyage policy is marine insurance coverage for risks to a ship’s cargo during a specific voyage.”

Voyage policies have several inclusions. Among them are damage due to faulty packaging or crew misconduct. This type of policy does not usually cover preventable risks. The policyholder will need to buy a separate policy to cover preventable risks.

Voyage insurance not time-based

Most insurance policies are time-based, but not this type. The policy expires as soon as the vessel arrives at its destination.

Exporting companies that need marine shipping only occasionally use this type of insurance the most. It is also useful for companies exporting a relatively small amount of cargo by sea .

Major exporters that deliver their goods by sea regularly prefer open cover marine insurance. Open cover protects all the cargo that the policyholder ships for a specified period.

Regarding a voyage policy, DieselShip.com says the following :

“The policy would be issued before the inception of the voyage. At the time of taking a specific voyage insurance policy, it is essential to give the complete details of the risk along with complete information about the bill of lading, vessel name, etc.”

The voyage policy covers the cargo during the whole voyage by sea, even if there are unexpected or unforeseen delays en route.

Marine insurance – a brief history

Marine insurance dates back to Ancient Greece and Rome. It wasn’t until the fourteenth century that proper marine insurance contracts were developed. These took place in Genoa and other Italian towns. From there, they spread to northern Europe.

Lloyd’s Coffee House, which opened in Tower Street in London in 1686, was the world’s first marine insurance market. People who worked in the shipping industry wanting to insure cargoes and ships would meet at Lloyd’s Coffee House. Individuals willing to act as underwriters also met there.

According to Risk & Insurance:

“ Lloyd’s Coffee House specialized in information about shipping. At this time, there were more than 80 coffee houses within the City of London’s walls, each claimed its own specialization.”

“By the 1730’s, Lloyd’s was emerging as the spot for marine underwriting by individuals.”

Share this:

- Renewable Energy

- Artificial Intelligence

- 3D Printing

- Financial Glossary

Cult of Sea

Maritime Knowledge base

What is a Marine Policy? Basics you need to know!

- 1.1 1. Voyage Policy

- 1.2 2. Time Policy

- 1.3 3. Valued Policy

- 1.4 4. Unvalued Policy

- 1.5 5. Floating Policy (Cargo Insurance)

- 2.1 Effects of Deviation on Marine Policy

- 2.2 When is deviation excused as per Marine Insurance Act?

- 3.1 Additional Perils

- 4.1 Pollution Hazard Clause

- 4.2 Collision Liability or 3/4th clause

- 5 Exclusions in a Marine Hull Policy

A contract of Marine Insurance shall not be submitted in evidence unless it is embodied in a Marine Policy accordance with Marine Insurance Act. The policy may be executed and issued either at the time when the contract is concluded or afterwards.

Dictionary Meaning of ” POLICY ” : A set of ideas or a plan of what to do in particular situations that has been agreed to officially by a group of people, a business organization, a government, or a political party.

Before proceeding further, please go through an example below:

A Marine Policy must specify the following:

- Name of the assured or the person who effects the insurance on his behalf;

- Subject matter insured and the risks insured against;

- Voyage or period of time or both;

- Amount insured;

- Names of the insurer(s);

- Signature of the insurer.

A marine policy must be signed by or on behalf of the insurer.

Types of Marine Policy

1. voyage policy.

When the contract is to insure the subject matter at and from or from one place to another, it is called Voyage Policy.

2. Time Policy

When the contract is to insure the subject matter for a definite period of time, it is called Time Policy. A time policy can be made for a maximum period of 12 months. A contract for both time and voyage may be included in the same policy.

3. Valued Policy

A Valued Policy is the one which specifies an agreed value of the subject-matter insured. The value fixed by the policy is as between the insurer and assured, conclusive of the insurable value of the subject matter intended to be insured irrespective of whether the loss is total or partial.

4. Unvalued Policy

An unvalued policy is the one which does not specify the value of the subject-matter insured. The insurable value of the subject matter is to be subsequently ascertained in the manner as mentioned in the insurance policy.

5. Floating Policy (Cargo Insurance)

It describes the insurance in general terms and leaves the names of the ships and other particulars to be defined by a subsequent declaration. The subsequent declaration may be made by an endorsement on the policy.

A deviation occurs where the vessel leaves the stated or customary course of the voyage with the intention of returning to that course and completing the voyage.

Effects of Deviation on Marine Policy

The liability of the insurer ceases immediately after the deviation occurs. Where a ship without lawful excuse deviates from the voyage contemplated by the policy, the insurer is discharged from the liability as from the time of deviation and it is immaterial that the ship may have regained her route before any loss occurs.

When is deviation excused as per Marine Insurance Act?

- When authorised by any special term in the policy or,

- When caused by circumstances beyond the control of the Master and employer or,

- Where reasonably necessary for complying with expressed or implied warranty or,

- When reasonably necessary for the safety of the ship or subject-matter insured or,

- For the purpose of saving human life or aiding a ship in distress where human life is in danger or,

- When reasonably necessary for all the purpose of obtaining medical or surgical aid for any person on board the ship or,

- Where caused by the Barratrous Act of the Master or crew, if barratry is one of the perils insured against.

When the cause of exercising the deviation ceases to operate, the ship must resume her course.

Insured Perils in a Marine Hull & Machinery Policy

- Perils of the sea, river, lakes and other navigable waters

- Fire Explosion

- Violent theft by a person outside the vessel

- Breakdown of or accident to nuclear installation or reactors

- Contact with aircraft or similar flying objects falling from the land conveyance, dock or harbour equipment or installation

- Earthquake, volcanic eruption or lightning

Additional Perils

- Accident in loading, discharging or shifting cargo or fuel

- Bursting of boilers, breakage of the shaft or any latent defect in Hull and Machinery (H&M)

- Negligence of Master, crew, officers or pilots

- Negligence of Charterer

- Negligence of Repairer

- Barratry by Master, officers or Crew.

Other Clauses in Marine Policy

Pollution hazard clause.

It covers loss or damage to the vessel caused by any governmental authority acting under the powers vested in it to prevent or mitigate a pollution hazard or threat.

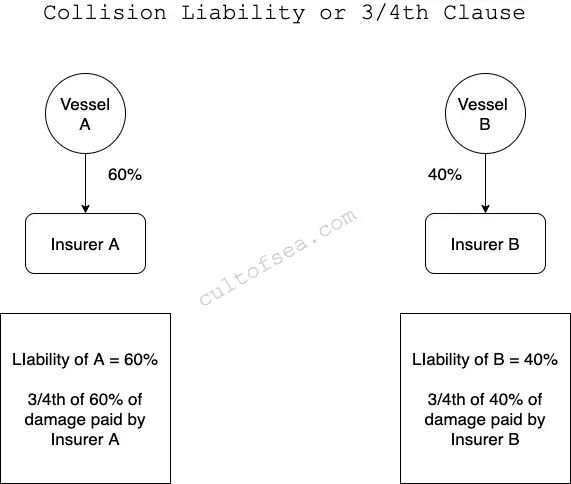

Collision Liability or 3/4th clause

Underwriters agree to indemnify the Assured for three-fourths of any sum or sums paid by the Assured to any other person or persons by reason of the Assured becoming legally liable by way of damages for:

- loss of or damage to any other vessel or property on any other vessel

- delay to or loss of use of any such other vessel or property thereon

- the general average of, salvage of, or salvage under contract of, any such other vessel or property thereon,

where such payment by the Assured is in consequence of the Vessel hereby insured coming into collision with any other vessel.

The remaining 1/4th of the liability is covered by the P&I club. This is called the 1/4th or 4/4th liability clause.

Exclusions in a Marine Hull Policy

- War, Civil War, Revolution

- Capture and Seizure arrest, restraint

- Derelict mines, torpedos or weapons of war

- Malicious Acts

- Nuclear Explosions

- Negligence of the assured

- Breach of Warranty

- Wrongful Disclosure

- International Institutions and their Association with…

- International Maritime Organization or IMO: what it is, what…

- UNCLOS - Salient Features, Objectives, Maritime Zones,…

- Port State Control (PSC) - An agreed regime for the…

- What is General Average & the importance of York-Antwerp…

- ISPS code - A measure to enhance the security of Ships and…

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Law Explorer

Fastest law search engine.

If you have any question you can ask below or enter what you are looking for!

- Law Explorer /

- MARITIME LAW /

TIME AND VOYAGE POLICIES

CHAPTER 4 TIME AND VOYAGE POLICIES INTRODUCTION Section 25(1) of the Act states: Where the contract is to insure the subject matter at and from, or from one place to another or others, the policy is called a ‘voyage policy’, and where the contract is to insure the subject matter for a definite period of time, the policy is called a ‘time policy’. A contract for both voyage and time may be included in the same policy. Thus, the Act provides for a contract of marine insurance to be in the form of: (a) a time policy; (b) a voyage policy; or (c) a mixed policy (both time and voyage). However, whilst it is the Act which lays down the statutory framework governing such policies of insurance, it is the Institute Clauses which determine the terms and conditions by which the parties to the insurance are governed. TIME POLICY A definite period of time The Act, in s 25(1), defines a ‘time policy’ as a policy ‘…where the contract is to insure the subject matter for a definite period of time…’. Ordinarily, the cover provided by the insurance will commence at a time and date specified by the policy and terminate at another time and date designated by the policy. Should, however, only the date of commencement and the date of termination of cover be stipulated by the policy, the actual time on those respective dates not being specified, the policy is said to run from 0000 hours on the day of commencement to 2400 hours on the day of termination. This was confirmed in the case of Scottish Metropolitan Assurance Co v Steward , below. Scottish Metropolitan Assurance Co v Steward (1923) 15 LlL Rep 55 A voyage policy of insurance was reinsured by the plaintiffs with the defendants whereby the steamship Earlshaw was covered against marine losses ‘from 20 September 1922, inclusive, to noon 20 February 1923’. When Earlshaw was actually lost at 7.30 pm on 20 September 1922, after being found abandoned in the North Sea, the insurers questioned whether the risk had attached at the time of the loss. The court ruled that the insurers were liable for the loss. It was the duty of the court to try and interpret the words in the contract of insurance in accordance with intention of the parties to that contract and, when only the dates and not the times were given to indicate the commencement and termination of the policy, the whole of those dates were to be included in the cover. Rowlatt J: [p 409] …As to the effect of fixing a period from a named day, it was clear that there was no technical rule of construction to be applied; the words must be construed in accordance with the intention of the parties as it could be gathered from the circumstances of the case…according to the ordinary construction of the English language, when two days were mentioned as the dates on which a period began and ended, both those days were included in that period. People only mentioned days with which they were actually concerned; for example, if it was said that the court sat from Monday to Friday in each week, or that the year ran from 1 January to 31 December, the days at each end of the period were included…this insurance expressed to run from 20 September included 20 September, and the risk had, therefore, attached before the vessel sank. Although the majority of time policies are underwritten for 12 month periods, there is no longer any statutory limit to the time period over which the policy may provide cover. 1 Time policy containing an extension clause One of the issues which arose in the Eurysthenes , case, below, was whether a policy of insurance which provided cover from a certain date, but did not contain a ‘definite’ termination date, was, in fact, a time policy within the meaning of s 25(1). Counsel for the shipowners submitted that the policy could not be a time policy because, once the policy had attached, it only terminated after notice was given by either the assured or the P & I Club; there was no actual date of termination. In the context of the case, this was an important point which was, however, rejected by the Court of Appeal. Compania Maritima San Basilio SA v Oceanus Mutual Underwriting Association (Bermuda) Ltd, ‘Eurysthenes’ [1976] 2 Lloyd’s Rep 171, CA The plaintiffs entered their vessel Eurysthenes with the defendant P & I Club to be covered for class 1 risks. The Club rules stated: [r 9] ‘…the ship shall be deemed to be entered in the Association from the time stated in the certificate and such entry shall continue from Policy year to year unless notice to the contrary be given…’; and [r 17] ‘A Member may terminate the entry of an entered ship by giving to the managers not less than two months’ notice in writing…and the Association may at any time discontinue the insurance of a Member…by giving him seven days’ notice in writing…’. Eurysthenes stranded on a voyage from the USA to the Philippines. The P & I Club contended that Eurysthenes was unseaworthy and, as the owners were privy to that unseaworthiness under s 39(5), the insurers were not liable. 2 The owners put forward the argument that s 39(5) did not apply, because the policy in question was not a true time policy as defined by s 25(1). Both the shipowners and the P & I Club sought guidance from the court as to their positions under the policy. The Court of Appeal ruled that the policy was, in fact, a time policy; there were only two types of marine policy—time or voyage, or a combination of both. Roskill LJ: [p 180] …Mr Mustill [for the shipowners] accepted that the club cover was a contract of marine insurance within s 1 of the 1906 Act, and that there was here a marine adventure within s 3(1) and (2)(c) of that Act which was properly the subject of a contract of marine insurance. But he sought to argue that s 25(1) did not create a statutory dichotomy between time policies and voyage policies, notwithstanding that that sub-section allows a policy of marine insurance to include a contract both for voyage and for time. There was room, he argued, for a contract of marine insurance which was neither a voyage nor a time policy nor a combination of the two…Therefore, it was said that this was not a 12 months’ policy, nor was it a policy for a ‘definite’ period, because there were so many events which might either extend or abridge its duration. [p 181] …It seems to me plain…that whether one looks at this matter simply as one of the construction of s 25 of the 1906 Act, coupled with s 23 of that Act, or more elaborately as one of the construction of those sections against the background of the revenue legislation enacted in the Stamp Act 1891, as amended by the Finance Act 1901, there is a clear statutory dichotomy between time and voyage policies, a combined time and voyage policy being also permitted. In short, a policy of marine insurance must be one or the other or both, but it cannot be something else. …I am, therefore, clearly of the view that a policy for a period of time and not for a voyage does not cease to be a time policy as defined merely because that period of time may thereafter be extended or abridged pursuant to one of the policy’s contractual provisions. The duration of the policy is defined by its own terms and is thus for a ‘definite period of time’. In my view, the word ‘definite’ was added to emphasise the difference between a period of time measured by time and a period of time measured by the duration of a voyage. Time policy with a geographical limit A geographical limitation placed upon a time policy does not change that time policy into a mixed policy. The policy remains fundamentally a time policy, even though it only covers voyages within the prescribed geographical limits. In Wilson v Boag [1957] 2 Lloyd’s Rep 564, the plaintiff owner of a motor launch insured her for four months on the basis that the policy provided cover for losses incurred within a 50 mile radius of Port Stephens. When a loss occurred within that 50 mile radius, but on a voyage intended to go as far as Sydney, 90 miles away, the insurers refused payment, contending that the policy was both a time policy and a voyage policy (mixed), and the cover only extended to voyages undertaken within the prescribed geographical limits. The Supreme Court of New South Wales ruled that the policy was a time policy only and, as the loss occurred within the prescribed geographical limit of 50 miles, the insurers were liable. Supreme Court of New South Wales: [p 565] …The plaintiff contends that, on the true construction of the policy, the launch was covered if a loss by a peril insured against occurred within the limits of the area set by the policy…and that at the time of the loss it was proceeding within that area to a destination outside it is irrelevant. The defendant contends that the policy is a ‘mixed policy’, that is to say, that it is both a time and voyage policy; that the only ‘voyages’ covered by the policy are those made within the prescribed perimeter; and that a ‘voyage’ embarked upon and designed to take the launch outside that perimeter was not within the policy even though the loss may have occurred while the launch was still within the defined geographical area. If the policy is a time and voyage policy, then it would not attach to a voyage embarked upon for the purposes of taking the launch to Sydney, even if the loss was sustained at a time when the launch in the course of its journey was within the geographical limit described in the policy. …On the whole, we are of opinion that the policy here in question should not be construed as a voyage policy attaching only to voyages intended to begin and end within the perimeter and to remain wholly within it. It is to be regarded rather as a time policy in which is contained a limitation of the liability of the insurer to loss sustained while the launch is within a defined geographical area. We think that the policy covers loss occurring within the perimeter even though the launch was then in the course of proceeding to a point outside it. That seems to us to be the natural meaning to be given to the relevant words. There appear to be no reported cases precisely in point, and to apply the rules of law relating to commercial voyage policies to this case seems to us to be somewhat unreal, and not to be warranted by anything to be found in the terms of the contract. The Navigation Clause The Navigation Clause, cl 1 of the ITCH(95), is identical to the equivalent Navigation Clause contained within the IVCH(95), except for cl 1.5, the ‘Scrapping Voyage Clause’, which is only relevant to a time policy of insurance. The purpose of the Navigation Clause is to confirm expressly that cover is provided for those less usual seaborne operations which may be considered to fall outside normal practice. At all times The first part of cl 1.1 states: The Vessel is covered subject to the provisions of this insurance at all times and has leave to sail or navigate with or without pilots, to go on trial trips and to assist and tow vessels or craft in distress… Thus, the Clause confirms that cover is provided by the policy at all times whilst the insured vessel: (a) sails or navigates with or without pilots; (b) goes on trial trips; and (c) assists and tows vessels or craft in distress. Towage and salvage warranty Having established those marine operations under which the policy remains in force, the second part of cl 1.1 confirms, by way of a warranty, those towage and salvage operations which are or are not covered by the policy: …but it is warranted that the Vessel shall not be towed, except as is customary or to the first safe port or place when in need of assistance, or undertake towage or salvage services under a contract previously arranged by the Assured and/or Owners and/or Managers and/or Charterers. This Clause 1.1 shall not exclude customary towage in connection with loading and discharging. That is, it is warranted that the vessel shall not: (a) be towed, except as is customary or to the first safe port or place when in need of assistance; 3 or (b) undertake towage or salvage operations under a contract previously arranged by the assured and/or owners and/or managers and/or charterers. But the warranty does not apply when the vessel is engaged in ‘customary towage in connection with loading and discharging’. Clause 1.2 of the Navigation Clause then goes on to qualify the conditions laid down in cl 1.1. Clause 1.2 states: This insurance shall not be prejudiced by reason of the Assured entering into any contract with pilots or for customary towage which limits or exempts the liability of the pilots and/or tugs and/or towboats and/or their owners when the Assured or their agents accept or are compelled to accept such contracts in accordance with established local law or practice. The Clause thus recognises the fact that some pilotage and towage contracts must be entered into in accordance with local law and practice; in particular where such contracts limit or exempt the liability of pilots, tugs and tug owners. In such circumstances, cl 1.2 ensures that the insurance cover remains in force. 4 The use of helicopters Clause 1.3 acknowledges that, with many modern marine operations, helicopters are utilised to transport personnel, supplies and equipment to and from a vessel. Thus, cl 1.3 states: The practice of engaging helicopters for the transportation of personnel, supplies and equipment to and/or from the Vessel shall not prejudice this insurance. Trading operations entailing loading and discharging operations at sea In the event of loading and discharging operations taking place at sea between two vessels, the ships would have to be ‘ranged’ alongside each other. Not surprisingly, such practice greatly increases the risk of contact and collision damage being sustained by either or both of the vessels. Thus, because of the hazardous nature of the operation and the attendant increase in risk, cl 1.4, often referred to as the ‘Ranging Clause’, confirms that such ‘trading’ 5 operations are not covered by the policy unless the vessels being loaded from or discharged into are ‘harbour or inshore craft’. Further, in recognition of the fact that transhipment is now a feature of modern sea-going operations, underwriters are prepared to undertake such risks provided that previous notice is given and the amended terms of cover and any additional premium is agreed. To this effect, cl 1.4 affirms: In the event of the Vessel being employed in trading operations which entail cargo loading or discharging at sea from or into another vessel (not being a harbour or inshore craft), no claim shall be recoverable under this insurance for loss of or damage to the Vessel or liability to any other vessel arising from such loading or discharging operations, including whilst approaching, lying alongside and leaving, unless previous notice that the Vessel is to be employed in such operations has been given to the Underwriters and any amended terms of cover and any additional premium required by them have been agreed. It is emphasised that the Clause excludes cover not only to the insured ship itself, but also liability for any damage caused to the other vessel. Thus, in such circumstances, it must be presumed that, in the event of any collision damage occurring between the two ships engaged in transhipment at sea, whether approaching, moored or leaving, the 3/4ths Collision Liability Clause, 6 would be ineffective. The Continuation Clause Clause 2 of the ITCH(95), the Continuation Clause, states that: Should the Vessel at the expiration of this insurance be at sea and in distress or missing, she shall, provided notice be given to the Underwriters prior to the expiration of this insurance, be held covered until arrival at the next port in good safety, or if in port and in distress until the vessel is made safe, at a pro rata monthly premium. Thus, provided that notice is given to the underwriter prior to the expiration of the insurance , the vessel is held covered even though she is: (a) at sea and in distress or missing—in which case, the vessel is held covered until arrival at the next port in good safety; or (b) in port and in distress – in which case, the vessel is held covered until she is made safe. However, the fact that the vessel may be held covered under the Continuation Clause, thereby extending the period of insurance, does not mean that the policy is anything other than a time policy within the meaning of s 25(1) of the Act. Reference to this was made by Lord Denning in the case of Compania Maritima San Basilio SA v Oceanus Mutual Underwriting Association (Bermuda) Ltd, ‘Eurysthenes’ [1976] 2 Lloyd’s Rep 171, CA, the facts of which were cited earlier. 7 Lord Denning MR: [p 177] …Mr Mustill [for the shipowners] stressed the word ‘definite’ in s 25. This means, I think, that the period must be specified. But it is, I think, sufficiently specified if it specifies a stated period, even though that period is determinable on notice, and even though the assurance will be renewed or continued automatically at the end of the period, unless determined; or will continue under a continuation clause. This is supported by the fact that, in an ordinary time policy, the Institute Time Clauses (Hulls) include a continuation provision in cl 4 [now cl 2], but that does not prevent the policy being a time policy. The Termination Clause Automatic termination A time policy of insurance will, under normal circumstances, expire on the date specified in that policy. However, ‘unless the underwriters agree to the contrary in writing’, a time policy of insurance will terminate automatically should any of the conditions laid down in cl 5, the Termination Clause, not be met. The importance of the Clause lies in the fact that it is prefaced with a paramount clause, in bold print, declaring: This Clause 5 shall prevail notwithstanding any provision whether written typed or printed in this insurance inconsistent therewith. The significance of the words ‘automatic termination’ in cl 5.1 is that, unlike the breach of a promissory warranty which a breach of cl 4, the Classification Clause, amounts to, there is no question of the breach being waived by the insurers; the contract of insurance is automatically terminated. The Termination Clause is in two parts: the first part deals with ‘classification’, and the second with ‘change of ownership or flag’ and related matters. It is emphasised that cl 5, the Termination Clause, must be read in conjunction with cl 4, the Classification Clause, discussed below. 8 As will be seen, there is a degree of overlap between these two Clauses on matters pertaining to classification societies and maintenance of class. Classification Clause 5.1 of the ITCH(95) confirms that: Unless the Underwriters agree to the contrary in writing, this insurance shall terminate automatically at the time of… change of the Classification Society of the Vessel, or change, suspension, discontinuance, withdrawal or expiry of her Class therein, or any of the Classification Society’s periodic surveys becoming overdue unless an extension of time for such survey be agreed by the Classification Society, provided that if the Vessel is at sea, such automatic termination shall be deferred until arrival at her next port. However, where such change, suspension, discontinuance or withdrawal of her Class or where a periodic survey becoming overdue has resulted from loss or damage covered by Clause 6 of this insurance or which would be covered by an insurance of the Vessel subject to current Institute War and Strikes Clauses Hulls—Time, such automatic termination shall only operate should the Vessel sail from her next port without prior approval of the Classification Society or in the case of a periodic survey becoming overdue without the Classification Society having agreed an extension of time for such survey… Thus, unless the underwriters agree to the contrary in writing, the insurance will terminate automatically at the time of: (a) change of the Classification Society of the vessel; or (b) change, suspension, discontinuance, withdrawal or expiry of her class therein; or (c) any of the Classification Society’s periodic surveys becoming overdue, unless an extension of time for such survey be agreed by the Classification Society. Change of classification society Clause 5.1, the Termination Clause provides for an automatic termination of the policy in the event of a ‘change of the Classification Society of the Vessel’. In this connection, there is a degree of overlap between cl 4.1.1 of the Classification Clause and cl 5.1, the Termination Clause. But, as the Termination Clause is expressly confirmed as prevailing over other provisions in the insurance, there must be ‘automatic termination’ of the insurance in the event of a change of classification society or a failure to maintain class, unless, of course, the underwriters agree to the contrary in writing. The only other proviso made by cl 5.1 with regard to automatic termination is that: ‘…if the vessel is at sea, such automatic termination shall be deferred until arrival at her next port.’ 9 Change, suspension, discontinuance, withdrawal or expiry of class Again, a degree of overlap can be seen here, in that cl 5.1, the Termination Clause, has also concerned itself specifically with ‘change, suspension, discontinuance, withdrawal or expiry’ of Class. Clause 4.1 is, however, couched in more general terms, that ‘her class within that Society be maintained’. Though it is expressly stated that its breach will result in discharging the insurer from liability, nevertheless, as described earlier, the paramount clause in the Termination Clause will take precedence and the contract will be automatically terminated. However, cl 5.1 offers a reprieve in its proviso, that termination of the policy will not operate: …where such change, suspension, discontinuance, withdrawal or expiry of her class has resulted from loss or damage covered by Clause 6 of this insurance or which would be covered by an insurance of the Vessel subject to current Institute War and Strikes Clauses Hulls—Time… But, termination will automatically take place ‘should the Vessel sail from her next port without prior approval of the Classification Society…’. So, what is meant by a ‘withdrawal’ of class or a failure to maintain class? This issue was considered in the Caribbean Sea case, below. Prudent Tankers Ltd SA v Dominion Insurance Co Ltd, ‘Caribbean Sea’ [1980] 1 Lloyd’s Rep 338 The tanker Caribbean Sea was insured under a policy incorporating the American Institute Hulls Clauses and classified by Bureau Veritas. When she sank in fair weather conditions whilst on a voyage from the Panama Canal to Tacoma, because of the circumstances surrounding the loss, the issue of classification arose. The insurers contended that they were not liable under the policy, because a previous minor grounding had invalidated her class. A ship’s class, the court decided, could only be withdrawn by the classification society if the ship had not been kept in proper condition or had not been subjected to surveys as required under the classification society’s rules. On confirmation of the rules laid down by way of a letter from the classification society regarding class, the court differentiated between ‘loss of validity of the classification certificate’ and ‘withdrawal of class’. Robert Goff J: [p 349] …M Ollivier, head of the relevant department of Bureau Veritas, wrote as follows on 7 June 1979: The Society’s Rules differentiate between the loss of validity of the classification certificate, which is an automatic consequence of the omission of the owner to fulfil his obligations towards the Society, and the withdrawal of class, which requires a positive act from the Society. After a grounding and in order to revalidate the classification certificate, the owner or his representative must, in conformity with regulation 2– 14.11 (1977 Rules), call in a surveyor. When Caribbean Sea was on transit in the Panama Canal and stopped at Cristobal and Balboa in May 1977, the Society did not have a surveyor in the area. In the absence of a BV surveyor, the ship’s captain should have, in conformity with regulation 2–14.14, notified BV Head Office in Paris of the grounding. At that time, the Society had a surveyor available for survey at Tacoma. …In the case of Caribbean Sea , apart from the automatic invalidation of the classification certificate rendering the class position irregular (if the vessel grounded in the Maracaibo Canal on 20 May 1977), the Society has no knowledge of any other circumstances which would have affected the class position of the vessel at the date of her loss. It is clear from this letter that, on the interpretation placed by Bureau Veritas on their own rules, and on the application of these rules to the events which occurred, the ship’s class was not, in fact, affected. It follows, in my judgment, that for this reason alone, the underwriters are unable to say that the ship’s class was changed, cancelled or withdrawn, and accordingly, their argument based on the hull clauses fails. But even if I am wrong in this conclusion and I have to decide the point as a matter of the construction which I myself would place upon r 2–14, I would reach the same conclusion. The words of 2–14.11 are, in my judgment, plain. They state that ‘the classification certificate loses its validity’. I can see no reason why I should give these words any other than their natural and ordinary meaning. As M Ollivier states, the rules themselves distinguish between the classification certificate, and the ship’s actual class. …The rule therefore refers expressly to r 2–14, and provides that, if the ship has not been subjected to the surveys as required by that rule, her class may be withdrawn. Now if the underwriters’ submission was correct, that rule would be nonsensical, because on their argument, the vessel’s class would already have automatically ‘lost its validity’ by virtue of the grounding or damage; if that were so, it would be otiose, indeed inconsistent, to provide that, in the event of a failure to subject the ship to a survey following such grounding or damage the vessel may lose her class. For this reason alone, I can see no reason why I should depart from the natural and ordinary meaning of the words of r 2–14.11; and it follows once again that there was, by virtue of the grounding, no change, cancellation or withdrawal of the ship’s class, and the underwriters’ argument fails. Periodic survey becoming overdue An ‘automatic termination’ of the contract of insurance would arise should any requirement by the Classification Society to undertake periodic surveys not be adhered to. The only exception to the rule is, as in the case of a ‘change, suspension, discontinuance, withdrawal or expiry of class’, where ‘a periodic survey becoming overdue has resulted from loss or damage covered by Clause 6 or which would be covered by an insurance of the Vessel subject to current Institute War and Strikes Clauses Hulls—Time’. But, ‘should the Vessel sail from her next port…without the Classification Society having agreed an extension of time for such survey, the policy will terminate automatically’. Change of ownership or flag Clause 5.2 of the Termination Clause states that: Unless the Underwriters agree to the contrary in writing, this insurance shall terminate automatically at the time of: …any change, voluntary or otherwise, in the ownership or flag, transfer to new management, or charter on a bareboat basis, or requisition for title or use of the Vessel, provided that, if the Vessel has cargo on board and has already sailed from her loading port or is at sea in ballast, such automatic termination shall if required be deferred, whilst the Vessel continues her planned voyage, until arrival at final port of discharge if with cargo or at port of destination if in ballast. However, in the event of requisition for title or use without the prior execution of a written agreement by the Assured, such automatic termination shall occur 15 days after such requisition whether the Vessel is at sea or in port. The primary purpose of cl 5.2 of the Termination Clause is to protect the insurer from changes in the vessel’s status with respect to: (a) any change in the ownership; (b) any change in the flag; (c) transfer to new management; (d) charter on a bareboat basis; or (e) requisition for title or use, all of which would materially alter the risks insured. But, if required, the ‘automatic termination’ may be deferred until arrival at the final port of discharge, if the vessel has cargo on board and has already sailed from her loading port. Similarly, it may also be deferred to the port of destination, if the vessel is in ballast and has already sailed. With respect to a ‘requisition’ which takes place without the prior execution of a written agreement to that requisition by the assured, termination shall occur 15 days after the requisition, regardless of whether the vessel is at sea or in port. The corollary of this is that, should the vessel be requisitioned ‘with’ the prior execution of a written agreement by the assured, there would be no period of grace, and the policy would terminate as from the time of that agreement. Return of premium The Termination Clause, cl 5, of the ITCH(95) concludes with a reference to return of premium in the event of ‘automatic termination’, when it states: A pro rata daily return of premium shall be made provided that a total loss of the Vessel, whether by insured perils or otherwise, has not occurred during the period covered by this insurance or any extension thereof. That is, unless there has been a total loss of the insured vessel, whether or not that loss has been caused by a peril insured against, there will be a pro rata return of premium. The Classification Clause Clause 4.1 of the Classification Clause states: 10 4.1 It is the duty of the Assured, Owners and Managers at the inception of and throughout the period of this insurance to ensure that: 4.1.1 the Vessel is classed with a Classification Society agreed by the Underwriters and that her class within that Society is maintained; 4.1.2 any recommendations requirements or restrictions imposed by the Vessel’s Classification Society which relate to the Vessel’s seaworthiness or to her maintenance in a seaworthy condition are complied with by the dates required by that Society. Clause 4.2 of the Classification Clause then goes on to spell out the effect of a breach of any of the conditions contained within cl 4.1, when it affirms: 4.2 In the event of any breach of the duties set out in Clause 4.1 above, unless the Underwriters agree to the contrary in writing, they will be discharged from liability under this insurance as from the date of the breach provided that if the Vessel is at sea at such date the Underwriters’ discharge from liability is deferred until arrival at her next port. For all intents and purposes, the duties imposed by cl 4.1 are warranties, the breach of which should now, in the light of the Good Luck case on promissory warranties, automatically discharge the insurer from liability. 11 The conditions set out in cl 4.1.1 of the Classification Clause are complementary to, and in some respects mirror, the classification conditions laid down under the Termination Clause, cl 5, discussed earlier. 12 However, by reason of the paramount clause incorporated into the Termination Clause, it must be remembered that the latter will have precedence over the Classification Clause and any breach with respect to classification, without agreement from the underwriters in writing, must bring about an ‘automatic termination’ of the contract of insurance. Though there is a degree of overlap between cl 4.1.1 (on classification) and cl 5 (the Termination Clause), cl 4.1.2, on the subject of seaworthiness, is, however, not covered by the Termination Clause. Regarded as the most significant provision of the Classification Clause, cl 4.2 is by no means to be read as introducing a warranty of seaworthiness into a time policy: its scope is confined specifically to ‘recommendations, requirements or restrictions’ imposed by the vessel’s Classification Society on matters relating to the vessel’s seaworthiness and her maintenance in a seaworthy condition. It is the failure to comply with such recommendations, etc, that constitutes a breach of the clause. Whether the vessel is, or is in fact not, rendered unseaworthy by reason of the failure to comply is beside the point. It is to be noted that cl 4.2—stipulating the effect of discharge from liability – is applicable only to a breach of cl 4.1. The legal consequences of a breach of cl 4.3, for a failure to report ‘any incident condition or damage in respect of which the Vessel’s Classification Society might make recommendations as to repairs or other action’, and of cl 4.4, for ‘failure on the part of the Assured to provide the necessary authorisation so as to enable the Underwriters to approach the Classification Society directly for information and/or documents’, are not stated. VOYAGE POLICY A voyage policy of insurance, whether it be on ship, goods or freight, is defined by s 25(1) of the Act in the following terms: Where the contract is to insure the subject matter at and from, or from one place to another or others, the policy is called a ‘voyage policy’ … Whilst it is accepted that most ships are now insured under time policies of insurance, for practical reasons, there is nothing to prevent a voyage policy on ship being effected, particularly in the event of one-off voyages. However, there are many old constraints and problems, associated with voyage policies, which do not apply to time policies. Goods, on the other hand, are almost invariably insured under voyage policies and, because of their importance, will be dealt with separately. Voyage policy on ship Over the years, a major issue associated with voyage policies has been that of determining when the policy ‘attaches’ and ‘terminates’. Section 25(1) describes a voyage policy as a policy where the contract is to insure the subject matter ‘at and from’ or ‘from’ one place to another. Furthermore, unless the policy provides otherwise, the words ‘from’ or ‘at and from’ must have the meaning given to them by rr 2 and 3 of the Rules for Construction contained within the Act. The policy attaches ‘from’ a particular place Rule 2 of the Rules for Construction states: Where the subject matter is insured ‘from’ a particular place, the risk does not attach until the ship starts on the voyage insured. Where a voyage policy is characterised as being ‘from’ a particular port or place, for the policy to attach, the vessel must have left her moorings or broken ground with the intention of starting upon the actual voyage insured. Simply moving from moorings to an anchorage in readiness to sail is not to be construed as the commencement of the insured voyage, as was shown in Sea Insurance Co v Blogg , below. Sea Insurance Co v Blogg [1898] 2 QB 398, CA This was a claim on a reinsurance policy on goods where a vessel was lost on a voyage from Newport News, Virginia, to London. The policy had been underwritten to attach on or after 1 March 1896. Late on 29 February 1896, the steamship Masacoit completed her loading at the wharf at Newport News and the master then moved her from the wharf to an anchorage in the James River in readiness for departure in the morning. Evidence was provided to show that the master had moved the ship in order to stop his crew going ashore and getting drunk. The following morning, 1 March, the Masacoit sailed for London and was lost. When the insurers claimed on their policy of reinsurance, the reinsurers refused payment, on the basis that the voyage had commenced on 29 February and, therefore, the policy had not, in compliance with the policy attached ‘on or after 1 March’. The Court of Appeal upheld the decision of the trial judge and ruled that the reinsurers were liable under the policy. The moving of the ship on the night of 29 February was not intended to be the commencement of the insured voyage; the voyage did not actually commence until the following morning, 1 March. AL Smith LJ: [p 400] …I think that the evidence is conclusive that it was not the intention that the ship should sail when she was moved from the quay that night, but the intention merely was that she should move out into the stream for the night, and should not start on her voyage till the next morning. She was only moved a short distance, namely, about 500 yards, from the wharf in order that the crew might not be able to go ashore and get drunk, and there was no intention of then commencing the voyage. Alteration of port of departure—s 43 Not surprisingly, if a vessel departs on her insured voyage from a port other than that named in the policy, the risk does not attach. This is confirmed by s 43 of the Act, which states: Where the place of departure is specified by the policy, and the ship, instead of sailing from that place, sails from any other place, the risk does not attach. Section 43 is based upon the principle laid down in the old case of Way v Modigliani , below. Way v Modigliani (1787) 2 Term Rep 30 The vessel Polly was insured: ‘…at and from 20 October 1786, from any ports in Newfoundland to Falmouth.’ On 1 October 1786, Polly left Newfoundland to fish on the Grand Banks, from whence she departed for England on 17 October with her catch of fish. Polly was lost on the voyage to Falmouth. When the policy was claimed upon, the court ruled that the insurance had never attached. Buller J: [p 32] …the policy never attached at all. Where a policy is made in such terms as the present to insure a vessel from one port to another, it certainly is not necessary that she should be in port at the time when it attaches, but then she must have sailed on the voyage insured, and not on any other. The above case should be compared with Driscoll v Passmore , below, where the question before the court was whether a ‘leg’ of an overall round voyage could be considered as a separate insurable voyage rather than as a part of the whole. The insurers of the freight to be earned on the leg on which the loss occurred denied liability for that loss, because, they contended, the ship had sailed from the wrong port on the previous leg. Driscoll v Passmore (1798) 1 B&P 200 The vessel Timandra was insured under three policies covering a round voyage from Lisbon to Madeira, thence to Saffi in Africa and back to Lisbon. The policy in question was a policy on freight covering the return voyage from Saffi to Lisbon. When Timandra arrived at Madeira, the crew refused to sail to Saffi, because of the presence of Moorish cruisers in the area. Thus, the captain brought Timandra back to Lisbon before sailing direct to Saffi. Timandra was captured on her return voyage from Saffi to Lisbon. The insurers of the voyage from Saffi to Lisbon refused to pay for the loss because, they contended, the voyage which had been insured was part of a voyage from Madeira to Saffi and back to Lisbon, not from Lisbon to Saffi and back. The latter being a new voyage, therefore, the insurance never attached. The court ruled that the insurers were liable for the loss; the voyage insured was separate from the voyage as a whole, and that part of the voyage had, in substance, been performed. Eyre CJ: [p 203] …It has been argued in support of the rule, that the voyage insured was the third branch of a specific voyage, specifically described in the policy; but I take the voyage insured to be a voyage from Saffi to Lisbon only. …The voyage from Saffi to Lisbon might have been performed with as much ease after the circuitous voyage had taken place (unless a Spanish war had broken out) as in the direct course originally proposed. On what principle then can the underwriters be discharged? The voyage has, in substance, been performed: the ship was diverted from her intended course by circumstances for which no one was to blame, and having arrived at Saffi, took in the cargo which was the original object of the insurance Sailing for a different destination—s 44 Where a vessel sails ‘from’ the agreed place of departure to a place or port other than that specified in the policy, the risk does not attach. To this effect, s 44 of the Act states: Where the destination is specified in the policy, and the ship, instead of sailing for that destination, sails for any other destination, the risk does not attach. Section 44 is based upon the ruling in the old case of Wooldridge v Boydell , below. Wooldridge v Boydell (1778) 1 Doug KB 16 The vessel Molly was insured for a voyage from Maryland to Cadiz. In reality, it was suspected that Molly was engaged in supplying the American army during the War of Independence and was actually bound for Boston. In the event, Molly left Maryland under papers for Falmouth and was captured in the Chesapeake Bay. The fact that her loss occurred before a different course could be set for Falmouth, rather than Cadiz, made no difference, because, where the port of destination was changed, the risk never attached. Lord Mansfield: [p 17] …The policy, on the face of it, is from Maryland to Cadiz, and therefore purports to be a direct voyage to Cadiz. All contracts of insurance must be founded on truth, and the policies framed accordingly… Here, was the voyage ever intended for Cadiz? There is not sufficient evidence of the design to go to Boston, for the court to go upon. But some of the papers say to Falmouth and a market, some to Falmouth only. None mention Cadiz, nor was there any person in the ship, who ever heard of any intention to go to that port…In short, that was never the voyage intended, and, consequently, is not what the underwriters meant to insure. Simon, Israel and Co v Sedgwick [1893] 1 QB 303, CA Goods specifically insured for a voyage from Bradford to Madrid via ‘…any port in Spain this side of Gibraltar’, were lost when they were carried in a ship bound for Cartagena, the other side of Gibraltar. The court held that the policy had not attached. Lindley LJ: [p 306] …The plaintiffs say that, upon the true construction of this policy, this is a policy from Bradford to Madrid. If it is, then I think it is not denied by their opponents that the underwriters would be liable. But it is contended that this is not a policy from Bradford to Madrid; and, on consideration, I have come to the conclusion that the view of the underwriters is right. We must ask ourselves what is the voyage that includes the risks to which I have alluded—the risks printed in type? …The starting point is that the goods were insured from Liverpool to some place this side of Gibraltar. They never were on that voyage; and, that being the case, you cannot extend the policy to cover the risks not included in the voyage for which these goods were insured. That appears to me to be the short answer, and the conclusive answer, to the plaintiffs’ argument. In other words, this policy is not a policy from Bradford to Madrid; and the plaintiffs are unable, by reason of the blunder which has been committed, to bring themselves within the risks which are included in a voyage for which these goods were insured. I think the view taken by the learned judge is right, and that this policy never attached, and, that being so, the memorandum about deviation, or change of voyage, does not affect the question. The policy attaches ‘at and from’ a particular place A ship may be insured under a voyage policy of insurance which specifies that the risk attaches ‘at and from’ a particular port or place. The significance of the words ‘at and from’ are spelt out by r 3 of the Rules for Construction, which states: (a) where a ship is insured ‘at and from’ a particular place, and she is at that place in good safety when the contract is concluded, the risk attaches immediately; (b) if she be not at that place when the contract is concluded, the risk attaches as soon as she arrives there in good safety, and, unless the policy otherwise provides, it is immaterial that she is covered by another policy for a specified time after arrival. However, there is a third scenario, not contemplated by the Act, namely, where the ship has already sailed from the named port at the time the contract is concluded. Thus, with respect to attachment of risk, there are three situations which may arise at the time the contract is concluded: (a) the ship is already at the named port; (b) the ship is not yet at the named port; or (c) the ship has already sailed from the named port. The significance of the word ‘at’ and the words ‘good safety’ will also be considered. The ship is already at the named port If the ship is already at the port named in the policy, the policy cannot attach if the ship is at the specified port for purposes other than the voyage insured. However, once the ship is deemed to be ‘preparing’ for the voyage insured and is in ‘good safety’ at the port named in the contract, the policy will attach. This was clearly illustrated in the case of Lambert v Liddard , below. Lambert v Liddard (1814) 5 Taunt 480 The ship Lion was insured under a voyage policy at and from Pernambuco or other ports in Brazil to London. When Lion , which had previously been engaged as a privateer, arrived near Pernambuco, an officer was dispatched ashore to inquire into the availability of cargo. On hearing there was no cargo available, Lion sailed for St Salvador, a Brazilian port 600 miles to the north, in order to secure an alternative cargo, but, whilst on passage, she was lost. When the plaintiff claimed on his policy of insurance, the insurers refused payment, contending that the ship had not put into any port in Brazil and, therefore, the policy had never attached. The court ruled that the insurers were liable as the policy had attached when Lion arrived off Pernambuco in preparation for the voyage insured. Chambre J: [p 487] …The ship had finished her cruise [as a privateer], and was preparing for her voyage to England. What preparation was she to make? She was not coming in ballast to England; she was to get a cargo. She goes to Pernambuco; she inquires there for a cargo, and does not obtain one; but can it be said, that while she was so employed, she was not preparing? She went thither for the very purpose of preparing. Not getting a cargo there, she goes to another part of the coast for the same purpose. The policy attached at Pernambuco, and there was no subsequent deviation, she had a right to go to any of the other ports, to perfect her cargo, I therefore think the rule must be discharged. In similar vein, the House of Lords referred to the above case when reaching their decision in Tasker v Cunninghame , below. Tasker v Cunninghame (1819) 1 Bligh 87, HL The vessel Henrietta was insured for a voyage ‘at and from’ Cadiz to the Clyde; the destination later being altered to Liverpool with the consent of the insurers. The purpose of the voyage was to sail to Liverpool and load salt for a fishery in Newfoundland. However, salt became available at Cadiz and, without informing the insurers, it was decided that Henrietta should load the salt at Cadiz and then sail direct to Newfoundland. Some eight days after the change of destination, Henrietta stranded in Cadiz harbour after a storm, and she was later totally lost when French troops set fire to her. The insurers refused to settle the claim because the intended voyage had been abandoned. The House of Lords ruled that the insurers were not liable under the policy; once the insured voyage was abandoned, the policy was no longer in force. House of Lords: [p 103] …The Lords found (7 July 1819) that the voyage ought to be considered as having been abandoned before the loss of the vessel – and the interlocutors were reversed. Upon the question, when a risk commences under the word ‘ at’ , the case of Lambert v Liddard (1814) 5 Taunt 480, makes the nearest approach to the case reported. In Lambert v Liddard , it was held that the risk had commenced upon the ground that the ship had prepared for the voyage , by inquiring for a cargo. Where the contract is, that the beginning of the adventure shall be ‘immediately from and after the arrival of ‘the ship at’, etc; or ‘from the departure’, the difficulty is removed. In the common case where it is ‘at and from’, etc, without any special words to restrict the meaning of the word ‘ at’ , the beginning to load the cargo, or preparing for the voyage, seem to be the principal circumstances to determine the commencement of the risk. It should be noted that the words ‘ at and from’ may have a wide or narrow meaning, depending on the context in which they are used. If, for example, a ship is insured ‘at and from’ Japan, the policy would attach whenever the ship arrived in good safety anywhere in Japan, provided that she was preparing for the insured voyage. But, if the ship is insured ‘at and from’ Tokyo, the policy could only attach when the ship actually arrived in Tokyo itself, in good safety and preparing for the voyage insured. This very point was the issue in the case of Maritime Insurance Co v Alianza Insurance Co of Santander , below. Maritime Insurance Co v Alianza Insurance Co of Santander (1907) 13 Com Cas 46 This was a case involving reinsurance. The plaintiffs, the original insurers of the vessel Dumfriesshire , underwrote a voyage policy ‘at and from a port in New Zealand to Nehoue, New Caledonia and while there and thence to Grangemouth’. The plaintiffs then effected a policy of reinsurance with the defendants, which only provided cover for part of the original risk, namely, ‘at and from 1 July 1904, until 31 August 1904…whilst at port or ports, place or places in New Caledonia’. Dumfriesshire struck the reef surrounding New Caledonia, about 10 miles from the mainland, and suffered damage. The reef was considered as being geographically part of New Caledonia. After settling the claim on the original insurance, the plaintiffs sought to recover their loss under the policy of reinsurance. The reinsurers refused payment. The court ruled that the plaintiffs could not recover under the policy of reinsurance. The words ‘port or ports, place or places’ limited the attachment of the cover to a port or place in New Caledonia. A reef, which surrounded the island, could not be construed to mean a ‘port’ or ‘place’ as described in the policy, which, therefore, had not attached at the time of the loss. Walton J: [p 49] …If the reinsurance had been against losses occurring whilst the vessel was ‘at’ New Caledonia, it may be that the defendants would be liable. I think that would be so if the reef was in New Caledonia. But the policy is not against losses occurring whilst ‘at’ New Caledonia. The words used are different—‘at port or ports, place or places in New Caledonia’. Is the effect the same? I have come to the conclusion it is not. [p 50] …I do not wish to attempt an exhaustive interpretation, but it seems to me that the word ‘place’ means some place at which the vessel has arrived to load, or maybe to discharge, or to take coal, or to repair, or even to shelter—a place at which the vessel is for some purpose, not a place at which she happens to be in passing. As the loss did not occur, within the meaning of the policy, at a ‘port or ports, place or places in New Caledonia’, there must be judgment for the defendants. Ship not at named port In accordance with r 3(b) of the Rules for Construction, a ship need not be at the named port at the time the contract of insurance is concluded; the policy attaching later, at the time when the ship arrives at the named port in good safety. In addition to r 3(b), the first part of s 42(1) of the Act also confirms that: Where the subject matter is insured by a voyage policy ‘at and from’ or ‘from’ a particular place, it is not necessary that the ship should be at that place when the contract is concluded. It is emphasised that, where the contract of insurance is concluded before the vessel is at the named port, the policy attaches at ‘the first arrival’ of the vessel in good safety within the ‘geographical limits’ of that named port. This was illustrated in the case of Houghton v Empire Marine Insurance Co Ltd , below. Houghton v Empire Marine Insurance Co Ltd (1866) LR 1 Exch 206 The vessel Urgent arrived at Havana, but, having entered the harbour, grounded and sustained damage when she fouled the anchor of another ship. The insurers claimed they were not liable under the policy because Urgent had not been in good safety when the damage occurred and, that being so, the policy on the previous voyage had not terminated, as the requirement for termination was that the ship should have arrived at the port of destination and be moored there in good safety for 24 hours. The court ruled that the insurers were liable, as the policy had attached as soon as Urgent arrived ‘geographically within the harbour’ of Havana. The meaning of ‘good safety’ at the commencement of the risk was not the same as that for the termination of the risk, 13 and, furthermore, it was irrelevant that the previous policy was still in force. Channel B: [p 209] …It appears that Urgent having arrived off Havana, the captain engaged the services of a steam tug and a pilot for the purpose of taking her to a clear anchorage. She was towed into the harbour, past the point where she ultimately discharged her cargo, to a point at the head of the harbour, called the Regla Shoal. There she grounded, and received damage from the anchor of another ship. In my opinion, she was at that time at Havana, and, consequently, the risk under the policy had attached. The damage occurred at Havana, geographically speaking, and there is nothing which, to my mind, shows that the parties, at the time this policy was underwritten, contemplated any other meaning of the word ‘ at’ . All the limitation which the law appears ever to have imposed as to the time of commencement of the risk in such a case is, that the ship should arrive at the port at which she is insured in a state of sufficient repair or seaworthiness to be enabled to be there in safety: see Parmeter v Cousins , and Bell v Bell , 14 in the latter of which cases the ruling of Lord Ellenborough CJ, at Nisi Prius , was upheld by the court in Blanc. Here, however, there seems to be no doubt that the ship was really within the harbour in good safety, and the loss occurred from a peril in the harbour, and in no way from any injuries she had received before her arrival. The ship being insured while at Havana is evidently, in the absence of any provision to the contrary, insured all the time she is there, and therefore the risk commences on her first arrival, as put by Lord Hardwicke in Motteaux v London Assurance Company . 15 Unless, therefore, we can say that her first arrival at the port is when she cast anchor there, instead of when she enters the port, our judgment must be for the plaintiffs. In many cases, the nature of the port may be such that the two events may be identical. There may be nothing to show the arrival till the vessel casts anchor. But here we have evidence as to the port of Havana which is sufficient, in my judgment, to show that the arrival was before casting anchor. It has been argued that the first arrival, which must be no doubt in good safety, must be identical with the mooring in good safety usually named in outward policies. But I think we cannot construe the terms of one contract by reference to those of another not referred to in it. And it is clear that there is no usage that the duration of the outward and homeward policies should not overlap, because the outward policy usually extends to 24 hours after the vessel is moored in good safety. During those 24 hours, there is no question that there is double insurance, and, therefore, I see no ground for saying that the parties contracted subject to any usage that such a policy would not attach until the previous one had determined…if…they had chosen to make the risk date from the vessel being moored in safety, they would have done so; but, as it stands, it is from the first arrival, which, as a matter of fact, I think to be on her entering the port. My judgment is, therefore, for the plaintiffs, that the rule be discharged. Pigott B: [p 211] …The sole question is whether the policy had attached. I am of opinion that it had. I agree with the plaintiffs counsel, that the language used by the parties ought to have a plain construction, and that as the ship had arrived geographically within the harbour of Havana, and was in good safety there before the injury was received, the risk then commenced. It is emphasised that the principles relating to the attachment of risk are the same whether the policy is on ship or freight. In Foley v United Marine Insurance Co of Sydney , below, the insurers put forward the argument that, because the policy was on freight, the risk could not attach until the vessel had fully discharged her previous cargo and was in readiness to receive the cargo for the voyage under which the freight was insured. Foley v United Marine Insurance Co of Sydney (1870) LR 5 CP 155 The plaintiff owner of the ship Edmund Graham chartered her to the agents of a merchant for a voyage from Mauritius to Akyab in Burma; there to await orders to load a cargo of rice for Europe. The plaintiff insured the freight to be earned under the charterparty with the defendants. Whilst Edmund Graham was discharging her outward cargo in Mauritius, she was wrecked by a violent hurricane. The plaintiff claimed on his policy on freight, but the insurers refused payment on the basis that the cargo from the previous voyage had not been fully discharged and, therefore, the voyage on which the freight had been insured had not yet commenced. Thus, the insurers contended, the policy on freight had not attached. The court ruled that the policy on freight had attached when the ship arrived at Mauritius. The fact that the ship still had cargo on board from a previous voyage when she was wrecked did not mean that the risk on the policy on freight covering the next voyage had not attached. Therefore, the insurers were liable for the loss of freight. Lush J:

- Find a Lawyer

- Ask a Lawyer

- Research the Law

- Law Schools

- Laws & Regs

- Newsletters

- Justia Connect

- Pro Membership

- Basic Membership

- Justia Lawyer Directory

- Platinum Placements

- Gold Placements

- Justia Elevate

- Justia Amplify

- PPC Management

- Google Business Profile

- Social Media

- Justia Onward Blog

voyage policy

- A type of marine insurance coverage that applies exclusively to a specified trip

- A voyage policy was obtained to secure the ship's transatlantic journey.

- The cargo was covered under the voyage policy for its transport from New York to London.

- Due to the risks involved, the freight company ensures all its ocean-bound trips with a voyage policy.

- Bankruptcy Lawyers

- Business Lawyers

- Criminal Lawyers

- Employment Lawyers

- Estate Planning Lawyers

- Family Lawyers

- Personal Injury Lawyers

- Estate Planning

- Personal Injury

- Business Formation

- Business Operations

- Intellectual Property

- International Trade

- Real Estate

- Financial Aid

- Course Outlines

- Law Journals

- US Constitution

- Regulations

- Supreme Court

- Circuit Courts

- District Courts

- Dockets & Filings

- State Constitutions

- State Codes

- State Case Law

- Legal Blogs

- Business Forms

- Product Recalls

- Justia Connect Membership

- Justia Premium Placements

- Justia Elevate (SEO, Websites)

- Justia Amplify (PPC, GBP)

- Testimonials

Simple English definitions for legal terms

voyage policy

Read a random definition: causa falsa

A quick definition of voyage policy:

A more thorough explanation:.

A voyage policy is a type of marine insurance policy that covers a vessel or its cargo during a specific voyage.

- A shipping company purchases a voyage policy to insure their cargo during a trip from New York to London.

- An individual purchases a voyage policy to insure their personal belongings while on a cruise.

These examples illustrate how a voyage policy provides coverage for a specific journey or voyage, protecting against potential losses or damages that may occur during transit.

voyage insurance | voyeur

- Data download

Help us make LSD better!

- Define: Voyage Policy

A voyage policy is a specific type of insurance that provides coverage for a ship or its cargo during a particular journey. It is a contractual agreement between the insurer and the insured, outlining the terms of the coverage. Accident policies cover bodily injuries from accidents, while homeowner’s policies cover risks like fire, water damage, and burglary. Insurance premiums are the payments made by the insured to the insurer for coverage. Insurance rating is the process of determining the premium for a specific risk. The Insurance Services Office is a nonprofit organisation that offers analytical and decision-support services to the insurance industry, including statistical data and model insurance policy forms.

A voyage policy is a form of marine insurance policy that provides coverage for a ship or its cargo during a designated journey. For instance, a shipping company may acquire a voyage policy to safeguard their cargo while traveling from New York to London. Similarly, an individual may purchase a voyage policy to protect their personal belongings while on a cruise. These instances demonstrate how a voyage policy offers protection for a specific trip or voyage, mitigating the risk of potential losses or damages that may arise during transportation.

A voyage policy is a type of marine insurance policy that covers a specific voyage or journey of a ship or vessel.

A voyage policy typically covers risks such as damage to the ship, loss of cargo, and liability for damage to other vessels or property.

Anyone who owns or operates a ship or vessel can purchase a voyage policy.

The premium for a voyage policy is typically based on the value of the ship or vessel, the type of cargo being transported, and the risks involved in the voyage.

A voyage policy covers a specific voyage or journey, while a time policy covers a specific period of time, such as a year.

Yes, a voyage policy can be cancelled by either the insurer or the insured, but there may be penalties or fees involved.

If a ship or vessel is damaged during a voyage covered by a voyage policy, the insurer will typically pay for the cost of repairs or replacement.

If cargo is lost or damaged during a voyage covered by a voyage policy, the insurer will typically pay for the value of the lost or damaged cargo.

General average is a principle of maritime law that requires all parties involved in a voyage to share the cost of any losses or expenses incurred for the common benefit of all parties.

Yes, a voyage policy may cover losses or damages caused by piracy, depending on the specific terms of the policy.

This site contains general legal information but does not constitute professional legal advice for your particular situation. Persuing this glossary does not create an attorney-client or legal adviser relationship. If you have specific questions, please consult a qualified attorney licensed in your jurisdiction.

This glossary post was last updated: 17th April 2024.

To help you cite our definitions in your bibliography, here is the proper citation layout for the three major formatting styles, with all of the relevant information filled in.

- Page URL: https://dlssolicitors.com/define/voyage-policy/

- Modern Language Association (MLA): Voyage Policy. dlssolicitors.com. DLS Solicitors. June 19 2024 https://dlssolicitors.com/define/voyage-policy/.

- Chicago Manual of Style (CMS): Voyage Policy. dlssolicitors.com. DLS Solicitors. https://dlssolicitors.com/define/voyage-policy/ (accessed: June 19 2024).

- American Psychological Association (APA): Voyage Policy. dlssolicitors.com. Retrieved June 19 2024, from dlssolicitors.com website: https://dlssolicitors.com/define/voyage-policy/

Our team of professionals are based in Alderley Edge, Cheshire. We offer clear, specialist legal advice in all matters relating to Family Law, Wills, Trusts, Probate, Lasting Power of Attorney and Court of Protection.

Table of Content

- What is Marine Insurance

Marine Insurance Act 1963

- How Marine Insurance works

Types of Marine Insurance

- Which clauses cover Marine Insurance

Difference between Fire Insurance & Marine Insurance

Explore Drip Capital’s Innovative Trade Financing Solutions

13 July 2021

Marine Insurance | Meaning, Types, Benefits & Coverage

What is marine insurance.

Marine insurance refers to a contract of indemnity. It is an assurance that the goods dispatched from the country of origin to the land of destination are insured. Marine insurance covers the loss/damage of ships, cargo, terminals, and includes any other means of transport by which goods are transferred, acquired, or held between the points of origin and the final destination.

The term originated when parties began to ship goods via sea. Despite what the name implies, marine insurance applies to all modes of transportation of goods. For instance, when goods are shipped by air, the insurance is known as the contract of marine cargo insurance.

Importance of Marine Insurance

Marine insurance is required in many import-export trade proceedings. Admitting the terms, both parties are liable for the payment of goods under insurance. However, the subject matter of marine insurance goes beyond contractual obligations, and there are several valid arguments necessary for buying it before dispatching the export cargo.

Goods in transit need to be insured by one of the three parties:-

- The Forwarding Agent

- The Exporter

- The Importer

Also, it can be taken by anyone involved in the transit of goods.

Also Read: Role of a Freight Forwarder | Functions, Duties & more

Where to get Marine Insurance?

The process to purchase marine insurance in India is easy. The country’s geographical position allows many banks and financial institutions to provide marine insurance.