- Press Releases

- Press Enquiries

- Travel Hub / Blog

- Brand Resources

- Newsletter Sign Up

- Global Summit

- Hosting a Summit

- Upcoming Events

- Previous Events

- Event Photography

- Event Enquiries

- Our Members

- Our Associates Community

- Membership Benefits

- Enquire About Membership

- Sponsors & Partners

- Insights & Publications

- WTTC Research Hub

- Economic Impact

- Knowledge Partners

- Data Enquiries

- Sustainability

- Social Impact

- Hotel Sustainability Basics

- Community Conscious Travel

- SafeTravels Stamp Application

- SafeTravels: Global Protocols & Stamp

- Security & Travel Facilitation

- Women Empowerment

- Destination Spotlight - SLO CAL

- Vision For Nature Positive Travel and Tourism

- Governments

- Consumer Travel Blog

- ONEin330Million Campaign

- Reunite Campaign

Economic Impact Research

- In 2023, the Travel & Tourism sector contributed 9.1% to the global GDP; an increase of 23.2% from 2022 and only 4.1% below the 2019 level.

- In 2023, there were 27 million new jobs, representing a 9.1% increase compared to 2022, and only 1.4% below the 2019 level.

- Domestic visitor spending rose by 18.1% in 2023, surpassing the 2019 level.

- International visitor spending registered a 33.1% jump in 2023 but remained 14.4% below the 2019 total.

Click here for links to the different economy/country and regional reports

Why conduct research?

From the outset, our Members realised that hard economic facts were needed to help governments and policymakers truly understand the potential of Travel & Tourism. Measuring the size and growth of Travel & Tourism and its contribution to society, therefore, plays a vital part in underpinning WTTC’s work.

What research does WTTC carry out?

Each year, WTTC and Oxford Economics produce reports covering the economic contribution of our sector in 185 countries, for 26 economic and geographic regions, and for more than 70 cities. We also benchmark Travel & Tourism against other economic sectors and analyse the impact of government policies affecting the sector such as jobs and visa facilitation.

Visit our Research Hub via the button below to find all our Economic Impact Reports, as well as other reports on Travel and Tourism.

An official website of the United States government

- Special Topics

Travel and Tourism

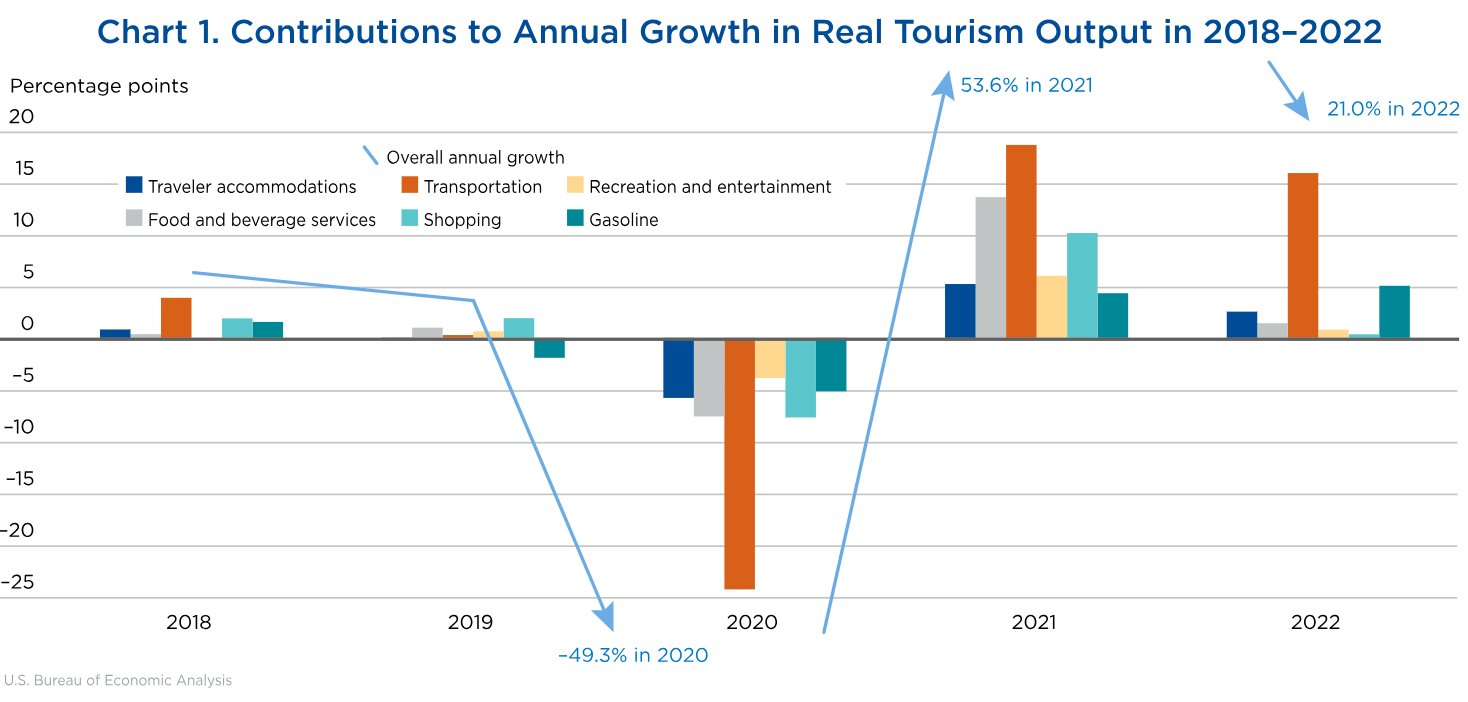

Travel and tourism satellite account for 2018-2022.

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA’s Travel and Tourism Satellite Account.

Data & Articles

- U.S. Travel and Tourism Satellite Account for 2018–2022 By Hunter Arcand and Paul Kern - Survey of Current Business April 2024

- "U.S. Travel and Tourism Satellite Account for 2015–2019" By Sarah Osborne - Survey of Current Business December 2020

- "U.S. Travel and Tourism Satellite Account for 2015-2017" By Sarah Osborne and Seth Markowitz - Survey of Current Business June 2018

- Tourism Satellite Accounts 1998-2019

- Tourism Satellite Accounts Data A complete set of detailed annual statistics for 2017-2021 is coming soon -->

- Article Collection

Documentation

- Product Guide

Previously Published Estimates

- Data Archive This page provides access to an archive of estimates previously published by the Bureau of Economic Analysis. Please note that this archive is provided for research only. The estimates contained in this archive include revisions to prior estimates and may not reflect the most recent revision for a particular period.

- News Release Archive

What is Travel and Tourism?

Measures how much tourists spend and the prices they pay for lodging, airfare, souvenirs, and other travel-related items. These statistics also provide a snapshot of employment in the travel and tourism industries.

What’s a Satellite Account?

- TTSA Sarah Osborne (301) 278-9459

- News Media Connie O'Connell (301) 278-9003 [email protected]

UN Tourism | Bringing the world closer

Share this content.

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

Tourism’s Importance for Growth Highlighted in World Economic Outlook Report

- All Regions

- 10 Nov 2023

Tourism has again been identified as a key driver of economic recovery and growth in a new report by the International Monetary Fund (IMF). With UNWTO data pointing to a return to 95% of pre-pandemic tourist numbers by the end of the year in the best case scenario, the IMF report outlines the positive impact the sector’s rapid recovery will have on certain economies worldwide.

According to the World Economic Outlook (WEO) Report , the global economy will grow an estimated 3.0% in 2023 and 2.9% in 2024. While this is higher than previous forecasts, it is nevertheless below the 3.5% rate of growth recorded in 2022, pointing to the continued impacts of the pandemic and Russia's invasion of Ukraine, and from the cost-of-living crisis.

Tourism key sector for growth

The WEO report analyses economic growth in every global region, connecting performance with key sectors, including tourism. Notably, those economies with "large travel and tourism sectors" show strong economic resilience and robust levels of economic activity. More specifically, countries where tourism represents a high percentage of GDP have recorded faster recovery from the impacts of the pandemic in comparison to economies where tourism is not a significant sector.

As the report Foreword notes: "Strong demand for services has supported service-oriented economies—including important tourism destinations such as France and Spain".

Looking Ahead

The latest outlook from the IMF comes on the back of UNWTO's most recent analysis of the prospects for tourism, at the global and regional levels. Pending the release of the November 2023 World Tourism Barometer , international tourism is on track to reach 80% to 95% of pre-pandemic levels in 2023. Prospects for September-December 2023 point to continued recovery, driven by the still pent-up demand and increased air connectivity particularly in Asia and the Pacific where recovery is still subdued.

Related links

- Download the News Release on PDF

- UNWTO World Tourism Barometer

- IMF World Economic Outlook

Category tags

Related content, international tourism reached 97% of pre-pandemic level..., international tourism to reach pre-pandemic levels in 2024, international tourism to end 2023 close to 90% of pre-p..., international tourism swiftly overcoming pandemic downturn.

- Global City & International State Travel

- Global Travel Service

- Air Passenger Forecasts

- Custom Forecasts

- Cruise Forecasts

- Visitor Economy

- Travel Industries

- Marketing Investment

- Events & Projects

- Testimonials

- Budget Analysis

- Policy Analysis

- Marketing Allocation Platform

- Project Feasibility

- In the News

- Client Login

- Oxford Economics

Global Travel Services

Global travel data, forecasts, and intelligence.

Unlock the power of economics

- Travel Data and Forecasts

- Economic Impact

- Policy & Market Analysis

- Symphony Login

- Book a Symphony Demo

Level-up with industry-leading custom forecast models and access the most comprehensive geographic travel trend data available.

Proving economic value through rigorous analysis of visitor, event and destination marketing contributions.

Informing critical policy and investment decisions with a solid foundation of opportunity, cost and benefit economic analysis.

The Symphony Intelligence Platform is a comprehensive, interactive hub for all of your data sources, backed by Tourism Economics' industry expertise.

Get the Industry Newsletter

Latest research.

Airbnb's Impact on Major UK Events

State of the Sports Tourism Industry Report

Impact of Cruise Tourism Globally

Destination Promotion: A Catalyst for Community Vitality

STR, Tourism Economics Nail Recovery Predictions

Case Studies

Featured Clients

American Gaming Association

Atlanta Braves

Bain and Company

California Travel Association

Dallas Fort Worth Airport

Destination Canada

Destinations International

Dubai Department of Tourism & Commerce Marketing

Empire State Development

Ernst & Young

European Travel Commission

Google Inc.

Greater Houston Convention and Visitors Bureau

Hilton Worldwide Holdings

Las Vegas Convention and Visitors Authority

Longwoods International

Marriott International

MasterCard (Global Products & Solutions)

MGM Resorts International Global Gaming Development LLC

NBC Universal

Philadelphia CVB

PricewaterhouseCoopers (UK - TE)

Rock & Roll Hall of Fame

Sandals Resorts International

TripAdvisor

US Travel Association

Visit California

World Travel and Tourism Council

Travel, Tourism & Hospitality

Travel and tourism in the U.S. - statistics & facts

What are the most popular travel destinations in the u.s., u.s. travel trends, key insights.

Detailed statistics

Tourism contribution to GDP in the U.S. 2019-2022

Total travel expenditures in the U.S. 2019-2026

Number of domestic leisure and business trips in the U.S. 2019-2026

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

International travel spending in the U.S. 2019-2026

Leading city destinations in the U.S. 2019, by number of international arrivals

Related topics

Recommended.

- National park tourism in the U.S.

- Millennial travel behavior in the U.S.

- Tourism worldwide

- Hotel industry worldwide

- Sustainable tourism worldwide

Recommended statistics

Industry overview.

- Basic Statistic Tourism contribution to GDP in the U.S. 2019-2022

- Premium Statistic Total travel expenditures in the U.S. 2019-2026

- Premium Statistic Direct travel spending in the U.S. 2019-2022, by traveler type

- Basic Statistic Countries that visited the U.S. the most 2019-2022

- Basic Statistic Leading outbound travel markets in the U.S. 2019-2022, country

- Basic Statistic Contribution of travel and tourism to employment in the U.S. 2019-2022

- Premium Statistic Most visited states in the U.S. 2022

Total contribution of travel and tourism to the gross domestic product (GDP) in the United States in 2019 and 2022 (in trillion U.S. dollars)

Total travel spending in the United States from 2019 to 2022, with a forecast until 2026 (in trillion U.S. dollars)

Direct travel spending in the U.S. 2019-2022, by traveler type

Total direct travel spending in the United States from 2019 to 2022, by type of traveler (in billion U.S. dollars)

Countries that visited the U.S. the most 2019-2022

Distribution of international tourist arrivals in the United States in 2019 and 2022, by country

Leading outbound travel markets in the U.S. 2019-2022, country

Distribution of outbound tourist departures in the United States in 2019 and 2022, by country

Contribution of travel and tourism to employment in the U.S. 2019-2022

Contribution of travel and tourism to employment in the United States in 2019 and 2022 (in millions)

Most visited states in the U.S. 2022

Most visited states by adults in the United States as of September 2022

Key players

- Premium Statistic Leading holiday travel provider websites in the U.S. Q2 2023, by share of voice

- Premium Statistic Number of aggregated downloads of leading travel apps in the U.S. 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps in the U.S. 2023

- Basic Statistic American Customer Satisfaction Index for internet travel companies U.S. 2002-2024

- Premium Statistic American Customer Satisfaction Index for U.S. lodging companies 2008-2024, by company

Leading holiday travel provider websites in the U.S. Q2 2023, by share of voice

Leading travel brands in the United States in 2nd quarter 2023, by share of voice

Number of aggregated downloads of leading travel apps in the U.S. 2023

Number of aggregated downloads of selected leading travel apps in the United States in 2023 (in millions)

Number of aggregated downloads of leading online travel agency apps in the U.S. 2023

Number of aggregated downloads of selected leading online travel agency apps in the United States in 2023 (in millions)

American Customer Satisfaction Index for internet travel companies U.S. 2002-2024

American Customer Satisfaction Index Scores for internet travel companies in the United States from 2002 to 2024

American Customer Satisfaction Index for U.S. lodging companies 2008-2024, by company

American Customer Satisfaction Index scores for lodging companies in the United States from 2008 to 2024, by company

- Premium Statistic U.S. hotel and motel industry market size 2012-2022

- Premium Statistic Number of hotel jobs in the U.S. 2019-2022

- Premium Statistic ADR of hotels in the U.S. 2001-2022

- Premium Statistic Occupancy rate of the U.S. hotel industry 2001-2022

- Premium Statistic Revenue per available room of the U.S. hotel industry 2001-2022

- Premium Statistic Change in monthly number of hotel bookings in the U.S. 2020-2023

- Premium Statistic YoY monthly change in number of online hotel searches in the U.S. 2020-2023

U.S. hotel and motel industry market size 2012-2022

Market size of the hotel and motel sector in the United States from 2012 to 2022 (in billion U.S. dollars)

Number of hotel jobs in the U.S. 2019-2022

Number of hotel jobs in the United States from 2019 to 2022, with a forecast for 2023 (in millions)

ADR of hotels in the U.S. 2001-2022

Average daily rate of hotels in the United States from 2001 to 2022 (in U.S. dollars)

Occupancy rate of the U.S. hotel industry 2001-2022

Occupancy rate of the hotel industry in the United States from 2001 to 2022

Revenue per available room of the U.S. hotel industry 2001-2022

Revenue per available room (RevPAR) of hotel industry in the United States from 2001 to 2022 (in U.S. dollars)

Change in monthly number of hotel bookings in the U.S. 2020-2023

Year-over-year monthly change in number of hotel bookings in the United States from 2020 to 2023

YoY monthly change in number of online hotel searches in the U.S. 2020-2023

Year-over-year monthly change in number of online hotel searches in the United States from 2020 to 2023

Attractions

- Premium Statistic Leading museums by highest attendance worldwide 2019-2022

- Basic Statistic Most visited amusement and theme parks worldwide 2019-2022

- Premium Statistic U.S. amusement park industry market size 2011-2022

- Premium Statistic Landmarks most recommended visitors in the U.S. 2022

Leading museums by highest attendance worldwide 2019-2022

Most visited museums worldwide from 2019 to 2022 (in millions)

Most visited amusement and theme parks worldwide 2019-2022

Leading amusement and theme parks worldwide from 2019 to 2022, by attendance (in millions)

U.S. amusement park industry market size 2011-2022

Market size of the amusement park sector in the United States from 2011 to 2022 (in billion U.S. dollars)

Landmarks most recommended visitors in the U.S. 2022

Most recommended landmarks by visitors in the United States as of September 2022

City tourism

- Basic Statistic City destinations with the highest direct travel and tourism GDP worldwide 2022

- Premium Statistic World's highest-priced business travel destinations Q4 2022

- Basic Statistic Selected cities with the highest hotel rates in the U.S. as of September 2023

- Basic Statistic Most affordable cities for backpacking in the U.S. 2024, by daily price

- Premium Statistic Average price per night of Airbnb listings in selected U.S. cities 2024

- Premium Statistic Number of Airbnb listings in selected U.S. cities 2024

City destinations with the highest direct travel and tourism GDP worldwide 2022

Leading city tourism destinations worldwide in 2022, ranked by direct contribution of travel and tourism to GDP (in billion U.S. dollars)

World's highest-priced business travel destinations Q4 2022

Most expensive cities for business tourism worldwide in 4th quarter 2022, by average daily costs (in U.S. dollars)

Selected cities with the highest hotel rates in the U.S. as of September 2023

Selected cities with the most expensive hotel rates in the United States as of September 2023 (in U.S. dollars)

Most affordable cities for backpacking in the U.S. 2024, by daily price

Most affordable cities for backpacking in the United States as of January 2024, by daily price (in U.S. dollars)

Average price per night of Airbnb listings in selected U.S. cities 2024

Average price per night of Airbnb listings in selected cities in the United States as of February 2024 (in U.S. dollars)

Number of Airbnb listings in selected U.S. cities 2024

Number of Airbnb listings in selected cities in the United States as of February 2024

Sustainable tourism

- Premium Statistic Travelers who find sustainable travel important in the U.S. 2022

- Premium Statistic Share of travelers that plan to make sustainable travel choices in the U.S. 2022

- Premium Statistic How much more travelers would pay to make a trip more sustainable in the U.S. 2022

- Premium Statistic U.S. consumers who have paid extra for sustainable travel in the past two years 2022

- Premium Statistic U.S. consumers willing to pay extra for a sustainable travel provider 2022

- Premium Statistic Share of U.S. travelers that feel guilty over non-eco-friendly past travel 2022

- Premium Statistic Reasons travelers were against staying in sustainable hotels in the U.S. 2022

Travelers who find sustainable travel important in the U.S. 2022

Share of travelers that think sustainable travel is important in the United States as of February 2022

Share of travelers that plan to make sustainable travel choices in the U.S. 2022

Share of travelers that intend to make more sustainable travel decisions in the United States as of March 2022

How much more travelers would pay to make a trip more sustainable in the U.S. 2022

Extra cost travelers would be willing to pay to make a trip more carbon friendly in the United States as of March 2022

U.S. consumers who have paid extra for sustainable travel in the past two years 2022

Share of consumers that have paid extra for sustainable travel in the past two years in the United States as of February 2022

U.S. consumers willing to pay extra for a sustainable travel provider 2022

Share of consumers willing to pay extra for a sustainable travel provider in the United States as of February 2022

Share of U.S. travelers that feel guilty over non-eco-friendly past travel 2022

Share of travelers that experience guilt over past trips not being sustainable in the United States as of August 2022

Reasons travelers were against staying in sustainable hotels in the U.S. 2022

Reasons travelers were against staying in a hotel with sustainable practices in the United States as of August 2022

- Premium Statistic Priorities when choosing a leisure travel destination in the U.S. 2023, by generation

- Premium Statistic Leading destinations travelers intend to visit in the next 12 months in the U.S. 2023

- Premium Statistic Trust in travel and hospitality brands in the U.S. 2023, by brand type

- Premium Statistic American Customer Satisfaction Index: travel and tourism industries in the U.S. 2024

Priorities when choosing a leisure travel destination in the U.S. 2023, by generation

Main factors for choosing a leisure travel destination among adults in the United States as of May 2023, by generation

Leading destinations travelers intend to visit in the next 12 months in the U.S. 2023

Leading leisure travel destinations travelers intend to go to in the next 12 months in the United States as of September 2023

Trust in travel and hospitality brands in the U.S. 2023, by brand type

Level of trust in travel and hospitality brands in the United States as of September 2023, by brand type

American Customer Satisfaction Index: travel and tourism industries in the U.S. 2024

American Customer Satisfaction Index for the travel and tourism sector in the United States in 2024, by industry

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Reimagining the $9 trillion tourism economy—what will it take?

Tourism made up 10 percent of global GDP in 2019 and was worth almost $9 trillion, 1 See “Economic impact reports,” World Travel & Tourism Council (WTTC), wttc.org. making the sector nearly three times larger than agriculture. However, the tourism value chain of suppliers and intermediaries has always been fragmented, with limited coordination among the small and medium-size enterprises (SMEs) that make up a large portion of the sector. Governments have generally played a limited role in the industry, with partial oversight and light-touch management.

COVID-19 has caused an unprecedented crisis for the tourism industry. International tourist arrivals are projected to plunge by 60 to 80 percent in 2020, and tourism spending is not likely to return to precrisis levels until 2024. This puts as many as 120 million jobs at risk. 2 “International tourist numbers could fall 60-80% in 2020, UNWTO reports,” World Tourism Organization, May 7, 2020, unwto.org.

Reopening tourism-related businesses and managing their recovery in a way that is safe, attractive for tourists, and economically viable will require coordination at a level not seen before. The public sector may be best placed to oversee this process in the context of the fragmented SME ecosystem, large state-owned enterprises controlling entry points, and the increasing impact of health-related agencies. As borders start reopening and interest in leisure rebounds in some regions , governments could take the opportunity to rethink their role within tourism, thereby potentially both assisting in the sector’s recovery and strengthening it in the long term.

In this article, we suggest four ways in which governments can reimagine their role in the tourism sector in the context of COVID-19.

1. Streamlining public–private interfaces through a tourism nerve center

Before COVID-19, most tourism ministries and authorities focused on destination marketing, industry promotions, and research. Many are now dealing with a raft of new regulations, stimulus programs, and protocols. They are also dealing with uncertainty around demand forecasting, and the decisions they make around which assets—such as airports—to reopen will have a major impact on the safety of tourists and sector employees.

Coordination between the public and private sectors in tourism was already complex prior to COVID-19. In the United Kingdom, for example, tourism falls within the remit of two departments—the Department for Business, Energy, and Industrial Strategy (BEIS) and the Department for Digital, Culture, Media & Sport (DCMS)—which interact with other government agencies and the private sector at several points. Complex coordination structures often make clarity and consistency difficult. These issues are exacerbated by the degree of coordination that will be required by the tourism sector in the aftermath of the crisis, both across government agencies (for example, between the ministries responsible for transport, tourism, and health), and between the government and private-sector players (such as for implementing protocols, syncing financial aid, and reopening assets).

Concentrating crucial leadership into a central nerve center is a crisis management response many organizations have deployed in similar situations. Tourism nerve centers, which bring together public, private, and semi-private players into project teams to address five themes, could provide an active collaboration framework that is particularly suited to the diverse stakeholders within the tourism sector (Exhibit 1).

We analyzed stimulus packages across 24 economies, 3 Australia, Bahrain, Belgium, Canada, Egypt, Finland, France, Germany, Hong Kong, Indonesia, Israel, Italy, Kenya, Malaysia, New Zealand, Peru, Philippines, Singapore, South Africa, South Korea, Spain, Switzerland, Thailand, and the United Kingdom. which totaled nearly $100 billion in funds dedicated directly to the tourism sector, and close to $300 billion including cross-sector packages with a heavy tourism footprint. This stimulus was generally provided by multiple entities and government departments, and few countries had a single integrated view on beneficiaries and losers. We conducted surveys on how effective the public-sector response has been and found that two-thirds of tourism players were either unaware of the measures taken by government or felt they did not have sufficient impact. Given uncertainty about the timing and speed of the tourism recovery, obtaining quick feedback and redeploying funds will be critical to ensuring that stimulus packages have maximum impact.

2. Experimenting with new financing mechanisms

Most of the $100 billion stimulus that we analyzed was structured as grants, debt relief, and aid to SMEs and airlines. New Zealand has offered an NZ $15,000 (US $10,000) grant per SME to cover wages, for example, while Singapore has instituted an 8 percent cash grant on the gross monthly wages of local employees. Japan has waived the debt of small companies where income dropped more than 20 percent. In Germany, companies can use state-sponsored work-sharing schemes for up to six months, and the government provides an income replacement rate of 60 percent.

Our forecasts indicate that it will take four to seven years for tourism demand to return to 2019 levels, which means that overcapacity will be the new normal in the medium term. This prolonged period of low demand means that the way tourism is financed needs to change. The aforementioned types of policies are expensive and will be difficult for governments to sustain over multiple years. They also might not go far enough. A recent Organisation for Economic Co-operation and Development (OECD) survey of SMEs in the tourism sector suggested more than half would not survive the next few months, and the failure of businesses on anything like this scale would put the recovery far behind even the most conservative forecasts. 4 See Tourism policy responses to the coronavirus (COVID-19), OECD, June 2020, oecd.org. Governments and the private sector should be investigating new, innovative financing measures.

Revenue-pooling structures for hotels

One option would be the creation of revenue-pooling structures, which could help asset owners and operators, especially SMEs, to manage variable costs and losses moving forward. Hotels competing for the same segment in the same district, such as a beach strip, could have an incentive to pool revenues and losses while operating at reduced capacity. Instead of having all hotels operating at 20 to 40 percent occupancy, a subset of hotels could operate at a higher occupancy rate and share the revenue with the remainder. This would allow hotels to optimize variable costs and reduce the need for government stimulus. Non-operating hotels could channel stimulus funds into refurbishments or other investment, which would boost the destination’s attractiveness. Governments will need to be the intermediary between businesses through auditing or escrow accounts in this model.

Joint equity funds for small and medium-size enterprises

Government-backed equity funds could also be used to deploy private capital to help ensure that tourism-related SMEs survive the crisis (Exhibit 2). This principle underpins the European Commission’s temporary framework for recapitalization of state-aided enterprises, which provided an estimated €1.9 trillion in aid to the EU economy between March and May 2020. 5 See “State aid: Commission expands temporary framework to recapitalisation and subordinated debt measures to further support the economy in the context of the coronavirus outbreak,” European Commission, May 8, 2020, ec.europa.eu. Applying such a mechanism to SMEs would require creating an appropriate equity-holding structure, or securitizing equity stakes in multiple SMEs at once, reducing the overall risk profile for the investor. In addition, developing a standardized valuation methodology would avoid lengthy due diligence processes on each asset. Governments that do not have the resources to co-invest could limit their role to setting up those structures and opening them to potential private investors.

3. Ensuring transparent, consistent communication on protocols

The return of tourism demand requires that travelers and tourism-sector employees feel—and are—safe. Although international organizations such as the International Air Transport Association (IATA), and the World Travel & Tourism Council (WTTC) have developed a set of guidelines to serve as a baseline, local regulators are layering additional measures on top. This leads to low levels of harmonization regarding regulations imposed by local governments.

Our surveys of traveler confidence in the United States suggests anxiety remains high, and authorities and destination managers must work to ensure travelers know about, and feel reassured by, protocols put in place for their protection. Our latest survey of traveler sentiment in China suggests a significant gap between how confident travelers would like to feel and how confident they actually feel; actual confidence in safety is much lower than the expected level asked a month before.

One reason for this low level of confidence is confusion over the safety measures that are currently in place. Communication is therefore key to bolstering demand. Experience in Europe indicates that prompt, transparent, consistent communications from public agencies have had a similar impact on traveler demand as CEO announcements have on stock prices. Clear, credible announcements regarding the removal of travel restrictions have already led to increased air-travel searches and bookings. In the week that governments announced the removal of travel bans to a number of European summer destinations, for example, outbound air travel web search volumes recently exceeded precrisis levels by more than 20 percent in some countries.

The case of Greece helps illustrate the importance of clear and consistent communication. Greece was one of the first EU countries to announce the date of, and conditions and protocols for, border reopening. Since that announcement, Greece’s disease incidence has remained steady and there have been no changes to the announced protocols. The result: our joint research with trivago shows that Greece is now among the top five summer destinations for German travelers for the first time. In July and August, Greece will reach inbound airline ticketing levels that are approximately 50 percent of that achieved in the same period last year. This exceeds the rate in most other European summer destinations, including Croatia (35 percent), Portugal (around 30 percent), and Spain (around 40 percent). 6 Based on IATA Air Travel Pulse by McKinsey. In contrast, some destinations that have had inconsistent communications around the time frame of reopening have shown net cancellations of flights for June and July. Even for the high seasons toward the end of the year, inbound air travel ticketing barely reaches 30 percent of 2019 volumes.

Digital solutions can be an effective tool to bridge communication and to create consistency on protocols between governments and the private sector. In China, the health QR code system, which reflects past travel history and contact with infected people, is being widely used during the reopening stage. Travelers have to show their green, government-issued QR code before entering airports, hotels, and attractions. The code is also required for preflight check-in and, at certain destination airports, after landing.

4. Enabling a digital and analytics transformation within the tourism sector

Data sources and forecasts have shifted, and proliferated, in the crisis. Last year’s demand prediction models are no longer relevant, leaving many destinations struggling to understand how demand will evolve, and therefore how to manage supply. Uncertainty over the speed and shape of the recovery means that segmentation and marketing budgets, historically reassessed every few years, now need to be updated every few months. The tourism sector needs to undergo an analytics transformation to enable the coordination of marketing budgets, sector promotions, and calendars of events, and to ensure that products are marketed to the right population segment at the right time.

Governments have an opportunity to reimagine their roles in providing data infrastructure and capabilities to the tourism sector, and to investigate new and innovative operating models. This was already underway in some destinations before COVID-19. Singapore, for example, made heavy investments in its data and analytics stack over the past decade through the Singapore Tourism Analytics Network (STAN), which provided tourism players with visitor arrival statistics, passenger profiling, spending data, revenue data, and extensive customer-experience surveys. During the COVID-19 pandemic, real-time data on leading travel indicators and “nowcasts” (forecasts for the coming weeks and months) could be invaluable to inform the decisions of both public-sector and private-sector entities.

This analytics transformation will also help to address the digital gap that was evident in tourism even before the crisis. Digital services are vital for travelers: in 2019, more than 40 percent of US travelers used mobile devices to book their trips. 7 Global Digital Traveler Research 2019, Travelport, marketing.cloud.travelport.com; “Mobile travel trends 2019 in the words of industry experts,” blog entry by David MacHale, December 11, 2018, blog.digital.travelport.com. In Europe and the United States, as many as 60 percent of travel bookings are digital, and online travel agents can have a market share as high as 50 percent, particularly for smaller independent hotels. 8 Sean O’Neill, “Coronavirus upheaval prompts independent hotels to look at management company startups,” Skift, May 11, 2020, skift.com. COVID-19 is likely to accelerate the shift to digital as travelers look for flexibility and booking lead times shorten: more than 90 percent of recent trips in China were booked within seven days of the trip itself. Many tourism businesses have struggled to keep pace with changing consumer preferences around digital. In particular, many tourism SMEs have not been fully able to integrate new digital capabilities in the way that larger businesses have, with barriers including language issues, and low levels of digital fluency. The commission rates on existing platforms, which range from 10 percent for larger hotel brands to 25 percent for independent hotels, also make it difficult for SMEs to compete in the digital space.

Governments are well-positioned to overcome the digital gap within the sector and to level the playing field for SMEs. The Tourism Exchange Australia (TXA) platform, which was created by the Australian government, is an example of enabling at scale. It acts as a matchmaker, connecting suppliers with distributors and intermediaries to create packages attractive to a specific segment of tourists, then uses tourist engagement to provide further analytical insights to travel intermediaries (Exhibit 3). This mechanism allows online travel agents to diversify their offerings by providing more experiences away from the beaten track, which both adds to Australia’s destination attractiveness, and gives small suppliers better access to customers.

Governments that seize the opportunity to reimagine tourism operations and oversight will be well positioned to steer their national tourism industries safely into—and set them up to thrive within—the next normal.

Download the article in Arabic (513KB)

Margaux Constantin is an associate partner in McKinsey’s Dubai office, Steve Saxon is a partner in the Shanghai office, and Jackey Yu is an associate partner in the Hong Kong office.

The authors wish to thank Hugo Espirito Santo, Urs Binggeli, Jonathan Steinbach, Yassir Zouaoui, Rebecca Stone, and Ninan Chacko for their contributions to this article.

Explore a career with us

Related articles.

Make it better, not just safer: The opportunity to reinvent travel

Hospitality and COVID-19: How long until ‘no vacancy’ for US hotels?

A new approach in tracking travel demand

- 672 Wine Club

- Motorcycles

- Car of the Month

- Destinations

- Men’s Fashion

- Watch Collector

- Art & Collectibles

- Vacation Homes

- Celebrity Homes

- New Construction

- Home Design

- Electronics

- Fine Dining

- Dubai Tourism

- Gateway Bronco

- On Location – Olympic Games Paris 2024

- One&Only

- The Ritz-Carlton, Kapalua

- Saratoga Spring Water

- Wynn Las Vegas

- Sports & Leisure

- Health & Wellness

- Best of the Best

- The Ultimate Gift Guide

Travel Will Inject a Record $11 Trillion Into the Global Economy This Year: Report

Tourism is expected to become a $16 trillion industry by 2034, the world travel & tourism council says., rachel cormack.

Digital Editor

Rachel Cormack's Most Recent Stories

- This 190-Foot Custom Superyacht Is a Luxe Haven for Fitness Lovers

- The Original Illustration for the First Harry Potter Book Just Sold for a Record-Breaking $1.9 Million

- The World’s Largest Carbon-Fiber Sailing Catamaran Could Be Yours for $19 Million

- Share This Article

All your jet-setting and hotel-hopping is having a significant effect on the global economy.

Related Stories

Forget greece. travelers are heading to scandinavia and scotland to keep cool this summer., put away your parka: why greenland isn’t the arctic paradise you think it is..

- Millionaires Are Expected to Leave the U.K. in Droves This Year: Report

The 14-figure sums can be broken down into three types of travel transactions, Bloomberg notes. Direct travel spending includes things like hotels, tours, and transportation, as well as public investment in these types of services. Indirect travel spending covers the expenses of those businesses, such as sheets and towels or the ingredients for the breakfast buffet. Finally, induced spending accounts for the trickle-down effects of hospitality employees.

In total, 142 out of the 185 surveyed countries are expected to exceed their 2019 tourism performance levels in 2024. Almost all nations are expected to see year-over-year growth, too. As a result, records are likely to be broken on a local level as well as a global.

Rachel Cormack is a digital editor at Robb Report. She cut her teeth writing for HuffPost, Concrete Playground, and several other online publications in Australia, before moving to New York at the…

Read More On:

- United States

More Destinations

These Two New Travel Experiences Will Help You Relive the Best of ‘Yellowstone’ and ‘Ripley’

Ask Robb: Prices for Mediterranean Vacations Are Out of Control—Where Should My Family Go Instead?

The Grand UK Debut

JULY 17 - 19, 2024 Head to the British countryside to test and evaluate the top luxury and performance vehicles of 2024.

Give the Gift of Luxury

Latest Galleries in Destinations

The 15 Best Hotels in Portugal to Visit This Summer

Kalmar Beyond Adventure’s Porsche Safari in Photos

More from our brands, pickle rental and lend clothing app expands to los angeles closets, macklin celebrini chosen first by san jose sharks in 2024 nhl draft, ‘trans memoria’ director readies for ‘trans love’: ‘i met religious, racist, transphobic people. and i slept with them’ (exclusive), independent report finds bührle foundation’s provenance research “not sufficient”, the best yoga mats for any practice, according to instructors.

By: Bastian Herre , Veronika Samborska and Max Roser

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000.

Tourism can be important for both the travelers and the people in the countries they visit.

For visitors, traveling can increase their understanding of and appreciation for people in other countries and their cultures.

And in many countries, many people rely on tourism for their income. In some, it is one of the largest industries.

But tourism also has externalities: it contributes to global carbon emissions and can encroach on local environments and cultures.

On this page, you can find data and visualizations on the history and current state of tourism across the world.

Interactive Charts on Tourism

Cite this work.

Our articles and data visualizations rely on work from many different people and organizations. When citing this topic page, please also cite the underlying data sources. This topic page can be cited as:

BibTeX citation

Reuse this work freely

All visualizations, data, and code produced by Our World in Data are completely open access under the Creative Commons BY license . You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

The data produced by third parties and made available by Our World in Data is subject to the license terms from the original third-party authors. We will always indicate the original source of the data in our documentation, so you should always check the license of any such third-party data before use and redistribution.

All of our charts can be embedded in any site.

Our World in Data is free and accessible for everyone.

Help us do this work by making a donation.

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

U.S. Department of Commerce

- Fact Sheets

Was this page helpful?

Fact sheet: 2022 national travel and tourism strategy, office of public affairs.

The 2022 National Travel and Tourism Strategy was released on June 6, 2022, by U.S. Secretary of Commerce Gina M. Raimondo on behalf of the Tourism Policy Council (TPC). The new strategy focuses the full efforts of the federal government to promote the United States as a premier destination grounded in the breadth and diversity of our communities, and to foster a sector that drives economic growth, creates good jobs, and bolsters conservation and sustainability. Drawing on engagement and capabilities from across the federal government, the strategy aims to support broad-based economic growth in travel and tourism across the United States, its territories, and the District of Columbia.

The federal government will work to implement the strategy under the leadership of the TPC and in partnership with the private sector, aiming toward an ambitious five-year goal of increasing American jobs by attracting and welcoming 90 million international visitors, who we estimate will spend $279 billion, annually by 2027.

The new National Travel and Tourism Strategy supports growth and competitiveness for an industry that, prior to the COVID-19 pandemic, generated $1.9 trillion in economic output and supported 9.5 million American jobs. Also, in 2019, nearly 80 million international travelers visited the United States and contributed nearly $240 billion to the U.S. economy, making the United States the global leader in revenue from international travel and tourism. As the top services export for the United States that year, travel and tourism generated a $53.4 billion trade surplus and supported 1 million jobs in the United States.

The strategy follows a four-point approach:

- Promoting the United States as a Travel Destination Goal : Leverage existing programs and assets to promote the United States to international visitors and broaden marketing efforts to encourage visitation to underserved communities.

- Facilitating Travel to and Within the United States Goal : Reduce barriers to trade in travel services and make it safer and more efficient for visitors to enter and travel within the United States.

- Ensuring Diverse, Inclusive, and Accessible Tourism Experiences Goal : Extend the benefits of travel and tourism by supporting the development of diverse tourism products, focusing on under-served communities and populations. Address the financial and workplace needs of travel and tourism businesses, supporting destination communities as they grow their tourism economies. Deliver world-class experiences and customer service at federal lands and waters that showcase the nation’s assets while protecting them for future generations.

- Fostering Resilient and Sustainable Travel and Tourism Goal : Reduce travel and tourism’s contributions to climate change and build a travel and tourism sector that is resilient to natural disasters, public health threats, and the impacts of climate change. Build a sustainable sector that integrates protecting natural resources, supporting the tourism economy, and ensuring equitable development.

Travel and Tourism Fast Facts

- The travel and tourism industry supported 9.5 million American jobs through $1.9 trillion of economic activity in 2019. In fact, 1 in every 20 jobs in the United States was either directly or indirectly supported by travel and tourism. These jobs can be found in industries like lodging, food services, arts, entertainment, recreation, transportation, and education.

- Travel and tourism was the top services export for the United States in 2019, generating a $53.4 billion trade surplus.

- The travel and tourism industry was one of the U.S. business sectors hardest hit by the COVID-19 pandemic and subsequent health and travel restrictions, with travel exports decreasing nearly 65% from 2019 to 2020.

- The decline in travel and tourism contributed heavily to unemployment; leisure and hospitality lost 8.2 million jobs between February and April 2020 alone, accounting for 37% of the decline in overall nonfarm employment during that time.

- By 2021, the rollout of vaccines and lifting of international and domestic restrictions allowed travel and tourism to begin its recovery. International arrivals to the United States grew to 22.1 million in 2021, up from 19.2 million in 2020. Spending by international visitors also grew, reaching $81.0 billion, or 34 percent of 2019’s total.

More about the Tourism Policy Council and the 2022 National Travel and Tourism Strategy

Created by Congress and chaired by Secretary Raimondo, the Tourism Policy Council (TPC) is the interagency council charged with coordinating national policies and programs relating to travel and tourism. At the direction of Secretary Raimondo, the TPC created a new five-year strategy to focus U.S. government efforts in support of the travel and tourism sector which has been deeply and disproportionately affected by the COVID-19 pandemic.

Read the full strategy here

MyTravelResearch.com

Easy to use market research and marketing tools for the travel and tourism industry.

- How Culture and Heritage Tourism Boosts More Than A Visitor Economy

by Carolyn Childs 37 Comments

Culture and heritage tourism plays a critical role in building the visitor economy and goes even beyond that. A recent survey showed that over 50% of respondents polled agreed that history and culture are strong influences on their choice of holiday destination.

Culture and heritage tourism is a fast-growing and high-yielding sector

Statistics also indicate that culture and heritage tourism continues to grow rapidly, especially in OECD and APEC regions. We estimate the direct global value of culture and heritage tourism to be well over $1billion dollars, with that of the Asia Pacific region being approximately $327 million.

It is already directly responsible for more than 50 million jobs in APEC countries. And what’s more, the indirect benefits of culture and heritage tourism are thought to be of the order of $1 billion and account for further 75 million jobs across the region.

There is no denying the fact that culture and heritage tourism tends to attract high-yield tourists. While global figures can be hard to obtain, all available statistics on tourism in various individual markets like the UK, New Zealand, Australia, India , etc. reveal a consistent pattern.

Culture and heritage tourists often stay longer and spend a lot more money in general than other tourists do. In fact, one study showed that a culture and heritage tourist spent as much as 38% higher per day and they stayed 22% longer overall compared to other kinds of travellers.

Taj Mahal, Indian Symbol

Although the statistical evidence doesn’t show consistency regarding repeat visitors, tourism data on United States’ Culture and Heritage visitors indicates that the level of repeat visitation amongst this group of travellers is higher than that of traditional tourists.

It builds engagement

Culture and heritage tourists usually visit cultural heritage attractions such as historic buildings and other historic attractions; archaeological sites; state, local, or national parks; art galleries or museums; concerts, plays, or musicals; ethnic or ecological heritage sites; and such attractions. These travellers say that these trips are more memorable than conventional holiday trips since they allow them to learn something new. This focus on learning skills and gain enrichment has been identified by Trendwatching as a core global trend in travel (and links to broader macro trends in consumer needs).

The benefits of culture and heritage tourism are amplified through the economy, so their impact is much wider than just the direct spending levels. As Simon Thurley of English Heritage has shown in his Heritage Cycle, heritage tourism has benefits that extend beyond the solely economic.

What are the benefits of heritage tourism?

Generally, the benefits of heritage tourism can be categorized into three groups: economic, social, and environmental. As they tend to be the highest focus for destinations and policymakers we have focused on the economic benefits first

Economic Benefits of Cultural and Heritage Tourism

- Injects new money into the economy, boosting businesses and tax revenues

- Creates new jobs, businesses, events, and attractions, thus helping diversify the local economy

- Supports small businesses and enables them to expand

- Promotes the active preservation and protection of important local resources

- Builds vital relationships among and within local communities

- Helps encourage the development and maintenance of new/existing community amenities

Social Benefits of Cultural and Heritage Tourism

- Helps build social capital

- Promotes positive behaviour

- Helps improve the community’s image and pride

- Promotes community beautification

- Builds opportunities for healthy and useful community relationships and partnerships

- Provides research, education, and work-placement opportunities for students

- Creates enjoyable opportunities for both local residents and visitors attracted to the cultural arts, history, and preservation

- Boosts local investment in heritage resources and amenities that support tourism services

There is evidence that helping maintain buildings of character culture and heritage tourism can contribute to precincts’ innovation and business diversification. Small businesses based in amazing buildings are typically innovators and provide a core for other larger businesses.

Environmental Benefits of Cultural and Heritage Tourism

- Heritage tourism helps encourage a culture of preservation

- Boost awareness of the tourist site, attraction, or area’s significance

- Helps encourage local residents and visitors to be mindful of their impact on the natural and built environment

Although there is a risk that this type of tourism can lead to a place being ‘loved to death (think the Taj Mahal or the Sistine Chapel ), properly handled it can provide a reason to invest in things like sewage and water resources in areas.

So that is why we think Cultural and Heritage Tourism is vital to the visitor economy – and destinations should seek to maximise the opportunities it brings. In future articles, we will be delving more deeply into practical opportunities on how to do that. (If you are an MTR member then you can also access more detailed content via the Members Only HomePage .)

Looking for more Culture and Heritage tourism information? You can check out our blog about defining cultural and heritage tourism and cultural tourism opportunities .

Do you want to hear more from us?

Want to be kept up to date with the latest travel and tourism insights? Join Our Mailing List. Every 2 weeks, we send the latest practical insight for you to apply to your business and destination marketing.

- Recent Posts

- Reflections for the end of 2023 – and 2024

- Callingtourism businesses, schools and students in Regional NSW – we’d like your views

Related posts:

About Carolyn Childs

Carolyn has spent more than 25 years’ helping businesses achieve their goals by using research and other evidence to guide strategy and planning – mainly in the aviation, travel and tourism fields. She has worked in more than 35 countries on every inhabited continent and brings a detailed understanding of customers and how to connect with them. As well as running her own businesses, she has worked for organisations such as the International Air Transport Association, TNS (the world’s largest custom research company) and the Travel Research Centre.

November 28, 2023 at 7:58 am

Your blog, ‘How Culture and Heritage Tourism Boosts More Than A Visitor Economy,’ brilliantly unveils the multifaceted impact of cultural and heritage tourism. The depth of your analysis and compelling narrative style make this a must-read. It’s a commendable exploration of the broader positive influence that goes beyond economic aspects, showcasing the richness and importance of cultural exploration. Excellent work!

December 22, 2023 at 11:14 am

Thanks Kenny!

June 12, 2023 at 12:00 pm

What are the pros of heritage tourism?

June 12, 2023 at 12:40 pm

We try to outline these in the article but this type of tourism helps us preserve our vital cultural assets, gives communities pride and helps build economic opportunity. You can also find out more at the website of the World Tourism Association for Culture and Heritage and at that of ICOMOS .

Of course you have to do it right! This starts by the community understanding what they have, then deciding what they want to share finally finding visitors who want that.

One challenge is the concept of heritage has some negative connotations in that it can seem ‘fusty’ but by showcasing culture and immersion it becomes incredibly engaging. In our work with SHP we are working to overcome this.

Travellers say that they want to get under the skin of a destination – culture and heritage tourism does just that.

November 23, 2022 at 8:58 am

Hello. Thank you for the great blog today. Have a nice day 강남호빠

June 12, 2023 at 12:45 pm

Glad you liked it…

December 30, 2021 at 1:52 am

Thank you for this interesting piece. Can you clarify time frame for stats like this: “We estimate the direct global value of culture and heritage tourism to be well over $1billion dollars, with that of the Asia Pacific region being approximately $327 million.” Is this an annual figure? I am citing your work and want to be sure I am doing so accurately.

October 4, 2022 at 1:57 pm

Dolly it is an annual number. I think this number is now well exceeded though as this has been a huge growth area

October 12, 2021 at 7:49 pm

I would like to know on how can we able to preserve our cultural heritage so as we can ensure imcrease of coming tourists especially to the developing countries, since it has mostly be an obstacle to those nations.

November 29, 2021 at 2:38 pm

I think there is a need to engage your local community and to demonstrate the benefits to them, including opportunities for employment. Community is important as we also need to make sure that the way we promote it benefits the community.

One simple framewok I have seen in Canada is

1) work out what you have. What do you have to share. This doesn’t have to be buildings, intangible culture like cuisine and arts are important to. Audit what you have, collect your stories 2) Agree what you want to share. Agree what you want to share with visitors 3) work out what visitors want. Identify what demand there is for what you have to offer, what customers are interested? then find out about how they book and plan travel (lots of resources in our blog on this) then create a destination management plan (guidance on what to use can be found at https://www.austrade.gov.au/ArticleDocuments/5499/DM_Guide.pdf.aspx ) This will help you work out how and what to do

March 2, 2023 at 12:10 am

we are having different activities that we can do as our culture-heritage but due to financial constrain we get it difficult tp practices such kind of activities to promote our culture and also to act as tourism attraction for other continent .

June 12, 2023 at 12:34 pm

Not all culture and heritage activities have to cost a lot. Community-based tourism generally starts small scale and is built by the community asking what it can do rather. This could be simply opportunities for visitors to meet members of the local community or come for a meal at their homes. Talking to visitors already coming (if any) is a good place to start.

May 6, 2021 at 12:16 pm

Hi that is a question how heritage attractions make global marketing in order to attract more foreign tourists and enhance their popularities all over the world. Is it possible for the heritage attraction make efforts oversea? like participating in exhibition.

June 15, 2021 at 2:00 pm

Hi Cindy we definitely think attractions can promote overseas, but it depends on the attraction and whether it is likely to appeal to individual visitors. Our advice on promotion for an attraction is normally to do so in partnership with their host destination

October 27, 2021 at 6:15 pm

Hie We appreciate what you are doing. We are also trying to come up with a plan to establish a Cultural Heritage and Adventure tourism resort in our rural area in Hwedza. If you are ininterested in helping us please be intouch and will post to pictures of the magnificent sites we wish to show the world. Thank you in advance.

Best Regards Tsungai Maphosa

November 29, 2021 at 2:39 pm

Tsungai … will be in touch soon

April 9, 2021 at 7:55 pm

In which year you published it? I need it for my research paper

August 19, 2021 at 3:59 pm

April 2015… we review it each year and it still holds true and is our most read post!

January 25, 2021 at 5:39 pm

I have a question in what way how leisure helps the tourism industry?

I’m not sure I understand your question. Can you explain a bit more

December 4, 2020 at 5:15 am

I have a question, How to use tourism culture element to attract tourists ?

April 22, 2021 at 11:01 am

It was updated in 2020 but initially published on Apri 18, 2015. We revisit it reqgularly and it still holds true

September 14, 2020 at 8:57 pm

Culture or heritage consumption requires understanding how tourist’ emotions and reasons interacting in experiencing these products to ensure long-term sustainability?

October 12, 2020 at 10:33 am

It does indeed. It also means encouraging the right tourists.

September 13, 2020 at 12:52 am

I have a question explain the economic benefits, social benefits and environmental benefits of heritage tourism. Specify specific examples /situation

October 12, 2020 at 10:31 am

This could honestly be a whole text book Natalia! The three are highly linked as in what brings money in gets valued and what is valued is protected. It is called the heritage cycle. The UK Lottery fund has a report on the value of conserving and adapting heritage buildings that shows they bring in GDP.

August 17, 2020 at 11:50 pm

What are the possible objects of cultural interest that may entice or impact tourist arrivals?

October 12, 2020 at 10:29 am

Krister… the process is a three step one. Identify what you have, Agree with the community what can be shared, identify if there are enough visitors who might be interested and who they are? There isn’t a one size fits all on this.

February 4, 2020 at 11:34 pm

In your own words what are the advantages of heritage tourism and what are the disadvantages or challenges of heritage tourism?

March 3, 2020 at 5:57 pm

Mark Great question. I don’t see any disadvantages if it is managed well. The challenges come when it isn’t developed with local buy on, people fail to plan for tourism and culture together and where you don’t let the story lead. The advantages are almost too numerous to mention: social capital, civic pride, economic benefit, a clear case for protecting assets.

January 19, 2020 at 11:22 am

I have a question how does cultural heritage promotes tourism?

January 24, 2020 at 11:12 am

Cultural heritage provides a compelling reason to visit. As more people have the ability to travel we see that the desire to understand other cultures grows. Cultural heritage often includes compelling human stories and provokes a sense of wonder. Who hasn’t stood in front of the pyramids and ‘gone wow!’?

There is strong supporting evidence. Research on the impact of gaining World Heritage status indicates that it boosts visitation. It’s a way of curating the ‘best of’ that anyone can understand.

July 4, 2019 at 12:37 am

Now, that’s a great question. All places are heritage destinations since all of them have their histories. However, some places are more historically significant than others. In that sense, all travel can be classified as heritage travel.

Attractions can be either heritage attractions or otherwise. In other words, non-heritage attractions like scenery, national parks, nightclubs, safaris, adventure are also reasons why people travel. In this case, heritage has no place.

I would like to ask one question of my own: How important do you think it is for travelers going to heritage destinations, to be acquainted with the history of the place?

September 11, 2019 at 2:18 pm

I am not sure we could police that. Maybe more like encourage it but great interpretation on site can do the same job

December 6, 2018 at 4:47 am

I have a great question if you can answer the question by my email address Does tourism exist without heritage or attraction? if you say yes how? if you say no how?

September 11, 2019 at 2:21 pm

It depends what you mean by an attraction … many holidays are about relaxation. They may include sightseeing, but the classic ‘fly and flop’ holiday is still tourism. We now know that even this type of holiday can help with mental and physical health

September 21, 2019 at 5:40 pm

YES you are absolutely right that tourism has a lot of advantage for health. Tourism is one which bring happiness in our life and enjoy Full moments. even through it we feel something fresh and new observation.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

- Get Connected

- globalEDGE Blog

The Importance of Tourism on Economies and Businesses

Published: 3/26/2019 12:21:08 PM

Image Source

Tourism is vital for the success of many economies around the world. There are several benefits of tourism on host destinations. Tourism boosts the revenue of the economy, creates thousands of jobs, develops the infrastructures of a country, and plants a sense of cultural exchange between foreigners and citizens.

The number of jobs created by tourism in many different areas is significant. These jobs are not only a part of the tourism sector but may also include the agricultural sector, communication sector, health sector, and the educational sector. Many tourists travel to experience the hosting destination’s culture, different traditions, and gastronomy. This is very profitable to local restaurants, shopping centers, and stores. Melbourne, Australia ’s population is greatly affected by tourism. It has a population of around 4 million people and around 22,000 citizens are employed by the tourism sector only.

Governments that rely on tourism for a big percentage of their revenue invest a lot in the infrastructure of the country . They want more and more tourists to visit their country which means that safe and advanced facilities are necessary. This leads to new roads and highways, developed parks, improved public spaces, new airports, and possibly better schools and hospitals. Safe and innovative infrastructures allow for a smooth flow of goods and services. Moreover, local people experience an opportunity for economic and educational growth.

Tourism creates a cultural exchange between tourists and local citizens. Exhibitions, conferences, and events usually attract foreigners. Organizing authorities usually gain profits from registration fees, gift sales, exhibition spaces, and sales of media copyright. Furthermore, foreign tourists bring diversity and cultural enrichment to the hosting country.

Tourism is a great opportunity for foreigners to learn about a new culture, but it also creates many opportunities for local citizens . It allows young entrepreneurs to establish new products and services that would not be sustainable on the local population of residents alone. Moreover, residents experience the benefits that come with tourism occurring in their own country.

To learn about the countries earning the most from international tourist arrivals, click on the link below!

Countries Earning the Most from International Tourism

Share this article

Travel & Tourism Development Index 2021: Rebuilding for a Sustainable and Resilient Future

Our Organisation

Our Careers

Tourism Statistics

Industry Resources

Media Resources

Travel Trade Hub

News Stories

Newsletters

Industry Events

Business Events

THRIVE 2030

The re-imagined visitor economy

- Share Share on Facebook Share on Twitter Share on WhatsApp Copy Link

THRIVE 2030 is Australia’s national strategy for the long-term sustainable growth of the visitor economy.

Prior to COVID-19, the visitor economy was Australia’s fourth largest export sector, comprising domestic and international tourism; international student, business and leisure travellers; and the associated industries of hospitality, aviation and accommodation.

The Australian Government released THRIVE 2030 to rebuild and return the visitor economy. The strategy sets a target of returning visitor expenditure to pre-COVID levels of $166 billion by 2024 and growing it to $230 billion by 2030, and it includes actions for governments and industry under three key themes:

- Collaborate

For more information on the THRIVE 2030 Strategy, visit www.austrade.gov.au/visitoreconomy

Tourism 2020

Tourism 2020 was a whole-of-government and industry long-term strategy to build the resilience and competitiveness of Australia’s tourism industry and grow its economic contribution.

Discover more

We use cookies on this site to enhance your user experience. Find out more .

By clicking any link on this page you are giving your consent for us to set cookies.

Acknowledgement of Country

We acknowledge the Traditional Aboriginal and Torres Strait Islander Owners of the land, sea and waters of the Australian continent, and recognise their custodianship of culture and Country for over 60,000 years.

*Disclaimer: The information on this website is presented in good faith and on the basis that Tourism Australia, nor their agents or employees, are liable (whether by reason of error, omission, negligence, lack of care or otherwise) to any person for any damage or loss whatsoever which has occurred or may occur in relation to that person taking or not taking (as the case may be) action in respect of any statement, information or advice given in this website. Tourism Australia wishes to advise people of Aboriginal and Torres Strait Islander descent that this website may contain images of persons now deceased.

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

IMAGES

COMMENTS

Tourism Economics has worked with hundreds of national, state, and city tourism offices to provide a foundational analysis of the importance of the visitor economy.The economic importance of tourism to a destination is commonly under-appreciated and extends well beyond core hospitality and transportation sectors

Inbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region ... Travel & Tourism: Global Economic Impact & Trends 2019 Contact. Get in touch with us. We are ...

WTTC's latest annual research shows: In 2023, the Travel & Tourism sector contributed 9.1% to the global GDP; an increase of 23.2% from 2022 and only 4.1% below the 2019 level. In 2023, there were 27 million new jobs, representing a 9.1% increase compared to 2022, and only 1.4% below the 2019 level.

The Travel & Tourism Development Index (TTDI) 2024 is the second edition of an index that evolved from the Travel & Tourism Competitiveness Index (TTCI) series, a flagship index of the World Economic Forum that has been in production since 2007. The TTDI is part of the Forum's broader work with industry and government stakeholders to build a ...

Travel and Tourism Satellite Account for 2018-2022 The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA's Travel and Tourism Sate

Tourism Statistics. Get the latest and most up-to-date tourism statistics for all the countries and regions around the world. Data on inbound, domestic and outbound tourism is available, as well as on tourism industries, employment and complementary indicators. All statistical tables available are displayed and can be accessed individually ...

Mar 6, 2024. While few industries were spared by the impact of the Covid-19 pandemic over the past three years, even fewer have been hit as hard as the tourism sector. After Covid-19 had made 2020 ...

Longer-term forecasts also point to optimism for the decade ahead. Travel and tourism GDP is predicted to grow, on average, at 5.8 percent a year between 2022 and 2032, outpacing the growth of the overall economy at an expected 2.7 percent a year. 5 Travel & Tourism economic impact 2022, WTTC, August 2022.

10 Nov 2023. Tourism has again been identified as a key driver of economic recovery and growth in a new report by the International Monetary Fund (IMF). With UNWTO data pointing to a return to 95% of pre-pandemic tourist numbers by the end of the year in the best case scenario, the IMF report outlines the positive impact the sector's rapid ...

Tourism Economics US Headquarters 303 West Lancaster Avenue, Suite 2E Wayne, PA 19087 U.S. +1 610 995 9600 Tourism Economics Europe Headquarters Abbey House 121 St Aldates Oxford, OX1 1HB U.K. +44 1865 268 900

Basic Statistic Contribution of travel and tourism to employment in the U.S. 2019-2022 Premium Statistic Most visited states in the U.S. 2022 Industry overview

Tourism made up 10 percent of global GDP in 2019 and was worth almost $9 trillion, 1 See "Economic impact reports," World Travel & Tourism Council (WTTC), wttc.org. making the sector nearly three times larger than agriculture. However, the tourism value chain of suppliers and intermediaries has always been fragmented, with limited coordination among the small and medium-size enterprises ...

Getty. All your jet-setting and hotel-hopping is having a significant effect on the global economy. The folks at the World Travel & Tourism Council (WTTC) estimate that the travel industry will ...

Increasingly, competitiveness in the visitor economy, which refers to the tourism and hospitality sectors and other interdependent sectors that involve visitor-related economic activities, has come to be considered a multi-level and dimensional construct that requires a broad conceptualisation that has moved away from its narrower economic origins.

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000. Tourism can be important for both the travelers and the people in the countries they visit. For visitors, traveling can increase their ...

Open the Visitor Economy Facts and Figures data in full-screen mode. Data results. The main data in this report are: monthly, quarterly and annual data on the number of domestic and international visitors. It also captures their reasons for travel and their total spend in Australia; total value of the visitor economy by its components

The federal government will work to implement the strategy under the leadership of the TPC and in partnership with the private sector, aiming toward an ambitious five-year goal of increasing American jobs by attracting and welcoming 90 million international visitors, who we estimate will spend $279 billion, annually by 2027.. The new National Travel and Tourism Strategy supports growth and ...

Tourism Economics is an international peer reviewed journal, covering the business aspects of tourism in the wider context. It takes account of constraints on development, such as social and community interests and the sustainable use of tourism and … | View full journal description. This journal is a member of the Committee on Publication ...

Culture and heritage tourism plays a critical role in building the visitor economy and goes even beyond that. A recent survey showed that over 50% of respondents polled agreed that history and culture are strong influences on their choice of holiday destination. Culture and heritage tourism is a fast-growing and high-yielding sector

Tourism is vital for the success of many economies around the world. There are several benefits of tourism on host destinations. Tourism boosts the revenue of the economy, creates thousands of jobs, develops the infrastructures of a country, and plants a sense of cultural exchange between foreigners and citizens.

The Travel & Tourism Competitiveness Report (TTCR) 2021 is the latest edition of the 15-year-old TTCR series, a flagship publication of the World Economic Forum's Platform for Shaping the Future of Mobility. Reports. Authors: Lauren Uppink Published: 24 May 2022 ...

The Australian Government released THRIVE 2030 to rebuild and return the visitor economy. The strategy sets a target of returning visitor expenditure to pre-COVID levels of $166 billion by 2024 and growing it to $230 billion by 2030, and it includes actions for governments and industry under three key themes: Collaborate. Modernise. Diversify.

Free-spending visitors are fueling a powerful boom in southern Europe, flipping economic power in the EU. Some economists think it could end badly. Tourists enjoy the views from a cafe in Lisbon ...

BISMARCK, N.D. - The travel and tourism economy in North Dakota surpassed pre-pandemic levels in 2023, according to a new report released by the North Dakota Department of Commerce. The number ...

The $25.6 billion number includes $15.7 in direct visitor spending, plus indirect effects like wages being spent in local economies. Not all counties benefit equally from tourism in Wisconsin, but ...

Karen Gallagher/Tourism Australia 5. Geneva, Switzerland: Western Europe was the best performing region this year, with four cities, including Switzerland's Geneva, in the top 10.

June 27 (UPI) --Qatari municipal and private sector leaders on Thursday announced the launch of a major tourism project aimed at diversifying the country's economy and attracting more foreign ...