- Skip to main content

- Skip to "About this site"

Language selection

- Français fr

Travel services

Resources for authorized Government of Canada (GC) travellers on official business.

On this page

Shared Travel Services portal

Other information and resources

Accommodation and car rental directory

Hotel Pass Program

The Shared Travel Services (STS) portal is an online travel management tool for authorized GC travellers on official business . From the portal, travellers can:

- air and rail transportation

- car rentals

- accommodations

- submit travel authorizations

- manage travel expenses

- find up-to-date travel related information

The STS portal supports the GC ’s priorities for greater accountability, visibility, and transparency in service delivery. It also modernizes and standardizes the processes for booking travel.

By choosing to follow this link, you will be navigating away from this Government of Canada website to a contracted service provider.

- Travel on government business

- Book travel (accessible only on the Government of Canada network)

- Travel services (accessible only on the Government of Canada network)

The accommodation directory offers information and rates on approved accommodations in Canada, the United States of America (USA) and other countries. It allows government travellers to search the directories using various parameters. The car rental directory provides an alphabetical index of city listings in Canada and the USA . In each city listing, car rental firms and their rates are shown in ascending order by price per vehicle category.

In compliance with subsection 41(1) of the Official Languages Act , the Public Services and Procurement Canada (PSPC) Hotel Pass Program supports Official Language Minority Communities (OLMC) in Canada.

The program is for staff and representatives of non-profit national and regional OLMC organizations who work to support and assist the development of these communities in areas such as:

- economic development

- immigration

- communications

Staff refers to employees who are on these organizations’ payroll, and representatives are the people who sit on their board of directors.

While travelling for business in Canada, they can benefit from the preferential rates offered by the establishments listed in the Government of Canada Accommodation Directory.

To benefit from this program, an application must be submitted to Public Services and Procurement Canada’s OLMC Secretariat, using the online Hotel Pass Program: Beneficiary application form .

For any questions, contact the OLMC Secretariat at tpsgc.dgrhsecretariatclosm-hrbolmcsecretariat.pwgsc@tpsgc-pwgsc.gc.ca .

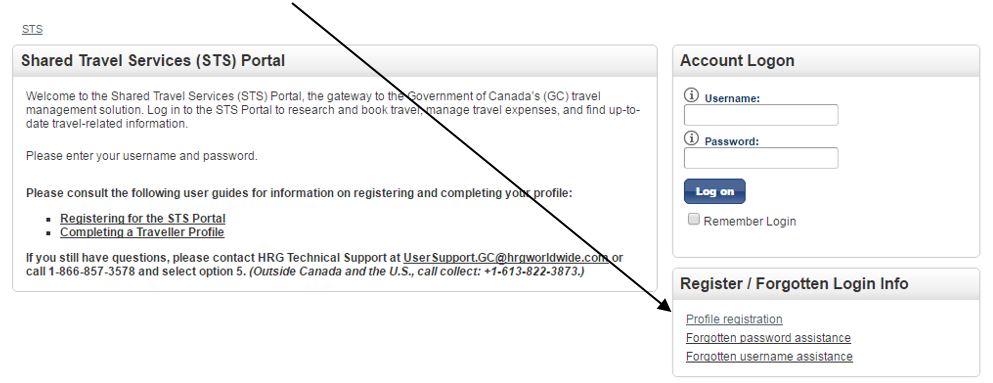

Shared Travel Services

- Forgotten Password

Welcome to Shared Travel Services

Please enter your username and password to log in.

Guideline on Common Financial Management Business Process 3.2 – Manage Travel

Executive summary.

This guideline is part of a set of guidelines designed to assist departments See footnote [1] in implementing common financial management business processes.

This guideline presents the “should be” model for Manage Travel which involves government business travel authorized by the employer under which expenses may be paid or reimbursed from public funds. See footnote [2] This guideline describes roles, responsibilities and recommended procedures in the context of the Financial Administration Act , other legislation, and Government of Canada policy instruments.

As illustrated in Figure 1, Manage Travel comprises 3.2 subprocesses 3.2.1 to 3.2.9. These are arranged in nine subprocess groups, as follows.

Figure 1. Manage Travel - Level 2 Process Flow

Text version: Figure 1. Manage Travel - Level 2 Process Flow

Manage Travel Planning and Requests is the start of the Manage Travel business process, beginning with the approved budget and approved plan from Manage Planning and Budgeting (Business Process 1.1). This subprocess group involves detailed travel planning in accordance with the appropriate policy instruments. Blanket travel authority may be requested or provided, typically at the start of the fiscal year. When the travel event is approaching, the person travelling completes the travel authorization and advance request, and ensures it is in accordance with the applicable policies. The travel request is approved by the individual with the appropriate expenditure initiation authority. This subprocess group also involves ensuring that there is a sufficient unencumbered balance, and includes creating and updating commitments prior to approving or amending travel requests and/or blanket travel authorities pursuant to section 32 of the FAA. The manager is accountable for managing his or her commitments in accordance with department-specific policy.

If a travel advance is requested, it is submitted to the manager for section 34 certification through the Manage Travel Administration and Travel Claims subprocess group and then sent to financial services for payment processing through the Manage Settlement of Travel Claims subprocess group.

Manage Travel Administration and Travel Claims involves obtaining a Travel Authorization Number (TAN), if required; making travel arrangements in accordance with the approved travel request and the applicable policy instruments; and handling requests for travel advances or travel claims by completing account verification and providing certification authority pursuant to section 34 of the FAA. Once travel has occurred and/or expenses have been incurred, the person travelling completes a travel claim and submits the claim with the required supporting documentation to the appropriate manager for approval. When the travel claim is received, the responsibility centre manager completes account verification and exercises section 34 certification authority; then a request for payment is made and sent to financial services.

Manage Settlement of Travel Claims ends the Manage Travel business process and involves performing quality assurance activities, where applicable; exercising payment authorization pursuant to section 33 of the FAA; completing and submitting payment requisitions; and finalizing payments. When quality assurance is not performed, the process proceeds to Manage Post-Payment Verification (Business Process 8.1). When quality assurance is performed, the process proceeds to Manage Financial Close (Business Process 8.2). Financial services is responsible for managing payment requisitions, certifying payments (section 33 of the FAA), and recording payments. The Receiver General for Canada through the Banking and Cash Management Sector of the Department of Public Works and Government Services is responsible for issuing payments.

Throughout the Manage Travel business process, there are specific times when the vendor master data file needs to be updated. The connection point to Manage Vendor Master Data File (Business Process 7.1) is provided in Manage Travel Claims and Advance Requests (Subprocess 3.2.7).

1. Date of Issue

This guideline was issued on May 15, 2013.

This guideline is part of a set of guidelines designed to assist departments See footnote [3] in implementing common financial management business processes. This guideline supports the Policy on the Stewardship of Financial Management Systems and the Directive on the Stewardship of Financial Management Systems .

This guideline presents the “should be” model for Manage Travel, describing roles, responsibilities and recommended activities from a financial management perspective. Most activities are financial in nature, but some non-financial activities are included in order to provide a comprehensive process description; these activities are identified as outside the scope of Manage Travel. The recommended activities comply with the Financial Administration Act , other legislation, and Government of Canada policy instruments.

Recognizing that deputy heads are ultimately responsible for all aspects of financial management systems within their department, standardizing and streamlining financial management system configurations, business processes and data across government provides significant direct and indirect benefits relative to the quality of financial management in the Government of Canada. By establishing a common set of rules, standardization reduces the multitude of different systems, business processes and data that undermine the quality and cost of decision-making information. As government-wide standardization increases, efficiency, integrity and interoperability are improved. See footnote [4]

3. Introduction

This guideline defines Manage Travel, which begins with managing travel plans based on an approved budget and ends with the settlement of a travel claim expense. This common financial business process focuses on government travel for Government of Canada employees and travellers.

This guideline covers the following three subprocess groups:

Manage Travel Planning and Requests

Manage Travel Administration and Travel Claims

Manage Settlement of Travel Claims

Expenditures or payments not involving government travel, such as non-pay employee–related transactions and payments related to the relocation of employees, are described in Manage Other Payments (Business Process 3.3). Payments related to government travel for consultants are described as part of Manage Procure to Payment (Business Process 3.1). Payments to other government departments are described in Manage Interdepartmental Settlements (Business Process 2.2).

Some financial management activities described in this guideline are also related to internal controls. The intent is neither to provide a complete listing of controls nor to produce a control framework, but the process description may provide useful content for the development of a department's control framework.

3.2 Structure of the Guideline

The remainder of this guideline is structured as follows. Section 4 provides an overview of the roles that carry out Manage Travel. Section 5 presents a detailed description of the Manage Travel business process, including subprocess groups, subprocesses, activities and responsible roles. Appendix A provides definitions of terminology used in the guideline, and relevant abbreviations are listed in Appendix B . Appendix C describes the methodology used in the guideline, and Appendix D elaborates on the roles and responsibilities outlined in Section 4.Given the particularities of travel cards, distinct process flows have been created and are described in Appendix E .

3.3 References

The following references apply to this guideline.

3.3.1 Acts and Regulations

- Federal Accountability Act

- Financial Administration Act

3.3.2 Policy Instruments

- Directive on Accountable Advances

- Directive on Account Verification

- Directive on Delegation of Financial Authorities for Disbursements

- Directive on Expenditure Initiation and Commitment Control

- Directive on Payment Requisitioning and Cheque Control

- Directive on Travel Cards and Travellers Cheques

- Directive on the Management of Expenditures on Travel, Hospitality and Conferences

- Directive on the Stewardship of Financial Management Systems

- Guideline on Accountable Advances

- National Joint Council Travel Directive

- Policies for Ministers' Offices

- Policy on Financial Management Governance

- Policy on Internal Control

- Policy on Learning, Training and Development

- Policy on the Stewardship of Financial Management Systems

- Special Travel Authorities

- Standards on Knowledge for Required Training

- Treasury Board Supplementary Travel Policy (for the Executive Group and excluded employees)

3.3.3 Other References

- Management Accountability Framework

- Receiver General Control Framework

- Receiver General Manual

- Shared Travel Services (various guidelines and guides)

- Travel Approval Guidelines for Deputy Ministers and Heads of Agencies, Boards and Commissions (Deputy Heads) (November 2010)

- Terms and Conditions of Employment for Full-Time Governor in Council Appointees

4. Roles and Responsibilities

Figure 2 depicts the roles involved in the Manage Travel business process, grouped by stakeholder category.

Figure 2. Roles Involved in Manage Travel

Text version: Figure 2. Roles Involved in Manage Travel

In this guideline, a role is an individual or a group of individuals whose involvement in an activity is described using the Responsible, Accountable, Consulted and Informed (RACI) approach. Because of differences among departments, a role may not correspond to a specific position, title or organizational unit. The roles and responsibilities for Manage Travel are briefly described in Sections 4.1 to 4.4 and are explained in more detail in Appendix D .

4.1 Requirements Framework

The following organizational roles act in support of such legislation as the Financial Administration Act (FAA) and the Federal Accountability Act , and define the policy and/or processes that are to be followed.

- Office of the Comptroller General- Financial Management Sector is the policy authority for financial management.

- The deputy head is responsible for providing leadership by demonstrating financial responsibility, transparency, accountability, and ethical conduct in financial and resource management, including compliance with legislation, regulations, Treasury Board policies, and financial authorities. See footnote [5]

- The purpose of the National Joint Council (NJC) is to promote the efficiency of the public service and the well-being of public service employees by providing for regular consultation between the government as the employer and bargaining agents on behalf of employees who come under the jurisdiction of the Public Service Labour Relations Act . See footnote [6] The NJC ensures fair treatment of employees who are required to travel on government business through the National Joint Council Travel Directive . See footnote [7]

- The Office of the Chief Human Resources Officer's (OCHRO's) mandate is to support deputy heads, managers and the human resources community in fulfilling their people management responsibilities. OCHRO represents the employer's side of the NJC through Compensation and Labour Relations. See footnote [8]

4.2 Financial Management

The following organizational roles act in response to financial management (i.e., Office of the Comptroller General - Financial Management Sector and deputy heads) policy and process requirements.

- The corporate finance role supports deputy heads and chief financial officers in meeting their financial management accountabilities by developing, communicating, and maintaining the departmental financial management framework and providing leadership and oversight on the proper application and monitoring of financial management across the department. See footnote [9]

- The financial services role carries out the day-to-day transactional financial management operations.

- Initiating expenditures;

- Controlling commitments pursuant to section 32 of the FAA; and

- Performing account verification procedures and certification pursuant to section 34 of the FAA.

- The activities attributed to this role can be fulfilled by an individual or a group of individuals. Please note that in this guideline, the responsibility centre manager is also referred to as “the manager.”

4.3 Central Services

The following organizational roles provide a central service to other government departments.

- Shared Travel Services provides travel services for public service employees and travellers, as well as streamlined travel processes for departments.

- The Receiver General - Banking and Cash Management Sector is responsible for managing the treasury functions of the government. These functions include issuing payments on behalf of the government and controlling the government's bank accounts.

4.4 Travel Administration

The following organizational roles are specific to the Manage Travel business process.

- An employee is a person employed in the public service. See footnote [10] The employee is responsible for consulting the appropriate policy instruments and obtaining authorization to travel, for managing his or her travel card, and for completing and submitting travel expense claims. Note that an employee can be a traveller; however, a traveller may not necessarily be an employee.

- A traveller is a person who is authorized to travel on federal government business. See footnote [11] The traveller is responsible for consulting the appropriate policy instruments and obtaining authorization to travel, and for completing and submitting travel expense claims. Note that an employee can be a traveller; however, a traveller may not necessarily be an employee.

- The designated departmental travel coordinator is responsible for policy interpretation for all travel-related questions within his or her department regarding the National Joint Council Travel Directive , rates and allowances, and Special Travel Authorities .

- The departmental travel card coordinator is an official representative of the department in all matters related to its participation in the travel card program who is responsible for liaising with the Department of Public Works and Government Services and the card issuer. See footnote [12]

5. Process Flows and Descriptions

Appendix C describes the methodology used in this section.

5.1 Overview of Manage Travel

As illustrated in Figure 3, the Manage Travel Level 2 business process comprises nine subprocesses (3.2.1 to 3.2.9). These are arranged in three subprocess groups: Manage Travel Planning and Requests, Manage Travel Administration and Travel Claims, and Manage Settlement of Travel Claims.

Figure 3. Manage Travel – Level 2 Process Flow

Text version: Figure 3. Manage Travel – Level 2 Process Flow

The subprocesses within each subprocess group and the roles and responsibilities relevant to each subprocess are summarized below.

- Manage Travel Plans (Subprocess 3.2.1): Based on the approved budget for the year from Manage Planning and Budgeting (Business Process 1.1), detailed travel planning occurs in accordance with the appropriate policy instruments.

- Manage Blanket Travel Authority (Subprocess 3.2.2): A blanket travel authority may be requested if an employee travels on a continuous or repetitive basis, with no variation in the specific terms and conditions of the trips, and if it is not practical or administratively efficient to obtain prior approval from the employer for each individual trip. See footnote [13] Typically, blanket travel authorities are provided at the start of the fiscal year.

- Manage Travel Requests (Subprocess 3.2.3): This subprocess starts when the travel event is approaching. The person travelling completes the travel authorization and advance request, and ensures it is in accordance with the applicable policies. The travel request is approved by the individual with the appropriate expenditure initiation authority. This subprocess is performed concurrently with both Verify Unencumbered Balance (Subprocess 3.2.4) and Manage Commitment (Subprocess 3.2.5).

- Verify Unencumbered Balance (Subprocess 3.2.4): Before approving the travel request, the manager needs to ensure that a sufficient unencumbered balance is available in an appropriation. See footnote [14]

- Manage Commitment (Subprocess 3.2.5): On receiving confirmation that a sufficient unencumbered balance is available, the manager records and updates the commitment according to department-specific policy. See footnote [15]

- Manage Travel Administration (Subprocess 3.2.6): Once travel has been approved, the person travelling is responsible for obtaining a Travel Authorization Number (TAN), if required, to make travel arrangements such as air travel. Travel arrangements are made by choosing an itinerary and booking arrangements in accordance with the approved travel request and the applicable policy instruments. When travel has occurred and/or expenses have been incurred, a travel claim is prepared. This becomes the input to Manage Travel Claims and Advance Requests (Subprocess 3.2.7).

- Manage Travel Claims and Advance Requests (Subprocess 3.2.7): Following receipt of the travel claim or travel advance request, account verification is completed pursuant to section 34 of the Financial Administration Act (FAA). Certification authority is exercised by the manager, See footnote [16] and a request for payment is prepared and sent to financial services.

- Perform Payment Authority (Subprocess 3.2.8): This subprocess starts with the receipt of a request for payment. During the payment process, quality assurance is performed by financial services as part of exercising payment authority pursuant to section 33 of the FAA. See footnote [17]

- Issue Payment (Subprocess 3.2.9): After payment authorization, the payment requisition is sent to the Receiver General for payment issuance. The payment requisition files are edited and verified, and the payments are released by the Receiver General. The Receiver General produces a generic return file containing unique payment references for control purposes. The payment records in the departmental financial and materiel management system are updated See footnote [18] by financial services, and Manage Travel (Business Process 3.2) ends. When quality assurance is not performed, the process proceeds to Manage Post-payment Verification (Business Process 8.1). When quality assurance is performed, the process proceeds to Manage Financial Close (Business Process 8.2).

5.2 Manage Travel Planning and Requests

Manage Travel Planning and Requests is the start of the Manage Travel business process, beginning with the approved budget and the approved plan from Manage Planning and Budgeting (Business Process 1.1). This subprocess group involves detailed travel planning in accordance with the appropriate policy instruments. Blanket travel authority may be requested or provided, typically at the start of the fiscal year. When the travel event is approaching, the person travelling completes the travel authorization and advance request, and ensures it is in accordance with the applicable policies. The travel request is approved by the individual with the appropriate expenditure initiation authority. This subprocess group also involves ensuring that there is a sufficient unencumbered balance and includes creating and updating commitments prior to approving or amending travel requests and/or blanket travel authorities pursuant to section 32 of the FAA. The manager is accountable for managing his or her commitments in accordance with department-specific policy.

5.2.1 Manage Travel Plans (Subprocess 3.2.1)

Based on the approved budget for the year from Manage Planning and Budgeting (Business Process 1.1), detailed travel planning occurs in accordance with the appropriate policy instruments. Figure 4 depicts the Level 3 process flow for Manage Travel Plans.

Figure 4. Manage Travel Plans (Subprocess 3.2.1) – Level 3 Process Flow

Text version: Figure 4. Manage Travel Plans (Subprocess 3.2.1) – Level 3 Process Flow

5.2.1.1 Activities

The Manage Travel business process begins with the department's approved budget from Manage Planning and Budgeting (Business Process 1.1), including the annual budget for travel approved by the deputy head. See footnote [19] From here, detailed travel planning occurs by responsibility centre managers throughout the department. It is at this point that the requirement for blanket travel authorities is considered and that action is taken.

An important step before finalizing a travel plan is determining which policy authority applies and which policy instruments are relevant (Activity 3.2.1.1 – Determine Appropriate Policy Authority) to establish the correct travel provisions. The primary policy instruments include:

- Organization-specific travel policies

It is important to note that more than one policy may apply. For example, the standards and conditions governing travel on government business for full-time Governor in Council appointees are prescribed in the National Joint Council Travel Directive and Treasury Board's Special Travel Authorities . In addition, further instructions could be provided in Orders in Council from the Privy Council Office .

How and when the policy instruments apply will depend on the following factors:

- Employee or traveller : Travel provisions differ based on whether the person travelling is considered an “employee” or a “traveller.” For example, as per the National Joint Council Travel Directive , employees (persons employed in the public service) are allowed dependant care expenses or home provisions for weekend travel, while travellers (persons authorized to travel on federal government business) are not.

- Employee category, group, and level : Some employees may be members of the Executive Group or may be excluded employees (i.e., excluded from a bargaining unit for managerial or confidential reasons); for these employees, the Treasury Board Supplementary Travel Policy (for the Executive Group and excluded employees) apply. For represented employees, policy instruments should be read in conjunction with the relevant collective agreements.

- Enabling legislation : An enabling legislation or Act may confer certain authorities to the Treasury Board or to departments and agencies to develop or propose a distinct travel policy, e.g., for Agents of Parliament, the Canada Revenue Agency, the Canadian Forces, and the Royal Canadian Mounted Police. These organizations may refer to existing policy instruments as a benchmark in developing their own travel policy.

- Cabinet direction : The Cabinet or budget direction for the Government of Canada may impose overarching limitations on travel, such as on the amount of travel or on certain entitlements.

Once the policy instruments are clearly determined, detailed travel plans are developed (Activity 3.2.1.2 – Define Detailed Travel Plans). Several considerations should be taken into account when planning travel, See footnote [20] such as the following:

- Travel costs should be avoided whenever there is a reasonable and more economical alternative available and deemed sufficient to meet the intended objective (e.g., use of government facilities, tele/videoconferencing);

- Booking transportation, accommodations, and conference facilities is expected to take place well in advance to obtain optimal discounted rates, where possible;

- The number of persons sent to the same event or activities, including conferences, should be kept to the minimum necessary for the effective conduct of government business, leveraging where possible individuals already located near the event or site; and

- In situations of periodic or multiple trips to the same destination or where several persons are sent to the same events or activities, including conferences, costs are to be minimized through effective planning and coordination.

Detailed travel planning includes an assessment of recurring travel arrangements to ensure their continued relevance to the department. It is also important to ensure that planned trip costs are minimized by considering alternatives to travel (e.g., teleconferencing), reducing the duration or extent of the trip, making early bookings to obtain discounts, and ensuring value for money when determining the location and number of attendees. See footnote [21]

As part of travel planning and managing travel within a department, consideration should be given to the specific arrangement of group travel because this may provide efficiencies and reductions in costs. Consideration should also be given to the use of available credits. Various suppliers give credits for unused travel, and certain airlines allow such credits to be transferred within organizations. A report for unused and partially used credits is sent to the department by the government travel service supplier.

Once travel plans have been confirmed and finalized at the start of the fiscal year, they are typically communicated to the parties involved. It is important to monitor the annual departmental budgets for travel over the course of the fiscal period to ensure that individual travel plans are compliant with the department's objectives and priorities, and that only necessary travel costs are incurred.

The Manage Travel Plans subprocess is complete once travel plans are defined and finalized, resulting in a detailed travel plan. At this point in the process, there are several options:

- In situations where employees are travelling on a continuous or repetitive basis, with no variation in the specific terms and conditions of the trips, See footnote [22] the Manage Blanket Travel Authority (Subprocess 3.2.2) is initiated;

- In situations where employees need to obtain a travel card, the Manage Travel Cards subprocess (see Appendix E ) is initiated; or

- In situations where a specific trip is to be undertaken, the Manage Travel Requests (Subprocess 3.2.3) is initiated.

5.2.1.2 Roles and Responsibilities

The responsibility centre manager is responsible and accountable for preparing the travel plans based on the approved budget. It may be necessary to consult with the designated departmental travel coordinator to determine the appropriate policy instruments that apply.

Table 1 provides an overview of the roles and responsibilities for this subprocess, using the Responsible, Accountable, Consulted and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D .

5.2.2 Manage Blanket Travel Authority (Subprocess 3.2.2)

A blanket travel authority may be requested if an employee travels on a continuous or repetitive basis, with no variation in the specific terms and conditions of the trips, and if it is not practical or administratively efficient to obtain prior approval from the employer for each individual trip. See footnote [23] Typically, blanket travel authorities are provided at the start of the fiscal year. Figure 5 depicts the Level 3 subprocess flow for Manage Blanket Travel Authority.

Figure 5. Manage Blanket Travel Authority (Subprocess 3.2.2) – Level 3 Process Flow

Text version: Figure 5. Manage Blanket Travel Authority (Subprocess 3.2.2) – Level 3 Process Flow

5.2.2.1 Activities

Blanket travel authorities are typically documented by the employee or the responsibility centre manager at the beginning of the fiscal year during the planning phase (Manage Travel Plans (Subprocess 3.2.1). However, a blanket travel authority can be created at any time during the fiscal year (Activity 3.2.2.1 – Complete Blanket Travel Authority Form). This activity includes providing details such as the consecutive travel days, the estimated dollar value for each individual trip, the geographic location, and the start and end dates. Blanket travel authority templates are provided in Appendix E of the National Joint Council Travel Directive , should your department not possess a standard blanket travel authority form.

Once the blanket travel authority form has been completed, the appropriate authority is identified by consulting the Delegation of Authority documents (Activity 3.2.2.2 – Determine Appropriate Authority).

The individual with the appropriate delegated authority exercises expenditure initiation authority (Activity 3.2.2.3 – Exercise Authority). Once the blanket travel authority has been approved by the authorizing manager, the next step is to ensure that there are sufficient unencumbered funds available (Verify Unencumbered Balance (Subprocess 3.2.4) and that there is a commitment in place (Manage Commitment (Subprocess 3.2.5). If the blanket travel authority is not approved or the travel is outside the conditions of the blanket travel authority or a TAN or travel advance is required, the employee proceeds to Manage Travel Requests (Subprocess 3.2.3) and completes a travel authorization and advance request to obtain authority for each individual trip to be undertaken.

5.2.2.2 Roles and Responsibilities

- For activities 3.2.2.1 and 3.2.2.2, there are two potential scenarios: the blanket travel authority is initiated by the employee (scenario 1) or the blanket travel authority is initiated by the responsibility centre manager (scenario 2).

- For Activity 3.2.2.3, the manager is responsible for exercising authority to provide a blanket travel authority.

Table 2 provides an overview of the roles and responsibilities for this subprocess, using the Responsible, Accountable, Consulted and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D .

5.2.3 Manage Travel Requests (Subprocess 3.2.3)

The Manage Travel Requests subprocess starts when the travel event is approaching. The person travelling completes the travel authorization and advance request, and ensures it is in accordance with the applicable policies. The travel request is approved by the individual with the appropriate expenditure initiation authority.

Whether or not it is anticipated that expenses will be incurred, government travel should be authorized in advance in writing to ensure that all travel arrangements are in compliance with the provisions of the National Joint Council Travel Directive , See footnote [24] or other appropriate policy, by a duly authorized agency because this may impact eligibility for insurance protection.

The Manage Travel Requests subprocess is performed concurrently with both the Verify Unencumbered Balance and the Manage Commitment subprocesses. If a travel advance is requested, it is first submitted to the manager for section 34 certification through the Manage Travel Claims and Advance Requests subprocess group and then sent to financial services for payment processing through the Manage Settlement of Travel Claims subprocess group.

Figure 6 depicts the Level 3 process flow for Manage Travel Requests.

Figure 6. Manage Travel Requests (Subprocess 3.2.3) – Level 3 Process Flow

Text version: Figure 6. Manage Travel Requests (Subprocess 3.2.3) – Level 3 Process Flow

5.2.3.1 Activities

To proceed with the travel request, the person travelling defines the travel requirements, including the date, purpose, destination, and duration of the trip. This information can be obtained by checking the travel plan or consulting with the responsibility centre manager. The person travelling is responsible for ensuring that the appropriate policy instruments are followed and applied. For Activity 3.2.3.1 – Estimate Travel Costs, for instance, the person travelling ensures that the most economical and efficient alternatives for travel have been considered. See footnote [25]

Once the travel costs are estimated, a travel authorization and advance request is completed (Activity 3.2.3.2 – Complete Travel Authorization and Advance Request). When completing the form, the person travelling consults the appropriate policies to ensure that the correct entitlements are being used. In addition, the person travelling ensures that the appropriate policy authority is applied as described in Activity 3.2.1.1 – Determine Appropriate Policy Authority (Manage Travel Plans (Subprocess 3.2.1). If a blanket travel authority has been provided, a travel authorization and advance request may still be required when a TAN is issued using an automated system or when a travel advance is requested.

Travel advances can be obtained most efficiently through the use of a travel card for an advance of funds. The Executive Group and excluded employees governed by the Treasury Board's Special Travel Authorities and the National Joint Council Travel Directive should be made aware that they are required by the Treasury Board to use the travel card for authorized official government travel, as stated in the Directive on Travel Cards and Travellers Cheques . See footnote [26] For employees who do not use a travel card, a travel advance request may be completed. See footnote [27] It should be noted that only employees on government travel are permitted to obtain travel advances.

After completing the appropriate travel form, the person travelling determines the appropriate expenditure initiation authority by consulting the Delegation of Authority documents (Activity 3.2.3.3 – Determine Appropriate Expenditure Initiation Authority).

The manager approving the travel form is responsible for ensuring that the travel expenditures are cost-effective, necessary to achieve departmental mandates and priorities, and aligned with departmental objectives See footnote [28] (Activity 3.2.3.4 – Exercise Travel and Advance Authorization). The responsibility centre manager ensures that the appropriate policy instruments are applied and, when approving a travel advance, that the employee has considered the use of a travel card. The process for obtaining a travel card is described in Appendix E . In some situations, travel may not be approved, in which case the travel requirements may be redefined and/or the travel process stops.

As the appropriate expenditure initiation authority is being exercised, a sufficient unencumbered balance has to be available in an appropriation See footnote [29] Verify Unencumbered Balance (Subprocess 3.2.4). If a sufficient unencumbered balance is available, a commitment is created Manage Commitment (Subprocess 3.2.5) in accordance with department-specific policy. The approved request then becomes an input in Manage Travel Claims and Advance Requests (Subprocess 3.2.7).

Even when the employee has a blanket travel authority Manage Blanket Travel Authority (Subprocess 3.2.2) , travel costs are estimated to ensure that they are within the authorized dollar value per individual trip and that unencumbered funds continue to be available Manage Travel Claims and Advance Requests (Subprocess 3.2.7) .

If a travel advance has been requested and approved, it is submitted for processing to financial services (Activity 3.2.3.5 – Submit Travel Advance Request); otherwise, the next step is to proceed to Manage Travel Administration (Subprocess 3.2.6) to make travel arrangements. Travel advances may only be requested by an employee when that person is entitled to such an advance pursuant to a contract, a collective agreement, or a Treasury Board directive. See footnote [30] When issuing a travel advance, the manager is responsible for ensuring that eligible credits were applied when reserving transportation or accommodations and that other alternatives, such as travel cards, were examined. See footnote [31]

A travel advance may be obtained at any time during Manage Travel Requests (Subprocess 3.2.3) . When requesting a travel advance, it is important to allow sufficient time for processing.

Once the travel advance request has been submitted to the manager, who provides section 34 certification through Manage Travel Claims and Advance Requests (Subprocess 3.2.7), the funds are disbursed to the employee by financial services in the Manage Settlement of Travel Claims subprocess group. When processing the travel advance, it is practical to put in place a mechanism that enables the matching of advances with the subsequent travel claim.

While the travel advance is being processed for disbursement by financial services, the employee can begin to prepare the travel arrangements in Manage Travel Administration (Subprocess 3.2.6). In addition, it is good practice for the manager to monitor outstanding travel advances and ensure they are being appropriately addressed.

5.2.3.2 Roles and Responsibilities

The person travelling is responsible for estimating travel costs and completing the necessary travel authorization and advance request prior to obtaining approval.

- In scenario 1, the employee is responsible and accountable for estimating travel costs, completing the necessary travel authorization and advance request, and determining the appropriate authority. Only employees have access to a blanket travel authority; travellers cannot obtain blanket travel authorization.

- In scenario 2, the traveller is responsible and accountable for defining the travel requirements, estimating travel costs, etc.; however, the responsibility centre manager performs certain activities on behalf of the traveller such as completing the necessary travel authorization request and determining the appropriate authority. In these instances, the responsibility centre manager is responsible and accountable on behalf of the traveller. Travellers cannot request travel advances; only employees have access to travel advances.

- For activity 3.2.3.4, the manager is responsible and accountable for exercising the travel and advance authorization.

- For activity 3.2.3.5, the employee is responsible for submitting the travel advance request, if applicable.

Table 3 provides an overview of the roles and responsibilities for this subprocess using the Responsible, Accountable, Consulted and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D .

5.2.4 Verify Unencumbered Balance (Subprocess 3.2.4)

Before approving the travel request Manage Travel Requests (Subprocess 3.2.3), the responsibility centre manager ensures that a sufficient unencumbered balance is available in an appropriation. See footnote [32] Figure 7 depicts the Level 3 process flow for Verify Unencumbered Balance.

Figure 7. Verify Unencumbered Balance (Subprocess 3.2.4) – Level 3 Process Flow

Text version: Figure 7. Verify Unencumbered Balance (Subprocess 3.2.4) – Level 3 Process Flow

The deputy head is responsible for the development and implementation of department-specific policies and procedures for the control of commitments. In addition, departments must have the appropriate processes in place to verify the availability of funds at the time of expenditure initiation and prior to approving travel requests. See footnote [33] Commitment authority is delegated in writing to departmental officials by the deputy head (Delegation of Authority). The creation and maintenance of the delegation documents is excluded from the scope of the Manage Travel business process and is addressed in a separate process, Manage Delegation of Financial and Spending Authorities (Business Process 7.4). Commitment control is an ongoing activity throughout the travel process.

5.2.4.1 Activities

The delegated official, usually the responsibility centre manager, is responsible for ensuring that there is a sufficient unencumbered balance available before approving travel See footnote [34] (Activity 3.2.4.1 – Determine Unencumbered Balance). Ongoing, multiple-year travel plans require that continuing commitments for the current fiscal year and for each future year are kept separately within the most recently approved budget. See footnote [35]

When the unencumbered balances are insufficient, it will be necessary to:

- Reallocate budgets;

- Revise the approved budget and travel requirements; or

- End the Manage Travel business process.

If there are sufficient unencumbered balances, department-specific functions related to commitment authority are carried out. Appropriate evidence must be provided to substantiate that authorization pursuant to section 32 of the FAA took place (Activity 3.2.4.2 – Provide Authorization), as stipulated in the department-specific policy and procedures. See footnote [36]

5.2.4.2 Roles and Responsibilities

The responsibility centre manager is accountable for ensuring there is an unencumbered balance available. Table 4 provides an overview of the roles and responsibilities for this subprocess, using the Responsible, Accountable, Consulted and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D .

5.2.5 Manage Commitment (Subprocess 3.2.5)

While the unencumbered balance is being confirmed, the responsibility centre manager records and updates the commitment according to department-specific policy. Once the unencumbered balance has been confirmed and there has been appropriate commitment control, section 32 of the FAA has been exercised. Figure 8 depicts the Level 3 process flow for Manage Commitment.

Figure 8. Manage Commitment (Subprocess 3.2.5) – Level 3 Process Flow

Text version: Figure 8. Manage Commitment (Subprocess 3.2.5) – Level 3 Process Flow

5.2.5.1 Activities

The responsibility centre manager is accountable for ensuring that the commitment, including a continuing commitment that impacts future fiscal years, is recorded in accordance with department-specific policies. Throughout the Manage Travel business process, the commitment is monitored and updated as needed (e.g., when the travel costs have changed) (Activity 3.2.5.1 – Record or Update Commitment).

Following receipt of section 34 of the FAA certification of the travel claim, the commitment is closed out (Activity 3.2.5.2 – Close Out Commitment). If the travel claim is associated with a blanket travel authority, the commitment is not closed out until the end date or the final travel event has occurred. Then Manage Travel Claims and Advance Requests (Subprocess 3.2.7) resumes. The objective of subprocesses Manage Travel Requests, Verify Unencumbered Balance and Manage Commitment is that all commitments are managed and that managers do not exceed their allocated budgets or appropriation. See footnote [37]

It may be impractical to formally record commitments for each travel arrangement, such as travel of a lower dollar value. Departments can implement alternative accounting methods for these commitments provided that their department-specific policy identifies when it is appropriate to do so and how these commitments are to be accounted for. See footnote [38] Commitments are recorded based on the department's approved budget; they quantify the financial implications of the planned travel requirements. For an ongoing, multiple-year travel arrangement, it is necessary to record commitments annually.

5.2.5.2 Roles and Responsibilities

The responsibility centre manager is accountable for his or her commitments. Table 5 provides an overview of the roles and responsibilities for this subprocess, using the Responsible, Accountable, Consulted and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D .

5.3 Manage Travel Administration and Travel Claims

Manage Travel Administration and Travel Claims involves obtaining a Travel Authorization Number (TAN), if required; making travel arrangements in accordance with the approved travel request and the applicable policy instruments; and handling requests for travel advances or travel claims, completing the account verification and providing certification authority pursuant to section 34 of the FAA. Once travel has occurred and/or expenses have been incurred, the person travelling completes a travel claim and submits the claim with the appropriate supporting documentation for approval to the appropriate manager. When the travel claim is received, the responsibility centre manager completes account verification and exercises section 34 certification authority; then a request for payment is made and sent to financial services.

5.3.1 Manage Travel Administration (Subprocess 3.2.6)

Once travel has been approved, the person travelling is responsible for obtaining a Travel Authorization Number (TAN), if required, to make travel arrangements such as air travel. Travel arrangements are made by choosing an itinerary and booking arrangements in accordance with the approved travel request and the applicable policy instruments. When travel has occurred and/or expenses have been incurred, the person travelling completes a travel claim and submits the claim with the supporting documentation to the manager for approval. If travel is cancelled and no expenses are incurred, the commitment is closed out and the Manage Travel business process ends. Figure 9 depicts the Level 3 process flow for Manage Travel Administration.

Figure 9. Manage Travel Administration (Subprocess 3.2.6) – Level 3 Process Flow

Text version: Figure 9. Manage Travel Administration (Subprocess 3.2.6) – Level 3 Process Flow

5.3.1.1 Activities

Once the travel authorization and advance request has been approved or a blanket travel authority has been obtained, the person travelling needs to determine whether a Travel Authorization Number (TAN) is required. A TAN is a unique number allocated to each authorized trip. See footnote [39] TANs are required when making travel arrangements through Government of Canada Shared Travel Services. They are issued by the departmental TAN holder(s), who have the option of using online TANs, if the department has implemented the Expense Management Tool, or offline TANs, which is a paper-based process. See footnote [40] In some cases, the issuance of TANs within the department is automated. If a TAN is issued for non-employee travel, appropriate controls are needed, such as having departmental personnel make the travel arrangements (Activity 3.2.6.1 – Obtain Travel Authorization Number). Departments are responsible for maintaining and ensuring the integrity of the TANs.

Once the TAN is obtained, the person travelling can make the necessary travel arrangements using their user identification code (Activity 3.2.6.2 – Make Travel Arrangements in Accordance With Authorization). The user identification code is associated with the user's profile, which includes information such as contact information, emergency contact information, and travel preferences. The person travelling is responsible for keeping his or her profile up to date. Use of the travel card is encouraged to access relevant insurance coverage and to facilitate the creation of the expense report in the Expense Management Tool via an automated data feed (for departments that have implemented this optional tool). Employees on government travel shall utilize government-approved suppliers, services and products, when these are available. Where access to these suppliers, services, and products requires the use of an individual designated travel card, the provision and use of the individual designated travel card requires the employee's agreement. See footnote [41] The use of the travel card is mandatory for the Executive Group and excluded employees. Travel arrangements are expected to take place well in advance of travel in order to obtain optimal discounted rates, where possible. When choosing the mode of transportation, the most economical option available is selected, taking into account cost, duration, safety, and practicality, respecting the principles of the National Joint Council Travel Directive. See footnote [42] Transaction authority is exercised when travel arrangements are made and the person travelling enters into a contract with the service provider.

When making travel arrangements, the person travelling needs to consider the following:

- Travel arrangements are within the travel authorization (including the blanket travel authority) and comply with policy provisions;

- Available airline credits are used, to the extent possible;

- Travel arrangements are booked online to take advantage of lower transaction fees;

- For group travel, consideration is given to additional discounts, group rates and/or travel efficiencies;

- Appendix B—Kilometric Rates - Modules 1, 2 and 3 ;

- Appendix C—Allowances - Module 1, 2 and 3 ; and

- Appendix D—Allowances - Module 4 ; and

- Other relevant policy instruments have been considered.

Once travel has occurred and/or expenses have been incurred, the person travelling prepares and attests a travel claim, ensuring that all prepaid portions are included (e.g., travel advances and amounts paid through the departmental travel expense card, such as air fare) (Activity 3.2.6.3 – Prepare and Attest Travel Claim). Sometimes travel may be cancelled, i.e., it does not occur, while expenses such as non-refundable deposits or reservation fees have still been incurred. In such cases, preparing and attesting a travel claim is required in order to be reimbursed for these expenses. The output of this subprocess is a travel claim that includes supporting documentation and attestation by the person travelling.

If travel arrangements were paid through the departmental travel expense card or account, refer to the periodic payment category in Manage Other Payments (Business Process 3.3) for a description of the process for paying the travel card statement. It is important to ensure that the portion that was paid using the departmental travel expense card or account is included in the travel claim.

If no travel has occurred and no expenses have been incurred, the manager proceeds to Manage Commitment (Subprocess 3.2.5) to close out the commitment. In situations where travel has not occurred and an employee has obtained a travel advance, it is necessary to recover the funds. It is good practice to monitor outstanding travel advances to ensure that they are applied to the appropriate travel claim or that action is taken to recover the funds. The recovery of funds is described in Manage Revenues, Receivables and Receipts (Business Process 2.1). If the travel advance was obtained through a travel card, the employee will need to ensure that the travel card balance is settled.

5.3.1.2 Roles and Responsibilities

The person travelling is responsible for obtaining a TAN, making travel arrangements and preparing the travel claim. In some cases, the responsibility centre manager may choose to obtain the TAN and make the travel arrangements on behalf of a traveller, when the traveller is not an employee.

Two potential scenarios exist:

- In scenario 1, the employee is responsible and accountable for obtaining a TAN and making travel arrangements.

- In scenario 2, the traveller is responsible and accountable, however, the responsibility centre manager may perform certain activities on behalf of the traveller, such as obtaining a TAN and making travel arrangements. In this case, the responsibility centre manager is responsible and accountable on behalf of the traveller.

Table 6 provides an overview of the roles and responsibilities for this subprocess, using the Responsible, Accountable, Consulted and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D .

5.3.2 Manage Travel Claims and Advance Requests (Subprocess 3.2.7)

This subprocess includes handling requests for travel advances or travel claims, completing account verification and providing certification authority pursuant to section 34 of the FAA. Once the travel claim or travel advance is received, the following takes place:

- Account verification procedures are performed;

- Section 34 certification authority is exercised by the responsibility centre manager; and

- A request for payment is prepared and sent to financial services.

Figure 10 depicts the Level 3 process flow for Manage Travel Claims and Advance Requests.

Figure 10. Manage Travel Claims and Advance Requests (Subprocess 3.2.7) – Level 3 Process Flow

Text version: Figure 10. Manage Travel Claims and Advance Requests (Subprocess 3.2.7) – Level 3 Process Flow

Manage Travel Claims and Advance Requests includes receiving travel advance requests, travel claims or other documents from the person travelling, and verifying and validating travel claim information. The travel authorization and advance request is part of the account verification process.

Account verification provides the necessary evidence to demonstrate that:

- The proper amounts were claimed in compliance with the regulatory instruments;

- The transaction is accurate; and

- All authorities have been complied with. See footnote [43]

Primary responsibility for verifying individual accounts rests with the managers who have the authority to confirm and certify entitlement pursuant to section 34 of the FAA. See footnote [44] These steps rely upon the attested travel claim from Manage Commitment (Subprocess 3.2.5) and the approved travel authorization and advance request from Manage Travel Requests (Subprocess 3.2.3). When receiving these documents, the responsibility centre manager is responsible for ensuring that supporting documentation is complete. All payments and settlements must be certified pursuant to section 34 of the FAA. See footnote [45]

To ensure adequate separation of duties, the following functions are kept separate when responsibility is assigned to individuals involved in the travel process: See footnote [46]

- Determination of entitlement, verification of accounts, and preparation of requisitions for payment or settlement, pursuant to section 34 of the FAA (certification authority) (Manage Travel Claims and Advance Requests (Subprocess 3.2.7));

- Certification of requisition for payment or settlement, pursuant to section 33 of the FAA (payment authority) (Activity 3.2.8.3).

- If the process or other circumstances do not allow such separation of duties, alternative control measures are implemented and documented.

5.3.2.1 Activities

The Manage Travel Claims and Advance Requests subprocess involves the following activities See footnote [47] that support the certification and verification of travel claims and advance requests pursuant to section 34 of the FAA:

- Confirming that the travel claim is in agreement with the approved travel authorization and advance request (Activity 3.2.7.1 – Confirm That Travel Authorization Terms are Met);

- Confirming that the payee is entitled to or eligible for the payment. This includes ensuring that the payment is appropriate, particularly in the case of a supplier's debt (Activity 3.2.7.2 – Confirm That Payee is Eligible for Payment);

- Ensuring that documents such as the travel claim or travel advance, supporting documentation (e.g., original receipts), and the approved travel authorization and advance request are in agreement (Activity 3.2.7.3 – Ensure That Documents are in Agreement);

- Ensuring payee information is accurate and complete. The payee information should also be verified against the vendor master data file. If the payee information is not accurate and changes are required, see Manage Vendor Master Data File (Business Process 7.1) to learn how to make changes to the vendor master data file (Activity 3.2.7.4 – Ensure Payee Information is Accurate);

- Ensuring that the financial coding that has been provided is accurate and complete (Activity 3.2.7.5 – Ensure Financial Coding is Correct);

- Verifying that all relevant statutes, regulations, orders-in-council, policies and directives, and other legal obligations have been complied with (Activity 3.2.7.6 – Verify That Relevant Regulations, Policies and Directives Were Followed); and

- Confirming that the transaction is accurate, including that the payment is not a duplicate; that accountable advances, discounts or credits have been deducted; that charges not payable have been removed; and that the travel claim or advance total, including amounts paid on the departmental credit card, has been calculated correctly (Activity 3.2.7.7 – Verify Accuracy of Transaction).

In the event that there are amounts owed to the Government of Canada, the claim may be offset against the receivable; so a payment requisition would not be initiated. This is further described in Manage Revenue, Receivable and Receipts (Business Process 2.1).

Certain policy instruments need to be consulted for specific transactions, such as Special Travel Authorities , Terms and Conditions of Employment for Full-Time Governor in Council Appointees , the Directive on Travel Cards and Travellers Cheques , the National Joint Council Travel Directive , the Travel Approval Guidelines for Deputy Ministers and Heads of Agencies, Boards and Commissions and the Directive on the Management of Expenditures on Travel, Hospitality and Conferences . Some of these policy instruments were not previously identified in this guideline (see “References,” Section 3.2).

Account verification also includes confirming that travel advance payments meet appropriate requirements See footnote [48] in accordance with the Directive on Accountable Advances and the Guideline on Accountable Advances .

If at any point during the account verification process a discrepancy is noted, or if the information is incomplete, the responsibility centre manager resolves this discrepancy by tracing the issue to its source (Activity 3.2.7.8 – Resolve Discrepancies). Once the issue is resolved, account verification may resume or start over.

Once the travel claim has been verified and no discrepancies or issues have been noted, account verification is completed and certified pursuant to section 34 of the FAA (Activity 3.2.7.9 – Exercise or Obtain Certification Authority), which is usually provided through a signature block on the travel claim or a completed account verification checklist. The travel claim is recorded, and the commitment is then closed out to reflect the travel claim receipt. The final output of this subprocess is a certified travel claim in the form of a payment request for issuing a payment to the employee. Where the travel advance is greater than the travel expenses incurred, a remittance (or recovery) from the employee is required.

Account verification pursuant to section 34 of the FAA also involves ensuring that there is auditable evidence of verification (i.e., that the process identifies the individuals who performed the account verification procedures and that there is an audit trail). See footnote [49]

5.3.2.2 Roles and Responsibilities

The responsibility centre manager is responsible and accountable for completing account verification and certification of invoices pursuant to section 34 of the FAA. Table 7 provides an overview of the roles and responsibilities for this subprocess, using the Responsible, Accountable, Consulted and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D.

5.4 Manage Settlement of Travel Claims

Manage Settlement of Travel Claims ends the Manage Travel business process and involves the performance of quality assurance activities, where applicable; exercising payment authorization pursuant to section 33 of the FAA; completing and submitting payment requisitions; and finalizing payments.

5.4.1 Perform Payment Authority (Subprocess 3.2.8)

The Perform Payment Authority subprocess starts with the receipt of a request for payment. During the payment process, quality assurance is performed by financial services as part of exercising payment authorization pursuant to section 33 of the FAA. Figure 11 depicts the Level 3 process flow for Perform Payment Authority.

Figure 11. Perform Payment Authority (Subprocess 3.2.8) – Level 3 Process Flow

Text version: Figure 11. Perform Payment Authority (Subprocess 3.2.8) – Level 3 Process Flow

5.4.1.1 Activities

The request for payment is received by financial services (Activity 3.2.8.1 – Receive Request for Payment) for payment issuance. The request for payment includes the claim data, payment details (e.g., date the claim was received, due date, amount of claim, etc.), vendor data, the payment type (i.e., regular or priority payment), and the financial coding block. With respect to interest on payments to employees (e.g., travel claim reimbursements), the standard 30-day payment term does not apply because employees are expected to be paid as soon as possible; See footnote [50] therefore, no calculation of interest is required.

As part of this subprocess, the financial officer with delegated authority for section 33 of the FAA performs quality assurance (Activity 3.2.8.2 – Perform Quality Assurance). The financial officer exercises payment authority and is responsible for certifying and ensuring the following: See footnote [51]

- There is auditable evidence demonstrating that account verification has taken place and has been certified by an individual with delegated financial signing authority pursuant to section 34 of the FAA;

- Is not a lawful charge against the appropriation;

- Will result in an expenditure exceeding the appropriation; or

- Will result in an insufficient balance in the appropriation to meet the commitments charged against it;

- All high-risk transactions are subjected to a full review; and

- A sample of medium- and low-risk transactions is selected based on a selection methodology, and the most important aspects of each selected transaction are subjected to a review; and

- Certification of payments pursuant to section 33 of the FAA is provided to the Receiver General (Standard Payment System). See footnote [52]

If a discrepancy is found during this process, the payment requisition is returned to the responsibility centre manager for resolution.

The department is responsible for defining high, medium, and low risks on the basis of its risk tolerance. Manage Post-Payment Verification (Business Process 8.1) describes the quality assurance requirements of section 33 of the FAA for sampling of medium- and low-risk transactions. Furthermore, the financial officer is responsible for requesting corrective action when a critical error is identified during the quality assurance process for payment authority. See footnote [53]

The next step is to determine whether there is a recovery (remittance). A recovery is needed when the travel advance that was issued is higher than the travel claim, or in any situation where an employee is indebted to the Crown. In these cases, no claim is reimbursed to the employee, and funds are recovered through Manage Revenue, Receivables and Receipts (Business Process 2.1).

In addition, Section 6.2.2 of the Directive on Delegation of Financial Authorities for Disbursements requires that persons with delegated authority for section 33 of the FAA not exercise the following:

- Certification authority and payment authority on the same payment; and

- Spending , certification , or payment authority for an expenditure from which they can directly or indirectly benefit (e.g., when the payee is the individual with financial signing authority or when the expenditure is incurred for the benefit of that individual).

Once the financial officer is satisfied that all the requirements have been met, the payment requisition is certified for section 33 of the FAA, and electronic authorization and authentication (EAA) is performed (Activity 3.2.8.3 – Exercise FAA, Section 33 Certification (Including EAA Key)).

The payment requisition is then prepared and submitted to the Receiver General (Activity 3.2.8.4 – Submit Payment Requisition to Receiver General) in accordance with the:

- Directive on Payment Requisitioning and Cheque Control ;

- Payments and Settlements Requisitioning Regulations, 1997 ; and

- Receiver General Manual , Chapter 4 “Standard Payment System and Departments.”

The requisitions within the payment file contain full payment details: name, date, amount, delivery address, financial institution routing information, stub details (if required), and the type of payment. Departments assign a unique requisition number to each batch of payments. See footnote [54]

The Receiver General Control Framework and the Receiver General Manual provide additional details and steps for ensuring that the payment requisition is properly submitted to the Receiver General. Authorized requisitions can be paid using several types of payment. When selecting the type of payment, there are several characteristics to consider. Table 8 provides the relevant references and key characteristics of the most common types of payment used for settling travel claims and disbursing travel advances.

5.4.1.2 Roles and Responsibilities

Financial services are responsible and accountable for managing payment requisitions and certifying payments pursuant to section 33 of the FAA. Table 9 provides an overview of the roles and responsibilities for this subprocess, using the Responsible, Accountable, Consulted and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D .

5.4.2 Issue Payment (Subprocess 3.2.9)

After payment authorization pursuant to section 33 of the FAA is exercised, the payment requisition is sent to the Receiver General for payment issuance. The payment requisition files are edited and validated, and payments are released by the Receiver General. The Receiver General produces a generic return file containing unique payment references for control purposes. At this time, the payment records should be updated in the departmental financial and materiel management system. See footnote [56] Manage Travel (Business Process 3.2) ends, and Manage Post-payment Verification (Business Process 8.1) or the Manage Financial Close (Business Process 8.2) begins.

Figure 12 depicts the Level 3 process flow for Issue Payment.

Figure 12. Issue Payment (Subprocess 3.2.9) – Level 3 Process Flow

Text version: Figure 12. Issue Payment (Subprocess 3.2.9) – Level 3 Process Flow

5.4.2.1 Activities

The Department of Public Works and Government Services uses the Standard Payment System (SPS) to issue Receiver General payments in Canadian and foreign currencies (Activity 3.2.9.1 – Issue Payment). All program, accounts payable, and compensation payments are issued by the Receiver General on behalf of all departments and agencies under section 2 of the FAA, and are drawn from the Consolidated Revenue Fund (CRF). See footnote [57] The SPS is an integrated system, with various components and menus that incorporate the entire payment process. See footnote [58] Further details regarding the SPS payment processing steps can be found in Chapter 4 of the Receiver General Manual .

Post-payment processing such as cheque replacement and exceptions is part of Manage Financial Close (Business Process 8.2).

Departments receive notification by return file that their payments have been released by the SPS. Departments process the return payment file (Activity 3.2.9.2 – Process Return Payment File) and subsequently finalize and record the payment details (e.g., payment reference number, payment date, etc.) in their departmental financial management system (Activity 3.2.9.3 – Finalize Payment).

Departments regularly reconcile the payment requisitions submitted to the SPS with the payment return/notification file sent by SPS. Departments also regularly reconcile the control account balances in the departmental financial and materiel management system with the control account totals received daily from the Receiver General - General Ledger (RG-GL), based on control data received from the SPS. Control account balance reconciliation is part of Manage Financial Close (Business Process 8.2).

5.4.2.2 Roles and Responsibilities

The Receiver General - Banking and Cash Management Sector is responsible for issuing payments; financial services is responsible for recording completed payments. Table 10 provides an overview of the roles and responsibilities for this subprocess, using the Responsible, Accountable, Consulted and Informed (RACI) approach. These roles and responsibilities are further described in Appendix D.

Appendix A: Definitions

The following definitions apply to this guideline and reflect common definitions used in Treasury Board policies, standards, directives, guides and tools.

In the context of the RACI tables, the role that can attest to the truth of the information or a decision and that is accountable for the completion of the activity. There must be exactly one role accountable for each activity.

Account verification provides a means to ensure the following:

- That the work has been performed;

- That goods have been supplied or services have been rendered;

- That relevant contract or agreement terms and conditions have been met;

- That the transaction is accurate; and

- That all authorities have been complied with.

As required by the Financial Administration Act , all payments and settlements are to be certified pursuant to sections 33 and 34. Financial signing authorities are to be exercised according to the requirements of the Financial Administration Act , the Directive on Delegation of Financial Authorities for Disbursements , and departmental delegation documents. See footnote [59]

For further description of these requirements, consult the Treasury Board Directive on Account Verification .

An elaboration on a subprocess appearing in a Level 3 business process flow. See also Process; Subprocess .

The level of resources allocated to carry out planned activities. It is the annual base against which expenditures, commitments and forecasts are compared, and variances measured and analyzed. Once the departmental budget has been allocated, responsibility centre budgets serve as a basis for effective budget management, financial reviews, budget controls, forecasting, and reporting over the course of the year.

In the context of the RACI tables, a system that holds the official version of the information generated by the activity or a decision resulting from the activity. The authoritative source can be automated or manual.

An authorization for travel that is continuous or repetitive in nature, with no variation in the specific terms and conditions of the trips and where it is not practical or administratively efficient to obtain prior approval from the employer for each individual trip. Any exceptions to the parameters of the blanket travel authority (BTA) shall require that the individual trip be specifically approved prior to travel status, where possible. BTA does not apply to groups of employees. Employees may have more than one BTA simultaneously. See footnote [60]

The authority, according to section 34 of the Financial Administration Act to certify, before payment, contract performance and price, entitlement or eligibility for the payment. See footnote [61]

A collective of departments working together to promote and implement business-driven and standardized solutions for interoperable financial and materiel management in the Government of Canada. See footnote [62]

The recording of obligations to make future payments at the time they are planned and before the time services are rendered and billings are received. Such obligations may represent contractual liabilities, as is the case when purchase orders or contracts for goods or services are issued. Commitments are recorded individually. When it is impractical to formally record commitments individually (e.g., low-value transactions), the organization's procedures will be designated to identify these instances and describe how they will be accounted for. See footnote [63]

The authority that carries out one or more specific functions related to the control of financial commitments as required by the Directive on Expenditure Initiation and Commitment Control . See footnote [64] Commitment authority is delegated in writing to departmental officials by the deputy head (or equivalent) for ensuring that there is a sufficient unencumbered balance available before entering into a contract or other arrangement. Note that subsection 32(2) of the Financial Administration Act applies.

Consists of established procedures that prevent an organization from entering into a contract or any other arrangement that provides for a payment unless there is enough money available in that year's appropriation to discharge the debt that is incurred during that fiscal year. See footnote [65]

In the context of the RACI tables, a role that is required to provide accurate information or a decision for an activity to be completed. There may or may not be a consulted role, and consultation may or may not be mandatory. When consultation does occur, there is typically a two-way communication between those consulted and the responsible party.

Is a financial management system (FMS) whose primary objectives are to demonstrate compliance by the government with the financial authorities granted by Parliament, comply with the government's accounting policies, inform the public through departmental financial statements, provide financial and materiel information for management and control, provide information for economic analysis and policy formulation, meet central agency reporting requirements and provide a basis for audit. See footnote [66]

The departmental official who represents the department in all matters related to its participation in the travel card program. This official is responsible for acting as liaison with Public Works and Government Services Canada and the card issuer. See footnote [67]

Departmental travel expense cards are available in two formats: See footnote [68]

- Accounts (no card is issued) used to purchase common carrier transportation that is arranged through the government-approved supplier. The accounts are also used for travel service transaction fees.

- Cards issued in the name of an authorized person within a responsibility centre that are to be used for authorized government travel expenses of groups composed of public service employees, non–public service employees, or individual employees or persons. They are also used to purchase traveller's cheques.

The role responsible for policy interpretation for all travel-related questions within the coordinator's department regarding the National Joint Council Travel Directive , rates and allowances, and Special Travel Authorities .

A person employed in the public service. See footnote [69] Note that an employee may be a traveller; however, a traveller may not necessarily be an employee.

The authority to incur an expenditure or to make an obligation to obtain goods or services that will result in the eventual expenditure of funds. This includes the decision to hire staff; to order supplies or services; to authorize travel, relocation or hospitality; or to enter into some other arrangement for program purposes. See footnote [70]