Tourist Tax in Italy: the 2024 Full and Complete Guide With All Rates

In most European countries visitors have to pay a tourist tax and Italy is no exception. In this full and complete guide I will answer the most common questions about it. If you’re planning to visit Italy soon, check out the information below and calculate your rate for your trip!

1. What’s The Tourist Tax?

The tourist tax in Italy is a tax that tourists have to pay for each night of their stay. It is collected by the accommodation they’re staying at – from all types of hotels to B&B, hostels, and campsites – over their vacation.

The amount varies according to the municipality and the type of accommodation : the more luxurious the higher the rate.

2. Why Is it Necessary?

Although the tourist tax is reinvested by the municipality mainly in heritage preservation , it is also used to implement all local services and facilities in order to keep the city in a good state and easily accessible to tourists.

It’s a small amount per person but it helps us to make the difference in keeping our cultural heritage maintained .

→ you may also like

What to Eat in Sicily

3. Do Children Pay Tourist Tax in Italy?

In most cases, children up to a certain age don’t have to pay. However, conditions are different in each municipality. To see in which category your kids fall, please check the table below (see paragraph 4).

Where to Store your Luggage in Train Stations, Airports and for Free in Italy

Driving on the Highway in Italy: A Complete Guide

4. How Much Is The Tourist Tax In Italy?

The tourist tax rate depends on each municipality. This tax is usually updated every year (sometimes every 2 years), therefore you always need to check the most recent rate.

In order for you to know how much you have to pay in each city you’ll be visit ing, I collected all the helpful data below: you will find the most touristic areas and corresponding taxes in three accommodation categories, children and elderly policies together with the period of time when the rate is applicable.

* depends on the hotel rates

5. Are There Any Exemptions?

Yes, there are some exemptions.

Below I collected the most common as each municipality has its own rules and regulations. The following, however, are shared with pretty much every municipality. Those who are exempt are:

a) residents in the municipality;

b) people with disabilities , with suitable medical certification, and relative accompanying person and parents who accompany children with disabilities;

c) patients in healthcare facilities and accompanying family members;

d) coach drivers and tour leaders who accompany groups organized by travel agencies;

e) members of the police and military forces, as well as the National Fire and Civil Protection Corps in case of service needs;

f) volunteers who offer their services in the social sector for events and manifestations organized by the Municipal, Provincial and Regional Administration or for environmental needs;

g) people who stay in the accommodation as a result of measures taken by public authorities to deal with emergency situations ;

h) university students (only in some cases and upon certain conditions).

Renting a Car in Italy: A Complete Guide for North Americans

6. Is It Possible To Get Any Refunds?

If you book your stay in any accommodation in Italy where the tourist tax is automatically collected (e.g. Airbnb) and you are entitled to a refund (e.g. if you fall into the exemption category), you can request it by completing a refund form that you can find on each municipality website. Refunds will be processed at the end of your booking .

Take a look at examples of forms in Bologna and Milan .

7. If I Stay In An Airbnb Or Apartment, Do The Same Rules Apply?

If you stay in any accommodation other than hotels, you have to pay the tourist tax. There is no exemption in this case.

The rate and conditions vary according to the type of accommodation, so you should check in with the place you’re staying at to verify all conditions applicable to your situation. In the case of Airbnb, you can check the rates on their website at this link .

Has this guide been helpful? Take a look at the other articles below!

Is Water Free and Safe to Drink in Italy?

Mosquitoes in Italy: Tips on How to Survive Them

Did you Like the Post? Follow Me on Social Media and Stay Tuned for More Content!

Enjoy this blog? Please spread the word :)

Table of Contents

Renato Prosciutto in Italy

Rome, Venice, Florence and small town Italy.

Tourist Tax Rome (2024)

When you make a hotel reservation in Rome , make sure that you ask whether or not the Roman tourist tax or city tax is included in your room rate. This tourist tax ( contributo al soggiorno , in Italian) was introduced in January 2011, upped in September 2014 and upped again in October 2023. This money is to be used to improve on the city’s infrastructure and thus should contribute to tourists’ enjoyment of their Rome holiday . For the moment, the new rates are valid till December 2024. 2025 being a Jubilee year , it would not be surprising if rates were to go up again then.

Tourist Tax Rome 2024

How much tourist tax should you pay in rome.

The amount to be paid depends on the type of accommodation selected.

People staying in a 5 star hotel will be paying 10 Euros per person per night on top of the room rate, while those staying in a 4 star hotel will pay only 7,50 Euros per night. Visitors to Rome staying in 3 star hotels pay 6 Euros per night, those staying in 2 star accommodation 5 Euros and 1-star hotel guests pay 4 Euros.

Guests at Rome bed and breakfasts will pay 6 Euros per night.

People staying in guesthouses ( affittacamere , in Italian) will pay between 5 and 7 Euros per night, depending on the category.

Guests of Airbnb-style accommodations will also pay 6 Euros per person per night.

Guests in holiday homes pay either 5 or 6 Euros per night, again depending on the category.

People staying in camp grounds will be paying 3 and those staying in youth hostels 3,50 Euros per night.

The tourist tax is to be paid only during the first 10 days of one’s stay and children under 10 years of age are exempt.

Note that if you book your Rome accommodation through Airbnb , the city tax is already included. Your host cannot charge you anything extra.

Tourist tax on Rome attractions and city tours

It is not only the hotel accommodation in Rome that has become more expensive: There is also an extra charge of 1 Euro per person on city tours, including the popular Hop On Hop Off buses. Museums run by the city of Rome have also added a surcharge of 1 Euro to their admission fees. (It is interesting that this was initially presented as a 1 Euro surcharge for visitors to the Eternal City and now, on the official website of the city, has become a 1 Euro discount for citizens of Rome itself.)

What happens with the tourist tax after you have paid it?

Every three months the hotel, bed and breakfast or hostel has to pay the entire tourism fee collected into the coffers of the city of Rome . The city of Rome is then supposed to use this money to make the capital into an easier place to visit for tourists (and for the Romans themselves) of course. So far it seems fairly safe to say that the city of Rome has done this in as gentle and unobtrusive a manner as possible, with nobody really noticing any changes (at least not for the better).

Improvements (?)

- A number of the tourist information offices in Rome have closed (or reduced their hours).

- The free maps the city used to give out at these offices are usually not available anymore.

- The Settimana della Cultura , or “Culture Week”, one week in April when all the city- and state-run museums were free, has been abolished, and so has the Notte Bianca or “White Night”, when all museums can keep their doors open all night long.

Rome and surroundings

8 thoughts on “ tourist tax rome (2024) ”.

My hotel Hotel Sonya is insisting that I pay in cash Euros to them directly. Why can’t they add it to their bill and take it from that to give to city of Rome? Is this a shakedown?

Hello Connie, it doesn’t really matter in what way you pay, just make sure that they give you an official invoice (not just a bit of paper). Regards, Rene.

Maybe you should s et n DC this article to Airbnb, as my host emailed to inform me if this and they processed the payment.shouldn’t they be on top of this?

Hello Margaret, I’m sorry, but I don’t really understand your question. “my host emailed to inform me if this and they processed the payment.shouldn’t they be on top of this?” Your host informed you of what? Who processed the payment? Who should be on top of what, exactly? As far as I know, Airbnb (the company) includes the tourist tax in your invoice. The actual Airbnb hosting you cannot charge you anything extra after that.

My B&B is informing me to pay 6€ per person per night but they are not 6 stars hotel this is only a little B&B. Is there a official way to profe they are wrong or is there a possibility to make a complain? Thanks in advance

Hello Ali, actually they are not wrong. As of October 1st 2023, there are new tariffs and for a B&B the new rate is indeed 6 euros per person per night.

In my opinion, the tourist tax is a rort that the officials can impose on a captured audience. Quite sad really that they resort on their people to be tax collectors. The collection process is so fraught with opportunities for corruption because the tourists don’t know if the rates and age groups are correct or not, and no invoices or receipts were issued!

Hi Ken, you are wrong in saying that the tourist tax is a scam. Almost every country does it. Assuming, from your use of the word “rort” (I had to google that one) that you are Australian, foreigners also pay a tourist tax when visiting your country, but this is included in the price of the plane ticket. In fact, your “Passenger Movement Charge (PMC)” will increase by AU$10 to AU$70 from July 2024. You are right in saying the Italian system is fraught with opportunities for corruption and you are also right in saying that tourist might not now exactly how much they have to pay. It’s not very difficult to check this though. You are also completely in your right to refuse to pay the tax if your host does not give you an invoice. They won’t call the police on you, because they are in the wrong. It’s as easy as that. (For future visitors to Italy, the tourist tax here is local, not national, so you have to check the rates for every city you visit.)

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Known as Tassa di Soggiorno in Italian, the Rome Tourist Tax is a charge paid upon check-out from any form of accommodation within city limits. All cities in Italy have some form of tourist tax that varies in price, so expect to see it on your bill while traveling around the boot.

Here we’ll go over specifically the Rome Tourist Tax: what it is, how much it is, and what it’s used for.

What is the Rome Tourist Tax?

The Rome Tourist Tax is a special tax charged per person per night* by any lodging facility or campsite. The tax is added to your final bill at check-out and payable in cash or card. It’s very common for structures to request this tax to be paid in cash for 2 reasons: 1) initially it was only payable in cash, card was not accepted. So many structures haven’t updated their internal policies. 2) to avoid high credit card commissions, structures will encourage cash only.

*For the first 10 nights only

There are a few exemptions to the Rome Tourist Tax, including:

- children under 10 years old

- Rome residents

- guests who accompany other guests for health reasons (1 per disabled guest)

- State police force and other (Italian) armed forces

- 1 driver/leader for every group of 23 guests

How Much is Rome Tourist Tax?

The Rome Tourist Tax rate varies based on the typo of accommodation. The rates as of April 2018 ( source ) are as follows:

All rates are per person per night (e.g. use the following formula to calculate your tourist tax:

rate x # of guests (over 10 y.o.) x # of nights (up to 10)

Agriturismi and Residences (not vacation rentals)

Bed and breakfast, vacation rentals (airbnb, vrbo, homeaway, etc.).

*It’s important that you receive a receipt for the Tourist Tax. If you are not provided a receipt upon payment of the tourist tax then there is no proof of payment and the property may forgo registration (a sneaky business practice that is all too common in Rome. ROMAC prides itself on respecting all such accommodation regulations and taxes.)

**Tourist tax is calculated for a maximum of 5 nights for Campsites

What is the Rome Tourist Tax used for?

AP52 Altemps apartment by ROMAC, a stone’s throw from Piazza Navona

The Rome Tourist Tax is put toward maintenance and promotion of Rome in the tourism capacity. The city of Rome raised €123 million in 2016 from the tourist tax which goes to promoting Rome’s destination and supporting tourist services and assistance, info points, and materials.

Need an affordable vacation rental in Rome?

Check out vacation rentals by ROMAC – a local leader in vacation rentals for over a decade. Browse our portfolio of dozens of vacation rentals at ROMAC exclusively located in the center of Rome and use filters to narrow your search by location, price, size, and amenity!

I owe €21 for three days of stay in a apartment near Termini Station , for two people. How can I pay this amount? I am in the United States right now . I stayed on that apartment From the 7/ 15 until 7/18

Hello Raul, have you stayed in one of our apartments? I suggest you to contact the landlord to arrange the payment of the city tax.

Hope this helps, Rubina

Hi I’m happy to pay city tax but why it has to be cash and how do I know its reaches the government.

Hello Hemin, most of the hotel and vacation rental requires the payment of the city tax in cash because they have to forward this money to the government. If they accepted the payment by credit card, they would have to pay the credit card commission and the taxes on this amount, so they would lose money. In addition they have to register all the guests and to communicate their presence to the central police department, if they don’t do that, they can receive a criminal complaint.

I feel it’s time for the authorities in Rome to change this to a digital solution so as to reduce the risk for corruption and increase transparency like they did in Greece. Also many people are not used to using cash now because tourists have to pay fees when taking out cash at foreign cash machines. I don’t mind paying a bit extra as long as I know it can’t contribute to corruption.

Hi We have stayed at one Air BnB apartment and now are moving to another (all in Rome). We paid the full 10 days tax at our first apartment.

Question: Do we have to pay the tax again at our new apartment.

There has been no break in our stay in Rome over the two apartments (ie we have never left Rome).

Thanks Richard

Yes, you have to pay again. The law says you don’t have to pay if you spand more than 10 nights in the same accommodation: http://www.060608.it/it/accoglienza/servizi/servizi-turistici/contributo-di-soggiorno-nella-citta-di-roma-capitale-1.html

Hope this helps!

I was in Rome for 7 days and i paid 4 euros for each day to the reception but i didn’t take a receipt…is it normal?And the other thing that i want to ask if is normal that i paid this taxes because when i paid the hotel to booking.com they wrote that i paid everything with taxes…

Hello! You should have received the receipt for your payment. Regarding Booking.com, the city tax is not included in the total amount, so it was OK to pay extra. The VAT taxes only are included in their rates. Hope this helps!

Hi Rubina, I find very strange your last observation. In my booking receipt says literally: “È incluso 3,50 € di Tassa di soggiorno per notte a persona” Isn’t this the tourist tax that we are talking about? Because I received and email from my b&b telling me that rates do not include the Rome City Tax

In this case, you should check the details of the payment. It can be sometimes included.

Hi Rubina , I was in Rome at the end of December last year and paid the city tourist tax twice. I had to pay it upfront on an Air BNB we were supposed to stay in where we had to pay the tax to Vikey ( it was set up by the hosts as they live in England )before the door to the accommodation would open . It didn’t open and we had to find alternative accommodation. This was on 26th December and I have been back and forth with the person who the money went to ( via my Visa card) and I think I’m getting the run around. She has agreed to the refund but has asked for my bank details twice which I have supplied both times. Is there an official department I could complain to ?

Hello Tatyana, unfortunately not.

You could dispute the payment to the credit card circuit.

I don’t think charging a tourist tax is a good idea as it discourages people from visiting again. We are in Rome now and will have to pay €60 for the pleasure of spending our money in an Italian city. I think the Italians need to re-think this strategy to encourage visitors instead of penalising them like this!

Hello Russell, thanks for sharing your thoughts. Actually there are a lot of things that we could improve. Hopefully somebody will listen to us regarding this matter!

Leave a comment Cancel reply

Your email address will not be published. Required fields are marked *

By using this form you agree with the storage and handling of your data by this website. *

The Tourist Tax in Italy: Complete Guide and Updates 2024

Understanding tourist tax in italy: a complete guide.

In Italy, the tourist tax is a municipal tax applied to tourists who stay overnight in accommodation facilities. This article provides a detailed overview of the tax, from the basis of the calculation to recent legislative changes, with the aim of offering a comprehensive guide for tourists and operators in the sector.

1. What is the Tourist Tax?

Definition and purpose.

The tourist tax is a municipal tax in Italy, imposed on tourists for each night spent in an accommodation facility. Includes hotels, bed & breakfasts, holiday apartments, and other forms of paid accommodation. This tax is used to generate revenue that municipalities use to finance projects aimed at improving tourist attractiveness, maintaining and enhancing cultural and environmental heritage, and supporting the local tourist infrastructure.

- How it works

The tax is calculated per night and per guest. The rate can vary greatly depending on several factors:

- Location : Each municipality in Italy can establish its own tariffs. Cities with a high tourist influx such as Rome, Venice, and Florence tend to have higher rates.

- Type of Structure : Rates may differ depending on the type and category of accommodation. For example, a 5-star hotel may have a higher tourist tax than a B&B or hostel.

- Season : Some locations charge different rates based on the season, with higher prices during peak tourist periods.

Objectives and Use of Funds

The funds raised through the tourist tax are intended for different purposes, all aimed at improving the tourist experience and preserving local resources. Examples of uses include:

- Maintenance and restoration of historical and cultural sites.

- Improvement of public services and tourist infrastructure, such as signage, lighting and cleanliness.

- Tourist promotion and organization of cultural events.

Specific Examples

- In Rome, the tourist tax contributes to the maintenance of its many historical sites.

- In Venice, part of the funds raised is intended for the conservation of the city and the management of its delicate ecological balance.

Implications for Tourists and Managers

For tourists, the tourist tax represents an additional cost, although usually modest, on the total cost of the stay. For hospitality managers, it is essential to inform customers about this tax and ensure they collect and remit it correctly to local authorities.

Conclusions

The tourist tax, although it can be seen as a small burden for tourists, plays a crucial role in supporting and improving the quality and attractiveness of Italian tourist destinations, ensuring that cultural and natural heritage is preserved for future generations.

2. Calculation of the Tourist Tax

Determinant Factors

The calculation of the tourist tax in Italy is based on a series of factors which mainly include the classification of the accommodation and the duration of the stay. Here are some key aspects:

- Accommodation Classification : The accommodation facilities are classified into different categories, such as hotels (from 1 to 5 stars), bed & breakfasts, holiday homes, hostels, etc. Each category has an associated fee that varies from municipality to municipality.

- Duration of stay : The tax is generally calculated for each night spent in the property. In some locations, there may be a maximum number of nights for which the tax is due.

- Location : Each municipality in Italy has the autonomy to establish its own rates, which can vary considerably depending on the needs and tourist attractions of the area.

Practical Examples

- Roma : In the capital, the tax can vary from 3 to 7 euros per night, depending on the type of establishment. For example, a 4-star hotel might have a city tax of 6 euros per night per person, while a B&B might have a rate of 3 euros per night per person.

- Venice : In a city with a unique urban structure and specific problems related to mass tourism such as Venice, the tourist tax rates may be higher to contribute to the maintenance of the city.

Considerations for Tour Operators

- Updated information : It is essential for tourism operators to keep information on their municipality's tourist tax rates updated. This includes periodically checking for updates or changes to local regulations.

- Communication to Customers : Operators should clearly inform their guests about the tourist tax, both at the time of booking and upon arrival, to avoid surprises or misunderstandings.

- Administrative Management : It is important for operators to correctly manage the collection and payment of the tax to local authorities, respecting the established deadlines.

The tourist tax, although it may seem like a minor detail, is an important element of tourism management in Italy. Correct application and effective communication of this tax contributes to a positive experience for tourists and ensures that tour operators comply with local regulations.

3. Regulations and Regional Variations of the Tourist Tax

Regional diversity.

In Italy, regulations relating to the tourist tax vary considerably from region to region and from municipality to municipality, reflecting the different needs and tourist attractions of each area. This diversity manifests itself in terms of tariffs, methods of application and destination of the funds raised.

Examples of Regional Variations

- Venice : One of the most iconic cities in Italy, Venice, adopts relatively high tourist tax rates. This is due to the need to maintain and protect its unique historical and cultural heritage, as well as managing the impact of mass tourism on a city built on canals.

- Roma : As the capital, Rome uses the tourist tax to preserve its rich historical and archaeological heritage, as well as improve tourist services in the city.

- Small Cities and Municipalities : In contrast to large art cities, many small cities or tourist municipalities can adopt lower rates. The objective may be to encourage tourism, especially in less well-known or developing tourist areas.

Different motivations

Changes in rates and methods of application of the tourist tax are influenced by various factors:

- Conservation needs : In cities with important historical and cultural sites, rates tend to be higher to fund preservation and maintenance.

- Tourism Sustainability : In areas with intense tourist flows, the tourist tax can be used to manage the sustainability of tourism and mitigate environmental impact.

- Promotion of Local Tourism : Some regions may use the tourist tax to finance tourism promotion campaigns or to develop new attractions.

Considerations for Tourists and Operators

Understanding local tourist tax regulations is essential for tourists and tour operators. While tourists need to be aware of additional expenses when planning their trip, operators need to be informed about their municipality's specific fees and how to pay.

The tourist tax in Italy is an example of how tax policies can be adapted to meet the specific needs of each region. This flexibility allows municipalities to use revenue to preserve their unique heritage, manage the impact of tourism and promote their attractions in a sustainable way.

New Introduced

The 2024 Budget Law has made significant changes to the management of the tourist tax in Italy, introducing the possibility for local authorities to increase the tax up to a maximum of 2 euros per night per person. This increase was designed to finance specific local needs and projects, in particular in view of major events such as the 2025 Jubilee.

Purpose of the Increase

- Financing for the Jubilee 2025 : The Jubilee is an event of great importance that requires substantial preparations, especially in cities of greater historical and religious interest such as Rome. The increase in the tourist tax will help finance the infrastructure and services necessary to manage the expected increase in visitors.

- Coverage of waste collection and disposal costs : With the increase in tourist flows, urban cleaning and maintenance services are also intensifying. The increase in the tourist tax will help cover the additional costs for waste collection and disposal, helping to keep the urban environment clean and welcoming.

Implications for Local Authorities and Tourists

- Greater Flexibility for Municipalities : Local authorities will be able to take advantage of this new flexibility to adapt the rates of the tourist tax to their specific needs, balancing financing needs with tourist attractiveness.

- Impact on Tourists : Although the increase may slightly affect the cost of accommodation for tourists, the funds raised are intended to improve the quality and sustainability of the tourist experience, as well as finance projects of cultural and environmental importance.

The changes introduced by the 2024 Budget Law represent an important adjustment in the management of the tourist tax in Italy, reflecting a response to current and future needs related to tourism and the conservation of cultural heritage. This increase, although it may be perceived as an additional burden on visitors, is essential to ensure that Italian cities can continue to offer a high-quality tourist experience, particularly in view of international events such as the 2025 Jubilee.

5. Management and Declaration of the Tourist Tax

Responsibility of accommodation facilities.

Accommodation facilities have the important responsibility of collecting, declaring and paying the tourist tax to the municipal authorities. This process requires special attention to ensure that all procedures are followed correctly.

Declaration Procedure

- Tax Collection :Properties must collect the tax from their guests, typically at check-out.

- Recordkeeping and Record Keeping : It is essential to maintain an accurate record of all guests and tourist taxes collected, often required by municipal regulations.

- Periodic Declaration : The facilities must periodically declare (monthly or quarterly, depending on the municipality) the total amount of the tax collected and pay it to the local administration.

Penalties for Failure or Incorrect Declaration

- Heavy sanctions : Failure or incorrect declaration of the tourist tax can result in significant penalties, which can vary from 100% to 200% of the amount due. These sanctions highlight the importance of careful and precise management.

- Checks and controls : Local authorities can carry out checks and checks to ensure that accommodation facilities comply with tourist tax regulations.

Tips for Effective Management

- Management software : Using hotel management software that tracks accommodation taxes and facilitates the filing process can be very helpful.

- Staff training : Ensure that all staff are adequately trained on the procedures for collecting and declaring the tourist tax.

- Communication with Guests : Inform guests about the tourist tax, both at the time of booking and upon arrival, to avoid misunderstandings and ensure transparency.

Correct management of the tourist tax is crucial for accommodation facilities. It not only ensures compliance with local regulations and avoids heavy fines, but also helps support the municipality's efforts in improving tourism offerings and preserving cultural and environmental heritage. For this reason, it is important for each accommodation facility to dedicate the resources necessary for efficient and precise management of this important tax.

6. Impact of the Tourist Tax on Tourists and Local Tourism

Perception by tourists.

The tourist tax, although an additional cost for tourists, is generally considered a small price to pay to contribute to the preservation and improvement of the destinations they visit. However, transparency in communicating this tax is crucial to avoid misunderstandings or negative perceptions.

Contribution to the Sustainability of Tourism

- Infrastructure Improvement : The funds raised are often used to improve tourism infrastructure, such as signage, lighting, street cleaning, and improved public services, all of which directly improve the visitor experience.

- Heritage Conservation : In many Italian cities, the tourist tax contributes to the maintenance and restoration of historical and cultural sites, ensuring that they remain accessible and in good condition for tourists.

Positive Impact on Local Communities

- Economic Benefits : The tourist tax provides a revenue stream to municipalities that can be reinvested in local projects, benefiting not only tourists but also residents.

- Mass Tourism Management : In some destinations, tourist tax revenues can be used to manage the effects of mass tourism, helping to preserve the environmental and cultural integrity of tourist areas.

Strengthening Tourist Attractiveness

- Investments in Events and Attractions : Some municipalities use tourist tax funds to organize cultural events, festivals and activities that enrich the tourist offer, attracting a greater number of visitors.

- Promotion of Responsible Tourism : Using funds to support sustainable and responsible tourism practices can improve the image of a destination and attract more aware tourists.

Although the tourist tax represents an additional cost for tourists, its impact on improving the quality and sustainability of tourist destinations is invaluable. This small expense contributes significantly to the conservation of cultural and natural heritage, the quality of tourist services and the well-being of local communities, thus enriching the overall experience of those who visit these splendid locations.

7. Importance of the Tourist Tax in Italian Tourism

The importance of the tourist tax and represents a crucial component of the tourism system in Italy. This tax not only supports the conservation of Italy's rich cultural and historical heritage, but also contributes to the improvement of tourism infrastructure and services. Its effective management and application have a direct impact on the quality of the tourist experience.

Impact on Tourists and Accommodation Managers

For tourists, the tourist tax can be seen as a small contribution towards the maintenance and enrichment of the places they visit. For hospitality facility managers, complying with tourist tax regulations is essential to avoid penalties and to ensure a positive experience for their guests. Careful management of this tax is, therefore, essential to the success of any business in the tourism sector.

Detailed Help Resource

Managers of accommodation facilities can find detailed guidelines and updated information on the calculation and management of the tourist tax by consulting official and local resources. Sites like EasyEntry and the web pages of Italian municipalities are precious resources that offer assistance and clarifications on the regulations in force.

Sustainability and Local Development

Ultimately, the tourist tax is a tool that promotes the sustainability of the tourism sector. It helps balance the needs of tourists with those of local communities, ensuring that tourism not only enriches the experience of visitors, but also brings tangible benefits to the places that host them.

Final Conclusions

In conclusion, the tourist tax is a fundamental element for the balance and development of tourism in Italy. Its correct application and management are essential to guarantee a high-quality tourist experience and to support the sustainable development of Italian tourist destinations.

The tourist tax plays a fundamental role in Italian tourism, supporting the development and conservation of tourist destinations. For hospitality managers, managing this tax efficiently is essential not only to comply with regulations, but also to improve their guests' experience.

In an era in which digitalisation is transforming the hotel sector, it is appropriate to consider solutions that simplify and automate the management of administrative activities. A perfect example of this type of innovation is the service offered by GuestKey , which allows the automatic sending of slips to the Police and ISTAT , as well as the calculation of the tourist tax.

This solution not only lightens the workload of hotel staff, but also ensures greater precision and compliance with current regulations. We invite you to explore how their service EasyEntry can transform the management of your facility, making sending slips and calculating the tourist tax simpler and more efficient.

Comments are closed.

Via Consulare Antica, 402 98071 - Capo D'Orlando (ME) Messina - ITALY +39 0941 912335 +39 0941 901172 +39 0941 901749 [email protected] P.IVA IT01388530832

Via Consulare Antica, 402 98071 - Capo D'Orlando (ME) Messina - ITALY +39 0941 912335 +39 0941 901172 +39 0941 901749 FAX [email protected] P.IVA IT01388530832

Information

Shopping cart.

- User manual

- Specifications

- Installation manual

- How the electronic lock works

- Technical Specifications

- Management user manual

- How ECOMSART works

- GuestKey Proof

- GuestKey Security

- GuestKey Energy Saving

- RFID GuestCard Badge Reader

- RFID reader with IP67 keypad

- Fingerprint reader

- Energy Saving with key

- Timed Energy Saving

- Energy Saving cassette 503

- Bluetooth lock with RFID keypad

- Fingerprint lock

- Aladdin home automation

- Home automation expansion (7+4)

- Complete Aladdin Kit

- Home automation system for Gyms & SPAs

- Kit for Gyms and SPAs

- Impulsive contactor

- Electric Encounter

- Electric Encounter for Armored Vehicles

- Electric striker for panic bar

- Bridge Ecosmart

- Aladdin management software

- GuestKey management software

- SHOPPING CART

- Home automation for hotels and B&Bs

- Home automation kit

- i-Lock electronic lock kit

- Condominium Kit

- ECOSMART Door

- Intercom gatelink

- Bticino Control Module

- ECOSMART Light

- ECOSMART management software

- ONLINE CHECK-IN

- INTEGRATIONS

- GuestKey keyboard

- Energy Saving Keyboard

- Hotel home automation

- FAQ: ECOSMART Automation

- Things to Do in Rome

- Where to Stay

- Rome Restaurant Reviews

- Day Trips from Rome

- Shopping in Rome

- Explore Italy

- Life in Italy

- Practical Information

Practical Information , Rome

What to know about the rome city hotel tax.

Hidden charges are never any fun so I’m here to tell you to expect to pay a tourist tax in Rome. This is a legitimate, legally required fee for anyone staying overnight in Rome but it can sometimes come as a surprise if your hotel or Airbnb doesn’t warn you ahead of time. To avoid a scam, here is a guide to the Rome tourist tax.

Note: These taxes vary by city and each Italian city has its own rate for overnight hotel taxes. Venice is even planning a tourist tax for day trippers who do not spend the night. The information included about showing your passport to hotels, however, is true for all of Italy.

Rome Hotel Tax

All hotels, vacation rentals, B&Bs and Airbnbs are technically required to collect a hotel tax in Rome. This tax is often requested to be paid in cash because it is turned over to the authorities rather than going to the business itself. I find that people ask most often about this in the case of Airbnbs because the Airbnb website does not collect the city tax when you are paying for the apartment. The city tax is paid directly to the Airbnb owner and this can sometimes feel like a scam.

The tourist tax is not a scam, but you are absolutely entitled to an official receipt. Feel free to request one. This also helps to ensure that the Airbnb owner is actually turning over the cash to the city of Rome.

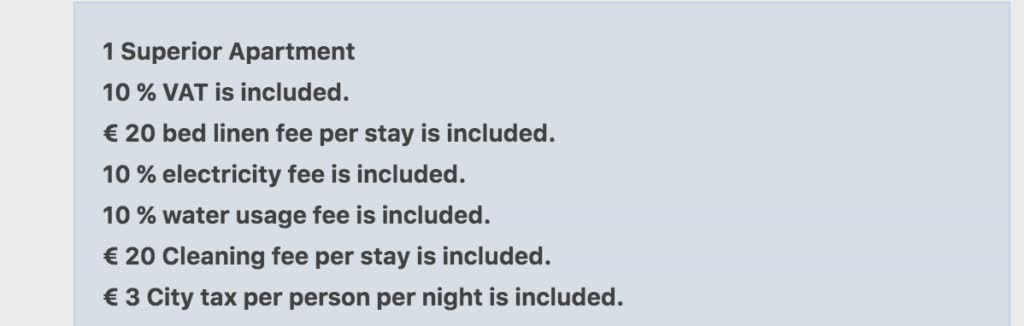

I usually make my hotel reservations through booking.com because I like their cancellation policies and support desk. However, I always have to check the fine print in my booking confirmation to confirm if the city tax was included in the price that I already paid. In this case (for an apartment that I booked in Florence), you can see that the tax was already paid. The last item notes that the city tax is included:

Regardless of how you book, this information about if you have already paid the tax should always be included in the fine print. Good Airbnb owners will write this into the description of their apartment so that you are aware of the charges in advance.

Cost of the Rome Hotel Tax

The amount you pay for the tourist tax in Rome depends on the type of hotel you are staying at. The price goes up based on the number of stars that your hotel has.

The rates for the Rome city tax are:

- €3 per person per night for 1 and 2-star hotels

- €4 per person per night for 3-star hotels

- €6 per person per night for 4-star hotels

- €7 per person per night for 5-star hotels

- €3.50 per person per night for hostels, Airbnbs, holiday rentals, guesthouses, B&Bs, and similar accommodations.

The rules for the Rome city tax are:

- It must be paid for the first 10 nights. If you are staying more than 10 nights, you do not pay a city tax starting on night 11 and running through the end of your stay. These nights must be cumulative. If you leave Rome after 9 nights and return later in your trip, your 10-day tax requirement starts over.

- Children under the age of 10 are exempt from the tax.

For more information, here is the official city website with all the details (in Italian) .

Providing Documents and Personal Information to Hotels in Rome

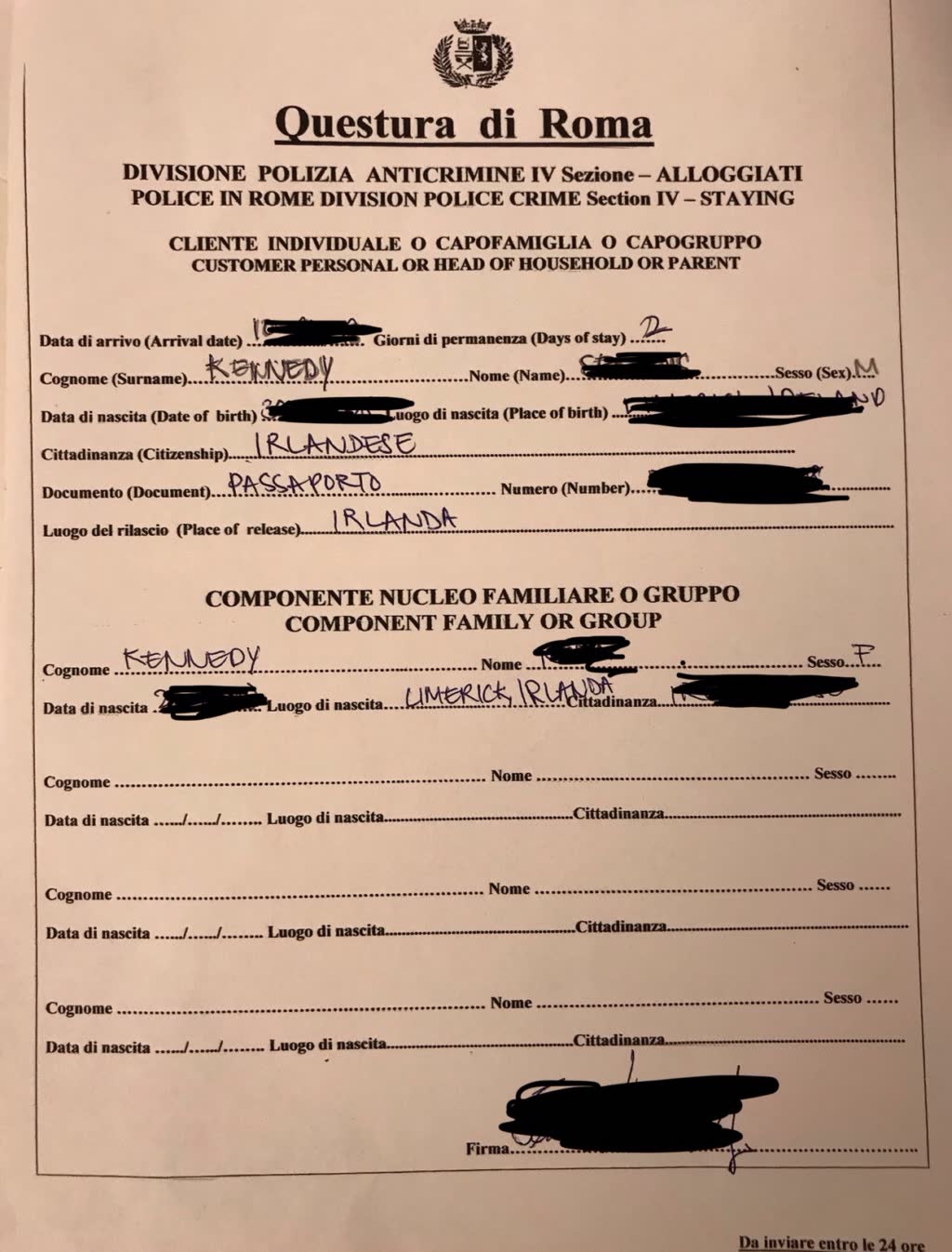

Don’t be alarmed if you are asked to show your passport when you are checking into a hotel, B&B or Airbnb in Rome. It is actually required that you show official identification when you are staying overnight anywhere in Italy. This is because all hotel and vacation rental owners are required to register guest information with the Italian police within 24 hours of arrival.

Your information will be added by the hotel to alloggiatiweb, the official police website. Some hotels will ask to keep your passport, some will make a copy of the document, and some will simply record the information right away.

You may be asked to fill out a form that looks like this, recording your name, birthday, place of birth and passport number. Otherwise, the hotel will take your passport and complete the form on your behalf.

You do not need to send the Airbnb owner a copy of your passport before your arrival in Rome if this makes you uncomfortable. You are only required to show the document upon check-in. However, there is no way to avoid showing your passport at all. It is Italian law that the police be informed about who is staying where.

Ready for your trip to the Eternal City? Here are my favorite areas to stay in Rome , the best hotels for any budget , and a guide to the most romantic hotels in Rome .

Featured image by Christian Dubovan. This post may include affiliate links for services that I use and recommend. I may earn a small commission if you choose to book through these links but you are under no obligation to do so.

Natalie is a food and travel writer who has been living in Rome full time since 2010. She is the founder and editor of this blog and prefers all of her days to include coffee, gelato, and wine.

2 thoughts on “ What to Know About the Rome City Hotel Tax ”

Wow, Natalie, maybe I missed something but did you do your site over? It looks fantastic, complimenti!

Thank you! It is a work in progress but it was time for a small facelift.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Project Description

In Rome, as in many other European cities, you have to pay a tourist tax, which is used to improve the tourists’ welcome. In particular, a fraction of the income is put towards urban decoration and tourist promotions.

In welcoming structures, which do not include hostels, the tourist tax is applied to a maximum of 10 consecutive overnights in the solar year and the different fees are shown in the following chart:

How do you pay it? You can pay by card or with cash at the end of your stay, directly to your welcoming structure which will give you a nominative receipt after the payment. The contribution is applied up to a maximum of 10 consecutive overnights in the solar year as long as they have taken place in the same welcoming structure; 5 nights if you are staying in open places such as camping sites and equipped areas for temporary stays.

Who can avoid paying? People who live in Rome, children up to 10 years of age, those who accompany patients, members of the State Police and of the Armed Forces and one bus driver or tourist accompanying every 23 people.

Share this article!

- Via Del Forte Braschi, 23 - Roma (RM)

Rome Tourist Tax 2023 - What Changes

- Sep 1, 2023

What is the Tourist Tax

What the tourist tax is used for..

- Tourism promotion: The promotion of the city as a tourist destination through advertising and marketing campaigns.

- Maintenance and restoration: The maintenance and restoration of historic sites, museums, monuments and other tourist attractions.

Tourist services: The provision of tourist services, such as cleaning tourist areas, improving infrastructure, and providing security in areas frequented by visitors.

Who has to pay the Tourist Tax

The Tourist Tax must be paid by all guests staying in accommodation facilities designated by the City of Rome. These facilities include hotels, bed and breakfasts, room rentals, residences and other hospitality facilities. Payment is required for each night spent in the tourist facility for a maximum of 10 consecutive nights in the calendar year.

Who is exempt from paying the tourist tax

- Children and young people under a certain age: Children under the age of 10, are exempt from the tax.

- Persons with disabilities: In some cases, people with disabilities or their companions may be exempt from paying the Tourist Tax.

- Students: Students staying for study purposes may be exempt or have discounts, provided they prove their student status.

- Other specific exemptions: The City of Rome may provide additional specific exemptions based on certain situations or circumstances. It is advisable to check local regulations for specific exemptions applicable to Rome.

2023 increases for the Tourist Tax in Rome

In these days, the Deliberation of the Capitoline Council No. 255 of July 17, 2023 with the following subject: Approval of the rates of the tourism tax of Roma Capitale for the year 2023, was published in the Albo Pretorio of the Municipality of Rome.

The Capitoline Council approved an increase in the tourist tax for almost all types of accommodation facilities.

Entry into force of the new rates

The new increased rates for the Rome Tourist Tax will be in effect as of Oct. 01, 2023.

All travelers who booked even before the new rates came into effect will be required to pay the updated amount if they are scheduled to arrive in Rome on any date on or after October 01, 2023.

What are the new amounts of the Tourist Tax in Rome

In the following table we will see the detailed amounts divided by accommodation type:

B&B L'Amaca

+39 | WhatsApp

Codice identificativo 2396

You are using an outdated browser. Please upgrade your browser to improve your experience.

- 01273 827327

- Get a quote

- Request brochure

Rome City Tax has increased: Here's what you need to know before your trip

20 Sept 2023, 13:23 by Sam Taylor

Rome City Council has increased the City Tax tourists must pay when staying in Rome.

The City Tax, also referred to as tourist tax, has been in place since 2011. So, if you’ve travelled on a school trip to Rome recently, you'll already be familiar with the process. If not, don't fret—here's everything you need to know before you go.

How much is Rome City Tax?

The amount of euros each guest must pay is calculated by person by night and varies depending on the star-rating of their hotel.

How much has Rome City Tax increased by?

The recent decision by Rome City Council marks the first increase to the tax since 2014.

The changes to the Rome City Tax have not affected 1-star and 2-star hotels.

How do I pay Rome City Tax?

Rome City Tax is paid directly to your hotel via cash or card. It's the hotel's decision whether the payment is required upon arrival or checkout. Alternatively, you can send us the payment in advance and we can pay the hotel on your behalf via bank transfer.

Do school students need to pay City Tax in Rome?

Yes. Only children under the age of 10 are exempt from the Rome city tax rules.

Why do I have to pay Rome City Tax?

City Tax is commonplace all over Italy, including in popular destinations such as Florence, Milan, Naples & Venice .

Though the tax is paid directly to the hotel, the fee actually goes to the City Council and is used for general upkeep of the city and its tourism infrastructure, which is necessary due to the huge visitor numbers attracted by Rome’s many attractions.

More about school trips to Rome

- How your school trip to Rome is financially protected

- Essential checks you need to make before travelling to Rome

Why choose Voyager School Travel for your school trip?

You are in specialist hands

Our team use their teaching, language & destination experience to organise educational trips that are not only enriching but hassle-free. Read more →

Safety assured, bonded & accredited

As a member of the School Travel Forum & protected through ABTA & ATOL you can be sure of our high standards. Read more →

Trusted by teachers

Schools trust Voyager School Travel to organise the educational trips for over 32,000 passengers a year. Read more →

We deliver the educational elements

Signature educational experiences with our own language & activity instructors allow teachers to enjoy the trip too. Read more →

Stay at our own residential centres

Groups staying at our own residential centres in France will benefit from high quality learning, safety & service. Read more →

Our own overseas teams

Peace of mind knowing our French m anagers, instructors, coach drivers & support team will look after your every need. Read more →

For teachers who are serious about the educational outcomes of their school trip.

Get a quote ✅

Receive a no-obligation quote for your group from one of our educational travel experts.

Get a quote for your school trip to Rome

Our experienced and friendly team is at hand to answer any questions you may have

The tourist tax increase: no, it is not a scam against tourists!

- October 13, 2023

- From Home to Rome , Rome 101 , What's On in Rome

In the last few weeks, tourists planning to visit Rome may have received a notification from Airbnb or other similar platforms about their accommodation, warning them to pay a higher than usual amount for the city tax/tourist tax .

Understandably, some travelers arriving in Rome may have been surprised at the news – disappointingly, this was discussed over the summer but not announced until the very last minute. Even worse, they may have been even annoyed at the idea of having to pay a city tax! First-time visitors, in particular, probably don’t even know that there is a city tax to pay , even though it is common in many European cities and throughout Italy.

Here’s why we thought a blog post on the subject was necessary.

First of all – what is a tourist tax and why does it need to be paid?

The city tax is a local charge levied on all non-residents staying in hotels, guesthouses, hostels, bed and breakfasts and, in general, any type of vacation rental (yes, even barges!). The money raised by this tax is used to finance tourism infrastructure and cultural projects. Some examples that are very visible in Rome are the free maps distributed at the Fiumicino airport or the Virtual Reality Bus : both were developed with the money from the tourist tax. The recent decision of the Rome City Council, effective this month of October, marks the first increase of the tax since 2014 .

A common question: I don’t pay any city tax when I stay at a hotel!

This is not true – a city tax is paid no matter where you stay, unless you are a resident – we’re talking about Italy but again, city taxes are the norm in many cities of Europe and the world. Hotels simply add it to the total cost of your room, so some people don’t even realize the tax is part of their bill.

Of course, there are accommodations that never charge this type of tax. Whether it’s a rented apartment or a luxury hotel, this usually means that the owners are working illegally, possibly without the necessary permits, but 100% they’re not paying their taxes – this or any other!

Another common question: why do I have to pay a difference if I have already paid my city tax?

This is where some tourists may feel like they have been scammed – in a confusing turn of events, instead of letting reservations made before October pay the previous amount required for the city tax, Airbnb and other similar platforms, but even just individual entrepreneurs like ourselves, started asking for a difference to comply with the new rates . It’s not their/our fault – it’s the unfortunate consequence of the Rome city council’s sudden launch of the updated rates.

Also, my host asked me to pay the city tax in cash and leave it at the apartment when I check out. Is this a scam?

That’s a resounding no – and to be fair, we do it ourselves on occasion. Again, the services that allow you to book an apartment online often have a built-in city tax that is included in the final cost of the accommodation, but these are foreign companies and their convenience is trumped by the headache that is the Italian tax system . For purely accounting reasons, the vast majority of Italian property managers prefer to pay the city tax separately , hence the request for this amount either in cash or via a separate transaction.

Still not convinced? Look here!

Above, a news piece on the original launch of the tourist tax, to give you more context.

Also, this city-council operated website has the details on the upgraded tax. And if you have more questions, drop us a line! We’re always available!

- apartments for rent

- City tax 2023

- City tax in Rome

- City tax increase

- tourist tips

- vacation rentals

- When in Rome

Unknown Rome: Palazzo Poli

New at From Home to Rome: Avignonesi 2

Related posts

New at From Home to Home: Testaccio 11

- June 21, 2024

- From Home to Rome , Landmarks , Off the beaten path , Off the beaten path , Rome 101 , Rome 101 , Rome 101 , Testaccio area

June in Rome: fairs, open air cinemas and festivals

- June 13, 2024

- The city center , Trastevere area , What's On in Rome

Summer has not…

New at From Home to Rome: Barberini

- May 31, 2024

- Barberini area , Spagna area , Via Veneto area

You’re planning a…

Join The Discussion

Cancel reply.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

- Aventine Hill area (4)

- Barberini area (2)

- Building (30)

- Campo de' Fiori area (28)

- Campo Marzio area (8)

- Catacombs (6)

- Churches (25)

- Colosseum area (31)

- Esquilino area (7)

- Food & Drinks (36)

- Fountains (7)

- From Home to Rome (81)

- Jewish Ghetto area (9)

- Landmarks (65)

- LGBTQIA friendly (5)

- Markets (14)

- Monteverde area (2)

- Monti area (15)

- Museums (42)

- Navona area (35)

- Off the beaten path (89)

- Our commitment (8)

- Pantheon area (17)

- Piazza Venezia area (14)

- Prati area (1)

- Rome 101 (206)

- San Giovanni area (14)

- Shopping (9)

- Spagna area (12)

- Square (30)

- Termini area (10)

- Testaccio area (9)

- The city center (103)

- Trastevere area (30)

- Trevi area (23)

- Tridente area (1)

- Trieste area (5)

- Uncategorized (8)

- Vatican Area (25)

- Via Giulia area (7)

- Via Veneto area (2)

- What's On in Rome (148)

August 2024

September 2024, october 2024, november 2024, december 2024, january 2025, february 2025, forgot password.

Please enter your username or email address. You will receive a link to create a new password via email.

Compare listings

SELECT DATE:

- Best Sellers

- Food & Wine

- Villa Getaways

- Off-the-Beaten Path and the Great Outdoors

- Romance & Honeymoon

- Emilia Romagna

- Bike/Vespa/Segway Tours

- Cooking Classes

- Exotic Cars

- Food Tours & Wine Tastings

- Vatican Tours

- Train Travel

- Private Drivers

- Travel Insurance

- City Taxes In Italy

- Passports & Customs

- Telephone & Internet

- Electricity

- Travel Tips

Receive exclusive specials,

You have been included on our list.

Taxes listed per city in Italy When staying overnight in Italy, certain cities have a tourist tax. This Italy City tax must be paid by the PASSENGER directly to the hotel before the end of the stay.

Example: 2 Adults staying in a 4* hotel in Rome for 3 days = 36 Euro in tax, paid directly to the hotel at checkout , not ItalyVacations.com.

- Terms of Travel

- About Italy

- Travel Advisors

The tourist tax on accommodation. What is it and in which Italian cities do you pay it?

An unpleasant surprise if you are coming on holiday to Italy: the tourist tax on accommodation. What is it and in which Italian cities do you pay it?

It happens very often that tourists (especially foreigners) that come on vacation to Italy, have to face an unpleasant surprise when they go to pay their hotel or B&B room at the checkout. In fact, the hotel/B&B staff will ask them to pay, in addition to the price for their room, a tax of which most tourists are absolutely unaware: the tourist tax.

The tourist tax was introduced by the law on fiscal federalism (Legislative Decree March 14, 2011, n0. 23) with the intention of financing public policy on tourism. Italian municipalities are entitled to apply a tax on tourists’ stays in hotels, bed & breakfasts, holiday homes, cottages, campsites, etc.. The amount of the tax ranges from € 1 to € 5 per day per person depending on the type and “luxury level” of the facility (except in the case of Rome where it is up to € 7 per day in 5-star hotels).

Therefore, the amount of the tourist tax, which a tourist staying in an Italian hotel/B&B etc. will have to pay to the hotel/B&B etc. (the facility will then transfer the sum to the municipality) at the time of the checkout, is not fixed but is calculated according to the rate decided by each municipality.

For example, the fees that a tourist will have to pay if he/she stays in a hotel in the city of Rome are the following:

The tourist tax can be paid in cash or by card , and the accommodation must issue a payment receipt.

So, if, for example, a couple stays in a 4-star hotel in Rome for two nights, in addition to the cost of the hotel room, the couple will have to pay an extra € 24 (€ 6x2x2= € 24).

However, there are some exemptions , that for the city of Rome are the following (they generally apply to other cities as well):

- those who reside in the city;

- children up to 10 years of age;

- those who stay at youth hostels;

- bus drivers and tour leaders for every 23 participants;

- people who are ill and one caregiver for a patient admitted to a health facility;

- parents accompanying their children under the age of 18 who are admitted to a medical facility;

- State Police and other armed forces personnel who are carrying out activities of public order and security.

For students and workers who stay overnight, even non-continually, for prolonged periods of time, to attend study courses or for work reasons the fee is applied up to a maximum of ten overnight stays in the calendar year, as long as the student or worker stays in the same accommodation facility. In order to benefit from this exemption, the student/worker must document the reason for their stay.

The tourist tax which already must be paid in major Italian tourist centers, such as Milan, Rome, Florence, Naples, Turin, Venice, starting from January 1, 2018, will be extended to other smaller municipalities including Todi, Assisi, Pompeii, Paestum, and later on in the year to Portofino, Rapallo, Santa Margherita Ligure and many others.

64 Comments

Can a hotel force me tot pay the tourist tax in cash (even if they allow a card payment for the stay itself)?

Dear Charlotte, No, the Hotel should not force you to pay in cash.

The tourist tax can be paid in cash or by card, and the accommodation must issue a payment receipt.

For example, the Comune di Roma has published the following FAQ: “ L’importo del contributo deve essere pagato in contante dal cliente? Laddove l’importo del Contributo di Soggiorno viene pagato insieme all’importo dovuto per la camera può essere pagato anche con carta di credito. Qualora invece il turista deve pagare solo l’importo del Contributo di Soggiorno è preferibile (ma non obbligatorio) pagarlo in contanti.” .

Thank you, David.

My Air BNB host wants info about the guests (age, nationality, etc) and says its part of the required tourist tax info. He also asked for one person’s document info… is this legit? Thanks

Dear Judy, Thank you for contacting VI.

Every owner of a Bed and Breakfast should ask customers for a copy of their passport in order to identify them, and collect their relevant information (full name, date and place of birth, citizenship, sex).

Regards, David.

Is it possible to write down my name, nationality, citizenship and sex, and give that to the Airbnb host? I just dont understand why a copy of my passport is required from a safety standpoint.

Dear Toyib, Thank you for your query.

Hotels,B&Bs etc. have an obligation to identify those who intend to stay at the facility.

Regards, VI.

We have been asked to pay a €2 per day tourist tax at a b&b in Ortigia. We were asked for cash but have not been given a receipt yet. Is this the correct amount? We are staying for 4 nights

Hi Rosario, Thank you for your query.

It depends on the “rating” of the facility. It could be correct. You should find the info you need by clicking on this link http://www.comune.siracusa.it/index.php/it/gli-uffici/741-settore-entrate/tassa-di-soggiorno . The facility should give you a receipt that includes the tourist tax.

I stayed in an apartment in Rome and received an email three weeks after my return to the U.S. that they had failed to ask for the tourist tax. They were most apologetic for their failure. I was asked to wire the 35 euro to their account at that time. My bank had a minimum of 100 euro for wire transfers. Eventually, I was able to acquire the company’s address and sent a cashier’s check in Euros. Never received any acknowledgement and the funds were deducted from my account upon the issuance of the check not the cashing of the check. Are their any consequences to the tourist if the company did not collect the tax?

Just realized I entered my email incorrectly. I stayed in an apartment in Rome for a week. Three weeks upon my return to the US I was notified the agent had failed to collect 35 Euros for the tourist tax. I was asked to wire that amount. My bank would not wire anything less than 100 euro. Eventually, I acquired the company’s address and sent a certified check for the amount. The funds were deducted when the check was cut, so I have no cancelled check or receipt of the check. My question is whether there are any consequences the tourist should be aware of if the tourist returns to Rome and the agent did not report collection of the tax.

Dear Alice, There should be no consequences in a case like yours, especially if you have the receipt of the cashier’s check you sent or any proof that you tried to pay, and the email with which they ask you for the late payment.

However, I am sending you an email to inform you of what I can do for you.

Hello, We have a hotel booked in Rome for 16 days. However, we will be traveling to Venice and staying for 3 nights during the 16-day time period. Are we still required to pay 3 nights Tax to the Rome hotel even though we will not be there?

Regards, Lisa

Hello, We have a hotel booked in Rome for 16 days. We will be going to Venice for 3 nights during the 16-day period. Are we still required to pay the Tax for the Rome hotel for 3 nights even though we will not be there?

Hi Lisa, According to “Regolamento sul contributo di soggiorno nella città di Roma capitale”, art. 4, par. 3, the fee is applied up to a maximum of ten consecutive overnight stays in the calendar year, as long as you stay in the same accommodation facility. Otherwise, unless you are in a case of exemption, you could try to prove (with your reservation) to the hotel in Rome that you will be staying in Venice and ask them to give you a “suspension” for those three days based on the fact that, although you have booked a room, considering that you will not stay at the hotel during those days, technically you should not be considered as a taxable person (those staying overnight at a facility) for the purposes of Article 2 of the above-mentioned Regulation. However, I cannot guarantee that they will accept this interpretation, especially if you consider that being a very uncommon case they will not be very familiar with the matter. Please let me know their answer. I look forward to hearing from you. Thank you, David.

Hi dear, I would like to know what is the consequense of not paying hotel tax?

Dear Sahar, I apologize for the late reply.

Technically, the manager of the facility where you stayed, if required by municipal regulations, can ask you to sign a paper where you state that you do not intend to pay the tax, and then forward your information to the Municipality. The Municipality could then try to collect the tax, which can also be increased by 30 percent.

Hello, I recently stayed at a place where I received a non fiscal receipt which showed the payment for my stay and also the additional city tax I paid. But there was no VAT shown on this receipt. Is it legal to give those non fiscal receipts to the hotel customers? To my understanding this hotel took the city tax all for themselves and also didn’t pay any tax. How would you deal with a situation like this? They also insisted that the city tax had to be paid in cash.

Dear Heinze, In general, they should issue a regular fiscal receipt. I cannot know if they kept the city tax for themselves or if they will pay it. If you want you can inform the authorities, but, unfortunately, I don’t think they will take care of the case.

I stayed in Hotel Centrale in Siena, Italy. I paid my city tax in cash and received a receipt for it. Then a few days after I left the hotel I noticed a charge for the same amount to my credit card. I advised them of their mistake and they have acknowledged it and say they are refunding the money but they have been unsuccessful so far. I am always initiating contact about this issue with them. First they said that it’s been to long and they didn’t have my credit card number. Okay, I gave them my credit card information. Waited 10 days nothing. Contacted them again and they said they couldn’t give me my refund onto the credit card. They had all the information they needed including expiry and CVV. I called the credit card company and they said they have the information they need to refund it. Next the hotel advised they needed some number a combination of my, name, birthday and something else. No idea what this number is. Yes, I know, I’m dealing with the Hotel and not fraud as I recognize the voices I’m Skyping with also. I’m Canadian, this is 2018, you’re a Hotel figure out how to get me back my money, I don’t care if it’s refunded back to my credit card, get it to me thru email, PayPal, Western Union, there aremult iple ways to refund money. It’s now 1.5 months into this. I will not give up on this and am also posting all over the internet as I suspect this might be a common problem with “City Tax” or perhaps it is a problem with this one Hotel in Siena, Italy called Hotel Centrale. Be ware, it’s a great way to collect money for personal gain perhaps.

Hello When I booked a room in 2 star hotel for 5 nights for 2 persons the total price included the taxes, then on the check out they charged us with 6euro per night per person? Is this correct?

Kika, I can’t say for sure if I don’t see the papers. However, it seems correct. They probably charged you the tassa di soggiorno at check out.

Hello i am Italian resident. But anytime i took a hotel they ask me for City taxes is it right. Is because I am living in italy.

Dear Kempex, If you are not a formal resident of that municipality you will have to pay the tax, regardless of the fact that you are Italian or formally residing in Italy.

Hi David, does this tourist tax also apply to business travellers? I can’t find any info anywhere on that. I know that in Germany, long as the purpose of the travel is business, you don’t pay tourist taxes. TIA!

Dear Tanya, It applies to business travellers, but in some Comuni the amount is reduced.

You should ask the Comune or the Hotel before your arrival.

A couple things:

First, the tourist tax is becoming much more widespread all across Italy and over and above the tourist tax, some few popular Italian cities, such as Venice are contemplating charging an “admission” fee for day trippers. Those staying overnight will be exempt.

Second, one reason accommodations ask for the tax in cash is so that they aren’t forced to pay credit card fees on a tax. Sure, they’ll accept a credit card, but it’s kinder and more thoughtful to pay in cash. They also like it when you book direct with them instead of booking with a third-party aggregator, such as Booking.com – you’ll often get a reduced rate or small percentage discount for booking direct. They save money, you save money.

Third, all legal accommodations are required to report the passport information of ALL their guests to the authorities. If you book an Airbnb and they DON’T ask for a copy of your passport or the passport itself, that’s a red flag. Occasionally they’ll ask you to give them your passport – don’t be alarmed – they aren’t doing it for nefarious purposes, it means they probably just haven’t got the time right then to copy out the information or make a photocopy.

What would happen you refuse to pay tourist tax?

What will happen if you refuse to pay the tourist tax?

Hello David, I want to ask you if there is any place to file a report for a hotel that miscalculate the city tax. More specific, I was staying with my family (we were two adults and two kids (7 year old each which can be verified from the passport information that hotel took) in Rome from 19/5/2019 to 25/5/2019 and the amount of the city tax (Tassa di soggiorno) was calculated 84 euros and not 42 as it was supposed. Thank you

it’s ok, i have resolved the issue.

Dear Ioanna, Than you for letting me know.

I am curious to know how you solved your issue.

Please let me know.

Thank you, D.

Very informative article..this is the topmost topic when we actually traveled other countries and we should have knowledge about all this tax-related stuff, thank you for sharing and keep sharing

When renting from an AirBnB situation, why arent the taxes collected with the payment of renting the location?

Dear Gena, I don’t know when you paid, but the city tax is collected when you are leaving (check-out) the hotel or B&B.

Hi David, we were told to leave 8 euros on the table as city tax before we self check-out of the apartment in Como. However, I had already received an invoice 2 days before we checked in that full payment has been made and we owe 0 euros. Since nobody will issue us a receipt when we leave and we have an invoice that says we have been charged, can I assume we were mistakenly asked to pay city tax?

I suggest contacting them and asking them to send you proof that you paid the city tax.

Hello David Please Could you Help Me out. Is first time i intend to visit Italy . City Tax …. i intend to stay 3 days in Venice ; 8 days near Rome ; 14 days in Sorrento Or Rimini . Do i only pay Tax on 10 days??? Is this in What town out if The three i mentioned above ??? Or i need to pay Tax in each town And each accomidation??? We are 5 in our family. Thank you

I’m staying at a 4 star camping in Cavallino-treporti near Venice. We are leaving 2 days earlier than our reservation due to practical reasons. We were expecting to pay to full amount if rent for our pitch, but they also charged the tourist tax. 13.50 euros a day a person extra = 81 euros since we are staying with 3 adults. I’m not certain thus us correct since all 3 of us will be out if the region and even out of the country by tomorrow evening.

Thank you for your help!

Dear Sara, The tourist tax is linked to the reservation/stay. Therefore, if you stayed a few days only, if they asked you to pay the reservation in full they should ask you to pay the tax in full. Otherwise, the number of days of your stay will not match the number of days of the tax, and the authority could think that they kept part of the tax for them. I cannot study the case, it is just a thought, how I see it.

Regards, D.

Hi, we are staying in Nesso (Lake Commo). Upon arrival we have been asked for 84 Euro tourist tax. There are two adults and 2 children (14 and 16). We are staying for 14 nights. His calculation is 1.5 euros per person per night. When looking online I can find lots of info with regards to child exemptions for and limits on the amount of days charged. Can you offer any assistance?

I am sorry I do not offer this kind of assistance at the moment.

Im going to Venice for 2 day only and I will be staying in a friend place. How can I pay for the tourist tax?

If you will be staying at a facility you will be able to pay by card or in cash at the check out

Did not receive a receipt and was asked to pay 2.50 euros per day for 7 nights and our Son did not come,so there was just three of us but was charged for 4 people. We weren’t aware of the Tourist Tax and on our invoice it was quoted as 56 euros for the 7 nights but were charged 70 euros. I have tried to explain this to the owner about the misrepresentation of the cost which weren’t aware of this tax and it is at the cheaper rate. He informed us that it had gone up in April this year, even though we booked in June this year. He has updated the webpage now but that is not helpful to us. He thinks that is ok after the event and not accepted the principle of misrepresentation and thinks it is ok to not have updated the webpage and took responsibility earlier. He has not suggested any good will gestures and just oblivious to the fact of consumer rights. At least no-one else will fall into this trap. Did we need to pay for the 4th person as he did take pictures of our passports which was ok but clearly shows only 3 travellers. He said that we booked for 4 people so may be that is the case? Had we had know about the tax I would have informed him, not sure whether that would have made any difference.

I stayed in a B&B in Naples that did not correctly charging the tourist tax. It should be 3,50 euros per night for a B&B, payable in cash or credit card, and the customer should get a receipt. We were charged 5 euros per night, obliged to pay cash, and given no receipt. Is there a way to complain?

The reason why most of the owners required a payment in cash is because in italy there is an important taxation request by municipality for any credit card transaction, differently than in many other places in the world. If you think that it is correct to charge the owner of the place where you stay with an extra tax you should keep on paying any service provided with credit card, but don’t be surprised in the future if you will find no more the same place in the next few year. THIS is the reason. However you are going to pay the city tax, with cash or card, you MUST receive an invoice from the reception at the moment of the payment. In case it is already included in the price of the room it has to be specified in the booking.

Hi there, I’m a little confused and hope for a reply from someone who knows. Me and my family are willing to rent a house in Positano through Airbnb. The “house rules” section says that there’s a city tax from April to 2nd of November, but we’re staying from 7th till 12th of November, does it mean that there’s no tourist tax from November till April and we won’t have to pay it? Thanks in advance.

Hello David ! I have booked an inn for 4 nights. The room is for 3 people. But I will be alone. I do not think that the inn is aware of this. In their summary email, the Inn mentions that I will need to pay the price of the room + the city tax (3 people x 4 nights x 3.50€ = 42€). I would like to know if I will need to pay the 42€ or only 14€ (1 person x 4 nights x 3.50 €). Could you please help me so i may give an explanation to the inn when the issue of payment will come ? Looking forward to discovering your beautiful city, and thank you in Advance.

Hello, David! Thank you very much for creating such a helpful article and thread discussion!

We are currently in Venice, renting appartment from booking and host is demanding tax payed in cash and is not giving us fiscal receipt. He even got angry at us because “it’s just 36 euros”, but we don’t like being screwed even for 1 euro.

So now he said he will report us to local authorities if we don’t pay him.

Is it that difficult to make a fiscal receipt or what could be the reason for him not willing to cooperate on this one?

Also he says he needs money now, because he has to register us within 24 hours of our arrival.

The B&B owner should register its clients.

The tourist tax can be paid in cash or by card, and the accommodation must issue a payment receipt or an invoice.

For example, the Comune di Roma has published the following FAQ: “L’importo del contributo deve essere pagato in contante dal cliente? Laddove l’importo del Contributo di Soggiorno viene pagato insieme all’importo dovuto per la camera può essere pagato anche con carta di credito. Qualora invece il turista deve pagare solo l’importo del Contributo di Soggiorno è preferibile (ma non obbligatorio) pagarlo in contanti.”.

We are consist of 22 peoples traveling to Rome and being charged for City Tax of EUR6/pax which total is EUR132 and there will be more nights to comes before we flying back to our country on Dec 4th. My question is, can we claim back our city tax from VAT?