- Schengen Visa

- 30,000 Euro Travel Insurance for Schengen visa

Travel insurance 30000 euro coverage

For international tourists visiting the Schengen countries, the Schengen state consulates have made it mandatory for travelers applying for the Schengen visa to buy travel insurance Europe 30000 euro coverage to insure medical expenses and medical evacuationin the case of any sickness or an accident.

30,000 Euro travel insurance cost – Quotes

Schengen visa travel insurance 30000 euro, an overview.

- The insurance plan must cover expenses involved in evacuation of the insured to a medical care center in case of an emergency medical situation in the Schengen region.

- The insurance plan must cover expenses involved in transportation of cremation remains or cremation in case of death in the Schengen region.

- The insurance company from which you buy the insurance must have a regional office in the Schengen region.

- The insurance must be valid for the entire duration or more than the period of stay in the Schengen area.

What does Schengen visa travel insurance cover?

Satisfies visa requirements, doctor visit, medical evacuation, health care expenses, repat of remains, pre-existing conditions, testimonials - from our customers.

I had a no-problem trip but Seven corners was easy to deal with in the securing of the travel insurance and dealing with a few issues prior to departure.

I have always gotten a quick response with a live person. I placed a claim, we will see it their payment to me is as good as their customer service is.

Good policy options and pricing. Like to purchase high coverage for medical without covering full cost of trips - like the options Seven Corners provides.

How much does Schengen Visa health insurance cost?

There is no single travel insurance cost for travelers from India to Spain. The cost of best travel insurance for Indian visitors to Spain varies based on several factors such as the age of the travelers, duration of coverage, medical maximum coverage, deductible for the plan, type of health insurance and the cost of travel insurance for pre-existing conditions. For an average traveler, there are cheap travel insurance plans at less than a dollar a day. Understandably, the more expensive the travel insurance, the better and more comprehensive will be the travel insurance coverage.

Patriot International Lite

- Available for US and Non-US citizens traveling outside home country & outside USA.

- For ages 14 days to 99 years.

- Coinsurance is available 100% up to the maximum limit.

- Covers acute onset of pre-existing conditions up to 70 years of age.

- This plan can be renewed upto 2 years.

Safe Travels International

- Available for non-U.S. citizens/residents traveling outside home country & outside USA.

- For ages 14 days to 89+ years.

- Covers unexpected recurrence of a pre-existing medical condition up to $20,000 of covered expenses up to age 65 or the first $10,000 for age 65 or over.

- Co-insurance percentage is 100% up to the policy maximum after the deductible is met.

Safe Travels International Cost Saver

- Covers unexpected recurrence of a pre-existing condition up to $2500 per policy period.

Travel Medical Choice

- Coverage for non-U.S. Residents/Citizens while traveling outside home country.

- Covers Acute onset of pre-existing conditions are covered up to $50k for age under 64 years and a coverage of $10k for age of 65-79.

- The plan pays 100% for co-insurance.

- The Benefit period is 180 days to receive treatment from the date of an injury or illness. Initial treatment must occur within 30 days.

Atlas International

- Covers acute onset of pre-existing conditions up to 79 years of age.

- 79 years old turing 80 during the coverage period, Atlas International plan does not affect coverage as long plan is purchased at age 79.

- Covers complications of pregnancy.

Popular tourist destinations in Europe

Venice may conjure up images of romantic gondola rides down the Grand Canal, but this European city isn't only for swooning lovebirds.

Paris, France's capital, is a major European city and a global center for art, fashion, gastronomy and culture.

There's more to Amsterdam than its notorious coffee shop culture and Red Light District. Spend the day biking along the city's canals and stylish streets.

Athens was made for history buffs and architecture aficionados, but it also serves as a great European getaway for the everyday travel.

Schengen travel insurance 30000 euro medical coverage - FAQ’s

1. what does the coverage amount of 30,000 euros mean in travel insurance.

The coverage amount of 30,000 euros is the minimum medical coverage limit set by Schengen consulates for applying for the Schengen visa. In travel insurance this refers to the limit of coverage provided by the insurance policy. It means that if you incur eligible expenses or face covered risks during your trip, the insurance company will reimburse you up to a maximum of 30,000 euros, subject to the terms and conditions of the policy.

2. What expenses are typically covered under a 30,000 euro travel insurance policy?

A 30,000 euro travel insurance policy typically covers a range of expenses, including but not limited to:

- Trip cancellation or interruption costs

- Emergency medical and hospitalization expenses

- Medical evacuation and repatriation

- Lost, stolen, or damaged baggage and personal belongings

- Trip delay or missed connection expenses

- Emergency travel and accommodation arrangements

- Personal liability for accidental injury or property damage caused to others

- Legal assistance and related expenses

It's important to read the policy wording and understand the specific coverage details and exclusions provided by the insurance company.

3. Does travel insurance with 30,000 euro coverage include pre-existing medical conditions?

The coverage for pre-existing medical conditions can vary among insurance providers and policies. Some travel insurance plans may offer coverage for pre-existing conditions, while others may exclude them. It is important to compare the different travel insurance plans for Europe on American Visitor Insurance’s Schengen visa insurance compare engine or contact our licensed agents to understand the coverage and any limitations or requirements regarding pre-existing conditions.

4. Can I increase the coverage amount beyond 30,000 euros if needed?

Yes, many travel insurance providers offer options to increase the coverage amount beyond the standard limits. If you require higher coverage, you can often choose a policy with a higher maximum limit or consider adding supplemental coverage options to meet your specific needs. However, note that higher coverage limits will come with additional premiums.

5. Are adventure sports and activities covered under a 30,000 euro travel insurance policy?

Adventure sports and activities may or may not be automatically covered under a 30,000 euro travel insurance policy. Some insurers include coverage for certain adventure sports as part of their standard policies, while others may require you to add optional coverage specifically for these activities. It's important to check the policy details on American Visitor Insurance for any exclusions related to adventure sports to ensure you have the necessary coverage.

6. What steps should I take if I need to make a claim under my 30,000 euro travel insurance policy?

If you need to make a claim under your travel insurance policy, follow these general steps:

- Contact your insurance provider: Notify your insurance company as soon as possible, following the claim procedures provided in your policy documents.

- Gather documentation: Collect all necessary documentation to support your claim, such as receipts, medical reports, police reports (in case of theft), or any other relevant proof of loss or expenses.

- Complete claim forms: Fill out the claim forms provided by your insurance company accurately and provide all the requested information.

- Submit the claim: Send the completed claim forms and supporting documents to your insurance provider within the specified time frame.

- Follow up: Keep records of all communication with the insurance company and follow up on the progress of your claim if necessary.

Remember to familiarize yourself with the specific claims process outlined in your policy and adhere to any deadlines or requirements set by the insurance company.

7. Why do I need travel insurance for Schengen visa?

Travel insurance with 30,000 Euro coverage is a mandatory requirement for obtaining a Schengen visa. The Schengen visa insurance offers the following coverage:

- Emergencies: Travel insurance provides coverage for medical emergencies that may occur during your stay in the Schengen area. It ensures that you have financial protection in case you need medical treatment, hospitalization, or emergency medical evacuation. The insurance coverage must meet the minimum requirements specified by the Schengen visa regulations.

- Healthcare Costs: The Schengen countries have a high standard of healthcare, but medical expenses can be quite expensive. Having travel insurance helps cover these costs, including doctor's visits, medications, and hospitalization, so you don't have to bear the financial burden yourself.

- Repatriation of Remains: In unfortunate circumstances where a traveler passes away during their visit to a Schengen country, travel insurance covers the costs of repatriating the remains to their home country.

- Travel Cancellation or Interruption: Travel insurance also provides coverage for trip cancellation or interruption due to unforeseen circumstances, such as illness, injury, or a death in the family. This coverage helps protect your travel investment by reimbursing non-refundable expenses, such as flight tickets and hotel reservations.

- Travel Assistance: Travel insurance often includes 24/7 travel assistance services. In case of emergencies or unforeseen events, such as lost passports, legal issues, or emergency evacuations, you can contact the insurance provider's assistance helpline for guidance and support.

The Schengen countries require proof of travel insurance while issuing the Schengen visa as a way to ensure that visitors have adequate financial protection during their stay. It gives both the traveler and the host country peace of mind by mitigating potential risks and liabilities.

8. Is travel insurance necessary for Schengen visa?

Yes, Europe travel insurance is mandatory for applying for the Schengen visa according to Schengen state consular requirements. The Schengen visa travel insurance requirement is a minimum coverage of 30,000 Euros. Compare and buy cheapest travel insurance for schengen visa.

9. How can I get travel medical insurance for Schengen visa?

Travelers to Europe who are applying for the Schengen visa can buy Schengen visa travel insurance on our website. Our Schengen visa travel insurance quote facility lists the travel insurance that satisfy Schengen visa consulate requirements. Once you complete buying the policy online, you can download the required Schengen visa letter which you can submit while applying for the Schengen visa.

10. How much is 30000 euro travel insurance cost for Schengen Visa?

The cost of 30000 Euro travel insurance depends mainly on the age of the traveler and the duration of coverage required. The older the traveler the higher will be the cost. The longer the duration of travel medical insurance coverage required, the greater will be the cost. The schengen travel insurance 30000 euro insurance application quote facility on our website lists the travel insurance that satisfy 30000 euro travel insurance cost for Schengen visa consulate requirements.

Travel insurance cover 30000 euros, Cheapest travel insurance for Schengen visa

Instant schengen visa letter, nationalities for schengen visa, schengen visa letter, schengen travel insurance with 30,000 euro coverage, cheapest schengen health insurance for travel faqs.

Cheap travel medical insurance for Schengen Visa FAQs.

Best Schengen travel insurance blogs

Best insurance for schengen visa blogs and articles

Best schengen travel insurance forum

Travel insurance for Schengen visa, Schengen insurance forum.

Europe Schengen travel insurance - related links

Cheapest europe travel insurance.

Cheapest Europe travel insurance for Schengen visa.

Travel tips for schengen visa

Best Schengen Visa Europe Travel Insurance Tips.

Schengen Visa Requirements

Schengen Visa Travel Insurance Requirements.

Europe group travel insurance

Europe group travel insurance for Schengen visa.

Schengen visa travel insurance cost

Cost of travel insurance for Schengen visa.

Pre-existing travel insurance

Provides coverage for individuals with pre-existing medical conditions.

Schengen visa annual travel insurance

Provides coverage for multiple trips within a specified period.

Expatriate Health Insurance

Provides healthcare coverage for people working abroad.

List of Popular Schengen countries

Popular schengen visa insurance providers.

You can find reliable Schengen visa insurance providers like International Medical Group(IMG), Seven Corners, WorldTrips, Trawick International insurance.

Related Schengen visa insurance pages

Schengen visa insurance

Schengen visa letter

Group Travel Insurance

Annual travel insurance

Europe trip from USA

Long term Europe visa

30,000 Euro travel

Schengen visa forum

Schengen visa Blogs

Schengen visa FAQ

Schengen visa factors

- Call: (877)-340-7910

- Contact

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Travel Insurance for Europe: 4 Best Options for 2024

Allianz Travel Insurance »

Travelex Insurance Services »

Generali Global Assistance »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance for Europe.

Table of Contents

- Allianz Travel Insurance

- Travelex Insurance Services

You almost certainly will want travel insurance for Europe, mostly because the high cost for international trips is worth protecting against travel delays and trip cancellations. Since your U.S. medical coverage will not apply overseas, you also need international health insurance that covers surprise medical expenses and medical evacuation.

If you're searching for the best Europe travel insurance that money can buy, consider the following plans and all they have to offer.

Frequently Asked Questions

Most people need travel health insurance at a bare minimum when traveling to European destinations like France, Italy or Switzerland, as well as additional countries inside and outside of the Schengen area. After all, U.S. health insurance plans do not provide coverage for medical emergencies overseas, and the same is true for government health plans like Medicare. Check out our article on whether your health insurance covers international travel .

Other benefits built into Europe travel insurance plans can also protect the money that's been spent on airfare, hotel stays, Europe cruises and tours. For example, travelers can benefit from having coverage for trip cancellation, trip delays, lost or delayed baggage, and more.

Every travel insurance policy is unique, so you'll want to read over individual travel insurance plans to see what they protect against. That said, the bulk of travel insurance plans for trips to Europe provide the following coverages:

- Trip cancellation

- Trip interruption

- Travel delays

- Lost luggage reimbursement

- Baggage delay coverage

- Medical expenses

- Emergency medical evacuation

- Rental car damage

Some travel insurance plans also offer additional or optional coverage for sports equipment or sports equipment delays, missed connections, accidental death and dismemberment (AD&D), adventure sports and more.

Some visitors to countries in the Schengen area are required to have a visa for short stays that can last for up to 90 days within a timeline of up to 180 days. However, this is not the case for American citizens, who can stay in Europe for up to 90 days at a time without meeting specific visa requirements.

The U.S. Department of State also notes that American citizens who want to stay in Europe for more than 90 days should reach out to the country they plan on visiting to inquire about their visa process.

If you live in a country that requires a Schengen visa, you are required to purchase Schengen visa insurance that pays for overseas medical expenses. This coverage must provide at least 30,000 euros in protection against medical expenses that result from hospitalization, emergency treatment and repatriation of remains in the case of accident or death.

- Allianz Travel Insurance: Best Overall

- Travelex Insurance Services: Best Cost

- Generali Global Assistance: Best for Medical Emergencies

- WorldTrips: Best for Groups

Optional cancel for any reason (CFAR) and preexisting medical conditions coverage available

Kids 17 and younger covered for free

Lower coverage amount for medical expenses than some providers

- $100,000 per traveler in coverage for trip cancellation

- $150,000 per traveler in coverage for trip interruptions

- $500 in coverage for eligible trip changes

- $50,000 in emergency medical coverage

- $500,000 for emergency medical transportation

- $1,000 toward baggage loss or damage

- $300 in coverage for baggage delays of 12 hours or more

- $800 in protection for travel delays (daily limit of $200 applies)

- $100 per insured person per day in SmartBenefits coverage for eligible delays

- 24-hour hotline assistance

- Concierge services

SEE FULL REVIEW »

Optional CFAR and preexisting medical conditions coverages available

Kids 17 and younger are covered for free

Many coverages cost extra

- 100% of trip cost for trip cancellation (up to $50,000)

- 150% of trip cost for trip interruption (up to $75,000)

- $2,000 in coverage for trip delays of five hours or longer

- $750 in coverage for missed connections

- $50,000 in coverage for emergency medical expenses ($500 dental sublimit included)

- $500,000 in coverage for emergency medical evacuation and repatriation

- $1,000 in coverage for baggage and personal effects

- $200 for baggage delays of 12 hours or longer

- $200 for sporting equipment delays of 24 hours or longer

- $25,000 for accidental death and dismemberment coverage

- 24/7 travel assistance

- 100% of the insured trip cost for financial default of a travel provider (maximum of $50,000)

- Trip cancellation and interruption coverage for preexisting medical conditions (maximum of $50,000)

- Cancel for work reasons coverage

- CFAR insurance

- Car rental coverage worth up to $35,000

- $50,000 in additional emergency medical coverage

- $500,000 in additional coverage for emergency medical evacuation and repatriation

- Adventure sports exclusions waiver

- $200,000 in coverage for flight accidental death and dismemberment

CFAR and preexisting medical conditions coverages available

High coverage limits for medical expenses and evacuation

CFAR coverage only reimburses at 60%

- $1,000,000 coverage limit for emergency medical evacuation and transportation

- $250,000 coverage limit for medical expenses ($500 limit for dental emergencies)

- 100% of trip cost for trip cancellation

- 175% of trip cost for trip interruption

- $1,000 per person for travel delays ($300 per person daily limit applies)

- $2,000 per person in coverage for baggage and $500 for baggage delays

- $2,000 per person in coverage for sporting equipment and $500 for sporting equipment delays

- $1,000 per person in coverage for missed connections

- Air flight accident AD&D coverage worth $100,000 per person and $200,000 per plan

- Travel accident AD&D coverage worth $50,000 per person and $100,000 per plan

- $25,000 in coverage for rental cars

- 24-hour travel support

Discounts for groups of five or more

Potential for high coverage limits for medical expenses

No coverage for trip cancellation

Available coverage limits vary by age

- $5,000 for local burial or cremation

- Up to $25,000 in AD&D coverage

- $100,000 in coverage for emergency reunions

- $10,000 in coverage for trip interruption

- $1,000 for lost checked luggage

- $100 in coverage for lost or stolen passports or visas

- $100 in coverage per day for travel delays of at least 12 hours (two days of coverage maximum)

- Up to $25,000 in personal liability coverage

Why Trust U.S. News Travel

Holly Johnson is a travel writer who has created content about travel insurance, family travel, cruises, all-inclusive resorts and more for over a decade. She has visited more than 50 countries around the world and has an annual travel insurance plan of her own. Johnson also has experience navigating the claims process for travel insurance plans and has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson works with her husband, Greg, who is licensed to sell travel insurance and owns the travel agency Travel Blue Book .

You might also be interested in:

9 Best Travel Insurance Companies of 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

The Best Travel Medical Insurance of 2024

Explore protection options for unexpected health issues abroad.

Expat Travel Insurance: The 5 Best Options for Globetrotters

Find the coverage and benefits you need for your adventures abroad.

Visa Traveler

Exploring the world one country at a time

Travel Insurance for Schengen Visa: A Comprehensive Guide

Updated: September 8, 2023

One of the key requirements of Schengen visa is the travel medical insurance. The travel insurance for Schengen visa must meet certain coverage and must be valid throughout the Schengen region for the entire duration of your stay.

With a myriad of travel insurance options in the market, picking out the right policy for your Schengen visa is difficult. In this article, you will everything about Schengen visa travel insurance and how to choose a policy for your visa.

Table of Contents

BONUS: FREE eBOOK

Enter your name and email to download the FREE eBOOK: The Secret to VISA-FREE Travel

Opt in to receive my monthly visa updates

You can unsubscribe anytime. For more details, review our Privacy Policy.

Your FREE eBook is on it’s way to your inbox! Check your email.

What is Schengen Travel Medical Insurance?

Schengen travel insurance is a type of insurance policy for travelers visiting the Schengen area. This type of travel insurance plan is designed specifically to comply with Schengen visa criteria of minimum coverage and validity requirements. Schengen travel insurance is also a mandatory requirement for obtaining a Schengen visa.

Who Requires Schengen Travel Health Insurance?

Visitors from visa-required countries planning to visit any Schengen country must require Schengen travel insurance.

If you are a traveler from a country that requires a visa to enter the Schengen zone, you must have a valid travel insurance policy. You must buy travel insurance not only for your Schengen visa application but also for any or all trips that you take to the Schengen area.

Is Travel Insurance Mandatory for Schengen Visa?

Yes, obtaining travel insurance is mandatory for Schengen visa . The European Commission’s 810/2009 Regulation mandates submitting valid travel medical insurance for Schengen visa applications.

Proof of travel medical insurance is not only mandatory for the first trip, but also for all subsequent trips for multiple-entry Schengen visas.

At the time of application, you would only need to provide proof of insurance for the first entry.

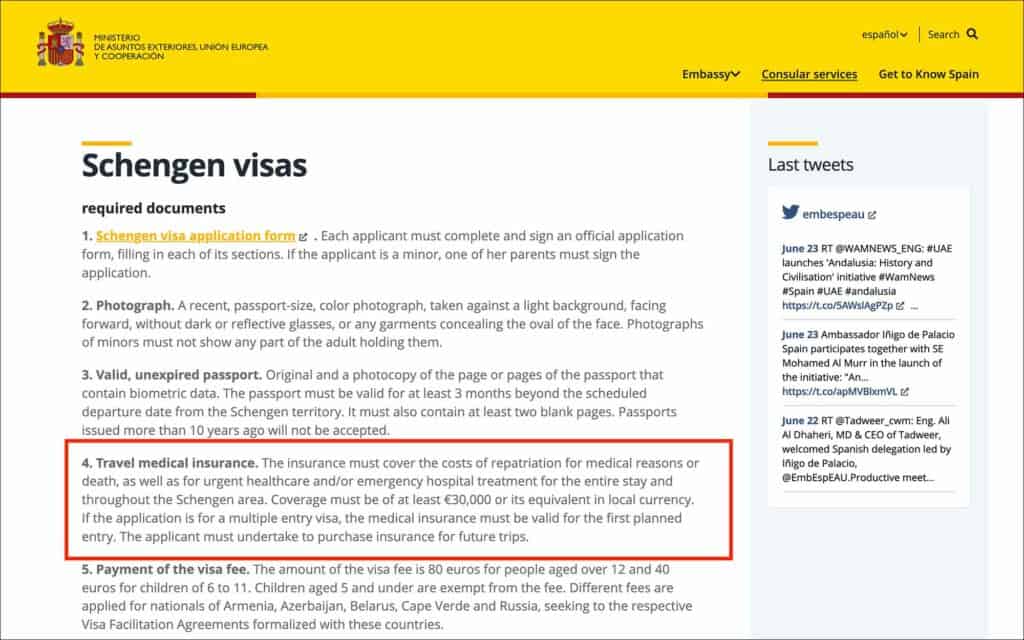

What are the Schengen Visa Insurance Requirements?

As per the Article 15 of REGULATION (EC) No 810/2009 , your Schengen visa travel insurance must meet the following three criteria:

- Must cover medical expenses up to a minimum of €30,000

- Must be valid for the entire duration of your stay

- Must be valid in all 27 Schengen countries

The policy must cover all medical expenses arising from emergency medical attention, treatment, hospitalization, emergency medical evacuation, repatriation due to medical reasons and death.

Let’s look at each of those requirements in detail.

1. Minimum Coverage

Your Schengen visa travel insurance must meet the minimum coverage requirement of €30,000. When purchasing Schengen visa travel insurance in USD, make sure the policy covers at least $50,000.

This minimum coverage is applicable for any medical expenses, emergency evacuation, and repatriation of remains.

This coverage is necessary to financially protect you in case of accidents, unforeseen illnesses, or other emergency situations that may arise during your travels in the Schengen area.

2. Validity Duration

Your travel insurance for the Schengen visa must remain valid for the entire duration of your stay in the Schengen area.

This travel insurance policy should cover you from the day you arrive in the Schengen area until the day you leave.

In terms of a multiple-entry visa, the Schengen visa insurance must be valid for the entire duration of your first entry only.

Here is an example:

You are applying for a multiple-entry visa and your trip is from Jan 01 to Jan 14. Your Schengen visa insurance must be valid from Jan 01 to Jan 14.

If you take another trip on the same visa, say from May 01 to May 14, then you must purchase another Schengen travel insurance at the time of your second trip.

For your visa application, you would only need to provide insurance for Jan 01 to Jan 14.

3. Validity in the Schengen Zone

Lastly, your Schengen visa travel insurance must be valid in all 27 Schengen countries. This is to make sure that you have coverage regardless of which Schengen country you visit during your trip.

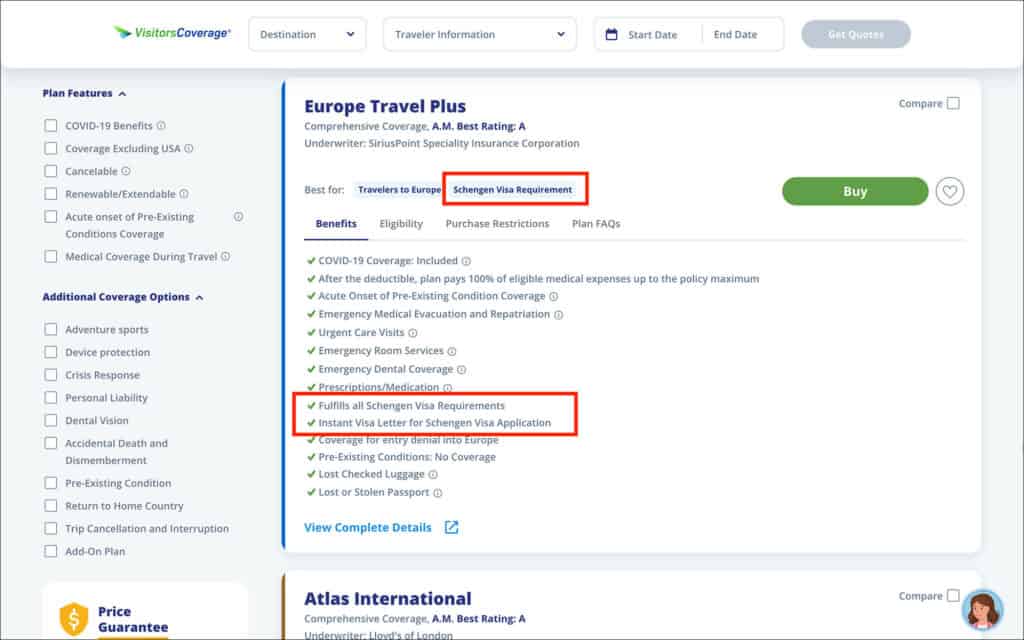

Most Schengen travel insurance aggregators such as VisitorsCoverage provide insurances that are valid in the entire Schengen zone.

In fact, any insurance valid globally is acceptable for the Schengen visa. Provided, the the insurance covers at least €30,000 in all medical costs and emergencies.

What Does Schengen Visa Insurance Plan Cover?

In general, any Schengen visa insurance plan covers medical expenses, COVID-19 protection, and trip coverage.

These coverage options are designed not only to provide comprehensive protection but also to meet the Schengen visa insurance requirements.

1. Medical Coverage

Medical coverage is the most important aspect of Schengen travel insurance. It provides coverage for emergency medical expenses, accidents, and unexpected illnesses.

The coverage also includes hospitalization, emergency hospital treatment, doctor visits, prescription drugs, and other necessary medical treatments that are considered emergency and necessary.

The policy must cover at least €30,000 for the visa. But depending on your needs and activities in the Schengen area, you can opt for policies with higher coverage.

2. COVID-19 Protection

COVID protection is not mandatory for Schengen visa. But most Schengen visa travel insurance policies offer coverage for medical treatment and quarantine expenses related to COVID. COVID tests and quarantine must be prescribed by a doctor to be eligible for the coverage.

That being said, you must review the policy details to make sure that COVID protection is included. Even though it’s not mandatory, it can provide peace of mind during your trip.

3. Trip Coverage

Trip coverage is also not mandatory for Schengen visa. But most travel insurance plans provide protection against flight cancellations, delays, and lost luggage during your travels. Trip coverage will help lessen any expenses arising from trip interruptions and baggage delays.

Review the policy details to make sure comprehensive trip coverage is included. This way, you can ensure that your trip goes smoothly, even when faced with unexpected setbacks.

What Does Schengen Visa Insurance Plan Not Cover?

Though Schengen travel insurance plans provide coverage for a wide range of scenarios, there will usually be some exclusions. One common exclusion is the coverage for pre-existing medical conditions.

It’s crucial to understand the limitations and exclusions of your Schengen visa insurance policy. Let’s look into the exclusion of pre-existing medical conditions in detail.

Pre-existing Medical Conditions

Pre-existing medical conditions are generally not covered by Schengen visa insurance plans. If you have a medical condition that was present prior to the purchase of your Schengen insurance policy, any medical expenses related to that condition during the trip will not be covered.

Review the terms and conditions of your travel insurance policy to determine if any exclusions apply to pre-existing medical conditions.

Is COVID-19 Coverage Mandatory for Schengen Visa Travel Insurance?

No, COVID-19 coverage is not mandatory for Schengen visa travel insurance. But most Schengen travel insurance companies include COVID coverage in their policy.

Even though it’s not required, having COVID protection in your travel insurance can provide financial security during your Schengen trip.

It is always better to be prepared and have coverage than face challenges during the trip.

How Much Does Schengen Visa Medical Insurance Cost?

The cost of Schengen visa medical insurance varies depending on several factors, such as age, duration of your trip, total coverage amount, and the insurance company.

Schengen travel insurance from IMG Global, through VisitorsCoverage for up to 39 years of age will cost about a dollar a day. For a one-week trip, it would be about $7 USD. The cost goes up with age.

IMG Global is a US-based insurance company offering Schengen visa insurance. If you opt for a Europe-based insurance company such as Europ Assistance, the prices are even higher. A one-week insurance policy can cost about €18.

To find the most affordable insurance policy for the Schengen visa, compare different insurance providers and policies using an insurance aggregator such as VisitorsCoverage .

How to Choose the Right Travel Insurance for Schengen Visa?

With a myriad of options available in the market, choosing travel insurance for your Schengen visa can be a daunting task. To make this process easier, consider factors such as the reputation of the insurance company, coverage limits, and customer reviews.

Let’s look at each of these factors in detail.

1. Reputation of the Company

When selecting a travel insurance provider, it’s important to evaluate their reputation in the market. A reputable insurance company will have a track record of providing reliable and quality coverage, as well as excellent customer service.

You can assess the reputation of an insurance company by looking at its reviews and ratings on sites such as Trustpilot. VisitorsCoverage , for example, has a 4.7 rating on Trustpilot.

If you choose an insurance company with a strong reputation, you will have confidence in the coverage and support they provide throughout your trip.

2. Coverage Limits and Exclusions

Another important aspect to consider is the coverage limit. The policy must be Schengen visa compliant, meaning the policy must meet the minimum coverage requirement of €30,000.

Additionally, it’s important to review if there are any exclusions such as pre-existing medical conditions or other limitations.

By reviewing the coverage limits and exclusions, you can pick out a policy that is Schengen visa compliant and provide enough protection during your trip.

3. Customer Reviews and Ratings

Reviews and ratings can be invaluable resources when evaluating any product or service in the market. Travel insurance is no different. The reviews and ratings provide insight into the insurance provider’s customer service, claims process, and embassy acceptability.

By considering the experiences of other travelers you can assess the quality and reliability of the travel insurance.

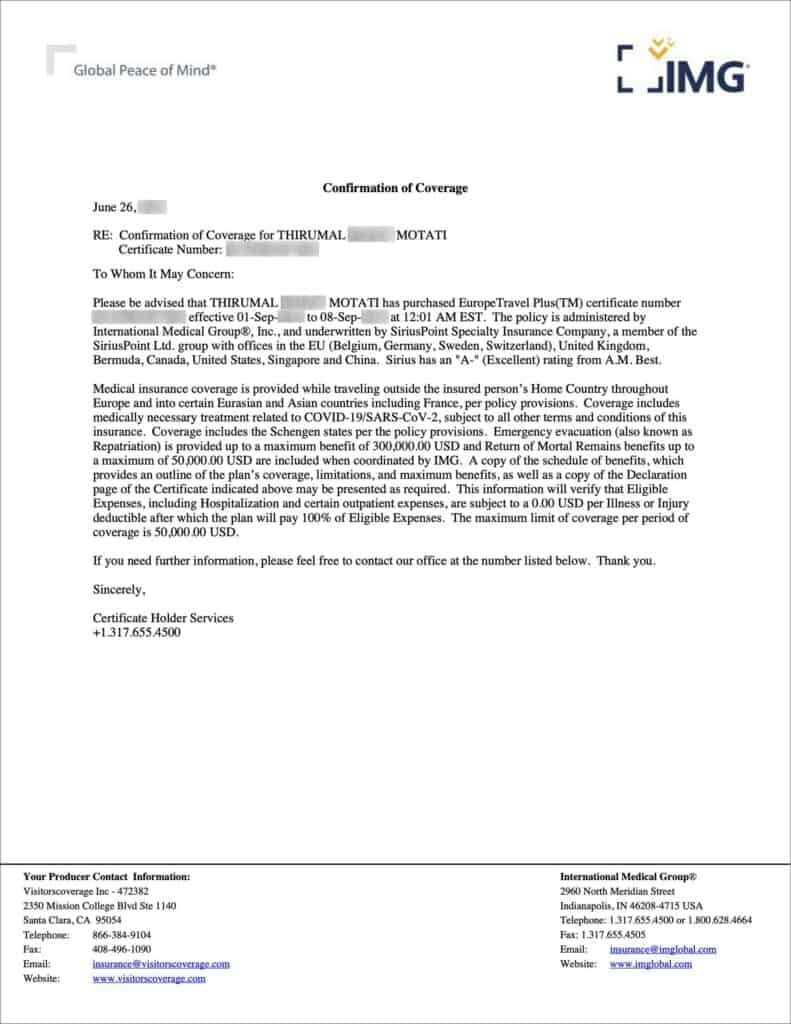

4. Schengen Insurance Certificate

Lastly, the insurance company must be able to issue a Schengen insurance certificate, also called a visa letter. Submitting a visa letter along with the policy is a mandatory requirement for the Schengen visa.

This certificate confirms that your insurance policy meets the Schengen visa criteria. The certificate should include:

- Your name (as the policyholder)

- Policy number

- Total coverage amount, which should be no less than €30,000 (or $50,000)

- Dates of validity (must cover the entire duration of your stay in the Schengen area)

- Contact details for the insurance company, in case of emergencies

Where to Purchase Travel Insurance for Schengen Visa?

Travel insurance for Schengen visas can be purchased from online insurance providers, local insurance companies and travel agencies.

Local insurance companies and travel agencies can offer personalized advice. With online platforms, you can compare prices and coverage options from multiple insurers.

Regardless of where you purchase your insurance, it’s important to make sure the insurance policy meets Schengen visa insurance requirements and provides the necessary coverage for your trip.

My recommendation is to buy Schengen visa insurance from VisitorsCoverage. Their Europe Travel Plus policy is specifically designed for the Schengen visa, meeting the minimum coverage requirements and downloadable visa letter. Here is a comparison for a 33-year-old, 7 days trip to the Schengen area.

How to Purchase Travel Insurance for Schengen Visa

To purchase your travel insurance for Schengen visa, go to the VisitorsCoverage’s Europe Travel Plus plan. Enter the following details.

- Destination Country

- Citizenship

- Residence/Home country

- Coverage Start Date

- Coverage End Date

- Arrival Date

- Date of Birth

- Email Address

Click on Continue. In the deductible and policy maximum, select $0 for the deductible and $50K for the policy maximum. Then click on Continue.

In the next steps, enter your details as per your passport. Complete the payment and purchase the policy. Once your purchase is complete, you can download your visa letter.

How To Find Cheap Schengen Travel Insurance?

Finding cheap Schengen travel insurance requires research and comparison of policies and companies. I have done this already for you. VisitorsCoverage was the cheapest in my research. If you are older than 50, then you might want to check other insurance companies to see if you can find a cheaper option.

Frequently Asked Questions (FAQS)

Do us citizens need schengen insurance.

No. US citizens do not require Schengen insurance when traveling to the Schengen area. This is because Schengen insurance is mandatory for those that require a visa for the Schengen area. And, US citizens do not require a visa for the Schengen area.

Is Schengen travel insurance refundable?

Yes. Most Schengen visa insurance companies offer reimbursement or free cancellation in the event of visa refusal. That being said, review the terms and conditions of the insurance policy before purchasing to make sure the policy is cancellable in case of visa refusal.

Can I purchase travel insurance after obtaining a Schengen visa?

No. You must purchase travel insurance before obtaining the visa. This is because travel insurance is one of the mandatory requirements for obtaining the Schengen visa. Without purchasing travel insurance, you won’t even be able to apply for the Schengen visa.

Are pre-existing medical conditions covered by travel insurance?

Pre-existing medical conditions are usually not covered by Schengen visa insurance plans. This means that any medical expenses arising due to pre-existing conditions will not be covered during your trip. Before purchasing, review the terms and conditions of the policy to determine the exclusions.

Can I extend my travel insurance coverage if my stay in the Schengen area is prolonged?

It may be possible to extend travel insurance coverage if your stay in the Schengen area is prolonged. But it depends on the insurance company and the policy type. Review the terms and conditions and also contact the insurance provider to inquire about extensions.

Obtaining the right travel insurance is a crucial step in your Schengen visa application process. The travel insurance for Schengen visa must provide at least €30,000 coverage and must be valid throughout the Schengen region for the entire duration of your trip.

While purchasing your Schengen visa insurance, consider factors such as the provider’s reputation, coverage limits and customer reviews. Compare different travel insurance providers and policies to pick out the right insurance for your Schengen visa.

WRITTEN BY THIRUMAL MOTATI

Thirumal Motati is an expert in tourist visa matters. He has been traveling the world on tourist visas for more than a decade. With his expertise, he has obtained several tourist visas, including the most strenuous ones such as the US, UK, Canada, and Schengen, some of which were granted multiple times. He has also set foot inside US consulates on numerous occasions. Mr. Motati has uncovered the secrets to successful visa applications. His guidance has enabled countless individuals to obtain their visas and fulfill their travel dreams. His statements have been mentioned in publications like Yahoo, BBC, The Hindu, and Travel Zoo.

PLAN YOUR TRAVEL WITH VISA TRAVELER

I highly recommend using these websites to plan your trip. I use these websites myself to apply for my visas, book my flights and hotels and purchase my travel insurance.

01. Apply for your visa

Get a verifiable flight itinerary for your visa application from DummyTicket247 . DummyTicket247 is a flight search engine to search and book flight itineraries for visas instantly. These flight itineraries are guaranteed to be valid for 2 weeks and work for all visa applications.

02. Book your fight

Find the cheapest flight tickets using Skyscanner . Skyscanner includes all budget airlines and you are guaranteed to find the cheapest flight to your destination.

03. Book your hotel

Book your hotel from Booking.com . Booking.com has pretty much every hotel, hostel and guesthouse from every destination.

04. Get your onward ticket

If traveling on a one-way ticket, use BestOnwardTicket to get proof of onward ticket for just $12, valid for 48 hours.

05. Purchase your insurance

Purchase travel medical insurance for your trip from SafetyWing . Insurance from SafetyWing covers COVID-19 and also comes with a visa letter which you can use for your visas.

Need more? Check out my travel resources page for the best websites to plan your trip.

LEGAL DISCLAIMER We are not affiliated with immigration, embassies or governments of any country. The content in this article is for educational and general informational purposes only, and shall not be understood or construed as, visa, immigration or legal advice. Your use of information provided in this article is solely at your own risk and you expressly agree not to rely upon any information contained in this article as a substitute for professional visa or immigration advice. Under no circumstance shall be held liable or responsible for any errors or omissions in this article or for any damage you may suffer in respect to any actions taken or not taken based on any or all of the information in this article. Please refer to our full disclaimer for further information.

AFFILIATE DISCLOSURE This post may contain affiliate links, which means we may receive a commission, at no extra cost to you, if you make a purchase through a link. Please refer to our full disclosure for further information.

RELATED POSTS

- Cookie Policy

- Copyright Notice

- Privacy Policy

- Terms of Use

- Flight Itinerary

- Hotel Reservation

- Travel Insurance

- Onward Ticket

- Testimonials

Search this site

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Sites To Sell a Car

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best Accounting Software

- Best Receipt Scanner Apps

- Best Free Accounting Software

- Best Online Bookkeeping Services

- Best Mileage Tracker Apps

- Best Business Expense Tracker Apps

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best SEO Services

- Best Mass Texting Services

- Best Email Marketing Software

- Best SEO Software

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- Best Home Appliance Insurance

- American Home Shield Review

- Liberty Home Guard Review

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Brands

- Best Window Replacement Companies

- Cheap Window Replacement

- Best Gutter Guards

- Gutter Installation Costs

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Cheap Same Day Car Insurance

- Best Pet Insurance

- Cheapest Pet Insurance

- Pet Insurance Cost

- Pet Insurance in Texas

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

- Cheapest Homeowners Insurance

- Cheapest Renters Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Schengen Visa Travel Insurance (2024 Guide)

Alex Carver is a writer and researcher based in Charlotte, N.C. A contributor to major news websites such as Automoblog and USA Today, she’s written content in sectors such as insurance, warranties, shipping, real estate and more.

Sabrina Lopez is a senior editor with over seven years of experience writing and editing digital content with a particular focus on home services, home products and personal finance. When she’s not working, Sabrina enjoys creative writing and spending time with her family and their two parrots.

The Schengen area is an alliance of 27 European countries that allows border-free travel. It covers most of mainland Europe, including 23 European Union countries and four members of the European Free Trade Alliance.

Travel insurance is a requirement for the Schengen visa application process. You need at least €30,000 (US$32,800) in coverage in case you need medical attention during your stay in Europe, and you have to purchase coverage and obtain a certificate showing insurance to include with your visa application. Read on to learn more about the unique requirements of a Schengen visa and the role travel insurance plays in the application process.

Which Insurance Provider is Best for Schengen Visa?

Use the table below to compare the top recommended choice for travel insurance for a Schengen visa.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

Is Insurance Required for a Schengen Visa?

With a few exceptions, travelers from the U.S. do not need a visa for the Schengen area if staying for 90 days or less. Americans visiting for over three months, permanent residents without citizenship and foreign nationals traveling from the U.S. will need a Schengen visa if they are citizens of a country without a visa-free arrangement with Schengen countries.

The countries in the Schengen area are: Austria , Belgium, Croatia, Czech Republic, Denmark , Estonia, Finland, France , Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovenia, Slovakia, Spain, Sweden and Switzerland. Bulgaria, Cyprus, Ireland and Romania are currently not Schengen countries.

Travelers from the U.S., Canada , and other visa-exempt countries only have to go through immigration and customs in the first country they visit in the Schengen zone. After that, they can travel to any other nation in the alliance without taking out their passport. For instance, you can fly, drive or take a train from Sweden all the way to Spain on the same visa.

Citizens from visa-exempt countries like the U.S. don’t need a visa or travel insurance to visit Europe. However, because of the high price of healthcare in Europe, travel insurance is still a good idea for visa-free travelers. But note that if you have to visit with a Schengen visa, you need to meet specific health insurance mandates.

Schengen visa holders must have comprehensive health insurance coverage. It should last for the length of their stay in the area (but does not need to cover the duration of the visa).

When you apply for a Schengen visa at the consulate or embassy of the country you plan to visit first or spend most of your time in, they will explain the specifics of the travel insurance requirements. You will need proof of a travel insurance plan for visa approval.

Schengen Visa Insurance Requirements

Schengen visa applicants need travel medical insurance . However, the policy must have specific features and minimum limits for medical coverage and medical evacuation.

Here is a closer look at the requirements for Schengen visa eligibility.

- Medical emergency insurance

- Repatriation coverage for death

- Medical evacuation insurance if you need long-term care in your home country

- Coverage limits of at least €30,000 (US$32,000)

- Coverage lasting for the entire length of your stay in the Schengen area

The purpose of these requirements is to ensure you can pay for medical treatment without requiring assistance from your host country’s healthcare system.

You need a document from your travel insurance company as proof that you have a visa-compliant policy. This insurance certificate shows that you have met the minimum requirements. It is a vital part of your visa application, and you won’t gain approval without it.

Types of Travel Insurance Policies

Schengen visa insurance plans focus on medical expenses, but travel policies can also offer other protections. Comprehensive travel insurance covers additional risks, including those related to cancellations and delays.

Here is a look at the different travel insurance coverages.

- Medical, evacuation and repatriation coverage is required for visa approval.

- Trip cancellation insurance provides reimbursement if your trip gets canceled due to covered reasons, such as an unexpected illness or injury or a crisis or disaster in your European destination.

- Trip delay and interruption coverages pay for expenses related to delays or incidents that cancel your journey earlier than planned.

- Baggage delay or loss reimburses you for missing items so that you can replace necessities and continue your travels.

- Add-ons to standard policies may include rental car insurance, pre-existing condition coverage and insurance for exclusions from standard insurance like scuba diving or climbing.

Schengen visa applicants can purchase travel insurance with comprehensive coverage to protect the non-medical aspects of their trip. International travel can be expensive, so cancellation insurance and other protections available through a complete travel policy can save you from frustration and financial loss.

Choosing the Right Schengen Visa Insurance

There are several factors to consider when selecting travel insurance.

- Coverage limits are the maximums that the insurer will pay for each claim type. Schengen visas require €30,000 (about $32,800) in medical emergency, evacuation, and repatriation insurance, but you can get a policy with higher limits if you wish.

- Pre-existing conditions are another important factor. Insurers may or may not cover them on a standard policy, but those that do not provide coverage directly may sell waivers that add coverage for your conditions.

- Deductibles are another factor to consider. This amount is an out-of-pocket payment you have to make before the insurer takes over payment. Some low-cost policies have high deductibles.

Finally, you should always get insurance with a reputable company that can provide the necessary documentation for your visa application.

Here are six reputable insurers to consider.

- Travelex offers budget and mid-range plans for international travelers. You can opt for both medical and trip cancellation coverage.

- Trawick International travel insurance offers stand-alone medical and cancellation policies, so you can opt for minimum requirements for your Schengen visa if you wish.

- AIG Travel Guard offers several tiers of travel insurance, all of which offer comprehensive coverage and provide optional add-ons.

- Seven Corners has customizable travel plans that include medical emergency, evacuation, and repatriation coverage necessary for a Schengen visa

- IMG offers stand-alone medical insurance policies and separate plans providing cancellation, lost baggage and delay benefits.

Use our insurance comparison tool to find the prices and coverage details for each of these insurance providers.

Applying for Schengen Visa with Travel Insurance

You apply for a Schengen visa at the consulate or embassy of the country you intend to travel to first or spend most of your time during your stay.

You must purchase a policy that covers the entire duration of your stay and is valid throughout the Schengen area, not just in the countries you plan to visit.

You need proof of insurance to include with the rest of application documents when applying for the visa. This means you need to purchase the insurance before submitting your application. You should only choose insurance companies able to provide the necessary documentation to include with your application.

Additional Expert Tips

There are some other considerations for Schengen visa insurance.

First, you should make copies of your insurance card, policy documents and other information and bring them with you on your trip.

Second, regulations require that you have coverage for the entire duration of your stay. If you have a multi-trip visa, you will need insurance that provides benefits for the entire stay. The best option in these cases is to get an annual or multi-trip policy that meets visa requirements for coverage types and limits.

Before leaving, you should perform a thorough policy review to ensure you have the appropriate coverage. You can consider the potential costs of medical care in your host countries and decide if the coverage you have is sufficient.

Frequently Asked Questions About Schengen Visa Insurance

Do you need travel insurance to visit schengen countries.

Travelers from visa-exempt countries can visit Europe without insurance, though they would not be protected from medical expenses or cancellations. However, those requiring a Schengen visa need €30,000 worth of medical coverage for approval.

Is Schengen travel insurance refundable?

You would be able to cancel your insurance if your visa application is not approved. Most companies will allow you to cancel the policy and get a full refund if you show evidence that your visa application was not approved.

Does travel insurance cover all of Europe?

Travel insurance for a Schengen visa must cover all 27 countries. However, some travel insurers may require that you specify all the countries you plan to visit to get comprehensive coverage.

What are the benefits of Schengen visa insurance?

In addition to being a requirement for the visa application process, Schengen insurance will cover medical costs if you get sick or suffer an injury during your Europe travel experiences. While travel health insurance is the only necessary policy component for the visa application, you can get additional benefits by purchasing a comprehensive policy.

If you have feedback or questions about this article, please email the MarketWatch Guides team at editors@marketwatchguides. com .

- Application Requirements

What expenses do Schengen visa insurance policies cover, and how much to pay for one

The cost of an EU or Schengen visa insurance policy depends on four factors:

- traveller’s age;

- the validity period of the insurance;

- list of risks.

For example, an insurance policy for a week-long relaxing holiday in the Schengen Area can be purchased for €20-40 if the insured person is between 20 and 45 years old. When calculating the cost of a policy for children and the elderly, an increased coefficient is applied.

Maximum validity period for a Schengen Visa insurance policy You can purchase a policy with a longer validity period, for example, a one-year policy. This is useful for those who make at least 10 trips to the Schengen states per year. Annual insurance costs start at €100.

The cost of insurance will increase if you add extra options. For instance, engaging in active recreation, such as skiing, increases the cost of insurance by 2 times. Engaging in freeride, which is an extreme sport, increases the cost of insurance by 4 times.

In addition to insuring life and health, a policy can also cover other situations:

- cancellation of the trip;

- flight delay;

- lost or delayed baggage by the airline;

- lost or stolen documents;

- forced quarantine;

- legal assistance;

- damage to the vehicle;

- civil liability — unintentional injury to another person or damage to someone else’s property.

Coverage for coronavirus treatment is included in most insurance plans by default. Travellers are compensated for emergency medical care, transportation to the clinic, and COVID-19 treatment in the hospital or at home.

Suppose there is no such clause in the contract. In that case, the insurance will only cover the cost of emergency medical care, and the traveller will have to pay for coronavirus treatment separately.

Additionally, a traveller can add PCR test coverage and coverage of transportation costs associated with a trip delay in cases of mandatory quarantining due to coronavirus contracting.

European travel insurance for Europe or the Schengen Area can be obtained either in person or remotely. Of all documents, you will only need a passport. To get an insurance policy for a child or a disabled person, you will need a passport of a parent, guardian, or legal representative.

Some visa application centres partner with insurance companies and offer to get insurance through them right before applying for a visa. In that case, the policy cost will increase at the expense of the centre’s visa application commission.

Applying for an insurance policy yourself is more cost-effective, but you need to do this before visiting the visa application centre.

To get insurance for a Schengen visa or EU online , you need to fill out a form on the insurance company’s website: enter your personal data, email address and trip information. After the payment, the policy will be sent to the provided email address.

To get a Schengen visa, the insurance policy must be printed out and included in the application documents. If the policyholder already has a valid visa to the Schengen states, printing is not needed — saving it on a smartphone is enough. Still, we recommend taking a printed copy with you on the trip in case your phone runs out of battery or gets stolen.

To get full-time insurance for a Schengen visa or Europe , you need to come to the office of the selected insurance company with your passport. The staff will clarify the trip details and recommend additional options based on them.

Getting insurance doesn’t take much time: you can get it on the day of applying for a visa or on the day of departure if the previous insurance has ended and the visa is still valid.

The policyholder and the insured can be different people. For example, if the whole family goes on a trip, one of the members can hold insurance for all of them. Also, the policyholder may be a legal entity.

If the insured person is a child or a disabled person, their legal representative should apply for assistance in an insured event. In all other cases, the insured can apply in person, even if they are not the policyholder.

A scenario: Michael acted as a policyholder and purchased a Schengen visa insurance policy for himself, his wife and his child. Michael contacted the insurance company when his son had a fever and required a doctor’s consultation. When Michael’s wife needed emergency dental care, she contacted the insurance company herself.

If an emergency occurs during your trip, you must:

- Call the 24-hour service centre of the insurance company; the phone number is always provided in the insurance policy.

- Describe the incident details to the operator.

- Follow the operator’s instructions.

- Save all receipts related to an insurance event, even if it’s a taxi ride bill.

If you need medical assistance, the operator will find a doctor and send a guarantee letter to the clinic so that the insured traveller will be accepted free of charge.

If you don’t require medical assistance, the operator will tell you what to do to cover your expenses.

Yes, all travellers who enter the Schengen Area with a visa must have an insurance policy . This rule is enshrined in the EU Visa Code .

Border control officers do not always ask for an insurance policy, so this is possible. However, this is also illegal: everyone travelling with a Schengen visa is required to have insurance .

To get an insurance policy , you only need a passport.

Yes, large insurance companies provide an opportunity to buy Schengen visa insurance online .

To do this, fill out a form on their website: enter your personal information, email address, and trip details. After payment, the policy will be sent to the specified email address: you will need to print out the insurance or save it to your phone.

The cost of a Schengen visa insurance policy depends on its validity period, the amount of coverage, the risk list, and the insured traveller’s age.

For example, an insurance policy for a one-week trip to the Schengen Area can cost from €20 to €40. Such insurance will not cover expenses related to active and extreme sports.

Schengen Area travel insurance must cover all expenses related to:

For an additional fee, you can include extra options in your insurance: active, beach and extreme vacations, chronic diseases, pregnancy, alcohol intoxication, natural disasters and terrorist attacks.

Yes, most insurance plans already have a default coronavirus treatment . However, this must be clearly stated in the contract.

Suppose there is no such clause in the contract. In that case, the insurance will only cover the cost of emergency medical care, and the rest of the coronavirus treatment will have to be paid separately.

The insured traveller calls the phone number listed on the insurance policy, tells the operator what happened, and follows the operator’s instructions.

If the traveller needs help or medical advice, the operator will find a suitable clinic. They will send a guarantee letter there so the insured patient can be accepted free of charge.

GET A QUOTE

What are the different warranties of Schengen insurance?

What do i need to check when booking my insurance.

When taking out a travel insurance policy, it is always important to check its warranties and limits - both so you know that you are choosing the right travel and medical insurance for you, and so there are not any nasty surprises after you try and make a claim. The most basic check to make, should you need a Schengen Visa, is that it meets the minimum requirements needed to obtain your visa - that it is valid for all 27 Schengen states and covers you for expenses up to €30,000.

AXA has a variety of different Schengen travel insurance policies, tailored for different budgets, trips, and depending on what coverage you would like - all with different levels of warranty and limits on claims.

Our cheapest option is the Low Cost Schengen Area travel insurance that meets your visa requirements from as little as €22 per week - a fee that will cover you for medical expenses up to €30,000 in all Schengen countries. A certificate proving you are insured will be available immediately, meaning you can get on with your application.

Other coverage available includes our Europe Travel insurance, costing €33 per week, or Schengen Multi Trip insurance, which is perfect for regular travelers and available for €328 for a year’s coverage. These offer greater warranties and fewer limits on claims, and for lost documents, important items or other problems you may encounter on your trips.

For Terms & Conditions, please click on the "General conditions" link below

Do you cover emergency medical costs related to Coronavirus?

We will cover your medical costs related to Coronavirus provided you haven't travelled against World Health Organisation or any other government body’s advice in your home country or the country you are travelling to) or medical advice.

The embassy states that I must get an insurance certificate with Covid protection. Is this possible?

All issued electronic certificates purchased on the axa-schengen site include this disclaimer: “Medical fees related to COVID-19 are covered in the terms, conditions & exclusions established in the insurance policy”.

All our policies cover repatriation and medical expenses, however, as AXA Assistance has developed a policy for these, which meets all the requirements of the European Union for obtaining a Schengen visa - the details are below:

Related topics on Schengen insurance

- What is the health insurance for Schengen visa?

- What is the minimum coverage required for a Schengen Visa?

- Is Schengen travel insurance mandatory?

- How much does Schengen travel insurance cost?

- How to book Schengen insurance online ?

- How to choose the best Schengen travel insurance online?

- Where can I get my Schengen travel insurance certificate?

- What are the requirements for Schengen travel insurance?

Frequently asked questions about Schengen insurance warranties

Will my travel insurance cover repatriation if i get injured.

Yes. AXA’s insurance will cover your repatriation in case of injury or illness- if necessary and if within the limits of expenses.

Will my travel insurance warranties be invalidated if information is incorrectly given when purchasing?

Yes. All the information you give us must be accurate to the best of your knowledge and belief and it’s your responsibility to make sure that it’s updated if it changes. If it is not your policy may be canceled or - in extreme deliberate cases - investigated for fraud.

Will my warranties still be valid if I need to claim while outside of the Schengen Area?

No. Unless you are in a European Union state covered by AXA’s Europe Travel or Multi Trip policies. Being outside the countries stated as being covered by your policy will invalidate your claim.

Get Schengen insurance

Copyright AXA Assistance 2023 © AXA Assistance is represented by INTER PARTNER ASSISTANCE SA/NV, a public limited liability company governed by Belgian law with registered office at Regentlaan 7, 1000 Brussel, Belgium – Insurance company authorized by the National Bank of Belgium under number 0487 and registered with the Crossroads Bank for Enterprises under number 0415 591 055 – RPR Brussels- VAT BE0415 591 055

AXA Travel Insurance Global | AXA Assicurazione Viaggio | AXA Assurance Voyage | AXA Seguros y asistencia en viajes | AXA Seguro de viagem

- 30000 Europe Travel Insurance

30,000 Euro Schengen Visa travel insurance, Best travel insurance for Schengen Visa

Free quotes for 30000 euro travel insurance, plans satisfy schengen visa requirements.

- Minimum medical insurance coverage of at least €30,000

- Travel medical insurance coverage for repatriation and emergency medical evacuation.

- The insurance company must have an representative office in Europe.

- Click here for Know more

Find the best 30,000 euro travel insurance cost from top Indian insurance providers. These plans Schengen visa travel insurance requirements and offer good medical insurance coverage for Indians in Europe.

How much travel insurance for Schengen visa?

Traveling across Europe is by and large covered by the introduction of the Schengen visa. If you are a traveler transiting through or visiting the Schengen countries, you have to obtain your Schengen visa from the Consulate of the country of your main destination. However, the proof of health insurance cover for your stay in the Schengen country has to be presented to the consulate prior to issuance of visa. The Schengen Visa requires that the insured traveler have an Accident & Sickness coverage of a minimum of Euros €30,000 covering the duration of the trip. The Schengen visa requirements also state that the insurance plan opted for by the insured needs to cover Emergency Medical Evacuation and Repatriation of Remains.

Hence some insurance companies offer a Schengen specific plan ensuring this minimum coverage is offered in their plans. The Schengen countries are Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden and Switzerland. Hence if you are travelling to any of these countries, one must have a Schengen visa in place.

List of European countries

Get quotes for india travel insurance, compare other travel insurance, india travel insurance blogs and articles.

Tips to find best travel insurance

Tips to find good and adequate international travel health insurance... Click here to read more

Health care cost comparison

Comparison of overseas Healthcare cost and popular tourist destinations... Click here to read more

How does travel insurance work

How to use Indian visitor insurance in case of sudden sickness and accidents... Click here to read more

Popular Travel Destinations

Indian travel insurance for popular overseas tourist destinations... Click here to read more

India travel insurance useful links

How to buy online.

You can buy insurance online by using a credit/debit card, direct funds transfer using NEFT or RTGS or by using a cheque.

Already outside India

Travelers who have already traveled from India and do not have insurance can buy travel medical insurance after approval.

Travel Insurance Online Renewal

Insurance customers can renew their existing policy online before the exipry date at any time.

Insurance Claims

In case of a claim or reimbursement of treatment expenses, notify by contacting them.

Tips on air travel

Travel tips for Indian parents

How are Claims settled?

Are travel insurance directly billed or is it reimbursement basis, is there a hospital network.

How to use Indian visitor insurance in case of sudden sickness and accidents

Healthcare cost overseas

Comparison of overseas Healthcare cost and popular tourist destinations

Tips to find good and adequate international travel health insurance

EIndia General Insurance Partners

Indian travel insurance resources

Insurance benefits

Compare plans

Travel destinations

Customer Care

Chat with Us

Insurance Guide

Useful links

- Insurance Categories

- Compare Insurance

- Insurance Claims

- Disclaimer

- Privacy Policy

- Terms & Conditions

- Blog

- Resource Centre

- Insurance FAQs

- About Us

- Contact Us

- SiteMap

Product links

- Health Insurance

- Life Insurance

- Travel Insurance

- Motor Insurance

- Home Insurance

- Personal Accident

Keep in touch

InstantCover Insurance Web Aggregator Private limited 710, 6th B Cross, 16th Main Road, Koramangala 3rd Block, Bangalore - 560 034.

- 080-41101026

- Send an email

- Call : 080-41101026

- Contact

- Chat with us

ONLINE CHAT

What are you looking for?

Provide your contact information

- Best overall

- Best for trip cancellation

- Best for medical-only coverage

- Best for families

- Best for value

- Best for reputation

- Why you should trust us

Best Cheap Travel Insurance of July 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

In an ever-evolving world, emergency medical and evacuation travel insurance coverage is essential, especially if you're traveling internationally. However, sports equipment coverage, pet protection, and cancel for any reason coverage are among the increasingly popular coverage options that are changing the way we travel. We've gathered the best cheap travel insurance plans to help you protect your trip while on a budget.

Best Cheap Travel Insurance Plans of 2024 Summary

- Best overall: HTH Worldwide Travel Insurance

- Best for trip cancellation: Aegis General Travel Insurance

- Best for medical-only coverage: GeoBlue Travel Insurance

- Best for families: C&F Travel Insured

- Best value: Nationwide Travel Insurance

- Best for reputation: Trawick International Travel Insurance

Top Cheap Travel Insurance Company Comparison

The best travel insurance meets your needs at a price you're willing to pay. Sometimes, you're just not willing to pay that much. The following companies offer decent coverage for low prices. To determine which companies made this list, we compared quotes across the travel insurance industry for the same trip, making a note of which companies offered particularly good coverage in certain areas and which companies were well reviewed.

Here are the best affordable travel insurance companies picked by Business Insider editors in 2024.

Best Affordable Travel Insurance Overall

Hth worldwide travel insurance.

The HTH Worldwide Travel Insurance Economy plan offers the most comprehensive coverage across major categories of all the providers in this guide.

You'll have some peace of mind with up to $75,000 of financial protection for eligible medical emergencies, and up to $500,000 per person for medical evacuation costs. For more everyday expenses, you can also relax with baggage loss and delay, trip interruption, cancellation and delay coverage that will help you recoup many, if not all, of your costs.

However, this plan falls short on missed connection benefits and accidental death coverage, both of which are not available under most circumstances (missed connection coverage only applies to cruises, and will only cover up to $500 per person after a three-hour delay).

Read our HTH Worldwide Travel Insurance review .

Best Affordable Travel Insurance for Trip Cancellation

Aegis general travel insurance.

The Aegis Trip Cancellation Plan is exactly that: a cost-effective plan that offers protection in the event that your trip is canceled for a covered reason. The plan we priced out for our hypothetical trip cost just 1.16% of our total travel expenses — a very small amount of money to pay for the guarantee of our money back in the right circumstances.

The benefit is that this plan can supplement other coverage you already have, or give you a little bit of protection for a trip where you might not otherwise have opted for insurance altogether. On the downside, you won't get any protection for medical emergencies, trip interruption or delays or lost bags from this plan.

Read our Aegis Travel Insurance review .

Best Affordable Travel Insurance for Medical Coverage

Geoblue travel insurance.

GeoBlue is a travel insurance provider that specializes in travel medical insurance. Because it doesn't offer much trip protection or travel inconvenience coverage, it can charge cheaper premiums. A 30-year-old from California would pay as low as $20.55 for a policy that covers a two-week trip. GeoBlue plans can cover medical expenses up to $1 million with several multi-trip annual plans available. It offers coinsurance plans for trips within the U.S. and 100% coverage for international trips. It also has a network of clinics in 180 countries, streamlining the claims process. It's worth noting that coverage for pre-existing conditions comes with additional costs. Read our GeoBlue travel insurance review .

Best Affordable Travel Insurance for Families

C&f travel insured.

There's a lot to like about C&F Travel Insured. For one, it is one of the only travel insurance companies that offers CFAR coverage for annual travel insurance plans . Additionally, C&F is widely praised for its customer service, offering quick reimbursements for claims. Claims that don't reimburse within 30 days begin to accrue interest at 9% APY.

When it comes to affordability, C&F remains on the lower end of travel insurance costs. Policies for younger solo travelers are generally around 4% of total trip costs, which isn't bad considering average costs for travel insurance is around 4-8% of total trip costs. However, C&F excels at insuring families as children are heavily discounted with the Edge plan and completely free with the Protector plan.

Read our C&F Travel Insured review .

Best Affordable Travel Insurance for Value

Nationwide travel insurance.