U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The Best Travel Medical Insurance of 2024

Allianz Travel Insurance »

Seven Corners »

GeoBlue »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Medical Insurance Plans.

Table of Contents

- Allianz Travel Insurance

- Seven Corners

Buying travel insurance is a smart move for any type of trip, but you may not need a policy that covers everything under the sun. If you don't need coverage for trip cancellations or delays because you're relying on your travel credit card to offer these protections, for example, you may find you only need emergency medical coverage that works away from home.

Still, travel medical coverage varies widely based on included benefits, policy limits and more. If you're comparing travel insurance plans and hoping to find the best option for unexpected medical expenses, read on to learn which policies we recommend.

Frequently Asked Questions

The term travel insurance usually describes a comprehensive travel insurance policy that includes coverage for medical expenses as well as trip cancellations and interruptions, trip delays, lost baggage, and more. Meanwhile, travel medical insurance is coverage that focuses on paying for emergency medical expenses and other related care.

Travelers need international health insurance if they're visiting a place where their own health coverage will not apply. This typically includes all international trips away from home since U.S. health plans limit coverage to care required in the United States.

Note that if you don't have travel health insurance and you become sick or injured abroad, you'll be responsible for paying back any health care costs you incur.

Many travel insurance policies cover emergency medical expenses you incur during a covered trip. However, the included benefits of each policy can vary widely, and so can the policy limits that apply.

If you're looking for a travel insurance policy that offers sufficient protection for unexpected medical expenses, you'll typically want to choose a plan with at least $100,000 in coverage for emergency medical care and at least that much in protection for emergency medical evacuation and transportation.

However, higher limits can provide even more protection from overseas medical bills, which can become pricey depending on the type of care you need. As just one example, Allianz says the average cost of emergency medical evacuation can easily reach up to $200,000 or more depending on where you’re traveling.

Your U.S. health insurance policy almost never covers medical expenses incurred abroad. The same is true for most people on Medicare and especially Medicaid. If you want to ensure you have travel medical coverage that applies overseas, you should purchase a travel insurance plan with adequate limits for every trip. Read the U.S. News article on this topic for more information.

The cost of travel medical insurance can vary depending on the age of the travelers, the type of coverage purchased, the length of the trip and other factors. You can use a comparison site like TravelInsurance.com to explore different travel medical insurance plans and their cost.

- Allianz Travel Insurance: Best Overall

- Seven Corners: Best for Families

- GeoBlue: Best for Expats

- WorldTrips: Best Cost

Coverage for preexisting conditions is available as an add-on

Easy to purchase as needed for individual trips

Relatively low limits for medical expenses

No coverage for trip cancellations or trip interruption

- Up to $50,000 in emergency medical coverage

- Up to $250,000 in emergency medical evacuation coverage

- Up to $2,000 in coverage for baggage loss and damage

- Up to $600 in baggage delay insurance

- Up to $1,000 for travel delays

- Up to $10,000 in travel accident insurance

- 24-hour hotline assistance

- Concierge services

SEE FULL REVIEW »

Purchase comprehensive medical coverage worth up to $5 million

Coverage for families with up to 10 people

Low coverage amounts for trip interruption

Medical coverage options vary by age

- Up to $5 million in comprehensive medical coverage

- Up to $500,000 in emergency evacuation coverage

- Up to $10,000 in coverage for incidental trips to home country

- Up to $25,000 in coverage for terrorist activity

- Up to $500 in accidental dental emergency coverage

- Up to $100 per occurrence in coverage for emergency eye exams

- $50,000 in coverage for local burial or cremation

- 24/7 travel assistance

- Up to $25,000 in coverage for accidental death and dismemberment per traveler

- Up to $500 for loss of checked baggage

- Up to $5,000 for trip interruptions

- Up to $100 per day for trip delays

- Up to $50,000 for personal liability

Qualify for international health insurance with no annual or lifetime caps

Use coverage within the U.S. with select providers

Deductible from $500 to $10,000 can apply

Doesn't come with any nonmedical travel insurance benefits

- Up to $250,000 in coverage for emergency medical evacuation

- Up to $25,000 for repatriation of mortal remains

- $50,000 in coverage for accidental death and dismemberment

High limits for medical insurance and emergency medical evacuation

Covers multiple trips over a period of up to 364 days

Deductible of $250 required for each covered trip

Copays required for medical care received in the U.S.

- Up to $1,000,000 of maximum coverage

- Up to $1,000,000 for emergency medical evacuation

- Up to $10,000 for trip interruptions

- Up to $1,000 for lost checked luggage

- Up to $100 per day for travel delays

- Up to $25,000 in personal liability coverage

- Medical coverage for eligible expenses related to COVID-19

- Ability to add coverage for your spouse and/or child(ren)

- Repatriation of remains coverage up to overall limit

- Up to $5,000 for local burial or cremation

- $10,000 to $50,000 for common carrier accidental death

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family media business.

You might also be interested in:

9 Best Travel Insurance Companies of 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

How to Get Airport Wheelchair Assistance (+ What to Tip)

Suzanne Mason and Rachael Hood

From planning to arrival, get helpful tips to make the journey easier.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Review

- Best Car Buying Apps

- Best Sites To Sell a Car

- CarMax Review

- Carvana Review (July 2024)

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best Accounting Software

- Best Receipt Scanner Apps

- Best Free Accounting Software

- Best Online Bookkeeping Services

- Best Mileage Tracker Apps

- Best Business Expense Tracker Apps

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best SEO Services

- Best Mass Texting Services

- Best Email Marketing Software

- Best SEO Software

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- Best Home Appliance Insurance

- American Home Shield Review

- Liberty Home Guard Review

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Brands

- Best Window Replacement Companies

- Cheap Window Replacement

- Best Gutter Guards

- Gutter Installation Costs

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Cheap Same Day Car Insurance

- Best Pet Insurance

- Cheapest Pet Insurance

- Pet Insurance Cost

- Pet Insurance in Texas

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

- Cheapest Homeowners Insurance

- Cheapest Renters Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

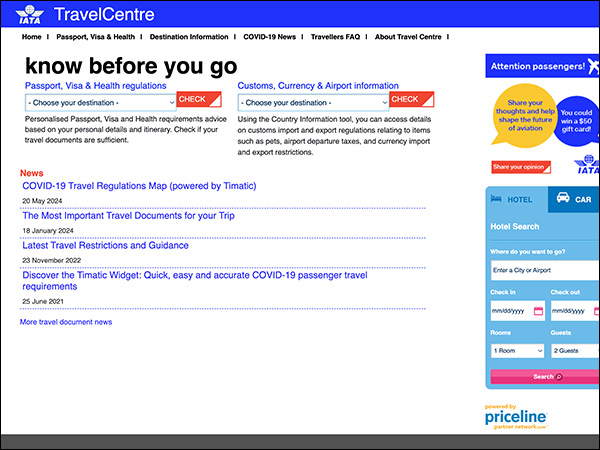

Best Medical Insurance for Visitors to the U.S. (2024)

U.S. visitors can get travel medical insurance for as low as $89 per trip.

with our comparison partner, Squaremouth

Alex Carver is a writer and researcher based in Charlotte, N.C. A contributor to major news websites such as Automoblog and USA Today, she’s written content in sectors such as insurance, warranties, shipping, real estate and more.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

Seven Corners, WorldTrips, IMG and Trawick offer the best health insurance plans for visitors to the U.S.

In this guide, we’ll provide you with details on travel health insurance plans from these providers, including example quotes, information on how to use your visitor health insurance and more.

Do Visitors Need U.S. Health Insurance?

While health insurance is not always mandatory when traveling to the U.S., regulations may vary depending on the circumstances around your visit and your visa needs. In addition, health plans from different countries are generally not accepted in the U.S., which means you could pay thousands of dollars out-of-pocket for treatment in an emergency without a valid plan.

Note that many foreign visitors traveling to the U.S. do not need a visa to enter the country for less than 90 days. However, some visa requirements for long-term visitors require health insurance coverage for the duration of their stay. Regardless of the requirements for your travels, it’s worth considering a travel medical insurance plan based on the high cost of U.S. healthcare. According to GoodRx, an emergency room visit can cost upwards of $2,400 to $2,600 without insurance in the U.S.

Health Insurance Requirements for People Visiting the U.S.

While tourists do not technically need a travel medical insurance plan to obtain a visa, other types of visitors do. For instance, if you’re a student planning to study abroad in a U.S.-based college or university using an F-1 or J-1 visa, you’ll likely need some sort of health insurance or a comparable equivalent. Many universities that accept students on visas require medical coverage that complies with the school’s outlined health insurance requirements.

Note that health insurance requirements for visitors to the U.S. largely depend on the type of visa you need to enter the country. Regardless of whether it’s required, we recommend medical insurance based on the high costs of U.S. healthcare services.

Best Travel Health Insurance for Visitors to the U.S.

Our team has spent extensive time researching the best travel medical insurance plans for visitors to the U.S., considering factors such as availability, coverage, customer support and provider reputation.

- Seven Corners Travel Medical Basic: Our pick for group travelers

- WorldTrips Atlas America : Our pick for high coverage limits

- IMG Patriot Lite : Our pick for budget coverage

- IMG Patriot America Plus : Our pick for continuous coverage

- Trawick Safe Travels USA Comprehensive : Our pick for wellness coverage

Seven Corners

Why We Picked It

Seven Corners’ Travel Medical Basic plan is our pick for group travelers. This plan is specifically designed for groups of up to 10 non-U.S. residents and non-U.S. citizens aged 14 days or older, making it ideal for families traveling together . However, it is also available for solo travelers. You can extend coverage for up to a year, with protection both in the U.S. and worldwide.

Pros and Cons

Medical coverage details.

The Travel Medical Basic plan offers extensive coverage with benefit maximums of up to $1 million and various deductible options, making it easy to customize a plan to suit your needs. Medical coverage offered through this plan includes the following:

- General medical

- Emergency dental

- Emergency services and assistance

- Accidental death and dismemberment (AD&D)

- Optional adventure activity coverage

Learn more : Seven Corners Travel Insurance Review

WorldTrips’ Atlas America plan is our pick for high coverage limits. This plan is designed for U.S. tourists, temporary workers, business visitors and international students studying abroad , providing accessible health coverage to a variety of travelers. It provides overall coverage maximums of up to $2 million, with up to $1 million for emergency medical evacuation coverage.

The Atlas America plan offers up to $2 million in overall coverage and seven different deductible options, providing sound medical coverage along with supplemental travel benefits. Medical coverages include services that fall under the following categories:

- Emergency dental and vision

Learn more: WorldTrips Travel Insurance Review

We chose IMG’s Patriot Lite plan as our pick for budget coverage — the company quoted us less for this plan than its competitors on our list. You can buy this plan as an individual or group, making it ideal for family members traveling to the U.S. together. Like other insurance companies in this review, IMG is partnered with UnitedHealthcare, meaning policyholders have access to a domestic network of over 1.4 million physicians for medical care.

Policyholders can choose coverage with a maximum of up to $1 million with the Patriot Lite plan, with deductibles ranging from $0 to $2,500. Coverages with the Patriot Lite plan include the following:

Learn more : IMG Travel Insurance Review

IMG’s Patriot America Plus plan also made our list for providing short-term insurance for business and leisurely travelers. We named it our pick for continuous coverage, as it provides up to 24 months of renewable, consecutive coverage. Other benefits include access to multilingual customer service representatives and a maximum limit of up to $1 million. Unlike IMG’s Patriot Lite plan, Patriot America Plus covers COVID-19 treatments.

As with IMG’s Patriot Lite plan, coverage with a maximum of up to $1 million is available, with your choice of deductible from $0 to $2,500. Coverages with the Patriot America Plus plan include the following:

Trawick International

We named Trawick’s Safe Travels USA Comprehensive plan our pick for wellness coverage, as it affords policyholders a general wellness visit with a U.S. doctor during their travels for up to $125. As is standard across most plans in our review, Trawick’s Safe Travels plan offers up to $1 million in medical expense coverage. It also offers up to $2 million in emergency medical evacuation coverage and eight deductible options up to $5,000.</p

The Safe Travels USA Comprehensive plan covers up to $1 million in medical benefits after you pay your deductible. Benefits provided with each plan include:

- Optional sports activity coverage (excludes extreme sports)

Read more : Trawick International Travel Insurance Review

Compare Travel Medical Insurance Plans for U.S. Tourists

See the table below for a direct comparison of costs, deductibles and more between travel medical insurance plans for U.S. visitors.

We based plan costs on quotes we obtained for a 30-year-old Australian citizen traveling to the U.S. for 30 days. Each plan includes a medical maximum of $500,000 with a $250 deductible. Note that your actual cost will depend on factors such as your age, number of travelers, chosen deductible and more.

Types of Health Insurance for U.S. Visitors

Travelers have options when it comes to health insurance for U.S. visitors. For one, you could choose an international travel medical insurance plan, which provides coverage for emergency medical expenses or evacuation abroad. A U.S. short-term health insurance plan is also an option. Some health insurance companies, such as UnitedHealthcare, work with providers to allow policyholders to use the company’s preferred provider organization (PPO) network.

If you’re wondering whether your domestic health insurance policy will cover you in the U.S., we encourage you to contact your insurance provider for more details. You may need to purchase valid coverage specifically for your U.S. trip if you’re concerned about or foresee needing medical care abroad.

Fixed Medical Insurance

Fixed medical insurance or fixed indemnity insurance pays a predetermined amount of money for specific medical procedures and services. This type of medical insurance plan is limited — no matter what your total bill amounts to, it will not cover more than the agreed-upon amount. Fixed medical insurance plans are usually cheaper than comprehensive policies, which we cover in the next section.

Comprehensive Medical Insurance

Comprehensive medical insurance covers doctor’s visits, hospital care, prescription drugs and more without setting limits on certain services. Note that these plans typically have coverage maximums, deductibles and copays, so you will have to pay a certain amount before your policy covers any medical expenses.

Comprehensive coverage does not have benefit limits based on the type of medical service like fixed medical does, but it will cost you more overall. However, because health care in the U.S. is expensive, you may find comprehensive plans more beneficial in the long run despite being pricier than a fixed plan.

Short-Term vs. Long-Term Health Insurance

Short-term and long-term health insurance plans provide coverage that lasts for a specific period. You can consider travel medical insurance plans short-term policies for U.S. visitors, as they can cover medical expenses incurred during a period lasting less than a year.

If you plan on staying in the U.S. for longer than a year, you may be eligible to purchase a health insurance plan through a domestic provider, depending on your visa. For example, if you have a J-1 or F-1 visa, you may be eligible for a university-sponsored or private health insurance plan. We encourage you to check with the U.S. Department of State when you receive your visa for more on what long-term health insurance options are available to you.

What Does Travel Insurance in the U.S. Cover?

Travel insurance in the U.S. provides a variety of coverages for unexpected events that can affect your travel plans both before and during your trip. Specifics will vary depending on your choice of policy but will likely include some or all of the following coverages:

Created with Sketch Beta. Trip cancellation: If you must cancel your trip for a covered reason, travel insurance can help you recover non-refundable costs such as hotel reservations, airline tickets and more.

Created with Sketch Beta. Trip interruption: If you need to cut your vacation short for a covered reason, travel insurance plans can compensate you for expenses you didn’t use during your trip.

Created with Sketch Beta. Trip and baggage delays: A travel insurance policy can help cover costs you incur if your trip or baggage gets delayed for a covered reason. Most coverage also includes lost or stolen baggage.

Created with Sketch Beta. Emergency medical: Emergency medical coverage can reimburse the cost of necessary treatments if you experience a medical emergency abroad up to a maximum amount.

Created with Sketch Beta. Emergency evacuation and transport: If you need transportation to a medical facility in the U.S. during a medical emergency, this coverage will provide an expense limit for the services. This benefit can also cover emergency evacuations if a natural disaster or political conflict occurs and affects your travels.

How Much Does Travel Health Insurance for U.S. Visitors Cost?

Our research found that the cost of travel insurance for U.S. visitors can range from $96 to $115 . This range is based on quotes gathered for a 30-year-old Australian citizen traveling to the U.S. for 30 days. Each plan we obtained a quote for included a medical maximum of $500,000 with a $250 deductible.

For cost data specific to your travel needs, we encourage you to gather quotes from the providers in this review. The quotes you receive will depend on factors such as your age, plan limits, chosen deductible, number of travelers and more.

How To Use Visitor Health Insurance

If you’ve purchased a visitor medical insurance plan for your stay in the U.S., it’s important you understand how to use it. Healthcare facilities in the U.S., such as doctor’s offices, urgent care locations and emergency rooms, often require you to bring an insurance card with you. This card includes essential information associated with your policy that helps the facility file a claim with your insurance provider. If you have one through your visitor health insurance plan, it is best to have it on hand when receiving medical treatment.

Your health insurance plan may require pre-approval before you receive treatment in non-emergent cases. Your insurance company may request to verify a procedure or medicine is necessary before agreeing to cover it. Be sure to check your policy to find out what the restrictions are.

Many visitor health insurance plans also cover prescription medications. If you’ve been prescribed medicine through a U.S. doctor during a medical visit, a pharmacy may choose to verify your prescription before filling it. This means the pharmacy will contact your healthcare provider with any questions about the prescription being correct. Verification could delay when you receive your medication, but it likely won’t take longer than three to 10 business days.

Finding Doctors and Hospitals as a Visitor

Most insurers provide online tools that help you find in-network healthcare providers and facilities covered by your insurance policy. Note that you may pay more if you choose to receive care through a doctor or facility that is not considered in-network. Out-of-network providers do not contract with your health insurance plan to provide agreed-upon rates. Unless you have a plan that lets you pick any provider you’d like, you will need to find a provider or facility working with your insurance.

If you want to verify the benefits offered by your insurance plan, contact your insurance provider directly or consult any documentation provided at the time of purchase. Healthcare providers may also take steps to verify your coverage, as it ensures the facility receives payment and lessens the chance of a denied insurance claim.

The cost of medical treatment depends entirely on the type of insurance plan you have. If you’ve purchased a travel medical insurance plan, your provider will cover emergency medical expenses up to a maximum amount. Once you’ve hit that limit, you will have to pay the rest of your bill. If you have a plan with a deductible or co-pay, you must pay that amount before your insurer will cover your expenses.

Paying Medical Bills Without Insurance

If you opt out of medical coverage when visiting the U.S. and end up needing medical care, you will have to cover the entire bill out of pocket. However, you have several options regarding payment. You can contact the debt collector in charge of your bill and work to negotiate the cost of your bill down . You can also set up a payment plan that works with your income and what you can afford.

While these payment options can be helpful, they do not negate the high U.S. healthcare costs, and can still leave you with a substantial bill after a medical crisis.

According to a study by the Peterson-KFF Health System Tracker , health expenditures per person in the U.S. in 2022 were over $4,000 more than any other high-income nation. For this reason, we recommend some form of medical coverage to help cover potential emergency expenses when visiting the U.S.

Filing a Claim with Visitor Health Insurance

Filing a claim through a visitor insurance plan or travel medical insurance policy will vary based on your provider. Note that providing proper documentation will help the claims process go smoothly, so it is important to keep track of hospital invoices and other billing forms.

If you have a domestic health insurance policy, the healthcare facility that provided your treatment will file your claim. You’ll receive a bill once your insurance provider processes the claim. On the other hand, travel medical insurance may require you to submit documents proving your claims for emergency medical treatment. Once your claim has been approved, your travel insurance company will reimburse your medical bills.

Where Can You Buy Visitors Insurance?

You can buy visitors’ insurance directly from travel insurance companies, international health insurance companies, university-approved providers and domestic providers, depending on the type of visa required during your stay. If you’re on a tourist visa, you can purchase travel medical insurance covering emergency medical services and transport, if needed, to a healthcare facility. Most travel insurance providers also offer travel healthcare plans that can last up to a year if you are planning multiple trips.

If you’re on a J-1 or F-1 visa and enrolling in a schooling program, contact your university to see if you’re eligible for a sponsored or private health insurance plan. If you need clarification on the available coverage or plan to stay in the U.S. for longer than a year, contact the U.S. Department of State for more information.

Do U.S. Visitors Need Health Care Coverage?

Healthcare in the U.S. is expensive. While medical insurance isn’t required for some visitors — such as tourists on a B-2 visa — it’s still worth considering if you’re concerned about an unexpected medical emergency abroad. We encourage you to extensively research your visa type and the coverage available to you before settling on a plan. Understanding the benefits and exclusions of a healthcare coverage plan will ensure there are no surprises if you need medical care during your U.S. trip.

Frequently Asked Questions About Visitor Health Insurance

How much is visitor health insurance in the u.s..

Visitor health insurance costs in the U.S. depend on factors unique to your travel needs. After gathering quotes from the providers in our review, we found that visitor health insurance can range from $89 to $115 . This range is based on a 30-year-old Australian citizen traveling to the U.S. for 30 days, opting for a plan with a medical maximum of $500,000 and a $250 deductible. Your actual costs will vary.

How much does travel insurance cost for trips to the U.S

Our research team found the average cost of travel insurance ranges from $35 to $400, with the average being $221 for a standard policy. Your costs will vary depending on your chosen plan, provider, length of travels, number of travelers and more.

Can foreign visitors get insurance while in the U.S.?

Yes, foreigners can get insurance while in the U.S. Various insurance options are available to travelers depending on their length of stay and visa type. It’s best to research what’s available to you based on your visa requirements before purchasing a plan.

Is it hard to get travel insurance for U.S.-based trips?

No, it’s not hard to get travel insurance for travel to the U.S. Providers such as Seven Corners, WorldTrips, IMG, Trawick and more provide plans for non-U.S. citizens seeking trip and medical coverage while abroad.

Methodology: Our System for Rating Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

More Travel Insurance Guides

- Best covid travel insurance companies

- Best cruise insurance plans

- Best travel insurance companies

- Cheapest travel insurance

- Best group travel insurance companies

- Best senior travel insurance

- Best travel insurance for families

- Best student travel insurance plans

- Travel insurance for parents visiting USA

- Best travel medical insurance plans

- How much does travel insurance cost?

If you have feedback or questions about this article, please email the MarketWatch Guides team at editors@marketwatchguides. com .

Related Articles

Visa Traveler

Exploring the world one country at a time

Travel Insurance for Schengen Visa: A Comprehensive Guide

Updated: September 8, 2023

One of the key requirements of Schengen visa is the travel medical insurance. The travel insurance for Schengen visa must meet certain coverage and must be valid throughout the Schengen region for the entire duration of your stay.

With a myriad of travel insurance options in the market, picking out the right policy for your Schengen visa is difficult. In this article, you will everything about Schengen visa travel insurance and how to choose a policy for your visa.

Table of Contents

BONUS: FREE eBOOK

Enter your name and email to download the FREE eBOOK: The Secret to VISA-FREE Travel

Opt in to receive my monthly visa updates

You can unsubscribe anytime. For more details, review our Privacy Policy.

Your FREE eBook is on it’s way to your inbox! Check your email.

What is Schengen Travel Medical Insurance?

Schengen travel insurance is a type of insurance policy for travelers visiting the Schengen area. This type of travel insurance plan is designed specifically to comply with Schengen visa criteria of minimum coverage and validity requirements. Schengen travel insurance is also a mandatory requirement for obtaining a Schengen visa.

Who Requires Schengen Travel Health Insurance?

Visitors from visa-required countries planning to visit any Schengen country must require Schengen travel insurance.

If you are a traveler from a country that requires a visa to enter the Schengen zone, you must have a valid travel insurance policy. You must buy travel insurance not only for your Schengen visa application but also for any or all trips that you take to the Schengen area.

Is Travel Insurance Mandatory for Schengen Visa?

Yes, obtaining travel insurance is mandatory for Schengen visa . The European Commission’s 810/2009 Regulation mandates submitting valid travel medical insurance for Schengen visa applications.

Proof of travel medical insurance is not only mandatory for the first trip, but also for all subsequent trips for multiple-entry Schengen visas.

At the time of application, you would only need to provide proof of insurance for the first entry.

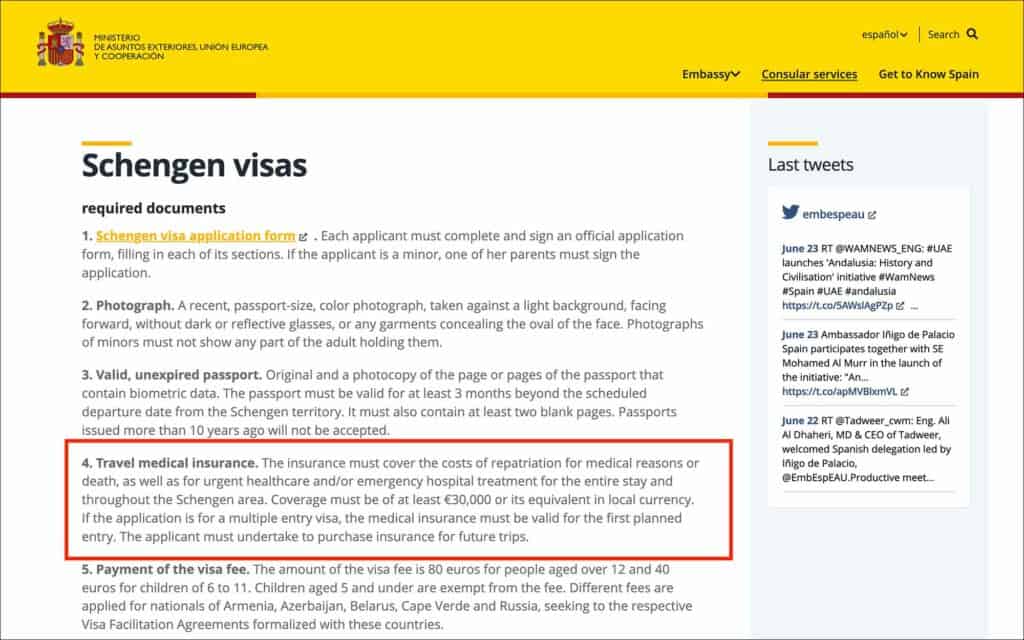

What are the Schengen Visa Insurance Requirements?

As per the Article 15 of REGULATION (EC) No 810/2009 , your Schengen visa travel insurance must meet the following three criteria:

- Must cover medical expenses up to a minimum of €30,000

- Must be valid for the entire duration of your stay

- Must be valid in all 27 Schengen countries

The policy must cover all medical expenses arising from emergency medical attention, treatment, hospitalization, emergency medical evacuation, repatriation due to medical reasons and death.

Let’s look at each of those requirements in detail.

1. Minimum Coverage

Your Schengen visa travel insurance must meet the minimum coverage requirement of €30,000. When purchasing Schengen visa travel insurance in USD, make sure the policy covers at least $50,000.

This minimum coverage is applicable for any medical expenses, emergency evacuation, and repatriation of remains.

This coverage is necessary to financially protect you in case of accidents, unforeseen illnesses, or other emergency situations that may arise during your travels in the Schengen area.

2. Validity Duration

Your travel insurance for the Schengen visa must remain valid for the entire duration of your stay in the Schengen area.

This travel insurance policy should cover you from the day you arrive in the Schengen area until the day you leave.

In terms of a multiple-entry visa, the Schengen visa insurance must be valid for the entire duration of your first entry only.

Here is an example:

You are applying for a multiple-entry visa and your trip is from Jan 01 to Jan 14. Your Schengen visa insurance must be valid from Jan 01 to Jan 14.

If you take another trip on the same visa, say from May 01 to May 14, then you must purchase another Schengen travel insurance at the time of your second trip.

For your visa application, you would only need to provide insurance for Jan 01 to Jan 14.

3. Validity in the Schengen Zone

Lastly, your Schengen visa travel insurance must be valid in all 27 Schengen countries. This is to make sure that you have coverage regardless of which Schengen country you visit during your trip.

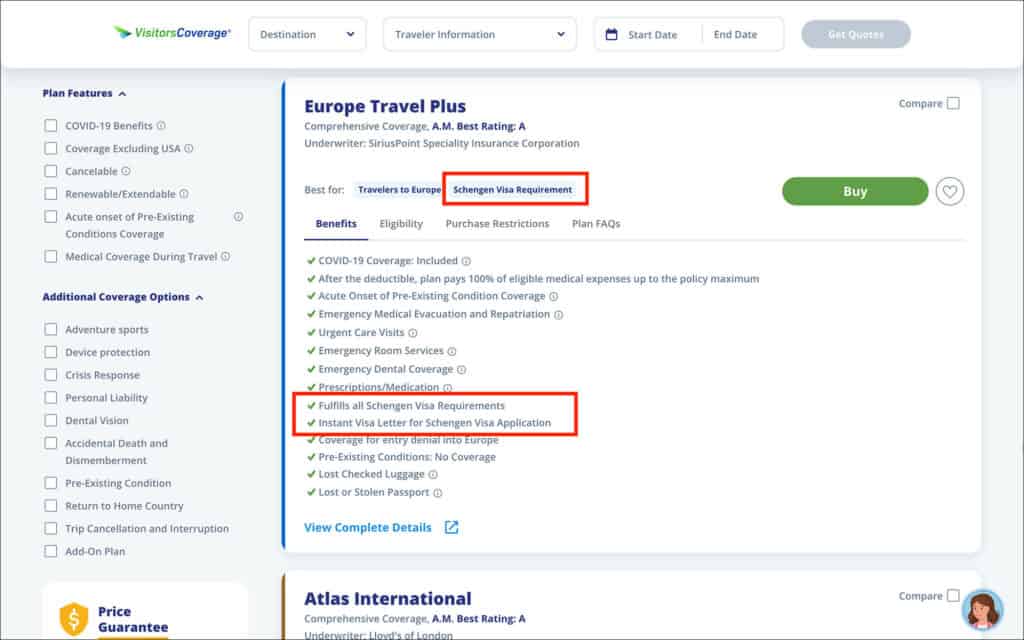

Most Schengen travel insurance aggregators such as VisitorsCoverage provide insurances that are valid in the entire Schengen zone.

In fact, any insurance valid globally is acceptable for the Schengen visa. Provided, the the insurance covers at least €30,000 in all medical costs and emergencies.

What Does Schengen Visa Insurance Plan Cover?

In general, any Schengen visa insurance plan covers medical expenses, COVID-19 protection, and trip coverage.

These coverage options are designed not only to provide comprehensive protection but also to meet the Schengen visa insurance requirements.

1. Medical Coverage

Medical coverage is the most important aspect of Schengen travel insurance. It provides coverage for emergency medical expenses, accidents, and unexpected illnesses.

The coverage also includes hospitalization, emergency hospital treatment, doctor visits, prescription drugs, and other necessary medical treatments that are considered emergency and necessary.

The policy must cover at least €30,000 for the visa. But depending on your needs and activities in the Schengen area, you can opt for policies with higher coverage.

2. COVID-19 Protection

COVID protection is not mandatory for Schengen visa. But most Schengen visa travel insurance policies offer coverage for medical treatment and quarantine expenses related to COVID. COVID tests and quarantine must be prescribed by a doctor to be eligible for the coverage.

That being said, you must review the policy details to make sure that COVID protection is included. Even though it’s not mandatory, it can provide peace of mind during your trip.

3. Trip Coverage

Trip coverage is also not mandatory for Schengen visa. But most travel insurance plans provide protection against flight cancellations, delays, and lost luggage during your travels. Trip coverage will help lessen any expenses arising from trip interruptions and baggage delays.

Review the policy details to make sure comprehensive trip coverage is included. This way, you can ensure that your trip goes smoothly, even when faced with unexpected setbacks.

What Does Schengen Visa Insurance Plan Not Cover?

Though Schengen travel insurance plans provide coverage for a wide range of scenarios, there will usually be some exclusions. One common exclusion is the coverage for pre-existing medical conditions.

It’s crucial to understand the limitations and exclusions of your Schengen visa insurance policy. Let’s look into the exclusion of pre-existing medical conditions in detail.

Pre-existing Medical Conditions

Pre-existing medical conditions are generally not covered by Schengen visa insurance plans. If you have a medical condition that was present prior to the purchase of your Schengen insurance policy, any medical expenses related to that condition during the trip will not be covered.

Review the terms and conditions of your travel insurance policy to determine if any exclusions apply to pre-existing medical conditions.

Is COVID-19 Coverage Mandatory for Schengen Visa Travel Insurance?

No, COVID-19 coverage is not mandatory for Schengen visa travel insurance. But most Schengen travel insurance companies include COVID coverage in their policy.

Even though it’s not required, having COVID protection in your travel insurance can provide financial security during your Schengen trip.

It is always better to be prepared and have coverage than face challenges during the trip.

How Much Does Schengen Visa Medical Insurance Cost?

The cost of Schengen visa medical insurance varies depending on several factors, such as age, duration of your trip, total coverage amount, and the insurance company.

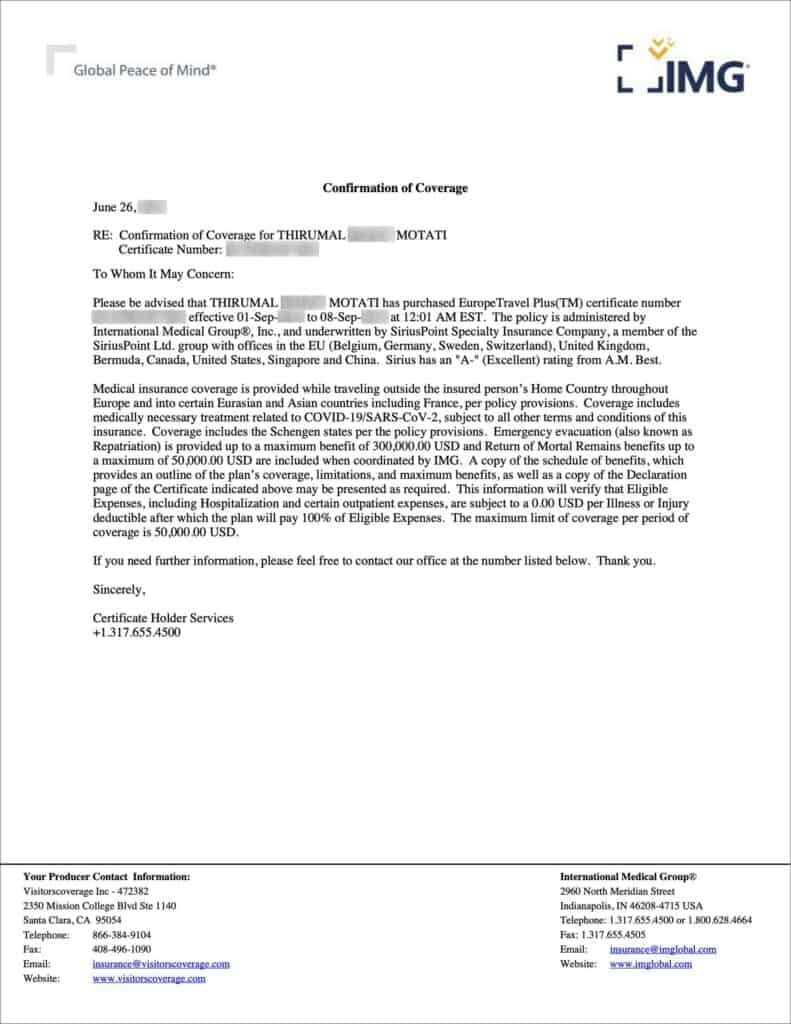

Schengen travel insurance from IMG Global, through VisitorsCoverage for up to 39 years of age will cost about a dollar a day. For a one-week trip, it would be about $7 USD. The cost goes up with age.

IMG Global is a US-based insurance company offering Schengen visa insurance. If you opt for a Europe-based insurance company such as Europ Assistance, the prices are even higher. A one-week insurance policy can cost about €18.

To find the most affordable insurance policy for the Schengen visa, compare different insurance providers and policies using an insurance aggregator such as VisitorsCoverage .

How to Choose the Right Travel Insurance for Schengen Visa?

With a myriad of options available in the market, choosing travel insurance for your Schengen visa can be a daunting task. To make this process easier, consider factors such as the reputation of the insurance company, coverage limits, and customer reviews.

Let’s look at each of these factors in detail.

1. Reputation of the Company

When selecting a travel insurance provider, it’s important to evaluate their reputation in the market. A reputable insurance company will have a track record of providing reliable and quality coverage, as well as excellent customer service.

You can assess the reputation of an insurance company by looking at its reviews and ratings on sites such as Trustpilot. VisitorsCoverage , for example, has a 4.7 rating on Trustpilot.

If you choose an insurance company with a strong reputation, you will have confidence in the coverage and support they provide throughout your trip.

2. Coverage Limits and Exclusions

Another important aspect to consider is the coverage limit. The policy must be Schengen visa compliant, meaning the policy must meet the minimum coverage requirement of €30,000.

Additionally, it’s important to review if there are any exclusions such as pre-existing medical conditions or other limitations.

By reviewing the coverage limits and exclusions, you can pick out a policy that is Schengen visa compliant and provide enough protection during your trip.

3. Customer Reviews and Ratings

Reviews and ratings can be invaluable resources when evaluating any product or service in the market. Travel insurance is no different. The reviews and ratings provide insight into the insurance provider’s customer service, claims process, and embassy acceptability.

By considering the experiences of other travelers you can assess the quality and reliability of the travel insurance.

4. Schengen Insurance Certificate

Lastly, the insurance company must be able to issue a Schengen insurance certificate, also called a visa letter. Submitting a visa letter along with the policy is a mandatory requirement for the Schengen visa.

This certificate confirms that your insurance policy meets the Schengen visa criteria. The certificate should include:

- Your name (as the policyholder)

- Policy number

- Total coverage amount, which should be no less than €30,000 (or $50,000)

- Dates of validity (must cover the entire duration of your stay in the Schengen area)

- Contact details for the insurance company, in case of emergencies

Where to Purchase Travel Insurance for Schengen Visa?

Travel insurance for Schengen visas can be purchased from online insurance providers, local insurance companies and travel agencies.

Local insurance companies and travel agencies can offer personalized advice. With online platforms, you can compare prices and coverage options from multiple insurers.

Regardless of where you purchase your insurance, it’s important to make sure the insurance policy meets Schengen visa insurance requirements and provides the necessary coverage for your trip.

My recommendation is to buy Schengen visa insurance from VisitorsCoverage. Their Europe Travel Plus policy is specifically designed for the Schengen visa, meeting the minimum coverage requirements and downloadable visa letter. Here is a comparison for a 33-year-old, 7 days trip to the Schengen area.

How to Purchase Travel Insurance for Schengen Visa

To purchase your travel insurance for Schengen visa, go to the VisitorsCoverage’s Europe Travel Plus plan. Enter the following details.

- Destination Country

- Citizenship

- Residence/Home country

- Coverage Start Date

- Coverage End Date

- Arrival Date

- Date of Birth

- Email Address

Click on Continue. In the deductible and policy maximum, select $0 for the deductible and $50K for the policy maximum. Then click on Continue.

In the next steps, enter your details as per your passport. Complete the payment and purchase the policy. Once your purchase is complete, you can download your visa letter.

How To Find Cheap Schengen Travel Insurance?

Finding cheap Schengen travel insurance requires research and comparison of policies and companies. I have done this already for you. VisitorsCoverage was the cheapest in my research. If you are older than 50, then you might want to check other insurance companies to see if you can find a cheaper option.

Frequently Asked Questions (FAQS)

Do us citizens need schengen insurance.

No. US citizens do not require Schengen insurance when traveling to the Schengen area. This is because Schengen insurance is mandatory for those that require a visa for the Schengen area. And, US citizens do not require a visa for the Schengen area.

Is Schengen travel insurance refundable?

Yes. Most Schengen visa insurance companies offer reimbursement or free cancellation in the event of visa refusal. That being said, review the terms and conditions of the insurance policy before purchasing to make sure the policy is cancellable in case of visa refusal.

Can I purchase travel insurance after obtaining a Schengen visa?

No. You must purchase travel insurance before obtaining the visa. This is because travel insurance is one of the mandatory requirements for obtaining the Schengen visa. Without purchasing travel insurance, you won’t even be able to apply for the Schengen visa.

Are pre-existing medical conditions covered by travel insurance?

Pre-existing medical conditions are usually not covered by Schengen visa insurance plans. This means that any medical expenses arising due to pre-existing conditions will not be covered during your trip. Before purchasing, review the terms and conditions of the policy to determine the exclusions.

Can I extend my travel insurance coverage if my stay in the Schengen area is prolonged?

It may be possible to extend travel insurance coverage if your stay in the Schengen area is prolonged. But it depends on the insurance company and the policy type. Review the terms and conditions and also contact the insurance provider to inquire about extensions.

Obtaining the right travel insurance is a crucial step in your Schengen visa application process. The travel insurance for Schengen visa must provide at least €30,000 coverage and must be valid throughout the Schengen region for the entire duration of your trip.

While purchasing your Schengen visa insurance, consider factors such as the provider’s reputation, coverage limits and customer reviews. Compare different travel insurance providers and policies to pick out the right insurance for your Schengen visa.

WRITTEN BY THIRUMAL MOTATI

Thirumal Motati is an expert in tourist visa matters. He has been traveling the world on tourist visas for more than a decade. With his expertise, he has obtained several tourist visas, including the most strenuous ones such as the US, UK, Canada, and Schengen, some of which were granted multiple times. He has also set foot inside US consulates on numerous occasions. Mr. Motati has uncovered the secrets to successful visa applications. His guidance has enabled countless individuals to obtain their visas and fulfill their travel dreams. His statements have been mentioned in publications like Yahoo, BBC, The Hindu, and Travel Zoo.

PLAN YOUR TRAVEL WITH VISA TRAVELER

I highly recommend using these websites to plan your trip. I use these websites myself to apply for my visas, book my flights and hotels and purchase my travel insurance.

01. Apply for your visa

Get a verifiable flight itinerary for your visa application from DummyTicket247 . DummyTicket247 is a flight search engine to search and book flight itineraries for visas instantly. These flight itineraries are guaranteed to be valid for 2 weeks and work for all visa applications.

02. Book your fight

Find the cheapest flight tickets using Skyscanner . Skyscanner includes all budget airlines and you are guaranteed to find the cheapest flight to your destination.

03. Book your hotel

Book your hotel from Booking.com . Booking.com has pretty much every hotel, hostel and guesthouse from every destination.

04. Get your onward ticket

If traveling on a one-way ticket, use BestOnwardTicket to get proof of onward ticket for just $12, valid for 48 hours.

05. Purchase your insurance

Purchase travel medical insurance for your trip from SafetyWing . Insurance from SafetyWing covers COVID-19 and also comes with a visa letter which you can use for your visas.

Need more? Check out my travel resources page for the best websites to plan your trip.

LEGAL DISCLAIMER We are not affiliated with immigration, embassies or governments of any country. The content in this article is for educational and general informational purposes only, and shall not be understood or construed as, visa, immigration or legal advice. Your use of information provided in this article is solely at your own risk and you expressly agree not to rely upon any information contained in this article as a substitute for professional visa or immigration advice. Under no circumstance shall be held liable or responsible for any errors or omissions in this article or for any damage you may suffer in respect to any actions taken or not taken based on any or all of the information in this article. Please refer to our full disclaimer for further information.

AFFILIATE DISCLOSURE This post may contain affiliate links, which means we may receive a commission, at no extra cost to you, if you make a purchase through a link. Please refer to our full disclosure for further information.

RELATED POSTS

- Cookie Policy

- Copyright Notice

- Privacy Policy

- Terms of Use

- Flight Itinerary

- Hotel Reservation

- Travel Insurance

- Onward Ticket

- Testimonials

Search this site

- Visa Insurance

USA Medical Insurance

Best travel medical insurance for usa, compare and buy us travel insurance, usa healthcare for tourists, 01. how can i buy usa travel insurance online.

American Visitor Insurance offers a wide range of travel medical insurance plans for visitors to the USA designed by the top US travel insurance providers. Customers can compare different travel insurance plans offered by US insurance company on American Visitor Insurance. After comparing different plans, you can choose the one that best meets your needs and budget and buy the policy online by filling out an application and paying for the travel insurance USA using a credit card.

02. Do tourist get free healthcare in USA?

No, international tourists do not get free healthcare in the USA. The United States does not have a universal healthcare system, and US healthcare services are very expensive, especially for the uninsured. If you are a tourist visiting the US, it is very important to have the best travel medical insurance for any unexpected medical expenses that may arise during your trip. US travel medical insurance covers emergency medical expenses, including hospitalization, doctor visits, emergency medical evacuation, and repatriation.

Tourists can compare and review the best US travel insurance options using the American Visitor Insurance comparison tool as well as review the policy brochures to understand the coverage limits and exclusions.

03. Why is travel insurance for USA so expensive?

There is no denying that travel insurance to USA is unfortunately very expensive. The main reason for this is simply because the cost of healthcare in the USA is very expensive and the travel insurance USA costs are directly related to the healthcare costs. One more factor for some USA travel insurance plans to be very expensive is that there are specially designed travel insurance for USA plans available for older travelers, with higher medical coverage as well as some plans with coverage for pre-existing ailments.

Visitor visa health insurance USA

Visitor visa health insurance covers medical expenses and emergency services for travelers visiting the United States on a B-1 or B-2 visa. These B visas are for nonimmigrants who allowed to enter the US for business or tourism purposes. Visitor visa health insurance USA is not mandatory, but it is highly recommended, as the US has high healthcare costs and does not have a universal healthcare system. Simply having US visitor visa medical insurance will significantly lower the hospital bills. The US insurance company preferred provider organisation (PPO) network healthcare billing is usually significantly lower than regular hospital bills without PPO network in the United States

Some of the benefits of visitor visa health insurance USA are:

- It can cover covid19 related expenses, such as testing, treatment, hospitalization, and quarantine, up to the policy limit.

- It can cover other medical expenses, such as doctor visits, prescriptions, surgery, ambulance, and repatriation, in case of illness or injury during the trip.

- It can cover emergency services, such as evacuation, accidental death and dismemberment, and travel assistance, in case of a life-threatening situation or a travel disruption. Lower hospital bills since US insurance preferred provider organisation (PPO) network healthcare billing is significantly lower than regular hospital bills without PPO network in the United States.

Best medical insurance for tourist in USA

An overview of international travel insurance for tourists, definations.

Reliability : A.M Rating evaluates the financial stability and reliability of the insurance company.

Benefit Period : The greater the benefit period the better the coverage.

Deductible : Deductible is what the customer pays before the insurer pays anything.

Coinsurance : Coinsurance is the what the customer should pay for any given expense after paying the deductible. The Co-insurance is typically a percentage of the bill (20%, 25 % etc…)

- Per period of coverage - Amount of benefit applies to claims throughout policy period

- Per injury - Benefit amount applies to individual sickness or injury.

- Including USA - These plan provide coverage in USA

- Excluding USA - Coverage extends outside the USA

- Including USA, Canada and Mexico - Coverage is in USA, Canada and Mexico

- Longer duration for Expatriates - Plans purchased for longer duration are little expensive

- Shorter duration for vacationers (travel health insurance and trip cancellation plans) - Plans purchased for shorter duration are cheaper

Travel health insurance for visitors to USA

Tourist health insurance usa.

- B1 and B2 visas are most common tourist visas. Those who are visiting the USA for exchange visitor program should apply for the J1 visa. There are other US visas like H1B, L1, K visa... for professionals, H4, J2, F2 for spouses of visa holders. The F1 visa is issued to international students coming to the US.

- Along with the Visa, visitors must also be aware of the health care system in the USA. Staying in America as an uninsured visitor is risky since medical emergencies and hospitalization can leave the victim with huge medical bills.

- While outside your home country it is always advisable to be careful. To avoid financially disastrous situations, travelers need health insurance for foreign nationals in USA coverage. Many US insurers have designed tourist medical insurance plans specifically as health insurance foreigners can use within the United States.

- Visitors to the US can buy medical insurance for tourist visa in USA while still in their home country. A quick and convenient compare tool allows tourists evaluate different travel medical insurance USA plans based on price and benefits offered and then make an informed choice.

- Given the Covid pandemic many tourist medical insurance USA has included coverage for Coronavirus. Tourists should consider buying medical insurance for travel to USA with Covid coverage. Another factor to be aware of is the need for pre-existing conditions coverage within the tourist medical insurance USA plan. While many health insurance for travelers to USA plans exclude pre-existing condition ailments, some plans for tourist in USA provide coverage for acute onset of pre-existing conditions and a few provide more comprehensive plans for foreign nationals coverage for pre-existing ailments.

Visitors Visa Insurance, B2 Visa Medical Insurance

Health insurance usa for foreigners.

Applicants for an US tourist visa must pay the fees in US Dollars. The fees paid by the applicant is an interview fee to a US consulate and is charged for the interview with the Consular Officer who will determine if the applicant is qualified to receive a visa to travel to America.

In case if the applicant is rejected the fee amount will not be refunded. Amongst the items included in the qualification decision

These are the few steps that an applicant should undergo to seek tourist visa or B2 Visa. Health Care for visitors to US is very expensive and it is important to have proper health insurance for tourist visa in usa for the US irrespective of the length of stay. Once the visitor visa is issued, travelers can buy medical insurance for tourist visa in USA .

Visitor visa, Tourist B1 B2 Visas

Student visas and health insurance usa for foreigners.

In order to visit the USA, one should get a visa issued from the US consulate. Foreigners who intend to study, stay and work in the USA for an extended period should apply for the appropriate visa which enables them to work and stay longer. Among the commonly issued visas are B1 B2 visa for tourists, F1 visa for international students and J1 visa for exchange scholars.

Those visiting the USA for a temporary period be it for business, education, tourism... need a non-immigrant visa. Those visiting the US on a vacation or to meet family need the visitor's visa and best medical insurance for tourist visa in USA People who want to be permanent residents in the United States without any time limitation should apply for different immigrant visas.

Since healthcare is extremely expensive in the US, and there is no public healthcare available for visitors, it is very important to buy the appropriate health insurance for foreign visitors. Tourists should buy appropriate health insurance for b1 b2 visa holders as medical insurance for tourists in USA.

New immigrant insurance for US visa

The Donald Trump administration had announced that the US government will insist on proof of adequate US immigrant health insurance without which visas to enter the US will be denied. The concern is that all new immigrants who enter the US without proper US immigrant insurance add to the burden of US taxpayers for the cost of their healthcare.

Prospective new US immigrants would be asked for proof of immigrant health insurance coverage. The Visas can be denied if the consular office is not satisfied by the provided proof of health insurance in the US.

Visitors visa applicants must show that they qualify under provisions of the Immigration and Nationality Act of America. According to the presumption in the law every visitor visa applicant is an intending immigrant. Therefore, applicants for visitor visas must overcome this presumption by demonstrating that:

- They are visiting the US for business, tourism or medical care.

- Applicant will stay in the US for a specific period or limited period.

- They have a residence outside the USA and binding ties which will ensure their return at the end of the visit.

Extending the US visitor visa while inside the United States

The Covid has pandemic has disrupted travel plans around the globe and many travelers are stranded within the US for lack of travel options as well as for health reasons. Travelers who are forced to extend their stay in the US have to extend or renew their visa status. The following is the procedure to extend the US short term visa:

- The visitor should complete the I-539 form for extension of a Non-Immigrant Visa

- The visitor should submit a letter stating the reason with detailed explanation for extension.

- The visitor should submit a copy of form I-94 that that he/she received on entry into the US

- The visitor should provide documentary evidence that the extended stay is temporary along with the booked return tickets

- The visitor should provide proof that the stay is fully taken care and he/she is financially covered and will not be a public charge in the US.

- The visitor should confirm that if the applicant has received any state benefits after 11-Feburary-2020; they need to be supported with proof of documents separately. The applicant should not have accessed any monetary state benefits or supplementary income from state post this period.

Pay the required renewal fees

Visa extension processing, what does usa visa insurance cover, health care expenses.

Covers hospital expenses for sickness or accidents.

Doctor visit

Insures Doctor visits for sudden injury or sickness.

Pharmacy drugs

Doctor prescribed eligible pharmacy drugs expenses.

Pre-existing conditions

Medical evacuation, repat of remains.

Repatriation of remains to home country included.

Testimonials - From Our Customers

"I had a no-problem trip but Seven corners was easy to deal with in the securing of the travel insurance and dealing with a few issues prior to departure."

"I have always gotten a quick response with a live person. I placed a claim, we will see it their payment to me is as good as their customer service is."

"Good policy options and pricing. Like to purchase high coverage for medical without covering full cost of trips - like the options Seven Corners provides."

US Travel health insurance for non residents in USA

American visitor insurance is a travel health insurance comparison website where international travelers can compare the most popular US travel medical insurance plans and buy it online. Travel insurance while relevant all along, has become more important in the current Covid pandemic situation. Given the increased stress on healthcare systems in several countries, many nations are insisting on adequate travel insurance before allowing international travelers enter their countries.

This information can guide international travellers to USA in better understanding US travel insurance requirements and the financial support it offers.

1. Common US Healthcare Terms of travel insurance

Deductible is the amount that insured travelers need to pay for coverage before the travel insurance actually starts to pay for the healthcare services along with the co-pay or coinsurance. Travelers will need to pay the medical fees up to the amount of deductible and along with coinsurance and co-pay. For example if the deductible amount is $1,500 then travelers need to pay up to $1,500, it is only after this amount is paid that the insurance plan stays paying. The Deductible is introduced to prevent frivolous claims.

Coinsurance is similar to co-pay in domestic US health insurance. Here the insured needs to pay a percentage of the total cost of the medical fee instead of paying a fixed amount. If you have 10% of coinsurance that the insured will have to pay 10% of the total cost of the bill .Co-insurance is paid on top of the Deductible. Typical Co-insurance ranges from 10% to 20%. The higher the co-insurance, the lower will be the cost of travel insurance.

Travelers can review the insurance glossary for travel to the USA to understand other terms and also check our travel insurance guide for easy understanding.

Riders – Riders are additional benefits that a traveler can purchase within the insurance policy. These are benefits that are usually not covered under the standard insurance policy. Depending on the need of the traveler, customers can add rider benefits at additional cost while buying the policy.

Copay or copayment is the fixed amount that the insured will have to pay for the medical service availed. The amounts would usually differ depending on the service availed.

Network and Out of Network - In US most hospitals have PPO networks. In the PPO network there are selected doctors and hospitals that have a working agreement with the insurance providers who charge the insurance provider directly and work out cheaper for the travelers. If the insurance provider is in the network they will provide a list of in network facilities so that the insured finds it easy to use the provider who can offer services.

Out of network insurance is literally when the customer goes to a healthcare facility outside of the covered network provider. In this situation, the insured will have to pay for the treatment themselves and then file a claim, this process might be confusing and sometimes out of network doctors and hospitals are more expensive and may even not be covered.

2. Travel insurance with acute onset of Pre-existing Conditions Coverage

Pre-existing condition is a medical ailment that existed before the start of the travel insurance cover. Acute onset of a pre-existing condition is a sudden relapse of the pre-existing condition without advance warning which requires medical attention within 24 hours. Travelers with pre-existing conditions always find it hard to buy travel health insurance. There are various conditions that are considered as pre- existing diseases but some of common ailments in this category are Asthma, heart related issues, high blood pressure, kidney disease, cancer, diabetes etc.

3. Affordable US insurance for travelers above 70 years

4. state limitations on travel insurance, 5. pre-approvals for medical treatment and hospital visits.

In a case where the insured is using an out-network provider the insured will need to notify the insurance provider to get pre approval or pay and then apply for a reimbursement. In situations like an admission at the hospital for overnight stay, Major Surgery, Prescription of expensive drugs, Medical appointment to a behavioural, physical, speech or occupational therapist for treatment all of this would typically require pre-approvals from the insurance provider.

6. Renewability and Deductible in an extended /renewed Travel insurance

7. multi-trip travel insurance, 8. important benefits of us travel insurance coverage to look out for while buying travel insurance.

- Acute onset of Pre-existing conditions, look back period

- Dental care for dental emergencies

- Skin care and dermatological problems

- Vision care except for treating eye injuries

- Preventative or routine health care coverage

- Injuries and illness due to terrorism or war

- Childbirth, pregnancy, and maternity

- Injury from high-risk sports

- Mental health care

- Injuries related to drugs and alcohol

Along with comparing different travel insurance options (commonly known as US visitors insurance), travellers can find out details about the different factors to consider while buying travel medical insurance as well as see responses to typical questions that customers have. Some of the important foreigners health insurance for travelers factors to consider in US travel insurance include fixed benefits vs comprehensive benefits , coverage for pre-existing ailments , coverage for Covid19 and Quarantine , medical maximum coverage, co-insurance , deductible and renewability.

American Visitor insurance has a friendly health insurance for travelers comparison tool where customers can compare prices and benefits of the several health insurance for non residents in USA options available.

What does the visitor health insurance for foreign nationals not cover?

- Preventive care like routine health checks, physical examinations, inoculation, vaccination.

- Regular treatment for pre-existing conditions.

- Maternity coverage if conception occurs before purchase of visitor visa health insurance.

Cost of best US travel insurance for pre-existing conditions

What is the best travel insurance for usa, patriot america plus insurance acute onset of pre-existing condition coverage.

$50,000 - $1,000,000

- Covers acute onset of pre-existing conditions up to chosen maximum limit (aged up to 70 years).

- Patriot America Plus Covid insurance offers coverage for coronavirus illness.

- Available for US citizens visiting USA

Patriot America Plus brochure links

View Patriot America Plus insurance brochures in different languages:

Visitors Protect Insurance Full Pre-existing condition coverage

$50,000 - $2,50,000

- Availble for visitors traveling from their home country to the U.S., Canada, and Mexico.

- The plan offers temporary medical coverage with pre-existing conditions up to 99 years.

- Care Clix consultation is a new benefit under this plan where you can get access to a doctor by different means like a video chat , mobile app, phone... and consult about non emergency issues.

- Minimum purchase is 90 days.

Safe Travels USA Comprehensive Insurance Acute onset of Pre-existing condition coverage

- Covers Acute onset of Pre-existing condition coverage: Covers Acute onset of Pre-existing condition coverage up to 69 years the limit is up to the medical maximum purchased per period of coverage and for any coverage related to cardiac disease, coverage is limited to $25,000.

- Up to $25,000 Maximum Lifetime Limit for Emergency Medical Evacuation.

- It offers coverage for visitors up to 89 years.

- This plan is not available to any individual who has been residing within the United States for more than 365 days prior to their Effective Date

Safe Travels USA Insurance Unexpected recurrence of a Pre-existing coverage

- Covers Up to $1,000 for sudden, unexpected recurrence of a Pre-existing Condition

- Safe travel USA Covid insurance offers coverage for coronavirus.

Safe Travels USA - Cost Saver Insurance Unexpected recurrence of a Pre-existing coverage

- Covers unexpected recurrence of a pre-existing medical conditions up to $1000

- Eligible for foreign residents visiting USA and worldwide

Safe Travels Elite Insurance Acute onset of Pre-existing condition coverage

$50,000 - $175,000

- Foreign residents visiting USA and worldwide.

- Plan can be renewed up to 2 years.

- The plan provides Emergency Medical Evacuation of $100,000 for the Economy, Basic and Silver plan and covers up to policy maximum for the Gold and the Platinum plan.

- Acute onset of pre-existing condition is covered up to policy maximum up to the age of 69.

Atlas America Insurance Acute onset of Pre-existing condition coverage

$50,000 - $2,000,000

Atlas Travel Insurance Brochure Links

Visitorsecure insurance acute onset of pre-existing condition coverage.

$50,000 - $130,000

- It offers coverage for acute onset of pre-existing conditions up to 70 years.

- Plan can be renewed up to 364 days.

Travel Medical Choice Insurance Acute onset of Pre-existing condition coverage

- Travel Medical Choice available for Non US residents and citizens traveling to the US.

- For the acute onset of pre-existing condition coverage with cardiac condition and/or stroke for age range of 14 days to 69 years, $50k coverage is available and for age range of 70 to 79 years, $5k coverage is available .

- For the acute onset of pre-existing condition coverage other than cardiac condition and/or stroke for age range of 14 days to 69 years, $75k coverage is available and for age range of 70 to 79 years, $7,500 coverage is available .

- Including USA

- Excluding USA

Travel Medical Basic Insurance Acute onset of Pre-existing condition coverage

- Travel Medical Basic available for Non US residents and citizens traveling to the US.

- The policy maximum for this comprehensive insurance starts from $50,000 and provides up to $1,000,000. For people above age 80 years, they get a policy maximum of $10,000

- Acute onset of pre-existing conditions are covered up to $25,000 for age under 69 years and a coverage of $2,500 for age of 70-79.

Diplomat America Insurance Pre-existing exclusion

- This plan is for Non Us citizens and Non US residents visiting the US.

- Covers pre-Existing condition exclusion: 24 Months prior to the start date of coverage

Visit USA Insurance Acute onset of Pre-existing condition coverage

$50,000 - $250,000

- Visit USA Insurance is an excellent medical insurance for tourists and holiday travelers, parents of students studying in the United States, new immigrants and visiting scholars in the USA.

- Visit USA offers 3 plans to satify your requirements and budget.

- Covers Acute onset pre-Existing condition up to Ages 65 and above: $2,500 ; All others: $20,000(excludes chronic and congenital conditions)

INF Elite Insurance Full Pre-existing condition coverage

$150,000 - $1,000,000

- There is a minimum purchase of 90 days required to buy this plan.

- This plan is available for Non-US Citizens.

- Anyone visiting USA or Canada can enroll in this plan.

- Elite plan with policy maximum $150,000 covers pre-existing condition coverage up to $25,000 maximum with deductible $1,500 for age 0 to 69 years and for policy maximum $75,000 covers pre-existing condition coverage up to $20,000 maximum with deductible $1,500 for age 70 to 99 years.

INF Elite Plan Travel Insurance Brochure Links

- Description document age 0-69

- Description document age 70-99

INF Premier Plus Insurance Full Pre-existing condition coverage

$150,000 - $300,000

- Covers Preventive & maintenance care and coverage for full body physicals. Coverage for TDAP, Flu, etc Vaccines

- Pre-Existing complications from Covid-19 covered.

INF Elite 90 Insurance Full Pre-existing condition coverage

- Covers 90% of eligible medical expenses

INF Elite 90 Plan Travel Insurance Brochure Links

Inf premier insurance full pre-existing condition coverage.

- This plan is available for Non-US Citizens & Anyone visiting USA or Canada can enroll in this plan

- Premier plan provides policy maximum $100,000 covers pre-existing condition maximum of $20,000/$40,000 with deductible $1,000/$5000, policy maximum $150,000 covers pre-existing condition maximum of $30,000/$60,000 with deductible $1,000/$5,000 and policy maximum $300,000 covers pre-existing condition maximum of $50,000/$100,000 with deductible $1,000/$5,000 for age 0 to 69 years.

- For age 70 to 99 years for policy maximum $100,000 covers pre-existing condition maximum of $15,000/$25,000 with deductible $1,000/$5,000.

INF Premier insurance brochures

- Covers preventive & maintenance care

- Coverage for TDAP, Flu, etc Vaccines

- Premier Plus plan provides policy maximum $300,000 covers pre-existing condition maximum of $50,000/$100,000 with deductible $1,000/$5,000 for age 0 to 69 years.

INF Premier Plus Insurance brochures

Full pre-existing condition coverage.