At Morgan Stanley, we lead with exceptional ideas. Across all our businesses, we offer keen insight on today's most critical issues.

Personal Finance

Learn from our industry leaders about how to manage your wealth and help meet your personal financial goals.

Market Trends

From volatility and geopolitics to economic trends and investment outlooks, stay informed on the key developments shaping today's markets.

Technology & Disruption

Whether it’s hardware, software or age-old businesses, everything today is ripe for disruption. Stay abreast of the latest trends and developments.

Sustainability

Our insightful research, advisory and investing capabilities give us unique and broad perspective on sustainability topics.

Diversity & Inclusion

Multicultural and women entrepreneurs are the cutting-edge leaders of businesses that power markets. Hear their stories and learn about how they are redefining the terms of success.

Wealth Management

Investment Banking & Capital Markets

Sales & Trading

Investment Management

Morgan Stanley at Work

Sustainable Investing

Inclusive Ventures Group

Morgan Stanley helps people, institutions and governments raise, manage and distribute the capital they need to achieve their goals.

We help people, businesses and institutions build, preserve and manage wealth so they can pursue their financial goals.

We have global expertise in market analysis and in advisory and capital-raising services for corporations, institutions and governments.

Global institutions, leading hedge funds and industry innovators turn to Morgan Stanley for sales, trading and market-making services.

We offer timely, integrated analysis of companies, sectors, markets and economies, helping clients with their most critical decisions.

We deliver active investment strategies across public and private markets and custom solutions to institutional and individual investors.

We provide comprehensive workplace financial solutions for organizations and their employees, combining personalized advice with modern technology.

We offer scalable investment products, foster innovative solutions and provide actionable insights across sustainability issues.

From our startup lab to our cutting-edge research, we broaden access to capital for diverse entrepreneurs and spotlight their success.

Core Values

Giving Back

Sponsorships

Since our founding in 1935, Morgan Stanley has consistently delivered first-class business in a first-class way. Underpinning all that we do are five core values.

Everything we do at Morgan Stanley is guided by our five core values: Do the right thing, put clients first, lead with exceptional ideas, commit to diversity and inclusion, and give back.

Morgan Stanley leadership is dedicated to conducting first-class business in a first-class way. Our board of directors and senior executives hold the belief that capital can and should benefit all of society.

From our origins as a small Wall Street partnership to becoming a global firm of more than 80,000 employees today, Morgan Stanley has been committed to clients and communities for 87 years.

The global presence that Morgan Stanley maintains is key to our clients' success, giving us keen insight across regions and markets, and allowing us to make a difference around the world.

Morgan Stanley is differentiated by the caliber of our diverse team. Our culture of access and inclusion has built our legacy and shapes our future, helping to strengthen our business and bring value to clients.

Our firm's commitment to sustainability informs our operations, governance, risk management, diversity efforts, philanthropy and research.

At Morgan Stanley, giving back is a core value—a central part of our culture globally. We live that commitment through long-lasting partnerships, community-based delivery and engaging our best asset—Morgan Stanley employees.

As a global financial services firm, Morgan Stanley is committed to technological innovation. We rely on our technologists around the world to create leading-edge, secure platforms for all our businesses.

At Morgan Stanley, we believe creating a more equitable society begins with investing in access, knowledge and resources to foster potential for all. We are committed to supporting the next generation of leaders and ensuring that they reflect the diversity of the world they inherit.

Why Morgan Stanley

How We Can Help

Building a Future We Believe In

Get Started

Stay in the Know

For 88 years, we’ve had a passion for what’s possible. We leverage the full resources of our firm to help individuals, families and institutions reach their financial goals.

At Morgan Stanley, we focus the expertise of the entire firm—our advice, data, strategies and insights—on creating solutions for our clients, large and small.

We have the experience and agility to partner with clients from individual investors to global CEOs. See how we can help you work toward your goals—even as they evolve over years or generations.

At Morgan Stanley, we put our beliefs to work. We lead with exceptional ideas, prioritize diversity and inclusion and find meaningful ways to give back—all to contribute to a future that benefits our clients and communities.

Meet one of our Financial Advisors and see how we can help you.

Get the latest insights, analyses and market trends in our newsletter, podcasts and videos.

- Opportunities

- Technology Professionals

Experienced Financial Advisors

We believe our greatest asset is our people. We value our commitment to diverse perspectives and a culture of inclusion across the firm. Discover who we are and the right opportunity for you.

Students & Graduates

A career at Morgan Stanley means belonging to an ideas-driven culture that embraces new perspectives to solve complex problems. See how you can make meaningful contributions as a student or recent graduate at Morgan Stanley.

Experienced Professionals

At Morgan Stanley, you’ll find trusted colleagues, committed mentors and a culture that values diverse perspectives, individual intellect and cross-collaboration. See how you can continue your career journey at Morgan Stanley.

At Morgan Stanley, our premier brand, robust resources and market leadership can offer you a new opportunity to grow your practice and continue to fulfill on your commitment to deliver tailored wealth management advice that helps your clients reach their financial goals.

- Dec 21, 2022

2023 Outlook: Business Travel Bounces Back

Corporate travel budgets are recovering to pre-covid levels, our new survey finds. see where companies are spending in the year ahead..

After grinding to a near halt during the COVID-19 pandemic, business trips—and profits for hotels and airlines catering to higher-paying corporate clients—are bouncing back even beyond pre-pandemic levels, per a recent survey from Morgan Stanley Research.

Despite higher airfares and room rates, the survey of 100 global corporate travel managers found that many respondents believe their company's travel expenditures are already back to pre-pandemic levels and will continue to grow. The biggest demand is coming from small companies, which means lower-cost airlines may benefit the more than their bigger peers.

“Travel budgets are expected to see a noticeable improvement in 2022, with 2023 nearly back to ‘normal,’” says Ravi Shanker, an equity analyst covering North American transportation. “Most interesting is that nearly half of the respondents expect 2023 budgets to increase versus 2019 overall. And of those that expect an increase in budgets, the majority believe 2023 budgets will be between 6% to 10% higher than 2019.”

Overall travel budgets show an improvement over previous surveys, with 2023 budgets expected to be 98% of 2019 levels on average.

Survey Highlights

- Smaller companies lead demand for corporate travel. More than two-thirds (68%) of companies with under $1 billion in annual revenue expect travel budgets to increase next year, versus just 41% of companies with annual revenues over $16 billion. Similarly, 32% of smaller companies said travel budgets had returned to pre-pandemic levels compared with 23% of big firms. “This trend could likely favor low-cost carriers, as smaller enterprises tend to be more localized and require less long-haul travel,” says Shanker. “However, the legacy carriers with strong corporate exposure should see gains as well.”

Nearly a quarter of both large and small companies say their firms are already back to pre-COVID travel levels, and 34% anticipate a full recovery by the end of 2023.

ESG Rate of Change

Holiday budgets hit by inflation, seeing a peak for food prices.

- Airfares are higher, but that’s not a drag on bookings. On average, corporate airfares are expected to be about 9% higher than pre-pandemic prices. “Clearly the expected increase in corporate airfares is not having a major impact on corporate travel as passenger volume is expected to be basically flat versus 2019,” says Shanker.

- Room rates will continue to rise, though not as fast as they have recently. As of this October, market room rates had spiked 20% to 25% over 2019. Next year they will rise even more, though by an average of just 8%, say respondents (9% in the U.S. and U.K.; 5% to 6% in Latin America, Asia and Africa).

- Hotels face economic and competitive headwinds. While overall travel budgets are growing, companies are cutting costs by trading down when it comes to accommodations. (Historically, budget hotels outperform upscale lodging in tough economic times.) Alternative sources of accommodation also threaten traditional hotels, with 31% of respondents saying they intend to use short-term rental services in the next year.

- Virtual meetings aren’t going away. Almost 18% of corporate travel will be replaced with virtual meetings, falling slightly to 17% in 2024, suggesting a degree of permanence in the shift with companies recognizing the benefits of virtual meetings ranging from cost savings to lower carbon footprints. Expect companies providing collaboration software to gain from this shift.

For more Morgan Stanley Research insights and analysis on global travel, ask your Morgan Stanley representative or Financial Advisor for the full reports, “Global Corporate Travel Survey: Snapping Back" (Nov. 8, 2022) and “Global Corporate Travel Survey: 2023 Travel Budgets Nearly Back to 2019 Levels, but ~20% of Meetings Could Still Shift to Virtual” (Nov. 8. 2022). Morgan Stanley Research clients can access the reports directly here and here . Plus more Ideas from Morgan Stanley’s thought leaders.

Sign up to get Morgan Stanley Ideas delivered to your inbox.

*Invalid email address

Thank You for Subscribing!

Would you like to help us improve our coverage of topics that might interest you? Tell us about yourself.

Dividends: A Volatility Shield

Dividend-paying stocks with steady distribution growth can offer outsized contributions to long-term portfolio returns.

Global Outlook: Tech & Beyond

Disruption in connected advertising, a digital-driven economic boom in India and more trends in tech, media and telecom.

Building Credit for Immigrants

Wemimo Abbey and Samir Goel present credit solutions for immigrants financially marginalized by America’s credit validation system.

After slow end to 2022, the business travel outlook is turning more positive for 2023

There is a growing sense that lower levels of business flying are here to stay, with many still expecting top executives to set corporate flying reduction targets, driven by cost savings, changing travel habits and sustainability needs.

Messaging regarding the recovery of the business travel segment remains mixed.

Since the onset of the COVID-19 pandemic, a number of the industry's leading voices have claimed that business travel will never fully recover due to changing working habits - namely, remote working and digital nomadism; company cost reduction; and a growing awareness of environmental issues.

Indeed, international business travel has been recovering at a much slower rate than leisure tourism.

- Recovery in business travel slowed in 2H2022, but a rapid recovery is expected for 2023.

- Confidence in business travel has nearly fully recovered to pre-pandemic levels.

- Suppliers are highly optimistic about the outlook for business travel, with expectations of increased spending by corporate customers.

- Customer meetings and new business prospects are expected to drive business travel investment.

- The recovery in US business travel spending has been driven by increased prices for airfares, car rentals, and accommodation.

- COVID-19 has brought changes to the demand for business travel, including hybrid and remote working arrangements, additional layers of corporate travel approvals, and sustainability considerations.

- Recovery in business travel slowed in 2H2022...but rapid recovery is expected for 2023.

- Confidence in business travel nearly fully recovered to the levels from before the COVID-19 pandemic.

- Suppliers are highly optimistic about the outlook for business travel; higher spend trend echoed by travel buyers and procurement professionals.

- Customer meetings and new business prospects to hold weight of business travel investment.

- A large part of the recovery in US business travel spending has been due to the growth of prices - such as for airfares, car rentals and accommodation.

- COVID-19 has produced a range of changes that have modified the landscape of demand for business travel globally.

- Hybrid and remote working arrangements have persisted for a large proportion of workforces globally.

- Additional layers of corporate travel approvals and duty of care arrangements introduced during the pandemic have proved stubborn to remove.

- Sustainability considerations are also weighing much more heavily on travel activity.

Recovery in business travel slowed in 2H2022...

The global recovery in business travel experienced a pause over much of 2H2022.

After a rapid bounce-back of business travel during 1H2022, the expectation had largely been that the sector would have a continued, if steady, recovery over the second half of the year. However, in the face of rising travel costs due to inflationary pressures, airline operational chaos across multiple regions, and wider concerns about the macroeconomic outlook - businesses revised their plans and travel and budgets were largely static.

This was clearly evident when listening to comments from some of the leading airlines in the US , where business travel recovery had been strong.

In early Dec-2022 United Airlines CEO Scott Kirby stated that business travel had "plateaued" in late 2022, adding that this was "indicative of pre-recessionary behaviour". Delta Air Lines President Glen Hauenstein reported at the start of Jan-2023 that corporate travel demand had been "steady" over 4Q2022, with domestic corporate sales recovering to 80% of 4Q2019 levels.

Alaska Airlines CEO Ben Minicucci reported that large Silicon Valley technology companies had largely "turned off" business travel in late 2022.

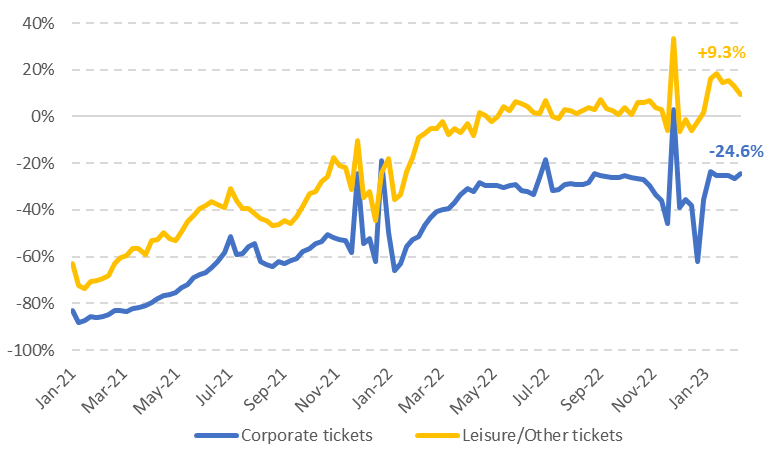

Airlines Reporting Corporation : US corporate and leisure ticket bookings (percentage vs 2019), 2021-2023

Source: Airlines Reporting Corporation .

...but rapid recovery expected for 2023

Despite the recent slowing performance, there is an increasing undercurrent of positive expectations for business travel for 2023.

Airlines, corporate travel management organisations, travel agencies and business travel associations are now pointing to a rapid recovery for 2023, particularly when it comes to business spending.

Global forward-ticketing data from Forward Keys indicates that after a slowing in business ticket sales over 2H2022, forward sales indicate that corporate air travel is due to accelerate through the early part of 2023.

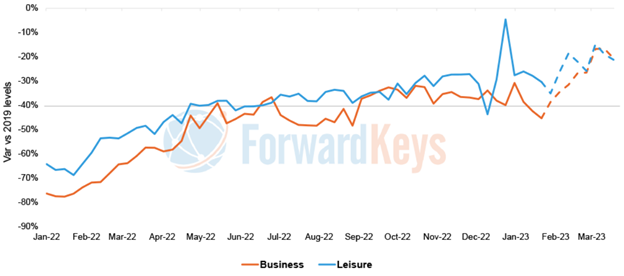

ForwardKeys: forward business and leisure air ticket data, 2022-2023

Source: ForwardKeys.

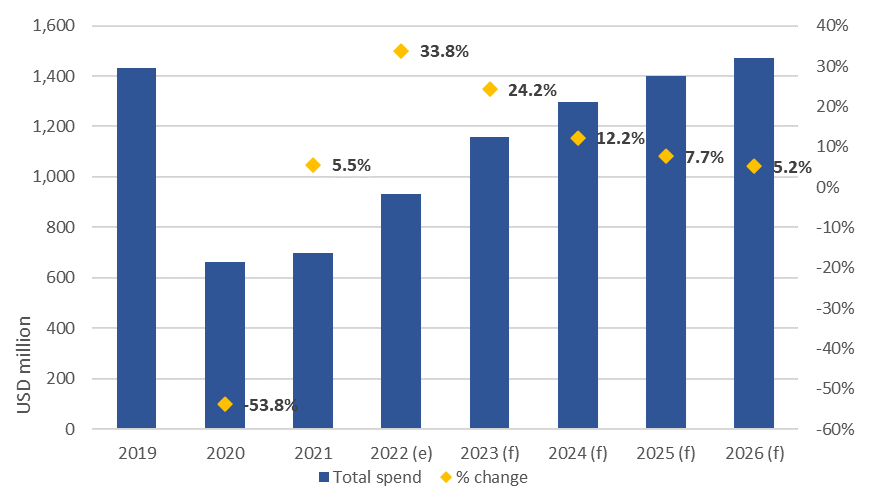

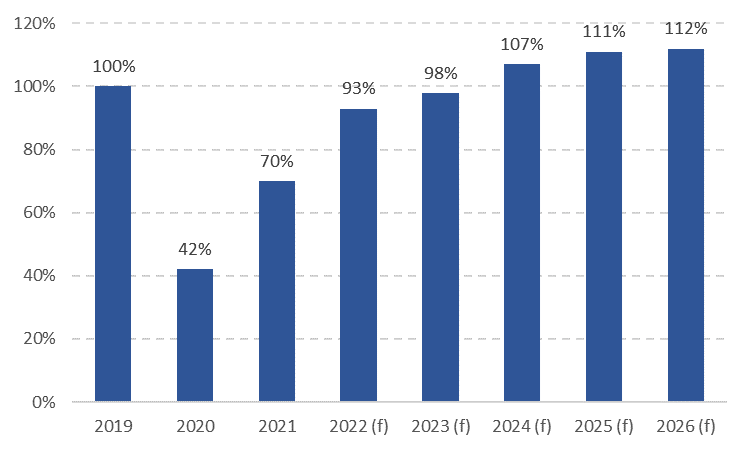

The Global Business Travel Association (GNTA) projects global business travel spending of just under USD1.2 trillion in 2023.

While this is still down, around USD273 billion down on 2019 levels (-19.1%), the outlook is for overall spending to increase 24.2% year-on-year for 2023.

GBTA : business travel spending outlook, 2019-2026

Source: Global Business Travel Association .

Confidence in business travel nearly fully recovered to levels before the pandemic

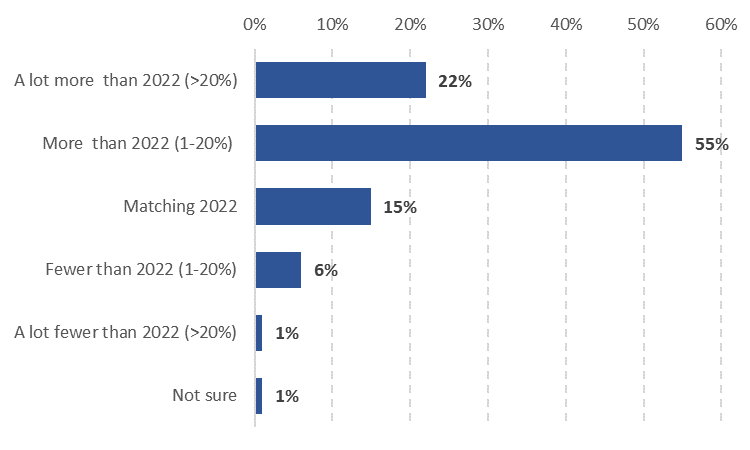

GBTA 's Business Travel Outlook Poll for 1Q2023 found expectations for business travel in 2023, with confidence nearly fully recovered to levels before the COVID pandemic.

Of travel buyers - 91% reported that they feel that employees at their company are now either 'somewhat willing' or 'very willing' to travel for work in the current environment.

This is up from just 64% of reported workers who were willing to travel in Feb-2022, and 86% in Oct-2022.

According to GBTA 's polling, 78% travel managers globally expect their companies will engage in more business travel in 2023.

Expectations about travel volumes increases are almost uniform between the North America , Latin America , Europe and the Asia Pacific regions.

Just 7% of travel managers expect reduced travel.

Reduced travel expectations are lowest with travel managers in North America (6%) and the Asia Pacific (7%), and higher with managers in Europe (10%) and Latin America (13%).

Travel buyer/procurement: professional expectations for 2023 business travel volumes

More travel suppliers expect increased spending on travel by their corporate customers

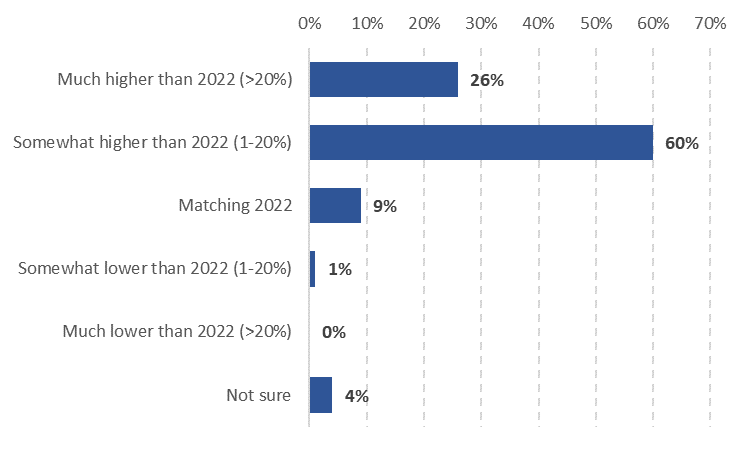

Further to this, GBTA 's data shows that 86% of travel suppliers expect spending on travel by their corporate customers will increase in 2023 - up from 80% in the association's Oct-2022 survey.

This confidence is high, regardless of region - all travel suppliers surveys in the Asia Pacific expect spending to be somewhat or much higher than it was in 2022, followed by 91% in Latin America , 90% in Europe and 85% in North America .

Just 1% expect reduced spending by corporate customers.

Travel supplier/travel management company: expectations for 2023 business travel spending

Suppliers are also highly optimistic about the outlook for business travel.

According to GBTA polling, 24% report feeling 'very optimistic' about the industry's path to recovery, and 65% are optimistic. Just 3% report they are pessimistic about the outlook.

Travel suppliers expectations about higher spend are echoed by travel buyers and procurement professionals. Of those polled, 46% expect a higher budget for travel programmes for 2023 when compared to 2022, while 41% expect budgets will be about the same as the previous year.

Customer meetings and new business prospects to hold weight of business travel investment

The key area for business travel spending in 2023 is expected to be for trips for sales staff or account managers to meet with customers or new business prospects.

On average, travel managers estimate that their companies will allocate 28% of their travel spend for these purposes in 2023. This is followed by spending on trips for internal company meetings (19%) and spending on attending conferences, trade shows and other industry events (18%).

North American business travel to return to close to normal in 2023

The US Travel Association (USTA) project that the volume of business travel by air will recover to around 98% of pre-pandemic levels in 2023, with recovery back above 100% in 2024.

Domestic travel is at or above pre-pandemic levels, but international arrivals are still in recovery mode.

For 2022, inbound arrivals by foreign nationals into the US were down 24% compared to 2109. This was chiefly due to the slow rebound of traffic from the Asia Pacific , as well as some sluggishness in the early part of the year in Europe and parts of Latin America .

As of the start of Feb-2023, arrivals from mainland China were down 97% when compared to 2019, and arrivals from Hong Kong were still down by 80%.

Inbound travel from Japan was down 41.6%, and from Australia it was down 30.4%.

From Europe , UK arrivals were down 18.5%, while arrivals from Italy were still 14.2% below pre-pandemic levels and German arrivals were down 7%. Of the main Latin American markets, arrivals from Brazil were still a third below 2019 levels.

USTA estimates for Dec-2022 were that US business travel spending would be USD97 billion, which was an increase of 3% compared to pre-pandemic levels.

US business travel forecast: volume, percentage of 2019 levels, 2019-2026

Source: US Travel Association.

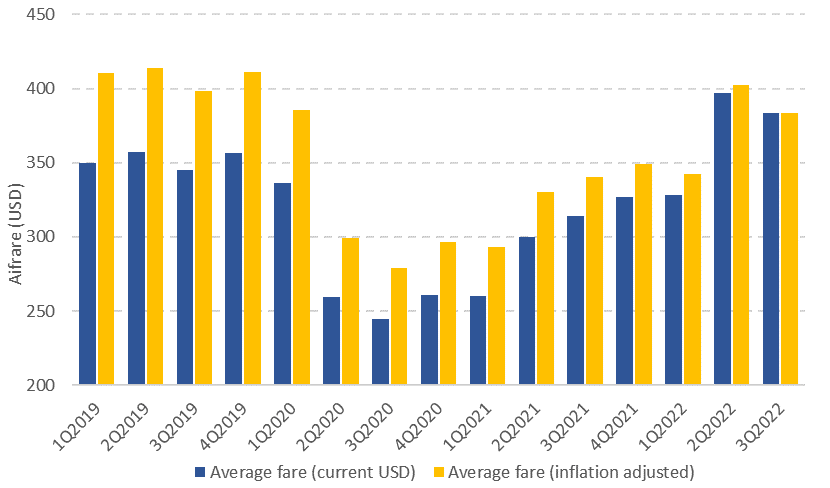

A large part of the recovery in US business travel spending has been due to the growth of prices, such as for airfares, car rentals and accommodation.

According to the USTA, airfares rose 28.5% year-on-year for the full year 2022.

US Bureau of Transport Statistics data shows US domestic fares averaged USD384 in 3Q2022. This is up from an (inflation adjusted) average domestic fare of USD279 in 3Q2020, an increase of 37.4% over the two-year period, and up 12.8% over the past 12 months.

US average domestic round trip airfares, by quarter, 1Q2019- 3Q2022

Source: US Bureau of Transportation Statistics.

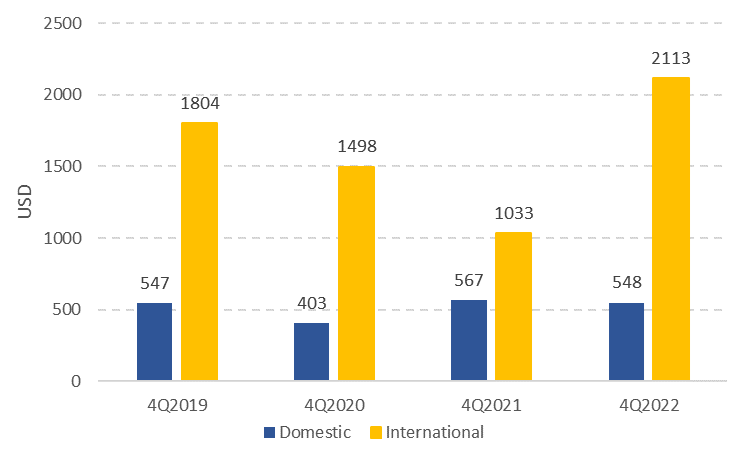

Data from the corporate travel solutions provider Emburse shows that average spend per round trip domestic business travel by air for 4Q2022 was USD548, putting it just ahead of 4Q2019 levels.

Spend per round trip on international business travel was significantly higher: USD2113 in 4Q2022, vs USD1804 in 4Q2019 (an increase of 17.1%).

Domestic and international air travel: average spend per round trip, 4Q2019-4Q2022

Source: Emburse.

New hope for full recovery in 2023

COVID-19 has produced a range of changes that have altered the landscape of demand for business travel globally - some of which have slowed the recovery, and others that are contributing to business travel coming back, albeit in modified form or with higher spending.

Hybrid and remote working arrangements have persisted for a large proportion of workforces globally, cutting into historical business travel volumes, while at the same time creating greater demand for 'bleisure' travel.

Although video conferencing technology became ubiquitous during the pandemic, enterprises continue to report strong demand for face-to-face meetings, particularly given the uncertainties in global supply chains and the need to train new staff working from remote locations.

Additional layers of corporate travel approvals and duty of care arrangements introduced during the pandemic have proved stubborn to remove - particularly in large corporations. The response has been to consolidate multiple smaller business trips into larger - and often more costly - single trips.

In this same vein, sustainability considerations are also weighing much more heavily on travel activity, but businesses have also shown greater willingness to spend money to be good corporate citizens and offset the impact of their travel.

Despite the structural trends and concerns about an economic slowdown in developed economies, business travel has renewed its upwards trend.

Although the recovery is happening more slowly than expected, and is still well below where most airlines would like it to be, there is renewed confidence in the recovery outlook for 2023.

Want More Analysis Like This?

- Serviced Accommodation Guide 2023

- TMC Guide 2023

- The Knowledge

- Speaking Out

- Talking Travel

- Diary of a CTO

- Accommodation

- Sustainability Specialists

- Business Travel People Awards 2023

- Events calendar

- Business Travel People Awards

- People Awards: Meet the winners

- Destinations

- Latest issues

2023 Global Business Travel Forecast

The price of flights, hotels, ground transportation, and meetings and events will continue to rise this year and next, says a report from CWT and the GBTA

Global travel prices will continue to rise significantly in the remaining months of 2022 and throughout 2023, according to a report out today from CWT and the GBTA.

The price of meetings and events is expected to climb particularly sharply this year, while air fares and hotel rates are also being pushed up, driven by soaring fuel prices, staff shortages and inflationary pressures in raw material costs.

According to the 2023 Global Business Travel Forecast, prices will continue to rise next year but not at such a dramatic rate.

“Demand for business travel and meetings is back with a vengeance, of that there is absolutely no doubt,” said Patrick Andersen, CWT Chief Executive Officer.

“Labour shortages across the travel and hospitality industry, rising raw material prices, and greater awareness for responsible travel are all having an impact on services, but predicted pricing is, on the whole, on par with 2019.”

The report says the main forces exerting pressure on the economy and the business travel industry are Russia’s invasion of Ukraine, other geopolitical uncertainties, inflationary pressures, and the risk of further Covid outbreaks that could restrict business travel.

It also highlights that greater visibility at the point of sale for greener travel options, as well as carbon foot-printing and environmental impact assessment, as an opportunity for the travel industry to actively assist in responsible choice-making.

Meetings and events

The cost-per-attendee for meetings and events in 2022 is expected to be around 25% higher than 2019 and is forecast to rise by a further 7% in 2023.

Alongside pent-up demand, corporate events are now competing with many other types of events that were cancelled in 2020.

Demand is also being fuelled by the move to remote working, which means companies are now booking meeting spaces when staff gather in person.

Shorter lead times for events, varying from one to three months versus six to 12 months, are also contributing to this perfect storm, perhaps underscored by corporate concerns that the situation they face today could change very rapidly.

Air fares are expected to rise 48.5% in 2022 compared to 2021, but even with this steep price increase prices are expected to remain below pre-pandemic levels until 2023.

Following an increase of 48.5% in 2022, prices are expected to rise 8.4% in 2023.

Premium class tickets comprised over 7% of all tickets purchased in 2019. The share of premium class tickets fell to 6.5% in 2020 and to 4.5% in 2021 but have started to rise in 2022.

Through the first half of the year, premium tickets made up 6.2% of all tickets purchased.

The report says following two years of minimal to no expenditure, business travellers are likely to be willing to spend more on tickets, especially as availability reduces due to labour shortages.

Hotel rates

Hotel prices fell 13.3% in 2020 from 2019 and a further 9.5% in 2021, however the report expects them to rise 18.5% in 2022 followed by an 8.2% lift in 2023.

Hotel prices have already eclipsed 2019 levels in some areas such as Europe, the Middle East & Africa and North America and are expected do so globally by 2023.

Hotel rates have risen sharply in parts of the world including a 22% rise in North America – and a forecast 31.8% across Europe, the Middle East & Africa – driven by an accelerated recovery coupled with continued capacity constraints.

Hotel rate increases were initially driven by strong leisure travel in 2021 but group travel for corporate meetings and events is improving and transient business travel is similarly gaining healthy pace, putting further pressure on average daily hotel rates.

Ground transportation

Global car rental prices fell 2.5% in 2020 from 2019, before rising 5.1% in 2021.

Prices are expected to increase 7.3% in 2022, hitting new highs, and rise a further 6.8% in 2023.

The vehicle industry remains capacity constrained and rental agencies that reduced fleet sizes in the wake of the pandemic have not yet fully recovered – due in part to component shortages and supply chain disruptions that have reduced global auto production.

Rental agencies have reverted to buying used vehicles to increase fleet sizes and are keeping their vehicles longer.

Some agencies are also buying vehicles from auto-makers outside of their historically supported brands.

Skyrocketing prices, vehicle shortages and the need for visibility into carbon emissions from door-to-door are driving corporate travel managers to factor ground transport into full trip planning from the beginning.

* The 2023 Global Business Travel Forecast uses anonymised data generated by CWT and GBTA , with publicly available industry information, and econometric and statistical modelling developed by the Avrio Institute .

EDITOR'S CHOICE

Team tactics, paying the price, work and play, sustainability trends, more than a magazine.

For everyone involved in booking, buying, managing or arranging business travel and meetings.

OTHER TITLES

The Business Travel Magazine is published by BMI Publishing Ltd: 501 The Residence, No. 1 Alexandra Terrace, Guildford, GU1 3DA. Tel: 020 8649 7233

© BMI Publishing Plugged In Media

Advertisement

Supported by

Business Travel’s Rebound Is Being Hit by a Slowing Economy

By the early fall, domestic business travel was back up to nearly two-thirds of its prepandemic level. But companies have now begun to cut back.

- Share full article

By Jane L. Levere

Business travel came back this year more strongly than most industry analysts had predicted in the depths of the pandemic, with domestic travel rebounding by this fall to about two-thirds of the 2019 level.

But in recent weeks, it appears to have hit a new hurdle — companies tightening their spending in a slowing economy.

Henry Harteveldt, a travel industry analyst for Atmosphere Research, said that corporate travel managers have told him in the last few weeks that companies have started to ban nonessential business travel and increase the number of executives needed to approve employee trips. He said he was now predicting that corporate travel would soften slightly for the rest of the year and probably remain tepid into the first quarter of 2023.

Mr. Harteveldt also said his conversations led him to believe that business travel would “come in below the levels airline executives discussed in their third-quarter earnings calls.”

Airlines were bullish on those earnings calls, a little over a month ago. Delta Air Lines, for one, said 90 percent of its corporate accounts “expect their travel to stay the same or increase” in the fourth quarter. United Airlines, too, said its strong third-quarter results suggested “durable trends for air travel demand that are more than fully offsetting any economic headwinds.”

Hotels, too, were optimistic. Christopher J. Nassetta, president and chief executive of Hilton, said on his earnings call that overall occupancy rates had reached more than 73 percent in the third quarter, with business travel showing growing strength.

The change in mood has come as the economy has more visibly slowed. Technology companies, in particular, have been announcing significant layoffs. Housing lenders have also been reducing staff, as rising mortgage rates cut into their business.

The travel industry has long relied on business travel for both its consistency and profitability, with companies often willing to spend more than leisure travelers. When the pandemic almost completely halted business travel in 2020, people were forced to meet via teleconference, and many analysts predicted that the industry would never fully recover.

But business travel did come back. As the economy reopened, companies realized that in-person meetings serve a purpose. In a survey taken in late September by the Global Business Travel Association, a trade group, corporate travel managers estimated that their employers’ business travel volume in their home countries was back up to 63 percent of prepandemic levels, and international business travel was at 50 percent of those levels.

One reason international business travel has not come back as strongly, Mr. Harteveldt said, is that some employers have imposed restrictions on high-priced business-class airline tickets for long-haul flights. He said employers are instead requiring travelers to take a cheaper connecting flight or to fly nonstop in premium economy or regular economy class.

“Travelers are telling managers they won’t fly long-haul in economy if they have to go directly to a meeting when they arrive,” Mr. Harteveldt said.

What will business travel look like in the next year?

Pandemic travel restrictions will probably play less of a role. A survey by Tourism Economics, U.S. Travel Association and J.D. Power released in October found that 42 percent of corporate executives had policies in place restricting business travel because of the pandemic, down from 50 percent in the second quarter. Over half expected pandemic-related business travel policies to be re-evaluated in the first half of 2023.

With Americans able to work remotely, many are combining professional and leisure travel, airline and hotel executives said on recent earnings calls. That was a big reason travel did not drop off in September, when the peak vacation period ended, as it used to in years past.

Jan Freitag, national director for hospitality market analytics at CoStar Group, said hotel occupancy by business travelers currently varies by market, with occupancies high in markets like Nashville, Miami and Tampa, Fla. — places where business travelers may well be taking “bleisure” trips. But hotel occupancies by business travelers are low in markets like Minneapolis, San Francisco and Houston.

Mr. Freitag said the lower hotel occupancies in some cities may reflect a lower return-to-office rate in those places, which reduces the ability to have in-person business meetings.

Mr. Freitag said he was “very bullish on group travel, trips for meetings, association events, to build internal culture.” Those trips will recover more quickly, he predicted, than individual business travel.

“It’s all about building relationships,” he said. “It’s very hard to do that online.”

On the other hand, short business meetings and employee training sessions may continue to be conducted online, which is less expensive than in person, said Grant Caplan, president of Procurigence, a consulting firm in Houston that advises companies on their spending for business travel, meetings and events.

Even as business travel has resumed, hotels, airlines and airports still have inadequate staffing. A survey of hoteliers by the American Hotel and Lodging Association, a trade group, released in October found that 87 percent of respondents were experiencing staffing shortages. Although that was an improvement over May , when 97 percent of respondents said they were short-staffed, the current findings do not bode well for smooth hotel stays.

Disruptions in flying, particularly in the United States and Europe — because of weather delays, inadequate flight crews or air traffic control and security issues at airports — have been notoriously high, particularly earlier this year.

Although “we can’t say that these disruptions have discouraged business travel, they have clearly complicated” the experience for travelers, said Kathy Bedell, senior vice president of the Americas and affiliate program for BCD Travel, a travel management company.

Kellie Kessler, a pharmaceutical clinical researcher in Raleigh, N.C., said the travel disruptions she faced this year were too much. She changed jobs recently to take one that requires her to travel on business 10 percent of the time, compared with 80 percent in her previous position.

“The reason I took a nontravel position is that I can count on one hand the number of on-time flights I had this year,” she said.

And flight disruptions have led to a decline in some road warriors’ loyalty to airlines, even those who have accrued elite status in the carriers’ frequent-flier programs.

“The disruptions overall have caused me to be less loyal to any one airline,” said Trey Thriffiley, chief executive of QIS Aviation Group a consulting company in Savannah, Ga., that advises individuals and companies about their use of private jets. He is also an elite member of the loyalty programs at Delta, United and American Airlines. “Instead of searching by preferred airline or even cheapest price,” he said, “I search for direct flights or connecting flights to cities closest to where I live that I can drive home from if I need to.”

Airlines’ bullish forecasts notwithstanding, some experts find prospects for business travel this fall and next year extremely murky.

They say they cannot accurately predict how strong business travel will be and what airfares and hotel room rates will look like because of many unknowns, including the duration of the war in Ukraine and its impact on the European and global economies; increasing gasoline and jet fuel prices; and rising inflation, recession fears and political uncertainty.

Mr. Harteveldt, the travel industry analyst, said the recovery of business travel varies by geographic region, with the United States rebounding faster than Europe.

He said the Chinese government could be using its reopening strategy “in a geopolitical way,” adding, “If a country is more friendly, China will grant access to that country’s business and leisure travelers rather than to travelers from countries with which China has greater political differences.”

He predicted that 2023 would be a “difficult year” for business travel unless the war in Ukraine “comes to an abrupt end and there is more certainty about oil and the price of jet fuel.” Also a factor, he said, could be decisions by companies that may have added too much staff during the pandemic to save money by reducing business travel rather than by laying people off.

“If there’s a symbol that can be used to describe the outlook for business travel in 2023, it’s a question mark,” he said. “No airline, travel management company or travel manager can be 100 percent certain what 2023 will bring right now. It’s one of the most confounding, confusing times to be in business travel, perhaps in decades.”

In a report issued in August, Mike Eggleton, director of research and intelligence at BCD Travel, had a similar take on the immediate future for business travel. “Producing a credible travel pricing forecast in the current environment is incredibly difficult,” he wrote. “The near-term travel outlook is more uncertain than ever. Volatility has never been so high and seems likely to persist. There’s vast variation in market performance and outlook.”

Going forward, Ms. Bedell said, perhaps the overriding question about business travel will be whether the trip is necessary.

“Client-facing and revenue-generating travel is taking a priority over internal meetings,” she said.

Business travel strong outlook in 2023 – GBTA

Contributors are not employed, compensated or governed by TD, opinions and statements are from the contributor directly

The last quarter of a calendar year can typically be busy and productive for global business travel and travellers. But in a time when so much isn’t back to being typical, where does the recovery of global business travel stand now? The October 2022 Business Travel Recovery Poll released today by the Global Business Travel Association (GBTA), the world’s premier association serving the business travel industry, unveils the latest insights and sentiments from a survey of almost 600 business travel buyers, suppliers, and other stakeholders around the world. This survey marks the 29 th poll in the GBTA series since the pandemic began to understand the path forward as the industry navigates recovery.

“We continue to see progress as business travel makes its way back to being a $1.4 trillion global industry, pre-pandemic. It is also important to understand the context of global business travel’s recovery. Asia is still opening its borders, international business travel in general started picking up only earlier this year across the globe, and the U.S. has only permitted unrestricted travel since June,” said Suzanne Neufang, CEO, GBTA. “Even as this latest poll shows economic considerations have eclipsed COVID-19 concerns, the industry is showing positive indicators and sentiment for 2023, a strong sign as business travel continues to come back over time,” she said.

Here are some of the key takeaways from the October GBTA Business Travel Recovery Poll:

- On average, travel managers estimate their company’s domestic business travel volume is back to 63% and international business travel is back to 50% of their 2019 pre-pandemic levels. In addition, 26% of respondents estimate their international business travel volume has recovered to more than 70% of their company’s pre-pandemic levels.

- When asked to choose among factors that are more likely to limit business travel next year, 80% of travel suppliers say economic conditions while only 4% cited COVID-19.

- However, 75% of travel buyers surveyed say their company had no immediate plans to limit business travel because of economic concerns. One-third (30%) say their company is unlikely to limit business travel, while 45% say they are taking a wait-and-see approach but are not seriously considering limiting business travel at this point due to economic concerns.

- Currently, 86% of survey respondents say non-essential domestic business travel is sometimes or usually allowed at their company. Additionally, 74% say the same for non-essential international business travel.

- Over three-fourths (78%) of travel managers expect the number of business trips taken by employees at their company will be higher or much higher in 2023 versus 2022.

- Among travel suppliers, 85% expect the number of bookings by corporate clients will be higher or much higher in 2023. Additionally, 80% of suppliers expect travel spendin g by corporate clients will be higher or much higher in 2023 year over year.

- Over 65% of travel managers are optimistic that their company will conduct more internal travel and external travel . Internal travel was defined as meetings with colleagues or working at other company office locations, while external travel examples are trips for sales meetings and conference travel.

Tracking the Business Travel Impact of Remote Work and Blended Travel

GBTA also continues to follow how evolving developments related to the future of work and changing workforces might play out in the global business travel landscape.

- The industry is embracing remote work models (88%), as 68% of respondents say their company has a hybrid approach where employees are expected to report to the office on some days and 20% indicate their company is working “full-time remote.” An additional 12% say they are “full-time in-office.”

- Of those with a hybrid or full-time remote work policy, 72% of respondents do not expect flexibility to work from home will impact the number of business trips taken by their employees. Additionally, 14% expect it will lead to more business travel while an identical percent expect it will lead to less business travel.

- For companies that allow hybrid or fully remote work, 44% say employees are allowed to work for extended periods outside of the city, state, or province where they are typically based. This also includes 22% that even allow employees to work for an extended period outside of their home-base country.

- Some companies even reimburse employees for costs or expenses while working remotely – 27% of respondents say their company does reimburse, while most do not (42%) or leave it to the manager’s discretion (25%).

- Many travel managers report they are seeing a rise in the desire for blended or “bleisure” travel among employees. Two in five travel managers (41%) have seen an increase in employees asking for blended travel, whereby they combine a business trip with a vacation or leisure component.

GBTA: Bookings, spending and optimism on the upswing

Innovating corporate travel programs for their business travellers

Technology plays a vital role in ensuring seamless travel

Global business travel recovery witnesses double-digit surge since February

Since you're here...

...there are many ways you can work with us to advertise your company and connect to your customers. Our team can help you design and create an advertising campaign

We can also organize a real life or digital event for you and find thought leader speakers as well as industry leaders, who could be your potential partners, to join the event. We also run some awards programmes which give you an opportunity to be recognized for your achievements during the year and you can join this as a participant or a sponsor.

Let us help you drive your business forward with a good partnership!

Yes, contact me I want to download the media kit

Comments are closed.

LATEST STORIES

Hamad International Airport commemorates milestone of serving over 50 million passengers in a year

Vivid Sydney reveals groundbreaking 'Tekno Train Experience by Paul Mac'

HBX Group appoints Brendan Brennan as new CFO

United Airlines extends flights between New York and Tenerife into the winter season

Welcome, Login to your account.

Sign in with Google

Powered by wp-glogin.com

Recover your password.

A password will be e-mailed to you.

Welcome back, Log in to your account.

SIGN UP FOR FREE

Be part of our community of seasoned travel and hospitality industry professionals from all over the world.

- LOGIN / SIGN UP

- Middle East

- UK & Europe

- USA & Canada

- Hospitality

- HR & Careers

- Luxury Travel

- MICE (Meetings, Incentives, Conferencing, Exhibitions)

- Travel Tech

- Travel Agents

- Airlines / Airports

- Conferences

- Cruising (Ocean)

- Cruising (River)

- Destination Management (DMC)

- Hotels & Resorts

- Hotel Management Company

- Hotel Technology

- HR / Appointments

- Meetings, Incentives, Conferencing, Exhibitions (MICE)

- Travel Agents (all)

- Travel Technology

- Tourism Boards

- TDM Travel Show

- Industry appointments

- Travel Bloggers

- Podcasts – Features

- How to join

- RSVP Portal

- Event Photos/Videos

- Competitions

- Middle East September 2024

- Thailand October 2024

- Destination NaJomtien BanAmphur BangSaray *NEW*

- จุดหมายปลายทาง นาจอมเทียน หาดบ้านอำเภอ บางเสร่ *NEW*

- South Australia Reward Wonders *NEW*

- Ponant Yacht Cruises and Expeditions

- Encore Tickets (Chinese Guide)

- Affordable Luxury in Thailand by Centara Hotels

- Rising Above the Oridinary by Conrad Bangkok

- The Best of Thailand

- Who is IWTA

- Philippines

- Recommend Someone

- Recommend yourself

- IWTA Awards

- TRAVEL CLUB

You are using an outdated browser. Please upgrade your browser to improve your experience and security.

- Strategic Account Management

- Small Business Solutions

- Event Travel

- Resource Travel

- Sport Travel

- Leisure Travel

- The CTM Story

Sustainability

- Business Travel Blog

- Case Studies

- Investor Centre

Local solutions, delivered globally

CTM provides local service solutions to customers around the world. Please select your local region, and start experiencing the CTM difference!

Don’t show this again

18 January 2023

2023 Business Travel Outlook

What a difference 12 months can make in travel. we commence 2023 with a much-welcomed sense of normalcy and familiarity in the travel experience, with traveller confidence, demand, and activity fast returning to pre-pandemic levels. businesses have now shifted their focus away from pandemic travel considerations and towards a more acute focus on regional economic impacts that may influence the form and function of the travel program’s strategy and budget..

As we enter the new year, we welcome the much-anticipated re-opening of China, the ‘final piece of the jigsaw puzzle’ creating a truly reconnected world. We expect China’s re-opening to add critical airline competition in regional and international markets in 2023, putting downward pressure on unsustainably high international airfare prices as extra services and seat capacity extends into the US, European and Australasian markets.

In our 2023 Business Travel Outlook , we share some of the latest global travel industry research alongside Corporate Travel Management (CTM) leaders’ expert insights to explore the key trends impacting travel pricing, technology, and sustainability in 2023 and beyond.

2023 Business Travel Snapshot

One of our key takeaways from the last few years of travel is learning from disruption and how our customers and their travellers continue to evolve, adapt and embrace new opportunities for engagement, collaboration, and growth.

According to research conducted by the Global Business Travel Association ( GBTA ) [1] released in October 2022, “ Economic considerations have eclipsed COVID concerns for the industry, but a majority of companies are not limiting their business travel specifically due to economic concerns.” Despite this shift in focus, the survey showed strong ongoing demand for business travel activity in 2023:

- 75% of Travel Managers said their company had no immediate plans to limit business travel because of economic concerns.

- 78% of Travel Managers expect the number of business trips employees take at their company will be higher or much higher in 2023 versus 2022.

- 80% of travel suppliers expect travel spending by corporate clients will be higher or much higher in 2023 .

- 66% of Travel Managers anticipate that their company will conduct more internal travel (colleague meetings or regional office travel) and 67% expect more non-internal travel (sales meetings/conference travel)in 2023 compared to 2022.

- 72% of respondents do not expect remote/flexible work models to impact the number of business trips their employees take . Additionally, 14% expect it will lead to more business travel .

[1] GBTA business travel recovery poll results – October 2022.

Supplier Snapshot

2023 will be a year of increased airline capacity and resources, improved service offerings, and new routes – better connecting our world. Setting the tone for an exciting year ahead, our teams are already witnessing a broad range of enhancements to supply services and routes across all CTM operating regions, positively impacting how our customers travel.

Australia & New Zealand

- Qantas and Virgin Australia: Announcing additional capacity increases for the end of March/April will see an additional 10% domestic capacity to the market.

- Virgin Australia: Introducing a new direct Cairns to Tokyo service commencing in late June.

- Singapore Airlines: Reintroducing their A380s into Melbourne to operate double daily flights effective mid-May. This will bring their capacity back to 76% of pre-COVID.

- With China reopening , major Chinese carriers will be recommencing flights, with Air China restarting Sydney services in early February with an initial offering of 3 flights per week.

- Emirates: Commencing February, Melbourne will become the second Australian destination to be served with the signature Emirates A380 featuring Premium Economy.

- Hong Kong fully reopened its borders with China on the 8 th of January, allowing 60,000 Hong Kong travellers to enter mainland China daily.

- Air China : Doubling Hong Kong – Bejing flight services from twice to four times per week.

- China Southern: Resuming Hong Kong services to various key China routes commencing from the 12 th of January.

- Cathay Pacific: Cathay Pacific will more than double its flights into the Chinese Mainland, operating 61 return flights per week between Hong Kong and 13 Mainland cities from 14 January 2023.

- Hong Kong Airlines: Plan to hire 1,000 workers and boost its number of flights to reach 75% of its operating capacity by the end of 2023 .

North America

- Delta airlines: Overall flight capacity in 1Q23 is expected to be only 1% down from 2019 levels.

- Airline resourcing: In response to challenges around service resumption, U.S. airlines have employed the most employees in nearly two decades.

- Rebound in air traffic between the S. and China is expected in late 1Q23, subject to government approval.

- American Airlines : Resuming non-stop flights to Shanghai from Dallas Forth Worth twice a week commencing late March.

- United Airlines: Implementing a large expansion of its North Atlantic schedule, including 3 new routes to and from Newark and Malaga, Stockholm, and Dubai. United’s total Trans-Atlantic capacity is expected to be 10% in 2022 and 30% in 2019.

- Air France and KLM: Flight capacity is back to 93% of 2019 levels. New routes are commencing and returning in 1Q23, including Aarhus, Innsbruck, and Salzburg, and increasing flights to China, Hong Kong, and Singapore.

- British Airways: Growth is predicted for North America, where the airline will service 27 U.S. destinations from London commencing in the summer of 2023.

- United Airlines: Increasing their daily flights from 17 to 23 between the UK and North America by the end of 1Q23. This includes a second daily service between Heathrow and Los Angeles and a daily service to Boston.

- Air Canada: Capacity is back to 95% of pre-pandemic levels, including all routes from the UK except services between Heathrow and Ottawa. This service is not likely to return before 2024.

- Lufthansa Group: There is a focus on regional flights, with Bristol-Zurich returning from the 4 th of February and Gatwick-Frankfurt / Belfast-Frankfurt returning on the 23 rd of April 2023. Lufthansa is also rolling out its long-haul product ‘Allegris’ during 2023, which will have a First Class Suite, a new Business Class Suite, and a Premium Economy product.

Business Travel Trends

At CTM, we witness exciting developments in how our customers travel for business and leisure, from their servicing needs and communications channels to technology adoption and content choices. 2023 is set to be no different, with many exciting new trends that will pave the way for more effective, sustainable, and personalised travel solutions in the year ahead.

CTM’s leaders share their insights and views on the key trends shaping travel program development and innovation in the travel industry in 2023.

Technology & Innovation

It is no secret that 2022 presented widespread resourcing challenges across the travel industry, as the rebound in travel activity out-paced recruitment and onboarding of staff across agent and airline service teams, airport services and security, and hoteliers. This challenge provided an opportunity for travel and hospitality businesses to innovate how they provide service to travellers, with advancements in the use of robotics, AI, and automation becoming key drivers to overcoming the industry’s resourcing challenges in 2023 and beyond.

Automation and AI will continue to change and enhance the way travel management companies (TMCs) deliver services and solutions to travellers throughout every step of the travel management experience and for every travel stakeholder. From trip research to travel booking, navigating airport processes, and in-trip experiences, technology can deliver exceptional customer outcomes at greater speeds, with more relevance and heightened personalisation, by automating manual processes. In turn, automation will allow greater capacity for human expertise to focus on managing more complex travel requirements, presenting a win-win-win scenario for travellers, corporate customers, and the travel industry in general.

CTM’s Global Chief Technology Officer, Mike Kubasik, explains how hyper-automation and robotics are transforming the travel and travel management experience:

“Hyper-automation involves the orchestrated use of multiple technologies, tools or platforms such as AI, machine learning, robotic process automation (RPA), integration platforms and low-code/no-code tools, to deliver high-speed outcomes via the users’ choice of service channel – whether that’s email, chat, in-app or phone.

“This type of technology investment behind the scenes will have a significant impact on the front-line traveller and travel arranger experience, as traditional booking and in-trip processes become faster and more relevant for customers. The use of hyper-automation enables us to identify, vet and automate processes, which frees up Travel Advisors’ time to focus on more complex service-related tasks. As advanced automation and AI continue to be built into the booking experience through online booking tools and the tools our Travel Advisors use to make offline bookings and service requests, it will ensure every avenue for booking and trip management is optimised for speed, relevance, and personal preference, all of which support increased customer satisfaction and efficiency.”

2023 will be an important year for sustainability across the travel industry as travel continues to demonstrate its role as a strategic enabler to reaching 2030 sustainability targets. Organisations globally increasingly rely on TMCs to support the delivery of their sustainability objective and targets through sustainable travel solutions.

Business travel can play a positive and important role in supporting businesses to reach their sustainability targets by reducing carbon emissions through the choice of environmentally-focused suppliers and travel options, including rail and electric vehicles, and by promoting sustainable travel practices, such as the use of locally engaged suppliers and enterprises that support community prosperity through employment and local sourcing of materials and products.

CTM’s Global Head of ESG & Sustainability, John Nicholls, explains:

“Social connection is a new travel trend in 2023, and one which requires social health and well-being enhancements across airlines, hoteliers, and car hire, in alignment with the UN Social Development Goals (SDGs). Corporate travel buyers and managers need to embrace local and social connections as part of their sustainability purpose to enhance the prosperity of people and communities.”

In 2023, we can expect to see an increase in collaborative partnerships between corporate clients, TMCs, and supply partners to deliver proactive sustainability benefits, with a continued focus on reducing and/or abating carbon footprints, advancements in the online booking experience to support sustainable travel booking behaviours, and widespread access to sustainable travel data that will support and enhance sustainable travel program development.

There has been much focus recently on developing Sustainable Aviation Fuels (SAF) as a leading solution to reduce airline emissions to meet Net Zero Targets. However, the scope of impact remains constrained by infrastructure, manufacturing and distribution limitations. We expect to see continued SAF investment across industry and airlines in 2023 and beyond, which will need to be coupled with Government support to overcome infrastructure and supply constraints.

Supply & Content

Traveller expectations are increasing, so the traveller experience will be increasingly important in 2023. Suppliers will be seeking to retain and gain new customers not just by simply offering low prices but equally by providing additional value through their services and experiences.

We can expect the airline industry to recover and gain momentum in 2023. The International Air Transport Association (IATA) has predicted that the airline industry could return to profit in 2023 as travel demand continues to build momentum.

The travel experience will continue to be a focal point in 2023, with airports and airlines continuing to navigate traveller expectations and remedy the pain points (cancellations, lost baggage, heightened screening, and security) around the passenger journey.

According to CAPA Centre for Aviation, traveller expectations have created a competitive landscape for airlines where experiences will be key to securing new customers. Travellers will be looking for more – whether that’s the best in-flight experience or premium class services – and will be willing to pay more for those services should they be deemed ‘valuable’.

Personalisation is gaining momentum. Measuring ‘value ’ in hotel programs is no longer just about cost but also the value in demonstrating sustainability practices, knowing unique traveller preferences, and delivering personalised experiences – including additional amenities, welcome gifts, pillow menus, and customised messages.

Hotels are also adapting to the remote worker movement, ensuring their facilities can accommodate co-working spaces, fast Wi-Fi, and meeting spaces, and adopting new technologies to service guests, whether through mobile check-in or virtual concierge chatbots that provide customer service around the clock.

Following meteoric growth in 2022, we expect hotel average daily rates (ADRs) in key markets to stabilise in 2023 as price elasticity increases and capacity and resourcing constraints level out. In markets still recovering from COVID-19, we expect moderate ADR gains in 2023.

Meetings & Events

Many businesses continue adapting to the unique needs, challenges, and opportunities presented by operating a more decentralised workforce. This global shift in workplace environments continues to challenge how businesses and their employees connect and collaborate to drive strategic outcomes. Ultimately, we can expect growing demand for more frequent, small-group, and in-person collaboration between internal and external stakeholders, putting pressure on venues and business services in key hub locations.

Advanced bookings will be key to controlling budgets while maintaining maximum choice and relevance for meetings venues. Additionally, companies and Travel Managers will need to be creative in developing engaging and strategically planned meetings and motivating employees in a more decentralised work environment in 2023.

Event Travel Management (ETM) Global Strategic Lead Tracey Edwards explains:

“ Booking well in advance to meet expectations around the destination and budget will be highly important going into 2023 with the high venue and accommodation demand. We are seeing up to 40% savings on venues when booked more than 6 months in advance. There are, however, more benefits to booking in advance, above and beyond securing availability.

“Equally, exploring opportunities to motivate, connect and reward employees will be key to attracting and retaining employees, from the frequency and style of face-to-face meetings to large group conferences and events. We are seeing an increased demand for incentive travel programs across our customer portfolio as an effective way to reward performance, build connections, and memorable one-in-a-lifetime experiences unique to the company and culture.

“The ability to plan an entire event experience for attendees that makes the most of the chosen destination, building in cultural experiences, meeting sustainability goals and tying back to the purpose of the meeting, incentive or event will also be important.”

In Conclusion

Our travel teams in every region continue to work closely with industry partners, customers, and our employees to ensure our services meet and exceed the needs of tomorrow’s travel environment. As we embark on 2023, we look forward to working with our customers and prospective customers to evolve and elevate their travel programs to embrace the opportunities of the new travel environment and to deliver more effective travel outcomes that drive business success.

Eager to find out more about the 2023 Business Travel Outlook?

Contact our expert travel team today to discuss your travel needs.

Related Articles

2022 Business Travel Landscape

Corporate Travel Management Year in Review – 2022

2022 Business travel insights and trends

Global Travel Outlook for 2023

December 22nd, 2022 at 6:07 AM EST

Today’s edition of Skift’s daily podcast looks at the global outlook for 2023, top TV spenders in the U.S. this year, and Carnival's optimism.

Skift Daily Briefing Podcast

Listen to the day’s top travel stories in under four minutes every weekday.

Good morning from Skift. It’s Thursday, December 22, and here’s what you need to know about the business of travel today.

🎧 Subscribe

Apple Podcasts | Spotify | Overcast | Google Podcasts

Episode Notes

The travel industry is still facing hurdles such as a possible worldwide recession on its path to a full recovery. So what is the state of travel entering 2023? Skift Research delves into the topic and more with its newly published annual outlook for the travel industry, which features global revenue forecasts for sectors including airlines, hotels and cruise lines.

Senior research analyst Seth Borko writes that travel remains a mixed bag heading into the new year, with pent-up demand catapulting the Americas back to 2019 levels while Asia is beginning its recovery. But every region of the globe is seeing potential for growth, Borko adds.

The outlook also includes projections for cross-border trips between 2023 and 2025 as well as a look at how economic uncertainty could affect the travel industry.

Next, rising Covid cases in recent weeks are making some travelers cautious about going on cruises . Still, Carnival believes that’s not deterring consumers from booking cruises, with the company seeing a surge in bookings for 2023 sailings, reports Associate Editor Rashaad Jorden.

Carnival CEO Josh Weinstein didn’t provide any specific booking figures during Wednesday’s earnings call that reported its fiscal fourth quarter ending on November 30. But he said the desire of many travelers to put Covid behind them has contributed significantly to the booking surge. Weinstein added that Carnival posted a record in revenue per diem during the fourth quarter, adding the company placed 90 ships, roughly 35 percent of its fleet, back in service this year. Carnival generated $3.8 billion in revenue during the fourth quarter, which was 80 percent of 2019 levels. However, the company posted a $1.1 billion adjusted net loss.

We end today with a look at the biggest spending travel brands on U.S. TV in 2022 , through November. Airbnb has taken the top spot, reports Executive Editor Dennis Schaal in this week’s Online Travel Briefing.

Airbnb spent roughly $87 million on ads on national TV in the U.S. during the first 11 months of this year, according to TV analytics firm iSpot.tv. Schaal writes that Airbnb’s heavy emphasis on TV ads is not surprising, noting the company has been vocal about preferring brand advertising on TV to search engine marketing.

However, iSpot.tv found that budget hotel brand Choice Hotels has been the most seen travel company on TV throughout the U.S. in 2022. Choice Hotels ran 139 more ads in the first 11 months of this year compared to the same period in 2021.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: advertising , carnival , marketing , skift podcast , skift research

- Stand Up for Free Enterprise

The State of the Travel Industry in 2023: Current Trends and Future Outlook

Kentucky chamber ceo: we must protect the free enterprise system, how franchising can help fuel the american dream, microsoft president: responsible ai development can drive innovation, suzanne clark's 2024 state of american business remarks, rhythms of success: the free enterprise tune of a small business.

January 12, 2023

Featured Guest

Tony Capuano CEO, Marriott International, Inc.

Chip Rogers President & CEO, American Hotel & Lodging Association (AHLA)

As COVID-19 restrictions have continued to ease, the travel and hospitality industries have seen a resurgence in customers. Companies like Marriott have seen percentage increases in revenue and rate, even topping pre-pandemic levels.

During the U.S. Chamber of Commerce’s 2023 State of American Business event, Chip Rogers, President and CEO of the American Hotel and Lodging Association , and Tony Capuano, CEO of Marriott International, Inc. , sat down for a fireside chat. Read on for their insights on the post-COVID state of the travel industry, a shifting customer base, and the outlook for 2023 and beyond.

2022 Demonstrated the Power and Resilience of Travel

After declines amid the pandemic, 2022 brought about a positive recovery for the travel industry.

“[2022] reminded us of the power and resilience of travel,” said Capuano. “If you look at the forward bookings through the holiday season, [you’ll see] really strong and compelling numbers … so we’re really encouraged.”

“The only caveat I would give you about that optimism is, as you know, the booking windows are much shorter than we’ve seen them in a pre-pandemic world,” he added. “So those trends can change more quickly than we’re accustomed to."

The ‘Regular’ Customer Segments Are Shifting

At the start of pandemic recovery, industry leaders believed leisure travel would lead travel recovery, with business travel closely behind and group travel at a distant third, according to Capuano. While some of those predictions have held, others have shifted.

“Leisure [travel] continues to be exceedingly strong, and group [travel] has surprised to the upside,” he explained. “Business travel is perhaps the tortoise in this ‘Tortoise and the Hare,’ slow-and-steady recovery.”

However, Capuano noted customer segments are becoming less and less strictly defined.

“[There’s] this trend we've seen emerge over the pandemic of blended trip purpose … [where] more and more folks are combining leisure and business travel,” he said. “If this has staying power, I think it’s absolutely a game changer, as we get back to normal business travel and hopefully maintain that leisure travel.”

To accommodate this shifting demand, Marriott has focused on expanding offerings to accommodate both the business and leisure sides of travelers’ trips.

“[We’ve had] a very big focus on [expanding bandwidth], so that if [we’ve] got 300 rooms full of guests on Zoom calls simultaneously, we’ve got the bandwidth to cover it,” Capuano added. “[We’re also] being more thoughtful about fitness, leisure, and food and beverage offerings — and having the flexibility to pivot those offerings as somebody sheds their business suit on Thursday and changes into shorts and flip flops for the weekend.”

2023 Offers Hope for Continued Growth in the Travel and Hospitality Sectors

As the travel and hospitality sectors continue to grow and shift in the post-pandemic era, Capuano shared reasons for optimism in 2023.

“Number one, it's our people,” he emphasized. “When you see their passion, their enthusiasm, their resilience, their creativity, and just how joyful they are to have their hotels full again … it's hard not to be filled with optimism.”

“If you look at how far the industry has come over the last few years,” Capuano continued, “any lingering doubts folks may have had about the resilience of travel — and about the passion that the general public has to explore cities and countries — it's hard not to be excited about the future of our industry.”

- Post-Pandemic Work

From the Series

State of American Business

View this online

- Updated Terms of Use

- New Privacy Policy

- Your Privacy Choices

- Closed Captioning Policy

Quotes displayed in real-time or delayed by at least 15 minutes. Market data provided by Factset . Powered and implemented by FactSet Digital Solutions . Legal Statement .

This material may not be published, broadcast, rewritten, or redistributed. ©2024 FOX News Network, LLC. All rights reserved. FAQ - New Privacy Policy

Travelers delayed over 2.1M hours at airports last year: FAA says 'safety' and 'efficiency' is top priority

Passengers flying to and from an airport in utah last year experienced the longest flight delays across the country.

FOX Business Flash top headlines for May 23

Check out what's clicking on FoxBusiness.com

Americans are unsurprisingly fed up with constant flight delays and cancellations across the U.S., and it is only to be expected. From 2023-2024, passengers lost over 2.1 million hours of time due to travel issues.

Data for 2 million flights from the Bureau of Transportation was probed, and a newly released Places to Travel report concluded that from Jan. 2023 to Feb. 2024, passengers lost 2,100,140 hours and 43 minutes of travel time as a result of delays.

A small regional airport in Utah, Provo Airport, accounted for the longest average flight delays during the allotted time period, according to the report.

5 TOOLS TO SAVE YOUR TRIP AFTER A CANCELED OR DELAYED FLIGHT

Three airports in Florida made the top 10 list of worst airports with delays, according to a Places to Travel report that used Bureau of Transportation data to conclude its findings. (Getty Images / Getty Images)

Commercial airlines , Allegiant Air and American Airlines facilitate consumer travel to and from major cities within Provo.

"Both airlines flying out of Provo Airport are low cost carriers flying non-stop, point-to-point service," Brian Torgersen, Director at Provo Airport, told FOX Business via email.

"These airlines that currently operate in Provo do not have spare aircraft, or flight crews, sitting in Provo to plug into the schedule during extended delays," he added. "Aside from the first flights of the day, flights departing from Provo cannot leave until the aircraft arrives from its previous destinations, accruing delay throughout the day at every previous stop."

Torgersen added that other airports topping the Places to Travel list experience these same issues due to providing non-stop service to destinations, too. Planes experiencing mechanical issues or severe weather without a backup can create delays all day.

On average, the Beehive State airport hinders travel with an average delay time of 1 hour and 43 minutes. Of the 2,194 flights surveyed in and out of Provo, 39.74% of them were delayed.

A representative at the FAA provided FOX Business with safe summer travel documentation found on their website ahead of the upcoming busy months.

"Our job is to get you to your destination safely and efficiently," the FAA site reads . "This summer will see more planes in the skies, frequent bad weather, and increased use of the nation’s airspace. We are continuously working to address these challenges."

Provo Airport, a small regional airport in Utah, experienced the lengthiest flight delays for passengers from Jan. 2023-Feb. 2024. (Education Images/Universal Images Group via Getty Images / Getty Images)

Orlando Sanford International in Florida averages delay times for travelers of 1 hour and 35 minutes, according to the report.

From Jan. 2023 to Feb. 2024, 9,847 flights landed at Orlando Sanford, and 28.09% of them were delayed. The report shows that passengers experienced 4,095 days, or 11 years, worth of delays.

Dallas Fort Worth International Airport accounted for 4,096 days worth of domestic and international impediments, with an average of 1 hour and 29 minutes in delays. Of the 308,806 flights arriving at Dallas Fort Worth, 66,105 of them, or 21.41%, were delayed.

Hilo International Airport in Hawaii had the shortest average delays of 40 minutes.

In total, travelers lost 40 days due to delays in Hilo.

Of all the airports evaluated, three of the top 10 airports with the longest delays are located in Central Florida. In August, Florida airports first experienced lengthy lines of halted passengers that were later accompanied by cancelations due to Hurricane Idalia.

CRAZY AIRPORT, PLANE BRAWLS FROM RECENT FLIGHTS AROUND THE US

Of the over 9,800 flights flown into Orlando Sanford International in Florida last year, over 28% of them were delayed. ( (Joe Burbank/Orlando Sentinel/Tribune News Service via Getty Images) / Getty Images)

In mid-Feb., two members of Congress, Reps. Brian Mast, R-Fla., and Lois Frankel, D-Fla., failed to make it to Washington, D.C., in time for Homeland Security Secretary Alejandro Mayorkas' impeachment due to flight delays at Palm Beach International Airport.

At the time, Mast posted to X that he had been anticipating a flight for nine hours already.

Though Palm Beach does not appear on the list of airports with the worst delays, the location experienced a high volume of grounded planes for extensive periods of time around the holidays late last year.

Airports with the longest average delays, per the report:

- Provo Airport: 1 hour, 42 minutes

- Orlando Sanford International Airport: 1 hour, 34 minutes

- Dallas Fort Worth International Airport: 1 hour, 29 minutes

- Charlotte Douglas International Airport: 1 hour, 28 minutes

- Philadelphia International Airport: 1 hour, 26 minutes

- John F. Kennedy International Airport: 1 hour, 24 minutes

- St. Pete-Clearwater International Airport: 1 hour, 23 minutes

- Montgomery Regional Airport: 1 hour, 23 minutes

- Punta Gorda Airport: 1 hour, 23 minutes

- Phoenix-Mesa Gateway Airport: 1 hour, 21 minutes

CLICK HERE TO GET THE FOX NEWS APP

Airports across the U.S. with the shortest average delays:

- Hilo International Airport: 40 minutes