Best Travel Cards in Australia in 2023 For Overseas Travel

Byron Mühlberg

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Jarrod Suda

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

From the multitude of bank fees and ATM charges to hidden currency conversion fees, there's no question that travelling abroad can be a costly endeavour — and that's saying nothing of the cost of the holiday itself!

As you prepare for your trip abroad, the golden rule is to pay using the local currency of your destination. This means accessing local cash with ATMs and using a prepaid debit card that can access the local currency. If it's not possible for you to spend in the local currency when travelling abroad, then spending in your home currency while using a card that doesn't charge any hidden exchange rate markups from your bank (e.g. only paying Visa or Mastercard exchange rates to convert currency) is still a good bet for most Australians when travelling abroad.

In this guide, we explore cards like Revolut and Wise that can lower ATM fees and hold multiple currencies. Spend on your holiday like a local and enjoy peace of mind after each tap and swipe.

In general, we consider Revolut to be the best travel card in Australia for all-around use, as its versatile account and card can be used to spend like a local pretty much anywhere in the world. With Revolut, you'll get a debit card, multi-currency account balance in 32 currencies, and a savvy mobile experience.

Best Travel Cards in Australia

- 01. Revolut — Best all-round travel card in Australia scroll down

- 02. Wise — Best for number of currencies and foreign account details scroll down

- 03. Considering going through your bank scroll down

- 04. Compare the best travel cards in Australia scroll down

- 05. Tips to save money when travelling overseas scroll down

- 06. FAQ about the best travel cards in Australia scroll down

Revolut: Best All-Round Travel Card in Australia

Revolut is impressive for its vast currency options and additional services, such as international money transfers and a money management interface. Revolut is one of the most well-known mobile finance platforms in the world because it offers services not only in Australia but also across Europe, the Americas, and Asia.

Like Wise, Revolut converts your currency to the local currency of your travel destination at the Revolut rate, which is close to the real mid-market exchange rate. It does set a cap on free allowances, however, since fair use limits and weekend surcharges may apply (Revolut's Standard Plan only allows free exchanges for transfers worth $1,000 per month). Once you make your exchange from AUD to the local currency of your destination, your card will be treated like a local card (avoiding foreign transaction fees or dynamic currency conversions ).

ATM withdrawals are also free for the first $350. These allowances can be waived by upgrading memberships. Bear in mind that third-party ATM fees may apply, even though Revolut doesn't charge any fees of its own for withdrawals up to $350 per month.

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.3

- Account name: Standard

- Account type: Personal account (not a bank)

- Total cost: $0 per month .

- Noteworthy features: AUD account details, multi-currency balances.

- More info: See our full Revolut review .

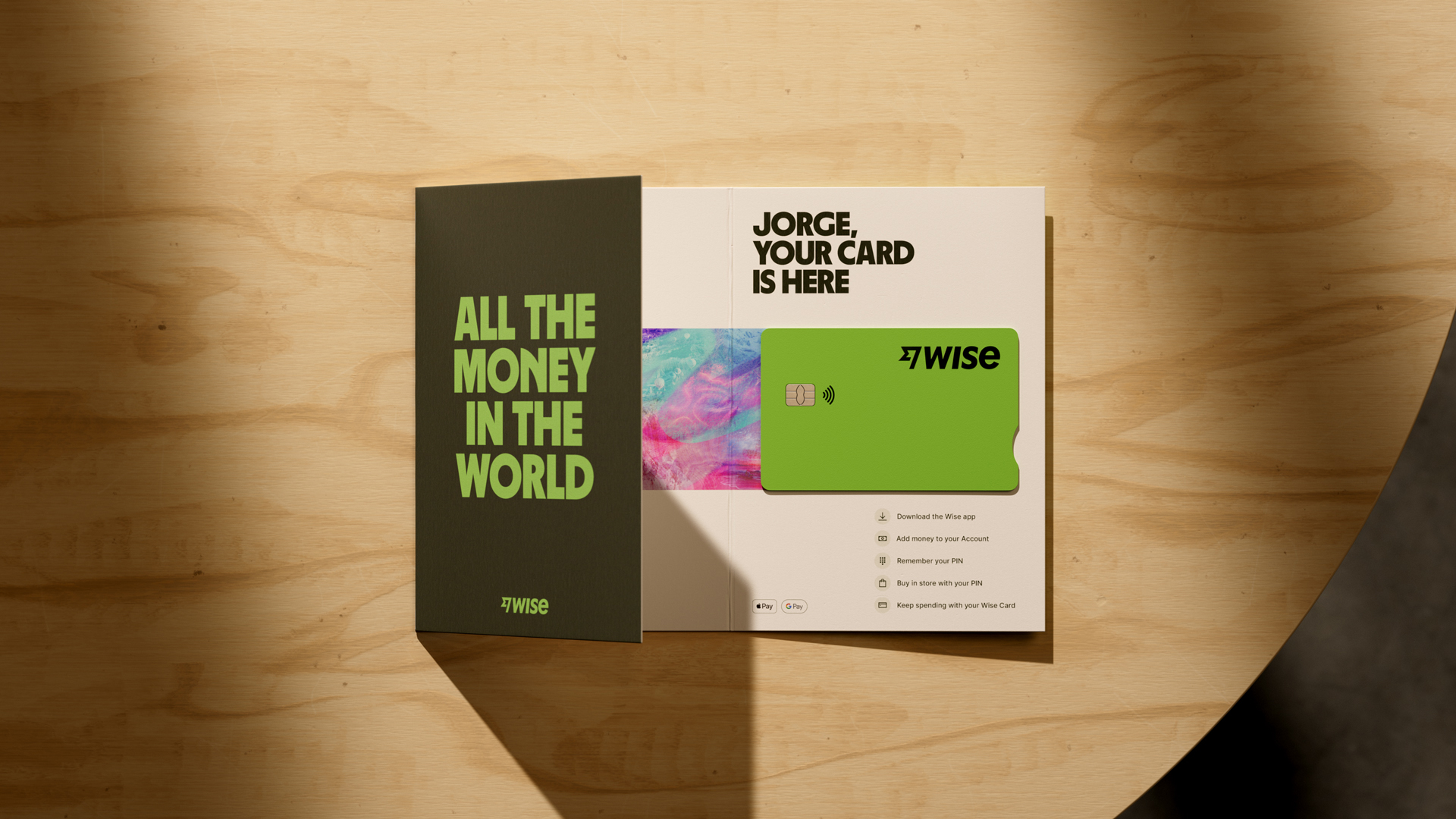

Wise: Best for Number of Currencies and Foreign Bank Details

Wise has one of the best multi-currency cards available on the market. Load up to 54 currencies onto this card at the real exchange rate, giving you access to truly global travel.

Unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your home currency into up to 54 currencies. The live rate you see on Google or XE.com is the one you get with Wise. An industry-low commission fee per transaction will range from 0.35% to 2.85%, depending on the currency.

- Trust & Credibility 9.3

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.4

- Account name: Multi-Currency Account

- Account type: Electronic Money Account (held by local banks).

- Total cost: $0 per month.

- Noteworthy features: International money transfers, multiple account details, multi-currency balances.

- More info: See our full Wise Account review .

Consider Your Australian Bank Travel Money Card

Another option for spending abroad is to use your bank. Some Australian banks offer prepaid debit cards onto which you can load AUD and convert it into many countries around the world. These include the Commbank Travel Money Card. However, as of 2023, some banks such as ANZ, NAB, and Westpac have cancelled their travel card offerings, meaning you'll need to use a third-party prepaid card like Revolut .

You could also travel abroad with your ordinary debit or credit card, however, this will generally be the most expensive choice , as in most cases you'll pay an exchange rate fee plus a currency conversion fee. If you decide to use a standard bank card, make sure that you choose a card produce that explicitly waives foreign transasction fees .

What’s the Best Travel Card in Australia?

To discover the best travel money card in Australia to suit your overseas travel needs, compare the two fintech offerings we discussed above, Wise and Revolut, with a typical bank travel card like CBA's Travel Money Card:

Last updated: 6/1/2023 ¹ Bank account details in USD, EUR, GBP, AUD, NZD, SGD, CAD, RON, HUN, and TRY

Money-Saving Tips When Traveling Abroad From Australia

When you convert Aussie dollars into a foreign currency, foreign exchange service providers will charge you two kinds of fees:

- Exchange rate margin: Providers apply an exchange rate that is poorer than the true "mid-market" exchange rate . They keep the difference, called an exchange rate margin .

- Conversion fee: This fee is usually a percentage of the amount converted or a fixed amount, which is charged for the service provided.

With these facts in mind, let's see what practices are useful to avoid ATM fees, foreign transaction fees, and other charges you may encounter while on your travels.

Tip 1: Avoid Bureaux de Change

Have you ever wondered how bureaux de change and currency exchange desks are able to secure prime real estate in touristic locations like the Champs-Élysées in Paris or Covent Carden in London while claiming to take no commission? It’s easy: they make (plenty of) money through hidden fees on the exchange rates they’re giving you.

Our study shows that Bureaux de Change in Paris charges a margin ranging from 2.15% at CEN Change Dollar Boulevard de Strasbourg to 16.6% (!!) at Travelex Champs-Élysées when exchanging 500 US dollars into Euros for example.

If you really want cash and can’t wait to withdraw it with a card at an ATM at your destination, ordering currencies online before your trip is usually cheaper than exchanging currencies at a bureau de change, but it’s still a very expensive way to get foreign currency which we, therefore, would not recommend.

Tip 2: Always Pay In the Local Currency

Don’t fall for the dynamic currency conversion trap! When using your card abroad to pay at a terminal or withdraw cash at an ATM, you’ve probably been asked whether you’d prefer to pay in your home currency (i.e. Australian dollars) instead of the local currency of the foreign country. This little trick is called dynamic currency conversion , and the right answer to this sneaky question will help you save big on currency exchange fees.

As a general rule, you always want to pay in the local currency (Euros in Europe, GBP in the UK, DKK in Denmark, THB in Thailand, etc.) when using your card abroad, instead of accepting the currency exchange and paying in Australian dollars.

This seems like a trick question - why not opt to pay in AUD? On the plus side, you would know exactly what amount you would be paying in Aussie dollars instead of accepting the unknown exchange rate determined by your card issuer a few days later.

What is a Dynamic Currency Conversion?

When choosing to pay in AUD instead of the local one, you will carry out what’s called a “ dynamic currency conversion ”. This is just a complicated way of saying that you’re exchanging between the foreign currency and AUD at the exact time you use your card to pay or withdraw cash in a foreign currency, and not a few days later.

For this privilege, the local payment terminal or ATM will apply an exchange rate that is often significantly worse than even a traditional bank’s exchange rate (we’ve seen margins of up to 8%!), and of course, much worse than the exchange rate you would get by using an innovative multi-currency card.

Knowing what amount you will pay in Australian dollars is not worth the additional steep cost of the dynamic currency conversion, hence why we recommend always choosing to pay in the local currency.

Tip 3: Don't Use a Traditional Card To Pay

Only use traditional Australian bank cards for overseas travel if they waive international card transaction fees . As mentioned before, providers make money on foreign currency conversions by charging poor exchange rates — and pocketing the difference between that and the true mid-market rate. They also make money by charging commission fees, which can either come as flat fees or as a percentage of the transaction.

FAQ About the Best Travel Cards in Australia

Having reviewed and compared several of the industry's leading neobanks, experts at Monito have found Revolut to offer the best prepaid multi-currency card in 2023 in Australia.

In general, yes! You can get a much better deal with new innovative travel cards than traditional banks' debit/credit cards. However, not all cards are made equal, so make sure to compare the fees to withdraw cash abroad, the exchange rates and monthly fees to make sure you're getting the best deal possible.

- Sign up for a multi-currency account;

- Link your bank to the account and add Aussie dollars;

- Convert amount to the local currency of holiday destination ( Wise and Revolut convert at or near the actual mid-market rate);

- Tap and swipe like a local when you pay at vendors.

Yes, the Wise Multi-Currency Card is uniquely worthwhile because it actually converts AUD into foreign currency at the real mid-market exchange rate . Wise charges a transparent and industry-low commission fee for the service instead. More traditional currency cards like the Travelex Money Card are good alternatives, but they will apply an exchange rate that is weaker than the mid-market rate.

The Wise Multi-Currency Card is the best money card for euros because unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your local currency into euros with them.

The live rate you see on Google or XE.com is the one you get with Wise . An industry-low commission fee will range from 0.35% to 2.85%. USD to EUR transfers generally incur a 1.6% fee.

Learn more about how to buy Euros in the United States before your trip.

There are usually three types of travel cards, prepaid travel cards, debit travel cards and credit travel cards. Each have pros and cons, here's a short summary:

- Prepaid travel cards: You usually need to load cards with your home currency via a direct entry or credit/debit card top-up. You're then able to manage the balance from an attached mobile app and can use it to pay in foreign currencies or withdraw cash at an ATM abroad tapping into your home currency prepaid balance. With prepaid travel cards, as the name indicates, you can't spend more than what you've loaded before hand. Some prepaid card providers will provide ways to "auto top-up" when your balance reaches a certain level that you can customize. On Revolut for example, you can decide to top-up £100/£200/£500 from your debit card each time your balance reaches below £50.

- Debit travel cards: Some innovative digital banks, like N26 or Monzo, offer travel debit cards that have the same advantages than a Prepaid Travel Cards, except that they're debit card directly tapping into your current account balance. Like a Prepaid travel card, you can't spend more than the balance you have in your current account with N26 or Monzo, but you can activate an overdraft (between €1,000 or €10,000 for N26 or £1,000 for Monzo) if you need it, for a fee though.

Note that even if they're Prepaid or Debit cards, you can use them for Internet payments like a normal credit card.

- Credit travel cards: You can find credit cards made for international payments offering good exchange rates and low fees to withdraw money abroad, but you'll need to pay interests in your international payment if you don't pay in FULL at the end of every month and interest on your ATM withdrawals each day until you pay them back.

Other Monito Guides and Reviews on the Best Travel Cards in Australia and Top Multi Currency Cards

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

The savvy way to pay on holiday Travel Money Card

A safe-to-use, prepaid, reloadable, multi-currency card that’s not linked to your bank account

No charges when you spend abroad*

Make contactless, Apple Pay and Google Pay™ payments

Manage your account and top up or freeze your card easily with our Travel app

*No charges when you spend abroad using an available balance of a local currency supported by the card.

Why get a Travel Money Card?

Carry up to 22 currencies safely.

Take one secure, prepaid Mastercard® away with you that holds multiple currencies (see ‘common questions’ for which).

Accepted in over 36 million locations worldwide

Use it wherever you see the Mastercard Acceptance Mark – millions of shops, restaurants and bars in more than 200 countries.

Manage your card with our travel app

Top up, manage or freeze your card, transfer funds between currencies, view your PIN and more all in our free Travel app .

Safe and secure holiday spending

Manage your holiday funds on a Travel Money Card with our free travel app. Top it up, freeze it, swap currencies, view your PIN and more.

It’s simple to get started

No need to carry lots of cash abroad. Order a Travel Money Card today for smart, secure holiday spending.

Order your card

Order online, via the app or pick one up in branch and load it with any of the 22 currencies it holds.

Activate it

Cards ordered online and in-app should arrive within 2-3 working days. Activate it by following the instructions in your welcome letter.

It’s ready to use

Spend in 36 million locations worldwide, and top up and manage your card in the app or online.

What is Post Office Travel Money Card?

Discover how easy our Travel Money Card makes managing your spending aboard

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

Order a Travel Money Card

Order your card online – or through the Post Office travel app – and we'll deliver it within 2-3 days. Just activate it and go.

Need it quick? Visit a branch

Pick up a Travel Money Card instantly at your local Post Office. Bring a valid passport, UK driving licence or valid EEA card as ID.

Need some help?

We’re here to help you make the most of your Travel Money Card – or put your mind at ease if it’s been lost or stolen

Lost or stolen card?

Please immediately call: 020 7937 0280

Available 24/7

To read our FAQs, manage your card or contact us about using it:

Visit our Travel Money Card support page

Common questions

How can i order my card.

There are three ways that you able to obtain a Travel Money Card, each very simple.

Please note, you must be a UK resident over the age of 18 to obtain a Travel Monday Card.

- Via our travel app: you can order and store up to three Travel Money Cards in our free travel app . Delivery will take 2-3 working days.

- Online: follow our application process to order your card online. Your card will take 2-3 working days to be delivered. Once it arrives you can link it to our Travel app to manage on the go.

- In branch: simply find a nearby Post Office branch and pop in to get your Travel Money Card there. Please remember to take a valid passport, UK driving licence or a valid EEA card in order to obtain your card, and you can take it away the same day.

Whichever way you choose to order your card, don't forget to activate it once it arrives. Full details of how to activate your card will be provided in your welcome letter, to which your card will be attached if it’s been sent in the post.

How do I use my card?

Travel Money Card is enabled with both chip & PIN and contactless, so you can make larger and lower-value value payments with it respectively. For convenience, you can also add it to Apple Pay and Google Wallet.

You can load it with between £50 and £5,000 (see more on load limits below). You can use it to pay wherever the Mastercard Acceptance Mark is displayed. And you can withdraw cash with it at over 2 million ATMs worldwide (charges and fees apply, see 'Are there top-up limits?' below).

Your Travel Money Card is completely separate from your bank account so it’s a safe and secure way to pay while you’re abroad.

How can I manage my card?

After you've activated your card, you can manage it using our travel app or via a web browser. You can check your recent transactions, view your PIN, transfer funds between different currency ‘wallets’, top up your card, freeze your card and more.

Our travel app brings together travel essentials including holiday money, travel insurance and more together in one place. As well as managing your Travel Money Card you can buy cover for your trip, access your policy documents on the move, book extras such as airport parking and hotels, and find your nearest ATM while overseas or Post Office branches here in the UK.

Which currencies can I use?

The Post Office Travel Money Card can be loaded with up to 22 currencies at any one time. You can top up funds on the card and transfer currencies between different ‘wallets’ for these currencies easily in our travel app or online.

Currencies available:

- EUR – euro

- USD – US dollar

- AUD – Australian dollar

- AED - UAE dirham

- CAD – Canadian dollar

- CHF – Swiss franc

- CNY – Chinese yuan

- CZK – Czech koruna

- DKK – Danish krone

- GBP – pound sterling

- HKD – Hong Kong dollar

- HUF – Hungarian forint

- JPY – Japanese yen

- NOK – Norwegian krone

- NZD – New Zealand dollar

- PLN – Polish zloty

- SAR – Saudi riyal

- SEK – Swedish Krona

- SGD – Singapore dollar

- THB – Thai baht

- TRY – Turkish lira

- ZAR – South African rand

What are the charges and fees?

Full details of our charges and fees can be found in our Travel Money Card terms and conditions .

The Post Office Travel Money Card is intended for use in the countries where the national currency is the same as the currencies on your card. If the currency falls outside of any of the 22 we offer on your card, you’ll be charged a cross-border fee. For example, using your card in Brazil will incur a cross-border fee because we do not offer the Brazilian real as a currency.

Cross border fees are set at 3% and are only applicable when you use your currency in a country other than the ones we offer.

For more information on cross border fees, please visit our cross border payment page.

There are no charges when using your card in retailers in the country of the currency on the card. This means that a €20 purchase in Spain would cost you €20 and will be deducted from your euro balance.

To avoid unnecessary charges to your card, wherever asked, you should always choose to pay for goods or withdraw cash in the currencies of your card. For example, if you are using the card in Spain you should always choose to pay in euro if offered a choice; choosing to pay in sterling (GBP) in this example would allow the merchant to exchange your transaction from euro to sterling. This would mean your transaction has gone through two exchange rate conversions, which will increase the total cost of your transaction.

For loads in Great British pounds, a load commission fee of 1.5% will apply (min £3, max £50). A monthly maintenance fee of £2 will be deducted from your balance 12 months after your card expires. Expiration dates can be found on your TMC; all cards are valid for up to 3 years.

A cash withdrawal fee will be charged when withdrawing cash from a UK Post Office branch or from any ATM globally that accepts Mastercard.

We have listed all available currencies and their associated withdrawal limits and charges below:

EUR – euro Max daily cash withdrawal: 450 EUR Withdrawal charge: 2 EUR

USD – US dollar Max daily cash withdrawal: 500 USD Withdrawal charge: 2.5 USD

AED – UAE dirham Max daily cash withdrawal: 1,700 AED Withdrawal charge: 8.5 AED

AUD – Australian dollar Max daily cash withdrawal: 700 AUD Withdrawal charge: 3 AUD

CAD – Canadian dollar Max daily cash withdrawal: 600 CAD Withdrawal charge: 3 CAD

CHF – Swiss franc Max daily cash withdrawal: 500 CHF Withdrawal charge: 2.5 CHF

CNY – Chinese yuan Max daily cash withdrawal: 2,500 CNY Withdrawal charge: 15 CNY

CZK – Czech koruna Max daily cash withdrawal: 9,000 CZK Withdrawal charge: 50 CZK

DKK – Danish krone Max daily cash withdrawal: 2,500 DKK Withdrawal charge: 12.50 DKK

GBP – Great British pound Max daily cash withdrawal: 300 GBP Withdrawal charge: 1.5 GBP

HKD – Hong Kong dollar Max daily cash withdrawal: 3,000 HKD Withdrawal charge: 15 HKD

HUF – Hungarian forint Max daily cash withdrawal: 110,000 HUF Withdrawal charge: 600 HUF

JPY – Japanese yen Max daily cash withdrawal: 40,000 JPY Withdrawal charge: 200 JPY

NOK – Norwegian krone Max daily cash withdrawal: 3,250 NOK Withdrawal charge: 20 NOK

NZD – New Zealand dollar Max daily cash withdrawal: 750 NZD Withdrawal charge: 3.5 NZD

PLN – Polish zloty Max daily cash withdrawal: 1,700 PLN Withdrawal charge: 8.5 PLN

SAR – Saudi riyal Max daily cash withdrawal: 1,500 SAR Withdrawal charge: 7.50 SAR

SEK – Swedish Krona Max daily cash withdrawal: 3,500 SEK Withdrawal charge: 20 SEK

SGD – Singapore dollar Max daily cash withdrawal: 500 SGD Withdrawal charge: 3 SGD

THB – Thai baht Max daily cash withdrawal: 17,000 THB Withdrawal charge: 80 THB

TRY – Turkish lira Max daily cash withdrawal: 1,500 TRY Withdrawal charge: 7 TRY

ZAR – South African rand Max daily cash withdrawal: 6,500 ZAR Withdrawal charge: 30 ZAR

Are there top-up limits?

Yes, all currencies have top-up limits and balances. See full information below, which is applicable to all currencies available on the Travel Money Card.

- Top-up limit: minimum £50 – maximum £5,000

- Maximum balance: £10,000 at any time, with a maximum annual balance of £30,000

- Read more Travel Money Card FAQs

Other related services

Hoi An in Vietnam is still the best-value long haul destination for UK ...

Travelling abroad? These tips will help you get sorted with your foreign ...

We all look forward to our holidays. Unfortunately, though, more and more ...

From European hotspots to far-flung destinations, UK travellers are making ...

Our annual survey of European ski resorts compares local prices for adults and ...

The nation needs a holiday. And, with the summer season already underway, new ...

If you’re driving in Europe this year, Andorra’s your best bet for the cheapest ...

One of the joys of summer are the many music festivals playing across the ...

Prepaid currency cards are a secure way to make purchases on trips abroad. They ...

Thinking of heading off to Europe for a quick city break, but don’t want to ...

Knowing how much to tip in a café, restaurant, taxi or for another service can ...

Post Office Travel Money unveils the first Islands in the Sun Holiday Barometer ...

To avoid currency conversion fees abroad, always choose ‘local currency’ ...

Long-haul destinations offer the best value for UK holidaymakers this year, ...

Kickstarting your festive prep with a short getaway this year? The Post Office ...

Eastern Europe leads the way for the best value city breaks this year. And ...

Find out more information by reading the Post Office Travel Money Card's terms and conditions .

Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF, (Financial Services Register No. 900412). Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Post Office and the Post Office logo are registered trademarks of Post Office Limited.

Post Office Limited is registered in England and Wales. Registered number 2154540. Registered office: 100 Wood Street, London, EC2V 7ER.

These details can be checked on the Financial Services Register by visiting the Financial Conduct Authority website and searching by Firm Reference Number (FRN).

- Individuals myGov is a simple and secure way to access online government services.

- PRODA Log in to access HPOS, Business Hub, Aged Care Provider Portal and a range of other government online services.

- Centrelink Business Online

- Child Support Business Online

Visiting from the United Kingdom

If you’re visiting Australia from the United Kingdom you may be eligible for medical care under Medicare while you’re here.

on this page

Who can get it, what’s covered, how to enrol in medicare, when your cover starts and ends.

To be eligible, you must have been living in the United Kingdom (UK) before arriving in Australia.

If you’re here on a student visa you’re eligible.

If you’re in Australia for a short time and don’t need medical care, there’s no need to enrol.

If you’re a diplomat

If you’re a diplomat, you and your family are eligible to enrol in Medicare while you’re posted here.

This means the cover under the agreement will apply for as long as you’re in Australia.

If you’re not eligible for Medicare

If you’re not eligible for Medicare, you can’t claim a benefit for treatment you have in Australia. If you need to lodge an income tax return in Australia, you may be eligible for a Medicare levy exemption. This applies if you weren’t eligible for Medicare for all or part of the financial year. You’ll need to get a Medicare Entitlement Statement from us to do this.

Read more about the Medicare levy exemption on the Australian Taxation Office website.

The agreement covers:

- medically necessary care out of hospital

- medically necessary care as a public patient in a public hospital including inpatient and outpatient services

- some PBS prescription medicines at the general rate.

Read more about the Pharmaceutical Benefits Scheme (PBS).

You’ll need to give us copies of your supporting documents. These documents don’t need to get certified. To enrol in Medicare you will need to download and complete the Medicare enrolment form . Follow the instructions on the form to enrol.

Documents you need to show us

You’ll need to show:

- your current visa

- your British passport or non-British passport

- evidence you are a resident of the UK, Jersey, Guernsey or the Isle of Man.

You can prove you are a resident of UK, Jersey, Guernsey or Isle of Man by showing us:

- your UK Global Health Insurance Card (GHIC)

- your European Health Insurance Card with the initials UK

- your National Health Insurance card if you’re from the Isle of Man

- your Health Service card if you’re from Northern Ireland

- a Health card from the Health and Social Services department of the States of Jersey

- proof of insurance from the Guernsey States Insurance Authority

- other proof that you’re a resident of Guernsey

- 2 documents proving you live in the UK, Jersey, Guernsey or the Isle of Man.

This could include:

- a work contract

- a rental or lease agreement or bond receipt

- a bank statement

- evidence of child enrolled in childcare or school

- property or contents insurance

- gas, electricity, water or rates account.

Documents must have a date marked on them.

Your cover starts the day you arrive in Australia.

It ends when the first of these expires:

- your British health insurance

If you get medical treatment in Australia before you enrol in Medicare, you may get a Medicare benefit for it.

Once you enrol, submit a claim. We’ll then be able to tell you if you can get a benefit under the agreement or not.

This information was printed 18 June 2024 from https://www.servicesaustralia.gov.au/reciprocal-health-care-agreements-visiting-from-united-kingdom . It may not include all of the relevant information on this topic. Please consider any relevant site notices at https://www.servicesaustralia.gov.au/site-notices when using this material.

Printed link references

AUSSIE OWNED & OPERATED | FAST & FREE SHIPPING | Money Back Guarantee

- All Products

- Switzerland

- Netherlands

- Czech Republic

- United Kingdom

- South Korea

- Philippines

- New Zealand

- El Salvador

- UAE (Dubai)

- South Africa

- Europe eSIMs

- Egypt eSIMs

- France eSIMs

- Germany eSIMs

- Middle East eSIMs

- Turkey eSIMs

- Caribbean eSIMs

- Travel Accessories and Necessities

- Travel Journals

- Packing Cubes

- Laundry Bags

- Login / Register

- Travel Tips and Hacks

- Travel Guides

Stay Connected Across United Kingdom – Avoid Roaming Fees!

Get a United Kingdom SIM Card or a United Kingdom eSIM for your travels. Avoid high roaming fees and enjoy connectivity with our United Kingdom SIM cards. Perfect for Aussie travellers!

Trusted by Travellers: Join thousands of satisfied customers. Over 19,000+ Reviews across

7GB of 4G Data

Unlimited Minutes within UK to standard UK landlines and mobiles

Unlimited SMS to UK mobiles

30 Days of service from activation date

25GB of Data

Unlimited Minutes within UK to standard UK landlines and mobiles

Unlimited SMS to UK mobiles

30 days service from activation.

100GB of 5G/4G Data

Unlimited Minutes within UK

250 Minutes International minutes to 42 countries.

Unlimited SMS within UK

30 days of service from activation

12GB of Data

365 Day service from activation

![travel card uk to australia [eSIM] UK Data eSim Card (450GB)](https://simcorner.com/cdn/shop/files/uk-esim-450gb-28-days_{width}x.png?v=1715752760)

450GB of Data

Not Included

28 days service from activation.

Shop by Countries in United Kingdom

Related blog.

Article: Best Travel SIM Cards to use in your phone to avoid roaming fees

SimCorner: Providing the Best Travel SIM Cards to use in your phone overseas and avoid roaming fees! When you are planning an overseas vacation, there are a lot of different things to think about. From packing lists to passports, hotel reservations to attractions you want to see, you can get so b...

Best Prepaid SIM Cards for UK Travel in 2024

The United Kingdom is one of the world’s most visited countries, drawing tourists far and wide to experience everything from the stunning natural beauty of Scotland to the busy streets of London. The country’s appreciation for art and culture is seen in its many theatres and museums, while its appreciation for diversity and community can be found in the wide range of cuisines available. All of these factors make the UK a must see, and those lucky enough to spend long lengths of time here should visit as much of the country as possible. If you're travelling to the UK for holiday or to visit family or have relocated on a work visa, chances are that you’ll need a new local SIM card. Choosing the best UK prepaid SIM card for your needs is essential in ensuring that you don’t buy a product that isn’t compatible with your needs and ensure you stay connected without breaking the bank.

What is a UK SIM card?

A UK SIM card is a local SIM card for the UK that gives you access to the UK’s mobile networks. By using a UK SIM card, you can avoid hefty international roaming charges and stay connected at local rates.

It’s perfect for:

- Short-term or long-term visits

- Making calls, sending texts, and data usage

- Recharging for that extra month when required

If they're UK-based SIM cards from UK carriers such as ThreeUK or O2 like the ones we sell at SimCorner, they'll get assigned a UK mobile number. This means you can make calls, send texts, and, most importantly, access the internet without racking up hefty international roaming charges. If they're not UK-based SIM cards, they might be roaming sim cards. At SimCorner, we always recommend customers purchase a UK-based SIM.

Why You Need a UK SIM Card

Visiting the UK can be an incredible experience, but to make the most of your trip, having a local SIM card is essential. With a UK SIM card, you can enjoy the following benefits:

Cost-Efficiency : International roaming charges can quickly add up, leaving you with a hefty phone bill. A UK SIM card offers more cost-effective options for data, calls, and texts.

Reliable Network Coverage : The United Kingdom boasts a robust and reliable network infrastructure, ensuring you stay connected no matter where you travel within the country.

Convenience : Purchasing a UK SIM card is hassle-free and can be done both before your trip or upon arrival. No need to hunt for Wi-Fi hotspots or rely on public networks.

Can I buy a UK SIM card in Australia?

To purchase a prepaid UK SIM card in Australia, you'll need to buy the SIM card online. SIM cards can be bought from various online providers. However, if you're looking for a cheaper deal, fortunately there's an easy way, buy a UK SIM card from SimCorner.

At SimCorner:

- We sell a range of UK SIM cards for Australian travellers

- They are all prepaid SIM cards, so no hidden fees

- Our cards include data, unlimited calls and texts standard UK landlines and mobile numbers

- We provide shipping Australia wide and it can reach your door with 2-3 days for those with urgent travel plans

By purchasing one of our awesome ranges and having it shipped straight to your home or work address, you can be sorted even before you step on the plane! Buying UK travel sim cards online has never been easier.

But with so many UK SIM cards to choose from, how do you choose the right one for your needs? Let's explore some of the top choices for UK SIM cards available at SimCorner, and check out our reviews .

The Best Prepaid UK Sim Cards

At SimCorner we've got you covered when it comes to different prepaid UK SIM cards for your next holiday If you’re:

- A budget-conscious traveller

- Looking for extra data

- An Australian traveller searching for the best prepaid plans around

With these prepaid SIMs you’ll be able to work, travel and use your phone in the UK without incurring expensive roaming charges.

To cater to a wide range of preferences and data needs, we offer several options:

O2 - UK Travel SIM Card with 100GB Data

Need data? The O2 - 100GB UK Travel SIM Card ensures that you'll have an abundance of data to stay connected throughout your journey. Whether it's for work or leisure, this SIM card has you covered. It also runs on one of the leading network providers in the UK- O2, which offers excellent coverage, with its 4G networks that covers 99% of the UK population. Its 5G network is also expanding. This SIM card is an excellent choice for tourists who want to stay connected throughout their entire trip.

Three UK - 25GB UK SIM Card

One of the more popular options for travellers to the UK is the 12GB Three UK SIM Card. This SIM card offers a moderate 12GB of data, which should be more than enough for staying connected, checking emails, and even streaming your favourite shows during your stay. You also get Unlimited Minutes to standard UK landlines and mobiles

O2 - 7GB UK SIM Card

For those who prefer the network quality of O2, and small amount of data usage, why not check out our O2 - 7GB UK SIM Card for an affordable and reliable option. Enjoy fast internet speeds and Unlimited Minutes to standard UK landlines and mobiles with this SIM card. Whether you're strolling through the historic streets of London or taking in the breathtaking landscapes of the UK, this SIM card offers you reliable network coverage.

Three UK - UK Data-Only SIM Card (12GB)

For those who only need data, the UK Data-Only SIM - 12GB is a fantastic option. Ideal for tablets and mobile hotspots, this SIM card provides high-speed data access for your internet-dependent tasks.

Prepaid Travel eSIM UK SIM Card (450GB)

For travellers who prefer eSIM, The Prepaid UK eSIM Card - 450GB delivers an astonishing 450GB of data. This eSIM is designed for travellers with data-intensive needs. Stay connected with the best eSIM the UK has to offer.

If you’re looking for an international SIM card for the UK and Europe, look no further than our Multi-Country SIMS. These UK prepaid sim cards allow people to use data, make calls and send messages both in the UK and European union countries, perfect for weekend trips to France and beyond. If you’re planning to regularly stay in touch during your time travelling, take a look at our 12GB Europe SIMs . If you’re just looking for a travel SIM card to browse the internet or use in your iPad or tablet, look no further than our 12GB Data Only SIM Card which can be used in mobile phones, iPads, tablets and many other products. Click on the link to find out more.

Choosing the Right UK SIM Card

Selecting the perfect UK SIM card depends on your specific needs. Here are a few factors to consider:

Data Usage : If you plan to use data extensively for streaming or work, opt for higher data allowances like the O2 100GB UK Travel SIM Card or the P repaid Travel eSIM UK SIM Card with 450GB .

Short-Term or Long-Term : If your stay in the UK is temporary, a short-term plan with lower data limits might suffice. The O2 7GB UK SIM Card is a great choice for tourists.

Coverage : Check the coverage maps and consider the areas you'll be visiting. O2 and Three UK both offer extensive coverage. If you did want better cover, O2 is one of UKs leading network provider and provides better coverage. It will ensure you stay connected in most parts of the UK.

Device Compatibility : Ensure that the SIM card is compatible with your device, whether it's a smartphone, tablet, or mobile hotspot.

Which type of phone is best to use with your new international UK sim card?

To use the new UK SIM card with your Australian mobile phone:

Check your phone is unlocked

If you've previously used your phone abroad and inserted various SIM cards, it's likely already unlocked.

Check with your mobile provider

Newer phones can be locked to specific mobile networks, always check first or simply insert the SIM for another provider and check yourself.

Insert your SIM

Place the SIM into your phone and switch it on, and it’s ready to go.

Please note that being on a postpaid plan or contract with your local carrier doesn't mean your phone is locked. If you are unsure, please check with your current service provider.

Get prepaid SIM card UK that are right for you!

Now that you have the SIM Card for UK options laid in front of you, you would have already made up your mind on the data card that is ideal for you in terms of your travel itinerary. Though all the SIM cards are available in three sizes and fit most phones, it’s always good to check the specifications and compatibility before getting one that would be right for you. Why not, check out all the options that we offer at SimCorner and get a UK SIM card for your next trip to the UK. If you like more information use the contact us link above to get in touch with us. Get your travel SIM today.

What are the best UK SIM card options for travellers?

SimCorner offers a variety of UK SIM cards, including options from O2, Three UK, and eSIMs. You can choose from cards with different data allowances to suit your needs.

How do I choose the right UK SIM card for my needs?

When selecting a UK SIM card, consider factors like the duration of your stay, your data requirements, and your preferred network. SimCorner offers various options to ensure you find the perfect fit.

How do I activate my UK SIM card from SimCorner?

Activating your UK SIM card from SimCorner is easy. Follow the instructions provided with your SIM card pack as soon as you receive you order. If you face any issues, our customer support is available to assist.

Is it possible to top up or recharge my UK SIM card whilst in the UK

Absolutely. With the physical sim cards, If you wish to add credit or recharge the sim you can only do this whilst you are in the UK at 3UK or O2 stores (depending on which sims was purchased), supermarkets, petrol stations and convenience stores. Unfortunately you are unable to top-up online as some providers requires a UK debit/credit card that is linked to a UK residential address.

Do your UK SIM cards support 4G or 5G networks?

Yes, our UK SIM cards support both 4G and 5G networks, depending on your device's compatibility and location you are in.

- Choosing a selection results in a full page refresh.

- Press the space key then arrow keys to make a selection.

- My Account My Account

- Cards Cards

- Banking Banking

- Travel Travel

- Rewards & Benefits Rewards & Benefits

- Business Business

- Argentina

- Australia

- Brasil

- Česko

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- Nederland

- New Zealand

- Österreich

- Polska

- Portugal

- România

- Schweiz

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

The 5 Best Travel Cards for Europe 2024

Europe is one of the top destinations for Australians heading on holiday - with year round attractions depending on whether you’re looking for a beach break, ski trip, or simply some time to eat, drink and soak up the culture. No matter what you’re off to Europe for, you’ll need to pay for things while you’re there. This guide walks through our picks of 5 of the best travel cards available for Australians heading to Europe, with a look at their features, benefits and drawbacks.

5 best travel cards to use in Europe

- Wise - debit card

- Revolut - debit card

- Travelex - prepaid card

- 28 Degrees Platinum - credit card

- Bankwest Zero Platinum Mastercard - credit card

Wise is our pick for travel debit card for Europe

With this card:

- Convert Aussie dollars to Euros at the mid-market exchange rate

- It's very easy to set up and order

- You can receive foreign currency into a multi-currency account linked to the card

- You can transfer money to a bank account overseas

It's not all good news though

- There is a 1.75% ATM withdrawal fee when you withdraw over $350 during a month

- It takes 7-14 days for delivery

Click here to see the full list of cards and how Wise compares

Read the full review

What are different types of travel cards?

It can be tricky working out which is the best travel card to use in Europe.

The fact is, the best one for you will really depend on what you need from the card you're using. We've listed what we think are three of the best travel money cards you can use while you're in Europe.

They can be either prepaid, debit or credit cards designed specially for overseas use. You can use travel cards to make purchases online, in stores and to withdraw money at ATMs. There are 3 popular types:

Travel Debit Cards

Prepaid travel cards, travel credit cards.

Let's have a look at each one.

Debit Cards offer the convenience of a credit card, but work differently. They draw money directly from your bank account when you make a purchase. It's designed for everyday money transactions and means that you're not accumulating debt.

If you have spending issues, it's a better option to use your debit card whenever possible. This is because it will prevent you from falling into credit card debt. And for daily purchases, we think a debit card can help you stick to your travel budget, because you can't overdraw money from your account.

Generally, we recommend having the combination of a travel debit and travel credit card for safety, flexibility and convenience on your trip.

Wise - travel debit card for Europe

The Wise card offers a flexible way to pay and make withdrawals with most European currencies covered for holding and exchange. You’ll be able to order your card for a low one time fee, with no ongoing costs to worry about.

Whether you’re spending in euros, British pounds, or any of the other 40+ currencies supported, you’ll get the mid-market exchange rate when you switch from AUD, with low fees from 0.43%. Exchange your AUD to the currency or currencies you need in advance, or just let the card handle the conversion at the point of payment for extra convenience.

- No annual fee, hidden transaction fees, exchange rate markups

- No minimum balance requirements

- Allows you to make payments and withdrawals wherever you are in the world in over 40 currencies

- Local bank account details in Australia (AUD), the UK (GBP), the USA (USD), Europe (EUR) and New Zealand (NZD)

- It takes 7-14 business days to receive the card

- Can't always access local technical support depending on where you are

- Free cash withdrawals limited to under $350 every 30 days

- Only currently available in the US, UK, Europe, Australia and New Zealand

Revolut - prepaid travel card for Europe

The Revolut prepaid travel card lets you pick the account and card type that suits your personal needs and preferences. Go for a Standard plan with no monthly fee to pay, or upgrade to one of the higher tier account options with ongoing costs, which unlock extra features and benefits. Whichever card you pick you can spend in 150+ countries and get some no fee ATM withdrawals and currency conversion which uses the mid-market rate. Fair usage fees apply once you’ve used your account plan no-fee limit for a particular transaction type.

Click here to see the full list of cards and how Revolut compares

- Very easy to use app

- Free to set up

- No hidden fees or exchange rate mark-ups (except on weekends)

- You can use it to transfer money to a bank account overseas

- Additional fees for using the card on a weekend

- 2% ATM fee once you withdraw more than $350 in any 30 day period

- 3-4 business days before you receive your card

- Ongoing subscription fee for Premium and Metal cards

For prepaid cards, you're able to load the card with a set amount of money in the currencies you need. Ideally you do this before your trip, but often you can reload them as well.

Most prepaid travel cards allow for multiple currencies to be loaded onto the card. So it's important to know what currency you'll be using on your travels. Airlines also offer prepaid cards so the money you spend can earn you reward points.

Depending on where you're visiting, there might be better local alternatives available. Check out our lists of the best prepaid cards available in the USA and UK .

With prepaid travel cards you need to be careful. They can have numerous fees and charges, which can make it more expensive than other options. But if you're organised and travelling to multiple cities a prepaid travel card is a good option.

Travelex - prepaid travel card for Europe

The Travelex travel money card can be a convenient pick if you’re in a hurry as you can walk into a Travelex store and get one in just a few minutes. Just take along a suitable ID document, to get your card and account before you travel. You’ll be able to hold and exchange 10 major currencies, which covers euros and pounds. Bear in mind that exchange rates may include a markup - and other European currencies aren’t supported for holding or exchange so while you’ll be able to spend in a selection of other currencies, you won’t be able to buy them in advance to lock in a rate and set your travel budget.

Click here to see the full list of cards and how Travelex compares

- Supports 10 major global currencies for holding and exchange

- Get your card online or in person for extra convenience

- No Travelex fee to spend or make an ATM withdrawal

- Some fee free ways to top up your card balance are available

- Exchange rates are likely to include a markup on the mid-market rate

- Fees may apply when you buy or top up your card

- Relatively low number of supported currencies

- Account closure and inactivity fees may apply

Credit cards have obviously been around for a long time. But now there are specialised travel credit cards. Generally, these cards give you longer to pay back what you've spent but the interest rates after this time can be quite high.

The main advantage with credit cards are the reward points you get in return for your customer loyalty when you spend. But it only works if you pay off the balance in full each month.

Credit cards are great to use for car hire, restaurants and accommodation - larger expenses that are easier for you to pay back over time. Some services only take credit cards to hold purchases so they can definitely be handy while you're travelling.

28 Degrees - travel credit card for Europe

- There are no annual fees

- No overseas purchase fee or currency conversion fee

- You get 55 days interest free on purchases

- Access to free 24/7 concierge service

- Emergency card replacement worldwide

The 28 Degrees Platinum Mastercard has additional benefits including shoppers and repayments benefits cover.

- Can have 9 additional cardholders

- No overseas purchase fee, or currency conversion fee

- No foreign transaction fee

- Free Replacement Card

- High interest rates after the initial 55 days

- Minimum credit limit is $6,000

- No introductory offers or rewards

Bankwest Zero Platinum Mastercard - travel credit card for Europe

The Bankwest Zero Platinum Mastercard has no annual fee to pay, and no foreign transaction fee either. That can make it a good option if you’d prefer to spend using a credit card and then pay off your travel bills later. There’s even a buy now, pay later which may let you split the costs of some eligible purchases into 4 payments with no extra interest to pay. Bear in mind that some fees and costs do apply to this card, particularly if you want to make ATM withdrawals, or if you’d prefer not to pay your bill off in full every month.

- No annual fee to pay

- No Bankwest foreign transaction fee

- Some complimentary travel insurance available for card holders

- Can be used as a payment guarantee, such as when renting a car or checking into a hotel

- Interest applies if you don’t pay your bill in full every period

- Cash advance fee of 3%, and a higher rate of interest compared to card spending

- 6,000 AUD minimum credit limit

- Subject to eligibility requirements and credit checks

FAQ - 5 best travel cards for Europe

Which card is better to use in Europe?

The best card for Europe will depend on exactly where you’re heading and how you like to manage your money. Using a travel debit card or travel prepaid card like Wise travel card or Revolut can be a handy way to hold, exchange, spend and manage your money across a selection of major European currencies, offering flexibility and low costs.

What's the best prepaid card to use in Europe?

There’s no single best prepaid card for Europe, but picking one which covers all the currencies you’ll need is essential. Bear in mind that there are many other European currencies aside from pounds and euros - choose a card which has a broad range of supported currencies for convenience. Wise supports 40+ currencies, while Revolut has 25+ currencies, making either of these a good place to start your research.

Can I use my Australian debit card in Europe?

You can use your Australian debit card in Europe anywhere the network - often Visa or Mastercard - is supported. Bear in mind that you may need to tell your bank you’re planning to travel, to avoid your card being frozen for security reasons. Double check if your debit card has a foreign transaction fee to pay - if it does, using a specialist travel card can mean you pay less overall when you spend in foreign currencies.

What is the best way to pay when travelling in Europe?

Having a selection of ways to pay whenever you travel is a good idea. You may choose to carry some local cash, some AUD for exchange, your Australian debit card and a specialist travel credit or debit card, for example. This should mean you’re covered - even if you find a merchant which can’t accept your preferred payment method.

Which debit card has no fees in Europe?

A travel card from a provider like Wise, Revolut or Travelex lets you hold a foreign currency balance and spend it with no extra fee. Each card has its own features and fees so you’ll need to compare a few to decide which is best for your specific needs.

Is Visa or Mastercard better for Europe?

Both Visa and Mastercard are very widely accepted in Europe. Look out for the symbol displayed on ATMs or at payment terminals in stores.

Need to know more about travelling to Europe?

Passports, Visas and Vaccinations

How Much Things Cost in Europe

Currency in Europe

Banks, ATMs & Currency Exchange

The Best Cards to Use in Europe

7 Common Travel Money Traps to Avoid in Europe

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

Register to vote Register by 18 June to vote in the General Election on 4 July.

beta This is a test version of the layout of this page. Take the survey to help us improve it

- Help and services around the world

- UK help and services in Australia

Travelling to Australia

Includes travel advice and how to get married abroad.

Subscriptions

- Get emails for this topic Travelling to Australia

Australia travel advice

Latest FCDO travel advice for Australia including on entry requirements, safety and security and local laws and customs

Getting married or registering a civil partnership abroad

Requirements, paperwork and processes for weddings and civil partnerships overseas - registration, restrictions, fees

Gold Coast 2018 Commonwealth Games

Guidance and tips for fans, families and teams travelling to the Gold Coast 2018 Commonwealth Games.

Reduce your risk from terrorism while abroad

How to minimise your risk, and what to do if there's a terrorist attack.

Is this page useful?

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. Please fill in this survey (opens in a new tab) .

Australia Recommends 2024

Come and Say G'day

G'day, the short film

Discover your Australia

Travel videos

Deals and offers

Australian Capital Territory

New South Wales

Northern Territory

South Australia

Western Australia

External Territories

The Whitsundays

Mornington Peninsula

Port Douglas

Ningaloo Reef

Airlie Beach

Kangaroo Island

Rottnest Island

Hamilton Island

Lord Howe Island

Tiwi Islands

Phillip Island

Bruny Island

Margaret River

Barossa Valley

The Grampians

Hunter Valley

Yarra Valley

McLaren Vale

Glass House Mountains

Alice Springs

Uluru and Kata Tjuta

The Kimberley

Flinders Ranges

Kakadu National Park

Eyre Peninsula

Karijini National Park

Great Barrier Reef

Blue Mountains

Daintree Rainforest

Great Ocean Road

Purnululu National Park

Cradle Mountain-Lake St Clair National Park

Litchfield National Park

Aboriginal experiences

Arts and culture

Festivals and events

Food and drink

Adventure and sports

Walks and hikes

Road trips and drives

Beaches and islands

Nature and national parks

Eco-friendly travel

Health and wellness

Family travel

Family destinations

Family road trips

Backpacking

Work and holiday

Beginner's guide

Accessible travel

Planning tips

Trip planner

Australian budget guide

Itinerary planner

Find a travel agent

Find accommodation

Find transport

Visitor information centres

Deals and travel packages

Visa and entry requirements FAQ

Customs and biosecurity

Working Holiday Maker visas

Facts about Australia

Experiences that will make you feel like an Aussie

People and culture

Health and safety FAQ

Cities, states & territories

Iconic places and attractions

When is the best time to visit Australia?

Seasonal travel

Events and festivals

School holidays

Public holidays

How to get to Australia's most iconic cities

How long do I need for my trip to Australia?

How to travel around Australia

Guide to driving in Australia

How to hire a car or campervan

How to plan a family road trip

How to plan an outback road trip

- Australian visa information

- Working holiday visas

Sydney Airport, New South Wales © Sydney Airport

Australian Visa and Entry Requirements FAQs

Learn about visa requirements for entry to Australia for tourism purposes with this list of frequently asked questions.

Please note this page is intended to provide general information only and does not constitute legal advice. Tourism Australia is not the Australian government visa granting authority. For information on visas to enter Australia, visitors should seek the most up-to-date information from Australian Government Department of Home Affairs .*

Ready to plan your trip? We're ready to welcome you! Here are some helpful tips for getting your visa sorted:

- Be sure to secure the appropriate visa before travelling to Australia. Use the Visa Finder to explore your options.

- Ensure all details are correct and provide all required documents when you apply. An incomplete or incorrect application can delay your visa.

- Submitting multiple applications at the same time can slow the process. For visitor visas, submit one application per person, including children.

- Questions? The Australian Government's Global Service Centre can help.

Australian Visa Information

Unless you are an Australian citizen, you will need a valid Australian visa to enter the country. New Zealand passport holders can apply for a visa upon arrival in the country. All other passport holders, regardless of age, must apply for a visa before leaving home. You can apply for a range of Australian visa types, including tourist visas and working holiday visas, via the ETA app or on the Department of Home Affairs website.

There are different Australian visa types available for travellers to Australia. Knowing which Australian visa to apply for depends on the length of your stay, your passport and the purpose of your visit. You’ll also need to meet certain financial and medical requirements, be outside of Australia when applying and maintain health insurance for the duration of your stay.

Electronic Travel Authority visa (subclass 601) This visa allows you to visit Australia as many times as you want, for up to a year, and stay for three months each visit. This visa is available to passport holders from a number of countries and regions, who live outside Australia. A step-by-step guide on how to apply is here .

All ETA-eligible passport holders must apply for an ETA using the Australian ETA app. Agents can assist you in the application process, but you must be physically present as a live facial image is required.

eVisitor (subclass 651) This is a free visa for multiple visits to Australia for tourism or business purposes for up to three months at a time within a 12-month period. This visa is available to passport holders from a number of European countries and it cannot be extended.

Visitor visa (subclass 600) The Visitor visa allows you to visit Australia, either for tourism or business purposes. It is open to all nationalities. Generally, a period of stay of up to three months is granted, but up to 12 months may be granted in certain circumstances. Applicants will have to pay a fee to submit their application.

The application process may differ depending on which visa you need.

You can only apply for the Electronic Travel Authority visa (subclass 601) through the Australian ETA app. A step-by-step guide on how to apply is located here .

For other visas, you can apply online by creating an ImmiAccount and completing the application process. Be sure to submit your application well in advance of your travel date to allow enough time for processing. You may be asked to provide further supporting information. You will be notified in writing if your tourist visa is approved and it will be digitally linked to your passport. For more information on different visa types, and Australian visa requirements including how to apply for an Australian visa, visit the Department of Home Affairs website.

If you are already in Australia and hold a valid Electronic Travel Authority visa (subclass 601) you can extend your stay by applying for another visa, such as a Visitor visa (subclass 600). An eVisitor (subclass 651) cannot be extended.

See the Department of Home Affairs website for details.

Working Holiday Visas

Australia's Working Holiday Maker program allows visitors aged under 30 (or 35 in certain cases) who hold a passport from a participating country to travel and work in Australia. Working holiday visas are valid for one year, or up to three years if you meet certain conditions.

Find out more about working holiday visas here .

*Australian visa regulations (including visa application charges) change from time to time. The information provided here is valid at the time of publication, but visitors should check this information is still current by visiting the Australian Department of Home Affairs .

More articles like this

We use cookies on this site to enhance your user experience. Find out more . By clicking any link on this page you are giving your consent for us to set cookies.

Acknowledgement of Country

We acknowledge the Traditional Aboriginal and Torres Strait Islander Owners of the land, sea and waters of the Australian continent, and recognise their custodianship of culture and Country for over 60,000 years.

- International (English)

- New Zealand (English)

- Canada (English)

- United Kingdom (English)

- India (English)

- Malaysia (English)

- Singapore (English)

- Indonesia (Bahasa Indonesia)

- Deutschland (Deutsch)

- France (Français)

- Italia (Italiano)

- 中国大陆 (简体中文)

*Product Disclaimer: Tourism Australia is not the owner, operator, advertiser or promoter of the listed products and services. Information on listed products and services, including Covid-safe accreditations, are provided by the third-party operator on their website or as published on Australian Tourism Data Warehouse where applicable. Rates are indicative based on the minimum and maximum available prices of products and services. Please visit the operator’s website for further information. All prices quoted are in Australian dollars (AUD). Tourism Australia makes no representations whatsoever about any other websites which you may access through its websites such as australia.com. Some websites which are linked to the Tourism Australia website are independent from Tourism Australia and are not under the control of Tourism Australia. Tourism Australia does not endorse or accept any responsibility for the use of websites which are owned or operated by third parties and makes no representation or warranty in relation to the standard, class or fitness for purpose of any services, nor does it endorse or in any respect warrant any products or services by virtue of any information, material or content linked from or to this site.

Prince William to travel to Germany to cheer on England at Euro 2024

William, who is president of the FA, faced criticism last year for not attending the women's World Cup final in Australia when the Lionesses lost to Spain.

Wednesday 12 June 2024 15:47, UK

Please use Chrome browser for a more accessible video player

The Prince of Wales will travel to Germany to cheer on England at the Euro 2024 tournament.

William will watch Gareth Southgate's side take on Denmark at the Frankfurt Arena on Thursday 20 June, Kensington Palace announced.

The heir-to-the-throne, who will celebrate his 42nd birthday the following day, is not expected to be accompanied by any other members of the Royal Family .

The Princess of Wales is currently away from public duties due to her ongoing cancer treatment - while the match comes on a school night for Prince George, Princess Charlotte and Prince Louis.

William, who is president of the FA, faced criticism last year for not attending the women's World Cup final in Australia when England lost to Spain.

It was the first time the Lionesses had reached that stage - and the first time an England football team had competed in a World Cup final since Alf Ramsey's men beat West Germany in 1966.

Keep up with all the latest news from the UK and around the world by following Sky News

William spoke to the England squad on Monday when he made a surprise visit to St George's Park, England's national football centre, in Burton-upon-Trent.

He also shared his youngest son Prince Louis' advice , who suggested the players "eat twice the amount" to secure their bid for glory.

Aston Villa fan William will not be at England's first Group C match on Sunday against Serbia. The Three Lions play their third group game against Slovenia on Tuesday 25 June.

The tournament kicks off in Munich on Friday when Scotland take on hosts Germany in their Group A clash.

Read more: Security ramped up for 'high-risk' England game Poll reveals whether England fans are optimistic about Euros

Be the first to get Breaking News

Install the Sky News app for free

Scotland will be hoping for an early upset as they attempt to get past the group stage for the first time in 11 international tournaments.

Related Topics

- Prince William

Sport | Football

Kylian Mbappe injury latest LIVE! News and updates after France captain taken to hospital with broken nose

Kylian Mbappe injury latest LIVE!

France have confirmed that Kylian Mbappe can continue at Euro 2024 . The influential Les Bleus captain and attacking talisman suffered a broken nose during the latter stages of Monday night’s physical 1-0 win over Austria that got their Group D campaign off to a winning start.

Mbappe was left covered in blood in gruesome scenes after his head made contact with the shoulder of Austria defender Kevin Danso as the duo competed at a late free-kick at the Dusseldorf Arena. Austria goalkeeper Patrick Pentz signalled for immediate medical assistance and Mbappe received lengthy treatment on the pitch, before walking off and then receiving a yellow card for coming back onto the field unauthorised and sitting on the turf in bizarre scenes to halt the game after France were unable to get a substitute on and had to temporarily play with 10 men.

Mbappe was eventually replaced by Olivier Giroud, with French boss Didier Deschamps revealing after the game that he had broken his nose. Mbappe was then transported to a local hospital via ambulance, where assessments determined that he does not need surgery but will undergo dedicated treatment in the days ahead as a protective facemask is designed for his return to action. Follow all the latest news and updates on Kylian Mbappe’s injury live below.

Kylian Mbappe injury latest

Live updates

France fixtures

Will Kylian Mbappe be fit to face Netherlands on Friday night? It is their toughest game on paper.

France’s next group games

- Netherlands vs France (Friday, 8pm)

- France vs Poland (Tuesday, 5pm)

Kylian Mbappe NOT ruled out of Euro 2024

Kylian Mbappe has rejoined the France squad after being released from hospital and will NOT be ruled out of the competition.

The star forward will "undergo treatment in the coming days, without undergoing surgery immediately".

The French Football Federation added: "A mask will be made so as to allow the number 10 of the French team to consider resuming competition after a period devoted to treatment."

Kylian Mbappe 'not doing well'

France boss Didier Deschamps has confirmed captain Kylian Mbappe is "not doing well" after suffering a suspected broken nose.

During France's 1-0 win over Austria, Mbappe's face hit Kevin Danso's shoulder after heading the ball in a freak accident.

Mbappe, covered in blood, was soon replaced and it was later confirmed he did not need surgery. Deschamps said afterwards: "He's not doing well.

"His nose got badly hit. We need to check it out but it seems quite complicated, which is really very unfortunate for us.

"The medical staff are checking him out. I saw him on the massage table. He didn't get off lightly. It's still to be seen and I cannot at this stage give you a precise answer."

French Football Federation confirm no surgery with Mbappe to wear facemask

We now have an official statement from the French Football Federation (FFF).

They confirm that Mbappe did indeed fracture his nose against Austria, but will not undergo surgery “in the immediate future”.

He will receive a period of dedicated treatment in the days ahead, with a protective facemask being designed for when he returns.

No word yet on his availability for the Netherlands game on Friday night in Leipzig.

“Kylian Mbappe returns to the base camp of the French national team,” the FFF said.

“Kylian Mbappe suffered a broken nose during the second part of the Austria-France held this Monday in Dusseldorf.

“The captain of France was treated first by the medical staff and Dr. Franck Le Gall, who diagnosed him with a nose fracture.

“Mbappe will receive treatment in the next few days, but he will not undergo surgery in the immediate future. “A mask will be made for him so that the number 10 of the French national team can prepare for his return to the competition after a period dedicated to treatment.”

Another positive update on Mbappe from French journalist Julien Laurens...

Mbappe tweets: 'Any ideas for masks?'

Mbappe has now tweeted, asking if anyone has any ideas for masks.

That would appear to suggest that he is planning on playing on at the Euros...

Kylian Mbappe will NOT have surgery, claims Fabrizio Romano

A breaking update now on Kylian Mbappe from Fabrizio Romano.

“Kylian Mbappe has just left the hospital after it was confirmed that he broke his nose,” he wrote on social media. “Mbappe will not undergo surgery despite initial indications, waiting to decide how to manage him for upcoming two games.”

Good news for France...

Deschamps refuses to speculate on Mbappe lay-off

Didier Deschamps has admitted that he does not know if Mbappe will be available to face Group D rivals the Netherlands in Leipzig on Friday night.

He is also not being drawn into any hypothetical discussions on a potential lay-off for his star man.

"I don't have the elements in my hands," he said. "He didn't get off lightly.

“It is still to be seen. I cannot at this stage give the answer (if he will be ruled out).”

Deschamps added: “I'm not going to go into hypothesis.

“The French team with Kylian would always be stronger.

“If the news doesn't go along these lines then we'll have to fight without him, but Kylian is Kylian and any team with him in the squad is obviously a lot stronger."

N'Golo Kante admits France stars 'worried' over Mbappe injury

France’s man-of-the-match N’Golo Kante reacts to the Kylian Mbappe injury...

"We're worried to see Kylian leave the field like that,” said the former Chelsea midfielder.

“We still don't know what the situation is.

“We hope that it's not too severe and that he's back with us for the rest of the competition."

Mbappe taken to hospital as surgery decision awaits

A lot of conflicting reports still swirling around about Mbappe’s injury.

The latest seems to be that he has been taken to hospital, with post-game video footage circulating on social media showing him walking into an ambulance for transportation to the University Hospital of Dusseldorf.

Mbappe has also reportedly been seen arriving there.

Some say that Mbappe will have surgery, others say that a decision on an operation will actually be taken overnight after initial assessments. But that it’s not looking good.

Some say it’s still a suspected broken nose, others say it’s been confirmed as such by the French Football Federation (FFF).

Whatever the case, it’s a hugely important few hours coming up in the context of France’s Euro 2024 campaign.

Real Madrid and their legions of fans will also be keeping a very close eye on developments regarding Mbappe, no doubt.

WWE Clash at the Castle 2024: Time, how to watch, match card and more

Get ready for another raucous European WWE crowd.

WWE is heading across the pond again and is bringing back Clash at the Castle, this time hosting the event in Scotland in what is expected to be another loud audience. The first premium live event ever to be held in the country will have five matches taking place Saturday, all of them for championship titles.

Headlining the event will be the rematch of Cody Rhodes and AJ Styles for the Undisputed WWE Universal Championship, except this time it will be an "I Quit" match. Scotland-native Drew McIntyre also will go after the World Heavyweight Championship again when he takes on champion Damian Priest.

Here's what to know for 2024 Clash at the Castle: