Trends, Growth, Opportunity Analysis of Medical Tourism in Thailand

In-depth Look at Demand Forecast for Medical Tourism in Thailand by Cosmetic and Cardiovascular Treatment through 2034

Medical Tourism Viewed as a Cash Cow in Thailand! FMI Pins Down Opportunities for Players in Thailand’s Wellness Retreat Hub and Medical Tourism Sector

- Report Preview

- Request Methodology

Thailand Medical Tourism Industry Outlook 2024 to 2034

In the updated research report, FMI analyzed the demand for medical tourism in Thailand to be US$ 15,378.00 million in 2024. Factors like high standards for medical care, reasonable fees, quality treatments, and affordable cost of living for long-stayers make Thailand a popular choice for medical tourists.

With favorable medical visa and constant government support, key players can anticipate sales from medical tourism in Thailand to exceed US$ 66,104.90 million figure by 2034.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Megatrends Making Thailand a Top Destination for Medical Tourists

- Tourists save large sums of money when it comes to medical expenses incurred in Thailand, even if they include their travel expenses. This is inducing the patient population to travel to Thailand for medical treatment.

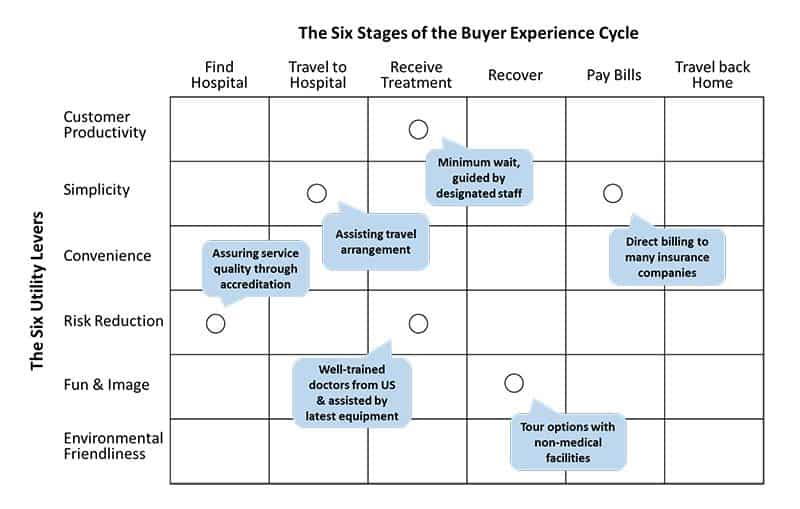

- Foreigners enjoy quick access to medical care in the kingdom. They can easily visit any accredited Thai hospital, even if they do not carry special documentation, without any worry.

- Thai government has simplified the visa process for medical tourists to attract large crowds of medical patients from across the globe. Patients that require long-term treatment can also avail a one-year medical visa.

- Thailand healthcare facilities are globally known for their strict hygiene standards. Additionally, the country is enthusiastic about innovation, which is why it is funding several medical research institutions.

- Short waiting times for healthcare services in Thailand are an appealing point for foreigners visiting for treatments. Foreign patients can go for walk-in appointments, and enjoy access to online healthcare services and hospital booking systems, just like Thai citizens.

- Thailand boasts of international hospitals that are situated in tourist cities and have multilingual staff. Since these hospitals are well-equipped to treat patients of cardiovascular disorders, cancer, etc. and perform high-quality cosmetic surgery, patients are flocking to the country.

- Hospitals in Thailand offer a variety of medical treatment packages that help patients save their money on medical procedures.

- The rich cultural heritage and beautiful scenery of Thailand offer medical tourists an effective way to recoup from surgery.

Overview of Markets Adjacent to the Thailand Medical Tourism Industry

Medical travel is increasing in Thailand, as government is consistently introducing incentives to attract medical tourists to the country. Similar patterns are detected in countries like the United Kingdom and China, where patient population is increasingly traveling for medical treatments.

Tour operators in these countries are building relationship with the hospitality sector to promote high-class services to their clients. Further, high standard of medical treatments is also boosting confidence among people to get treated abroad.

Thailand Medical Tourism Industry:

The United Kingdom Medical Tourism Industry:

China Medical Tourism Industry:

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

Category-wise Thailand Medical Tourism Industry Analysis

International travelers constitute large consumers of medical services in thailand.

International tourists account for 63% value share in 2024. International travelers are flocking to Thailand to enjoy affordable treatment options. Visiting medical tourists from developed countries also benefit from the favorable currency exchange rates.

Medical tourists are also choosing Thailand for its exceptional hospitality services. The climate of Thailand offers a relaxing stay after a surgical procedure. The top-notch facilities and highly qualified experts in Thailand make it a popular choice among international tourists, thus influencing the adoption trends

Medical Reasons Motivate Age Group of People Aged 46-55 Years to Avail Medical Tourism Services of Thailand

Geriatric popular are susceptible to various diseases, chronic pain , or illnesses. This population base is more likely to pursue medical treatments for their illnesses, diseases, or joint problems. In case, the treatment costs in their homeland are out of their pocket, people prefer to travel abroad to get treated.

Strategies Implemented by Players in Thailand Medical Tourism Sector to Attract More Medical Tourists

Key players can work on branding the medical tourism of Thailand in the global industry by highlighting the expertise of Thailand’ healthcare industry in certain treatments. Other than that, competitors are using soft power to induce interest among foreigners to visit Thailand for affordable and high-quality medical treatments.

Principal players are forming alliances with players in different business sectors like hotels, airlines, rehabilitation centers, insurance companies, spas, and tour operators, to provide comprehensive medical tourism packages to their customers. A key benefit of this strategy is that players can reach more tourists by promoting their value-for-money packages.

The healthcare sector in Thailand is constantly upgrading its service quality and advancing its treatment procedures to maintain its position in the global industry. Players can emphasize this aspect while selling packages.

Another such progress is the use of HealthTech in the medical center, as it leads to convenience and efficiency in providing medical services. This aspect of the medical sector in Thailand is acting as a selling point for industry participants.

News Coverage

- In February 2024, Thailand released a medical coverage scheme. This campaign offers $ 14,000 to foreign tourists in case of accidents and over one million baht in case of death, all in good faith to increase confidence in travel safety.

- In December 2022, the Public Health Ministry introduced the “Health for Wealth” concept to promote medical tourism. This initiative is aimed at strengthening the country’s economic state.

- In November 2022, the Cabinet approved a 90-day stay permit for people seeking medical treatment. Additionally, Thailand announced that it will be issuing one-year visas to medical tourists, as the country represents itself as a global hub for healthcare tourism.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Key Coverage in the Thailand Medical Tourism Industry Research Report

- Overview of Medical Travel Industry

- Thailand Medical Tourism Industry Opportunities

Top Companies in the Thailand Medical Tourism Industry

- Jet Medical Tourism

- TMI Medical Tourism (Tour My India Pvt. Ltd.)

- Lotus Medical International

- World Medical and Surgical LLC

- MedEx Ventures Co. Ltd.

- Lyfboat Technologies Pvt. Ltd.

- Medical Electronic Devices and Services Inc.

- Health-Tourism.com

- Smile Planners

- Health Tour Booking (Easy Golf Booking Company Limited)

- Asia Cosmetic Getaways

- Med Tourism Co, LLC

- Thai Medical Vacation

- My Body & Spirit

- Bookimed Limited

Thailand Medical Tourism Industry by Categories

Multiple medical treatment types available in thailand:.

- Dental Treatment

- Cosmetic Treatment

- Cardiovascular Treatment

- Orthopedic Treatment

- Neurological Treatment

- Cancer Treatment

- Fertility Treatment

Different Services Offered in Thailand:

- Wellness Services

- Therapeutic Services

Type of Tourists Visiting Thailand:

- International

Various Tour Types Popular Among Customers:

- Independent Traveller

- Package Traveller

Orientation of Consumer Opting for Medical Tourism Services in Thailand:

Segregation of visitors based on different age groups:.

- 15-25 Years

- 26-35 Years

- 36-45 Years

- 46-55 Years

- 66-75 Years

Different Booking Channels Available for Medical Tourism Packages:

- Phone Booking

- Online Booking

- In-Person Booking

Frequently Asked Questions

What is the sales valuation of medical tourism in thailand as of 2024.

The medical tourism sector of Thailand is nearly US$ 15,378.00 million valuation in 2024.

What is the Demand Forecast for Thailand Medical Tourism for the Years Between 2024 to 2034?

The demand growth of medical tourism in Thailand is going to increase at a 15.70% CAGR through 2034.

How Much Revenue this Industry is Expected to Generate by 2034?

The medical tourism sector of Thailand is likely to reach US$ 66,104.90 million figure by 2034.

Which Age Group Forms the Substantial Consumer Base for Medical Tourism Services of Thailand?

People between 46-55 years are the frequent consumers of Thailand’s medical tourism.

Which Players in the Thailand Medical Tourism Industry are Influential?

Lotus Medical International, World Medical and Surgical LLC, and MedEx Ventures Co. Ltd. are promising participants in the Thailand medical tourism industry.

Table of Content

Recommendations

Travel and Tourism

Thailand Culinary Tourism Industry

REP-GB-15323

Trends, Growth, and Opportunity Analysis of Sustainable Tourism in Thailand

REP-GB-15335

Explore Travel and Tourism Insights

- Get Free Brochure -

Your personal details are safe with us. Privacy Policy*

- Request Methodology -

- customize now -.

I need Country Specific Scope ( -30% )

- Talk To Analyst -

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Key Trends in Thailand’s Medical Tourism Market

For the past decade, Thailand has been a top destination for medical tourists. It has become increasingly common for consumers to cross borders for medical services. One of the countries with the highest influx of medical tourists in the world is Thailand. In 2019, it scored 66.83 in the worldwide medical tourism market index.

In an effort to curb the spread of the COVID-19 pandemic, Thailand closed its borders for most of 2020 and 2021. The country was successful in dealing with the pandemic, and after rolling out nationwide vaccination programs, it opened its borders late in 2021 and promptly positioned itself as a top medical tourism destination once again.

How has Thailand managed to become the region’s top medical tourism destination, and how can they develop this market to accelerate its growth in the post-pandemic world? We look at the current trends and opportunities based on the statistics of medical tourism in Thailand.

Why is Thailand popular for medical tourism?

Thailand is known for having affordable yet advanced healthcare services, which draws many medical tourists to the country. Compared to its Southeast Asian neighbors, healthcare institutions in Thailand highly prioritize certifications, high-quality equipment, and training for professionals. They also offer universal healthcare that provides coverage to most of the population.

In 2019, Thailand’s medical tourism market drew more than 600,000 inbound tourists, logging a value of 1.8 billion US dollars. It is projected that this value will rise to 9.9 billion by 2023 and increase further to 24.4 billion by 2027.

Treatments that medical tourists go to Thailand for range from major surgeries like heart bypass and hip replacements to dental and cosmetic work. In October 2021, as the country reopened to tourists, hospitals and medical institutions introduced COVID-19 recovery units and quarantine resorts in Bangkok as part of their plans to revive the medical tourism industry.

Thailand’s medical tourism market has maintained a competitive edge over Singapore, another popular destination for medical tourists in Southeast Asia. Treatment costs as well as travel expenses are cheaper in Bangkok, which helps the country draw more tourists every year.

Moreover, the hospitality industry in Thailand is also highly developed, offering tourists many interesting destinations prior to or after their treatment, allowing them to make the most out of their trips. The country is known for its beaches, cultural heritage, and local cuisine, which are all considered affordable experiences.

The future of medical tourism in Thailand

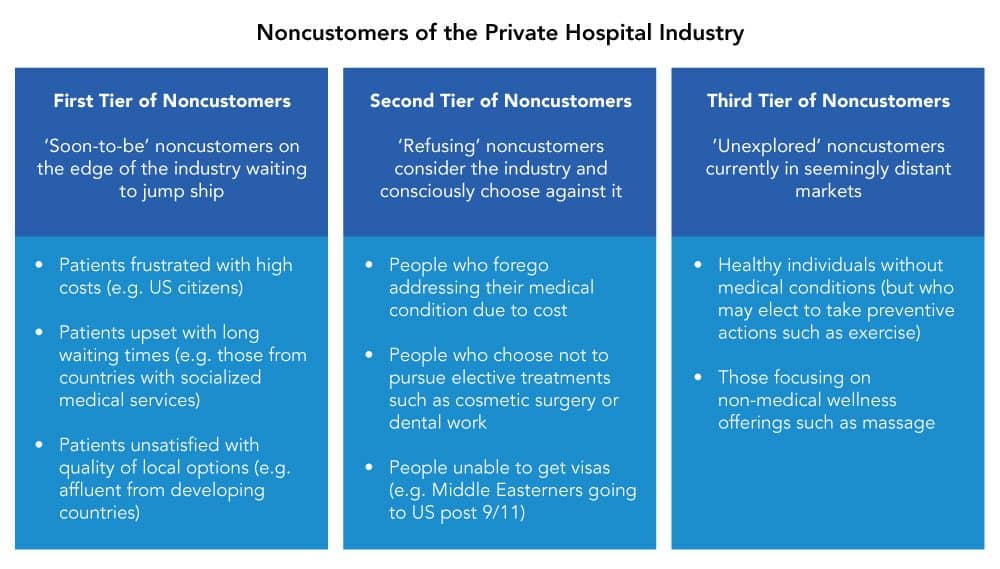

Thailand’s medical tourism market is already known for offering great value and providing great care at the same time. In the post-COVID era, wellness can be promoted as another major avenue for tourists that are not seeking strict medical care. Some services that can be offered under this new banner include traditional medicine, mind and body fitness, nutrition, meditation, yoga, and spa treatments.

Hospitals and other medical institutions in Thailand may also be able to attract new customers by securing international accreditation and certifications that will help assure patients that they will be safe and taken care of when seeking treatment in the country. Adopting smart technology solutions for hospitals, such as patient databases, smart medical devices, and automated administrative workflows can help healthcare providers focus on their patients’ needs more while also optimizing their processes.

Latest Articles

Exploring the Digital Health Competitive Landscape in Thailand

Thailand has experienced significant growth in its digital health market, propelled by the government's push towards digital transformation and the rising adoption of health technologies. The market encompasses a range of digital health solutions, including telemedicine, electronic health records (EHR), mobile health apps (mHealth), and wearable technologies. These conditions create a digital health competitive landscape in Thailand.

Global Changes in Technology Roles in Companies

The global changes in technology roles are reshaping business operations and strategies. We explore these changes in this article.

Exploring Thailand's Electric Vehicle Ecosystem: Growth, Segments, and Market Players

Thailand's electric vehicle (EV) ecosystem is undergoing rapid development, marked by diverse segments experiencing substantial growth and dynamic market shifts. The positive performance of EV segments in Thailand is expected to shape the future of transportation in the country.

ASEAN EV Market: Expanding Production in Thailand

Electric vehicle (EV) adoption in Southeast Asia has gained momentum in recent years, albeit slower than in other regions like Europe and China. Indonesia boasts the largest nickel deposits globally, while Vietnam's abundant nickel reserves make it ideal for battery production. Thailand, the region's largest producer and market for EVs, offers incentives to position itself as a base for EV manufacturing. These factors provide good provisions for the ASEAN EV industry.

Discuss your needs with our team

Talk to us to discuss your needs and pain points.

Future Market Insights Blog

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- February 2023

- January 2023

- Automotive & Transportation

- Chemicals & Materials

- Electronics, Semiconductors & ICT

- Energy, Mining, Oil & Gas

- Food and Beverages

- Industrial Automation & Equipment

- Market Trends

- Press Release

- Retail and Consumer Products

- Services and Utilities

- Testing Equipment

Healing Wave: Thailand Medical Tourism Industry Surges at 15.70% CAGR by 2034, Y-o-Y Growth Analysis

The sun-drenched shores of Thailand are beckoning not just for leisure travelers, but also for medical tourists seeking high-quality, affordable healthcare. FMI’s latest research estimates the Thailand medical tourism market at a substantial USD 15,378.00 million in 2024 , projected to surge to a staggering USD 66,104.90 million by 2034 , reflecting a phenomenal CAGR of 15.7% . Are you ready to be a part of this healthcare haven’s success story?

Why Thailand’s Medical Tourism Market is Your Golden Opportunity:

- Quality Care at Competitive Costs: Thailand offers exceptional medical care at a fraction of the price compared to Western countries. Attract cost-conscious patients seeking high-quality treatments.

- Favorable Government Policies: The Thai government actively supports medical tourism with simplified visa processes and ongoing industry development. Benefit from a supportive regulatory environment.

- Efficiency Matters: Foreign patients enjoy quick access to care, short waiting times, and convenient online appointment booking systems. Offer streamlined services that prioritize patient experience.

Request Sample copy Here: https://www.futuremarketinsights.com/reports/sample/rep-gb-15249

- Cutting-Edge Technology: Thailand prioritizes medical innovation – a boon for patients seeking advanced treatments. Partner with forward-thinking hospitals to attract patients seeking the latest procedures.

- Hygienic Standards You Can Trust: Thai healthcare facilities adhere to strict hygiene protocols, ensuring patient safety and peace of mind. Showcase your commitment to the highest quality standards.

- Multilingual Care: Hospitals cater to international patients with multilingual staff, ensuring clear communication and a comfortable experience. Attract a diverse clientele seeking seamless communication.

- Recuperation in Paradise: Thailand’s stunning landscapes and rich cultural heritage provide the perfect backdrop for medical recovery. Offer patients a holistic recovery experience.

- Packaged Solutions for Savings: Hospitals offer cost-effective medical packages, making treatments even more affordable for patients. Promote these packages to attract budget-conscious medical tourists.

Competitive Edge for Astute Healthcare Providers:

This flourishing market demands excellence and a patient-centric approach:

- Specialization is Key: Focus on specific medical specialties to attract patients seeking advanced treatment options in Thailand.

- Invest in Patient Care: Prioritize patient comfort and well-being. Offer personalized care plans, cultural sensitivity training for staff, and comfortable recovery facilities.

- Embrace Technology: Utilize online platforms for patient consultations, appointment booking, and post-treatment follow-up. Offer a seamless digital experience for patients.

- Strategic Partnerships: Collaborate with travel agencies to create holistic medical tourism packages that combine healthcare with leisure activities.

- Building Trust is Paramount: Maintain transparency in pricing and procedures. Showcase success stories and patient testimonials to build trust with potential patients.

Key Takeaways:

- Thailand remains the pioneer in the global medical tourism market due to its systematic approach while establishing the sector.

- Cosmetic and Dental Treatments are some of the most affordable and trusted procedures in Thailand, making them the prominent treatments opted for by medical tourists.

- Online bookings were the most preferred mode of bookings among the consumers in the Thailand medical tourism market share.

- Female medical tourists outnumbered the male medical tourists in the Thailand medical tourism market size.

Request Customization @ https://www.futuremarketinsights.com/customization-available/rep-gb-15249

Key Manufacturing Companies:

- Jet Medical Tourism

- TMI Medical Tourism (Tour My India Pvt. Ltd.)

- Lotus Medical International

- World Medical and Surgical LLC

- MedEx Ventures Co. Ltd.

- Lyfboat Technologies Pvt. Ltd.

- Medical Electronic Devices and Services Inc.

- Health-Tourism.com

- Smile Planners

- Health Tour Booking (Easy Golf Booking Company Limited)

- Asia Cosmetic Getaways

- Med Tourism Co, LLC

- Thai Medical Vacation

- My Body & Spirit

- Bookimed Limited

Competitive Landscape

Key firms in the Thailand medical tourism market are focused on providing customers with a hassle-free experience. To provide customers with utmost comfort, the service providers offer end-to-end solutions for all the travel needs and accommodation. For instance:

- Thai Medical Vacation offers complete solutions on their online platform for major treatments, providing services ranging from visa, consultation appointments, and stay accommodations.

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer, Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of ~400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Contact Us:

Future Market Insights Inc. Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware – 19713, USA T: +1-845-579-5705 For Sales Enquiries: [email protected] Website: https://www.futuremarketinsights.com LinkedIn | Twitter | Blogs | YouTube

About the Author

Associate Vice President at Future Market Insights is deeply committed to uncovering actionable insights for consumer and food and beverage players. She brings a unique blend of analysis, industry trends, and consumer behavior to put data into perspective.

What she makes out of data becomes a delight to read. She has authored many opinions, including for publications like Process Industry Informer and Spinal Surgery News, as she understands the market pulse and consumers' shifting preferences.

She likes to bring experts to a roundtable to weigh the impact of a trend on an industry. Catch up with her discussion on the impact of AI in packaging.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Recent Posts

Flexible battery market to surge to usd 2,028.8 million by 2034, driven by rapid development and innovation, europe rubber derived unrefined pyrolysis oil market to hit us$ 12,202.5 thousand by 2032, with 5.5% cagr growth, gypsum market poised for significant growth, forecasted to hit us$ 13.76 billion by 2033 with 6.2% cagr, wood-charcoal market to hit us$ 27.6 billion in 2034 with steady growth, according to future market insights.

- Rising Demand for Coatings and Lubricants Fuels Growth in Precipitated Barium Sulphate Market

Recent Comments

You may also like these.

MarkWide Research

444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 310-961-4489

24/7 Customer Support

[email protected]

Email us at

All our reports can be tailored to meet our clients’ specific requirements, including segments, key players and major regions,etc.

Thailand Medical Tourism Market Analysis- Industry Size, Share, Research Report, Insights, Covid-19 Impact, Statistics, Trends, Growth and Forecast 2024-2032

Corporate User License

- Report Description

- Major Segmentation

- Major Companies

Market Overview

Thailand has emerged as one of the leading destinations for medical tourism, offering high-quality healthcare services, state-of-the-art facilities, and affordable treatment options. With its renowned medical expertise, world-class hospitals, and a wide range of specialized procedures, Thailand attracts millions of international patients every year. This comprehensive market analysis explores the key insights, trends, opportunities, and challenges in the thriving Thailand Medical Tourism market.

Medical tourism refers to the act of traveling to another country for medical treatment, often seeking specialized procedures, cost savings, or access to advanced healthcare facilities not available in the home country. In the case of Thailand, medical tourism encompasses a broad spectrum of treatments, including cosmetic surgery, dental procedures, fertility treatments, orthopedics, cardiology, and more.

Executive Summary

The Thailand Medical Tourism market has experienced remarkable growth over the past decade, fueled by the country’s exceptional healthcare infrastructure, renowned medical professionals, and attractive tourist destinations. The market has become a global hub for individuals seeking affordable, high-quality medical procedures. This report provides a comprehensive analysis of the market dynamics, key trends, competitive landscape, and future outlook, highlighting the immense potential and opportunities that Thailand offers to medical tourists.

Key Market Insights

- The Thailand Medical Tourism market is projected to witness substantial growth, driven by factors such as affordable treatment costs, shorter waiting times, internationally accredited hospitals, and the country’s reputation for exceptional healthcare services.

- The availability of a wide range of medical treatments, including cosmetic procedures, cardiac surgeries , orthopedic surgeries, and IVF, positions Thailand as a comprehensive medical tourism destination.

- The market is attracting a diverse range of patients, including individuals from neighboring countries, expatriates, and tourists from Western countries, drawn by the affordability, quality, and hospitality of Thailand’s healthcare sector.

Market Drivers

- Cost Advantage: Thailand offers cost savings of up to 50-70% compared to Western countries, making it an attractive choice for individuals seeking affordable healthcare without compromising on quality.

- High-Quality Healthcare Infrastructure: Thailand boasts a robust healthcare infrastructure, with internationally accredited hospitals equipped with cutting-edge technology, advanced medical equipment, and well-trained medical professionals.

- Reputation for Medical Excellence: Thailand has gained a strong reputation for medical expertise and successful outcomes in various specialties, attracting patients seeking specialized treatments.

- Government Support: The Thai government has actively supported the development of the medical tourism industry, implementing policies to streamline visa procedures, ensuring patient safety, and promoting international marketing campaigns.

Market Restraints

- Language and Cultural Barriers: While English is widely spoken in major hospitals, language and cultural differences can still pose challenges for some patients, requiring improved communication and cultural sensitivity.

- Lengthy Travel and Recovery Periods: Traveling for medical treatment involves time and logistical considerations. Some patients may find the travel and recovery periods prolonged, particularly for complex procedures.

- Insurance Coverage Limitations: Insurance coverage for medical tourists can vary, limiting accessibility and affordability for certain treatments, especially for patients from countries with limited coverage options.

Market Opportunities

- Rising Demand for Cosmetic Procedures: Thailand is witnessing a significant surge in medical tourists seeking cosmetic surgeries, including facelifts, breast augmentations, and liposuction. This trend presents a lucrative opportunity for healthcare providers specializing in cosmetic procedures.

- Growing Aging Population: The increasing aging population globally, coupled with the rising demand for specialized geriatric care , opens avenues for Thailand to position itself as a destination for senior healthcare and retirement options.

- Technological Advancements: Embracing emerging technologies, such as telemedicine, robotics, and artificial intelligence, can enhance Thailand’s medical tourism industry by providing remote consultations, improving surgical precision, and reducing recovery times.

Market Dynamics

The Thailand Medical Tourism market operates in a dynamic environment, influenced by various factors such as changing patient preferences, advancements in medical technology, geopolitical conditions, and evolving healthcare regulations. It is crucial for stakeholders to adapt and innovate to stay competitive in this ever-evolving landscape.

Regional Analysis

Thailand’s medical tourism market is not limited to Bangkok; it extends to popular tourist destinations such as Phuket, Chiang Mai, and Pattaya. Each region offers unique advantages, including specialized medical facilities, scenic beauty, and leisure activities, attracting medical tourists from different parts of the world.

Competitive Landscape

The Thailand Medical Tourism market features a competitive landscape with a mix of local and international healthcare providers. Renowned hospitals, medical centers, and wellness retreats vie for market share by offering specialized treatments, competitive pricing, personalized care, and superior patient experiences. Maintaining high standards of quality, adopting innovative practices, and building strong relationships with patients are crucial for long-term success in this competitive market.

Segmentation

The Thailand Medical Tourism market can be segmented based on the types of medical procedures, including cosmetic surgery, dental treatments, orthopedic surgeries, cardiac procedures, fertility treatments, and wellness tourism. Each segment presents unique opportunities and challenges, catering to diverse patient needs and preferences.

Category-wise Insights

- Cosmetic Surgery: Thailand has gained a reputation as the “cosmetic surgery capital of the world.” The market offers a comprehensive range of procedures, including breast augmentations, rhinoplasty, liposuction, and gender reassignment surgeries.

- Dental Tourism: Thailand’s dental tourism sector has witnessed substantial growth, with advanced dental clinics, skilled dentists, and affordable treatments attracting patients from around the world.

- Orthopedic Procedures: Thailand is renowned for its orthopedic expertise, offering joint replacements, spinal surgeries, and sports medicine treatments, catering to both local and international patients.

- Cardiac Treatments: The country has developed world-class cardiac centers, performing complex heart surgeries, cardiac catheterization, and cardiac rehabilitation programs.

- Fertility Treatments: Thailand is emerging as a popular destination for fertility treatments, providing advanced reproductive technologies, such as in-vitro fertilization (IVF) and surrogacy options.

- Wellness Tourism: Thailand’s wellness tourism sector offers a range of holistic treatments, spa therapies, detox programs, and yoga retreats, combining healthcare with relaxation and rejuvenation.

Key Benefits for Industry Participants and Stakeholders

- Revenue Generation: The thriving medical tourism market in Thailand presents significant revenue opportunities for healthcare providers, hospitals, clinics, and associated service providers.

- Enhanced International Reputation: Participation in the medical tourism sector allows healthcare institutions to establish an international reputation for excellence and attract patients from diverse global markets.

- Economic Growth: Medical tourism contributes to the overall economic growth of Thailand, driving investments, employment opportunities, and infrastructure development.

- Knowledge Exchange and Collaboration: International patients contribute to knowledge exchange, allowing healthcare providers to learn from global best practices and collaborate with international experts.

SWOT Analysis

- Strengths: World-class healthcare infrastructure, affordable treatment costs, renowned medical expertise, favorable government policies, and an attractive tourist destination.

- Weaknesses: Language and cultural barriers, limited insurance coverage options, long travel and recovery periods for complex procedures.

- Opportunities: Rising demand for cosmetic procedures, growing aging population, embracing technological advancements, and expanding wellness tourism.

- Threats: Competition from other medical tourism destinations, geopolitical uncertainties, changing healthcare regulations.

Market Key Trends

- Rise in Wellness Tourism: The increasing focus on holistic well-being and preventive healthcare has led to a surge in wellness tourism in Thailand. Visitors seek rejuvenation, stress reduction, and relaxation through wellness retreats, spa therapies, and yoga retreats.

- Digital Marketing and Online Presence: Healthcare providers are leveraging digital marketing strategies, social media platforms, and online medical tourism portals to reach a wider audience, build brand awareness, and facilitate patient inquiries and bookings.

- Collaboration with International Partners: Thai hospitals are forming strategic partnerships and affiliations with international healthcare providers to enhance their reputation, attract more international patients, and exchange medical knowledge and expertise.

- Emphasis on Medical Quality and Safety: Accreditation by international bodies such as Joint Commission International (JCI) and International Organization for Standardization (ISO) is becoming crucial to establish trust, ensure patient safety, and maintain high-quality standards.

Covid-19 Impact

The COVID-19 pandemic significantly impacted the global medical tourism industry, including Thailand. Travel restrictions, lockdowns, and health concerns led to a temporary decline in medical tourism activities. However, Thailand’s successful management of the pandemic, implementation of stringent safety protocols, and vaccine rollout have instilled confidence among international patients, gradually revitalizing the market.

Key Industry Developments

- Virtual Consultations: To address travel restrictions and facilitate patient consultations, healthcare providers have adopted telemedicine and virtual consultation services, allowing patients to discuss treatment options remotely.

- Health and Safety Measures: Hospitals and clinics have implemented strict health and safety protocols, including enhanced sanitation, social distancing, and COVID-19 testing, to ensure patient and staff safety.

- Vaccine Tourism: Thailand has started offering vaccine tourism packages, attracting individuals from countries with limited vaccine availability to receive their doses while enjoying the country’s tourist attractions.

Analyst Suggestions

- Strengthening Language Support: To overcome language barriers, healthcare providers should focus on providing multilingual staff, interpretation services, and translated medical documents, ensuring effective communication with international patients.

- Targeted Marketing Campaigns: Healthcare providers should develop targeted marketing campaigns that highlight Thailand’s competitive advantages, such as cost savings, quality healthcare, personalized care, and the country’s unique tourist attractions.

- Collaboration with Travel Industry: Collaborating with travel agencies, airlines, and hotels can create comprehensive medical tourism packages that offer seamless travel and treatment experiences for international patients.

Future Outlook

The Thailand Medical Tourism market is poised for sustained growth in the coming years. The increasing recognition of Thailand as a preferred medical tourism destination, coupled with the country’s commitment to continuous improvement, innovation, and patient satisfaction, positions it to tap into new market segments and expand its global reach.

Thailand’s medical tourism market offers a compelling combination of high-quality healthcare, affordable treatment costs, and a rich cultural experience. With its advanced medical infrastructure, skilled healthcare professionals, and diverse range of treatments, Thailand continues to attract a growing number of medical tourists seeking world-class healthcare services. As the market evolves, stakeholders must remain adaptable, embrace technology, focus on patient-centered care, and leverage strategic partnerships to capitalize on the immense potential of the Thailand Medical Tourism market.

Thailand Medical Tourism Market

Leading companies in the Thailand Medical Tourism market:

- Bumrungrad International Hospital

- Bangkok Hospital Group

- Samitivej Hospital

- Vejthani Hospital

- Yanhee Hospital

- Bangkok Dusit Medical Services Public Company Limited

- Paolo Hospital Group

- Phyathai Hospitals Group

- Rajavithi Hospital

- Sikarin Public Company Limited

Important Questions Covered in this Study

- Which are the main companies that are currently operating within the market?

- What are the factors that are predicted to propel the growth of the market?

- What are the factors that are expected to limit the growth of the market?

- Which company had the largest market share?

- What are the main opportunities available in the market?

- What are the market size and growth rates of the various segments within the market?

- What are the market sizes and growth rates of the overall market or specific regions ?

- Which region or segment is projected to be the primary driver of market growth during the forecast period?

- What are the significant trends observed in the market?

Why Choose MWR ?

Quality research.

Our goal is to provide high-quality data that stimulates growth and creates a win-win situations.

Unlimited User Access

We offer Corporate User license access on all our reports in which you can share the report with your entire team without any restrictions.

Free Company Inclusion

We give you an option to include 3-4 additional company players of your choice in our report without any extra charges.

Post Sale Assistance

Unlimited post sales service with an account manager dedicated to making sure that all your needs are met.

Covid-19 Impact Analysis

All our research report includes latest Covid-19 Impact and its analysis.

Client Associated with us

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

Client Testimonials

+1 424 360 2221, sales@markwidere search.com, download free sample pdf, customize this study, speak to analyst.

Press enter to see results or esc to cancel.

An Overview of Thailand’s Medical Tourism Industry

If you’ve been paying attention to the trends among healthcare systems , you may be familiar with the impact of Thailand’s medical tourism. But what exactly is medical tourism? The short answer is that it’s a cost-effective way of seeking quality medical care and treatments in a foreign country.

Since COVID-19, people from outside of Thailand have been traveling here for high-quality hospitals. Foreigners can access high-quality care at top-notch facilities for a fraction of the cost they would find in their home countries.

In addition, with vaccination programs successfully implemented across the globe, Thailand is now welcoming foreign medical tourists looking to invest in their health and improve their wellbeing with open arms. For patients who need long-term treatments, there is now even a one-year medical visa .

In this article, Pacific Prime Thailand examines the current state of Thailand’s medical tourism industry, the most popular treatments and procedures, and the ongoing wellness trends.

Thailand Medical Tourism

There are several reasons that make Thailand the best destination for medical tourism with the main one being Thailand performed outstandingly well during the pandemic. From policymakers to researchers and doctors, every party in the healthcare industry displayed Thailand’s resilience to the world.

Experts have estimated that in 2023, the size of the Thai medical tourism industry will exceed what it was in 2019 and will be valued at THB ฿2 billion (USD $56.4 million). They are optimistic about future growth prospects, in part due to the recent onset of the silver economy.

Some countries, like the UK’s National Health Service (NHS) , have public healthcare systems that provide free medical treatment. However, these public healthcare systems often have long waiting lists for non-life-threatening conditions, leading patients to seek private healthcare for quicker treatment instead.

Thailand’s Private Hospitals

When it comes to medical tourism, private hospitals in Thailand truly shine . Thai doctors are well-trained in the latest treatments, and hospitals are outfitted with cutting-edge technology. Doctors and medical staff who attract tourists in Thailand also have excellent language skills.

Beyond the medical side, people who travel to Thailand for healthcare are often amazed at the excellent amenities Thai hospitals offer. In addition, their customer service can compete with that of world-class hotels!

Most Common Medical Tourism Treatments and Procedures

Nobody becomes a medical tourist to save money after a heart attack. Medical tourism isn’t for emergency medical care; any critical conditions should be treated immediately at the best possible facility in the area, hence the most common reasons for medical tourism are:

1. Scans of Various Kinds

The average cost of an MRI scan in the United States (U.S.) is USD $1,325. Therefore, some people are willing to pay for a flight to Thailand where the highest cost of the same scan is only USD $1,100 . Other medical scans like PET scans, CT scans, ultrasounds, and X-rays are also less expensive too.

2. Cosmetic Procedures and Dental Work

Whether it’s a facelift, tummy tuck, breast augmentation, anti-aging treatment, veneers, or any other elective or non-elective cosmetic surgery , significant savings can be realized by choosing Thailand for the procedure.

Dental treatment is also a good reason to visit Thailand. Dental clinics with full accreditation are comparable to those in the U.S., while the costs are significantly cheaper. Of course, this depends on what you want. A simple consultation followed by a thorough scaling costs no more than USD $60 .

3. Physical Examination

Why not combine your regular physical examination with a tropical holiday and substitute a stuffy hospital environment with a medical facility that could pass for a 5-star resort at an affordable price? It’s easy to see why people opt for check-ups in Thailand.

Additionally, private hospitals offer several annual promotions to attract medical tourists for full health check-ups that can be considerably cheaper than back home.

4. Heart Surgery

The biggest savings can be made on more complicated procedures. For example, a heart-valve replacement, which typically costs an average of USD $170,000 in the U.S. , is priced at only USD $26,400 in Thailand , even at one of the country’s most expensive hospitals. Still, prices may vary among individuals.

5. Joint Replacement

In the U.S., the average cost of hip replacement starts from USD $45,000. In Thailand, however, the same procedure may cost only USD $7,000 on average. Likewise, knee replacement surgery can cost USD $50,000 on average in the U.S. but only USD $7,000 in Thailand.

6. Eye Surgery

While LASIK for both eyes will set you back roughly USD $4,400 in the U.S. , in Thailand, patients typically only need to pay around USD $1,650 for the same procedure. It should come as no surprise that eye surgeries are another big category for medical tourism in Thailand.

7. Cannabis-based Medical Treatments

Marijuana has multiple medical applications. Medical marijuana can be used to manage chronic pain, especially for multiple sclerosis and nerve pain. Marijuana is also an effective muscle relaxant, reducing tremors in Parkinson’s disease. It helps in managing nausea, weight loss, glaucoma, and shows promise in treating PTSD, HIV-related pain, irritable bowel syndrome, and Crohn’s disease, among other uses.

Wellness: The Future of Medical Tourism

Another area of Thailand’s medical tourism industry that’s growing rapidly is wellness tourism . At present, Thailand’s global wellness tourism industry is estimated to be worth US $4.4 trillion each year, with predictions that it will rise to as high as USD $7 trillion by 2025.

Wellness Tourism

So, what is wellness tourism? While it can be many things, wellness tourism is generally regarded to be health-related services that aren’t medical treatments provided by people who aren’t doctors or nurses. Health-conscious people often travel to Thailand for better physical and mental wellbeing.

There are many types of activities that can be categorized as wellness tourism, including:

- Nutrition education

- Fitness and mind-body

- Personalized preventive care

- Traditional medicine

- Beauty and anti-aging treatment

- Alternative medicine

It’s generally believed that the rise of wellness tourism has much to do with the rising affluence and education worldwide. We’re now in an age where many realize that longevity is linked to developing and maintaining a healthy lifestyle.

Additionally, stressful events in modern days are unavoidable. As more people look for getaways to help them alleviate stress, more medical tourists spend less time in hospitals and clinics and more time in spas and hotels.

Covering Costs

If you’re going to Thailand as a medical tourist, how will you cover the costs? While the cost of healthcare in Thailand is affordable, expenses can still add up to a very significant amount, especially if complications occur, and some health insurance won’t provide coverage for medical tourism.

Secure the Right Health Insurance Plan for Thailand

Individual health insurance plans are mostly local. Once the insured is out of their country of residence, they’re not protected by their insurance anymore. Travel insurance also provides only coverage for medical emergencies, so you won’t be covered for any procedures scheduled ahead of time.

Although some health insurance plans can cover the cost of wellness tourism activities, the majority of them don’t. However, there is a solution! International health insurance plans grant you access to virtual medical care anywhere in the world, including Thailand and other destinations.

Purchasing international insurance can provide peace of mind, especially if you reach out to a health insurance broker like Pacific Prime. Contact our team of experts at Pacific Prime Thailand for the most suitable international health insurance plan and a free quote comparison service today!

Related posts:

Recent posts.

- An Overview of Thailand’s Medical Tourism Industry - September 20, 2023

- How to Open a Bank Account in Thailand in 2023 - August 25, 2023

- Typhoid Fever in Thailand - August 22, 2023

Suphanida Thakral

Suphanida is a Senior Content Creator at Pacific Prime, an award-winning global health insurance and employee benefits specialist.

With over 5 years of experience in the field, Suphanida spends the majority of her day synthesizing complex pieces of insurance-related information and translating this into easy-to-understand, engaging, and effective content across a variety of media such as articles, infographics, whitepapers, videos, and more.

Suphanida is also responsible for planning and publishing three whitepapers released annually by Pacific Prime: The State of Health Insurance Report, The Cost of Health Insurance Report, and The Global Employee Benefits Trends Report. Additionally, she handles the LinkedIn profiles of Pacific Prime’s Founder and CEO, as well as Global HR Lead.

Suphanida’s strengths lie in her strong research and analytical skills, which she has gained from her BA in Politics from the University of Warwick and Erasmus Mundus Joint MA in Journalism from Aarhus University and City, University of London.

Being of Thai-Indian origin and having lived, studied, and worked in Thailand, the UK, and Denmark, Suphanida also has a unique, multicultural perspective that helps her understand the struggles of expats and globetrotters.

Outside of work, she enjoys traveling to new places and immersing herself in different cultures.

Comments for this post are closed.

About pacific prime thailand.

Pacific Prime Thailand provides expats and companies based in Thailand robust local support and reliable management of their international health insurance solutions.

Learn more about us here.

Find a post

- The Thai Senate has Approved a Historic Bill to Legalize Marriage Equality in Thailand

- Pacific Prime Thailand awarded the AXA Top Sales International Broker Award

- Why Thailand is an Attractive Country for LGBTQIA+ Expats

- Your Go-To Guide for Coping with Retirement Stress

- Staying Healthy During the Summer Heat in Thailand

- Accessing Telemedicine in Thailand: Benefits and Effective Tips for Expats

- Bangkok: Thailand’s Most Affordable Expat City

Recent Comments

Thailand: Medical tourism profile

The standard of healthcare varies from excellent if crowded public hospitals in major cities, to basic care in rural areas.

Medical tourism numbers in

Kasikorn Research Centre: number of treatments to international patients:

Medical tourism numbers out

Environment, medical tourism promotion.

The country promotes medical and health tourism but is niche marketing to drive up income rather than just going for larger numbers.

Find an organisation

Organisations.

+ Add your organisation to IMTJ

Medical tourism news and opinion

IMTJ is powered by LaingBuisson. We can help to grow your international business

A leading business intelligence provider for over 30 years – LaingBuisson work globally with clients in 25+ countries

Get doctor listing on ClinicSpots.

Gynecologist

Cardiologist

Get answers for your health queries from top Doctors for FREE!

100% Privacy Protection

We maintain your privacy and data confidentiality.

Verified Doctors

All Doctors go through a stringent verification process.

Quick Response

Reduce Clinic Visits

Save your time and money from the hassle of visits.

Medical Tourism in Thailand 2023

Millions of travelers from all over the world move from one location to another as part of the growing business known as medical tourism to receive treatment for their health issues. In Asia, Thailand consistently ranks as one of the top locations for medical tourism. Other nations are falling to the bottom of the ranking as the business of medical tourism in Thailand is expanding. The quantity of tourists going to Thailand for medical treatment has considerably grown since the early 2000s.Medical tourism in Thailand now occupies the top spot. You'll learn why Thailand is the ideal location for receiving medical care in this blog, along with the choices open to visitors from abroad.

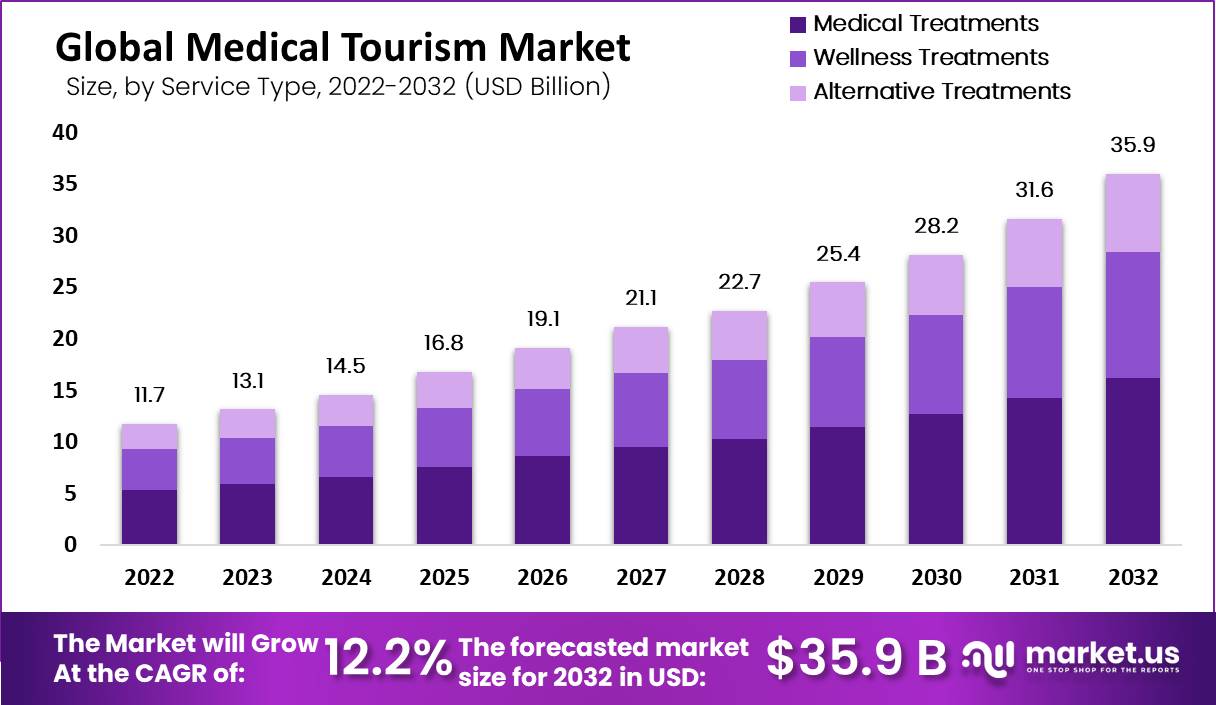

In 2022, the market for medical travel is anticipated to grow to $5,687 million USD. The studies predict that medical tourism in Thailand will grow at a strong rate of 18.4%. 2% to 7% of the world's medical tourism business is represented by the total revenue of the Thai medical tourism industry. In Johns Hopkins University Global Health Security Index (2021), it is shown that due to its ability to respond to the outbreak of pandemics, Thailand was ranked 5th out of 195 countries and first in Asia.

The market for medical tourism in Thailand is anticipated to expand steadily between 2022 and 2032. Thailand's rapidly expanding health facilities and adequate government support will contribute to the expansion of the country's medical tourism industry.

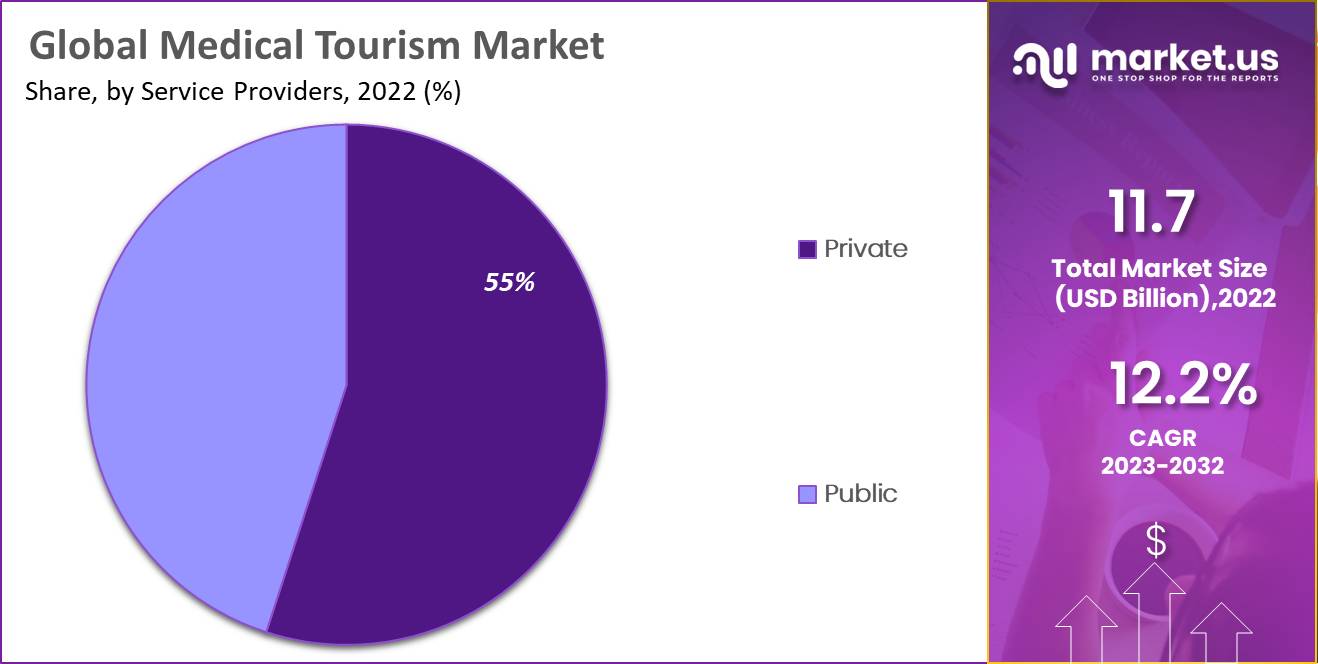

The public-private collaboration will aid in increasing the effectiveness of medical tourism in Thailand and keep the industry organized. During the forecast timeframe, it is anticipated that the Thailand medical tourism market will continue to draw tourists. The reason behind this is the growing need for economical, high-quality healthcare throughout the world's developing nations.

Bangkok is the only megacity in the world to anticipate 16 million international tourists this year. More than 900,000 of these are anticipated to seek medical attention as more and more people from all over the world visit Thai hospitals and centers.

Is Thailand Good for Medical Tourism? This is the question you might be most bothered about!! Read further to get your answers!!

Is Thailand good for medical tourism?

If you're searching for high-quality and affordable medical care , Thailand is undeniably one of your best options. More than 470 of the 1,000 hospitals in Thailand are private facilities. The nation takes pride in housing the biggest private hospital in Asia and is the first hospital to receive JCI and ISO 9001 approval. All 37 of Thailand's top private institutions have received JCI accreditation.

With best in class facilities and top-notch medical assistance Thailand can provide you with the best medical experience in the world.

Now let's see why Thailand is gaining popularity for medical tourism!!

Why is Thailand famous for medical tourism?

Patients travel in large numbers to Thailand for a variety of causes. The following section discusses some key benefits of having medical treatments performed in Thailand.

What are common medical procedures performed in Thailand?

Thailand attracts medical travelers who seek a range of treatments. But some of the most commonly performed procedures are as follows:

- Aesthetic or plastic and cosmetic surgeries

- Dental procedures

- Cardiac treatment procedures

- Orthopedic treatment

- Treatment for Infertility

- Bariatric surgery procedures

- Eye surgery and ophthalmology

- Health screening services

- Transgender Surgeries

How do I choose the best hospital for medical tourism in Thailand?

For a medical tourist, choosing a specific facility for the best care in a foreign nation can be challenging. As a result, the following advice can be used to choose the top hospitals in Thailand :

- Accreditations: The first and most crucial thing you should look into before choosing any hospital in Thailand is the hospital's foreign recognition and certifications. Check for Joint Commission International (JCI) certification. The hospital also should be affiliated with other esteemed medical institutions and possess accreditations like ISO 9000.

- Verify the Facility Standards: Before choosing a facility, make sure the amenities meet your expectations. Ask about the types of accommodations that are accessible and the other amenities that the place will have. You can also find out if they offer airport transportation services by asking them. Make careful to inquire in advance if you require any unique services.

- Check the Credentials of the Doctors: In addition to verifying the hospital's licensure, it's important to confirm the board certification of the physicians. Since most hospitals post their doctors' biographies on their websites, you can verify them using that resource. Look for their credentials, level of experience, areas of expertise, and qualifications if you want the finest care.

- Medical Technology & Equipment: Hospitals with foreign certifications always have cutting-edge medical technology & equipment, but it is the patient's duty to do their study. Find out if the therapy you're looking for uses any novel technology or procedures . If so, find out from the doctor whether they have it or not.

- Use a Medical Tourism Company's Assistance: Finding the finest facility and medical care while traveling abroad is a difficult job. Many individuals find this frustrating. A medical travel business can step in at this point. You can ask for their assistance, and they will make all the necessary arrangements for you, including locating the finest hospitals, scheduling appointments, arranging transportation, and reserving lodging.

What insurance options are available for medical tourism in Thailand?

Prior to planning your medical trip, we strongly suggest you check with your employer or insurance company in your country to see if they will cover the treatment or not. The good news is that, if your company is providing the insurance, they will be more than happy to cover the costs because Thailand's medical tourism packages are very reasonable.

Although, there are a lot of inexpensive and affordable insurance options to choose from, choosing expensive insurance plans will always give you more coverage for a wide range of treatments. Most affordable insurance plans may not even cover the costs of your treatment for a motorcycle accident.

If you are opting for international medical treatment, you will find that there are many insurance plans that are tailored according to your requirements. Also have global medical coverage, especially in Thailand. However, local health insurance plans for international patients frequently exclude elderly citizens, so expat retirees in Thailand may do better to locate insurance plans from overseas.

How do I prepare for Thailand medical tourism before I arrive in Thailand?

Since you are traveling to another country, there are a few things that you need to be careful about. Here are the things that you should consider before arriving in Thailand for your treatment:

- An active visa

- Travel and health coverage

- Paperwork and COVID-19 immunization certification (refer to the COVID-19 requirements for entry above)

- Numbers of the healthcare aides you've located or been given, as well as the medical facility you're attending,

- Reputable purchasing methods around the world (VISA, Master Card, cash, etc.)

- Your visa and immunization documents in photo form

- Data regarding flights

There are few things that you must consider after reaching for health tourism in Thailand:

If you've scheduled a visit to one of Thailand's more expensive, higher-quality medical facilities, a medical assistant will probably meet you there. Your healthcare aide will assist you with understanding COVID-19 rules and making travel arrangements to the medical facility.

Thailand is a simple place to travel, and cabs are inexpensive and courteous. To follow local safety laws, be careful to ask the concierge at your hotel for a cab. If you're traveling to Bangkok, you can also take advantage of the Sky Train or subway system, which runs throughout the entire city and pauses at all the main hubs. Your preferred medical facility will probably be close to one of the locations.

What are the Thailand medical tourism packages?

Most medical institutions offer packages that include diagnostic procedures and treatment. They occasionally also include instruction and spa treatments (massage, yoga, acupuncture, sunbathes, and others). Packages for medical travel are less expensive than individual treatments.

Your travel advisor will be able to customize your journey specifically for you once they are aware of your desired travel experience. This entails deciding on the best kind of lodging, means of transportation, tourism, and more. Representatives can offer a variety of helpful travel advice, as well as suggestions for top day retreats, massage parlors, and restaurants.

Top companies for medical tourism in Thailand

Do you know what the most amazing aspect of wellness tourism in Thailand is? They have created a complete infrastructure with the express purpose of assisting visitors to overcome any challenges they may experience after arriving from abroad and settling in a new nation.

Let's take a look at the top medical organizations out of all those available to help you have a seamless medical voyage!

The best 7 medical tourism businesses in Thailand are listed below, along with the services they offer to assist patients to stay and access healthcare.

1. ClinicSpots

ClinicSpots is an Indian company. It will help you sift through a large number of institutions and help you choose the best one as per your requirements. They provide you with the best solution after thorough research and put a lot of effort into finding the best medical facilities for you. When you reach Thailand, the ClinicSpots team will also place you in contact with a cordial and welcoming executive to help with any linguistic or financial difficulties you may encounter.

How ClinicSpots help you on your medical path?

- Providing information on a hospital's location, the costs of all of its services, its staff of professionals, and a cost contrast with other healthcare groups.

- Transportation to and from the airport.

- will assist you in making lodging plans in accordance with your budget.

- Help with the medical passport application process.

- A forum for medical Q&A in case you have medical queries.

Why choose ClinicSpots?

- more than 250 recognized institutions are connected to us!

- Over 5700 medical professionals have joined.

- Their dedication and excellent patient initiatives are the primary cause of the positive patient experience.

Vaidam is an Indian Company. Whatever location you decide on for your therapy, you can rely on it to assist you in making the best arrangements for your stay and lodging.

Vaidam will give your requirements top priority and assist you in getting the best bargain on your treatment and accommodation!

Let's look at how Vidam can help you:

- Support with regard to a medical visa.

- Deciding on the most affordable flight rates.

- Daily requirements for meals, language, and transport.

3. Medsurge India

In the area of medical travel in India, Medsurge India is a reputable and innovative business. Medsurge India provides the finest medical care and travel arrangements for foreign patients traveling to other countries.

Through their innovative cost-control methodology, they help foreign patients access the best medical care and therapy centers available.

How will Medsurge India assist you in your journey?

- Helping people acquire medical visas.

- Offer cheap airline seats, assistance with linguistic barriers, and information on cuisine

Med Ex is a provider of full-service medical travel services. They guarantee improved health care results by working with a tele-consultation medical team for affordable second opinions and a committed medical travel service team.

What benefits do they give?

- Reduce Hospital Expenses

- Exceptional Medical Services

- Hospital Travel Expertise That Is Smooth

- Liaison for Customized Service

MedEx provides a remedy for these issues.

- expensive medical care

- Hassle free appointments with doctors and hospital bookings

- Absence of health insurance

https://www.statista.com/statistics/1311335/thailand-market-value-of-medical-tourism/

https://www.bloomberg.com/asia

https://www.futuremarketinsights.com/reports

Related Blogs

Dr. Sandeep Nayak - Best Oncologist in Bangalore

Dr. Sandeep Nayak - Best oncologist in Bangalore. Experience of 19 years. Consults at Fortis, MACS & Ramakrishna. To book an appointment, call @ +91-98678 76979

Eye Cancer Treatment in India: Advanced Care Solutions

Explore advanced eye cancer treatment in India. Renowned specialists, state-of-the-art facilities ensure comprehensive care and better outcomes. Discover options today!

PET Scan in Mumbai: Revealing Insights with Advanced Imaging

You’ll find all the available details for the PET scan in Mumbai on this page.

Cancer Treatment in India: Costs, Hospitals, Doctors 2024

Discover cutting-edge cancer treatment in India. Renowned specialists, advanced technology ensure comprehensive care and better outcomes. Explore options today!

Organ Specific Cancer Treatment in India

Organ-specific cancer treatment in India. Explore cutting-edge therapies, compassionate care, and renewed possibilities for healing. Learn more now!

Best Medical Tourism Companies in India 2024 List

Discover excellence in healthcare with top-rated Medical Tourism Companies in India. Your journey to world-class treatment begins here.

10 Best Hospitals in Istanbul - Updated 2023

Looking for the best hospital in Istanbul? Here is a compact list for you of the 10 Best Hospitals in Istanbul.

15 Best Places of Hair Donation for Cancer Patients in India

Explore the best places for hair donation for cancer patients in India. Join the meaningful movement with our guide to Hair Donation for Cancer Patients in India, making a positive impact with every strand

Question and Answers

33 days Radiation Cost of price

Answered on 26th June '24

Dr. Shubham Jain

How much charge on immunotherapy

How much is charge for treatment of breast cancer

Female | 23

Ovranain cancer is which stages are control how many chemotherapy then easy surgery

Female | 38

I WANT TO DONATE HAIRS, IS THERE ANY PLACE NEAR BY NAVI MUMBAI CHEMBUR TO CONTACT FOR HAIR DONATION FOR CANCER PATIENT

Female | 48

Cancer Hospitals In Other Cities

Top related speciality doctors in other cities, cost of related treatments in country.

- Thailand Medical Tourism Market

Thailand Medical Tourism Market Size, Share, Opportunities And Trends - Forecasts From 2022 To 2027

- Published : Mar 2020

- Report Code : KSI061610897

- Pages : 114

- Description

- Table Of Contents

Offered with this report

Market Data and Estimates in Excel

2 Months of Post Sale Analyst Support

Requirement Specific Customization

Thailand Medical Tourism Business Opportunities report provides in-depth analysis of business opportunities available for Medical Tourism players. This research study examines the medical tourism business and investment opportunities in the country through various segments. The first segment includes the country outlook which covers demographic trend, economic scenario, political scenario, stock market movement, and international trade dynamics of the country.

The second segment provides the exhaustive picture of healthcare industry outlook in Thailand which includes key policies and regulations, industry participants and major market players. Moreover, the research study analyzes the overall healthcare regulatory framework in Thailand, offering stakeholders a better understanding of the key factors affecting the market environment.

The report also provides investment analysis including recent deals, FDI regulations, and proposals and MoUs along with the analysis of key market players in the country. This is followed by World Bank and UN Outlook for Thailand’s Healthcare Industry. The next segment provides the analysis of tourism industry in Thailand which includes tourism industry outlook, and medical tourism which includes number of medical tourists per year, healthcare services provided by Thailand healthcare facilities, favorable policies and regulations, and other factors impacting the country’s medical tourism industry.

Thailand Medical Tourism market outlook segment includes market size, competitive intelligence, and total cost of ownership. The analysis is complemented with presentation, charts, graphics and other different formats helping the clients in faster and efficient understanding of the market. The last segment provides the future outlook for Thailand Medical Tourism market to give a clear picture for business opportunities that lie ahead in this particular sector in the country.

1. Introduction 2. Country Outlook 2.1. Demographic Trend 2.2. Economic Scenario 2.3. Political Scenario 2.4. Stock market movement over the last one year 2.5. Trade Dynamics 2.5.1. Import-Export 2.5.2. Major Global Trading Partners 3. Thailand Healthcare Industry Outlook 3.1. Key Industry Policies and Regulations 3.2. Industry Participants 3.3. Key Players 4. Investment Analysis 4.1. Recent deals in last two years 4.2. Foreign Direct Investments 4.3. Proposals and Memorandum of Understanding (MoUs) 5. Stock Movement of Key Players 5.1. MedRetreat 5.2. CosMediTour 5.3. International Medical Health Solutions 5.4. Lotus Medical International 5.5. Phuket Health and Travel 6. World Bank and United Nations Outlook for Thailand Healthcare Industry 7. Thailand Tourism Industry 7.1. Tourism Industry Outlook 7.2. Medical Tourism 7.2.1. Number of Medical Tourists per Year 7.2.2. Healthcare Services 7.2.2.1. Dentistry 7.2.2.2. Orthopedic 7.2.2.3. Cosmetic Surgery 7.2.2.4. Transplants 7.2.2.5. Others 7.3. Favorable Policies and Regulations 7.4. Other Factors (availability of cheaper airlines, hotel rooms, etc.) 8. Thailand Medical Tourism Market Outlook 8.1. Market Size and Forecast 8.1.1. Short Term 8.1.2. Medium Term 8.1.3. Long Term 8.2. Competitive Intelligence 8.3. Total Cost of Ownership 9. Future Outlook

Related Reports

License Type

Explore custom options available with this study.

- Customize this report

- Buy sections of the study

- Buy country specific report

Subscribe Us

Let us know the industries you are interested in, request free sample.

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Search ITA Search

- Market Overview

- Market Challenges

- Market Opportunities

- Market Entry Strategy

- Agriculture

- Defense and Security

- Education Services

- Medical Devices and Technology

- Telecommunications

- Trade Barriers

- Import Tariffs

- Import Requirements and Documentation

- Labeling/Marking Requirements

- U.S. Export Controls

- Temporary Entry

- Prohibited and Restricted Imports

- Customs Regulations

- Standards for Trade

- Trade Agreements

- Licensing Requirements for Professional Services

- Distribution and Sales Channels

- Selling Factors and Techniques

- Trade Financing

- Protecting Intellectual Property

- Selling to the Public Sector

- Business Travel

- Investment Climate Statement

With affordable healthcare, well-developed healthcare infrastructure, highly skilled medical professionals, and medical services meeting international standards, Thailand is a leading destination for medical tourism. As of August 2023, the Joint Commission International (JCI) accredited 59 Thai medical institutes which offers diverse medical treatments, ranging from organ transplants to dental and cosmetic surgery.

Thailand’s low cost of medical care attracts increasing number of medical tourists. The average medical tourist can expect to save 25 percent to 75 percent on various procedures and treatment options. For example, a heart bypass surgery in Thailand costs $13,000, nearly nine times less than in the U.S. ($113,000). A facelift costs up to $15,000 in the U.S., but as low as $3,000 in Thailand. Hip replacement in Thailand costs about $7,800 compared to $50,000 in the U.S.

In addition to low costs, Thailand has highly trained and experienced medical specialists and is well known for quality service. Thailand has also made impressive strides in the use of advanced technologies and treatment options. Furthermore, the country’s abundant tourist attractions are another major draw for medical tourists.

According to the 2020-2021 Medical Tourism Index by the International Healthcare Research Center, Thailand ranked 5th out of 46 destinations for medical tourism. Siam Commercial Bank’s Economic Intelligence Center has forecasted that Thailand’s medical tourism market is valued at $829 million in 2023 and medical tourists from CLMV countries (Cambodia, Lao PDR, Myanmar, and Vietnam), the Middle East, and China are major sources of foreign patients. Favorite medical treatments among medical tourists include cosmetic surgery, dental treatment, and medical check-up and treatments including MRI, PET/CT scans, mammography, heart surgery, and joint replacements.

According to Krungsri Bank Research Center, Thailand’s demand for medical devices connected to healthcare and hygiene will increase in 2023, due to the following factors:

- Increasing rates of illness due to the increasing prevalence of non-communicable diseases, requiring long term care.

- Increasing numbers of foreign tourists seeking healthcare in Thailand.

- Continuous investment in hospitals by private-sector healthcare providers.

- Rising awareness and interest in health and wellness globally.

- Growing demand for medical devices and equipment in Thailand’s main export markets.

- Prevalence of government policies promoting Thailand as an international medical hub.

In 2022, the value of Thailand’s medical device market was approximately $7.2 billion. Owing to global recovery from the COVID-19 pandemic, the local production and export of personal protective equipment (PPE) decreased significantly. As a result, Thailand’s overall production and export of medical devices decreased by 35 percent and 39 percent, respectively. Thailand imported $2.7 billion in medical devices in which medical devices from the United States accounted for 17.2 percent of total imports or $478 million. Thailand imported $784.32 in medical devices from China, followed by $478.34 million from the United States, $218.42 million from Germany, and $163.1 million from Japan. The United States remains the top supplier of higher technological devices such as cardiovascular devices, ultrasound, and X-ray devices, electro-diagnostic devices, etc.

Table: Medical Devices (Millions USD)

(Total market size = (total local production + imports) – exports) Source: Medical Devices Intelligence Unit (MEDIU), Thailand Office of Industrial Economics

Leading Sub-Sectors

- In vitro diagnostic devices

- Cardiovascular devices

- Dental devices

- Dermatological devices

- Electro-diagnostic devices

- Neurological and surgical devices

- Ophthalmic and optical devices

- Orthopedic and fracture devices

- Rehabilitation equipment

- Therapeutic respiration devices

- Ultrasound and X-ray devices

- Health information technology

Opportunities

Thailand’s population is aging rapidly and the country has the 2nd most aged society in ASEAN after Singapore. Currently, 20 percent of Thais are older than 60 years old, and by 2030, approximately one-third of the Thai population will be over 60 years old. Out of 12 million elderly people, 700,000 have dementia. The National Statistical Office of Thailand has forecasted that by 2035, the country will become a super-aged society, with 30 percent of the population over 60 years old. This offers given ample business opportunities for products and services for the elderly, valued at approximately $2.8 billion.

The Thai government plans to turn Phuket into a world-class hub of medical tourism by 2028. Phuket will construct an international medical tourism complex called “Medical Plaza.” The Medical Plaza project comprises a one-stop medical center operated by Vachira Phuket Hospital and a 5,000-capacity multipurpose convention center. Construction of the medical center is expected to finish by 2026. The center’s services include geriatric and palliative care, physical therapy and rehabilitation, and international healthcare.

Several public hospitals in Thailand are in the process of reviewing their current electronic medical records (EMR) and considering migrating to a better system. Consequently, it should be optimal timing for U.S. EMR companies including Epic Systems Corporation, Cerner, InterSystems, and other SME suppliers to explore this business opportunity.

In 2019, the Thai government launched the five-year Genomics Thailand Project, with the first phase to sequence the genomes of 50,000 Thai individuals within five disease groups: cancer, rare diseases, non-communicable diseases, infectious diseases, and pharmacogenomics. The country aims to build infrastructure to harness genomic information and provide a bioinformatics platform for both researchers and healthcare service personnel to access genome analysis tools.

One long-term goal is to gain better preventative information and provide better health outcomes for Southeast Asian populations. Currently, the Genomics Thailand Consortium has more than 40 participating national agencies, institutes, medical schools, and hospitals. The first phase of cataloging 50,000 human whole genome sequences is expected to be complete in 2025. The Project plans to integrate genomic medicine into the health system so that it will raise the standard of healthcare.

- Consumer Goods and Services /

- Travel and Tourism /

- Medical Tourism

Medical Tourism Market Size, Share & Trends Analysis Report by Country (Thailand, India, Mexico, Costa Rica, Malaysia, Singapore, Brazil, Colombia, Turkey, Taiwan, South Korea, Spain, Czech Republic, China), and Segment Forecasts, 2022-2030

- Region: Global

- Grand View Research