What is the future of travel?

All aboard! After the pandemic upended life and leisure as we know it, travel is roaring back. The industry is set to make a full recovery by the end of 2024, after losing 75 percent of its value in 2020. Much of this has been so-called “revenge travel,” or people embarking on international or bucket list trips that were delayed by the pandemic. But domestic travel is recovering quickly too and is set to represent 70 percent of travel spending by 2030.

Get to know and directly engage with senior McKinsey experts on travel and tourism

Margaux Constantin is a partner in McKinsey’s Dubai office, Matteo Pacca is a senior partner in the Paris office, and Vik Krishnan is a senior partner in the Bay Area office.

We’ve done a deep dive into the latest travel trends and how industry players can adjust accordingly in The state of travel and hospitality 2024 report. Check out the highlights below, as well as McKinsey’s insights on AI in travel, mass tourism, and much more.

Learn more about McKinsey’s Travel, Logistics, and Infrastructure Practice .

Who are today’s travelers, and what do they want?

In February and March 2024, McKinsey surveyed more than 5,000 people in China, Germany, the United Arab Emirates (UAE), the United Kingdom, and the United States who had taken at least one leisure trip in the past two years. Here are six highlights from the results of that survey:

- Travel is a top priority, especially for younger generations. Sixty-six percent of travelers we surveyed said they are more interested in travel now than before the COVID-19 pandemic. And millennials and Gen Zers are traveling more and spending a higher share of their income on travel than their older counterparts.

- Younger travelers are keen to travel abroad. Gen Zers and millennials who responded to our survey are planning nearly an equal number of international and domestic trips in 2024. Older generations are planning to take twice as many domestic trips.

- Baby boomers are willing to spend if they see value. Baby boomers still account for 20 percent of overall travel spending. They are willing to spend on comforts such as nonstop flights. On the other hand, they are more willing to forego experiences to save money while traveling, unlike Gen Zers who will cut all other expense categories before they trim experiences.

- Travel is a collective story, with destinations as the backdrop. Travelers both want to hear other travelers’ stories and share their own. Ninety-two percent of younger travelers were inspired by social media in some shape or form for their last trip.

- What travelers want depends on where they’re from. Sixty-nine percent of Chinese respondents said they plan to visit a famous sight on their next trip, versus the 20 percent of European and North American travelers who said the same. Respondents living in the UAE also favor iconic destinations, as well as shopping and outdoor activities.

Learn more about McKinsey’s Travel, Logistics, and Infrastructure Practice .

What are the top three travel industry trends today?

Travel is back, but traveler flows are shifting. McKinsey has isolated three major themes for industry stakeholders to consider as they look ahead.

- The bulk of travel spending is close to home. Seventy-five percent of travel spend is domestic. The United States is currently the world’s largest domestic travel market, but China is set to overtake it in the coming years. Stakeholders should make sure they capture the full potential of domestic travelers before turning their attention abroad.

- New markets such as India, Southeast Asia, and Eastern Europe are growing sources of outbound tourism. Indians’ travel spending is expected to grow 9 percent per year between now and 2030; annual growth projections for Southeast Asians and Eastern Europeans are both around 7 percent.

- Unexpected destinations are finding new ways to lure travelers and establish themselves alongside enduring favorites. Rwanda, for example, has capitalized on sustainable tourism by limiting gorilla trekking permits and directing revenue toward conservation.

Introducing McKinsey Explainers : Direct answers to complex questions

For a more in-depth look at these trends, check out McKinsey’s State of travel and hospitality 2024 report .

How will AI change how people travel?

In the 1950s, the introduction of the jet engine dramatically reduced travel times, changing the way people traveled forever. Now AI is upending the industry in a similarly fundamental way. Industry players down to individual travelers are using advances in generative AI (gen AI) , machine learning , and deep learning to reimagine what it means to plan, book, and experience travel. “It’s quite clear,” says McKinsey partner Vik Krishnan , “that gen AI significantly eases the process of travel discovery.”

For travel companies, the task now is to rethink how they interact with customers, develop products and services, and manage operations in the age of AI. According to estimates by McKinsey Digital, companies that holistically address digital and analytics opportunities have the potential to see an earnings improvement of up to 25 percent .

McKinsey and Skift Research interviewed executives from 17 companies across five types of travel business. Here are three key findings on how travel companies can reckon with emerging technologies, drawn from the resulting report The promise of travel in the age of AI :

- Segmentation. Companies can use AI to create hyperspecific customer segments to guide how they interact with and serve customers. Segmentation can be based on a single macro characteristic (such as business versus leisure), or it can be so specific as to relate to just one customer.

- Surprise and delight. In the travel context, gen AI could take the form of digital assistants that interact with customers throughout their journeys, providing personalized trip itineraries and tailored recommendations and helping to resolve unexpected disruptions.

- Equipping workers better. AI tools can free up frontline workers’ time, allowing them to focus more on personal customer interactions. These tools can also shorten the training time for new hires and quickly upskill the existing workforce.

AI is important, yes. But, according to Ella Alkalay Schreiber, general manager (GM) of fintech at Hopper, “The actual challenge is to understand the data, ask the right questions, read prediction versus actual, and do this in a timely manner. The actual challenge is the human thinking, the common sense .”

How is mass tourism changing travel?

More people are traveling than ever before. The most visited destinations are experiencing more concentrated flows of tourists ; 80 percent of travelers visit just 10 percent of the world’s tourist destinations. Mass tourism can encumber infrastructure, frustrate locals, and even harm the attractions that visitors came to see in the first place.

Tourism stakeholders can collectively look for better ways to handle visitor flows before they become overwhelming. Destinations should remain alert to early warning signs about high tourism concentration and work to maximize the benefits of tourism, while minimizing its negative impacts.

Destinations should remain alert to early warning signs about high tourism concentration and work to maximize the benefits of tourism, while minimizing its negative impacts.

For one thing, destinations should understand their carrying capacity of tourists—that means the specific number of visitors a destination can accommodate before harm is caused to its physical, economic, or sociocultural environment. Shutting down tourism once the carrying capacity is reached isn’t always possible—or advisable. Rather, destinations should focus on increasing carrying capacity to enable more growth.

Next, destinations should assess their readiness to handle mass tourism and choose funding sources and mechanisms that can address its impacts. Implementing permitting systems for individual attractions can help manage capacity and mitigate harm. Proceeds from tourism can be reinvested into local communities to ensure that residents are not solely responsible for repairing the wear and tear caused by visitors.

After risks and funding sources have been identified, destinations can prepare for growing tourist volumes in the following ways:

- Build and equip a tourism-ready workforce to deliver positive tourism experiences.

- Use data (gathered from governments, businesses, social media platforms, and other sources) to manage visitor flows.

- Be deliberate about which tourist segments to attract (business travelers, sports fans, party groups, et cetera), and tailor offerings and communications accordingly.

- Distribute visitor footfall across different areas, nudging tourists to visit less-trafficked locations, and during different times, promoting off-season travel.

- Be prepared for sudden, unexpected fluctuations triggered by viral social media and cultural trends.

- Preserve cultural and natural heritage. Engage locals, especially indigenous people, to find the balance between preservation and tourism.

How can the travel sector accelerate the net-zero transition?

Global warming is getting worse, and the travel sector contributes up to 11 percent of total carbon emissions. Many consumers are aware that travel is part of the problem, but they’re reticent to give up their trips: travel activity is expected to soar by 85 percent from 2016 to 2030. Instead, they’re increasing pressure on companies in the travel sector to achieve net zero . It’s a tall order: the range of decarbonization technologies in the market is limited, and what’s available is expensive.

But decarbonization doesn’t have to be a loss-leading proposition. Here are four steps travel companies can take toward decarbonization that can potentially create value:

- Identify and sequence decarbonization initiatives. Awareness of decarbonization levers is one thing; implementation is quite another. One useful tool to help develop an implementation plan is the marginal abatement cost curve pathway framework, which provides a cost-benefit analysis of individual decarbonization levers and phasing plans.

- Partner to accelerate decarbonization of business travel. Many organizations will reduce their business travel, which accounts for 30 percent of all travel spend. This represents an opportunity for travel companies to partner with corporate clients on decarbonization. Travel companies can support their partners in achieving their decarbonization goals by nudging corporate users to make more sustainable choices, while making reservations and providing data to help partners track their emissions.

- Close the ‘say–do’ gap among leisure travelers. One McKinsey survey indicates that 40 percent of travelers globally say they are willing to pay at least 2 percent more for carbon-neutral flights. But Skift’s latest consumer survey reveals that only 14 percent of travelers said they actually paid more for sustainable travel options. Travel companies can help close this gap by making sustainable options more visible during booking and using behavioral science to encourage travelers to make sustainable purchases.

- Build new sustainable travel options for the future. The travel sector can proactively pioneer sustainable new products and services. Green business building will require companies to create special initiatives, led by teams empowered to experiment without the pressure of being immediately profitable.

What’s the future of air travel?

Air travel is becoming more seasonal, as leisure travel’s increasing share of the market creates more pronounced summer peaks. Airlines have responded by shifting their schedules to operate more routes at greater frequency during peak periods. But airlines have run into turbulence when adjusting to the new reality. Meeting summer demand means buying more aircraft and hiring more crew; come winter, these resources go unutilized, which lowers productivity . But when airlines don’t run more flights in the summer, they leave a lot of money on the table.

How can airlines respond to seasonality? Here are three approaches :

- Mitigate winter weakness by employing conventional pricing and revenue management techniques, as well as creative pricing approaches (including, for example, monitoring and quickly seizing on sudden travel demand spikes, such as those created by a period of unexpectedly sunny weather).

- Adapt to seasonality by moving crew training sessions to off-peak periods, encouraging employee holiday taking during trough months, and offering workers seasonal contracts. Airlines can also explore outsourcing of crew, aircraft, maintenance, and even insurance.

- Leverage summer strengths, ensuring that commercial contracts reflect summer’s higher margins.

How is the luxury travel space evolving?

Quickly. Luxury travelers are not who you might expect: many are under the age of 60 and not necessarily from Europe or the United States. Perhaps even more surprisingly, they are not all millionaires: 35 percent of luxury-travel spending is by travelers with net worths between $100,000 and $1 million. Members of this group are known as aspirational luxury travelers, and they have their own set of preferences. They might be willing to spend big on one aspect of their trip—a special meal or a single flight upgrade—but not on every travel component. They prefer visibly branded luxury and pay close attention to loyalty program points and benefits .

The luxury-hospitality space is projected to grow faster than any other segment, at 6 percent per year through 2025. And competition for luxury hotels is intensifying too: customers now have the option of renting luxurious villas with staff, or booking nonluxury hotels with luxury accoutrements such as rainfall showerheads and mattress toppers.

Another critical evolution is that the modern consumer, in the luxury space and elsewhere, values experiences over tangible things (exhibit).

Luxury properties may see more return from investing in a culture of excellence—powered by staff who anticipate customer needs, exceed expectations, create cherished memories, and make it all feel seamless—than in marble floors and gold-plated bath fixtures. Here are a few ways luxury properties can foster a culture of excellence :

- Leaders should assume the role of chief culture officer. GMs of luxury properties should lead by example to help nurture a healthy and happy staff culture and listen and respond to staff concerns.

- Hire for personalities, not resumes. “You can teach someone how to set a table,” said one GM we interviewed, “but you can’t teach a positive disposition.”

- Celebrate and reward employees. Best-in-class service is about treating customers with generosity and care. Leaders in the service sector can model this behavior by treating employees similarly.

- Create a truly distinctive customer experience . McKinsey research has shown that the top factor influencing customer loyalty in the lodging sector is “an experience worth paying more for”—not the product. Train staff to focus on tiny details as well as major needs to deliver true personalization.

What’s the latest in travel loyalty programs?

Loyalty programs are big business . They’ve evolved past being simply ways to boost sales or strengthen customer relationships; now, for many travel companies, they are profit centers in their own right. One major development was that travel companies realized they could sell loyalty points in bulk to corporate partners, who in turn offered the points to their customers as rewards. In 2019, United’s MileagePlus loyalty program sold $3.8 billion worth of miles to third parties, which accounted for 12 percent of the airline’s total revenue for that year. In 2022, American Airlines’ loyalty program brought in $3.1 billion in revenue, and Marriott’s brought in $2.7 billion.

But as this transition has happened, travel players have shifted focus away from the original purpose of these programs. Travel companies are seeing these loyalty programs primarily as revenue generators, rather than ways to improve customer experiences . As a result, loyalty program members have become increasingly disloyal. Recent loyalty surveys conducted by McKinsey revealed a steep decline in the likelihood that a customer would recommend airline, hotel, and cruise line loyalty programs to a friend. The same surveys also found that airline loyalty programs are driving fewer customer behavior changes than they used to.

So how can travel brands win customers’ loyalty back? Here are three steps to consider:

- Put experience at the core of loyalty programs. According to our 2023 McKinsey Travel Loyalty Survey , American respondents said they feel more loyal to Amazon than to the top six travel players combined, despite the absence of any traditional loyalty program. One of the reasons for Amazon’s success may be the frictionless experience it provides customers. Companies should strive to design loyalty programs around experiential benefits that make travelers feel special and seamlessly integrate customer experiences between desktop, mobile, and physical locations.

- Use data to offer personalization to members. Travel brands have had access to customer data for a long time. But many have yet to deploy it for maximum value. Companies can use personalization to tailor both experiences and offers for loyalty members; our research has shown that 78 percent of consumers are more likely to make a repeat purchase when offered a personalized experience.

- Rethink partnerships. Traditionally, travel companies have partnered with banks to offer cobranded credit cards. But many credit card brands now offer their own, self-branded travel rewards ecosystems. These types of partnerships may have diminishing returns in the future. When rethinking partnerships, travel brands should seek to build richer connections with customers, while boosting engagement. Uber’s partnership with Marriott, for example, gives users the option to link the brands’ loyalty programs, tapping into two large customer bases and providing more convenient travel experiences.

In a changing travel ecosystem, travel brands will need to ask themselves some hard questions if they want to earn back their customers’ loyalty.

Learn more about McKinsey’s Travel, Logistics, and Infrastructure Practice . And check out travel-related job opportunities if you’re interested in working at McKinsey.

Articles referenced include:

- “ Updating perceptions about today’s luxury traveler ,” May 29, 2024, Caroline Tufft , Margaux Constantin , Matteo Pacca , and Ryan Mann

- “ The way we travel now ,” May 29, 2024, Caroline Tufft , Margaux Constantin , Matteo Pacca , and Ryan Mann

- “ Destination readiness: Preparing for the tourist flows of tomorrow ,” May 29, 2024, Caroline Tufft , Margaux Constantin , Matteo Pacca , and Ryan Mann

- “ How the world’s best hotels deliver exceptional customer experience ,” March 18, 2024, Ryan Mann , Ellen Scully, Matthew Straus, and Jillian Tellez Holub

- “ How airlines can handle busier summers—and comparatively quiet winters ,” January 8, 2024, Jaap Bouwer, Ludwig Hausmann , Nina Lind , Christophe Verstreken, and Stavros Xanthopoulos

- “ Travel invented loyalty as we know it. Now it’s time for reinvention. ,” November 15, 2023, Lidiya Chapple, Clay Cowan, Ellen Scully, and Jillian Tellez Holub

- “ What AI means for travel—now and in the future ,” November 2, 2023, Alex Cosmas and Vik Krishnan

- “ The promise of travel in the age of AI ,” September 27, 2023, Susann Almasi, Alex Cosmas , Sam Cowan, and Ben Ellencweig

- “ The future of tourism: Bridging the labor gap enhancing customer experience ,” August 1, 2023, Urs Binggeli, Zi Chen, Steffen Köpke, and Jackey Yu

- “ Hotels in the 2030s: Perspectives from Accor’s C-suite ,” July 27, 2023, Aurélia Bettati

- “ Tourism in the metaverse: Can travel go virtual? ,” May 4, 2023, Margaux Constantin , Giuseppe Genovese, Kashiff Munawar, and Rebecca Stone

- “ Three innovations to solve hotel staffing shortages ,” April 3, 2023, Ryan Mann , Esteban Ramirez, and Matthew Straus

- “ Accelerating the transition to net-zero travel ,” September 20, 2022, Danielle Bozarth , Olivier Cheret, Vik Krishnan , Mackenzie Murphy, and Jules Seeley

- “ The six secrets of profitable airlines ,” June 28, 2022, Jaap Bouwer, Alex Dichter , Vik Krishnan , and Steve Saxon

- “ How to ‘ACE’ hospitality recruitment ,” June 23, 2022, Margaux Constantin , Steffen Köpke, and Joost Krämer

- “ Opportunities for industry leaders as new travelers take to the skies ,” April 5, 2022, Mishal Ahmad, Frederik Franz, Tomas Nauclér, and Daniel Riefer

- “ Rebooting customer experience to bring back the magic of travel ,” September 21, 2021, Vik Krishnan , Kevin Neher, Maurice Obeid , Ellen Scully, and Jules Seeley

Want to know more about the future of travel?

Related articles.

The promise of travel in the age of AI

Travel Disruptors: Bringing fintech to travel booking

Latest News

Braemar Hotels & Resorts and Blackwells Capital enter into cooperation agreement

TUI driving Tours & Activities offering for lastminute.com brands as preferred partner

Viking marks float out of newest ocean ship, Viking Vesta

United now texts live radar maps and uses AI to keep travelers informed during weather delays

Ryanair announces approved OTA partnership with lastminute.com

EURO 2024: Agoda shares top markets searching for holiday accommodations in Germany

LOT Business Lounge Polonez at the Warsaw Chopin Airport will get a brand new interior

Fairmont Hotels & Resorts and SOL Properties to debut Fairmont Residences Solara Tower Dubai

Finnair: Over one million passengers and slight decline in passenger load factor year-on-year in June 2024

Emirates Group announces senior appointments, including 7 UAE nationals

Deloitte’s 2024 travel industry outlook: Unpack the biggest travel trends for the year ahead

After more than two years of consistent year-over-year gains, leisure travel may have tapped all its pent-up demand from the peak pandemic years. Is US travel demand due for a correction? Our 2024 travel industry outlook explores signals of the strength of travel demand.

Even during times of financial anxiety, travel has held a consistent share of Americans’ wallets. Enthusiasm for in-destination activities, growing interest in more diverse destinations, and the return of baby boomers in greater numbers add to the positive indicators for travel. And workplace flexibility appears poised to further buoy demand.

Despite this optimistic outlook, could an economic downturn shift travel behaviors? Travel frequency and certain indulgences may see a decline, but if higher-income groups are relatively insulated from economic headwinds, higher-end travel products could have a better year than budget ones. On the corporate side, many decision-makers in the coming year will seek a delicate balance between conservative budgeting and pursuing the strategic benefits that travel can support.

- Suppliers find ways to touch up the travel experience. High interest rates and elevated costs of some goods can make it difficult to update, let alone upgrade, hotels. And some of airlines’ biggest challenges have stemmed from weather events and staffing matters not entirely in their control. Still, airlines and hospitality providers know they need to improve the experiences they offer or risk losing travelers’ attention.

- The corporate comeback continues, but gains decelerate. While trips to build client relationships and support team collaboration remain key to business success, costs are a significant concern. Amid these efforts at prudent budgeting, US corporate travel spend is still likely to finally pass the pre-pandemic line within the next year.

- More trips or longer trips? Travelers choose their own adventure. One of the most lasting effects of the pandemic has been a shift in how white-collar work gets done. Remote and hybrid arrangements appear to be here to stay, and the share of travelers who plan to work on their longest leisure trips has surged. In addition to adding and extending trips, this laptop lugger behavior also has an impact on travelers’ in-destination needs and preferences.

- Marketing spend shifts to account for changes in platforms and demographics. As travel demand has returned and shown continued resilience to economic anxiety, the industry’s marketing spend has trended up, and travel providers have ridden a wave of pent-up demand. But as travel growth slows, there will be a greater need for more targeted marketing and for travel providers to build new strategies for a changing landscape.

- Gen AI: Behind the scenes and front and center. Gen AI is already influencing travel, with call center efficiencies the most widely reported benefit. In the coming year, expect it to influence the industry in major ways. More visible applications (new options for discovery, shopping, booking) will garner much of the attention, but less visible applications might actually be more influential. Promising use cases for travel providers include advertising strategy, marketing content, and personalization.

[pdf-embedder url=”https://www.traveldailynews.com/wp-content/uploads/securepdfs/2024/01/Deloitte-US-travel-hospitality-industry-outlook-2024.pdf” title=”Deloitte-US travel-hospitality-industry-outlook-2024″]

Vicky Karantzavelou

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief . She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.

- Braemar Hotels & Resorts and Blackwells Capital enter into cooperation agreement

Related posts

Inflation impact on US Summer travel: Spending resilient amid cost concerns

Experts outline a promising future for the GCC hospitality sector, as the UAE market is forecasted to exceed US$7bn by 2026

Cyviation announces collaboration on aviation cybersecurity intelligence and monitoring solutions

WTTC and Trip.com Group global traveller report reveals shift towards sustainable travel

Previous post, villas of distinction expands its villa offerings, turnberry breaks ground on one park tower by turnberry at solé mia.

Over 439,000 passengers on Air Serbia’s flights in June

AHLA workforce report: Hotels add 700 jobs in June

Collaboration on sustainable cruise tourism discussed with local authorities during CLIA visit in Santorini

American Airlines releases 2023 Sustainability Report

The Feathers Hotel Woodstock announced as Experience Oxfordshire Ambassador Partner

Air Tanzania extends its partnership with APG to cover 13 further markets

2.5 million passengers traveled with SAS during June

WTTC and U.S.-Mexico Foundation sign MOU to enhance cooperation in North America’s Travel & Tourism sector

CHTA President praises Jamaica’s hurricane preparedness, assures ongoing support

Jet2.com and Jet2CityBreaks celebrate taking off to brand-new Porto for the first time

Ethiopian Airlines expands with new multiple routes in June 2024

MICHELIN Guide Dubai 2024 underpins Emirate’s status as culinary hotspot

Iberia and Widerøe reach an interline agreement to increase connectivity between Spain and Norway

Uzbekistan launches new Aviation Safety Program with support from ICAO and partners

Ascott enters strategic partnership with S Hotels & Resorts under Singha Estate to expand hospitality portfolio in the UK

Jamaica reopens for business after Hurricane Beryl

IATA and ASF to develop Standard Cabin Waste Composition Audit Program

Paris Olympics 2024: A spectacle of sports and culture

Vacationing in Argentina: How to safely surf from Argentina and mitigate cyber breaches with innovative VPN technologies

Discovering food experiences in Athens, Greece

Everything you need to know about taking a private jet for The first time

Melissa Khedar: Portrait of a world traveller

Timeless appeal of commerical outdoor furniture

Hilton set to expand presence in Ras Al Khaimah with signing of Hilton Marjan Island Beach Resort & Spa

American Airlines commits to conditional purchase of 100 ZeroAvia hydrogen-powered engines

Data from DidaTravel reveals German hoteliers to be the big winner in EURO 2024 tournament

FEDHASA applauds Minister Schreiber’s swift action on visa concessions

Stephanie Leavitt appointed Group Director of Sales and Marketing for Ocean House Collection

InterContinental Crete is now open

Iberia celebrated the 75th anniversary of its first flight to Paris

Alaska Airlines launches historic routes to La Paz and Monterrey, Mexico from Los Angeles

Hahnair welcomes ten new partner airlines into its leading network

European Transport Workers’ Federation statement on Lufthansa – ITA Airways deal

flynas launches a sign language training program for cabin crew

Wego data highlights top European summer destinations for Saudi Arabian travelers

Quendoo launches innovative optimisation software for the UK hospitality sector

Etihad Guest welcomes 10 millionth member

ACI Europe confirms Armando Brunini for a second term at its helm

Spanish and Turkish fans will have the most affordable flights to the Euro 2024 final

Fiera Milano wins the 2024 UFI Industry Partners Award

ITA Airways operates new nonstop flight to Senegal

Eric Martino joins Hard Rock International as President of Hard Rock Cafe & Retail Division

Wyndham Connect rolls out across North America, elevates the guest and owner experience

Introducing Ultra by Private Luxury Events at Atlantis The Royal in Dubai

Air France reinvents its lounge at Cayenne airport

June was Tallinn Airport’s busiest month ever

DoubleTree by Hilton to debut in new Cairo’s “At Forty” Commercial Complex

Innovative travel insurance options for the modern traveler

680-room Hotel 101-Madrid Spain exceeds expectation

airBaltic adds new routes for Winter 2024/2025 from Riga

Tower Bridge visitor attraction unveils long-term plan

HotelREZ announces 74 new hotels amidst continued global expansion

MNAA appoints new leadership for Nashville International and John C. Tune airports

Hornblower Group completes financial restructuring with new ownership

IHG Hotels & Resorts, in partnership with the V&A Waterfront bring InterContinental brand to Cape Town

ACI Europe announces 2024 Best Airport Award winners in Istanbul

EU Commission gives “green light” for Lufthansa Group’s participation in ITA Airways

Family camping in the Smoky Mountains: Making the most of your family adventure

Hillary Rodham Clinton to headline TFWA World Conference with keynote conversation

Weekend events drove Dublin hotel rates past 300 euros

Yuno and Meili join forces to improve payments infrastructure for airlines

Servantrip urges agents respond to ‘dupe destinations’ trend to drive tours & activities sales

Swedavia’s traffic statistics for June 2024: The trend of strong international travel continues

ATTA for Action Award winners announced at Experience Africa in London

easyJet announces year-round connection from London Gatwick to Menorca

DerbySoft launches strategic partnership with IDeaS

AIM Group International publishes 2023 Annual Report announcing record economic and business results

Hawai‘i Tourism Authority Work Wise Program provides jobs for public high school graduates and students

Volotea inaugurates 21st European base in Bari, Italy

Sircle Collection unveils Sir Devonshire Square

IATA: International demand rose 14.6% in May

More than 250 initiatives have been analysed by the FiturNext Observatory for the Challenge 2025

Over 300 European airports lead the charge to net zero CO2 emissions under their control

VIVA Cruises partners with Wimbledon players to expand river cruising awareness

Wizz Air celebrated the 4th anniversary of its base in Tirana International Airport

ACI Europe President puts decarbonisation, air connectivity, and Single Aviation Market at the core of Europe’s competitiveness and cohesion

CTO Chairman calls for preparedness and solidarity during hurricane season

World Travel Awards reveals 2024 Caribbean & Americas winners

Luxury Group flies onto the scene with Blade collaboration, elevating and redefining Summer travel in New York City

SAS’ restructuring plan approved by European Commission

Mews sponsors Hotelschool The Hague’s Sustainable Hospitality Challenge for greener travel

Coury Hospitality promotes Jennifer Burgess-Wright to Senior Vice President, Marketing & Digital Strategy

WorldVue expands leadership and footprint to properties in Europe and the UK

Future-proofing at the heart of airports’ business transformation in the new normal

HSMAI Commercial Strategy Conference welcomed record attendance for two days of collaboration

Tulsa Club Hotel Curio Collection by Hilton awarded prestigious AAA Four Diamond rating

London’s historic Great Northern Hotel acquired by Kaya Tourism Group

FABEC 2024 AU Associations Consultation: Tackling challenges together

MAI welcomes Hamad International Airport at Munich Airport Academy

Arlington visitor spending hit record $4.5bn. in 2023

Future Travel Trends: Insights from HBX Group’s Anna Grigoryan at MarketHub 2024

AnimaWings appoints APG as its online GSA in France and Sweden

Ethiopian Airlines commences new service to Warsaw, Poland

Summer 2024: More Europeans plan to travel, but taking fewer trips, finds ETC

Hostaway launches Dynamic Pricing tool for vacation rental managers

Seven routes available between China and Budapest Airport from August

Easyfairs wins the 2024 UFI Sustainable Development Award

Canadian North expands agreement with Sabre, adding new airline IT solutions and renewing SabreSonic PSS

Singita Milele opens – an expansive, contemporary villa in the heart of the Serengeti

“Brand Africa” to take centre stage as UN Tourism unlocks region’s potential

Trip.com Group partners with Prioticket to unlock more travel experiences in Europe, the Middle East and the US

Air Canada to receive eight Boeing 737-8 aircraft

Qatar Airways Group celebrates a record-breaking net profit of US$1.7bn. for the 2023/24 Financial Year

Institute of Travel Management announces new Board Directors at AGM

AirAsia X expands into Africa with a new intercontinental route between Kuala Lumpur and Nairobi

Greater Miami Convention & Visitors Bureau announce 17th Annual Miami Spa Months

Viva Aerobus kicks off Miami service

Sustainability on the frontline of online education, by Booking.com and UN Tourism

The Adventure Travel Show returns for its 25th edition

Summer 2024 trends: How Spaniards plan their vacations

Istanbul welcomed pan-European airport leaders for 34th ACI Europe Annual Congress & General Assembly

Decoding the fire emojis

Ryanair’s new Summer ’24 routes from Bristol to Fuerteventura and Prague take off

Now introducing: Coquillade Provence’s latest -and most luxurious- accommodations

IAEE announces changes to leadership: Staff member promotion, new addition to the team

Oceania Cruises floats out new ship Allura at Fincantieri Shipyard in Genoa, Italy

Los Deseos at Marina Fiesta Resort & Spa debuts after renovation

Jens Fehlinger to become CEO of Swiss International Air Lines

Lufthansa Group introduces environmental cost surcharge

Seasoned caravanner’s guide: Advanced tips for long-term travel

Rob McKinney parts ways effective immediately as CEO of New Pacific Airways and Ravn Alaska

The green connection: Sustainable networking for a better tomorrow

How to earn money while traveling? Eight innovative methods to consider!

Nashville International Airport launches non-ticketed guest pass program for post-security shopping and dining

HBX Group and PerfectStay join forces to offer roll out B2B2C travel packages globally

Vennersys successfully expand into Northern Ireland

2024 ACI Europe Airport Industry Connectivity Report: European air connectivity lags rising traffic volumes

Taste your way through Italy: Top culinary tours for food lovers

Qatar Airways welcomes fifth destination in Germany with launch of Hamburg flights

SATSA welcomes reappointment of Minister de Lille and new Cabinet appointments

New airline, new destination: Gulf Air launched its new Munich to Bahrain route

Air Arabia marks its first flight to Athens

KLM reveals the name of the first A321neo: Swallowtail

Corendon Hotels & Resorts appoints four new executive team members

Park Hyatt Marrakech opens its doors to guests seeking summer sun

Nile Air introduces flights to Milan Bergamo Airport

Travel Risk Management Services market set to expand at a staggering 8.1% CAGR, reaching $223.62bn. by 2031

Dolce by Wyndham Versailles opens in famed Domaine Du Montcel Park

Experience Africa 2024 opened its doors to record-breaking attendance

Travel & Tourism in LATAM could boost region’s economy by US$260bn. over the next decade

TAAG Angola Airlines to connect the Republic of Congo via Brazzaville from August ahead

Eve Air Mobility announces $94m. new equity to support eVTOL development

Caribbean Days 2024 at the Renaissance Brussels a great success

History meets luxury at the Sir Winston Churchill Suite, Al Habtoor Palace

Wyndham opens first Dolce hotel in Turkey

Ultimate packing list for an African safari

Leisure travel market expected to hit $1,737.3bn. by 2027

KM Malta Airlines and ITA Airways sign codeshare agreement

What casino games are most popular in different destinations

Key Insights from WTTC on Travel and Tourism Trends at MarketHub 2024

Exploring Amsterdam through its historic waterways

KLM adds year-round trans-Atlantic service between Portland and Amsterdam

How to safely return home after a wildfire evacuation

Braniff Airways Foundation welcomes two new Board of Directors

Pilots take a stand against Single Pilot Flights: “One Means None”, says ECA

How to tell the story of your love through creative mix of marital anniversary blooms

Gulf Air and BAS forge strategic partnership to enhance aircraft maintenance training experience

Discover the magic of Egypt vacations: Your ultimate guide

Euroairlines Group and International Carrier Consult sign agreement

Jet2.com: Jerez and Costa de la Luz announced for Summer 2025

Mandarin Oriental opens new properties in Mayfair ad Muscat

Robinson: New club resorts on Zanzibar and Boa Vista

Hyatt acquires the me and all hotels brand

Jet2holidays partners with The Fun Lab

IHG Hotels & Resorts to launch the Holiday Inn Express brand in Egypt

MMGY quarterly travels survey reveals rising U.S. interest international vacations

Hawai’i’s Governor signs landmark Regenerative Tourism Bill into law

Explora I arrives in Piraeus for her maiden call ahead of the Eastern Mediterranean season

Visit SLO CAL Board of Directors appoints new President & Chief Executive Officer

Moxy Hotels expands in Paris with opening of Moxy Paris Clamart

Amsa Hospitality aims to enable a sustainable future with innovative ideas for a greener tomorrow

American Airlines welcomes Fiji Airways to the world of AAdvantage

Opatija welcomes Keight Hotel Opatija, Croatia’s first Curio Collection by Hilton opening

Spanish Government should adopt ecological Commission’s recommendations for SAF production

Writer Relocations and Private Jet Charter join hands to meet growing demand for luxury relocations in the GCC region

Margaritaville Resort Lake Tahoe appoints Dania Duke as Managing Director

Caribbean Hotel and Tourism Association announces 2024 CHIEF and Taste of the Caribbean dates

Planet 9 celebrates six-year anniversary

Delta celebrates 45 years of nonstop service from Germany to the U.S.

Etihad Airways launches international roadshow in major pilot recruitment drive

WTTC: Travel & Tourism in Kenya and Tanzania on a record-high last year

- Top Travel Retail Companies

"We Envision Growth Strategies Most Suited to Your Business"

Increasing Introduction of Duty-free Campaigns to Boost the Market for Top Travel Retail Companies

February 01, 2023 | Consumer Goods

The travel retail industry revolves around cruise ships, airport duty-free shops, and airlines. The industry is made up of four primary channels, each of which is completely unique. Each channel has a different passenger profile, consumer behavior, and business dynamics.

Fortune Business Insights stated that the global market size for travel retail was valued at USD 51.28 billion in 2021. The global market is projected to grow from USD 55.74 billion in 2022 to USD 96.11 billion by 2029, exhibiting a CAGR of 8.1% during the forecast period.

Below mentioned are the four types of travel retail platforms:

- Airport

Airports across the world have stores in the terminals for arrivals and departures, allowing passengers to shop while on the go. In terms of sales and the number of passengers, it is the largest channel in the travel retail sector and the key growth engine for the sector.

- Aircraft

Pre-ordered or in-flight purchases of goods are possible during flights, and both digital entertainment options and paper catalogs are accessible. It is a channel that commands the full attention of passengers yet necessitates carefully chosen strategic merchandise and meticulous attention to detail to ensure success.

- Cruise Ship

Cruise ship allows for possibilities for shopping at sea while moving between ports globally, allowing passengers to utilize the long transit time to repeatedly explore travel retail offerings. Cruise ships offer the market a rapid growth trajectory, particularly as young passengers have an inclination to become more popular.

- Downtown Duty-free

It offers opportunities for shopping that let visitors from other countries buy tax-free goods right away or reserve them to pick up after customs at the airport. It is a channel that focuses on the rapidly expanding trend of duty-free shopping outside of the typical channels, particularly in the Asia Pacific region.

Below mentioned are the top 10 travel retail companies around the world:

1. Lagardère Group

Lagardère Group is an international group headquartered in Paris, France, with operations in more than 40 countries worldwide. The group started functioning in 1852. The company houses Burberry, Gucci, Hermes, and Victoria's Secret products and adopts various strategies such as acquisitions and partnerships to grow its sales.

2. LVMH (DFS Group Ltd)

DFS is a luxury travel retailer established in 1960 and headquartered in Hong Kong. It offers a broad spectrum of product categories, including wines & spirits, perfume & cosmetics, and fashion accessories. These companies target international travelers in Europe, the Americas, Asia, and the Middle East.

The company has around 400 boutiques spread over 13 countries offering high-end products.

3. Dufry AG

Dufry is a Swiss-based travel retail company established in 1865. It operates more than 2,300 duty-paid, duty-free shops and convenience stores in cruise lines, seaports, railway stations, airports, and central tourist areas worldwide. The company is headquartered in Basel, Switzerland and employs approximately 36,000 individuals worldwide.

4. King Power International Group

King Power International Group is a Thai company based in Bangkok and established in 1989. The group has three primary duty-free operations in Thailand. It operates through four business units, travel-retail, hotel, travel and sports-related.

The group provides duty-free beauty & cosmetics, fashion, and electronic products for travelers in its retail stores. It mainly focuses on competitive strategies such as collaborations and joint ventures with various luxury brands to generate higher revenue.

5. DAA (Aer Rianta International)

Aer Rianta International, headquartered in Dublin and established in 1988, is one of the significant players in the global market. The company manages and owns duty-free retail outlets in Europe, the Middle East, Asia Pacific, and the Americas.

6. Delhi Duty-Free Services Pvt. Ltd.

Delhi Duty-Free Services Pvt. Ltd is a joint venture between Delhi International Airport Limited, Yalorvin Limited, and GMR Airports Ltd. The company's flagship store is at Delhi International Airport. It also has 11 stores that offer products such as watches & jewelry, toiletries & cosmetics, apparel, liquor, and tobacco products. The group focuses on introducing novel products at its flagship stores.

7. Lotte Duty-Free

Lotte Duty-Free is one of Korea's leading duty-free operators, established in 1980. The brand has its presence in 19 locations across 7 countries. Lotte Duty-Free also has an online presence that is accessible from any place. The company provides 1,613 brands as of 2019 and is expanding globally to reach more travelers worldwide.

8. Gebr Heinemann SE & Co. KG

Gebr Heinemann SE & Co. KG is a German travel retailer established in 1879. The company operates duty-free shops, fashion-label boutiques at international airports along with stores on board cruise ships and border crossings. The group provides perfumes & cosmetics, confectionery, wine & spirits, fashion & accessories, watches & jewelry, and tobacco products.

9. China Duty-Free Group Co. Ltd.

Established in 1984, China Duty-Free Group is a state-owned organization that operates duty-free businesses across China. It works in 90 cities across 30 provinces of China and has over 200 retail stores. The company strongly focuses on launching new stores and introducing innovative products.

In December 2021, the company launched its first flagship store, CDF Macau Grand Lisboa Palace Shop, in Macau, China. The store offers over 170 brands of fashion, watches, accessories, cosmetic products, jewelry, perfumes, culinary delights, wines, and souvenirs.

10. Abu Dhabi Duty-Free

Established in 1984, Abu Dhabi Duty-Free operates and manages retail, food & beverage, and service operations in the airport's facilities. The group offers an array of duty-free products, high-street stores, luxury boutiques, and theme-based dining outlets. Abu Dhabi Duty-Free's product categories include beauty, fragrances, watches, toys, food, and souvenirs. The company aims to open new stores in airports and cruises to promote its brands.

Duty-free Campaigns are Regularly Offered by Retailers to Increase Product Demand

Nowadays, leading businesses use marketing campaigns to entice customers to purchase duty-free goods. For the higher-income airport traveler groups, businesses also consistently offer high-quality, privately labeled goods and services. The product sales at the airport's retail stores are expected to be aided by the above-mentioned factors.

To Gain Further Insights on this Market, Write Us:

Thank you....

Our Clients

Inquiry Before Buying

+1 424 253 0390 (US)

+44 2071 939123 (UK)

+91 744 740 1245

[email protected]

Jewelry Market

Luxury Goods Market

Skincare Market

Pet Care Market

I hope you enjoy reading this blog post.

To receive tailor made services, feel free to share your research requirements.

- News Releases

Tourism is Back to Pre-Pandemic Levels, but Challenges Remain

World Economic Forum, [email protected]

عربي | 日本語 | 中文 | Deutsch | Español | Français | Português

- High-income economies in Europe and Asia-Pacific continue to lead the World Economic Forum Travel and Tourism Index, with the United States, Spain and Japan topping the rankings again.

- Despite post-pandemic growth, the global tourism sector still faces complex challenges, with recovery varied by region; only marginal overall score improvements since the 2021 edition.

- Developing economies are making strides – who account for 52 out of 71 economies improving since 2019 – but significant investment is needed to bridge gaps and increase market share.

- Read the report here .

New York, USA, 21 May 2024 – International tourist arrivals and the travel and tourism sector’s contribution to global GDP are expected to return to pre-pandemic levels this year, driven by the lifting of COVID-19-related travel restrictions and strong pent-up demand, as per the new World Economic Forum travel and tourism study, released today.

Topping the 2024 list of economies are the United States, Spain, Japan, France and Australia. The Middle East had the highest recovery rates in international tourist arrivals (20% above the 2019 level), while Europe, Africa and the Americas all showed a strong recovery of around 90% in 2023.

These are some of the top findings of the Travel & Tourism Development Index 2024 (TTDI) , a biennial report published in collaboration with the University of Surrey, which analyses the travel and tourism sectors of 119 countries around a range of factors and policies.

“This year marks a turning point for the travel and tourism sector, which we know has the capacity to unlock growth and serve communities through economic and social transformation,” said Francisco Betti, Head of the Global Industries team at the World Economic Forum. “The TTDI offers a forward-looking window into the current and future state of travel and tourism for leaders to navigate the latest trends in this complex sector and sustainably unlock its potential for communities and countries across the world.”

Post-pandemic recovery

The global tourism industry is expected to recover from the lows of the COVID-19 pandemic and surpass the levels seen before the crisis. This is largely being driven by a significant increase in demand worldwide, which has coincided with more available flights, better international openness, and increased interest and investment in natural and cultural attractions.

However, the global recovery has been mixed. While 71 of the 119 ranked economies increased their scores since 2019, the average index score is just 0.7% above pre-pandemic levels.

Although the sector has moved past the shock of the global health crisis, it continues to deal with other external challenges, from growing macroeconomic, geopolitical and environmental risks, to increased scrutiny of its sustainability practices and the impact of new digital technologies, such as big data and artificial intelligence. In addition, labour shortages are ongoing, and air route capacity, capital investment, productivity and other sector supply factors have not kept up with the increase in demand. This imbalance, worsened by global inflation, has increased prices and service issues.

TTDI 2024 highlights Out of the top 30 index scorers in 2024, 26 are high-income economies, 19 are based in Europe, seven are in Asia-Pacific, three are in the Americas and one (the United Arab Emirates) is in the Middle East and North Africa region (MENA). The top 10 countries in the 2024 edition are the United States, Spain, Japan, France, Australia, Germany, the United Kingdom, China, Italy and Switzerland.

The results highlight that high-income economies generally continue to have more favourable conditions for travel and tourism development. This is helped by conducive business environments, dynamic labour markets, open travel policies, strong transport and tourism infrastructure, and well-developed natural, cultural and non-leisure attractions.

Nevertheless, developing countries have seen some of the greatest improvements in recent years. Among the upper-middle-income economies, China has cemented its ranking in the top 10; major emerging travel and tourism destinations of Indonesia, Brazil and Türkiye have joined China in the top quartile of the rankings. More broadly, low- to upper-middle-income economies account for over 70% of countries that have improved their scores since 2019, while MENA and sub-Saharan Africa are among the most improved regions. Saudi Arabia and the UAE are the only high-income economies to rank among the top 10 most improved economies between 2019 and 2024.

Despite these strides, the TTDI warns that significant investment is needed to close gaps in enabling conditions and market share between developing and high-income countries. One possible pathway to help achieve this would be sustainably leveraging natural and cultural assets – which are less correlated with country income level than other factors – and can offer developing economies an opportunity for tourism-led economic development.

“It’s essential to bridge the divide between differing economies’ ability to build a strong environment for their travel and tourism sector to thrive,” said Iis Tussyadiah, Professor and Head of the School of Hospitality and Tourism Management at the University of Surrey. “The sector has big potential to foster prosperity and mitigate global risks, but that potential can only be fully realized through a strategic and inclusive approach.”

Mitigating future global challenges

According to the World Economic Forum’s 2024 Global Risks Report, the travel and tourism sector faces various complex risks , including geopolitical uncertainties, economic fluctuations, inflation and extreme weather. Balancing growth with sustainability also remains a major problem, due to high seasonality, overcrowding, and a likely return of pre-pandemic emissions levels. The report also analyses persistent concerns about equity and inclusion. While the tourism sector offers a major source of relatively high-wage jobs, particularly in developing countries, gender parity remains a major issue for regions such as MENA and South Asia.

Despite these challenges, the sector can play a significant role in addressing them. To achieve this, decision-makers should prioritize actions such as leveraging tourism for nature conservation efforts; investing in skilled, inclusive and resilient workforces; strategically managing visitor behaviour and infrastructure development; encouraging cultural exchange between visitors and local communities; and using the sector to bridge the digital divide, among other policies.

If managed strategically, the travel and tourism sector – which has historically represented 10% of global GDP and employment – has the potential to emerge as a key contributor to the well-being and prosperity of communities worldwide.

About the Travel and Tourism Development Index 2024

The 2024 edition of the TTDI includes several improvements based on newly available data and recently developed indicators on the environmental and social impact of travel and tourism. The changes made to the 2024 Index limit its comparability to the previously published TTDI 2021. This year's report includes recalculated 2019 and 2021 results, using new adjustments. TTDI 2024 reflects the latest available data at the time of collection – end of 2023. The TTDI is part of the Forum’s broader work with industry communities actively working to build a better future enabled by sustainable, inclusive, and resilient industry ecosystems.

Notes to editors

Read the Forum Agenda also in Spanish | Mandarin | Japanese Learn about the Forum’s impact Check out the Forum’s Strategic Intelligence Platform and Transformation Maps Follow the Forum on social media: @wef | Instagram | LinkedIn | Facebook | TikTok | Weibo | Threads | WhatsApp Watch Forum videos at wef.ch/videos | YouTube Get Forum podcasts at wef.ch/podcasts | YouTube Subscribe to Forum news releases

Travel Industry Maintains Momentum with Steady Growth – Skift Travel Health Index

Saniya Zanpure , Skift

July 1st, 2024 at 10:51 AM EDT

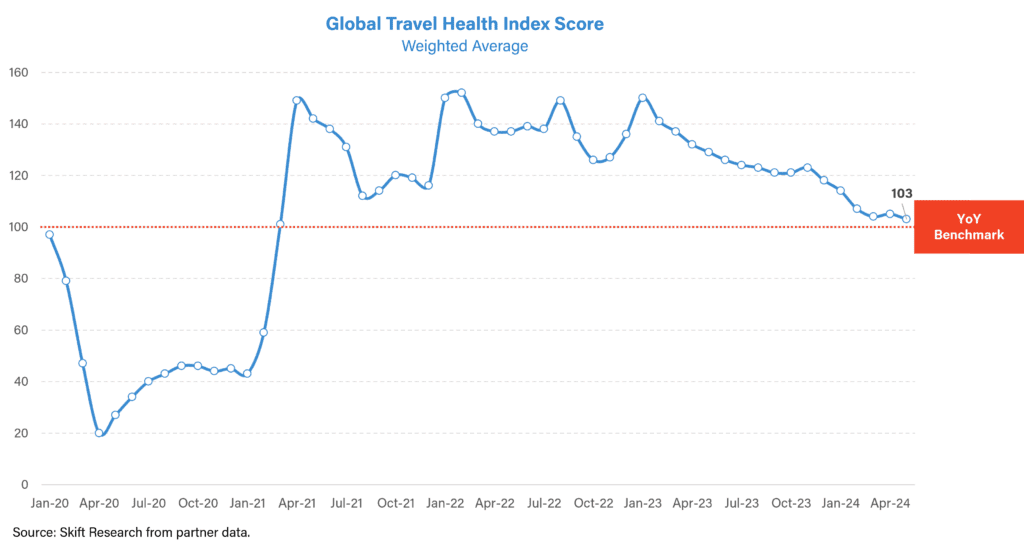

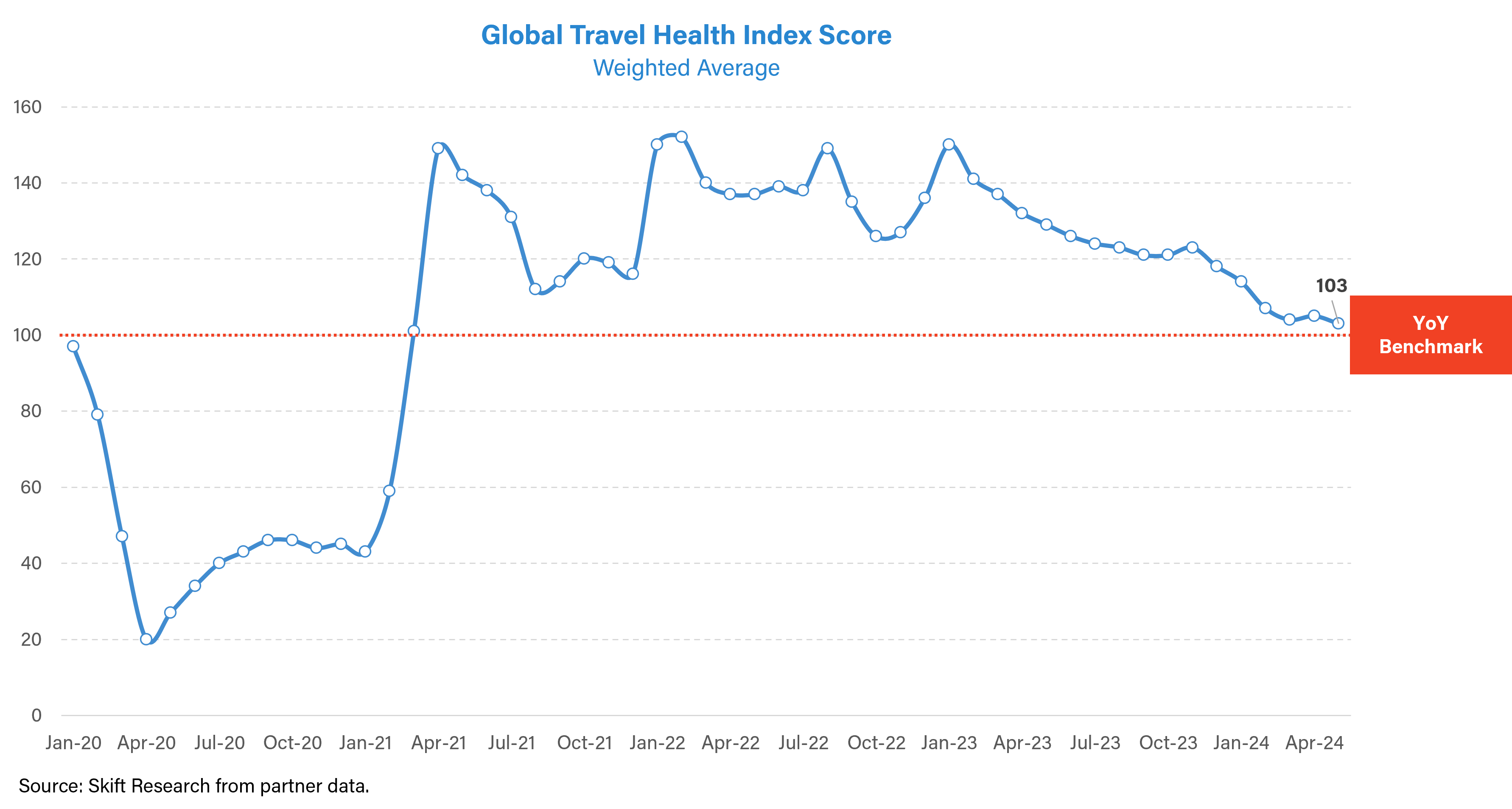

The Skift Travel Health Index reached 103 in May 2024, reflecting a 3% year-over-year increase. Hotels lead the accommodation sector at a 7% growth, while vacation rentals lag 4% behind 2023 performance due to declines in China.

Saniya Zanpure

In May 2024, the travel industry reached 103, marking a 3% rise over last year, according the latest Skift Travel Health Index: May 2024 Highlights . This highlights a transition from the post-pandemic recovery phase to moderate and sustainable growth levels in 2024.

Hotels Lead the Accommodation Sector

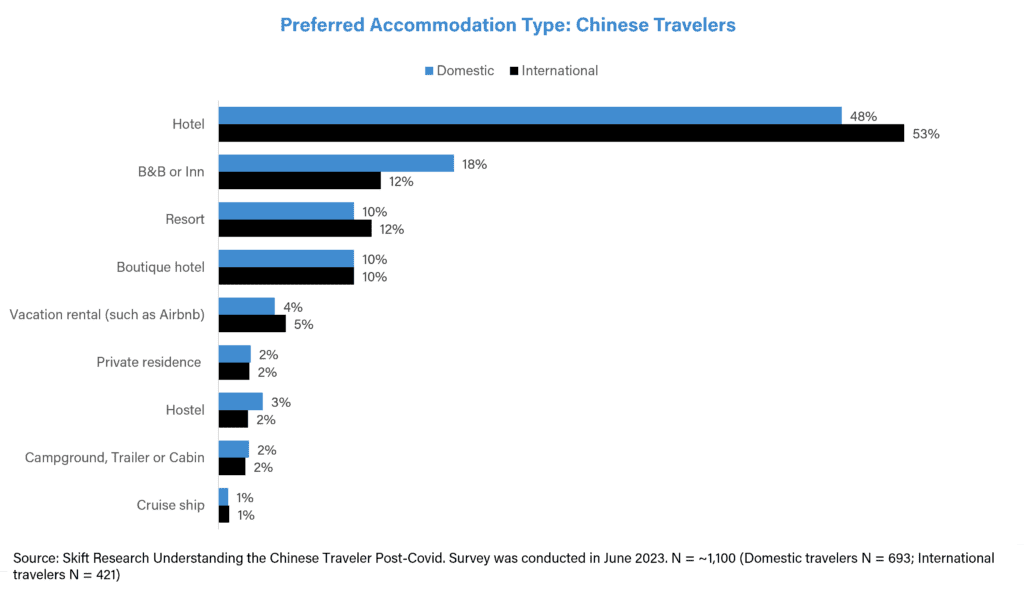

The hotel sector is showing robust growth, increasing 7% over May 2023, staying at the forefront of the accommodation sector this year. This surge contrasts with the performance of vacation rentals, which have fallen 4% behind their 2023 levels. While vacation rentals are thriving in most Asia Pacific countries, the sector’s overall performance is dampened by a decline in China.

The latest May 2024 Highlights dive into factors holding back vacation rental growth an shares insights on performance in the coming months.

The Chinese Market: A Preference for Hotels

Skift Research’s 2023 survey of over 1,000 Chinese travelers found that hotels are the most preferred accommodation choice in China. This trend aligns with the current decline in vacation rental performance in China, indicating a strong preference for hotels.

Read our latest report, Skift Travel Health Index: May 2024 Highlights and the Travel Health Index dashboard for further travel insights.

Skift Travel Health Index: May 2024 Highlights

The Skift Travel Health Index reached 103 in May 2024, reflecting a 3% year-over-year increase. This aligns with Skift Research’s travel outlook for 2024, which predicts a transition from recovery to stable, moderate growth for the travel industry.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: accommodations , chinese tourism , global travel , hotels , skift research , skift travel health index , tourism , Travel Trends , vacation rentals

Hospitality.today™

- Market Data

Deloitte's 2024 travel industry outlook

After more than two years of consistent year-over-year gains, leisure travel may have tapped all its pent-up demand from the peak pandemic years

Despite this optimistic outlook, could an economic downturn shift travel behaviors? Travel frequency and certain indulgences may see a decline, but if higher-income groups are relatively insulated from economic headwinds, higher-end travel products could have a better year than budget ones. On the corporate side, many decision-makers in the coming year will seek a delicate balance between conservative budgeting and pursuing the strategic benefits that travel can support.

Key takeaways

- Suppliers find ways to touch up the travel experience. High interest rates and elevated costs of some goods can make it difficult to update, let alone upgrade, hotels. And some of airlines’ biggest challenges have stemmed from weather events and staffing matters not entirely in their control. Still, airlines and hospitality providers know they need to improve the experiences they offer or risk losing travelers’ attention;

- The corporate comeback continues, but gains decelerate. While trips to build client relationships and support team collaboration remain key to business success, costs are a significant concern. Amid these efforts at prudent budgeting, US corporate travel spend is still likely to finally pass the pre-pandemic line within the next year;

- Marketing spend shifts to account for changes in platforms and demographics. As travel demand has returned and shown continued resilience to economic anxiety, the industry’s marketing spend has trended up, and travel providers have ridden a wave of pent-up demand. But as travel growth slows, there will be a greater need for more targeted marketing and for travel providers to build new strategies for a changing landscape;

- Gen AI: Behind the scenes and front and center. Gen AI is already influencing travel, with call center efficiencies the most widely reported benefit. In the coming year, expect it to influence the industry in major ways. More visible applications (new options for discovery, shopping, booking) will garner much of the attention, but less visible applications might actually be more influential. Promising use cases for travel providers include advertising strategy, marketing content, and personalization.

Get the full report at Deloitte

Related must-reads

U.S. summer travel highlights economic divide - A new New York Times report uses summer travel as a barometer of the widening gap between the economic haves and have-nots in the U.S. economy.

Jul 4, 2024 • Travel

How "shoulder season" became popular with tourists - As people seek to avoid extreme heat and beat the crowds, off-season travel is more popular than ever.

Why it's time to rethink what it means to be a tourist - "Does tourism build up our world or tear it apart? The only answer to both of these questions is 'Yes’,” writes McClanahan in The New Tourist.

JOIN 34,000+ HOTELIERS

Global Travel Retail Market – Industry Trends and Forecast to 2031

- Upcoming Report

- No of Tables: 220

- No of Figures: 60

- Report Description

- Table of Content

- List of Table

- List of Figure

- Request for TOC

- Speak to Analyst

- Inquire Before Buying

- Free Sample Report

Market Size in USD Billion

CAGR : 14.09 %

Major markets players.

Global Travel Retail Market, By Product (Perfume and Cosmetics, Wine and Spirit, Electronics, Luxury Goods, Food, Confectionery, and Catering, Tobacco, and Others), Distribution Channel (Airport, Cruise Liner, Railway Station, and Border, Downtown, and Hotel Shop), Sector (Duty-Free and Duty Paid), End Users (Children (Less Than 18 Years Old), Youth (18-30 Years Old), Middle-Aged (18-59 Years Old), The Elder (Greater Than 60 Years Old)) – Industry Trends and Forecast to 2031.

Travel Retail Market Analysis and Size

Brand presence and visibility are pivotal features of the travel retail market, where leading brands strategically position themselves to capture the attention of travelers. With millions of passengers passing through airports and other transit hubs annually, travel retail offers an unparalleled opportunity for brands to display their products to a diverse global audience. Investing in eye-catching displays, exclusive promotions, and immersive experiences, brands aim to enhance visibility, strengthen brand recognition, and ultimately drive sales. The competitive nature of the travel retail environment compels brands to innovate and differentiate themselves, leading to a dynamic marketplace where brand presence plays a crucial role in influencing consumer purchasing decisions..

Global travel retail market size was valued at USD 70.06 billion in 2023 and is projected to reach USD 201.12 billion by 2031, with a CAGR of 14.09% during the forecast period of 2024 to 2031. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and consumer behaviour.

Report Scope and Market Segmentation

Market Definition

Travel retail encompasses a wide range of products including cosmetics, alcohol, luxury goods, and souvenirs. Travel retail capitalizes on the captive audience of travelers who are often looking for convenient shopping options and exclusive deals while in transit. It offers brands a unique opportunity to reach a diverse global customer base and often features duty-free shopping, making it an attractive shopping destination for international travelers.

Travel Retail Market Dynamics

- Expanding Duty-Free Shopping Incentives Provides Tax Reductions for Travelers on Products

Duty-free shopping incentives serve as a compelling value proposition for consumers, attract them to make purchases while traveling. It offers tax savings through which travel retailers can attract a larger customer base and drive higher sales volumes. This strategy enhances the shopping experience for travelers and stimulates revenue growth for retailers and contributes to the overall expansion of the travel retail market. Consequently, leveraging duty-free shopping incentives has become a strategic imperative for retailers seeking to capitalize on the lucrative opportunities within the duty-free and travel retail sector.

- Rise in Development of New Travel Hubs due to Growing Tourism Industry

As more people travel domestically and internationally for leisure, business, or other purposes, there is an increased demand for retail products at various travel destinations, including airports, train stations, and tourist hotspots. Tourists often seek souvenirs, gifts, and everyday essentials during their trips, driving retail sales. Moreover, the expansion of the tourism industry leads to the development of new travel hubs and infrastructure, providing opportunities for retailers to establish outlets and cater to the needs of travelers. This sustained growth in tourism fuels the continuous expansion and innovation within the travel retail sector, making it a vital component of the global retail landscape.

Opportunities

- Growing Infrastructure Development Facilitates Convenient Travel Experiences For Consumers

Improved transportation hubs, such as airports, train stations, and ports, offer enhanced connectivity and accessibility, making it easier for travelers to reach their destinations. As infrastructure expands, it creates more opportunities for retail outlets within these travel hubs, where consumers can shop for a wide range of products conveniently during their journeys. This increased accessibility leads to higher foot traffic and sales volumes in travel retail outlets, driving growth in the market. Modernized infrastructure often accompanies enhancements in amenities and services, further enhancing the overall shopping experience for travelers and incentivizing spending.

- Expanding Consumer Base with Rising Disposable Income

As people have more money to spend, they are inclined to indulge in travel experiences and luxury purchases during their journeys. This trend particularly benefits travel retail outlets located in airports, train stations, and other transit hubs, where travelers have time and inclination to shop. Additionally, higher disposable incomes often correlate with increased international travel, further boosting sales in duty-free and travel retail environments. Capitalizing on this trend allows travel retailers to cater to a growing demographic of affluent consumers seeking convenience and luxury while on the move.

Restraints/Challenges

- Growing Infrastructure Limitations Hinders the Physical Space for Retail Operations

Limited retail space and capacity bottlenecks can restrict the expansion of retail outlets, leading to fierce competition for prime locations. This constraint impedes retailers' ability to meet the evolving demands of travelers and offer a diverse range of products and services. Infrastructure constraints may hinder the implementation of innovative retail concepts and the provision of seamless shopping experiences, thereby affecting revenue potential and customer satisfaction in the travel retail sector..

- Travel Retailers Experiencing Intense Competition from Online Retail

As consumers increasingly turn to e-commerce for convenience and a wider product selection, traditional travel retailers face challenges in capturing sales within physical travel hubs. Online platforms offer 24/7 accessibility, competitive pricing, and personalized shopping experiences, drawing customers away from brick-and-mortar stores in airports and other transit locations. The ease of comparing prices and products online makes it harder for travel retailers to differentiate themselves and attract customers.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In January 2023, Lotte Duty Free's collaboartion with South Korean beauty brand, nonfiction, exemplifies the travel retail industry's trend towards diversifying product offerings. It introduces renowned local brands, Lotte Duty Free enhances its appeal to travelers seeking authentic experiences and premium beauty products

- In June 2021, LVMH's collaboration with environmental nonprofit Canopy underscores the increasing focus on sustainability in the travel retail market. Such initiatives demonstrate a commitment to eco-conscious practices, aligning with the growing consumer demand for environmentally friendly products and experiences while traveling

- In February 2021, Hudson Group's launch of the Hudson Nonstop store at Dallas Love Field Airport, utilizing Amazon's Just Walk Out technology, illustrates the integration of innovative retail solutions in travel environments. This advancement enhances convenience for travelers by streamlining the shopping experience, reflecting the industry's adaptation to evolving consumer preferences and technological advancements

- In February 2021, DFS's joint venture with Shenzhen Duty Free Group to establish a duty-free shopping center in Haikou Mission Mills, Hainan, highlights the expansion strategies employed by travel retailers to capitalize on emerging markets and popular travel destinations. Strategically locating duty-free outlets in high-traffic areas, such as downtown centers and tourist destinations, retailers can reach to the growing demand for duty-free shopping experiences among travelers

Travel Retail Market Scope

The market is segmented on the product, sector, distribution channel and end users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

- Perfume and Cosmetics

- Wine and Spirit

- Electronics

- Luxury Goods

- Confectionery and Catering

Distribution channel

- Cruise Liner

- Railway Station

- Children (less than 18 years old)

- Youth (18-30 years old)

- Middle-aged (18-59 years old)

- The Elder (greater than 60 years old)

Travel Retail Market Regional Analysis/Insights

The market is analysed and market size insights and trends are provided by product, distribution channel, sector and end users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico, Germany, U.K., Italy, France, Spain, Russia, Turkey, Switzerland, Belgium, Netherlands, rest of Europe, Japan, China, South Korea, India, Australia and New Zealand, Singapore, Thailand, Indonesia, Malaysia, Philippines, rest of Asia-Pacific, Brazil, Argentina, rest of South America, South Africa, Egypt, Saudi Arabia, United Arab Emirates, Israel and rest of Middle East and Africa.

The Asia-Pacific is expected to dominate the market due to its rapid infrastructure development and the booming travel and tourism industry, particularly in China and India. This growth is further propelled by increasing per capita income and improved standards of living across the region. As disposable incomes rise, consumers are increasingly inclined towards travel and leisure activities, contributing to the expansion of the market. This favorable economic landscape creates a conducive environment for sustained growth and investment opportunities in various sectors within the Asia-Pacific.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Travel Retail Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the market.

Some of the major players operating in the market are:

- King Power Group (Thailand)

- Aer Rianta International (Ireland)

- DFS Group Ltd. (Hong Kong)

- Dubai Duty Free. (U.A.E.)

- China tourism group (China)

- Gebr. Heinemann SE & Co. KG (Germany)

- Duty Free Americas, Inc. (U.S.)

- Flemingo. (India)

- Qatar Duty Free (Qatar)

- 3Sixty Duty Free (U.S.)

- Dufry (Switzerland)

- Lagardère (France)

Please fill in the below form for detailed Table of Content

By clicking the "Submit" button, you are agreeing to the Data Bridge Market Research Privacy Policy and Terms and Conditions

Please fill in the below form for detailed List of Table

Please fill in the below form for detailed list of figure, please fill in the below form for infographics, research methodology:.

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Please fill in the below form for Research Methodology

Customization available:.

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.

Please fill in the below form for Available Customization

Get online access to the report on the world's first market intelligence cloud.

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

FREQUENTLY ASK QUESTIONS

Browse related blogs.

- View Infographics...

- Research Methodology

- Available Customization

CHOOSE LICENCE TYPE

- Enterprise User 7000.00

- Single User 4800.00

- DBMR Factbook 3000.00

- DBMR Prime 8000.00

- DBMR Supreme 12000.00

Can be used by entire organization across the globe + Downloadable and Printable PDF + 30 + Countries

Why Choose Us

Industry coverage.