TD Visa Car Rental Insurance: Complete Coverage Guide

Renting a car for business or leisure travel? Be sure to understand the rental car insurance benefits that come with your TD Visa card. TD Visa cards provide valuable coverage that can protect you during vehicle rentals.

This comprehensive guide will explain everything you need to know about TD Visa rental car insurance.

Overview of TD Visa Auto Rental Benefits

Most TD Visa cards come with Auto Rental Collision/Loss Damage Insurance . This provides coverage against damage or theft when you rent a car and decline the rental company’s collision damage waiver (CDW).

Key features of TD Visa rental car insurance:

- Covers up to 48 consecutive rental days

- Pays for losses from collision, theft, vandalism, etc.

- Covers most rental cars with MSRP up to $65,000

- Primary coverage pays before your personal car insurance

To activate benefits, you must:

- Decline the rental company’s collision damage waiver

- Use your eligible TD Visa to pay for the entire rental

This valuable coverage means you can rent worry-free knowing your TD Visa card has you protected if the unexpected occurs.

When the TD Visa Benefit Applies

The TD Visa rental car insurance becomes active when:

- You rent a qualifying rental vehicle for personal or business use

- You use your TD Visa card to pay for the entire car rental

- You decline the CDW or similar coverage offered by the rental company

Coverage lasts for up to 48 consecutive rental days. Rentals booked as part of a pre-paid travel package are also eligible.

If the vehicle gets damaged or stolen during the rental period, TD Visa’s coverage kicks in to reimburse you for associated losses like repairs or replacement.

TD Visa Car Rental Insurance Coverage Details

TD Visa Auto Rental insurance provides valuable protection while driving a rental car. Here are key details about what is covered:

Covered Vehicles

Most standard passenger vehicles are covered, including:

- Convertibles

- Limited-use trucks

Notable Exclusions:

- Exotic/luxury vehicles

- Pick-up trucks

- Off-road vehicles

- Motorcycles

- Antique cars

Covered Losses

- Collision damage

- Hail damage

You are covered for the cash value of repairs or replacement if the vehicle suffers direct physical loss or damage from a covered peril.

Policy Limits

TD Visa rental insurance covers vehicles with an MSRP up to $65,000. There is no deductible.

Where Coverage Applies

The insurance is valid worldwide except where prohibited by law or where the coverage violates local public policy. This makes it ideal for worldwide travel.

Steps to Using the TD Visa Auto Rental Benefit

Follow these steps when renting a car to ensure TD Visa’s rental coverage protects you:

Use your eligible TD Visa card to pay for the entire rental upfront.

Review the rental agreement and specifically decline the CDW, LDW or similar coverage offered by the rental company.

Verify with the rental agent that all coverage has been declined on the rental contract.

Keep copies of your TD Visa statement showing the rental charge and the final rental agreement.

Inspect the vehicle before driving and note any prior damage.

Report any accidents, losses or theft to the rental agency immediately.

Call TD Visa within 48 hours to report a claim if an eligible loss occurs.

Following this process ensures you do not void any of the valuable rental car insurance benefits that come with your TD Visa card.

Important TD Visa Rental Car Coverage Exclusions

While TD Visa’s Auto Rental insurance provides robust protection, some key exclusions apply:

- Rentals longer than 48 days

- Leased or rented vehicles

- Vehicles with an MSRP over $65,000

- Trucks, pickups, box trucks, campers, trailers

- Exotic, expensive, or antique cars

- Motorcycles and mopeds

- Losses from illegal activities

Liability exclusions :

- Injury to other people

- Damage to other property

Losses from :

- War or hostilities

- Wear and tear

- Gradual deterioration

- Mechanical breakdowns

- Driving while intoxicated

Review your TD Visa’s full certificate of insurance for a complete list of rental car exclusions.

Coordinating With Your Personal Auto Insurance

Your own personal or business automobile insurance may provide secondary coverage if the TD Visa benefit does not fully reimburse a rental car claim. However, TD’s coverage acts as primary insurance and pays out first.

Notify your personal insurer of the loss, but TD’s claims team will handle the claim process as the primary insurer for rental vehicles. Follow their required procedures for submitting rental car damage claims.

Never assume your personal insurance automatically covers rental cars – always verify policy specifics. The TD Visa benefit offers assurance your rental car has primary coverage.

How to File a TD Visa Rental Car Claim

If an accident, theft or damage occurs during a covered rental period, take these steps to file your TD Visa claim:

Notify the rental agency immediately and obtain necessary documents and reports.

Call TD Visa claims within 48 hours at 1-866-374-1129. Inform them you want to submit an Auto Rental CDW claim.

Provide details about the rental, accident, damages, and any payments from the rental agency.

Submit all required documentation when requested (rental agreement, police report, invoices, etc).

TD will confirm whether the claim is approved and process approved payments within 60 days whenever possible. You may need to pay rental or repair charges first, then get reimbursed.

TD Visa will need proof of damages and losses to process the reimbursement, so be sure to take photos and get documentation from the rental agent.

The Bottom Line on TD Visa Rental Coverage

The inherent risks with renting and driving an unfamiliar vehicle make rental car insurance extremely valuable protection. TD Visa Auto Rental Coverage provides primary insurance that can save you from major out-of-pocket costs if the unforeseen strikes during a car rental.

By paying with a TD Visa card and declining the CDW, you can drive rental cars worry-free knowing your card has you covered in case of an accident or theft during the rental period. Just be sure to follow proper procedures to activate benefits and file a claim if the need arises.

Does My Credit Card Have Rental Car Insurance? What Does it Cover?

Does my Visa card cover rental car insurance?

Does TD First Class Visa cover car rental insurance?

Does TD Visa Infinite have travel insurance?

Does my Visa card have travel insurance?

Related posts:

- An In-Depth Look at Colonial County Mutual Insurance Company

- A Guide to General Liability Insurance for Contractors in Colorado

- Top Insurance Companies in Columbus, Indiana

- Finding the Right Insurance in Dothan, Alabama with I Go Insurance

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

- Our Bloggers

Select Page

TD Auto Rental Collision / Lost Damage Insurance with your TD Credit Card

Posted by Maple Miles | Feb 23, 2024 | Commentary , Credit Cards | 0

I have summarized important details as you evaluate whether you need to purchase car rental insurance directly from the rental car company or you can rely on your TD credit card.

The following credit cards have TD Auto Rental Collision / Lost Damage Insurance:

- TD Platinum Travel Visa | Certificate of Insurance

- TD Aeroplan Visa Infinite | Certificate of Insurance

- TD First Class Travel Visa Infinite | Certificate of Insurance

- TD Cash Back Visa Infinite | Certificate of Insurance

- TD Aeroplan Visa Infinite Privilege | Certificate of Insurance

Other insurance benefits information for being a TD credit card holder is available here:

- TD Travel Medical Insurance

For other credit card issuers, information about their car rental policy is available here:

- American Express Car Rental Insurance

- BMO Car Rental Insurance

- CIBC Car Rental Insurance

- RBC Car Rental Insurance

- Scotiabank Car Rental Insurance

- TD Car Rental Insurance

The information listed below is my interpretation of the insurance policy.

Coverage Eligibility

For all credit cards, the following conditions apply prior to using your credit card car rental insurance:

- You must use the credit card to pay for the entire rental from the rental agency.

- You must decline the rental agency’s damage waiver coverage.

- Coverage will be extended if you use the credit card rewards to pay for your car rental. If the credit card reward will not cover the full amount, then any remaining amount must be put on your TD credit card. For TD, this will either be using your TD First Class Travel points or Aeroplan Points.

- Coverage will be extended if the car rental is part of a prepaid travel package, and the travel package was paid in full on your credit card.

- Coverage will be extended for free rentals as a result of a promotion where you had to make previous vehicle rentals, provided, if all previous rentals were paid entirely with your credit card.

Coverage is also extended to all additional drivers who legally drive the rental vehicle and who follow all the terms of the rental contract. In addition to that, a few additional notes that apply specifically to TD:

- Car sharing programs are explicitly called out as being covered by TD

- Turo or Turo like services are not explicitly called out as being covered by TD. If you are renting a vehicle from Turo, I would recommend purchasing rental car insurance directly from the platform.

Vehicles Covered

All vehicles that are used to transport a maximum of 8 people, including the driver. The vehicle must also:

- Exotic brands are not covered. However, luxury brands, such as BMW, or Mercedez Benz are covered, or,

- Replacement vehicle for which your personal automobile insurance is covering all or part of the cost of the rental, or,

- Pick-up trucks are not included.

Even though luxury brands are covered, the maximum manufacturer suggested retail price (MSRP) for the vehicle will differ depending on the credit card. The differences are listed below:

- TD Platinum Travel Visa, TD Aeroplan Visa Infinite, TD First Class Travel Visa Infinite, TD Cash Back Visa Infinite have a maximum MSRP of C$65,000.

- TD Aeroplan Visa Infinite Privilege have a maximum MSRP of C$85,000.

There are more conditions, most of which are irrelevant, that are listed in the certificate of insurance.

What is not covered?

The following are not covered when using the TD Auto Rental Collision / Lost Damage Insurance:

- Third party liability, or,

- Personal injury or damage to property, other than the rental vehicle.

TD has a very standard Auto Rental Collision / Lost Damage Insurance policy provided for holding selected TD Credit Cards.

Join our mailing list to receive the latest news and updates from our team.

You have successfully subscribed, maple miles.

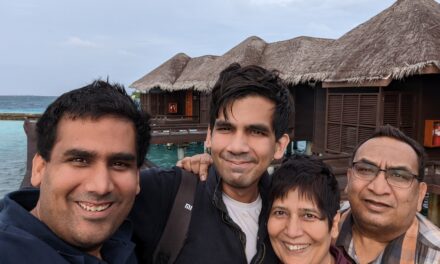

Hello Hello, this is Moli! Welcome to Maple Miles. A tech professional on a weekday, and a global traveler outside of work. I manage my entire family's travel, connecting us across the globe, between Canada (Vancouver is home, for now), India and whatever country comes in between. I love water, so you might always find me either dreaming of a beach, or actually at a beach in my free time.

More Posts from Maple Miles

Oh, Hello from Maple Miles

March 8, 2023

Best Ways to Earn Free WestJet Flights

March 9, 2023

WestJet Companion Voucher: How to earn them?

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Most Popular Posts

Our Authors

The Unaccompanied Flyer

Travel Gadget Reviews

The Flight Detective

Takeoff To Travel

The Hotelion

Bucket List Traveler

MJ on Travel

The Points Pundit

Family Flys Free

Recent Reviews

- St Regis Cairo Review – A perfect stay Score: 100%

- Six Passengers in Two Business Class Seats in Gulf Air Score: 90%

- Review: Hyatt Place Waikiki Score: 83%

- Review: Hyatt Centric Waikiki Score: 81%

- Gulf Air Business Class from Mumbai to Bahrain Score: 65%

- Personal Finance

The TD First Class Travel Visa Infinite Card and its travel insurance benefits

Insurance Coverage

First, it is very important to read the most recent version of the TD First Class Travel Visa Infinite Card Benefits Coverage Guide .

They can change at any time and it is your responsibility to be aware of these insurance benefits .

If you have any questions, please contact TD Customer Service at 1-866-374-1129 . It is strongly recommended that you call them before booking travel with your card and before you leave on your trip.

Eligibility

Travel insurance coverage is only available to :

- Primary cardholder

- Spouse and dependent children of the primary cardholder

- Additional cardholder

- Spouse and dependent children of the additional holder

In addition, the card account must be in good standing . This means:

- The Primary Cardholder has not asked TD to close the Account

- TD has not suspended and revoked credit privileges or closed the account

Eligibility Tool

To make it easier to understand the insurance coverage of its credit cards, TD has put together an interactive tool on travel insurance . In 6 questions, you can quickly find out if you qualify or not, when you pay in full for the trip in cash.

TD First Class Travel Visa Infinite Card Description

Travel medical insurance.

The maximum benefit for emergency medical care is $2,000,000. To be eligible, you only need to have the card, as per the Eligibility section above. This includes the following inclusions:

- Hospitalization

- Physician’s fees

- Private nursing

- Diagnostic services

- Ambulance and air ambulance services

- Prescription drugs

- Accidental dental and emergency relief of dental pain

- Medical Appliances

- Emergency return home

- Transportation to the bedside and compensation for the bedside companion

- Compensation for the travel companion

- Meals and accommodation

- Incidental hospital expenses

- Vehicle return

- Repatriation of deceased

- Baggage return

Trip cancellation and trip interruption insurance

To receive the benefits of this insurance coverage, the full cost of your trip must be paid with your ® Visa Infinite* Card" href="https://milesopedia.com/en/go/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card and/or TD Rewards points.

A trip cancellation occurs before departure .

A trip interruption occurs on or after the departure date when the trip has begun .

Eligible reasons may be:

- The death of an insured person or an immediate family member

- A sudden, unexpected illness or accidental injury to a person or a member of his or her immediate family

- A natural disaster at the insured person’s principal residence

- Weather conditions during the trip

Common Carrier Travel Accident Insurance

To be eligible for this insurance, you must:

- Privileges under your account have not ceased or been suspended

- The account is not more than 90 days past due

- And the TD credit card must be in good standing

A common carrier is a land, air or water conveyance that is authorized to carry passengers for compensation. This can be a :

- Ferry or Cruise ship

- Bus or Train

- Cab or Limousine

If there is an accidental death or dismemberment, the maximum benefit is $500,000 .

Delayed and Lost Baggage Insurance

In order to benefit from this insurance, the credit card must have been used to pay 100% of the airfare .

Flight and travel delay insurance

To benefit from this insurance, at least 75% of the cost of your trip must be charged to the ® Visa Infinite* Card" href="https://milesopedia.com/en/go/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card .

The reason for the delay may be due to weather, an outage or a strike for example.

This flight or travel delay insurance can be up to $500 , for a delay of 4 hours or more .

Hotel/Motel Burglary Insurance

This is for hotel and motel reservations in Canada and the United States only. At least 75% of the total cost of the stay must be charged to the card. The use of TD Rewards points is also valid under certain conditions.

The maximum amount is $2,500 .

Collision and damage insurance for rental vehicles

- Pay for the car rental at the rental agency with the ® Visa Infinite* Card" href="https://milesopedia.com/en/go/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card MD (payment with TD Rewards points is accepted, under certain conditions).

- Refuse to purchase the Collision Damage Waiver (CDW ) or an equivalent coverage from the rental agency and have it written into the contract

The car rental covers up to 48 consecutive days and the manufacturer’s suggested retail price (MSRP) of the car must be under $65,000 . Some types of vehicles are not insured.

Purchase Assurance and Extended Warranty Protection

Purchase insurance covers items purchased with the ® Visa Infinite* Card" href="https://milesopedia.com/en/credit-cards/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card for 90 days from the date of purchase . If the item is lost, stolen or damaged, it will be replaced or repaired with this insurance.

Extended warranty protection extends the manufacturer’s warranty up to one year . It begins after the manufacturer’s warranty expires and the item must be purchased with the Card.

Mobile Device Insurance

Did your new smartphone or tablet have a major accident and stop working? Mobile device insurance can come to the rescue, up to a maximum of $1,000 in reimbursement!

To qualify, at least 75% of the total cost of the device must be charged to the TD First Class Travel Visa Infinite Card. Under certain conditions, insurance is also eligible if the total cost of the device is financed through a plan with monthly payments .

Emergency travel assistance services

It is not really an insurance, but rather a help to solve a problem during a trip in unknown land. They do not offer payment or refunds. They are more of a medical second opinion or will tell you what to do if you don’t know what to do when you are in total panic.

The phone number is 1-800-871-8334 for Canada or the United States. Or if you are in another country: 1-416-977-8297 (collect).

This phone line can be useful for the following situations:

- Medical consultation and follow-up

- Medical emergency travel and medical referrals

- Payment to medical service providers

- Assistance in case of lost luggage

- Legal assistance

- Replacement of lost tickets and documents

- Translation Services

- Emergency transfer of funds

What to do if you have an insurance claim with the TD First Class Travel Visa Infinite Card

You must call 1-866-374-1129 , within the time frame following the date the event occurred.

In summary, here are the various insurance coverages of the ® Visa Infinite* Card" href="https://milesopedia.com/en/go/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card :

Bottom Line

In addition to all this insurance to prevent inconvenience, the ® Visa Infinite* Card" href="https://milesopedia.com/en/go/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card has a very profitable welcome offer from TD Bank .

With all these points, you can afford to get a stay that will not cost much. This is in addition to his annual TD Travel Credit of $100 for Expedia for TD bookings of $500 or more.

To save on travel and insurance, this is a secret card to have in your wallet!

All posts by Caroline Tremblay

Suggested Reading

Exciting news for TD Rewards members

Members can earn and redeem points on vacation packages, flights, hotels, car rentals and more. Who doesn't like to save?

Sign-in using your existing TD online banking credentials.

The expedia for td program.

It's easier than ever for TD Travel or Rewards credit card holders to find and book their dream vacation on Expedia For TD.

The best part? Not only do you have the flexibility to use your TD Rewards Points to pay for all or part of your trip, but eligible TD credit cards can also earn up to 9 points for every $1 spent on travel purchases 1.

TD First Class Travel Visa Infinite *

- 8 TD Rewards Points per $1 Spent on Travel Purchases at Expedia For TD (Online/ Phone) 1

- Annual $100 TD Travel Credit on your first Eligible Travel Credit purchase of $500 that is made with Expedia For TD 2

- Birthday Bonus - earn up to 10K bonus TD Rewards Points a year (up to $50 value on Expedia For TD) 3,4

- Comprehensive Travel insurance coverage 4

TD Platinum Travel Visa *

- 6 TD Rewards Points per $1 spent on Travel Purchases at Expedia For TD (Online/Phone) 1

- Car Rental Discounts 5,6,7

TD Rewards Visa *

- 4 TD Rewards Points per $1 Spent on Travel Purchases at Expedia For TD (Online/Phone) 1

- Car rental discounts 5,6,7

TD Business Travel Visa *

- 9 TD Rewards Points per $1 when you book travel online, or 6 Points per $1 Spent on travel made by phone through Expedia For TD 1

Not only does Expedia For TD provide you with exclusive deals on travel , but y ou r TD points are worth more when redeeming them and you can earn TD points faster when purchasing travel with your TD credit card. 1,9

Explore with Options

A flight to Las Vegas? How about an all-inclusive stay at a Cancun resort? A house in Banff for a ski trip? All of these are available on Expedia For TD.

No restrictions on adventure

We don't have black-out dates or seat restrictions on flights, 8 which means you're free to book anytime you want.

Redeem and earn points on:

- Flights and packages

- Hotels, vacation rentals, car rental

- Activities and cruises

And you’ll have access to Expedia benefits

Expedia’s Price Guarantee

Find a cheaper Flight + Hotel package within 24 hours of booking or a cheaper hotel rate up to 48 hours before check-in and Expedia will refund the difference. Sign in to find out more.

Save on hotels

Exclusive offers and deals, including up to 20% off hotel stays

Fulltime support

A dedicated customer service team available 24/7 at 1-877-222-6492

How it works

Paying with TD points .

It’s easy to shop for travel: Find your ideal trip and pay with your TD Travel or Rewards Credit Card at checkout. On the billing page, select the amount of TD points you wish to redeem.

200 TD Rewards Points = $1 . .

Every 200 points are worth $1 off travel purchases on Expedia For TD. Redemptions are made in 200-point increments, and travelers need a minimum of 200 points to make a redemption.

Use points for all or part of your trip

For example, if your trip costs $1000, use 120,000 Rewards Points (worth $600). Pay the remainder with your TD credit card and earn up to additional 8 points for every $1 spent 1,9 . That is up to 32k additional points!

Automatic credit for points redeemed

When you purchase travel using TD Rewards Points your TD credit card will be charged the full amount. The dollar value of points redeemed will be credited to your account in 3-5 business days.

Already an eligible TD cardholder?

Use your existing TD online banking credentials to sign in to Expedia For TD and find your perfect trip Sign In

Earn TD Rewards Points on bookings made with your TD Travel Rewards Credit Card and pay with points by redeeming TD Rewards Points towards all or part of your trip. Sign In

Pay for travel and everyday items with your TD Travel Credit Card to earn TD Reward Points. When you're ready, you can redeem TD points to pay for all or part of your trip.

Looking to become a TD travel cardholder?

Learn more about TD’s travel credit cards and choose the one that best matches your spending habits and travel style.

1 TD First Class Travel Cardholders earn eight TD Rewards Points for every dollar spent on travel Purchases made online or by phone through Expedia For TD. TD Platinum Cardholders earn six TD Rewards Points for every dollar spent on travel purchases made online or by phone through Expedia For TD. TD Rewards Cardholders earn four TD Rewards Points for every dollar spent on travel purchases made online or by phone through Expedia For TD. TD Business Travel Cardholders earn 9 TD Rewards Points for every dollar spent on travel purchases made online through Expedia For TD and 6 TD Rewards Points for every dollar spent on travel purchases made by phone through Expedia For TD. Any returned items, refunds, rebates or other similar credits will reduce or cancel the TD Rewards Points earned on the original Travel Purchase. Fees, Cash Advances (including Balance Transfers, Cash-Like Transactions and TD Visa Cheques), interest charges, optional service, refunds, rebates or other similar credits do not earn TD Rewards Points. Other Conditions: Offer may be changed, withdrawn or extended at any time and cannot be combined with any other offer.

2 In order to receive the TD Travel Credit, the Account must be open, active and in Good Standing. An Eligible Travel Credit Purchase means: • A Hotel, Motel, Lodging, or Vacation Rental Purchase of $500.00 CAD or more made with Expedia For TD; • A Vacation Package Purchase of $500.00 CAD or more made with Expedia For TD, that includes a Hotel, Motel, Lodging or Vacation Rental booking packaged with a transportation booking. See your TD Rewards Program Terms and Conditions for more details.

3 Each year, receive a TD Rewards Birthday Bonus (“Birthday Bonus”) equal to 10% of the TD Rewards Points earned while using the TD First Class Travel® Visa Infinite* over the 12 months preceding the Primary Cardholder’s birthday, to a maximum Birthday Bonus of 10,000 TD Rewards Points. For the first year, we will only award the TD Rewards Birthday Bonus based on the TD Rewards Points earned from October 30, 2022, to your next birthday. Previously earned points on other Rewards Cards, Acquisition Bonus Points, or other Promotional Rewards Points earned do not count towards the Birthday Bonus.

4 Insurance coverages are subject to conditions, limitations and exclusions. For more information, (including information on the insurer and/or administrator) please refer to the Certificate of Insurance included with your TD Credit Cardholder Agreement.

5 Rate displayed by Expedia For TD reflects the discounted offer. No discount code needs to be applied.

6 Provided by Avis Rent A Car System ULC. Minimum discount offer subject to discount code and to terms and conditions which may change without notice. Blackout dates may apply. Base rate refers to time and kilometer/mile charges only. Taxes, fees and surcharges are extra. The Toronto-Dominion Bank is not responsible for any vehicles, services, discounts or other offers made available by Avis Rent A Car System ULC.

7 Provided by Budget Rent A Car System, Inc. Minimum discount offer subject to discount code and to terms and conditions which may change without notice. Blackout dates may apply. Base rate refers to time and kilometer/mile charges only. Taxes, fees and surcharges are extra. The Toronto-Dominion Bank is not responsible for any vehicles, services, discounts or other offers made available by Budget Rent A Car System, Inc.

8 Subject to carrier/space availability. 9 Every 200 TD Points redeemed are worth $1 in travel savings off the cost of Travel Purchases made through Expedia For TD. Redemptions can only be made in 200 TD Points increments. * Trademark of Visa International Service Association; Used under license.

This browser is not supported. Please use another browser to view this site.

- All Save & Spending

- Credit cards

- Newcomers to Canada

- All Investing

- ETF finder tool

- Best crypto

- Couch potato

- Fixed rates

- Variable rates

- Mortgage calculator

- Income property

- Renovations + maintenance

- All Insurance

- All Personal Finance

- Finance basics

- Compound interest calculator

- Household finances

- All Resources + Guides

- Find a Qualified Advisor

- Monthly budget template

- ETF Finder Tool

- Student money

- First-time home buyers

- Guide For New Immigrants

- Best dividend stocks

- Best online brokers

- Where to buy real estate

- Best robo-advisors

- All Columns

- Making sense of the markets

- Ask a Planner

- A Rich Life

- Interviews + profiles

- Retired Money

Advertisement

By Winston Sih and Courtney Reilly-Larke on March 31, 2022 Estimated reading time: 6 minutes

TD First Class Travel Visa Infinite Card review

This premium TD card lets travellers redeem flexible rewards through a partnership with Expedia.

With a plethora of travel-focused credit cards on the market, the TD First Class Travel Visa Infinite Card may not be the obvious choice—especially considering how many Aeroplan cards TD currently has on its roster. That said, the TD First Class Travel Visa Infinite Card is worth considering. Why? It boasts a flexible redemption program and a partnership with Expedia. Cardholders get access to Expedia For TD online portal to redeem rewards for flights, hotels and car rentals on expediafortd.com.

Add to that comprehensive insurance coverage and generous earn rates and the TD First Class Travel Visa Infinite Card becomes a solid choice for avid travellers.

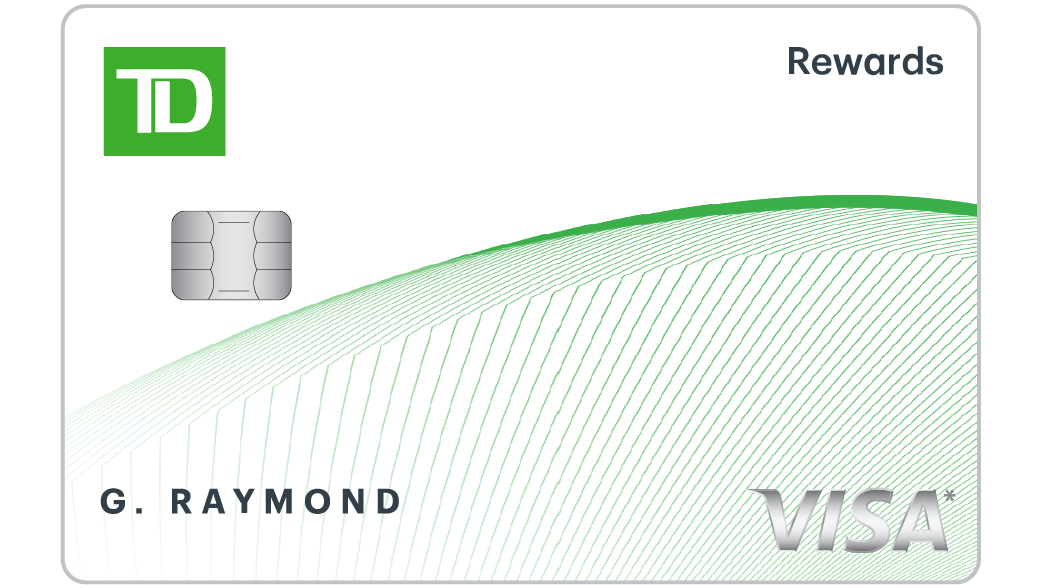

TD First Class Travel Visa Infinite Card

- Annual fee: $139 (annual fee rebate—conditions apply to qualify)

- Earn rates: Up to 8 TD Rewards points per $1 on travel; 6 points per $1 on groceries and restaurants; 4 points per $1 on recurring bills; and 2 points per $1 on all other purchases

- Welcome offer: You can earn up to $700 in value, including up to 75,000 TD Rewards Points and no Annual Fee for the first year. Conditions Apply. Account must be approved by September 3, 2024. Plus, you get an annual birthday bonus of 10% of your previous year’s points (up to 10,000 points).

- Annual income requirement: Personal income of $60,000 or household income of $100,000

- Point value: 1 TD Rewards point = $0.005 when redeemed for travel via Expedia For TD or $0.004 when redeemed through other providers and websites

- Recommended credit score for approval: 725 or higher

- Interest rates: 20.99% on purchases, 22.99% on cash advances, 22.99% on balance transfers

The TD First Class Travel Visa Infinite Card

- Three things you need to know about the TD First Class Travel Visa Infinite Card

- How to redeem your TD Rewards

- What are the best ways to benefit from this card?

Are there any drawbacks to the TD First Class Travel Visa Infinite Card?

4 things to know about the td first class travel visa infinite card, 1. the you earn points under the td rewards program.

T he TD points system is easier to understand than the point system for the bank ’ s Aeroplan credit cards. Your Point values stay the same no matter where you ’ re flying, so it ’ s easy to work out how much they ’ re worth. Plus, TD Points can be redeemed on any airline, not just Air Canada or Star Alliance Partners. While Aeroplan Miles are valuable, if you prefer simplicity the TD First Class Travel Visa Infinite Card might be more up your alley.

2. Your points go farther when you book with ExpediaForTD.com

If you already use Expedia to book your travel, this card is a savvy choice. When you book travel online through Expedia For TD, you earn 8 TD points per $1.

3. The card comes with a generous welcome bonus

You can earn up to $700 in value, including up to 75,000 TD Rewards Points and no Annual Fee for the first year. Conditions Apply. Account must be approved by September 3, 2024.. Plus, earn a birthday bonus of up to 10,000 rewards points (conditions apply). You can also receive a $100 TD travel credit when you spend at least $500 at Expedia for TD.

4. You’ll get great travel insurance

The TD First Class Travel Visa Infinite Card comes with up to $2 million of travel medical insurance coverage for the first 21 days of a trip. Trip cancellation, trip interruption, common carrier travel accident insurance, travel assistance services, flight delay insurance, auto rental collision insurance, and delayed and lost baggage insurance round out the card’s benefits. For a premium rewards card, The TD First Class ’ s insurance is fairly standard, however; so, if you ’ re looking for more comprehensive credit card insurance , you could consider a card like the National Bank World Elite Mastercard, * which comes with up to $5 million in out-of-province-of-residence medical/hospital insurance for trips up to 60 days (if you ’ re under 54).

How to redeem your TD Points:

You can redeem your TD Points for travel in two ways. The best—and most valuable—way is through the Expedia For TD online portal, where you can redeem 200 TD points per $1 in travel credit (0.5%) and pay the balance of the cost (if any) using your credit card (you’ll also earn Points on this spend).

Your other redemption choice is the “Book Any Way” option, which lets you book via other travel websites; however, your bookings can cost up to 25% more if you go this route. When using “Book Any Way” you’ll redeem at 250 TD points per $1 (0.4%) applied as a statement credit on your first $1,200 in travel purchases and 200 TD points per $1 (0.5%) for your travel purchases over $1,200. In comparison, with Expedia For TD, you’ll get a better and more consistent return of 0.5% on all your travel spending.

In both cases, the TD First Class Travel Visa Infinite Card allows you to redeem for any seat on any airline. Additionally, you can redeem points for rewards in small increments (minimum 200), so this means you don’t need to build up a large pool of points before you’re able to apply them towards travel.

Finally, through the TD Rewards site, you can shop for items such as a Vitamix blender, a Dyson vacuum or gift cards. However, you won’t get the same value as you would booking travel. For example, a $50 gift card at Best Buy will cost you 20,000 TD points, whereas you can use the same amount of points for $100 in travel on the Expedia For TD portal.

How to optimize the TD First Class Travel Visa Infinite Card

Ultimately, your best bet is to redeem points for travel from ExpediaForTD.com . Generally, prices on the website are similar to those on the main Expedia website, and you’ll be able to redeem at the rate of 200 points per $1. If you redeem points for travel outside of the TD portal, your points can lose up to 25% in value; however this could be a smarter route if you find a really good deal on another travel portal.

If you do find a better hotel or flight deal elsewhere, you have the option to price match, but there are some restrictions: you must have booked within the last 24 hours; your travel plans must be at least 48 hours away; and travel dates, and flight and hotel classes must all be the same to submit a claim.

Does the TD First Class Travel Visa Infinite Card have travel insurance?

With this card you’ll get an extensive suite of travel insurance coverage, for big and small emergencies. For frequent travellers and those who cross the border often, this is a must. The card includes travel medical insurance of up to $2 million of coverage for the first 21 days. (If you or your spouse are over 65 or older, you’re only covered for the first four days of your trip.) You’ll also get up to $1,500 of trip cancellation insurance with this card up to a maximum of $5,000 for all insured persons. For trip interruption insurance, you get $5,000 per insured person, up to $25,000 for all the insured people on the same trip.

You’ll also get common carrier travel accident insurance, emergency travel assistant services and delayed/lost baggage insurance (up to $1,000 per insured person if your baggage is delayed for more than six hours or gets lost ultimately).

There is a minimum personal income requirement of $60,000 or a household income of $100,000. However, this is a common requirement for many cards in the same category.

Other cards offer more incentive to spend in categories like groceries, dining and entertainment. The TD First Class Travel Visa Infinite Card only offers three times the Points earn on travel booked through the Expedia For TD portal (4.5%)—everything else is at the base three TD points per $1 (1.5%) rate. To compare, the Scotiabank Gold American Express has a five-times Points accelerator on restaurants and groceries (5% per dollar).

Finally, the TD First Class Travel Visa Infinite Card doesn’t offer airport lounge access , and you’ll be charged foreign transaction fees . So, if you like to use airport lounges, or you often find yourself shopping in a foreign currency, you may want to consider a card that offers those perks.

Bottom line

TD’s unique partnership with Expedia, accelerated earn rates and incremental points redemption structure make the TD First Class Travel Visa Infinite Card a worthwhile consideration as a travel credit card . However, the biggest boost in earning points you’ll get with this card is by booking with ExpediaForTD.com. If you don’t want to be locked into booking that way, you may want to explore other travel card options.

More on credit cards :

- Canada’s best travel cards 2022

- Canada’s best credit cards for gas

- Canada’s best credit cards for grocery purchases 2022

- Best cash back credit cards

What does the * mean?

Affiliate (monetized) links can sometimes result in a payment to MoneySense (owned by Ratehub Inc.), which helps our website stay free to our users. If a link has an asterisk (*) or is labelled as “Featured,” it is an affiliate link. If a link is labelled as “Sponsored,” it is a paid placement, which may or may not have an affiliate link. Our editorial content will never be influenced by these links. We are committed to looking at all available products in the market. Where a product ranks in our article, and whether or not it’s included in the first place, is never driven by compensation. For more details, read our MoneySense Monetization policy .

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

Comments Cancel reply

Your email address will not be published. Required fields are marked *

One of the TD First Class Infinite VISA Benefits List include : “ Earn 3 points per $1 on everything spent “ Could you clarify why on my recent Bill Statement, showed $5 earned for 1,178 points Wouldn’t 1,178 points translate into 1178 divided by 3 ?

I have this card, but rarely use except for buying something on a trip to get the insurance coverage. The issue I have is I like to book my travel through web sites like tripcentral.ca (better for packages), VRBO (for condo rentals) and booking.com (much better selection), so only end up rarely using Expedia for TD and end up getting 1.2% back on my purchases, unless I want to wait until I have over $1,200 of points and then buy a major trip, getting 1.5% on the part over $1,200.

So, its pretty good and the insurance is good, but its not as great for travel as they like to claim.

I have had this card for about 2 years now and I am so dessapointed with it. I will stop using it from now on and I will tell everybody I know NOT to get this card or anything related to TD Bank. I changed to this card because they assured me I have full trip coverage with it so I booked my last vacation with it and considering that I did not get what I wanted on my trip they will take some responsibilities and give me some refund after my claim was with them for 8 months. They kept asking me for documents that I provided every time they asked and at the end they kept asking for documents I already submitted three times before. TD is a disgrace for Canadians. I wish the government take actions and do a deep audit on these guys. I will slowly withdraw everything I have with TD to go to another bank. Anything is better than this. Please people, do not do anything with this bank and definitely nothing with this credit card. I am been having issues with this bank since 2008 and it’s time to move on to a better service.

This is the all lying I have issues with that I lost my luggage on my way back home and my flight cut and delayed for 5 months they don’t cover anything’s this massage is for the Visa highly in-charge manager if you guys don’t find me solution I have to take legal step and say bye to TD my whole family since they denied my claim it’s really really broke my heart. I was really trust them never ever again.

I want to redeem my points from my business travel which I have accumulated as I switched to the rewards cash card now .How do I do this June 15,2022

This card is excellent and works well if you are looking to use it for travel specifically. I find it comes in handy when even needing a car rental or a hotel stay on the fly.

We have this card and use it often, we had enough points to use it for 5 hotels on our roadtrip last spring (booked them through expedia). I guess it all depends on what you plan to do. We often go on little roadtrips to Canmore, Banff or Jasper and use it to stay there as well so it really saves us for accommodations. Also not having to get separate car insurance for rental cars is a big plus.

I just got back from Cuba. Unfortunately my flight from Ottawa to Cuba was delayed by 4 hours. And from Cuba to Ottawa for 14 hours. I want to be reimbursed because I bought a ride on my The TD First Class Travel Visa Infinite. Please give me the contact information to whom to apply for compensation. Thank you,

I have First Travel Visa card. My trip is more than 21 days. How can I get travel insurance for the days after first 21 days?

This is incorrect. the $100 travel credit is only for hotels and vacation rentals ALONG with flights. Not if your travel consists only of flights. It is a Hotel credit and NOT a travel flight credit. Beware! This credit card is absolutely useless.

Related Articles

Honda Accord review: The best used car for families

If you need a roomy, reliable and fuel-efficient ride, check out our pick for the best pre-owned family sedan...

Toyota Corolla review: The best used small sedan

The Corolla is Toyota’s bestselling vehicle, as it’s easy to see why. Here’s what to look for when buying...

Ford Escape review: The best used hybrid car

The Ford Escape entered its fourth and current generation in 2020—alongside a compelling hybrid-powered variant. Our review outlines its...

Kia Soul review: The best used small SUV

I peer deep into the Kia Soul for this review—and I like what I see. Find out why this...

GMC Yukon review: The best used large SUV

The hardworking GMC Yukon offers the best value among used SUVs in Canada—especially if it has a Duramax diesel...

Dodge Grand Caravan review: The best used minivan for most families

Canadian families adore the Dodge Grand Caravan. Here’s why it offers great value as a second-hand minivan—and what to...

Ford F-150 review: The best used pickup truck

This hardworking pickup is still the bestselling vehicle in North America. Here’s how to choose a great pre-owned F-150...

Lexus ES review: The best used small luxury car

If you want luxury without a sky-high price tag, consider Lexus’ entry-level sedan. Here’s what to look for when...

Genesis G90 review: The best used large luxury car

Looking for a used large luxury car? Consider a Genesis G90. Here’s why it’s one of Canada’s best pre-owned...

Best used economy hybrid: Toyota Camry Hybrid

If you’re looking for a used Toyota Camry Hybrid, these two model years might be the best ones.

- Book Travel

- Credit Cards

The Beginner’s Guide to TD Rewards Credit Cards

TD Rewards is the in-house points currency offered exclusively by TD Bank. The rewards program allows TD Rewards credit card holders to earn TD Rewards Points.

The rewards program is available through three of TD’s personal credit cards: the TD Rewards Visa* Card, the TD Platinum Travel Visa* Card, and the TD First Class Travel® Visa Infinite* Card.

In This Post

What is td rewards, td rewards credit cards, redeeming td rewards points.

TD Rewards is TD Bank’s in-house points currency that’s accessible through three personal credit cards and one business TD Rewards credit card.

Credit cards in the TD Rewards program earn TD Rewards Points, which are a fixed-value points currency that’s exclusive to the bank.

The fact that the currency has fixed value means that the value of the points doesn’t fluctuate, and instead its value is based on the way in which you choose to redeem them (more on this below).

TD Rewards Points can be earned exclusively through credit card welcome bonuses that you can access as a first-time cardholder when you get a TD Rewards credit card, and through spending on the same eligible card.

As you earn a welcome bonus and additional points through day-to-day spending, your TD Rewards account balance will grow.

These accumulated points can be redeemed several ways, with the fixed value of a single TD Rewards Point ranging from 0.25 cents per point to 0.5 cents per point (all figures in CAD).

This means that if you had 100,000 TD Rewards Points in your account, you could redeem these for a value of between $250 and $500, depending on which type of redemption you choose.

The most valuable way to redeem TD Rewards Points is for travel, which we’ll explore in detail below.

TD Rewards Points are a great points currency to collect if you’re someone who wants to be able to redeem points for travel, and especially if you often book your trips through Expedia.

TD Rewards Points are also a great currency to collect in addition to other airline and hotel points, since they’re useful in offsetting other travel costs, such as cruises, independent hotels, and short-term rentals that aren’t covered by brand-specific programs (e.g., Aeroplan, Marriott Bonvoy, WestJet Rewards ).

Since TD Rewards Points are redeemable at a fixed value that’s tied to the cash value of the redemption, they’re not the best choice for aspirational travel like business class or First Class flights; however, they remain a valuable currency for other travel expenses.

As we mentioned above, TD Rewards Points can only be earned through TD Rewards credit cards.

TD currently offers three personal credit cards for this program: the TD First Class Travel® Visa Infinite* Card, the TD Platinum Travel Visa* Card, and the TD Rewards Visa* Card.

To sort out which of the above three is best for you, let’s look at each of the personal credit cards’ features and eligibility requirements.

TD First Class Travel® Visa Infinite* Card

This is the TD Rewards program’s flagship card, offering the strongest earning rates and the best welcome bonus.

The card’s welcome bonus fluctuates depending on the bank’s current offer, often coming in around 100,000 TD Rewards Points and with an all-time high of 135,000 TD Rewards Points.

Given this, it’s ideal to time your application to coincide with an elevated welcome bonus, as this is a one-time opportunity for new cardholders.

The fees and eligibility requirements of this card are as follows:

- Annual fee: $139

- Supplementary cardholders: $50

- Minimum income requirement: $60,000 (personal), $100,000 (household)

- Estimated credit score needed: Good to Excellent

Since this is a premium credit card, you can enjoy elevated earning rates in specific categories, with earning rates as follows:

- Earn 8 TD Rewards Points† per dollar spent on eligible travel booked through Expedia® for TD†

- Earn 6 TD Rewards Points† per dollar spent on eligible grocery and restaurant purchases†

- Earn 4 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account†

- Earn 2 TD Rewards Points† per dollar spent on all other eligible purchases†

As an example of the earning power of these rates, let’s imagine that you spend $500 on groceries and restaurants in a month.

Given the earning rate of 6 TD Rewards Points per dollar spent, $500 in spending within this category will earn you 3,000 points. These 3,000 TD Rewards Points can then be redeemed for between $7.50 and $15 in value, depending on the redemption path you choose.

This value is equivalent to a 1.5–3% return on your $500 in purchases ($7.50/$500 = 1.5%, $15/$500 = 3%).

Since TD Rewards Points can be redeemed for a maximum value of 0.5 cents per point, the return on spending you get is 4%, 3%, 2%, or 1%, depending on your purchase.

Plus, as an annual birthday perk, you can earn 10% of the TD Rewards Points earned in the previous 12 months back on your cardholder anniversary,† up to 10,000 TD Rewards Points per year.†

The TD First Class Travel® Visa Infinite* Card also comes with a range of perks and benefits.

For example, cardholders are eligible to earn a $100 TD Travel Credit† on accommodations and vacation packages of at least $500 booked through Expedia® for TD†, and can also enjoy car rental discounts at Avis and Budget to the tune of 10% in Canada and the US, and 5% internationally.†

Additionally, the card often offers a first-year annual fee rebate, and it comes with strong insurance coverage for travel and eligible purchases.

Overall, the TD First Class Travel® Visa Infinite* Card is best suited for individuals who meet the income requirements and who are looking to accumulate TD Rewards Points rapidly with the elevated earning rates.

More in-depth information about the TD First Class Travel® Visa Infinite* Card can be found in our dedicated guide for the card.

- Earn 20,000 TD Rewards Points upon making your first purchase †

- Earn 55 ,000 TD Rewards Points upon spending $5,000 within 180 days of account opening †

- Plus, earn up to 10,000 TD Rewards Points back on your birthday †

- Plus, earn 8x TD Rewards Points † on eligible travel purchases when you book through Expedia ® for TD †

- Get an annual TD Travel Credit † of $100 when you book through Expedia ® for TD †

- Use your rewards for any travel bookings available on Expedia ® for TD †

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $139, rebated for the first year †

- Application must be approved by September 3, 2024 to receive this offer

TD Platinum Travel Visa* Card

The TD Platinum Travel Visa* Card is the mid-tier card in the TD Rewards lineup, and it offers good earning rates and an enticing welcome bonus.

- Annual fee: $89

- Supplementary cardholders: $35

- Minimum income requirement: N/A

Similarly to the TD First Class Travel® Visa Infinite* Card , the TD Platinum Travel Visa* Card also earns elevated rates in specific categories, just at a slightly lower rate than its premium counterpart.

These earning rates are as follows:

- 6 TD Rewards Points† per dollar spent on eligible Expedia® for TD†

- 4.5 TD Rewards Points† per dollar spent on eligible groceries and dining†

- 3 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account†

- 1.5 TD Rewards Points† per dollar spent on all other eligible purchases†

To see these rates in action, let’s again imagine that you spent $500 on groceries and restaurants in a month.

With the 4.5 TD Rewards Points per dollar rate, $500 in spending within this category will earn you 2,250 points. These 2,250 TD Rewards Points can then be redeemed for between $5.60 and $11.25 in value, depending on the redemption path you choose.

This value is equivalent to a 1.12–2.25% return on your $500 in purchases ($5.60/$500 = 1.12%, $11.25/$500 = 2.25%).

In terms of perks and benefits, the TD Platinum Travel Visa* does not provide much, which is expected with a mid-tier card.

Cardholders can often enjoy a first-year annual fee rebate as well as car rental discounts at Avis and Budget to the tune of 10% in Canada and the US, and 5% internationally†. The card also provides some basic insurance coverage.

This card is best suited for individuals who would like to earn TD Rewards Points with elevated earning rates, but who don’t meet the eligibility requirements of the TD First Class Travel® Visa Infinite* Card.

More in-depth information about the TD Platinum Travel Visa* Card can be found in our dedicated guide for the card.

- Earn 15,000 TD Rewards Points upon first purchase †

- Earn 35,000 TD Rewards Points upon spending $1,000 in the first 90 days †

- Plus, earn 6x TD Rewards Points † on eligible travel purchases when you book through Expedia ® for TD †

- Earn 4.5x TD Rewards Points † on eligible grocery and restaurant purchases †

- No minimum income requirement

- Annual fee: $89, rebated in the first year †

TD Rewards Visa* Card

The TD Rewards Visa* Card is the program’s entry-level, no-fee card. It offers the lowest earning rates of the three TD Rewards credit cards, and it typically comes with the opportunity to earn a modest welcome bonus.

- Annual fee: $0

- Supplementary cardholders: $0

- Estimated credit score needed: N/A

As can be expected with any no-fee credit card, the earning rates for the TD Rewards Visa* Card are lower than the other TD Rewards cards; however, there are still elevated rates in specific categories.

The TD Rewards Visa* comes with the following earning rates:

- 4 TD Rewards Points† per dollar spent on eligible Expedia® for TD purchases†

- 3 TD Rewards Points† per dollar spent on eligible groceries and dining purchases†

- 2 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account†

- 1 TD Rewards Point† per dollar spent on all other eligible purchases†

To help understand the value of these earning rates, let’s look at the same monthly spend of $500 on groceries and restaurants as above.

Since you earn 3 TD Rewards Points per dollar in the groceries and dining category, $500 of spending within this category will earn you 1,500 points. These 1,500 TD Rewards Points can then be redeemed for between $3.75 and $7.50 in value, depending on the redemption path you choose.

This value is equivalent to a 0.75–1.5% return on your $500 in purchases ($3.75/$500 = 0.75%, $7.50/$500 = 1.5%).

In terms of perks and benefits, the TD Rewards Visa* Card comes with very little.

Cardholders can enjoy car rental discounts at Avis and Budget to the tune of 10% in Canada and the US, and 5% internationally†, and they will have access to some minimal insurance coverage, such as extended warranty, purchase protection, and Mobile Device Insurance.

The TD Rewards Visa* Card is best suited for individuals who are looking for a no-fee way to earn TD Rewards Points.

More in-depth information about the TD Rewards Visa* Card can be found in our dedicated guide for the card.

- Earn 15,152 TD Rewards Points when you spend $500 within 90 days of Account opening+ †

- Plus, earn 4x TD Rewards Points † on eligible travel purchases when you book through Expedia ® for TD †

- Application must be approved by January 6, 2025 to receive this offer

TD Rewards Points can be redeemed for travel, gift cards and merchandise, higher education, statement credits, and on amazon.ca,

We’ll focus on the travel options in the sections below since these are the most valuable options, and given that you’re on our website, they’re likely the options that most intrigue you.

That said, if you’re interested in learning more about the other available options, check out our Essential Guide to TD Rewards, which goes over each alternative in detail.

Redeeming TD Rewards Points on Expedia for TD

The most valuable way to redeem TD Rewards Points is by using them through Expedia for TD.

When redeemed this way, each TD Rewards Point is worth 0.5 cents per point, meaning that 100,000 TD Rewards Points can be redeemed for $500 worth of travel.

Expedia for TD is essentially the same as the regular Expedia platform, except it’s linked with your TD Rewards Points account, and you log in with your TD credentials.

To access Expedia for TD, simply sign in to your TD Rewards account, click “Expedia for TD” under the “Redeem” tab, and then click through to the Expedia for TD portal.

You can use Expedia for TD the same way you would use regular Expedia, allowing you to book flights, hotels, car rentals, and other travel purchases.

Notably, through this redemption avenue, you can also redeem your TD Rewards Points for cruises, tours, and Disney tickets.

After signing in to Expedia for TD, you can search for your desired hotel, cruise, tour, or whatever else you might like to book.

As an example, let’s say you’d like to redeem your TD Rewards Points for tickets to Universal Orlando Resort.

Once you’ve selected your purchase on Expedia for TD, look for “Use your TD Points” on the check-out page. From there, select the number of points you’d like to redeem and then proceed with your purchase.

The minimum redemption amount is 200 points (equal to $1), and you’re able to make the purchase with a combination of cash and points, allowing you to decide how much of the purchase you’d like offset with your TD Rewards Points.

When redeeming your points through Expedia for TD, you still need to pay the full purchase amount up front. The value from your redeemed points will be credited to your TD Rewards credit card statement after the purchase is completed and within 3–5 business days.

When booking through Expedia for TD, it’s important to remember that you’re booking through a third-party vendor (Expedia) and not directly with the airline, hotel, car rentals, etc.

For hotel bookings, this means that you won’t earn any hotel status benefits or accrue elite qualifying nights. For car rentals, you won’t earn things like Hertz points or free rentals through National Free Days.

However, you will still be able to accrue elite-qualifying points/miles with airlines as long as you attach your associated membership number to your booking at the time of purchase or add it at the check-in counter.

Most importantly, when booking a flight through Expedia for TD, be aware that any and all changes and cancellations must be pursued through Expedia for TD, and can’t be done through the airline.

Redeeming TD Rewards Points with Book Any Way Travel

If you’d rather book travel directly with vendors (e.g., Hyatt, WestJet, VIA Rail) instead of using Expedia for TD, you can still get great value from your points.

When redeemed for purchases made outside of Expedia for TD, each of your TD Rewards Points is worth 0.4 cents. This means that 100,000 TD Rewards Points is worth $400 for travel booked using your TD Rewards credit card.

To redeem your TD Rewards Points through the Book Any Way option, all you need to do is charge the eligible flight, hotel, train ticket, etc. to your TD Rewards credit card.

Once the purchase has posted to your credit card account, you can redeem your TD Rewards Points to offset the cost by using the TD Rewards website or by calling 1-800-983-8472 within 90 days of the purchase date.

To redeem TD Rewards Points online, log in to your TD Rewards account and select “Book Any Way Travel” from the “Redeem” tab.

On the next screen, fill in the information about the transaction against which you’d like to redeem points.

You’ll need to have the purchase transaction date, its description, and the exact dollar amount before proceeding. This information can be found on your credit card account statement.

If you’d like to redeem points for multiple transactions at once, simply click on “add another transaction” and fill in the additional information.

Once you’ve submitted your request for redemption, you can expect to receive the value back as a statement credit within 3–5 business days.

While you won’t get the best value from your TD Rewards Points this way, this option does offer excellent flexibility as TD has one of the most generous definitions of an eligible “travel expense” in the industry.

Using Book Any Way, you can redeem your TD Rewards Points for the vast majority of travel expenses, including campsites, jet-ski rentals, and even theatre tickets as long as they were purchased while travelling.

Keep in mind though that in the cases involving more unique travel expenses, you may need to speak with a customer service representative in order to redeem your points.

If you’d like more details about how you can redeem your TD Rewards Points through other redemption methods, we’ve included more options and additional details in our Essential Guide for TD Rewards.

Alternatively, you can always check out the TD Rewards website to explore the program further.

TD Bank offers three personal TD Rewards credit cards that allow you to earn TD Rewards Points.

These points are a valuable currency that can be redeemed for almost all your travel expenses at a fixed value, making them one of the most flexible fixed-value currencies on offer in Canada.

If you’re looking for a credit card that earns points redeemable for travel expenses and you prioritize flexibility, the TD Rewards travel cards are great options to consider.

Can I have a TD Rewards credit card if I don’t bank with TD?

Yes, you can. To pay your TD Rewards credit card bill without a TD bank account, simply search for TD as a payee within your online banking’s bill payment feature, and then add your TD credit card number as the account number.

Can I book travel for other people with my TD Rewards Points?

Yes, you can make a booking for someone else using your TD Rewards Points. To do so, go through the search and booking process as usual, using your friend/family member’s name and information in lieu of your own.

Do I have to redeem my TD Rewards Points for travel?

No. TD Rewards Points can also be redeemed for merchandise, gift cards, statement credits, higher education, and on amazon.ca.

Can I exchange my TD Rewards Points for cash?

TD Rewards Points can be redeemed for a cash credit towards your TD credit card statement at a rate of 400 points = $1 (CAD).

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Prince of Travel is Canada’s leading resource for using frequent flyer miles, credit card points, and loyalty programs to travel the world at a fraction of the price.

Join our Sunday newsletter below to get weekly updates delivered straight to your inbox.

Have a question? Just ask.

Business Platinum Card from American Express

120,000 MR points

American Express Aeroplan Reserve Card

85,000 Aeroplan points

American Express Platinum Card

100,000 MR points

TD® Aeroplan® Visa Infinite Privilege* Card

Up to 75,000 Aeroplan points†

Latest News

AIR MILES Now Transferable Between Dream Miles and Cash Miles

News Jun 27, 2024

Buy American Airlines AAdvantage Miles with a 50% Discount

Deals Jun 27, 2024

Air India to Launch A350 on Delhi–London Route

Recent discussion, aeroplan estore canada day promotion: earn up to 7x points, aeroplan extends no-expiry policy through november 2025, the best ways to book aer lingus with avios, how my family travelled to hawaii for cheap, is flying in canada getting more expensive, prince of travel elites.

Points Consulting

- Credit Cards

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

TD First Class Travel Vs. TD Aeroplan: Which Is Better?

Updated: Jun 25, 2024, 7:41am

Table of Contents

What is td first class travel, earning rewards, what is td aeroplan, td first class travel vs td aeroplan: which to choose, td first class travel and td aeroplan cards comparison, td first class travel vs. td aeroplan.

One bank, two rewards programs. If you’re looking for a travel rewards card with TD Bank, you’ll have the choice between one of the many TD Aeroplan cards they offer and a TD First Class Travel Visa Infinite. But how do you know which one will benefit you the most? We break down the differences between these two types of travel cards.

Featured Partner Offer

TD® Aeroplan® Visa Infinite Privilege* Card

On TD’s Website

Welcome Bonus

Up to $2,700 in value† including up to 75,000 Aeroplan points†

Regular APR (Purchases) / Regular APR (Cash Advances)

20.99% / 22.99%

American Express® Aeroplan®* Card

On American Express’s Secure Website

Up to 50,000 Aeroplan points

Regular APR

30% (charge card)

- TD® Aeroplan® Visa Infinite* Card

Up to $1,000 in value† including up to 40,000 Aeroplan points†

Credit Score Description

Good/Excellent

TD First Class Travel isn’t really the name of a rewards program with TD. Rather, it refers to a specific credit card TD issues: the TD First Class Travel Visa Infinite . This card and several others from TD earn TD Reward points.

TD Reward points are exclusive to TD and are specifically linked to TD credit cards , meaning you won’t find them anywhere else. TD Reward points use a fixed-value points system, ensuring they can be redeemed consistently across various redemption options. This feature makes them good for covering incidental travel expenses like boutique hotel bookings, vacation rentals and other travel-related expenses.

How Many TD First Class Travel cards does TD offer?

TD only offers one TD First Class Travel card: the TD First Class Travel Visa Infinite Card.

It does offer a few other credit cards that earn TD Rewards points, including:

- TD Platinum Travel Visa

- TD Travel Rewards Visa

- TD Business Travel Visa

TD First Class Travel Rewards

Pros of td first class travel.

- Earn up to 8 points per dollar on select spending

- Points can be redeemed through multiple travel booking sites, including Expedia for TD

- Includes travel insurance

Cons of TD First Class Travel

- TD Rewards points are exclusive to TD Bank

- Must earn either $60,000 in annual personal income or $100,000 in annual household income to be eligible for this card

Redemption Options for TD First Class Travel

TD Rewards points can be redeemed for Amazon.ca purchases, Starbucks Rewards Stars and gift cards. You can also redeem TD Rewards points for travel bookings, like flights , hotels and car rentals, on any site through the TD Book Any Way option on any travel booking website or on Expedia For TD. You can also use your TD Reward points for a statement credit or for continuing education credits.

TD Aeroplan refers to credit cards issued by TD Bank that earn Aeroplan points. Aeroplan was originally designed as a loyalty program for Air Canada customers but changed hands several times over the years. 2018 Air Canada repurchased the program and reintroduced it in 2020.

Following its relaunch, Aeroplan focused on flexible rewards and expanded, adding a wide range of airline and retail partners to its network and removing fuel surcharges. Aeroplan credit cards are issued by TD Bank but are also issued by CIBC and American Express .

How Many TD Aeroplan cards does TD offer?

TD currently offers four Aeroplan credit cards:

- TD Aeroplan Visa Infinite

- TD Aeroplan Visa Platinum

- TD Aeroplan Visa Infinite Privilege

- TD Aeroplan Visa Business

TD Aeroplan Rewards

Pros of td aeroplan.

- Generous welcome bonus

- Points can be used for various items, including travel, merchandise, gift cards, and statement credit.

- Many partner retailers earn more points

- Business card option

- Cards include other travel perks, like travel insurance

Cons of TD Aeroplan

- The most benefits for redemption are with Air Canada

- All TD Aeroplan cards have an annual fee

- Lower earn rates than the TD First Class Travel card.

- Some Aeroplan cards have income eligibility requirements.

- You must fly Air Canada when redeeming Aeroplan Points.

Redemption Options for TD Aeroplan Credit Cards

Aeroplan points can be used for everything from booking flights and vacations with Air Canada to flights on partner airlines, hotel rooms, and car rentals. You can also redeem your Aeroplan points for merchandise, gift cards, and statement credit.

In order to take a closer look and help us choose between choose a TD First Class Travel Visa and a TD Aeroplan card, let’s review some of the facts.

Best for frequent flyers

Td first class travel® visa infinite* card.

Up to $700 in value†, including up to 75,000 TD Rewards Points†

$139 (fee rebated in the first year)

Think of the TD First Class Travel Visa Infinite Card as a cheaper step down from its higher-flying cousins on this list. Packed with travel benefits, but lacking a heavyweight rewards program, this card is really aimed at frequent fliers rather than high spenders who also like to travel.

- High earn rate for rewards with Expedia.

- Exclusive travel benefits.

- Expensive annual fee.

- Low annual net rewards earnings for average spenders.

- Earn up to $700 in value†, including up to 75,000 TD Rewards Points, no Annual Fee for the first year† and additional travel benefits. Conditions Apply. Account must be approved by September 3, 2024.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†.

- Earn 55,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- Earn a Birthday Bonus of 10% of the TD Rewards Points you have earned over the past year, up to a maximum of 10,000 TD Rewards points†.

- Get an annual TD Travel Credit † of $100 when you book at Expedia ® For TD.

- Get an Annual Fee Rebate for the first year†.

- To receive the first-year annual fee rebate for the Primary Cardholder, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by September 4, 2024.

- This offer is not available for residents of Quebec.

- † Terms and conditions apply.

Best for earn rates

Thanks to the TD Aeroplan Visa Infinite Card ’s robust Aeroplan rewards program, cardholders can earn roughly twice what they’d net through any of the other cards on this list, although its travel insurance coverage leaves something to be desired.

- Great rewards program earnings

- Plenty of perks, including comprehensive travel insurance and a NEXUS rebate

- High annual fee

- Earn up to $1,000 in value†, including up to 40,000 Aeroplan points† and additional travel benefits. Account must be approved by September 3, 2024.

- Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†.

- Earn 15,000 Aeroplan points when you spend $7,500 within 180 days of Account opening†.

- Plus, earn a one-time anniversary bonus of 15,000 Aeroplan points when you spend $12,000 within 12 months of Account opening†.

- Enroll for NEXUS and once every 48 months get an application fee rebate†.

- Plus, share free first checked bags with up to 8 travel companions†.

- This offer is not available to residents of Quebec.

Best For Aeroplan Points with Low Annual Fee

Td® aeroplan® visa platinum* card.

Up to $500 in value†

$89 (first year of annual fee rebated)

The TD Aeroplan Visa Platinum Card shares many lots of the same features seen in premium cards that cost five times the annual fee. However, it does lack a bit in the insurance department.

- Decent travel and consumer protection benefits

- Allows cardholders to earn Aeroplan Points twice

- Low annual fee that’s rebated the first year

- Lower insurance coverage than other Aeroplan cards

- Earn up to $500 in value† including up to 20,000 Aeroplan points† and no annual fee for the first year. Conditions Apply. Account must be approved by September 3, 2024.

- Earn an additional 10,000 Aeroplan points when you spend $1,000 within 90 days of Account opening†.

- Get an annual fee rebate for the first year†.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by September 4, 2024.

Best For Exclusivity

True to its name, the TD Aeroplan Visa Infinite Privilege Card is exclusive and expensive, but brings to bear a broad array of perks and benefits, along with a surprisingly accessible credit score threshold.

- Extensive travel perks, insurance and consumer protections

- Low credit score threshold for such a powerful card

- The most expensive annual fee on the list

- Requires minimum personal income of $150,000 a year or $200,000 in annual household income

- Earn up to $2,700 in value† including up to 75,000 Aeroplan points (enough for a round trip to Honolulu†) and additional travel benefits. Conditions Apply. Account must be approved by September 3, 2024.

- Earn a welcome bonus of 20,000 Aeroplan points when you make your first purchase with your new card†

- Earn an additional 25,000 Aeroplan points when you spend $12,000 within 180 days of Account opening†

- Plus, earn a one-time anniversary bonus of 30,000 Aeroplan points when you spend $24,000 within 12 months of Account opening†

- Share first free checked bags with up to 8 travel companions† and get unlimited access to Maple Leaf Lounges†, including complementary access for one guest.

- Plus, primary card holders get 6 complimentary worldwide select airport lounge visits annually through the Visa Airport Companion Program†.

- †Terms and conditions apply.

Best Aeroplan Card for Business Owners

Td® aeroplan® visa* business card.

Up to 65,000 Aeroplan points

This card is a must for business owners , especially those who travel. With exclusive perks and benefits starting at the airport, insuring you at take-off and at your destination with a robust travel insurance package and even providing discounts when you rent a car, you’ll feel like someone’s rolling out the red carpet for you on every business trip.

- High earn rate, especially on essential categories for business

- Travel perks like travel insurance and priority check-in and boarding

- $149 annual fee

- Limited travel benefits compared to other premium cards

- Limited acceptance outside of Aeroplan and Air Canada partners

- Earn up to $1,850 in value† including up to 65,000 Aeroplan points, no annual fee for the first year, and additional travel benefits†. Accounts must be opened by January 3, 2024.

- Get an annual fee rebate for the first year for the primary cardholder and two additional cardholders†.

- Share free first checked bags and get access to Maple Leaf Lounges†.

- Earn 2 points for every dollar spent on eligible purchases made directly with Air Canada® including Air Canada Vacations®.

- Earn 1.5 points for every dollar you spend on eligible purchases for travel, dining and select business categories such as shipping, internet, cable and phone services made on your Card.

- Earn 1 point for every dollar you spend on all other eligible purchases on your Card.

- Earn 50% more points at Starbucks when you link your TD card with your Starbucks® Rewards account.