- Skip to main content

- Skip to primary sidebar

Additional menu

Project Financially Free

Let's grow our wealth together!

Carnival Cruises: Shareholder Benefits

Last Updated 15th January 2024 | By Brianna Johnson | This post may contain affiliate links: Disclaimer

Imagine waking up to a new, beautiful view every day. Instead of packing and unpacking your bags, all you need to do is wander around the ship and enjoy the various activities. Whether you’re looking for an adventure or a relaxing escape, a cruise can provide it all.

You might therefore be wondering, do Carnival shareholders get any benefits or perks? The answer is Yes. Shareholders receive benefits in the form of Onboard Credits. The value of these credits ranges from $50 to $250 (£30 to £150), depending on the cruise line brand and the duration of the cruise.

Let’s dive in to the details below.

Onboard Credits for Carnival Corporation & Carnival Plc Shareholders

Carnival wants to acknowledge its shareholders who also become customers, so if you own 100 shares or more of CCL or CUK , then you’re all set to receive some perks through onboard credits! You will receive one OBC per shareholder-occupied stateroom. Onboard credits are a type of currency that can be used onboard Carnival’s cruise ships. Guests can use their onboard credits to purchase drinks, souvenirs, spa treatments, book shore excursions, and more. The benefits vary based on which brand of cruise line you are on, so it’s important to pay attention to this. I have discussed this further below.

The good news is that Carnival recently updated their benefits information and extended these benefits out to 2024. This means if you are going on a cruise in 2023 or if you are simply booking one now but will be cruising in 2024 (up until July 31), you’re covered by the benefits!

The current rules are in place for reservations made by February 28, 2024 and the benefit is applicable on sailings through July 31, 2024.

Exclusions and Important Conditions

There are some important exclusions to keep in mind. You are not eligible to receive these benefits and perks if:

- You are cruising on a reduced rate or complimentary basis

- You are an employee of Carnival, a travel agent cruising at travel agent rates, interline rates, or a tour conductor.

It is also important to note that the benefit is not transferrable, so you cannot pass on the benefit to someone else. You must be going on the cruise and the OBC will only be given to you (and the people in your party in your stateroom).

Finally, the OBC cannot be exchanged for cash, or used for casino credits and charges, or for gratuities charged to your onboard account.

How to apply for Onboard Benefits for Carnival

The process for applying for the OBCs is fairly simple. There is no form to fill out. You have to provide by email, fax, or by regular mail (see contact information below), the following pieces of information:

- Complete legal name

- Reservation/booking number

- Ship and sailing date

- Photocopy of shareholder proxy card; OR

- A dividend tax voucher; OR

- A current brokerage or nominee statement with your current mailing address. Please black out your brokerage account number.

When to apply for Onboard Credits for a Carnival cruise

You must apply for the onboard credits at least 4 weeks prior to your departure. Note that there is some conflicting information in Carnival’s own literature about this period (at one point they say 3 weeks prior to departure date is acceptable).

My suggestion is to stick to the more conservative requirement of 4 weeks. It’s better to be safe than sorry. There’s no point waiting till the end and letting 1 week get in the way of you, a great vacation, and some nice perks!

If you have a travel agent, I recommend contacting your travel agent for the easiest and fastest results. Alternatively, you can contact Carnival directly too. I recommend contact them by email as it’s the easiest way to keep track of your conversation with them and the fastest way of communicating. See the section below for contact details.

How much are Carnival shareholder Onboard Benefits?

The Onboard Credits provided to shareholders and stockholders varies based on the brand of the cruise line that you are going on and the period of the voyage.

Please remember that the onboard credit for Carnival Cruise Line, Costa Cruises, Cunard, and Princess Cruises is determined based on the operational currency onboard the vessel.

Carnival Cruises – North American brands

For Carnival’s North American brands, for sailings up to July 31, 2023, you get the following benefits:

Carnival’s North American brands along with their contact information are listed below. Remember that if you have a travel agent who booked your tickets, you can contact them as well.

If you want to contact by regular mail, please see Carnival’s documentation for the mailing address for each brand.

Carnival Cruises – Continental Europe brands

For Carnival’s Continental European brands, for sailings up to July 31, 2024, you get the following benefits:

Carnival’s Continental European brands along with their contact information are listed below. Remember that if you have a travel agent who booked your tickets, you can contact them as well.

Carnival Cruises – UK brands

For Carnival’s UK brands, for sailings up to July 31, 2024, you get the following benefits:

Carnival’s UK brands along with their contact information are listed below. Remember that if you have a travel agent who booked your tickets, you can contact them as well.

Carnival Cruises – Australian brands

For Carnival’s Australian brands, for sailings up to July 31, 2024, you get the following benefits:

Carnival’s Australian brands along with their contact information are listed below. Remember that if you have a travel agent who booked your tickets, you can contact them as well.

For Carnival branded cruises in Australia, you have to contact their North American email or fax number.

Is it Worth Buying Carnival Shares for the Onboard Credit?

In the post-Covid world, I do not think it is worth buying Carnival shares simply to claim the shareholder benefits. As you may be aware, the cruise industry was hit very badly during Covid as all voyages were cancelled. In order to pay the bills, all the cruise companies had to borrow huge sums of money from banks and from the financial markets. This meant that the balance sheets of all the cruise lines went from being reasonable to now being in a vary precarious state.

While President Trump was favourably disposed to bail out the cruise lines with cheap financing, the fact that cruise companies pay minimal income tax (anywhere between 0% to 3% in any given year) meant that Congress did not want to be seen bailing them out using taxpayers’ funds.

Carnival’s net debt level has ballooned from around $11 billion at the end of November 2019 to $29 billion by the end of 2023. While earnings at the company have started to recover from the Covid shock, there is still a long way to go reduce their financial leverage. It will likely take Carnival another 10 years or more of running at pre-Covid profitability levels to reduce their debt back to the $11 billion level. This is a very long time!

Due to Carnival’s significantly worsened financial position, the shares have also become significantly more volatile. The shares easily move 5-10% in one day. And while that might not seem like much, it’s important to remember that the shares have declined by 80% from their pre-Covid levels.

An important metric to quantify stock volatility is Beta. Using our Beta calculator , you can see that the stock has a Beta of over 2 when compared to the S&P 500. This means the stock is highly volatile.

For these reasons, you can easily end up losing more on the shares than you will gain in OBCs.

How much will 100 Carnival shares cost?

The box below shows the cost to buy 100 shares of CCL based on the latest closing price:

Stock Price

Calculating...

Based on this investment, a 10% decline in the share prices (whether in one day or over a few days or months), would cost you at least $170. Depending on the duration of your cruise, this can be more than what you would receive in benefits!

Yes, if the shares go back up, you could gain a lot of money too. But at this point, that’s just pure speculation. Sure you can have a little fun with the shares if they go up, but unless you really know what you are doing, you’re better off just going on that cruise. Plus its more enjoyable to get lucky in the stateroom than pray and hope that maybe you can get lucky in the markets! If you want to make money in the markets, there are better options to consider.

Is CCL a good stock to buy?

Given Carnival’s ridiculously high debt level and the difficult position that they’re in, unfortunately for no fault of their own, I do not feel that CCL (or CUK) is a good stock to buy as an investment. One could buy Carnival shares in the hope that they recover, but that would purely be speculation, not investing. Unfortunately, the situation is similar across the industry, with other companies like Royal Caribbean and Norwegian also struggling.

Investing means you are taking a calculated bet and you only take that bet when the risk vs reward dynamics are skewed heavily in your favour. At this point, for the reasons I laid out above, I do not feel that rewards heavily outweigh the risks.

For those who are tolerant of volatility, I think Carnival could potentially make a good trading stock. It would make sense to buy the stock when it gets beat up due to external factors (i.e. not stock-specific issues) and sell when it bounces.

Will Carnival stock recover?

The path to recovery for Carnival’s shares is murky. The company has to pay off a significant amount of debt in order to bring its balance sheet to a healthy level, or at least back to its pre-Covid levels. Based on the expected free cash flow generation of around $2.5 billion annually, starting in 2025, it will take a long time to pay off the $20 billion of incremental debt that they have taken on since 2020.

While all of this is doable, there may be many more macroeconomic and geopolitical challenges that they company may face during that period. The first few years are the most crucial, as that is when the company is most vulnerable.

If the management can effectively steer the company through the next 3 to 5 years without any hiccups – this means generating profits and paying off debt with it – the stock may recover in the years beyond that. But do you want to own the shares during such a volatile period?

If you You are likely better off investing in opportunities where the odds are in your favour . I would recommend monitoring Carnival’s financials over the next few years and if it looks like they’re on track, it would be worth buying for an eventual recovery.

Or as I mentioned, from a trading perspective, one could buy when they get beat up and sell when the price recovers.

What’s the difference between CCL vs CUK?

From a financial perspective, CCL and CUK are functionally equivalent and there is no difference. This means that 1 share of CCL is equal to 1 share of CUK, and there is no difference between CCL and CUK.

So then why does Carnival have two stocks to its name? The main difference has to do with where Carnival shares are trading. CCL is the ticker of the stock you’ll find trading in the US on the NYSE and represents an ownership of in Carnival Corp. Meanwhile, CCL in London is equivalent to 1 share of CCL in the US and represents interest in Carnival plc.

Meanwhile, and confusingly enough, you’ll find CUK trading on the NYSE (in USD), representing Carnival PLC. CUK is a sponsored ADR which means its more directly tied to CCL shares in London.

Yes, there are some differences in liquidity and sometimes one of the shares might trade at a premium, but for most investors, those differences are irrelevant.

Using our total return calculator , you can see that both CCL and CUK have identical returns over the last 5 years.

Here’s what the company discloses in its annual report about the three securities’ structure:

Carnival Corporation common stock, together with paired trust shares of beneficial interest in the P&O Princess Special Voting Trust, which holds a Special Voting Share of Carnival plc, is traded on the NYSE under the symbol “CCL.” Carnival plc ordinary shares trade on the London Stock Exchange under the symbol “CCL.” Carnival plc American Depositary Shares (“ADSs”), each one of which represents one Carnival plc ordinary share, are traded on the NYSE under the symbol “CUK.” The depositary for the ADSs is JPMorgan Chase Bank, N.A. Carnival Corporation Annual Report, 2022

Does CCL pay dividends?

No. Carnival (both CCL and CUK) used to pay dividends, however they were suspended due to the unprecedented circumstances related to Covid-19. I do not expect Carnival to pay dividends for the foreseeable future as their debt load is simply too high. It may take them another several years before they can start paying out a dividend without jeopardizing their balance sheet.

How to buy Carnival Shares?

In order to buy Carnival shares, you will need to have a brokerage account that allows you to buy shares. Many brokerages allow you to open an account easily, but there may be a minimum amount of deposit required first.

If you are in the US, some good options for brokerage accounts are M1 Finance , Robinhood, or Vanguard.

If you are in the UK, you can buy either CCL shares in the US or CUK in the UK. Some good options for brokerages include Fineco , Moneyfarm , Hargreaves Lansdown , Interactive Investors , or eToro . You can learn more about other options on our articles covering the Best Way to Buy US Stocks in the UK and the Best Investment Apps .

Is there a Carnival shareholder benefit request form?

No, Carnival does not have a form to claim any shareholder benefits or onboard credits (OBC). There is a very simple process to get your benefits. You have to email them your personal details, information about your voyage, and proof of share ownership. Please do this at least 4 weeks prior to your departure date.

Do Carnival shareholders get cruise discounts?

No, Carnival shareholders do not receive any discounts for booking a cruise. Instead, shareholders receive benefits in the form of Onboard Credits. The value of these credits ranges from $50 to $250 (£30 to £150), depending on the cruise line brand and the duration of the cruise.

Can I claim Onboard credit multiple times with Carnival?

Yes, you can request this benefit multiple times! However it can only be claimed once per trip per shareholder. This means that if you book 3 separate trips with Carnival, then you can claim this benefit 3 times, once for each trip! All their terms and conditions apply.

What is the P&O shares price?

P&O is a brand of Carnival Cruise Lines, so it does not have its own shares. Please check the share price of Carnival Cruise Lines instead. Carnival’s symbol is CCL on the NYSE or CUK on the LSE.

by Brianna Johnson

Brianna Johnson, a Miami-based finance veteran, is a wealth advisor for high net-worth families. She loves to write and to share her knowledge. For PFF, she writes in-depth articles on finance and investments that help readers get unique insights. See more .

You May Also Like

- Royal Caribbean: Shareholders With Benefits

- Norwegian Cruise Lines: Shareholders With Benefits

- How to Get Rich From a Poor Background

Reader Interactions

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Cruise Monkeys

Bananas about cruising

Carnival Shares – The shareholder benefits

Carnival Corporation & plc is one of the largest cruise operators in the world. The company’s portfolio of global cruise line brands includes Carnival Cruise Line, Princess Cruises, Holland America Line, Seabourn, P&O Cruises (Australia), Costa Cruises, AIDA Cruises, P&O Cruises (UK) and Cunard. Owning Carnival shares means you have a stake in one of the biggest cruise companies and can bag your self some shareholder benefits too.

In this post we will discuss what the shareholder benefits are and how many shares you need to get them. Do remember this post does not constitute financial advice, if you are interested in buying Carnival stock, do seek independent financial advice first!

Page Contents

How many Carnival shares do I need to purchase?

To be entitled to shareholder benefits, you need to purchase a minimum number of shares. This benefit is available to shareholders holding a minimum of 100 shares of Carnival Corporation or Carnival plc.

What are the Carnival shareholder benefits (as of June 2023)?

Carnival stopped giving dividends due to the global pandemic and the impact on the business. Prior to this, shares were trading at £40-£50 a share, before plummeting to £5. While it doesn’t appear dividends will reappear anytime soon, there are still some shareholder benefits in the form on Onboard Credit. You only need to purchase 100 shares to receive the Carnival shareholder onboard credit, you wont get extra credit for buying more and it will only be applied to a room once.

How much onboard credit will I receive?

The amount on onboard credit you’ll receive as a shareholder will depend on the cruise line and the cruise length. See the table beow:

How do I apply for my Carnival shareholder benefits?

You can apply for you shareholder benefits any time between 90days and 28days prior to sailing. While we have heard of people having them added in advance of 90 days, in most cases people are told to reapply nearer the cruise.

Applying is easy, you just need to send a copy of your share certificate or the latest statement proving you own 100 shares along with the following details:

- Your complete legal name

- Reservation/booking number

- Ship and sailing date

- Proof of ownership of Carnival Corporation or Carnival plc shares

The easiest way to do this is via email, but you can also send the details by post. We have listed the contact you need for each brand below:

The onboard credit for Carnival Cruise Line, Costa Cruises, Cunard and Princess Cruises is determined based on the operational currency onboard the vessel.

Please visit the Carnival Corporation website at www.carnivalcorp.com for updates. We often use our shareholder benefits on our P&O, Princess and Cunard cruises.

- Celebrity Infinite Veranda review

- P&O Iona sea view Cabin Tour

You May Also Like

Seasickness on a cruise.

P&O Azura Cruise Review

Which is the best way to book a cruise?

Carnival Corp. is now on Stockperks!

Carnival Corporation has engaged Stockperks to implement a more automated and streamlined process for the processing of shareholder benefits. The Stockperks service is governed by Stockperks’ Privacy Policy, Terms of Service, and may be subject to other Stockperks policies and terms. For information regarding Stockperks’ use and processing of your information, technical support, account setup, and all other questions regarding the use of Stockperks, please contact Stockperks at [email protected] . For all other questions, please contact Carnival Corporation at the respective brand emails listed below.

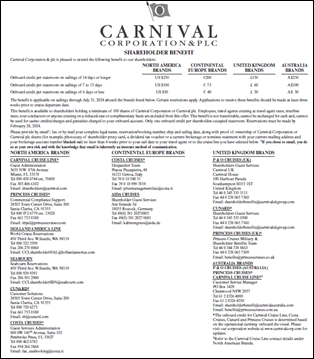

Carnival Corporation & plc is pleased to extend the following benefit to our shareholders:

Shareholder Benefits

* The onboard credit for Carnival Cruise Line, Costa Cruises, Cunard and Princess Cruises is determined based on the operational currency onboard the vessel.

The benefit is available on sailings through December 31, 2024. Applications to receive this benefit should be made at least three weeks prior to cruise departure date.

This benefit is available to shareholders holding a minimum of 100 shares of Carnival Corporation or Carnival plc. Employees, travel agents cruising at travel agent rates or interline rates, tour conductors or anyone else cruising at a reduced-rate or on complimentary basis are excluded from this offer. This benefit is non-transferable, cannot be exchanged for cash and cannot be used for casino credits/charges and gratuities charged to your onboard account. We reserve the right, at our sole discretion, to change, modify or terminate this benefit or any of the terms and conditions relating to the benefit at any time without notice. Only one onboard credit per shareholder-occupied stateroom is permitted.

Carnival Corporation & plc has engaged Stockperks to implement a more automated and streamlined process for the processing of shareholder benefits. Simply:

- Download the app via the links below, or search for “Stockperks” in your app store

- Once downloaded, create a Stockperks user profile

- Then search for “Carnival” in the app, and select the cruise line you are traveling with

- Click the blue button “Validate your portfolio” and you will be guided through the process of providing your CCL ownership details

- Once confirmed you can then submit a claim for each eligible booking

Thank you for being a loyal Carnival Corporation & plc shareholder and enjoy your cruise!

Redeem your Perk!

Download the Stockperks app today and create your profile. Then visit the Carnival profile and select the cruise line you're sailing on to confirm eligibility and claim your onboard credit!

The Stockperks service is governed by Stockperks’ Privacy Policy, Terms of Service, and may be subject to other Stockperks policies and terms. For information regarding Stockperks’ use and processing of your information, technical support, account setup, and all other questions regarding the use of Stockperks, please contact Stockperks at [email protected] . For all other questions, please contact Carnival Corporation & plc at the respective brand emails listed below.

- AIDA: [email protected]

- Carnival Cruise Lines: [email protected]

- Costa Cruises: [email protected]

- UK: [email protected]

- Australia/ New Zealand: [email protected]

- North America: [email protected]

- Holland America Line: [email protected]

- P&O Cruises (UK): [email protected]

- P&O Australia: [email protected]

- Princess Cruises: [email protected]

- Seabourn: [email protected]

- Carnival Cruise Lines

New way for requesting Carnival shareholder obc now?

By martinchem , November 8, 2023 in Carnival Cruise Lines

Recommended Posts

Carnival Corp is now on Stockperks!

Carnival Corporation & plc is pleased to extend the following benefit to our shareholders

Shareholder Benefits

* The onboard credit for Carnival Cruise Line, Costa Cruises, Cunard and Princess Cruises is determined based on the operational currency onboard the vessel.

The benefit is available on sailings through July 31, 2024. Applications to receive this benefit should be made at least three weeks prior to cruise departure date.

This benefit is available to shareholders holding a minimum of 100 shares of Carnival Corporation or Carnival plc. Employees, travel agents cruising at travel agent rates or interline rates, tour conductors or anyone else cruising at a reduced-rate or on complimentary basis are excluded from this offer. This benefit is non-transferable, cannot be exchanged for cash and cannot be used for casino credits/charges and gratuities charged to your onboard account. We reserve the right, at our sole discretion, to change, modify or terminate this benefit or any of the terms and conditions relating to the benefit at any time without notice. Only one onboard credit per shareholder-occupied stateroom is permitted.

Carnival Corp has partnered with Stockperks to streamline the process to claim this benefit. Simply:

- Download the app via the links below, or search for “Stockperks” in your app store

- Once downloaded, create a Stockperks user profile

- Then search for “Carnival” in the app, and select the cruise line you are traveling with

- Click the blue button “Validate your portfolio” and you will be guided through the process of providing your CCL ownership details

- Once confirmed you can then submit a claim for each eligible booking

Thank you for being a loyal Carnival Corporation & plc shareholder and enjoy your cruise!

Redeem your Perk!

Download the Stockperks app today and create your profile. Then visit the Carnival profile and select the cruise line you're sailing on to confirm eligibility and claim your onboard credit!

Link to comment

Share on other sites.

here is the page: https://www.stockperks.com/carnivalcorp

i can not find any information about this on carnival corporation website about this

it seems all this app does it collects your info and then forwards it to carnival, kind of like a middle man

I just received the new request in my email, after I had emailed my request in on Sunday.

I just downloaded the app, and submitted my stock statement. It said that I should have a response within 2 days with the next steps.

Ken the cruiser

On 11/7/2023 at 7:54 PM, martinchem said: Carnival Corp is now on Stockperks! Carnival Corporation & plc is pleased to extend the following benefit to our shareholders Shareholder Benefits NORTH AMERICA BRANDS Carnival Cruise Line*, Princess Cruises*, Holland America Line, Seabourn, Cunard*, Costa Cruises* CONTINENTAL EUROPE BRANDS Costa Cruises*, AIDA Cruises UNITED KINGDOM BRANDS P&O Cruises (UK), Cunard*, Princess Cruises (UK)* AUSTRALIA BRANDS P&O Cruises (Australia), Princess Cruises*, Carnival Cruise Line* Onboard credit per stateroom on sailings of 14 days or longer US $250 €200 £150 A$250 Onboard credit per stateroom on sailings of 7 to 13 days US $100 €75 £60 A$100 Onboard credit per stateroom on sailings of 6 days or less US $50 €40 £30 A$50 * The onboard credit for Carnival Cruise Line, Costa Cruises, Cunard and Princess Cruises is determined based on the operational currency onboard the vessel. The benefit is available on sailings through July 31, 2024. Applications to receive this benefit should be made at least three weeks prior to cruise departure date. This benefit is available to shareholders holding a minimum of 100 shares of Carnival Corporation or Carnival plc. Employees, travel agents cruising at travel agent rates or interline rates, tour conductors or anyone else cruising at a reduced-rate or on complimentary basis are excluded from this offer. This benefit is non-transferable, cannot be exchanged for cash and cannot be used for casino credits/charges and gratuities charged to your onboard account. We reserve the right, at our sole discretion, to change, modify or terminate this benefit or any of the terms and conditions relating to the benefit at any time without notice. Only one onboard credit per shareholder-occupied stateroom is permitted. Carnival Corp has partnered with Stockperks to streamline the process to claim this benefit. Simply: Download the app via the links below, or search for “Stockperks” in your app store Once downloaded, create a Stockperks user profile Then search for “Carnival” in the app, and select the cruise line you are traveling with Click the blue button “Validate your portfolio” and you will be guided through the process of providing your CCL ownership details Once confirmed you can then submit a claim for each eligible booking Thank you for being a loyal Carnival Corporation & plc shareholder and enjoy your cruise! Redeem your Perk! Download the Stockperks app today and create your profile. Then visit the Carnival profile and select the cruise line you're sailing on to confirm eligibility and claim your onboard credit!

If I might ask, how did you learn about this StockPerks app?

7 hours ago, Ken the cruiser said: If I might ask, how did you learn about this StockPerks app?

After requesting shareholder obc from Carnival by email they replied with instruction link.

I downloaded the app Weds eve & sent our etrade screenshots (just used "Fidelity" option).

Thurs AM they already emailed me as they needed 1 more screenshot...of course Etrade is being fussy & not letting me back in; need to call.

But I am impressed with their promptness!

I sent my usual request by Fax. After 10 days of not receiving credit, I called and was given e-mail for customer support and was told to use www.stockperks.com/carnivalcorp in the future.

Waiting to see what happens. MJ

I signed up for stock perks on Friday, got my confirmation from them on Saturday, filled out my request with Carnival and was already approved for my credit on Monday. Easy as can be!

2 hours ago, ChrisToni said: I signed up for stock perks on Friday, got my confirmation from them on Saturday, filled out my request with Carnival and was already approved for my credit on Monday. Easy as can be!

I'm confused - if pax are being directed to StockPerks, what request are you sending to Carnival?

41 minutes ago, Haljo1935 said: I'm confused - if pax are being directed to StockPerks, what request are you sending to Carnival?

Stockperks just simply confirms that you are a stockholder. Once that is done you fill out the request for a specific cruise with carnival.

7 minutes ago, ChrisToni said: Stockperks just simply confirms that you are a stockholder. Once that is done you fill out the request for a specific cruise with carnival.

So we still email as usual, just including whatever we get back from StockPerks?

2 minutes ago, Haljo1935 said: So we still email as usual, just including whatever we get back from StockPerks?

Once Stockperks verifies, just go to the app and select carnival, then follow the prompts.

The Carnival Shareholder benefit form doesn't mention this as of now on their website.

I just did this two days ago, and the credit was loaded within 48 hours of starting the process. It was easy to do on the app, and I just took a photo of my screen showing my stock holdings and this was verified overnight, and the money was loaded a few hours later.

westbaysheri

I downloaded the stick work app and opened an account but can’t get in

My institution is not on the Plaid platform yet. So do we just email like normal then ?

VentureMan_2000

hoping this somehow makes applying easier... all the redacting of my portfolio documents is a pain.

7 hours ago, VentureMan_2000 said: hoping this somehow makes applying easier... all the redacting of my portfolio documents is a pain.

I asked someone who had submitted & rec'd the OBC using this new process about redacting & they said they did still redact all the usual personal info.

" This benefit is non-transferable, cannot be exchanged for cash and cannot be used for casino credits/charges and gratuities charged to your onboard account."

Is the part about gratuities new? On our cruises the Stockholder OBC was applied to gratuities as well.

lostsoulcruiser

A couple of questions/concerns:

- How does Stockperks protect your stock account privacy, in particular the account number you were able to black out when requesting your OBC via the fax or email?

- Did Carnival change the on-board accounting system to be able to target stockholder OBC for certain charges and not others? Sounds like it and does that show up when you check your account on the ship during a cruise?

- Does the stockholder OBC change also apply to a booking OBC?

Thanks for the replies.

I used the app for the first time this week.

1. I downloaded the app. A few glitches but did get it to download.

2. Opened app and it requires you to open an account.

3. Opened and account, a few glitches again, but it opened.

4. Once in the new account, it ask you to upload a copy of your statement, it also allows you to take a picture and upload while the account is open.

5. Took a statement and redacted the other holdings, amounts, account #, addresses, etc. I did this when I mailed before.

6. took picture and uploaded and sent to Stockperks.

7. Received confirm that they would be back to be in to 2 days.

8. Received email telling me to open Stockperks account and complete cruise information.

9. Opened account and entered Carnival cruise confirm #, date of cruise, ship name, etc. and hit enter.

10. Received confirm email stating they would be back in touch.

11. Received confirm stating that I had received my $100 OBC for my 7 day cruise.

I downloaded and used Stockperks this week. Once I had the app I simply allowed it to "pair" with my Robinhood app and entered info for 2 upcoming sailings. It took 2 days but I received an email for each sail date saying it was approved and the credits are both on my Carnival booking details. I understand the security concerns but I have all of my high dollar investments (IRA and 401K) with other brokers. I use the Robinhood account to "play" a little bit and that is where I hold my Carnival shares.

There is some good reading in the Princess forum about this. You don't need to divulge all the info the app asks for. Just what we all need is another app to clutter on our phones ! I will use and delete as necessary. Apps can lead to info being stolen if they are compromised.

19 hours ago, VentureMan_2000 said: hoping this somehow makes applying easier... all the redacting of my portfolio documents is a pain.

It would still be prudent to redact with this new app. Give them minimal info to be safe.

I don't get what the benefit is of downloading another app. I just submitted my request via email and received credit in about 3 days.

Please sign in to comment

You will be able to leave a comment after signing in

- Welcome to Cruise Critic

- Hurricane Zone 2024

- Cruise Insurance Q&A w/ Steve Dasseos of Tripinsurancestore.com June 2024

- New Cruisers

- Cruise Lines “A – O”

- Cruise Lines “P – Z”

- River Cruising

- Cruise Critic News & Features

- Digital Photography & Cruise Technology

- Special Interest Cruising

- Cruise Discussion Topics

- UK Cruising

- Australia & New Zealand Cruisers

- Canadian Cruisers

- North American Homeports

- Ports of Call

- Cruise Conversations

Announcements

- New to Cruise Critic? Join our Community!

Write Your Own Amazing Review !

Click this gorgeous photo by member SUPERstar777 to share your review!

Features & News

LauraS · Started Saturday at 06:48 PM

LauraS · Started Friday at 05:25 PM

LauraS · Started Friday at 02:57 PM

LauraS · Started Thursday at 06:25 PM

LauraS · Started Wednesday at 03:59 PM

- Existing user? Sign in OR Create an Account

- Find Your Roll Call

- Meet & Mingle

- Community Help Center

- All Activity

- Member Photo Albums

- Meet & Mingle Photos

- Favorite Cruise Memories

- Cruise Food Photos

- Cruise Ship Photos

- Ports of Call Photos

- Towel Animal Photos

- Amazing, Funny & Totally Awesome Cruise Photos

- Write a Review

- Live Cruise Reports

- Member Cruise Reviews

- Create New...

Shareholder Benefits

This exclusive benefit offer is reserved solely for shareholders owning a minimum of 100 shares of Royal Caribbean Group (NYSE: RCL) at time of sailing.

$1,000 Onboard Credit per Stateroom on a World Cruise

$250 Onboard Credit per Stateroom on Sailings of 14 or more nights.

$100 Onboard Credit per Stateroom on Sailings of 6-13 nights.

$50 Onboard Credit per Stateroom on Sailings of 5 nights or less.

- Applicable on any eligible Royal Caribbean International, Celebrity Cruises or Silversea Cruises sailing.

- Excludes any charter or Galapagos sailings.

To complete your Shareholder Onboard Credit Offer Request electronically click here .

You can complete your Shareholder Onboard Credit Request for Silversea Cruises here .

Requests should be received in our office approximately 2-3 weeks prior to your sail date.

The benefit is only available for the stateroom in which the shareholder (with a minimum of 100 shares) is sailing. Onboard credit is applied on a per stateroom basis, double occupancy. Only one shareholder credit per stateroom on any one sailing. If shares are held jointly, 100 shares are required for each onboard credit request on any one sailing.

Yes, you may request this benefit multiple times-as often as you sail on Royal Caribbean International, Celebrity Cruises or Silversea Cruises. (excludes any charter or Galapagos sailings)

Benefit is non-transferable and not available to employees of Royal Caribbean Group or its subsidiaries and affiliates. Benefit cannot be redeemed for chartered sailings, any Galapagos sailings or complimentary sailings.

No. Benefit is non-transferable. Only the stateroom that the shareholder is traveling in will be eligible for the onboard credit.

Shareholder benefit offer applies to bookings made on or after June 1, 2023. Onboard credit is applied on a per stateroom basis; double occupancy, one shareholder credit per stateroom, and one credit per shareholder per sailing. If you are requesting shareholder onboard credit for two or more separate staterooms and shares are held jointly, a minimum of 100 shares per stateroom booked must be held. Single guests paying 200% of applicable fare receive full onboard credit value. Onboard credit may not be used for onboard service charges or pre-purchased activities. Any unused credit after the final night of the sailing shall be forfeited and is not redeemable for cash. Notwithstanding the foregoing, World Cruise onboard credit benefit may be used for shore excursions and, if unused, may be refunded upon request to the shareholder’s original form of payment. Benefit is non-transferable and not available to employees of Royal Caribbean Group or its subsidiaries and affiliates. Benefit cannot be redeemed for chartered sailings, complimentary sailings or Galapagos sailings. The shareholder must own the Royal Caribbean Group (NYSE: RCL) stock at time of sailing. Onboard credit is calculated in US dollars except on sailings where the onboard currency used is a foreign currency (in which case the onboard credit will be converted at a currency exchange rate determined by the cruise line). Onboard credit amount is credited to shareholder’s stateroom folio at time of sailing. Other terms and conditions may apply. Prices and offers are subject to availability and change without notice, capacity controlled, and may be withdrawn at any time.

You can download the Shareholder Benefits PDF here .

You can complete your Shareholder Onboard Credit Offer Request electronically here .

Email us at [email protected]

For Silversea Cruises Email us at [email protected]

Cautionary Statement Concerning Forward-Looking Statements

Certain statements in this release relating to, among other things, our future performance estimates, forecasts and projections constitute forward-looking statements under the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to: statements regarding revenues, costs and financial results for 2020 and beyond. Words such as “anticipate,” “believe,” “could,” “driving,” “estimate,” “expect,” “goal,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “will,” “would,” “considering”, and similar expressions are intended to help identify forward-looking statements. Forward-looking statements reflect management’s current expectations, are based on judgments, are inherently uncertain and are subject to risks, uncertainties and other factors, which could cause our actual results, performance or achievements to differ materially from the future results, performance or achievements expressed or implied in those forward-looking statements. Examples of these risks, uncertainties and other factors include, but are not limited to the following: the impact of the global incidence and spread of COVID-19, which has led to the temporary suspension of our operations and has had and will continue to have a material adverse impact on our business and results of operations, or other contagious illnesses on economic conditions and the travel industry in general and the financial position and operating results of our Company in particular, such as: the current and potential additional governmental and self-imposed travel restrictions, the current and potential extension of the suspension of cruises and new additional suspensions, guest cancellations; our ability to obtain sufficient financing, capital or revenues to satisfy liquidity needs, capital expenditures, debt repayments and other financing needs; the effectiveness of the actions we have taken to improve and address our liquidity needs; the impact of the economic and geopolitical environment on key aspects of our business, such as the demand for cruises, passenger spending, and operating costs; incidents or adverse publicity concerning our ships, port facilities, land destinations and/or passengers or the cruise vacation industry in general; concerns over safety, health and security of guests and crew; further impairments of our goodwill, long-lived assets, equity investments and notes receivable; an inability to source our crew or our provisions and supplies from certain places; the incurrence of COVID-19 and other contagious diseases on our ships and an increase in concern about the risk of illness on our ships or when traveling to or from our ships, all of which reduces demand; unavailability of ports of call; growing anti-tourism sentiments and environmental concerns; changes in US foreign travel policy; the uncertainties of conducting business internationally and expanding into new markets and new ventures; our ability to recruit, develop and retain high quality personnel; changes in operating and financing costs; our indebtedness, any additional indebtedness we may incur and restrictions in the agreements governing our indebtedness that limit our flexibility in operating our business, including the significant portion of assets that are collateral under these agreements; the impact of foreign currency exchange rates, interest rate and fuel price fluctuations; the settlement of conversions of our convertible notes, if any, in shares of our common stock or a combination of cash and shares of our common stock, which may result in substantial dilution for our existing shareholders; our expectation that we will not declare or pay dividends on our common stock for the near future; vacation industry competition and changes in industry capacity and overcapacity; the risks and costs associated with protecting our systems and maintaining integrity and security of our business information, as well as personal data of our guests, employees and others; the impact of new or changing legislation and regulations or governmental orders on our business; pending or threatened litigation, investigations and enforcement actions; the effects of weather, natural disasters and seasonality on our business; emergency ship repairs, including the related lost revenue; the impact of issues at shipyards, including ship delivery delays, ship cancellations or ship construction cost increases; shipyard unavailability; and the unavailability or cost of air service.

In addition, many of these risks and uncertainties are currently heightened by and will continue to be heightened by, or in the future may be heightened by, the COVID-19 pandemic. It is not possible to predict or identify all such risks.

More information about factors that could affect our operating results is included under the caption “Risk Factors” in our most recent quarterly report on Form 10-Q, as well as our other filings with the SEC, and the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent annual report on Form 10-K, copies of which may be obtained by visiting our Investor Relations website at www.rclinvestor.com or the SEC’s website at www.sec.gov . Undue reliance should not be placed on the forward-looking statements in this release, which are based on information available to us on the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Brands Logos

- Carnival Cruises

- P&O Australia

- P&O Cruises

- Princess Cruises

- Holland America

Investor Relations

- Annual Reporting

- Quarterly & Semiannual Reporting

- Supplemental Schedules

- SEC Filings

- Webcasts / Presentations

- Archived Financial Information

- Stock Quote / Chart

- Investment Calculator

- Historical Lookup

- News Releases

- Events Calendar

- Email Alerts

- Analyst Coverage

- Earnings Estimates

- Shareholder Benefit

- Dividend/Split History

- Investor FAQs

- Online Investor Kit

- Information Request

Carnival Corporation and Carnival plc operate a dual listed company, whereby the businesses of Carnival Corporation and Carnival plc are combined and they function as a single economic entity through contractual agreements between separate legal entities. Shareholders of both Carnival Corporation and Carnival plc have the same economic and voting interest but their shares are listed on different stock exchanges and are not fungible. Carnival Corporation common stock is traded on the New York Stock Exchange under the symbol CCL. Carnival plc is traded on the London Stock Exchange under the symbol CCL and as an ADS on the New York Stock Exchange under the symbol CUK. Carnival is the only company in the world to be included in both the S&P 500 index in the US and the FTSE 250 index in the UK.

- Stock Quote

- Stock Chart

Data Provided by Refinitiv. Minimum 15 minutes delayed.

Carnival Corporation & plc 2023 Annual Report 444.1 KB

Carnival Corporation & plc 2022 Annual Report 517 KB

Investor Kit

Click here to view Investor Kit documents.

AIDA Cruises is the market leader in the German-speaking cruise market. Home of the smile, AIDA Cruises is the epitome of a premium-quality, relaxing cruise and operates one of the world’s most state-of-the-art fleets. Visit: www.aida.de

Carnival Cruise Line, also known as America’s Cruise Line, is a leader in contemporary cruising and operates a fleet of ships designed to provide fun and memorable vacation experiences at a great value. Visit: www.carnival.com

Costa Cruises delivers Italy’s finest at sea, bringing modern Italian lifestyle to its ships to provide guests with a true European experience that embodies a unique passion for life through warm hospitality, entertainment and gastronomy. Visit: www.costacruise.com

Cunard is the epitome of British refinement for travelers who relish the line’s impeccable White Star Service, gourmet dining, world-class entertainment, and the legacy of historic voyages and transatlantic travel. Visit: www.cunard.com

Holland America Line's premium fleet of spacious, elegant mid-sized ships feature sophisticated five-star dining, extensive entertainment and activities, innovative culinary enrichment programs and compelling worldwide itineraries. Visit: www.hollandamerica.com

P&O Cruises (UK) is Britain’s favorite cruise line with a fleet of ships combining genuine service and a sense of occasion and attention to detail, ensuring passengers have the holiday of a lifetime, every time. Visit: www.pocruises.co.uk

P&O Cruises (Australia) provides a quintessential holiday experience for Australians and New Zealanders, taking them to some of the world's most idyllic and hard-to-reach places across Asia and the South Pacific. Visit: www.pocruises.co.au

Princess is the world’s leading international cruise line and tour company operating a fleet of modern cruise ships, renowned for the innovative design and wide array of choices in dining, entertainment and amenities. Visit: www.princess.com

Seabourn provides ultraluxury cruising vacations in a unique, small-ship style that focuses on genuine, intuitive service, all-suite accommodations, superb cuisine and unique experiences in destinations worldwide. Visit: www.seabourn.com

Brands Logos

- Carnival Cruises

- P&O Australia

- P&O Cruises

- Princess Cruises

- Holland America

Investor Relations

- Annual Reporting

- Quarterly & Semiannual Reporting

- Supplemental Schedules

- SEC Filings

- Webcasts / Presentations

- Archived Financial Information

- Stock Quote / Chart

- Investment Calculator

- Historical Lookup

- News Releases

- Events Calendar

- Email Alerts

- Analyst Coverage

- Earnings Estimates

- Shareholder Benefit

- Dividend/Split History

- Investor FAQs

- Online Investor Kit

- Information Request

News Release

Carnival corporation to strategically align portfolio and absorb p&o cruises australia into carnival cruise line.

Carnival Cruise Line to boost its capacity by absorbing P&O Cruises Australia in 2025, further optimizing the company's brand portfolio creating operational efficiencies

MIAMI and SYDNEY , June 3, 2024 /PRNewswire/ -- Carnival Corporation & plc (NYSE/LSE: CCL; NYSE: CUK), the world's largest cruise company, today announced that in March 2025 , the company will sunset the P&O Cruises Australia brand and fold the Australia operations into Carnival Cruise Line , the most popular cruise line in the world.

This change is the latest in a series of strategic moves designed to increase guest capacity for Carnival Cruise Line , the company's flagship brand and the highest-returning brand in Carnival Corporation's global portfolio. This will result in the addition of eight new ships to Carnival Cruise Line's fleet since 2021, including the successful shift of three vessels from sister brand Costa Cruises . In addition, the company recently placed its first new ship order in half a decade for two new Excel-class cruise ships to join Carnival Cruise Line in 2027 and 2028.

Josh Weinstein , chief executive officer of Carnival Corporation & plc. "In 2019, Carnival Cruise Line was 29% of our total capacity, and when we complete this move early next year, Carnival Cruise Line – our highest-returning brand – will make up approximately 35% of our total global capacity. While our company's overall growth between 2019 – 2028 is projected to be less than 2% (CAGR), the majority will be for Carnival Cruise Line , which will grow by approximately 50% over that time period."

In addition to further optimizing the composition of Carnival Corporation's global brand portfolio, the realignment will strengthen the company's performance in the South Pacific through numerous operational efficiencies.

"P&O Cruises Australia is a storied brand with an amazing team, and we are extremely proud of everything we have accomplished together in Australia and the broader region," said Weinstein. "However, given the strategic reality of the South Pacific 's small population and significantly higher operating and regulatory costs, we're adjusting our approach to give us the efficiencies we need to continue delivering an incredible cruise experience year-round to our guests in the region. Carnival Corporation & plc remains committed to Australia and we will continue to be the largest cruise operator in the region with 19 ships calling on 78 destinations and representing almost 60% of the market."

Building on Shared Legacy in the Region As the P&O Cruises Australia brand retires early next year, the Pacific Encounter and Pacific Adventure ships will be rebranded and operated by Carnival Cruise Line brand. Pacific Explorer will exit the fleet in February of 2025. Current itineraries will operate business as usual, and guests will be notified in the coming days of any changes to future bookings as a result of this announcement.

When the transition is complete next year, Carnival Cruise Line – which has served the South Pacific since 2013 – will have four ships in the market, including Sydney -based Carnival Splendor and Carnival Luminosa sailing seasonally from Brisbane , in addition to their new sister ships Encounter and Adventure.

Christine Duffy , president of Carnival Cruise Line . "While we plan to make some technology upgrades and other small changes to the two P&O Cruises Australia ships, they will continue to be geared to the unique Australian market with a familiar feel and much of the same experiences for P&O Cruises Australia guests. The most notable change will be the availability of our popular HubApp, enabling guests to make online dining and excursion reservations, request food and beverage delivery, and chat with other guests, among other features. P&O Cruises Australia guests will also be invited to participate in Carnival's loyalty program and promotional offerings specific to Carnival ships sailing in the region."

"Over the coming months, we will find ways to celebrate and honor P&O Cruises Australia – a valued part of our legacy and an important contributor to the tourism industry in the South Pacific ," said Weinstein. "We value the connection our P&O Cruises Australia guests, employees, travel advisor partners, public officials and destinations have with our company and are committed to building on this association moving forward as Carnival."

[EDITOR'S NOTE: This announcement does not impact P&O Cruises ( UK ), which is a separate Carnival Corporation & plc brand based in England and dedicated to the UK market.]

About Carnival Corporation & plc Carnival Corporation & plc is the largest global cruise company, and among the largest leisure travel companies, with a portfolio of world-class cruise lines – AIDA Cruises , Carnival Cruise Line , Costa Cruises , Cunard, Holland America Line , P&O Cruises ( Australia ), P&O Cruises ( UK ), Princess Cruises , and Seabourn.

Additional information can be found on www.carnivalcorp.com , www.aida.de , www.carnival.com , www.costacruise.com , www.cunard.com , www.hollandamerica.com , www.pocruises.com.au , www.pocruises.com , www.princess.com , and www.seabourn.com .

For information on Carnival Corporation's industry-leading sustainability initiatives, visit www.carnivalsustainability.com .

SOURCE Carnival Corporation & plc

Carnival Corporation Media Contacts: Jody Venturoni, Carnival Corporation, [email protected]; Lucy Colonnetta Clifton, LDWW, [email protected]

AIDA Cruises is the market leader in the German-speaking cruise market. Home of the smile, AIDA Cruises is the epitome of a premium-quality, relaxing cruise and operates one of the world’s most state-of-the-art fleets. Visit: www.aida.de

Carnival Cruise Line, also known as America’s Cruise Line, is a leader in contemporary cruising and operates a fleet of ships designed to provide fun and memorable vacation experiences at a great value. Visit: www.carnival.com

Costa Cruises delivers Italy’s finest at sea, bringing modern Italian lifestyle to its ships to provide guests with a true European experience that embodies a unique passion for life through warm hospitality, entertainment and gastronomy. Visit: www.costacruise.com

Cunard is the epitome of British refinement for travelers who relish the line’s impeccable White Star Service, gourmet dining, world-class entertainment, and the legacy of historic voyages and transatlantic travel. Visit: www.cunard.com

Holland America Line's premium fleet of spacious, elegant mid-sized ships feature sophisticated five-star dining, extensive entertainment and activities, innovative culinary enrichment programs and compelling worldwide itineraries. Visit: www.hollandamerica.com

P&O Cruises (UK) is Britain’s favorite cruise line with a fleet of ships combining genuine service and a sense of occasion and attention to detail, ensuring passengers have the holiday of a lifetime, every time. Visit: www.pocruises.co.uk

P&O Cruises (Australia) provides a quintessential holiday experience for Australians and New Zealanders, taking them to some of the world's most idyllic and hard-to-reach places across Asia and the South Pacific. Visit: www.pocruises.co.au

Princess is the world’s leading international cruise line and tour company operating a fleet of modern cruise ships, renowned for the innovative design and wide array of choices in dining, entertainment and amenities. Visit: www.princess.com

Seabourn provides ultraluxury cruising vacations in a unique, small-ship style that focuses on genuine, intuitive service, all-suite accommodations, superb cuisine and unique experiences in destinations worldwide. Visit: www.seabourn.com

This Cruise Life

2023 carnival shareholder benefit (valid through july 2024).

In 2022, I talked about the benefits of being a shareholder in your favorite cruise line’s stock. At the time of that writing, Carnival Corporation provided up to $250 onboard credit depending on the length of sailing. That is, as long as the reservation was made by February 28, 2023 for sailings through July 31, 2023. Several of our readers have asked: What about sailings after July 31st?

Carnival Corporation Shareholder Benefit Update

Good news: Earlier this year, Carnival Corporation updated the Shareholder Benefit. With that said, they have yet to update their official Shareholder Benefits website (as of May 5, 2023). Not to fear, we’ve got you covered!

According to the updated document, included at the end of this article, all benefits remain the same from last year:

Shareholder Benefits Extended

Included inside Carnival Corporation’s 2022 Annual Report is an updated version of the Shareholder Benefit PDF. While nothing materially has changed with how to receive the benefit, the timeframe has been extended for when you can receive the benefit:

- Reservations must be made by February 28, 2024

- Shareholder Benefit applicable on sailings through July 31, 2024

For specific step-by-step instructions on how to request the benefit , be sure to check out our original post.

Not Just Carnival Cruise Lines

Several of our readers were surprised to learn that the Carnival Shareholder Benefit extended beyond Carnival Cruise Line. It’s valuable to remember that this is a Carnival Corporation Shareholder Benefit – which is inclusive of namesake Carnival Cruise Lines, but the benefit extends to all of Carnival’s brands, including:

- Carnival Cruise Line

- Princess Cruises

- Holland America Line

- Costa Cruises

- AIDA Cruises

- P&O Cruises

2023-2024 Carnival Corporation Shareholder Benefit

The most current Shareholder Benefit can be downloaded here :

Fine Print and Disclaimers

As always, when talking about Shareholder Benefits and the stock market, there are always some key disclaimers:

- Only one onboard credit per stateroom, even if multiple sailors own the required minimum stock amounts.

- Employees, travel agents cruising at travel agent rates, interline rates, tour conductors or anyone cruising on a reduced-rate or complimentary basis are excluded from this offer.

- This benefit is not transferable, cannot be exchanged for cash and, cannot be used for casino credits/charges and gratuities charged to your onboard account.

- Reservations must be made by February 28, 2024.

- As with any stock purchase or investment, there is market risk. You could lose money with the investment. Additionally, as you buy/sell stock, there could be tax implications. Nothing on this page should be used to make an investment or tax decision and I retain zero liability for any decisions you may make

Video Recap

Soon after publishing this article, we recorded a video to recap all of the benefits of participating in the cruise line shareholder program. Give it a watch below!

22 thoughts on “2023 Carnival Shareholder Benefit (valid through July 2024)”

- Pingback: Cruise lines offer Shareholder Benefits

We have carnival stock. We are taking a Carnival cruise on September 16 2023, on Carnival Sunshine. How do we get credit to use onboard? Thank you. Joanne and Dan Irons

Hello! Thank you for reaching out. Check out our original article which has instructions on how to submit for your OBC for that upcoming sailing ( https://www.thiscruiselife.com/cruise-blog/carnival-shareholder-benefit/ ). The Carnival Sunshine is a beautiful ship and we hope you have a fantastic sailing!

Carnival wants to force us to install a third party app “stockperks” so we can submit information on stock ownership. Read the Stockperks privacy policy: https://www.stockperks.com/privacy Stockperks requires access to you personal financial information. The app also needs a lot of permissions to to look at all your stuff. either A: Carnival wants to offload processing to another data miner to save money regardless of the risks to its passengers or B: Carnival doesn’t want to be responsible for ending the credit, they are just hoping their cruisers will just stop applying for the stock ownership OBC because they do not want to give up privacy and security. What is your opinion?

Hey Bob. Thanks for the message. We have been taking advantage of the Shareholder Benefit for years and never had to go through stockperks.com for anything. It looks like that website just sources information on how to get the most out of your investment across different methods. If you follow the instructions we posted ( https://www.thiscruiselife.com/cruise-blog/carnival-shareholder-benefit/ ), there is no need to use a third party company/site.

They now require the use of Stockperks. I tried to submit the old way but got an email back saying it was now the only way to apply for stock OBC. I too hate the third party permissions.

We will do some digging into this as that method is not listed on the Carnival Corporation Shareholder Benefit qualifier sheet. Thank you for sharing your experience with us.

Hello, question regarding carnival stock. Do we get on board credit if we are able to use interline price? Thank you

You can try to request your shareholder credit, but according to the benefit guide, the credit is only offered to full-price fares. We’ve been able to get the credit applied to bookings that were made during special promotions, so we’re not sure how consistent they are in following this rule.

My wife and I our booked a princess cruise,Booking #6W2K8L Caribbean princess Feb 11 2024.We have CHANIVAL STOCK 100 Shares.I have FAX:661.753.0180. We sent 8 times the Shareholders Request form,Front page and back page Brokerage Information, Also Mailed the same Information to CA 91355. Carol and I have 144 cruises with princess cruises and never had a problem getting our Shareholders Benefits.

If you are in the US, have you also tried emailing your information to their Shareholder team? The email address is [email protected] . Not sure why there would be delays, but perhaps that will help to expedite things. The good news is you’re still more than a month out from sailing.

Dale , have you ever used interline price or free cruise and still got on board stock credit

Hey Rocky, We are cruising September 2024. What are our options. Do we need to wait until the new policy comes out to apply? Thanks

Hi Danne! You’ll have to wait to submit until closer to your sailing. We typically submit between 45 to 60 days out. We’ve tried to submit prior to that and we’ve received it kicked back asking to submit closer to time of sailing. So that means we’ll have the 2024-2025 terms and conditions out by then!

A good friend and I have traveled Carnival Lines(Princess Cruises) numerous times and share a cabin. He holds the minimum amount of shares, whereas I hold much more….even though he has traveled 4 times as much as me. I think it absolutely SUCKS that we have to SHARE the “minimal” amount of credits that Carnival offers…..especially since we EACH buy the drink package as well. And now after reading this about having to use an app to get the credits???? It has made me start to re evaluate whether I want to continue with this cruise line much longer.

We completely understand your frustration. The limiter on how many shareholder accounts can be used on each sailing is consistent with Royal Caribbean and Norwegian Cruise Lines. All of the brands limit the redemption to one Shareholder credit per stateroom. We are still doing our research on the app side of things to better understand why that change is being reported.

We were told today by the people at carnival that the stockperks app is the only way to request our onboard credit. We downloaded the app and then it wants my username and password to my Edward Jones account!!! Seriously, they want me to give a random third party my username and password to my financial accounts?!?!? I am beyond frustrated.

Hey there! I just finished the 2024 Carnival Shareholder Article where I talk about StockPerks App. We experienced the same pushback from Carnival Shareholder Services and were required to use the new process. I also created a post on the StockPerks App – here, I share some tips to reduce your exposure. You do also have an option for manual upload of your statement (just like today), however, the StockPerks App says it’ll take longer and it isn’t the recommended way to go. Talking to some of our readers, they share it worked without any issue!! 🙂 Thanks for reading and sharing your thoughts! -Mark

Any idea what will happen to this benefit after July 2024? We have a HOLLAND AMERICA cruise scheduled in October so not sure if this benefit will be available by then.

In our experience, Carnival Corporations usually releases the new Shareholder Benefit program for the new year after their annual meeting (late February/early March). In previous years, the program was the exact same year after year. Once the new details get released, we will post a new article with the updated details (if anything changed).

I’ve been receiving the stock credit for MANY years and the past few years it hasn’t showed up when I board the ship. Thanks to your video I now know why. Even though I’ve gotten free cabins from the casino before apparently now they won’t give the credit to those bookings. At least now I won’t be applying for them. Thanks!

We’re glad to hear that our videos helped you out! And congratulations on your casino offers, sometimes the savings seen in those offers far offsets the benefits you receive as a shareholder.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Carnival Corp to fold P&O Cruises Australia brand into Carnival Cruise Line

Carnival Corp. will fold P&O Cruises Australia into Carnival Cruise Line next year.

- Other Carnival Corp. brands include Holland America Line, Princess Cruises and Seabourn.

- The change does not affect Carnival Corp.’s England-based P&O Cruises, which is a separate brand.

The cruise line operator will retire the P&O Cruises Australia brand in March 2025, the company announced Monday.

"Despite increasing Carnival Cruise Line's capacity by almost 25% since 2019 including transferring three ships from Costa Cruises, guest demand remains incredibly strong so we're leveraging our scale in an even more meaningful way by absorbing an entire brand into the world's most popular cruise line," Carnival Corp. CEO Josh Weinstein said in a news release .

Other Carnival Corp. brands include Holland America Line , Princess Cruises and Seabourn.

Carnival Cruise Line will constitute around 35% of the company’s worldwide capacity when the transition is finished, up from 29% in 2019. P&O’s Pacific Encounter and Pacific Adventure ships will sail for Carnival following a rebrand, while Pacific Explorer will leave the fleet in February.

"P&O Cruises Australia is a storied brand with an amazing team, and we are extremely proud of everything we have accomplished together in Australia and the broader region," Weinstein continued. "However, given the strategic reality of the South Pacific's small population and significantly higher operating and regulatory costs, we're adjusting our approach to give us the efficiencies we need to continue delivering an incredible cruise experience year-round to our guests in the region.”

A spokesperson for the company told USA TODAY the integration "will unfortunately result in some staffing reductions, and we are notifying employees," though they did not share specific numbers. "We also expect to have most members of the P&O Australia shipboard team redeployed to work for Carnival Cruise Line or our six other cruise lines operating in the region," the spokesperson said in an emailed statement.

Following the change, Carnival will have four ships sailing in the market, including Carnival Splendor and Carnival Luminosa. The company said guests will be contacted “in the coming days” about any changes to future cruises because of the consolidation. Current itineraries will sail as scheduled.

Cruise booking tips: There's more to it than picking your travel dates

"We look forward to building on the history and heritage of P&O Cruises Australia by bringing some of our innovations to more cruise guests in the region," Carnival Cruise Line president Christine Duffy added in the release. "While we plan to make some technology upgrades and other small changes to the two P&O Cruises Australia ships, they will continue to be geared to the unique Australian market with a familiar feel and much of the same experiences for P&O Cruises Australia guests.”

The change does not affect Carnival Corp.’s England-based P&O Cruises, which is a separate brand. The company also recently announced that Carnival Cruise Line will add two new Excel-class ships in 2027 and 2028.

Nathan Diller is a consumer travel reporter for USA TODAY based in Nashville. You can reach him at [email protected].

NEWS... BUT NOT AS YOU KNOW IT

Tom Cruise’s estranged daughter Suri, 18, shares big announcement in rare statement

Share this with

Suri Cruise has announced the next big step in her life as she’s set to attend the prestigious Carnegie Mellon University in September.

Suri , 18, the daughter of Hollywood icons Tom Cruise and Katie Holmes, revealed the news in a rare TikTok post where she and a group of friends each wore a sweatshirt from their chosen college.

The video, set to the tune of Abbi Sutphen’s Always Remember You, has the caption: ‘LaG commitment day.’

Carnegie Mellon’s School of Design is one of the oldest and most highly ranked programs in the US, and it’s believed the 18-year-old is leaning towards studying fashion .

‘She is a smart girl, and she is turning into a very intelligent mature young woman,’ an insider told the Daily Mail .

‘She has a very close group of loyal friends, and she knows exactly where she comes from.’

Top Gun icon Tom, 61, and Dawson’s Creek’s Katie, 45, welcomed Suri on April 18, 2006, the anniversary of their first date.

Suri is reportedly extremely close to her mum, but it’s believed she hasn’t seen her dad for 11 years .

It’s claimed that the Mission Impossible actor helps his daughter financially, but no longer sees her after he and Katie divorced in 2012 and she left the Church of Scientology.

Tom also has two children from his marriage to Nicole Kidman – Isabella, 31, and Connor, 29 – who he is believed to see regularly and are both members of the Scientology church .

Their divorce settlement stated that the actor agreed to pay his ex-wife $400,000 (£314,200) a year until Suri turned 18, and he will pay for all her college fees.

The agreement states that although he might not see his daughter, he has to cover ‘medical, dental, insurance, education, college and other extracurricular costs.’

Around the time of the divorce was the last time Tom was publicly pictured with Suri, taking her to Disney World in 2012.

At the time, a spokesperson said: ‘Kate has filed for divorce and Tom is deeply saddened and is concentrating on his three children.’

It’s reported that Tom has not seen Suri in the 10 years since, with the pair being no contact for the last three years.

A source told Heat magazine: ‘Tom is feeling guilty about missing so much of her life, but insists that he hasn’t completely shut Suri out of his life, and does get updates from time to time.’

Katie has not commented on Tom’s relationship with their daughter and has stressed the importance of allowing Suri to maintain her privacy.

Got a story?

If you’ve got a celebrity story, video or pictures get in touch with the Metro.co.uk entertainment team by emailing us [email protected], calling 020 3615 2145 or by visiting our Submit Stuff page – we’d love to hear from you.

MORE : Fans mourn as legendary gameshow host bows out after ‘incredible’ 43-year run

MORE : The shocking real-life inspiration behind Netflix’s new murderous little rom-com

MORE : Naomi Campbell, 54, confirms her children were born via a surrogate

Get us in your feed

- P&O Cruises ( UK )

Shareholder Benefit

By wowzz , February 23, 2021 in P&O Cruises ( UK )

Recommended Posts

I buy shares through an online broker, as part of an ISA.

I just send a copy of my online ISA statement, with all information redacted, with the exception of the details of the Carnival shares.

Or that's what I used to do. Got rid of my Carnival shares when the price started falling last year. Probably not a great move, but hindsight is a wonderful thing!

Link to comment

Share on other sites.

terrierjohn

1 hour ago, silkworms said: I could do with some help re shares. Know nothing about shares! I bought 100 carnival shares last March when they were very low priced. Bought them through the Share Centre which has now been taken over by Interactive Investments. What do I actually need to prove to P and O or Princess that I have these shares? Everything was done online. I have found something called a Contract Note from March last year. Do I just print it out and email it to them? Or do you recommend transferring them to Equiniti which evidently, according to P and O , they will liaise with them for proof of ownership. We have three cruises this year and three next year so would really appreciate someone’s help with this. Thanks. Terri

Share centre used to advise Carnival on your behalf, but no idea if ii will do the same. But if our July cruise goes ahead I will find out.

30 minutes ago, Esprit said: For the past few years an email from me requesting the Shareholders OBC has sufficed. Can't remember the last time I sent a copy of the share certificate!

You dont need too that is one of the benefits of having a share certificate P&O/Cunard can check shareholding with Equiniti.

I bought my shares many years ago and option was a share certificate which I took. Dont pay anyone anything and I know I once sent a copy of my share certificate to P&O and they said I would never need to send copy in future for any bookings with them or Cunard. Princess is a different system altogether unless it has changed since we last cruised with them. There is a form that they ask for you to fill in and fax to them. Nobody seems to fax anymore in UK but is still widely used in US. They also used to request a recent proof of shareholding with a date on not more than a month before you cruise which obviously means a share certificate is no good as its not dated except for when you purchased shares. In the end I finally turned to my TA for help and they sorted it out. Let's hope Princess have changed for UK customers wanting to apply shareholding benefit to their cruises.

Yes Majortom, that is what confused me, because I thought if the

document is dated last year, how do they know I haven’t sold

the shares!

Nearer the time I will contact PandO share advice office to see

what they will accept and take it from there.

yorkshirephil

4 minutes ago, majortom10 said: I bought my shares many years ago and option was a share certificate which I took. Dont pay anyone anything and I know I once sent a copy of my share certificate to P&O and they said I would never need to send copy in future for any bookings with them or Cunard. Princess is a different system altogether unless it has changed since we last cruised with them. There is a form that they ask for you to fill in and fax to them. Nobody seems to fax anymore in UK but is still widely used in US. They also used to request a recent proof of shareholding with a date on not more than a month before you cruise which obviously means a share certificate is no good as its not dated except for when you purchased shares. In the end I finally turned to my TA for help and they sorted it out. Let's hope Princess have changed for UK customers wanting to apply shareholding benefit to their cruises.

The last twice with Princess 2019 I sent my share account number to [email protected] and they applied the benefit exactly as Carnival brands.

2 minutes ago, silkworms said: Yes Majortom, that is what confused me, because I thought if the document is dated last year, how do they know I haven’t sold the shares! Nearer the time I will contact PandO share advice office to see what they will accept and take it from there. Terri

Last year I sent my contract from hargreaves Lansdown for the shares. They accepted that and credited the room. However the cruise has been moved to next April and the room credit for the shares wasn't. I did have it added before I had paid off the full amount. Since then I have bought and sold the shares 3 times.

40 minutes ago, yorkshirephil said: The last twice with Princess 2019 I sent my share account number to [email protected] and they applied the benefit exactly as Carnival brands.

Same for us with our Princess cruises since about 2016.