JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

- Contact AIG

We've got your back.

Security, Travel and other assistance services provided by your employer's Lifeline Plus policy.

Lifeline Plus, Group Personal Accident & Business Travel + Crisis Insurance

Lifeline plus protects a business’s people after serious work related injuries & against a host of travel emergencies while they’re away on business..

The global cover and services we provide, designed to keep employees informed and as safe as possible, continue to get wider and stronger in order to meet evolving risks.

Introducing Lifeline Plus

Watch this short video for an introduction to the cover, assistance and tools Lifeline Plus provides.

Who is it for?

UK businesses of all sizes in all sectors.

See our Risk Appetite

Product Details

Evolving client protection.

- Travel Assistance app : quick-call help button, geo-fenced check-in tool, claim notification, GPS enabled medical provider finder, medical translation and drug brand equivalency tools, country and city reports, security alerts and online training modules

- MyLifeline assistance website

- HR resource hub

- Virtual assistance card

- Virtual Medical Care with GP Consultation and Expert Case Management

- Crisis consultants to help handle negative media coverage

See below for a summary of the insurance protection and range of services that Lifeline Plus has to offer.

Lifeline Plus GPA & Travel

Serious injury and accident help.

- Death benefits

- Loss of limbs

- Loss of eyes, speech and hearing

- Permanent disability

- Temporary disability

- Cosmetic reconstruction

- Recovery support

- Role retraining

- Lifesaver benefit

Have a Safe Trip

- 24/7 travel assistance

- Concierge service

- Pre-crisis consultancy

- Security and safety advisories, global risk analysis

- 24/7 travel and security alerts

- Flight, hotel and rental vehicle re-bookings

- Cash transfer assistance

- Telephone interpretation assistance

- Message relay to family, friends or business associates

- Embassy or consulate referral

- Security awareness training

- Country reports and city guides

- Translation tools and resources

If You Run Into Trouble

- Medical and emergency travel expenses, rescue and assistance

- Legal liabilities and expenses

- Money, baggage, personal property

- Cancellation, curtailment, disruption, replacement and delay of travel

- Vehicle rental

- Kidnap, extortion and detention

- Political and natural disaster evacuation

- Crisis consultancy

- Inpatient hospital admission and monitoring

- In and outpatient case management

- Outpatient expense guarantee and payment

- Compassionate visit and family travel assistance

- Dispatch of medication and equipment

- Emergency return travel arrangements

- Lost baggage search/stolen luggage replacement assistance

- Lost passport/travel documents assistance

What's Inside Lifeline Plus

Our brochure will help you understand the cover and services included in a Lifeline Plus policy.

Why choose Lifeline Plus from AIG?

Serious injury & accident claims.

Our claims teams handle thousands of injury payments a year – for everything from temporary to life changing conditions. We’ll confirm cover and settlement as quickly as possible. Once confirmed, we will start to make payments within 24 hours by either bank transfer or cheque to help the business’s people back on the road to recovery as soon as we can.

Have a safe trip

Our global assistance company, AIG Travel, provides a wealth of services to help keep travelling employees comfortable, informed and safe wherever they’re going. Whether that’s concierge services, help in locating lost luggage or travel security training in preparation for an upcoming trip - we’re on hand 24/7 to help.

If you run into trouble

Your people are in safe hands even if their trip takes a turn for the worst. Whether that’s support on the ground, medical help or evacuation to get out quickly, we provide the essential expertise and crisis response capabilities (see our Crisis Plus extension upgrade). And our concierge claims service aims to pay baggage and money claims in under 15 minutes over the phone.

"We've got your back" tools

We’re always looking to improve. Our Travel Assistance app now includes a check-in feature to notify selected contacts that they’ve arrived safely plus a claim notification tool. Our Virtual Medical Care service provides employees (and their immediate families) with GP Consultations and Expert Case Management should they need it. We can even help clients protect their reputation in the event of a crisis or bad publicity.

Travel Assistance App

Employees can access many of our travel, security and assistance services directly on their mobile phones, via the AIG Travel Assistance App. To download the app onto an iPhone or Android device, visit the App store or Google play . Employees will need their Lifeline Plus policy number to register.

HR Manager Hub

We’ve introduced a dedicated website designed to support HR Managers at organisations with an AIG Lifeline Plus policy.

HR Managers will find documents that will help them to inform their people about the tools, resources and benefits available to them under Lifeline Plus. Ranging from pre-written staff emails through to app download guides, we’ve assembled helpful templates that will assist in bringing the policy to life for staff.

www.aig.co.uk/LifelinePlusResourceHub

Claims Excellence

Help when it matters most

Related Documents

Get lifeline plus documents, how can we help, risk appetite & claims, support for hr & benefits managers.

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Log in to pay bills, manage policies, view documents, company news, materials & more.

Individuals

A travel assistance website for Lifeline Plus policyholders with resources that help prepare for a trip and offer support while abroad.

Virtual Medical Care

Round-the-clock access to GPs for consultations and an expert case management service for complex medical cases and second opinions. (A complimentary service included with specific AIG policies).

A travel assistance website for Lifeline Plus policyholders with resources that help prepare for a trip and offer support while abroad

Round-the-clock access to GPs for consultations and an expert case management service for complex medical cases and second opinions.(A complimentary service included with specific AIG policies).

AIG Multinational Insurance Fundamentals

Receive free, accredited online training in multinational risk assessment and program design.

Health and Safety eLearning

Our safety, cyber and workplace skills eLearning platform for Employers’ Liability policyholders helps drive down their total cost of risk.

Trade business online with AIG. AIG eXtra is a full-cycle e-trade platform that allows brokers to quote and bind SME business with AIG.

myAIG Portal for Multinational

Track the status of controlled master programs, view policy details, download policy documents, access invoices, and more.

IntelliRisk Advanced

Clients and brokers can file claims, manage risks, and access claims data from 100+ countries.

Risk Managers

Our safety, cyber and workplace skills eLearning platform for Employers’ Liability policyholders helps drive down their total cost of risk.

Log in to access our supporting tools and services, plus portals for brokers and risk managers.

- INDIVIDUALS

- RISK MANAGERS

Group Personal Accident and Travel

Lifeline plus.

If you need emergency assistance, call

Making an insurance claim should be straight forward and stress free – here are some simple steps to follow when making a claim:

Inform the insurance contact for your organisation

Call our claims team on

You can also notify your claim online – either by logging into the Travel Assist website (click orange button) and then selecting the ‘File a Claim’ option; or you can access the easy- to-use claims tool available in our mobile app.

To download the app, go to the Apple App Store or Android Play Store from your smartphone and search ‘AIG Business Travel App’. Please note you will need your employer’s business travel policy number to register for these tools.

Or download, complete and return one of our claims forms (as below)

Travel Assistance Site

Loss of and Damage to Property (PDF)

Personal Accident and Sickness (PDF)

Cancellation / Curtailment (PDF)

Medical Expenses (PDF)

Medical Certificate (PDF)

Fatal Accident (PDF)

If you have a baggage claim please contact our Concierge Service on

This type of claim can usually be settled quickly over the phone

If you are completing a form ensure that you attach the required documentation. We will need the following:

Evidence of your trip - travel tickets or itineraries or similar

Confirmation of the incident - official reports or third party correspondence

Details of the financial impact - receipts, cancellation invoices, replacement quotes or similar

Then send all documentation to us by email, post or fax:

A&H Claims, American International Group UK Limited

The AIG Building

2-8 Altyre Road

We will then send you confirmation that we have received your correspondence and provide you with a case reference number

If you do not hear from us within 10 working days of sending us your documentation then please contact us again.

AIG Travel Insurance: The Complete Guide

Everything you need to know before you buy AIG Travel insurance plans

:max_bytes(150000):strip_icc():format(webp)/joecortez_headshot-56a97f185f9b58b7d0fbf9ac.jpg)

For decades, AIG Travel , part of American International Group, Inc., has provided travel insurance options for many travelers. Marketed under Travel Guard, the company offers travel insurance solutions and travel-related services, including medical and security services, marketed to both leisure and business travelers around the globe.

If you have purchased a trip insurance plan in the past, it may have been provided by AIG Travel without you even knowing it: the company also creates custom policies for several smaller insurance brokers, airlines and even travel groups. Is AIG Travel the right company for your trip?

About AIG Travel

AIG Travel is a member of American International Group, Inc., a global insurance company that provides everything ranging from property casualty insurance, life insurance, retirement products, and other financial services. Travel Guard is the marketing name that AIG Travel uses to advertise its portfolio of products.

Today, the company is headquartered in Stevens Point, Wisc., and serves travelers in 80 countries and jurisdictions through eight wholly-owned global service centers in key regions, including Houston, Texas; Stevens Point, Wisc.; Kuala Lumpur, Malaysia; Mexico City, Mexico; Sofia, Bulgaria; Okinawa, Japan; Shoreham, England; and Guangzhou, China.

How Is AIG Travel Rated?

AIG Travel policies are underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., another subsidiary of AIG. As of June 2018, the policy writer has an A.M. Best A rating, putting them in the “Excellent” credit category with a stable outlook.

For customer service, AIG Travel is highly rated on three major travel insurance marketplaces online. With more than 400 reviews, AIG Travel has a five-star rating from TravelInsurance.com , with a 98 percent recommendation rate. Customers of InsureMyTrip.com give the company 4.56 stars (out of five). Although Squaremouth.com no longer offers AIG Travel policies anymore, previous customers gave the company 4.46 stars (out of five), with less than one percent negative reviews.

What Travel Insurance Does AIG Travel Offer?

AIG Travel offers four plans for consumers, based on their needs and travel plans: Basic, Silver, Gold, and Platinum. Although the Basic plan is not available direct through AIG Travel, it can be purchased through marketplaces like TravelInsurance.com. All travel insurance plans include travel medical assistance, worldwide travel assistance, LiveTravel® Emergency Assistance, and personal security assistance, but only take effect when travelers are at least 100 miles away from home.

Please note: All schedules of benefits are subject to change. For the most up-to-date coverage information, contact AIG Travel.

- Travel Guard Basic: Travel Guard Basic is the lowest level of coverage available through AIG Travel Guard, with the smallest benefits for trip cancellation , trip interruption , and trip delay. The basic plan offers 100 percent coverage of trip cancellation or trip interruption events (up to $100,000), but has very low coverage ceilings for return airfare due to trip interruption ($500 maximum), trip delay (maximum of $100 per day, up to $500), baggage loss ($500 before a $50 deductible) and baggage delay ($100 maximum). The basic plan includes an optional rental car damage policy for an additional price but does not include options for a pre-existing medical condition exclusion waiver or accidental death and dismemberment. Read the schedule of benefits here.

- Travel Guard Silver : Travel Guard Silver is the lowest level of coverage available directly through AIG Travel Guard. Described as “savvy coverage that helps give you peace of mind on a budget,” Travel Guard Silver offers more generous benefits for baggage delay and baggage loss ($750; $50 deductible) and accident sickness medical expenses ($15,000; $50 deductible). This plan also offers optional coverage for pre-existing medical condition exclusion waivers, trip cancellation or interruption due to financial default and additional flight coverage. Typically, travelers who elect to purchase Travel Guard Silver over Travel Guard basic can expect to pay around 2.5% more. Read the schedule of benefits here.

- Travel Guard Gold : The most popular plan offered by AIG Travel Guard, Travel Guard Gold balances insurance costs with benefits. The Gold plan offers more money for trip interruption (150 percent, up to $150,000 maximum), return airfare due to trip interruption (the greater of $750 or 150 percent of the trip cost) and trip delay coverage ($150 per day maximum, up to $750 total). This plan also introduces several additional benefits, including baggage and travel document loss (up to $1,000), baggage delay ($300) and missed connection coverage (up to $250). When purchasing within 15 days of the initial trip payment, travelers may also be covered for pre-existing condition waivers, trip cancellation or interruption due to financial default and primary coverage for accident sickness medical expenses. Optional coverage levels include Cancel for Any Reason insurance (up to 50 percent of insured trip costs), car rental collision coverage and upgrades for medical expense and emergency evacuation coverage. Before any optional coverage, expect to pay 20 percent more for Travel Guard Gold compared to Travel Guard Silver. Read the schedule of benefits here.

- Travel Guard Platinum : Travel Guard Platinum is the highest level of coverage offered by AIG Travel Guard, with the biggest benefit levels. In addition to trip cancellation and trip interruption benefits, travelers can receive up to $1,000 for return air travel due to trip interruption, trip delay benefits of up to $200 per day ($1,000 maximum) and up to $500 in missed connection benefits. Like Travel Guard Gold, travelers who purchase their policy within 15 days of their initial trip payment may also receive the pre-existing medical condition exclusion waiver, trip cancellation or interruption coverage due to financial default, primary accident sickness medical expense coverage and primary baggage and personal effects coverage. Optional policy add-ons include Cancel for Any Reason (up to 50 percent of insured trip costs), car rental collision coverage, and medical coverage upgrades. Because Travel Guard Platinum is the highest level of coverage available, it is also the most expensive: travelers should expect to pay between 50 and 60 percent more than Travel Guard Gold before any additional add-on coverage. Read the schedule of benefits here.

What Won't AIG Travel Cover?

While AIG Travel offers plans to cover many common travel issues, they will not necessarily cover everything. Excluded situations include:

- Self-inflicted injuries: If you are in crisis while traveling, there are ways to get help anywhere around the world. Note that mental health care may not be covered by your travel insurance plan .

- Pregnancy or childbirth: In many situations, pregnancy or childbirth are not covered under AIG Travel plans.

- Dangerous activities: Planning on mountaineering, going motor racing, or participating in a professional-level athletic event? All of these situations are not covered under AIG Travel plans.

- Baggage loss for items seized by governments or customs officials: Before you return home, be sure to understand what may (or may not) be allowed in your home country. If you believe your items were stolen by customs or Transportation Security Administration officials , there is a separate protocol for reporting those losses.

- Baggage loss for eyeglasses, sunglasses, or hearing aids: Loss or replacement of prescription vision wear is not covered by AIG Travel.

This is just an abbreviated list of situations that may not be covered under AIG Travel trip insurance plans. For a full list, refer to the schedule of benefits of each plan, which are linked in the above content.

How Do I File a Claim With AIG Travel?

Travelers who purchased an AIG Travel plan in the United States can start their claims online . After starting an account online, travelers can file claims for the most common situations, including trip cancellation, baggage loss, and trip delay. Policyholders can also find documentation requirements online , as well as receive updates online. Those who have questions about their policies or claims can call AIG Travel direct at +1-866-478-8222.

The online claims tool is only available for American travelers who purchased their travel insurance plans in the United States. All other travelers should contact AIG Travel directly via their provided telephone number to start the claims process.

Who Is AIG Travel Best For?

At the Basic and Silver levels, AIG Travel is a very basic-level travel insurance plan that may cover those who do not already have trip coverage through a credit card or otherwise have access to a trip insurance plan. Before considering either of these AIG Travel plans, be sure to check that you don't already have coverage through the credit card used to pay for your trip.

If you are planning a major international trip, or are going on a big trip aboard a cruise line, AIG Travel Gold and Platinum may offer better coverage than a credit card. With large benefit levels and coverage already built in for pre-existing conditions when purchased within the first 15 days of an initial travel payment, Gold and Platinum can be a better bet for those who are spending money on a big vacation and want to make sure their trip runs smoothly.

Travelex Insurance: The Complete Guide

The 8 Best Luggage Sets of 2024, Tested and Reviewed

Nationwide Travel Insurance: The Complete Guide

Flight Insurance That Protects Against Delays and Cancellations

The Best Credit Cards for Travel Insurance

The 14 Best Backpack Brands of 2024

Does Travel Insurance Cover Earthquakes?

Dealing With Lost, Damaged, or Stolen Luggage While Flying

What Are North American Airlines' Policies on Bereavement Fares?

8 Air Travel Rights You Didn’t Know You Have

Loss of Use Car Rental Insurance

Should You Buy Collision Damage Waiver Insurance for Your Rental Car?

How to Get Your Miles Back After Canceling an Award Flight

How to Get Free Breakfast at Hotels

Best Car Rental Companies of 2024

Etihad Gives All Passengers Free COVID-19 Insurance

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

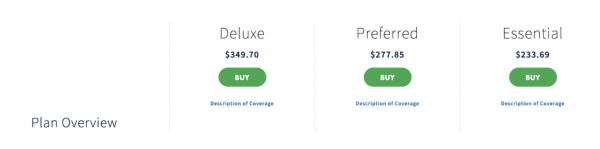

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Log in to pay bills, manage policies, view documents, company news, materials & more.

Individuals

Private client group.

Policyholders in the U.S. can make online payments.

Workers’ Compensation (AIG Go WC)

Access workers’ compensation claims information, including FAQs, payments, prescription data, doctor information, and more.

Report a Claim

Report Aerospace, Commercial Auto, General Liability, Property, and Workers’ Compensation claims.

Dental, Group Life, and AD&D Claims

Employers and employees can access claim forms, claim reports, and information on claim status.

IntelliRisk Advanced

Clients and brokers can file claims, manage risks, and access claims data from 100+ countries.

myAIG Client Portal for Multinational

Track the status of controlled master programs, view policy details, download policy documents, access invoices, and more.

AIG Multinational Insurance Fundamentals

Receive free, accredited online training in multinational risk assessment and program design.

Brokers & Agents

Myaig portal for north america.

Generate loss runs, download policy documents, access applications and tools, and more.

myAIG Portal for Multinational

U.s. producer appointment and licensing.

Submit requests to become an AIG appointed brokerage/agent, expand or terminate your current AIG appointment.

Risk Managers

Log in to pay bills, manage policies, view documents, company news, materials & more.

- INDIVIDUALS

- BROKERS & AGENTS

- RISK MANAGERS

Contact AIG

If you have questions or need more information, our team is here to help.

For bill pay, account support, claims, corporate information, or any general questions, you can call us toll-free at

+1(800) CALL-AIG (800-225-5244)

Or, for more specific needs, please contact us using the options below.

Private Client Select

U.S. Toll Free:

Accident & Health

Businesses (Brokers/Agents, Risk Managers)

North America Business Lines

Available Monday through Friday 9am-5:30pm ET

Broker Services

Lexington Insurance

Warranty Management

Glatfelter Insurance Group

Western World

Business Claims

AIG Private Client Group

Investor Relations

Contact at:

Media Relations

Related Content

Contact Investor Relations

AIG Claims: Delivering Excellence in Insurance Claims

Media Contacts

DO NOT SELL OR SHARE MY PERSONAL INFORMATION

The California Consumer privacy Act gives California residents the right to opt-out of the sale or sharing of their personal information. A "sale" is the exchange of personal information for payment or other valuable consideration and includes certain advertising and anatytics practices. "Sharing" means the disclosure of personal information for behavioral advertising purposes, where the informatirm used to serve ads is collected across different online services.

Opt-out from the sale or sharing of your personal information.

Your request to opt out will be specific to the browser from which you submit your request, and you will need to submit another request from any other browser you use to accessour website. Additionally, if you clear cookies from your browser after submitting an opt-out request, you will clear the cookie that we used to honor your request. For this reason, you will have to submit a new opt-out request.

For information about our privacy practices, please review our Privacy Notice .

Thank you. We have received your request to opt out of the sale/sharing of personal information.

More information about our privacy practices.

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

- Forms Centre

- Self-Service

Beware of phishing scams. For more information, please visit our Safety Tips page.

The GST rate will increase to 9% on 1 January 2024. Visit this page for more information.

Travel Guard ® Direct

√ Up to $80 in eCapitaVouchers (Single Trip Plan)

√ Luggage & travel data (Annual Multi-Trip Plan)

√ Promo code AIGTGD

√ Promo till 19 May 2024

Make a claim

- Renew Annual Travel

- Make Changes to Your Travel Policy

- Request for Proof of Cover Letter

Current Promotion

May Travel Promotion

Use promo code: aigtgd for annual multi-trip and single trip plans. .

Promotion is valid till 19 May 2024 . T&Cs apply.

AIG Travel Assistance Services

Get 24/7 travel assistance exclusively to AIG policyholders. We operate globally across 8 service centres, with a team that is proficient in over 40 languages , providing comprehensive support for travel or medical emergencies abroad.

Top 3 reasons to buy Travel Guard® Direct

QUICK QUOTE

To get a quick quote, select the destination you are travelling to:.

SINGLE TRIP COVERAGE

The maximum length of each insured trip is 182 days.

ANNUAL COVERAGE

The Insured Policyholder(s) will be covered for an unlimited number of trips made during the Policy Period. The maximum length of each insured trip is 90 days

Policy Type

The policy type shows which people are insured under the policy. You can choose from either Individual or Family cover.

If you choose Individual cover this policy insures you only.

If you choose Family cover this policy insures you and/or your spouse and/or your children.

- Under a Per Trip policy, the family must depart from and return to Singapore on the same itinerary together as a family for cover to apply.

- Under an Annual Multi-Trip policy, cover will apply to you or your spouse whilst travelling separately of each other; however your children must be accompanied by you and/or your spouse for the entire trip for cover to apply.

Group/ Couple

Select this option if you have individuals travelling together on the same dates and to the same destination.

For Group/ Couple up to a maximum of 10 individual policies on the same transaction.

Region 2 Destinations

Brunei Darussalam, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Vietnam

Argentina, Bahrain, Bangladesh, Belize, Bolivia, Brazil, Chile, China (excluding Tibet), Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, Guyana, Honduras, Hong Kong SAR - China, India, Kuwait, Macau SAR - China, Maldives, Mexico, Mongolia, Nicaragua, Oman, Pakistan, Panama, Paraguay, Peru, Qatar, Sri Lanka, Suriname, Taiwan - China, Thailand, United Arab Emirates, Uruguay, Venezuela

Region 3 Destinations

Region 1, Region 2, Australia, Japan, South Korea, New Zealand, Nepal, Tibet - China and the rest of the world.

(Exclude Cuba, Iran, Syria, North Korea or the Crimea region)

Modal Message

Please select coverage type

travelCoverageType

We do not provide Annual Multi Trip for Group

travelPolicyType

Please select policy type

Please select destination(s)

Please select region of travel

Please provide start date

Please provide end date

Please select if you are going on a cruise

Please select if only 1 adult is travelling

Please provide age

less than or equal to

Please provide valid age

greater than or equal to

Please enter age of at least 2 travellers

Please select no of travellers

Key Benefits

Before you buy, travel alerts, testimonials.

COVID-19 Benefits & FAQ

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites ( www.AIG.sg or www.gia.org.sg or www.sdic.org.sg ).

Case Study Illustration

Learn more about AIG's Travel Guard Direct

- Policy Wording (issued on/after 24 September 2022)

- Policy Wording (issued on/before 23 September 2022)

Enquiries: 6419 3000 24-hour overseas emergency assistance hotline : 6733 2552 Travel claims : 6224 3698

Enquire online

Send an enquiry

Policy Changes

Make changes to your policy

You might like

AIG On the Go driving app

Score your driving performance and get up to 15% off your AIG vehicle insurance premium.

IMAGES

VIDEO

COMMENTS

Contact AIG UK. The AIG Building 58 Fenchurch Street London EC3M 4AB +44(0)20 7954 7000. ... AIG Multinational Insurance Fundamentals. Receive free, accredited online training in multinational risk assessment and program design. ... American International Group UK Limited The AIG Building 2 - 8 Altyre Road Croydon, CR9 2LG. AIGDirect.Queries ...

If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc . (Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP. This is only a brief description of ...

Club M Travel Insurance. Brought to you by AIG (American International Group UK Ltd) Making a claim. To make a claim online, visit the AIG portal. Go to the AIG portal. Alternatively, to make a travel insurance claim call AIG on: 01273 740 982. The claims department is open Monday to Friday between 9am and 5pm. Medical Emergency Helpline.

Wherever you're going on holiday you'll need to remember to pack your travel insurance. Unity Travel is underwritten by AIG and administered by Just Insurance Agents Limited. Contact Us. 0800 015 1215. Monday - Friday Thursday 9-6, Friday 9-530, Saturday 9-1, Sunday closed. ...

Inform the insurance contact for your organisation. Call our claims team on +44 (0) 345 603 9892. You can also notify your claim online - either by logging into the Travel Assist website (click orange button) and then selecting the 'File a Claim' option; or you can access the easy- to-use claims tool available in our mobile app.

Unity Travel | Travel Insurance by AIG. Contact Us. 0800 015 1215. Monday - Friday Thursday 9-6, Friday 9-530, Saturday 9-1, Sunday closed. ... My Account. Contact Us. Travel Insurance Sales and Enquiries. ... the travel insurance providers we work with include full details of what you should do in the event of a claim and full contact details ...

Travel Assistance App. Employees can access many of our travel, security and assistance services directly on their mobile phones, via the AIG Travel Assistance App. To download the app onto an iPhone or Android device, visit the App store or Google play. Employees will need their Lifeline Plus policy number to register.

Inform the insurance contact for your organisation. Call our claims team on +44 (0) 345 603 9892. You can also notify your claim online - either by logging into the Travel Assist website (click orange button) and then selecting the 'File a Claim' option; or you can access the easy- to-use claims tool available in our mobile app.

Required documentation. Check Status of Existing Claims. Note: This tool currently supports policies purchased in USA only. All others please call us directly at 1.866.478.8222. Questions? Call us at: 800-826-5248. Manage your Travel Guard insurance claim online here and we'll do our best to make it right.

We're here to help: Monday to Thursday from 8:30am - 6:00pm, or Friday 8:30am - 5:30pm, except UK bank holidays. When contacting us, please include/have ready the following details, so we can verify your identity and help more quickly:

Typically, travelers who elect to purchase Travel Guard Silver over Travel Guard basic can expect to pay around 2.5% more. Read the schedule of benefits here. Travel Guard Gold: The most popular plan offered by AIG Travel Guard, Travel Guard Gold balances insurance costs with benefits. The Gold plan offers more money for trip interruption (150 ...

Cons. The Travel Guard Deluxe plan has generous coverage but a high average cost compared to other top-rated policies. Medical expense coverage of $100,000 is on the low side, but might be ...

When it comes to buying travel insurance, AIG is only available to residents of the U.S. Contact information. You can call AIG's travel insurance phone number any time to get more information about your policy or request help. Both of these numbers have 24/7 availability: U.S. toll-free, 1-855-203-5962; U.S. and international collect, 1-715 ...

Insure and Go - Black. 77% policy score - joint 10th out of 161 policies rated. We like: If you're covering a very expensive trip, the Black policy has one of the highest cover limits for costs if you have to cancel - £10,000. You also don't pay excesses.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan. Like the Preferred, you'll get 100% coverage for trip cancellation and 150% of the cost of your insured trip ...

Travel Guard. 3300 Business Park Drive. Stevens Point, WI 54482. *= Required. To help us expedite this process select one of the categories below: *. Call us at: 800-826-5248. Contact us for more information about purchasing a travel insurance plan, or for additional information on your existing plan. We can also help if you are currently on a ...

For bill pay, account support, claims, corporate information, or any general questions, you can call us toll-free at. +1 (800) CALL-AIG (800-225-5244) Or, for more specific needs, please contact us using the options below.

Get 24/7 travel assistance exclusively to AIG policyholders. We operate globally across 8 service centres, with a team that is proficient in over 40 languages, ... please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites (www.AIG.sg or ...