- Maryo Bittar

- Barnett Q. Brooks

- Timothy M. Hartman

- Joyce Smithey

- Lisa L. Walker

- Reuben W. Wolfson

- Krista Johnson Smiley

- Wage Issues

- Discrimination

- Sexual Harassment and Abuse

- Employee Contract and Severance Negotiations

- Equal Pay Act

- Mediation and Alternative Dispute Resolution

- In the Media

- Presentations and Publications

- Federal Government Agencies

- Maryland State Government Agencies

- Non-Profit Agencies

- Other Employment Related Organizations

Have you been retaliated against, wrongfully let go, or forced to work in unsafe conditions due to COVID-19? Find out if you qualify for a claim!

What to Do If Your Employer Won’t Reimburse Business Expenses

At Smithey Law Group LLC , our attorneys are frontrunners in the employment law community and have represented employees in thousands of disputes. We have the experience and knowledge to help you recoup your business expenses and damages from your employer.

When can I expect reimbursement from my employer for expenses?

Typically, your employer must reimburse you for necessary and reasonable expenses within three years of the expense being incurred.

Is a Business Expense Reimbursement Part of My Wages?

Plain and simple, your employer must pay you wages for your work. And how does the law define wages? Under Maryland law, wages include the following :

- Your standard rate of pay (which must comply with the minimum wage laws),

- Commissions,

- Fringe benefits,

- Overtime pay, and

- Any other promised compensation.

While business expenses are not listed above, federal law states that your employer must remit payment to you “free and clear” or unconditionally. Your employer’s payment to you is not free and clear if your work requires you to purchase materials or pay other costs for the benefit of your employer, and those costs bring your pay below minimum wage or infringe on your overtime entitlements. Those costs must be reimbursed.

Expenses that are for the benefit of an employer and subject to reimbursement can include the costs of :

- Purchasing materials requested explicitly by an employer;

- Depreciation in value of a personal vehicle that an employee is obligated to use during working hours;

- Mileage for trips an employer requires an employee to make during working hours;

- Purchasing tools requested explicitly by an employer;

- Buying gas used for trips an employer requires an employee to make during working hours; and

- Other travel expenses.

Please keep in mind that an employer’s obligation to compensate an employee for travel expenses does not include an employee’s travels to work before a shift starts or travels back home after a shift ends. Also, an employer doesn’t necessarily have to reimburse an employee for the exact amount of costs they incur. An employer has to pay for only a “reasonable approximation of expenses” its employee collects on its behalf.

In addition to its obligations under federal and state wage laws, your employer also has obligations to you under any employment agreement you have. If a business, agency, or organization promises to pay you a certain wage for your work and also requires you to make purchases that reduce your wages, a failure to reimburse you might be a breach of contract. Your employer’s refusal to cover your business expenses could subject it to a breach of contract lawsuit , regardless of whether the expenses reduce your pay to less than minimum wage or overtime entitlements.

Taking Legal Action Against an Employer that Won’t Reimburse Business Expenses

Unfortunately, some employers put their employees in a position where they have to fight for the compensation they earned. If an employer requires you to use your money or personal belongings to benefit the employer’s business without recompense, you are not receiving your full wages. Employees who do not receive their full wages can file wage complaints with the government or lawsuits in court.

The Employment Standards Service (ESS) of the Maryland Department of Labor and the Wage and Hour Division (WHD) of the U.S. Department of Labor handle wage complaints against employers that fail to reimburse their employees . The ESS and WHD investigate complaints, review evidence, and conduct interviews and conferences in an effort to resolve complaints. And if the WHD or ESS is unable to adjudicate a wage complaint, an employee still has the option of suing their employer in court.

If their complaint or lawsuit is successful, an employee can win remedies such as :

- Liquidated damages,

- Treble damages, and

- Attorney fees.

An employer that willfully fails to reimburse an employee could also be subject to civil and criminal penalties.

There are many steps to initiating and maintaining a legal complaint against your employer for improper payment of wages. As soon as a wage issue arises at your workplace, you should speak to an experienced wage and hour attorney to help ensure that you take the right course of action to get the compensation your employer owes you.

Deadline for Filing a Complaint or Lawsuit

Not only do you need to file your wage complaint or lawsuit in the right place, but you also need to file your legal action on time. You must file your complaint with the WHD within two years if your employer’s failure to reimburse you is not willful. And you must file with the WHD within three years if your employer’s actions are willful. Under Maryland law , you have two years to file a complaint with the ESS and three years to file a lawsuit in court.

Let Smithey Law Group Help You

You worked hard on your own to earn money at work; why should you have to fight alone to recover that money from your employer? The answer is simple: You don’t have to fight alone to recover your wages, nor should you. At Smithey Law Group , we focus exclusively on representing individuals in employment disputes. We are experienced and knowledgeable regarding how to resolve the employment law challenges Maryland residents face. We are also award-winning leaders in the employment law community.

If you are searching for an advocate who gets results and can successfully litigate, negotiate, and educate on matters regarding employment, speak to us. We are sought-after professionals who can maximize your recovery and protect your rights. You can call us at 410-881-8190 or contact us online whenever you need help.

High Contrast

- Asia Pacific

- Latin America

- North America

- Afghanistan

- Bosnia and Herzegovina

- Cayman Islands

- Channel Islands

- Czech Republic

- Dominican Republic

- El Salvador

- Equatorial Guinea

- Hong Kong SAR, China

- Ireland (Republic of)

- Ivory Coast

- Macedonia (Republic of North)

- Netherlands

- New Zealand

- Philippines

- Puerto Rico

- Sao Tome & Principe

- Saudi Arabia

- South Africa

- Switzerland

- United Kingdom

- News releases

- RSM in the news

- AI, analytics and cloud services

- Audit and assurance

- Business operations and strategy

- Business tax

- Consulting services

- Family office services

- Financial management

- Global business services

- Managed services

- Mergers and acquisitions

- Private client

- Professional Services+

- Risk, fraud and cybersecurity

- See all services and capabilities

Strategic technology alliances

- Sage Intacct

- CorporateSight

- FamilySight

- PartnerSight

Featured topics

- 2024 economy and business opportunity

- Generative AI

- Middle market economics

- Environmental, social and governance

- Supply chain

Real Economy publications

- The Real Economy

- The Real Economy Industry Outlooks

- RSM US Middle Market Business Index

- The Real Economy Blog

- Construction

- Consumer goods

- Financial services

- Food and beverage

- Health care

- Life sciences

- Manufacturing

- Nonprofit and education

- Private equity

- Professional services

- Real estate

- Technology companies

- See all industry insights

- Business strategy and operations

- Family office

- Private client services

- Financial reporting resources

- Tax regulatory resources

Platform user insights and resources

- RSM Technology Blog

- Diversity and inclusion

- Middle market focus

- Our global approach

- Our strategy

- RSM alumni connection

- RSM Impact report

- RSM Classic experience

Experience RSM

- Your career at RSM

- Student opportunities

- Experienced professionals

- Executive careers

- Life at RSM

- Rewards and benefits

Spotlight on culture

Work with us.

- Careers in assurance

- Careers in consulting

- Careers in operations

- Careers in tax

- Our team in India

- Our team in El Salvador

- Apply for open roles

Popular Searches

Asset Management

Health Care

Partnersite

Your Recently Viewed Pages

Lorem ipsum

Dolor sit amet

Consectetur adipising

Tax issues arise when employers pay employee business travel expenses

Employers must determine proper tax treatment for employees.

Most employers pay or reimburse their employees’ expenses when traveling for business. Generally, expenses for transportation, meals, lodging and incidental expenses can be paid or reimbursed by the employer tax-free if the employee is on a short-term trip. However, the tax rules become more complex when the travel is of a longer duration. Sometimes the travel expenses paid or reimbursed by the employer must be treated as taxable compensation to the employee subject to Form W-2 reporting and payroll taxes.

The purpose of this article is to address some of the more common travel arrangements which can result in taxable income to employees for federal tax purposes. Although business travel can also raise state tax issues, those issues are beyond the scope of this article. This article is intended to be only a general overview as the tax consequences to an employee for a given travel arrangement depend on the facts and circumstances of that arrangement.

In the discussion below, it is assumed that all travel expenses are ordinary and necessary and incurred by an employee (or a partner in a partnership) while traveling away from home overnight for the employer’s business. In addition, it is assumed that the expenses are properly substantiated so that the employer knows (1) who incurred the expense; (2) where, when, why and for whom the expense was incurred, and (3) the dollar amount. Employers need to collect this information within a reasonable period of time after an expense is incurred, typically within 60 days.

Certain meal and lodging expenses can fall within a simplified substantiation process called the “per diem” rules (although even these expenses must still meet some of the substantiation requirements). The per diem rules are outside the scope of this article.

One of the key building blocks for the treatment of employee travel expenses is the location of the employee’s “tax home.” Under IRS and court holdings, an employee’s tax home is the employee’s regular place of work, not the employee’s personal residence or family home. Usually the tax home includes the entire city or area in which the regular workplace is located. Generally, only expenses paid or reimbursed by an employer for an employee’s travel away from an employee’s tax home are eligible for favorable tax treatment as business travel expenses.

Travel to a regular workplace

Usually expenses incurred for travel between the employee’s residence and the employee’s regular workplace (tax home) are personal commuting expenses, not business travel. If these expenses are paid or reimbursed by the employer, they are taxable compensation to the employee. This is the case even when an employee is traveling a long distance between the employee’s residence and workplace, such as when an employee takes a new job in a different city. According to the IRS, if it is the employee’s choice to live away from his or her regular workplace (tax home), then the travel expenses between the two locations which are paid or reimbursed by the employer are taxable income to the employee.

Example: Bob’s personal residence is in Chicago, but his regular workplace is in Atlanta. Bob’s employer reimburses him for an apartment in Atlanta plus his transportation expenses between the two cities. Since Atlanta is Bob’s tax home, these travel expenses are personal commuting expenses and the employer’s reimbursement of the expenses is taxable compensation to Bob.

Travel to two regular workplaces

Sometimes an employer requires an employee to consistently work in two business locations because of the needs of the employer’s business. Factors such as where the employee spends the most time, has the most business activity, and earns the highest income determine which is the primary location with the other being the secondary location. The employee’s residence may be in either the primary or the secondary location. In general, the IRS holds that transportation costs between the two locations can be paid or reimbursed by the employer tax-free. In addition, lodging and meals at the location which is away from the employee’s residence can generally be paid or reimbursed tax-free.

Example: Caroline lives in Location A and works at her company headquarters there. Her employer opens a new store in Location B and asks her to handle the day-to-day operations for two years while the store is getting up to speed. But Caroline is also needed at the headquarters so her employer asks her to spend two days a week at the headquarters in Location A and three days a week at the store in Location B. Because the work at each location is driven by a business need of Caroline’s employer, she is treated as having primary and secondary work locations and is not treated as commuting between the two locations. Caroline’s travel between the two locations and her meals and lodging at Location B can be reimbursed tax-free by her employer.

As a practical matter, the employer must carefully consider and be able to support the business need for the employee to routinely go back and forth between two business locations. In cases involving two business locations, the courts have looked at time spent, business conducted and income generated in each location. Merely having an employee “sign in” or “touch down” at a business location near his or her residence is unlikely to satisfy the requirements for having two regular workplaces. Instead, the IRS would likely consider the employee as having only one regular workplace with employer-paid travel between the employee’s residence and the regular workplace being taxable commuting expenses.

Travel when a residence is a regular workplace

In some cases an employer hires an employee to work generally, or only, from the employee’s home, as he or she is not physically needed at an employer location. If the employer requires the employee to work just from his or her residence on a regular basis, does not require or expect the employee to travel to another office on a regular basis, and does not provide office space for the employee elsewhere, then the residence can be the tax home since it is the regular workplace for the employee. When the employee does need to travel away from his or her residence (tax home), the temporary travel expenses can be paid or reimbursed by the employer on a tax-free basis.

Example: Jason is a computer programmer and works out of his home in Indianapolis for an employer in Seattle. He periodically travels to Seattle for meetings with his team. Since Jason has no assigned office space in Seattle and is expected by his employer to work from his home, Jason’s travel expenses to Seattle can be reimbursed by his employer on a tax-free basis.

Travel to a temporary workplace

Sometimes an employer temporarily assigns an employee to work in a location that is far from the employee’s regular workplace, with the expectation that the employee will return to his or her regular workplace at the end of the assignment. In this event, the key question is whether the employee’s tax home moves to the temporary workplace. If the tax home moves to the temporary workplace, the travel expenses between the employee’s residence and the temporary workplace that are paid or reimbursed by the employer are taxable compensation to the employee because they are personal commuting expenses rather than business travel expenses. Whether or not the employee’s tax home moves to the temporary workplace depends on the duration of the assignment and the expecations of the parties.

- One year or less . If the assignment is expected to last (and actually does last) one year or less, the employee’s tax home generally does not move to the temporary workplace. Therefore, travel expenses between the employee’s residence and temporary workplace that are paid or reimbursed by the employer are typically tax-free to the employee as business travel.

Example: Janet lives and works in Denver but is assigned by her employer to work in San Francisco for 10 months. She returns to Denver after the 10-month assignment. Janet’s travel expenses associated with her assignment in San Francisco that are reimbursed by her employer are not taxable income to her as they are considered temporary business travel and not personal commuting expenses.

- More than one year or indefinite . If the assignment is expected to last more than one year or is for an indefinite period of time, the employee’s tax home generally moves to the temporary workplace. This is the case even if the assignment ends early and actually lasts one year or less. Consequently, travel expenses between the employee’s residence and the temporary workplace that are paid or reimbursed by the employer are taxable compensation to the employee as personal commuting expenses.

Example: Chris lives and works in Dallas but is assigned by his employer to work in Oklahoma City for 15 months before returning to Dallas. Chris’s travel expenses associated with his assignment to Oklahoma City that are reimbursed by his employer are taxable income to him as personal commuting expenses.

- One year or less then extended to more than one year . Sometimes an assignment is intended to be for one year or less, but then is extended to more than one year. According to the IRS, the tax home moves from the regular workplace to the temporary workplace at the time of the extension. Therefore, travel expenses incurred between the employee’s residence and the temporary workplace that are paid or reimbursed by the employer are non-taxable business travel expenses until the time of the extension, but are taxable compensation as personal commuting expenses after the extension.

Example: Beth’s employer assigns her to a temporary workplace in January with a realistic expectation that she will return to her regular workplace in September. However, in August, it is clear that the project will take more time so Beth’s assignment is extended to the following March. Once Beth’s employer knows, or has a realistic expectation, that Beth’s work at the temporary location will be for more than one year, changes are needed to the tax treatment of Beth’s travel expenses. Only the travel expenses incurred prior to the extension in August can be reimbursed tax-free; travel expenses incurred and reimbursed after the extension are taxable compensation.

When an employee’s residence and regular workplace are in the same geographic location and the employee is away on a temporary assignment, the employee will often return to the residence for weekends, holidays, etc. Expenses associated with travel while enroute to and from the residence can be paid or reimbursed by an employer tax-free, but only up to the amount that the employee would have incurred if the employee had remained at the temporary workplace instead of traveling home.

Travel to a temporary workplace – Special situations

In order for an employer to treat its payment or reimbursement of travel expenses as tax-free rather than as taxable compensation, the employee’s ties to the regular workplace must be maintained. The employee must expect to return to the regular workplace after the assignment, and actually work in the regular workplace long enough or regularly enough that it remains the employee’s tax home. Special situations arise when an employee’s assignment includes recurring travel to a temporary workplace, continuous temporary workplaces, and breaks in assignments to temporary workplaces.

- Recurring travel to a temporary workplace . Although the IRS has not published formal guidance which can be relied on, it has addressed situations where an employee has a regular workplace and a temporary workplace to which the employee expects to travel over more than one year, but only on a sporadic and infrequent basis. Under the IRS guidance, if an employee’s travel to a temporary workplace is (1) sporadic and infrequent, and (2) does not exceed 35 business days for the year, the travel is temporary even though it occurs in more than one year. Consequently, the expenses can be paid or reimbursed by an employer on a tax-free basis as temporary business travel.

Example: Stephanie works in Location A but will travel on an as-needed basis to Location B over the next three years. If Stephanie’s travel to Location B is infrequent and sporadic and does not exceed 35 business days a year, her travel to Location B each year can be reimbursed by her employer on a tax-free basis as temporary business travel.

- Continuous temporary workplaces . Sometimes an employee does not have a regular workplace but instead has a series of temporary workplaces. If the employee’s residence cannot qualify as his or her tax home under a three-factor test developed by the IRS, the employee is considered to have no tax home and is “itinerant” for travel reimbursement purposes. In this case, travel expenses paid by the employer generally would be taxable income to the employee.

Example: Patrick originally worked in Location A, but his employer sends him to Location B for eleven months, then assigns Patrick to Location C for another eight months. Patrick will be sent to Location D after Location C with no expectation of returning to Location A. Patrick does not maintain a residence in Location A. Travel expenses paid to Patrick by his employer will likely be taxable income to him.

- Breaks between temporary workplaces . In an internal memorandum, the IRS addresses the outcome when an employee has a break in assignments to temporary workplaces. When applying the one-year rule, the IRS notes that a break of three weeks or less is not enough to prevent aggregation of the assignments, but a break of at least seven months would be. Some companies choose to not aggregate assignments when the breaks are shorter than seven months but are considerably longer than three weeks, given the lack of substantive guidance from the IRS on this issue.

Example: Don’s regular workplace is in Location A. Don’s employer sends him to Location B for ten months, back to Location A for eight months, and then to Location B again for four months. Although Don’s time in Location B totals 14 months, since the assignments there are separated by a break of at least seven months, they are not aggregated for purposes of applying the one-year rule. Consequently, the travel expenses associated with each separate assignment to Location B can be reimbursed by the employer on a tax-free basis as temporary business travel since each assignment lasted less than a year.

Conclusion

The tax rules regarding business travel are complex and the tax treatment can vary based on the facts of a situation. Employers must carefully analyze business travel arrangements to determine whether travel expenses that they pay or reimburse are taxable or nontaxable to employees.

RSM contributors

Subscribe to RSM tax newsletters

Tax news and insights that are important to you—delivered weekly to your inbox

THE POWER OF BEING UNDERSTOOD

ASSURANCE | TAX | CONSULTING

- Technologies

- RSM US client portals

- Cybersecurity

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.

© 2024 RSM US LLP. All rights reserved.

- Terms of Use

- Do Not Sell or Share My Personal Information (California)

Everything You Need to Know About the Business Travel Tax Deduction

.jpeg)

Justin is an IRS Enrolled Agent, allowing him to represent taxpayers before the IRS. He loves helping freelancers and small business owners save on taxes. He is also an attorney and works part-time with the Keeper Tax team.

You don’t have to fly first class and stay at a fancy hotel to claim travel expense tax deductions. Conferences, worksite visits, and even a change of scenery can (sometimes) qualify as business travel.

What counts as business travel?

The IRS does have a few simple guidelines for determining what counts as business travel. Your trip has to be:

- Mostly business

- An “ordinary and necessary” expense

- Someplace far away from your “tax home”

What counts as "mostly business"?

The IRS will measure your time away in days. If you spend more days doing business activities than not, your trip is considered "mostly business". Your travel days are counted as work days.

Special rules for traveling abroad

If you are traveling abroad for business purposes, you trip counts as " entirely for business " as long as you spend less than 25% of your time on personal activities (like vacationing). Your travel days count as work days.

So say you you head off to Zurich for nine days. You've got a seven-day run of conference talks, client meetings, and the travel it takes to get you there. You then tack on two days skiing on the nearby slopes.

Good news: Your trip still counts as "entirely for business." That's because two out of nine days is less than 25%.

What is an “ordinary and necessary” expense?

“Ordinary and necessary” means that the trip:

- Makes sense given your industry, and

- Was taken for the purpose of carrying out business activities

If you have a choice between two conferences — one in your hometown, and one in London — the British one wouldn’t be an ordinary and necessary expense.

What is your tax home?

A taxpayer can deduct travel expenses anytime you are traveling away from home but depending on where you work the IRS definition of “home” can get complicated.

Your tax home is often — but not always — where you live with your family (what the IRS calls your "family home"). When it comes to defining it, there are two factors to consider:

- What's your main place of business, and

- How large is your tax home

What's your main place of business?

If your main place of business is somewhere other than your family home, your tax home will be the former — where you work, not where your family lives.

For example, say you:

- Live with your family in Chicago, but

- Work in Milwaukee during the week (where you stay in hotels and eat in restaurants)

Then your tax home is Milwaukee. That's your main place of business, even if you travel back to your family home every weekend.

How large is your tax home?

In most cases, your tax home is the entire city or general area where your main place of business is located.

The “entire city” is easy to define but “general area” gets a bit tricker. For example, if you live in a rural area, then your general area may span several counties during a regular work week.

Rules for business travel

Want to check if your trip is tax-deductible? Make sure it follows these rules set by the IRS.

1. Your trip should take you away from your home base

A good rule of thumb is 100 miles. That’s about a two hour drive, or any kind of plane ride. To be able to claim all the possible travel deductions, your trip should require you to sleep somewhere that isn’t your home.

2. You should be working regular hours

In general, that means eight hours a day of work-related activity.

It’s fine to take personal time in the evenings, and you can still take weekends off. But you can’t take a half-hour call from Disneyland and call it a business trip.

Here's an example. Let’s say you’re a real estate agent living in Chicago. You travel to an industry conference in Las Vegas. You go to the conference during the day, go out in the evenings, and then stay the weekend. That’s a business trip!

3. The trip should last less than a year

Once you’ve been somewhere for over a year, you’re essentially living there. However, traveling for six months at a time is fine!

For example, say you’re a freelancer on Upwork, living in Seattle. You go down to stay with your sister in San Diego for the winter to expand your client network, and you work regular hours while you’re there. That counts as business travel.

What about digital nomads?

With the rise of remote-first workplaces, many freelancers choose to take their work with them as they travel the globe. There are a couple of requirements these expats have to meet if they want to write off travel costs.

Requirement #1: A tax home

Digital nomads have to be able to claim a particular foreign city as a tax home if they want to write off any travel expenses. You don't have to be there all the time — but it should be your professional home base when you're abroad.

For example, say you've rent a room or a studio apartment in Prague for the year. You regularly call clients and finish projects from there. You still travel a lot, for both work and play. But Prague is your tax home, so you can write off travel expenses.

Requirement #2: Some work-related reason for traveling

As long as you've got a tax home and some work-related reason for traveling, these excursion count as business trips. Plausible reasons include meeting with local clients, or attending a local conference and then extending your stay.

However, if you’re a freelance software developer working from Thailand because you like the weather, that unfortunately doesn't count as business travel.

The travel expenses you can write off

As a rule of thumb, all travel-related expenses on a business trip are tax-deductible. You can also claim meals while traveling, but be careful with entertainment expenses (like going out for drinks!).

Here are some common travel-related write-offs you can take.

🛫 All transportation

Any transportation costs are a travel tax deduction. This includes traveling by airplane, train, bus, or car. Baggage fees are deductible, and so are Uber rides to and from the airport.

Just remember: if a client is comping your airfare, or if you booked your ticket with frequent flier miles, then it isn't deductible since your cost was $0.

If you rent a car to go on a business trip, that rental is tax-deductible. If you drive your own vehicle, you can either take actual costs or use the standard mileage deduction. There's more info on that in our guide to deducting car expenses .

Hotels, motels, Airbnb stays, sublets on Craigslist, even reimbursing a friend for crashing on their couch: all of these are tax-deductible lodging expenses.

🥡 Meals while traveling

If your trip has you staying overnight — or even crashing somewhere for a few hours before you can head back — you can write off food expenses. Grabbing a burger alone or a coffee at your airport terminal counts! Even groceries and takeout are tax-deductible.

One important thing to keep in mind: You can usually deduct 50% of your meal costs. For 2021 and 2022, meals you get at restaurants are 100% tax-deductible. Go to the grocery store, though, and you’re limited to the usual 50%.

{upsell_block}

🌐 Wi-Fi and communications

Wi-Fi — on a plane or at your hotel — is completely deductible when you’re traveling for work. This also goes for other communication expenses, like hotspots and international calls.

If you need to ship things as part of your trip — think conference booth materials or extra clothes — those expenses are also tax-deductible.

👔 Dry cleaning

Need to look your best on the trip? You can write off related expenses, like laundry charges.

{write_off_block}

Travel expenses you can't deduct

Some travel costs may seem like no-brainers, but they're not actually tax-deductible. Here are a couple of common ones to watch our for.

The cost of bringing your child or spouse

If you bring your child or spouse on a business trip, your travel expense deductions get a little trickier. In general, the cost of bring other people on a business trip is considered personal expense — which means it's not deductible.

You can only deduct travel expenses if your child or spouse:

- Is an employee,

- Has a bona fide business purpose for traveling with you, and

- Would otherwise be allowed to deduct the travel expense on their own

Some hotel bill charges

Staying in a hotel may be required for travel purposes. That's why the room charge and taxes are deductible.

Some additional charges, though, won't qualify. Here are some examples of fees that aren't tax-deductible:

- Gym or fitness center fees

- Movie rental fees

- Game rental fees

{email_capture}

Where to claim travel expenses when filing your taxes

If you are self-employed, you will claim all your income tax deduction on the Schedule C. This is part of the Form 1040 that self-employed people complete ever year.

What happens if your business deductions are disallowed?

If the IRS challenges your business deduction and they are disallowed, there are potential penalties. This can happen if:

- The deduction was not legitimate and shouldn't have been claimed in the first place, or

- The deduction was legitimate, but you don't have the documentation to support it

When does the penalty come into play?

The 20% penalty is not automatic. It only applies if it allowed you to pay substantially less taxes than you normally would. In most cases, the IRS considers “substantially less” to mean you paid at least 10% less.

In practice, you would only reach this 10% threshold if the IRS disqualified a significant number of your travel deductions.

How much is the penalty?

The penalty is normally 20% of the difference between what you should have paid and what you actually paid. You also have to make up the original difference.

In total, this means you will be paying 120% of your original tax obligation: your original obligation, plus 20% penalty.

.jpeg)

Justin W. Jones, EA, JD

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email [email protected] with your questions.

Voted best tax app for freelancers

More Articles to Read

Free Tax Tools

1099 Tax Calculator

- Quarterly Tax Calculator

How Much Should I Set Aside for 1099 Taxes?

Keeper users have found write-offs worth

- Affiliate program

- Partnership program

- Tax bill calculator

- Tax rate calculator

- Tax deduction finder

- Quarterly tax calculator

- Ask an accountant

- Terms of Service

- Privacy Policy

- Affiliate Program

- Partnership Program

- Tax Bill Calculator

- Tax Rate Calculator

- Tax Deduction Finder

- Ask an Accountant

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

- EXPENSES & DEDUCTIONS

Proving employee business expense deductions

- Individual Income Taxation

Editor: Mark G. Cook, CPA, CGMA

Prior to the passage of the law known as the Tax Cuts and Jobs Act (TCJA), P.L. 115 - 97 , taxpayers were allowed to deduct unreimbursed employee business expenses as miscellaneous itemized deductions, subject to Sec. 67's 2% floor on miscellaneous itemized deductions and Sec. 68's overall limitation on itemized deductions, on Schedule A, Itemized Deductions , of Form 1040, U.S. Individual Income Tax Return . The deduction was disallowed for the years 2018 to 2025 by the enactment in the TCJA of Sec. 67(g), which suspends the allowance of miscellaneous itemized deductions. Nonetheless, because unreimbursed employee business expenses will be deductible again in 2026, and court cases involving disputes between the IRS and taxpayers over their deduction on tax returns for years before 2018 continue to make their way through the courts, knowledge of the details of the unreimbursed employee business expense deduction remains important.

Employee business expense deduction

To get started, what is a deductible unreimbursed employee business expense? Per Sec. 162(a), there shall be allowed as a deduction all the ordinary and necessary expenses paid or incurred during the tax year in carrying on any trade or business. Performing services as an employee constitutes a trade or business (see, e.g., Primuth , 54 T.C. 374 (1970)). Thus, with respect to employee business expenses, a deduction under Sec. 162(a) will be allowed for an unreimbursed expense that is:

- Paid or incurred during an employee's tax year;

- For carrying on his or her trade or business of being an employee; and

- Ordinary and necessary.

An expense is ordinary if it is common and accepted in the taxpayer's trade, business, or profession. An expense is necessary if it is appropriate and helpful to the taxpayer's business; it does not have to be required to be considered necessary.

Employer reimbursements

To prevent a taxpayer from obtaining a double benefit, only unreimbursed business expenses are deductible. Also, business expenses are not "necessary" if reimbursement is possible ( Podems , 24 T.C. 21 (1955)). Thus, if an employee incurs an expense that he or she has a right to reimbursement for under an expense reimbursement plan of his or her employer, but the employee fails to obtain reimbursement for the expense, the employee cannot take a Sec. 162(a) deduction for the expense.

This is true regardless of why an employee does not seek reimbursement for a business expense incurred on behalf of his or her employer. The Ninth Circuit held in Orvis , 788 F.2d 1406 (9th Cir. 1986), that a taxpayer's lack of knowledge that his employer had a policy of reimbursing such expenses was not relevant to whether he could take a deduction for the expenses on his personal return.

The burden of proof

Should the tax return be audited or a notice of deficiency be received, the taxpayer generally has the burden of proof. However, the burden of proof switches to the IRS if an individual taxpayer produces credible evidence in support of an expense, has complied with the substantiation requirements for the expense, has maintained all required records for the expense, and has cooperated with reasonable requests by the IRS for witnesses, information, documents, meetings, and interviews regarding the expense.

Credible evidence is evidence that, after critical analysis, the court would find sufficient upon which to base a decision on the issue if no contrary evidence were submitted (without regard to the judicial presumption of IRS correctness). The burden is not shifted if the taxpayer presents incredible or implausible evidence, even if that evidence is not controverted.

Substantiation requirements

An employee must be able to substantiate a deduction for an unreimbursed business expense by keeping (and producing for the IRS, if requested) adequate records. In general, the Code does not require the records to be in a specific form. However, under Sec. 274(d), specific proof is necessary to substantiate deductions for away - from - home travel and business gift expenses, and deductions related to listed property. A taxpayer must substantiate these expenses by adequate records or by sufficient evidence corroborating the taxpayer's own statement showing:

(A) the amount of such expense or other item, (B) the time and place of the travel or the date and description of the gift, (C) the business purpose of the expense or other item, and (D) the business relationship to the taxpayer of the person receiving the benefit.

Temp. Regs. Sec. 1. 274 - 5T (c)(2) in general defines "adequate records" as an account book, diary, log, statement of expense, trip sheets, or similar record, and documentary evidence that, in combination, are sufficient to establish each of the required elements of an expense.

Temp. Regs. Sec. 1. 274 - 5T (c)(3) defines "sufficient evidence corroborating the taxpayer's own statement" as the taxpayer's own statement, whether written or oral, containing specific information in detail about the required element of an expense and other corroborative evidence sufficient to establish that element. However, the Tax Court has routinely held that it is not required to accept a taxpayer's self - serving testimony without objective, corroborating evidence.

The taxpayer must substantiate the required elements for every Sec. 274(d) expense. Because Sec. 274(d) overrides the Cohan rule ( Cohan , 39 F.2d 540 (1930)), courts cannot estimate the amount of the taxpayer's expenses.

Temp. Regs. Sec. 1. 274 - 5T (c)(5) offers an exception to the adequate - records rule if the loss of records is due to circumstances beyond the taxpayer's control (e.g., a natural disaster). In this circumstance, the taxpayer has the right to substantiate his or her deductions through reasonable reconstruction of expenses.

If, as scheduled, unreimbursed employee business expenses again become deductible, employees should understand their employer's policy about business expense reimbursements to avoid denial for business expense deductions. If the employer's policy is unclear, the taxpayer should attempt to receive a reimbursement and document the results as evidence. It is important for taxpayers to keep a good record of the business expenses and make sure it is detailed enough to show that the expenses were incurred or paid during the tax year. For deductions for travel expenses, gifts, and deductions related to listed properties, taxpayers must ensure that they can substantiate the deductions under the strict standards in Sec. 274(d).

Editor Notes

Mark G. Cook , CPA, CGMA, MBA, is the lead tax partner with SingerLewak LLP in Irvine, Calif.

For additional information about these items, contact Mr. Cook at 949-623-0478 or [email protected] .

Contributors are members of SingerLewak LLP.

Dual consolidated losses: Recapture considerations

Sec. 338(g) elections for foreign corporations and ‘creeping acquisitions’, the sec. 645 election to treat a trust as part of the estate, wealth transfer strategies amid shifting interest rates, interim guidance for sre expenditures.

This article discusses the history of the deduction of business meal expenses and the new rules under the TCJA and the regulations and provides a framework for documenting and substantiating the deduction.

PRACTICE MANAGEMENT

CPAs assess how their return preparation products performed.

- Search Search Please fill out this field.

- Career Planning

- Succeeding at Work

- Pay & Getting a Raise

How Do Business Travel Expenses Work?

Employers Pay for Company Business Travel in Several Ways

:max_bytes(150000):strip_icc():format(webp)/Susan-LargeImage-5b771f8846e0fb002ca317db.jpg)

- Employees on Long-Term Assignments

- Employers Pay for Travel Expenses?

- Know Your Travel Expense Policies

- Using Travel As an Employee Incentive

Travel expenses are expenditures that an employee makes while traveling on company business. Company business can include conferences, exhibitions, business meetings, client and customer meetings, job fairs, training sessions, and sales calls, for example.

Expenses can include lodging, personal car mileage reimbursement , flights, ground transportation, tips to bellhops, meals, tips to waiters, room service, and other incidental expenses an employee might experience while on the road.

Expenditures that an organization will reimburse are found in the company’s business travel policy. Become familiar with your company’s policy because expenses, as varied as dry cleaning and gym membership, can be covered for employees on extended trips in addition to the expected travel costs, housing, and meals.

Travel Expenditures for Employees on Long-Term Assignments

When using long-term housing facilities for traveling employees, many employers also supply opportunities for the employee's family to visit when the employee is traveling extensively on business. When an employee is assigned to another company location on a temporary basis, employers will sometimes pay for the family of the employee to visit at prescribed time intervals. This keeps the burden of remote work from affecting family relationships adversely.

Employers seek to provide options of value for employees who are away from home and family for extended periods of time. You need to take advantage of any travel privileges that your employer offers to build employee morale and dedication.

Client entertainment at conferences, on sales calls, and on-site visits is another reimbursable expense, but know your company’s policies so you don’t exceed the limits that are placed on entertainment costs. For example, companies frequently place a cap on what you can spend on taking a client to dinner.

Know also your company's policy on the awarding of airline miles credit. It varies. Some companies allow employees to accrue airline travel miles that they then can use for personal family travel. Others accrue a bank of travel miles that they use to cover additional employee business travel. Again, knowing your company's policies is crucial.

How Do Employers Pay for Employee Travel Expenses?

Typically, organizations pay employee travel expenses in these three ways.

Company credit cards

Credit cards are issued to employees who must travel frequently for business. Employees may charge most of the expenses they incur on a business trip to the company credit card. For reimbursement of incidentals such as tips and fast food, employees will need to fill out an expense report when they return from their trip.

Charge cards are convenient for employees as they do not have to come up with the cash to pay for business expenses prior to reimbursement. Become knowledgeable about your company's policies, though; you may still need to turn in receipts and other supporting documentation even when you charge these expenses to a credit card.

Organizations without employee company credit cards require employees to fill out an expense reimbursement report for each expenditure while the employee is on the road. They generally require receipts and some level of justification for each expense.

Only rarely would an organization ask employees to pay for the big-ticket items such as airfare and seek reimbursement later. A company purchase order or company credit card will pay for large expenses upfront. But employees are often required to pay cash out-of-pocket for day-to-day travel expenses that are later reimbursed.

A per diem is a daily allowance of a certain amount of money that an employee is given to cover all expenses. The employee is responsible for making sound travel expense choices within the parameters of the amount of money that he or she is allotted daily.

Some companies pay directly for transportation and housing but give traveling employees a per diem for all other expenses including meals and ground transportation. Employees have been known to underspend on expenses to keep the extra cash from the per diem. Companies generally allow this.

Know Your Employer's Travel Expense Policies

Employees who travel for business are advised to stay up-to-date on company travel policies and costs covered for reimbursement. Expenses that fall outside of the policies are generally not reimbursed or covered.

Receipts are required by most companies except for those that pay a per diem. Your company also likely has a form that they expect employees to use for turning in travel expenses.

To stay on top of reimbursable expenses, employees are often given a deadline by which they need to file an expense report and turn in applicable receipts. The finance department will have guidelines that help it stay current.

If you have questions about what constitutes appropriate travel expenses in your organization, check with your manager and the Human Resources department. You don't want to spend the money and receive a surprise later.

Employers Are Using Travel As an Employee Incentive

Some employers have started to use travel as an employee incentive. When employees are rewarded with travel by their company for meeting a goal, the incentive travel will increase both employee loyalty and workplace engagement.

Tax Resources for Accountants and Small Businesses (U.S.)

- Expense Reimbursements / IRS / Meals and Incidental Expenses / Mileage / Payroll / Per Diem Rates / Small business

- Complete Guide to Reimbursing Employees for Travel Expenses

Published September 2, 2020 · Updated April 21, 2021

When an employee travels away from the office and incurs expenses, the company should reimburse them. Whether travelling across the world or just driving their car to a client’s location, getting the reimbursement right isn’t hard.

Keep reading to learn how to make proper employee reimbursements.

Accountable Plans

You’ll first need to decide if you will implement an accountable or nonaccountable plan. This is just as it sounds; either you’ll have employees be accountable for business expense reimbursements or not.

All businesses should have an expense reimbursement plan in writing. This includes corporations, sole proprietors, the self-employed, and non-profits. Non-profits should be extremely careful when reimbursing disqualified persons because nonaccountable plan reimbursements not properly approved or recorded can cause significant tax exposure to the charitable organization.

An accountable plan must follow the IRS guidelines for expense reimbursement. To qualify, the following rules must be met:

- Expenses must be for business purposes.

- Expenses must be adequately reported to the company in reasonable time.

- Any excess reimbursement or allowance must be returned in a reasonable amount of time.

Any expense that doesn’t meet these three criteria is considered a reimbursement under a nonaccountable plan.

This distinction between these two types of plans is important because accountable plan reimbursements are not taxable to the employee, whereas nonaccountable plans are taxable.

Business Purpose

Expenses incurred as an employee while completing work for an employer have a business purpose. Examples include things like registration fees for a conference, taxi rides to the airport for a business trip, or meals while away on a business trip.

If however, an employer reimburses an employee for dinner when the employee works late, this does not qualify as a business purpose. This reimbursement would be taxable to the employee because it was made under a nonaccountable plan.

Reporting in a Reasonable Time

While what is considered a reasonable amount of time is subjective, the general rule is that all reimbursable expenses must be submitted within 60 days of when they were incurred.

Adequate reporting involves providing a record, like an expense report, of all expenses incurred and providing evidence, like receipts, to support the expenses.

Excess Reimbursement

If an employee receives a travel advance to cover travel expenses but spends less than the advance, the difference is an excess reimbursement and must be returned to the employer to not be taxable. If the excess isn’t returned in a reasonable amount of time, it’s taxable.

A reasonable period of time in this instance is generally deemed to be within 120 days of when the expense was incurred.

With a travel advance, employees should submit an expense report and receipts to substantiate all expenses.

Mileage and Business Use of Personal Vehicle

When an employee uses their personal vehicle for company business, you’ll need to reimburse them. You have three options.

- Standard mileage rate

- Actual costs

- Monthly allowance

Standard Mileage Rate

If you use the standard mileage rate, it is 57.5 cents per mile for 2020.

You can pay more, but the IRS’ safe-harbor threshold of 57.5 cents per mile will allow you a tax deduction without having to substantiate the rate.

Note that the IRS typically updates rates in December. So, you can expect to see the 2021 rate announced in December 2020. IRS 2021 Mileage Rates are here.

IRS Standard Mileage Rates 2020

Actual Costs

Instead of using the standard rate, you can reimburse employees for actual expenses.

The employee will sum up all the costs of owning the vehicle including everything from fuel, maintenance, tolls, registration, and insurance. And based upon the percentage of business miles driven, that portion of the total actual costs is reimbursed.

Monthly Allowance

Using the monthly allowance method is relatively easy. Each month you provide a set dollar amount to the employee.

If you require the employee to provide a mileage log at the end of the month, this will determine if any part of the allowance is taxable. If no mileage log is required, the entire allowance is taxable under an unaccountable plan.

If a mileage log is provided and the employee drove less than expected, they should return the excess allowance within 30 days. If they don’t, the excess becomes taxable to them.

An employee’s commute from their home to their normal place of business is not a reimbursable expense. Any business miles driven in excess of the commute miles is reimbursable.

For example, an employee’s normal round-trip commute is 20 miles. On Fridays, the employee works on-site at a client’s office that is 30 miles away from the employee’s home. So, the employee drives 60 miles round-trip on Fridays. Since this is longer than he would drive if he commuted to the office, you’ll want to reimburse the employee for 40 miles (60 miles – 20 miles).

Mileage Logs

Employees should keep mileage logs when using a personal vehicle for business use. The log should include:

- Employee’s name

- Description of vehicle

- Date of business use

- Purpose of business use

- Starting mileage on odometer

- Ending mileage on odometer

- Approval authorization

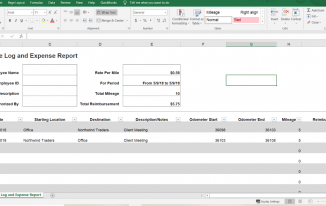

Here’s an example of a mileage log using Microsoft Excel.

Mileage log and expense report – employee reimbursement

Note that in this example, the employee drove from the office to a client and then back to the office. Therefore, there is no need to deduct commuting mileage.

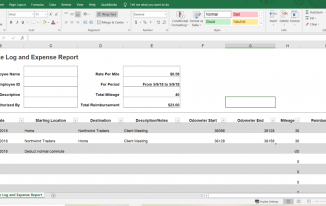

But suppose, like in our example from above, that on Fridays the employee drives from home to the client’s location and back home. His mileage log would look like this:

Mileage log and expense report example – employee reimbursement

But what if in this example, the drive to the client’s office from the employee’s home was shorter than his regular commute? In this case there is nothing to reimburse and the employee enjoys the benefit of less driving.

What would happen if this same employee didn’t normally work on Fridays or he always worked from home on Fridays? Then the entire drive to the client’s office would be reimbursable since the employee’s normal work schedule didn’t require him to commute on Fridays.

Many employees will forget to deduct their normal commute from mileage reimbursement requests. You’ll want to remind them.

Direct Expense Reimbursement of Travel Expenses

For employees who travel frequently, providing them with a company credit card is ideal. But for those times when an employee must use their own money for business expenses, you’ll want to reimburse employees quickly.

For easy recordkeeping, have employees complete expense reports when seeking reimbursements. Like the mileage log, it will detail who incurred the expense and when, what it was for, and the amount.

You can reimburse your employees with cash; however best practices would be to pay with check or some other trackable means, like ACH.

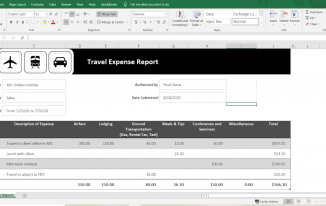

Here’s an example of an easy expense report in Excel.

Travel expense report example – employee reimbursement

For each expense, the employee should include receipts to support the amounts requested.

Receipts for purchases should contain the amount, date, place, and a brief description of the expense.

For example, hotel receipts should include:

- The name and location of the hotel.

- The dates stayed.

- Separate amounts for charges (i.e. lodging, meals, or food).

Restaurant and meal receipts should include:

- The name and location of the restaurant.

- The names of people in attendance.

- The date and amount of the meal.

You may choose to reimburse employees for meal tips. Be sure to have a clear policy of what will be reimbursed and what will not. For example, you’ll reimburse up to 20% for tips. Anything above that will not be reimbursed.

You’ll also need to consider your policy for lost receipts. You can still reimburse but have the employee fill out a missing receipt form to document the expense.

In lieu of direct expense reimbursement, consider using a per diem.

A per diem provides the employee with a specified dollar amount per day to use on meals, snacks, lodging, or other miscellaneous purchases. Larger expenses like airfare would be paid using the direct expense reimbursement method or paid for directly by the company.

Per diems should be prorated for partial days of travel. Acceptable methods include the ¾’s method or any other method you choose that is reasonable. The ¾’s method adds ¾ of a daily per diem rate on departure days and another ¾’s on return days.

The IRS sets per diem rates for cities and metropolitan areas. More expensive locales have higher daily rates than cheaper cities. For example, the daily rate for high cost cities like San Francisco, Vail, Colorado, and Nashville, Tennessee is $297. And many cities are designated high cost for only portions of the year. Miami and Park City, Utah are considered high cost only from December 1 – March 31.

And if you’re not in a high cost city, the daily rate is $200. These per diem rates are often updated each year. So you’ll always want to check for the current rates.

For example, Dave is travelling to Seattle for business. Seattle is a high cost locale. He’s leaving on Monday and returning on Thursday. Seattle’s maximum per diem rate is $297 per day. Dave will receive $222.75 ($297 x ¾) for Monday and Thursday and the full $297 for Tuesday and Wednesday.

Per diems are not taxable income to your employee if you use the IRS rates and your employee provides an expense report with receipts. However, using higher rates will create taxable income for the amount above the federal rate. And not submitting an expense report and receipts will make the entire per diem taxable because you’ll have an unaccountable plan and your company will not have the required receipts to support the tax deduction.

If your business operates in the transportation sector (i.e. shipping, trucking, or rail, etc…), it’s important to note that there are different per diem limits and rules you must follow.

Entertainment Expenses

With the 2017 Tax Cuts and Jobs Act, entertainment expenses are no longer tax deductible for companies.

As an employer, you may still reimburse your employees for entertainment expenses; however, these reimbursements will need to be segregated so that they are not included on your tax return. Examples of entertainment expenses include tickets to entertain clients at sporting events or country club fees for golf memberships.

What documentation you require for entertainment reimbursements is up to you but best practices suggest following the same requirements for travel or mileage reimbursements.

Commingling

If travel or meals involve both a business and personal aspect, only the portion of the expense that is business related is reimbursable. Expense reports and receipts should indicate whether there are any personal expenses.

For example, an employee makes a business trip to California from Georgia and elects to stay two days after business is finished for a mini-vacation. Best practices would have the employee check out of his hotel room and check back in using his personal credit card to pay the hotel bill for his extended stay. This way he has two different receipts; one for business and one for pleasure. However, if he doesn’t do that and the entire hotel stay is charged on the same receipt, you’ll need to back out the charges related to his personal stay.

None of this information should be taken as legal or financial advice, nor should it deter you from seeking the assistance of a licensed attorney, accountant, or financial services professional. But if you want to make sure your company’s policies for employee reimbursements are consistent with best practices, implementing these policies is a great place to start!

Tags: Business Use of Personal Vehicle Commingling Direct Expense Reimbursement employee Commuting reimbursement Employee Expense Reimbursement employee Monthly Allowance employees reimbursements entertainment expenses Excess Reimbursement Expense Reimbursement IRS Accountable Plans IRS Expense Reimbursement Mileage log and expense report Mileage Logs mileage on odometer Per Diem reimbursed expenses Reimbursing Employees Standard Mileage Rate travel expenses

- Next story 11 Facts about Employee Reimbursements Taxation

- Previous story Late Payment Calculator

- 2020 Mileage rates

- 2021 Mileage Rates

- Employee Reimbursements Taxation

- Gross from Net Calculator

- Reverse Sales Tax Calculator

- Taxation of Fringe Benefits

- IRS Mileage

Useful links

- Chamber of Commerce

Bistvo.com – Daily Inspiration

- 2020 Tax Calculator

- Accounting books

- Accounting education

- Accounting Jobs

- Accounting links

- Accounting Software

- Accounting software

- Accounting tutorials

- Additional Medicare Tax

- Annual Reports

- Calculators

- Chart of accounts

- Coronavirus

- Court decisions

- Depreciation

- EU Electronic Services

- European VAT on digital services

- Expense Reimbursements

- Federal income tax

- Federal Tax

- Financial statements

- FLSA – Fair Labor Standards Act

- Fringe Benefits

- Invoicing software

- Local Taxes

- Massachusetts

- Meals and Incidental Expenses

- Minimal Wage

- Minimum Wage

- Mississippi

- Net investment tax

- Nonprofits & Activism

- North Carolina

- OVDI Offshore Voluntary Disclosure Initiative

- Overtime pay

- Partnerships

- Payroll outsourcing

- Payroll software

- Penality and Interest

- Pennsylvania

- Per Diem Rates

- Principal business codes

- Professional tax software

- Retirement planning

- Self-Employed

- Small business

- Social Security and Medicare

- Sole Proprietorship

- State Licenses and Permits

- State Sales Tax

- Tax and Accounting Dictionary

- Tax calculators

- Tax court cases

- Tax Preparation Software

- Tax websites

- Title 26 – Internal Revenue Code

- U.S. Department of Labor (DOL)

- Underpayment Interest Rates

- Washinghton

- West Virginia

- West Viriginia

- 1-800-234-5573

- Secure Email

- Client Login

- Employee Portal

- Previous Portal

- Pay My Bill

What are the Rules for Employee Business Travel?

- Feb 1, 2022

- Best practices for small businesses , Tax

Business travel has substantially decreased over the past couple of years due to the pandemic, but from time to time, employees still need to travel for work-related reasons. Maybe it’s driving between different employer-owned locations within a workday, or maybe it’s to attend a conference or trade show that includes an overnight stay. Regardless of the purpose, it’s important to know how employees are paid for these different activities.

Paying Business Travel Expenses

The first question to ask is whether the company reimburses travel expenses under an accountable plan. An accountable plan allows travel expenses to be excluded from the employee’s wages, meaning they’re not subject to withholding or reporting (i.e., the travel reimbursement doesn’t trigger a Form W-2). There are three requirements for an accountable plan:

- The expense must be work-related

- The employee must provide accurate documentation within a reasonable time

- Any excess reimbursements or advances must be returned to the employer within a reasonable time

Employees are responsible for maintaining good records, which means receipts, mileage documentation, and turning in a reimbursement request in a timely manner. The employer is then responsible for reimbursing the employee also in a timely fashion, generally within 30 days after the employee submits a reimbursement request.

The next question is whether the business travel is within the employee’s normal workday, or whether it requires an overnight stay. Rules for paying expenses and employee hourly wages differ for each of those scenarios.

Meals. If an employee is away from the workplace for the day and has lunch and/or dinner while on the road, that is not a reimbursable business expense because the employee is not staying overnight. However, if the meal is directly related to and necessary for the business, such as attending a business meeting that includes a meal, then it is reimbursable.

Overnight Travel Expenses. Reasonable business-related expenses for travel, lodging and meals can be paid to employees using a per diem rate or reimbursed for actual expenses.

Per diem is a flat rate under an accountable plan for business travel away from home. The General Services Administration (GSA) sets the federal per diem rate, which is $59 for meals and incidentals and $96 for lodging in 2022. Employers can also choose to use the IRS simplified per diem rates which set one rate for urban areas with a higher cost of living and a lower rate for areas with a lower cost. Per diems are not considered wages as long as employees follow the accountable plan rules above for documentation and returning any excess.

Note – business owners and sole proprietors can’t use per diem for lodging expenses and must maintain records of actual expenses instead.

Vehicle Usage. If an employee uses their personal vehicle for business travel, the employee can be reimbursed using the cents-per-mile method or using the actual cost incurred by the employee substantiated by receipts including date(s), mileage, and business purpose. Any reimbursement over the federal mileage rate (58.5 cents per mile in 2022) is taxable and reportable on Form W-2.

If the employee uses a company-owned vehicle for business travel, there are no tax consequences but the employee is required to maintain mileage records. For more information, refer to our blogs on this topic.

- The (Fringe) Benefits of Providing a Company Car

- 2022 Mileage Rates and Tax Rules for business Use of an Automobile

When is Travel Time Paid?

Employees must report – and the employer must pay – all hours the employee works. Employees who are subject to overtime (non-exempt employees) are paid overtime for working more than 40 hours in a week (and in some states, for working more than 8 hours in a workday). Exempt employees are not subject to overtime, so time spent traveling is not paid any differently than their normal salary.

Here are examples of how pay should be handled for different travel situations:

Travel During the Normal Work Day

- An employee’s normal commute between work and home is not work time. This is true even if the employee normally works at a different location each day, and if the employee goes to the workplace outside their normal work hours (to catch up on work over the weekend, for example).

- If an employee travels to different work locations throughout the normal workday, that travel time should be paid. This can include traveling from the employee’s normal workplace to other employer-owned locations, to visit customers, or other work-related travel. This includes traveling out of town and returning within the workday.

Business Travel Requiring an Overnight Stay

- If an employee is a passenger on an airplane, train, bus, boat, or automobile traveling outside normal working hours, that time is not considered work time. However, if the employee is working while a passenger, that time should be paid.

- If the employee is required to drive themselves or others, that time must be paid. If the employee volunteers to drive their own vehicle, the time outside normal work hours is not required to be paid.

- While out of town on overnight business travel, time spent working must be paid, but time spent in personal activities is not compensable. That means if an employee attends a conference from 8 a.m. to 6 p.m. and then goes out to eat with conference buddies, then back to the hotel to watch TV and sleep, only the 10 hours of work – attending the conference – is paid.

What About Spouses or Traveling Companions?

Any company-paid travel expenses on behalf of a spouse or non-employee traveling companion are considered income and reportable on the employee’s Form W-2 as a taxable fringe benefit. For instance, if you have a larger hotel room because of your spouse, only the cost of a single room is considered to be a reasonable business expense. If both parties travel on an airplane, only the employee’s ticket is a business expense.

Your State May Differ

State rules usually follow these federal rules, but be sure to check your state’s requirements to ensure you’re in compliance.

For More Information

Both IRS Publication 15-B, Employer’s Tax Guide to Fringe Benefits and Publication 463, Travel Gift, and Car Expenses cover the topic of business travel. Or contact your Mize relationship manager for assistance with your situation – we’re here to help!

Alternative Minimum Tax basics for individuals

The IRS’s new audit strategy: what wealthy individuals, corporations, and complex partnerships need to know

Preparing for the post-TCJA era: corporate tax changes for 2026 and beyond

- previous post: Utilizing the FICA Tip Tax Credit

- next post: Numerous tax limits affecting businesses have increased for 2022

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Run » finance, 6 commonly asked questions about employee mileage reimbursement.

Is your company complying with the rules and policies surrounding employee mileage reimbursement? Here are the main things you need to know.

Editor’s Note : Is your small business one of the best in America? Apply for our premier awards program for small businesses, the CO—100, today to get recognized and rewarded. One hundred businesses will be honored and one business will be awarded $25,000. Apply here !

If your employees use their personal vehicles for work-related tasks, you may be required to reimburse them for their mileage. Let’s look at six frequently asked questions about mileage reimbursement .

[Read more: Should You Give Employees a Company Car ?]

What is mileage reimbursement?

Mileage reimbursement involves compensating your employees for any business-related driving they do. It’s often done when employees use their personal vehicles to travel and run business-related errands.

That means employees will receive a certain amount of compensation for every mile they drive for the business. You could choose to give your employees a monthly mileage allowance, but using the IRS’s standard rate is usually more straightforward. Just make sure that your employees understand how the reimbursement is calculated.

What is considered work-related mileage?

According to the IRS, business mileage is any mileage driven between two places of work. That means you can reimburse your employees for work-related trips outside of their regular commute. This includes the following activities:

- Business trips.

- Meetings with clients and prospective clients.

- Running errands for the business.

- Making deliveries for the business.

Am I required to reimburse my employees?

No federal law requires you to reimburse your employees for using their personal vehicles for work, but some state laws do. California, Illinois, and Massachusetts require companies to reimburse their employees for business-related mileage and expenses.

You should check the laws in your state and consult with an attorney to determine whether you’re required to provide mileage reimbursement. Even if it isn’t a requirement, it may be a good idea if your employees do a lot of work-related driving.

No federal law requires you to reimburse your employees for using their personal vehicles for work, but some state laws do.

How is mileage reimbursement calculated?

The IRS sets a standard mileage reimbursement rate of 58.5 cents per business mile driven in 2022. This rate is based on an annual study of the fixed and variable costs of operating a vehicle, like gas, insurance, depreciation, and standard maintenance.

You’re not required to reimburse employees using the IRS’s mileage reimbursement rate — you can choose a higher or lower amount if you prefer. But if you reimburse your employees at a higher rate, the additional amount is considered gross wages and is subject to payroll taxes.

Are mileage reimbursements tax-deductible?

Yes, reimbursements based on the federal mileage rate are tax-deductible. And since they aren’t considered income, they’re non-taxable for your employees. But if you provide more than the federal mileage rate, the difference is regarded as taxable income.

[Read more: 10 Tax Deductions Your Business Should Know About ]

How do I come up with an employee mileage reimbursement policy?

Here are the biggest things you need to think about when setting up a mileage reimbursement policy:

- Consider the location : Vehicle and fuel costs can vary significantly depending on where you live. A San Francisco-based tech company will pay a different rate than a small business located in Ohio. You should choose a rate that is fair based on your location.

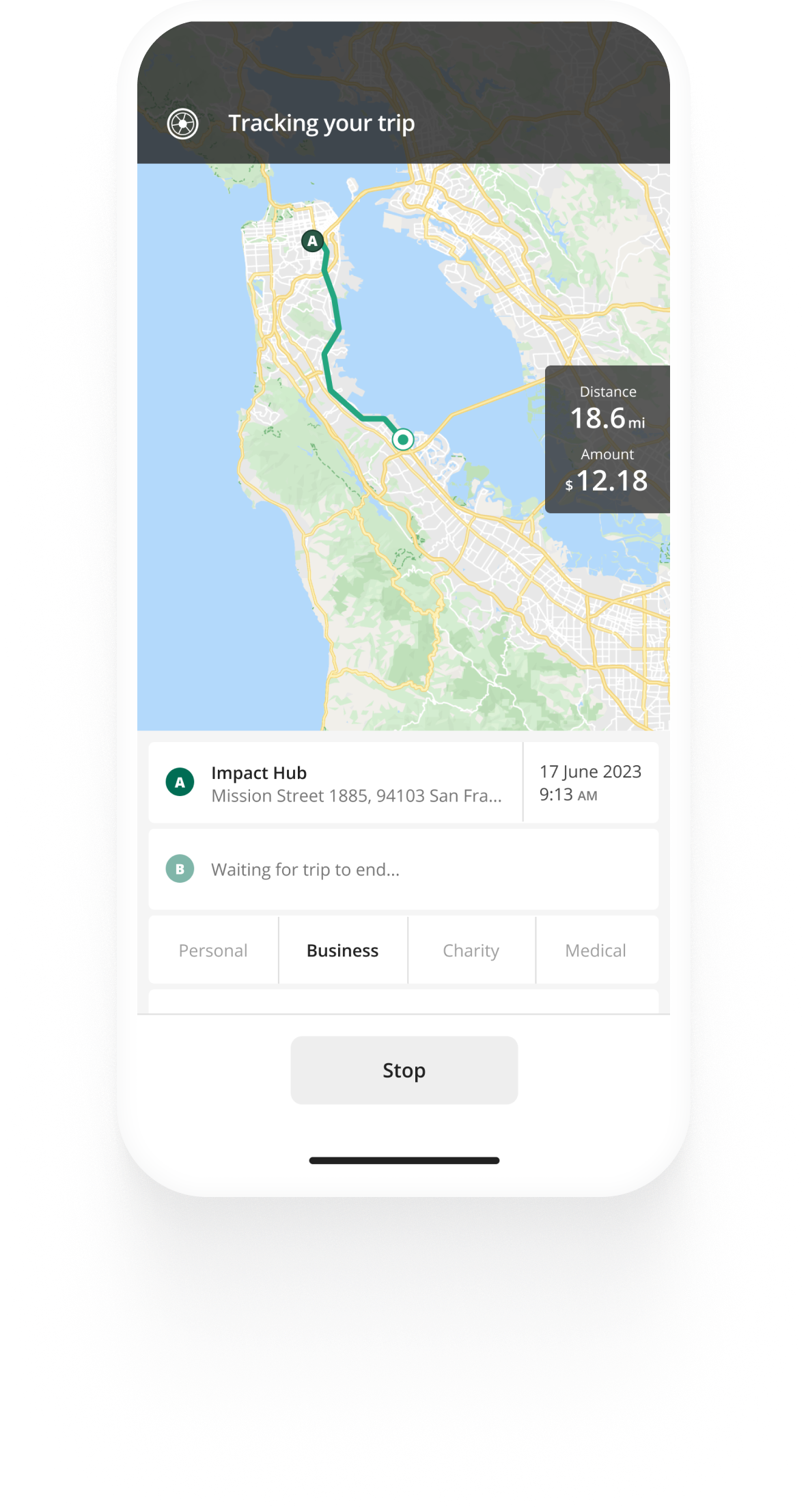

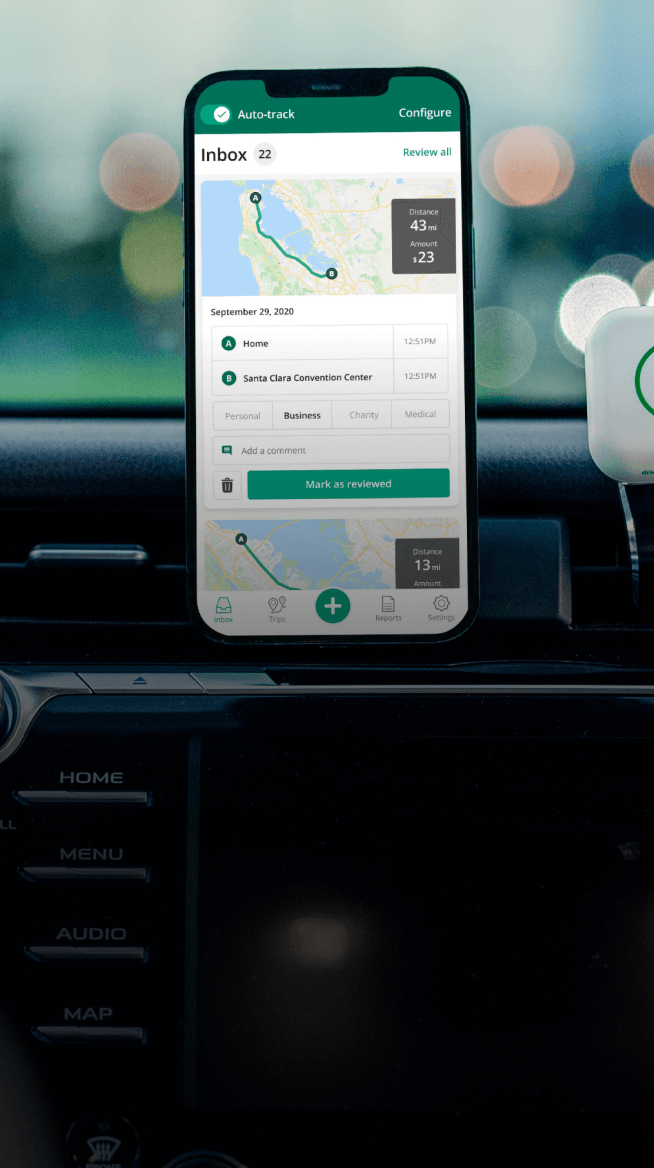

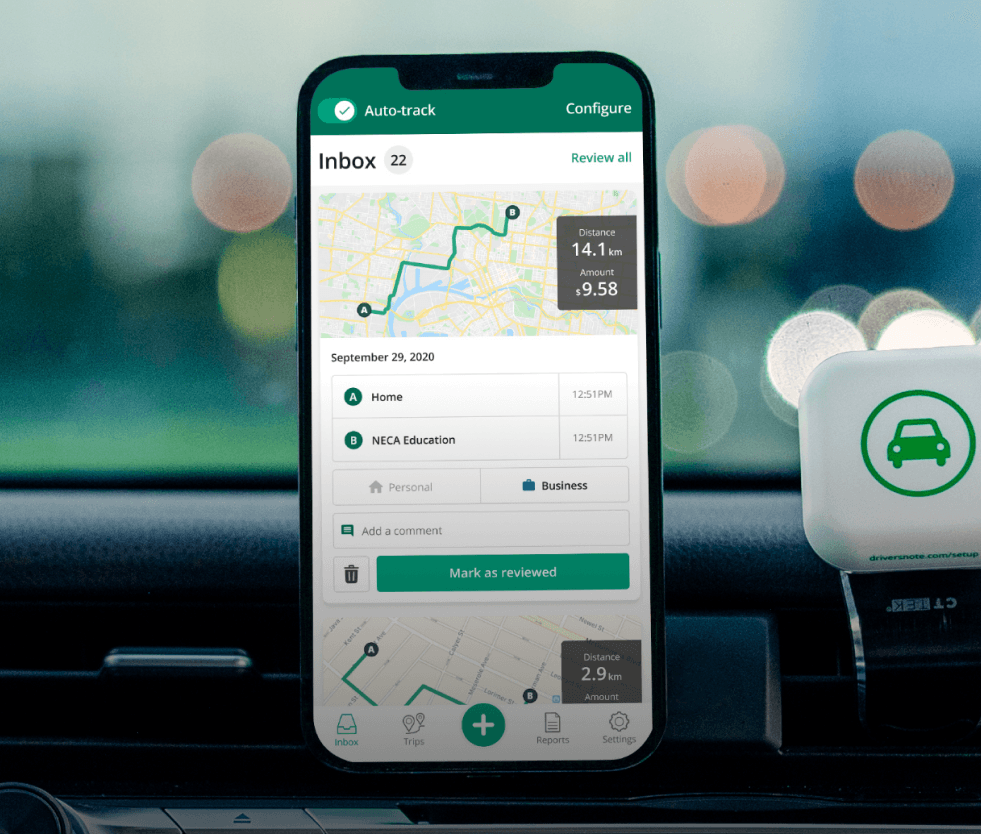

- Find a tracking solution : Your employees need a way to track their mileage so that they can be reimbursed. Fortunately, there are apps that will track your mileage for you so you can avoid manual logging. Using an app also ensures your employees don’t overreport their mileage.

- Create a written policy : You also need to have a written document that outlines your mileage reimbursement policy. For instance, you should clearly identify what constitutes a business trip and what doesn’t.

- Provide examples : Using specific examples will make your policy easier for employees to understand.

- Create a mileage reimbursement form : Finally, creating a standard mileage reimbursement form that employees can fill out each month is helpful. This form ensures you have the information you need come tax season.

[Read more: Top 4 Tech Tools for Managing Travel Expenses ]

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.