It's time for an update.

To continue accessing and managing your account, please update your browser.

AAdvantage ® Aviator ® Red World Elite Mastercard ®

Earn 60,000 AAdvantage ® bonus miles 2

First checked bag free 2, enjoy preferred boarding 2.

annual fee 1

Rewards & Benefits

Earn 60,000 aadvantage ® bonus miles.

after making your first purchase and paying the $99 annual fee in full, both within the first 90 days. 2

Earn 1X AAdvantage ® miles

for every $1 spent on all other purchases. 2

Anniversary Companion Certificate

Each anniversary year: earn a Companion Certificate good for 1 guest at $99 (plus taxes and fees) if you spend $20,000 on purchases and your account remains open for 45 days after your anniversary date. 2

First checked bag free

on domestic American Airlines itineraries for the primary cardmember and up to 4 companions traveling with you on the same reservation. 2

No foreign transaction fees

on international purchases. 1

Travel Coverage

Eligible for Travel Accident Insurance, Trip Cancellation and Interruption coverage, Baggage Delay Insurance, and Auto Rental Collision Damage Waiver. 3

Introductory APR on balance transfers

0% intro APR for 15 months on balance transfers made within 45 days of account opening. After that, a variable APR will apply, 21.24% to 29.99%, based on your creditworthiness and other factors. There is a fee for balance transfers. 1

Earn 2X AAdvantage ® miles

for every $1 spent on eligible American Airlines purchases. 2

Get up to $25 back as statement credits on inflight Wi-Fi purchases

every anniversary year on American Airlines operated flights. 2

Inflight savings

Receive 25% inflight savings as statement credits on food and beverages when you use your card on American Airlines operated flights. 2

Preferred boarding

for the primary cardmember and up to 4 companions on their reservation for all American Airlines operated flights. 2

Travel and Lifestyle Services

Access a suite of benefits, amenities and upgrades, preferential treatment and premium travel offers from best-in-class travel companies. 3

$0 Fraud Liability protection

means you're not responsible for charges you did not authorize.

AAdvantage ® Benefits

Aadvantage ® benefit.

The new AAdvantage ® program now has only one way to earn status — Loyalty Points. Earning one eligible AAdvantage ® mile will earn you one Loyalty Point. Learn more at aa.com/loyaltypoints 4

Hotels, cars and more

Redeem your miles for hotel stays, rental cars, vacation packages and other retail products. 4

Earn miles faster with SimplyMiles ™

Join and earn miles faster on purchases by activating offers and shopping your favorite brands in store and online. 4

Earn more miles eShopping ™

Sign up and shop at 1,200+ online stores and earn miles on every dollar you spend in addition to those earned with your credit card. 4

Earn miles with AAdvantage Dining SM

Join and earn miles faster on purchases when you dine at local restaurants. 4

Interest Rates and Charges Summary

Fee summary.

See Terms and Conditions for a complete listing of rates and fees

Important Information

Offer subject to credit approval. This offer is available through this advertisement and may not be accessible elsewhere. Other offers may be available. For complete pricing and other details, please see the Terms and Conditions .

This offer is valid for approved applicants. Any bonus associated with this offer may only be earned once. You may not be eligible for this offer if you currently have or previously had an account with us in this program. In addition, you may not be eligible for this offer if, at any time during our relationship with you, we have cause, as determined by us in our sole discretion, to suspect that the account is being obtained or will be used for abusive or gaming activity (such as, but not limited to, obtaining or using the account to maximize rewards earned in a manner that is not consistent with typical consumer activity and/or multiple credit card account applications/openings). Please see the About This Offer section of the Terms and Conditions for important information.

Annual fee is $99. 0% introductory APR on balance transfers made within 45 days of account opening is applicable for the first 15 billing cycles that immediately follow each balance transfer. This introductory APR offer does not apply to purchases and cash advances. For new and outstanding balance transfers after the introductory period and all purchases, the variable APR is 21.24% to 29.99%, depending upon our review of your application, your credit history at account opening, and other factors. The variable APR for cash advances is 29.99%. The APRs on your account will vary with the market based on the Prime Rate and are subject to change. The minimum monthly interest charge will be $0.50. Balance transfer fee: 5% (min. $5). Cash advance fee: 5% (min. $10). Foreign transaction fee 0%. See Terms and Conditions for updated and more information about the terms of this offer, including the "About the Variable APRs on Your Account" section for the current Prime Rate information.

Conditions and limitations apply. Please refer to the Introductory Bonus Offer section within the Terms and Conditions for additional information about this introductory offer. Please refer to the Reward Rules within the Terms and Conditions for additional information about the rewards program. Anniversary Companion Certificate may not be achievable based on the assigned credit line and ability to maintain that credit line.

Restrictions, limitations and exclusions apply. Upon account approval, we will send you a Guide to Benefits which includes a full explanation of coverages and details regarding specific time limits, eligibility and documentation requirements.

Benefit provided by American Airlines. Conditions and limitations apply. Visit aa.com/loyaltypoints for complete details.

The AAdvantage ® Aviator ® Red World Elite Mastercard ® is issued by Barclays Bank Delaware pursuant to a license from Mastercard International Incorporated. Mastercard, World Mastercard, World Elite Mastercard, and the circles design are registered trademarks of Mastercard International Incorporated.

American Airlines reserves the right to change the AAdvantage ® program and its terms and conditions at any time without notice, and to end the AAdvantage ® program with six months' notice. Any such changes may affect your ability to use the awards or mileage credits that you have accumulated. Unless specified, AAdvantage ® miles earned through this promotion/offer do not count toward elite-status qualification or AAdvantage ® Million Miler SM status. American Airlines is not responsible for products or services offered by other participating companies. For complete details about the AAdvantage ® program, visit aa.com/aadvantage .

© 2024 Barclays Bank Delaware, PO Box 8801, Wilmington, DE 19801, Member FDIC.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

16 Best Travel Credit Cards of September 2024

The best travel credit card is one that brings your next trip a little closer every time you use it. Purchases earn points or miles you can use to pay for travel. If you're loyal to a specific airline or hotel chain, consider one of that company's branded travel credit cards. Otherwise, check out our picks for general-purpose travel cards that give you flexible travel rewards without the restrictions and blackout dates of branded cards.

400+ credit cards reviewed by our team of experts ( See our top picks )

80+ years of combined experience covering credit cards and personal finance

27,000+ hours spent researching and reviewing financial products in the last 12 months

Objective comprehensive ratings rubrics ( Methodology )

NerdWallet's credit cards content, including ratings and recommendations, is overseen by a team of writers and editors who specialize in credit cards. Their work has appeared in The Associated Press, USA Today, The New York Times, MarketWatch, MSN, NBC's "Today," ABC's "Good Morning America" and many other national, regional and local media outlets. Each writer and editor follows NerdWallet's strict guidelines for editorial integrity .

Show summary

NerdWallet's Best Travel Credit Cards of September 2024

Chase Sapphire Preferred® Card : Best for Max flexibility + big bonus

Capital One Venture Rewards Credit Card : Best for Flat-rate rewards

Capital One Venture X Rewards Credit Card : Best for Travel portal benefits

Chase Freedom Unlimited® : Best for Cash back for travel bookings

American Express® Gold Card : Best for Big rewards on everyday spending

Wells Fargo Autograph℠ Card : Best for Bonus rewards + no annual fee

The Platinum Card® from American Express : Best for Luxury travel perks

Ink Business Preferred® Credit Card : Best for Business travelers

Citi Strata Premier℠ Card : Best for Triple points on multiple categories

Capital One VentureOne Rewards Credit Card - Miles Boost : Best for Flat-rate rewards + no annual fee

Chase Sapphire Reserve® : Best for Bonus rewards + high-end perks

World of Hyatt Credit Card : Best for Best hotel card

Bilt World Elite Mastercard® Credit Card : Best for Travel rewards for rent payments

United℠ Explorer Card : Best for Best airline card

PenFed Pathfinder® Rewards Visa Signature® Card : Best for Credit union benefits

Wells Fargo Autograph Journey℠ Card : Best for Booking directly with airlines/hotels

Best Travel Credit Cards

Find the right credit card for you..

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Max flexibility + big bonus

Flat-rate rewards, travel portal benefits, cash back for travel bookings, big rewards on everyday spending, bonus rewards + no annual fee, luxury travel perks, business travelers, triple points on multiple categories, flat-rate rewards + no annual fee, bonus rewards + high-end perks, best hotel card, travel rewards for rent payments, best airline card, credit union benefits, booking directly with airlines/hotels, full list of editorial picks: best travel credit cards.

Before applying, confirm details on the issuer’s website.

Capital One Venture Rewards Credit Card

Our pick for: Flat-rate rewards

The Capital One Venture Rewards Credit Card is probably the best-known general-purpose travel credit card, thanks to its ubiquitous advertising. You earn 5 miles per dollar on hotels and car rentals booked through Capital One Travel and 2 miles per dollar on all other purchases. Miles can be redeemed at a value of 1 cent apiece for any travel purchase, without the blackout dates and other restrictions of branded hotel and airline cards. The card offers a great sign-up bonus and other worthwhile perks ( see rates and fees ). Read our review.

Capital One VentureOne Rewards Credit Card - Miles Boost

Our pick for: Flat-rate rewards + no annual fee

With the Capital One VentureOne Rewards Credit Card - Miles Boost , you don't pay an annual fee, but you also don't get rewards as rich as those on the regular Venture card ( see rates and fees ). Still, the bonus offer makes this a solid card for starting out with travel rewards. Read our review.

Chase Sapphire Reserve®

Our pick for: Bonus rewards + high-end perks

The high annual fee on the Chase Sapphire Reserve® gives many potential applicants pause, but frequent travelers should be able to wring enough value out of this card to more than make up for the cost. Cardholders get bonus rewards (up to 10X) on dining and travel, a fat bonus offer, annual travel credits, airport lounge access, and a 50% boost in point value when redeeming points for travel booked through Chase. Points can also be transferred to about a dozen airline and hotel partners. Read our review.

Chase Sapphire Preferred® Card

Our pick for: Max flexibility + big bonus

For a reasonable annual fee, the Chase Sapphire Preferred® Card earns bonus rewards (up to 5X) on travel, dining, select streaming services, and select online grocery purchases. Points are worth 25% more when you redeem them for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. The sign-up bonus is stellar, too. Read our review.

Wells Fargo Autograph Journey℠ Card

Our pick for: Booking directly with airlines/hotels

The Wells Fargo Autograph Journey℠ Card stands out among general-purpose travel cards because it pays its highest rewards rates on travel bookings made directly with airlines and hotels, rather than requiring you to go through the issuer's travel agency, where prices might not be competitive. The points are flexible, you get a good bonus offer, and the card comes with a few other nice perks. Read our review.

Wells Fargo Autograph℠ Card

Our pick for: Bonus rewards + no annual fee

The Wells Fargo Autograph℠ Card offers so much value, it's hard to believe there's no annual fee. Start with a great bonus offer, then earn extra rewards in a host of common spending categories — restaurants, gas stations, transit, travel, streaming and more. Read our review.

Citi Strata Premier℠ Card

Our pick for: Triple points on everyday categories

The Citi Strata Premier℠ Card earns bonus points on select travel, supermarkets, dining, gas stations and EV stations. There's a solid sign-up bonus as well. Read our review.

U.S. Bank Altitude® Connect Visa Signature® Card

Our pick for: Road trips

The U.S. Bank Altitude® Connect Visa Signature® Card is one of the most generous cards on the market if you're taking to the skies or the road, thanks to the quadruple points it earns on travel and purchases at gas stations and EV charging stations. It's also a solid card for everyday expenses like groceries, dining and streaming, and it comes with ongoing credits that can offset its annual fee: $0 intro for the first year, then $95 . Read our review .

Capital One Venture X Rewards Credit Card

Our pick for: Travel portal benefits

Capital One's premium travel credit card can deliver terrific benefits — provided you're willing to do your travel spending through the issuer's online booking portal. That's where you'll earn the highest rewards rates plus credits that can make back the bulk of your annual fee ( see rates and fees ). Read our review.

Chase Freedom Unlimited®

Our pick for: Cash back for travel bookings

The Chase Freedom Unlimited® was already a fine card when it offered 1.5% cash back on all purchases. Now it's even better, with bonus rewards on travel booked through Chase, as well as at restaurants and drugstores. On top of all that, new cardholders get a 0% introductory APR period and the opportunity to earn a sweet bonus. Read our review.

The Platinum Card® from American Express

Our pick for: Luxury travel perks

The Platinum Card® from American Express comes with a hefty annual fee, but travelers who like to go in style (and aren't afraid to pay for comfort) can more than get their money's worth. Enjoy extensive airport lounge access, hundreds of dollars a year in travel and shopping credits, hotel benefits and more. That's not even getting into the high rewards rate on eligible travel purchases and the rich welcome offer for new cardholders. Read our review.

American Express® Gold Card

Our pick for: Big rewards on everyday spending

The American Express® Gold Card can earn you a pile of points from everyday spending, with generous rewards at U.S. supermarkets, at restaurants and on certain flights booked through amextravel.com. Other benefits include hundreds of dollars a year in available dining and travel credits and a solid welcome offer for new cardholders. There's an annual fee, though, and a pretty substantial one, so it's not for smaller spenders. Read our review.

Bilt World Elite Mastercard® Credit Card

Our pick for: Travel rewards on rent payments

The Bilt World Elite Mastercard® Credit Card stands out by offering credit card rewards on rent payments without incurring an additional transaction fee. The ability to earn rewards on what for many people is their single biggest monthly expense makes this card worth a look for any renter. You also get bonus points on dining and travel when you make at least five transactions on the card each statement period, and redemption options include point transfers to partner hotel and loyalty programs. Read our review.

PenFed Pathfinder® Rewards Visa Signature® Card

Our pick for: Credit union rewards

With premium perks for a $95 annual fee (which can be waived in some cases), jet-setters will get a lot of value from the PenFed Pathfinder® Rewards Visa Signature® Card . It also offers a generous rewards rate on travel purchases and a decent flat rate on everything else. Plus, you’ll get travel credits and a Priority Pass membership that offers airport lounge access for $32 per visit. Read our review.

United℠ Explorer Card

Our pick for: B est airline card

The United℠ Explorer Card earns bonus rewards not only on spending with United Airlines but also at restaurants and on eligible hotel stays. And the perks are outstanding for a basic airline card — a free checked bag, priority boarding, lounge passes and more. Read our review.

» Not a United frequent flyer? See our best airline cards for other options

World of Hyatt Credit Card

Our pick for: Best hotel card

Hyatt isn't as big as its competitors, but World of Hyatt Credit Card is worth a look for anyone who spends a lot of time on the road. You can earn a lot of points even on non-Hyatt spending, and those points have a high value compared with rival programs. There's a great sign-up bonus, free nights, automatic elite status and more. Read our review.

» Not a Hyatt customer? See our best hotel cards for other options.

Ink Business Preferred® Credit Card

Our pick for: Business travelers

The Ink Business Preferred® Credit Card starts you off with one of the biggest sign-up bonuses of any credit card anywhere: Earn 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. You also get bonus rewards on travel expenses and common business spending categories, like advertising, shipping and internet, cable and phone service. Points are worth 25% more when redeemed for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. Learn more and apply .

OTHER RESOURCES

How travel rewards work.

Modern-day adventurers and once-a-year vacationers alike love the idea of earning rewards toward their next big trip. According to a NerdWallet study , 68% of American adults say they have a credit card that earns travel rewards.

With a travel rewards credit card, you earn points or miles every time you use the card, but you can often earn more points per dollar in select categories. Some top travel credit cards, such as the Chase Sapphire Reserve® , offer bonus points on any travel spending, while the Marriott Bonvoy Boundless® Credit Card grants bonus points when you use the card at Marriott hotels, grocery stores, restaurants or gas stations.

Not all points and miles earned on travel rewards credit cards are the same:

General-purpose travel credit cards — including the Chase Sapphire Preferred® Card , the American Express® Gold Card and the Capital One Venture Rewards Credit Card — give you rewards that can be used like cash to pay for travel or that can be exchanged for points in airline or hotel loyalty programs. With their flexible rewards, general-purpose options are usually the best travel credit cards for those who don't stick to a single airline or hotel chain.

Airline- and hotel-specific cards — such as the United℠ Explorer Card and the Hilton Honors American Express Card — give points and miles that can be used only with the brand on the card. (Although it's possible in some cases to transfer hotel points to airlines, we recommend against it because you get a poor value.) These so-called co-branded cards are usually the best travel credit cards for those who always fly one particular airline or stay with one hotel group.

How do we value points and miles? With the rewards earned on general travel cards, it's simple: They have a fixed value, usually between 1 and 1.5 cents per point, and you can spend them like cash. With airline miles and hotel points, finding the true value is more difficult. How much value you get depends on how you redeem them.

To better understand what miles are worth, NerdWallet researched the cash prices and reward-redemption values for hundreds of flights. Our results:

Keep in mind that the airline values are based on main cabin economy tickets and exclude premium cabin redemptions. See our valuations page for business class valuations and details about our methodology.

Our valuations are different from many others you may find. That’s because we looked at the average value of a point based on reasonable price searches that anyone can perform, not a maximized value that only travel rewards experts can expect to reach.

You should therefore use these values as a baseline for your own redemptions. If you can redeem your points for the values listed on our valuations page, you are doing well. Of course, if you are able to get higher value out of your miles, that’s even better.

HOW TO CHOOSE A TRAVEL CREDIT CARD

There are scores of travel rewards cards to choose from. The best travel credit card for you has as much to do with you as with the card. How often you travel, how much flexibility you want, how much you value airline or hotel perks — these are all things to take into account when deciding on a travel card. Our article on how to choose a travel credit card recommends that you prioritize:

Rewards you will actually use (points and miles are only as good as your ability to redeem them for travel).

A high earning rate (how much value you get in rewards for every dollar spent on the card).

A sign-up bonus (a windfall of points for meeting a spending requirement in your first few months).

Even with these goals in mind, there are all kinds of considerations that will influence your decision on a travel rewards credit card.

Travel cards are for travelers

Travel cards vs. cash-back cards.

The very first question to ask yourself when choosing a travel credit card is: Should I get a travel card at all? Travel credit cards are best for frequent travelers, who are more likely to get enough value from rewards and perks to make up for the annual fees that the best travel credit cards charge. (Some travel cards charge no annual fee, but they tend to offer lesser rewards than full-fee cards.) A NerdWallet study found that those who travel only occasionally — say, once a year — will probably get greater overall rewards from cash-back credit cards , most of which charge no annual fee, than from a travel card.

Flexibility and perks: A trade-off

Co-branded cards vs. general travel cards.

Travel credit cards fall into two basic categories: co-branded cards and general travel cards.

Co-branded cards carry the name of an airline or hotel group, such as the United℠ Explorer Card or the Marriott Bonvoy Boundless® Credit Card . The rewards you earn are redeemable only with that particular brand, which can limit your flexibility, sometimes sharply. For example, if your credit card's co-branded airline partner doesn't have any award seats available on the flight you want on the day you want, you're out of luck. On the other hand, co-branded cards commonly offer airline- or hotel-specific perks that general travel cards can't match.

General travel cards aren't tied to a specific airline or hotel, so they offer much greater flexibility. Well-known general travel cards include the Capital One Venture Rewards Credit Card and the Chase Sapphire Preferred® Card . Rewards on general travel cards come as points (sometimes called "miles" but they're really points) that you can redeem for any travel expense. You're not locked into using a single airline or hotel, but you also won't enjoy the perks of a co-branded card.

Evaluating general travel credit cards

What you get with a general travel card.

The credit cards featured at the top of this page are general travel cards. They're issued by a bank (such as Chase or Capital One), carry only that bank's name, and aren't tied to any single airline or hotel group. With these cards, you earn points on every purchase — usually 1 to 2 points per dollar spent, sometimes with additional points in certain categories.

Issuers of general travel cards typically entice new applicants with big sign-up bonuses (also known as "welcome offers") — tens of thousands of miles that you can earn by spending a certain amount of money on the card in your first few months.

» MORE: NerdWallet's best credit card sign-up offers

What do you do with those points? Depending on the card, you may have several ways to redeem them:

Booking travel. With this option, your points pay for travel booked through the issuer's website, using a utility similar to Orbitz or Expedia. For example, if points were worth 1 cent apiece when redeemed this way, you could book a $400 flight on the issuer's portal and pay for it with 40,000 points

Statement credit. This lets you essentially erase travel purchases by using your points for credit on your statement. You make travel arrangements however you want (directly with an airline or hotel, through a travel agency, etc.) and charge it to your card. Once the charge shows up on your account, you apply the necessary points and eliminate the cost.

Transferring to partners. The card issuer may allow you to transfer your points to loyalty programs for airlines or hotel chains, turning your general card into something like a co-branded card (although you don't get the perks of a co-brand).

Cash back, gift cards or merchandise. If you don't plan to travel, you can burn off your rewards with these options, although you'll often get a lower value per point.

Airline and hotel cards sharply limit your choice, but they make up for it with perks that only they can offer, like free checked bags or room upgrades. General travel cards, on the other hand, offer maximum flexibility but can't provide the same kinds of perks, because the banks that issue them don't operate the airlines or hotels. Still, there are some noteworthy perks on general travel cards, including:

Travel credit. This is automatic reimbursement for travel-related spending. Some top travel credit cards offer hundreds of dollars a year in travel credit.

Trusted traveler reimbursement. More and more travel credit cards are covering the application fee for TSA Precheck and Global Entry, programs that allow you to move through airport security and customs more quickly.

Airport lounge access. Hundreds of lounges worldwide operate separately from airlines under such networks as Priority Pass and Airspace, and several general travel cards offer access to these lounges.

Points programs

Every major card issuer has at least one travel card with a points program. American Express calls its program Membership Rewards, while Chase has Ultimate Rewards® and Citi pays in ThankYou points. Wells Fargo has Wells Fargo Rewards, and U.S. Bank has FlexPerks. Bank of America® travel cards offer points without a fancy name. Travel cards from Capital One, Barclays and Discover all call their points "miles."

These programs differ in how much their points are worth and how you can use them. Some offer the full range of redemption options, including transfers to loyalty programs. Others let you use them only to book travel or get statement credit.

» MORE: Travel loyalty program reviews

Evaluating airline credit cards

What you get with an airline credit card.

Airline credit cards earn "miles" with each purchase. You typically get 1 mile per dollar spent, with a higher rate (2 or more miles per dollar) on purchases with the airline itself. (Some airline cards have also begun offering extra miles for purchases in additional categories, such as restaurants or car rental agencies.) These miles go into the same frequent-flyer account as the ones you earn by flying the airline, and you can redeem them for free flights with the airline or its alliance partners.

Co-branded airline cards typically offer sign-up bonuses (or welcome offers). But what really sets them apart are the perks they give you. With some cards, for example, the checked-bag benefit alone can make up for the annual fee after a single roundtrip by a couple. Common perks of airline cards include:

Free checked bags. This commonly applies to the first checked bag for you and at least one companion on your reservation. Some cards extend this perk to more people, and higher-end cards (with higher annual fees) may even let you check two bags apiece for free.

Priority boarding. Holders of co-branded airline credit cards often get to board the plane early — after the airline's elite-status frequent flyers but before the general population. This gives you time to settle in and gives you a leg up on claiming that coveted overhead bin space.

In-flight discounts or freebies. You might get, say, 25% off the cost of food and beverages during the flight, or free Wi-Fi.

Airport lounge access. High-end cards often include a membership to the airline's airport lounges, where you can get away from the frenzy in the terminal and enjoy a complimentary snack. Some less-expensive airline cards give you only limited or discounted lounge access; others give you none at all.

Companion fares. This perk lets you bring someone with you for a lower cost when you buy a ticket at full price.

A boost toward elite status. Miles earned with a credit card, as opposed to those earned from actually flying on the airline, usually do not count toward earning elite status in an airline's frequent-flyer program. However, carrying an airline's high-end card might automatically qualify you for a higher tier within the program.

The biggest U.S. airlines — American, United and Delta — offer an array of credit cards. Each airline has a no-annual-fee card that earns miles on purchases but provides little in the way of perks (no free bags or priority boarding). Each has a high-end card with an annual fee in the neighborhood of $450 that offers lounge access and sumptuous perks. And each has a "middle-class" card with a fee of around $100 and solid ongoing perks. Southwest offers three credit cards with varying fees; smaller carriers may just have a single card.

» MORE: NerdWallet's best airline credit cards

Choosing an airline

Which airline card you get depends in large part on what airline you fly, and that's heavily influenced by where you live. Alaska Airlines, for example, has an outstanding credit card, but the airline's routes are concentrated primarily on the West Coast. So it's not a great option for those who live in, say, Buffalo, New York, or Montgomery, Alabama.

If your local airport is dominated by a single airline, then you're probably flying that carrier most (or all) of the time by default. Delta, for example, is the 800-pound gorilla at Minneapolis-St. Paul and Salt Lake City. United has the bulk of the traffic at Newark and Washington Dulles. American calls the shots at Charlotte and Dallas-Fort Worth. That airline's credit card may be your only realistic option. If you're in a large or midsize market with frequent service from multiple airlines, you have more choice.

» MORE: How to choose an airline credit card

Evaluating hotel credit cards

What you get with a hotel card.

Hotel credit cards earn points with each purchase. As with airline cards, you typically get more points per dollar for purchases from the co-brand partner, and some cards also give bonus points in additional categories. (Hotel cards tend to give you a greater number of points overall than airline cards, but each individual point is generally worth less than a typical airline mile.) Similar to the airline model, the points you earn with the card go into the same loyalty account as the points you earn from actually staying at a hotel. You redeem your points for free stays.

Hotel cards usually offer a sign-up bonus, but like airline cards, they really make their bones with the ongoing perks. Common perks on hotel cards include:

Free nights. Several cards offer this perk, which can make up for the card's annual fee. You may get a free night automatically every year, or you may unlock it by spending a certain amount within a year. In the latter case, it comes on top of the points you earn for your spending.

Upgrades and freebies. Cardholders may qualify for automatic room upgrades when available, or free or discounted amenities such as meals or spa packages.

Early check-in/late check-out. No one likes having to cool their heels in the hotel lobby waiting for 3 o'clock to check in. And no one likes have to vacate their room by 11 a.m. when their flight doesn't leave till evening.

Accelerated elite status. Some hotel cards automatically bump you up a level in their loyalty program just for being a cardholder.

» MORE: NerdWallet's best hotel credit cards

Choosing a hotel group

If you decide to go the hotel-card route, you'll need to decide which hotel group gets your business. Hotels aren't as market-concentrated as airlines, so if your travels take you mostly to metropolitan areas, you'll have a decent amount of choice. Keep in mind that even though there are dozens of nationally recognizable hotel brands, ranging from budget inns to luxury resorts, many of them are just units in a larger hotel company, and that company's card can unlock benefits across the group.

Marriott, for example, includes not only its namesake properties but nearly 30 other brands, including Courtyard, Fairfield, Renaissance, Residence Inn, Ritz-Carlton, Sheraton and Westin. The Hilton family includes DoubleTree, Embassy Suites, Hampton Inn and Waldorf-Astoria. InterContinental includes Holiday Inn, Candlewood, Staybridge and Crowne Plaza. Wyndham and Choice have more than 15 mid-tier and budget-oriented brands between them.

HOW TO COMPARE TRAVEL CREDIT CARDS

No travel rewards credit card is going to have everything you want. You're going to be disappointed if you expect to find a high rewards rate, a generous sign-up bonus, top-notch perks and no annual fee. Each card delivers value through a different combination of features; it's up to you to compare cards based on the following features and choose the best travel credit card for your needs and preferences.

Most of the best travel cards charge an annual fee. Fees in the range of $90 to $100 are standard for travel cards. Premium cards with extensive perks will have fees of $450 or more. Weigh the value of the rewards and perks you'll get to make sure they'll make up for the fee.

Can you find good cards without an annual fee? Absolutely! There are no-fee options on our list of the best travel credit cards, and we've rounded up more here . Just be aware that if you go with a no-fee travel card, you'll earn rewards at a lower rate, your sign-up bonus will be smaller, and you won't get as many (if any) perks.

Rewards rate

Rewards can be thought of in terms of "earn rate" and "burn rate".

The earn rate is how many points or miles you receive per dollar spent. Some general travel cards offer flat-rate rewards, meaning you get the same rate on all purchases, all the time — 2 miles per dollar, for example, or 1.5 points per dollar. Others, including most co-branded cards, offer a base rate of maybe 1 point per dollar and then pay a higher rate in certain categories, such as airline tickets, hotel stays, general travel expenses or restaurant meals.

The burn rate is the value you get for those points or miles when you redeem them. The industry average is about 1 cent per point or mile. Some cards, particularly hotel cards, have lower value per point on the "burn" side but give you more points per dollar on the earning side.

When comparing rewards rates, don't just look at the numbers. Look at the categories to which those numbers apply, and find a card that matches your spending patterns. Getting 5 points per dollar seems great — but if those 5X points come only on purchases at, say, office supply stores, and you don't spend money on office supplies, then you're getting lousy value.

Sign-up bonus

Travel cards tend to have the biggest sign-up bonuses — tens of thousands of points that you earn by hitting a certain amount of spending. But there's more to consider when comparing sign-up bonuses than just how many points or miles you earn. You must also take into account how much you have to spend to earn the bonus. While cash-back credit cards often require just $500 to $1,000 in spending over three months to unlock a bonus, travel cards commonly have thresholds of $3,000 to $5,000.

Never spend money you don't have just to earn a sign-up bonus. Carrying $3,000 in debt for a year in order to earn a $500 bonus doesn't make economic sense — the interest you'll pay could easily wipe out the value of the bonus.

Finally, keep in mind that the biggest bonuses will come on cards with annual fees.

Foreign transaction fees

A good travel card will not charge a foreign transaction fee. These fees are surcharges on purchases made outside the U.S. The industry standard is about 3%, which is enough to wipe out most if not all of the rewards you earn on a purchase. If you never leave the U.S., then this isn't much of a concern, but anyone who travels abroad should bring a no-foreign-transaction-fee card with them.

Some issuers don't charge foreign transaction fees on any of their cards. Others charge them on some cards but not all.

International acceptance

Not all travel credit cards are great companions for international travel. While Visa and Mastercard are good pretty much worldwide, you may encounter limited acceptance for American Express and, especially, Discover, depending on the destination. This doesn't mean world travelers should dismiss AmEx and Discover. Just know that if you take one of these cards with you overseas, you'd be smart to bring along a backup in case you run into acceptance problems. (Having a backup card is good advice within the U.S., too, really.)

Travel protections

Consider which travel protections — car rental insurance , trip cancellation coverage , lost baggage protection — are important to you.

"Rewards" are what you get for using a credit card — the points earned with each transaction and the bonuses you unlock with your spending. "Perks" are goodies that you get just for carrying the card. There's a very close correlation between the annual fee on a card and the perks you get for carrying it. Cards with no annual fee are all about rewards and go very light on perks. Premium cards with annual fees of $450 or more are laden with perks (although sometimes their rewards aren't too special). Midtier cards (in the $100 range) tend to have solid rewards and a handful of high-value perks.

Assuming you take advantage of them, the perks often make up for the annual fee on a card quite easily. This is especially true with co-branded cards. Free checked bags can pay for an airline card several times over, and a free night is usually worth more than the fee on a hotel card. When comparing the perks of various cards, be realistic about which ones you will and won't use. Sure, that card may entitle you to a free spa package the next time you're at a five-star hotel, but how often do you stay at five-star hotels?

SHOULD YOU GET A TRAVEL CARD? PROS AND CONS

Pros: why it's worth getting a travel card.

The sign-up bonus gives you a big head-start on travel. Bonuses on the best travel credit cards typically run $500 or more — enough for a roundtrip ticket in many instances.

Perks make travel less expensive and more relaxing. You won't have to worry about cramming a week's worth of clothes into a carry-on if your travel credit card gives you a free checked bag (or automatically reimburses you for the bag fee). Hate the crush of travelers in the terminal? Escape to the airport lounge. Renting a car? Use a travel card that provides primary rental car insurance.

Rewards get you closer to your next trip with every purchase. Spending money on the mundane activities of daily life has a silver lining when you know that every $1,000 you spend will knock $10 or $20 off the cost of that future beach vacation or trip home to see Mom and Dad.

No foreign transaction fee can mean big savings. Take just any old credit card with you on vacation outside the U.S., and $1,000 worth of purchases can cost you $30 off the top due to the foreign transaction surcharge. Good travel cards don't charge this fee.

"Double dipping" gives you more points on travel purchases. Buy a plane ticket or book a hotel room, and you'll earn loyalty points or miles regardless of how you pay. Use the right credit card, though, and you'll earn even more points and miles on top of those.

Strategic redemption can multiply your value. With cash-back credit cards, 1 cent is worth 1 cent, and that's just how it goes. The points and miles on many travel credit cards have variable value based on how you redeem them — booking travel with them vs. transferring them to a partner, booking domestic vs. international flights and economy vs. business class, staying at budget hotels vs. high-end resorts, and so on.

Cons: Why a travel card might not be for you

The best cards charge annual fees. In many cases, the value you get from a credit card more than makes up for the annual fee. But some people are dead set against paying a fee under any circumstances. If that's you, your options in travel cards will be sharply limited, and you won't get the perks that provide a big portion of the value on many cards.

Sign-up bonus spending requirements can be steep. A bonus worth $500, $600 or $700 is attractive, but only if you can afford to earn it with spending you were going to do anyway. If you have to amass thousands of dollars in debt and then pay interest on it, it's not worth it.

Travel cards aren't ideal for infrequent travelers. In the first year with a travel card, you're probably going to come out ahead: You can earn a big sign-up bonus, and several popular cards waive the first year's annual fee, too. In subsequent years, though, you'll break even on that fee only if you use the card enough to make up for it (with the rewards you earn and redeem and the perks you use). Infrequent travelers are more likely to get more total rewards from a cash-back card with no annual fee.

Cash back is simpler and more flexible. Some travel cards allow you to redeem your rewards only for travel. Others give you poor value unless you redeem for travel. Still others have complicated redemption options, making it hard to get the most out of your rewards. With cash-back credit cards, you can use your rewards on anything, you know exactly how much your rewards are worth, and redemption is usually simple.

Rewards cards tend to charge higher interest rates. If you regularly carry a balance from month to month, a travel credit card — or any rewards credit card — probably isn't your best choice. The interest you pay is eating up the value of your rewards. You're better off with a low-interest card that reduces the cost of carrying debt.

MAKING THE MOST OF YOUR TRAVEL CARD

Maximize your rewards with the following tips:

Plan your credit card application around a big purchase to earn the sign-up bonus.

Seize every opportunity to pick up the tab, especially if your travel credit card pays bonus rewards on dining; your friends can pay you back while you collect rewards.

Redeem rewards for travel instead of gift cards, merchandise or (in most cases) cash back to get the best value.

Join the loyalty program associated with a co-branded card — a frequent-flyer or frequent-guest program.

Shop for essentials in your card’s online bonus mall or through its exclusive offers, if available, to get extra rewards.

OTHER CARDS TO CONSIDER

It’s worth considering whether a travel credit card is even right for you in the first place. A NerdWallet study found that cash-back credit cards often earn more money — even for many travelers.

If you carry a balance from month to month, the higher interest rates typically charged by rewards cards can cancel out any rewards earned. If you have a good credit score, you're better off with a low-interest credit card that can save you money on interest.

A good travel credit card shouldn't charge foreign transaction fees, but there are good non-travel cards that also don't charge them. See our best cards with no foreign transaction fee .

If you value transparency and flexibility in your rewards, you can't go wrong with a cash-back card — and you can still use the rewards for travel, if you want.

Finally, if you're still not sure what's right for you, take a look at our best rewards credit cards for options beyond travel and cash back.

NerdWallet's Sam Kemmis contributed to this article.

To view rates and fees of the American Express® Gold Card , see this page . To view rates and fees of The Platinum Card® from American Express , see this page .

Last updated on September 6 , 2024

Methodology

NerdWallet's Credit Cards team selects the best travel rewards credit cards based on overall consumer value, as evidenced by star ratings, as well as their suitability for specific kinds of travelers. Factors in our evaluation include each card's annual fee, foreign transaction fees, rewards earnings rates, ease of use, redemption options, domestic and international acceptance, promotional APR period, bonus offers, and cardholder perks such as automatic statement credits and airport lounge access. Learn how NerdWallet rates credit cards.

Frequently asked questions

Travel credit cards earn points (sometimes called miles) each time you buy something. The standard earning rate is 1 to 2 points per dollar spent, and many cards give you extra points for certain purchases, particularly travel expenses. The value of a point depends on the card that earned it and how you redeem it, but a good rule of thumb is to assume each point is worth an average of about 1 cent.

Your points accumulate in a rewards account, where you can use them to pay for travel. Most cards let you book travel directly using a portal similar to those at online travel agencies or on airline and hotel websites, but instead of paying cash, you pay with your points. Depending on the card, you may also have the option of booking travel any way you want, paying for it with the card and then cashing in your points for a credit against those expenses.

Points and miles are just different names for the same thing: the currency used in a travel rewards program. Some travel credit cards call them points, some call them miles.

Airline frequent flyer programs have long used the term “miles” to refer to the rewards you earn for flying. That’s because at one time, you really did earn rewards according to how many miles you flew — the longer the flight, the more miles you earned. Nowadays, most domestic airlines give out “miles” based on how much you spend, not how far you fly, so they’re really just points. (There are a few exceptions, though, notably Alaska Airlines.)

Especially when it comes to redeeming your rewards, there’s no difference between points and miles. The number of points or miles you need is based mostly on the cost of what you’re redeeming them for. It takes more than 500 miles (value about: $5) to get a free 500-mile flight!

The value of a point or mile depends on the card you earned it with and how you redeem it. A common rule of thumb is to assume that each point or mile is worth an average of 1 cent, although you can certainly get a much higher (or lower) redemption value. See our travel loyalty roundup page for NerdWallet’s current valuations for airline miles and hotel points.

Travel credit cards fall into two main categories: co-branded and general-purpose.

• Co-branded travel cards carry the name of an airline or hotel chain. The rewards you earn on the card can typically be redeemed only with that brand (or maybe its partners). Co-branded cards limit your flexibility, but because they are issued in partnership with an airline or hotel, they can give you special perks, like free checked bags or room upgrades.

• General-purpose travel cards are issued by a credit card company and are not directly tied to any particular airline or hotel. They earn points in the issuer's own program, such as American Express Membership Rewards, Chase Ultimate Rewards® or Citi ThankYou. These points are a lot more flexible, as you can use them to pay for a range of travel expenses, including flights on any airline or stays at any hotel. However, they don’t offer the airline- or hotel-specific perks of co-branded cards.

Travel cards — like rewards cards in general — typically require good to excellent credit for approval. Good credit is generally defined as a credit score of 690 or better. However, credit scores alone do not guarantee approval. Every issuer has its own criteria for evaluating applications.

Business travel can earn credit card rewards just like leisure travel. Credit cards that earn rewards for travel purchases don't distinguish between one or the other — meaning, if a card pays 3X points on airfare, for example, it's going to pay it no matter why you're buying the ticket. There are also travel credit cards specifically designed for business operators, with benefits and perks better aligned with their needs.

Where things get complicated is when you're not arranging the travel yourself. With credit card points, the rewards go to the cardholder. So if you arrange travel through your employer and the cost goes on the "company card," then the company card gets the points. Put it on your own card and get reimbursed later, and you get the points. (And if you have a company card with your name on it? That may come down to company policy.)

When redeeming travel rewards, you want to get as much value as possible. If you can get more value by using your rewards than by using cash, then it's smart to do so. (And of course, the reverse also applies.) NerdWallet has calculated the baseline values of most major credit card points, airline miles and hotel points. When you get a value that exceeds these baselines, go ahead and use your rewards. If not, consider using cash.

For example, say you could book a trip by paying $400 cash for a ticket or by redeeming 50,000 points or miles. In that case, your points would be getting you a value of 0.8 cents apiece (50,000 x 0.8 cents = $400). If the baseline value of each point is 1 cent, then you're better off paying cash and saving the points for when you can redeem them for 1 cent or better.

That said, you don't want to be overthinking it and hoarding points indefinitely in search of the deal to end all deals. Like any other currency, travel rewards lose value over time. That flight that costs 50,000 points today might cost 55,000 next year. Do you have enough points to get you where you want to go, when you want to go, in the way you want to get there? If so, don't let fractions of a penny stop you from booking your trip. It's your money, and you get to decide how to spend it.

A number of travel credit cards come with "travel credits," which reimburse you for specific expenses. The Chase Sapphire Reserve® , for example, has a $300 annual travel credit; several cards offer credits toward things like airline fees or hotel bookings; and a bunch of cards have a credit for the application fee for TSA PreCheck or Global Entry .

The less restrictive a credit is, the easier it is to redeem. The easiest travel credit to redeem is one that:

Applies to a broad range of expenses. Some credits are very fickle. You may get $200 a year in "airline credit," but it applies only to incidental fees (not airfare) on a single airline that you have to choose ahead of time. A card may offer hundreds of dollars in credit toward travel, but you have to go through the issuer's booking portal, where rates may be more expensive and options more limited. Other credits, however, are broad and open-ended: $300 on any travel expense, $100 toward any airline booking, and so on.

Shows up automatically on your statement. Your issuer's system should be able to recognize qualifying expenses and then apply the credit to them without you having to do anything. If the only way to receive the credit is by calling a phone number or submitting receipts or other documentation, that makes it harder to redeem, which in turn makes it less likely that you'll redeem (and that may be the point).

About the author

Sara Rathner

Istanbul.tips

Unique Routes and Hidden Gems

The Guide to IstanbulKart: Price, Where to Buy & How to Use Istanbul Transport Card

Discover the wonders of Istanbul with ease using the IstanbulKart, the city’s all-in-one public transportation card. Navigate the city like a pro with our comprehensive guide, covering everything from purchasing and loading credit to utilizing special offers and navigating the diverse transportation options available.

Page Contents

What is IstanbulKart?

IstanbulKart is a versatile, prepaid smart card designed to provide full access to Istanbul’s extensive public transportation system, including the metro, buses, trams, ferries, and more.

See also: Unlimited City Travel Card

Do I Need an Istanbul Card?

With Istanbul Card, you can navigate transport more easily and cheaply. The prices are better when you pay with it (almost 50% less) and you won’t need to find ticket booth and stay in the queue every time you need a ride.

Importantly, one Istanbulkart can be used by an individual or shared among a family, adding to its convenience. However, it’s worth noting that there is no monthly spending limit of 2500 TL for the Istanbulkart.

An excellent alternative is the Istanbul City Card , specifically designed for tourists, providing unlimited transport access.

Where and How to Buy Istanbulkart

Istanbul new airport (ist).

Upon arrival at Istanbul Airport, you can purchase your IstanbulKart from yellow/blue vending machines or authorized exchange offices located on the -2 arrivals floor.

Sabiha Gokcen Airport

You can purchase an Istanbul public transport card from the kiosk located on the street level across from the exit of the arrivals terminal.

Alternatively, you may buy it from IETT’s supervision booth at the public bus station after exiting the terminal if you intend to take the public bus to your destination.

Metro Stations and Other Locations

IstanbulKart can also be acquired from over 2,000 points across the city, including subway, tram, ferry, metrobus, and funicular stations. Look for yellow/blue vending machines or ticket-matics and kiosks near public bus stops.

Supermarkets & Local Booth

You can also purchase an Istanbulkart at various supermarkets, including BIM, SOK, Migros, and local booths. Look for IstanbulKart signs.

IstanbulKart Vending Machines

These user-friendly machines allow you to purchase an IstanbulKart by depositing cash. Simply follow the on-screen instructions and use banknotes of 5, 10, 20, 50, 100, or 200 TRY.

IstanbulKart Pricing: Know the Costs

Card Price: The Anonymous IstanbulKart costs 70 TL without any credits. It is the red city card.

IstanbulKart is a pre-paid and rechargeable card, which means you’ll need to load credits onto it before using it for public transportation.

Fare System, Transfers, and Discounts

The fare system is based on zones and pricing structures, with opportunities for transfers and discounts. IstanbulKart offers substantial savings compared to single-ride tickets.

Understanding Fares and Pricing of Public Transport Options with IstanbulKart

- Buses: 17,7 TL

- Tram: 17,7 TL

- Metro: 17,7 TL

- Metrobus: from 12,67 TL

- Cable Car: 17,7 TL

- Funicular: 17,7 TL

- Ferry: from 19,53 TL

- Marmaray Train: from 17,7 TL

Check all prices and transfer discounts here.

Fare Zones and Pricing Structure

Metrobus, some ferry routes, and Maramray IstanbulKart fares are determined by a zonal pricing structure, where the cost of a journey depends on the number of stops.

After using your IstanbulKart on the Ferry, Marmaray Train or Metrobus, you can place your card on a special stand near the exit to receive a refund for the part of trip on your card.

Stress-Free Transport Cards for Your Istanbul Adventure

If the Istanbulkart system seems a bit complicated for you, we recommend booking a transport card, pre-charged with 5 or 10 rides, for a seamless travel experience in Istanbul. Available for pickup at Havalines Kiosks at the airport or delivered to your hotel, this card allows you to effortlessly navigate the city and focus on soaking up the rich history and culture that Istanbul offers.

Loading Credit onto Your IstanbulKart

To add credit to your IstanbulKart, put the card onto a yellow/blue vending machine, wait for it to scan, and then deposit cash. Alternatively, you can top up your card online at Istanbulkart .

How Much Money Should I Load?

When using the Istanbul card for public transportation, it’s important to consider your approximate usage and load the card with the appropriate amount of cash. The yellow vending machines, which are the most common machines for loading the card, do not give change in return. This means that if you load more cash than you need, you won’t be able to get the excess cash back.

If you plan to take at least 20 rides on Istanbul’s public transportation system, it’s recommended that you load up to 400 TRY onto your IstanbulKart to ensure you have sufficient credit.

IstanbulKart Mobile: A Digital Option

IstanbulKart Mobile is an app developed by the Municipality of Istanbul, enabling users to manage their card and load credits online. It offers a convenient alternative to physical cards and can be found on both the App Store and Google Play.

How to Set Up and Use IstanbulKart Mobile

To start using IstanbulKart Mobile, download the app from your device’s app store and create an account. Once logged in, you can add your IstanbulKart details, check your balance, and top up credits as needed. The app also offers an English version for international users.

How to Use Istanbul Card?

When boarding a metro, tram, bus, ferry, or funicular, you will see card readers at the entrance. Simply hold your Istanbulkart up to the reader until you hear a beep, which indicates that your card has been successfully read.

It’s important to remember to tap your card again when you exit the transportation mode. This is necessary to calculate the correct fare for your journey, and to ensure that you’re not charged extra for not tapping out.

Transfers and Discounts: How to Save on Your Trips

IstanbulKart allows you to transfer between different modes of transportation, such as metro, tram, bus, and ferry, for a reduced fare. This means that you can easily switch between modes of transportation without having to pay for each trip separately, which can add up quickly. Read more…

The Istanbul City Card: Unlimited Transport Access for Your Trip

Unlock the wonders of Istanbul with the Istanbul City Card , a passport to unlimited public transportation throughout the city. Effortlessly navigate its vibrant streets, hopping between enchanting attractions and soaking up the rich tapestry of local life.

The Istanbul City Card comes with 1-3-5-7-15 day options for you to choose from, so you can tailor your experience to the length of your stay and explore Istanbul to your heart’s content. Say farewell to ticket queues and embrace the freedom to roam, as this indispensable pass propels you on an unforgettable urban adventure.

Easily purchase it online and have it delivered to your hotel for ultimate convenience. To buy a transport card, click on the link below and click “Book this attraction” after that:

IstanbulKart for Families and Groups

Child fares and family discounts.

Children under the age of six can travel for free on public transportation in Istanbul.

Find more places to visit with kids in Istanbul >>

Another important thing to keep in mind is that the Istanbulkart is not a personal card. If you’re traveling with a group, you can purchase only one card and use it for each passenger. Keep in mind that each card has a 2 500 TL monthly limit and you will need to buy another one if you exceed it. Also, children under the age of 6 do not need a card.

IstanbulKart Online with Free Hotel Delivery/Airport Pick-Up

Traveling to a new city can be overwhelming, especially when it comes to navigating the public transportation system. But did you know that you can also purchase and receive your IstanbulKart online with free hotel delivery or airport pick-up?

Istanbul Welcome Card offers this convenient service for those who want to skip the hassle of waiting in line and buying their IstanbulKart from vending machines or kiosks. With Istanbul Welcome Card, you can have your IstanbulKart delivered directly to your hotel in the areas of Taksim, Sultanahmet, and Besiktas, or you can pick it up at the airport between 8:00 AM and 11:00 PM.

IstanbulKart is Still a Must-Have

IstanbulKart provides an affordable, efficient, and convenient way to explore Istanbul’s public transportation system, granting you access to various modes of transport and helping you save money on your journeys. It’s an essential travel companion for tourists visiting the city.

You Might Be Interested in

- Istanbul in May: Weather & Things to Do, Events in 2024

- Explore Maltepe in Istanbul (Asian Side): Things to Do & See, Hotels, Restaurants (2024)

- Combo Tickets and Guided Tours to Blue Mosque (2024)

- Hagia Sophia History Museum: Collection, Entry Fees & Opening Hours (2024)

- Nightlife in Istanbul: Best Clubs, Bars, and Areas (2024)

Don’t Miss The Best Tours and Cruises in Istanbul

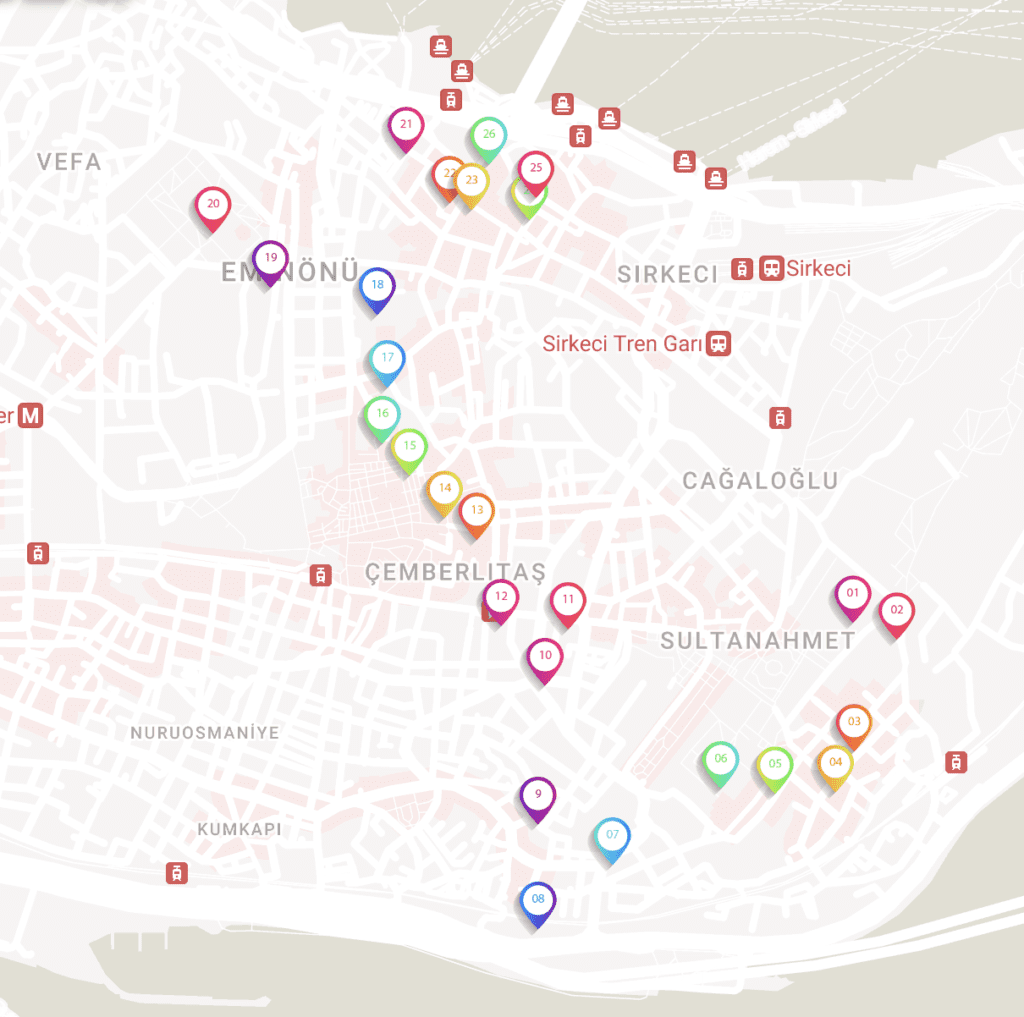

Old City Digital Route №1

A step-by-step guide to uncovering Istanbul’s hidden gems beyond Sultanahmet. Access the route via Google Maps and a handy PDF guide, both packed with:

- Local dining spots for any budget

- Currency exchange tips

- Recommended hotels in Fatih

- Directions from the airport to Sultanahmet

- Souvenir and gift ideas

Similar Posts

Süleymaniye Mosque in Istanbul (Fatih): What to See, Hours and Tips 2024

Save up to 70% on Museums & Attractions with Istanbul E-Pass Pay Once and Have Free Attractions Entry for 2, 3, 5 or 7 days Save up to 70% As you explore the captivating city of Istanbul, the striking silhouette of the Süleymaniye Mosque is hard to miss. A masterpiece of Ottoman architecture, this magnificent…

How to Get from New Istanbul Airport (IST) to Kadikoy and Back: Metro, Havaist Shuttle Bus, Transfer, and Taxi (2024)

Save up to 70% on Museums & Attractions with Istanbul E-Pass Pay Once and Have Free Attractions Entry for 2, 3, 5 or 7 days Save up to 70% Istanbul, the city that straddles two continents, is a melting pot of history, culture, and stunning landscapes. This guide will help you smoothly traverse the distance…

Istanbul Naval Museum: What to See, Entrance Fee, and Opening Hours (2024)

Save up to 70% on Museums & Attractions with Istanbul E-Pass Pay Once and Have Free Attractions Entry for 2, 3, 5 or 7 days Save up to 70% Welcome aboard! Prepare to dive into the depths of Istanbul’s rich maritime history at the Istanbul Naval Museum. This captivating museum offers a mesmerizing journey through…

Sapphire Tower Istanbul: What to See, Working Hours & Entry Fees (2024)

Save up to 70% on Museums & Attractions with Istanbul E-Pass Pay Once and Have Free Attractions Entry for 2, 3, 5 or 7 days Save up to 70% Welcome to your ultimate guide for visiting the Sapphire Tower Istanbul in 2024. As an enchanting metropolis with rich history, vibrant culture, and countless attractions, Istanbul…

Exactly How Many Days in Istanbul? An Expert Guide

Save up to 70% on Museums & Attractions with Istanbul E-Pass Pay Once and Have Free Attractions Entry for 2, 3, 5 or 7 days Save up to 70% Istanbul, a city that effortlessly straddles two continents, is a traveler’s dream come true. With its rich history, diverse culture, and mouthwatering cuisine, it’s no wonder…

Fast Food in Istanbul: McDonald’s, Burger King, and Turkish Fast Food Brands (2024)

Save up to 70% on Museums & Attractions with Istanbul E-Pass Pay Once and Have Free Attractions Entry for 2, 3, 5 or 7 days Save up to 70% Istanbul, a city famous for its rich culture and history, also has thriving fast-food restaurants. From kebap food culture to the new generation of steakhouses, the…

One Comment

We recently visited Istanbul and bought 4 red card to travel with. There was no one about at the airport to ask how to buy one or load money onto it. However, a commuter helped us purchase them and we travelled both on the metro and trams which was good. When we got to the airport and went to the same place where we bought the cards, we found that it was not refunding the money back to us. Again no one to ask and nothing on the card machine to tell you how. There was a small machine that refunds ‘tap’ here but error message kept coming up. We still have monies loaded on our cards and do not know how to obtain refunds. Any advice would be much appreciated.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Is the AAdvantage Aviator Red Mastercard the best credit card for you?

- How to earn miles

How to use American Airlines miles

- Benefits and features

Fees and costs

- Barclays AAdvantage Aviator Red vs other American Airlines credit cards

- Frequently asked questions (FAQ)

AAdvantage Aviator Red card review

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: AAdvantage® Aviator® Red World Elite Mastercard®, Citi® / AAdvantage® Executive World Elite Mastercard®, American Airlines AAdvantage® MileUp®, Citi® / AAdvantage® Platinum Select® World Elite Mastercard®. The details for these products have not been reviewed or provided by the issuer.

With a generous, easy-to-earn welcome bonus and elite-like travel perks, the AAdvantage® Aviator® Red World Elite Mastercard® is well worth it for frequent or occasional American Airlines flyers. The annual fee of $0 intro for the first year, then $99 is manageable, and other benefits like travel insurance and discounts can save you money.

Earn 1-2x miles on purchases

$0 intro for the first year, then $99

0% intro APR for 15 months on balance transfers made within 45 days of account opening

20.24%, 24.24% or 29.24% variable

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You’ll earn the welcome bonus after making your first purchase and paying the annual fee

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Free checked bag and preferred boarding on American Airlines

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Inflight Wi-Fi statement credits

- con icon Two crossed lines that form an 'X'. To earn a companion certificate you have to spend $20,000 or more in a year

- con icon Two crossed lines that form an 'X'. Annual fee isn’t waived the first year

- con icon Two crossed lines that form an 'X'. No bonus categories outside of American Airlines purchases

- The information related to the AAdvantage® Aviator® Red World Elite Mastercard® has been collected by Business Insider and has not been reviewed by the issuer.

- Earn 50,000 AAdvantage® bonus miles after making your first purchase within the first 90 days

- Earn 2X miles for every $1 spent on eligible American Airlines purchases

- Earn 1X miles for every $1 spent on all other purchases

- Get up to $25 back as statement credits on inflight Wi-Fi purchases each year on American Airlines operated flights

- Earn a Companion Certificate good for 1 guest at $99 (plus taxes and fees) if you spend $20,000 on purchases and your account remains open for 45 days after your anniversary date

- Receive 25% inflight savings as statement credits on food and beverages when you use your card on American Airlines operated flights

AAdvantage Aviator Red Mastercard Overview

The AAdvantage® Aviator® Red World Elite Mastercard® is best for frequent American Airlines flyers or anyone looking to give their AAdvantage balance a boost. Perks include free checked bags, a 25% discount on inflight food and beverage purchases, up to $25 in annual credit towards inflight Wi-Fi, a $99 annual Companion Certificate when you meet a spending threshold, and priority boarding.

The card comes with a generous welcome bonus offer of 50,000 AAdvantage® bonus miles after making your first purchase within the first 90 days. This is by far the lowest minimum spending requirement of any airline credit card .

While the card's category bonuses aren't the most competitive, every dollar you spend will count towards AA elite status. Combined with a reasonable annual fee and an easy sign-up bonus, this card is an excellent option for a wide range of travelers.

Keep in mind American Airlines has four personal co-branded credit cards , ranging from the premium Citi® / AAdvantage® Executive World Elite Mastercard® to the no-annual-fee American Airlines AAdvantage® MileUp® . Depending on how often you fly American Airlines and your spending habits, one of these cards could be a better fit.

How to earn miles with the AAdvantage Aviator Red card

The AAdvantage® Aviator® Red World Elite Mastercard® earns 2 miles per dollar spent on eligible American Airlines purchases and 1 point per dollar on everything else. AA purchases that qualify include eligible tickets, goods, and services purchased directly from American Airlines (purchases made through online third-party travel agencies don't count).

The card also offers one of the most attainable welcome bonuses out there: 50,000 AAdvantage® bonus miles after making your first purchase within the first 90 days.

While the welcome bonus is quite generous, the AAdvantage® Aviator® Red World Elite Mastercard® isn't the best AAdvantage card for everyday spending. The category bonuses are limited, especially compared to the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® , which earns 2x miles on American Airlines purchases, restaurants, and gas stations, and 1 mile per dollar on all other eligible purchases.

As one of the few airlines still publishing an award chart, American Airlines makes it easy to determine how far your miles will go. With the welcome bonus offer from the AAdvantage® Aviator® Red World Elite Mastercard®, you can book up to four round-trip tickets in economy class.

These awards sometimes go on sale as part of American Airlines' Web Specials. You can book award tickets as cheap as 5,000 miles each way during these sales.

Alternately, you can redeem AAdvantage miles for American Airlines vacations or Admiral's Club membership at 1 cent per mile. This isn't a good redemption since American Airlines miles are worth an average of 1.4 cents each (based on Business Insider's valuations ), and you can get a lot more value by using them for airfare.

AAdvantage Aviator Red benefits and features

The AAdvantage® Aviator® Red World Elite Mastercard® is packed with benefits that can help you save money on travel. The savings can really add up at every step of your journey, from check-in to boarding to the flight itself.

In fact, if you take just one trip per year with a companion, you might offset the annual fee through the free bag benefit alone.

Up to $25 back per year as statement credits on inflight Wi-Fi purchases

If you like to get work done on flights or simply watch the latest Tik Tok videos, you can do so with free Wi-Fi. The AAdvantage® Aviator® Red World Elite Mastercard® offers up to $25 in statement credits each anniversary year for inflight Wi-Fi purchases on American Airlines-operated flights.

Anniversary Companion Certificate

The Anniversary Companion Certificate is arguably the most valuable benefit this card offers. Cardholders who make at least $20,000 in purchases on this card in an anniversary year receive a round-trip qualifying domestic economy companion certificate valid for one guest. All you have to pay is $0 intro for the first year, then $99, plus taxes and fees.

In addition to meeting the $20,000 spending requirement, you have to keep your account open for 45 days after your anniversary date. Since the category bonuses on this card aren't the most lucrative, the Anniversary Companion Certificate offers a rewarding incentive to keep spending on this card. Those who earn and redeem this benefit annually will easily offset the card's $0 intro for the first year, then $99 annual fee.

25% savings on inflight food and beverage purchases

Food and drink expenses can really add up when you're traveling. With the AAdvantage® Aviator® Red World Elite Mastercard®, you can offset some of this spending. Cardholders receive 25% back as a statement credit on food and beverage purchases made with their card on American Airlines flights.

This benefit could be worthwhile if you fly American Airlines often, especially on long segments when you're more likely to pay for food and drinks.

First checked bag free

The free checked bag benefit is the most practical and lucrative benefit offered by the AAdvantage® Aviator® Red World Elite Mastercard®. American Airlines charges $30 for the first checked bag per person on domestic flights. That adds up to $60 round-trip for one person.

With the AAdvantage® Aviator® Red World Elite Mastercard®, you and four travel companions on the same reservation get your first checked bag free on American Airlines domestic itineraries. That's a savings of up to $150 each way.

Preferred boarding

If you prefer not to check your luggage, you can still benefit from the AAdvantage® Aviator® Red World Elite Mastercard®. Cardmembers and up to four companions traveling on the same reservation will receive preferred boarding on American Airlines flights.

The advantage of this perk is that you'll get to board earlier, giving you more opportunities to store your belongings. This decreases your chances of having to gate-check your bag due to a lack of overhead space.

Earn AAdvantage elite status from everyday purchases

American Airlines revamped its elite status requirements this year, introducing a new loyalty metric. AAdvantage members no longer have to rely on flying to earn elite status. With the new Loyalty Point system, all credit card spending counts towards elite status. Every dollar spent on the AAdvantage® Aviator® Red World Elite Mastercard® earns 1 Loyalty Point, regardless of the category bonus.

It's important to note that Loyalty Points are different from redeemable miles. While the AAdvantage® Aviator® Red World Elite Mastercard® offers several category bonuses, you'll only earn 1 Loyalty Point on every dollar spent.

Travel insurance

AAdvantage® Aviator® Red World Elite Mastercard® cardholders are eligible for travel accident insurance, trip cancellation and interruption coverage , baggage delay insurance, and car rental insurance.

AAdvantage Dining program

Your AAdvantage® Aviator® Red World Elite Mastercard® is automatically enrolled in the American Airlines AAdvantage dining program, which allows you to earn bonus miles when you dine at participating restaurants.

The AAdvantage® Aviator® Red World Elite Mastercard® has an annual fee of $0 intro for the first year, then $99, which is on par with most other mid-tier airline credit cards.

The card has no foreign transaction fees , which can be around 3% or more on other cards. This means you can use it to earn miles abroad without incurring a penalty.

Lastly, the AAdvantage® Aviator® Red World Elite Mastercard® offers a 0% intro APR for 15 months on balance transfers made within 45 days of account opening. After that, there's a 20.24%, 24.24% or 29.24% variable APR. A balance transfer fee of 5% or $5, whichever is greater, applies.

Comparison: Barclays AAdvantage Aviator Red vs other American Airlines credit cards

Aadvantage aviator red card frequently asked questions (faq).

If you fly American Airlines a couple of times a year and check bags, the AAdvantage® Aviator® Red World Elite Mastercard® is worth opening. The free checked bag perk alone can offset the card's annual fee, and if you can make use of other benefits, you'll receive even more value.

This is also a great choice for big spenders who can qualify for the card's annual companion certificate by spending $20,000 or more each year. Depending on how you use the certificate, it can translate into savings of hundreds of dollars.