A Safer Way to take your NZD on Holiday

The Travelex Money Card may be a safer way to take your New Zealand dollars with you when taking a trip to the land of the long white cloud. While it’s a good idea to take some cash and you can use most bank cards in NZ, carrying around large sums of cash can be nerve wracking, plus if something happens to your Travelex Money Card while you’re overseas you don’t have to worry about it being linked to any of your bank accounts!

Features and Benefits

UNLIMITED FREE overseas ATM withdrawals 1

Highly competitive exchange rates

NO fees when you buy online $0 Currency conversion fee ^

24/7 Global Assistance

Convenient Mobile App Download it here

Shop at millions of outlets wherever Mastercard is accepted and on international websites with the local currency

Buy online, collect in-store or get it delivered to your home (allow up to 7 days from when payment is received)

5 ☆ outstanding value award winning travel money card

Exclusive offers with Mastercard Priceless TM Cities

TAP & GO with your Android phone via Google Pay™ and Google Wallet™ Read more

How our Travel Card Works

Order your travel card.

Order your Travelex Money Card online or in-store (passport or driver's license required)

Get your travel card

Collect from a Travelex store or delivered FREE to your home (allow up to 7 days from when payment is received)

Download the App

Download the app from the Google Play and Apple App stores

Register for My Account

Simply activate your card by registering your account via the app or online

Manage and check your balance online and on your mobile

Exchange leftover currency

After your trip, exchange leftover money for another currency, transfer into your bank account or withdraw in-store or at an ATM.

Download the Travelex Travel Money App

Convenience on the go

- Top up your Travelex Money Card

- Check your balance

- Quick touch log in

The app requires Android 5.0 and up or iOS 10.0 or later. Compatible with iPhone, iPad and iPod touch.

Fees and Limits

NO fees online $0 Currency conversion fee ^

Withdraw daily up to AU$3,000 (or currency equivalent)

Maximum Card limit of AU$50,000

Free initial and replacement card

The following fees and limits apply. Fees and limits are subject to variation in accordance with the Terms and Conditions. Unless otherwise specified, all fees will be debited in AU$ Currency

If there are insufficient funds in AU$ Currency to pay such fees, then we will automatically deduct funds from other Currencies in the following order of priority: AU$, US$, EU€, GB£, NZ$, THB, CA$, HK$, JP¥, SG$.

• Online: FREE via travelex.com.au or the Travelex Money App • In-Store: FREE for loads of foreign currency (loads of Australian dollars (AUD) incur a fee of 1.1% of the amount or $15 whichever is greater).

• Online: FREE via travelex.com.au or the Travelex Money App • In-Store: FREE for top-ups of foreign currency (top-ups of AUD incur a fee of 1.1% of the amount or $15 whichever is greater). • BPAY: Top-ups not made via travelex.com.au or the Travelex Money App incur a fee of 1% of the amount. - MasterCard Biller Code: 184416 - Reference No: your 16 digit Travelex Money Card number - Funds will be allocated to your default currency. To check your default currency login to your account.

FREE (note: Some ATM operators may charge their own fees or set their own limits)

- Charged at the start of each month if you have not made any transactions on the card in the previous 12 months

- Unless your card is used again, or reloaded, this fee applies each month until the card is closed or the remaining card balance is less than the inactivity fee.

AU$4.00 per month

- Charged when you close your card or withdraw from your Card Fund. This fee is set and charged by Mastercard Prepaid.

- This is applied when you move your funds from one currency to another currency.

At the then applicable retail foreign exchange rate determined by us. We will notify you of the rate that will apply at the time you allocate your funds from one currency to another.

- Applied when a purchase or ATM withdrawal is conducted in a currency either not loaded or sufficient to complete the transaction and the cost is allocated against the currency/ies used to fund the transaction.

FREE* *The Spend Rate will apply to foreign exchange transactions in accordance with the Terms and Conditions.

AU$350 or currency equivalent AU$100 or currency equivalent

AU$50 or currency equivalent

The maximum amount you can load on the card at the time of the initial online purchase is AU$5,000 equivalent.

to a maximum of $10,050 per single top-up; and to a maximum of $10,050 top-up value over 24hrs; and to a maximum of $20,000 top-up value over 21 days.

AU$3,000 or currency equivalent

AU$15,000 or currency equivalent

Other Important Information

Please read the following information about your Travelex Money Card carefully:

- Your Travelex Money Card does not generate any interest or any other similar return. You do not earn interest on the amount standing to the credit of the Travelex Money Card Fund accessed by the card.

- Although the issuer of the card is an authorised deposit-taking institution in Australia, the Card is not a deposit account with the Issuer.

Important Information about Fees & Limits for loads/top ups made online:

- If you are making a purchase or topping up the Card online via www.travelex.com.au (i) the initial load and top up fee may differ to (but not be greater than) those contained in the “Fees and Limits Table” of this Product Disclosure Statement; and (ii) the limits may differ to those contained in the “Fees and Limits Table” of this Product Disclosure Statement. Travelex may also charge a card surcharge if you pay with a credit or debit card. Please refer to the relevant online terms and conditions available at www.travelex.com.au for details of the applicable fees and limits.

- AU$ cannot be loaded or topped up onto a card online via www.travelex.com.au

Terms & Conditions

Other ways to get foreign currency, everything about the new zealand dollar and all the easy options to access nzd with travelex.

- Travel Money Card

About NZD on Travelex Money Card online and in-store

- Travel Insurance

Discover more of the world with travel insurance by your side

All you need to know about NZD, how much things cost and how much you need

Get NZD from an ATM in Australia and when you arrive in NZ

- Other Services

About New Zealand

Guide to New Zealand places and experiences

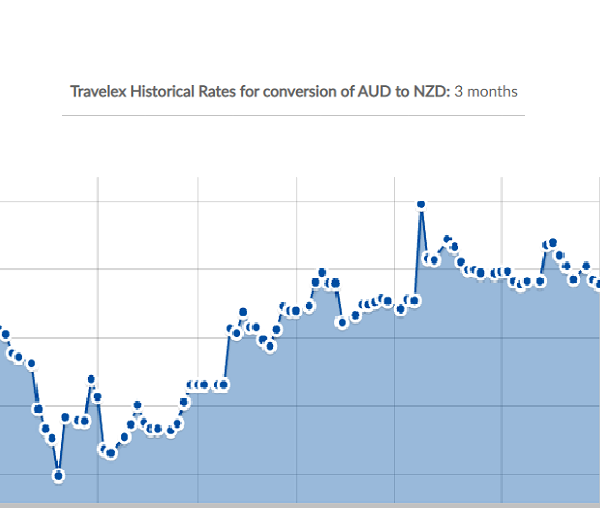

Historical Rates

Check out current and historical AUD to NZD Travelex rates

Track the NZD Rate

Receive an alert when the New Zealand dollar has reached your desired rate

- Find a Store

Purchase NZD cash, a Travelex Money Card or Transfer Money in-store

Travelex Travel Card Currency Information

Travel card faq links.

Getting Started

Using the Card

Topping up the Card

Travelex Money Card FAQ

You can only hold one card in your name at any one time.

Top-up via the Travelex website

Note that you must use your unique reference number when paying or the transfer may be delayed.

Top-up via the Travelex Money App

Move currencies on your card, instantly.

If you have AUD (or any other currency) already loaded on the card, you can move your funds to another currency within the Travelex Money App. Instant top-up!

Top-up in a Travelex store

Direct top-up via bpay:.

Top-ups not made via travelex.com.au or the Travelex Money App incur a fee of 1% of the amount. You must make payment using your own account.

MasterCard Biller Code: 184416 Reference No: your 16 digit Travelex Money Card number

Funds will be allocated to your default currency. To check your default currency login to your account. Top ups will generally take two business days to be processed however may take longer if the payment is not made before 2pm on a business day Australian Eastern Standard Time.

- Locking in fixed foreign currency exchange rates and avoiding foreign transaction fees before you travel

- The ability to load multiple currencies onto one card, similar to a travel debit card

- The ability to spend money conveniently and comfortably overseas

- No overseas ATM withdrawal fees

- No fees when making online purchases

- Travel money cards can be ordered online and collected in store next day.

- Just walk in store. Cards purchased and loaded in-store are active and ready-to-use on the spot. We will automatically transfer funds between currencies complete your card transactions.

- Home delivery within 5-7 business days.

Most common questions

An Additional Emergency card is a replacement card as back-up only which you must only use if your primary card is damaged, lost, misused or stolen. An Additional Emergency card can only be purchased at the time of purchasing the Travelex Money Card. It cannot be added to your account at a later date.

Yes, travel money cards come with a host of advantages that can save you money when travelling. These include the ability to load multiple currencies at a fixed and competitive exchange rate, and the capability to make purchases in-store, online, and at ATMs worldwide with no overseas ATM or withdrawal fees.

The best travel money card for your New Zealand trip should help you save money and access the most competitve exhange rate available. For example, a Travelex Money Card allows you to lock in exhange rates ahead of time, make purchases in-store and avoid overseas ATM or withdrawal fees.

While cash and bank cards are generally accepted in New Zealand, a Travelex Money Card can provide more security than carrying around large amounts of cash. Unlike a standard card, it’s not linked to any of your bank accounts so your money will stay safe even if your travel card gets lost or stolen.

A travel money card is a global currency card that allows you to load several foreign currencies into a personal account at a prevailing exchange rate . Like debit and credit cards, a travel money card can be used to make purchases in stores, online, and to withdraw cash at ATMs while travelling. You can buy currencies and add or reload them into your travel money card account via a mobile app whilst abroad.

One of the best ways to use the Travelex Money Card is with the Travelex Money App. The Travelex Money App makes ordering, transferring, and checking currencies quick and simple on your travel card. You can also use the Travelex travel exchange rate tracker to check currencies in real time.

You can order a travel money card online or purchase one directly from a Travelex store. Find a store near you.

Some of the benefits of a travel card include:

Money travel cards can be ordered online and topped up via a convenient mobile app.

The Travelex Money Card is a Mastercard travel card, meaning it is free to make international withdrawals at ATMs displaying the Mastercard acceptance mark. It is also free to obtain cash over the counter and to make online purchases with a travel money card. However, some ATM operators may charge their own withdrawal ATM fees. Be sure to check with the ATM in question prior to making cash withdrawals.

Similar to any bank account, you can withdraw money from your travel money card at ATMs worldwide. When withdrawing cash, select the “credit” option on the ATM machine screen to access funds. You will not be charged credit card fees by selecting this option. If the “credit” option does not work, try selecting “debit” or “savings”. The maximum withdrawal amount is 3,000 Australian dollars each 24 hour period. Bear in mind that some ATMs may also have their own ATM fee, adding a cost to your withdrawal.

The Travelex Money Card is a prepaid travel card and has been awarded the best prepaid travel card by Mozo two years in a row.

The Travelex Money Card is a multi currency card that can be used in most countries around the world. Widely considered the best travel money card for overseas travel, the Travelex Money Card can be used in the US, Europe, Japan, Canada, Hong Kong, Singapore, Japan, New Zealand, and many more countries.

More on New Zealand from our Travelex Hub Blog

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386 837) arranges for the issue of the Travelex Money Card in conjunction with the issuer, EML Payment Solutions Limited (‘EML’)(ABN 30 131 436 532, AFSL 404131). You should consider the Product Disclosure Statement for the relevant Travelex Money Card and Target Market Determination available at www.travelex.com.au , before deciding to acquire the product. Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

* Transacting via some online merchants may incur a surcharge.

- Join our Mailing List

- Price Promise

- About Travelex

- Best Ways to Buy Foreign Currency

- Travelex Money App

- Currencies Available to Buy

- Currency Converter

- Rate Tracker

- Sell Your Currency

- Travelex Travel Hub

- Australia Post

- Become an Affiliate

- International SIM Cards

Travelex Info

- Business Services

- Product Disclosure Documents and Terms & Conditions

- Website Terms of Use

- Privacy Policy

- Fraud & Scams

Join the conversation

Customer support.

Online Order Queries:

- Tel.: 1800 440 039

- Email: [email protected]

- Map: Suite 45.01, Level 45, 25 Martin Place, Sydney NSW 2000

Travelex: Travel Money Card

About this app

Data safety.

Ratings and reviews

- Flag inappropriate

What's new

App support.

Editorial note: We may not cover every product in this category. For more information, see our Editorial guidelines .

The 6 best travel money cards for new zealand in 2024.

New Zealand is one of the most visited countries by Australians, being one of our closest neighbours. It is full of pristine and breathtaking wilderness including walks, snow covered mountains and majestic fjords.

In New Zealand you are likely to pay for accommodation, food, transport and entertainment as well as withdraw cash from ATMs with your card.

We have analysed a number of the best overseas travel cards to take to New Zealand for Australians in 2024 and have summarised their best points.

Best 6 Travel Money Cards for New Zealand in 2024:

- Wise Travel Card for the best exchange rates

- Revolut Travel Currency Card for low fees

- Travelex Money Card - Best all rounder

- Australia Post Travel Platinum for best international prepaid debit card

- Westpac Travel Money Card for best prepaid card from major bank

- Macquarie Transaction Debit Card best debit card for use in Australia too

Wise Travel Card - Best Exchange Rates

- 40+ currencies available

- Best exchange rates globally

- One of the lowest conversion fee on the market

- No international transaction fees

- No annual or monthly fees

- Extremely low costs to send money overseas

Wise Travel Card

- Cross currency conversion fees are between 0.24–3.69%. AUD to USD, EUR or GBP was 0.42%, which is one of the lowest on the market

- Free cash withdrawals up to $350 every 30 days. However after that, Wise Card charge a fixed fee of $1.50 per transaction + 1.75%

- Daily ATM withdrawal is $2,700

- Issue up to 3 virtual cards for temporary usage

- It takes between 7 to 14 business days to receive your card

- Can be used wherever MasterCard is accepted

For those traveling to New Zealand, the Wise Travel Card offers a suite of benefits that are particularly well-suited for their travel needs. A standout feature of this card is the access it provides to over 40 currencies at the intermarket exchange rate, globally renowned for being the most cost-effective rate. However if you use ATMs frequently this is not the card to use due to the fees. Finally Wise Travel Card lets you transfer money to an overseas bank account with extremely low fees and the best exchange rate.

Revolut - Low Fees

- 30+ currencies available

- One of the best exchange rates globally

- No annual or monthly fees for standard membership

- No initial card fee

- Instant access to a range of cryptocurrencies

Read our Revolut Card Review

Revolut Travel Card

- No fee ATM withdrawals up to A$350, or 5 ATM withdrawals, whichever comes first, per rolling 30 day period and 2% of withdrawal amount (minimum charge of A$1.50) after that

- Exchanging currency on the weekend can incur a 1% mark-up fee

- Fees on international money transfers were introduced in April 2021.

- Can be used wherever Visa is accepted

The Revolut Travel Card is a decent option for those who travel a lot as it offers over 30 currencies at a great exchange rate, which is the cheapest rate globally. However if you exchange currency on the weekend you can incur a one-percent mark-up fee. In addition they have introduced fees for international transfers. Finally if you use ATMs frequently this is not the card to use due to the fees.

Travelex Money Card - Best All Rounder

Best features.

- Unlimited free ATM withdrawals

- 24/7 Emergency Assistance

- Initial and replacement card are free

- Lock in up to 10 currencies

- Travelex Travel Money app

Read our Travelex Travel Card Review

Travelex Money Card

Minimum load of $100 and maximum load of $100,000

Can be used wherever Mastercard is accepted

Fees include a $10 closure fee, $5 for an additional card and $4 inactivity monthly fee.

While Travelex don't charge ATM fees, some ATM operators may charge their own fees.

Currencies that can be loaded are AU$, US$, EU€, GB£ , NZ$, TH฿, CA$, HK$, JP¥, SG$

If your card is lost or stolen you can access cash in your account through Moneygram or Western Union agents, with no charge

Boingo hotspots offer free wifi and you can look at their number of free hotspots per country on this map

The Travelex Money Card is a good all-rounder no matter if you are heading to the vibrant cities of Auckland or Wellington, or exploring the stunning landscapes of the South Island.

You can use it to take money out of the ATM, for merchant purchases like restaurants and even for online shopping in foreign currency. While the exchange rates aren't as good as Wise or Revolut abroad , the support network if the card is lost or stolen is very good. This perk can be especially handy while experiencing the majestic sights of New Zealand.

Australia Post Travel Money Card - Platinum Mastercard

- Initial card and replacement cards are free

- No fee on reloads via bank transfers

- No monthly or inactivity fees

- Increased protection with Mastercard Zero Liability

- Access to cash from your account through the Global Emergency Assistance, if your card is lost or stolen

Currencies that can be loaded are NZD, AUD, USD, EUR, GBP, THB, CAD, HKD, JPY, SGD and AED

1.1% Admin fee for instore loads, including initial load

$5 fee for reloads via debit bank card

$10 closure fee

2.95% on withdrawals from Australian ATMs is expensive

$3.50 on withdrawals from overseas ATM is expensive

$3.99 + 5.95% fee on cross currency transactions

Min load of $100 and max of $100,000

If your card is lost or stolen you can access cash that is in your account through MoneyGram or Western Union agents, with no charge

Boingo hotspots offer the free wifi and you can look at their number of free hotspots per country on this map

The Australia Post Travel Platinum travel money card is the best of the prepaid cards in New Zealand as its exchange rate for New Zealand dollars is best when compared to Travelex, Commonwealth bank, HSBC or Citibank travel cards.

To avoid the fees on this card we advise to deposit a small amount instore for your initial load and deposit the rest by bank transfer to avoid fees. In addition we recommend this card for tap, swipe or insert card transactions only like paying for hotels, restaurants and entertainment. Do not use it for ATM withdrawals as the fees are expensive and avoidable if you use a different card like the Macquarie Transaction card.

Westpac Travel Money Card

- Best New Zealand dollar exchange rate offered by the major 4 banks

- No foreign transaction fees

- No fee on initial card, load, unload or inactivity fees

- No ATM fee at 50,000 Global Alliance ATMs worldwide

- Free additional card

Macquarie Transaction Account Debit Card

- No ATM fees in New Zealand

- No ATM fees in Australia

- No monthly fees or initial card fee

- No foreign transaction fee

- Contactless limit with no PIN up to $200 per transaction

- Joint accounts available

Learn more about the best credit, debit and prepaid cards for travel

Best Credit Card for International Travel

Best Prepaid Travel Cards

More Travel Card Guides

Learn more about the best travel money cards for your holiday destination.

ASIC regulated

Like all reputable money exchanges, we are registered with AUSTRAC and regulated by the Australian Securities and Investment Commission (ASIC).

S Money complies with the relevant laws pertaining to privacy, anti-money laundering and counter-terrorism finance. This means you are required to provide I.D. when you place an order. It also means the order must be paid for by the same person ordering the currency and you must show your identification again when receiving your order.

- Travel Money Cards

Wise: New Zealand’s Best Travel Money Card

Posted by Andrew Broadley June 16, 2022

Travel has been on the backburner for what feels like forever now. But with things finally opening up, many are looking to make up for lost time. And if you’re going to be leaving our shores behind, chances are you’ll be leaving your NZD, too.

While it’s easy and convenient to get foreign currency, it leaves you at the mercy of hidden fees and exchange rates. In fact, a quick trip to the ATM while abroad, or the currency exchange at the airport, can really sting.

Somehow, the exchange rate Google gives you is always far removed from what you actually end up with.

That’s where a travel money card can help. These cards let you load up foreign currency on them so you can swipe away without being stung by exorbitant overseas exchange rates and fees.

But while convenient, not all cards offer the same features or charge the same conversion fees. Indeed, some are as expensive as many overseas FX operators.

So as part of our mission to help consumers make the right choices, Canstar’s expert in-house researchers crunched the numbers on several travel money cards. Using our highly technical methodology and weighing up a variety of factors, we can now announce that Wise is our Travel Money Card | Card of the Year award winner for 2022.

What is Wise?

Wise goes far beyond a simple travel money card.

Wise provides users with a single multi-currency account, that allows people in their increasingly global lives to pay, to get paid, and to spend, in any currency – wherever they are and whatever they’re doing.

Through your Wise account, you can send, receive and spend multiple currencies, either online or with the Wise debit card.

All of this is done at the real market exchange rate, and with a single upfront low-cost exchange fee. Saving users, on average, 6x more than the traditional banks.

What does Wise offer?

A wise account offers:.

- Account details: get account details in nine countries (NZ, Australia, UK, US, Eurozone, Canada, Singapore, Hungary, Poland and Turkey) in minutes, so you can pay and get paid in those countries like a local

- Direct debits – share your AU, EU and UK account details with merchants to conveniently automate and pay bills and subscriptions

- BPAY: pay bills in NZ with BPAY, from around the world

- Balances: hold and convert 55 currencies instantly at the real exchange rate

- Debit card: use your card in around 200 countries and anywhere online, spend with Apple and Google Pay, and withdraw anywhere with no foreign transaction fees or exchange rate mark-ups

- Savings jars: stash away money in any currency, for rainy day funds, long-term savings and more. Money in jars can’t be spent using the debit card or used to pay via direct debit until it’s moved back to balances

- International money transfers: send money to over 70 countries at the real exchange rate, up to seven times cheaper than the banks and instantly when sending money with PayID

- Scheduled transfers: Set up recurring transfers to automate the process of sending money abroad

What does the Wise debit card offer?

- Spend: use the card in around 200 countries and anywhere online, spend with Apple and Google Pay, and withdraw anywhere with no foreign transaction fees or exchange rate mark-ups

- Free to use: no monthly subscription fees, no monthly maintenance fees and no transaction fees. Only a small conversion fee is charged if your card doesn’t have the local currency preloaded and currency conversion is required.

- Save money: spend at the real exchange rate, with no sneaky mark-ups

- Withdraw cash: for free at any ATM in the world

- Multiple currencies: hold and convert over 55 currencies instantly

- Security: set spending limits, freeze/unfreeze the card instantly in the app and get real-time notifications for every transaction

- Smart money-saving technology : automatically chooses the currency that offers the best conversion rate

- Virtual Visa Cards: add up to 10 virtual cards, each with a unique number to shop with and better manage expenses

How does a Wise debit card differ from other travel money cards?

The old school banks would let you convert your NZD to a currency of your choice, and load it onto a travel money card for you to take overseas with you. While this lets you conveniently spend abroad, without the fees, to do so you had to first exchange your NZD into the currency you wanted. And to do that, you had to use the bank’s exchange rates (which contain hidden mark-ups) and pay its fees.

With Wise, you can simply send NZD from your bank account to your Wise account (which is free) and then convert it to the currencies of your choice, all at the real market rate, and only pay a small upfront fee (around 0.45% of the amount exchanged). This account is linked to your Wise debit card, providing you with a debit card that holds multiple currencies and can be used anywhere Visa is accepted.

Not only is this great for spending abroad, but it’s great for shopping online, too. Traditionally when shopping on a site that bills you in a foreign currency, the payment has to be converted by the big banks, at unfair rates. With the Wise debit card, you can simply pay in that local currency (so long as you have that currency on your account), avoiding any exchange rate mark-up or fees.

How can Wise offer the real market rate and such low fees?

Wise states that it just simply doesn’t have the same overhead costs as the big banks, so it doesn’t have to charge as much. And this goes a long way in offering such low fees.

But furthermore, Wise uses a clever network of international bank accounts to bypass the cost of sending money abroad and converting currencies. And it passes those savings on to you.

Instead of sending money from your bank account to an overseas account, Wise uses its own local accounts in those countries to move money without it having to cross borders. Allowing it to send money as if a local transfer. And because it has accounts all across the globe, you can effectively send and spend, at domestic rates, all over the globe!

For example:

- You want to send NZ$1000 to family living in the US

- NZ$1000 is withdrawn from your bank account (or Wise account) and deposited into a local bank account belonging to Wise

- A Wise US account then deposits the equivalent (in USD) into the recipient’s local US account

- As a result, no money has actually crossed borders

Travel money cards: what other options do you have?

While Wise is our Travel Money Card | Card of the Year Award winner, our team crunched the numbers on four other travel money cards in this year’s award.

Travelex Money Card

Westpac global currency card, mastercard cash passport platinum mastercard, air new zealand onesmart.

- Manage nine popular currencies on the go including: US dollar, Australian dollar, Euro, British pound, Canadian dollar, Singapore dollar, Japanese yen, Hong Kong dollar and NZ dollar

- No ATM fees

- 24/7 support and emergency cash assistance if card is lost

- Shop at millions of online or in-store outlets wherever Mastercard is accepted

- Manage it online, anytime

- Pre-load up to nine currencies at any one time

- Lock in exchange rates to give you certainty around prices when loading card

- No purchase fee, no monthly fees and no bank transfer load fees

- 24/7 assistance

- Pre-load up to 10 currencies at any one time

- Lock in exchange rates each time you load and reload

- Manage and track your Cash Passport on the go via your mobile, tablet, laptop or PC

- Use it like you would a credit or debit card, except with your own prepaid funds. In-store, online or to withdraw local currency at ATMs

- Three months of free access to Boingo wi-fi hotspots each time you top-up

- Load up to eight foreign currencies, plus NZ Dollars

- Earn 1 Airpoints Dollar for every $100NZD spent overseas

- First three ATM withdrawals of every month are free

- Use anywhere MasterCard is accepted

Compare Travel Money Cards

Headed off overseas and looking for the best in money cards? Here’s a rundown of some of the most popular cards in New Zealand:

The display order does not reflect any ranking or rating by Canstar.

This information is not an endorsement by Canstar of travel money cards or any specific provider. Information correct as of 20/09/23. For full pricing details see individual providers’ websites.

Compare Travel Money Cards with Canstar

About the author of this page

This report was written by Canstar Content Producer, Andrew Broadley. Andrew is an experienced writer with a wide range of industry experience. Starting out, he cut his teeth working as a writer for print and online magazines, and he has worked in both journalism and editorial roles. His content has covered lifestyle and culture, marketing and, more recently, finance for Canstar.

Enjoy reading this article?

You can like us on Facebook and get social, or sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy

Share this article

Travel money cards allow travellers to access pre-loaded money throughout the world. Find the best-value travel money card for your next trip

View latest Travel Money Cards Star Ratings

View winner of Travel Money Card of the Year Award 2023

Canstar Reveals its Outstanding Value Travel Insurance Award Winners 2022

Do I Need Travel Insurance to Visit Australia?

Travel Insurance When Riding a Motorcycle Overseas

Quick Links

Currency Experts

Why Travel Money

- Argentina

- Australia

- Brasil

- Česko

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- Nederland

- New Zealand

- Österreich

- Polska

- Portugal

- România

- Schweiz

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

Travelex New Zealand Review

This Travelex NZ Review runs through everything you need to know about the company.

Travelex NZ is the largest retail foreign exchange company in New Zealand. They are licensed to provide currency in cash, drafts, foreign currency bank cheques, telegraphic transfers, travellers cheques and travel cards.

The Currency Shop says:

- Travelex has a massive network of stores and pick-up locations making it easy to order online and collect later.

- Their exchange rates are consistently better than any New Zealand bank.

- They do not charge any commissions or fees. However paying them using a credit card may incur fees.

- Use our travel money comparison tool to compare foreign exchange rates , fees and services of other providers.

What We Will Cover

We’re most interested in how safe it is to use Travelex, how they work and when you should use them. In this Travelex review, we’ll explore:

- The costs, fees and charges to buy currency from Travelex.

- How it works: buying currency online and in-store.

- International money transfers at Travelex.

- Travelex travel cards.

- Should you use Travelex?

- 36 pick up locations, including all the international airports.

- You can order online 24/7.

- A large number of currencies to transfer money – 87 currencies in total.

- Card handling fees if you want to buy currency using a credit card.

- 3-5 business day wait for online orders.

How Safe and Secure Travelex are and Who Owns Them

In 2015, the founder of Travelex , Lloyd Dorfman sold the company to Dr Shetty. The Indian businessman who also owns UAE Exchange .

Being one of the largest currency companies in the world, Travelex has a strong focus on customer security .

The Costs, Fees and Charges to Buy Currency from Travelex

Travelex does not charge a commission, or fee for exchanging currency with them.

Travelex Exchange Rates

Travelex consistently has better exchange rates than the ASB, ANZ, or Westpac for most major currencies.

Please note that their online exchange rates may vary from their in-store exchange rates.

How to improve the exchange rate

There are 3 ways you can improve the exchange rate you get.

- Firstly, if you are ordering online, you will receive a better rate than the store.

- You can often get a better exchange rate on the most popular currencies when you order over $2,000 in New Zealand.

- Finally, if you are in-store, the best way to get a better exchange rate is to ask for it. It doesn't always work but is worth the effort, particularly for larger amounts over $1000.

How it works: Buying Currency Online and In-Store

Find at travelex store location.

Travelex have a strong network of stores all over New Zealand. Click here to locate a store.

The biggest advantage that Travelex has is their pick-up locations. They have agents like HSBC banks that can be used to collect currency you have bought online.

Available Currencies

You can send 87 currencies in total.

How to buy Currency online

To buy currency online , there are 2 steps:

- Ordering – entering the amount of currency you need, your pick-up location and when you’d like to pick it up. You’ll also need to choose a payment method (either BPay, credit card or debit card).

- Your details – provide your contact and payment details.

How to Buy Currency In-Store

To buy currency in-store, there are 2 steps:

- Tell them what currency you need and how much. They will provide an exchange rate and a total cost

- Pay in cash or by card

For most purchases, you will need to provide identification.

Paying Travelex: Do They Accept Credit Cards?

You can pay in cash, debit card or credit card.

If you pay in cash or debit card, there is no charge. When using a debit card, keep in mind that most banks have a daily EFTPOS limit attached to each card. If you want to buy more than $1000 in currency, ask your bank what your limit is first.

Credit card transactions attract a fee of 1.45%. Your bank also may charge you in the form of a cash advance fee so be careful.

What about Travel Cards?

You can purchase the Travelex Money Card online or at your local Travelex store (excluding HSBC branches). It’s a matter of filling in an application form in-store and attaching acceptable photo identification, along with the money you initially want to load onto the card. Travelex then issue the card on the spot and you’re ready to use it overseas. Check the Travelex Money Card Product Disclose Statement (PDS) for all terms and conditions to make sure it meets your needs.

International Money Transfers at Travelex

If you are sending money overseas in a Travelex store, you will be directed to Western Union. You can read more information about the company, below.

Related: Western Union Reviewed.

How Much Does It Cost to Go to Paris this Summer?

*All prices and converted amounts are approximate and subject to change.

Looking for cheap flights to Paris from Sydney? Check out the best return flights we found below based on the following criteria:

Accommodation in Paris

Here's our approximate breakdown per budget:

Food & Drink

Wondering how much spending money you need on a daily basis for Paris? Check out the breakdown below for the average cost of local food and beverages based on a mid-range budget.

Tourist Attractions

First time in the city of love? Don't miss out on top attractions in between sporting events.

Please note that the prices listed are from May 2024. Prices that have been converted to AUD are approximate and subject to fluctuating conversion rates. For the most accurate figures, check out our live online exchange rates or use our currency converter .

Travelex Money Card is an unsecured debt security issued by EML Payment Solutions Limited (“Issuer”). Travelex Money Card is not guaranteed by the Issuer or any of its related companies or any other entity. A Product Disclosure Statement is available free of charge from Travelex.co.nz. Information has been prepared without taking into account your objectives, financial situation or needs and you should consider the appropriateness of the information about the Travelex Money Card facility before making any decisions about whether to acquire or continue using the prepaid facility. You should also refer to the Terms and Conditions, Online Ordering Terms and Conditions, Online Prepaid Card Reload Terms and Conditions, and Privacy Policy. Mastercard® is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Get In Touch

Travelex info, join the conversation, customer support.

IMAGES

COMMENTS

The Travelex Money Card is a multi-currency card that can be used in most countries around the world to easily use and withdraw local currency. Widely considered the best travel money card for overseas travel, the Travelex Money Card can be used in the US, UK, Europe, Japan, Canada, Hong Kong, Singapore, Japan, and New Zealand.

Unlike standard credit cards, travel cards can be loaded with multiple currencies - making them particularly useful if travelling to different destinations in one trip (our Travelex Money Card allows you to load up to 10 currencies at a time!) You won't have to worry about carrying all your cash with you, or having it stolen. If your travel ...

Avoid your bank's bad exchange rates as well as high FX charges from debit and credit cards by choosing the right travel card. We compare five travel money cards from Wise, Travelex, Air New Zealand, Mastercard and Westpac. Updated 28 March 2024. Summary.

The Travelex Money Card is a multi currency card that can be used in most countries around the world. Widely considered the best travel money card for overseas travel, the Travelex Money Card can be used in the US, Europe, Japan, Canada, Hong Kong, Singapore, Japan, New Zealand, and many more countries.

By downloading the Travelex Travel Money Card, you are choosing a faster, safer way to spend while you travel. ... Australian dollars, Canadian dollars, New Zealand dollars, South African rand, Turkish lira, Swiss franc, UAE dirham, Mexican peso, Polish zloty, Czech koruna, Swedish krona and Japanese yen. Lock-in your exchange rates.

Pros and cons of using Travelex Money Card. Smartphone app and Free Wifi. Manage your account instantly with the Travelex Money app. Enjoy free WiFi at over 1 million Boingo Hotspots. $0 international ATM fees. This is a huge benefit if you are travelling often and prefer to take out local cash from an ATM.

Some key features of a Travelex Money Card include: Load or top-up with NZD. Load up to eight additional currencies. Move money between currencies on your card 24/7. Contactless payment option. No international ATM withdrawal fees. Competitive exchange rates. Optional additional emergency card 24/7 global assistance.

Here is a list of the 3 best prepaid cards you can take with you on your travels and the positives and negatives for each one: Wise - best overall for low fees and the Google exchange rate. Travelex Money Card - best for getting your hands on a card instantly. Westpac Travel Money Card - best for no fees to load by bank transfer.

Travelex has long been the go-to travel money card, but our research below confirms the Travelex Money Card offers poor value exchange rates and high fees compared to Wise's Debit Card. . Savvy travellers are also aware that Wise offers far better exchange rates than Travelex. Wise's business model eliminates the fees associated with exchanging ...

Exchange currency, transfer money abroad, or order travel money online with Travelex, offering great rates with home delivery, airport and bureau pick-up available.

BNZ customers can access special rates by using promo code TRAVELEXBNZ at checkout. You can buy: online at travelex.co.nz to click and collect from your selected Travelex location in New Zealand. in person at a Travelex location with proof that you bank with BNZ (such as a statement or your BNZ banking card with your name on it).

Best 6 Travel Money Cards for New Zealand in 2024: Wise Travel Card for the best exchange rates. Revolut Travel Currency Card for low fees. Travelex Money Card - Best all rounder. Australia Post Travel Platinum for best international prepaid debit card. Westpac Travel Money Card for best prepaid card from major bank.

Wise: New Zealand's Best Travel Money Card. Posted by Andrew Broadley June 16, 2022. With the borders back open, travel is on the cards. And with it, so are travel money cards. ... Air New Zealand OneSmart; Travelex Money Card. Manage nine popular currencies on the go including: US dollar, Australian dollar, Euro, British pound, Canadian ...

The Cash Passport customer service team is available 24/7 to answer your questions or assist if your currency card has been lost or stolen. Simply call the number dedicated to the country you're in: New Zealand - 0800 444 691. Australia - 1800 098 231. UK - 0800 056 0572. USA/Canada - 1877 465 0085. Japan - 00531 780 221. Thailand ...

Take off with more. If you find a better price, we'll guarantee to beat it. Compare exchange rates for 60+ foreign currencies. Use our currency calculator to work out how much you need in cash, or loaded on one of our travel money cards, for your overseas trip. When you're ready, order online or head to any of our 20+ stores across New Zealand.

Travelex has a massive network of stores and pick-up locations making it easy to order online and collect later. Their exchange rates are consistently better than any New Zealand bank. They do not charge any commissions or fees. However paying them using a credit card may incur fees. Use our travel money comparison tool to compare foreign ...

So, we replicated Miranda's holiday, exploring how much it would cost to: buy 1000 US Dollars, 2500 Great British Pounds and 1000 Euros in cash. spend that money on a debit or credit card - taking a month's worth of interest into account. spend that money on Wise's currency card. use travel cards for the same amount.

Accommodation in Paris. Paris, as the host city, will see a surge in accommodation prices during the summer events. For a two-week stay, expect to pay around AUD $2,500 to $3,500 for one room, depending on the type of accommodation. Budget hotels and hostels offer cheaper alternatives, while mid-range hotels provide more comfort at a higher cost.

Published: 05 Jun 2024 16:52. Richard Wazacz is a tech-savvy chief executive. With a strong background in digital businesses, he took up the challenge of leading foreign exchange specialist ...