An official website of the United States government

- Special Topics

Travel and Tourism

Travel and tourism satellite account for 2018-2022.

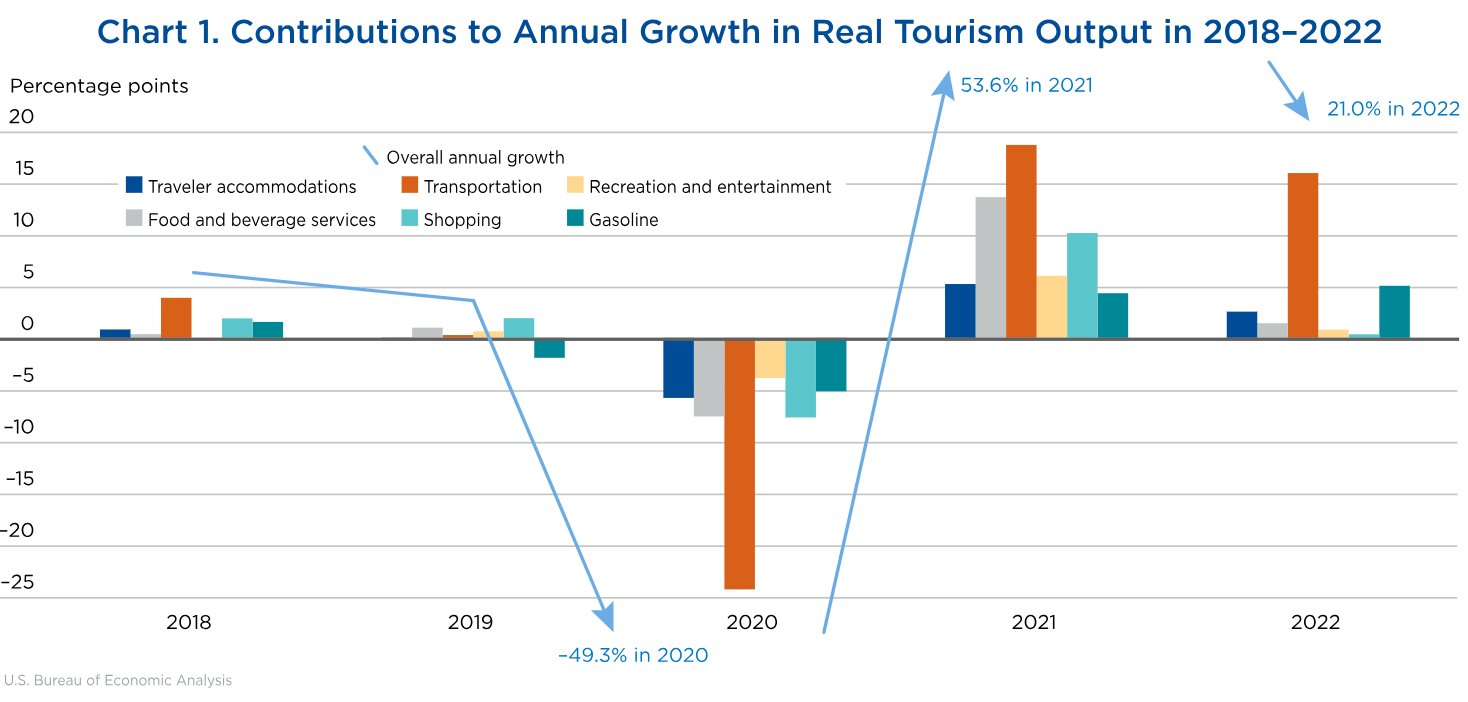

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA’s Travel and Tourism Satellite Account.

Data & Articles

- U.S. Travel and Tourism Satellite Account for 2018–2022 By Hunter Arcand and Paul Kern - Survey of Current Business April 2024

- "U.S. Travel and Tourism Satellite Account for 2015–2019" By Sarah Osborne - Survey of Current Business December 2020

- "U.S. Travel and Tourism Satellite Account for 2015-2017" By Sarah Osborne and Seth Markowitz - Survey of Current Business June 2018

- Tourism Satellite Accounts 1998-2019

- Tourism Satellite Accounts Data A complete set of detailed annual statistics for 2017-2021 is coming soon -->

- Article Collection

Documentation

- Product Guide

Previously Published Estimates

- Data Archive This page provides access to an archive of estimates previously published by the Bureau of Economic Analysis. Please note that this archive is provided for research only. The estimates contained in this archive include revisions to prior estimates and may not reflect the most recent revision for a particular period.

- News Release Archive

What is Travel and Tourism?

Measures how much tourists spend and the prices they pay for lodging, airfare, souvenirs, and other travel-related items. These statistics also provide a snapshot of employment in the travel and tourism industries.

What’s a Satellite Account?

- TTSA Sarah Osborne (301) 278-9459

- News Media Connie O'Connell (301) 278-9003 [email protected]

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Search ITA Search

Travel and Tourism Research

National travel and tourism research.

The National Travel and Tourism’s (NTTO) research products provide critical market intelligence to a range of stakeholders, including agencies within the U.S. Department of Commerce, other federal departments and agencies, Congressional offices, local and state policymakers, domestic travel and tourism industry firms and organizations, foreign governments and companies, the media, and academia, and more.

Travel and Tourism Statistics, Research Programs, and Monitors

Download the National Travel and Tourism Office’s collection of PDF fact sheets and reports. They reflect the latest trends and information on the international travel and tourism industry market.

- U.S. Travel and Tourism Fast Facts

- International Visitation to the United States

- Balance of Trade

- Travel and Tourism Exports

- Travel Trade by Category

- Travel and Tourism Satellite Account

Discover Travel and Tourism Industry News “TI News”

Sign up to receive Travel and Tourism Industry News “TI News” e-mail updates. Receive updates from NTTO featuring the latest data and research releases, and other information related to international travel to and from the United States right to your inbox!

Discover the faces behind our amazing research team!

Have a question or need assistance? Reach out to our team and we will get back to you as soon as possible.

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

U.S. Department of Commerce

- Fact Sheets

Was this page helpful?

Fact sheet: 2022 national travel and tourism strategy, office of public affairs.

The 2022 National Travel and Tourism Strategy was released on June 6, 2022, by U.S. Secretary of Commerce Gina M. Raimondo on behalf of the Tourism Policy Council (TPC). The new strategy focuses the full efforts of the federal government to promote the United States as a premier destination grounded in the breadth and diversity of our communities, and to foster a sector that drives economic growth, creates good jobs, and bolsters conservation and sustainability. Drawing on engagement and capabilities from across the federal government, the strategy aims to support broad-based economic growth in travel and tourism across the United States, its territories, and the District of Columbia.

The federal government will work to implement the strategy under the leadership of the TPC and in partnership with the private sector, aiming toward an ambitious five-year goal of increasing American jobs by attracting and welcoming 90 million international visitors, who we estimate will spend $279 billion, annually by 2027.

The new National Travel and Tourism Strategy supports growth and competitiveness for an industry that, prior to the COVID-19 pandemic, generated $1.9 trillion in economic output and supported 9.5 million American jobs. Also, in 2019, nearly 80 million international travelers visited the United States and contributed nearly $240 billion to the U.S. economy, making the United States the global leader in revenue from international travel and tourism. As the top services export for the United States that year, travel and tourism generated a $53.4 billion trade surplus and supported 1 million jobs in the United States.

The strategy follows a four-point approach:

- Promoting the United States as a Travel Destination Goal : Leverage existing programs and assets to promote the United States to international visitors and broaden marketing efforts to encourage visitation to underserved communities.

- Facilitating Travel to and Within the United States Goal : Reduce barriers to trade in travel services and make it safer and more efficient for visitors to enter and travel within the United States.

- Ensuring Diverse, Inclusive, and Accessible Tourism Experiences Goal : Extend the benefits of travel and tourism by supporting the development of diverse tourism products, focusing on under-served communities and populations. Address the financial and workplace needs of travel and tourism businesses, supporting destination communities as they grow their tourism economies. Deliver world-class experiences and customer service at federal lands and waters that showcase the nation’s assets while protecting them for future generations.

- Fostering Resilient and Sustainable Travel and Tourism Goal : Reduce travel and tourism’s contributions to climate change and build a travel and tourism sector that is resilient to natural disasters, public health threats, and the impacts of climate change. Build a sustainable sector that integrates protecting natural resources, supporting the tourism economy, and ensuring equitable development.

Travel and Tourism Fast Facts

- The travel and tourism industry supported 9.5 million American jobs through $1.9 trillion of economic activity in 2019. In fact, 1 in every 20 jobs in the United States was either directly or indirectly supported by travel and tourism. These jobs can be found in industries like lodging, food services, arts, entertainment, recreation, transportation, and education.

- Travel and tourism was the top services export for the United States in 2019, generating a $53.4 billion trade surplus.

- The travel and tourism industry was one of the U.S. business sectors hardest hit by the COVID-19 pandemic and subsequent health and travel restrictions, with travel exports decreasing nearly 65% from 2019 to 2020.

- The decline in travel and tourism contributed heavily to unemployment; leisure and hospitality lost 8.2 million jobs between February and April 2020 alone, accounting for 37% of the decline in overall nonfarm employment during that time.

- By 2021, the rollout of vaccines and lifting of international and domestic restrictions allowed travel and tourism to begin its recovery. International arrivals to the United States grew to 22.1 million in 2021, up from 19.2 million in 2020. Spending by international visitors also grew, reaching $81.0 billion, or 34 percent of 2019’s total.

More about the Tourism Policy Council and the 2022 National Travel and Tourism Strategy

Created by Congress and chaired by Secretary Raimondo, the Tourism Policy Council (TPC) is the interagency council charged with coordinating national policies and programs relating to travel and tourism. At the direction of Secretary Raimondo, the TPC created a new five-year strategy to focus U.S. government efforts in support of the travel and tourism sector which has been deeply and disproportionately affected by the COVID-19 pandemic.

Read the full strategy here

- Secretary’s Corner

- GAD Activities

- GAD Issuances

- Mission and Vision

- Department Structure

- Key Officials

- Citizen’s Charter

- Attached Agencies

- General Info

- Culture & Arts

- People & Religion

- Tourism Industries Products

- Promotional Fair and Events

- Doing Business

- Philippines RIA Pilot Program

- Tourism Demand Statistics

- Standards Rules and Regulations

- Online Accreditation

- Accredited Establishments

- Learning Management System (LMS)

- News and Updates

- Announcements

- Publications

- Bids and Awards

DOT BRINGS BACK DAVAO DIVE EXPO

The Department of Tourism (DOT), through its Region XI office, partners with SM Lanang, bringing back the highly anticipated...

PHILIPPINES LAUDED FOR “IMPRESSIVE” HOSTING OF INT’L FORUM ON GASTRONOMY TOURISM

CEBU – The Philippines has emerged as an “impressive” host for the United Nations (UN) Tourism Regional Forum on...

PHILIPPINES SUCCESSFULLY HOSTS FIRST UN TOURISM REGIONAL FORUM ON GASTRONOMY TOURISM FOR ASIA AND THE PACIFIC

CEBU, PHILIPPINES – A grand display of Cebu’s sights, sounds, and taste welcomed over 600 global delegates of the inaugural...

Accreditations

Published Vacant Position – July 03, 2024

Published vacant position – may 29, 2024, published vacant position – february 13, 2024, published vacant position – january 29, 2024.

Balik Bayani sa Turismo: FAQs – March 2024 issue

Balik bayan sa turismo: briefer – march 2024 issue, on the dot: official dot newsletter – december 2023 issue, on the dot: official dot newsletter – november 2023 issue.

Tourism in the Philippines

Philippine tourism industries, explore by interest, tourism videos.

THE PHILIPPINES IN NUMBERS

100,972,303, 134,107,832, dot attached agencies.

- Open Data Portal

- Official Gazette

- Office of the President

- Sandiganbayan

- Senate of the Philippines

- House of Representatives

- Department of Health

- Department of Finance

- Supreme Court

- Court of Appeals

- Court of Tax Appeals

- Judicial Bar and Council

- Bureau of Internal Revenue

- Bureau of Customs

- Bureau of Treasury

- Bureau of Local Government Finance

Department of Tourism

The Department of Tourism provides tourism statistics in PDF format. Available data includes industry performance for travel and tourism and visitor arrival to the Philippines by country of residence. Access the DOT’s data below.

Share This Article :

Powered by BetterDocs

Travel, Tourism & Hospitality

Travel and tourism in the U.S. - statistics & facts

What are the most popular travel destinations in the u.s., u.s. travel trends, key insights.

Detailed statistics

Tourism contribution to GDP in the U.S. 2019-2022

Total travel expenditures in the U.S. 2019-2026

Number of domestic leisure and business trips in the U.S. 2019-2026

Editor’s Picks Current statistics on this topic

International travel spending in the U.S. 2019-2026

Leading city destinations in the U.S. 2019, by number of international arrivals

Further recommended statistics

Industry overview.

- Basic Statistic Tourism contribution to GDP in the U.S. 2019-2022

- Premium Statistic Total travel expenditures in the U.S. 2019-2026

- Premium Statistic Direct travel spending in the U.S. 2019-2022, by traveler type

- Basic Statistic Countries that visited the U.S. the most 2019-2022

- Basic Statistic Leading outbound travel markets in the U.S. 2019-2022, country

- Basic Statistic Contribution of travel and tourism to employment in the U.S. 2019-2022

- Premium Statistic Most visited states in the U.S. 2022

Total contribution of travel and tourism to the gross domestic product (GDP) in the United States in 2019 and 2022 (in trillion U.S. dollars)

Total travel spending in the United States from 2019 to 2022, with a forecast until 2026 (in trillion U.S. dollars)

Direct travel spending in the U.S. 2019-2022, by traveler type

Total direct travel spending in the United States from 2019 to 2022, by type of traveler (in billion U.S. dollars)

Countries that visited the U.S. the most 2019-2022

Distribution of international tourist arrivals in the United States in 2019 and 2022, by country

Leading outbound travel markets in the U.S. 2019-2022, country

Distribution of outbound tourist departures in the United States in 2019 and 2022, by country

Contribution of travel and tourism to employment in the U.S. 2019-2022

Contribution of travel and tourism to employment in the United States in 2019 and 2022 (in millions)

Most visited states in the U.S. 2022

Most visited states by adults in the United States as of September 2022

Key players

- Premium Statistic Leading holiday travel provider websites in the U.S. Q2 2023, by share of voice

- Premium Statistic Number of aggregated downloads of leading travel apps in the U.S. 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps in the U.S. 2023

- Basic Statistic American Customer Satisfaction Index for internet travel companies U.S. 2002-2024

- Premium Statistic American Customer Satisfaction Index for U.S. lodging companies 2008-2024, by company

Leading holiday travel provider websites in the U.S. Q2 2023, by share of voice

Leading travel brands in the United States in 2nd quarter 2023, by share of voice

Number of aggregated downloads of leading travel apps in the U.S. 2023

Number of aggregated downloads of selected leading travel apps in the United States in 2023 (in millions)

Number of aggregated downloads of leading online travel agency apps in the U.S. 2023

Number of aggregated downloads of selected leading online travel agency apps in the United States in 2023 (in millions)

American Customer Satisfaction Index for internet travel companies U.S. 2002-2024

American Customer Satisfaction Index Scores for internet travel companies in the United States from 2002 to 2024

American Customer Satisfaction Index for U.S. lodging companies 2008-2024, by company

American Customer Satisfaction Index scores for lodging companies in the United States from 2008 to 2024, by company

- Premium Statistic U.S. hotel and motel industry market size 2012-2022

- Premium Statistic Number of hotel jobs in the U.S. 2019-2022

- Premium Statistic ADR of hotels in the U.S. 2001-2022

- Premium Statistic Occupancy rate of the U.S. hotel industry 2001-2022

- Premium Statistic Revenue per available room of the U.S. hotel industry 2001-2022

- Premium Statistic Change in monthly number of hotel bookings in the U.S. 2020-2023

- Premium Statistic YoY monthly change in number of online hotel searches in the U.S. 2020-2023

U.S. hotel and motel industry market size 2012-2022

Market size of the hotel and motel sector in the United States from 2012 to 2022 (in billion U.S. dollars)

Number of hotel jobs in the U.S. 2019-2022

Number of hotel jobs in the United States from 2019 to 2022, with a forecast for 2023 (in millions)

ADR of hotels in the U.S. 2001-2022

Average daily rate of hotels in the United States from 2001 to 2022 (in U.S. dollars)

Occupancy rate of the U.S. hotel industry 2001-2022

Occupancy rate of the hotel industry in the United States from 2001 to 2022

Revenue per available room of the U.S. hotel industry 2001-2022

Revenue per available room (RevPAR) of hotel industry in the United States from 2001 to 2022 (in U.S. dollars)

Change in monthly number of hotel bookings in the U.S. 2020-2023

Year-over-year monthly change in number of hotel bookings in the United States from 2020 to 2023

YoY monthly change in number of online hotel searches in the U.S. 2020-2023

Year-over-year monthly change in number of online hotel searches in the United States from 2020 to 2023

Attractions

- Premium Statistic Leading museums by highest attendance worldwide 2019-2022

- Basic Statistic Most visited amusement and theme parks worldwide 2019-2022

- Premium Statistic U.S. amusement park industry market size 2011-2022

- Premium Statistic Landmarks most recommended visitors in the U.S. 2022

Leading museums by highest attendance worldwide 2019-2022

Most visited museums worldwide from 2019 to 2022 (in millions)

Most visited amusement and theme parks worldwide 2019-2022

Leading amusement and theme parks worldwide from 2019 to 2022, by attendance (in millions)

U.S. amusement park industry market size 2011-2022

Market size of the amusement park sector in the United States from 2011 to 2022 (in billion U.S. dollars)

Landmarks most recommended visitors in the U.S. 2022

Most recommended landmarks by visitors in the United States as of September 2022

City tourism

- Basic Statistic City destinations with the highest direct travel and tourism GDP worldwide 2022

- Premium Statistic World's highest-priced business travel destinations Q4 2023

- Basic Statistic Selected cities with the highest hotel rates in the U.S. as of September 2023

- Basic Statistic Most affordable cities for backpacking in the U.S. 2024, by daily price

- Premium Statistic Average price per night of Airbnb listings in selected U.S. cities 2024

- Premium Statistic Number of Airbnb listings in selected U.S. cities 2024

City destinations with the highest direct travel and tourism GDP worldwide 2022

Leading city tourism destinations worldwide in 2022, ranked by direct contribution of travel and tourism to GDP (in billion U.S. dollars)

World's highest-priced business travel destinations Q4 2023

Most expensive cities for business tourism worldwide in 4th quarter 2023, by average daily costs (in U.S. dollars)

Selected cities with the highest hotel rates in the U.S. as of September 2023

Selected cities with the most expensive hotel rates in the United States as of September 2023 (in U.S. dollars)

Most affordable cities for backpacking in the U.S. 2024, by daily price

Most affordable cities for backpacking in the United States as of January 2024, by daily price (in U.S. dollars)

Average price per night of Airbnb listings in selected U.S. cities 2024

Average price per night of Airbnb listings in selected cities in the United States as of February 2024 (in U.S. dollars)

Number of Airbnb listings in selected U.S. cities 2024

Number of Airbnb listings in selected cities in the United States as of February 2024

Sustainable tourism

- Premium Statistic Travelers who find sustainable travel important in the U.S. 2022

- Premium Statistic Share of travelers that plan to make sustainable travel choices in the U.S. 2022

- Premium Statistic How much more travelers would pay to make a trip more sustainable in the U.S. 2022

- Premium Statistic U.S. consumers who have paid extra for sustainable travel in the past two years 2022

- Premium Statistic U.S. consumers willing to pay extra for a sustainable travel provider 2022

- Premium Statistic Share of U.S. travelers that feel guilty over non-eco-friendly past travel 2022

- Premium Statistic Reasons travelers were against staying in sustainable hotels in the U.S. 2022

Travelers who find sustainable travel important in the U.S. 2022

Share of travelers that think sustainable travel is important in the United States as of February 2022

Share of travelers that plan to make sustainable travel choices in the U.S. 2022

Share of travelers that intend to make more sustainable travel decisions in the United States as of March 2022

How much more travelers would pay to make a trip more sustainable in the U.S. 2022

Extra cost travelers would be willing to pay to make a trip more carbon friendly in the United States as of March 2022

U.S. consumers who have paid extra for sustainable travel in the past two years 2022

Share of consumers that have paid extra for sustainable travel in the past two years in the United States as of February 2022

U.S. consumers willing to pay extra for a sustainable travel provider 2022

Share of consumers willing to pay extra for a sustainable travel provider in the United States as of February 2022

Share of U.S. travelers that feel guilty over non-eco-friendly past travel 2022

Share of travelers that experience guilt over past trips not being sustainable in the United States as of August 2022

Reasons travelers were against staying in sustainable hotels in the U.S. 2022

Reasons travelers were against staying in a hotel with sustainable practices in the United States as of August 2022

- Premium Statistic Priorities when choosing a leisure travel destination in the U.S. 2023, by generation

- Premium Statistic Leading destinations travelers intend to visit in the next 12 months in the U.S. 2023

- Premium Statistic Trust in travel and hospitality brands in the U.S. 2023, by brand type

- Premium Statistic American Customer Satisfaction Index: travel and tourism industries in the U.S. 2024

Priorities when choosing a leisure travel destination in the U.S. 2023, by generation

Main factors for choosing a leisure travel destination among adults in the United States as of May 2023, by generation

Leading destinations travelers intend to visit in the next 12 months in the U.S. 2023

Leading leisure travel destinations travelers intend to go to in the next 12 months in the United States as of September 2023

Trust in travel and hospitality brands in the U.S. 2023, by brand type

Level of trust in travel and hospitality brands in the United States as of September 2023, by brand type

American Customer Satisfaction Index: travel and tourism industries in the U.S. 2024

American Customer Satisfaction Index for the travel and tourism sector in the United States in 2024, by industry

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Commerce Data Hub

Travel and tourism indicators.

The U.S. Department of Commerce, Department of Homeland Security, and Department of State prepare these performance indicators for international travel to the United States and for travel facilitation programs.

About this Dataset

Access this data, was this page helpful, share this page.

Experience the Culture

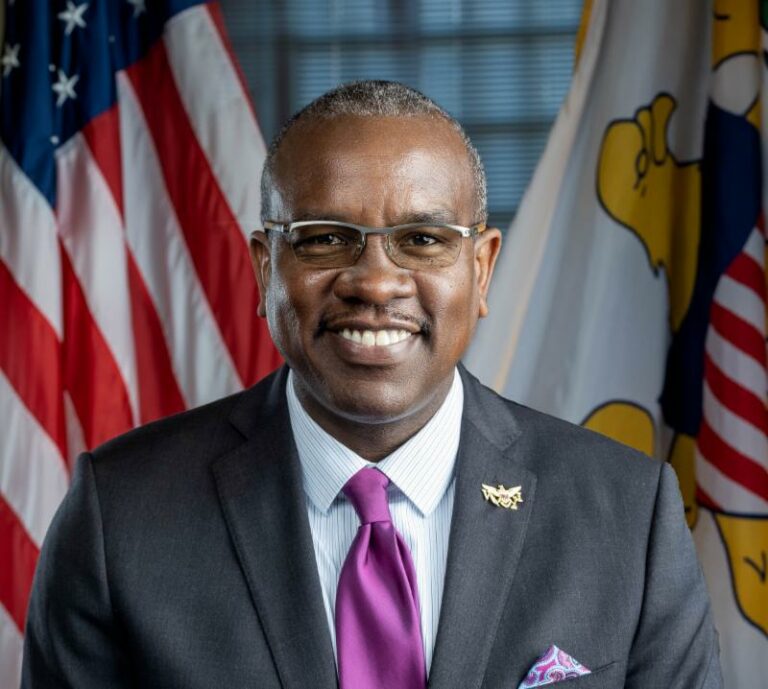

The 21st Legislature of the Virgin Islands created the Department of Tourism on May 8, 1995. The Department is primarily responsible for the economic development of the Territory through the promotion of tourism and related activities. Other responsibilities include the formulation, implementation, administration and coordination of programs and policies pertaining to all aspects of tourism. The Department is under the supervision of the Commissioner of Tourism.

Enjoy our beautiful beaches, inspiring dining experiences, historic towns, and cultural events. Discover your real nice experience in the US Virgin Islands.

- Our Colorful History

U.S. Virgin Islands: Three Distinct Islands In One Destination

Culturalst. croix.

The United States Virgin Islands is part of the Lesser Antilles of the Caribbean. The three principal islands – St. Croix, St. John and St. Thomas – are magnificent tropical environments, each distinguished by its own personality.

Latest News

U.S. Virgin Islands Embraces Innovation As Tourism Engine Restarts

For Immediate Release Source: United States Virgin Islands Department of Tourism Contacts: Alani Henneman-Todman, U.S. Virgin Islands Department of Tourism +1 340 774-8784 [email protected] Bevan

U.S. Virgin Islands Governor Asks Florida Counterpart To Consider Vaccination Checks For Cruise Passengers

For Immediate Release Source: Government of the United States Virgin Islands Contacts: Richard Motta Jr. Office of Governor Albert Bryan Jr. + 1 340 773-1404

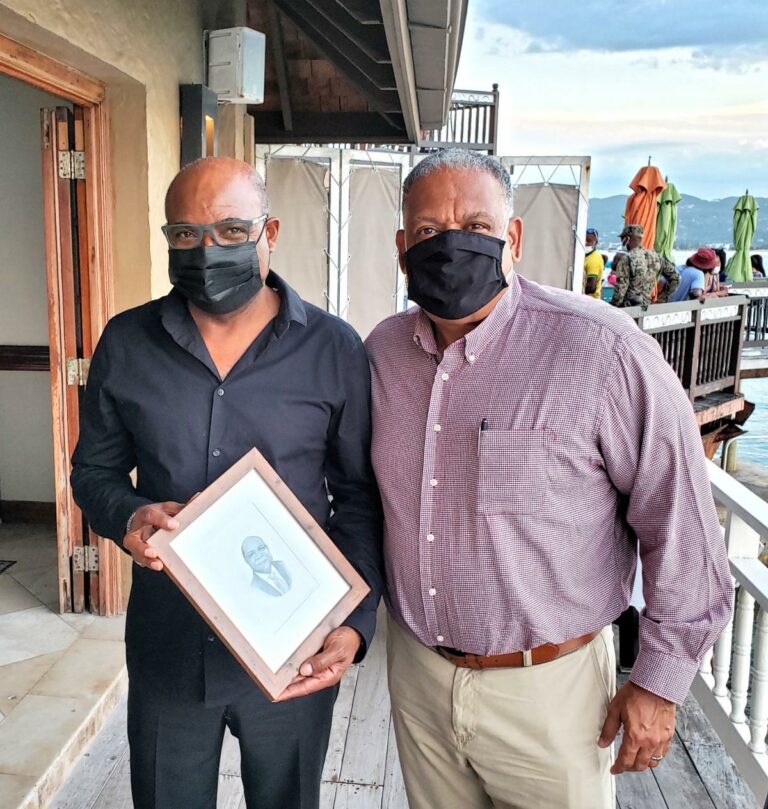

U.S. Virgin Islands, Jamaica Explore Caribbean Tourism “Coopetition”

For Immediate Release Source: United States Virgin Islands Department of Tourism Contacts: Alani Henneman-Todman, U.S. Virgin Islands Department of Tourism +1 340 774-8784 [email protected]

Do you have a project or event in The Virgin Islands?

- 321 King Street Suite 7 Frederiksted, VI 00840

- 340-772-0357

- 2318 Kronprindsens Gade Charlotte Amalie, St. Thomas 00802

- 340-774-8784

Follow us on Social Media

- #usvistillnice

- @usvitourism

UN Tourism | Bringing the world closer

Global and regional tourism performance.

- international tourist arrivals and receipts and export revenues

- international tourism expenditure and departures

- Seasonality

- Tourism Flows

- Accommodation

- Tourism GDP and Employment

- Domestic Tourism

The UN Tourism Data Dashboard – provides statistics and insights on key indicators for inbound and outbound tourism at the global, regional and national levels. Data covers tourist arrivals, tourism receipts, tourism share of exports and contribution to GDP, source markets, seasonality, domestic tourism and data on accommodation and employment.

- Cette page n'est pas disponible en Français

OECD Tourism Trends and Policies 2024

- Industry, business and entrepreneurship

- Regional, rural and urban development

- Digital transformation

- Economic policy

- Future of work

- Global value and supply chains

- Services trade

- SMEs and entrepreneurship

- Sustainable economic growth

- Well-being and beyond GDP

- AI and work

- Artificial intelligence and education and skills

- Changing skill needs in the labour market

- Data governance

- Digital skills

- Digitalisation of SMEs

- Economic resilience

- Environmental statistics, accounts and indicators

- Inclusive growth and well-being

- Inclusive, green and digital transformation

- Sustainable supply chains

- Trade policy and global value chains

Cite this content as:

The 2024 edition of OECD Tourism Trends and Policies analyses the latest tourism performance and policy trends across 50 OECD countries and partner economies. It takes stock of the tourism economy’s recovery post-pandemic and highlights the need for co-ordinated, forward-looking policies, as challenges remain to build momentum for a more resilient, sustainable and inclusive future for the sector. Evidence on the significance of the tourism economy is presented, with data covering domestic, inbound, and outbound tourism, enterprises and employment, and internal tourism consumption. Tourism policy priorities, reforms and developments are analysed, and examples of country practices highlighted. Thematic chapters provide insights on strengthening the tourism workforce and building the evidence base for sustainable tourism policies.

In the same series

Related publications

What is Colorado's Best business? Vote now!

The Colorado Sun

Telling stories that matter in a dynamic, evolving state.

Department of Justice investigating antitrust issues with Alterra’s plan to buy Arapahoe Basin

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on X (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Original Reporting

- Subject Specialist

The Trust Project

The Department of Justice is taking a closer look at Alterra Mountain Co.’s planned acquisition of Arapahoe Basin ski area .

The department has requested information from the ski area and the 18-resort Alterra Mountain Co., as well as annual surveys and studies of the resort industry conducted by Boulder’s RRC Associates for the National Ski Areas Association.

“It’s taking time,” said Alan Henceroth, the longtime boss at Arapahoe Basin, who described the information requested by the federal government as demographics of visitors, visitation numbers, financial information and “all the business issues” involving the ski area.

Alterra Mountain Co., which owns the Steamboat ski area and operates the city of Denver-owned Winter Park ski area, in February announced its plan to buy the 1,428-acre Arapahoe Basin from Dream Unlimited Corp, the Canadian real estate investment trust that has owned the Summit County ski area since 1998.

The Justice Department served the National Ski Areas Association and market research firm RRC Associates with civil investigative demands earlier this month. The inquiries seek data from RRC’s annual surveys of U.S. ski areas, including the NSAA’s yearly Kottke Report as well as demographic and economic analyses of the resort industry. In a letter to NSAA’s member resorts in the Rocky Mountains, the association on June 26 said it had worked with the federal government to narrow the scope of its inquiry to just ski areas in the association’s six-state Rocky Mountain Region.

The letter, first reported by Matthew Scott with the website Snowology , promised that NSAA was “determined to maintain the strictest confidentiality” in providing the information “to ensure that the information is used for the good of all the membership.” The annual reports are not available to the public.

“We are assured that the Department of Justice is bound by statute to maintain the confidentiality of this data as well, and they have further represented to us that none of it should ever be disclosed in any public document or forum,” reads the letter from NSAA sent to select members.

The U.S. Attorney General’s Office in Colorado declined to comment on the inquiry. RRC Associates declined to comment as well. Executives with the National Ski Areas Association did not immediately return emails or texts Thursday.

☀️ READ MORE

Colorado’s u.s. senators express support for added protection of dolores river, with safeguards for existing uses, demographics are changing quickly in america but not in the outdoors. enter a new colorado excursion company., this former dumping ground in nederland is being turned into an eco-friendly nature center.

Alterra Mountain Co. emailed a statement saying a filing with the Justice Department was “customary given the size of the transaction.”

“We are working through the process, but we cannot otherwise comment on the state of the ongoing review with the DOJ,” reads the statement. The company declined to say if its previous acquisitions since forming in 2018 have been investigated by the Justice Department.

🎧 Listen here!

Go deeper into this story in this episode of The Daily Sun-Up podcast.

Subscribe: Apple | Spotify | RSS

But it is not the first time that the federal government has had antitrust issues with ski area consolidation in Colorado.

The Colorado attorney general and the Department of Justice’s Antitrust Division in 1996 sued in U.S. District Court in Denver seeking to block Vail Resorts’ acquisition of Arapahoe Basin. Vail Resorts in 1996 announced a $310 million deal to buy Breckenridge, Keystone and Arapahoe Basin ski areas from Ralston Resorts, Inc. The civil lawsuit forced Vail Resorts to sell Arapahoe Basin to a Canadian real estate firm that became Dream Unlimited.

The suit filed by the federal government in 1996 argued that Vail Resorts’ acquisition of Arapahoe Basin would have “lessened competition substantially in the Front Range skier market.” In 1996, Ralston’s three Summit County ski areas accounted for 26% of visits from Front Range skiers, and Vail Resorts’ Vail and Beaver Creek ski areas in Eagle County accounted for about 12% of Front Range skier traffic.

Vail Resorts selling Arapahoe Basin “will prevent Front Range skiers from paying higher lift ticket prices,” reads a January 1997 statement from the Department of Justice .

Arapahoe Basin was the first ski area not owned by Vail Resorts to join the company’s Epic Pass. The ski area offered unlimited access to Epic Pass skiers from 1998 to 2019, but the resort’s parking lots were overwhelmed with crowds and Henceroth dropped the Epic Pass for Alterra Mountain Co.’s Ikon Pass partner program, offering skiers either five or seven days of access.

Henceroth earlier this week told his loyal skiers that Ikon Pass access for the 2024-25 ski season would remain at five and seven days. There are 12 ski areas within a couple hours drive from Denver and eight of those ski areas are available to skiers using the Epic or Ikon passes. And those eight — Arapahoe Basin, Beaver Creek, Breckenridge, Copper Mountain, Eldora, Keystone, Vail and Winter Park — easily host more than half of Colorado’s annual skier visits.

While the Department of Justice review is delaying the deal, Henceroth said the Forest Service is reviewing the transfer of Arapahoe Basin’s special use permit to Alterra Mountain Co.

The Forest Service review is going well, Henceroth said, but it can’t be finalized until the Justice Department completes its analysis.

“Once the Department of Justice is done, I think the closing will happen very quickly,” he said. “I know Dream is ready to get it done.”

Type of Story: News

Based on facts, either observed and verified directly by the reporter, or reported and verified from knowledgeable sources.

Jason Blevins Outdoors Reporter

Jason Blevins lives in Eagle with his wife, daughters and a dog named Gravy. Job title: Outdoors reporter Topic expertise: Western Slope, public lands, outdoors, ski industry, mountain business, housing, interesting things Location:... More by Jason Blevins

- LIVE DISCOURSE

- BLOG / OPINION

- SUBMIT PRESS RELEASE

- Advertisement

- Knowledge Partnership

- Media Partnership

- Art & Culture

UP Tourism Partners with MakeMyTrip to Boost State's Tourist Potential

Uttar pradesh tourism department has teamed up with makemytrip to promote tourism in the state. this partnership aims to utilize consumer trends and supply-side data for future policy-making. makemytrip will help tourists planning trips and provide packages to explore local areas, aiding in the growth of up's tourism..

The Uttar Pradesh Tourism Department announced on Friday a partnership with online travel giant MakeMyTrip aimed at promoting tourism within the state.

Under a newly signed memorandum of understanding, MakeMyTrip will assist the local government by providing vital insights into consumer trends, tourist preferences, and supply-side information—data that will prove invaluable for future policy-making, according to the department's statement.

"Uttar Pradesh has immense potential for tourism and MakeMyTrip will be a partner in realizing this potential," stated Mukesh Kumar Meshram, the Principal Secretary of the Department of Tourism and Culture for UP. Online travel insights from MakeMyTrip will benefit tourists interested in eco-tourism, adventure tourism, and spiritual tourism.

Meshram added that tourists often explore nearby areas and purchase local goods, promoting local economies. MakeMyTrip will support these tourists by creating tailored travel packages.

Rajesh Magow, Co-founder and Group CEO of MakeMyTrip, said, "Our goal is to collaborate with UP tourism by leveraging our platform's insights and the availability of hotels and homestays to boost tourism in the state. We are confident that this public-private partnership will meet our shared objectives."

AfDB and WFP Partnership Boosts Sudan's Wheat Production Amidst Conflict

Lula and xi plan strategic partnership at g20 summit, propel industries and omega crushing forge strategic partnership, jaishankar calls on sheikh hasina, appreciates her guidance on developing india-bangladesh special partnership, eu seeks defence industry partnerships with japan and south korea.

Enhancing India's HFSS Food Ad Regulations: Protecting Children from Unhealt...

After a strong rally during week, stock market opens in negative territory o...

Global Health: Breakthroughs, Setbacks, and Innovations

Realme Partners with Sony for AI-Enabled 5G Smartphone Breakthrough

Latest news, escalating tensions and humanitarian crisis amid gaza conflict, trump's legal battles and unexpected incidents dominate us news, sports highlights: injury updates, thrilling wins & controversies, world news highlights: global shifts and turning points.

OPINION / BLOG / INTERVIEW

Fairjob dataset: enhancing fairness and reducing bias in online job recommendation systems, protecting our planet: mapping the path to biodiversity conservation, breakthrough in the battle against cervical cancer: therapeutic hpv vaccines on the horizon, enhanced marketing and advertising with glyphdraw2's advanced ai poster generation, connect us on.

- ADVERTISEMENT

- KNOWLEDGE PARTNERSHIP

- MEDIA PARTNERSHIP

- Agro-Forestry

- Economy & Business

- Energy & Extractives

- Law & Governance

- Science & Environment

- Social & Gender

- Urban Development

- East and South East Asia

- Europe and Central Asia

- Central Africa

- East Africa

- Southern Africa

- West Africa

- Middle East and North Africa

- North America

- Latin America and Caribbean

OTHER LINKS

- Write for us

- Submit Press Release

- Opinion / Blog / Analysis

- Business News

- Entertainment News

- Technology News

- Law-order News

- Lifestyle News

- National News

- International News

OTHER PRODUCTS

Email: [email protected] Phone: +91-720-6444012, +91-7027739813, 14, 15

© Copyright 2024

- The Star ePaper

- Subscriptions

- Manage Profile

- Change Password

- Manage Logins

- Manage Subscription

- Transaction History

- Manage Billing Info

- Manage For You

- Manage Bookmarks

- Package & Pricing

Two Kunak supermarkets fined RM10,000 each for water theft

- Sabah & Sarawak

Wednesday, 03 Jul 2024

Related News

Sabah not ready for e-invoicing, says Warisan man

Heavy electricity users in sabah urged to apply for energy audit grants, 'tremendous' response to sabah's mm2h programme, says liew.

Kunak Water Department enforcement team found an illegal connection at one of the supermarkets in the district on Tuesday (July 2).

KOTA KINABALU: Two supermarkets in Kunak were each made RM10,000 poorer for illegally connecting and tampering with water pumps.

According to Kunak district Water Department works officer Mohd Mohd Suhaizan Mohd Yunus, the offences were discovered by an enforcement team during an operation at 9am on Tuesday (July 2) following a tip-off.

He said one of the supermarkets was found using a 5cm pipe to connect directly from the department’s main pipe to its premises.

“This pipe was detected channelling water to the supermarket premises without passing through the provided meter.

“The fine was imposed under Section 49(b) of the Sabah State Water Supply Enactment 2003,” he said on Wednesday (July 3).

The other supermarket was found using a tampered water pump to draw additional supply, punishable under Section 59 of the same enactment.

Suhaizan advised consumers to use water legally and refrain from putting up illegal connections.

"The public is also urged to notify us of any water theft or leaking pipes through our careline number 088-326888,” he said.

Tags / Keywords: Sabah , Kunak , Water Department , Supermarkets , Fined , Water Theft , Illegal Connections , Water Pump , Sabah State Water Supply Enactment 2003

Found a mistake in this article?

Report it to us.

Thank you for your report!

24-HOUR ACCIDENT PROTECTION FOR MALAYSIAN WORKERS

Next in nation.

Trending in News

Air pollutant index, highest api readings, select state and location to view the latest api reading.

- Select Location

Source: Department of Environment, Malaysia

Others Also Read

Best viewed on Chrome browsers.

We would love to keep you posted on the latest promotion. Kindly fill the form below

Thank you for downloading.

We hope you enjoy this feature!

IMAGES

COMMENTS

Tourism Demand Statistics . Philippine Tourism Satellite Account. 2000 - 2022; Visitor Arrivals to the Philippines

The National Travel and Tourism Office is the official government source for data and analysis on international travel and we assist in establishing and updating policy that affects the travel and tourism industry. Our goal is to increase international competitiveness and exports. 1. 2.

The National Travel and Tourism Office, part of ITA, creates a positive climate for growth in travel and tourism by reducing institutional barriers to tourism, administers joint marketing efforts, provides official travel and tourism statistics, and coordinates efforts across federal agencies through the Tourism Policy Council. The Office works to enhance the international competitiveness of ...

International Tourism and COVID-19. Export revenues from international tourism dropped 62% in 2020 and 59% in 2021, versus 2019 (real terms) and then rebounded in 2022, remaining 34% below pre-pandemic levels. The total loss in export revenues from tourism amounts to USD 2.6 trillion for that three-year period. Go to Dashboard.

Travel and Tourism Satellite Account for 2018-2022 The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA's Travel and Tourism Sate

Travel and Tourism Research. The official U.S. government source for data and analysis on international travel to and from the United States. The National Travel and Tourism Office is charged with managing, improving, and expanding the system of travel statistics to fully account for and report on the impact of U.S. travel and tourism.

The demand for domestic tourism soared in 2021 amid the pandemic, this is according to the data from the Department of Tourism (DOT). The DOT and the Philippine Statistics Authority (PSA) bared encouraging industry figures in the 2021 Philippine Tourism Satellite Accounts (PTSA) and Tourism Statistics Online Dissemination forum held Tuesday ...

The federal government will work to implement the strategy under the leadership of the TPC and in partnership with the private sector, aiming toward an ambitious five-year goal of increasing American jobs by attracting and welcoming 90 million international visitors, who we estimate will spend $279 billion, annually by 2027.. The new National Travel and Tourism Strategy supports growth and ...

dot chief: intramuros tourist center to elevate tourism experience in the walled city June 10, 2024 Manila, Philippines - Department of Tourism (DOT) Secretary Christina Garcia Frasco expresses her full support as First Lady (FL) Louise...

Generated earnings from tourism activities accumulated to Php 274,351.04 billion as of October 2017. The month of July recorded the biggest receipts of Php 33.53 billion while the month of September registered the highest growth of 117.23%

The Department of Tourism provides tourism statistics in PDF format. Available data includes industry performance for travel and tourism and visitor arrival to the Philippines by country of residence. Access the DOT's data below. Department of Tourism. demographic data, economic, tourism.

Thanks to this influx of visitors and a boost in U.S. travel spending, the travel and tourism industry contributed over two trillion U.S. dollars to the country's GDP in 2022. Domestic leisure ...

Tourism Statistics. Get the latest and most up-to-date tourism statistics for all the countries and regions around the world. Data on inbound, domestic and outbound tourism is available, as well as on tourism industries, employment and complementary indicators. All statistical tables available are displayed and can be accessed individually ...

Complementary (macroeconomic) indicators. The 2023 Edition of the Compendium of Tourism Statistics presents in English, French and Spanish data for 194 countries from 2017 to 2021. Moreover, in this edition, the context of the COVID-19 pandemic is taken into account, as it has caused an unprecedented situation worldwide that has especially ...

TOR ARRIVALS1,482,53582%Based on the Arrival Cards from the Bureau of Immigration, the Philippines received a total of 1,482,535 visitors from January to December 2020, a decline of 82.05% from the 8, ISITOR ARRIVALS, 2016-2020It can be noted that while inbound international arrivals plunged in 2020, the influx of Overseas Fil.

KNOXVILLE, Tenn. (Sept. 14, 2023) - Tennessee tourism generated $29 billion in direct visitor spending and saw 141 million visitors to the state in 2022, according to newly released data from Tourism Economics. Tennessee Governor Bill Lee and Department of Tourist Development Commissioner Mark Ezell announced the news today at Hospitality TN's Governor's Conference on Hospitality and ...

Compendium of Tourism Statistics, Data 2016 - 2020, 2022 Edition. Published: May 2022 Pages: 854. eISBN: 978-92-844-2358-3. Abstract: Understanding, for each country, where its inbound tourism is generated is essential for analysing international tourism flows and devising marketing strategies, such as those related to the positioning of ...

Table representation of structured data; Title: Travel and Tourism Indicators: Description: The U.S. Department of Commerce, Department of Homeland Security, and Department of State prepare these performance indicators for international travel to the United States and for travel facilitation programs. Modified: 2020-06-17: Publisher Name

The 21st Legislature of the Virgin Islands created the Department of Tourism on May 8, 1995. The Department is primarily responsible for the economic development of the Territory through the promotion of tourism and related activities. Other responsibilities include the formulation, implementation, administration and coordination of programs ...

The UN Tourism Data Dashboard - provides statistics and insights on key indicators for inbound and outbound tourism at the global, regional and national levels. Data covers tourist arrivals, tourism receipts, tourism share of exports and contribution to GDP, source markets, seasonality, domestic tourism and data on accommodation and employment.

Evidence on the significance of the tourism economy is presented, with data covering domestic, inbound, and outbound tourism, enterprises and employment, and internal tourism consumption. Tourism policy priorities, reforms and developments are analysed, and examples of country practices highlighted. Thematic chapters provide insights on ...

Yearbook of Tourism Statistics, Data 2017 - 2021, 2023 Edition. Published: April 2023 Pages: 1136. eISBN: 978-92-844-2413-9. Abstract: Understanding, for each country, where its inbound tourism is generated is essential for analysing international tourism flows and devising marketing strategies, such as those related to the positioning of ...

The Department of Justice is taking a closer look at Alterra Mountain Co.'s planned acquisition of Arapahoe Basin ski area.. The department has requested information from the ski area and the 18-resort Alterra Mountain Co., as well as annual surveys and studies of the resort industry conducted by Boulder's RRC Associates for the National Ski Areas Association.

for Corrections through the Attorney -General's department to expand those programs in correcti onal settings. That is a $3.81m investment that has been transferred to the Attorney-General's department. That is the suite of programs that are still in the design and development stage that will be delivered in those correctional settings.

Uttar Pradesh Tourism Department has teamed up with MakeMyTrip to promote tourism in the state. This partnership aims to utilize consumer trends and supply-side data for future policy-making. MakeMyTrip will help tourists planning trips and provide packages to explore local areas, aiding in the growth of UP's tourism.

Yearbook of Tourism Statistics, Data 2016 - 2020, 2022 Edition. Published: May 2022 Pages: 1138. eISBN: 978-92-844-2357-6. Abstract: Understanding, for each country, where its inbound tourism is generated is essential for analysing international tourism flows and devising marketing strategies, such as those related to the positioning of ...

Lake Oroville, California's second-largest reservoir and a popular tourism destination, has permanently shrunk over the past half-century, new data shows. The vast Lake Oroville is, slowly but ...

Comprehensive data collection can measure success of rural tourism, says Sabah Tourism Board Sabah & Sarawak 2h ago Sabah Customs seize drinks with fake tax stamps in Tawau

Compendium of Tourism Statistics, Data 2015 - 2019, 2021 Edition. Published: February 2021 Pages: 854. eISBN: 978-92-844-2249-4. Abstract: Understanding, for each country, where its inbound tourism is generated is essential for analysing international tourism flows and devising marketing strategies, such as those related to the positioning of ...