Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Search ITA Search

2022 Annual and 2023 Year-to-Date Outbound Results

Ntto publishes 2022 and 2023 (through q2) outbound siat results.

—Highlights for Calendar Year 2022: U.S. outbound travelers reached 80.7 million; Mexico (33.5 million) was the largest destination while the United Kingdom (3.7 million) was the largest overseas destination —Highlights for Q2 2023: U.S. outbound air travelers to overseas countries of 13.98 million were +8.9% compared to the second quarter of 2019

The International Trade Administration’s National Travel and Tourism Office (NTTO) is releasing the results of the Outbound Survey of International Air Travelers (SIAT) covering calendar year 2022 as well as the first and second quarters of 2023. The Outbound SIAT measures the characteristics and destinations of international outbound air travelers who are residents of United States.

International Outbound Travelers From the United States in Calendar Year 2022

- Total (Overseas, Canada, and Mexico) U.S. outbound travelers rebounded to 80.7 million in 2022, up 64% over 2021 and nearly 81% of the record U.S. outbound travel in 2019 when it reached 99.7 million.

- Mexico, the largest outbound market (33.5 million), increased 17% from 2021 and attained 84% of its 2019 level.

- Canada, with a significant but smaller base (9.1 million), increased 334% from 2021, but had only achieved 61% of its 2019 level.

- Overseas countries (38.1 million) increased 109% from 2021, and reached 85% of its 2019 level.

- Top overseas countries visited were the United Kingdom (3.7 million), France (3.1 million), the Dominican Republic (2.7 million), Italy (2.6 million), and Germany/Spain (both 2.0 million).

- Top states of residence for U.S. travelers to overseas destinations were California (5.4 million), New York (5.1 million), Florida (4.5 million), Texas (2.9 million), and New Jersey (2.5 million).

- The average U.S. outbound traveler had a combined annual household income of $148,000, stayed 17.9 nights and spent $1,783 outside of the United States.

- The average U.S. outbound traveler started planning their trip outside the United States 102 days prior to departure.

- Vacation/Holiday was the top main purpose of the trip (67%), followed by Visit Friends/Relatives (44%) and Business1 (9%).

- Sightseeing was the top (79.5%) leisure activity engaged, followed by Shopping (71%), Small Towns/Countryside (47.4%), Historical Locations (40.7%), and Experience Fine Dining (36.9%).

International Outbound Air Travelers From the United States in Q2 2023

- Total (Overseas, Canada, and Mexico) U.S. outbound air travelers were 18.7 million in the second quarter of 2023.

- U.S. outbound air travelers to overseas countries of 13.9 million were +8.9% compared to the second quarter of 2019.

- Top overseas countries visited were the United Kingdom (1.6 million, +25% compared to Q2 2019), Italy (1.5 million, +35%), France (1.3 million, +22%), the Dominican Republic (993,000, +14%), and Spain (867,000, +18%).

How to Access Outbound SIAT Statistics

- The SIAT Outbound Survey Monitor is an interactive tool to analyze the characteristics of international outbound air visitors to overseas destinations at the country or world region level on an annual or quarterly basis from 2012 to present. The Monitor is also capable of calculating current year-to-date (YTD) estimates, for example 2Q2023 YTD (which includes 3Q2022 + 4Q2022 + 1Q2023 + 2Q2023)

- Analysis of 2022 U.S. Resident Travel to International Destinations

- Overseas: containing 2 Banners, each containing 40 tables: Banner 1 All Overseas (Characteristics) and Banner 2 Overseas Destinations

- Canada: containing 2 Banners, each containing 40 tables: Banner 1 Canada-Air (Characteristics) and Banner 2 Canada-Air Destinations

- Mexico: containing 2 Banners, each containing 40 tables: Banner 1 Mexico-Air (Characteristics) and Banner 2 Mexico-Air Destinations

- Learn more about the SIAT by visiting the SIAT Program Page .

Discover the Details of the SIAT Program

International Travel Volume to the U.S. in 2022 Reached 64 Percent of Pre-Pandemic Level

Dawit Habtemariam , Skift

March 14th, 2023 at 12:43 PM EDT

The U.S. hosted 51 million international visitors in 2022, amounting to 64 percent of its 2019 volume, according to the National Travel and Tourism Office’s latest data. Outbound travel from the U.S. totaled 80.8 million, down 19 percent from its pre-pandemic volume.

About 24 million traveled from overseas, i.e. not Canada and Mexico, up 161 percent from 2021. Western Europe was the largest regional source market with over 10 million visitors. South America came in second with 4.2 million.

Among overseas countries, the UK was at the top with 3.5 million, followed by Germany at 1.5 million and France at 1.3 million. In 2022, New York was the largest point of entry at 4.5 million, Miami at second with 3.8 million, followed by Los Angeles at 2 million.

In December, international inbound volume rose 46.2 percent year over year to 5 million, representing 73 percent of its pre-pandemic December volume. Overseas visitor volume to the U.S. totaled 2.5 million, representing 94 percent of its pre-pandemic December volume.

Tags: coronavirus recovery , global tourism , international tourism , international travel , tourism

An official website of the United States government

The Journal of the U.S. Bureau of Economic Analysis

- Articles by Date

- Articles by Subject

- Infographics

- Research Spotlights

U.S. Travel and Tourism Satellite Account for 2018–2022

By Hunter Arcand and Paul Kern | April 29, 2024

Download PDF

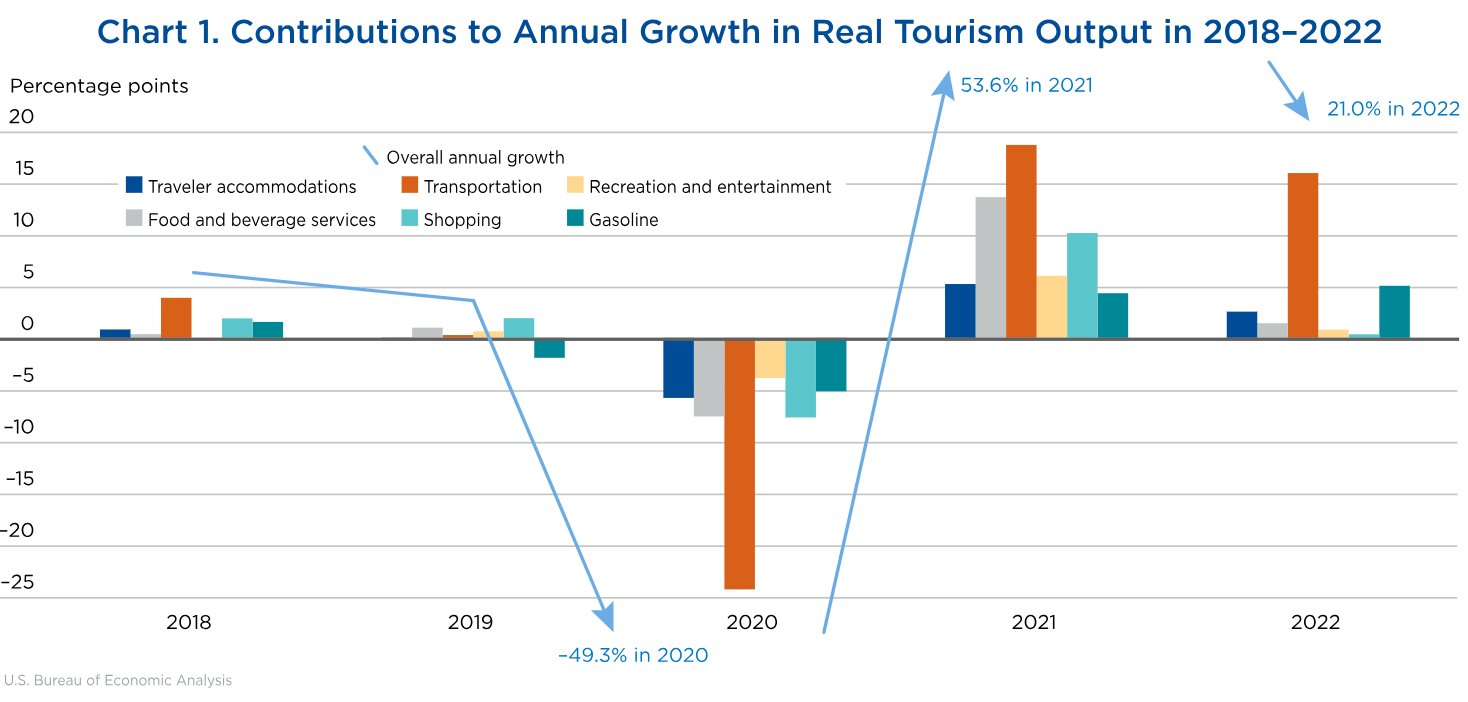

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to statistics released today by the U.S. Bureau of Economic Analysis (BEA). 1 By comparison, the broader economy, as measured by real gross domestic product (GDP), increased 1.9 percent in 2022 after increasing 5.8 percent in 2021.

BEA released new national-level travel and tourism statistics for 2022, with updated statistics from 2017 to 2021. These new and revised statistics primarily reflect the incorporation of source data from the 2023 comprehensive update of BEA’s National Economic Accounts. Improved Estimates of the National Economic Accounts: Results of the 2023 Comprehensive Update ,” Survey of Current Business (November 2023)."> 2 Combined with new and revised tourism-specific source data, these improvements allow BEA's Travel and Tourism Satellite Account (TTSA) to capture the dynamics of this sector more accurately. In addition, the reference year for the chained-dollar estimates is updated to 2017 from 2012.

Highlights from the TTSA include the following:

- As the industry continued to recover from the COVID–19 pandemic, travel and tourism's share of GDP increased from 2.76 percent in 2021 to 2.97 percent in 2022 (table A).

- The travel and tourism industry's real output increased $197.1 billion in 2022 but has not fully recovered from the pandemic. Travel and tourism's real output for 2022 was 94.2 percent of its 2019 level (table B).

- In 2022, real output increased for 22 of 24 commodities. The largest contributors to the increase were domestic passenger air transportation services, international passenger air transportation services, and gasoline.

- Prices for travel and tourism goods and services increased 12.2 percent in 2022 after increasing 6.9 percent in 2021. The largest contributors to the increase were domestic passenger air transportation services, gasoline, and shopping (table C).

- The TTSA is available on the BEA website; see the box “ Data Availability .”

The remainder of this article includes a discussion of trends in travel and tourism output, prices, value added, and employment.

Trends in Output and Prices

Real output.

Travel and tourism real output increased 21.0 percent in 2022. The largest contributors were domestic passenger air transportation services, gasoline, international passenger air transportation services, and traveler accommodations (table B and chart 1). The increases reflect the continued recovery of the travel and tourism industry after the COVID–19 pandemic.

[View larger chart]

Travel and tourism prices accelerated in 2022, increasing 12.2 percent after increasing 6.9 percent in 2021, with prices of 20 of 24 commodities contributing to the increase (table C and chart 2). The acceleration was led by increases in domestic passenger air transportation services, gasoline, and shopping.

Total output

Total tourism-related current-dollar, or nominal, output increased to $2.32 trillion in 2022, up from $1.72 trillion in 2021. In 2022, total output consisted of $1.36 trillion in direct tourism output and $963 billion in indirect tourism output. The 1.71 ratio of total output to direct output in 2022 means that every dollar of direct tourism output requires an additional 71 cents of indirect tourism output (chart 3).

Direct tourism output includes goods and services sold directly to visitors, such as passenger air travel. Indirect tourism output includes sales of all goods and services used to produce that direct output, such as jet fuel to fly the plane and catering services for longer flights.

Tourism Value Added and Employment

Value added.

A sector's value added measures its share of GDP. The travel and tourism industry's share of GDP was 2.97 percent in 2022, 2.76 percent in 2021, and 2.15 in 2020 (table A). This pattern indicates that travel and tourism industries contracted and expanded disproportionately to non-travel and tourism industries during the COVID–19 pandemic and that travel and tourism industries are still slightly below pre-COVID–19 levels.

Direct employment

Direct tourism employment refers to jobs that are directly related to visitor spending on goods and services. Airline pilots, hotel clerks, and travel agents are examples of such employees. Overall, direct employment increased by 1.0 million jobs in 2022 after increasing by 1.3 million jobs in 2021. This was after decreasing by 2.9 million jobs in 2020. The largest contributors to the 2022 increase were traveler accommodations, which gained 244,000 jobs; food services and drinking places, which gained 213,000 jobs; and shopping, which gained 176,000 jobs (chart 4 and table D).

Total employment

Total tourism-related employment (the sum of direct and indirect jobs) increased to 9.4 million jobs in 2022 from 8.9 million jobs in 2021. The 9.4 million jobs consisted of 6.6 million direct tourism jobs and 2.8 million indirect tourism jobs (chart 5). While direct tourism employment includes jobs that produce direct tourism output, such as airline pilots, indirect tourism employment is generated by the businesses that supply goods and services to the tourism sector, such as refinery workers producing jet fuel. Data for 2022 indicate that for every 100 jobs supported directly by the travel and tourism industry, an additional 42 indirect tourism jobs are also required.

- All measures of travel and tourism activity not identified as being in “real,” inflation-adjusted terms are current-dollar, or nominal, estimates.

- For more, information see “ Improved Estimates of the National Economic Accounts: Results of the 2023 Comprehensive Update ,” Survey of Current Business (November 2023).

Subscribe to the SCB

The Survey of Current Business is published by the U.S. Bureau of Economic Analysis. Guidelines for citing BEA information.

Survey of Current Business

bea.gov/scb [email protected]

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

U.S. Department of Commerce

- Fact Sheets

Was this page helpful?

Fact sheet: 2022 national travel and tourism strategy, office of public affairs.

The 2022 National Travel and Tourism Strategy was released on June 6, 2022, by U.S. Secretary of Commerce Gina M. Raimondo on behalf of the Tourism Policy Council (TPC). The new strategy focuses the full efforts of the federal government to promote the United States as a premier destination grounded in the breadth and diversity of our communities, and to foster a sector that drives economic growth, creates good jobs, and bolsters conservation and sustainability. Drawing on engagement and capabilities from across the federal government, the strategy aims to support broad-based economic growth in travel and tourism across the United States, its territories, and the District of Columbia.

The federal government will work to implement the strategy under the leadership of the TPC and in partnership with the private sector, aiming toward an ambitious five-year goal of increasing American jobs by attracting and welcoming 90 million international visitors, who we estimate will spend $279 billion, annually by 2027.

The new National Travel and Tourism Strategy supports growth and competitiveness for an industry that, prior to the COVID-19 pandemic, generated $1.9 trillion in economic output and supported 9.5 million American jobs. Also, in 2019, nearly 80 million international travelers visited the United States and contributed nearly $240 billion to the U.S. economy, making the United States the global leader in revenue from international travel and tourism. As the top services export for the United States that year, travel and tourism generated a $53.4 billion trade surplus and supported 1 million jobs in the United States.

The strategy follows a four-point approach:

- Promoting the United States as a Travel Destination Goal : Leverage existing programs and assets to promote the United States to international visitors and broaden marketing efforts to encourage visitation to underserved communities.

- Facilitating Travel to and Within the United States Goal : Reduce barriers to trade in travel services and make it safer and more efficient for visitors to enter and travel within the United States.

- Ensuring Diverse, Inclusive, and Accessible Tourism Experiences Goal : Extend the benefits of travel and tourism by supporting the development of diverse tourism products, focusing on under-served communities and populations. Address the financial and workplace needs of travel and tourism businesses, supporting destination communities as they grow their tourism economies. Deliver world-class experiences and customer service at federal lands and waters that showcase the nation’s assets while protecting them for future generations.

- Fostering Resilient and Sustainable Travel and Tourism Goal : Reduce travel and tourism’s contributions to climate change and build a travel and tourism sector that is resilient to natural disasters, public health threats, and the impacts of climate change. Build a sustainable sector that integrates protecting natural resources, supporting the tourism economy, and ensuring equitable development.

Travel and Tourism Fast Facts

- The travel and tourism industry supported 9.5 million American jobs through $1.9 trillion of economic activity in 2019. In fact, 1 in every 20 jobs in the United States was either directly or indirectly supported by travel and tourism. These jobs can be found in industries like lodging, food services, arts, entertainment, recreation, transportation, and education.

- Travel and tourism was the top services export for the United States in 2019, generating a $53.4 billion trade surplus.

- The travel and tourism industry was one of the U.S. business sectors hardest hit by the COVID-19 pandemic and subsequent health and travel restrictions, with travel exports decreasing nearly 65% from 2019 to 2020.

- The decline in travel and tourism contributed heavily to unemployment; leisure and hospitality lost 8.2 million jobs between February and April 2020 alone, accounting for 37% of the decline in overall nonfarm employment during that time.

- By 2021, the rollout of vaccines and lifting of international and domestic restrictions allowed travel and tourism to begin its recovery. International arrivals to the United States grew to 22.1 million in 2021, up from 19.2 million in 2020. Spending by international visitors also grew, reaching $81.0 billion, or 34 percent of 2019’s total.

More about the Tourism Policy Council and the 2022 National Travel and Tourism Strategy

Created by Congress and chaired by Secretary Raimondo, the Tourism Policy Council (TPC) is the interagency council charged with coordinating national policies and programs relating to travel and tourism. At the direction of Secretary Raimondo, the TPC created a new five-year strategy to focus U.S. government efforts in support of the travel and tourism sector which has been deeply and disproportionately affected by the COVID-19 pandemic.

Read the full strategy here

An official website of the United States government

- Special Topics

Travel and Tourism

Travel and tourism satellite account for 2018-2022.

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA’s Travel and Tourism Satellite Account.

Data & Articles

- U.S. Travel and Tourism Satellite Account for 2018–2022 By Hunter Arcand and Paul Kern - Survey of Current Business April 2024

- "U.S. Travel and Tourism Satellite Account for 2015–2019" By Sarah Osborne - Survey of Current Business December 2020

- "U.S. Travel and Tourism Satellite Account for 2015-2017" By Sarah Osborne and Seth Markowitz - Survey of Current Business June 2018

- Tourism Satellite Accounts 1998-2019

- Tourism Satellite Accounts Data A complete set of detailed annual statistics for 2017-2021 is coming soon -->

- Article Collection

Documentation

- Product Guide

Previously Published Estimates

- Data Archive This page provides access to an archive of estimates previously published by the Bureau of Economic Analysis. Please note that this archive is provided for research only. The estimates contained in this archive include revisions to prior estimates and may not reflect the most recent revision for a particular period.

- News Release Archive

What is Travel and Tourism?

Measures how much tourists spend and the prices they pay for lodging, airfare, souvenirs, and other travel-related items. These statistics also provide a snapshot of employment in the travel and tourism industries.

What’s a Satellite Account?

- TTSA Sarah Osborne (301) 278-9459

- News Media Connie O'Connell (301) 278-9003 [email protected]

- Global Locations -

Headquarters

Future Market Insights, Inc.

Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware - 19713, United States

616 Corporate Way, Suite 2-9018, Valley Cottage, NY 10989, United States

Future Market Insights

1602-6 Jumeirah Bay X2 Tower, Plot No: JLT-PH2-X2A, Jumeirah Lakes Towers, Dubai, United Arab Emirates

3rd Floor, 207 Regent Street, W1B 3HH London United Kingdom

Asia Pacific

IndiaLand Global Tech Park, Unit UG-1, Behind Grand HighStreet, Phase 1, Hinjawadi, MH, Pune – 411057, India

- Consumer Product

- Food & Beverage

- Chemicals and Materials

- Travel & Tourism

- Process Automation

- Industrial Automation

- Services & Utilities

- Testing Equipment

- Thought Leadership

- Upcoming Reports

- Published Reports

- Contact FMI

Trends, Growth, and Opportunity Analysis of Outbound Tourism in the United States

In-depth Look at Demand Forecast for Outbound Tourism in the United States by Leisure Travel and Business Travel through 2034

Growing Desire Among the American Population to Indulge in Diverse Cultural Traditions Leading to Increase in Outbound Tourists from the United States

- Report Preview

- Request Methodology

United States Outbound Tourism Industry Snapshot

The demand for outbound tourism in the United States is expected to be valued at US$ 108.81 billion in 2024 and reach US$ 412.26 billion by 2034. Outbound tourism is expected to progress at an impressive CAGR of 14.2% through 2034.

Industry Outlook

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

United States Outbound Tourism Growth Analysis

- Tourists from the United States are increasingly flocking outbound not only to roam destinations but also to immerse themselves in the culture of the region. Thus, outbound tourism’s function is increasing in consumers’ eyes in the United States.

- The United States is recognized to be a melting pot of cultures and an increasing number of tourists in the country are traveling internationally to connect to their roots.

- Rising disposable income in the United States is enabling the population of the country to spend more money on outbound tourism activities.

- The United States passport is in the top 10 when it comes to passport rankings, allowing American tourists to travel to nearly every recognized country in the world. Thus, the ease factor is propelling the outbound tourism industry in the country.

- By highlighting previously little-explored locales around the world or showcasing popular destinations in a new light, social media is playing a key role in inducing wanderlust among the population of the United States and leading to growth in outbound tourism in the country.

United States Outbound Travel Trends

- Mexico remains the region that Americans travel to the most, with a survey by the National Travel and Tourism Office of the United States pegging the number at 33.5 million in 2022. The vibrant culture of the nation, along with party hotspots like Acapulco and Tijuana, is inducing more outbound tourism from the United States to the country.

- Increasing number of American patients are taking the plunge and traveling abroad for medical tourism . This trend is particularly evident in Americans traveling to Asian countries for local remedies not widely available in the United States, like Ayurveda treatments in India.

- Rise in pollution levels in the United States is seeing an increasing number of tourists in the country traveling abroad for escapism. Beaches in the Caribbean and jungle safaris in Africa are winning over tourists from the United States.

- Continuing expansion of American companies in the United States is seeing more international travel from the country for business purposes.

- Passionate sports culture in the United States is helping the outbound tourism industry in the country. A survey commissioned by Visit Anaheim that about 45% of American sports fans have traveled abroad to watch sports and 35% have planned international trips around the location of a sporting event.

- With remote work becoming more prominent among the American population, an increasing number of Americans are taking workcations, thus increasing the scope of outbound tourism from the United States.

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

Overview of Restrictive Factors for Outbound Tourism in the United States

Worsening geopolitical conditions and rising flight prices are factors restraining the growth of outbound tourism in the United States. Safety concern while traveling abroad is another factor impeding the growth of the industry.

Comparative View of Adjacent Industries

In addition to the United States outbound tourism industry, analysis has been done on two other related industries. The industries by name are the India outbound tourism industry and the Japan outbound tourism industry.

Government initiatives to facilitate more international travel are helping the growth of outbound tourism in India. Social media influence is also fueling the desire for international travel among Indians.

Rising disposable income in Japan is enabling more Japanese people to engage in outbound tourism. Japanese people’s propensity to make frequent trips to nearby nations like the Philippines and South Korea is also benefitting the outbound tourism industry in Japan.

United States Outbound Tourism Industry:

India Outbound Tourism Industry:

Japan Outbound Tourism Industry:

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Category-wise Insights

Leisure travel is the overwhelming reason for outbound travel among american consumers.

Leisure travel is anticipated to account for 45.0% of the industry share in 2024. Some of the reasons it is the top reason for outbound tourism are:

- Rising disposable income among the American youth is seeing the young generation of the country more inclined towards taking luxurious holidays. Thus, leisure-based abroad trips are getting more extensive among American tourists.

- Tourists are traveling abroad in the United States to immerse themselves entirely in the traditions of the locale they are visiting. Thus, the scope of leisure travel is increasing in the United States outbound tourism.

Families are the Predominant Configuration of Outbound Tourists from the United States

In 2024, families are expected to account for 44.3% of the industry share by tourist type. Some of the reasons families remain the predominant type of tourists are:

- Tourist companies in the United States advertising attractive packages for group travel are seeing tourist units comprised of families travel abroad more.

- Rising concerns with safety and comfort show that American consumers prefer taking trips with families over solo travel.

Competitive Landscape

Framing attractive packages and introducing discounts, offers, and more, is a common policy among players in the United States. Extensive trips spanning multiple countries are also being increasingly offered by these tour providers.

Butterfield & Robinson is one of the prominent players in the American outbound tourism landscape. The company is attracting consumers through its luxury tours. Other players are focused on partnerships and mergers to strengthen their position in the landscape.

Recent Developments

- In July 2023, Brand USA hosted its first sales mission in Japan.

- In 2019, LoungeBuddy, a platform that aims to ease access to lounges in airports, was acquired by American Express.

Key Coverage in the United States Outbound Tourism Industry Report

- USA Overseas Tourism Industry Analysis

- Growth Forecast of Traveling Abroad from the United States

- USA Tourist Spending Overseas Assessment

- USA Outbound Tourism Growth Report

- Demand in the USA Outbound Tourism Industry

- Industry Value of the USA Outbound Tourism

Scope of the Report

The united states outbound tourism industry by category, by purpose:.

- VFR & Others

By Booking Channel:

- Phone Booking

- Online Booking

- In Person Booking

By Tourism Type:

- Cultural & Heritage Tourism

- Medical Tourism

- Eco/Sustainable Tourism

- Sports Tourism

- Wellness Tourism & Others

By Tourist Type:

- Independent Traveller

- Package Traveller

By Age Group:

- 15-25 Years

- 26-35 Years

- 36-45 Years

- 46-55 Years

- 66-75 Years

Frequently Asked Questions

What is the estimated industry value for outbound tourism in the united states in 2024.

The United States outbound tourism demand value is estimated to be US$ 108.81 billion in 2024.

What is the Demand Forecast for Outbound Tourism Through 2034 in the United States?

Outbound tourism demand is expected to reach US$ 412.26 billion by the end of 2034 in the United States.

What is the United States Outlook for Outbound Tourism?

The United States is expected to register a CAGR of 14.2% over the forecast period.

What are the Key Trends for Outbound Tourism in the United States?

Undertaking tourist expeditions to escape worsening environmental conditions and the rising popularity of medical tourism are two of the trends related to outbound tourism in the United States.

What are the Prominent Companies for Outbound Tourism in the United States?

Butterfield & Robinson, Expedia Inc., Priceline Group, and America Express Global Business Travel are some of the prominent companies offering outbound tourism in The United States.

Table of Content

Recommendations

Travel and Tourism

India Outbound Tourism Market

Published : March 2024

Trends, Growth, and Opportunity Analysis of Outbound Tourism in Japan

Published : October 2023

Explore Travel and Tourism Insights

Talk To Analyst

Your personal details are safe with us. Privacy Policy*

- Talk To Analyst -

This report can be customized as per your unique requirement

- Get Free Brochure -

Request a free brochure packed with everything you need to know.

- Customize Now -

I need Country Specific Scope ( -30% )

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

- Diversity Inclusion

- Advisory Panel

- Our Audience

- Private Tourism Academies

- Tourism Ambassador Training

- Destination Training

- Tourism Keynote Speakers

- Sponsorship

- Business Class Podcast

- Skill & Knowledge

- Product Training

- Our Technology

- Become An Instructor

- Sponsorship Opportunities

- Product Training & Promotion

- Hire Us To Speak

U.S. Travel & Tourism Statistics 2020-2021

The ultimate fact guide to america's tourism industry including outbound, inbound, domestic & business travel figures..

The American tourism industry is thriving, International and domestic travel is currently contribution over $1.1 trillion to the United States GDP every year. When looking at the annual travel split of domestic and international travel, Americans domestically traveling within the country last year made up the lion's share, totaling 2.29 Billion, a 2% increase from the previous year. Following past US tourism trends, the volume of Americans outbound traveling internationally was of course much less, amounting to 79.6 Million, which was a 3.5% increase from the previous year.

Leisure based travel accounts for 73.8% of all tourism in America, leaving 26.2% for business and other reasons. Overall the tourism expenditure accounts for $1,089 Billion a year, and the industry provides a direct source of employment for 5.29 million jobs.

RELATED: 2022 Tourism Trends & Outlook

RELATED: Tourism Experts & Inspiring Speakers For Your Next Meeting

TOP U.S. TOURISM STATISTICS:

US Citizen domestic tourism: Americans take 2.29 Billion domestic trips each year.

US Citizen outbound tourism: Americans take 93.0 Million international outbound trips each year.

International Inbound Tourism: Annually, there are currently 79.6 Million international visitors to the US.

$1,089 Billion: Yearly American tourism expenditure ($932.7b domestic / $156.3b international)

Expenditure sources: $267.7B on food services, $232.2B on lodging, $200.4B on public transport, $166.5B on auto transportation, $112.6B on recreation, $109.6B on retail.

15.7 Million American jobs were supported by travel in 2018.

By 2028, yearly U.S. tourism is estimated to hit the $2.4 trillion mark.

Days/yr. traveled by age group: Gen Z (29 days) , Millennials (35 days) , Gen X (26 days) and Baby Boomers (27 days).

Top 5 inbound countries: Mexico (19.1m), Canada (12.3m), UK (4.9), Japan (3.4), China (2.9)

Top 5 outbound by continent: Europe (17.7m), Caribbean (8.7m), Asia (6.2m), South America (2.1m), Central America (3.2m)

Top US cities visited: New York (9.8m), Miami (5.38m), LA (4.98m), Orlando (4.47m), San Francisco (3.57m), Vegas (3.33m)

Business vs. leisure: U.S. travelers took 466.2 million domestic trips for business (26.2%), and 1,779.7 million for leisure (73.8%)

hbspt.cta._relativeUrls=true;hbspt.cta.load(8602415, 'b0bae044-f1ad-4d53-8aec-bd61f4894c04', {"useNewLoader":"true","region":"na1"});

Quick links: navigate our statistic topics, how many americans travel out of their country a year, how much did americans and tourists spend on travel last year, how much is the travel industry worth to america, which american age groups travel the most, why do americans travel, what are the popular trending activities in america, how do americans book their travel.

Find a Tourism Expert, Keynote Speaker or Travel & Hospitality Trainer

US INBOUND & OUTBOUND TOURISM STATISTICS

US domestic travel increased by +2% YTD in 2019 with Americans taking 2.29 Billion domestic trips.

Domestic leisure travel increased 1.9% in 2019 to 1.9 billion.

80% of all US domestic trips were for leisure travel in 2019.

Domestic business travel in 2019 accounted for 464 million trips.

US Citizen outbound tourism: Americans take 93.0 Million international outbound trips each year. (+6.3% YTD Change)

International Inbound Tourism: Annually, there are currently 79.6 Million international visitors to the US. (+3.5% YTD Change)

Top 5 inbound countries: Mexico (19.1m), Canada (12.3m), UK (4.9), Japan (3.4), China (2.9).

Top 5 outbound by continent: Europe (17.7m), Caribbean (8.7m), Asia (6.2m), South America (2.1m), Central America (3.2m).

Top US cities visited: New York (9.8m), Miami (5.38m), LA (4.98m), Orlando (4.47m), San Francisco (3.57m), Vegas (3.33m).

Each year, 35% of American families plan vacations 50 miles or more from home.

In a Travel Leaders Group survey, 24% of Americans stated they plan to travel to Europe.

22% of American vacations are via road trips.

USA’s top 5 road trip routes: #1 Las Vegas – National Parks, #2 Northern California - Southern Oregon Coast, #3 Northern New England, #4 Blue Ridge Parkway #5 Black Hills.

The lion’s share of the United States tourism is from its own citizen’s domestic travel, with over 2.29 billion Americans taking trips within the country. This saw a +2% year to date increase, which is enormous considering that domestic travel spend was worth $932.7 Billion.

As you can see from the US outbound travel statistics above, the number of Americans traveling out of the country is remarkably low compared to domestic travel. According to Trade.gov, outbound tourism hit 93 Million last year and saw a sizable +6.3% year to date increase, showing more Americans are willing to take an outbound trip and travel out the country.

The outbound travel expenditure of these 93 million people was worth $156.3 Billion to America’s tourism industry, so 6.3% is a very significant outbound tourism statistic! The hottest US outbound destinations were Europe, Caribbean, Asia, South America, and Central America.

The US inbound tourism statistics also paint a fascinating picture of America’s continued tourism industry growth, with visitors flocking from Mexico, Canada, UK, Japan, and China. International visitors totaled 79.6 Million with a 3.5% year to date increase, with the top US vacation destinations being cities such as New York, Miami, LA, Orlando, San Francisco, and Las Vegas.

Sources : Statista , AAA , TravelLeadersGroup , TravelAgentCentral , MMGY

RELATED: Keynote Talks, Custom Training Programs & LIVE Workshops

AMERICAS TOURISM INDUSTRY SPEND STATISTICS

American’s spent around $930 billion USD on domestic travel in 2018.

In 2017 the amount spent on summer vacations was around $101.1 billion USD , up from $89.9 billion in 2016.

$1.1 Trillion / $1,089 Billion: Yearly U.S. travel and tourism expenditure ($932.7b domestic / $156.3b international).

U.S. leisure spend totalled $761.7 billion in 2018 from domestic and international travellers.

U.S. business sped totalled $327 billion in 2018, with $136 Billion from travellers attending conventions or meetings.

Expenditure Sources: $267.7B on food services, $232.2B on lodging, $200.4B on public transport, $166.5B on auto transportation, $112.6B on recreation, $109.6B on retail.

Behind nightlife/dining, travel was voted America’s most popular choice for spending disposable income at 36%.

$101.1 Billion is spent every year in America on summer vacations alone.

The average American spends $6,080 on international trips.

Inbound overseas tourists stay an average of 18 nights and spend $4,200 while in America.

Overseas travellers account for 84% of international tourist spend, despite being half of all international arrivals.

Canadian tourists are the biggest spenders with £22.2 billion in the U.S. every year.

New York brings in $16.1 Billion a year from international visitors.

If you’re wondering how much Americans spend on travel each year, it was huge; International and domestic travelers spent $1.1 Trillion US dollars ($1,089 Billion). Americans spending through domestic travel increased by a massive +5.8% year to date, whereas international tourism spends only saw a 0.3% bump from the previous year. To break this down, this sort of spending would support 8.9M jobs, which in turn would generate $171 Billion in tax and $268 Billion in payroll.

Out of the $1.1 Trillion spending, leisure travelers from both international and domestic spent $762 Billion in 2018, which was a +6.1% increase from the previous year. When looking at business travel spend, it had risen +2.4% to $327 Billion, with 41.5% coming from

What are American tourists spending this $1.1 Trillion on? According to the latest US travel spending statistics, food services such as restaurants, bars, and grocery stores were the most popular spending category at 26.7%. This was followed by 23.1% on lodging, 20.0% on public transport, 16.6% on auto transportation, 11.2% on recreation, and 10.9% on retail.

Furthermore, this $1.1 Trillion spending isn’t the only financial impact of the tourists. When you look at the inputs used to supply or produce the goods travelers desire, and take into account the spend of the employees of travel businesses – there is a considerable multiplier of the financial impact to the US economy, estimated to be a total of $2.5 Trillion.

Sources : US Travel , US Travel 2 , Phocuswright , TravelAgenctCentral , Squaremouth , Statista

RELATED: Engaging & Insightful Speakers

US TRAVEL AND TOURISM INDUSTRY JOB STATISTICS

The travel industry accounts for 7.1% of America’s private employment.

15.7 Million American jobs were supported by travel in 2018.

8.92 Million American travel-related jobs were supported by tourism in 2018 (7.73M domestic / 1.19M international)

$1 Million in travel revenue directly produces eight jobs with the industry.

1 in 10 jobs in the U.S. depend on the travel industry (Excluding farming).

$267.9 Billion in payroll is generated yearly by U.S. travel and tourism ($234.6 Billion domestic / $33.3 Billion international).

$170.9 Billion in tax revenue is generated yearly by U.S. travel and tourism ($147.3 Billion domestic / $23.6 Billion international).

A massive $117.4 billion of the $170.9b in tax revenue was spent on leisure travel, $53.5b on business.

International and domestic business travel generated $327.3 billion in 2018 through direct spending.

In 2018, U.S. residents recorded 463.6M trips for business (38% being events and meetings).

The tourism industry is vital to the US economy, so much so that it accounts for 7.1% of the countries private employment. Overall, 15.7 Million American jobs were supported by the tourism industry last year, making one in eight non-farm jobs dependent on it in some way, direct and indirectly. The trend is on the up, the 15.7 Million American jobs in the travel industry had a +1.3% increase from the previous year.

Jobs, where workers are supplying goods or services directly to visitors, would be classed as ‘direct’ - this supported 8.9 million U.S. travel-specific jobs. The remaining 6.8 Million jobs were classed as indirect, these would include areas whereby workers created goods or services which helped produce the goods or services (sold or used by the 8.9M direct jobs).

The travel industry is known for being extremely labor intensive, its upwards trends have the power to develop new career opportunities much fast than any other niche. If you exclude the farming industry, one in ten jobs would be dependent on the travel industry – as an example, one in five non-farming industry jobs would be created from $1 million sales, but the same value in the travel industry would create one in eight.

Sources : US Travel 1 , US Travel 2

US TRAVEL STATISTICS BY DEMOGRAPHIC

42% of Americans own a passport, up from 27% 10 years ago.

Days a year traveling by age: Millennials ( 35 days ), Gen Z ( 29 days ), Baby Boomers ( 27 days ), and Gen X ( 26 days ).

Millennials : 62% of parents travel with kids under five.

Millennials : 58% prefer traveling with friends, 49% book last-minute vacations.

Millennials : 58% want to solo travel, 26% already have.

Solo Travel Women: Take 3 more trips a year and are the most likely to travel alone.

Solo Travel: 43% take over three trips a year.

Solo Travel: 50% have a college or university diploma/degree.

Family: 4 out of 10 plan a trip with a family each year.

Family: 80% take summertime trips to travel with family.

Family: 42% opt for spring break vacations.

Baby Boomers: Aim to take 4+ leisure vacations a year.

Baby Boomers: 30% opt for a cruise as their vacation choice.

When analyzing the latest US outbound travel statistics by age, it was clear that millennials are the group willing to travel for the most extended period at 35 days a year, while generation X vacationed an average of 26 days.

Millennial Americans that are without children are now less of the typical ‘tourist’ and more of the ‘experience’ generation. Most of their booking habits are focused on exploring cultures, booking retreats, or activities rather than visiting theme parks and tourist trap areas. Their freedom and spontaneity let almost half of them book last-minute vacations, with or without friends as, to them, solo travel means cultural growth and meeting new people.

These travel age statistics also show us that half of the solo travelers take up to 3 more trips a year, have a college or university degree, and American solo travel is more prominent in women. What percentage of Americans own a passport? The myth was only one in ten do which appears in many blogs across the web, but now the Census and State department confirm that over 42% of Americans own a passport.

One travel by age group statistic shows almost one in three baby boomers opt for a cruise as their vacation and aim to take at least 4 trips per year. When it comes to families, the majority go during summer break (80%), and only 4 in 10 plan trips with their family. However, millennial families are far more likely to travel with younger children, at 62%.

Sources : Expedia, Resonanceco, InternetMarketingInc , PRNewswire , SoloTravelWorld , TravelAgentCentral , NYU 1 , NYU 2 , AARP , TripAdvisor

REASONS AMERICANS TRAVEL FACTS & STATISTICS

Business/Leisure: U.S. travellers took 466.2 million domestic trips for business (26.2%), and 1,779.7 million for leisure (73.8%).

Family: 95% prioritized their family to be happy and entertained.

Family: 89% prioritized vacation deals and value.

Family: 85% needed planning around school holidays.

Family: 85% wanted outdoor activities for their family.

Gen Z: 55% travelled to increase their knowledge and experience.

Gen Z: 40% travelled to avoid stress and relax.

Millennials: 43% want to find themselves.

Millennials: 23% want to meet new people.

57% of U.S. travellers would choose a free heritage vacation over alcohol for a year.

56% of global international travellers agree it taught them life skills.

51% want to escape normal life and recharge mentally.

42% take trips to visit friends and family.

35% are travelling to experience local delicacies.

Top bucket list vacations are volunteering trips (39%), food travel adventure (38%), mystery journey (38%), ancestry/heritage trip (36%), and sabbatical (36%).

59% of solo travellers stated the reason they went alone is to see the world without waiting for others.

Why do Americans travel? When looking at the data from several survey sources, it was clear that the gender and age of respondents had little impact on the three most important factors.

RELATED: Find An Inspiring Tourism Speaker For Your Next Event

The most important reasons why Americans travel were:

Being with friends and family

Fun experiences (did index higher in younger generations)

Relaxing and unwinding

In terms of gender-based travel reasons, men indexed higher than women overall for exploring the great outdoors or outdoor activities that fall into that category. Generation Z, Millennials, or general age groups from 18-35 had higher responses around wanting to travel for music events or festivals than people aged 35 and over.

The most important trend we’ve noticed from reviewing multiple studies around American’s desires for travel is that younger generations are factoring in ‘experience tourism,’ this was very common in their responses. Experience tourism can be defined by people wanting to book activities or retreats, meet new people and ‘find themselves’. This is popular among solo travellers, like a cultural trip to Thailand for a detox retreat rather than visiting a traditional tourist attraction like a theme park.

Americans over 35 were keen on finding a vacation where food and drink was priority. Visiting a town or city that had cultural foodie scenes or breweries were very trendy.

Sources : ShortTermRentalz, Wysetc , Trekksoft , TravelNews , USTravel , Booking.com , HospitalityNet , SoloTravelWorld

US TOURISM & TRAVEL ACTIVITY STATISTICS

Top 5 culture activities: #1) 65% visit history/art museums, #2) 59% visit aquariums, #3) 56% visit science museums, #4) 55% visit theme parks, #5) 55% visit zoos

73% of families take their children to a theme park, 34% aim for a world famous one.

Overseas visitors top 5 activities: #1) 54% Shopping, #2) 49% visit historical/cultural sights, #3) 49% Restaurants, #4) 46% Monuments / National Parks, #5) 46% Sightseeing tours.

Trending: 89% increase in sunset cruise excursions trips since last year.

Trending : 64% increase in snorkelling activities since last year.

Trending : 55% increase in sailing trips since last year.

Trending : 49% increase in kayaking and canoeing experiences since last year.

33% of visitors will get spa or beauty treatments while on vacation.

15% of travellers book mindfulness or meditation retreats.

One of the reasons Americans do not travel abroad that much is that there is so much to offer in their own country. There is a wealth of cultural activities such as art galleries, museums that index high on the popular activities list, not to mention the volume of theme parks, zoos, and aquariums across the country.

Families want to book all-inclusive trips where everything is taken care of, and they can focus on shopping or taking their children sightseeing. An overwhelming volume of people wanted to book a cruise in the future, which pairs well with relaxing is one of the most popular reasons for travel data above. Cruises were particularly popular in respondents over the age of 45, as well as self-guided tours, whereas group tours were one of the least popular options for booking.

Even though sporting related activities are trending up, going to a physical sporting event was one of the least popular reasons Americans book travel, with most wanting to support their team… from home.

Sources : MMGY , NYU , StatisticBrain, TripAdvisor , Booking.com

RELATED: Online Destination Training For Agents

US TOURISM BOOKING STATISTICS

65% of hotels are booked on the smartphone the same day as it was researched.

79% of Americans researching trips will eventually book on their smartphone via app or online.

90% of U.S. travellers use apps at their destination to make life easy.

#1 factor in Americans booking travel is price, but reviews and amenities are close runners up.

Americans aged 18-24 classed reviews as the second most crucial factor in the booking.

Overall, travel is most commonly booked between 1 to 3 months in advance.

Men are more likely to last-minute book their trips 2 to 4 weeks out.

Excluding price as the main factor for Americans booking travel, amenities, and reviews were the most popular choices. So when comparing hotels, resorts or cruises of similar price, these are the factors that will sway the booking decision.

Popular amenities people look for when booking hotels are free breakfasts, pool access, fitness centers, and on-site restaurants. Public transportation was the least influential factor for people considering amenities when booking; this increased with ride-share options.

Only 11% of travellers book trips 6 months out; the most standard booking periods were for trips within 1 to 3 months.

Demographics wise, travelers without children would be the target market for last-minute booking, the no strings attached lifestyle leaves their schedules open. This makes them the ideal target for using last-minute deals to sign them up to hotel or travel loyalty programs.

Sources : StatisticBrain, ThinkWithGoogle , Trekksoft

Leave a comment

Related articles, these six tourism trends will rule 2022, tourism academy announces top travel trends for 2023, top 20 tourism keynote topics for inspiring journeys.

What are you looking for?

77+ us travel & tourism statistics (2023).

A huge country with 50 states, the U.S. is undoubtedly one of the strongest nations in the world.

It’s also a very popular destination amongst global travellers, thanks to the sheer diversity of its attractions that include manmade wonders and natural landmarks alike.

From financial metropolis to star-studded cities, there’s something for everyone!

For instance, the epic national parks found when exploring Utah and the epic coastal views and nightlife in Santa Barbara .

Did you know that 79.3 million people visit the U.S. in 2019 alone?

The direct domestic and international traveller spending in 2019 totaled to roughly $1.1 trillion.

Yes, travel and tourism plays a key role in the country’s economy.

Below, we’ve summed up some of the most important statistics about U.S. tourism, including the number of outbound travellers, its most popular destinations, and the effects of the recent Covid-19 pandemic .

Let’s dive in!

Sources : Attached with each stat is the source article or data. For a full list of all the sources used, head to the bottom of the post.

Travellerspoint

How many people visit the US each year?

There were around 79.3 million international visitations to the U.S. in 2019.

How big is the tourism industry in the US?

The direct domestic and international traveller spending in 2019 was $1.1 trillion, which resulted in $2.6 trillion of economic output.

Which country visits USA the most?

The country that visits the USA the most is Canada , with 20.7 million trips recorded in 2019 alone. This is followed by Mexico with 18.1 million trips.

How much money do US tourists spend abroad each year?

The average U.S. tourist spends $6,080 abroad.

US Travel & Tourism Key Statistics

- The average overseas traveller spent $3,700 during their visit to the U.S.

- The 2022 National Travel and Tourism Strategy aims to welcome 90 million international visitors annually by 2027.

- The most popular travel destination for U.S. resident travellers in 2019 is Mexico, with 39.3 million visitors.

- The travel and tourism industry was the largest services export in 2019, producing a trade surplus of $53.4 billion in.

- In 2019, there were 9.5 million jobs in the American travel and tourism industry.

- 1 in every 20 jobs in the U.S. was either directly or indirectly supported by travel and tourism.

- With 5.42 million foreign visitors in 2020, New York is the most popular city destination in the U.S.

- In 2021, the U.S. hotel and motel market size was valued at $171.1 billion.

- A third of the 9 million direct travel jobs were lost when the pandemic hit in 2020.

- In 2020, the number of outbound tourists from the United States fell to 33.5 million, only one third of the 2019 figure.

International inbound tourism in the US

1. there were around 79.3 million international visitations to the u.s. in 2019..

[U.S. Travel]

2. 20.7 million of those were made by Canadian residents.

Canada had the largest share of global visitations to the U.S.

The closest US state to Canada is Alaska, and there lots of interesting things to do there !

3. The second largest share of global visitations to the U.S. in 2019 was from Mexico.

This was followed by the UK (4.8 million) , Japan (3.8 million), and China (2.8 million).

4. Excluding Canada and Mexico, the U.S. received 40 million overseas visitors in 2019.

5. the average overseas traveller spent $3,700 during their visit to the u.s. , 6. each overseas traveller stayed an average of 17 nights., 7. however, international arrivals in the u.s. declined to 29 million in 2021. this is a 36% decrease from 2019., 8. the 2022 national travel and tourism strategy aims to welcome 90 million international visitors annually by 2027..

[U.S. Commerce]

9. There were approximately 5.4 million arrivals to the U.S. by overseas business travellers in 2019.

Us outbound travel statistics, 10. there were 99.74 million outbound tourists from the united states in 2019..

11. The most popular destination for U.S. resident travellers in 2019 is Mexico, with 39.3 million visitors.

We can see that a huge proportion of U.S. residents who travel internationally prefer to visit nearby countries like Mexico, with 39.3 million visitors in 2019 .

12. This is followed by Canada (15 million), the UK (3.9 million), Italy (3.2 million), and France (3.1 million).

France is the fifth most popular destinations for US residents, with 3.1 million trips made in 2019 .

13. Barbados received six times the number of U.S. visitors in 2019 than it did in 2014.

14. over the same five year period, the number of american tourists travelling to iceland and morocco rose threefold..

In comparison, 177 thousand Americans travelled to Peru in 2021.

15. As of July 2022, a survey reported that 36% of Americans plan to travel over the next three months.

16. in 2019, 9.4 million trips were taken to the caribbean from the united states..

[TourismAnalytics]

17. 19 million trips were made in 2019 from the U.S. to Europe . This decreased by 86.4% in 2020.

There were a total of 19 million European trips made by Americans from the U.S. in 2019, while only 2.58 million such trips were taken in 2020.

18. The total trips taken to Mexico by air fell from 10.2 million trips in 2019 to 5 million trips in 2020.

19. 63% of adults in the united states have taken a staycation, while 37% have not..

Staycation refers to a holiday spent in one’s home country or city, often involving visits to local attractions.

According to Thrillist, Moab is one of the top staycation destinations in 2023. Surrounded by scenic landscapes and national parks, the best things to do in Moab are centered around its nature.

American travel & tourism economy

20. the travel and tourism industry was the largest services export in 2019, producing a trade surplus of $53.4 billion in..

It’s an extremely important industry with a huge role in lowering the country’s overall trade deficit.

21. Without the tourism industry, the U.S. trade deficit would be 9.3% higher at $630 billion, instead of $576 billion.

22. in 2025, international travel spending in the u.s. is predicted to reach $198 billion., 23. overall, domestic and international travellers spent over $680 billion in 2020., 24. this number comprises of $642.2 billion by domestic travellers and $38.1 billion by international travellers., 25. the direct domestic and international traveller spending in 2019 was $1.1 trillion, which resulted in $2.6 trillion of economic output., 26. the total domestic and international expenditure on business tourism in the united sates was $354 billion in 2019 alone..

The G20 member country with the highest business travel spending in 2019 was the U.S.

Jobs in American travel & tourism industry

27. in 2019, there were 9.5 million jobs in the american travel and tourism industry., 28. 1 in every 20 jobs in the u.s. was either directly or indirectly supported by travel and tourism. .

Jobs varied in different fields, including food services, arts, entertainment, and transportation.

29. In 2022, 5.1 million people are employed in the U.S. tourism industry.

[IBIS World]

30. In terms of employment growth, the number of employees in the travel industry has decreased by 2.9% on average between 2017 and 2022.

This decline is mainly due to the Covid-19 pandemic.

31. Tourism businesses in the United States have an average of 10.4 employees.

32. in terms of employment, travel was within the top 10 industries in 49 states and d.c..

This became only in 25 states in 2021.

33. The American glamping industry was worth $463.7 million in 2021, or 28.9% higher than 2020.

[Grand Review Research]

A subsector in the US travel and tourism industry that is on the rise is the glamping industry, which had a market share of $463.7 million in 2021 .

Popular travel destinations in the US

34. with 5.42 million foreign visitors in 2020, new york is the most popular city destination in the u.s., 35. new york is the city with the fourth most cultural attractions worldwide, with 2,119 attractions open to the public..

The city with the highest number of cultural attractions is Tokyo.

36. After New York, the most popular city destinations in the U.S. are Miami, Orlando, San Francisco, and Las Vegas.

As the fourth most popular city destination in the US, there are surely many things to do in San Francisco .

Likewise, there are also lots of things to do in Las Vegas that would cater to different types of travellers.

Read more: Las Vegas Travel & Tourism Statistics

37. The cheapest city in the U.S. for backpacking is New Orleans, with an average cost of $94.7 dollars per day.

New Orleans is reportedly the most affordable city destination for backpacking in the country.

This includes a dorm bed in a hostel, three budget meals, two rides on public transportation, one paid visit to a cultural attraction, and a small entertainment fund.

38. The second cheapest U.S. city for backpacking is Miami Beach ($97.9 per day).

And surprisingly, LA is the fourth cheapest city for backpacking in the US . There are quite a lot of things to do in Los Angeles that are free or affordable.

US travel & tourism activities

39. the most popular cultural activity for travellers in the u.s is visiting history or art museums (65% of respondents)..

[CondorFerries]

40. For overseas visitors to the U.S., shopping is the most popular activity (54%), followed by visiting historical or cultural sights (49%) and dining in restaurants (49%).

Shopping is one of the things you must do when in Seattle , as it's full of independent shops and major department stores alike.

41. 33% of visitors will usually book a beauty and spa session during their stay in the U.S.

42. 15% of people who visit the united states will stay at a mindfulness or meditation retreat., 43. in 2020, magic kingdom (walt disney world) had 7 million visitors, making it the world’s most visited amusement park. .

It received 20.96 million visitors in 2019, much higher consider the pre-pandemic circumstances. This was also the highest number of visitors compared to other amusement parks worldwide.

44. Disney’s Animal Kindgom recorded 4.17 million visitors in 2020. It’s the fifth most visited amusement park in the world.

45. the most visited waterpark worldwide is the typhoon lagoon at disney world, in orlando, fl. it welcomed 2.25 visitors in 2019., 46. as of march 2020, 51% of travellers in the u.s. believed there were not enough sustainable travel options available., sports impact on us travel industry, 47. the total size of the north american sports market (united states, canada and mexico) was $71.1 billion in 2018., 48. in 2018, over 150 million people attended professional events for the five major sports leagues..

The five major sports leagues include MLB, NFL, NHL, NBA, and MLS.

49. With 190 million domestic trips, sports travel constituted 8% of the domestic travel market in 2018.

50. travellers attending or participating in a sports event spent an aggregate of $41 billion..

51. In 2019, 37% of international travellers in the U.S. said they were interested in an NBA, NFL or MLB experience.

This was an increase from 24% in 2018, which indicates a growing demand from international travellers to attend American sporting events.

US hotels statistics

52. in 2021, the u.s. hotel and motel market size was valued at $171.1 billion..

This has increased from the total of $127 billion in 2020 , and is expected to rise to $258.13 billion in 2022.

53. The U.S. hotel occupancy rate in 2021 is 57.6%, an increase from just 44% in 2020.

54. There were 33.9 million adults using Airbnb in the United States in 2017. This is expected to reach 45.6 million in 2022.

In 2017, 33.9 million adults used Airbnb in the United States.

55. As of January 2022, an average hotel room in Miami cost $304, the highest out of all other American cities.

The average rate for a hotel room in New York was $235, which is the second most expensive in the country.

56. The revenue per available room (RevPAR) of the American hotel industry was $72 in 2021, compared to $45.48 in 2020.

The revenue per available room is calculated from the average daily rate (ADR) and the occupancy rate.

57. The leading hotel company in the Americas is Wyndham Hotel Group, with approximately 7,000 properties there.

The second and third place fall to Choice Hotels International and Marriott International respectively.

58. In terms of number of guestrooms, Marriott International takes the title with 985,756 guestrooms in the Americas alone.

This is followed by Hilton Worldwide with a total of 757,431 rooms.

59. 3 in 4 hotels in the US allow pets.

Approximately 75% of all hotels in the United States allow pets , which is a huge encouragement for people who want to travel with their pets.

US tourism booking

60. 48% of all experience bookings are made after travellers arrive at their destination..

[TrekkSoft]

61. In 2019, “near me” searches on Google Maps grew 150% from the previous year.

62. 51% of us travellers spend less than a week researching once they decide to go on a trip..

[Facebook IQ]

Just over half of travellers from the U.S. spend less than one week to research and plan their trip .

63. The most bookings are made at 10am CET, while 6am CET is the time of the day with the least amount of bookings made.

The highest number of online bookings for US travellers are made at 10am CET.

Why Americans travel

64. 55% of gen z travel to expand their knowledge and experience, while 40% travel to avoid stress and relax., 65. 37% of millennial and gen z travellers are most willing to splurge on food and drink experiences..

Taking food tours is one of the best things to do in Portland , as it's a true haven for foodies.

In fact, 37% of millennial and Gen Z who travels are willing to spend more on culinary experiences.

66. They are least willing to splurge on accommodation and airfare upgrades.

67. 66% of solo travellers travel alone because they want to see the world without having to wait for others..

[SoloTravelerWorld]

In the US, 66% of solo travellers say that they like to travel alone because of the ability to explore without waiting for other people.

68. 48% of solo travellers like the feeling of freedom and independence.

69. other popular reasons for solo travelling include wanting to meet new people, for personal growth, and having different interests than their friends., 70. in 2019, u.s. travellers took 464 million domestic business trips., 71. 28% of family travellers travel for play vacation, while 27% are for a relaxing trip. 13% say that their trips are a holiday to visit family or friends, and 11% are for a sightseeing vacation..

[ShortTermRentalz]

Family vacation is one of the major reasons for travelling in the U.S. In fact, 28% of family travellers travel for play vacation.

Covid-19 pandemic impact on US travel & tourism

72. from february to april 2020, 8.2 million jobs were lost in the leisure and hospitality industry..

This accounted for 37% of the total decrease in nonfarm employment during this period.

73. A third of the 9 million direct travel jobs were lost when the pandemic hit in 2020.

74. In 2021, 2.3 million jobs generated by travel were still lost, which means it was back to only 75% of pre-pandemic levels.

75. international arrivals rose back up in 2021, rising to 22.1 million from just 19.2 million in 2020..

This was a huge effect of the global vaccination programs and lifting of international and domestic travel restrictions.

76. In 2020, the number of outbound tourists from the United States fell to 33.5 million, only one third of the 2019 figure.

77. in 2021, that figure rose to 49.1 million., 78. travel exports decreased dramatically by almost 65% from 2019 to 2020., 79. in terms of how many personal trips baby boomers are planning to take within the next year, 34% answer 4 or more..

34% of baby boomers in America wanted to take 4 or more personal domestic trips in the next year.

As a global finance and culture center, it’s only natural that tourism in the United States will continue to grow, especially as we transition into a post-pandemic era.

Hopefully, this post has been comprehensive enough to help you understand more about travel and tourism in the U.S.A.

Did we miss any interesting aspect?

Drop us a comment below!

And check out these other insightful statistics…

- Airbnb Statistics

- Booking.com Statistics

- Female Travel Statistics

- U.S. Commerce

- U.S. Travel

- Facebook IQ

- ShortTermRentalz

- SoloTravelerWorld

- TourismAnalytics

- CondorFerries

Leave a comment

Let us know what you think.

5 million people can't be wrong

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

TSA checkpoint travel numbers (current year versus prior year/same weekday)

Passenger Volumes Home

Archived Data

* Archived Data has been updated including Known Crewmembers and later flight travel numbers.

An official website of the United States government Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Air Travel Consumer Report: March 2024 Numbers

Contact: [email protected]

WASHINGTON – The U.S. Department of Transportation (DOT) today released its Air Travel Consumer Report (ATCR) on airline operational data compiled for the month of March 2024 for on-time performance, mishandled baggage, mishandled wheelchairs and scooters, and 1st quarter oversales. The ATCR is designed to assist consumers with information on the quality of services provided by airlines.

For March 2024, 0.9% of flights were cancelled, lower than the 1.3% cancellation rate for March 2023 and the 2.0% cancellation rate for pre-pandemic March 2019.

DOT expects that airlines will operate flights as scheduled and that when they do not, airlines will provide consumers the services promised when a flight is cancelled or delayed because of an airline issue. After a two-year DOT push to improve the passenger experience, the 10 largest airlines now guarantee meals and free rebooking on the same airline and nine guarantee hotel accommodations. Consumer-friendly information regarding airline commitments to their customers is available on the Department’s Airline Customer Service Dashboard at FlightRights.Gov . DOT also pushed airlines to provide fee-free family seating and rolled out a new family seating dashboard that highlights the airlines that guarantee fee-free family seating, and those of the 10 largest that do not, making it easier for parents to avoid paying junk fees to sit with their children when they fly.

DOT recently announced two final rules that require airlines to provide automatic cash refunds to passengers when owed and protect consumers from costly surprise airline fees . These rules will significantly expand consumer protections in air travel, provide passengers an easier pathway to refunds when owed, and save consumers more than half a billion dollars every year in hidden and surprise junk fees. Provisions of the final rule on airline refunds were fortified through the FAA reauthorization bill that President Biden signed into law on May 16, 2024.

In addition, DOT is improving transportation for individuals with disabilities. In July 2023, DOT finalized a rule which requires airlines to make lavatories on new, single-aisle aircraft more accessible. Then, in February 2024, DOT issued a proposal to address other barriers that Americans who use a wheelchair encounter when it comes to air travel by, among other things, proposing to mandate enhanced training for airline employees and contractors who physically assist passenger with disabilities and handle passengers’ wheelchairs.

Further, when necessary, DOT takes enforcement action against airlines and ticket agents that fail to comply with the Department’s aviation consumer protection requirements. In 2023, DOT issued the largest fines in the history of the consumer protection office. This includes a $140 million penalty against Southwest Airlines for failing passengers during the 2022 holiday meltdown. That penalty, which was in addition to over $600 million DOT already ensured was refunded by Southwest to passengers, requires Southwest to establish a $90 million compensation system for passengers affected by significant delays and cancellations beginning April 30, 2024. Additionally, DOT has helped return nearly $4 billion in refunds to travelers since the pandemic began.

In April, DOT announced the launch of the bipartisan Airline Passenger Protection Partnership with 18 state attorneys general to investigate airlines and ticket agents and hold them accountable when they violate aviation consumer protection laws. The partnership significantly expands the Department’s oversight capacity by establishing a new fast-track system prioritizing misconduct cases from state attorneys general who uncover unfair or deceptive airline practices. Through the partnership, DOT will provide state attorneys general with access to the federal complaint database and help ensure that airlines cooperate with state investigations.

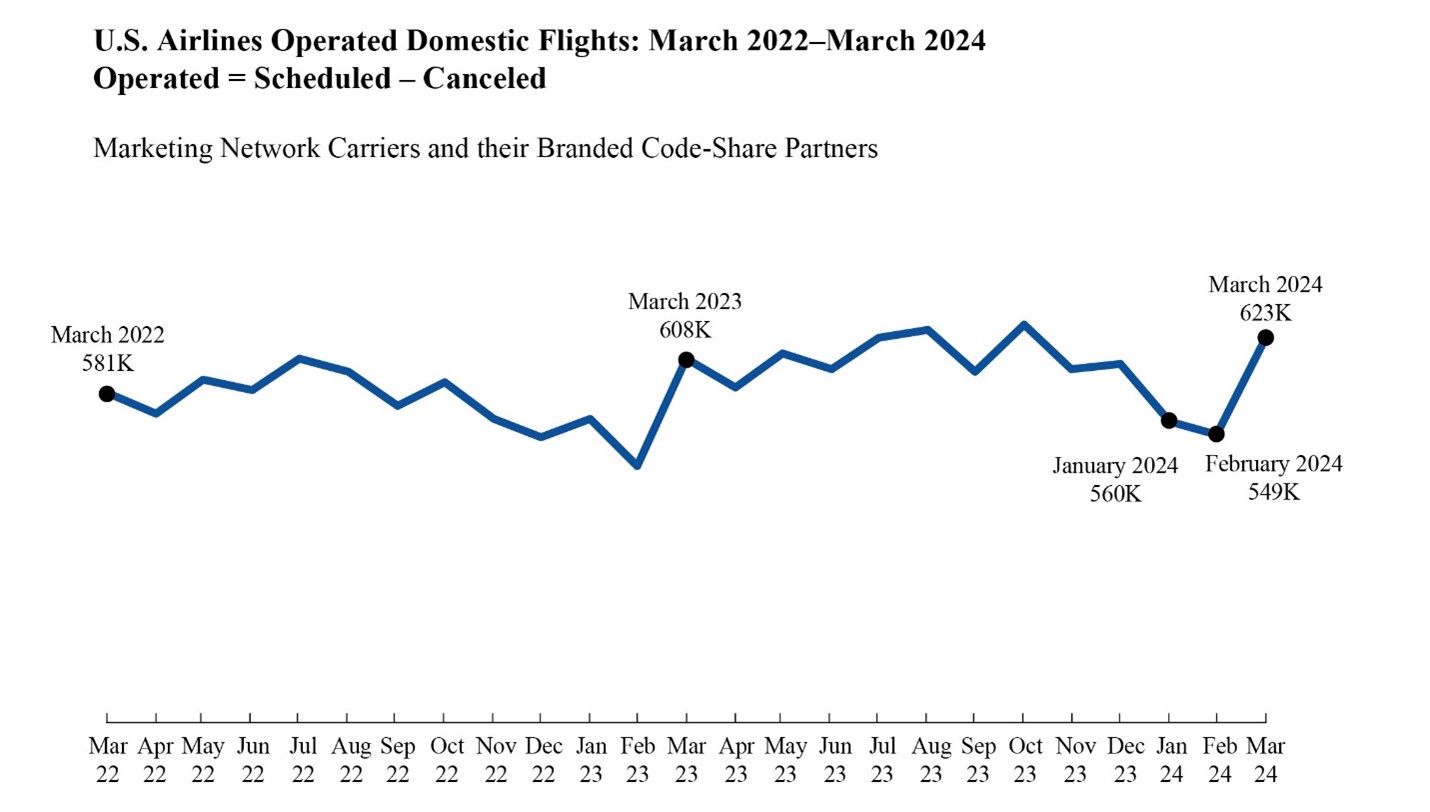

Flight Operations

The 623,409 flights operated in March 2024 were 102.47% of the 608,387 flights operated in March 2023. Operated flights in March 2024 were up 2.47% year-over-year from the 608,387 flights operated in March 2023 and up 13.46% month-over-month from 549,439 flights operated in February 2024.

In March 2024, the 10 marketing network carriers reported 628,786 scheduled domestic flights, 5,377 (0.9%) of which were cancelled. In February 2024, airlines scheduled 552,691 domestic flights, 3,252 (0.6%) of which were cancelled. In March 2023, airlines scheduled 616,234 domestic flights, 7,847 (1.3%) of which were cancelled.

March 2024 On-Time Arrival

In March 2024, reporting marketing carriers posted an on-time arrival rate of 78.7%, down from 83.7% in February 2024 and up from 75.4% in March 2023. The year-to-date on-time arrival rate for 2024 is 78.3%.

Highest Marketing Carrier On-Time Arrival Rates March 2024 (ATCR Table 1)

- Hawaiian Airlines – 87.2%

- Delta Air Lines Network – 84.8%

- United Airlines Network – 81.8%

Lowest Marketing Carrier On-Time Arrival Rates March 2024 (ATCR Table 1)

- Frontier Airlines – 66.4%

- JetBlue Airways – 68.4%

- Spirit Airlines – 69.6%

For the first three months of 2024, the reporting marketing carriers posted an on-time arrival rate of 78.31% up from 76.89% for the same period in 2023.

March 2024 Flight Cancellations

In March 2024, reporting marketing carriers cancelled 0.9% of their scheduled domestic flights, higher than the rate of 0.6% in February 2024 and lower than the rate of 1.3% in March 2023. The year-to-date cancellation rate for 2024 is 1.7%.

Lowest Marketing Carrier Rates of Cancelled Flights March 2024 (ATCR Table 6)

- Delta Air Lines Network – 0.2%

- Hawaiian Airlines – 0.6%

- Allegiant Air – 0.6%

Highest Marketing Carrier Rates of Cancelled Flights March 2024 (ATCR Table 6)

- Frontier Airlines – 2.7%

- Spirit Airlines – 1.7%

- JetBlue Airways – 1.4%

For the first three months of 2024, the reporting marketing carriers posted a cancellation rate of 1.7%, equal to 1.7% for the same period in 2023.

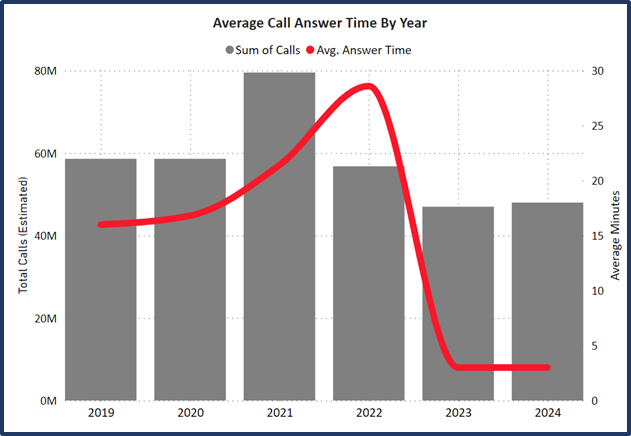

Complaints About Airline Service

The release of air travel service complaint data in the Air Travel Consumer Report (ATCR) has been delayed primarily because of the continued high volume of complaints against airlines and ticket agents received by the Office of Aviation Consumer Protection (OACP) and the time needed to review and process these consumer complaints. The Department is investing in modernizing its system for handling consumer complaints with the support of a Technology Modernization Fund (TMF) investment to improve the customer experience for the tens of thousands of consumers who use the system each year and enable OACP to more effectively engage in oversight of the airline industry.

As DOT modernizes its system, given the continued high volume of air travel service complaints concerning airlines and ticket agents, DOT has revised how it processes consumer complaints received after June 1, 2023. From June 2023 until the date its system is modernized, DOT intends to revise the ATCR to display consumer submissions (complaints, inquiries, and opinions) as opposed to complaints for this period. The Department will continue to display civil rights complaints in the ATCR in a similar manner as before and anticipates publishing submission and civil rights complaint numbers for June 1, 2023 to December 31, 2023 in June 2024.

Tarmac Delays

In March 2024, airlines reported six tarmac delays of more than three hours on domestic flights, compared to 10 tarmac delays of more than three hours on domestic flights reported in February 2024. In March 2024, airlines reported one tarmac delay of more than four hours on an international flight, compared to two tarmac delays of more than four hours on international flights reported in February 2024.

Airlines are required to have and adhere to assurances that they will not allow aircraft to remain on the tarmac for more than three hours for domestic flights and four hours for international flights without providing passengers the option to deplane, subject to exceptions related to safety, security, and Air Traffic Control related reasons. An exception also exists for departure delays if the airline begins to return the aircraft to a suitable disembarkation point to deplane passengers by those times.

The Department investigates extended tarmac delays.

Mishandled Baggage

In March 2024, reporting marketing carriers handled 43.1 million bags and posted a mishandled baggage rate of 0.52%, higher than the rate of 0.48% in February 2024, but lower than the rate of 0.58% in March 2023.

For the first quarter of 2024, the carriers posted a mishandled baggage rate of 0.58%, lower than the first quarter 2023 rate of 0.64%.