Your personal information will be collected by Qwikcilver for the purchase of the gift voucher. Do you want to continue?

Membership ID:

- Main Menu ×

- Search Flights

- Corporate Travel Programme

- Group Booking

- Special Offers

- Travel Insurance

- Flight Schedule

- Check In Online

- Manage Booking

- Seat Selection & Upgrades

- Self-Service Re-accommodation

- Request Refund

- Flight Status

- Nonstop International Flights

- Popular Flights

- Partner Airlines

- Baggage Guidelines

- Airport Information

- Visas, Documents and Travel Tips

- First-time Travellers, Children and Pets

- Health and Medical Assistance

- At the Airport

- Transforming Experiences

- The Air India Fleet

- About Flying Returns

- Sign In/Sign Up

- Our Partners

- Family Pool

- Earn Points

- Spend Points

- Upgrade Cabin Class

- Points Calculator

- Customer Support

What are you looking for?

Enjoy 10X Membership Rewards® points on booking

T&C Apply*

Offer Summary:

Enjoy 10X Membership Rewards® points on booking Air India Flights with American Express Platinum & Centurion Cards.

Terms and Conditions for American Express® RewardsXcelerator Program.

- This Offer is open to only American Express Centurion and Platinum Cardmembers whose accounts are valid and in good standing. An American Express Cardmember for the purpose of this Offer means a person holding an American Express® Centurion Card or American Express® Platinum Card, issued by American Express Banking Corp. in India.

- The Offer is not valid for American Express Corporate Cards issued by American Express Banking Corp. in India or Cards issued by a third party bearing the name or trademark or service mark or logo of American Express ("Network Cards ") issued in India.

- In case the Card account is cancelled before the time of offer fulfilment, Cardmember will not be eligible for the offer benefit.

- The offer in this program will be fulfilled by American Express.

- The offer would be valid on above mentioned Cards issued in India only.

- This offer is being made purely on a “best effort” basis. Cardmembers are not bound in any manner to participate in this offer and any such participation is purely voluntary.

- American Express is only responsible for the crediting of the Membership Rewards® Points into the linked Card account. The redemption is not limited or cannot be held against American Express.

- American Express & Air India reserves the right at any time without prior notice to add/ alter/ modify/ change all of these Terms & Conditions or to replace wholly, or in part, the Offer by other Offers, whether similar to this Offer or not, or to withdraw it altogether.

- This program is being offered by the participating service establishment only and shall be valid for the period mentioned in the offer.

- American Express is neither responsible for availability of services nor guarantees the quality of the goods/services and is not liable for any defect or deficiency of goods or services so obtained/availed of by the Cardmembers under this Offer. Any disputes with regard to the quality of goods/services availed shall be taken up with the merchant/service establishment directly. American Express shall have no liability whatsoever with regard to the same.

- American Express reserves its absolute right to withdraw and/or alter any of the terms and conditions of the Offer at any time without prior notice.

- Nothing expressed or implied in the Offer shall in any way waive or amend any of the terms and conditions of the existing Cardmember agreement with the Card issuer.

- Any disputes arising out of and in connection with this program shall be subject to the exclusive jurisdiction of the courts in the state of Delhi only.

This offer is subject to partner Terms and Conditions mentioned below.

RewardXcelerator Terms and Conditions

Promotional offer: get 10x membership rewards points on each spend on your card at participating merchants. .

- Centurion Card : Cardmember will receive 6 Membership Rewards points (Standard American Express Membership Rewards) and additional 54 Bonus Membership Rewards points for every INR 200 Spent on Centurion Card.

- Platinum Card : Cardmember will receive 1 Membership Rewards point (Standard American Express Membership Rewards) and additional 9 Bonus Membership Rewards points for every INR 40 Spent on Platinum Card.

- Eligible Cards: American Express Centurion and Platinum Cards only

- Validity*: This offer is valid from 28th February’2024 – 6th December 2024(both days included)

The above-mentioned Bonus Membership Rewards Points is for illustration purposes only.

Steps to avail the offer:

- The Cardmember transacts on their eligible American Express Card and with participating merchants to make a purchase during offer period.

- The Standard and Bonus Membership Rewards® Points will get credited to Cardmember’s account by American Express as per regular American Express process.

- The offer will be applicable on the transactions taken only on Air India website & mobile application.

Offer Terms and Conditions:

- There is no minimum spend required to be eligible for/avail the offer.

- There is no maximum capping on the number of Membership Rewards points that can be earned by the Cardmember under this offer.

- The offer with Air India is applicable only on the INR transactions made with Air India official website and/or Air India mobile app and it’s not valid for transactions made via travel agents, Online Travel Agent , any Air India offline counter and/or via any other available channel(s). Transactions made on a currency other than INR will not be applicable for this program.

- The offer can be availed multiple times during offer period.

- The offer is also applicable on transactions taken with Supplementary Card(s).

- Standard and additional Membership Rewards points are awarded to the Basic Card Account only. Eligible spending made on all Supplementary Card(s) will be considered as the cumulative spend of the respective Basic Card Account.

- To qualify for the additional Membership Rewards points, the Card Account must be in good standing, not cancelled for any reasons and enrolled successfully in the American Express Membership Rewards Program.

- The base Membership Rewards points earned on any transaction shall be governed by the product specific Membership Rewards construct and Membership Rewards terms and conditions. To view Membership Rewards terms and conditions, click here. https://www.americanexpress.com/content/dam/amex/en-in/benefits/rewards/membership-rewards/membership-rewards-terms.pdf

- In case the merchant accepts payments via third party establishment or aggregator or any change in the Merchant’s payment acceptance or settlement process, American Express cannot guarantee the credit of Bonus Membership Rewards points on Cardmember’s account.

- There might be instances wherein the Bonus Membership Rewards points are credited late or are not credited at all and American Express shall not be held liable in such cases.

- The offer is not applicable on payments done via digital wallets.

- Any queries pertaining to awarding the Membership Rewards Points will be entertained till 30 days from the date of transaction.

- Refund(s)/reversal(s) initiated (during the offer period) for transactions taken prior to the offer period with participating merchants will result in reversal of Membership Rewards points as per the RewardXelerator Program’s offer Earn rate (i.e., 10X or 20X).

- In case of any queries, Cardmembers can reach out at amex.in/contactus.

- Membership Rewards points will be awarded as per regular American Express process. In case there is a refund/cancellation of the order, the Membership Rewards Points (along with additional Membership Rewards points, under this program) will be reversed back from the Cardmember’s Account in future credit cycle(s).

- The Membership Rewards points will be calculated based on transaction amount billed to eligible American Express Card.

- The Net Cart Value is the total cart value arrived at after all applicable discounts including coupon code.

- In an instance where the partial payment is done by the Cardmember via Membership Rewards Points / cash / wallet / any other method, the additional Membership Rewards Points will be granted only on such part of the payment which is made using an eligible American Express Card.

- Offer can be combined with any other offer/promotion running on the partner site/store.

- In an instance where the full payment is done by the cardmember via Membership Rewards Points, there will be no additional Membership Rewards Points extended to the card member on that transaction.

- Any person availing this offer shall be deemed to have accepted all the terms and conditions.

- Product warranty will be regulated by the Terms and Conditions mentioned on the Warranty Card of respective product/manufacturer.

- Any defects in goods or deficiency in services or any claims, issues, damages or losses arising therefrom with respect to the Product/Services shall be the sole responsibility and liability of the manufacturer/Seller or the Service Provider.

- Pictorial representation of product(s) in communication(s) sent to the customers is purely representational.

- American Express/ Partner reserves the right to cancel an order in case of any fraudulent activity Upon cancellation, the order will not be reinstated.

- It is not mandatory for the American Express cardholders to participate in the offer. Participation in the Offer by the card holder is voluntary and free. Participation in the Offer by the Cardholder will be construed as acceptance of the Terms & Conditions of the Offer and Cardholder is advised not to participate in the Offer if such Terms & Conditions are not acceptable.

- American Express shall determine, from time to time at its discretion, those transactions which are eligible for credit of additional Membership Rewards Points (as part of this offer) and the number of additional Membership Rewards Points which Cardmember shall earn upon completion of a successful transaction on participating merchant website/store.

- The Offer is valid only in India.

- American Express is neither responsible for any deliveries, refunds & exchanges and any additional costs related to deliveries, refunds and exchange. This is to be managed between the Merchant and the Cardmember.

- All Bookings made under this Offer shall be subject to Air India’s conditions of carriage available at www.airindia.com

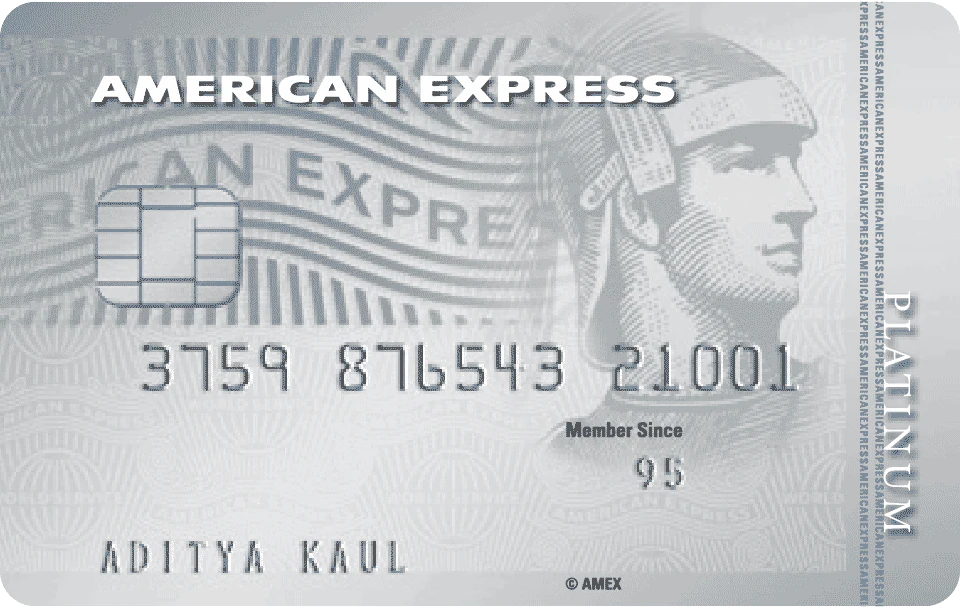

American Express Platinum Travel Credit Card Review (India)

If you’re looking for a best travel credit card in India, the American Express Platinum Travel Credit Card is a must have in your wallet. The attractive reward rate on the card is too good to believe and it holds intact even after so many years of it’s existence.

It has been holding the “best travel credit card” tag almost every year for about a decade and so it’s undoubtedly an amazing product that Amex has ever created. Here’s the detailed review of the Amex platinum travel credit card,

Table of Contents

Milestone Benefit

Airport lounge access, my experience, other benefits, how to apply, faq’s.

American Express Platinum Travel Credit Card has been everyone’s #1 choice when looking for a travel credit card because it comes with an attractive value and a relatively easy to reach spend targets.

Currently, one of the best offer you could get is an additional 2,000 MR points as a part of limited period offer when you apply using a referral link .

*** Limited Period Offer: 2,000 Bonus MR Points ***

Apply through the link above to get 2,000 additional Referral Bonus Membership Rewards ® points (spend INR 5,000 within 90 days).

While there are no renewal benefit (or) renewal fee waiver condition, you maybe eligible for the retention benefit based on your profile/spends which may include complete waiver of the fee as well.

Do note that the reward rate takes a little hit when you consider the renewal fee. However, there is a right way to go about it, we’ll discuss that later in the article.

Note: This is platinum travel card and not platinum charge card , which some get confused often, as multiple Amex cards carries the “platinum” tag.

While I’m not a great fan of the Platinum Travel Credit Card’s design, it’s subtle and you wouldn’t be disappointed to have it in hand. The new design is good indeed.

- Excluded spends : Insurance, Utilities, Fuel

- Rewards don’t expire.

The reward points earned on American Express Platinum Travel Credit Card are ideally meant for Marriott transfers (or) Taj voucher redemptions (according to me), as other options are not attractive enough.

Also note that the MR points earned on plat travel can’t be pooled with other Amex cards, so you can’t redeem for Gold (or) Platinum rewards collection.

While the reward rate on regular spends is not that attractive as seen above, its all about the milestone benefits that makes this card really click!

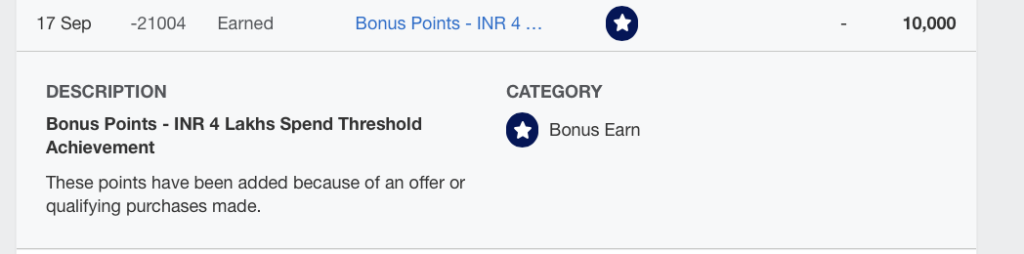

- Note: You’ll unlock 2 benefits on hitting 4L milestone spend, as above.

Note that the above calculation is done by considering “1 MR = 0.50 INR ” as we easily get that value by transferring to Marriott or redeem for Taj voucher redemptions.

With Amex Platinum travel card, you may also redeem your MR points for Flipkart vouchers at the rate of “1MR = 0.30 INR” but that’s not a wise option in my opinion.

So, if we consider regular rewards along with milestone benefits, we get a good ~8.5% return on spend post reaching 4L milestone.

What else one can ask for?!

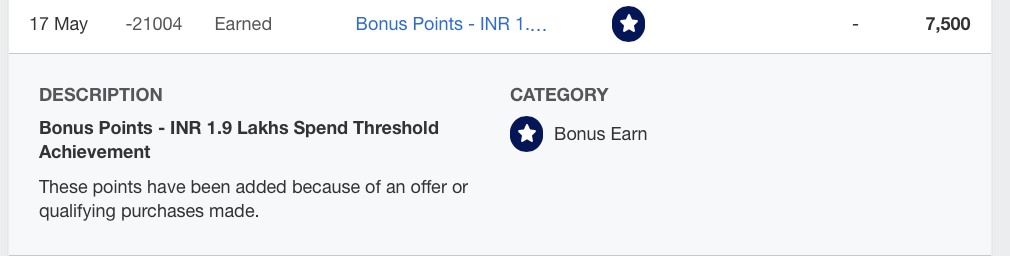

Note : On reaching milestones, you’ll only get 7,500 and 10,000 “bonus” MR points, you’ll then need to call support and ask them to credit remaining points into your account. Gets done in a minute.

Note that you’re eligible only for regular domestic lounge access (for primary cardholders only) but not to the American Express Lounges located in Delhi & Mumbai .

To access Amex proprietary lounges you would need Amex Platinum Charge Card .

While you get complimentary “membership” to Priority Pass for international lounge access, you do-not get any complimentary “access” with it, unfortunately.

I’ve been using American Express Platinum Travel Credit Card since past 6 years and it has been an amazing time with the card so far.

I’ve used the Taj vouchers received through amex platinum travel card and other Amex offers to explore some of the beautiful Taj properties (among others) across the country. Here are some of the nice ones that I’ve explored,

- Taj Santacruz, Mumbai

- Taj Fisherman’s Cove, Chennai

- Taj Mahal Palace, Mumbai

- Vivanta, Guwahati

- Vivanta, Coimbatore

- Taj Lands End, Mumbai

- Taj Bengal, Kolkata

- Taj Connemara, Chennai

- Taj West End, Bangalore & few more

Which one is your most-loved or aspirational Taj property? Maybe I can cover the review of it if that interests you.

- Foreign Exchange Markup fee: 3.5% + Service Tax

- Amex health insurance benefits (with ICICI Lombard)

- Amex Festive Offers

Applying online is the quickest way to get American Express Cards in India.

Currently, one of the best offer you could get is 2,000 additional MR points as a part of the Limited period offer when you apply using a referral link .

*** Best Travel Credit Card in India ***

Apply through the link above to get 2,000 Referral Bonus Membership Rewards ® points and even more, check out the link for current bonus gift.

Note : It’s better to apply using your Aadhaar address, otherwise the application might get rejected (or) delayed. If CIBIL is very good it will not ask for income documents.

1. Is Amex Plat Travel still good in 2024?

Very much it is, as it has the reward rate that is one of the best in industry.

2. What other travel cards can I hold along with Amex Platinum Travel?

Generally most travellers I know have Amex Platinum Travel + Axis Magnus Burgundy + Axis Vistara Infinite . That’s a brilliant combo to fetch overall average reward rate of >10% easily.

3. My address proof is not in serviceable area, what to do?

Amex is strict on that for now (as they know what happens when they don’t follow RBI rules) and so can apply only with valid address proof. Changing Aadhaar address is pretty quick and that works for most.

4. I don’t need a travel card, what other Amex card can I have for rewards?

You should then probably explore the MRCC card. The same can be applied via this referral link.

5. How fast does Amex process the application?

Usually within ~2 days for approval status and another ~3 days for delivery. They’re generally super fast. If it’s your first AMEX Card, it might take additional 1 week depending on various factors.

6. How to get renewal fee waived?

Spending >7L a year usually helps in renewal fee waiver, perhaps you can make use of the spend linked offers post hitting 4L.

- CardExpert Rating: 5/5

American Express Platinum Travel Credit Card with ~8.5% reward rate is one of the highest rewarding Credit Card in India and its a must have in your wallet if you love travel benefits.

That said, the only issue with the card might be the acceptance, but it’s understandable that those who get this card are most likely to use it only at premium hotels and restaurants where the acceptance is generally not an issue.

What’s your take on the American Express Platinum Travel Credit Card? Feel free to share your thoughts in the comments below.

Sign up for Weekly Newsletter

Get curated emails every week, so you don't miss any rewards.

Related Posts

120 thoughts on “ American Express Platinum Travel Credit Card Review (India) ”

I’ve explored.. 1.Taj Krishna , Hyderabad 2. Vivanta by Taj , Hyderabad

Ah yes, I’ve missed adding Taj Krishna to the list. It was a decent one.

I’m new to Amex. By any chance, do you have a referral link for their entry-level SmartEarn card? And does Amex often offer Life Time Free cards as promotions or should I just go ahead now and get the entry-level card? Thanks!

LTF is rare. You shall use the same link and click on “View our other cards” to apply for other card variants.

Thanks! I used your referral link to get the SmartEarn card. Though I’m new to Amex, it got approved within 24 hrs!

Siddharth, I am have decent use of travel platinum card, if we wish to use retention offers on travel platinum card or gold charge card, then when to approach customer care ?, I mean after deduction of renewal fee or before that ? Pls guide

After the fee gets charged.

Plz explain how to optimise Taj voucher for stay cation for family of 4, 2 adults and 2 children Or any other great way redeem Taj voucher

Yes this would be a great topic to elaborate on. Sid, please do consider.

This article and the comments may help: Taj Hotels: Tips on booking, upgrades and more

I have started using an Amex Plat Travel card with a limit of ₹150k, since the last month. I have another credit card with a limit of ₹260k. How many months of usage would it take for an enhancement of credit limit, considering my last month’s usage was about ₹90k and general usage will always be above ₹25-30k?

I have a good CIBIL score but a not very high net ITR of about ₹550k as I am a professional and take advantage of presumptive taxation at 50% of gross income and thereafter deductions of around ₹200k.

Hi Sid, appreciate your effort for reviewing this card. Do we need to call customer care to get the annual fee waived off?

Yes, they may have few options for you based on the spend.

Hi Sid, As always, a nice review, I’ve used this card for five years and it’s still among the finest for travel. I also have MRCC, and they once transferred my MRCC points to my platinum card when I asked them to and they said its one time offer:), which I transferred into Bonvoy and used for 4+1 free night in Thailand.

I have been using the MRCC for nearly 2 years now. Recently, Amex offered an upgrade to the Platinum Travel card FYF. Didn’t go for it, as my travels aren’t that extensive to make use of the benefits of the card that doesn’t offer a fee waver or can effectively be used offline. MRCC, with the monthly bonus rewards can offer up to a 6 percent reward on a spend of 20000, and that will also take care of the card fees too. Think Amex in general, will have to do better in terms of lounge access. The MRCC, with a very high yearly fee unless applied on referral, doesn’t offer any. Even the Platinum Travel card, despite being travel specific, doesn’t offer international lounge. Think the Axis Magnus, despite not being a travel specific card, can give the Platinum Travel a proper run for money for the number 1 travel card in the country as of now!

I just realized that I only got 7,500 MR points last year when I hit the Rs.1.9L threshold. This is why I make sure to read your articles. Always learn something new and I’ll make sure to call the support team and request for the full 15,000 MR points benefit. Won’t make that mistake again!!

Glad you got something useful!

Hey thanks for that Note to call customer care for remaining points. I used to see that i have been using the card and not getting equivalent points, but never gave it a thought to contact customer care. I think i missed my points of the previous years but at least managed to get them this year. Its really strange why i need to call them though.

Are they accepting utility bills or lease agreements or government flat allotment letters as address proof? I have an existing MRCC which was issued in Delhi basis lease agreement. But, now they are saying that they accept only aadhar, passport and election id. When I escalated, received a call back saying it can be worked out as I am an existing customer and will receive a call back in 48 hours. But, no response so far and it’s been 2 weeks. I got a Magnus approved and already have a LTF DCB. So, confused whether this is worth the trouble. But, milestone benefits looks enticing 😂. Any way out except changing aadhar address?

Unfortunately changing aadhar address is the only solution for now.

Hi Siddharth, great review. You’ve clearly done a lot of research which is evident from the article. You have earned yourself a new fan. I’ve got a question, if I may ask. Between this card and Amex MRCC (or some other card from Amex), which one would you recommend for me? A little background about me: I’m a 30 year old male living in Mumbai with a salary of 30 lakhs per annum. My annual spends are about 3-4 lakhs per year. I plan to do international trips one each year next year onwards. I’m mostly interested in AirMiles.

I look forward to your response. Thanks in advance.

If you can reach 4 Lakhs spends in an year, this card is better. MRCC is good for spends upto 20k per month.

Thanks for the review. I have been using it for past 4 years. Need to add an important info. Once the renewal fees are charged, you can just call their helpline. I did it this year. They just asked me to spend 35 k in 2 months which i did it easily and my renewal fee was reversed in the next billing cycle. I was also able to use this card twice at Amex lounge in Mumbai domestic terminal T1.

Sure? Mumbai T1 does not have any amex lounge.

Hi Siddharth, how does this fare against the HDFC Diners Club Black credit card? Given that both cards have the same fee structure.

I am a regular user of Amex reserve card, it’s no more that beneficial card this days, lot of other cards are with good benefits. In my City Surat, many of the shops, garments shops, Resturants doesn’t accept the card. When ever make travel bookings, doesn’t get any benefits, earlier there was benefits on MMT but no more now. Yes need priority pass to access the airport lounge out of India, this card won’t do. Only three discount cards for Taj hotels is given, that too is just to say.

Does Amex gives Card on Card basis? I am not fulfilling income criteria of amex

Hi Sid. Another good article. Have you ever booked Taj Stays under discount rates running on Taj website and faced any issue using Taj Vouchers against that stay? I recently booked a stay during Freedom sale offer on taj website but at the time of checkin, they refused to use Taj vouchers for the same. They showed me terms where it says these can be used only on “Public rates” and not for any already discounted booking, not even member rates (one becomes a member just be enrolling to Tata Neu). Took a lot of convincing to finally use them.

Hi Siddarth, I am holding a Amex Gold Charge Card for the past 8 years. I have recently used all points only for Marriott transfer. One deterrent was that 24K and 18K collection won’t be available anymore. Having said that, is it beneficial to move to Platinum Travel Card? Thanks, Vamsi

Sir, what do you mean by 24k, 18k collection wont be available anymore? source of this info? MRCC card exists on this 24k,18k collection. I will be discontinuing the card if this info is correct

What I meant was if I move from Gold card to Platinum Travel as my main card then the points from MRCC will need to move in to 1 account led by Platinum travel and then 24K and 18k might not be available.

If you want to get rid of this then go for Gold Card instead. The combination of Gold and MRCC and give 24k points every year if you simply spend 1.44 Lakhs for monthly spends with some discipline.

Sid, Awaiting your feedback pls. Thanks, Vamsi

Me: Hi Vamsi, I enjoyed driving Maruti Alto last few years. Shall I now upgrade to Baleno or maybe Ciaz? 🙂

It’s quite tough to answer just with little inputs, so I skip such queries.

That’s why I have the credit card consultation service. It ideally takes about 30 mins to 1hr for beginners to understand the game and arrive at a sweet strategy that they can really make use of.

I understand that not everyone may afford the fee, in which case, I suggest to go through each reviews and comments which will help you find the answer easily. So many lovely contributors have shared advices generously that you can make use of.

using this card for three years now cool points- just above 7 % rewards if annual fee taken into consideration not so cool points – 1.obligation to spend 4 Lakhs on a not so acceptable card 2.rewards of 34000rs Taj vouchers make you think and spend more on a lavish vacation = more expenses I am planning to get rid of this card when it approches renewal

Amex is back with the same old trick now !

Please mention this very clearly, those who are using the referral links, ensure that, they need to provide the same address as that of Aadhar. They pull out the address from Digi Locker.

If different address, then they take this as an opportunity to reject it, and advise the user to re-apply again.

Funny thing is, when they again apply, it will state ” After careful consideration, we are sorry to let you know that we will not be able to approve your application ”

This is the exact wordings they will get.

Then, after a cooling period of 30-45 days, Amex’s different sourcing team would contact these people and approve the card

This was those agents get their internal referral benefits, then fees , and then avoid giving refferal bonus to us (8000 points) .

I know that you (even me) a bug fan of Amex, but this is the bitter truth on how Amex India behave unprofessionally in India. They will find a small mistake to reject the application and contact those rejected ones later and approve the same application with same documents which was submitted earlier! Shame on Amex India.

I have experienced this for 6 friends earlier and even today same thing happened with another friend, will wait for another 3 months and see if they will contact him and approve the application, then I will sue them up 🙂

Thanks for sharing it Arun. Will update accordingly.

I’m aware that they were using this follow up system excessively in the past but now without the proof I doubt if they can still do it. But yes, very useful info for those who need smooth & fast approval apart from the additional rewards.

Hey Sid, i have been using CC from last 3 years and my highest limit is 5L. Credit score is good having no negative remarks. But the problem is I have started working 3 months ago and my package is 4LPA😅. Can I apply for this card?

Hey Siddharth, You are amazing! Thank you for such amazing reviews and offers that you bring about. I have 2 questions- 1. Does AMEX allow us to hold multiple cards of AMEX? As in, if I take travel card now, tomorrow AMEX MRCC offers Lifetime free, I can opt for that as well while holding Travel card? 2. I am a HNI based on my income as of now for HDFC(not a salary account though). I have recently opened bank account with them. I don’t have any cards with them, how do I get LTF offers on cards with them?

1 – Yes. With Amex, you can hold multiple cards and lower variant will be free for you. So if you have plat travel and MRCC both, MRCC will be free. 2- Chase your RM .

My RM doesn’t try at all. All he does is goes by bank policy. He says I cannot get offer on DCB as LTF, I cannot have 2 credit cards with HDFC in future as there is no policy. He’s not ready to believe that people have gotten these things. I am not sure what to do really, seems my RM is worthless

Change your account to different hdfc branch.

State reason “not happy with RM or particular Branch services, so moving a/c to other Branch” (another area/town/city)

I have done this, but not for credit cards. (Got enough sorry calls from RM and BM and got things done)

I don’t want different branch RM to also do the same. How do we make sure that my new branch and RM do have powers to make it happen?

I have got an offer for upgrade but no renewal fee waiver and with my 2-3lakh a year spend on MRCC, i don’t think upgrade is good for me. Since I use IDFC first select card more now because of it’s straight forward rewards and generous lounge access, and Amazon pay card for amazon purchases, even MRCC 1.5lakh spend to waive renewal fee is sometimes hard to come by. Amex really need to add more benefits than removing them to keep their cards trendy.

Hi Sid, no post from u for long time now even when many new cards has been come out from different bank, Ur post and guidance was helpful all the time so request you to share ur views info abt new cards and/or other useful things abt existing cards. #flywithsid

Thanks Sid. Glad that I read your article. Got 60k points credited for past 3 years as well, thanks to you.

Keep sending great stuff!

Hi Sid, Are you sure we can transfer milestone rewards to a transfer partner like Marriott? The signup page mentions the following: 1. Spend Rs. 1.90 lacs in a Card membership year and get 15,000 Membership Rewards points redeemable for Flipkart vouchers or Pay With points option in Amex Travel Online worth Rs. 4,500

2. Spend Rs. 4 lacs in a Card membership year and additionally get 25,000 Membership Rewards points redeemable for Flipkart vouchers or Pay With Points option in Amex Travel Online worth Rs. 7,500.

Thanks, Pankaj

Very much doable.

I just logged into my account and have the following offer:

“Upgrade and unlock benefits worth ₹45,000. Get a ₹1,000* Amazon voucher and 10,000* Membership Rewards® Points as a special offer to upgrade. Additionally, enjoy benefits of ₹45,000* and more on your upgraded Card.”

Full fee of Rs.3500+GST to be paid and spends of 15000/- within 90 days of issuance

Which is better – your referral or the above

FYF (or) Pay fee & get equivalent benefits. It’s a personal choice I would say!

Please clarify how you get 0.5 and 1.0 on Cash Credit and Taj Vouchers, respectively. I think the rate has been revised downwards as cash credit seems to have been revised to 0.25 now. Even Amazon and Flipkart vouchers are at 0.25.

Dear @Siddhart and @Arun Murugan,

I think I have become a victim of their bait and switch tactic as well. 😐

I applied for Amex MRCC card using Siddharth’s link on 25th Nov 2022. The VKYC was done on the same day.

The girl who did my VKYC told me that, “the address that you have mentioned on the application form, is slightly different than the one that is there on your Aadhaar card”. I informed her that, “that is the case because the layout of the fields to input address is weird on the application form”. She asked me, “If you wanna use the address that is mentioned on the Aadhaar card?” I told her yes.

For Employment Verification, on the application form, they required my Work Email Address. I didnt provide that coz my company’s policy is very strict. We are not allowed to provide that. The VKYC girl told me that, i would have to upload my Salary Slips using the link that i received on my Email. I did that on 25th Nov itself, plus on 26th Nov, i uploaded my bank statement as well as a rep from customer service told me that i would have to do that as well, that the VKYC girl didnt mention.

Today is 4th Dec, its been almost 9 days and they havent completed my Employment Verification yet, even though i have provided all the documents that they asked for. Whenever i call them, they give me different email addresses. I have sent an Email asking for an update but i am yet to receive a response.

What should i do?

Any help would be highly appreciated.

Could you explain what you meant by “Note: On reaching milestones, you’ll only get 7,500 and 10,000 “bonus” MR points, you’ll then need to call support and ask them to credit remaining points into your account. Gets done in a minute.”

I already have MRCC applied from Sid’s referral link in Jan 2020 Am enjoying subsequent year reduced fee due to referral Am interested in Plat travel. My query is how can I get plat travel as FYF (as I have existing MRCC card). Can I call and apply directly or use fresh application from referral link ? Please advise .

Yes, Plat travel FYF is possible via above links. MRCC doesn’t affect this app.

do supplementary card holders het lounge access?

Sid, Will I get the Taj Experiences E-Gift Card worth Rs. 10,000 if I apply with your referral link. As I understand its a welcome offer and usually not given on FYF cards. Please clarify.

You’re right.

Is the 10k Taj Experiences E-Gift Card on 4 lakh spends every year or first year only?

Taj vouchers can be earned on 4L spends every year

Which card you recommend in terms of rewards MRCC or Travel Platinum?

Travel plat for spending of 4lac+ Mrcc for 1-2l spends

Sid, so on spending 4 lakhs on this card, we get in total 30,000 INR Taj vouchers (including the 10k milestone benefit one)?

Also, is there a limitation on number of Taj vouchers that can be used during a stay?

– Yes

– Not known to me but it’s better to stick to ~5 or less at a time whenever possible.

Hi Anirban, Thr is no limit on the number og vouchers that can be redeemed in one go. Once i have used 11 vouchers amounting to rupees 110000 in total.

It’s not a 8.5% return Siddharth, you’ve got to factor in the annual charges also.

Although a great card earlier i think it’s lost its Sheen in recent past

Still a great card I would say!

Most do get at least 50% off on renewal when one hits 4L spend, also there maybe spend challenges to get 100% waived off.

Ideally we’ve to look at only one fee at a time. But even in worst case we get a healthy ~7% which is great!

i JUST APPLIED FROM YOUR REFERRAL LINK BUT I GOT THIS MESSAGE. CAN YOU FIND OUT THE REASON ?

Thank you NILESH! for applying for the American Express® Platinum Travel Credit Card. Application Reference No. ***** After careful consideration, we are sorry to let you know that we will not be able to approve your application.

Nilesh, You’re trying to apply for a 3rd “credit Card” Amex issues only 2 Credit Cards & 1 Charge Card per person.

Before applying, I had already cancelled one card. Then I applied using your link. Now they are saying you have to wait 90 days before applying. They did not mention anything like this before I cancelled the card.

Hi Siddharth, I recently purchased health insurance via Amex and did get reward points for it. I guess no reward points are awarded for buying insurance from any other portals or vendor. Cheers!

As a supplementary card holder of the platinum reserve, can I apply for this in my own name without closing the reserve?

Insurance offer is rolled out today on my Travel card, 5 membership rewards per 100 spend, up to 10000 rewards.

But why would anyone go for it? 🙂

Even I received offer 5 MR for every 100 spent on insurance. Unfortunately I have paid all my insurance from other card. Too late.

Hey since how long is the system of Calling Up for Bonus rewards going on? As I have not called for the same at all.

Can I request them to credit the bonus rewards for last 3 years?

Hi Siddharth,

I am new to the credit card world and have to say it was an amazing review. To give you a background, I’m 30 and have an annual salary of 24LPA. My annual spending is around 2-4L, and on an avg, my monthly spending is ~20K. I wish to generate Reward points that can help me with free/cheap airline tickets or gift vouchers on Flipkart/Amazon.

I request you to tell me which card would be suitable for me, Amex MRCC/ Platinum Travel/Axis Magnus/ Axis Vistara Infinite/ Axis Atlas. Your recommendation would be much appreciated

The spends vis-a-vis your salary is quite low though that is a personal thing but you may want to look into it to optimise your usage of cards. Given the information AMEX MRCC should be your best bet !

Applied for Amex Plat Travel card via Apply Now link of this post on 21 Dec. Digilocker Aadhar verification done instantly. VKYC done within minutes. Received mail regarding approval of card on 22 Dec. Received card via Bluedart today on 25 Dec. This is some speed ! Thanks for the referral link Sid !

Has anyone with an AMEX Indian card been able to apply for an AMEX US card? would be interested to know if yes , how can it be done

You have an option in netbanking to transfer your card to another country although I haven’t tried it. Else, you can call Cc.

I received AMEX card in UK based on my Indian Platinum Travel card.

I got Amex card in Canada based on my Amex card in India.

Hey Sid. I’ve been using this card for 4 years now. Two quick points: 1) Reward after hitting 4L is not attractive. So, I use HDFC regalia after hitting 4L. But regalia has been downgraded so much in recent years that I’m thinking about getting some other secondary card. 2) I’ve never been offered Annual fee waiver despite high spends. Do you contact customer service and request for it?

I currently hold an MRCC card and upgraded to a platinum travel card. Do I have to pay the annual fee for both cards considering if not reaching the spending threshold?

Wondering if AMEX would come up with 22 rewards point offer around republic day time…

Mostly the taj hotel rates on thier website is inflated by 30 percent so actual value of 10k voucher is 7k only.

One trivial question, are emi transactions also considered in milestone. Ex., (30k – split as 10k for 3 months) will this be added as 30k in the milestone ?

Thanks Sid. Glad that I read your article. Got 90k points credited for past 4 years as well, thanks to you.

Great article thanks. Had a quick question. You’ve said that Fuel, insurance and utilities are excluded spends. I’m assuming these are just for base reward points. Or do they no count towards the 1.9L and 4 L milestones as well.

It will be counted for milestone targets.

Has anybody noticed that amazon on its app have stopped taking amex card , I tried booking flight and railway tickets and it didn’t showed my amex card and when manually put the cards details and it’s says this type of card is not accepted. Strange

better way is to buy Amazon voucher from amex gyftr

I have a smart earn cc and the platinum travel cc. I have earned reward points on both. Its not making sense to keep the smart earn card, if I close it, will I lost on points? is it worth keeping smart earn if I already have the platinum travel cc?

Which Rent payment app accepting this card..?

Housing.com, i was able to unlock my milestones with a few txn’s

Does rent get covered in utilities? Also are rental spends counted towards milestone benefits?

Hi Mukund, You cannot use Amex card for making rental payments. Even if you make the payment through any rental payments app, you wont get any RP’s as it gets counted under utilities.

Where do you guys spend on Amex cards to reach milestone… Now that Cred Education fee payment thru Amex is stopped

Is the 0.5 conversion on marriot and taj still there? Don’t see it anymore. They have changed it to 0.25? Can you confirm?

Hi Siddharth, I currently hold this card – Amex Platinum Travel. I have been getting upgrade intimation to the Platinum Reserve. Should i upgrade to the reserve or stick to the travel? On a separate note, I have chosen not to upgrade to Platinum Metal Charge as of now, maybe later.

Hi Sid, I transferred 60k points to marriot and then to UnitedMilage. Currently there is offer going on for every 60k points transfer we will get 10k miles extra. Current transfer ratio is 3:1. So total I got 30k miles. Is it good transfer or bad one?

Essentially that’s 2:1 and it’s indeed good value with United.

Hi brother, I have a question related to amex platinum travel supplementary card.

will the supplementary card holder get separate login details and can see the transactions made by him/her and be able to pay outstanding on his/her card? Or only primary card holder can see the transactions made by supplementary card and only primary card holder has option to pay the outstanding?

Will the supplementary card holder get separate login details and can see the transactions made by him/her and be able to pay outstanding on his/her card? – Yes

has anyone got the complete fee waiver on amex platinum, i got complete waiver on MRCC

if we don’t get the complete waiver, then the card is too costly and no point in upgrading

I called Amex today and spoke to their customer care about the best way to utilize points, and they said either Flipkart vouchers or Taj vouchers. I asked if there’s any other hotels, they said no. So I’m confused about the Marriott thing now.

Marriott comes under “points transfer” and not as vouchers.

Also, the rewards section on the app shows, only Taj and shows the conversion rate as Rs 250 for every 1000 points, which is vastly different from this article. Am I the outlier, or is this the standard now?

Conversion rate is correct as you mentioned. However, if you go for Taj vouchers you will get 18k/24k gold under Rewards Redemption option.

Noticed a rounding off, for 376 spent, the RPs credited were 8, not 7.

There is strange rule in Amex that they need the applicant to have address proof document on current address. My all documents ( Aadhar, PAN Voter ID or Passport) have my permanent address and I stay away from home town due to job reasons. Hence they rejected my credit card and refusing to allow me to apply for it. What could be a possible way out for the same ?

It is easy to change Aadhar address. Change it. Apply for the card. Change it back again

Does one earn rewards point on rental transactions with this card ?did not see it as an exclusion

Amex is pretty notorious here, they should credit points automatically.

Note: On reaching milestones, you’ll only get 7,500 and 10,000 “bonus” MR points, you’ll then need to call support and ask them to credit remaining points into your account. Gets done in a minute.

Good review as always and yes we need reviews of Taj properties as you share of other properties you’ve visited.

The design has changed now. This is an amazing card and has no rigid monthly milestones like MRCC. On renewal last time I got the option of 50 per cent fee waiver or 10,000 RPs on paying the full fee. I opted for the latter.

Thanks Siddharth, the post helped me in getting ~1.2L points from previous years as I was unware of bonus points addition can be done only manually.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Don't subscribe All new comments Replies to my comments Notify me of followup comments via e-mail. You can also subscribe without commenting.

About Contact

Terms of Use

Terms of Use Privacy Policy Advertising Policy

Subscribe to Emails

Love Credit Card Rewards? Then you would love the email newsletters too!

- All Card Categories

- Best Credit Cards

- Lifetime Free

- Forex Credit Cards

- RuPay Credit Cards

- International Travel

- Fintech Cards

- All Card Issuer

- Offers & Rewards

- Lounge Access

- American Express

American Express Platinum Travel Credit Card

American Express is globally known for its range of premium credit cards. In India, American Express has only one offering in the travel category – The American Express Platinum Travel Credit Card, which is among the most premium AmEx Credit Cards. It comes with attractive welcome benefits and plenty of milestone benefits in the form of Membership Rewards Points, which can be redeemed not just for travel-related expenses like booking air tickets, hotels, and cars on the Amex Travel Online portal but also for shopping vouchers at online shopping sites, and e-vouchers on American Express’s online shopping portal.

Apart from the welcome and milestone benefits, you earn 1 Membership Rewards Points for every ₹50 spent using the card (with a few exceptions). This card is perfect for those who frequently travel as it offers Taj vouchers on achieving spends, complimentary airport lounge access, and useful memberships like Priority Pass.

If you apply for the American Express Platinum Travel Credit Card through Card Insider, you can get 2,000 Referral Bonus Membership Rewards points. Apply now to earn bonus points along with a limited edition playing cards set by Manish Malhotra.

Joining Fee

Renewal fee, best suited for, reward type, welcome benefits, movie & dining.

Up to 20% discount at select restaurants.

Rewards Rate

1 Membership Rewards Points/₹50 spent

Reward Redemption

Membership Rewards Points can be redeemed for online shopping vouchers, INSTA rewards for offline purchases, and transfers to various flight and hotel loyalty programs

Complimentary Airport Lounge Access and Priority Pass

Domestic Lounge Access

2 Domestic Lounge Access Every Quarter (8 Each Year)

International Lounge Access

Access With Free Priority Pass Membership Worth USD 99

Insurance Benefits

Spend-based waiver, rewards redemption fee, foreign currency markup.

3.5% of the transaction amount

Interest Rates

3.5% Per Month (Annually 42%)

Fuel Surcharge

No fuel surcharge at HPCL fuel stations for transactions of up to Rs. 5,000, 1% surcharge on transactions above Rs. 5,000

Cash Advance Charges

3.5% of the transaction amount subject to a minimum charge of Rs. 250.

- Welcome Gift of 10,000 Membership Rewards Points.

- 1 Membership Rewards Points for every Rs. 50 spent.

- Rewards Points-based Milestone benefits on reaching milestones like expenditure of Rs. 1.9 lakh / 4 lakh in a membership year.

- Complimentary Taj Stay voucher on expenditure of Rs. 4 lakh in a membership year.

- 8 domestic airport lounge access every year (max 2 per quarter).

- 0% convenience fee at all HPCL fuel stations across India.

AmEx Platinum Travel Card Features and Benefits

Being one of the premium credit cards issued by American Express, the Platinum Travel Card offers some great privileges across different categories, especially travel. To understand all the features and benefits of this card in detail, refer to the detailed information provided further in the article:

You get 10,000 American Express Membership Rewards Points as a welcome benefit, which can be redeemed on e-commerce websites like Flipkart for shopping e-vouchers from Amex’s store and for payment towards your card’s statement balance under the Cash + Points scheme. You get this welcome benefit only if you spend at least ₹15,000 in the first 3 months of the card’s issuance.

Milestone Benefits

- If you spend ₹1.9 lakh in a year, you are entitled to 15,000 Membership Rewards Points worth up to ₹4,500 (for redemption against Flipkart voucher or Pay with Points on AmEx Travel Online).

- Expenditure of ₹4 lakh entitles you to 25,000 Membership Rewards Points worth up to ₹7,500 (for redemption against a Flipkart voucher or Pay with Points on AmEx Travel Online) and an additional Taj Stay Voucher worth ₹10,000.

Travel Benefits

- It’s a travel card, so it comes with plenty of travel benefits like 8 domestic lounge access (2 per quarter) and complimentary membership of Priority Pass, with USD 99 waived off (however, a usage fee of USD 35 is payable for every lounge visit under the Priority Pass benefit) for the international lounge.

- The Membership Rewards Points can be spent for hotel/flight/car bookings on the Amex Travel Online portal.

- Expenditure of ₹4 lakh also entitles you to a Taj Stay voucher worth ₹10,000, which can be used at the Taj, SeleQtions, and Vivanta hotels.

Movie and Dining Benefits

You get up to a 20% discount on your dining bills at select partner restaurants on payment via the Platinum Travel Card. Apart from this, American Express frequently comes up with attractive offers on food delivery portals like Swiggy and Qmin.

Fuel Surcharge Waiver

You need not pay any fuel surcharge at any HPCL fuel stations across India for transactions up to ₹5000. However, a surcharge of 1% is payable for all transactions greater than ₹5000.

AmEx Platinum Travel Credit Card Rewards

Every ₹50 spent using the AmEx Platinum Travel Credit Card earns you 1 Membership Rewards Points. Certain categories would not be eligible for earning rewards, such as spending on fuel, insurance, utilities, cash transactions, and EMI conversion at the point of sale.

Rewards Redemption

- The Membership Rewards Points can be redeemed on popular e-commerce websites (like Flipkart) by purchasing e-vouchers from Amex’s online shopping portal, INSTA purchases at offline stores, and making credit card bill payments under the Cash + Points scheme.

- Amex’s Membership Rewards Points can also be transferred to other air miles and hotel loyalty programs like Asia Miles, British Airways Executive Club, Club Vistara, Emirates, Skywards, Etihad Guest, Finnair Plus, Qatar Privilege Club, Singapore KrisFlyer, Virgin Points, Marriott Bonvoy and Hilton Honors.

AmEx Platinum Travel Credit Card Charges

- Annual Fee: The annual renewal fee of the AmEx Platinum Travel Card is ₹5,000 per annum; however, the first year’s annual fee (joining fee) is just ₹3,500, while the renewal fee is applicable second year onwards.

- Interest Rate: If you are not able to pay off your American Express Platinum Credit Card bill on time, an interest rate of 3.5% per month is applicable on the due amount.

- Foreign Currency Mark-up Charge: A mark-up fee of 3.5% of the transaction amount is applicable on all foreign currency transactions made with this Credit Card.

Advantages of AmEx Platinum Travel Card

- Attractive Milestone Benefits: The AmEx Platinum Travel Card provides very attractive milestone benefits to cardholders- 15,000 Bonus Membership Rewards Points on an annual expenditure of ₹1.9 lacs and 25,000 Bonus Membership Rewards Points on the expenditure of ₹4 lacs in a year. Apart from the Bonus Membership Rewards Points, you get 3700 Regular Membership Points. You also get complimentary Taj Stay vouchers worth ₹10,000 with the card.

- Complimentary Domestic Airport Lounge Access: This credit card offers 8 complimentary lounge access per annum (max 2 per quarter) at domestic airports across India- which is a decent number of lounge visits for a sub-premium travel credit card.

- Movie and Dining Discounts: Although this credit card is a travel credit card, you also get a discount of up to 20% at partner restaurants across the country.

Drawbacks of the AmEx Platinum Travel Card

- Reward Rate: The AmEx Platinum Travel Card earns you 2 Membership Rewards Points per ₹100 spent with the card. Since the maximum monetary value of 1 Membership Rewards Point is ₹0.5, the maximum reward rate that you can get with an AmEx Platinum Travel Card is 1%. However, you get a 3x reward rate on purchases made via the American Express Reward Multiplier Portal .

- No Complimentary International Airport Lounge Access: Regarding international airport lounge access, the Platinum Travel Credit Card offers no complimentary lounge access at international airports. However, the card does provide a complimentary membership of the Priority Pass lounge access program (worth USD 99) for international airport lounge access. Lounge access under the Priority Pass membership that you get with the Platinum Travel Card is chargeable- USD 27 per visit per guest.

- No Insurance Benefits: While most travel credit cards offer a complimentary comprehensive insurance cover with travel-related insurance benefits like personal air accident cover, insurance against loss/delay of check-in luggage, loss of travel documents, etc., you do not get any insurance benefit with this Card.

Who Should Apply for American Express Platinum Travel Credit Card?

American Express Platinum Travel Credit Card is the right credit card for you if-

- You do not want to compromise your travel experience as the AmEx Platinum Travel Card offers complimentary Taj Stay Vouchers to the cardholders on achieving certain stipulated spend milestones.

- You are a frequent domestic traveler as the card entitles you to 8 complimentary airport lounge access at domestic airports across India.

You should look for a better option if-

- A direct reward rate is more important than add-on privileges like complimentary hotel vouchers.

- You are a frequent international flyer as American Express Platinum Credit Card entitles you to Priority Pass membership. You do not get any complimentary international airport lounge access with the card.

- You want a travel credit card with a lower markup fee on foreign currency transactions.

Credit Cards Similar to AmEx Express Platinum Travel

Marriott Bonvoy HDFC Bank Credit Card is a credit card similar to the American Express Platinum Travel Credit Card in terms of the benefits that it offers. The following table gives a comparison between the two credit cards-

AmEx Platinum Travel Card Eligibility

The income and age-based eligibility criteria for the American Express Platinum Travel Credit Card are as per below-

- Must be a resident of India.

- Applicant should be above the age of 18.

- Both salaried and self-employed individuals should have an annual income of ₹6 lakh or more.

- For self-employed individuals, the company should have been trading for the past 12 months.

How to Apply for AmEx Platinum Travel Credit Card

You can apply for an American Express Platinum Travel Credit Card online. The application procedure is effortless. Just click on the “Apply Now” button to get started. You need to provide a few documents, including identity proof like a PAN card and income proofs like ITR or salary slips, and submit your application online. American Express officials will contact you if any additional documents are required. If your application is successful, you’ll receive your card within 15 days.

AmEx Platinum Travel Credit Card Review

Although the annual fee of the American Express Platinum Travel credit card is slightly on the higher side (₹5,000 after the first year), it is a decent credit card for people with wanderlust and for those frequent fliers who travel on business trips. Apart from the travel benefits, the card also offers some shopping benefits, so it might also fit the needs of someone who loves to shop online.

What do you think about this card? Do let us know in the comments if you’re an existing user or have used this credit card. Feel free to comment and let us know about your experience with the card.

For places outside India, If I use the Amex Platinum, is the lounge access free or not? Can you please also confirm Whether Infinia and Magnus provides free access for priority pass lounges outside india?

Outside India lounge access shall be chargeable, Priority Pass membership shall be waived but lounge access still charged. Infinia and Magnus do offer complimentary airport lounge access outside India.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Add cards to start comparing

American Express Platinum Travel: One of the best Travel Credit Cards in India

March 18, 2023 by Ajay 8 Comments

Unlike other card-issuers, who provide enhanced rewards on booking travel with your “travel credit cards”, American Express Platinum Travel Credit Card focuses on providing rewards which enable you to experience travel.

On an ongoing basis, the Card provides you with 1 Membership Reward (MR) point for every INR 50 spent on the Card. There are exceptions, though, such as spending on fuel, insurance, and utilities, which do not earn any MR.

If you shop via the Rewards Multiplier portal , Amex offers additional points. In this case, the points rewarded can go up to three times the usual points received for using the Card.

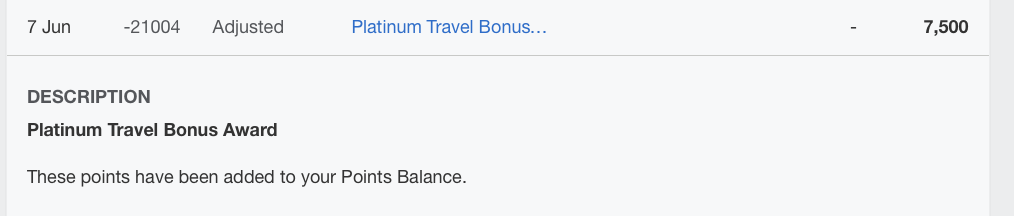

Amex Platinum Travel Credit Card does have more exciting offers like milestone benefits, which can be easily achieved and provide bumper rewards. When you spend INR 1.9 Lacs on the Card in a membership year, you are automatically credited with 7,500 threshold MR bonus points.

Additionally, when you spend a further INR 2.1 Lacs on the Card (a total of INR 4 Lacs in a membership year), you are credited an additional 10,000 threshold MR points and receive a Taj Hotels Gift Voucher worth INR 10,000.

You can also call on the American Express Helpline or use the chat function to get yourself a further milestone bonus of 7,500 MR points on spending INR 1.9 Lac per annum and 15,000 MR points on completing spends worth INR 4 Lacs in a year on the Card.

Summing things up, on spending INR 4 Lacs in a membership year, you will then earn 8,000 Membership Reward points (calculated basis of 100% of the amount spent by you on eligible categories throughout the entire year) and 40,000 Membership Reward points as a bonus, totalling up to 48,000 Membership Reward points. When you redeem these MR points for Taj Vouchers, you get INR 24,000 worth of vouchers (at the redemption value of INR 0.5 per MR converted).

This is over and above INR 10,000 worth of Taj Vouchers, which you receive on spending INR 4 Lacs anyway. So, you get INR 34,000 worth of value from using this Card in a year (assuming you hit both spending milestones). Those INR 34,000 vouchers are usually good for two nights at most Taj properties across India.

But even if you don’t want to use the MR points for Taj vouchers, you can convert them into Marriott Bonvoy points at 100:100 conversion or 1000:900 conversion to Hilton Honors points and use them for hotel stays. Alternatively, you can transfer them to the frequent-flyer program of leading airlines with Asia Miles, Club Vistara, British Airways Executive Club, Emirates skywards, Etihad Guest, Qatar Privilege Club, Singapore KrisFlyer, and Virgin Atlantic Flying Club.

A recent change has made spending on this Card even more beneficial. Your Membership Rewards points no longer expire, which means you can accumulate even more MR points and then use them for a more extensive travel plan rather than using them on an annual basis. Not just this, the Card also has options towards spending these MR on booking air tickets using the Amex Travel website or converting them into Flipkart vouchers to purchase goods with them.

Amex also offers eight complimentary domestic airport lounge visits per year (limited to two complimentary visits per quarter) on this Card across nine cities, making it worthwhile for those who occasionally travel by helping their pre-flight experience.

In a nutshell, the Amex Platinum Travel Credit Card gets you benefits worth over INR 30,000 rewards every year, all of which are oriented towards travel. You can use the rewards for a family trip or getaways with friends every year or accumulate the rewards to plan one long trip every few years.

The American Express Platinum Travel Credit Card is available for INR 3,500 fee for the first year, and you get an additional 10,000 bonus MR points (on spending INR 15,000 on the Card within 90 days). Alternatively, you can get the Card through the Member Get Member programme . You get it free for the first year and a bonus of 2,000 MR points (on spending INR 5,000 on the Card within 90 days).

This article is published in partnership with American Express India.

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on X (Opens in new window)

More from Live from a Lounge

Ajay Awtaney is the Founder and Editor of Live From A Lounge (LFAL), a pioneering digital platform renowned for publishing news and views about aviation, hotels, passenger experience, loyalty programs, travel trends and frequent travel tips for the Global Indian. He is considered the Indian authority on business travel, luxury travel, frequent flyer miles, loyalty credit cards and travel for Indians around the globe. Ajay is a frequent contributor and commentator on the media as well, including ET Now, BBC, CNBC TV18, NDTV, Conde Nast Traveller and many other outlets.

More articles by Ajay »

@Ajay I am planning to apply using your referral link in the ongoing MGM. Could you please clarify the below?

1) The Amex website seems to suggest that the RPs can be redeemed only for Flipkart or ATO at a value of 30p/point. Is this the case? I don’t see a reference to other redemption options that you have listed. 2) I was under the impression the points could be used in the 18k and 24k catalog. Is that the case or not? 3) I already have a MRCC. If I get a 2nd Amex, can the points earned on both be combined and redeemed?

Thanks very much for your time and efforts.

The lounge access isn’t worth it. They won’t let you into their Delhi Lounge. Apparently it’s only reserved for Platinum card holders, and Plat Travel doesn’t count.

@Nate, nowhere did we indicate that access is for the Amex Lounge. Amex publishes a list of applicable lounges for access for this card.

@Ajay Just to add, Amex offered me LTF MRCC Gold(which I was already holding) till I continue holding the Platinum Travel CC. Only 1 AF to be paid is a good thing!

Could please you expand on how to go about this? Thanks

“You can also call on the American Express Helpline or use the chat function to get yourself a further milestone bonus of 7,500 MR points on spending INR 1.9 Lac per annum and 15,000 MR points on completing spends worth INR 4 Lacs in a year on the Card.”

@David Rajan, what specific insight do you need? You just call Amex, ask them to review and see if any more points need to be added because you achieved the milestone.

AmEx does not post these bonus points without customer making the request. This helps AmEx profiteer from customers who might miss calling AmEx thinking this earning should be posted automatically / proactively by AmEx.

This card is indeed an amazing card if one is able to spend around 3.5 to 4 lakhs annually in a year.

And also if ones to redeem on Taj / Mariott, this probably gives the best value.

I think the greatest advantage AmEx has over other cards, is that the MR points usually don’t expire.

Even for the MRCC cards (unless one goes for the non FTO option) the points don’t expire.

Usually for other cards, the points have a validity for 3 years.

So this is where AmEx shines.

Just hoping that they keep trying to increase the ambit of card acceptance throughout the country.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email.

Notify me of new posts by email.

Pin It on Pinterest

- Print Friendly

The best ways to fly to India with points and miles

Update: Some offers mentioned below are no longer available. View the current offers here .

India is a top destination for many travelers. You can occasionally find flight deals to India, especially if you are patient and have flexible travel dates. If you find a good flight deal, you may want to use a credit card travel portal to book your flights .

Otherwise, you may want to redeem points and miles for flights to India . This guide will discuss some of the top airline loyalty programs to use when booking award flights between the U.S. and India.

Whether you are booking paid flights or award flights, remember to consider booking positioning flights in the U.S. and India. Doing so may unlock more award options or better pricing. Let's get started.

Related: Best credit cards for airport lounge access

ANA Mileage Club

If you're looking to book a round-trip award, booking with ANA Mileage Club may be a good option. ANA is a member of the Star Alliance but also partners with some airlines outside Star Alliance, including Etihad Airways and Virgin Atlantic.

You can redeem ANA miles to fly round-trip between North America and Asia (which includes India) at the following rates:

- Economy : 55,000 to 70,000 miles on ANA-operated flights; 80,000 miles on partners.

- Premium economy : 84,000 to 99,000 miles on ANA-operated flights; not available on partners.

- Business : 100,000 to 115,000 miles on ANA-operated flights; 136,000 miles on partners.

- First : 195,000 to 210,000 miles on ANA-operated flights; 240,000 miles on partners.

You'll still pay these rates even if you fly one-way. So you'll only want to consider ANA Mileage Club if you plan to book a round-trip award.

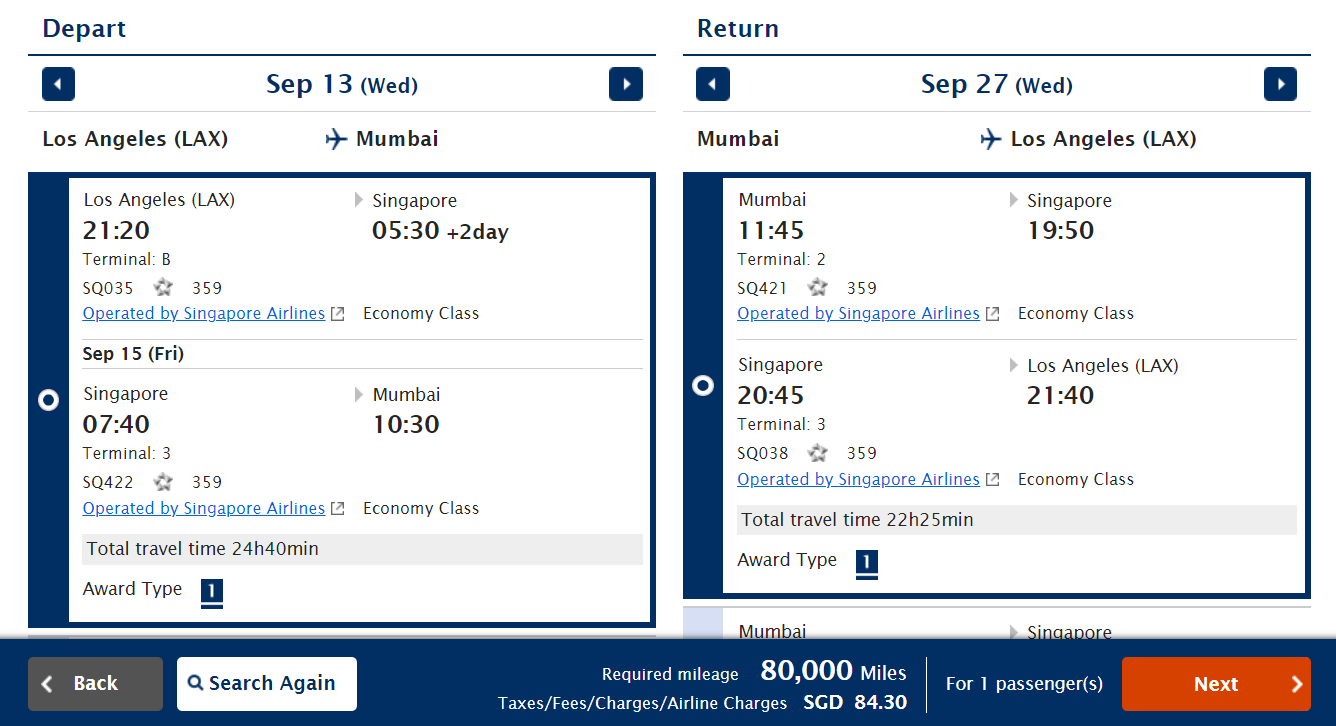

For example, here's an economy round-trip award operated by Singapore Airlines that you can book for 80,000 ANA miles plus 84.30 Singapore Dollars (about $64):

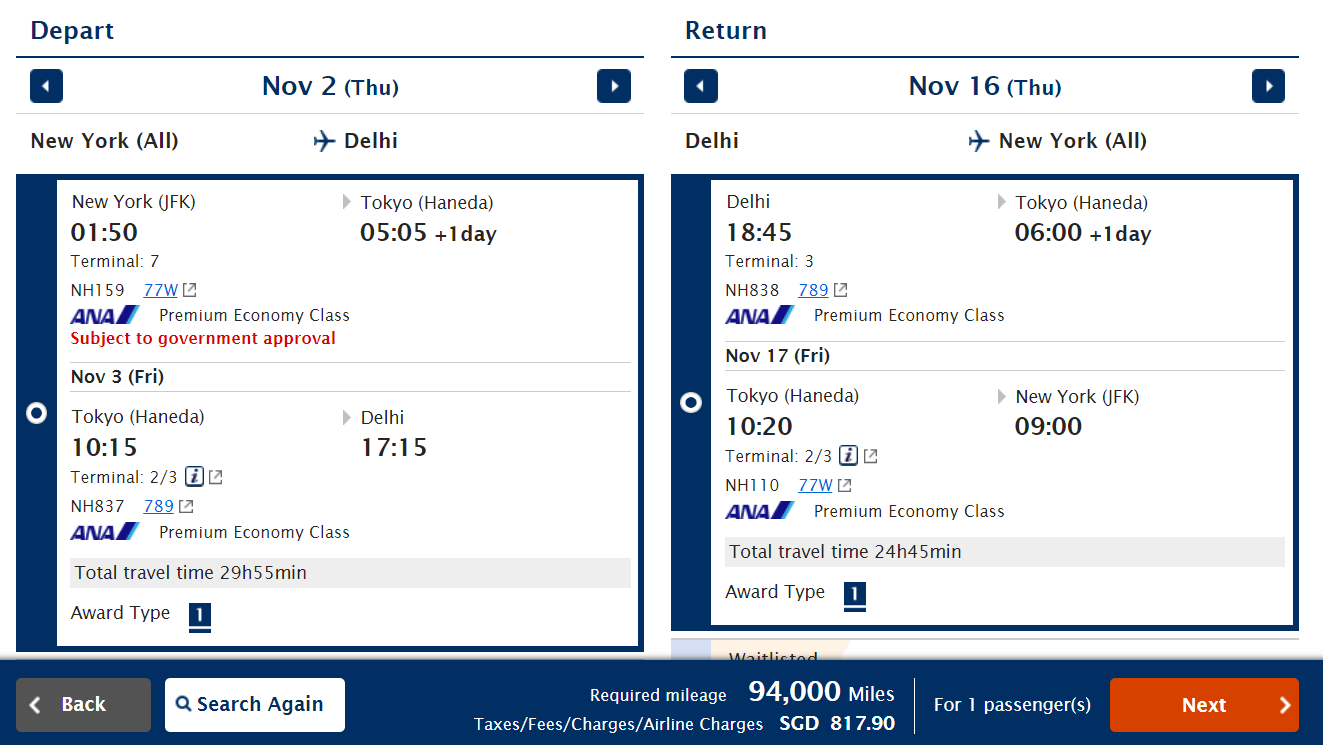

However, taxes and fees are a lot higher on ANA-operated awards. Here's a premium economy round-trip award operated by ANA that you can book for 94,000 ANA miles plus 817.90 Singapore dollars (about $618):

If you need to earn ANA miles to book your award, you can transfer American Express Membership Rewards points at a 1:1 ratio or Marriott Bonvoy points at a 3:1 ratio (with 5,000 bonus miles for every 60,000 points transferred).

Related: Quick Points: Book mixed-cabin awards with ANA Mileage Club to stretch your miles

Virgin Atlantic Flying Club

Virgin Atlantic Flying Club is another option for flights between the U.S. and India.

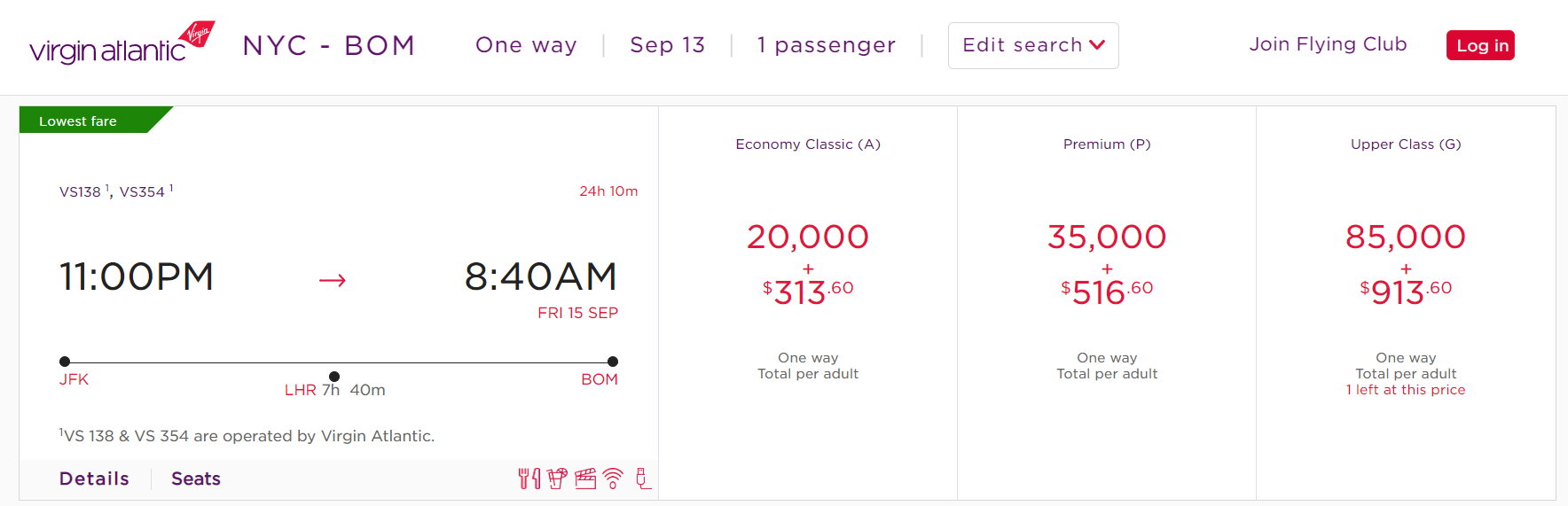

You can redeem for flights on Virgin Atlantic, although the taxes and fees are often too high for this to make sense. For example, consider the following off-peak awards from New York to Mumbai via London:

The award costs jump higher for Virgin Atlantic-operated awards on peak dates, though. Combined with the high taxes and fees, these awards won't appeal to most travelers.

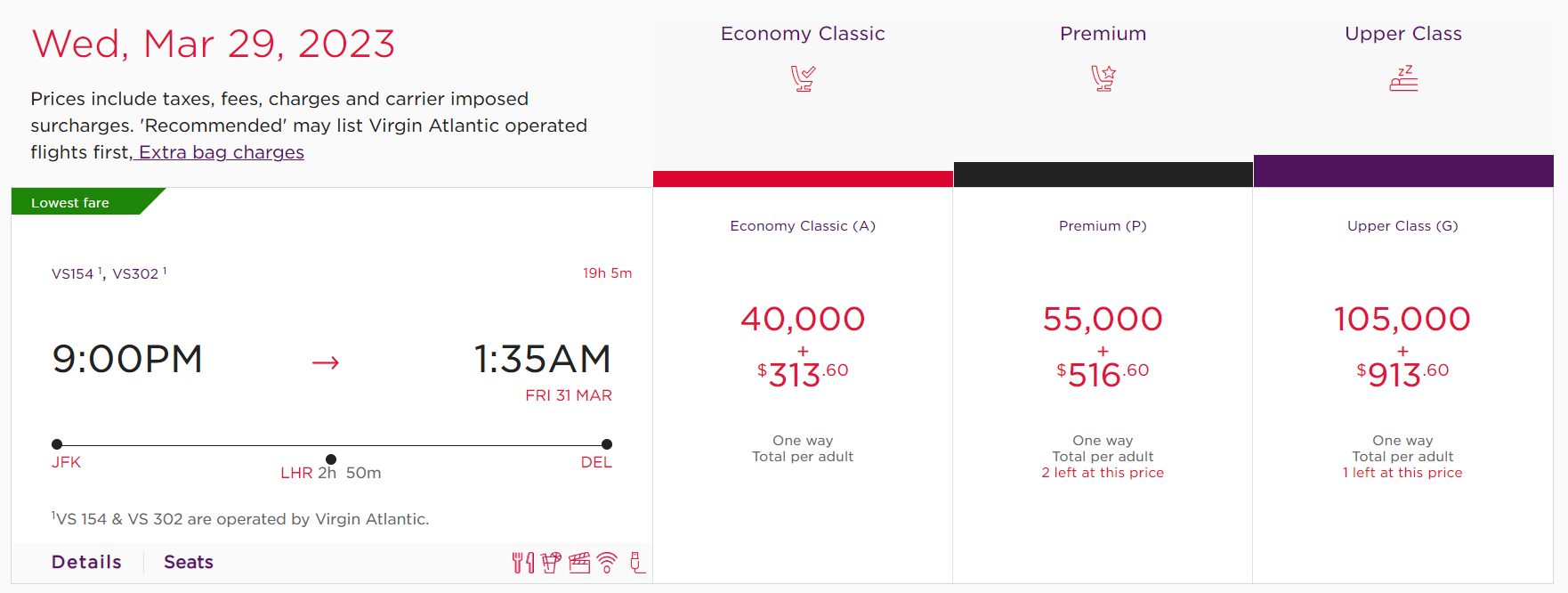

You can also redeem Virgin points according to off-peak and peak zone-based charts for long-haul flights operated by Air France and KLM. Here's the pricing you should see for one-way awards between the U.S. and India operated by Air France or KLM:

- Economy : 28,000 points off-peak to/from eastern U.S., 38,000 points peak to/from eastern U.S., 31,000 points off-peak to/from central or western U.S. and 41,000 points peak to/from central or western U.S.

- Premium economy (only on Air France): 56,000 points off-peak to/from the eastern U.S., 76,000 points peak to/from the eastern U.S., 62,000 points off-peak to/from central or western U.S. and 72,000 points peak to/from central or western U.S.

- Business : 110,000 points off-peak to/from eastern U.S., 120,000 points peak to/from eastern U.S., 122,500 points off-peak to/from central or western U.S. and 132,500 points peak to/from central or western U.S.

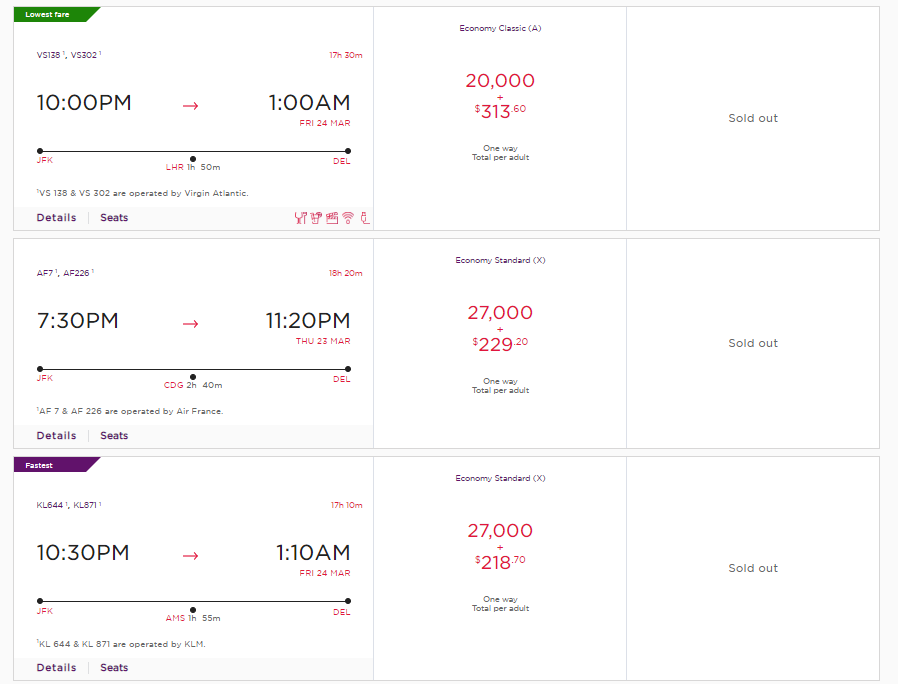

But in practice, the rates you'll see for awards operated by Air France and KLM on the Flying Club website may not match the award chart rates. For example, these awards operated by Air France and KLM cost 27,000 points (1,000 points less than we'd expect).

If you want to earn Virgin points , you can leverage the following transferable currencies:

- American Express Membership Rewards points at a 1:1 ratio.

- Citi ThankYou Rewards points at a 1:1 ratio (if you have the Citi Premier® Card (see rates and fees) or the Citi Prestige® Card , which is no longer open to new applicants).

- Chase Ultimate Rewards points at a 1:1 ratio.

- Bilt Rewards points at a 1:1 ratio.

- Marriott Bonvoy points at a 3:1 ratio (with 5,000 bonus points for every 60,000 points transferred).

- Capital One miles at a 1:1 ratio (to Virgin Red ).

The information for the Citi Prestige has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: When and how to book Delta awards with Virgin Atlantic Flying Club

Flying Blue

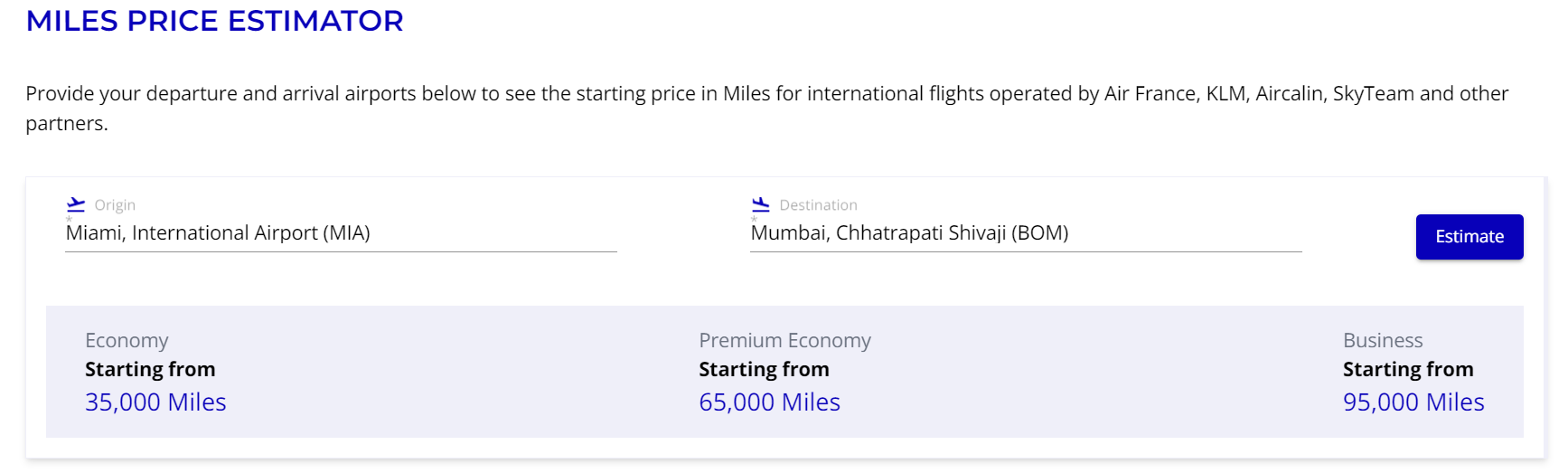

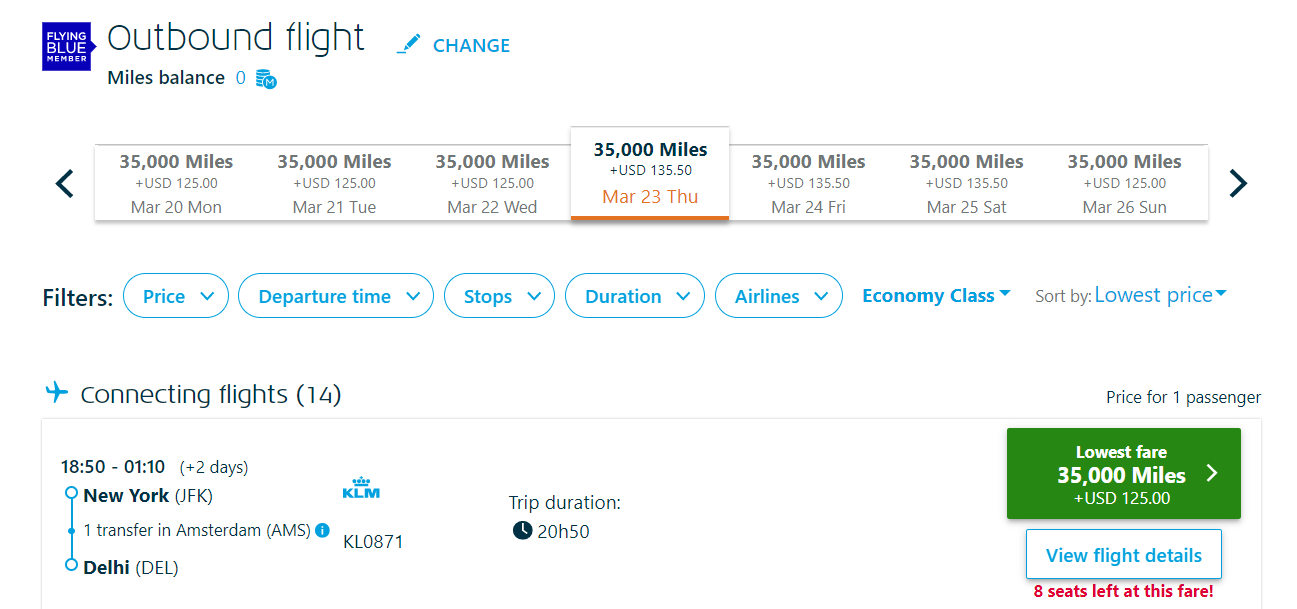

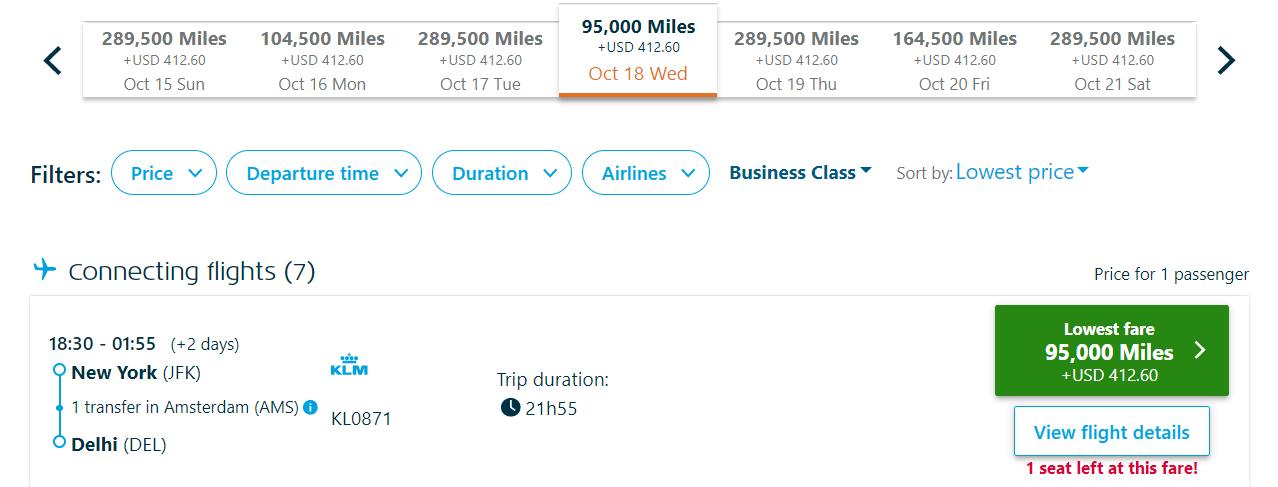

The Flying Blue program is another option for award flights between the U.S. and India. One-way awards between the U.S. and India start at 35,000 miles in economy, 65,000 miles in premium economy and 95,000 miles in business.

For example, we could book the one-way KLM-operated economy award that costs 27,000 Virgin points plus $219 (see the previous section) for 35,000 Flying Blue miles plus $125.

Finding business class awards at the starting rate of 95,000 miles can be challenging. But you can easily check award pricing by cabin around your desired travel dates by looking at the bar above the results. Unfortunately, as you'll see in the one-way business class award example below, the taxes and fees are rather high on business class awards.

If you want to earn Flying Blue miles , you can transfer any of the following transferable currencies:

- Capital One miles at a 1:1 ratio.

- Citi ThankYou Rewards points at a 1:1 ratio (if you have the Citi Premier Card or the Citi Prestige Card ).

- Marriott Bonvoy points at a 3:1 ratio (with 5,000 bonus miles for every 60,000 points transferred).

- Bilt Rewards points at a 1:1 ratio to either Air France or KLM (both of which use Flying Blue as their loyalty program).

Related: This month's Flying Blue Promo Rewards

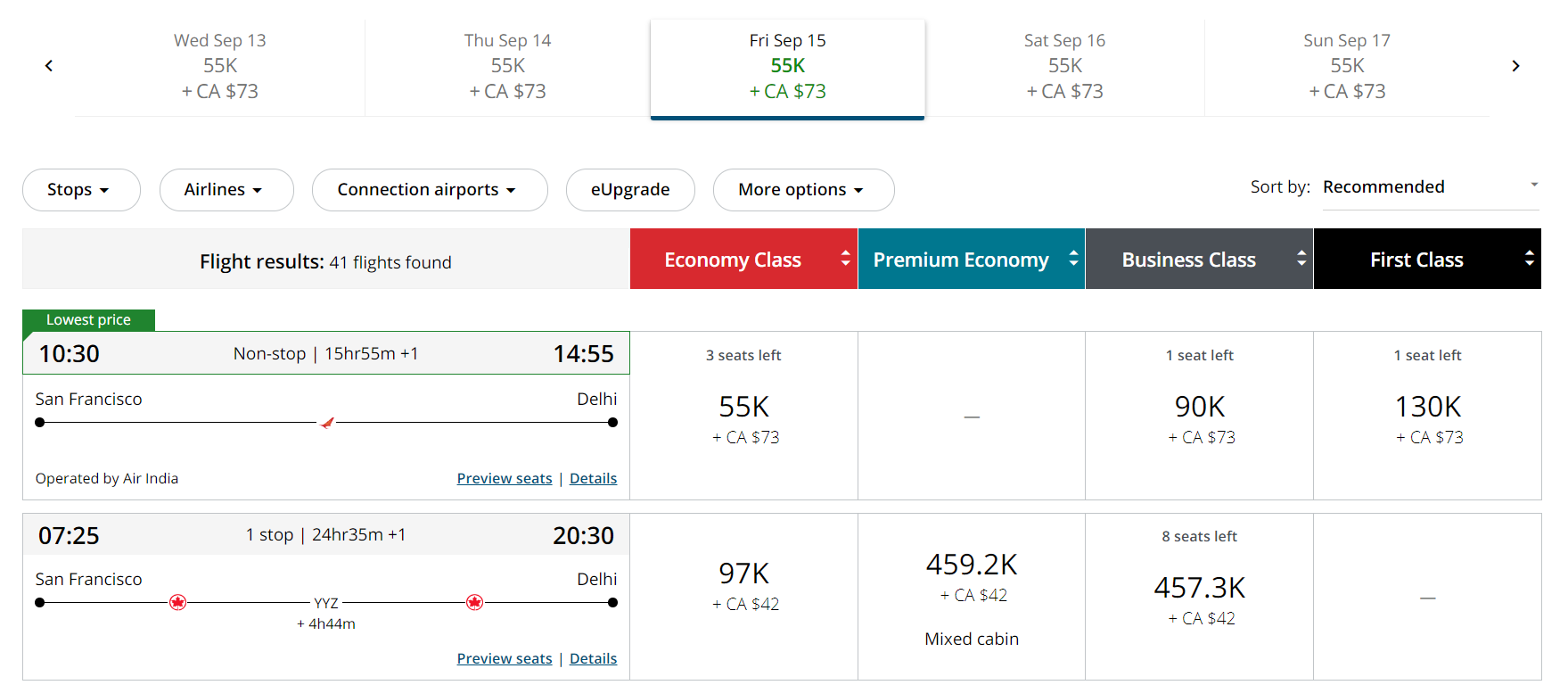

Air Canada Aeroplan

Air Canada Aeroplan award prices follow region-based award charts . The U.S. is in the North America region and India is in the Atlantic region. However, most one-way awards between the U.S. and India have a distance of 6,001 to 8,000 miles and hence are priced as follows:

- Economy : 55,000 to 80,000 points for Air Canada-operated flights; 55,000 points for partner-operated flights.

- Premium economy : 70,000 to 100,000 points for Air Canada-operated flights; not offered on partner-operated flights.

- Business : 85,000 to 200,000 points for Air Canada-operated flights; 90,000 points for partner-operated flights.

- First : 120,000 to 225,000 points on Air Canada-operated flights; 130,000 points on partner-operated flights.

However, if you combine Air Canada-operated flights with flights operated by partner airlines, you may see different pricing.

Aeroplan's rates are higher than what you'll find with other programs, especially once you consider the partner booking fee.

But, if you want to add in a stopover or have inflexible travel dates, you may find that the Aeroplan program is best for your trip to India. I had little trouble finding partner awards pricing as expected from major cities in the U.S. to major cities in India.

If you need to earn Aeroplan points for an award, you could use the Aeroplan® Credit Card . However, if you need points more urgently, you could leverage the following transferable currencies:

Related: Complete guide to Aeroplan's stopover and routing rules

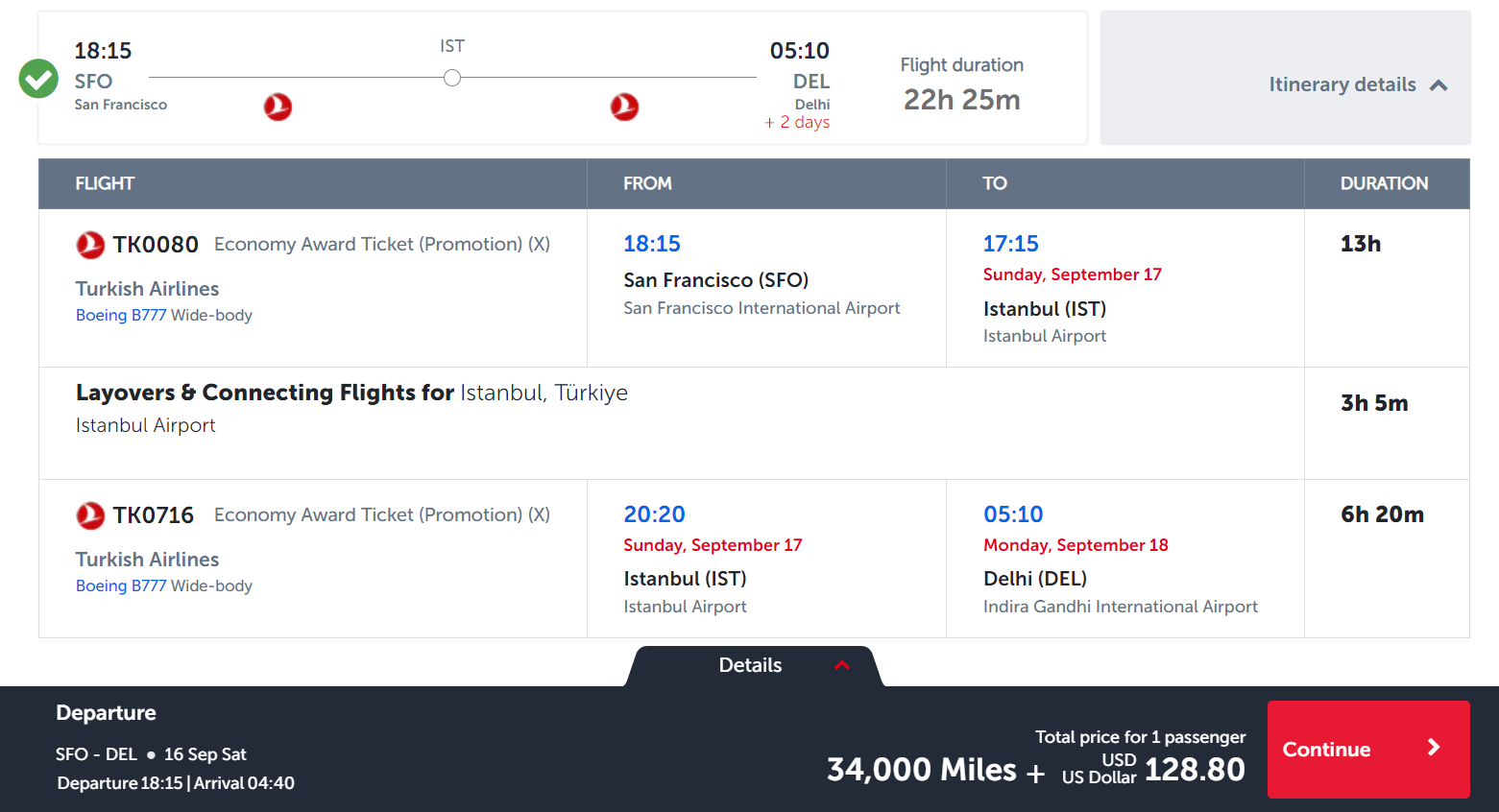

Turkish Airlines Miles&Smiles

Turkish Airlines Miles&Smiles can be a good way to book Star Alliance awards between the U.S. and India. You can book round-trip promotional awards on Turkish Airlines or its partners between the U.S. and India at the following rates:

- Economy : 68,000 miles.

- Business : 105,000 miles.

- First : 154,000 miles.

You can also book a one-way promotional award for half the cost in miles of a round-trip award. There's plenty of economy award availability on Turkish Airlines-operated flights from the U.S. to India for 34,000 miles plus $128.80 one-way.

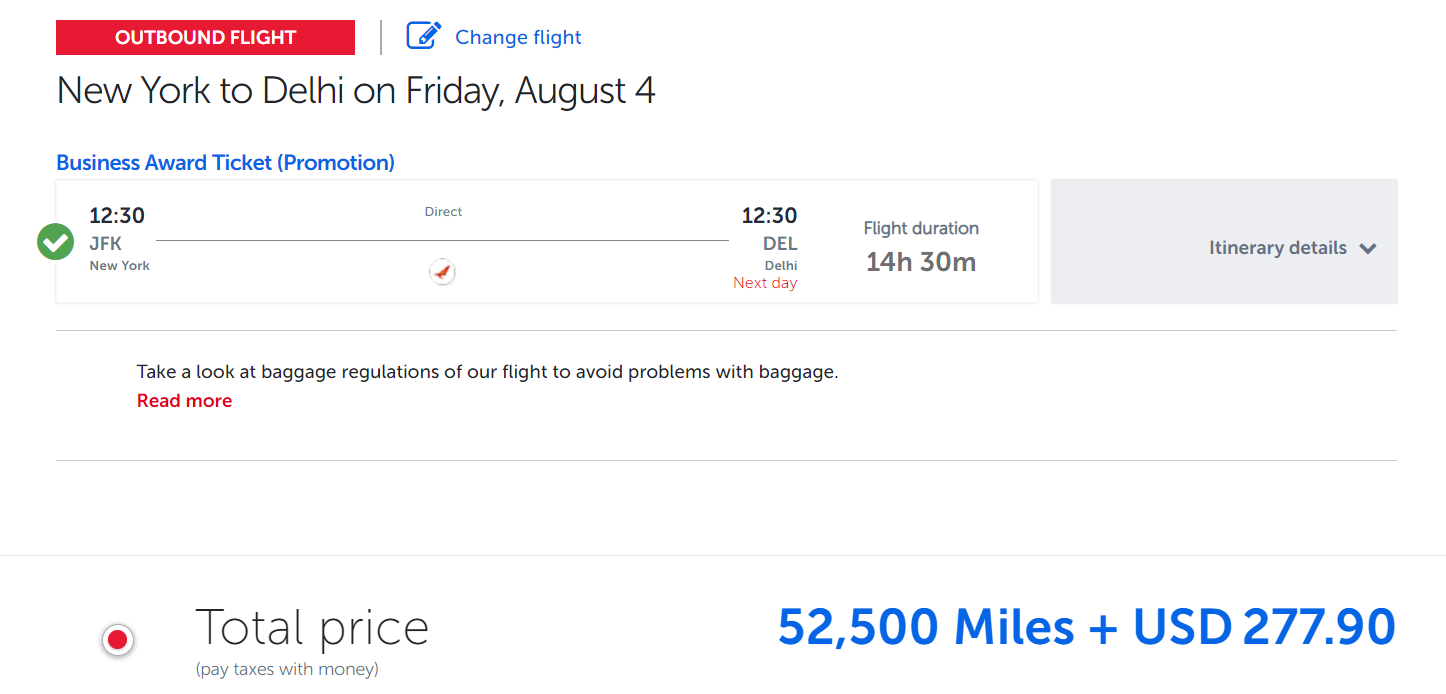

You can also find some availability on Star Alliance partners. For example, here's a one-way business class award on an Air India-operated flight from New York to Delhi for 52,500 miles plus $277.90.

If you want to earn Turkish miles to book an award, you can transfer Capital One miles at a 1:1 ratio, Citi ThankYou Rewards points at a 1:1 ratio (if you have the Citi Premier Card or the Citi Prestige Card ), Bilt Rewards points at a 1:1 ratio and Marriott Bonvoy points at a 3:1 ratio (with 5,000 bonus miles for every 60,000 points transferred).

Related: 10 things to know about flying Turkish Airlines

Avianca LifeMiles

Avianca LifeMiles is another option you could use if you want to fly Star Alliance airlines between the U.S. and India.

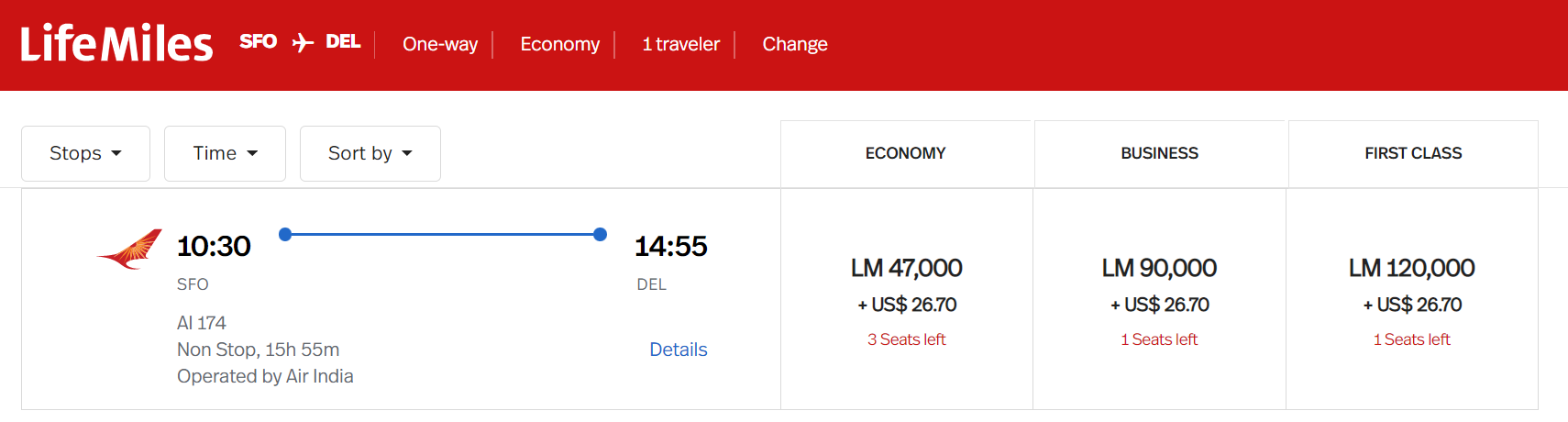

You'll usually find one-way Star Alliance awards between the U.S. and India for 47,000 miles in economy, 90,000 miles in business and 120,000 miles in first.

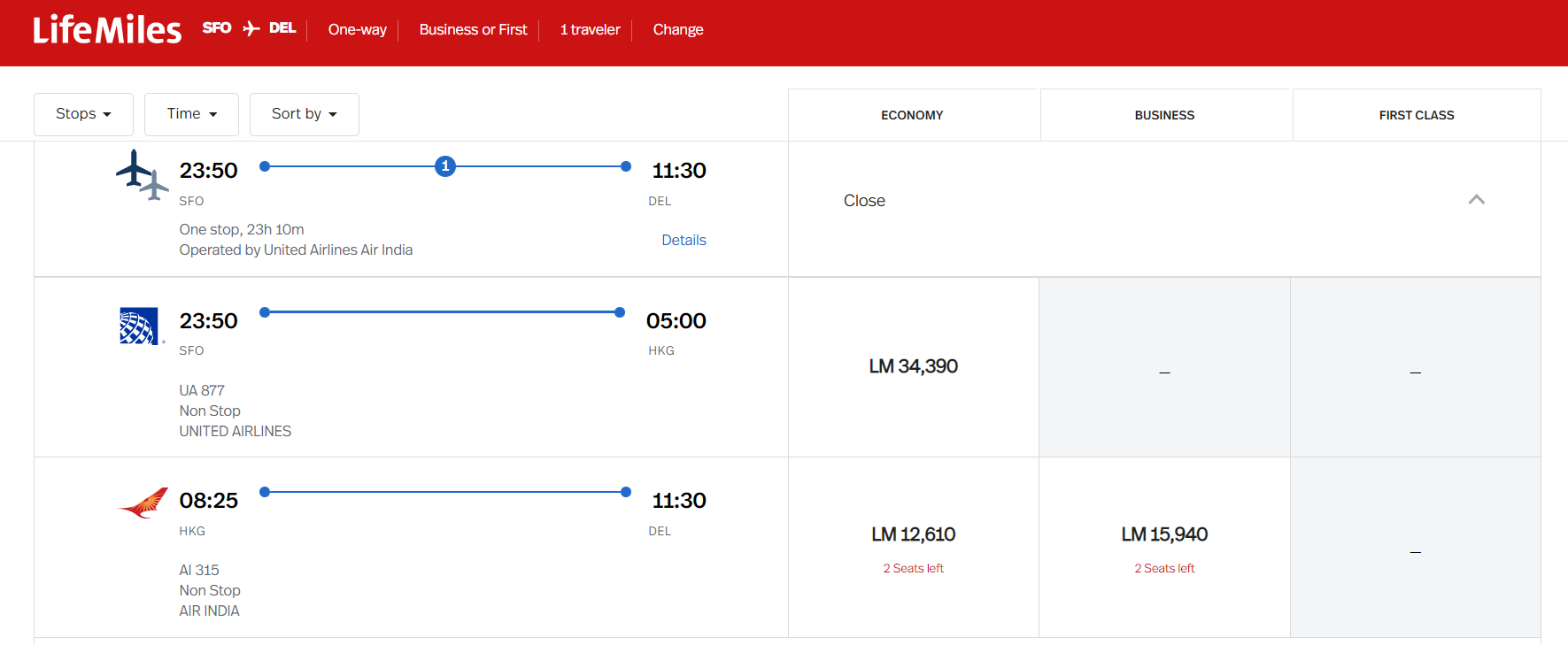

But one interesting part of the Avianca LifeMiles program is how it prices mixed cabin awards. For example, you could pay just 3,330 miles more to fly Air India business class instead of economy class from Hong Kong to Delhi on the following award.

If you want to earn Avianca LifeMiles, you can transfer American Express Membership Rewards points at a 1:1 ratio, Capital One miles at a 1:1 ratio, Citi ThankYou Rewards points at a 1:1 ratio (if you have the Citi Premier Card or the Citi Prestige Card ) and Marriott Bonvoy points at a 3:1 ratio.

Related: Can't find award availability with Avianca LifeMiles? Don't give up until you try this trick

United MileagePlus

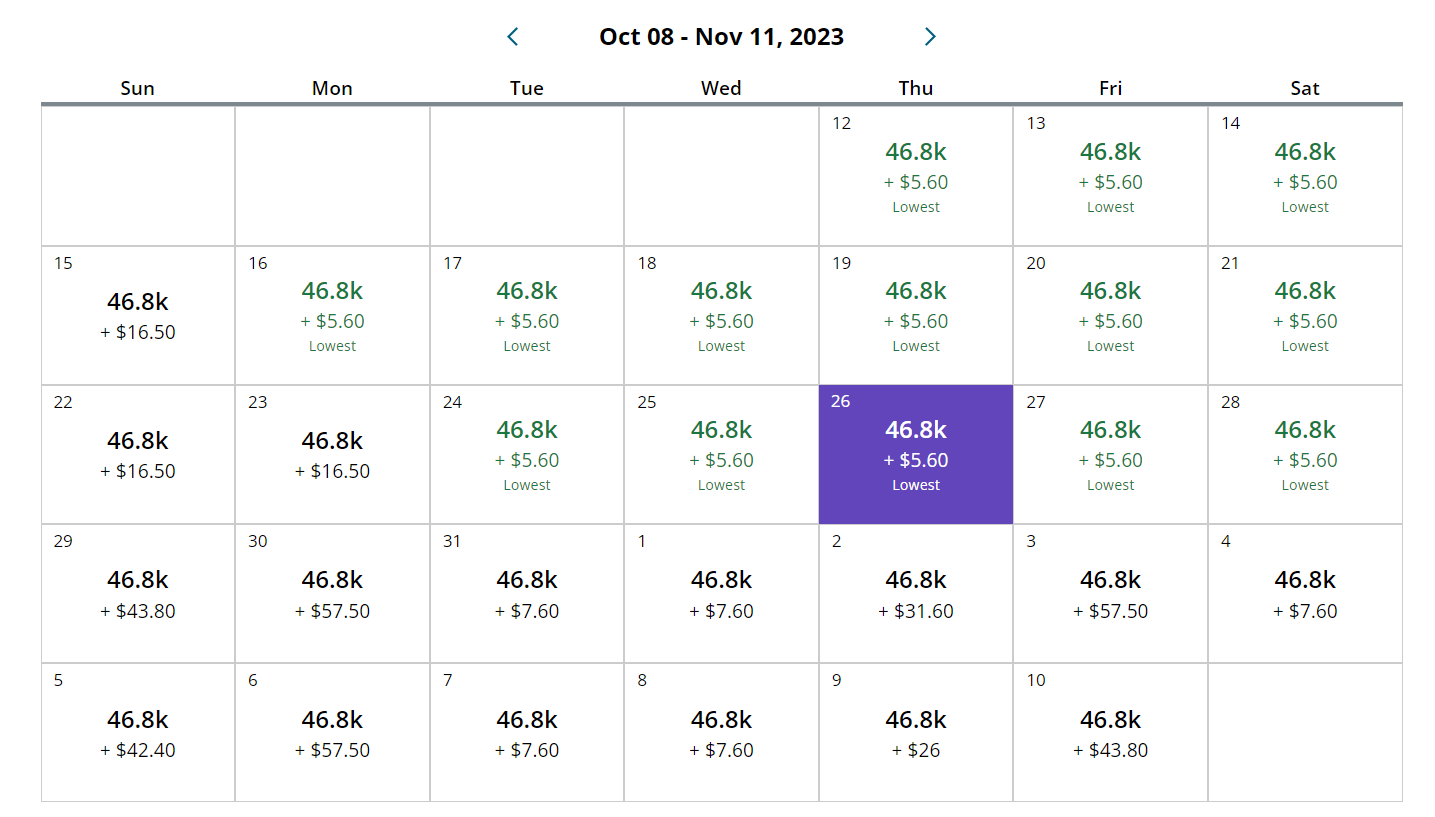

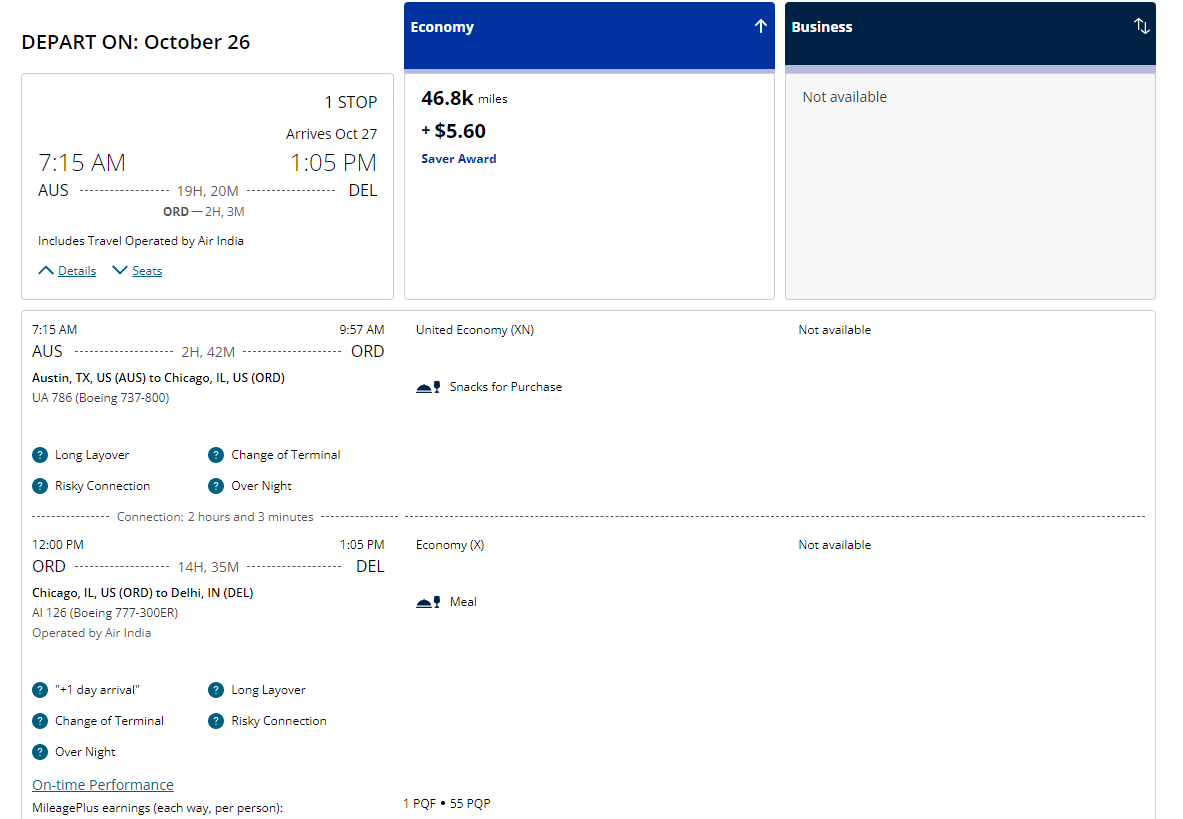

United MileagePlus offers reasonably priced economy awards between the U.S. and India on most dates. On most dates, you'll find one-way economy awards for 46,800 miles plus modest taxes and fees. For example, here's a calendar view of economy awards from Austin, Texas, to Delhi:

You'll likely end up on Air India if you're looking for the least-expensive one-stop routing:

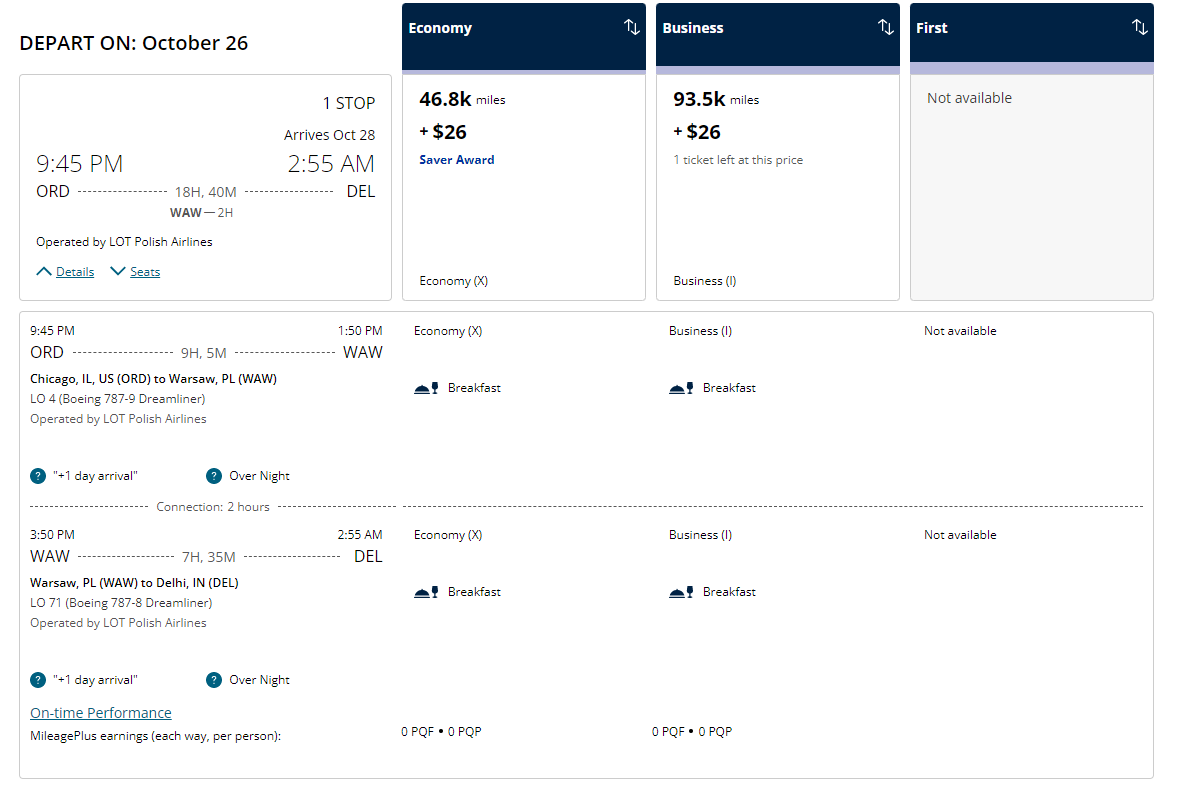

But keep an eye out for other Star Alliance carriers, such as LOT Polish:

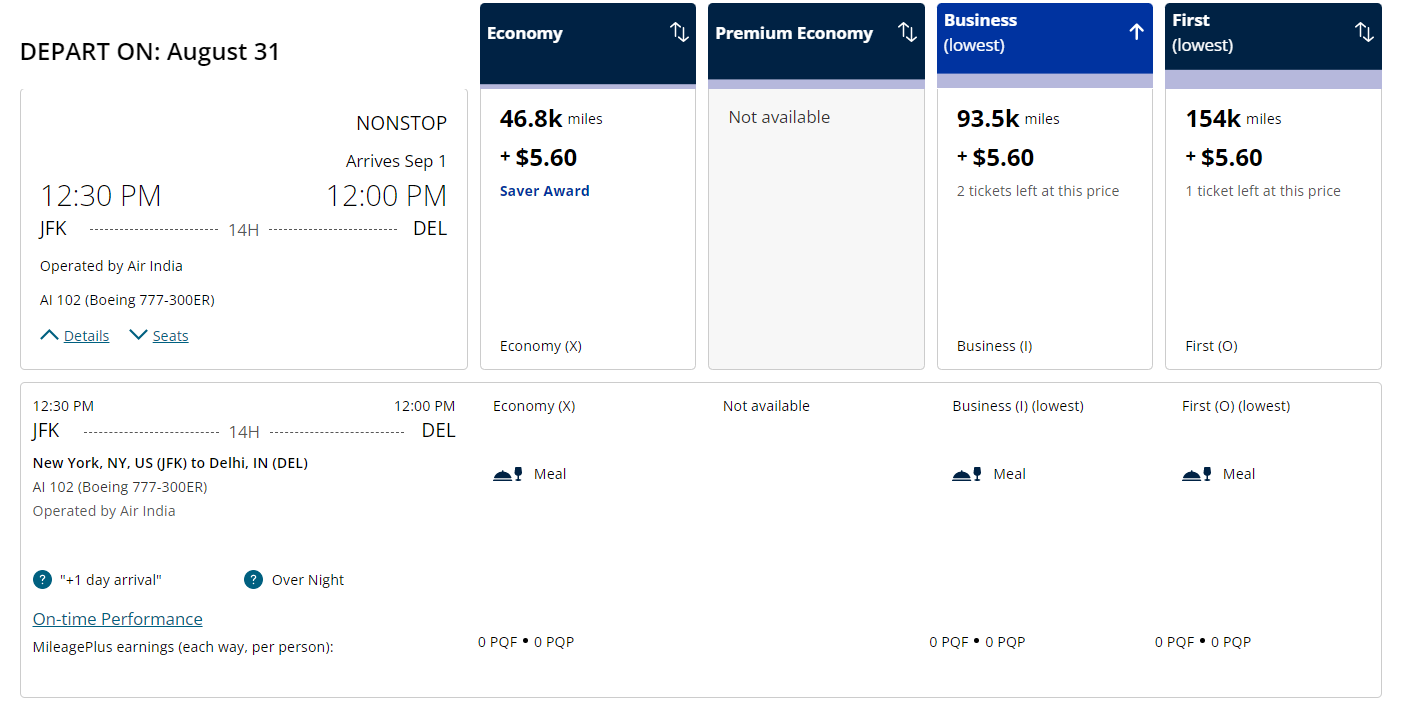

United MileagePlus awards between the U.S. and India are often expensive in premium cabins. So unless you have a lot of United miles , you'll likely want to utilize other programs if you want to fly in premium cabins. Here's an example of some of the least expensive business and first class awards I found between New York and Delhi:

If you want to earn United miles , you have multiple options. For example, you can use a United credit card or transfer rewards from Chase Ultimate Rewards at a 1:1 ratio, Marriott Bonvoy at a 3:1.1 ratio (with 5,500 bonus miles for every 60,000 points transferred) and Bilt Rewards at a 1:1 ratio.

Related: 6 things you need to know about United Airlines MileagePlus

Alaska Mileage Plan

Alaska Mileage Plan provides some nice options between the U.S. and India. Based on Alaska's new simplified award chart , you'd expect to see one-way awards starting at the following rates between the U.S. and India:

- Economy : 42,500 miles

- Premium economy : 55,000 miles.

- Business : 65,000 miles.

- First : 80,000 miles.

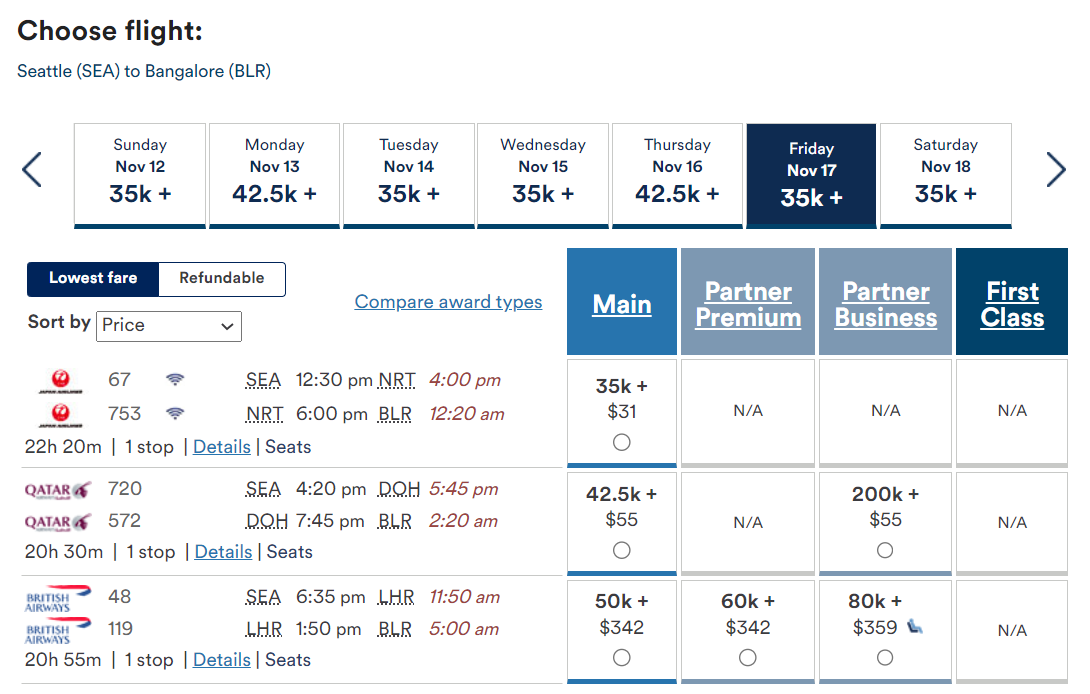

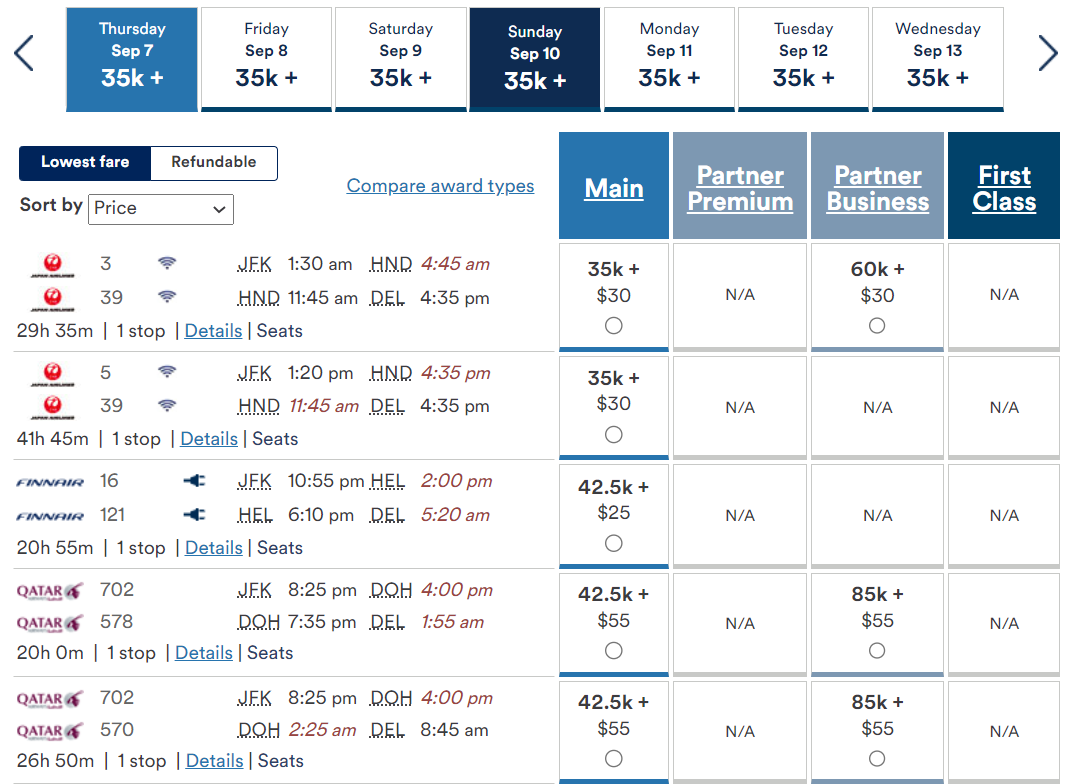

But in practice, you may find less-expensive awards when you search on Alaska's website. For example, here's a Japan Airlines-operated economy award from Seattle to Bangalore for 35,000 miles plus $31.

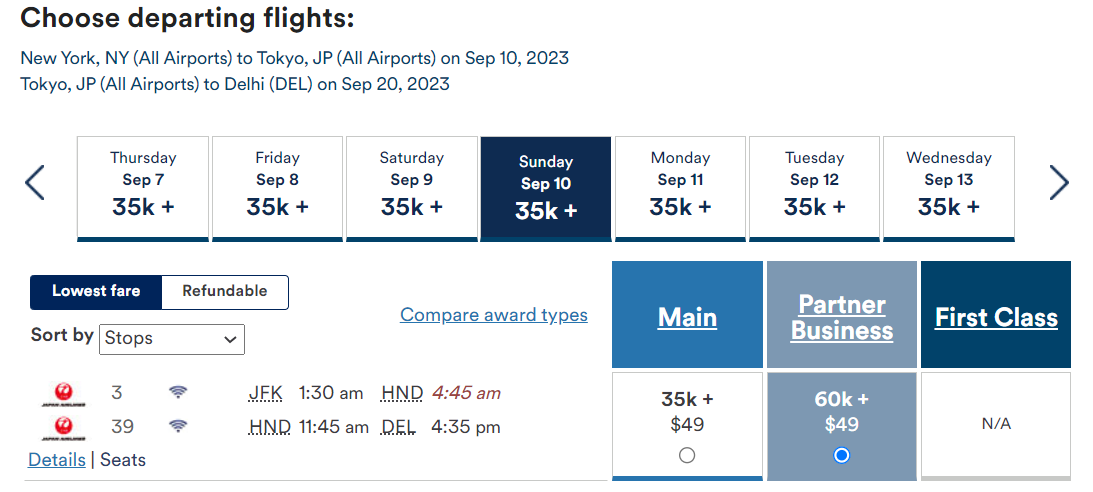

And here's a Japan Airlines-operated business award from New York to Delhi for 60,000 miles plus $30.

Alaska Mileage Plan may be very appealing if you want to build a stopover into your one-way award. For example, you can book the same Japan Airlines itinerary shown above with about a week stopover in Tokyo for the same number of miles and just slightly higher taxes and fees.

The primary downside of redeeming Alaska miles is the difficulty you may face in earning Alaska miles . That said, you can earn miles through Alaska credit cards , the Alaska Mileage Plan shopping portal and by transferring rewards from Marriott Bonvoy at a 3:1 ratio (with 5,000 bonus miles for every 60,000 points transferred).

Related: Maximizing redemptions with Alaska Airlines Mileage Plan

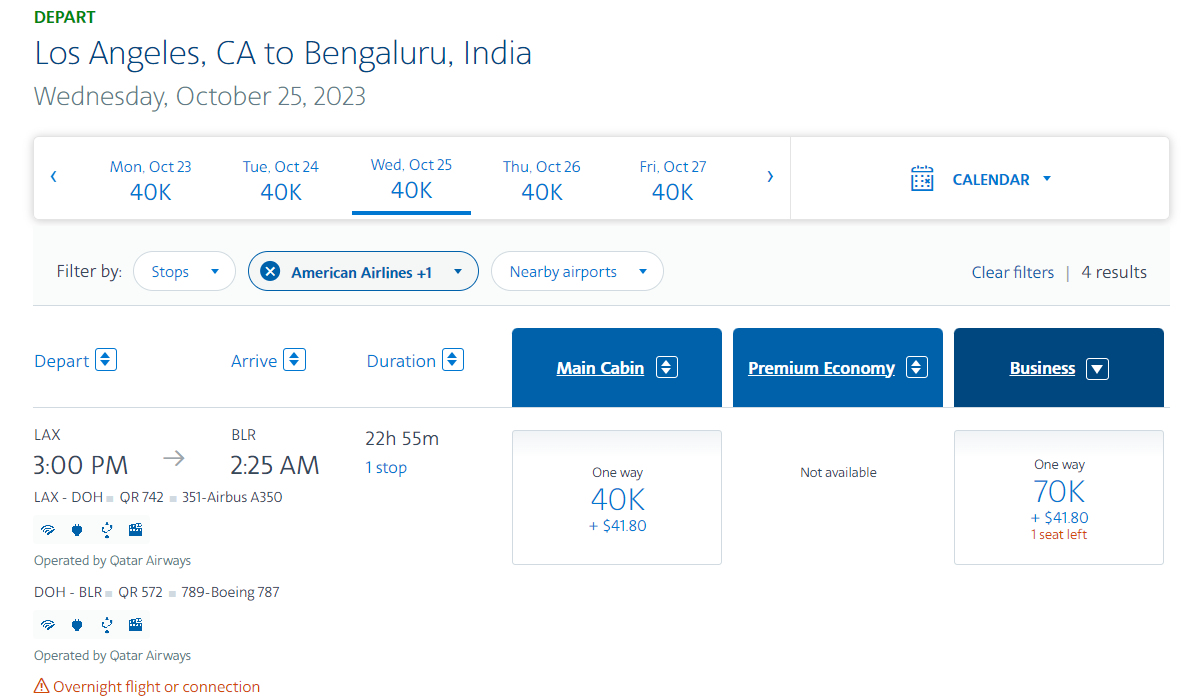

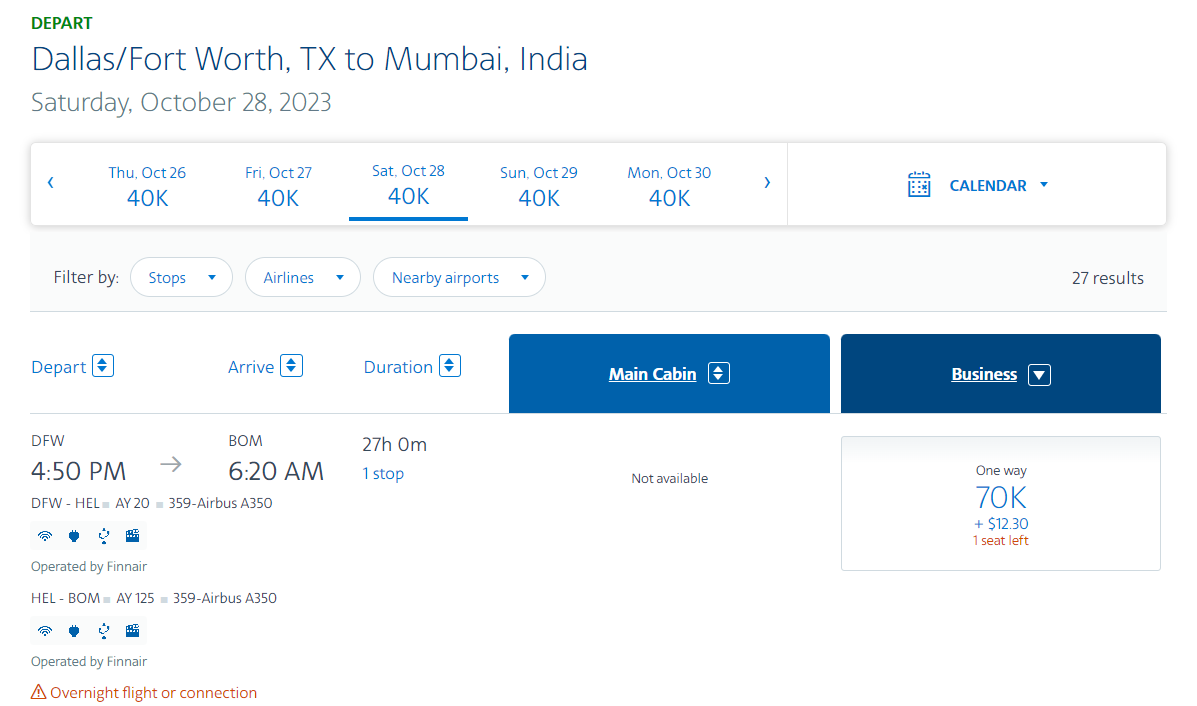

American AAdvantage