What are the main types of tourism distribution channels?

The travel and tourism chain of distribution

Variations in the chain of distribution, what is a tourism distribution channel.

For the owners and employees of travel businesses, it’s important to have a good understanding of the distribution channels available to you. The digital revolution means there is a wide choice of online channels today. But do not forget your strategic partnerships and offline channels too. To avoid spending unnecessary time and money, you need to know which channels do the best job of getting your travel products in front of your target audience.

But before we look at the various sales and marketing avenues at your disposal, we need to focus on the chain of distribution first. In order to maximize opportunities and efficiencies, it’s essential to understand the chain of distribution and where your company is positioned within the chain.

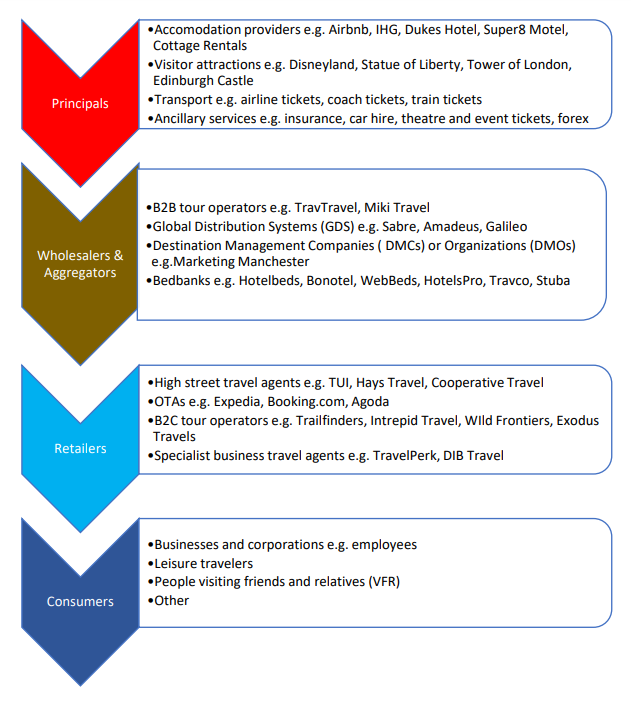

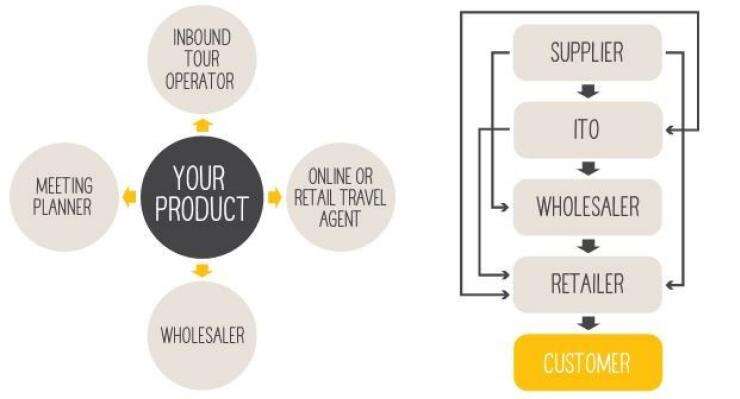

Generally speaking, there are four key stages within the chain of distribution . These are: principals, wholesalers & aggregators, retailers, and consumers (see chart 1).

Chart 1: The Travel and Tourism Chain of Distribution

The principals are the separate components of a travel product. For example, a leisure traveler buys a three-night stay in Paris that includes flights, accommodation, entrance to the Louvre and the Eiffel Tower, with other ancillary services such as travel insurance and foreign exchange thrown in too. In this case, each of the principals could have been sold separately. Instead, they were bundled together by a travel business and sold as a mini-break promotion.

Wholesalers & aggregators

Tour operators take various components of the travel experience and create a travel product which is then traditionally sold by a travel agent.

At the wholesaler stage in the distribution chain, the tour operator is providing a business-to-business (B2B) service by selling the product to a travel agent who then sells it to the consumer (a B2C service). They have their tour operator business plan which they follow to provide the best options to other travel-related businesses.

A global distribution system (GDS) is a computer system that holds records of availability from airlines, hotels, and car hire. Retailers such as OTAs and B2C travel agents are able to directly access this inventory.

As the oldest type of distributor in the travel industry, GDS are predominantly involved in the sale of air tickets rather than accommodation.

Destination Management Companies (DMCs) or Destination Management Organizations (DMOs) often contract travel products and sell on packages and itineraries relevant to their destination to a tour operator.

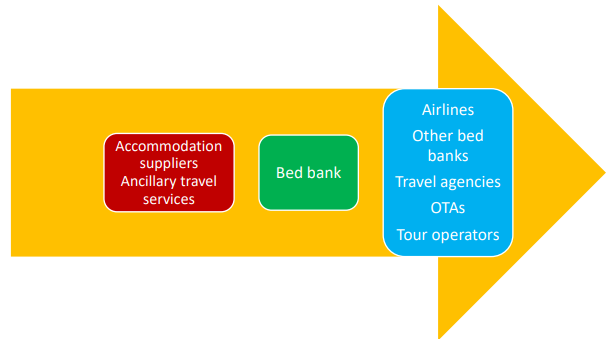

A bed bank is a B2B company that buys rooms from hotel groups and other accommodation providers in bulk at discounted and fixed prices for specific dates.

Some bed banks might also sell ancillary services such as tickets to visitor attractions or car hire.

Bed banks are middlemen, or intermediaries, between hotel companies and retailers. They might sell on their discounted bulk accommodation products to airlines, other bed banks, travel agents, OTAs or tour operators (see Chart 2). Chart 2: Bed Bank Distribution Chain

Retailers and consumers

Retailers are the organizations that sell the travel products directly to the consumer. These include traditional travel agents with a physical store in the high street such as TUI, Hays, and Cooperative Travel in the UK, for example. Other travel retailers are found online and include OTAs, B2C tour operators, and travel agents that specialize in business travel. Consumers are the end-users who buy the travel products or services. The main types of consumers are business travelers, leisure tourists (either domestic or international) and people who are visiting friends or relatives.

Chart 1 identifies the four key stages in the chain of distribution, although this process can vary and be more direct or indirect. For instance, a leisure traveler booking accommodation directly from a hotel website means there is only one stage in the chain. A bed bank that sells to another bed bank, results in five stages in the chain.

The wholesaler and retailer stages may be carried out by the same company . This is known as vertical integration , which happens when two or more organizations at different stages in the supply chain merge.

It is fairly common for tour operators and travel agents to buy each other. After all, the role of tour operators in sustainable tourism is quite significant. When mergers occur at the same level in the distribution chain, this is called horizontal integration . The original brand names are often retained, so consumers may not be aware that booking.com, KAYAK, Agoda and priceline, for instance, are all owned by one company: Booking Holdings. Digitalization and corporate mergers have resulted in plenty of crossover and consolidation in the travel and tourism distribution system.

As a B2C travel agent or tour operator, distribution channels represent the various ways to sell or market your product. You need to have a multi-channel presence to maximize your sales opportunities and brand presence, and to reduce your risk. There is specialized tour operator software that can help you manage this workload more efficiently. At the same time, depending on the size of your business and the resources you have available, it could be an error to spread yourself too thinly over too many channels.

Choosing the best distribution channels for your business needs to be done with care and attention.

Generally speaking, we can divide distribution into three main categories: online channels, strategic partnerships and offline channels (see Chart 3).

Chart 3 Travel & Tourism Distribution Channels

Online channels

As a tour operator or travel agent, the overriding benefit of optimizing your own website is that you pay no commission on direct bookings and have full control over how consumers interact with your brand.

Being listed on Google My Business is essential today. Google is the default destination for most consumers to gather information of any kind. Your listing will come up in Google searches and on Google Maps and registering is free.

Online travel marketplaces like Bookmundi and Viator have large audiences. Most are free to join but take a significant amount of sales commission, so monitor performance carefully.

Select one or two and keep your profile and listings current. The same goes for review sites such as Tripadvisor and TrustPilot . Only concentrating your energies on one or two review sites is a sensible strategy.

Channel managers, such as HRS , provide a service that sources hotel accommodation for corporate clients from a wide variety of OTAs instead of the client having to go directly to each separate OTA.

Similarly, instead of having individual accounts with OTAs, many hotel companies – big and small – will use channel management technology.

Omnibees , for example, allows hoteliers to sell to end-users and intermediaries through a single platform connected to the hotel’s property management system. Such solutions can automate sales and reduce the amount of commission paid by hotels.

Strategic partnerships

Working with other travel agents or tour operators is a great way to increase your sales. Working directly with Destination Marketing Organizations (DMO) will allow travelers to book with you directly when you advertise on the DMO website.

Building a relationship with travel bloggers will help get your name out there, as will close involvement with trade bodies associations.

To attract more bookings made directly on your website , a ffiliate digital marketing services are an option .

Offline channels

It would be a mistake to overlook offline distribution channels. The worldwide web may give you global reach, but cross-selling partnerships with local businesses such as stores, restaurants, cafes and hotels can turn out to be extremely valuable distribution channels.

Visitor information centers can be useful too because many tourists do not book tours and activities until they are in the destination.

Attending trade shows and industry events can be costly, especially for small businesses, but the resulting contacts and sales leads are often invaluable.

Subscribe to our newsletter

Yay you are now subscribed to our newsletter.

Cristóbal Reali, VP of Global Sales at Mize, with over 20 years of experience, has led high-performance teams in major companies in the tourism industry, as well as in the public sector. He has successfully undertaken ventures, including a DMO and technology transformation consulting. In his role at Mize, he stands out not only for his analytical and strategic ability but also for effective leadership. He speaks English, Spanish, Portuguese, and Italian. He holds a degree in Economics from UBA, complementing his professional training at Harvard Business School Online.

Mize is the leading hotel booking optimization solution in the world. With over 170 partners using our fintech products, Mize creates new extra profit for the hotel booking industry using its fully automated proprietary technology and has generated hundreds of millions of dollars in revenue across its suite of products for its partners. Mize was founded in 2016 with its headquarters in Tel Aviv and offices worldwide.

Related Posts

3 Reasons Why Tour Operators are Essential in the Industry

7 min. Today, tour operators are key to the success of the travel industry. Tourists rely on them to turn their dream vacations into a reality. And, as we know, one of the most common interactions between tour operators and travelers is the booking of a tour that allows them to explore different parts of […]

The 16 Types of Tour Operators That Keep Curated Travel Alive

29 min. Tour operators act as creators of unique and unforgettable travel experiences. They use their expertise and connections to arrange the best and most affordable transportation, accommodation, and activities. Today’s travelers are lucky to have them, and so is the industry as a whole. If you are in the travel business and you’re trying […]

List of 32 travel agency management groups

6 min. Whether you are thinking of moving into the travel industry or you already own a business in this sector, the concept of travel agency management groups is a task worthy of analysis and study. Defining an effective business model for your retail travel agency is one of the key factors in optimizing sales […]

An introduction to the travel distribution system

- Smart tools

- business improvement , distribution

The travel distribution system is an evolving beast, there are always new players, consolidations, new technologies and devices. So how do you as a tourism operator keep pace? The first step is to understand the landscape and who are the main players in online travel distribution.

Online bookings continue to grow

If you like statistics there here are some interesting facts and figures. Did you know that currently 57% of all travel bookings made online. This highlights the importance of having a great online booking system. The average growth in online bookings has been 12.8% for the last 5 years and the projected growth for the next 5 is 8.5%.

So what does this mean to you as a business operator? Well if you don’t already, now is the time to get your head around the travel distribution system.

Online travel agency brands are consolidating into less companies.

This is good news, there are take overs, mergers, consolidations and start ups, but you are probably aware of the major players like:

- TripAdvisor

- Booking.com

and then there are the aggregators that seem to advertise on TV all the time!

- Hotelscombined

Try this simple exercise, go to Google and search on your own business.

Does your own website feature highly in the results? If not, we suggest that you look into your SEO ( Search engine optimisation ) it sounds complicated but it just means that the search engines like Google can easily find your website when a consumer enters a relevant keyword.

If your business is showing up on the big players websites, congratulations, your booking engine is working well and you should be receiving bookings through these channels. You may like to visit this Hub and select “tutorials” to learn more and refine your strategy.

So what do you do if this is not the case? You need to learn how about the distribution system and develop a channel strategy.

What is a Channel Strategy?

A Channel Strategy is a plan that identifies the best websites, social networks and apps on which to market your business to move the consumer to purchase with you. It’s about ensuring your product can be found in the places your customers are looking.

The simplest approach is the direct channel

A direct channel means that you bring the customer direct to your own booking engine on your website, thus reducing commissions and fees. Your own website is an important place for customers to book online as you have reduced costs and usually money direct into your bank account. But, given the millions of websites, even with effective SEO you’d be wise to work with the larger players.

We recommend the you develop a balanced portfolio of distribution channels to build sustainability

So, if you found your own website in the Google search then your SEO is fine but if you’re not appearing on the big players websites you need to do the following;

The first step is to see where your current bookings are coming from and what commissions you are paying just so you understand your current state of play.

The second step is to ensure your booking system enables your product to reach the third parties you have identified as important. You can do this by checking on their websites, usually under “distribution partners” most will already be technically connected.

Price your product correctly and remember consumers search on average 7-13 websites before they make a booking and websites like hotelscombined and trivago compare prices for consumers!

Tip – Don’t promise every distribution partner the best rate and don’t advertise you’ll get the best rates direct with us or you may be in breach of distribution agreements.

Once your rates are correct on your website approach your booking system to enable distribution that matches your strategy.

Most booking systems have reports that enable you to see where your bookings are coming from and the cost per booking, review these reports to ensure you understand whats going on and adjust your strategy if necessary.

If the reverse is the case and your appearing on the “big players” websites and your own website is buried then you need to work on your SEO, quick smart. Click here for more information

- Know where your business is currently coming from and what it is costing you

- Research your own business online and understand your personal priorities

- Develop your own strategy which has a balanced portfolio of both direct and indirect bookings

- Focus your efforts on the best return on investment

- Review and refine

Where to from here?

- Get started with our Freebies

- Check out our upcoming live training events

- Get an overview of our services

Hi, we're Tourism Tribe

We are here to help you learn how to get more leads and sales from your tourism website and marketing tools. Join thousands of other tourism businesses and industry organisations in this exciting journey.

Free eCourse

Free ecourse >> here (or get the newsletter only)

Brisbane Head office

Suite 1, 57 Woodfield Rd Pullenvale QLD 4069 Australia

Suite 101, 18-20 Victoria St Erskineville NSW 2043 Australia

11 Yeomans Street, Northcote VIC 3070 Australia

Agnes Water

139 Bicentennial Dr Agnes Water QLD 4677 Australia

36C Rte de St Cergue 1260 Nyon Switzerland

Our team would like to acknowledge the traditional custodians of Country throughout Australia and their connections to land, sea and community. We pay our respect to their elders past, present and emerging and extend that respect to all Aboriginal and Torres Strait Islander peoples today. We acknowledge that the sharing of knowledge has occurred across the lands and waterways of Australia for many thousands of years. As we continue to share stories and support small tourism businesses we try to listen to the knowledge and practice that has always existed here and consider how we can contribute to the preservation of culture and Country wherever we live and work.

© proudly brought to you by Digital Coaching International ABN: 45 153 766 771 All prices are in Australian Dollars

Terms & Conditions | Privacy Policy

We use cookies to ensure you receive the best experience on our site. If you continue to use this site we will assume that you are a-okay with our terms.

10 distribution channels your tours and experiences business should be using

By Rezdy — 30 Aug 2018

distribution marketing tour operator tourism business strategy

Updated May 2023 – As a tour operator, bookings are your bread and butter. By maxing out your sessions and having high steady levels of bookings all year round, your business will flourish. However, achieving this goal isn’t always easy. It’s even more challenging when you solely rely on one distribution channel.

When it comes to examples of distribution channels in the tourism industry, many operators automatically assume that online travel agents (OTAs) are the only form of resellers available. However, this isn’t the case. Travel distribution channels come in a variety of different types of resellers and distribution strategies. By diversifying your distribution channels and understanding what the main types of tourism distribution channels are, you can maximize your visibility and attract a wider range of potential customers.

In this article, we’ll explore 10 types of distribution channels in the tourism industry that tour operators can use to reach new customers and increase bookings.

Why it’s important to target the right distribution channels

For many tourism businesses, broadening your distribution channels is a smart way to elevate your tourism marketing strategy. By delivering your products via different streams and using valuable third-party integrations, you’re expanding your reach to a bigger pool of potential customers.

Distribution channels are all the different ways that your services get delivered to your customers. There are many types of distribution channels in the tourism industry. A distribution channel can be a direct booking via your website or through third-party resellers within the tourism industry. To put it simply, any platform where your services can be turned into a transaction is considered a distribution channel.

Top 10 distribution channels

As a tour and activity operator, choosing the right distribution channels can greatly impact your business’s success. Below, we’ll take a closer look at 10 of the main distribution network partners in travel and tourism, along with the benefits of each one.

By understanding what the main types of tourism distribution channels are, you’ll be able to make an informed decision when forming partnerships with distributors and finding the right resellers for your products and services.

1. Your website

Don’t underestimate the power of your own website. Unlike other distribution channels, you remain in control of branding and customer experience during the booking process on your website. This enables you to take advantage of booking trends and more accurately finetune your messaging so that it is well received by customers.

Your website also has a direct impact on your business’s reputation. A professionally branded website helps foster trust and authority within the marketplace. Customers will be more willing to book directly through your website if they are welcomed by a mobile-optimized website that enables a seamless booking experience. When supported by a strong SEO strategy, your website can dramatically boost customer impressions of your website and increase overall engagement.

Tip: When it comes to content, quality always trumps quantity. Don’t fall into the trap of stuffing your blog and website pages with long keywords or boring content. Rather, scatter in relevant keywords and create content that matches the user’s intent when searching for the keywords you are targeting.

2. Online travel agencies (OTAs)

Online travel agencies are one of the biggest players within the chain of distribution in travel and tourism. There are heaps of top online travel agencies you can partner with. These include big names such as Tripadvisor, Expedia, and Viator to name a few. By partnering with OTAs, you can reach a wider audience, regardless of whether you are an inbound or outbound tour operator.

OTAs are one of the most popular travel distribution channels as their websites gain millions of visitors every day. OTAs appeal to travelers as it’s a one-stop shop for both travel and tourism products. By being able to compare the prices of these travel products and book all of them at once, it provides travelers with an easy booking process. And with the majority of customers now booking on their mobile devices, OTAs have made their booking process a lot easier by building their own applications.

Furthermore, with the help of their strong domain authority, OTAs rank at the top of search engine results – making your services quicker and more accessible for customers to book.

Tip: The competition on OTA websites is tough. Be sure to display professional-looking photos and videos that showcase your services. Well-written tour descriptions will also go a long way.

3. Tourist information centers

Almost every major city has visitor information centers (or VICS). These centers are a place for travelers to enquire about everything related to the area. From accommodation, tours and activities, transportation, or simply suggestions on things to do. VICS will help visitors in suggesting and organizing itineraries and travel arrangements based on their preferences.

Partnering with VICs helps boost the perception of your business as VICs usually hold an authoritative position in the customers’ eyes. They’re perceived as a trusted source and will most likely trust your business for being affiliated with VICs. It’s for this reason that visitor information centers are great to partner with to broaden your distribution channels in travel and tourism.

Tip: Some VICs don’t ask for commission for bookings that they send to you, while others have a pricing structure to list on their site. Make sure you do your research before you decide to partner with a VIC in your travel distribution channel strategy.

4. Your partner network

Your partner network can include Destination Management Organizations (DMOs), local governments, vendors, hotel concierge services or even other tour operators.

Local government websites, for example, often promote different travel businesses and experiences for tourists visiting a specific location. For example, Tourism Australia helps promote events and businesses every month by featuring them on their monthly e-guide, The Hot List. The Hot List is filled with the latest activities, events, and things to do in Australia and is published each month with new suggestions.

To expand your business’s travel distribution channels through partner networks, you can simply approach relevant businesses or organizations and enquire about promotional opportunities or partnerships.

Tip: Travel networking events and tourism conferences are great places to build mutually beneficial partnerships with other businesses.

Google manages a variety of tools that can be employed to increase your business’s online visibility. Two of the most useful tools offered by Google that have significantly enhanced the chain of distribution in travel and tourism are Google Business Profile and Google Things to do .

By creating and optimizing a free business profile on Google, companies can encourage more lead generation and boost their visibility for local searches. Business profiles are also valuable when fostering customer engagement as they are open for customers to leave reviews, ask questions, and submit relevant photographs.

Google Things to do is another free tool that can increase your business’s visibility and allow you to connect with potential customers. This search experience is designed specifically for tour, activity, and other attraction providers looking to increase their distribution channels in travel and tourism. By using Google Things to do, businesses can more seamlessly convert relevant Google searches into direct bookings.

Tip: When managing your Google Business Profile, it’s important to check it every week or so to ensure that contact details are up to date and that customer queries are answered without delay.

6. Destination websites

The travel and tourism industry has a significant impact on economies worldwide. With this in mind, it’s no surprise that many governments have taken notice and responded by providing support to local tourism businesses.

Many local, state and national governments have recognized the power of the tourism industry by creating destination websites to promote their area to potential visitors. These websites offer a wealth of information on local attractions, events, and accommodations. They may also feature package deals that include tours, activities, and other services.

As a tour or activity provider, you can benefit greatly from working with these destination management organizations. By offering your services as part of their packages, you can tap into a wider audience of potential customers. This can be especially valuable for businesses looking to attract international travelers who may not be familiar with the local area.

Tip: When reaching out to destination websites, it’s important to do your research first. Take the time to understand their audience, the type of content they feature, and the services they promote. This will help you tailor your pitch and ensure that your tours and activities align with their brand and messaging.

7. Daily deal sites

Who doesn’t love a bargain? Vouchers and daily deal sites like Groupon and Living Social can be a valuable distribution channel for your tour or activity business. These sites offer a platform to reach budget-savvy travelers who are always on the lookout for unique and affordable experiences.

When utilizing daily deal sites, it’s important to create a compelling offer that provides value to the customer while still generating revenue for your business. Consider offering a discounted rate on an activity package or bundling services for a more attractive deal.

However, it’s essential to limit the number of vouchers that can be sold to avoid

overbooking and ensure a high-quality experience for all customers. Additionally, be sure to set clear expiration dates and redemption instructions to avoid any confusion or frustration among customers.

Tip: Daily deal sites can be especially useful during low-season travel periods and when you have remaining slots to fill up. By carefully crafting your promotion and utilizing this distribution channel, you can attract new customers and generate additional revenue for your business.

8. Hotel concierges

While traditional, working with hotel concierges is a highly effective distribution channel for tour and activity operators. By collaborating with hotels and accommodation centers, you can reach a wide range of potential customers who are looking for things to do during their stay.

This strategic partnership is particularly useful for providing opportunities to maximize last-minute bookings. Many travelers prefer to plan their activities after arriving at their destination, and featuring your services at hotels can help you capture those customers. By making it easy for guests to book your tours and activities through the hotel, you can increase your chances of securing those last-minute bookings.

Another key benefit of working with hotels and accommodation centers is the reduced competition. Hotels naturally have a reputation to maintain, and they typically only refer their guests to a handful of trusted and professional tour operators. Building a strong relationship with hotels through providing exceptional service can secure your business’s place as one of their preferred partners.

Tip: To effectively work with hotels and accommodation centers, you must first develop a professional and trustworthy reputation. Make sure your tours and activities are high-quality, and prioritize providing exceptional customer service. You can also make it easier for hotels to refer their guests to your businesses by providing them with promotional materials such as brochures and flyers.

9. Retail travel agents

Retail travel agents can be a valuable distribution channel for tour and activity operators. These agents have an established customer base of travelers who are looking for assistance with planning their itineraries. By working closely with local travel agents, you can promote your tours and activities on a personal level to their customers.

One significant benefit of partnering with retail travel agents is that they offer personalized services that cater to their customers’ needs and wants. They have the ability to book multi-day tours, flights, private charters, and other services that complement your tours and activities. This personalized touch can be an excellent selling point for your business and can help you stand out from your competitors.

Another advantage of working with retail travel agents is that they offer consistency in incoming bookings. Their customers are often repeated customers who trust their agent’s recommendations and rebook their services through them. This provides a reliable source of bookings for your business and helps to ensure a steady stream of revenue.

Tip: To successfully work with retail travel agents, it’s essential to build and maintain strong relationships with them. Be sure to provide them with high-quality marketing materials, such as brochures and flyers, that showcase your tours and activities. You can even consider offering incentives or commissions for each booking they make on your behalf. These small gestures can go a long way in building a lasting partnership with retail travel agents.

10. Social media

Social media platforms such as Facebook, Instagram, Twitter, and LinkedIn can be an effective distribution channel for your business. With billions of users worldwide, social media platforms provide you with a massive audience to promote your services. By creating a social media marketing strategy that includes relevant hashtags, quality content, and engaging visuals, you can increase your brand visibility and reach a wider audience.

Social media has also become a key platform for customer engagement and communication. Customers expect brands to have a social media presence, and they often turn to social media to ask questions, provide feedback, or voice their concerns. By actively monitoring your social media channels and responding promptly to customer inquiries, you can build trust and loyalty with your audience.

Additionally, social media allows you to target specific audiences through paid advertising. With social media advertising, you can create highly targeted campaigns that reach the right people at the right time. For example, you can target users based on their location, interests, age, gender, and more. This can be a highly effective way to reach new customers and drive conversions.

Tip: Social media is a constantly evolving platform, and what works today may not work tomorrow. It’s essential to stay up to date with the latest social media trends, algorithms, and best practices to ensure that your social media marketing efforts remain effective.

Managing your distribution channels

Working with the main distribution channels in travel and tourism sure has its benefits, but it does come with added work. Connecting with them also comes with a set of challenges. Joining a tour operator marketplace and choosing the right channel manager can help alleviate the stress of setting up your travel distribution channels.

For instance, Rezdy Channel Manager is a marketplace platform designed specifically for tour operators. Through Rezdy Channel Manager, you’ll be able to connect with thousands of resellers and build your distribution channel with a click of a button.

Rezdy’s Marketplace platform simplifies the overall reselling process into 3 simple steps: 1. List your products 2. Set your commission rates 3. Let thousands of agents and resellers resell and promote your products

The good news is that if you’re already a Rezdy booking software customer, you instantly have access to Rezdy Channel Manager. Allowing you to benefit from the best of both worlds – an advanced booking system that will simplify your processes and the ability to instantly connect and manage thousands of resellers from one central system.

Ready to take the step to boost your bookings with Rezdy? Start a FREE 21-day trial or book a demo today.

If you enjoyed this article then make sure to subscribe to the Rezdy newsletter, where you’ll receive up-to-date learnings from the experiences industry, straight into your inbox.

Start your free trial today

Enjoy 21 days to take a look around and see if we are a good fit for your business.

No obligations, no catches, no limits, nada

Distribution

eBook: Guide to growing your tourism business through distribution & channel management tools

How to navigate API connections with resellers

Case Study: Wendella Tours & Cruises

See how Cvent can solve your biggest event challenges. Watch a 30-minute demo.

The Complete Guide to Hotel Distribution Channels

Your hotel has a number of options when it comes to distribution. You can receive direct bookings through your website or the phone, advertise on online travel agency (OTA) booking sites, and utilize a plethora of other channels to grow your business. But to maximize your hotel’s revenue , it’s of vital importance to use a mixture of channels that meet the needs of your target market(s).

Below, we cover a handful of the most popular hotel distribution channels, as well as strategies and examples for taking advantage of those channels.

What is a hotel distribution channel?

At its highest level, a hotel distribution channel is anywhere — online or offline — that properties can sell rooms to potential customers. Examples of hotel distribution channels include hotel websites , online travel agencies (OTAs), global distribution systems (GDS), metasearch sites, direct phone bookings, and more.

How to build a hotel distribution channel strategy:

Your hotel's distribution strategy is a plan for booking rooms at a profit using a variety of channels. The right strategy for you will take into account your pricing, target audience, location, marketing resources , and more.

To create the right strategy for your hotel, you should consider a few key things:

- Determine your business objectives. The goal of most hotel distribution strategies is to increase visibility with your ideal guests, thereby increasing bookings. Make sure that your distribution strategy aligns with your sales objectives and target metrics.

- Find your target audience. Your brand is likely to appeal to certain demographics and types of customers and be less appealing to others. Your distribution strategy should take your audience into consideration so that your visibility is greatest for your target market. Some channels, like phone reservations, will appeal primarily to an older audience, for example, while channels like direct social media bookings may be more appealing for a younger audience.

- Compare key metrics across channels. After you determine which metrics are important to your hotel based on your goals and objectives, you’ll want to compare those across your distribution channels. Some channels will offer more visibility than others, but may also have higher costs or slimmer margins. The right strategy will find a mix of visibility, profitability, and optimized brand messaging.

- Test and optimize over time. Your disitribution strategy should not be static. You should continuously test new channels, optimize existing ones, and make sure that your core channels are delivering profitable results.

Popular types of hotel distribution channels:

1. direct website bookings.

If you’re like most hotels, your website is probably the primary source for direct bookings. Direct bookings are often more profitable, more likely to result in repeat visits, and better optimized for upselling. Because of this, most hotels consider their website as the No. 1 distribution channel in their distribution strategy.

Your website offers many opportunities to highlight your unique amenities, show off your property with high-quality imagery , and boost engagement with videos, interactive content, and testimonials.

In order to increase hotel direct bookings , make sure that the mobile version of your website is optimized for simple and speedy bookings. Many guests are now researching and booking hotels on mobile devices without ever opening a desktop browser, so you definitely don't want to miss out on that business.

You’ll also want to make sure that your website is optimized for search engines and includes location-specific terms to increase discoverability. Clear navigation, responsive design, and a seamless booking experience will all increase the chances that guests choose this valuable hotel distribution channel.

Target more qualified business today

2. Direct phone bookings

Some target audience demographics, such as older adults, travel agents, and event planners, may find direct phone bookings to be the most useful way to get in touch with your hotel. This is especially true if the potential customers have specific questions related to their stay, or if their booking is complicated in some way.

Your call center, reservation line, and front desk are all channels that offer an opportunity for human connection and tailored customer service. Make sure that your staff are trained to take a booking, even if the guest calls the front desk.

This distribution channel is often low-cost because it is a direct line of communication with your guests . You can also get valuable feedback from this channel, since you’ll be able to hear why a guest made a booking (or why they chose not to book).

3. Online travel agencies (OTAs)

There is no getting around it: Online travel agencies are a ubiquitous and integral part of the hotel booking process. Sites like Priceline, Expedia, Booking.com, and Orbitz have huge audiences and are a great way to reach guests that you might not otherwise have reached.

You don’t have complete control over the messaging about your hotel on an OTA, but you can optimize your listing with photos, highlight certain amenities, and offer attractive pricing for OTA audiences. You should focus on OTAs that your target audience uses and understands in order to keep your costs down.

Learn more about how to increase hotel direct bookings

4. Global distribution systems

Global distribution systems (GDS) are an important distribution channel for connecting with travel agents. Travel agents use this system to browse hotels, view rates, and check availability. Well-known global distribution systems include Amadeus , Worldspan , Sabre , and Travelport .

Global distribution systems are helpful for keeping your information up-to-date with travel agent systems all around the world, as well as providing real-time pricing and availability information. To take full advantage of this channel, set your pricing at levels that will remain competitive against similar properties but high enough that you can overcome the GDS fees.

5. Metasearch sites

One level above an OTA is the metasearch engine. These sites, such as Tripadvisor , Trivago , and Google Hotels , charge hotels and OTAs on either a pay-per-click or commission basis for bookings.

The user experience on metasearch sites is usually particularly good, with a simple booking process and easily-searchable information about your hotel.

Here are a few ways you can maximize your bookings from metasearch:

- Make sure that your pricing in search engines matches the price listed on your website.

- Test your cost-per-click (CPC) to balance your costs and your competitiveness with OTAs.

- Adjust your strategy for the metasearch site that you’re targeting. Some sites will attract visitors with less booking intent, and should therefore have lower CPCs in order to be an efficient distribution channel.

6. Wholesalers

Wholesalers serve as an important link between travel agents and travel suppliers. Although profit margins may be thin for this channel, it's a helpful way to fill last-minute space at your hotel or book large blocks of rooms. Although this channel is important to increase occupancy , it should not be one of your primary distribution channels.

Technology you can use to manage your hotel's channels:

1. channel management tools.

A channel manager is a tool that helps you manage your distribution strategy, keeping track of all of your channels and providing useful performance insights. These tools are very helpful for keeping everything in one place and making sure all of your information is up-to-date.

2. Reputation management tools

Reputation management tools help you monitor online channels for mentions of your hotel and respond to guest feedback in a timely manner. This may not seem related to distribution, but if guests are leaving negative feedback on your most popular channel, you’ll want to respond to it right away to make sure that channel stays strong for your business.

3. Revenue management tools

Your revenue management system helps you to plan and forecast demand for your rooms through peak periods, slow periods, and everything in between. It’s also a great tool for determining the right price bands on each of your hotel distribution channels. By analyzing your pricing, expenses, and profit across multiple channels, you’ll have a better idea of which channels are driving the most profitable outcomes for your hotel.

Put this hotel distribution channel guide to use today!

Up next, check out nine proven strategies to help increase hotel occupancy .

Laura Fredericks

Laura brings a decade of insight to improving marketing, as she has worked in technology since 2010. She has experience starting and scaling a business, driving customer marketing, and speaking at live events, including WeDC Fest 2018. She founded Describli and Paradigm Labs, and currently works with companies to improve their customer relationship management and content strategy.

LinkedIn | Website

More Reading

Congratulations to the 2024 excellence awards winners, unlock excellence: premier meetings in los cabos await, congratulations to the 2024 cvent excellence awards finalists.

Subscribe to our newsletter

The Best Distribution Channels in Travel and Tourism

Distribution channels in travel and tourism are the medium tour operators, attractions, travel agencies and other travel companies use to sell their products to their customers.

This article aims to answer the following question:

What are the main types of tourism distribution channels?

Before giving you the answer, you must understand how distribution channels can help you grow your tour company.

Understanding the distribution channels in travel and tourism

The chain of distribution in travel and tourism has grown with the surge of new technologies. Nowadays, distributing brochures to hotels is not enough to stay competitive in the market.

Not only being listed in the right distribution channels will assure better exposure for your tour company , but it will also make it more credible. That is the combination you are looking for to increase your profits.

Basically there are two ways of reaching customers in tourism :

- Directly – In a travel agency or through a travel agency’s website.

- Indirectly – Through a partnership with third-party distribution channels.

The distribution channels in travel and tourism can also be divided into offline and online channels .

Offline channels are more traditional and most tour operators are familiar with them. I’m talking about hotels, hostels, B&Bs, souvenir stores, restaurants, cafes, visitor information centers, trade shows and local partners .

Social networks, review platforms, mobile location-based services, and online travel agencies are examples of online distribution channels.

The role of these new technologies in distributing travel products and generating revenue has grown a lot in the past years.

However, the virtual landscape changes fast. For that reason, it’s important to be aware of new opportunities to list your products to remain competitive and successful.

After this brief introduction, time to break down the distribution channels in travel and tourism.

The best distribution channels in travel and tourism

We’re highlighting five distribution channels for tours and trips , where a tour company should be, to stay competitive.

1. Tour company’s website – the number one direct distribution channel in travel and tourism

When was the last time you didn’t start planning a trip online? Not for a long time, right? It’s obvious, the internet changed the traveler’s behavior.

The time from finding travel inspiration to packing your bags for a new travel adventure has never been shorter. And travelers love it!

That said, we can guarantee that remarkable tour photos published on your tour company’s website will attract curious eyes. Videos from the trip you share on social media profiles will bring you sales too!

At the same time, you can integrate an online tour booking system to your website, turning it into a direct distribution channel. That way your future customers can easily book a tour with you and you pay no commission for that!

Did you know that in 2019 $755 billion worth of travel was booked online ?!

By the end of 2023, travel and tourism revenues are expected to reach this same level again.

Nowadays, travelers start and finish their travel arrangements online. Because of that, it’s so important to maintain an updated and optimized website.

2. Google My Business – a must for a successful tour company

Google My Business is one of the most important indirect distribution channel in travel and tourism to sell your trips online.

Most of it is related to Search Engine Optimisation (SEO). Being listed in Google My Business helps your organic reach on Google search because it improves your SEO ranking .

Another benefit is having your business featured on Google Maps, which includes relevant details, such as opening hours, website link, contact number and customer reviews .

If you don’t have a business profile in Google My Business, creating one should be your priority right now. Use this guide to create the perfect listing for your business in Google and other platforms.

3. Hostels & tourist information centers – sell more tours and activities

After checking-in at a hostel, visitors often ask an employee at the check desk for a tour recommendation. Hence, tour and activity operators can benefit from a partnership with their local hostel.

On the other hand, travelers who are not staying at a hostel usually seek information in a tourist information center. So, it would be wise to contact your local tourist information center and see how you can partner with them.

Tour companies usually drop off flyers and brochures to hostels and tourist information centers. And interested travelers will call to set up a reservation with your tour company .

Now you know how important it is to stay in good grace with the front desk and to develop perfect relationships!

4. Review sites – they will make or break your tour business

Is there a traveler who hasn’t heard about TripAdvisor ? I don’t think so.

Depending on the reviews you get , they will either make or break your tour business. All your marketing efforts won’t be able to reverse the negative effect of a couple of negative reviews.

However, not so much effort will be needed to marketing your travel packages , if your tour business has hundreds of positive reviews.

This is because only 14% of consumers trust traditional advertising, while 92% respect reviews on sites such as TripAdvisor .

That makes it a very important distribution channel in travel and tourism. So, you better be good!

5. Online travel agencies – online giants with huge audiences

Online Travel Agencies ( OTAs ) are powerful distribution channels in travel and tourism, boasting millions of users to their websites every month.

OTAs will list your tours and trips on their site and allow their users to book with you.

Usually, this works through a pay-per-click format. But it might worth the money, considering that bookings through those platforms are expected to grow year over year .

Three global OTAs that tour operators should consider partnering with are:

- GetYourGuide

- Touriosity (commission-free OTA)

There are also much less known local OTAs. Consider partnering with them, too.

Finally, choosing wisely the right distribution channels in travel and tourism means a strategic advantage for your tour company .

It takes a bit of time to figure out which one works best for your tour business. Anyway, starting from enabling direct online sales through a tour company’s website is always a good practice.

If you liked this article, consider downloading our infographic 5 Channel Ideas to Sell your Tours.

What are the distribution channels you find the most suitable for your tour business?

ORIOLY on May 5, 2021

by Lidija Šomodi

Subscribe to our newsletter

Receive the latest news and resources in your inbox

Thank you for subscribing the newsletter

Low Budget Digital Marketing Strategies for Tour Operators

In this ebook you will learn strategies to boost your digital marketing efforts, and the best part, at a low and even zero cost for your business.

The Ultimate Guide to Mastering Trip Advisor

TripAdvisor is an excellent tool to sell tours and activities online and this guide will teach everything you need to know to master it.

A Simple Guide on How to Sell Tours With Facebook

Zuckerberg’s platform is by far the most popular among all social media. So why not selling tours and activities with Facebook help?

Comprehensive Guide on Digital Marketing in Tourism for 2021

Online marketing is a new thing and it changes fast, for that reason we made this eBook where we compiled the latest online marketing trends in tourism!

Other resources

Live Virtual Tours: Everything You Need

5 Channel Ideas to Sell your Tours

How to start a food tour business, related articles.

How to Use TikTok to Promote Your Travel Business

Learn how to showcase your tours and activities on TikTok to convert potential customers into new guests for your travel business.

7 Tips to Get More Bookings From Gen Z Travelers

As Gen Z’s influence in travel grows, adapting to these shifts is not just advantageous—it’s imperative to success in the travel industry.

Unlocking Global Reach: The Ultimate Guide to OTAs for Tour Operators

Explore key strategies for tour providers to partner with OTAs like GetYourGuide and Viator, enhancing visibility and bookings.

- Tips & tricks

- Trends 2024

Travel Trends 2024: How the Digital Revolution Is Shaping the Future of Our Industry

Table of Content

Digital transformation in the travel industry, sales channels: balancing the old and the new, direct bookings vs resellers, marketing channels and strategies for 2024.

The world of travel is experiencing an unprecedented era of transformation: as we enter 2024, the industry continues to deal with the aftermath of the global pandemic and adapt to new consumer behaviors, technological advancements and evolving market dynamics. In 2023, we have witnessed a robust recovery, with international travel volumes approaching pre-Covid levels . However, this doesn’t mean a return to the old ways, as customer preferences have changed significantly in recent years.

There is a growing appetite for personalized, flexible and sustainable travel options, with digital nomadism redefining the concept of both leisure and business travel, blurring the lines between the two. In addition, the rise of experiential tourism is shifting the focus from sightseeing to immersive cultural adventures. Sustainability has also moved from a niche consideration to a mainstream demand , as most people are increasingly aware of their environmental footprint and seek out eco-friendly accommodations and responsible travel experiences. This is more than a fad: it is a broader societal movement that is forcing the tourism industry to rethink its practices and offerings.

For tour operators and activity providers, staying abreast of these changes is essential to survival and growth. To better understand the travel trends that will shape the future of the industry in 2024, we interviewed over 100 industry professionals from all across Europe. This article is designed to accompany our infographic detailing their responses . We hope it will provide valuable insight into the key drivers behind their business strategies and offer actionable takeaways to help you replicate their success. Without further ado, let’s dive right in!

Tourism is undergoing a profound digital transformation, reshaping the way services are delivered and experienced. The emergence of smart technology in accommodations, such as IoT-enabled rooms, and the use of big data for personalized recommendations are examples of how technology is becoming an integral part of the travel experience itself. This integration presents an opportunity for providers to deliver unique value to their customers and stand out in a competitive marketplace.

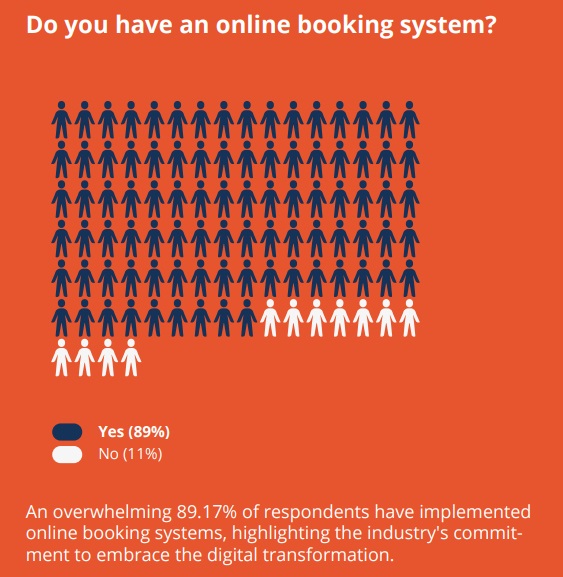

The pivotal role of booking systems

Booking systems are at the heart of this digital revolution and have quickly become a critical interface between the supplier and the customer. Not surprisingly, 89% of respondents to our survey use them to easily manage bookings, sell tickets online and connect with leading OTAs. Let’s explore the top 5 features they find most beneficial in a booking system:

Key features of booking systems

- Online payments: Offering secure, versatile online payment options is essential. This includes accepting multiple payment methods such as credit cards, PayPal, and digital wallets to serve a global customer base.

- Dashboard calendar: An intuitive dashboard calendar facilitates the management of bookings, availability, and scheduling. This feature enables suppliers to stay organized and respond quickly to changes, minimizing overbooking and scheduling conflicts.

- Booking widget: A customizable booking widget on the supplier’s website allows the booking process to be seamlessly integrated into the user experience. This results in a smoother booking flow and encourages more direct bookings.

- Channel manager: With the proliferation of distribution channels, a channel manager becomes vital. It ensures real-time synchronization of availability across multiple platforms such as OTAs, the official website of the supplier and other portals, reducing the risk of overbooking and facilitating inventory management.

- Booking management: Efficient booking management includes features such as easy cancellations or changes, automated confirmation and reminder emails, and customer management tools. This improves the overall customer experience and operational efficiency.

As the leading booking system provider in Europe, Regiondo has been at the forefront of incorporating these essential features. The platform offers a comprehensive solution that not only addresses the basic needs of booking and payment processing, but also provides advanced tools such as resource management , marketing integrations and detailed analytics. This makes Regiondo a model for digital transformation in the travel industry, demonstrating how technology can facilitate business operations and enhance the customer journey. To learn more about how Regiondo can help your business thrive, book a demo with one of our consultants.

In 2024, the sales channels of the travel industry will continue to evolve: understanding how to balance them is key to maximizing reach and profitability.

Offline vs online dynamics

The travel industry has historically relied on a mix of offline and online distribution channels. While online channels have seen tremendous growth, especially in the wake of digital transformation, offline channels such as in-person travel agents and booking offices still play an important role, especially for certain markets and demographics.

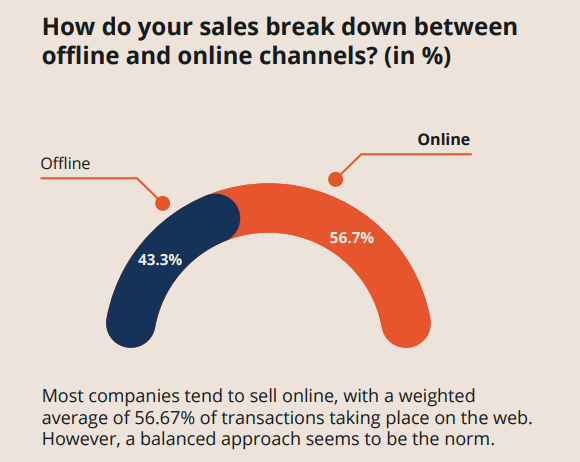

Current balance: In our Trends 2024 survey, we asked participants to break down the share of sales they make online vs. offline. The weighted average shows that 56.67% of tickets are sold through digital channels, while the rest (43.33%) are sold through phone, in-person, and other offline channels. In summary, the current landscape is skewed towards online, driven by the convenience, accessibility and wide range of options it offers. However, offline continues to thrive by catering to customers who value personal interaction and customized service.

Future trends: The future points to a more integrated approach, with a growing emphasis on phygital experiences that blend physical and digital elements. For example, interactive digital displays in physical travel agencies could increase customer engagement.

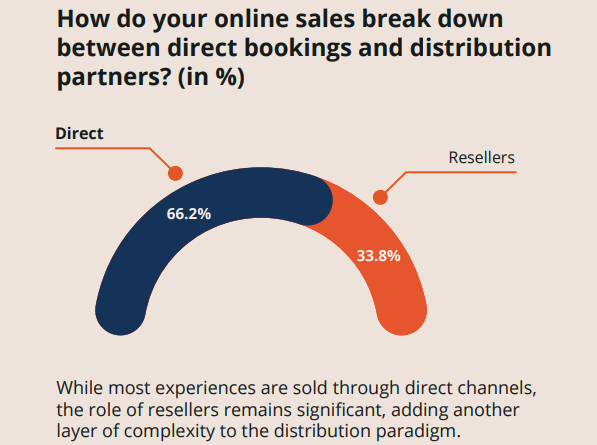

Another issue we wanted our experts to weigh is their relationship with distribution partners. Specifically, we asked them to disclose the number of online bookings they receive through direct channels (website, official social media pages, emails) versus those received through resellers. The results paint a clear picture, with a weighted average of only 33% of tickets sold through intermediaries. But let’s take a closer look at the pros and cons of these two types of channels:

Direct Bookings

- Pros: Higher margins, direct relationship with customers, greater control over customer experience.

- Cons: In order to attract direct bookings, you need to invest in marketing, technology and a strong brand presence.

- Pros: Extended reach, especially in markets where your brand has less presence; reduced marketing costs.

- Cons: Lower margins due to commissions, less control over the customer experience.

Leveraging Both

In our humble opinion, the key is to find the right balance. Leverage resellers to reach new markets and demographics, while building a robust direct booking strategy to drive customer loyalty and brand identity.

The Role of OTAs (Online Travel Agencies)

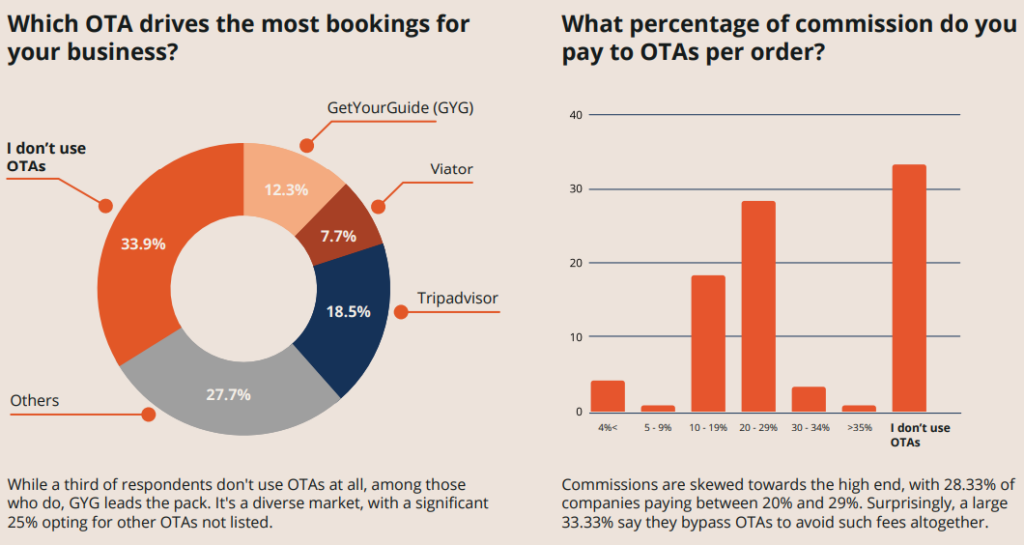

Among the various resellers, OTAs have become a dominant force in the travel booking landscape. As you know, they offer exposure to a huge audience, but at the cost of commissions. Speaking of which, we asked our survey participants about the average percentage of commission they pay to OTAs on each order. The results are interesting: 1 in 3 respondents said they don’t work with OTAs at all to save on these costs. As for the rest, the vast majority pay fees ranging from 20% to 29% of the price of their tickets.

We also asked our industry experts to identify which OTAs drive the most bookings for them from a selection of the most popular. Their response highlights how fragmented the digital distribution landscape can be, as a quarter of respondents said the resellers they have the most lucrative relationships with are not on our list. Still, when it comes to the top dogs, this is the podium:

- GetYourGuide

- TripAdvisor

Love ’em or hate ’em, OTAs continue to be a mainstay of the leisure industry, which is why we want to draw your attention to three important key elements that will help you get the most out of the commissions you pay:

- Perform a cost/benefit analysis: As we have seen, commissions can vary widely, typically ranging from 15% to 30%. It’s important to understand the cost/benefit ratio and how it impacts overall profitability.

- Negotiate: Negotiate better rates as your business grows, bundle services to increase the value of each booking, and use OTAs for visibility while encouraging repeat bookings through your direct channels.

- Follow these best practices: Ensure your listings are up-to-date and engaging, take advantage of OTA marketing tools and analytics, and tap into OTA platforms for market insights and trend analysis.

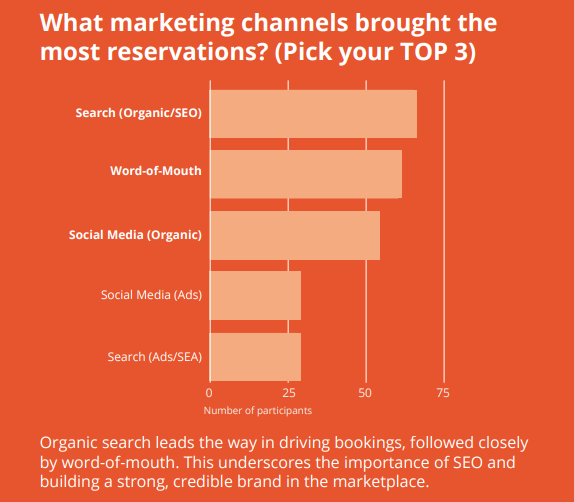

As the travel landscape continues to evolve with ever-changing customer preferences, it can be difficult for tour and activity providers to understand the most effective marketing strategies to employ. So we asked our experts to list the marketing channels that drive more bookings for their businesses. Here are their top 5:

SEO (Search Engine Optimization)

SEO (66% of respondents) continues to be a cornerstone of digital marketing strategies. It’s critical for increasing visibility in search engine results, driving organic traffic and building online authority.

- Key areas of focus: Local SEO is especially important for travel businesses to ensure they appear in searches for local attractions and services. Optimizing for mobile and voice search is also essential as these trends continue to grow.

- Content marketing: Creating valuable, engaging content that answers potential travelers’ questions can significantly improve search rankings and drive organic traffic.

Word of mouth

Word of mouth (61% of respondents) is a powerful tool, especially in the digital age. It can happen organically or be encouraged through referral programs.

- Leverage social proof: Encourage happy customers to share their experiences online, whether through social media, blogs or video content.

- Referral programs: Implementing referral incentives can motivate past customers to spread the word to friends and family.

Social media (Organic)

Organic social media marketing (54% of respondents) is about building community and engaging authentically with your audience.

- Platform-specific strategies: Tailor content to the strengths and audience of each platform, whether it’s visually-driven Instagram, conversation-centric X (previously known as Twitter), or the increasingly popular TikTok.

- Engagement and community building: Posting regularly, interacting with followers, and creating shareable content are key strategies.

Social media and Search ads

Paid social media and search advertising (29% of respondents) is a critical component of a comprehensive marketing strategy.

- Targeted campaigns: Use the granular targeting options available on platforms like Facebook, Instagram, and Google to reach specific demographics, interests, and behaviors.

- Retargeting: Implement retargeting campaigns to capture prospects who have shown interest but haven’t yet booked.

Online reviews (25% of respondents) continue to have a significant impact on consumer decisions in the travel industry.

- Online reputation management: Actively manage your presence on review platforms such as TripAdvisor, Google Reviews and Yelp.

But how much should you spend on marketing? As a point of reference, the estimated average marketing budget for respondents to our survey is €972.82 per month. The key, however, is to take a balanced (no pun intended) approach. While it’s tempting to focus on the latest trends, it’s more important to allocate resources across channels based on their performance and your target audience. We recommend regularly reviewing and adjusting your marketing budget based on analytics and ROI. This may mean shifting funds from underperforming campaigns to those that are delivering better results, or investing in new platforms and technologies.

As we look ahead to 2024, the travel industry is at a pivotal crossroads, marked by rapid technological advances, changing consumer behavior and evolving market dynamics.

Key points:

- Digital transformation: The integration of technology into the travel experience, particularly through advanced booking systems such as Regiondo, is fundamental. The adoption of digital tools and features such as online payments, dashboard calendars, and AI-driven personalization can significantly improve efficiency and customer experience.

- Sales channels: A balanced approach between offline and online distribution channels, and between direct bookings and resellers (primarily OTAs), is critical for long-term success.

- Marketing strategies: The marketing landscape of 2024 will require a mix of advanced digital marketing, content marketing through storytelling, strategic influencer partnerships, local SEO optimization, and well-planned budget allocation across channels.

Looking ahead, the call to action for travel and activity providers is clear: adapt, innovate and thrive. Embrace digital transformation with open arms, understanding that technology is not just a tool, but a bridge to connect with and better serve your customers. Align your sales and marketing strategies to leverage multiple channels and respond to the changing needs and habits of travelers. Most importantly, stay attuned to your audience’s preferences and values to ensure your offerings resonate with their desire for unique, sustainable and culturally rich experiences.

The future of travel is bright and full of possibilities. Let’s embark on this journey together, innovating and evolving to create memorable experiences for tourists around the world.

Related Articles

Stay updated with Regiondo by signing up for our Newsletter

Get a personalized demo or create your free account now

Take your business to the next level with Regiondo - it's free to get started and you don't need a credit card.

Our Organisation

Our Careers

Tourism Statistics

Industry Resources

Media Resources

Travel Trade Hub

News Stories

Newsletters

Industry Events

Business Events

The travel distribution system

- Share Share on Facebook Share on Twitter Share on WhatsApp Copy Link

Distribution channels and consumer purchasing behaviour varies from market to market, so you need to understand the structure of the distribution system specific to your target markets before attending a trade show.

How does the distribution system work?

The travel distribution system is a complex, global network of independent businesses. This network includes a series of distributors or intermediaries, who play a specific role in the development, promotion and purchasing process of Australian tourism experiences.

Online technology and company mergers have transformed the tourism industry, with an increasing amount of crossover in the roles and functions of various sectors of the distribution system. Businesses engage a mix of distribution partners to reach their target consumers.

The traditional structure of the distribution system includes Inbound Tour Operators (ITOs) based in Australia; wholesalers based overseas and international retail travel agents. However, this varies considerably from market to market. For example, it is not uncommon for an inbound tour operator to be part of a larger company that may also operate a wholesale arm in an overseas market, or for a wholesaler to also operate the travel agencies that sell its packages.

Many traditional travel distributors such as wholesalers and travel agents take an online approach as well as offering their services from a retail shop front.

Both online and traditional distribution partners have the opportunity to work with each other and directly with products and customers. As the traditional distribution system continues to evolve, it is important to clearly understand the structure of the companies that you work with and their relationships with other organisations.

Why work with travel distributors?

Travel distributors allow you to broaden your customer base far beyond the reach of your own marketing budget.

They are important to the inbound tourism industry as overseas consumers still heavily rely on the advice of local travel experts when planning and booking their Australian holiday, particularly in long-haul and emerging markets. Travel distributors can also provide market intelligence, insights and advice on a specific market. The travel distribution system covers all the channels through which an international traveller can buy your product.

Inbound tour operators

An inbound tour operator (ITO), also known as a ground operator or destination management company (DMC), is an Australian based business that provides itinerary planning and product selection, and coordinates the reservation, confirmation and payment of travel arrangements on behalf of their overseas clients. They bring the components of accommodation, tours, transport and meals together to create a fully inclusive itinerary. ITOs are the link between Australian tourism products and the overseas travel distributors that buy them, including travel wholesalers, direct sellers, travel agents, meeting planners and event planners.

Wholesalers

Wholesalers are located in overseas markets and have traditionally provided a link between travel agents and ITOs or tourism product. Wholesalers purchase programs developed by ITOs or develop their own packages and itineraries for travel agents and consumers. These packages will usually offer transport, accommodation, tours and attractions. In some markets, wholesalers are also ‘direct sellers’ who bypass travel agents to directly target consumers. In other markets, there are no wholesalers in the traditional sense and travel agents perform both roles. Traditionally, travel packages are published in brochures and promoted and distributed via retail travel networks. Wholesalers may operate their own retail outlets or work with an established network of travel agents in their own country. Many wholesalers specialise in specific market segments such as adventure or the seniors market and many also have an online presence.

Retail travel agents

Retail travel agents offer wide distribution in prominent shop front locations and a convenient place for travellers to make bookings and buy holidays. Traditionally, retail travel agents have provided a link between the wholesaler and consumers. With the integration of distribution roles, the retailer may deal directly with ITOs or Australian-based products, particularly in Asian markets. Many retail travel agents belong to a larger chain of travel agencies or consortiums that use their combined resources to market the agency brand. In some countries, retail agencies may be operated by travel wholesalers, or may concentrate on particular market segments such as special interest or family travel. Many retail travel agents also have an online presence.

Online travel agents

Online travel agents (OTAs) specialise in online distribution and have no intermediaries – they deal directly with consumers and tourism product. Consumers can purchase a product or an entire holiday package online. Online distribution is less structured than the traditional travel distribution system. Commission levels vary, depending on how the site is operated.

Meeting and incentive partners

The business events sector is one of the highest yielding inbound tourism segments. Meeting and incentive planners organise and manage all aspects of meetings and events including conventions, conferences, incentives, seminars, workshops, symposiums, exhibitions and special events.

Meeting and incentive planners use a wide variety of venues, tour operators, accommodation, team building companies and restaurants. They look for unique travel experiences and require different support and facilities to leisure tourism. Meeting and incentive planners are also known as: Professional Conference Organisers (PCO); Destination Management Companies (DMC); Conference Managers; Event Managers; Incentive Houses; Travel Fulfillment Companies; and Special Project Managers.

How do I price my products for distribution system partners?

Travel agents, wholesalers and ITOs provide valuable distribution that you may never be able to secure on your own. Commission is only paid once a sale has been made. You must understand the difference between nett and gross (or retail) rates and protect your rates by providing the correct rates to each level of the distribution system.

Rates should be clearly marked as either gross (retail) or nett. Gross Rate = Nett Rate + Agent’s Commission. The gross or retail rate of a product is the amount that the consumer pays and should be consistent across all distribution channels.

For example, a customer should pay the same price if they book direct, via an international travel agent or via the internet. Consumers will not purchase the product from a travel agent in advance if they know they can purchase it directly from you at a reduced price. Agents will not promote and market your product if they know the consumer is not going to buy from them.

Please note: Information on commission levels is intended as a guide only. For further details on the information you need to include in your rates agreements to distribution partners please refer to the Fact Sheet –“Product & Rate Information”. For further details on how to distribute your products via these distribution partners please refer to the Tourism Export Toolkit .

Discover more trade show tips

Trade show preparation

Trade show meetings and follow-up

Know your markets

Product and rate information

Product review and packaging

Working with the media

We use cookies on this site to enhance your user experience. Find out more .

By clicking any link on this page you are giving your consent for us to set cookies.

Acknowledgement of Country

We acknowledge the Traditional Aboriginal and Torres Strait Islander Owners of the land, sea and waters of the Australian continent, and recognise their custodianship of culture and Country for over 60,000 years.

*Disclaimer: The information on this website is presented in good faith and on the basis that Tourism Australia, nor their agents or employees, are liable (whether by reason of error, omission, negligence, lack of care or otherwise) to any person for any damage or loss whatsoever which has occurred or may occur in relation to that person taking or not taking (as the case may be) action in respect of any statement, information or advice given in this website. Tourism Australia wishes to advise people of Aboriginal and Torres Strait Islander descent that this website may contain images of persons now deceased.

- Products & services

- WHY HOTELBEDS

- Become a client

- List your property

Understanding Global Distribution Channels For Hotels: Bedbanks

3 March 2023

Understanding Global Distribution Channels for Hotels: Bedbanks

Within an industry as competitive and fast-paced as travel and hospitality, it can often be a challenge for many businesses to understand the complex nature of distribution channels , and the changing distribution landscape.

As hotel owners this, of course, is a crucial aspect of the hospitality sector to understand and ensure is bringing the utmost benefits for your hotel. Especially considering that the global hospitality market is expected to grow to as much as $6.7 billion by 2026 according to a recent global report .

So, it’s no longer enough to be competitive – as hotel owners you must remain competitive, capitalise on every available opportunity, and be as visible as possible to the right customer, at the right time, to maximise occupancy rates. To remain competitive and to develop a profitable strategy that works best for your hotel, it’s important to utilise technology and meet new and upcoming demands from potential guests. The best way to do this is by maximising your use of global distribution channels – such as Bedbanks, Direct Channel and Online Travel Agencies (OTAs). In this article, we'll have a closer look at the benefits of working with a Bedbank as a part of your wider distribution strategy, and how Bedbanks as a distribution channel offer many opportunities to boost your hotel’s success. For an even more in-depth look at the distribution landscape and its different channels, download our guide to understanding global distribution , a free resource available at the end of this article.

What Is a Distribution Channel?

In the travel industry, a distribution channel is a key chain of businesses and intermediaries , through which hotel rooms, travel services or products are passed through before they reach the final customer - the guest. These channels of distribution offer their own benefits to you as hotel owners and are commonly used alongside each other, with unique weightings depending on what works best for each hotel on an individual basis.

The most common types of travel distribution channels include:

Bedbanks

Online Travel Agencies (OTAs) - such as Booking.com, Expedia

Metasearch Platforms - such as Trivago, Kayak, TripAdvisor and Google

Direct - often also referred to as dotcom or brand.com distribution, direct channel distribution is via the hotel’s own website, point-of-sale system, app or affiliate website