Don’t have your Nedbank ID yet?

Nedbank ID single sign-on gives you full digital access to Nedbank’s banking and lifestyle products and services on the Money app or Online Banking.

Log in to Online Banking or another one of our secured services.

Bank your way with low fees and extra benefits.

Enjoy 55 days’ interest free credit and other benefits.

Bank on any device, from anywhere at anytime.

Move your salary and debit orders over easily.

Protect yourself against the latest schemes and scams.

For all your travel, international payments, and foreign currency investment needs.

More rewards at every level as you spend and invest.

- Explore Bank

Great interest rates and easy access to your money.

Local and international wealth management solutions.

All-in-one online trading or broker assistance.

- Explore Save & Invest

Affordable loans and interest rates from R2k to R300k.

Buy or build your home with up to 109% financing to cover bond and transfer costs.

Nedbank offers full or part-time loans to students.

Instant access to credit when you need it.

Easily apply for MFC vehicle finance in 5 steps.

Secure an affordable energy solution when in need.

Debt management support when you need it the most.

- Explore Borrow

Secure your family’s future with up to R2million.

Cover for you and your family in the event of death.

Car, building, house contents, valuables and more.

Bond, credit card, overdraft, loan and car repayments.

Global travel insurance with 24-hr emergency assist.

We have cover for small, medium or large businesses.

Guaranteed income and growth plans for future income.

- Explore Insure

Achieve your financial goals with expert planning.

We’ll help manage your assets, debts and estate planning.

Banking experience with customised solutions and rates.

Our experts are ready to assist when you need them.

- Explore Plan

Let our experts guide you on any financial matter.

- Explore Learn

We’re here to answer questions and resolve queries.

Find your nearest branch, ATM and currency exchange.

- Explore Contact us

- See all accounts

- Premium banking

- Get help choosing

- Goal saving

- Family Banking

- Refugees and asylum seekers

- How-to guides

- Discontinued accounts

Simpler more affordable

- MiGoals Premium

- MiGoals Plus

For children under 16

- MiGoals4Kids

For 16 to 26 year olds

For 55 years and older

- MiGoals Premium Senior

Personalised banking services

- Pay-as-you-use

- Young Professionals

- Private Bundle and Private One

The globally integrated account

- Private Wealth Bundle

Your phone is your bank account

- Credit cards

- See all cards

- How to guides

- Amex Platinum

- Digital banking

- Switch to Nedbank

- Fraud awareness

- Exclusive discounts

Money available at any time

Cash in your hand the next day

- PlatinumInvest

- Tax-free Savings

- MoneyTrader

- EasyAccess Fixed Deposit

- PrimeSelect

Funds ready within a month

- Electronic 32Day Notice

- 32Day Notice

Investments left until maturity

- Tax-free Fixed Deposit

- Electronic Fixed Deposit

- Electronic Optimum Plus

- Platinum Fixed Deposit

- Fixed Deposit

- OptimumPlus

- Investment services

- Share trading

- Personal loans

- Explore loans

- Loan consolidation

- Home improvement loan

- Exclusive short-term loan offers

- Explore home loans

- Request a call back

- Track application

With you from search to purchase

- Explore buy

- First time home buyer

- Repeat buyer

- Renewable energy financing

- Home-buying Toolkit

- Edge properties

- Repossessed properties

Bring your dream home to life

- Explore build

- Build your first home

Move your home loan to us

- Explore switch

All the value-adds, 24/7

- Explore manage

- Fixed interest rates

- Settlement and cancellation

Flexible and affordable solutions

- Explore further lending

- Student loans

- Explore student loans

- Vehicle finance

- Solar finance

- Debt assistance

- Consolidate all your debts into a simple loan | Nedbank

- Short-term payment relief | Nedbank

- Take charge and restructure your finances | Nedbank

- Assisted-sales solutions for homes and vehicles | Nedbank

- Flexible payment plans for loans and credit | Nedbank

- Understanding how repo rate works | Nedbank

- Get a call back

- Explore MyCover life

- Funeral cover

- Explore MyCover Funeral

- Individual R10,000

- Individual R30,000

- Family Cover

- Build your own cover

- Short term insurance

- Explore MyCover short term insurance

- Vehicle insurance

- Building insurance

- House contents insurance

- Valuables insurance

- Alternative energy insurance

- Legal expenses | Nedbank Insurance

- Credit Life

- Explore credit life

- Home loan credit life

- MFC Vehicle Finance Assurance

- Overdraft Assurance

- Balance Protection Plan

- Personal loan Assurance

- Travel insurance

- Business cover

- Secure investments

- Guaranteed Growth Income Plan

- Guaranteed Growth Plan

- Financial planning

- Investment planning

- Insurance planning

- Retirement planning

- Estate, wills & trust services

- Will drafting

- Ensure your estate is managed by an executor | Nedbank

- Trust services

- Financial accounting

- Tax services

- Leave the admin of your estate to us, and not to your loved ones | Nedbank

- Nedbank Private Wealth

- Speak to a financial adviser

- A financial adviser can help you plan your future

- PERSONAL Personal Private Wealth Business Corporate

- Save & Invest

- Login & Register

- Online Banking

- Online Share Trading

- NetBank Business

- Nedbank Greenbacks

- Nedgroup Investments

- Everyday banking

- Kids accounts

- Youth banking

- Seniors accounts

- Private Clients

- Private Wealth

- Digital wallet

- In 24 hours

- End of term

- Further lending

SAA Voyager Gold Credit Card

Now offering even better lifestyle benefits and enhanced rewards with every swipe.

Personalised

Earn great rewards and benefits.

Be the first to know about travel promotions

Automatic enrolment to the Voyager Rewards programme

Earn Miles at a faster rate

Rates and fees

R700 annual service fee.

R150 replacement card fee.

Credit facility fee of R27 a month.

Zero charges on card swipes.

Zero charges on additional cards.

Automatic enrolment to the Voyager Rewards programme.

Convenience and control

Manage your card with the Money app or Online Banking.

Tap and go .

Link your card to Apple Pay, Samsung Pay, Fitbit Pay or Garmin Pay.

Get monthly electronic statements.

Scan to pay using QR codes.

Create and use your virtual card for even more secure online and in-app payments.

Flexibility

Change your credit limit on request.

Use your card in-store, online, at ATMs or overseas.

Flexible repayment options.

Minimum repayment of 5% on outstanding balances.

Pay off your purchases over time with the budget facility.

Credit life insurance

Optional credit insurance in case of death, disability, critical illness or retrenchment.

Rewards and discounts

Earn 10,000 bonus Miles on the first SAA ticket you buy and use.

Earn 15,000 Bonus Miles when you spend R320,000 in a calendar year.

Earn double Miles for all eligible spend* in the first month after your account has been opened.

Get 1 Continental or 1 Global Companion Ticket per calendar year when meeting spend thresholds. See more

Convert your Miles to AvoPoints and shop for just about anything on Avo SuperShop.

Get 15% off all purchases or 25% of your first Club pack at Wine-of-the-Month Club .

Use your credit card and get 50% off your Nu M etro tickets.

Travel benefits

Automatic basic travel insurance up to R3,000,000, with the option to top up at a 10% discounted rate.

Exclusive access to promotional fares and Voyager promotions 24 hours before they are made public.

Travel to 1,200 destinations with 26 Star Alliance airline partners. See more

Go on an International Cruise with one of our partners. See more

Get one additional piece of luggage on SAA operated flights.

Pay for any SAA flight with your card and use or donate your Companion Ticket to any other traveller.

Exchange Global Companion Tickets for two Domestic Companion Tickets**. See how

Hire a car from Europcar.

Enjoy preferential check-in.

Use Miles for flight upgrade awards, Uber, Wine-of-the-Month Club, Netflorist and more.

Your card is chip- and PIN-enabled for added security. See more

Transactional SMS’ notifications. See more

Block and replace or freeze and unfreeze your card using the Money app or Cellphone Banking.

Stop or block your card at any time using Online Banking or call 0800 110 929.

Set your transfer and withdrawal limits by using the Money app.

* ‘Eligible spend' means all spend (local and international), excluding cash withdrawals, casino chip purchases, fuel purchases, finance or other card charges, fees or taxes levied by us or the government, purchases of travellers cheques or other negotiable instruments, garage card transactions, budget account instalments and interest thereon, insurance premiums and internet transfers or payments (EFT) from your account.

Things to know before you apply

You need to be over 18 years old.

You need to live in South Africa, and have a valid South African ID or a valid passport and work permit.

You need to earn at least R6,600 a month before tax and have a healthy credit score.

Do you know if you have a good credit score?

Documents you'll need, apply now using these channels, apply online, apply on online banking, find a branch, call 0860 555 111.

New to Nedbank?

Create your Nedbank ID on the Money app or on Online Banking before you apply.

Already a Nedbank client?

Log in to apply.

Not sure which card is best for you? We can help.

Learn more about card management, how to manage your credit card.

- Airlink Flights

- FlySafair Flights

- British Airways

- Lift Flights

- Qatar Flights

- Emirates Flights

- FlySafair specials

- Qatar specials

- Emirates specials

- SAA specials

- BA specials

- Cheap Flights

- Flights to Cape Town

- Flights from Cape Town

- Flights to Johannesburg

- Flights from Johannesburg

- Flights to Durban

- Flights from Durban

- Flights to Bloemfontein

- Flights to East London

- Flights to George

- Flights to Kruger

- Cape Town to London

- Johannesburg to London

- Cruises from Durban

- Cruises from Cape Town

- Cruises to Pomene

- Cruises to Portuguese Island

- MSC Sinfonia Cruises

- MSC Musica Cruises

- MSC Splendida Cruises

- New MSC Opera Cruises

- Grand Voyage Cruises

- MSC Cruises

- Royal Caribbean

- International Cruises

- Mediterranean Cruises

- First Car Rental Rates

- Bloemfontein car hire

- Cape Town car hire

- Durban car hire

- East London car hire

- George car hire

- Johannesburg car hire

- Lanseria Airport car hire

- Nelspruit car hire

- PE car hire

- Minibus Hire

12 - 15 yrs

under 2 yrs

SAA Credit Card

The Voyager credit card is part of SAA Voyager’s loyalty program (s being a Voyager Member is mandatory). There is the option of a Premium Card or a Gold Card, issued by Nedbank. The Premium Card has more benefits than the Gold Card, but has an annual card fee about triple that of the Gold Card - so you're going to have to spend a lot of time in business class lounges to make up for the additional cost!

Earning Rate

With the SAA Voyager Premium Card, you earn 1 Voyager Mile for every R6 of eligible spend. With the SAA Voyager Gold Card you earn a Voyager Mile for ever R6.50 spent.

The first month is the one in which to spend a lot if you've taken up the Premium Card options, as you earn double miles on all eligible spend.

For Premium Card holders there's the carrot of 19,000 SAA Voyager Miles being earned on the first purchase of a South African Airways flight ticket with the card, whilst Gold card members earn 10,000 Voyager Miles.

A complimentary Continental (Africa) or Global companion ticket on South African Airways, provided the annual eligible spend threshold is achieved - the complimentary part is only the base fare, not the taxes and carrier charges. This can't be used on SA Airlink, SA Express, Mango Airlines or other flights from SAA codeshare partners. It is not possible to upgrade these tickets either.

With both cards you can mae use of Souh African Airways' business class check-in, which usually has much shorter queues than the economy class check-in.

Voyager Premium credit card holders are allowed to use the departure lounges belonging to South African Airways when booked on a South African Airways flight. There are lounges at Cape Town International Airport, East London Airport, Harare Airport, King Shaka International Airport, Lusaka Airport, OR Tambo International Airport and Port Elizabeth Airport.

The Voyager credit card is the best of two worlds, on top of the Voyager member benefits one also gets:

Credit facilities of up to 55 without any interest accruing

Zero transaction fees when making purchases.

Competitive interest rates.

Budget facilities for up to 36 months.

Access local and international ATM displaying either the Amex or Visa logos.

Supplementary Visa card.

Automatic travel insurance

Exclusive access to the American Express Selects online lifestyle portal where you get the best offers and discounts available in over 50 countries around the world.

The card options are either the Premium or Gold card and the qualification criteria is that:

You must be 18 years old or older (& well done if you are 18 and already meeting the minimum earnings threshhold!);

Be an SA resident;

Have a clean credit record; and

Meet the minimum earning threshold

Up to date information

The information on this webpage may be out of date - to get up to date information go to the Nedbank Voyager credit card page .

The Voyager Credit Card was relaunched in October 2012 with new features which included: (1) an accelerated points earning rate for spending at any of SAA’s partners which include partner airlines, car rental companies, hotel and accommodation groups, retails outlets as well as property partners; and (2) earning double miles in the first month for eligible spend made locally and abroad – excludes cash withdrawals, casino chip and travelers cheque purchases, fees and finance charges.

5 Oct 2012. The SAA Voyager System migrates to a new IT platform enabling more value added services to be made available, and also to assist to better manage existing programs.

4 May 2008. Forms used when we went about applying for an SAA Voyager credit card . The site didn't work properly when I used Firefox.

29 Aug 2007. South African Airways launches its Voyager credit card.

Ask our lovely travel consultant your questions here. She would love to assist.

Back to Top

South African Airways

- Plan my trip

- Manage my trip

- Destinations

- SAA Holidays

- Voyager Credit Card

- Voyager Specials

- Voyager Programme Guide

- About Voyager

- Programme guide

Join Voyager Now

- Credit card

- Cheque card

Welcome to a world where your currency is Miles and your rewards are exceptional! As a frequent flyer, you already know that South African Airways Premier Rewards Programme can give you more than just the world!

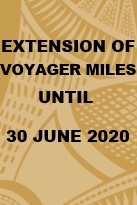

Miles will expire 30 June 2020

We have extended the expiry date with an additional three months due to the rapid outbreak of the Coronavirus (COVID-19). The new expiry date will be 30 June 2020.

Experience Africa in one country

Redeem your Miles for the awards below.

3,000 Miles

4,975 Miles

Health Spas

7,000 Miles

Enjoy premier rewards by activating your account online here with us. And, we can give you more than just the world!

Voyager has improved existing channels and introduced new ones, making sure our members have a wide range of ways to keep in touch with us and our team will work around the clock to provide you with friendly support, no matter the query.

Make the premium choice and join Voyager. You will enjoy the distinction of a rewarding membership. As a Voyager member you also experience special offers and unique deals.

SAA Voyager Credit Card

For the best Voyager Mile earn rate, apply for your SAA Voyager Credit Card today! More information .

Voyager guide

Discover the special features and services that make Voyager your passport to ideal travel.

Choose language and region

- Credit Cards

- Entrepreneurship

SAA Voyager Gold Credit Card: all the details

Get all the details about the SAA Voyager Gold Credit Card

- by Arya Arruda

- November 2, 2021 July 3, 2024

Manager Zanele SA

Average response time within 5 minutes..

Disclaimer: By clicking on the “Start Chat” button above, you will be redirected to another website.

To get yourself the SAA Voyager Gold Credit Card, it is mandatory to be a Voyager Member as the card is an important component of the SAA Voyager’s loyalty campaigns. Nedbank issues two card options, the Gold Card and the Premium Card. There is a significant difference in the benefits and cost between the two cards, but with every purchase, you easily earn more SAA Voyager air Miles.

There is no transaction fee on purchases. Not many credit cards offer such a cool feature. With the gold card, you get an extra, supplementary card; this card helps you in earning the Voyager miles at a greater speed. Credits are interest-free for up to 55 days. This means that you can use the money you need and you have 55 days to return it without paying anything extra. The interest rates on credits are very competitive as compared to other credit cards.

You also get access to ATMs in the local banks as well as internationally. Moreover, there are foolproof features in the credit card to protect you from different kinds of online fraud and scams. You get timely alerts on your transactions. These notifications are free of cost for a transaction of over 500 Rand. You also get a monthly e-statement that you can access on any of your online devices.

After the relaunch of the SAA Voyager Gold Credit Card in 2012, there were many new features added to the card. For example, you can earn extra points for your spending in South Africa Airways partner companies. These include hotels, car rentals, tour agencies, retail shops, and real estate agencies. You also get to earn double points in the first 30 days of eligible spending made internationally and locally. Exclusions include cash transactions, buying checks, financial charges, and card fees.

Financial benefits of SAA Voyager Gold Credit Card

Receive a free supplementary card to speed up your SAA Voyager Miles earning rate and also get preferred rates on balance transfer. Two remarkable benefits of the SAA Voyager Gold Credit card are, getting interest-free credit for up to 55 days while paying no transaction fee on any purchase. The interest rates afterward are also very competitive with an added benefit of access to ATMs both locally as well as internationally (ATMs with Amex or Visa logos). Both locally and internationally, you receive protection against any fraudulent activity against your gold credit card.

Travel benefits and insurance

On international travel, the SAA Voyager Gold Credit Card covers travel insurance providing medical coverage of R4 million. For all eligible spending in the first month, you will earn double miles and access a fast earn rate. You are awarded 2500 extra miles as a bonus once you become a new SAA Voyager member. When the annual eligible spend threshold of R80,000 is reached, you instantly become eligible for one complimentary Continental Companion Ticket. You can also qualify for a complimentary Global Companion Ticket if you reach the spend threshold of R180,000.

Bonus exclusive benefit

American Express Selects is an online lifestyle portal offering special discount offers and with your Gold Credit Card, you get exclusive access to the online lifestyle portal of the American Express Selects. The portal offers some of the best deals and discounts in 57 countries. You also receive monthly electronic statements. Another bonus benefit is the ten thousand Bonus Miles that you get on your first ticket purchase with SAA, done with your SAA Voyager Credit Card. This is given to you upon the completion of the trip. You can treat yourself with flying tickets, spa treatments as well as car rentals.

SAA Voyager Gold Credit Card Eligibility

To get yourself an SAA Voyager Gold Credit Card, your age must be over 18 years. You must also be living in South Africa, and have a valid South African ID or a valid passport and work permit. You must have a decent credit card score with a monthly income of at least R6,600 before tax. The application process is easy and the approval is subject to internal credit checks and other banking regulatory rules.

Documents needed for SAA Voyager Gold Credit Card

To apply for the Gold Credit Card, a valid passport or South African ID is necessary along with your work permit. You will also have to show your payslips for the latest 3 months; or stamped bank statements for the last 3 months. You will also be providing valid proof of residency; like an electricity bill that should not be older than 3 months. Pay attention to these requests to get your credit card as soon as possible.

‘Eligible spend’

Talking about eligible annual spend for the SAA Credit Card, there are a lot of things left to the imagination; which create ambiguity hence resulting in unnecessary complications. The term ‘Eligible Spend’ covers all local and international spend but what’s excluded? All spend excluding casino chips, cash withdrawals, purchasing fuel, tax of fee either by the service provider or the government; purchases of travelers’ cheques, premiums of insurance, and internet transfers.

Final Verdict about the SAA Voyager Gold Credit Card

If you are a frequent air traveler in and around South Africa, choosing SAA and benefiting from the Voyager Gold Credit Card is a great option for you. Not only do you get financial freedom with this card, but added security and a multitude of benefits and rewards as well; including interest-free credits for an extended period of time, insurances, and special discounts on many partner companies.

*You will be redirected to another website

Read also...

- South Africa

- March 20, 2024 March 20, 2024

- Credit Cards , South Africa

- March 9, 2023 December 14, 2023

South African Airways

- Czech Republic

- Democratic Republic of Congo

- Hong Kong, China

- Ivory Coast

- Netherlands

- New Zealand

- Philippines

- Republic of Congo

- Saudi Arabia

- South Africa

- South Korea

- Switzerland

- Taiwan, China

- United Arab Emirates

- United Kingdom

- United States

- Search Search

Cabin Upgrade with Step-Up

We are delighted to offer you a fantastic opportunity to experience luxury travel at its finest. With South African Airways Step-Up Cabin Upgrade you tell us what you're willing to pay to upgrade your seat from Economy Class to Business Class.

Once you have obtained confirmed flight tickets, you will be sent an email notifying you about potential availability of seats for upgrades, along with a link to our Step-Up Cabin Upgrade Offer page, where you can start bidding.

If you do not receive an email and have confirmed flights, you may check your eligibility below.

All it takes is 3 easy steps

Place your bid:.

Make us an offer by selecting the amount you would be willing to pay for an upgrade from Economy Class to Business Class.

Payment information:

Enter your credit card details. Your credit card will only be charged if your offer is accepted.

Review and submit:

We will advise you 24 hours prior departure if your offer is successful

After completion you will receive an email confirming your request to upgrade your seat, which can then be used to change or cancel your request. You will also receive an updated e-ticket with your new travel information and the amount you offered will be deducted from your credit card.

Your credit card will not be charged unless your offer is successful

Step-Up Terms and Conditions Collapsed Content

1. The following terms and conditions ("Terms and Conditions") shall apply to an offer (“Offer”) made by you (“you”) to South African Airways (“SAA”) for an opportunity to upgrade from the economy class ticket purchased by you for travel on SAA to a business class ticket on that same flight (“Upgrade”). Offers can only be made on selected flights operated by SAA (at its sole discretion) on condition that you possess a valid and issued SAA Economy Class ticket for the concerned flight. Upgrades shall not apply to code shared flights or flights operated by other airlines. The Offer shall apply solely to the single flight sector (i.e. one way) to which it is made and not in respect of additional flight sectors within the same itinerary.

2. All persons who submit an Offer must have reached the legal age of majority in their country of residence at the time their Offer is submitted. The parents of underage passengers and/or the adult responsible for such passengers may obtain an upgrade on their behalf. You shall be deemed to have the authority to act on behalf of and to bind the person or persons named or included in the Offer to these Terms and Conditions.

3. An Offer, when submitted by you in association with a booking made with SAA, whether made directly with SAA or indirectly through other means, and presented to SAA, shall entitle the person or persons named in the Offer, subject to these Terms and Conditions, to be considered for an Upgrade. If more than one passenger exists in the original flight booking, the upgrade offer shall apply individually to each passenger in that original booking. The offered amount will, accordingly, be multiplied by the number of persons included in the original flight booking. Prior to submitting your credit card details you will see the total amount for the upgrade. Your submission of an Offer constitutes a contractually firm and binding offer which SAA is entitled to either decline or accept.

4. Persons may only submit one Offer per flight which corresponds to the purchased ticket issued on South African Airways ticket documents 083, and offers must always be made and paid for by using a credit card.

5. SAA is under no obligation to accept your Offer, and it makes no representation that you or any passenger will be upgraded. The acceptance of any Offer is at the sole discretion of SAA.

6. SAA Step-Up Upgrade is not eligible for the following bookings: Tickets booked using Voyager miles for Journeyblitz or Saverblitz, and free or rebate tickets.

7. By submitting an Offer, you agree that your Offer will remain open for acceptance by SAA at any time up to 36 hours prior to the scheduled flight departure time. You may revise or cancel your Offer for as long as your Offer has not already been accepted by SAA. Once your offer is accepted by SAA, you are legally bound to complete payment for the price stated in your final Offer and you shall not entitled to withdraw from your Upgrade, except and to the extent as described in these Terms and Conditions.

8. In the event that SAA cancels a flight and re-accommodates you on another flight, any Offer you made in relation to the original booking may be transferred to the new flight(s) subject always to availability of seats in Business Class and at the sole discretion of SAA. If, for any reason, there are not enough seats available in the higher class of service to fulfil your Upgrade (only where your original Offer has been accepted), any amounts paid by you for the Upgrade will be refunded to the credit card that was used to pay for the Upgrade.

9. There will be no refunds, credits, or exchanges once your Offer has been accepted by SAA, except under the following conditions: • The flight for which your Offer was accepted and on which you were upgraded is cancelled. • The flight for which your Offer was accepted and in respect of which you were upgraded is cancelled, and SAA re-accommodates you on another flight but in the class of service of your original booking. • Your Offer was accepted and you were given an Upgrade, but you were not able to be seated in the upgraded class of service for reasons attributable to SAA, including, but not limited to, a change in equipment, a delay in the connecting flight that resulted in your missing the connection on which you were upgraded, but excluding reasons attributable to your own actions. For the avoidance of any doubt, if the refund is approved, the amount paid for the Upgrade will be refunded to the payment card that was used to pay for the Upgrade.

10. Should refunds be approved, they will be processed in the currency in which the Upgrade amount was charged. Such refunds will be limited to the amount charged by SAA for the upgrade and no bank related charges will be refunded by SAA.

11. The fare conditions for the original ticket you purchased shall remain in effect and will be applicable even if your Offer has been accepted and you have been upgraded, including, but not limited to, cancellation policies, change fees, and rules relating to the accrual of frequent flyer miles.

12. SAA does not guarantee specific seat assignments to passengers whose Offers are accepted and who are upgraded.

13. The amount of Baggage you may carry with you is determined separately and individually for each Flight Segment in accordance with the conditions and limitations applicable to the corresponding Flight Segment.

14. The fare conditions for the original ticket you purchased shall remain in effect and will be applicable even if your Offer has been accepted and you have been upgraded, including, but not limited to, cancellation policies, change fees and penalties. Mileage accrual will be awarded to SAA Voyager Members based on the amount spent for the original ticket and the upgrade. Additional baggage is given only on the single specific sectors in respect of which the upgrade is awarded, for more information on baggage allowances please click here .

15. In the event that your Offer is accepted and your credit card is charged the Offer amount but the Upgrade is not provided, you shall be entitled to apply for a refund. Your request must include the original boarding pass for the flight in question. If you are not able to provide the original boarding pass for the flight in dispute, SAA is under no obligation to refund you for the amount you paid for the Upgrade.

16. If you cancel or miss your flight in respect to which the Upgrade applies through no fault of SAA, no refund of the Upgrade fee shall be issued by SAA.

17. If you are travelling with an infant, the cost of the upgrade would be 10% of the bid price and would be chargeable separately at the departure airport subject to the travelling adult's Step-Up Cabin Upgrade bid being successful.

18. SAA reserves the right to modify and otherwise change these Terms and Conditions at its own discretion. Except as provided for in the preceding sentence, no amendment, modification or waiver to these Terms and Conditions shall be binding on SAA unless made in writing and signed by an authorized officer of SAA. By submitting an Offer, you accept all of the terms and conditions of the SAA Step-Up Upgrade.

19. These terms and conditions should be read in conjunction with the SAA Conditions of Carriage which are available on flysaa.com.

Frequently Asked Questions Collapsed Content

What is the stepup upgrade service.

SAA offers its passengers the opportunity to upgrade from Economy Class to Business Class by submitting a bid to SAA. SAA will evaluate all bids for that specific flight and inform you within 24 - 3 hours prior to departure whether your offer has been approved or not approved.

Who can make an offer?

- Passengers that hold a valid economy class ticket issued by SAA with a ticket number starting with 083 for a scheduled flight operated by SAA.

- You may submit your StepUp Upgrade offer up to 4 hours prior to departure.

Passengers not eligible for a StepUp Upgrade?

- Flight bookings which are not yet confirmed

- Free or Rebate Tickets

- SAA Voyager Journeyblitz or Saverblitz tickets

Which destinations is the StepUp Upgrade applicable for?

The Step Up programme is available on all SAA operated flights with ticket numbers starting with 083.

Can I use the StepUp Upgrade on SAA flights operated by its partner airlines?

The SAA StepUp Upgrade is available for SAA operated flights only, where the ticket issued by SAA starts with 083

How does the StepUp Upgrade Work?

- Book your flight on flysaa.com or your travel agent.

- You might receive an invitation email from SAA telling you about the service with a link to submit your offer. If you go to manage reservation, there will be a link to check whether your flight is eligible and to submit your offer or on the Step Up page, you can check your eligibility by clicking here .

- Enter your offer

- Enter your credit card details for general verification, review and confirm your offer

- You will receive an email which will contain your offer details for each leg of your flight.

- You may use this confirmation email as a link to cancel or change your offer up to 4 hours prior to departure.

- From 24 hours prior to departure all offers submitted are reviewed and the available seats in business class will be assigned. If your offer has been accepted, you receive an email confirmation of your upgrade within 24 - 3 hours prior to departure. If your offer is not accepted to you receive and email informing you on thus.

- You may proceed to check-in online for your Business Class seat.

If you booked your flight through a travel agency and the email in the booking is that of the travel agents, the travel agent may submit a bid on your behalf or they may forward the email to you and you may bid for yourself. Alternatively you may check your eligibility and place your bid by clicking here .

What will happen if I make an offer and it is successful?

You will receive an email 24 – 3 hours prior to departure informing you that your offer was successful. Your credit card will be charged by the amount you offered and a new ticket will be emailed to you.

What will happen if I make an offer and it is not successful?

You will receive an email 24 - 3 hours prior to departure informing you that your offer was unsuccessful. Your credit card will not be charged and your original travel ticket remains the same.

Does the SAA StepUp apply on a Roundtrip?

All flight legs/segment where the SAA StepUp Upgrade is available will be listed and you will have the opportunity to make your offer on any or all the legs you choose. You have to make your offer per leg in your itinerary; some legs in your itinerary might not be eligible.

Will there be additional taxes charged to the upgrade offer?

No, the offer amount includes all taxes. If there is a special type of tax in a specific country this will be shown to you throughout the offer process and will be charged as an additional amount to the offer.

What happens if I have to cancel or change my flight after I’ve submitted an offer?

You may cancel or change your offer any time prior to departure as long as SAA has not accepted your bid. If SAA has accepted your offer, you may contact us and we will evaluate if we can move the StepUp Upgrade to your new flight date.

What happens if I have to change or cancel my trip after SAA accepts my offer?

After your offer has been accepted by SAA, the upgrade amount is no longer refundable.

What happens if I cancel my offer by mistake?

You have up to 4 hours prior departure to correct your offer, re-offer or cancel the offer.

How does it work when traveling as a couple or family?

SAA StepUp Upgrade considers all passengers within the booking.

Note: The upgrade cost for a travelling infant would be 10% of the accepted bid price and would be charged separately at the airport at the time of departure.

Travelling with a colleague who does not want to use the StepUp Upgrade?

Please contact SAA’s contact centre and ask for the booking to be split, you will receive a new booking reference, once that is done you may submit your individual offer by clicking here .

Can Voyager members redeem their miles for SAA StepUp Upgrade?

No, Voyager members can redeem their miles for upgrade in the same way they currently doing.

Will I earn Voyager miles for the SAA StepUp Upgrade?

Yes, you will earn SAA voyager miles for the upgrade. You will earn the base miles as per your original ticket plus additional miles for the cabin upgrade bid spent.

Will the SAA StepUp Upgrade change the conditions of your ticket?

No, the same fare rules apply as the original fare purchased including change fees and cancellations penalties.

Can I choose any amount I want to bid?

Yes. The system has a strength indicator which is a guide to show you the strength of your bid; this does not guarantee the bids success. The minimum and maximum bid amount set, is a guide on a fair value of the upgrade.

Can I offer different amounts for each of my legs of the upgrade?

Yes, you can offer different amounts for each eligible leg.

If I have an existing offer and want to use a different credit card, how can I change my card information?

You need to cancel your current offer first. You will be able to submit a new bid using your preferred credit card only after the cancellation of your first offer.

Will I be refunded the amount I bid if the flight I was upgraded on has been cancelled?

If SAA cancels your flight, SAA will try to accommodate you on the next flight in an upgraded cabin. If SAA is unable to honour the upgrade, then your bid amount will be refunded back to you.

What are the benefits of an Upgrade from Economy Class to Business Class?

- You are entitled to priority check-in and boarding at the airport.

- You have access to SAA’s lounges.

- On-board, enjoy SAA’s 180 degree lie flat beds (on certain destinations), cuisine by award winning South African Chefs and a selection of award winning South African wines.

- On the segment of your flight you have been upgraded to, you are entitled to the business class baggage allowance. Click here , to see your baggage allowance for your destination.

When one segment of my trip is upgraded, what is my baggage allowance?

Additional baggage allowance applies only on the segment that has been upgraded. All other segments normal economy class baggage rules apply.

If you have any concerns or need clarification, please email: [email protected]

What to Consider when Making Your Offer

The success of your offer depends on a combination of factors

- The amount offered for the upgrade

- Other competing offers

- The original Economy Class fare you purchased

- Your SAA Voyager status

- The number of seats available for upgrade

Join Voyager now

Make the premium choice and join Voyager.

You will enjoy the distinction of a rewarding membership.

As a Voyager member you also experience special offers and unique deals.

Our Business Class Experience

Fine Dining

You can look forward to culinary indulgences served with excellent, award-winning South African wines and a wide range of complementary drinks, including champagne. Note that the airline needs to comply with Covid-19 regulations and this service may not be applicable on your flight.

Fly in Comfort

Seats in Business Class are more than seats and can recline to 180 degrees, lying fully flat for a relaxing journey. To make your experience even more comfortable, you will receive a duvet and full-size pillow, as well as an amenity bag containing everything you need to travel in ultimate relaxation. Available on flights where we operate a wide body aircraft.

Lounge Access

Enjoy access to our world-class airport lounges, where you can relax and refresh, catch up on work and get ready for your flight

Priority Boarding and Check-in

When travelling in Business Class, you will have the benefit of using our dedicated check-in and boarding counters, as well as priority baggage handling at the airport.

Entertainment

You'll be spoilt for choice with over 100 movies to enjoy from the latest blockbusters to old favourites. You can also access up to 100 TV features, comedy shows, fun kids' programming, as well as a wide range of music and games.

Baggage Allowance

You can take whatever you need with you and much more when you travel Business Class. A generous two-piece baggage allowance of up to 32kg per bag. To view our baggage policy click here .

Personalise your Experience

- Select your Seat

- Additional Bags

- Cabin Upgrade with Step-Up Current Page

- Additional Seats with Step-Up

Check your eligibility

The following field(s) contained an error. Please correct them.

Select the cookies you want

Tracking cookies

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

18 Best Ways To Redeem South African Airways Voyager Miles for Max Value

Former Senior Content Contributor

483 Published Articles

Countries Visited: 24 U.S. States Visited: 22

Keri Stooksbury

Editor-in-Chief

37 Published Articles 3323 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

6 Published Articles 1181 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Table of Contents

The pros and cons of south african airways voyager miles, the 18 best ways to use your south african airways voyager miles, using your south african airways voyager miles, how to boost your south african airways voyager miles, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

South Africa is quite a picturesque vacation spot, located at the southern tip of Africa. Home to some of the best wine in Cape Town and beautiful safari experiences across many ultra-luxurious game reserves throughout the country, there’s something to do for everyone.

The state-owned airline South African Airways, in operation since 1934, has hub airports at O.R. Tambo International in Johannesburg (JNB) and Cape Town International (CPT). It has maintained a boutique airline feel with numerous quirks. Although its fleet size is small, its partner list is quite large.

If you find yourself earning a stack of South African Airways Voyager miles and can’t figure out how to best use them, you’re not alone.

South African Airways Voyager has some neat attributes that make it an attractive program, provided you can get its miles. This program is unbeatable for intra-Asia premium cabin travel . You can also book Emirates premium cabin awards, though not at the best redemption price. Lastly, there’s tons of value in niche routes, such as between Guam and Asia in economy class.

On the other hand, Voyager can be quite confusing. Its routing rules are obscure, and it has many different award charts, depending on who you fly on.

Lastly, its website is built much like an early dot-com website. You’ll notice that South African Airways Voyager primarily employs a region-based pricing scheme, which leaves quite a bit of room for opportunity.

South African Airways’ frequent flyer program doesn’t get much publicity in the frequent flyer or award travel world.

In fact, Voyager’s website is replete with technical glitches, the award chart is nonsensical for the most part, and there aren’t many ways to transfer points to South African Airways Voyager.

However, this frequent flyer program has so much value , as long as you’re interested in niche routes. Some of these redemptions are competitively priced relative to the alternative and can represent the absolute best price you can pay for that particular route.

1. Fly Emirates First Class Round-Trip From Seoul to Dubai (200,000 Miles)

One of the quirks of South African Airways Voyager is the ability to book Emirates using miles . While the overall award pricing of Emirates awards is lackluster, there are some ways to get competitive redemption value.

If you fly to/from Dubai and the “Far East” region, you’ll pay 200,000 miles round-trip. Japan is excluded from the Far East region because it is a region itself. But, if you fly between South Korea and Dubai, you’ll have the opportunity to savor Emirates first class for 8 to 10 hours each way.

For this, you’ll pay 200,000 Voyager miles, and Emirates Skywards charges around the same price (197,500 miles.) So, if you find yourself with a ton of Voyager miles, consider using them for a round-trip Emirates first class experience.

Here is the exact route we’re talking about:

- Seoul-Incheon (ICN) – Dubai (DXB) round-trip in Emirates first class for 200,000 miles + ~$118 in taxes and fees per person

Hot Tip: You’ll want to avoid commencing your trip in Dubai due to the fuel surcharges that are levied. To give you an idea, the reverse route round-trip will have $923 in taxes and fees per person.

2. Fly Emirates Business Class Round-Trip Between North/South Africa and Dubai (From 125,000 Miles)

If business class is enough for you, you can still fly on Emirates business class for a great deal. However, the one restriction is that you can’t book Emirates award flights between Johannesburg and Dubai .

There are still many fantastic routes you can fly on. Here are some great example redemptions you can make:

- Cape Town (CPT) – Dubai (DXB) round-trip in Emirates business class for 125,000 miles + ~$219 in taxes and fees

- Casablanca (CMN) – Dubai (DXB) round-trip in Emirates business class for 125,000 miles + ~$289 in taxes and fees

- Durban (DUR) – Dubai (DXB) round-trip in Emirates business class for 125,000 miles + ~$219 in taxes and fees

3. Fly Emirates New First Class Suites Round-Trip Between London and Dubai (155,000 Miles)

Emirates’ Game Changer first class suites are sensational.

This ultra-exclusive, fully-enclosed first class suite is arguably the best first class product in the world. One of the routes on which this is offered is on select 777-300ER aircraft between London-Stansted and Dubai.

Unfortunately, the large fuel surcharges and the U.K. Air Passenger Duty means you’ll pay an arm and a leg for first class.

Here’s the exact redemption you’d be making:

- London-Stansted (STN) – Dubai (DXB) round-trip for 155,000 miles + ~$512 in taxes and fees

4. Fly Emirates First Class Round-Trip Between North America and Dubai (240,000 Miles)

If you’re in the market to fly directly from North America to Dubai in Emirates first class, you’d absolutely be able to make a case for using Voyager miles.

You can fly between any North American city and Dubai in Emirates first class for 240,000 miles . You’ll simply need to find award availability.

If you’re interested in maximizing your time in first class, you’ll want to book from the West Coast . Unfortunately, you won’t be able to avoid fuel surcharges on routes between North America and Dubai.

Here are some great example redemptions you can make:

- Houston (IAH) – Dubai (DXB) round-trip in Emirates first class for 240,000 miles + ~$400 in taxes and fees

- Los Angeles (LAX) – Dubai (DXB) round-trip in Emirates first class for 240,000 miles + ~$400 in taxes and fees

- New York (JFK) – Dubai (DXB) round-trip in Emirates first class for 240,000 miles + ~$400 in taxes and fees

- San Francisco (SFO) – Dubai (DXB) round-trip in Emirates first class for 240,000 miles + ~$400 in taxes and fees

- Washington, D.C. (IAD) – Dubai (DXB) round-trip in Emirates first class for 240,000 miles + ~$400 in taxes and fees

5. Fly Emirates First Class on the World’s Shortest A380 Flight (35,000 Miles)

If you’re looking to try out Emirates’ first class suites on a super-short flight, why not try it on the shortest A380 flight in the world ?

Cash tickets are usually over $2,000, which makes this round-trip ticket one of the most expensive flights you can get from an hourly standpoint.

Here is the exact route you can book:

- Muscat (MCT) – Dubai (DXB) round-trip in Emirates first class for 35,000 miles + ~$154 in taxes and fees

6. Fly Virgin Atlantic New Upper Class Round-Trip Between London and West Coast U.S. (127,000 Miles)

Another great partner that South African Airways has is Virgin Atlantic . This airline has offered a decent business class product in the past, though it had its fair share of complaints. However, in 2019 it launched its new business class product which is fantastic.

When you’re using South African Airways Voyager miles, it’s almost always better to fly to/from the West Coast as opposed to the East Coast, due to the negligible difference in required miles of 2,000.

You’ll pay 127,000 miles for West Coast flights round-trip, whereas East Coast will cost 125,000 miles . Here are some great example routes you can take:

- Los Angeles (LAX) – London-Heathrow (LHR) round-trip in Virgin Atlantic’s new Upper Class for 127,000 miles + ~$1,771 in taxes and fees

- San Francisco (SFO) – London-Heathrow (LHR) round-trip in Virgin Atlantic’s new Upper Class for 127,000 miles + ~$1,771 in taxes and fees

7. Fly Virgin Atlantic Upper Class Round-Trip Between London and the Caribbean (109,500 Miles)

If you’re considering travel that involves London and the Caribbean, you’ll find comfort in knowing that you can redeem South African Airways Voyager miles for this endeavor.

Virgin Atlantic doesn’t have the biggest route network in the world, but it actually offers nonstop flights to the Caribbean . Here are some great example routes you can take:

- London-Heathrow (LHR) – Bridgetown (BGI) round-trip in Virgin Atlantic Upper Class for 109,500 miles + ~$734 in taxes and fees

- London-Heathrow (LHR) – Havana (HAV) round-trip in Virgin Atlantic Upper Class for 109,500 miles + ~$747 in taxes and fees

8. Fly ANA Business Class Round-Trip Between Japan and Southeast Asia for Unbelievable Prices (32,200 Miles)

South African Airways Voyager has one of the most generous definitions of Asia of all the frequent flyer programs. Namely, it has decided to combine most of Asia into 1 region, dubbing it “North and South Asia.”

Normally, frequent flyer programs separate this gigantic continent into several regions and price awards accordingly. South African Airways has created a hidden gem for intra-“North and South Asia” flights.

In fact, these mileage prices blow the competition out of the water, which goes to show that these redemptions aren’t just competitive — they’re industry-leading .

This zone contains cities as far north as Tokyo and cities as far south as Bali, which are 7 to 8 hours away by flight. When you take this into account and look at the rock-bottom prices, you’ll see why this is a redemption you simply cannot ignore.

All Nippon Airways, or ANA , offers a fantastic business class product. When you use South African Airways Voyager miles, you can fly ANA business class anywhere within Asia for 32,200 miles round-trip .

Here are some great example routes you can take:

- Tokyo-Narita (NRT) – Yangon (RGN) round-trip in ANA business class for 32,200 miles + ~$144 in taxes and fees

- Tokyo-Narita/Haneda (NRT/HND) – Bangkok (BKK) round-trip in ANA business class for 32,200 miles + ~$143 in taxes and fees

- Tokyo-Narita/Haneda (NRT/HND) – Jakarta (CGK) round-trip in ANA business class for 32,200 miles + ~$161 in taxes and fees

- Tokyo-Narita/Haneda (NRT/HND) – Singapore (SIN) round-trip in ANA business class for 32,200 miles + ~$153 in taxes and fees

9. Fly Asiana Business Class Round-Trip Between Korea and Southeast Asia for Unbelievable Prices (32,200 Miles)

Asiana Airlines is the second-largest airline in South Korea, with Korean Air standing in front. Asiana Airlines offers a great business and business suites product, which used to be sold as first class.

We discussed ANA route options to take advantage of intra-North and South Asia award pricing above, so let’s now talk about Asiana Airlines via South Korea. Seoul, South Korea’s capital city, is situated in the northern part of Asia, which means that the longest flight times will be on flights bound for Southeast Asia.

- Seoul-Incheon (ICN) – Ho Chi Minh City (SGN) round-trip in Asiana business class for 32,200 miles + ~$81 in taxes and fees

- Seoul-Incheon (ICN) – Phnom Penh (PNH) round-trip in Asiana business class for 32,200 miles + ~$90 in taxes and fees

- Seoul-Incheon (ICN) – Phu Quoc (PQC) round-trip in Asiana business class for 32,200 miles + ~$79 in taxes and fees in taxes and fees

- Seoul-Incheon (ICN) – Phuket (PKT) round-trip in Asiana business class for 32,200 miles + ~$101 in taxes and fees

- Seoul-Incheon (ICN) – Singapore (SIN) round-trip in Asiana business class for 32,200 miles + ~$101 in taxes and fees

10. Fly Air China Business Class Round-Trip Between Beijing and Southeast Asia for Unbelievable Prices (32,200 Miles)

Yet another great option to fly intra-North and South Asia with Voyager miles is Air China business class. Although Air China’s business class doesn’t have the reputation that ANA or Asiana does, for example, it’s still an excellent Star Alliance partner airline with amazing connectivity within Asia.

Air China’s business class doesn’t feature direct aisle access at all seats for the most part; instead, you’ll most likely get a 2-2-2 configuration on any wide-body aircraft. Nonetheless, it’s still a great way to fly business class for mega-cheap prices .

- Beijing (PEK) – Chiang Mai (CNX) round-trip in Air China business class for 32,200 miles + ~$176 in taxes and fees

- Beijing (PEK) – Kashgar (KHG) round-trip in Air China business class for 32,200 miles + ~$172 in taxes and fees

- Beijing (PEK) – Kuala Lumpur (KUL) round-trip in Air China business class for 32,200 miles + ~$205 in taxes and fees

- Chengdu (CTU) – Colombo (CMB) round-trip in Air China business class for 32,200 miles + ~$15 in taxes and fees

- Guangzhou (CAN) – Urumqi (URC) round-trip in Air China business class for 32,200 miles + ~$145 in taxes and fees

- Shenzhen (SZX) – Urumqi (URC) round-trip in Air China business class for 32,200 miles + ~$122 in taxes and fees

11. Fly Thai Airways First Class Round-Trip Between Bangkok and Japan (47,900 Miles)

Thai Airways is indeed one of the rarest airlines in the world to fly first class on. At one point in time, Thai Airways even offered first class nonstop to the U.S. However, times have changed, financial struggles have mounted, and Thai Airways is on a crusade to become profitable again.

Thai Airways offers first class on flights to/from Tokyo for 47,900 miles round-trip This 5.5 to 7 hour flight is hardly an ultra-long-haul flight, but it’s one of the only opportunities you’ll ever get to try Thai Airways first class.

Just to give you an idea of how phenomenal this redemption is, the next-closest Star Alliance loyalty program, Asiana Airlines Asiana Club , charges 100,000 miles, as does Avianca LifeMiles . You’re going to save over half of your miles on this round-trip flight by booking through South African Airways.

Here are the exact redemptions you can make:

- Tokyo-Narita/Haneda (NRT/HND) – Bangkok (BKK) round-trip in Thai Airways first class for 47,900 miles + ~$209 in taxes and fees

12. Fly Air India First Class Round-Trip Between Jeddah and India (56,900 Miles)

Air India doesn’t have the best reputation out there. However, it’s a solid option if you’re looking to get to India comfortably. Additionally, Air India is one of the few airlines that offer first class on medium-haul flights .

When you look at other Star Alliance partners such as ANA, you’ll find that there are very few, if any, routes shorter than 8 hours than offer first class. This is where Air India can come in handy.

Air India has extraordinary connectivity to many cities in Saudi Arabia despite not being in the same alliance as Saudia, the flag carrier of Saudi Arabia. South African Airways Voyager blows its competitors out of the water when it comes to award pricing between Saudi Arabia and India. In fact, the closest runner-up comes in at 75,000 miles for round-trip first class.

Interestingly, the only reason why this routing works is that South African Airways Voyager has decided to label India and Saudi Arabia as members of “Central Asia,” despite neither being conventionally regarded as such. Saudi Arabia is normally considered a country in the Middle East, while India is normally regarded as a country in South Asia.

Nonetheless, here are the example redemptions you could make:

- Calicut (CCJ) – Jeddah (JED) round-trip in Air India first class for 56,900 miles + ~$244 in taxes and fees

- Delhi (DEL) – Jeddah (JED) round-trip in Air India first class for 56,900 miles + ~$219 in taxes and fees

- Hyderabad (HYD) – Jeddah (JED) round-trip in Air India first class for 56,900 miles + ~$258 in taxes and fees

- Kochi (COK) – Jeddah (JED) round-trip in Air India first class for 56,900 miles + ~$238 in taxes and fees

- Mumbai (BOM) – Jeddah (JED) round-trip in Air India first class for 56,900 miles + ~$233 in taxes and fees

13. Access Intra-Asia Business Class Availability on Singapore Airlines Business Class Round-Trip (32,200 Miles)

Singapore Airlines is notoriously stingy with releasing award availability to partners . This is especially true with U.S. routes , where the only hope you have to book one of these coveted flights in business or first class is to redeem KrisFlyer miles .

However, one of the most notable exceptions is on intra-Asia flights . Singapore Airlines releases lots of award seats for intra-Asia flights to partners. When you couple that with the fact that South African Airways Voyager has fantastic award pricing for most of these flights, you’ll see a gold mine of value.

While Singapore KrisFlyer charges up to 47,000 miles for Saver level availability and ANA charges up to 63,000 miles for Singapore Airlines flights, South African Airways Voyager charges a jaw-dropping 32,200 miles .

- Singapore (SIN) – Bangkok (BKK) round-trip in Singapore Airlines business class for 32,200 miles + ~$62 in taxes and fees

- Singapore (SIN) – Beijing (PEK) round-trip in Singapore Airlines business class for 32,200 miles + ~$50 in taxes and fees

- Singapore (SIN) – Fukuoka (FUK) round-trip in Singapore Airlines business class for 32,200 miles + ~$54 in taxes and fees

- Singapore (SIN) – Male (MLE) round-trip in Singapore Airlines business class for 32,200 miles + ~$86 in taxes and fees

- Singapore (SIN) – Nagoya (NGO) round-trip in Singapore Airlines business class for 32,200 miles + ~$74 in taxes and fees

- Singapore (SIN) – Osaka (KIX) round-trip in Singapore Airlines business class for 32,200 miles + ~$73 in taxes and fees

- Singapore (SIN) – Seoul-Incheon (ICN) round-trip in Singapore Airlines business class for 32,200 miles + ~$60 in taxes and fees

14. Fly Air India Business Class Between India and Israel (49,000 Miles)

Because India falls under Central Asia, it enjoys attractive pricing to the Middle East.

Also, Israel and Egypt are categorized as Middle East countries, which means that you’ll pay 49,000 miles for a 5- to 7-hour flight each way in business class. Not a bad deal! Here are the exact redemptions you want to be making:

- Delhi (DEL) – Tel Aviv (TLV) round-trip in Air India business class for 49,000 miles + ~$709 in taxes and fees

- Mumbai (BOM) – Cairo (CAI) round-trip in Egyptair business class for 49,000 miles + ~$354 in taxes and fees

15. Fly Air New Zealand Round-Trip From North America to Oceania in Business Class (169,300 Miles)

Air New Zealand is one of the best strategic Star Alliance partners in the world. Because the Oceania region is dominated primarily by Oneworld , thanks to Qantas, Air New Zealand represents a much-needed diversification in the Star Alliance network.

It’s not the best deal out there, but you can redeem South African Airways Voyager miles for round-trip flights between North America and Oceania for 169,300 miles . Here are some great example routes:

- Chicago O’Hare (ORD) – Auckland (AKL) round-trip in Air New Zealand business class for 169,300 miles + ~$110 in taxes and fees

- Houston (IAH) – Auckland (AKL) round-trip in Air New Zealand business class for 169,300 miles + ~$110 in taxes and fees

- Los Angeles (LAX) – Auckland (AKL) round-trip in Air New Zealand business class for 169,300 miles + ~$110 in taxes and fees

- San Francisco (SFO) – Auckland (AKL) round-trip in Air New Zealand business class for 169,300 miles + ~$110 in taxes and fees

16. Fly United Round-Trip Between Guam and Asia in Economy Class (20,400 Miles)

Guam is one of the most expensive, cash-intensive destinations for the flight distance traveled. United Airlines has established a stronghold in Guam, which means that the Star Alliance is extraordinarily useful here.

Round-trip nonstop flights from Guam to Japan cost a minimum of $600 to $900, so you’re definitely going to want to use miles to cushion yourself from a majority of these costs.

South African Airways will allow you to book 1 more segment, in addition to the Guam flight, which means you can extract even more value from these hugely expensive cash tickets. Here are some great example routes you can take:

- Guam (GUM) – Nagoya (NGO) – Sapporo (CTS) round-trip for 20,400 miles + ~$120 in taxes and fees ($1,600+ cash value!)

- Guam (GUM) – Tokyo-Narita (NRT) – Ho Chi Minh City (SGN) round-trip for 20,400 miles + ~$119 in taxes and fees ($2,000+ cash value!)

- Guam (GUM) – Tokyo-Narita (NRT) – Kuala Lumpur (KUL) round-trip for 20,400 miles + ~$122 in taxes and fees ($5,000+ cash value!)

17. Take Advantage of JourneyBlitz Awards on South African Airways Flights for Deeply Discounted Flights

When you look at South African Airways’ JourneyBlitz awards, you’ll see some opportunities for outstanding redemption value. You can book flights for as little as 13,050 miles , assuming you find availability. Here are some great example routes you can take:

- New York (JFK) – Johannesburg (JNB) one-way in South African Airways economy for 14,700 miles + ~$260 in taxes and fees

- Washington, D.C. (IAD) – Accra (ACC) one-way in South African Airways economy for 13,050 miles + ~$240 in taxes and fees

Although business class redemptions are certainly possible at decent rates, it’s practically impossible to find availability on JourneyBlitz awards.

18. Upgrade Eligible Economy Tickets to Business on South African Airways Between North America and Africa (From 23,000 Miles)

The last redemption option is an upgrade. You can pay as little as 23,000 miles to upgrade a one-way economy ticket in eligible fare classes on South African Airways to business class. The lowest level fare class you can upgrade is K, and the second-lowest level is M.

Here are some great redemptions you can make:

- New York (JFK) – Johannesburg (JNB) round-trip from $2,100 plus 70,000 miles in South African Airways business class (upgraded K-class tickets)

- Washington, D.C. (IAD) – Accra (ACC) round-trip from $2,167 plus 46,000 miles in South African Airways business class (upgraded K-class tickets)

The main challenge of redeeming Voyager miles is the relatively uncharted territory of this obscure mileage program. There is lots to look forward to, but also a steep learning curve. You might experience long call center wait times, inexperienced staff, and even the inability to find certain mileage awards.

South African Airways Award Charts

First and foremost, let’s talk about South African Airways’ award chart, of which there are multiple.

South African Airways has 2 award charts that correspond to flights wholly operated by South African Airways:

- JourneyBlitz awards

- Dynamic awards

JourneyBlitz awards will vary in price depending on the exact route. JourneyBlitz is much more comparable to promotional award sales than the conventional “Saver Award” availability.

Here’s how much it’ll cost to book JourneyBlitz awards:

These fares are extremely attractive in price, but availability is scarce.

On the flip side, Dynamic awards change in price and are closely connected to the revenue ticket price. As a result, the value you’ll get is so poor that it isn’t even worth considering.

Additionally, you can use Voyager miles to upgrade paid economy tickets. As long as they fall into eligible economy ticket fare classes and there’s availability, you’ll be able to upgrade your tickets using miles.

Here’s what the upgrade award chart looks like for South African Airways flights:

Furthermore, the regions are broken down into the following areas:

South African Airways’ website has outdated regions and routes, which means that the displayed cities may not have nonstop South African Airways flights anymore.

Star Alliance Airline Partners

South African Airways partners with all Star Alliance airlines . Voyager offers both awards and upgrades on Star Alliance flights.

However, award flights can only be booked round-trip , and Star Alliance upgrades can only be performed on a sector-by-sector basis.

Here are the Star Alliance airlines you can redeem miles for awards and upgrades on:

Here’s how much your Star Alliance award tickets will cost when spending Voyager miles. All of these prices are round-trip since Voyager doesn’t permit one-way flights.

To price out your itineraries correctly, you can reference the following region chart:

You can also spend Voyager miles to upgrade Star Alliance flights. These are priced in the following upgrade chart:

The drawback of using Voyager miles to upgrade Star Alliance flights is that the eligible fares are extremely restrictive . You’ll only be able to upgrade full-fare economy or premium economy tickets.

These tickets run as expensive as $1,000 to $3,000 one-way , which ultimately defeats the purpose of upgrading Star Alliance tickets.

Nevertheless, these upgrades are still available for redemption.

Non-Alliance Airline Partners

Lastly, there are flight redemptions on South African Airways’ non-alliance partners.

South African Airways uses different award charts for each of these partners.

AirLink is a regional airline based in Johannesburg. Although it is not owned by South African Airways, it serves to connect smaller cities in South Africa to the main hub airports.

Here’s the award chart for AirLink:

Here are how the regions are broken down for AirLink flights:

You can also redeem South African Airways Voyager miles on South African Express. South African Express is a close partner of South African Airways, though it is not majority-owned by South African Airways.

Here is how the award regions are broken down for South African Express flights:

Interestingly, you can also redeem South African Airways Voyager miles for Emirates flights according to the following award chart:

Here are how all the zones break down:

You can redeem your South African Airways Voyager miles for Virgin Atlantic flights as well:

Here’s how the zones are divided for Virgin Atlantic flights:

Virgin Australia offers round-trip awards as follows:

Lastly, the GOL award chart is as follows:

Awards Bookable Online vs. Phone

Unfortunately, the technical quirks of South African Airways show up as soon as you try to redeem your miles. The online booking/search tool doesn’t actually work.

As a result, you’ll need to make all award bookings over the phone by contacting South African Airways Voyager by phone at +27-11-978-1234 or email at [email protected] .

The office is open Monday to Friday from 7 a.m. to 9 p.m. local time (GMT+2) and Saturdays, Sundays, and public holidays from 8 a.m. to 2 p.m. (GMT+2).

Award Redemption Rules

When it comes to award or upgrade redemption rules, there is a slew of terms and conditions that you must conform to. These terms fall into 6 categories:

- Dynamic Awards

- Upgrade Awards

- JourneyBlitz Awards

- Non-Alliance

- Star Alliance Awards

Here are the most notable award terms and conditions for South African Airways JourneyBlitz Awards :

- JourneyBlitz awards can’t be canceled or refunded.

- No changes are permitted on JourneyBlitz Rewards.

- The booking class for economy is X, and the booking class for business is I.

Here are the notable award terms and conditions for South African Airways upgrades :

- Upgrades are released between 24 and 48 hours before departure.

- You need to request upgrades on a segment-by-segment basis.

- Eligible economy tickets must be in Y, B, M, or K booking classes. Also, eligible ticket numbers must begin with “083.”

- Date changes and refunds are permitted, but the fare will be subjected to the originally booked economy fare class.

Here are the notable award terms and conditions for Star Alliance award tickets :

- Round-trip tickets must be booked. No one-ways are allowed.

- You must take the most direct route possible.

- You’ll be allowed up to 6 segments per itinerary if you include domestic add-on sectors within South Africa. Otherwise, the maximum is 4 segments per itinerary.

- You have to book the departure and return ticket at the same time.

- Waitlists aren’t allowed.

- Mixed cabin tickets are allowed, but you must pay the highest cabin class price.

- No stopovers are allowed for purely domestic flights within South Africa, intra-European flights, or domestic U.S. flights.

- You’re allowed 1 stopover and 1 open-jaw on intercontinental flights only. You must return to the origin country, but not necessarily the same city.

- You can’t backtrack.

Here are the notable award terms and conditions for Star Alliance upgrades :

- You can only upgrade 1 class (economy to business or business to first).

- Miles earned will be based on the original ticket booking class.

- Upgrades are based on a per-segment basis.

- Upgrades can’t be requested earlier than 24 hours before a flight.

Here are the notable award terms and conditions for Emirates awards :

- Johannesburg (JNB) – Dubai (DXB) redemptions are not allowed

- Bookings must be round-trip.

- Date changes have a R210 (~$14) fee

- Mixed cabin bookings are not allowed.

- You have 30 days from the date of the initial booking to refund your award ticket.

Here are the notable terms and conditions for Virgin Atlantic awards:

- You must return to your origin city.

- 1 open-jaw is allowed, only if you’re leaving from a more expensive city (e.g. LHR-JFK with an open-jaw and then LAX-LHR).

- You’re allowed a stopover only in Hong Kong en route to Sydney.

- Date changes have a R210 (~$14) fee.

- You can only refund your ticket within 30 days of initial issuance.

Here are the notable terms and conditions for Virgin Australia awards:

- For infants under 2 without a seat, there’s no extra charge. All other children will be required to pay for another ticket at full cost.

- 1 open-jaw is allowed, but you must return to your origin airport.

There are many other terms and conditions, which you can view via the links provided in the list above. However, this is a summary of the most applicable rules and regulations.

As you can see, it can be quite a headache trying to keep track of all the rules across the different partner airlines.

Unfortunately, South African Airways only has 1 transfer partner: Marriott Bonvoy .

You’ll be able to transfer Marriott Bonvoy points to South African Airways at a 3:1 ratio with a 5,000-mile bonus for every 60,000 Marriott Bonvoy points transferred. This means that if you transfer 60,000 Marriott Bonvoy points, you’ll get a total of 25,000 South African Airways Voyager miles.

To put this all together, let’s say you need 80,000 South African Airways Voyager miles. You’ll need to transfer a total of 195,000 Marriott Bonvoy points to earn this many South African miles.

Hot Tip: Although South African Airways’ only transfer partner is Marriott Bonvoy, there are lots of ways to earn lots of Marriott Bonvoy points , so don’t fret!

Recommended Marriott Bonvoy Cards

The Marriott Bonvoy Bevy card gives you automatic Marriott elite status and helps you earn more Marriott Bonvoy points on your everyday purchases.

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

The Marriott Bonvoy Bevy™ American Express ® Card , the latest mid-tier offering in the Marriott Bonvoy lineup of cards, offers cardholders automatic elite status and ways to earn more Marriott Bonvoy points on each of their stays and daily purchases.

- 6x points per $1 at hotels participating in Marriott Bonvoy

- 4x points per $1 at restaurants worldwide and U.S. supermarkets (on up to $15,000 in combined purchases per calendar year, then 2X points)

- 2x points per $1 on all other purchases

- $250 annual fee ( rates and fees )

- Free Night Award certificate is not an automatic benefit

- Earn 85,000 Marriott Bonvoy bonus points after you use your new Card to make $5,000 in purchases within the first 6 months of Card Membership.

- Earn 6X Marriott Bonvoy ® points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy.

- Earn 4X points at restaurants worldwide and U.S. supermarkets (on up to $15,000 in combined purchases at restaurants and U.S. supermarkets per calendar year, then 2X points).

- Earn 2X points on all other eligible purchases.

- Marriott Bonvoy 1K Bonus Points Per Stay: Earn 1,000 Marriott Bonvoy ® bonus points per paid eligible stay booked directly with Marriott for properties participating in Marriott Bonvoy.

- With complimentary Marriott Bonvoy Gold Elites status, earn up to 2.5X points from Marriott Bonvoy ® on eligible hotel purchases with the 25% Bonus Points on stays benefit, available for Qualifying Rates.

- Marriott Bonvoy Bevy Free Night Award: Earn 1 Free Night Award after spending $15,000 on eligible purchases on your Marriott Bonvoy Bevy™ Card in a calendar year. Award can be used for one night (redemption level at or under 50,000 Marriott Bonvoy ® points) at a hotel participating in Marriott Bonvoy ® . Certain hotels have resort fees.

- 15 Elite Night Credits: Each calendar year with your Marriott Bonvoy Bevy™ American Express Card ® you can receive 15 Elite Night Credits toward the next level of Marriott Bonvoy ® Elite status. Limitations apply per Marriott Bonvoy member account. Benefit is not exclusive to Cards offered by American Express. Terms apply.

- Plan It ® is a payment option that lets you split up purchases of $100 or more into equal monthly installments with a fixed fee. Plus, you'll still earn rewards the way you usually do.

- $250 Annual Fee.

- Terms Apply.

- APR: 20.99%-29.99% Variable

- Foreign Transaction Fees: None

A premium card for Marriott fans who want perks like an annual statement credit and Free Night Award, plus a fast track to Marriott elite status.

The Marriott Bonvoy Brilliant ® American Express ® Card is a premium card designed with road warriors and Marriott Bonvoy loyalists in mind.