An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Future Developments

Who should use this publication.

Users of employer-provided vehicles.

Who doesn’t need to use this publication.

Volunteers.

Comments and suggestions.

Getting answers to your tax questions.

Getting tax forms, instructions, and publications.

Ordering tax forms, instructions, and publications.

- Useful Items - You may want to see:

Travel expenses defined.

Members of the Armed Forces.

Main place of business or work.

No main place of business or work.

Factors used to determine tax home.

Tax Home Different From Family Home

Temporary assignment vs. indefinite assignment.

Exception for federal crime investigations or prosecutions.

Determining temporary or indefinite.

Going home on days off.

Probationary work period.

Separating costs.

Travel expenses for another individual.

Business associate.

Bona fide business purpose.

Lavish or extravagant.

50% limit on meals.

Actual Cost

Incidental expenses.

Incidental-expenses-only method.

50% limit may apply.

Who can use the standard meal allowance.

Use of the standard meal allowance for other travel.

Amount of standard meal allowance.

Federal government's fiscal year.

Standard meal allowance for areas outside the continental United States.

Special rate for transportation workers.

Travel for days you depart and return.

Trip Primarily for Business

Trip primarily for personal reasons.

Public transportation.

Private car.

Travel entirely for business.

Travel considered entirely for business.

Exception 1—No substantial control.

Exception 2—Outside United States no more than a week.

Exception 3—Less than 25% of time on personal activities.

Exception 4—Vacation not a major consideration.

Travel allocation rules.

Counting business days.

Transportation day.

Presence required.

Day spent on business.

Certain weekends and holidays.

Nonbusiness activity on the way to or from your business destination.

Nonbusiness activity at, near, or beyond business destination.

Other methods.

Travel Primarily for Personal Reasons

Daily limit on luxury water travel.

Meals and entertainment.

Not separately stated.

Convention agenda.

North American area.

Reasonableness test.

Cruise Ships

Deduction may depend on your type of business.

Exceptions to the Rules

Entertainment events.

Entertainment facilities.

Club dues and membership fees.

Gift or entertainment.

Other rules for meals and entertainment expenses.

Costs to include or exclude.

Application of 50% limit.

When to apply the 50% limit.

Taking turns paying for meals.

1—Expenses treated as compensation.

2—Employee's reimbursed expenses.

3—Self-employed reimbursed expenses.

4—Recreational expenses for employees.

5—Advertising expenses.

6—Sale of meals.

Individuals subject to “hours of service” limits.

Incidental costs.

Exceptions.

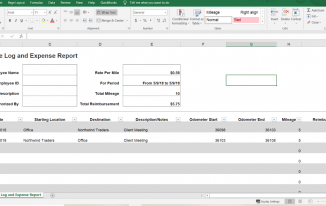

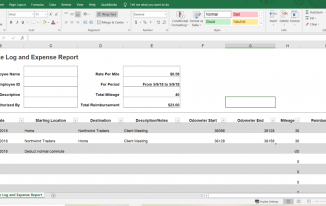

- Illustration of transportation expenses.

Temporary work location.

No regular place of work.

Two places of work.

Armed Forces reservists.

Commuting expenses.

Parking fees.

Advertising display on car.

Hauling tools or instruments.

Union members' trips from a union hall.

Office in the home.

Examples of deductible transportation.

Choosing the standard mileage rate.

Standard mileage rate not allowed.

Five or more cars.

Personal property taxes.

Parking fees and tolls.

Sale, trade-in, or other disposition.

Business and personal use.

Employer-provided vehicle.

Interest on car loans.

Taxes paid on your car.

Sales taxes.

Fines and collateral.

Casualty and theft losses.

Depreciation and section 179 deductions.

Car defined.

Qualified nonpersonal use vehicles.

More information.

More than 50% business use requirement.

Limit on the amount of the section 179 deduction.

Limit for sport utility and certain other vehicles.

Limit on total section 179 deduction, special depreciation allowance, and depreciation deduction.

Cost of car.

Basis of car for depreciation.

When to elect.

How to elect.

Revoking an election.

Recapture of section 179 deduction.

Dispositions.

Combined depreciation.

Qualified car.

Election not to claim the special depreciation allowance.

Placed in service.

Car placed in service and disposed of in the same year.

Methods of depreciation.

More-than-50%-use test.

Qualified business use.

Use of your car by another person.

Business use changes.

Use for more than one purpose.

Change from personal to business use.

Unadjusted basis.

Improvements.

Car trade-in.

Effect of trade-in on basis.

Traded car used only for business.

Traded car used partly in business.

Modified Accelerated Cost Recovery System (MACRS).

Recovery period.

Depreciation methods.

MACRS depreciation chart.

Depreciation in future years.

Disposition of car during recovery period.

How to use the 2023 chart.

Trucks and vans.

Car used less than full year.

Reduction for personal use.

Section 179 deduction.

Deductions in years after the recovery period.

Unrecovered basis.

The recovery period.

How to treat unrecovered basis.

- Table 4-1. 2023 MACRS Depreciation Chart (Use To Figure Depreciation for 2023)

Qualified business use 50% or less in year placed in service.

Qualified business use 50% or less in a later year.

Excess depreciation.

Deductible payments.

Fair market value.

Figuring the inclusion amount.

Leased car changed from business to personal use.

Leased car changed from personal to business use.

Reporting inclusion amounts.

Casualty or theft.

Depreciation adjustment when you used the standard mileage rate.

Depreciation deduction for the year of disposition.

Documentary evidence.

Adequate evidence.

Canceled check.

Duplicate information.

Timely kept records.

Proving business purpose.

Confidential information.

Exceptional circumstances.

Destroyed records.

Separating expenses.

Combining items.

Car expenses.

Gift expenses.

Allocating total cost.

If your return is examined.

Reimbursed for expenses.

Examples of Records

Self-employed.

Both self-employed and an employee.

Statutory employees.

Reimbursement for personal expenses.

Income-producing property.

Value reported on Form W-2.

Full value included in your income.

Less than full value included in your income.

No reimbursement.

Reimbursement, allowance, or advance.

Reasonable period of time.

Employee meets accountable plan rules.

Accountable plan rules not met.

Failure to return excess reimbursements.

Reimbursement of nondeductible expenses.

Adequate Accounting

Related to employer.

The federal rate.

Regular federal per diem rate.

The standard meal allowance.

High-low rate.

Prorating the standard meal allowance on partial days of travel.

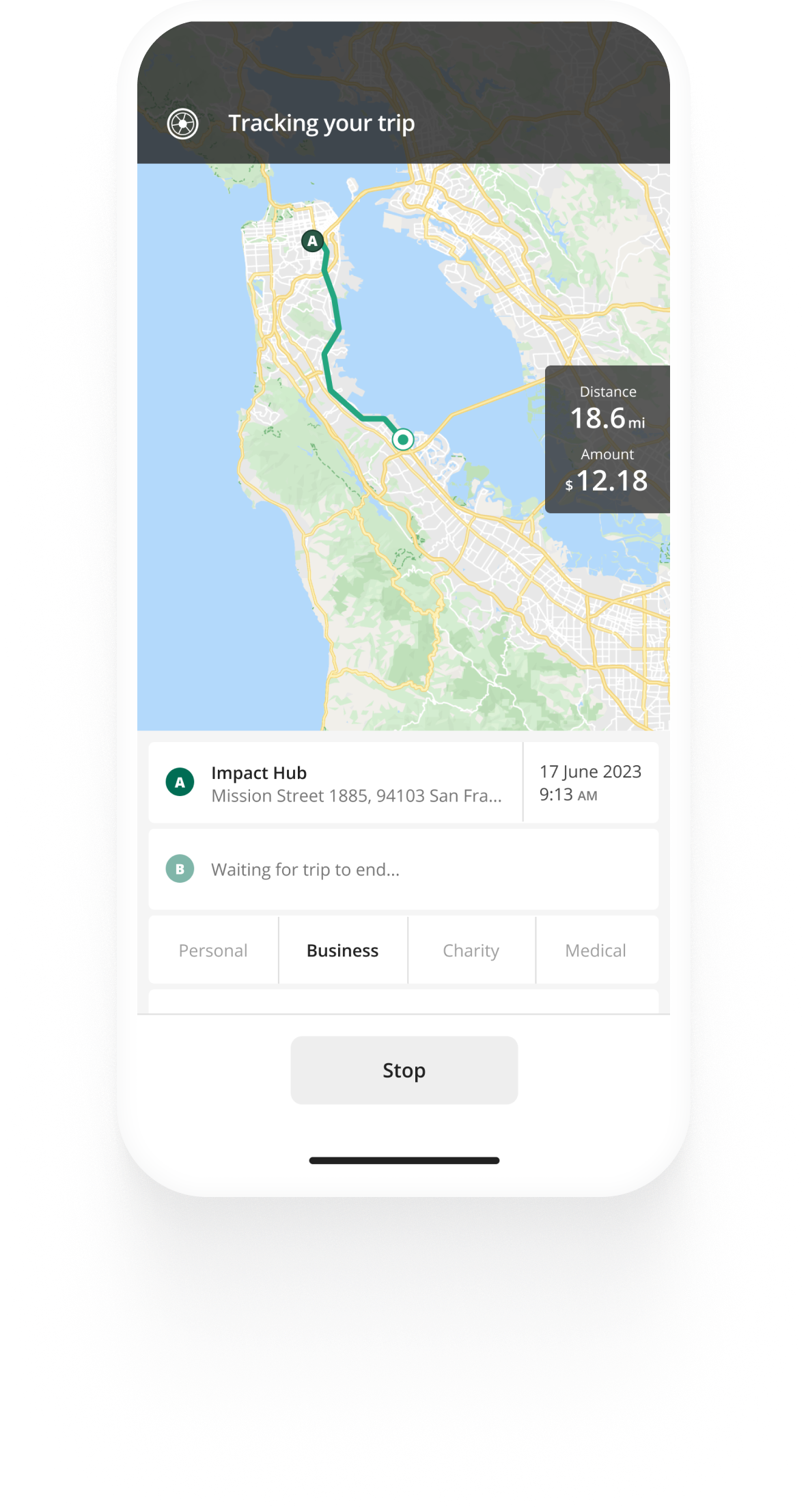

The standard mileage rate.

Fixed and variable rate (FAVR).

Reporting your expenses with a per diem or car allowance.

Allowance less than or equal to the federal rate.

Allowance more than the federal rate.

Travel advance.

Unproven amounts.

Per diem allowance more than federal rate.

Reporting your expenses under a nonaccountable plan.

Adequate accounting.

How to report.

Contractor adequately accounts.

Contractor doesn’t adequately account.

High-low method.

Regular federal per diem rate method.

Federal per diem rate method.

Information on use of cars.

Standard mileage rate.

Actual expenses.

Car rentals.

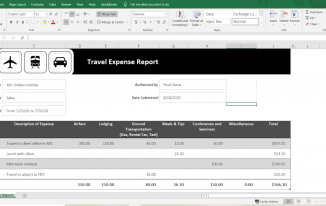

Transportation expenses.

Employee business expenses other than nonentertainment meals.

Non-entertainment-related meal expenses.

“Hours of service” limits.

Reimbursements.

Allocating your reimbursement.

After you complete the form.

Limits on employee business expenses.

1. Limit on meals and entertainment.

2. Limit on total itemized deductions.

Member of a reserve component.

Officials Paid on a Fee Basis

Special rules for married persons.

Where to report.

Impairment-Related Work Expenses of Disabled Employees

Preparing and filing your tax return.

Free options for tax preparation.

Using online tools to help prepare your return.

Need someone to prepare your tax return?

Employers can register to use Business Services Online.

IRS social media.

Watching IRS videos.

Online tax information in other languages.

Free Over-the-Phone Interpreter (OPI) Service.

Accessibility Helpline available for taxpayers with disabilities.

Getting tax forms and publications.

Getting tax publications and instructions in eBook format.

Access your online account (individual taxpayers only).

Get a transcript of your return.

Tax Pro Account.

Using direct deposit.

Reporting and resolving your tax-related identity theft issues.

Ways to check on the status of your refund.

Making a tax payment.

What if I can’t pay now?

Filing an amended return.

Checking the status of your amended return.

Understanding an IRS notice or letter you’ve received.

Responding to an IRS notice or letter.

Contacting your local TAC.

What Is TAS?

How can you learn about your taxpayer rights, what can tas do for you, how can you reach tas, how else does tas help taxpayers, low income taxpayer clinics (litcs), appendix a-1. inclusion amounts for passenger automobiles first leased in 2018, appendix a-2. inclusion amounts for passenger automobiles first leased in 2019, appendix a-3. inclusion amounts for passenger automobiles first leased in 2020, appendix a-4. inclusion amounts for passenger automobiles first leased in 2021, appendix a-5. inclusion amounts for passenger automobiles first leased in 2022, appendix a-6. inclusion amounts for passenger automobiles first leased in 2023, publication 463 - additional material, publication 463 (2023), travel, gift, and car expenses.

For use in preparing 2023 Returns

Publication 463 - Introductory Material

For the latest information about developments related to Pub. 463, such as legislation enacted after it was published, go to IRS.gov/Pub463 .

Standard mileage rate. For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. Car expenses and use of the standard mileage rate are explained in chapter 4.

Depreciation limits on cars, trucks, and vans. The first-year limit on the depreciation deduction, special depreciation allowance, and section 179 deduction for vehicles acquired before September 28, 2017, and placed in service during 2023, is $12,200. The first-year limit on depreciation, special depreciation allowance, and section 179 deduction for vehicles acquired after September 27, 2017, and placed in service during 2023 increases to $20,200. If you elect not to claim a special depreciation allowance for a vehicle placed in service in 2023, the amount increases to $12,200. Depreciation limits are explained in chapter 4.

Section 179 deduction. The maximum amount you can elect to deduct for section 179 property (including cars, trucks, and vans) you placed in service in tax years beginning in 2023 is $1,160,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,890,000. Section 179 deduction is explained in chapter 4.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2023 is $28,900.

Temporary deduction of 100% business meals. The 100% deduction on certain business meals expenses as amended under the Taxpayer Certainty and Disaster Tax Relief Act of 2020, and enacted by the Consolidated Appropriations Act, 2021, has expired. Generally, the cost of business meals remains deductible, subject to the 50% limitation. See 50% Limit in chapter 2 for more information.

Photographs of missing children. The IRS is a proud partner with the National Center for Missing & Exploited Children® (NCMEC) . Photographs of missing children selected by the Center may appear in this publication on pages that would otherwise be blank. You can help bring these children home by looking at the photographs and calling 800-THE-LOST (800-843-5678) if you recognize a child.

Per diem rates. Current and prior per diem rates may be found on the U.S. General Services Administration (GSA) website at GSA.gov/travel/plan-book/per-diem-rates .

Introduction

You may be able to deduct the ordinary and necessary business-related expenses you have for:

Non-entertainment-related meals,

Transportation.

This publication explains:

What expenses are deductible,

How to report them on your return,

What records you need to prove your expenses, and

How to treat any expense reimbursements you may receive.

You should read this publication if you are an employee or a sole proprietor who has business-related travel, non-entertainment-related meals, gift, or transportation expenses.

If an employer-provided vehicle was available for your use, you received a fringe benefit. Generally, your employer must include the value of the use or availability of the vehicle in your income. However, there are exceptions if the use of the vehicle qualifies as a working condition fringe benefit (such as the use of a qualified nonpersonal use vehicle).

A working condition fringe benefit is any property or service provided to you by your employer, the cost of which would be allowable as an employee business expense deduction if you had paid for it.

A qualified nonpersonal use vehicle is one that isn’t likely to be used more than minimally for personal purposes because of its design. See Qualified nonpersonal use vehicles under Actual Car Expenses in chapter 4.

For information on how to report your car expenses that your employer didn’t provide or reimburse you for (such as when you pay for gas and maintenance for a car your employer provides), see Vehicle Provided by Your Employer in chapter 6.

Partnerships, corporations, trusts, and employers who reimburse their employees for business expenses should refer to the instructions for their required tax forms, for information on deducting travel, meals, and entertainment expenses.

If you are an employee, you won’t need to read this publication if all of the following are true.

You fully accounted to your employer for your work-related expenses.

You received full reimbursement for your expenses.

Your employer required you to return any excess reimbursement and you did so.

There is no amount shown with a code L in box 12 of your Form W-2, Wage and Tax Statement.

If you perform services as a volunteer worker for a qualified charity, you may be able to deduct some of your costs as a charitable contribution. See Out-of-Pocket Expenses in Giving Services in Pub. 526, Charitable Contributions, for information on the expenses you can deduct.

We welcome your comments about this publication and suggestions for future editions.

You can send us comments through IRS.gov/FormComments . Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Although we can’t respond individually to each comment received, we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms, instructions, and publications. Don’t send tax questions, tax returns, or payments to the above address.

If you have a tax question not answered by this publication or the How To Get Tax Help section at the end of this publication, go to the IRS Interactive Tax Assistant page at IRS.gov/Help/ITA where you can find topics by using the search feature or viewing the categories listed.

Go to IRS.gov/Forms to download current and prior-year forms, instructions, and publications.

Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don’t resubmit requests you’ve already sent us. You can get forms and publications faster online.

Useful Items

Publication

946 How To Depreciate Property

Form (and Instructions)

Schedule A (Form 1040) Itemized Deductions

Schedule C (Form 1040) Profit or Loss From Business (Sole Proprietorship)

Schedule F (Form 1040) Profit or Loss From Farming

2106 Employee Business Expenses

4562 Depreciation and Amortization (Including Information on Listed Property)

See How To Get Tax Help for information about getting these publications and forms.

If you temporarily travel away from your tax home, you can use this chapter to determine if you have deductible travel expenses.

This chapter discusses:

Traveling away from home,

Temporary assignment or job, and

What travel expenses are deductible.

For tax purposes, travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job.

An ordinary expense is one that is common and accepted in your trade or business. A necessary expense is one that is helpful and appropriate for your business. An expense doesn’t have to be required to be considered necessary.

You will find examples of deductible travel expenses in Table 1-1 .

Traveling Away From Home

You are traveling away from home if:

Your duties require you to be away from the general area of your tax home (defined later) substantially longer than an ordinary day's work, and

You need to sleep or rest to meet the demands of your work while away from home.

You are a railroad conductor. You leave your home terminal on a regularly scheduled round-trip run between two cities and return home 16 hours later. During the run, you have 6 hours off at your turnaround point where you eat two meals and rent a hotel room to get necessary sleep before starting the return trip. You are considered to be away from home.

You are a truck driver. You leave your terminal and return to it later the same day. You get an hour off at your turnaround point to eat. Because you aren’t off to get necessary sleep and the brief time off isn’t an adequate rest period, you aren’t traveling away from home.

If you are a member of the U.S. Armed Forces on a permanent duty assignment overseas, you aren’t traveling away from home. You can’t deduct your expenses for meals and lodging. You can’t deduct these expenses even if you have to maintain a home in the United States for your family members who aren’t allowed to accompany you overseas. If you are transferred from one permanent duty station to another, you may have deductible moving expenses, which are explained in Pub. 3, Armed Forces' Tax Guide.

A naval officer assigned to permanent duty aboard a ship that has regular eating and living facilities has a tax home (explained next) aboard the ship for travel expense purposes.

To determine whether you are traveling away from home, you must first determine the location of your tax home.

Generally, your tax home is your regular place of business or post of duty, regardless of where you maintain your family home. It includes the entire city or general area in which your business or work is located.

If you have more than one regular place of business, your tax home is your main place of business. See Main place of business or work , later.

If you don’t have a regular or a main place of business because of the nature of your work, then your tax home may be the place where you regularly live. See No main place of business or work , later.

If you don’t have a regular or main place of business or post of duty and there is no place where you regularly live, you are considered an itinerant (a transient) and your tax home is wherever you work. As an itinerant, you can’t claim a travel expense deduction because you are never considered to be traveling away from home.

If you have more than one place of work, consider the following when determining which one is your main place of business or work.

The total time you ordinarily spend in each place.

The level of your business activity in each place.

Whether your income from each place is significant or insignificant.

You live in Cincinnati where you have a seasonal job for 8 months each year and earn $40,000. You work the other 4 months in Miami, also at a seasonal job, and earn $15,000. Cincinnati is your main place of work because you spend most of your time there and earn most of your income there.

You may have a tax home even if you don’t have a regular or main place of work. Your tax home may be the home where you regularly live.

If you don’t have a regular or main place of business or work, use the following three factors to determine where your tax home is.

You perform part of your business in the area of your main home and use that home for lodging while doing business in the area.

You have living expenses at your main home that you duplicate because your business requires you to be away from that home.

You haven’t abandoned the area in which both your historical place of lodging and your claimed main home are located; you have a member or members of your family living at your main home; or you often use that home for lodging.

If you satisfy all three factors, your tax home is the home where you regularly live. If you satisfy only two factors, you may have a tax home depending on all the facts and circumstances. If you satisfy only one factor, you are an itinerant; your tax home is wherever you work and you can’t deduct travel expenses.

You are single and live in Boston in an apartment you rent. You have worked for your employer in Boston for a number of years. Your employer enrolls you in a 12-month executive training program. You don’t expect to return to work in Boston after you complete your training.

During your training, you don’t do any work in Boston. Instead, you receive classroom and on-the-job training throughout the United States. You keep your apartment in Boston and return to it frequently. You use your apartment to conduct your personal business. You also keep up your community contacts in Boston. When you complete your training, you are transferred to Los Angeles.

You don’t satisfy factor (1) because you didn’t work in Boston. You satisfy factor (2) because you had duplicate living expenses. You also satisfy factor (3) because you didn’t abandon your apartment in Boston as your main home, you kept your community contacts, and you frequently returned to live in your apartment. Therefore, you have a tax home in Boston.

You are an outside salesperson with a sales territory covering several states. Your employer's main office is in Newark, but you don’t conduct any business there. Your work assignments are temporary, and you have no way of knowing where your future assignments will be located. You have a room in your married sister's house in Dayton. You stay there for one or two weekends a year, but you do no work in the area. You don’t pay your sister for the use of the room.

You don’t satisfy any of the three factors listed earlier. You are an itinerant and have no tax home.

If you (and your family) don’t live at your tax home (defined earlier), you can’t deduct the cost of traveling between your tax home and your family home. You also can’t deduct the cost of meals and lodging while at your tax home. See Example 1 , later.

If you are working temporarily in the same city where you and your family live, you may be considered as traveling away from home. See Example 2 , later.

You are a truck driver and you and your family live in Tucson. You are employed by a trucking firm that has its terminal in Phoenix. At the end of your long runs, you return to your home terminal in Phoenix and spend one night there before returning home. You can’t deduct any expenses you have for meals and lodging in Phoenix or the cost of traveling from Phoenix to Tucson. This is because Phoenix is your tax home.

Your family home is in Pittsburgh, where you work 12 weeks a year. The rest of the year you work for the same employer in Baltimore. In Baltimore, you eat in restaurants and sleep in a rooming house. Your salary is the same whether you are in Pittsburgh or Baltimore.

Because you spend most of your working time and earn most of your salary in Baltimore, that city is your tax home. You can’t deduct any expenses you have for meals and lodging there. However, when you return to work in Pittsburgh, you are away from your tax home even though you stay at your family home. You can deduct the cost of your round trip between Baltimore and Pittsburgh. You can also deduct your part of your family's living expenses for non-entertainment-related meals and lodging while you are living and working in Pittsburgh.

Temporary Assignment or Job

You may regularly work at your tax home and also work at another location. It may not be practical to return to your tax home from this other location at the end of each workday.

If your assignment or job away from your main place of work is temporary, your tax home doesn’t change. You are considered to be away from home for the whole period you are away from your main place of work. You can deduct your travel expenses if they otherwise qualify for deduction. Generally, a temporary assignment in a single location is one that is realistically expected to last (and does in fact last) for 1 year or less.

However, if your assignment or job is indefinite, the location of the assignment or job becomes your new tax home and you can’t deduct your travel expenses while there. An assignment or job in a single location is considered indefinite if it is realistically expected to last for more than 1 year, whether or not it actually lasts for more than 1 year.

If your assignment is indefinite, you must include in your income any amounts you receive from your employer for living expenses, even if they are called “travel allowances” and you account to your employer for them. You may be able to deduct the cost of relocating to your new tax home as a moving expense. See Pub. 3 for more information.

If you are a federal employee participating in a federal crime investigation or prosecution, you aren’t subject to the 1-year rule. This means you may be able to deduct travel expenses even if you are away from your tax home for more than 1 year provided you meet the other requirements for deductibility.

For you to qualify, the Attorney General (or their designee) must certify that you are traveling:

For the federal government;

In a temporary duty status; and

To investigate, prosecute, or provide support services for the investigation or prosecution of a federal crime.

You must determine whether your assignment is temporary or indefinite when you start work. If you expect an assignment or job to last for 1 year or less, it is temporary unless there are facts and circumstances that indicate otherwise. An assignment or job that is initially temporary may become indefinite due to changed circumstances. A series of assignments to the same location, all for short periods but that together cover a long period, may be considered an indefinite assignment.

The following examples illustrate whether an assignment or job is temporary or indefinite.

You are a construction worker. You live and regularly work in Los Angeles. You are a member of a trade union in Los Angeles that helps you get work in the Los Angeles area. Your tax home is Los Angeles. Because of a shortage of work, you took a job on a construction project in Fresno. Your job was scheduled to end in 8 months. The job actually lasted 10 months.

You realistically expected the job in Fresno to last 8 months. The job actually did last less than 1 year. The job is temporary and your tax home is still in Los Angeles.

The facts are the same as in Example 1 , except that you realistically expected the work in Fresno to last 18 months. The job was actually completed in 10 months.

Your job in Fresno is indefinite because you realistically expected the work to last longer than 1 year, even though it actually lasted less than 1 year. You can’t deduct any travel expenses you had in Fresno because Fresno became your tax home.

The facts are the same as in Example 1 , except that you realistically expected the work in Fresno to last 9 months. After 8 months, however, you were asked to remain for 7 more months (for a total actual stay of 15 months).

Initially, you realistically expected the job in Fresno to last for only 9 months. However, due to changed circumstances occurring after 8 months, it was no longer realistic for you to expect that the job in Fresno would last for 1 year or less. You can deduct only your travel expenses for the first 8 months. You can’t deduct any travel expenses you had after that time because Fresno became your tax home when the job became indefinite.

If you go back to your tax home from a temporary assignment on your days off, you aren’t considered away from home while you are in your hometown. You can’t deduct the cost of your meals and lodging there. However, you can deduct your travel expenses, including meals and lodging, while traveling between your temporary place of work and your tax home. You can claim these expenses up to the amount it would have cost you to stay at your temporary place of work.

If you keep your hotel room during your visit home, you can deduct the cost of your hotel room. In addition, you can deduct your expenses of returning home up to the amount you would have spent for meals had you stayed at your temporary place of work.

If you take a job that requires you to move, with the understanding that you will keep the job if your work is satisfactory during a probationary period, the job is indefinite. You can’t deduct any of your expenses for meals and lodging during the probationary period.

What Travel Expenses Are Deductible?

Once you have determined that you are traveling away from your tax home, you can determine what travel expenses are deductible.

You can deduct ordinary and necessary expenses you have when you travel away from home on business. The type of expense you can deduct depends on the facts and your circumstances.

Table 1-1 summarizes travel expenses you may be able to deduct. You may have other deductible travel expenses that aren’t covered there, depending on the facts and your circumstances.

If you have one expense that includes the costs of non-entertainment-related meals, entertainment, and other services (such as lodging or transportation), you must allocate that expense between the cost of non-entertainment-related meals, and entertainment and the cost of other services. You must have a reasonable basis for making this allocation. For example, you must allocate your expenses if a hotel includes one or more meals in its room charge.

If a spouse, dependent, or other individual goes with you (or your employee) on a business trip or to a business convention, you generally can’t deduct their travel expenses.

You can deduct the travel expenses of someone who goes with you if that person:

Is your employee,

Has a bona fide business purpose for the travel, and

Would otherwise be allowed to deduct the travel expenses.

If a business associate travels with you and meets the conditions in (2) and (3) above, you can deduct the travel expenses you have for that person. A business associate is someone with whom you could reasonably expect to actively conduct business. A business associate can be a current or prospective (likely to become) customer, client, supplier, employee, agent, partner, or professional advisor.

Table 1-1. Travel Expenses You Can Deduct

A bona fide business purpose exists if you can prove a real business purpose for the individual's presence. Incidental services, such as typing notes or assisting in entertaining customers, aren’t enough to make the expenses deductible.

You drive to Chicago on business and take your spouse with you. Your spouse isn’t your employee. Your spouse occasionally types notes, performs similar services, and accompanies you to luncheons and dinners. The performance of these services doesn’t establish that your spouse’s presence on the trip is necessary to the conduct of your business. Your spouse’s expenses aren’t deductible.

You pay $199 a day for a double room. A single room costs $149 a day. You can deduct the total cost of driving your car to and from Chicago, but only $149 a day for your hotel room. If both you and your spouse use public transportation, you can only deduct your fare.

You can deduct a portion of the cost of meals if it is necessary for you to stop for substantial sleep or rest to properly perform your duties while traveling away from home on business. Meal and entertainment expenses are discussed in chapter 2 .

You can't deduct expenses for meals that are lavish or extravagant. An expense isn't considered lavish or extravagant if it is reasonable based on the facts and circumstances. Meal expenses won't be disallowed merely because they are more than a fixed dollar amount or because the meals take place at deluxe restaurants, hotels, or resorts.

You can figure your meal expenses using either of the following methods.

Actual cost.

If you are reimbursed for the cost of your meals, how you apply the 50% limit depends on whether your employer's reimbursement plan was accountable or nonaccountable. If you aren’t reimbursed, the 50% limit applies even if the unreimbursed meal expense is for business travel. Chapter 2 discusses the 50% Limit in more detail, and chapter 6 discusses accountable and nonaccountable plans.

You can use the actual cost of your meals to figure the amount of your expense before reimbursement and application of the 50% deduction limit. If you use this method, you must keep records of your actual cost.

Standard Meal Allowance

Generally, you can use the “standard meal allowance” method as an alternative to the actual cost method. It allows you to use a set amount for your daily meals and incidental expenses (M&IE), instead of keeping records of your actual costs. The set amount varies depending on where and when you travel. In this publication, “standard meal allowance” refers to the federal rate for M&IE, discussed later under Amount of standard meal allowance . If you use the standard meal allowance, you must still keep records to prove the time, place, and business purpose of your travel. See the recordkeeping rules for travel in chapter 5 .

The term “incidental expenses” means fees and tips given to porters, baggage carriers, hotel staff, and staff on ships.

Incidental expenses don’t include expenses for laundry, cleaning and pressing of clothing, lodging taxes, costs of telegrams or telephone calls, transportation between places of lodging or business and places where meals are taken, or the mailing cost of filing travel vouchers and paying employer-sponsored charge card billings.

You can use an optional method (instead of actual cost) for deducting incidental expenses only. The amount of the deduction is $5 a day. You can use this method only if you didn’t pay or incur any meal expenses. You can’t use this method on any day that you use the standard meal allowance. This method is subject to the proration rules for partial days. See Travel for days you depart and return , later, in this chapter.

The incidental-expenses-only method isn’t subject to the 50% limit discussed below.

If you use the standard meal allowance method for non-entertainment-related meal expenses and you aren’t reimbursed or you are reimbursed under a nonaccountable plan, you can generally deduct only 50% of the standard meal allowance. If you are reimbursed under an accountable plan and you are deducting amounts that are more than your reimbursements, you can deduct only 50% of the excess amount. The 50% Limit is discussed in more detail in chapter 2, and accountable and nonaccountable plans are discussed in chapter 6.

You can use the standard meal allowance whether you are an employee or self-employed, and whether or not you are reimbursed for your traveling expenses.

You can use the standard meal allowance to figure your meal expenses when you travel in connection with investment and other income-producing property. You can also use it to figure your meal expenses when you travel for qualifying educational purposes. You can’t use the standard meal allowance to figure the cost of your meals when you travel for medical or charitable purposes.

The standard meal allowance is the federal M&IE rate. For travel in 2023, the rate for most small localities in the United States is $59 per day.

Most major cities and many other localities in the United States are designated as high-cost areas, qualifying for higher standard meal allowances.

If you travel to more than one location in one day, use the rate in effect for the area where you stop for sleep or rest. If you work in the transportation industry, however, see Special rate for transportation workers , later.

Per diem rates are listed by the federal government's fiscal year, which runs from October 1 to September 30. You can choose to use the rates from the 2022 fiscal year per diem tables or the rates from the 2023 fiscal year tables, but you must consistently use the same tables for all travel you are reporting on your income tax return for the year. See Transition Rules , later.

The standard meal allowance rates above don’t apply to travel in Alaska, Hawaii, or any other location outside the continental United States. The Department of Defense establishes per diem rates for Alaska, Hawaii, Puerto Rico, American Samoa, Guam, Midway, the Northern Mariana Islands, the U.S. Virgin Islands, Wake Island, and other non-foreign areas outside the continental United States. The Department of State establishes per diem rates for all other foreign areas.

You can use a special standard meal allowance if you work in the transportation industry. You are in the transportation industry if your work:

Directly involves moving people or goods by airplane, barge, bus, ship, train, or truck; and

Regularly requires you to travel away from home and, during any single trip, usually involves travel to areas eligible for different standard meal allowance rates.

Using the special rate for transportation workers eliminates the need for you to determine the standard meal allowance for every area where you stop for sleep or rest. If you choose to use the special rate for any trip, you must use the special rate (and not use the regular standard meal allowance rates) for all trips you take that year.

For both the day you depart for and the day you return from a business trip, you must prorate the standard meal allowance (figure a reduced amount for each day). You can do so by one of two methods.

Method 1: You can claim 3 / 4 of the standard meal allowance.

Method 2: You can prorate using any method that you consistently apply and that is in accordance with reasonable business practice.

You are employed in New Orleans as a convention planner. In March, your employer sent you on a 3-day trip to Washington, DC, to attend a planning seminar. You left your home in New Orleans at 10 a.m. on Wednesday and arrived in Washington, DC, at 5:30 p.m. After spending 2 nights there, you flew back to New Orleans on Friday and arrived back home at 8 p.m. Your employer gave you a flat amount to cover your expenses and included it with your wages.

Under Method 1 , you can claim 2½ days of the standard meal allowance for Washington, DC: 3 / 4 of the daily rate for Wednesday and Friday (the days you departed and returned), and the full daily rate for Thursday.

Under Method 2 , you could also use any method that you apply consistently and that is in accordance with reasonable business practice. For example, you could claim 3 days of the standard meal allowance even though a federal employee would have to use Method 1 and be limited to only 2½ days.

Travel in the United States

The following discussion applies to travel in the United States. For this purpose, the United States includes the 50 states and the District of Columbia. The treatment of your travel expenses depends on how much of your trip was business related and on how much of your trip occurred within the United States. See Part of Trip Outside the United States , later.

You can deduct all of your travel expenses if your trip was entirely business related. If your trip was primarily for business and, while at your business destination, you extended your stay for a vacation, made a personal side trip, or had other personal activities, you can deduct only your business-related travel expenses. These expenses include the travel costs of getting to and from your business destination and any business-related expenses at your business destination.

You work in Atlanta and take a business trip to New Orleans in May. Your business travel totals 900 miles round trip. On your way home, you stop in Mobile to visit your parents. You spend $2,165 for the 9 days you are away from home for travel, non-entertainment-related meals, lodging, and other travel expenses. If you hadn’t stopped in Mobile, you would have been gone only 6 days, and your total cost would have been $1,633.50. You can deduct $1,633.50 for your trip, including the cost of round-trip transportation to and from New Orleans. The deduction for your non-entertainment-related meals is subject to the 50% limit on meals mentioned earlier.

If your trip was primarily for personal reasons, such as a vacation, the entire cost of the trip is a nondeductible personal expense. However, you can deduct any expenses you have while at your destination that are directly related to your business.

A trip to a resort or on a cruise ship may be a vacation even if the promoter advertises that it is primarily for business. The scheduling of incidental business activities during a trip, such as viewing videotapes or attending lectures dealing with general subjects, won’t change what is really a vacation into a business trip.

Part of Trip Outside the United States

If part of your trip is outside the United States, use the rules described later in this chapter under Travel Outside the United States for that part of the trip. For the part of your trip that is inside the United States, use the rules for travel in the United States. Travel outside the United States doesn’t include travel from one point in the United States to another point in the United States. The following discussion can help you determine whether your trip was entirely within the United States.

If you travel by public transportation, any place in the United States where that vehicle makes a scheduled stop is a point in the United States. Once the vehicle leaves the last scheduled stop in the United States on its way to a point outside the United States, you apply the rules under Travel Outside the United States , later.

You fly from New York to Puerto Rico with a scheduled stop in Miami. Puerto Rico isn’t considered part of the United States for purposes of travel. You return to New York nonstop. The flight from New York to Miami is in the United States, so only the flight from Miami to Puerto Rico is outside the United States. Because there are no scheduled stops between Puerto Rico and New York, all of the return trip is outside the United States.

Travel by private car in the United States is travel between points in the United States, even though you are on your way to a destination outside the United States.

You travel by car from Denver to Mexico City and return. Your travel from Denver to the border and from the border back to Denver is travel in the United States, and the rules in this section apply. The rules below under Travel Outside the United States apply to your trip from the border to Mexico City and back to the border.

Travel Outside the United States

If any part of your business travel is outside the United States, some of your deductions for the cost of getting to and from your destination may be limited. For this purpose, the United States includes the 50 states and the District of Columbia.

How much of your travel expenses you can deduct depends in part upon how much of your trip outside the United States was business related.

Travel Entirely for Business or Considered Entirely for Business

You can deduct all your travel expenses of getting to and from your business destination if your trip is entirely for business or considered entirely for business.

If you travel outside the United States and you spend the entire time on business activities, you can deduct all of your travel expenses.

Even if you didn’t spend your entire time on business activities, your trip is considered entirely for business if you meet at least one of the following four exceptions.

Your trip is considered entirely for business if you didn’t have substantial control over arranging the trip. The fact that you control the timing of your trip doesn’t, by itself, mean that you have substantial control over arranging your trip.

You don’t have substantial control over your trip if you:

Are an employee who was reimbursed or paid a travel expense allowance, and

Aren’t related to your employer, or

Aren’t a managing executive.

“Related to your employer” is defined later in chapter 6 under Per Diem and Car Allowances .

A “managing executive” is an employee who has the authority and responsibility, without being subject to the veto of another, to decide on the need for the business travel.

A self-employed person generally has substantial control over arranging business trips.

Your trip is considered entirely for business if you were outside the United States for a week or less, combining business and nonbusiness activities. One week means 7 consecutive days. In counting the days, don’t count the day you leave the United States, but do count the day you return to the United States.

You traveled to Brussels primarily for business. You left Denver on Tuesday and flew to New York. On Wednesday, you flew from New York to Brussels, arriving the next morning. On Thursday and Friday, you had business discussions, and from Saturday until Tuesday, you were sightseeing. You flew back to New York, arriving Wednesday afternoon. On Thursday, you flew back to Denver.

Although you were away from your home in Denver for more than a week, you weren’t outside the United States for more than a week. This is because the day you depart doesn’t count as a day outside the United States.

You can deduct your cost of the round-trip flight between Denver and Brussels. You can also deduct the cost of your stay in Brussels for Thursday and Friday while you conducted business. However, you can’t deduct the cost of your stay in Brussels from Saturday through Tuesday because those days were spent on nonbusiness activities.

Your trip is considered entirely for business if:

You were outside the United States for more than a week, and

You spent less than 25% of the total time you were outside the United States on nonbusiness activities.

You flew from Seattle to Tokyo, where you spent 14 days on business and 5 days on personal matters. You then flew back to Seattle. You spent 1 day flying in each direction.

Because only 5 / 21 (less than 25%) of your total time abroad was for nonbusiness activities, you can deduct as travel expenses what it would have cost you to make the trip if you hadn’t engaged in any nonbusiness activity. The amount you can deduct is the cost of the round-trip plane fare and 16 days of non-entertainment-related meals (subject to the 50% Limit ), lodging, and other related expenses.

Your trip is considered entirely for business if you can establish that a personal vacation wasn’t a major consideration, even if you have substantial control over arranging the trip.

Travel Primarily for Business

If you travel outside the United States primarily for business but spend some of your time on other activities, you generally can’t deduct all of your travel expenses. You can only deduct the business portion of your cost of getting to and from your destination. You must allocate the costs between your business and other activities to determine your deductible amount. See Travel allocation rules , later.

If your trip outside the United States was primarily for business, you must allocate your travel time on a day-to-day basis between business days and nonbusiness days. The days you depart from and return to the United States are both counted as days outside the United States.

To figure the deductible amount of your round-trip travel expenses, use the following fraction. The numerator (top number) is the total number of business days outside the United States. The denominator (bottom number) is the total number of business and nonbusiness days of travel.

Your business days include transportation days, days your presence was required, days you spent on business, and certain weekends and holidays.

Count as a business day any day you spend traveling to or from a business destination. However, if because of a nonbusiness activity you don’t travel by a direct route, your business days are the days it would take you to travel a reasonably direct route to your business destination. Extra days for side trips or nonbusiness activities can’t be counted as business days.

Count as a business day any day your presence is required at a particular place for a specific business purpose. Count it as a business day even if you spend most of the day on nonbusiness activities.

If your principal activity during working hours is the pursuit of your trade or business, count the day as a business day. Also, count as a business day any day you are prevented from working because of circumstances beyond your control.

Count weekends, holidays, and other necessary standby days as business days if they fall between business days. But if they follow your business meetings or activity and you remain at your business destination for nonbusiness or personal reasons, don’t count them as business days.

Your tax home is New York City. You travel to Quebec, where you have a business meeting on Friday. You have another meeting on the following Monday. Because your presence was required on both Friday and Monday, they are business days. Because the weekend is between business days, Saturday and Sunday are counted as business days. This is true even though you use the weekend for sightseeing, visiting friends, or other nonbusiness activity.

If, in Example 1 , you had no business in Quebec after Friday, but stayed until Monday before starting home, Saturday and Sunday would be nonbusiness days.

If you stopped for a vacation or other nonbusiness activity either on the way from the United States to your business destination, or on the way back to the United States from your business destination, you must allocate part of your travel expenses to the nonbusiness activity.

The part you must allocate is the amount it would have cost you to travel between the point where travel outside the United States begins and your nonbusiness destination and a return to the point where travel outside the United States ends.

You determine the nonbusiness portion of that expense by multiplying it by a fraction. The numerator (top number) of the fraction is the number of nonbusiness days during your travel outside the United States, and the denominator (bottom number) is the total number of days you spend outside the United States.

You live in New York. On May 4, you flew to Paris to attend a business conference that began on May 5. The conference ended at noon on May 14. That evening, you flew to Dublin where you visited with friends until the afternoon of May 21, when you flew directly home to New York. The primary purpose for the trip was to attend the conference.

If you hadn’t stopped in Dublin, you would have arrived home the evening of May 14. You don’t meet any of the exceptions that would allow you to consider your travel entirely for business. May 4 through May 14 (11 days) are business days and May 15 through May 21 (7 days) are nonbusiness days.

You can deduct the cost of your non-entertainment-related meals (subject to the 50% Limit ), lodging, and other business-related travel expenses while in Paris.

You can’t deduct your expenses while in Dublin. You also can’t deduct 7 / 18 of what it would have cost you to travel round trip between New York and Dublin.

You paid $750 to fly from New York to Paris, $400 to fly from Paris to Dublin, and $700 to fly from Dublin back to New York. Round-trip airfare from New York to Dublin would have been $1,250.

You figure the deductible part of your air travel expenses by subtracting 7 / 18 of the round-trip airfare and other expenses you would have had in traveling directly between New York and Dublin ($1,250 × 7 / 18 = $486) from your total expenses in traveling from New York to Paris to Dublin and back to New York ($750 + $400 + $700 = $1,850).

Your deductible air travel expense is $1,364 ($1,850 − $486).

If you had a vacation or other nonbusiness activity at, near, or beyond your business destination, you must allocate part of your travel expenses to the nonbusiness activity.

The part you must allocate is the amount it would have cost you to travel between the point where travel outside the United States begins and your business destination and a return to the point where travel outside the United States ends.

None of your travel expenses for nonbusiness activities at, near, or beyond your business destination are deductible.

Assume that the dates are the same as in the previous example but that instead of going to Dublin for your vacation, you fly to Venice, Italy, for a vacation.

You can’t deduct any part of the cost of your trip from Paris to Venice and return to Paris. In addition, you can’t deduct 7 / 18 of the airfare and other expenses from New York to Paris and back to New York.

You can deduct 11 / 18 of the round-trip plane fare and other travel expenses from New York to Paris, plus your non-entertainment-related meals (subject to the 50% Limit ), lodging, and any other business expenses you had in Paris. (Assume these expenses total $4,939.) If the round-trip plane fare and other travel-related expenses (such as food during the trip) are $1,750, you can deduct travel costs of $1,069 ( 11 / 18 × $1,750), plus the full $4,939 for the expenses you had in Paris.

You can use another method of counting business days if you establish that it more clearly reflects the time spent on other than business activities outside the United States.

If you travel outside the United States primarily for vacation or for investment purposes, the entire cost of the trip is a nondeductible personal expense. However, if you spend some time attending brief professional seminars or a continuing education program, you can deduct your registration fees and other expenses you have that are directly related to your business.

The university from which you graduated has a continuing education program for members of its alumni association. This program consists of trips to various foreign countries where academic exercises and conferences are set up to acquaint individuals in most occupations with selected facilities in several regions of the world. However, none of the conferences are directed toward specific occupations or professions. It is up to each participant to seek out specialists and organizational settings appropriate to their occupational interests.

Three-hour sessions are held each day over a 5-day period at each of the selected overseas facilities where participants can meet with individual practitioners. These sessions are composed of a variety of activities including workshops, mini-lectures, roleplaying, skill development, and exercises. Professional conference directors schedule and conduct the sessions. Participants can choose those sessions they wish to attend.

You can participate in this program because you are a member of the alumni association. You and your family take one of the trips. You spend about 2 hours at each of the planned sessions. The rest of the time you go touring and sightseeing with your family. The trip lasts less than 1 week.

Your travel expenses for the trip aren’t deductible since the trip was primarily a vacation. However, registration fees and any other incidental expenses you have for the five planned sessions you attended that are directly related and beneficial to your business are deductible business expenses. These expenses should be specifically stated in your records to ensure proper allocation of your deductible business expenses.

Luxury Water Travel

If you travel by ocean liner, cruise ship, or other form of luxury water transportation for business purposes, there is a daily limit on the amount you can deduct. The limit is twice the highest federal per diem rate allowable at the time of your travel. (Generally, the federal per diem is the amount paid to federal government employees for daily living expenses when they travel away from home within the United States for business purposes.)

The highest federal per diem rate allowed and the daily limit for luxury water travel in 2023 are shown in the following table.

You are a travel agent and traveled by ocean liner from New York to London, England, on business in May. Your expense for the 6-day cruise was $6,200. Your deduction for the cruise can’t exceed $4,776 (6 days × $796 daily limit).

If your expenses for luxury water travel include separately stated amounts for meals or entertainment, those amounts are subject to the 50% limit on non-entertainment-related meals and entertainment before you apply the daily limit. For a discussion of the 50% Limit , see chapter 2.

In the previous example, your luxury water travel had a total cost of $6,200. Of that amount, $3,700 was separately stated as non-entertainment-related meals and $1,000 was separately stated as entertainment. Considering that you are self-employed, you aren’t reimbursed for any of your travel expenses. You figure your deductible travel expenses as follows.

If your meal or entertainment charges aren’t separately stated or aren’t clearly identifiable, you don’t have to allocate any portion of the total charge to meals or entertainment.

The daily limit on luxury water travel (discussed earlier) doesn’t apply to expenses you have to attend a convention, seminar, or meeting on board a cruise ship. See Cruise Ships , later, under Conventions.

Conventions

You can deduct your travel expenses when you attend a convention if you can show that your attendance benefits your trade or business. You can’t deduct the travel expenses for your family.

If the convention is for investment, political, social, or other purposes unrelated to your trade or business, you can’t deduct the expenses.

The convention agenda or program generally shows the purpose of the convention. You can show your attendance at the convention benefits your trade or business by comparing the agenda with the official duties and responsibilities of your position. The agenda doesn’t have to deal specifically with your official duties and responsibilities; it will be enough if the agenda is so related to your position that it shows your attendance was for business purposes.

Conventions Held Outside the North American Area

You can’t deduct expenses for attending a convention, seminar, or similar meeting held outside the North American area unless:

The meeting is directly related to the active conduct of your trade or business, and

It is as reasonable to hold the meeting outside the North American area as within the North American area. See Reasonableness test , later.

The North American area includes the following locations.

The following factors are taken into account to determine if it was as reasonable to hold the meeting outside the North American area as within the North American area.

The purpose of the meeting and the activities taking place at the meeting.

The purposes and activities of the sponsoring organizations or groups.

The homes of the active members of the sponsoring organizations and the places at which other meetings of the sponsoring organizations or groups have been or will be held.

Other relevant factors you may present.

You can deduct up to $2,000 per year of your expenses of attending conventions, seminars, or similar meetings held on cruise ships. All ships that sail are considered cruise ships.

You can deduct these expenses only if all of the following requirements are met.

The convention, seminar, or meeting is directly related to the active conduct of your trade or business.

The cruise ship is a vessel registered in the United States.

All of the cruise ship's ports of call are in the United States or in territories of the United States.

You attach to your return a written statement signed by you that includes information about:

The total days of the trip (not including the days of transportation to and from the cruise ship port),

The number of hours each day that you devoted to scheduled business activities, and

A program of the scheduled business activities of the meeting.

You attach to your return a written statement signed by an officer of the organization or group sponsoring the meeting that includes:

A schedule of the business activities of each day of the meeting, and

The number of hours you attended the scheduled business activities.

2. Meals and Entertainment

You can no longer take a deduction for any expense related to activities generally considered entertainment, amusement, or recreation. You can continue to deduct 50% of the cost of business meals if you (or your employee) are present and the food or beverages aren't considered lavish or extravagant.

Entertainment

Entertainment—defined.

Entertainment includes any activity generally considered to provide entertainment, amusement, or recreation. Examples include entertaining guests at nightclubs; at social, athletic, and sporting clubs; at theaters; at sporting events; on yachts; or on hunting, fishing, vacation, and similar trips. Entertainment may also include meeting personal, living, or family needs of individuals, such as providing meals, a hotel suite, or a car to customers or their families.

Your kind of business may determine if a particular activity is considered entertainment. For example, if you are a dress designer and have a fashion show to introduce your new designs to store buyers, the show generally isn’t considered entertainment. This is because fashion shows are typical in your business. But, if you are an appliance distributor and hold a fashion show for the spouses of your retailers, the show is generally considered entertainment.

If you have one expense that includes the costs of entertainment and other services (such as lodging or transportation), you must allocate that expense between the cost of entertainment and the cost of other services. You must have a reasonable basis for making this allocation. For example, you must allocate your expenses if a hotel includes entertainment in its lounge on the same bill with your room charge.

In general, entertainment expenses are nondeductible. However, there are a few exceptions to the general rule, including:

Entertainment treated as compensation on your originally filed tax returns (and treated as wages to your employees);

Recreational expenses for employees such as a holiday party or a summer picnic;

Expenses related to attending business meetings or conventions of certain exempt organizations such as business leagues, chambers of commerce, professional associations, etc.; and

Entertainment sold to customers. For example, if you run a nightclub, your expenses for the entertainment you furnish to your customers, such as a floor show, aren’t subject to the nondeductible rules.

Examples of Nondeductible Entertainment

Generally, you can't deduct any expense for an entertainment event. This includes expenses for entertaining guests at nightclubs; at social, athletic, and sporting clubs; at theaters; at sporting events; on yachts; or on hunting, fishing, vacation, and similar trips.

Generally, you can’t deduct any expense for the use of an entertainment facility. This includes expenses for depreciation and operating costs such as rent, utilities, maintenance, and protection.

An entertainment facility is any property you own, rent, or use for entertainment. Examples include a yacht, hunting lodge, fishing camp, swimming pool, tennis court, bowling alley, car, airplane, apartment, hotel suite, or home in a vacation resort.

You can’t deduct dues (including initiation fees) for membership in any club organized for business, pleasure, recreation, or other social purposes.

This rule applies to any membership organization if one of its principal purposes is either:

To conduct entertainment activities for members or their guests; or

To provide members or their guests with access to entertainment facilities, discussed later.

The purposes and activities of a club, not its name, will determine whether or not you can deduct the dues. You can’t deduct dues paid to:

Country clubs,

Golf and athletic clubs,

Airline clubs,

Hotel clubs, and

Clubs operated to provide meals under circumstances generally considered to be conducive to business discussions.

Any item that might be considered either a gift or entertainment will generally be considered entertainment. However, if you give a customer packaged food or beverages that you intend the customer to use at a later date, treat it as a gift.

As discussed above, entertainment expenses are generally nondeductible. However, you may continue to deduct 50% of the cost of business meals if you (or an employee) is present and the food or beverages are not considered lavish or extravagant. The meals may be provided to a current or potential business customer, client, consultant, or similar business contact.

Food and beverages that are provided during entertainment events are not considered entertainment if purchased separately from the entertainment, or if the cost of the food and beverages is stated separately from the cost of the entertainment on one or more bills, invoices, or receipts. However, the entertainment disallowance rule may not be circumvented through inflating the amount charged for food and beverages.

Any allowed expense must be ordinary and necessary. An ordinary expense is one that is common and accepted in your trade or business. A necessary expense is one that is helpful and appropriate for your business. An expense doesn't have to be required to be considered necessary. Expenses must not be lavish or extravagant. An expense isn't considered lavish or extravagant if it is reasonable based on the facts and circumstances.

For each example, assume that the food and beverage expenses are ordinary and necessary expenses under section 162(a) paid or incurred during the tax year in carrying on a trade or business and are not lavish or extravagant under the circumstances. Also assume that the taxpayer and the business contact are not engaged in a trade or business that has any relation to the entertainment activity.

Taxpayer A invites B, a business contact, to a baseball game. A purchases tickets for A and B to attend the game. While at the game, A buys hot dogs and drinks for A and B. The baseball game is entertainment as defined in Regulations section 1.274-11(b)(1)(i) and, thus, the cost of the game tickets is an entertainment expense and is not deductible by A. The cost of the hot dogs and drinks, which are purchased separately from the game tickets, is not an entertainment expense and is not subject to the section 274(a)(1) disallowance. Therefore, A may deduct 50% of the expenses associated with the hot dogs and drinks purchased at the game.

Taxpayer C invites D, a business contact, to a basketball game. C purchases tickets for C and D to attend the game in a suite, where they have access to food and beverages. The cost of the basketball game tickets, as stated on the invoice, includes the food and beverages. The basketball game is entertainment as defined in Regulations section 1.274-11(b)(1)(i) and, thus, the cost of the game tickets is an entertainment expense and is not deductible by C. The cost of the food and beverages, which are not purchased separately from the game tickets, is not stated separately on the invoice. Thus, the cost of the food and beverages is also an entertainment expense that is subject to the section 274(a)(1) disallowance. Therefore, C may not deduct any of the expenses associated with the basketball game.

Assume the same facts as in Example 2 , except that the invoice for the basketball game tickets separately states the cost of the food and beverages. As in Example 2 , the basketball game is entertainment as defined in Regulations section 1.274-2(b)(1)(i) and, thus, the cost of the game tickets, other than the cost of the food and beverages, is an entertainment expense and is not deductible by C. However, the cost of the food and beverages, which is stated separately on the invoice for the game tickets, is not an entertainment expense and is not subject to the section 274(a)(1) disallowance. Therefore, C may deduct 50% of the expenses associated with the food and beverages provided at the game.

In general, you can deduct only 50% of your business-related meal expenses, unless an exception applies. (If you are subject to the Department of Transportation's “hours of service” limits, you can deduct 80% of your business-related meal expenses. See Individuals subject to hours of service limits , later.)

The 50% limit applies to employees or their employers, and to self-employed persons (including independent contractors) or their clients, depending on whether the expenses are reimbursed.

Examples of meals might include:

Meals while traveling away from home (whether eating alone or with others) on business, or

Meal at a business convention or business league meeting.

Figure A. Does the 50% Limit Apply to Your Expenses?

There are exceptions to these rules. See Exceptions to the 50% Limit for Meals , later.

Figure A. Does the 50% limit apply to Your Expenses?TAs for Figure A are: Notice 87-23; Form 2106 instructions

Summary: This is a flowchart used to determine if employees and self-employed persons need to put a 50% limit on their business expense deductions.

This is the starting of the flowchart.

Decision (1)

Were your meal and entertainment expenses reimbursed? (Count only reimbursements your employer didn’t include in box 1 of your Form W-2. If self-employed, count only reimbursements from clients or customers that aren’t included on Form 1099-MISC, Miscellaneous Income.)

Decision (2)

If an employee, did you adequately account to your employer under an accountable plan? If self-employed, did you provide the payer with adequate records? (See Chapter 6.)

Decision (3)

Did your expenses exceed the reimbursement?

Decision (4)

Process (a)

Your meal and entertainment expenses are NOT subject to the limitations. However, since the reimbursement wasn’t treated as wages or as other taxable income, you can’t deduct the expenses.

Process (b)

Your nonentertainment meal expenses ARE subject to the 50% limit. Your entertainment expenses are nondeductible.

This is the ending of the flowchart.

Please click here for the text description of the image.

Taxes and tips relating to a business meal are included as a cost of the meal and are subject to the 50% limit. However, the cost of transportation to and from the meal is not treated as part of the cost and would not be subject to the limit.

The 50% limit on meal expenses applies if the expense is otherwise deductible and isn’t covered by one of the exceptions discussed later. Figure A can help you determine if the 50% limit applies to you.

The 50% limit also applies to certain meal expenses that aren’t business related. It applies to meal expenses you have for the production of income, including rental or royalty income. It also applies to the cost of meals included in deductible educational expenses.

The 50% limit will apply after determining the amount that would otherwise qualify for a deduction. You first have to determine the amount of meal expenses that would be deductible under the other rules discussed in this publication.

If a group of business acquaintances takes turns picking up each others' meal checks primarily for personal reasons, without regard to whether any business purposes are served, no member of the group can deduct any part of the expense.

You spend $200 (including tax and tip) for a business meal. If $110 of that amount isn’t allowable because it is lavish and extravagant, the remaining $90 is subject to the 50% limit. Your deduction can’t be more than $45 (50% (0.50) × $90).

You purchase two tickets to a concert for $200 for you and your client. Your deduction is zero because no deduction is allowed for entertainment expenses.

Exception to the 50% Limit for Meals

Your meal expense isn’t subject to the 50% limit if the expense meets one of the following exceptions.

In general, expenses for goods, services, and facilities, to the extent the expenses are treated by the taxpayer, with respect to entertainment, amusement, or recreation, as compensation to an employee and as wages to the employee for tax purposes.

If you are an employee, you aren’t subject to the 50% limit on expenses for which your employer reimburses you under an accountable plan. Accountable plans are discussed in chapter 6.

If you are self-employed, your deductible meal expenses aren’t subject to the 50% limit if all of the following requirements are met.

You have these expenses as an independent contractor.

Your customer or client reimburses you or gives you an allowance for these expenses in connection with services you perform.

You provide adequate records of these expenses to your customer or client. (See chapter 5 .)

In this case, your client or customer is subject to the 50% limit on the expenses.

You are a self-employed attorney who adequately accounts for meal expenses to a client who reimburses you for these expenses. You aren’t subject to the limitation on meal expenses. If the client can deduct the expenses, the client is subject to the 50% limit.

If you (as an independent contractor) have expenses for meals related to providing services for a client but don’t adequately account for and seek reimbursement from the client for those expenses, you are subject to the 50% limit on non-entertainment-related meals and the entertainment-related meal expenses are nondeductible to you.

You aren't subject to the 50% limit for expenses for recreational, social, or similar activities (including facilities) such as a holiday party or a summer picnic.

You aren’t subject to the 50% limit if you provide meals to the general public as a means of advertising or promoting goodwill in the community. For example, neither the expense of sponsoring a television or radio show nor the expense of distributing free food and beverages to the general public is subject to the 50% limit.

You aren’t subject to the 50% limit if you actually sell meals to the public. For example, if you run a restaurant, your expense for the food you furnish to your customers isn’t subject to the 50% limit.