- Accessibility Statement [Accesskey '0'] Go to Accessibility statement

- Skip to Content [Accesskey 'S'] Skip to main content

- Skip to site Navigation [Accesskey 'N'] Go to Navigation

- Go to Home page [Accesskey '1'] Go to Home page

- Go to Sitemap [Accesskey '2'] Go to Sitemap

Everyday banking

Online services & more

Banking online

Download our Mobile Banking app

Register for Online Banking

Sign in to Online Banking

Reset your sign in details

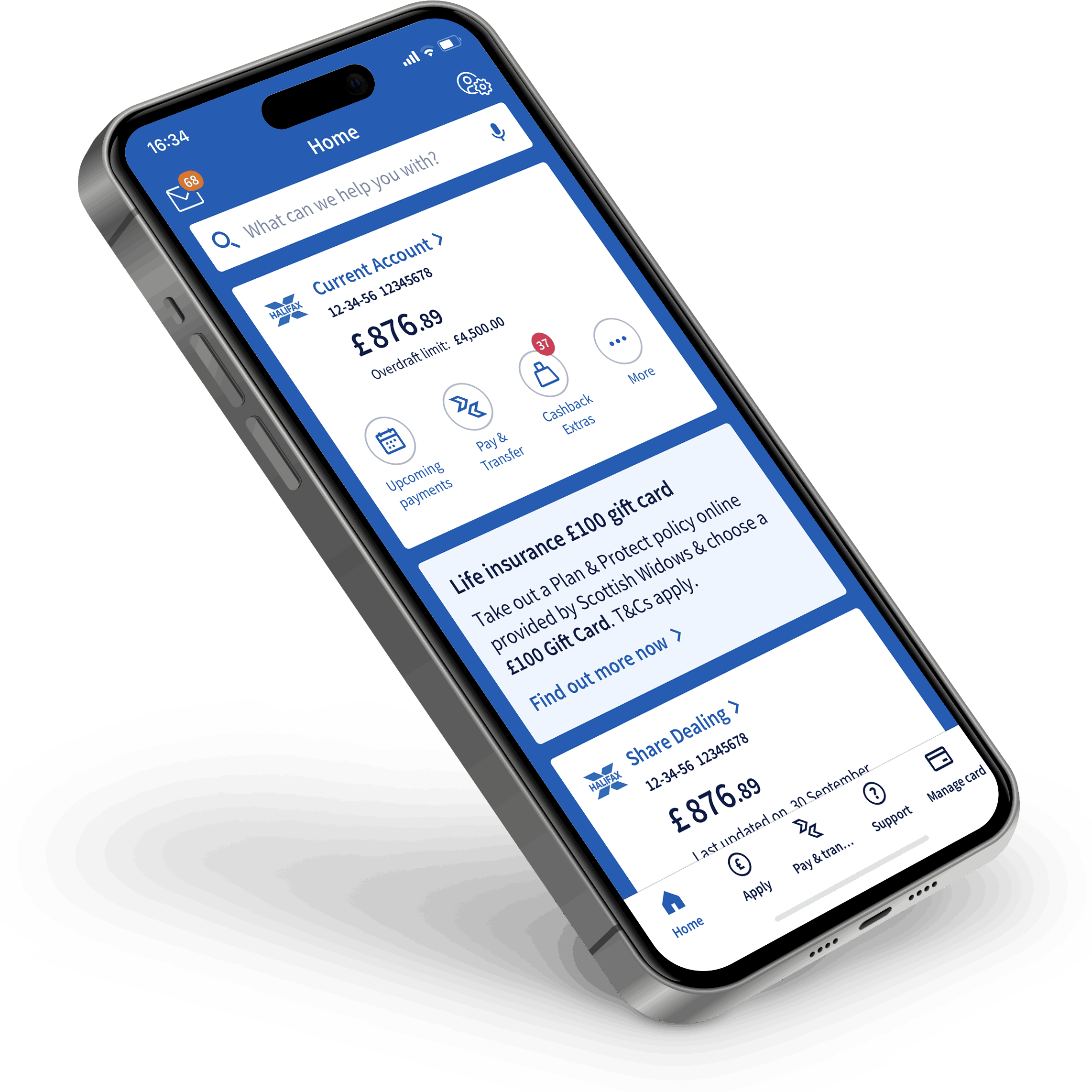

Mobile Banking app

Setting up the app

App notifications

Banking near you

Profile & settings

Change your telephone number

Change your address

Open Banking

Card & PIN

View your card details

Report your card lost or stolen

View your PIN

Payment limits

Cancel a Direct Debit

Pay in a cheque

Send money outside the UK

Paper-free statements

See upcoming payments

Search transactions

Download statements

Help & security

We're here for you

Fraud & security

Protecting yourself from fraud

Latest scams

Lost or stolen card

Unrecognised transactions

Managing your money

Credit explained

Helping someone else

Financial planning

Family finances

Life events

Buying a home

Getting married

Separation & divorce

Bereavement

Difficult times

Money worries

Mental health support

Financial abuse

Serious illness

Customer help

Support & wellbeing

Accessibility & disability

Message us online

Feedback & complaints

Go paper-free

Amend paper-free preferences for your statements and communications.

Bank accounts

Accounts & services

Current Account

Reward Current Account

Ultimate Reward Current Account

Youth & student accounts

Joint accounts

Compare our bank accounts

Travel services

Use your cards abroad

Travel money

Travel Ready

Before you go

Features & support

Switch to us

Cashback Extras

Rates, rewards & fees

Save the Change

Bank account help & guidance

Mobile device trade in service

Already bank with us?

Upgrading your account

Payments & transfers

Mobile banking

Cards, loans & car finance

Credit cards

Credit card eligibility checker

Balance transfer credit cards

Large purchase credit cards

Everyday spending credit cards

Travel credit cards

World Elite Mastercard®

Cashback credit card

Credit card interest calculator

Loan calculator

Loan eligibility checker

Debt consolidation loans

Home improvement loans

Holiday loans

Wedding loans

Car finance

Car finance calculator

Hire Purchase (HP)

Personal Contract Purchase (PCP)

Car leasing

Refinance your car

Credit cards help & guidance

Loans help & guidance

Car finance help & guidance

Other borrowing options

Already borrowing with us?

Existing credit card customers

Existing loan customers

Existing car finance customers

Use your card abroad

Your Credit Score

Thinking about applying for credit? Check Your Credit Score for free, with no impact on your credit file.

Accounts & calculators

First time buyer mortgages

Moving home

Remortgage to us

Existing Halifax mortgage customers

Buying to let

Equity release

Mortgage rates

Calculators & tools

Mortgage calculator

Remortgage calculator

Get an agreement in principle

Base rate change calculator

Overpayment calculator

Mortgage help & guidance

Mortgage Prize Draw

Mortgage protection

Already with us?

Existing customers

Manage your mortgage

Switch to a new deal

Borrow more

Switch deal & borrow more

Help with your payments

Learn about HelloHome

Your interest only mortgage

Mortgage support

Worried about paying your mortgage? We have various ways that we can help you.

Accounts & ISAs

Savings accounts

Easy access savings accounts

Fixed term savings accounts

Kids’ savings accounts

Joint savings accounts

Compare savings accounts

Compare cash ISAs

Junior Cash ISA

Stocks & Shares ISA

Investment ISA

ISA allowances explained

Savings calculator

Savers Prize Draw

Savings help & support

ISAs explained

Charges & withdrawals

Already saving with us?

Manage your ISA

Transfer your ISA

Dormant accounts

Tax on savings interest

Your personal savings allowance

Pensions & investments

Compare investing options

Share Dealing Account

18 – 25 Investing Accounts

Ready-Made Investments

MyInvest Investment Advice

ETF Quicklist

Introducing our ETF Quicklist

View our ETF Quicklist

Guides and support

Understanding investing

Research the market

Investing help and guidance

Regular investments

Trading Support

ETF Academy

Our charges

Bonds and Gilts

Pensions and retirement

Ready-Made Pension

Combining your pensions

Pension calculator

Self-employed

Pensions explained

Top 10 pension tips

Retirement options

Existing Ready-Made Pension customers

Share dealing SIPP

Wealth management

Is advice right for you?

Benefits of financial advice

Services we offer

Cost of advice

Already investing with us?

Sign in to Share Dealing

Introducing the new Ready-Made Pension

A simple, hassle-free way to save for your retirement.

Home, life & car

View all insurance products

Home insurance.

Get your quote now

Compare home insurance

Buildings & contents insurance

Contents insurance

Buildings insurance

Retrieve your quote

Home insurance guides

Manage your home insurance

Car insurance

Compare car insurance

Car insurance help & guidance

Temporary car insurance

Sign in to My Account to manage your car insurance

Life insurance

Critical illness cover

Mortgage protection insurance

Help & guidance

Other insurance

Business insurance

Landlord insurance

Make a home insurance claim

Make a life insurance claim

Make a critical illness claim

Make a car insurance claim

Already insured with us?

Support for existing customers.

Help with existing home insurance

Help with your existing car insurance

Help with your existing life insurance

Home insurance is 10% cheaper with Halifax when you get a quote and buy online.

- Branch Finder

- Help centre

- Accessibility and disability

- Search Close Close

- Bank Accounts

- Compare our current accounts

- In this section

- Money Smart

- Student Current Account

- Expresscash Account

- Basic Account

- Accounts no longer on sale

- International student

Benefits and rewards all in one place with our packaged bank account for a £19 monthly fee.

Existing Ultimate Reward Current Account customers

Benefits that come with this account

Worldwide family travel insurance.

Multi-trip travel cover for you (under the age of 71) and your family (subject to eligibility).

Includes cancellation, medical costs and personal belongings cover.

Cover for certain winter sports, golf trips and UK breaks.

Administered by AWP Assistance UK Ltd (trading as Allianz Assistance) and underwritten by AWP P&C SA.

More on travel insurance benefits and exclusions

AA Breakdown Family Cover

Covers Roadside Assistance and At Home in the UK, Channel Islands and Isle of Man.

The policy offers cover for you and your eligible family members, whether driver or passenger in any eligible vehicle

Provided by Automobile Association Developments Limited (trading as AA Breakdown Services)

More about AA Breakdown Family Cover benefits and exclusions

Mobile phone insurance

Covers breakdown, accidental damage, loss and theft up to £2,000.

Covers one phone per account holder.

Arranged through Lifestyle Services Group Limited with a single insurance provider, Assurant General Insurance Limited

More on mobile phone insurance benefits and exclusions

Home emergency cover

For sudden unexpected incidents that need immediate action to make your home safe and secure.

A qualified person chosen by the insurer will be provided to deal with the emergency.

Cover is for up to £250 per claim including VAT.

Underwritten by Inter Partner Assistance S.A. (IPA)

More on home emergency benefits and exclusions

- No debit card fees from us at home or abroad

We won’t charge your debit card fees when you use your card to:

- Make payments in a foreign currency

- Take out money in any currency from an ATM at home or abroad

- Take out money over the counter abroad

If you’re abroad, and choose to pay for something in Pounds Sterling, the provider of the currency conversion may still charge you.

Important information for customers with pre-existing medical conditions expandable section

Pre-existing medical conditions aren't covered under this policy, unless they are agreed with the insurer first. An additional premium may apply. If this affects you contact Allianz Assistance directly to find out more.

You might want to visit the Money Helper service, which lists firms offering travel insurance for customers with medical conditions. This could help if you’ve been offered cover with a high premium, been refused, or have had cover cancelled due to medical conditions. Think about what might suit your needs best and who you need specialist cover for. For more information access the directory .

Get more from your bank account with a monthly reward.

You can receive a Reward Extras offer each calendar month – by choosing one of the below offers for your Ultimate Reward Current Account. You’ll need to meet a set of conditions each month to get Rewarded.

Each year choose one monthly reward

Select from

- £5 in your account

Paid direct into your account

- 1x Cinema Ticket

See a film on us at any UK Vue Cinema (each ticket is valid for 12 months)

- 3x Digital Magazine

Choose from popular titles such as Cosmopolitan and Men's Health

How to qualify for a monthly reward

Choose to either

- Spend £500 on your debit card each month; or

- Keep £5000 or above in your account each day of the month

- Pay in £1500 or more into your account each month

- Stay in credit (keeping your balance at £0 or above)

To find out more take a look at our section on Reward Extras .

With an Ultimate Reward Current Account you get

- Account Benefits Hub - a handy feature allowing you to obtain account benefit information, submit and manage claims online & in our mobile app

- Exclusive Savings offers – You’ll get exclusive access to our Reward Bonus Saver and ISA Reward Bonus Saver accounts

- Family Boost Mortgages - Access to our Family Boost mortgages

- Preferential travel money rates – benefit from improved rates on your travel money

- Up to 15% Cashback - activate your offers using our mobile banking app or Online Banking and earn as you shop with Cashback Extras . Merchant offers and cashback amounts vary

- The option to apply for an arranged overdraft - all overdrafts are subject to our assessment of your circumstances, and are repayable on demand

- Save the Change - round up your card payments and put the change in your Halifax savings account with Save the change®

- Money Smart - you can open our bank account and savings account for 11 to 15 year olds

Our mobile app features expandable section

- Contactless payments - pay, tap & go with a Visa Debit Card up to £100. You can now use our mobile banking app to choose a contactless payment limit between £30 & £95 . You can also add your card to Apple Pay and Google Pay

- Quick, secure sign in - with the option to use fingerprint or other biometrics on compatible devices

- Freeze your card - if you lose it or want to limit how it's used

- Cheque scanning - pay in cheques of up to £10,000 in to your account by simply taking a photo of your cheque and uploading to the app. There is a maximum daily limit of £10,000 per day

- Check your credit score - register to use Your Credit Score using Online Banking or our Mobile Banking app

- Mobile alerts - you'll get alerts straight to your phone so you can stay up to date on your finances

Open an account today

Download the app to apply.

- Scan the QR code and join the millions of Mobile Banking app users

- Apply for a new bank account

- Change your existing Halifax current account

Apply on the website

I'm a new customer

I'm an existing customer

Do you want a joint account?

Joint bank accounts are an easy way to help two people manage money together.

More about joint accounts

- Join the millions of Mobile Banking app users

Apply with our app

Joint bank accounts are an easy way to help two people manage money together.

Still need some more information?

Switching to halifax expandable section, switch to us in seven working days.

Switching to us is quick and easy. Just fill in our simple online form and let us take care of the rest.

With the Current Account Switch Service, we'll switch your accounts within seven working days. And we handle all the admin - we'll set up your new account, transfer your Direct Debits, and close down your old account for you.

How does the Current Account Switch Service work?

New Customers Apply for a new current account and select to switch.

Existing Customers Sign in and complete our switching form .

You can continue to use your old account and your Halifax account.

We will transfer all your standing orders, direct debits, payments and wages from your old account to your selected account.

Switch complete.

We will close your old account and move any funds to your Halifax account.

6 months 0% interest free arranged overdraft when you switch

To help you during your switch, we may be able to arrange an interest-free arranged overdraft for 6 months, subject to application and approval. An arranged overdraft can act as a useful safety net. You can use it to borrow money up to an agreed limit through your bank account.

To qualify for the interest-free offer you must:

- Use the Current Account Switch Service. This service means your old account will be closed and all your payments transferred to your new Halifax account.

- Have not used the offer within the last 12 months.

- Have applied, and been approved for an arranged overdraft on your new Halifax account.

What happens after the 0% interest free period ends?

Once your six month interest-free period ends we will charge interest daily. The daily arranged overdraft interest rate will be based on how you manage any accounts with us and on the credit information we hold about you. We will let you know this rate in the pre contract credit information we give you if you apply for an arranged overdraft.

Representative example (based on using an Ultimate Reward Current Account)

An arranged overdraft on an Ultimate Reward Current Account has a variable interest rate of 39.9% EAR , and a variable representative rate of 61.7% APR , based on borrowing £1,200 .

The APR includes monthly account fees of £19 and an interest free amount of £50.

How does our overdraft compare?

You can use the representative APR to compare with other products or credit providers, this can help you make sure that you choose the right type of borrowing for you.

How much does my overdraft cost in pounds and pence?

As an example, the interest cost of borrowing £500 is: £2.87 for 7 days, £12.42 for 30 days and £25.18 for 60 days.

Arranged overdrafts are subject to application and approval and repayable on demand. You must be 18 or over to apply. Arranged overdraft limits and interest rates vary based on your individual circumstances.

More about switching

Apply and switch now

Current Account Switch Guarantee

We have designed the Current Account Switch Service to let you switch your current account from one bank or building society to another in a simple, reliable and stress-free way. It will only take seven working days. As your new current-account provider we offer the following guarantee.

- The service is free to use and you can choose and agree your switch date with us.

- We will take care of moving all your payments going out (for example, your Direct Debits and standing orders) and those coming in (for example, your salary).

- If you have money in your old account, we will transfer it to your new account on your switch date.

- We will arrange for payments accidentally made to your old account to be automatically redirected to your new account. We will also contact the sender and give them your new account details.

- If there are any issues in making the switch, we will contact you before your switch date.

- If anything goes wrong with the switch, as soon as we are told, we will refund any interest (paid or lost) and charges made on either your old or new current accounts as a result of this failure.

For more information and FAQs, please read the Account Switching Guide (PDF 1.7MB) .

Cashback Extras expandable section

Whether it's the weekly shop, popping out for lunch or hitting the high street, Cashback Extras makes it easy to earn up to 15% cashback. The offers you get will come from places you might like to try, as well as places where you already shop. Merchant offers and cashback amounts vary. The retailers above are just some of the offers you may receive, merchant offers and cashback amounts vary

- Quick and convenient - select to activate your offers using our mobile banking app or Online Banking.

- Spend and earn - Use any of your Halifax debit or credit cards with your chosen retailers, in store or online, in line with the offer conditions. Your cashback will be paid into your current account at the end of the following month.

- Straightforward - you can keep track of the amount of cashback you've earned by visiting the Cashback Extras hub.

Save the Change expandable section

Struggling to save? We’ve come up with a simple way to turn your pennies into pounds

Switch on Save the Change® and when you buy something with your Halifax debit card, we’ll round up the amount to the nearest pound. At the start of the next working day, we’ll transfer the difference into your nominated Halifax savings account.

For example, if your coffee costs £2.20, we’ll transfer 80p from your current account into your savings account.

It’s a clever feature that takes your leftover change and builds it into bigger savings.

Find out more about Save the Change

Switch on Save the Change

Back to the top

Arranged Overdraft expandable section

An arranged overdraft can act as a short term safety net. You can use it to borrow money up to an agreed limit through your bank account.

- You can apply to add an arranged overdraft to your account and you’ll only pay daily arranged overdraft interest if you use it.

- If you use your arranged overdraft but pay it back before the end of the day, then you won’t pay any arranged overdraft interest for that day.

Helpful tools - You can use our eligibility checker and cost calculator to check your eligibility and calculate the cost of an arranged overdraft.

Applying for an arranged overdraft - When you have applied for this account, at the end of the application you can apply for an arranged overdraft which you can add right away. You can also apply for one later.

Amending an arranged overdraft - You can reduce or remove your arranged overdraft at any time through Mobile Banking, Online Banking or Telephone Banking or by visiting your branch. But you must repay anything you owe if you want to remove an arranged overdraft or anything over the new reduced limit you want. You can also apply to increase it. Using an arranged overdraft increases your overall borrowing and may affect your credit score.

If you don't have enough money in your account or available arranged overdraft to make a payment, we may either let you borrow through an unarranged overdraft or refuse to make the payment. Missing payments and using an unarranged overdraft can damage your credit score, please get in touch with us as we may be able to help you.

Applying for this product does not improve your eligibility for an arranged overdraft.

All overdrafts are subject to application and repayable on demand. You must be 18 or over to apply.

Please read our important information on overdraft rates and charges

Arranged overdraft details.

- £50 interest free amount

- 39.9% EAR (variable) representative

- Your interest rate will be based on how you manage any accounts you have with us and on the credit information we hold about you

- No unarranged overdraft interest, fees or charges

Representative example

As an example, the interest cost of borrowing £500 is:

Useful tools

You can use our calculator to work out how much your anticipated arranged overdraft borrowing would cost over different periods of time. Check your eligibility and calculate the cost of an arranged overdraft:

Cost Calculator Eligibility Tool

*EAR is the Equivalent Annual Rate. This is the annual interest rate of an overdraft. This means you are charged over the year based on how often and how much you are overdrawn by, and the effect of compounding it – charging interest on interest already charged. This interest rate does not include any other fees and charges.

Find out more about arranged overdrafts

If you already have a current account with us and would like an arranged overdraft, you can apply for one through Online Banking or Mobile Banking. You can also apply to increase your existing arranged overdraft too.

Apply for an arranged overdraft

Family Boost Mortgages expandable section

Access to our Family Boost mortgages – this means your family could help with your deposit by putting 10% of the agreed property purchase price into a 3 year fixed term savings account.

Terms and Conditions expandable section

For more information and terms and conditions for this account, read the Ultimate Reward Current Account Getting Started Guide (PDF 1.3MB) .

For more information read the Reward Extras Terms and Conditions (PDF, 54KB)

For more information on lifestyle benefits, read the Lifestyle Benefits Terms and Conditions (PDF, 312KB)

More information about packaged bank account benefits

Aa breakdown family cover expandable section.

What you're covered for

The policy cover offers assistance at the roadside or at home if you or your eligible family member’s vehicle has broken down, whether as the driver or passenger.

There’s cover under the policy if your Ultimate Reward Current Account is open and you’re paying the monthly fee, This includes:

Mechanical breakdown - Assistance to deal with a breakdown on the road within the UK, Channel Islands and Isle of Man.

- Roadside Assistance - An AA Patrol will try to repair the vehicle at the roadside or, if this is not possible, arrange a tow to a local garage for you or eligible family members, the vehicle and up to 7 passengers.

- At Home - Brings all the benefits of AA Roadside to your and your eligible family member’s doorstep and within ¼ mile from home.

With AA Breakdown Family Cover, there’s cover for account holders and certain family members in vehicles, whether you or they are the driver or the passenger. Family members must live at the account holder’s home address or, be temporarily living away from that address, but still within the UK (e.g. students).

Eligible family members will include your:

- Siblings***

- Grandparents

- Children****

- Other family members*****

* including spouse, civil partner, fiancé/fiancée

** including stepparents, foster parents, father in-law, mother in-law

*** including brothers, sisters, brother in-law, sister in-law step-brothers, step sisters

**** including stepchildren, foster children, grandchildren, son in-law, daughter in-law

***** including aunts, uncles, nieces, nephews and first cousins

AA Breakdown Family Cover FAQ's

Please note:

- The service is only available in the UK, Channel Islands and Isle of Man.

- You or your eligible family member must be with the vehicle when it breaks down and when help arrives.

- There’s no cover when travelling in a car, van, minibus or motorcycle exceeding the weight restriction of 3.5 tonnes and max width restriction of 8ft 3in (2.55m).

- There may not be cover for same or similar causes of breakdown to that which the AA attended within the previous 28 days.

- The AA have the right to refuse to provide service if the vehicle is unsafe, unroadworthy, unlawful or you've failed to maintain it (for example no valid MOT or continued failure to refuel or charge your vehicle.)

- If you have an accident, the AA Breakdown Family cover does not provide vehicle recovery. The AA Accident Assist service may be available. See below for more information.

The AA Breakdown cover is provided by Automobile Association Developments Limited, trading as AA Breakdown Services.

We will also provide you with the Insurance Product Information Booklet (PDF 2.4MB) as part of the account application process.

AA Accident Assist

AA Accident Assist is available to account holders only. This service could help if you or a person insured on your vehicle are in a motor accident where all parties are insured. The service could recover and fix your vehicle, provide a replacement vehicle or courtesy car and manage insurance claims.

The service is only available in England, Wales and mainland Scotland and is not available for motorbikes or mopeds.

We have included the AA Accident Assist terms and conditions in the Ultimate Reward Current Account Getting Started Guide. The link is provided below. You will only be asked to agree to the terms if you choose to use the service. The AA will check to see if you are eligible, talk through your situation, describe the help the service can offer, as well as any costs that may be involved, so that you can decide if you want to go ahead.

Please note that these are just some of the important points – full details of the conditions and exclusions can be found in the policy document included in the Ultimate Reward Current Account Getting Started Guide (PDF 1.3MB).

Travel insurance expandable section

- Worldwide multi trip travel - this includes certain winter sports and golf trips. There's also cover for UK trips which have at least 2 nights' pre-booked accommodation.

- Your children - there's cover for the children of you/your partner when travelling with either of you or another responsible adult, provided the children are 18 or under (24 or under if still in full time education). There's cover for a dependent child where they are staying with a responsible adult even if they were not accompanied during their travel to the destination.

- Your partner - a spouse, civil partner or partner.

- Personal Baggage - up to £2,500 if it is lost, damaged or stolen. This includes up to £500 for valuables, and up to £500 for a single article or pair or set of articles.

- Personal Money - up to £750 for loss, or theft. This includes up to £300 cover for cash. This is limited to £50 for under 16s.

Don't forget:

- Pre-existing medical conditions are not covered unless agreed with the insurer first. An additional premium may apply.

- The longest trip length is 31 consecutive days. For winter sports, a maximum of 31 days cover in a calendar year.

- £75 excess per adult per incident may apply.

- There is no cover if travelling against the advice of the Foreign, Commonwealth & Development Office (FCDO) or other regulatory authority.

- There is no cover if you cannot travel or choose not to travel because the FCDO, or any other equivalent government body in another country advises against travel due to a pandemic.

- To be covered trips must start and end in the UK.

- The policy only covers persons permanently resident in the UK and registered with a doctor in the UK.

- There is no cover for any amount recoverable from any other source such as your airline or your accommodation provider.

- All cover ends when the account holder turns 71. As long as the account holder is less than 71, their spouse, partner or civil partner will also be covered until they reach 71.

You can access your packaged bank account benefits, view policy details and make a claim in the app and via Online Banking.

- For app, click on ‘view account benefits’ from the more button or search for ‘account benefits’.

- For Online Banking head to the ‘account benefits’ section.

Cover is administered by AWP Assistance UK Ltd (trading as Allianz Assistance) and underwritten by AWP P&C SA.

Please note that these are just some of the important points - full details of the conditions and exclusions can be found in the policy document included in the Ultimate Reward Current Account Getting Started Guide (PDF 1.3MB) .

We will also provide you with the Insurance Product Information Booklet (PDF 2.4MB) as part of the account application process.

Mobile phone insurance expandable section

Most of us would struggle without our mobile phones, so if it gets broken, damaged, lost or stolen there is cover for:

- Repair or replacement of your phone worth up to £2,000 (including VAT) per claim (replacement phones will come from refurbished or re-manufactured stock i.e. not brand new).

- One phone for you as the account holder, or up to two phones for a joint account.

Things to consider

- An excess of £100 is payable on all successful claims.

- You can’t have more than 2 successful claims per account holder in any 12 month period.

- If your phone is lost or stolen, you must let the police and your airtime provider know as soon as possible.

- You won't be covered for theft, loss, damage or breakdown where you have knowingly put your phone at risk or not taken care of it.

- You may be required to provide a proof of ownership to support your claim (for instance documentation from your network provider, till receipt etc.)

You can register your mobile phone details with the insurer using Online Banking.

Instructions for registering your phone online:

- Sign into Online Banking and select your Ultimate Reward Current Account.

- Select the More actions option and then Account information and benefits .

- Select View account benefits .

- From here, you can register your phone under Mobile phone insurance

If you don’t bank online, you can also register your phone by calling Membership Services .

Mobile phone insurance is arranged through Lifestyle Services Group Limited with a single insurance provider, Assurant General Insurance Limited.

Please note that these are just some of the important points – full details of the conditions and exclusions can be found in the policy document included in the Ultimate Reward Current Account Getting Started Guide (PDF 1.3MB) .

Assurant provide a mobile device trade in service for UK resident Halifax customers. You can trade in eligible mobile devices for a cash payment directly into your current account. More information on Assurant .

Home emergency cover expandable section

Home Emergency cover helps you deal with unexpected things that need immediate action to ensure your home is safe and secure. You never know when you might have to deal with your central heating failing or a pipe bursting in your home. The policy includes cover for up to £250 for the provider to choose a professional to deal with your problem.

The policy only covers home emergencies which need immediate action to:

- Make your home safe or secure.

- Avoid damage or prevent more damage.

- Get you electricity, gas or water back after total failure.

You are not covered if the home was left unoccupied for over 60 days.

If you need to make a claim, please note:

- You must contact the insurer before instructing any other tradesman.

- Are you a tenant? Ensure your landlord agrees before contacting the insurer.

If you don't do this, your claim could be rejected.

Home emergency cover is underwritten by Inter Partner Assistance SA (IPA).

Making a claim expandable section

You can access your packaged bank account benefits, view policy details and make a claim in the app and via Online Banking. Simply sign in and head to the Account Benefits section .

How to register for Online Banking.

If you don’t bank online, you can also make a claim by calling Membership Services . You’ll need your sort code and account number to hand when you call.

More information about additional account benefits

Reward extras expandable section.

Choose between:

- 3 x Digital Magazines - Choose from popular titles such as Cosmopolitan and Men's Health

- 1 x Cinema Ticket - See a film on us at any UK Vue Cinema (each ticket valid for 12 months)

- £5 in your account - Paid direct into your account

How to qualify

Each month you meet your chosen set of conditions you’ll receive your reward by the 12th of the following month. If you choose a lifestyle benefit you’ll receive the offer to your registered email address. If you choose the £5 offer, we’ll pay it into your account and it’ll appear on your statement.

Choose either to:

- Spend £500 on your debit card each month

- Keep £5,000 or above in your account each day of the month

You will also need to pay at least £1,500 into your account each month and stay in credit (keeping your balance at £0 or above).

Magazine Subscriptions

Choose three digital magazine from a host of well-known titles. The magazines currently available are:

Cosmopolitan

Country Living

ELLE Decoration

Good Housekeeping

Harper’s Bazaar

House Beautiful

Men’s Health

Runner’s World

Women’s Health

How does it work?

A code will be sent via email to your registered email address with instructions on how to choose and access your magazines

Codes are valid for 12 months from the date of issue

Magazines can be read online or offline, through your internet browser, smartphone or tablet

Cinema Tickets

Enjoy one free cinema ticket each month to catch the latest blockbusters at Vue cinemas across the UK

You’ll also get a code for half price popcorn

You can use the cinema voucher for 2D, 3D or Xtreme films screenings. If there are any VIP seats available at your screening, then you'll get a free upgrade too

Codes are valid for 12 months, so you can save them for a film you’ve been waiting for

A ticket voucher code will be sent via email to your registered email address and can be used to make bookings online at www.myvue.com or at the box office at any Vue cinema in the UK only

Voucher codes are valid for up to 12 months from the date of issue and are not subject to time extensions

Voucher codes can be used to make bookings for 2D, 3D & Xtreme screenings any day of the week. No additional booking costs apply

Additional upgrade fees will apply

You can earn up to £5 each calendar month – that’s up to £60 a year

You can keep on top of your progress for each monthly £5 offer by using the Reward Extras Tracker

As long as you meet the criteria for Reward Extras and have selected the £5 benefit, you don’t need to do anything else

Reward Extras Frequently Asked Questions expandable section

How do I know if I'll get my reward each month?

Use the Reward Extras Tracker to check if you’re on course to get your reward each month.

You can find the tracker under your account options in Online Banking and the Mobile Banking App.

When will I get my reward?

If you’ve done all the things we asked of you at the end of the month, you’ll get your reward around the 12th of the following month.

If you’ve selected a lifestyle benefit, you’ll receive the offer each month to your registered email address.

If you’ve selected the £5 offer, we’ll pay it into your account and it’ll appear on your statement. It’s as simple as that.

What kind of spending counts towards the offer?

There are a few payments which don’t count for Reward Extras offers:

- When you take cash out of a cash machine, branch or Post Office counter.

- When you make a money transfer to another account.

Any payments being queried or disputed won't count towards the £500 or £5,000. And we’ll only count payments that leave your account by the last day of the month.

But all purchases on your card count. This includes purchases you make online, in-store and abroad.

You can also use digital wallets, like Apple Pay, Google Pay or similar schemes, as long as they’re linked to your registered debit card.

Can I use this offer with a joint account?

Yes. Each month you just need to meet the offer conditions with your joint account.

Keep in mind, each joint account can only have one Reward Extras offer. You will only receive one benefit per account.

How long does the offer last?

All offers will last for at least 12 full calendar months from the day you choose to add it to your account. So if you added the offer on 10 July this year, it would end on 31 July next year. If you met the conditions for the £5 reward from 10 July to 31 July this year, then you'd still get £5 for July as well.

Once you’ve added a Reward Extras offer, you can’t switch to another offer until the 12 months have passed.

We’ll get in touch before your offer ends to let you know what will happen next.

What happens if I close my account?

You need to keep your account open to get your Reward Extras offer.

If you close your account before you’re due to get your offer then you won’t get your reward, even if you met all of the conditions in the previous month.

When does my offer start?

Your offer will start on the day you add it to your account. If you’re renewing, it will start the day after the current one expires.

Money Smart expandable section

Money Smart is our bank account and savings account for 11 to 15 year olds with parental oversight. They get their own bank account and savings account and a contactless Visa debit card. Plus, there are no monthly fees and you get full visibility of your child’s account activity through our Mobile Banking app or Online Banking.

To open Money Smart with your child you must:

- be 18 or over and your child be between 11 and 15 years old

- have an existing Ultimate Reward Current Account or Reward Current Account

- have an existing Kids' Saver or Kids' Monthly Saver for the child

- be registered for Online Banking

- both be living at the same UK address . If you or the child live outside the UK, you won’t be able to open an account for them.

More about Money Smart

Preferential exchange rates expandable section

As an Ultimate Reward Current Account customer you get preferential exchange rates when ordering travel money with Halifax.

Ordering travel money online is simple and secure. If you order by 3pm your money will be sent to your home or local branch the next working day.

More about travel money

I'm ready to apply

Already have an Ultimate Reward Current Account?

You can now view your policy details and make new claims in the app and Online Banking.

Explore Account Benefits

Explore your options

We want to make sure you know about our other bank account options. Here are some that might suit you.

Our Halifax Current Account allows you to manage your money 24/7, at home or on the go - a free everyday banking option.

Everyday banking and you can earn a reward each month you meet a set of conditions. You may need to pay a £3 monthly fee, this is waived each month you pay in at least £1,500 to your account.

Halifax current accounts and services are offered subject to status. Available only to personal customers aged 18 or over who are resident in the UK.

Whether you can have an arranged overdraft and the amount will depend upon your personal circumstances at the time you apply for one. Any overdraft we agree is repayable on demand.

The insurance cover and other services that come with the Ultimate Reward Current Account Benefits Package are renewed every month and will end if: (i) your Ultimate Reward Current Account is closed; (ii) you fail to pay the monthly fee for the account; (iii) your account is changed to another type of account with us; (iv) your residential address is no longer in the UK. Any other insurance policies that you yourself have taken out at a discount as part of the benefits package will not be affected.

Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries. Google Pay is a trademark of Google LLC.

Compare current accounts

We offer a range of current accounts to suit different needs.

Does Halifax Ultimate Reward Travel Insurance Cover?

- Coverage for you, your living spouse, and any children under the age of 18 (or 24 if they’re in full-time education).

Does Halifax travel insurance cover cancellation?

There is now coverage if you are overseas and are ordered to return home or prefer to leave early to avoid having to quarantine when you return due to an epidemic or pandemic declared by the World Health Organization (WHO) or a government body. The UK government or the government of the nation you’re visiting could issue the order to come home.

If you or someone you’re traveling with has scheduled to fly and the carrier or a government body refuses to allow you go because you or they are showing symptoms of a contagious sickness at the time of boarding, you or they are entitled for additional cancellation coverage.

If anyone traveling with the insurance holder has been advised to quarantine owing to a potential exposure to COVID-19, cancellation coverage will now be offered for those protected under the policy. Local lockdowns and a broader quarantine order are not included in this.

If you become unwell while traveling, you are still insured for emergency medical care. Anyone planned to go and protected under the policy will still have cancellation and medical coverage if they are required to quarantine on an individual basis.

On December 1, 2021, NHS Test and Trace / NHS Test and Protect (Scotland) contacts a friend you’re traveling with and informs them that they need to self-isolate and will be unable to accompany you. You will be insured for travel cancellation in this case.

You are scheduled to depart on December 1, 2021. There were no restrictions on traveling to your destination at the time you booked. The Foreign, Commonwealth and Development Office’s travel advice to that place changes two days before your journey begins, and now advises against all but essential travel. As a result, you must reschedule your vacation. You would not be protected for any cancellation expenses in this case, and you would need to seek compensation from the travel provider or another source, such as your credit card issuer.

It is critical that you study the terms and conditions of travel insurance to verify that the coverage matches your requirements.

What is covered by Halifax Ultimate Reward account?

The family travel insurance policy covers you, your spouse or partner (if you live together), and any children under the age of 18, or 24 if they’re in full-time education. Personal goods, specific sports and hobbies, and golf excursions are all covered.

Existing medical issues are not covered unless they are initially agreed upon with the insurer, in which case an additional premium may be required.

- Multi-trip travel around the world, including specific winter sports and golf excursions. There’s also coverage for UK excursions that include at least two nights of pre-booked lodging.

- Your children – any of your children who are 18 years old or younger, or who are 24 years old if they are in full-time education. When traveling with the account holder or a responsible adult, you are covered.

- As long as they reside with you, your partner can be a spouse, civil partner, or partner.

- If your personal baggage is lost, damaged, or stolen, you may be entitled to compensation of up to £2,500. This includes assets worth up to £500 and a single article, pair, or set of articles worth up to £500.

- Personal money is covered up to £750 in the event of loss or theft. This includes up to £300 in cash coverage. For those under the age of 16, the amount is limited to £50.

- Pre-existing medical issues are not covered unless the insurer has agreed to cover them.

- The excursion with the longest duration is 31 days. A maximum of 31 days of coverage in a calendar year for winter sports.

- Children are only protected if they are accompanied by you, the account holder, or another responsible adult.

- If you go against the recommendation of the Foreign, Commonwealth and Development Office (FCDO) or any regulatory authority, you are not covered.

- If you are unable to travel or prefer not to go because the FCDO or another equivalent government organization in another nation advises against travel due to a pandemic, you are not covered.

- When the account holder reaches the age of 71, all coverage terminates. As long as the account holder is under the age of 71, their spouse, partner, or civil partner (with whom they live) is insured until they become 71. Eligible children can also be covered if they are traveling with the policyholder’s spouse, partner, or civil partner.

If you need support when traveling abroad, dial +44 (0)208 239 3931 for Allianz Assistance’s 24-hour assistance line. Call Allianz Assistance at +44 (0)345 124 1400 if you need to lodge a claim or want additional information. You can also submit your claim online through the Allianz Assistance Hub, which is accessible via your banking app or Online Banking.

AWP Assistance UK Ltd (business as Allianz Assistance) administers the policy, which is underwritten by AWP P&C SA.

Please note that these are only a few of the key issues; the policy document included in the Ultimate Reward Current Account Getting Started Guide has complete details of the limitations and exclusions (PDF 1.3MB).

As part of the account application procedure, we will also send you the Insurance Product Information Booklet (PDF 2.4MB).

If your travel has been disrupted, you may also use our helpful travel disruption tool.

Do the Halifax do travel insurance?

Overview of Halifax travel insurance. Halifax’s Ultimate Reward Current Account package account includes travel insurance. For a monthly charge of £17, the account also includes AA breakdown cover, mobile phone insurance, and home emergency cover. AXA Insurance UK plc underwrites its insurance.

What is not covered in travel insurance?

Baggage delay, damage, and loss plans do not cover all of your belongings. Glasses, hearing aids, dental bridges, tickets, passports, keys, cash, and cell phones are all common travel insurance exclusions. These things are sometimes covered, but only up to a particular cost limit, so if you have several expensive electronic items (such as a laptop, tablet, and mobile phone), you may not have enough coverage to cover the loss of all of them.

Is Halifax Ultimate Reward account changing?

If we don’t hear from you by May 15, 2020, your account will be converted to a current account, and you won’t be eligible for monthly Reward Extras. You can upgrade to a Reward Current Account at any time after your account has been converted to a Current Account if you believe it is the ideal account for you.

We’re also adding a £3 monthly account maintenance fee on June 1, 2020, although this won’t apply if you deposit at least £1,500 into your account each month.

Between June and August, we won’t charge the £3 monthly account maintenance cost to help you get acclimated to your new account.

However, you must still pay £1,500 each month to be eligible for your reward.

To help you decide if this account is perfect for you, we’ve highlighted everything you’ll need to do to obtain Reward Extras.

Can I downgrade my Halifax Ultimate Reward account?

It’s good news for existing Halifax customers since if you haven’t received a switching bonus from Halifax since April 2020, you can still claim the bonus.

However, unlike Natwest, Halifax would not allow you to switch into an existing account and receive a bonus. You will need to create a new account.

If you have a Halifax “Current Account

The Current Account from Halifax is a no-frills ordinary account. If you have this, all you need to do now is create a Reward or UItimate Reward account.

If you have a Halifax Reward account

Many of you, I’m sure, already have this account thanks to the generous £5 per month offer. As a result, you’ll need to create an Ultimate Reward account. You can downgrade the account once you’ve switched and received the money if you don’t want to maintain it (details below).

If you have both the Reward and Ultimate Reward accounts

If you already have both of these accounts, that shouldn’t be a problem.

Simply downgrade one of your existing Halifax accounts to a different type of Halifax account. After that, reapply for the same account. Then switch back to normal mode! Halifax has confirmed that this is acceptable.

Of course, there may be some differences in your insurance policies if you do this with the Ultimate Rewards account, so compare them before deciding to downgrade the old account.

How do I claim on my Halifax phone insurance?

If you haven’t already done so, you can register your mobile phone number with the insurer via online banking or by dialing 0345 124 1400.

Raising a claim

You must notify the authorities and your airtime supplier as quickly as possible if your phone is lost or stolen. If you do not do these steps, your claim may be denied.

- Your phone’s make and model. Check your instruction manual for this information, or remove the back cover and battery to find a label with this information.

- Your network/service provider. Tip: Your service provider’s information is frequently displayed on your phone’s screen or on your contract or monthly statement.

- The IMEI (International Mobile Equipment Identity) number is a unique identifier for mobile devices. Tip: Dial *#06# on your phone’s keypad to get this information shown on your phone’s screen.

- Click on your Ultimate Reward Current Account once you’ve enrolled into Online Banking.

- Then, under the ‘Account information and benefits menu,’ select ‘View account benefits.’

- Your policy information will be automatically loaded if you’ve already entered your mobile phone insurance data.

- If you want to file a claim, go to ‘View and update details’, then ‘Make a claim,’ and follow the onscreen instructions.

What is Halifax Reward net?

The Halifax Incentive account is now fee-free and offers a £2 monthly reward provided you deposit at least £750, pay out two or more direct debits, and keep your account in good standing. You have until June 12 to determine whether or not to opt-in if you opened your Rewards account after March 13th.

You are using an outdated browser. Please upgrade your browser to improve your experience.

No results found

Try adjusting your search to see more results.

If you are unsure whether this review should be removed, please see our policy on reporting reviews .

A company can partner with Smart Money People and invite their verified customers to leave a review. When they do this it’s labelled as "Verified source" on the Smart Money People website.

There are a number of automated invitation techniques available to businesses. All of which are trusted and ensure that only verified customers can leave reviews through them.

Halifax Travel Insurance Review

Marvin's low-down on Travel Insurance from Halifax

The experts say:

Halifax is one of the leading providers of travel insurance, with a Which? Ranking of 33 out of 71 providers and a Policy score of 72% from Which?. Their Covid Cover rating is an impressive "Superior", and you can be sure that your medical expenses are well taken care of, with up to £10000000 in cover. As an added bonus, Halifax offers standard coverage for airline failure, and up to £2500 in baggage cover and £5000 in cancellation cover. Unfortunately, the excess payable on medical claims is not known. Fairer Finance does not have a rating for this provider. All-in-all, Halifax’s travel insurance looks like a strong option for those seeking solid coverage and peace of mind when travelling abroad.

What Halifax customers are saying right now:

- 🤗 Friendly and helpful staff in branches and on the phone

- 💰 Good rates for ISAs

- 🙌 Efficient service opening child savings accounts

- 🤝 Good customer service to move ISA to a better rate

- 🤩 Quick and easy transfer of ISAs to other providers

- 😡Phishing emails sent to children 🤬Decline payments without valid reason 🙁Poor customer service and long wait times

Halifax customer reviews summary

Halifax is a bank that offers a variety of services, from credit cards to savings accounts. While their fraud team has been known to decline payments with no reason given and their customer service can be erratic, there have also been reports of excellent customer service and efficient appointments. It seems that it's a bit of a mixed bag when it comes to Halifax, but overall the reviews are positive. Score: 6/10

Sign up for more like this.

IMAGES

COMMENTS

If you’re an Ultimate Reward Current Account customer, please read our FAQs (PDF, 144 KB) for more information about the travel insurance which comes with your account and COVID-19. You can also visit our payment disputes page, for help if your travel has been disrupted.

Debit card fees & charges. Find information on using your cards abroad, reporting a lost or stolen card and useful numbers for while you’re away. If you’re going abroad soon, don’t forget to tell us.

Check the expiry date on your card. Download our app to manage your card. Turn off Abroad Freeze, view your PIN and more. Take another form of payment in case of emergency. How you looked at our travel money rates? Check and update your contact details online in case we need to get in touch. Save our contact numbers in case you need to get in ...

Cover for certain winter sports, golf trips and UK breaks. Administered by AWP Assistance UK Ltd (trading as Allianz Assistance) and underwritten by AWP P&C SA. More on travel insurance benefits and exclusions.

Halifax’s Ultimate Reward Current Account package account includes travel insurance. For a monthly charge of £17, the account also includes AA breakdown cover, mobile phone insurance, and home emergency cover.

I'd suggest ringing the Halifax Travel Insurance Helpline and asking them. The Lloyd's helpline confirmed the cruise cover to me when I wanted to double check it was covered as we were booking a much longer cruise than usual- I expect it's actually the same call centre.

Click here to read 7 customer reviews of Halifax Travel Insurance, rated 4.14★ by real people like you on Smart Money People.

You get included multi-trip travel insurance for you and your family. The insurance covers you for cancellation, medical costs and personal belongings. You get some winter sports included, as well as golf holidays and UK getaways.

All-in-all, Halifax’s travel insurance looks like a strong option for those seeking solid coverage and peace of mind when travelling abroad. Get a quote for Travel Insurance from Halifax. What Halifax customers are saying right now: The Good. 🤗 Friendly and helpful staff in branches and on the phone. 💰 Good rates for ISAs.

Halifax is one of the leading providers of travel insurance, with a Which? Ranking of 33 out of 71 providers and a Policy score of 72% from Which?. Their Covid Cover rating is an impressive "Superior", and you can be sure that your medical expenses are well taken care of, with up to £10000000 in cover.