- You are here:

- Home »

- Blog »

- » RV Sales Tax By State (How Do You Avoid Sales Tax On an RV?)

RV Sales Tax By State (How Do You Avoid Sales Tax On an RV?)

- September 30, 2022 /

- RVing 101 /

- By James V.

The dreaded sales tax. Some countries in the world hide the sales tax in the purchase price. That way you see one price and pay that price. However, in America & Canada, the sales tax is added afterward. This can bring some serious sticker shock to some RV buyers

The best way to avoid paying a sales Tax is to make your purchase in Montana or Oregon or any other state that does not charge a sales tax. But buying out of state is no guarantee that you will avoid paying a sales tax. Some states add a sales tax when you make an out-of-state purchase.

To learn more about this issue, just continue to read our article. It is filled with the information you want to know about so you can decide where to buy an RV. Because all sales are well documented, tax officials collect every penny owed to their state.

Do You Pay Sales Tax on RVs?

Yes, you do, or at least in those estates that charge an RV sales tax. It is becoming more difficult to avoid paying this tax as states have stricter laws about buying out of state and then importing your RV.

If you do it too soon, you will be subject to a sales tax. When you buy out of state, and in one of those states that has no sales tax, be prepared to have a legal permanent address in the state of purchase.

That has become a requirement over the years. Also, states with no sales tax have become creative in their pursuit of revenue. Delaware is one example as they do not charge an RV sales tax, but they do charge a 4.25% document fee.

The name may be changed but the tax remains. When you go to register your RV, what fees you pay will depend on which state you register it in. This topic is a very complicated issue as all states have their own laws about RVs.

If you live on the border of a no sales tax state you may have some leeway but be careful, loopholes get closed very quietly sometimes.

States With no Sales Tax on RVs

There are only 5 states currently that charge no sales tax on RVs or other products. Those 5 states are Alaska, Delaware, Montana, New Hampshire, and Oregon. If you live on the border of these states, you may be able to save some money as well as on registration fees.

Unless you buy in Delaware. Also, you need to watch out for the registration deadline. Each state has its own deadline for when you are to register your RV in their state.

Each state is unique as well as along with no sales tax, Montana allows corporations to register vehicles in their state. This law has allowed a whole cottage industry to develop in the state.

Also, this law allows RV owners to avoid use taxes as well that are charged in their home state. Then you do not have to go this route alone. It turns out that there are a lot of law offices in Montana dedicated to helping you register your RV in Montana.

There is also what is called cross state sales which is living in one state and buying in another. Watch out for those laws as loopholes can be plugged very easily.

RV Sales Tax By State

Here is a list of states that have either no sales tax or a sales tax. There is also registration information included so you know what is expected of you when you make your purchase.

RV sales tax in Nevada--

8.1% and must register within 30 days of purchase

RV sales tax in Florida--

Pay local tax rate and must register within 10 days of purchase

RV sales tax California--

7.25% to 10.25% Must register within 10 days of purchase

RV sales tax Texas--

6.25% and must register within 30 days

RV sales tax in Arkansas--

6.5% + county + city Must register within 30 days of purchase

RV sales tax Washington state--

6.5% and must register within 15 days

RV sales tax Illinois--

6.25% and must be registered within 20 days of purchase

RV sales tax Arizona--

5.6% + county + city Must register within 15 days of purchase

RV sales tax Alabama--

2% + county rate+ city rate Must register within 20 days of purchase

Missouri RV sales tax--

4.225% + Local tax Must register within 30 days of purchase

Kansas RV sales tax--

7.3% to 8.775% Must be registered within 90 days of purchase

Tennessee sales tax for RV--

7% no time frame for registration requirements

Michigan sales tax for RV--

6% and must register within 15 days of purchase

Kentucky RV sales tax--

Rv sales tax montana--.

No RV State Sales Tax Must register within 60 days of purchase

RV sales tax in Mississippi--

5% and must register within 30 days of purchase

RV sales tax in Minnesota--

6.5% and must register within 60 days of purchase

RV sales tax North Carolina--

3% or to a maximum of $2,000. Must register within 30 days of purchase

RV sales tax Nebraska--

5.5% and must register within 30 days of purchase

RV sales tax New York--

4% and must register within 30 days of purchase or within 180 days of the effective insurance date

RV sales tax New Mexico--

4% and must register within 60 days of purchase

RV sales tax New Jersey--

6.225% and must register within 60 days of purchase

RV sales tax Oklahoma--

3.25% and must register within 30 days of purchase

RV sales tax Oregon--

No state RV sales tax, but 1.5% business tax for an LLC RV. Must be registered within 30 days of purchase

RV sales tax Ohio--

5.75% and must register within 30 days of purchase

Pennsylvania RV sales tax--

6% statewide 7% for residents of Allegheny County 8% for City of Philadelphia residents Must register within 20 days

RV sales tax South Carolina--

6% and must register within 30 days

RV sales tax South Dakota--

4.25% must register within 45 days

RV sales tax Utah--

6.85% + Documentation fee of $149 Must register within 60 days

RV sales tax Vermont--

6% and must register within 60 days

RV sales tax Virginia--

4.15% and must register within 30 day

RV sales Tax Washington, DC--

6% + Excise taxes of .3% or more. Must register within 60 days

RV sales tax Wisconsin--

5% and the dealership handles registration requirements

West Virginia RV sales tax--

6% + Titling fee. Must register within 30 days

Wyoming RV sales tax--

4% and you are required to self-register the vehicle as soon as possible

RV sales Tax Rhode Island--

7% and must register within 30 days

RV sales tax North Dakota--

5% and must register within 75 days of purchase

RV sales tax New Hampshire--

No RV State Sales Tax, but registration fees for State and municipalities and pass an emissions test. Must register within 20 days of purchase

RV sales tax Maryland--

6% and must register within 60 days of purchase

RV sales tax Maine--

5.5% and must register in person with the local municipality within 30 days of purchase

Louisiana RV sales tax--

4% and must register within 40 days of purchase

Hawaii RV sales tax--

4.12% + county taxes apply. Must register within 30 days of purchase

Georgia RV sales tax--

6.6% and must register within 60 days of purchase

RV sales tax Idaho--

Taxes calculated by RV value tiers Must be registered within 60 days of purchase

RV sales tax Indiana--

7% and must be registered within 45 days of purchase

RV sales tax Iowa--

5% and must be registered within 30 days of purchase

RV sales tax Delaware--

No state tax for RVs but there is a 4.25% “Motor Vehicle Document Fee”

RV sales tax Colorado--

2.9% + county + city + district Must register within 60 days of purchase

RV sales tax Connecticut--

6.35% for vehicles $50k or less7.75% for a vehicle over $50,000 Must meet emissions testing requirements

Alaska RV sales tax--

0% + Municipal or County Taxes

We apologize if we missed your state. The information was taken from the following website https://www.rvingknowhow.com/rv-sales-tax-by-state

How do You Avoid Sales Tax On An RV

There really is only one way. Due to the extensive documentation of RV sales and enhanced communication between states, state governments are able to track down RV owners who made their RV purchase in another state.

Once they do and if it is within a certain time period, they will assess the home state’s sales tax on your purchase. This means that if you are not careful and you make your purchase in a no sales tax state, you can be charged a sales tax by your home state.

Unless you make your purchase in Montana. In this state, it is legal to incorporate as an LLC as the law states that LLC businesses can register their vehicles in the state.

This, you can set up such a corporation and avoid paying any sales tax, anywhere. You get a legitimate permanent address in Montana plus you can register your RV there cutting out the sales tax.

Your LLC gets all the same benefits and rights a regular Montana citizen gets and you do not have to pay any taxes in your home state. To set up your LLC you first have to select a unique business name, no duplication is allowed.

Then you select an agency to help you file the paperwork and they will act as your legal representative and take care of the red tape. The fees vary between agencies so pick a good one at an affordable price.

Since you would be saving anywhere between $4000 and $30,000 in sales tax, you can afford a very good agency to help you. What you are required to submit are the following items:

The name of your LLC (remember that this needs to be unique)

Duration of your LLC / how long you want it to exist

Mailing address

Registered agent information

Member information

Defining the management structure of your LLC

Signature and title of the person completing the paperwork

The registration of your new company takes about 7 to 10 business days and once it is done you can buy your RV or register a trailer you already own. The same agency will handle all the registration paperwork for you.

All you need to do is send them the paperwork so they can. The good news is this move is perfectly legal. Whether it will change remains to be seen.

Is RV Sales Tax Deductible?

You can check with a tax consultant before you make your purchase. They will give you all the necessary information to follow but yes, you can deduct your RV sales tax.

However, this is a one-time deduction and you cannot do it every year. The same goes for the ad valorem tax some states apply. This tax is based on the value of your RV and it can be used once as well.

Besides the sales tax, you may be able to use your RV for other tax deductions. Here are some of those options:

#1. RV loan interest- if your RV is your primary or secondary home, you should be able to deduct the interest of your loan from your taxes.

#2. RV business expenses- there is a list of expenses you may deduct if you use your RV for business purposes. However, if you use it for personal purposes you may not qualify.

#3. RV renting expenses- if you use your RV for part of the year and rent it out for the rest of the time, rental listing fees and insurance costs may be tax deductible

The best thing to do is talk to your tax accountant and see what you can or cannot do when it comes to deducting RV expenses from your taxes. We are not giving any tax advice here but pointing you in the right direction and giving you something to think about.

Tax advice should only come from tax professionals. Also, your tax consultant should tell which areas of these deductions need to be itemized and which do not have to be. Ask a lot of questions so you get all the answers you need.

Buying RV Out Of State Sales Tax

First off, it is okay and legal to buy an RV from a different state. You can even go and buy one across the country if you want. If that is where you find your dream RV, you can do it.

While there are some good positives that come from buying out of state, there is one major drawback you should be aware of. If you register your new RV in your home state, you will be subject to your home state’s sales tax assessment.

That situation includes the purchase of your RV in a no sales tax state. Up above, we explained how to do this in Montana and it seems to be the only state that offers that loophole.

However, if you have another legitimate permanent address in a lower sales tax state, you can register it there to save some money. Out of 50 states, only 5 have no sales tax.

Chances are you do not have a permanent address in any of them. That means that you will have to pay a sales tax regardless of where you buy it. When you make your purchase, just make sure to buy insurance to cover you as you drive your RV home.

What To Watch Out For When Buying Out Of State

Most states now have laws governing out of state RV purchases. You may save a lot of money by buying and registering your RV in Montana but when you bring that RV back to your home state, you have to re-register it.

The time frame to re-register varies from state to state but you get anywhere from 30 days to 6 weeks to do it. Just like changing your driver’s license when you move to a new state.

If you wait to register your new RV in your home state and you go past that deadline, it is now a crime. You are in a lot of trouble if you are discovered. Check out the laws carefully so you do not end up paying for an LLC for nothing in return.

Some Final Words

Governments have a way of collecting their fair share of our money. They create laws that you may never have heard about that govern RV purchases. Before you make an out of state purchase, talk to a lawyer who is familiar with those laws.

Violating them will cost you a lot more than just the sales tax price. It is not a situation you want to be in.

Related Posts

Does CarMax Buy RVs? (CarMax RV Trade-In Guide)

300 Lbs Over Payload: What Happens If I Exceed My Payload?

Thor Vegas Problems (Windshield, Battery, Fridge, Swivel Chair)

Leave a Comment:

How Much Sales Tax On RVs? (50 States)

When considering the purchase of a motorhome, it’s important to be aware of all the costs involved, including sales tax.

The sales tax you’ll pay can vary greatly depending on the state you purchase it in. However, some states have no sales tax on motorhome sales.

In this guide, we’ll provide a breakdown of the sales tax rates for motorhomes in 50 US states, so you can make an informed decision on where to buy your motorhome and potentially save money on taxes.

Whether you’re a first-time motorhome buyer or upgrading your current one, this guide will help you budget for your purchase and ensure you’re getting the best deal possible.

Table of Contents

How Much Are the Sales Tax on RVs Across All 50 US States?

Much like state taxes, motorhome sales taxes differ on a state-by-state case.

These tax rates are generally stable, but they can change from year to year.

Below we have discussed the current RV sales taxes in every US state so that you can decide if driving to a nearby state to buy your new motorhome is worth the effort:

In Alabama, you must register a recently bought motorhome within 20 days of purchasing it.

The sale tax on RV sales in this state is 2%, but you will also need to pay the statewide and local city taxes.

Alaska is one of the few states with a 0% state tax rate on motorhome sales.

However, this state’s local governments can charge a local sales tax rate on RV purchases of up to 7.5%.

According to Arizona’s laws, a new RV purchase has to be registered within 15 days of the sale being finalized.

The sales tax on RVs in this state is 5.6%, in addition to the county and city taxes that need to be paid on motorized vehicle sales.

If you buy a motorhome that costs more than $4,000 in Arkansas, you must pay a sales tax of 6.5% plus the county and local city tax rates.

Motorhome purchases of less than $4,000 aren’t applicable for the state sales tax. You will also need to register your new RV within 30 days.

In California, the sales tax rate on RVs is 7.5% in addition to the local tax rates.

Additionally, you must register your new RV within ten days of buying it in this state.

In addition to county, city, and district tax rates, people purchasing an RV must pay a sales tax of 2.9% in Colorado. You will also need to register the motorhome within 60 days.

Connecticut

Unlike other states, Connecticut has a 6.35% sales tax on RV purchases less than $50,000 and 7.75% on motorhomes costing more than $50,000.

Additionally, the motorhome you purchase must meet Connecticut’s emission testing requirements.

Delaware is another US state with a 0% sales tax rate on RV purchases.

However, this state does have a 3.75% ‘Document Fee’ that has to be paid for mobile homes.

Any motorhome sold or delivered in Florida must adhere to the 6% RV sales tax, and local sales surtaxes apply to the first $5,000 of the sales price of a motorhome in this state.

The RV sales tax for motorhome purchases in Georgie is 6.6%, and owners must register their RV within 60 days of buying it.

There are no other hidden sales tax fees.

In Hawaii, the RV sales tax is 4.12%, and RV owners must pay this fee and the specific county taxes.

You will also need to register your motorhome within 30 days of buying it.

Idaho has an RV sales tax of 6%, and you might have to pay various other fees like title, registration, and plate fees.

The period within which you can register your new motorhome in Idaho is 60 days.

Illinois is one of the more expensive states regarding sales tax on RVs.

In this state, you can expect to pay an RV sales tax of 7.25%, and you will need to register the motorhome within 20 days of buying it.

In Indiana, the RV sales tax is 7% making it more than other US states.

You will have a maximum of 45 days to register your purchase.

All RVs sold or used in Iowa have a 5% motorhome sales tax according to Iowa Code section 423D.

Additionally, you’ll have to register your motorhome within 30 days of purchase.

Interestingly, you will have up to 90 days to register a new RV purchase in Kansas.

However, the sales tax on recreational vehicles is steep.

You can expect to pay within 7.3% to 8.775%, and local taxes of up to 1% also need to be paid.

Curiously, there are no local or state taxes on motorhome purchases in Kentucky, but you will be responsible for an RV sales tax of no more than 6%.

In Louisiana, the municipalities and parishes have a local sales tax of between 1.85% and 7% that you will have to pay in addition to the RV sales tax of 4%.

The RV sales tax in Maine is 5.5%, and you will have 40 days to register your motorhome from the date it was purchased in this state.

The RV sales tax is calculated on the purchase price for motorhomes older than seven years.

Motorhomes newer than seven years will be charged an RV sales tax of 6% of the motorhome’s book value or purchase price.

Massachusetts

In Massachusetts, the RV sales tax is 6.25% if the sale is made through a dealership or lessor registered to sell and lease.

You won’t have much time to register a newly bought motorhome in Michigan as the timeframe is only 15 days.

Additionally, the RV sales tax is 6% of the total purchase price of the motorhome.

In Minnesota, you will have 60 days to register a newly bought RV; the motorhome sales tax is 6.5%.

There is no local or municipal sales tax payable.

Mississippi

You will have 30 days to register your motorhome from the date of purchase, and you must pay an RV sales tax of 5% in this state.

In Missouri, the RV sales tax is 5%, and you will have 30 days to register your new purchase.

You will also have to pay local RV taxes.

Montana is known as a 0% sales tax state, so you won’t have to pay any sales taxes on an RV purchased in this state.

Additionally, you must register a motorhome within 60 days of purchasing it in Montana.

The RV sales tax in Nebraska is 5.5%, and you will have a maximum of 30 days from purchase to register a new motorhome.

Nevada has one of the highest RV sales tax rates in America.

This sales tax is 8.1%, and RVers only have 30 days to register a newly bought motorhome.

New Hampshire

New Hampshire is another of the few US states with no RV sales taxes.

However, if you buy a motorhome in this state, you will need to pay state and municipality registration fees, and your RV will need to pass an emissions test.

Additionally, you’ll have 20 days to register the motorhome.

The RV sales tax in New Jersey is 7%, and you will have 60 days to register your newly bought motorhome.

In New Mexico, the RV sales tax is 4% of the price of the RV, less any trade-in credit.

You will also only have 30 days from the date of purchase to register a new motorhome.

In New York, there is a 4% RV sales tax on all new motorhomes, and you will also have to pay county or local taxes of up to 4.5% of the total price of your RV.

North Carolina

The RV sales tax in North Carolina is 3% up to a maximum of $2,000.

North Dakota

North Dakota allows RVers 75 days to register their newly bought motorhome.

This state also has an RV sales tax of 5%.

There are Ohio county taxes that can be as high as 2% that you will have to pay in addition to a 5.75% RV sales tax when purchasing a motorhome.

Moreover, some dealerships in Ohio could charge you up to 199 dollars for a documentary service fee.

The first 1,500 dollars spent on a motorhome in Oklahoma is taxed at a flat fee of $20.

After that, you will need to pay an RV sales tax of 3.25%.

There is no RV sales tax in Oregon. However, there is a 1.5% tax fee for an LLC RV.

Additionally, you must register a motorhome within 30 days of purchasing it in Oregon.

Pennsylvania

Curiously, Pennsylvania has various RV sales taxes depending on the county.

For example, the statewide RV sales tax is 6% but its 8% for the City of Philadelphia residents and 7% for residents of Allegheny County.

In addition, if you buy a motorhome in this state, you will only have 20 days to register it.

Rhode Island

In Rhode Island, the RV sales tax on new or used motorhomes is 7% of the purchase price minus any allowances and trade-in credit.

You will also only have 30 days to register an RV.

South Carolina

Like other states, you will have 30 days to register a newly bought motorhome in South Carolina, with an RV sales tax of 6%.

South Dakota

South Dakotas RV sales tax is 4%, and you must register your new motorhome within 45 days.

There are no local or state taxes besides the sales tax on RV purchases.

Tennessee is the only US state with no registration timeframe.

Yet, there is an RV sales tax, and it is pretty high at 7%.

The RV sales tax in Texas is 6.25% minus any applicable trade-in credits.

Additionally, you’ll have 30 days to register a newly bought model.

Some Utah dealerships charge RVers a documentation fee of 149 dollars, which must be paid in addition to the RV sales tax of 6.85%.

The registration period for this is 60 days.

The RV sales tax in Vermont is 6%, and you must register your motorhome within 60 days of buying it.

The RV sales tax in Virginia must be paid at the time of titling, when the ownership changes, or when a motorhome is sold.

This sales tax is 4.15%, and you will have 30 days to register and pay it.

Washington has one of the shortest registration timeframes at 15 days for motorhomes.

This states RV sales tax fee is also high at 6.5%.

West Virginia

There is a titling fee and a 6% RV sales tax on new motorhome purchases in West Virginia.

You will also need to register your RV within 30 days of purchase.

In Wisconsin, there are county taxes of up to 0.5% and a stadium tax of up to 0.01%, and an RV sales tax of 5% for all motorhomes bought in this state.

Additionally, some Wisconsin RV dealerships also charge a 99-dollar service fee.

Some areas in Wyoming can charge a higher RV sales tax than others.

However, the RV sales tax is 4% for most parts of Wyoming.

You will also have to self-register your new motorhome as soon as possible.

What US States Have No Sales Tax On RVs?

At present, five US states have no sales tax on RVs.

These five states are Delaware, Oregon, Alaska, Montana, and New Hampshire.

If you buy a motorhome in these states, you will likely save money and get a better deal depending on local and state taxes.

What US States Have The Highest Sales Tax On RVs?

Some states in the US have higher sales taxes on RVs than others.

Although we listed them above, we’ve also listed them in one location below.

You might want to avoid buying your new motorhome in these states if you can help it and want to save money:

- Nevada: 8.1%

- Pennsylvania: 8% (Allegheny County)

- Kansas: 7.3% to 8.775% (depending on county)

- California: 7.25%

- Indiana: 7%

- Rhode Island: 7%

- Tennessee: 7%

Cheapest US States to Buy and Register an RV

States With No Sales Tax On Motorhomes And What To Know About Them

What US State Has No Sales Tax on RVs?

Click to share...

How Much Sales Tax On RVs? RV Sales Tax by State (All 50)

RVs are a popular way to travel and explore the country, but purchasing one can come with a plenty of costs you may not have considered. One of the costs that RV buyers need to consider is the sales tax, which varies depending on the state.

RV sales tax by state varies greatly, and some states even have additional local taxes. The states that do not charge sales tax on RV purchases are Alaska, Delaware, Montana, New Hampshire, and Oregon.

RV owners may also need to pay registration fees and other taxes, such as personal property taxes. Understanding these costs is crucial for budgeting and avoiding any surprises down the road.

We’ll cover everything you need to know in this guide.

RV Sales Tax By State

When purchasing an RV, it is important to consider the sales tax that will be imposed by the state where the purchase is made. Sales tax rates vary by state, and some states have exemptions or reduced rates for RV purchases. Here is an overview of RV sales tax in each state:

The RV sales tax rate in Alabama is 2% , but there is an additional county and city tax that can bring the total tax rate up to 3.375% to 4% .

Alaska does not have a statewide sales tax, so there is no sales tax on RV purchases in Alaska. Some local tax rates on RVs in Alaska can be up to 7.5% .

The RV sales tax rate in Arizona is 5.6% , but there is an additional city or county tax that can bring the total tax rate up beyond that percentage. RV purchases must be registered within 15 days of the RV sale being finalized in Arizona .

The sales tax rate in Arkansas is 6.5% , but there is an additional county tax that can bring the total tax rate up to 11.5%. There is no sales tax on RV purchases under $4,000 in Arkansas.

The sales tax rate in California is 7.25% , but there is an additional district tax that can bring the total tax rate up to 10.25% . You must register your RV in California within 10 days of purchase.

The sales tax rate in Colorado is 2.9% , and you may see additional city, county, and district tax rates in addition to that. You must register your RV in Colorado within 60 days of purchase.

Connecticut

The sales tax rate in Connecticut is 6.35% for RV sales under $50,000 , and 7.75% on RV sales over $50,000 . Your RV must also pass an emissions test in Connecticut.

Delaware does not have a sales tax, so there is no sales tax on RV purchases in Delaware.

The sales tax rate in Florida is 6% , but there is an additional county tax that can bring the total tax rate up to 8.5% . There are additional local sale taxes applied to the first $5,000 of the sales price of the RV or motorhome. All sales taxes are applied to any RV sold or delivered in Florida.

The sales tax rate in Georgia is 7% , and you must register the RV within 60 days of purchase .

The sales tax rate in Hawaii is 4.712% , and there may be additional county taxes to consider. You must register your RV within 30 days of purchase in Hawaii .

The sales tax rate in Idaho is 6%, and you must register the RV within 60 days of purchase .

The sales tax rate in Illinois is 7.25%, and you must register the RV within 20 days of purchase .

The sales tax rate in Indiana is 7% , and you must register the RV within 45 days of purchase .

You do not need to pay sales tax if you are a nonresident purchasing the RV in Indiana, unless you live in AZ, CA, FL, HI, MA, MI, NC, or SC.

The sales tax rate in Iowa is 5% , and you must register the RV within 30 days of purchase .

The RV sales tax rate in Kansas is between 7.3% and 8.775% , and you must register the RV within 90 days of purchase .

The sales tax rate in Kentucky is 6% for RV purchases.

The sales tax rate in Louisiana is 4% , but there is an additional parish tax or local tax that can vary between 1.85% and 7% .

The sales tax rate in Maine is 5.5% , and you must register the RV within 40 days of purchase .

The RV sales tax rate in Maryland is 6% for RVs that are 7 years or newer. There is no sales tax on RVs older than 7 years .

Massachusetts

The RV sales tax rate in Massachusetts is 6.25% .

The sales tax rate in Michigan is 6% , and you must register the RV within 15 days of purchase .

The sales tax rate in Minnesota is 6.5% , and you must register the RV within 60 days of purchase .

Mississippi

The sales tax rate in Mississippi is 5% , and you must register the RV within 30 days of purchase .

The sales tax rate in Missouri is 5% , and you may have additional city or county taxes. You must register the RV within 30 days of purchase .

Montana does not have a sales tax, so there is no sales tax on RV purchases in Montana.

The sales tax rate in Nebraska is 5.5% . You must register the RV within 30 days of purchase

The sales tax rate in Nevada is 8.1% , and you must register the RV within 30 days of purchase .

New Hampshire

New Hampshire does not have a sales tax, so there is no sales tax on RV purchases in New Hampshire. You must register the RV within 20 days of purchase .

The sales tax rate in New Jersey is 7% . You must register the RV within 60 days of purchase.

The sales tax rate in New Mexico is 4% . It’s important to note that New Mexico will only charge tax on the sales portion of the RV less any trade-in credit. You must register the RV within 30 days of purchase.

The sales tax rate in New York is 4% , but there is an additional county tax that can bring the total tax rate up to 8.5% .

North Carolina

The sales tax rate in North Carolina is 3% , up to a maximum RV sales tax of $2,000 . You must register the RV within 30 days of purchase.

North Dakota

The sales tax rate in North Dakota is 5% . You must register the RV within 75 days of purchase.

The sales tax rate in Ohio is 5.75%, and there is an additional county tax that can bring the total tax rate up to 7.75%.

Oklahoma charges a flat fee RV sales tax of $20 for the first $1,500 spent on any RV. The sales tax is 3.25% of the total purchase price after the initial $1,500.

There is no RV sales for personal use RVs in Oregon, but the state does charge a 1.5% tax for an RV registered to an LLC. You must register the RV within 30 days of purchase.

Pennsylvania

Pennsylvania charges 6% RV sales tax statewide, but the tax rate also varies by county. For example, the City of Philadelphia has an 8% tax rate, while Allegheny county has a 7% tax rate.

Rhode Island

Rhode Island charges a 7% RV sales tax on the purchase price after trade-in credits and allowances are deducted. You must register the RV within 30 days of purchase.

South Carolina

The sales tax rate in South Carolina is 6% , and you must register the RV within 30 days of purchase.

South Dakota

The sales tax rate in South Dakota is 4% , and you must register the RV within 45 days of purchase.

Tennessee’s RV sales tax rate is 7%.

Texas charges an RV sales tax rate of 6.25%, less any trade-in credits on the purchase amount. You must register the RV within 30 days of purchase.

There is an RV sales tax of 6.85% in Utah, along with an RV dealer documentation fee of $149 . You must register the RV within 60 days of purchase.

There is an RV sales tax of 6% in Vermont. You must register the RV within 60 days of purchase.

Virginia has an RV sales tax rate of 4.15% , and you must register the RV within 30 days of purchase.

There is an RV sales tax rate of 6.5% in Washington, and you must register the RV within 30 days of purchase.

West Virginia

West Virginia charges 6% sales tax on RVs and motorhomes, and you must register the RV within 30 days of purchase .

Wisconsin’s RVsales tax rate is 5%, but can come out to a total tax rate of around 5.51% after you factor in county taxes and stadium taxes. Some Wisconsin RV dealerships may also charge a service fee of $99.

Wyoming has a 4% sales tax on RVs for most parts of the state, but can go a little higher based on what part of the state you purchase in.

How To Avoid Sales Tax On An RV Purchase

When purchasing an RV, one of the significant expenses that buyers face is sales tax. However, there are ways to avoid paying sales tax on an RV purchase. Here are some ways to do it:

Register the RV Under a Legitimate LLC

One of the ways to avoid paying sales tax on an RV purchase is to register the vehicle under a legitimate Limited Liability Company (LLC). This business structure is similar to a Delaware corporation and can help reduce the sales tax liability.

RV buyers looking to avoid RV sales tax must ensure that they follow all the legal requirements and regulations when setting up an LLC to avoid any legal issues.

Buy an RV In a State With No Sales Tax

Another way to avoid paying sales tax on an RV purchase is to buy the vehicle in a state that does not charge sales tax.

Alaska, Delaware, Montana, New Hampshire, and Oregon do not charge sales tax on RV purchases.

RV buyers should be aware that some states (usually referred to as non-reciprocal states) may add sales tax when they make an out-of-state purchase.

Additional RV Ownership Costs and Deductions

Aside from sales tax, there are other costs associated with purchasing an RV that buyers should be aware of. These include registration fees, insurance costs, loan interest, personal property tax, and motor vehicle document fees .

Registration fees are typically charged by the state and vary depending on the size and weight of the RV. In some states, there may also be additional fees for emissions testing or safety inspections.

Insurance costs for RVs can also be higher than for regular cars due to the increased value and potential for damage. Buyers should shop around for insurance quotes and consider factors such as coverage limits and deductibles.

Loan interest is another cost to consider if financing the purchase of an RV. Interest rates can vary depending on the buyer’s credit score and the length of the loan.

Personal property tax is a tax on the value of personal property, including RVs, and is assessed by some states. However, some states may offer deductions for personal property tax paid on RVs.

In addition to these costs, there may be deductions available for RV owners when it comes to income tax. For example, RV owners may be able to deduct the interest paid on their RV loan or personal property tax paid on their RV.

It’s also important to note that some states may charge excise tax on the purchase of an RV, which is a tax on the sale or use of a product. Buyers should check with their state’s Department of Revenue to see if this applies to them.

Finally, buyers should be aware of motor vehicle document fees, which are charged by some states for processing RV registration paperwork. These fees can vary depending on the state and should be factored into the overall cost of purchasing an RV.

RV Ownership and Residency

When it comes to RV ownership and residency, there are a few things to keep in mind, especially when it comes to sales tax. In most cases, RV owners are required to register their vehicles and pay sales tax in the state where they reside or where the RV is primarily located.

For those who live in their RV full-time, establishing residency can be a bit more complicated. Most states require RV owners to have a legal residency in order to register their vehicle and obtain a driver’s license. This can include having a physical address, a mailing address, and proof of residency such as utility bills or a lease agreement.

Some full-time RVers choose to establish residency in states that have more favorable tax laws, such as those with no sales tax on RVs. However, it’s important to note that simply registering in a state with no sales tax may not be enough to avoid paying sales tax in the state where the RV is primarily located.

In some cases, RV owners may be able to establish their RV as their primary residence or secondary home for tax purposes. This can provide certain tax benefits, such as the ability to deduct mortgage interest and property taxes. However, it’s important to consult with a tax professional to ensure that all requirements are met and that the RV qualifies as a primary residence or secondary home.

Overall, RV ownership and residency can be a bit more complex than traditional home ownership. It’s important for RV owners to understand the requirements for registration and sales tax in their state of residence, as well as the potential benefits of establishing their RV as a primary residence or secondary home.

Out-of-State RV Purchase

Buying an RV out of state can be a great way to widen your search and find the perfect RV for your needs. However, it is essential to understand the consequences of an out-of-state purchase. Here are some things to keep in mind.

One of the most significant factors to consider when buying an RV out of state is sales tax. Each state has different sales tax rates, and some states do not charge sales tax on RV purchases. The five states that do not charge sales tax on new or used RV purchases are Alaska, Delaware, Montana, New Hampshire, and Oregon. If you live in one of these states or on the border, shopping there can save you a fair amount of money.

On the other hand, if you purchase an RV in a state with high sales tax rates, you may end up paying more than you bargained for. In some cases, you may have to pay sales tax in both the state where you bought the RV and the state where you register it . Double check both states’ regulations beforehand.

Registration Fees

Another factor to consider is registration fees. Each state has different registration fees, and some states charge more than others. When purchasing an RV out of state, you may be able to save money on registration fees by buying in a state with lower fees.

Delivery Options

If you purchase an RV out of state, you will need to figure out how to get it home. Some dealerships offer delivery options, which can save you time and money. However, delivery fees can be expensive, so be sure to factor them into your budget.

Travel Costs

If you decide to pick up your RV in person, you will need to factor in travel costs. This includes gas, food, lodging, and other expenses. If you are traveling a long distance, these costs can add up quickly. However, if the RV you are purchasing is saving you a significant amount of money, the extra travel costs may be worth it.

Professional Assistance and Resources

Navigating the different RV sales tax laws in each state can be a complicated process. Fortunately, there are resources available to help RV buyers make informed decisions and avoid costly mistakes.

One option is to seek the advice of a tax professional or lawyer who specializes in RV sales tax laws. They can provide valuable guidance on how to minimize sales tax liability and ensure compliance with state regulations. Additionally, they can assist with paperwork and other legal requirements to complete the sale.

RV dealers can also be a useful resource for buyers. They are familiar with the sales tax laws in their state and can provide guidance on how to properly register and title an RV. Some dealers may even offer financing options that can help buyers manage the cost of sales tax.

For those who prefer a do-it-yourself approach, there are several online resources available like RV forums or message boards full of helpful RVers who are ready to share firsthand experience and respond to RV-related questions.

RV as a Business Expense

When it comes to business expenses, many RV owners wonder if they can write off their RV as a business expense. The answer is yes, but there are certain conditions that must be met.

Firstly, the RV must be used for business purposes at least 50% of the time. This means that the RV must be used for activities that are directly related to the business, such as traveling to meet clients or attending trade shows.

Secondly, the RV must be used for business trips that are shorter than 30 days. This is because the RV will only count as transient lodging if the business trip is shorter than 30 days.

If these conditions are met, the RV owner can deduct expenses related to the RV as business expenses. This includes expenses such as gas, maintenance, and insurance.

It is important to note that if the RV is used for personal purposes, the expenses related to those personal purposes cannot be deducted. For example, if the RV is used for a family vacation, the expenses related to that vacation cannot be deducted as a business expense.

In addition, it is important to keep accurate records of all expenses related to the RV. This includes keeping receipts and tracking mileage. This will make it easier to calculate the amount that can be deducted as a business expense.

Ultimately, while it is possible to write off an RV as a business expense, it is important to ensure that the conditions are met and that accurate records are kept.

RV Purchase Considerations

When purchasing an RV, there are several factors to consider in order to get the best deal within your budget. Timing and location can play a big role in the cost of your RV purchase.

One consideration is the best month to buy an RV. Typically, the best time to buy an RV is during the off-season, which is usually from November to January. During this time, dealerships are looking to clear out inventory from the previous year and make space for new models. This can result in lower prices and more negotiating power for buyers.

It is also important to consider the overall cost of ownership. While a cheaper purchase price may seem like a good deal, there may be hidden costs to consider such as maintenance, repairs, and insurance. It is important to factor in these costs when determining your budget for an RV purchase.

When purchasing an RV, it is also important to find a unit that fits your needs. This can help you get more use out of the unit, which can make the cost of ownership drop considerably. It may be helpful to make a list of your must-haves and nice-to-haves before starting your search.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Terms and Conditions

- Sales Tax Compliance Platform

- Real Time Calculations

- Sales Tax Reports

- Nexus Insights

- Filing and Remittance

- Integrations

- Food and Beverage

- Mid-Market Business

- Small Business

- Resource Center

- Sales Tax Fundamentals

- Sales Tax by State

- Sales Tax Calculator

- Help & Support

- TaxJar & Stripe Tax

- Contact Sales

Featured content

Subscribe to our free sales tax newsletter

Resources Blog Services

Sales tax by state: are services taxable?

by Sarah Craig June 5, 2024

When researching sales tax laws, you’ll often see taxability rules for “tangible personal property” or “physical goods”. This is because most states wrote these laws with only physical goods in mind. Historically, most states defaulted to a mindset of “products are taxable, services are exempt”. However, that has changed significantly in recent years, making sales tax compliance for businesses offering services complex.

On top of changing legislation, there are different definitions of services for sales tax purposes. While there are a wide variety of services, services are generally organized into four categories:

- Business services: These include services for businesses such as advertising, computer services, human resources services, lobby and consulting and payroll services.

- Personal services: These include services such as dry cleaning, hair care, and tanning salons.

- Professional services: These include services provided by accountants, architects, attorneys, and doctors.

- Maintenance and repair services: These include services that are provided to tangible personal property (for example, cars, or your house) or improvements to buildings and land (for example, landscaping).

Software as a service (SaaS) is generally not included in service taxability legislation. Instead, it is treated as software. We outline SaaS taxability for each state in this blog post .

Additionally, it’s difficult to find accurate information on how to manage service taxability for each state. This often means digging into rulings and documented minutes from state legislature meetings to determine if you need to charge sales tax in a certain state. To help make this easier, we’ve compiled a quick reference guide to service taxability by state. To dig in deeper to service taxability for each state, click the link on the state name for more information.

Service taxability by state

Alabama – Services in Alabama are generally not taxable, with a few exceptions.

Alaska – Services are not taxable in Alaska.

Arizona – Services in Alaska are generally not taxable, with a few exceptions.

Arkansas – Many services are taxable in Arkansas.

California – Services are not taxable in California.

Colorado – Services are not taxable in Colorado.

Connecticut – Many services are taxable in Connecticut.

Florida – Services in Florida are generally not taxable, with a few exceptions.

Georgia – Services are not taxable in Georgia.

Hawaii – Services are generally taxable in Hawaii.

Idaho – Services in Idaho are generally not taxable, unless the service you provide includes creating or manufacturing a product.

Illinois – Services are not taxable in Illinois.

Indiana – Services are not taxable in Indiana.

Iowa – Many services are taxable in Iowa.

Kansas – Many services are taxable in Kansas.

Kentucky – Services in Kentucky are generally not taxable, with a few exceptions.

Louisiana – Services in Louisiana are generally not taxable, with a few exceptions.

Maine – Services in Maine are generally not taxable, but there are a few exceptions.

Maryland – Services in Maryland are generally not taxable, with a few exceptions.

Massachusetts – Services in Massachusetts are not taxable.

Michigan – Services in Michigan are not taxable.

Minnesota – Services in Minnesota are generally not taxable, with a few exceptions.

Mississippi – Many services are taxable in Mississippi.

Missouri – Services in Missouri are generally not taxable, but there are a few exceptions.

Montana – Services are not taxable in Montana.

Nebraska – Services are generally not taxable in Nebraska, with a few exceptions.

Nevada – Services in Nevada are generally not taxable.

New Hampshire – Services are not taxable in New Hampshire.

New Jersey – Many services are taxable in New Jersey.

Sales tax is complex, and always changing. But staying up to date on sales tax news is crucial for businesses. Sign up to stay on top of changes that can impact your sales tax compliance.

New Mexico – Most services performed in New Mexico are subject to gross receipts tax.

New York – Many services are taxable in New York.

North Carolina – Services are generally not taxable in North Carolina, with a few exceptions.

North Dakota – Services are generally not taxable in North Dakota, with a few exceptions.

Ohio – Many services are taxable in Ohio.

Oklahoma – Many services are taxable in Oklahoma.

Oregon – Services are not taxable in Oregon.

Pennsylvania – Many services are taxable in Pennsylvania.

Rhode Island – Services are not taxable in Rhode Island.

South Carolina – Services are generally not taxable in South Carolina, with a few exceptions.

South Dakota – Services are taxable by default in South Dakota, with a few exceptions.

Tennessee – Services are generally not taxable in Tennessee, with a few exceptions.

Texas – Many services are taxable in Texas.

Utah – Many services are taxable in Utah.

Vermont – Services are generally not taxable in Vermont, with a few exceptions.

Virginia – Services are generally not taxable in Virginia, with a few exceptions.

Washington – Many services are taxable in Washington.

West Virginia – Services in West Virginia are taxable by default, with some exceptions.

Wisconsin – Many services are taxable in Wisconsin.

Wyoming – Services generally not taxable in Wyoming, with a few exceptions

How to stay compliant with sales tax when you sell services

Managing all the moving parts of sales tax can be challenging. Are accounting services taxed? What about hair care or car maintenance? They may not be taxed in your state today, but sales tax laws change all the time. TaxJar makes it easier for you to stay current with it all, especially as you scale your business across states.

If you need to charge sales tax on services, TaxJar takes all of these state laws into account and makes your job simple. To learn more about TaxJar and get started automating your sales tax compliance, start a free, 30-day trial today.

The basics of US sales tax

Learn the fundamentals of sales tax.

Related posts

Does Arkansas charge sales tax on services?

Does Wyoming charge sales tax on services?

Does West Virginia charge sales tax on services?

Most popular posts.

Calculations

2024 sales tax holidays

Resale certificate, how to verify

Sales tax by state: Is SaaS taxable?

by TaxJar February 1, 2024

Sales tax by state: should you charge sales tax on digital products?

Distilled Spirits Taxes by State, 2024

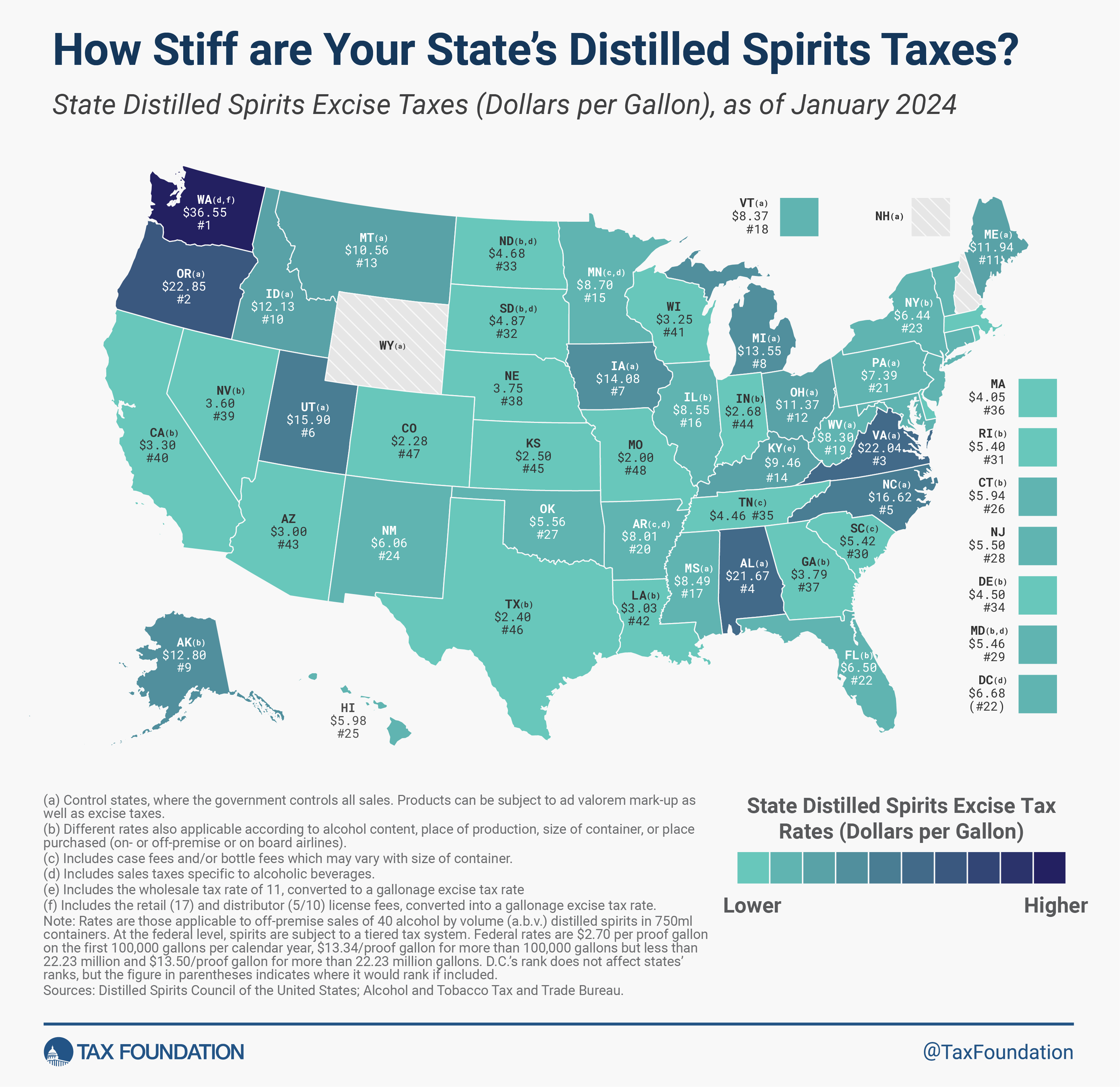

Distilled spirits lead American alcohol sales. In 2023, spirits sales (42 percent of market share) outpaced beer sales (41.9 percent of market share) for the second straight year. Newer products like spirits-based hard seltzers and ready-to-drink cocktails have fueled growth, while also blurring the lines of a categorical tax system . The result has been a spirited competition throughout the alcohol industry for market share, including calls to reform tax A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. policy.

Distilled spirits face the stiffest tax rates of all alcoholic beverages. These high tax rates are a combination of greater alcohol content in spirits than wine or beer and higher tax rates applied per alcohol content to spirits. A one-ounce shot of 40 percent alcohol-content spirit (0.4 oz of alcohol) carries greater taxes than an identical 12-ounce beer with 4.8 percent alcohol content (0.4 oz of alcohol).

Across states, a variety of policies are applied to the sale of distilled spirits. Data for this map come from the Distilled Spirits Council of the United States (DISCUS). To allow for comparability across states, DISCUS uses a methodology of estimating tax rates that combines the various ways in which spirits are taxed and sold.

In 17 states, the government operates a monopoly of state-controlled liquor stores. In these control states, the government can leverage its market power to artificially inflate prices in lieu of levying a formal tax. The data in the map represent the implied excise tax An excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda , gasoline , insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. rates in those states with government monopoly sales.

These data also include additional fees and sales taxes applied to spirits in addition to legislated excise taxes. The other taxes and fees include case and bottle fees, special sales taxes on spirits, wholesale taxes, and retail and distributor license fees. Distilled spirits tax rates may also differ within states according to alcohol content, place of production, or place purchased (such as on- or off-premises or onboard airlines).

Across states, Washington state levies the greatest excise tax rate on distilled spirits, at $36.55 per gallon. Rounding out the five stiffest rates are Oregon ($22.85), Virginia ($22.04), Alabama ($21.67), and North Carolina (16.62).

Distilled spirits are taxed the least in Wyoming and New Hampshire . These two control states gain revenue directly from alcohol sales through government-run stores and have set prices low enough that they are comparable to buying spirits without taxes. Missouri taxes are the next lightest at $2.00 a gallon, followed by Colorado ($2.28), and Texas ($2.40).

The disparity in tax rates across states underscores the complex tax and regulatory environment surrounding distilled spirits. As the product landscape continues to evolve, and calls for policy reform intensify, principled public policy changes should support both industry growth and responsible consumption with neutral, simple, and transparent taxes.

State Spirits Excise Tax Rates (Dollars per Gallon) As of January 1, 2024

Stay informed on the tax policies impacting you..

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Previous Versions

Distilled spirits taxes by state, 2023, distilled spirits taxes by state, 2021, distilled spirits taxes by state, 2020, distilled spirits taxes by state, 2019, distilled spirits taxes by state, 2018, distilled spirits taxes by state, 2017, distilled spirits taxes by state, 2016, distilled spirits taxes by state, 2015, distilled spirits taxes by state, 2014.

COMMENTS

If the department determines a value for a travel trailer or camper under RCW 82.50.425 equivalent to a manufacturer's base suggested retail price, any person who pays the tax for that travel trailer or camper may appeal the valuation to the department under chapter 34.05 RCW.

RV sales tax Oregon--No state RV sales tax, but 1.5% business tax for an LLC RV. Must be registered within 30 days of purchase. RV sales tax Ohio--5.75% and must register within 30 days of purchase. Pennsylvania RV sales tax--6% statewide 7% for residents of Allegheny County 8% for City of Philadelphia residents Must register within 20 days

82.50.530. Ad valorem taxes prohibited as to mobile homes, travel trailers or campers — Loss of identity, subject to property tax. HTML PDF. 82.50.540. Taxed and licensed travel trailers or campers entitled to use of streets and highways. CONSTRUCTION OF 1971 ACT. HTML PDF. 82.50.901.

Washington has a 6.5% statewide sales tax rate, but also has 183 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 2.434% on top of the state tax. This means that, depending on your location within Washington, the total tax you pay can be significantly higher than the 6.5% state sales tax.

Quarterly tax rates and changes. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and annexations. Use our local Tax rate lookup tool to search for rates at a specific address or area in Washington. Sign up for our notification service to get future sales & use tax rate ...

Use this search tool to look up sales tax rates for any location in Washington. Street Address: City: ZIP:--ZIP code is required, but the +4 is optional. Taxable Amount: Optional: To calculate sales and use tax only. Taxable Amount: Optional: To calculate sales and use tax only. Latitude: Decimal degrees (between 45.0° and 49.005°) Longitude:

Exemptions — Sales of motor vehicles, trailers, or campers to nonresidents for use outside the state. (1) The tax levied by RCW 82.08.020 does not apply to sales of motor vehicles, trailers, or campers to nonresidents of this state for use outside of this state, even when delivery is made within this state, but only if:

Arkansas. If you buy a motorhome that costs more than $4,000 in Arkansas, you must pay a sales tax of 6.5% plus the county and local city tax rates. Motorhome purchases of less than $4,000 aren't applicable for the state sales tax. You will also need to register your new RV within 30 days.

We use a vehicle or vessel's fair market value (see below) to calculate use tax. The use tax is the sum of the 0.3% motor vehicle sales and use tax and the sales tax rate at the buyer's address. Contact a vehicle and vessel licensing office if you have questions about whether you must pay use tax. Visit the website of the Washington Department ...

Oklahoma. Oklahoma charges a flat fee RV sales tax of $20 for the first $1,500 spent on any RV. The sales tax is 3.25% of the total purchase price after the initial $1,500. Oregon. There is no RV sales for personal use RVs in Oregon, but the state does charge a 1.5% tax for an RV registered to an LLC.

According to the Sales Tax Handbook, a 6.5 percent sales tax rate is collected by Washington State. On top of that is a 0.3 percent lease/vehicle sales tax. This means that in total, the state tax ...

Generally, use tax applies to trucks and trailers primarily garaged in Washington if not used at least 25% in interstate commerce. Use tax applies even though the property may have qualified for a sales tax exemption at the time of purchase. Use tax exemptions. Trucks and trailers are exempt from use tax if all of the following conditions are met:

Follow the steps to transfer ownership of a vehicle to apply for a title and registration. If you have a camper that is attached to a vehicle registered in Washington, the camper must also be licensed in Washington. Campers are not eligible for collector plates. If the camper is 10 years old or newer, you must complete the Recreational Vehicle ...

Washington. View Makes | View Used | Find RV Dealers in Washington | About Travel Trailer RVs. View our entire inventory of New Or Used Travel Trailer RVs in Washington and even a few new non-current models on RVTrader.com. Top Makes. (859) Forest River. (299) Jayco. (266) Keystone. (213) Grand Design. (200) Airstream.

The use tax rate, unlike the sales tax rate, is calculated on where you first use the article in Washington, not where the sale takes place. The state portion of the tax is 6.5 percent. Local governments impose their own additional use tax. Depending on the rate of local tax, the combined use tax rate ranges from 7 percent to 9 percent.

New residents who move to Washington may be exempt from use tax on the vehicle brought into the state. To qualify for the exemption, the "private motor vehicle" must have been acquired and used in another state more than 90 days before moving to Washington. The vehicle must also be licensed in Washington within 30 days of moving to this state.

Recreational Vehicle Data Use Tax. Complete the Recreational Vehicle Data Use Tax form if the motor home is 20 years old or newer. Washington State Patrol inspection. We will require a WSP inspection in these situations: The motor home is homemade. It is assembled from a conversion kit by someone other than a licensed motor home manufacturer.

Hawaii - Services are generally taxable in Hawaii. Idaho - Services in Idaho are generally not taxable, unless the service you provide includes creating or manufacturing a product. Illinois - Services are not taxable in Illinois. Indiana - Services are not taxable in Indiana. Iowa - Many services are taxable in Iowa.

Across states, Washington state levies the greatest excise tax rate on distilled spirits, at $36.55 per gallon. Rounding out the five stiffest rates are Oregon ($22.85), Virginia ($22.04), Alabama ($21.67), and North Carolina (16.62). Distilled spirits are taxed the least in Wyoming and New Hampshire. These two control states gain revenue ...

Complete a bill of sale. Before the buyer can apply for a new title and pay fees or taxes on the vehicle, you'll both need to sign a Bill of Sale, unless the sale price and date are included on the title. Not to be confused with a Report of Sale, the Bill of Sale includes information about the vehicle, as well as the buyer and seller.