ASDA Travel Money

Find out more about asda's travel money options with our useful guide..

In this guide

What services does ASDA offer?

What currencies can i order through asda, how much can i transfer with asda, how soon can i get my money, how safe is my money, are there any fees i might have to pay, customer service information for asda travel money.

ASDA is a British supermarket headquartered in Leeds, West Yorkshire. Founded in 1965, ASDA is now owned by American retail giant Walmart after a £6.7Bn takeover in 1999.

ASDA offers three services:

- In-store cash. You can buy foreign currencies at several stores across the country. It’s a good idea to call beforehand to make sure they have the funds you require available.

- Cash delivieries. You can buy foreign currency via the post and get it delivered to your door (minimum £500). Once you’ve completed your order, it will be sent out by secure post as soon as it is ready.

- ASDA Money CurrencyCard. Like cards offered by other companies, the ASDA Money CurrencyCard is accepted wherever you see the MasterCard Symbol.

Here’s a list of the currencies that are available with ASDA:

- Australian Dollar (AUD)

- Canadian Dollar (CAD)

- East Caribbean Dollar (XCD)

- Bahraini Dinar (BHD)

- US Dollar (USD)

- Barbados Dollar (BBD)

- Brunei Dollar (BND)

- Bulgarian Lev (BGN)

- Cayman Islands Dollar (KYD)

- Chilean Peso (CLP)

- Chinese Yuan Renminbi (CNY)

- Costa Rican Colon (CRC)

- Croatian Kuna (HRK)

- Czech Koruna (CZK)

- Danish Krone (DKK)

- Dominican Peso (DOP)

- Fiji Dollar (FJD)

- Hong Kong Dollar (HKD)

- Hungarian Forint (HUF)

- Iceland Krona (ISK)

- Rupiah (IDR)

- New Israeli Sheqel (ILS)

- Jamaican Dollar (JMD)

- Japanese Yen (JPY)

- Jordanian Dinar (JOD)

- Korean Won (KRW)

- Kuwaiti Dinar (KWD)

- Malaysian Ringgit (MYR)

- Mauritius Rupee (MUR)

- Mexican Peso (MXN)

- New Zealand Dollar (NZD)

- Norwegian Krone (NOK)

- Omani Rial (OMR)

- Philippine Peso (PHP)

- Polish Zloty (PLN)

- Qatari Rial (QAR)

- Saudi Riyal (SAR)

- Singapore Dollar (SGD)

- South African Rand (ZAR)

- Swedish Krona (SEK)

- Swiss Franc (CHF)

- New Taiwan Dollar (TWD)

- Thai Baht (THB)

- Turkish Lira (TRY)

- UAE Dirham (AED)

- Brazilian Real (BRL)

- Australia (AUS)

- Canada (CAN)

- Anguilla (AIA)

- Austria (AUT)

- Bahrain (BHR)

- United States (USA)

- Belgium (BEL)

- Brunei (BRN)

- Bulgaria (BGR)

- Cayman Islands (CYM)

- Chile (CHL)

- China (CHN)

- Costa Rica (CRI)

- Croatia (HRV)

- Cyprus (CYP)

- Czech Republic (CZE)

- Denmark (DNK)

- Dominican Republic (DOM)

- Estonia (EST)

- France (FRA)

- Germany (DEU)

- Greece (GRC)

- Hong Kong (HKG)

- Hungary (HUN)

- Iceland (ISL)

- Indonesia (IDN)

- Ireland (IRL)

- Israel (ISR)

- Italy (ITA)

- Jamaica (JAM)

- Japan (JPN)

- Jordan (JOR)

- South Korea (KOR)

- Kuwait (KWT)

- Latvia (LVA)

- Lithuania (LTU)

- Luxembourg (LUX)

- Malaysia (MYS)

- Malta (MLT)

- Mexico (MEX)

- Netherlands (NLD)

- New Zealand (NZL)

- Norway (NOR)

- Philippines (PHL)

- Poland (POL)

- Portugal (PRT)

- Qatar (QAT)

- Saudi Arabia (SAU)

- Singapore (SGP)

- Slovakia (SVK)

- Slovenia (SVN)

- South Africa (ZAF)

- Spain (ESP)

- Sweden (SWE)

- Switzerland (CHE)

- Taiwan (TWN)

- Thailand (THA)

- Turkey (TUR)

- United Arab Emirates (ARE)

The minimum ASDA will process is £50 worth of currency in-store and for deliveries.

The maximum in cash is £2,500

If you place your order before 2pm between Monday and Thursday, you will have your money the next day if you choose next-day delivery . If you wish to collect in store, 24 hour notice is needed for Euros and US dollars, and 72 hours for other currencies.

If you are getting money delivered and are not home, a card will be left as the parcel needs to be signed for. The card will let you know where to collect your money from.

The only fee you’ll have to pay is the postage fee. This only applies on orders under £500. There is also an inactivity fee on the CurrencyCard – please make sure to look at the terms and conditions when getting a card.

We show offers we can track - that's not every product on the market...yet. Unless we've said otherwise, products are in no particular order. The terms "best", "top", "cheap" (and variations of these) aren't ratings, though we always explain what's great about a product when we highlight it. This is subject to our terms of use . When you make major financial decisions, consider getting independent financial advice. Always consider your own circumstances when you compare products so you get what's right for you. Most of the data in Finder's comparison tables has the source: Moneyfacts Group PLC. In other cases, Finder has sourced data directly from providers.

Charlie Barton

Charlie Barton was a publisher at Finder. He specialised in banking and investments products, including banking apps, current accounts, share-dealing platforms and stocks and shares ISAs. Charlie has a first-class degree from the London School of Economics, and in his spare time enjoys long walks on the beach. See full profile

More guides on Finder

Raspberry Pi recently went public with an initial public offering (IPO), listing on the London Stock Exchange (LSE) – here’s what we know so far and what might happen next.

Charles Schwab now offers a brokerage service to UK investors. Find out what Finder’s investing expert thought when testing and using this broker.

Find out the cost and car insurance group of BMW i3, and see how much you could pay based on age, location and model.

Are switching deals worth the stress these days? Here’s how to bag the most cash and keep your cool in the process.

A recent Freedom Of Information request made by the comparison site, Finder, has found that millions of people could be trapped in Help To Buy (H2B) ISAs, with nearly 2.2 million H2B ISAs currently open.

Full members can now redeem their Yonder points on any flight booking.

Advertising features from our award-winning team are finance like you’ve never seen it before. Here’s how it works.

Sponsored content from our award-winning team is finance like you’ve never seen it before. Here’s how it works.

Premium content with sponsorship is made by our award-winning team. It’s finance like you’ve never seen it before. Here’s how it works.

Open a new current account with The Co-operative Bank and take advantage of the latest switching bonus.

6 Responses

I ordered money online, got a date to collect it but I can’t make it to that date. Can I collect it the next day?

Thank you for your comment.

Yes, you can collect it the next day. Please note that as soon as the store receives your order, they will send you a text message or email to tell you that it’s available for collection. Your order will be held in store for 10 days, after this time it will be returned to their depot and you will be refunded.

Should you wish to have real-time answers to your questions, try our chat box on the lower right corner of our page.

Regards, Jhezelyn

When buying foreign currency from Asda, are there any commission charges? My credit card receipt showed a figure but my credit card statement showed a higher figure. I bought US and Canadian dollars.

Hello Royston,

Upon checking, Asda money will buy back most foreign currency notes you have at 0% commission, whether you bought the currency from them or not. In addition, you will not be charged a card processing fee by Asda if you choose to pay by debit or credit card. However, your card issuer may apply additional charges and they recommend that you check this with your card provider before you buy currencies.

How long have you got to collect an order

Thanks for reaching out to finder.

If you fail to collect your order from ASDA nominated locations within 4 working days of the collection time then your order will be marked as non-collected. Your order will then be cancelled and will be automatically refunded onto the payment card at the daily buy back rate minus an administration charge of £15.

I hope this helps.

Cheers, Charisse

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Asda Travel Money 4+

Travelex global, designed for iphone.

- #180 in Finance

- 4.7 • 1.4K Ratings

iPhone Screenshots

Description.

Take the hassle out of travelling with Asda Travel Money. Manage your Asda Travel Money Card or top your travel money on the go via the app. With the app you can easily reload your card, check your balance and recent transactions. The Asda Travel Money Card is the perfect travel companion with: 16 currencies to choose from Free ATM withdrawals worldwide* Safe and Secure No links to your bank accounts Millions of locations to choose from Pin protected to safeguard against fraud Lock in your exchange rates Accepted anywhere Mastercard® Prepaid is accepted 24/7 global assistance to replace your card or provide you with emergency cash You can also order cash in the app to lock in our very best rates on your foreign currency. Whether you are looking for euros, dollars or one of our other 50 currencies, we can deliver to your home or you can pick up in store. Want to get in touch? Email us at [email protected] *Although we at Asda Travel Money do not charge ATM fees, please check the ATM before using it as some operators may charge their own fees. Asda Money Currency Card is issued by PrePay Technologies Limited (PPS) pursuant to license by Mastercard International. PPS is an electronic money institution authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN:900010) for the issuing of electronic money and payment instruments, with its registered office at Floor 6, 3 Sheldon Square, London, W2 6HY, UK. PPS is registered in England under company number 04008083. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Asda Travel Money ordered via the app is provided by Travelex Currency Services Limited, registered number 04621879 with registered address Worldwide House, Thorpewood, Peterborough, PE3 6SB If you have any feedback on the experience of our app we’d love to hear it; email us at [email protected]

Version 30.8

Welcome to the new version of ASDA Travel Money! We've improved our app to make a smoother, faster, and more secure experience with exciting features added just for you. Now you can easily view your PIN and card details directly in the app, and enjoy an improved transaction history that makes tracking your spending effortless.

Ratings and Reviews

1.4K Ratings

Easy to use, if you don’t want to carry notes around, you can use this card aboard, even add extra on the app from your debit card. Would definitely recommend and use for future holidays

Developer Response ,

Hi. Thank you so much for your review! Kind regards, Online Support Team

Terrible app and customer service

I am currently in Spain, brought the Asda Travel Money card before departing the UK. I downloaded the app for ease. It took me around 20 plus attempts just to register my card! Once registered, it just keeps crashing. I can’t see my balance or top up the card. After many attempts, I reluctantly called customer service, which kept dropping the call. I tried one last time only to receive a voicemail saying they are having technical issues and to call back in 4 hours! I am due to head out for the day, but now have to stay at in as I cannot top up my card. Absolute shambles! You would think a multi billion pound company would have a workable app / service. I am trying to give you money for goodness sake! I would give it a zero if I could. Thanks for spoiling my holiday.

Hi, sorry to hear this, so we can investigate the issue further, please can we ask you to email us at [email protected] so that we can follow up and perhaps provide a resolution. Kind regards, Online Support Team

Get ready for a hassle

When opening the travel card at the Asda branch, they failed to inform me that this card has one of the most pointless policies I have ever heard, it can only be topped up once every 24hrs. Luckily I tried to top it up before my flight as I would have found myself with no money on the card before the initial 24hr period. Now, when registering on the app, I would continuously receive the prompt stating I have entered incorrect information. So had to call customer service and they confirmed the info was indeed correct and then they had to register my details on the account before setting up the app.

App Privacy

The developer, Travelex Global , indicated that the app’s privacy practices may include handling of data as described below. For more information, see the developer’s privacy policy .

Data Linked to You

The following data may be collected and linked to your identity:

- Financial Info

- Contact Info

- Identifiers

Data Not Linked to You

The following data may be collected but it is not linked to your identity:

- Diagnostics

Privacy practices may vary based on, for example, the features you use or your age. Learn More

Information

- Developer Website

- App Support

- Privacy Policy

Get all of your passes, tickets, cards, and more in one place.

More by this developer.

Travelex Travel Money

You Might Also Like

ASDA Money Credit Card

Sainsbury's Bank Travel Card

Hays Travel Currency Card

Creation Credit Card

Cash Passport

Asda Travel Money

About this app

Data safety.

What's new

App support, more by travelex central services limited.

Find out more about sending money to your location of choice.

Read our range of money transfer and banking guides.

Reviews and comparisons of the best money transfer providers, banks, and apps.

Unlock efficient global money movement for your business.

A Guide to Travel Money Cards

Often deemed the cheapest way to spend money abroad , travel money cards are deemed a failsafe option for many travellers. Given the rapid growth of the financial services sector, we want to find out if travel money cards are still as cutting edge as they once were, by comparing them to the new alternatives. Our job is to identify the best international money transfer services and payment providers in the industry: will travel money cards make the cut?

What are travel money cards?

Travel money cards are a popular payment method for individuals headed abroad. Customers will load funds onto the card, using the money as foreign currency when overseas, much like a debit card is used at home. Also known as travel money prepaid cards or currency cards, they facilitate free foreign transactions and overseas ATM withdrawals.

We recommend finding a travel money card which lets you lock-in a favourable exchange rate and supports multiple currencies on one card, to make sure you are securing a flexible and cost-effective deal.

How do you use a travel money card?

Using a travel money card should be straightforward and stress-free. Simply load funds onto the card before you leave, and once abroad, you will be able to reload funds and change currencies using the website or associated money transfer app . The card can be used to make withdrawals, in-store purchases and book travel arrangements.

Where can I get a travel money card?

Travel money cards are available from different retailers and can be purchased and preloaded online, over the phone or in-store, depending on the brand. In the UK, popular brands include Travelex and the Post Office.

Where can I use a travel money card?

Again, this depends on the brand and where you get your money travel card from. Available currencies vary from card to card but commonly used currencies include US Dollars, UK Pound sterling, Euros, Japanese Yen and New Zealand Dollars. Make sure you check with the provider before ordering a travel money card.

How secure are travel money cards?

Generally, travel money cards are considered a lot safer than handling multiple currencies in cash, or travellers cheques, as your provider will be able to cancel it if need be. Furthermore, some of the best travel money cards employ an equivalent level of security to traditional debit cards, including a PIN code, touch ID and face recognition.

Many consider it safer to use a travel money card abroad than a debit card, as they are not associated with your bank account and therefore cannot be linked if lost or stolen.

Travel money cards vs. Credit cards: What is the difference?

One of the biggest advantages of using a travel money card is that your chosen currency is preloaded before you arrive in the foreign country and you won’t be charged conversion fees. This means you are able to benefit from the most favourable exchange rates, locking it in ahead of time and using the funds at a later date.

Most people who use their credit card abroad do it because it is more convenient. The cost of this convenience, however, can sometimes amount to 3 - 5% per use, depending on the transaction and financial institution. Making a foreign ATM withdrawal with your credit card can incur flat-fees of $5 and up, each time.

This being said, there are some excellent traveller credit cards on the market, so we would recommend users compare exchange rates and transfer fees offered by each provider before making a decision on which card is more beneficial.

If you're planning on using your credit card, we suggest you take a look at our credit card wire transfer guide.

What are the alternatives to travel money cards?

Multi-currency accounts.

International money transfer companies are often tailoring their products and services to meet the needs of their customers. Wise , offers a multi-currency account designed with “international people" in mind. This savvy travel credit card is aimed at frequent flyers who want to spend in various currencies in over 200 countries. Wise is a reliable company to trust with your overseas spending habits.

Challenger banks

More and more alternative service providers are popping up around the world, many of them offering reputable banking features for the modern traveller. In a bid to distinguish themselves from traditional banks, challenger banks are scrapping fees on foreign exchange and international spending. Monzo customers, for example, can benefit from free international ATM withdrawals as well as fee-free spending overseas.

We hope this guide to travel money cards has enlightened you and helped you make a decision about whether this is a suitable payment method for your next trip overseas. We appreciate the value of your hard-earned cash and want all our customers to benefit from the best possible rates when dealing with international payments. Use our comparison tool today to make sure you are offered the most desirable exchange rate for your currency.

Related Content

- Revealed: Summer Cruises Increase your CO2 Emission by 4700% per KM vs Train Travel Travelling by cruise ship rather than train this summer could increase passengers’ CO2 emissions each kilometre by 4716%, MoneyTransfers.com can reveal. May 3rd, 2024

- 10 Years of Data Predicts the Go-to Holiday Destinations for Brits Now COVID Is Over To establish the expected changes to tourism and GBP(£) spend abroad going forwards, MoneyTransfers.com analysed 10 years' worth of UK travel data from the Office for National Statistics (ONS) - 2009 - 2019, to discover and predict where Brits will be travelling to in the next 10 years now that travel is well and truly back on again since Covid! May 22nd, 2024

.jpg)

- A Guide to Travellers Cheques The history of the travellers cheque spans as far back as 1772 when the first of its kind was issued by the London Credit Exchange Company, in the UK. Over the coming centuries the concept became popularised on a global scale, with major banks and financial institutions adopting this form of travel money in the 20th century. American Express became the largest issuer of travellers cheques and continues to offer these services to customers to this day. May 3rd, 2024

- Millennial Guide For Baby Boomers & Generation X We looked over the stats for the past few years, and found that out of £1.5 billion payments abroad, 1 in 5 debit cards payments are made by the UK residents travelling abroad and credit card payments made outside the UK has increased in recent years, reaching 467 million payments. May 3rd, 2024

Contributors

April Summers

- Prepaid cards >

- Guides >

- How Do Prepaid Travel Cards Work?

How do prepaid travel cards work?

Prepaid travel cards are a handy and cost-effective way to manage your holiday money. Find out more, including how to choose the right card for your needs.

Prepaid currency cards, also known as multicurrency cards, travel money cards, prepaid travel cards and forex cards, are designed to be a safe and straightforward way to use money abroad.

Providers often have slightly different rules for their prepaid cards, but typically, you load money onto them before your holiday and then use them like regular bank cards while you’re away. That means you can use them for everyday spending and even cash withdrawals.

There are two main types.

Multi-currency cards allow you to load numerous currencies onto one card. You choose the currency you need and then add cash at an agreed-upon exchange rate. This can be a great way of locking in rates and is handy if you’re travelling to several countries.

Prepaid sterling cards allow you to load money in pounds, which is exchanged when you use it abroad. The downside of this is that you won’t know what rate you’ll get and could be impacted by currency fluctuations.

Never use a credit card to top up a prepaid card, as this counts as a cash withdrawal and could lead to hefty fees from your credit card company. Instead, use a debit card or bank transfer.

Learn more about withdrawing cash while abroad

What exchange rate will I get on my prepaid card?

The exchange rate you get depends on the provider. Some offer the interbank rate (the rate banks charge each other), some use the rates set by Mastercard or Visa, while others add their own foreign exchange fee. Finding a card that pays the interbank rate will give you the best deal overall.

Find out how to avoid currency conversion while abroad

What fees and charges apply to a prepaid card?

Checking all the fees and charges before choosing a prepaid card is essential. Some will have few or no fees, while others will have a long list.

The key ones to look out for are:

Application fees – a charge for getting your first card, often £5-£10

Replacement fees – a charge if your card is lost or stolen, or, in some cases, to replace the card after a year, meaning you’ll need to pay to keep using it and access your funds

Transaction fees – usually charged as a percentage or a flat fee when you use the card to make purchases

Withdrawal fees – a cost for using the card to withdraw money at a cashpoint

Inactivity charges – some providers will charge a fee if you don’t use the card within a certain period – for instance, a month

Advantages and disadvantages of a prepaid travel card

Advantages of a prepaid travel card

You can lock in advantageous rates by loading money in advance

It’s easier to set and stick to a budget

Thieves only have access to the funds loaded on the card if it’s stolen

Many prepaid travel cards have helpful security features, such as enabling you to use an app to block a card that’s gone missing

Perks like cashback or travel insurance are available with some cards

Disadvantages of a prepaid card

Some have long lists of fees and charges, including replacement fees you need to pay every year

There are maximum loading or withdrawal limits on some cards

You can’t always use them to hire cars or at petrol stations

Sometimes, you have to pay for a replacement card if yours goes missing

Not all cards are widely accepted everywhere - you should check which cards work in your destination country before applying

What to consider when getting a prepaid travel card

When choosing a card, the first thing to check is that it offers the currency you need. Some cards provide just a few options, while others have more than 50.

Next, you should check the exchange rate you’ll get. Ideally, you want the interbank rate. However, some have quirky rules. For instance, Revolut offers the interbank rate from Monday to Friday but charges up to a 1% fee on weekends. You can beat this by loading the card during the week to spend on Saturday and Sunday.

Unless you’re a frequent traveller, avoid cards that charge a fee if you don’t use them. And make sure that any cash withdrawal limits suit your spending needs.

Alternatives to prepaid travel cards

Prepaid cards aren’t the only way to get a good deal on your travel money. You should also consider the following methods.

Specialist travel debit and credit cards

Most credit and debit cards are expensive to use abroad because they charge foreign transaction fees, sometimes with a chunky flat fee on top. However, specialist cards often provide fee-free spending and interbank exchange rates. Lots also have perks such as cashback or free cash withdrawals. Opting for a credit card will give you Section 75 protection, but you must pay it off in full each month to avoid hefty interest charges.

Foreign currency

If you want to exchange foreign currency for cash, shop around ahead of your trip. Avoid getting holiday money at the airport unless it’s an emergency, as it’s typically very expensive (even pre-booking an exchange and picking up money at the airport can be cheaper than arranging it at the last minute). Getting money online, at a local exchange or at the post office will almost always result in a better deal than using airport bureaux.

Learn more about travel money

Whether you need a prepaid card for spending overseas, easy budgeting or due to bad credit, we can find the right option for you by comparing some of the best deals around.

You may also like

- What is the difference between Visa and MasterCard?

- How to use a prepaid card

- Should you get a prepaid card?

- What are prepaid cards?

- Chargeback claims: How to get your money back

Prepaid cards

Prepaid travel cards

Business prepaid cards

About Sara Benwell

ASDA Kirkcaldy Travel Money Bureau

Opening hours, store hours:.

Please Wait...

Can't remember your password?

- Click ' Forgot Password '

- Confirm your account details

- An email with a link to reset your password will be sent to you

- If you need help with accessing your account please call Card Services at 0800 260 0355 from the UK or +44 203 284 8395 from abroad

Please check your email

Please enter your 6 digit One Time Passcode

Need an account? Register your card

Asda Travel Money Card is issued by PrePay Technologies Limited pursuant to licence by Mastercard® International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

ASDA Travel Money Review: Is It Safe? How Does It Work? What Are the Rates?

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Is Asda Money Transfer the best option for sending money abroad? Compare your options to make sure you get the best exchange rate and lowest fees for your transfer.

What Monito Likes About Asda Money Transfer

- Wide availability across the U.K.

- A range of online, local, foreign transfer and travel card services

- Asda Travel Money services are safe, secure and regulated

What Monito Dislikes About Asda Money Transfer

- Exchange rates can be considerably more expensive than the base exchange rate or exchange rates from other providers

- Local bureau de change rates can be more expensive still

- Fixed fee for international wire transfers can be expensive for sending smaller amounts

- Very poor reviews from customers

Compare Cheaper Travel Money Cards

Read our in-depth guide for the best travel cards in the UK that will reduce or eliminate foreign transaction fees, ATM fees, and expensive currency conversion fees.

Our Independent Review of Asda Travel Money

Asda Travel Money is a currency exchange provider offered by the popular U.K. supermarket chain. Asda travel money lets you exchange money at a bureau de change, have foreign currency delivered to your home or transfer money to a foreign bank account.

Asda is a large U.K. supermarket with many travel money stores across the U.K. This makes their money transfer services widely accessible and easy to use. They offer currency exchange and transfers into more than 50 currencies.

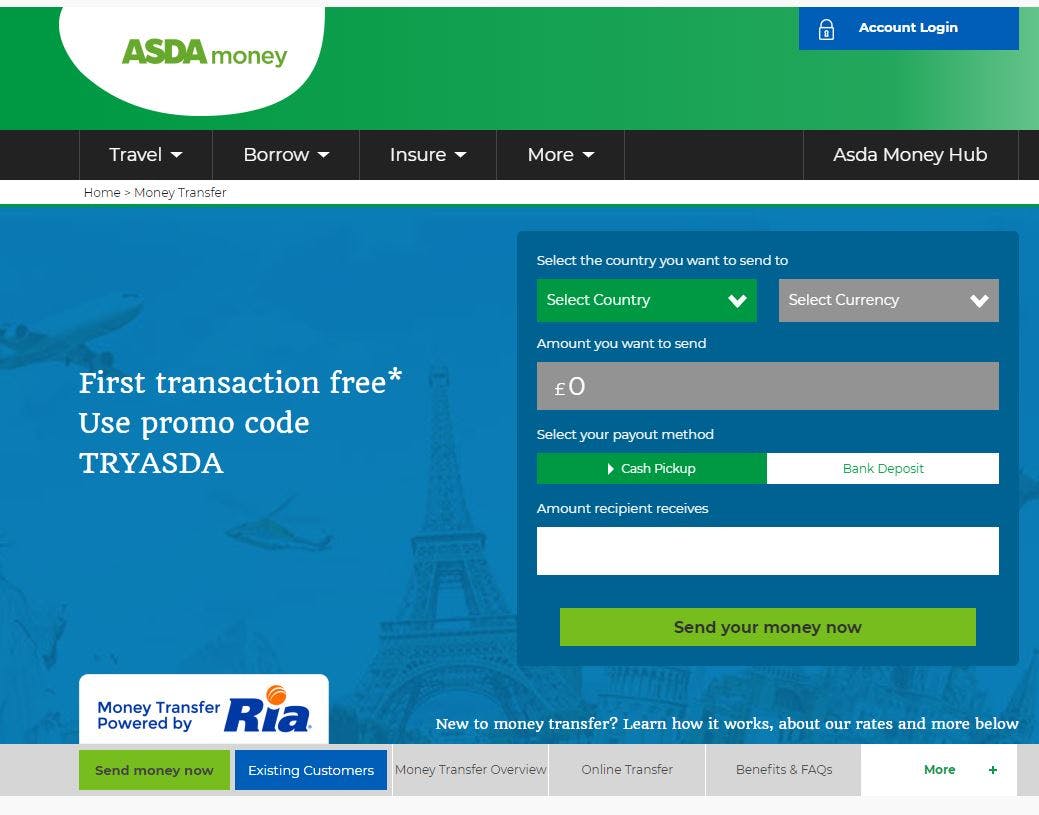

Asda Money Transfers to Foreign Bank Accounts

Asda has partnered with Ria to offer direct, bank-to-bank transfers for when you want to make an international payment or send money to a friend or family member living in another country. We’ve provided exchange rates and fees for international money transfers through Asda below, and it’s important to note that their charges are higher than many of their competitors.

Signing up for an account is free, then you just need to select where you’re sending money, add the beneficiary's details and make a payment. Asda / Ria will then convert the money and deposit it in the beneficiary’s account. You can get your first transfer for free by redeeming a code on the money transfer website.

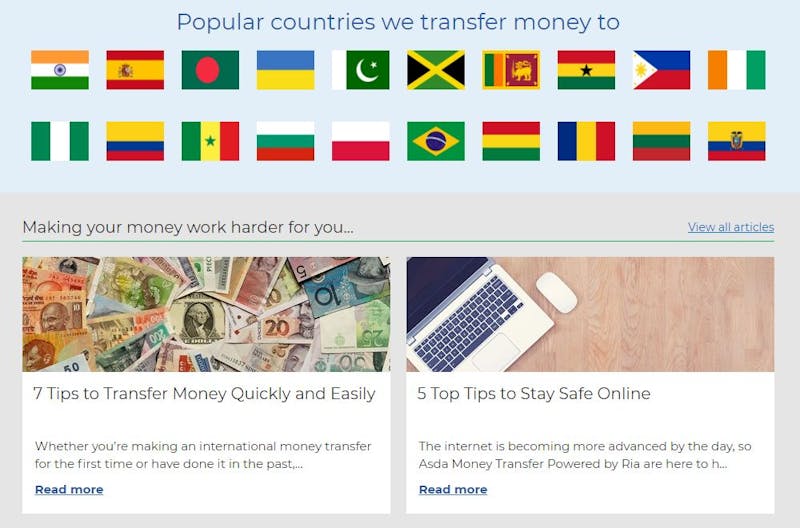

Asda Money Transfers for Local Currency Pickup

Asda’s partnership with Ria also allows you to send money for collection in cash from a foreign agent location. Ria have over 350,000 locations around the world in over 140 countries where the beneficiary can get their money.

Asda Currency Exchange at Local Bureaux de Change

Asda also provides immediate money exchange at 140 locations across the U.K. These locations are open seven days a week with same-day collection on many popular currencies.

Asda “Click and Collect” Foreign Currency Exchange

Asda allows you to order and pay for your foreign currency online. You can choose to have it delivered to your home or to an Asda travel money store. They provide free home delivery for orders of £500 or more, or you can get home delivery for £3.95 for exchanges under that amount.

Asda Money Currency Card

Asda provides a prepaid currency card. You can order and top-up an Asda travel card and then use it to withdraw money from cash machines around the world or pay for products and services in the 36,000,000 locations that accept Mastercard. The travel card is available in seven currencies: Euros, U.S. Dollars, South African Rand, Australian Dollars, Canadian Dollars and New Zealand Dollars. You can top up your travel card at an Asda money store, online, by phone or through online banking.

Paying for Asda Money Services

You can pay for most services with Visa, Visa Delta, MasterCard, Maestro or Solo.

You will not be charged a card processing fee by Asda if you pay by debit or credit card. However, a card issuer may apply additional charges so you should check with them before ordering and paying.

Asda Exchange Rate Guarantee

Asda provides a price match guarantee on local bureau de change orders. This does not apply to online orders. Here’s what Asda says about their exchange rate guarantee (ERG):

- “We guarantee to beat the rate of any other walk-in bureau currency exchange provider within 5 miles of an Asda Travel Money bureau. You must confirm the rate, currency, bureau name, location, and time and date the rate was offered, prior to the completion of the sale.

- ERG is subject to rate verification, applies only to transactions where you are exchanging Pounds Sterling for personal use into any of the foreign currencies sold and in stock at the time of purchase. Excludes Sterling products. Not available in conjunction with any other offer related to exchange rates.

- ERG is only available at the in-store Travel Money bureau. The 5 miles are measured from the Asda Store address using the AA Route Planner.

- We will not refund your transaction to offer you a better rate if you try to use the Asda Rate Guarantee after you have purchased your foreign currency from us.

- ERG applies to competitor exchange rates available in the ordinary course of business and does not apply to exchange rates which are only available to staff.”

Asda exchange rates may vary whether you are buying in-store, online or over the phone.

Asda Money Transfer Fees & Exchange Rates

Asda Travel Money does charge fees for some specific services, like certain activities on their travel card or for international money transfers. In most cases, they make their money on the difference between the “base,” interbank* exchange rate and the exchange rate that they charge to you.

*The interbank rate is also known as the mid-market or standard exchange rate, which is the midpoint between the buying and the selling prices of the two currencies.

Asda Travel Money Money Card Fees

- There is no fee added by Asda for topping up your travel card with a debit or credit card.

- If an ATM withdrawal or point of sale transaction is made in a currency which is different to the currency on the card, the foreign exchange rate used is the rate determined by Mastercard on the day of the transaction plus a foreign exchange fee of 5.75%.

- If you have not used your travel card for 12 months, there is a monthly inactivity fee of £2

- There is a cash over-the-counter fee for withdrawing money at a bank or bureau de change of £4

- There is a cashout fee of £6 through card services

Asda Travel Money Money Card Limits

Asda Travel Money does have limits for its prepaid money card.

- The minimum amount you can load onto the card is £50

- The maximum amount you can withdraw in 24 hours is £500 at a cash machine

- The maximum amount you can spend at merchants in 24 hours is £3,000

- The maximum amount you can have on your card is £5,000 and you can’t load more than £18,000 in a 12-month period

- There is a cash over-the-counter limit for withdrawing money at a bank or bureau de change of £150

Overseas Money Transfer Fees

Asda Travel Money does charge a fee for sending money directly to some countries. The example fees they list are:

- Pakistan from £3

- Poland from £2

- The Philippines from £2.50

- New Zealand from £7

They also list fees as follows:

- Send between £1.00 and £100 for £4

- Send between £100.01 and £1,000 for £7

- Send between £1,000.01 and £1,800 for £13

The most you can send in an international transfer is £1,800.

About Fees Levied by Banks

Certain fees may be levied by banks when you are transferring money to another account. These fees are outside the control of Asda Travel Money. Circumstances where banks may charge additional fees include:

- Wire transfers into or out of sender or beneficiary accounts

- Transfers that are sent via SWIFT or certain other banking protocols

- Beneficiary banks charging a fee to receive a transfer

- Intermediary banks charging fees to process money in transit

These fees could mean that the beneficiary receives less money than stated by Asda Travel Money due to circumstances beyond Asda Travel Money’s control. If you want to understand what these extra fees are likely to be, please contact your bank and the beneficiary's bank.

Asda Travel Money Exchange Rates for Online Travel Money

Asda Travel Money makes most of their money on the difference between the exchange rate they offer to customers and the base exchange rate. For example, the base rate to convert U.K pounds into euros is 1.146 euros per pound. Asda Travel Money offers an exchange rate of 1.126 euros per pound, a difference of 2 percent. That means if you’re exchanging 1,000 pounds into euros, you’ll pay an exchange rate fee of around £20.

Here are some other examples:

Exchanging 1,000 U.K. Pounds Into U.S. Dollars

- Base exchange rate, 1,000 GBP converts to 1,266 USD

- Asda Travel Money online exchange rate, 1000 GBP converts to 1,245 USD

- The Asda Travel Money exchange rate is 1.7 percent more expensive, or around 17 GBP in exchange rate fees

Exchanging 1,000 U.K. Pounds Into South African Rands

- Base exchange rate, 1,000 GBP converts to 18,672 ZAR

- Asda Travel Money exchange rate, 1000 GBP converts to 18,033 ZAR

- The Asda Travel Money exchange rate is 3.5 percent more expensive, or around 35 GBP in exchange rate fees

Exchanging 1,000 U.K. Pounds Into Australian Dollars

- Base exchange rate, 1,000 GBP converts to 1,862 AUD

- Asda Travel Money exchange rate, 1000 GBP converts to 1,810 AUD

- The Asda Travel Money exchange rate is 2.8 percent more expensive, or around 28 GBP in exchange rate fees

If you’re purchasing currency online or you want to transfer money to an overseas account, you can get much better deals by comparing specialist currency exchange providers . Several money exchange services have overall fees of one percent or lower, even when taking into account differences in exchange rates.

All of the Asda Travel Money exchange rates quoted in this section are based on their online rates for converting money for home delivery or store pickup. Local bureau de change rates may vary and are likely to be more expensive than what we quote here. All rates correct as of early October 2019.

Asda Travel Money Exchange Rates for International Money Transfers

Here are the rates Asda charges for sending money to foriegn bank accounts.

Sending 1,000 U.K. Pounds to a Euro Account

- Base exchange rate, 1,000 GBP converts to 1,146 EUR

- Asda Travel Money exchange rate, 1000 GBP converts to 1,106 EUR

Sending 1,000 U.K. Pounds to a Brazilian Real Account

- Base exchange rate, 1,000 GBP converts to 5,182 BRL

- Asda Travel Money exchange rate, 1000 GBP converts to 5,058 BRL

- The Asda Travel Money exchange rate is 2.4 percent more expensive, or around 24 GBP in exchange rate fees

Sending 1,000 U.K. Pounds to a New Zealand Dollar Account

- Base exchange rate, 1,000 GBP converts to 1,996 NZD

- Asda Travel Money exchange rate, 1000 GBP converts to 1,931 NZD

- The Asda Travel Money exchange rate is 3.3 percent more expensive, or around 33 GBP in exchange rate fees

Note that you may need to pay an Asda Travel Money international money transfer fee to send money to a foreign account.

All of the Asda Travel Money exchange rates quoted in this section are based on their online rates for sending money to an overseas bank account. All rates correct as of early October 2019.

Comparing Asda Travel Money Rates To Other Providers

You can easily compare many money transfer services directly using our comparison tool . There are several new services that it’s worth comparing directly to Asda Travel Money.

Modern, Mobile-Only Banks

There are several new, mobile-only banks that are becoming more widely available throughout the U.K. and Europe. Providers like N26 , Monese , Revolut , Monzo or Bunq provide a wide variety of financial services to the modern consumer. All of these modern banks provide international travel cards and international money transfer services, and it’s worth comparing them to Asda Travel Money.

For example, N26 provides international money transfers through TransferWise, a very popular and trusted currency exchange provider. If you compare sending 500 GBP to Mexico, the recipient would get 12,137 MXN with N26 / TransferWise compared to 11,800 with Asda Travel Money, a difference of around 2.8 percent or £14.

Specialist Currency Providers for Other Destinations

You may also be able to get a better deal for money transfers when you’re sending money to certain countries. For example, if you’re sending 500 GBP to Switzerland, the beneficiary would get around 628 CHF with Transferwise compared to 610 CHF with Asda Travel Money, a difference of around 2.9 percent or £15.

How Easy Is It To Send Money With Asda Money Transfer

Asda Travel Money services provide convenient local and online currency exchange and money transfer services, combined with an international travel card.

Credibility and Security

ASDA is an agent of Euronet Payment Services Limited (“EPS”), trading as Ria. EPS is registered in England (6975932) with its registered office at North Block, 55 Baker Street, London W1U 7EU. EPS is authorised by the Financial Conduct Authority under the Payment Services Regulations 2009 (FRN: 504630). See asda.com/moneytransfer for further details.

With a worldwide agent network of more than 314,000 locations in 146 countries, Ria is the third largest provider of money transfer services in the world. Since opening its first storefront in 1987, Ria has grown to be the third largest money transfer service with a mission to offer people the most simple, reliable and friendly services, both online and in-store through trusted partners.

Customer Satisfaction

Asda Money scored very poorly for customer satisfaction on Trustpilot, achieving a score of just 1.5 out of 5 across 50 reviews. Two percent of reviews said that they were “excellent” or “great” compared to ninety-seven percent of reviews that said they were “poor” or “bad.” Note that these reviews were across Asda Money as a whole, not just for travel money or currency or online overseas transfers.

There was only one positive review, which said that Asda was better than another supermarket money provider.

There were numerous negative reviews including problems with the travel card, poor customer service and issues with account closure. Here’s an exam-le of a review, “Ordered travel money (Turkish Lira). Paid for it. Checked the next day as I still hadn't received a confirmation email to be greeted with a message that said your order has been cancelled and suggested it was a card fault and I should try again with a different card. I rang my bank and there wasn't an issue with my card.”

How Asda Travel Money works

To pick up money from a travel store, you will need to provide:

- The payment card you used to place the order

- Valid photo ID, either a passport, full UK photographic driving licence or EU ID card, which matches the details of the cardholder

Here’s how to make a money transfer:

- Log into your profile

- Choose who and where you’re sending money to

- How much you’d like to send and how they’ll receive it

- Pay using a debit card

- Your money transfer is on its way

Here are the beneficiary details you’ll need:

- Your recipient’s first name and last name as displayed on their officially-issued ID.

- Your recipient’s address and phone number.

- A selected method for how your recipient will receive the money transfer. If you choose to deposit money directly into your recipient’s account, you’ll need their bank account and routing number (this might be called an IBAN or SWIFT number).

- If you would rather have your recipient pick up the money in person, you’ll need to select a local, preferred payout location.

- Home ›

- Reviews ›

Asda Money reviews

Asda Money are rated Poor in 204 reviews

ASDA offer a simple way to order your travel money. Place your order online, over the phone or at an in-store Travel Money bureau all with zero commission and no fees if you pay with your Asda Money Credit Card or debit card. Note: these are ONLINE rates - you may get a lower rate in-store unless you order online in advance.

Reviews by day

Showing reviews 1-15 of 204

14 May 2024

Ordered a currency card

Appalling customer service. Cost more in fees and time. Had to use an alternative card which fortunately I had taken abroad with me. Will not use again

They are garbage , the app is abhorrent, I tried to check my balance , everything I entered my unique one time number it was rejected.

Viktor Bohdan

25 March 2024

Bought £200 worth of Euros

Went to Asda in Spondon, Derby. Exchanged 200 pound for euros. No questions asked, nothing explained. When i got home I found out that the lady charge me for exchange fees. How can you charge someone without explanation? Will never use their service ever again.

21 February 2024

I put £200.00 in my travel card went to make sure that it had gone onto the card but the money is nowhere to be seen contacted card services who then contacted Travelex and still no sign of the money, I have contacted my bank they are now looking into this.

28 January 2024

Bought travel money

Ordered local currency for Barbados. Ordered on Monday and told it would be a few days and we would be phoned. Not heard anything so went in Friday - going away next Thursday, nothing arrived. Telephone call Saturday afternoon to say they can’t get any! Very unreliable!

15 January 2024

Bought £50 worth of Euros

Got my travel money card today, and it was a piece of cake with the help of Millie in the Spondon branch. Any worries were put at ease, so helpful in how to setup it up and knowing how I can use the card when aboard. I was really happy with the service provided.

Bought £100 worth of Euros

quick straight forward service

18 December 2023

Bought £1 worth of US dollars

This is the fourth time I have attempted to use the service in Asda Fareham, as it is the only place within a few miles that sells foreign currency. 3 pre ordered and today randomly.

Each and every time there has been a note to say just popped out, be back at a certain time and this is not usually between 12 & 2. It is usually just after 3pm for pre ordered. Today, I randomly popped in at 12.20 and once again, there was a note to say that the person has popped out and will be back at 12.50. Surely if their website displays opening times, a member of staff should be there to serve customers or they should display opening hours open and not actually on lunch or gone out etc…it’s not cheap to keep having to drive backwards and forwards, 6 miles to be precise to not be able to get the money ordered or even randomly. Asda, this needs sorting out!

Had to put in an amount that I supposedly purchased to leave review.

7 November 2023

Like Sue Williams says on her review I was charged a buy back fee without an explanation.

As a pensioner £2.99 Charge for nothing is better in my pocket.

I was so mad I went back the next day. The same girl said I always explain this Charge!

Not to me you didn't as we never return Euros.

I insisted on having the money back, which she finally agreed to.

3 November 2023

Bought £500 worth of Euros

Had a great experience in the Blackburn asda with the help of a lovely women Heena. Was a great help with everything as it was my first time exchanging money. Great customer service from her. Would definitely recommend to go to the Blackburn asda will be going again.

29 October 2023

Bought £250 worth of Euros

I always go to the bureau in clayton green, I always get good service from the two ladies there, I got tips etc about where I was going last time and its always service with a smile and welcoming

21 October 2023

Bought £1 worth of Euros

Went to Asda Tamworth the customer service was diabolical there were two people serving behind the counter , neither of them had any customer service skills tutting because I queried the exchange rate no please and thank yous .. apparently they don’t accept Scottish

£20 even though it’s legal tender. Will avoid from now on and go where I’m welcome

Jeff Leahey

29 September 2023

What ever you do don’t get one of these Asda travel money cards. Ive waited over 4 days to get a response to an email regarding a problem registering my card. I’ve sent all information requested and yet I’m still waiting. I’m starting to panic as I’m getting low on cash. Dreadful customer service you try finding numbers from abroad. Trying that this doesn’t ruin holiday.

21 September 2023

Sold 500 US dollars

I went to Asda exchange some US Dollars to pounds today just after 5pm. The gentleman who was serving did not seem to be professional at all. I gave him the dollars, he counted, asked for ID, gave him ID, then he looked into his till, and he said to me he does not have enough money to exchange. He could only exchange half of it. This is an exchange place and they did not have money. They need more professional people there. Disappointed. This guy was not fit for the job. Sorry.

7 September 2023

Bought £250 worth of Danish kroner

Turned up to collect currency I ordered 4 days prior. I arranged to collect the travel money at 2.56pm and was told I couldn’t have it till after 3. Won’t used Asda again and staff was cocky

Write a review of Asda Money

Rate your experience.

Click or tap a star to rate

Write your review

What product or service are you reviewing.

These last questions are optional, but your answers will appear with your review and will help to give it some context.

What currency did you buy?

How much did you spend.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

How do travel credit cards work?

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- Connect with Holly D. Johnson on Twitter Twitter

- Connect with Holly D. Johnson on LinkedIn Linkedin

- • Credit cards

- • Travel loyalty programs

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- A travel credit card offers points or miles for the purchases you make with the card that you can redeem for future travel.

- Travel credit cards come in all shapes and sizes, from co-branded hotel or airline cards to general travel cards that allow points and miles transfers to partner brands.

- In terms of redemption, you'll typically get the most value by redeeming toward travel in your issuer's portal or by transferring rewards to hotel and airline loyalty programs.

- Before applying for a travel card, consider its fees, ongoing rewards structure and first-year welcome bonus opportunity.

Travel credit cards make it easy to earn rewards — usually offered in the form of points or miles — for certain types of purchases. You can typically redeem your travel rewards for the big expenses associated with your next trip such as flights, hotels, car rentals and vacation packages. Some issuers also let you redeem travel rewards for statement credits and other non-travel options.

Some travel credit cards are associated with a specific airline or hotel loyalty program, whereas others let you earn rewards within a credit card’s rewards program . At the end of the day, you’ll want to understand the type of travel rewards your card offers, as well as available redemption options before you sign up.

Regardless of which type of card you choose, becoming a savvy travel rewards credit card holder can help offset travel costs and enhance your overall travel experience.

Types of travel credit cards

No matter your spending habits and rewards preferences, there’s likely a travel credit card that fits. Top travel credit cards include flexible rewards cards and those that are co-branded with another program, such as hotel credit cards and airline credit cards.

Flexible travel credit cards

Hotel credit cards, airline credit cards, how to redeem points and miles.

Once you’ve met the requirements for a hefty welcome offer or earned enough miles to cover your next flight or hotel stay, how do you redeem them? The kind of travel card you have and its respective rewards program determine how you can apply those rewards. If you have a hotel or airline credit card, you can typically only redeem those points with their respective loyalty programs, with a few exceptions. However, there are more ways to redeem flexible travel rewards , like booking through your card issuer’s online travel portal or transferring your points or miles to an issuer’s travel partners.

Redeeming rewards on an issuer’s online portal

Your card issuer will typically have a portal on its website that lists redemption options and points values. Examples of redemption options include statement credits, travel purchases, gift cards and cash back.

Rewards programs typically use a 1 point:1 cent conversion rate, meaning every 100 points or miles is worth $1. Some issuers, like Chase, also offer boosted points values or other perks for travel purchases made through their online portal. To get an idea of how much your points and miles are worth, take a look at Bankrate’s points and miles valuations page for an in-depth look at airline, hotel and credit card program rewards values.

To redeem your rewards on an issuer’s online portal, simply log in to your account and locate the appropriate rewards or travel section.

Redeeming rewards by transferring to a travel partner

Some travel rewards cards let you transfer points or miles to the issuer’s travel partners, which may include frequent flyer programs or hotel loyalty programs. This is often how to get the most value out of your travel rewards.

You can redeem travel rewards by transferring to an eligible travel partner through the issuer’s online portal. Transfer times can range from instantly to a few days — so plan ahead. Note, once you transfer points or miles from an issuer to a travel partner, you won’t be able to transfer them back to the issuer.

After you’ve transferred your points, you can book travel directly through the airline or hotel’s own loyalty program. Your credit card issuer is no longer involved in the process.

Other ways to redeem points and miles

Some credit cards allow you to redeem your points and miles for things like statement credits, cash back, gift cards or other merchandise. This is usually the least valuable way to redeem your points and miles so you’d be better off using them towards travel most times.

What’s the best way to maximize travel rewards?

When you want to make the most of your rewards, there’s no shortage of ways to spend a stockpile of points or miles. But here are some of the best ways to use your travel rewards :

- Book luxury accommodations

- Cover or lower the cost of your next flight

- Reserve a rental car at your destination

- Upgrade a flight or hotel stay

Be sure to check your card issuer’s online portal and travel partners for deals — such as a travel portal redemption bonus or transfer bonus to a specific hotel or airline — to help stretch your rewards further. In many cases, you can also choose to exchange your travel rewards for cash or a statement credit. But keep in mind that doing so usually dilutes the value of those rewards. Once you get the hang of using your travel credit card, you can maximize those rewards on bigger, better travel plans.

In general, the best value for flexible travel rewards will come from transferring them to various loyalty programs. For instance, the Chase Sapphire Preferred® Card’s rewards points are worth 1 cent each when redeemed for cash back, 1.25 cents each when redeemed for travel through the Chase Travel portal and 2 cents each on average when transferred to a travel partner (according to Bankrate’s valuations ).

However, the value you get out of transferring points ultimately depends on how you redeem them. If you transfer 10,000 points from your travel credit card to an airline partner to book a flight that would’ve cost $300 in cash, your points would be worth 3 cents apiece in this case. However, if you used those same points to book a flight worth $100, your points would only be worth 1 cent apiece.

How to maximize your travel rewards

As we’ve mentioned, the best way to redeem points or miles is to transfer your rewards to one of the issuer’s airline or hotel partners and redeem them for accommodations or airline tickets. But making good use of a travel rewards card is about more than just earning and redeeming rewards — it’s also about managing the card itself well.

Whether you’re trying to get the best possible redemption value or want to know which pitfalls to avoid, here are a few tips to help you get the most out of your travel rewards.

Use your card responsibly

The most important rule of using a travel credit card is to always pay your bill on time and in full and never carry a balance if you can help it. To do this, make sure you never charge more than you can afford to pay off each month, and don’t let the prospect of rewards cause you to overspend. Credit card rewards aren’t worthwhile if you’re going into debt or racking up interest charges and fees to get them.

Don’t miss out on a sign-up bonus

Many travel credit cards come with generous sign-up bonuses requiring you to spend a certain amount within the first few months of opening the account. Although these bonuses are often an attractive incentive to apply for a card, make sure the spending requirement is realistic for your budget and travel plans before you choose a travel credit card . You don’t want to end up in debt for the sake of earning extra rewards.

Don’t ignore the card’s fees

Credit card fees don’t directly affect the rewards you earn, but the cost of the fees does affect a card’s overall value to you. Take note of all the fees associated with any card you’re interested in getting.

One of the biggest fees to watch out for with travel credit cards is the annual fee some cards charge. Not all travel cards come with an annual fee, but those that do can range from an approachable $95 to $695 (or more). If you’re interested in a travel card that has an annual fee, be sure that the rewards and benefits will offset the cost. Otherwise, consider our list of the best travel credit cards with no annual fee .

Watch out for foreign transaction fees

Some credit cards charge a foreign transaction fee for purchases made abroad or in a foreign currency. This fee is usually around 3 percent of a purchase, and you’ll pay this fee for every transaction you make overseas. If you travel abroad frequently, you should consider getting a credit card with no foreign transaction fees .

Luckily, many of the best travel rewards cards don’t charge foreign transaction fees, but it’s always a good idea to verify that before applying.

Make sure you have the right card

It’s important to find the right travel card for your needs, which you can do after comparing options and considering all their pros and cons . For example, if you’re partial to a certain airline or hotel chain, a co-branded credit card can offer better rewards rates, discounts and perks related to that specific airline or hotel compared to a generic travel card.

Additionally, pay attention to a travel credit card’s rewards categories. For example, earning points or miles at restaurants won’t deliver a lot of value if you rarely dine out. But if you use services like Lyft or Uber a lot, you may want to look into a card that offers points or miles for rideshares.

How to choose a travel rewards card

Choosing the right travel rewards card is a highly personalized decision. Ultimately your spending habits, goals, finances and credit history will determine which travel card works best for you. This may require some self-reflection and an assessment of your financial situation to find the right travel card. Review these factors in your financial life to get clear on which travel card you need:

- Travel preferences. Do you prefer using one specific airline or hotel chain when you travel? Or would you rather have the freedom to use your points on whichever hotel and flight you choose? For loyalty-based rewards, go for a co-branded travel card. If you prefer flexibility, generic travel cards will give you more options.

- Spending habits. What do you spend the most money on? One of the best ways to choose a travel card is finding one that offers the highest rewards for the categories you spend the most in.

- Welcome offers. You may find welcome offers for travel credit cards where you can earn extra rewards by meeting purchase requirements within a certain timeframe. As long as you’re able to comfortably meet the spending requirements, a bonus offer could be a deciding factor.

- Credit history. Like most credit cards, applying for a travel rewards card means a hard credit check to determine eligibility. If you know where your credit score stands, it’s best to choose travel rewards cards that fit your credit profile to avoid unnecessary denials and credit inquiries. For cards that match your credit, use Bankrate’s CardMatch™ tool .

- Annual fee. There are plenty of travel credit cards with no annual fee if that’s what works for your budget. However, some cards with annual fees are worth it thanks to extra perks and benefits.

Travel rewards cards for beginners

When you’re ready to earn rewards, it’s best to start with a beginner-friendly travel card so you can get the hang of things. Here are our picks for beginner travel rewards credit cards:

- Discover it® Miles . Earn unlimited 1.5X miles on all of your purchases without an annual fee. With a simple rewards structure and a mile-for-mile match on all of the miles you earn at the end of your first year, you’ll find plenty of ways to make the most of this flexible travel rewards card.

- Capital One Venture Rewards Credit Card . Get flexible travel rewards that are easy to use and understand, for a modest $95 annual fee. Earn 2X miles on all purchases and 5X the miles on hotels and rental cars booked through the Capital One Travel portal.

- Bilt Mastercard® . If you want to earn travel rewards by paying your rent, the Bilt Mastercard has you covered. Earn 1X points on rent (up to 100,000 points each year) without any transaction fees, 2X on travel and 3X on dining. Plus you’ll access exclusive benefits on the first of every month as part of Bilt’s monthly “ Rent Day ” promotions.

- Chase Sapphire PreferredⓇ Card . If you’re looking for your first travel credit card, but it’s not your first time using a credit card, the Sapphire Preferred offers tons of cardholder perks and high rewards on travel and everyday categories like dining. For $95 per year, you’ll benefit from a $50 annual hotel credit through the Chase Travel portal, a solid lineup of travel protections and 25% more value when you redeem your points through Chase Travel.

These might not be your forever cards, but they’re a good starting point for learning how travel credit cards work. They’ll also help you get familiar with earning, redeeming and eventually maximizing travel rewards.

The bottom line

Using a travel rewards credit card can help you elevate your travel experiences by earning points or miles from your purchases. When you choose a travel card that aligns with your budget and goals, it can significantly reduce your travel costs or provide perks that enhance your trip. There’s a learning curve to using a travel card, but once you get the hang of it, you may be surprised by how much you can accomplish with your redemptions.

To make sure a travel credit card is ultimately worth it for you , be sure to select a card that rewards you for the type of purchases you make most often or the categories you spend the most in. Ideally, it won’t charge a fee that costs more than you’ll earn in rewards. If you’re ready to jump into the travel rewards lifestyle and start earning points toward your next trip, take a look at the best travel rewards cards to make your decision a little easier.

A guide to earning and redeeming frequent flyer miles

Do I need credit card travel insurance?

5 benefits you need from a travel credit card

Are travel credit cards worth it?

The pros and cons of travel credit cards

Should I get a travel credit card that earns points, miles or both?

5 steps to choose the best travel card

Best Travel Credit Cards of 2024

We earn a commission for products purchased through some links in this article.

The best money-saving apps to cut the cost of everyday spending

Why pay full price when you can get a discount or cashback with these great money-saving apps?

Inflation is only just beginning to fall, with some way to go before the Government target of 2% is met, and the cost of groceries , electronics, holidays and travel is continuing to rise. So these handy apps can really make a difference when it comes to making your money go that little bit further. And as these money-saving apps are free, you've got nothing to lose!

Money-saving apps to check out

Trolley.co.uk.

Seen as a replacement to the popular MySupermarket app, which closed in 2020 after 14 years, Trolley.co.uk claims to be the UK's fastest-growing grocery price comparison app. It searches supermarket brands such as Asda, Tesco, Sainsbury's, Morrisons, Boots, Aldi, Waitrose and B&M and highlights deals where there are savings to be made.

Customers can search for Daily Deals at specific stores, such as a 40p reduction on McVitie's Milk Chocolate Digestives at Asda, or £1 off Gillette shaving gel at Waitrose. There is also a Today's Top Deals section showing savings on the same product across many different retailers, such as Nivea Q10 Anti-Wrinkle serum – £15 at Sainsbury's but £8 from Amazon at the time of writing. The app is available via Google Play or Apple's App Store – you can find the same information on the Trolley.co.uk website .

LatestDeals.co.uk

Available on app via Google Play or Apple's App Store , or on its website , Latest Deals says it has three million members looking for bargains, vouchers, freebies and competitions. Founded in 2016 by Deepak Tailor, Tom Kelsey and Tom Church, Latest Deals looks at offers across many different shopping categories, including books, fashion, food and drink, travel, music and technology.

There's a handy browser extension to search out the latest retailer discount codes as well as an Amazon discount finder, and you can create Deal Alerts to be the first to find out about discounts and offers.

CheckoutSmart

Get cashback on your in-store grocery shopping with this app. All you have to do is buy a product that is featured on the app, snap a copy of your receipt and get money back, paid directly into your bank or via PayPal. The app features cashback on plenty of everyday products from popular supermarkets such as Tesco, Sainsbury's, Morrisons, ASDA, Waitrose, Co-op, Ocado, Boots, Iceland, Spar, Superdrug, Marks & Spencer, Aldi and Lidl.

At the time of writing, offers on the website include £2 cashbask on Illy coffee at Tesco, a free Peperami Chicken at Asda and Sainsbury's and a free Rockstar strawberry and lime drink at Co-op.

Where cashback is available on a specific product, you have to buy it at the stores stated on the app to be able to claim it. Apply this to your shopping basket every week, and you’ll be amazed at just how much your rewards could add up to – you could save hundreds of pounds a year simply by shopping smarter. Available on Google Play or Apple's App Store .

PriceSpy compares the price of electricals, beauty products, toys or computers from 6,100 retailers. You can search for an item you want to buy and it will find you the cheapest retailer. For example, if you’re looking to buy running shoes, PriceSpy shows at the time of writing that a pair of Asics Women's Kayano 30 trainers is currently £86.40 at Amazon but available at Runner's Need for the full price of £180, a saving of almost £100. Meanwhile, a Gtech Air Ram Mk2 cordless vacuum cleaner is £229.99 at Gtech but just £179 at Currys, a saving of just over £50.

Sometimes the price difference of products can be significant, so this really is a handy money saving app. You can also set up product alerts, and maybe buy from your wish list when there is a price drop. Available on app via App Store or Google Play or on the PriceSpy website .

Vouchercloud

One of the oldest money-savings app around, Vouchercloud has been sharing vouchers and discount codes with its customers since 2009. The range of retailers is impressive, across travel, transport, home furnishing, fashion and hospitality, including TUI, AA, Morrisons, Currys, easyJet, Dunhelm, UberEats and John Lewis. The app provides users with voucher codes for various retailers and restaurants, allowing you money off or meal deals.

You simply find an offer and show the code on your phone to staff, so you don't have to worry about printing off vouchers before you head out for a meal or worry about missing discounts when not shopping online.

If you’re eating out, the app features discounts at popular chains such as Pizza Hut, Prezzo and Domino's – current offers include 50 per cent off Domino's and 2 for 1 on meals with Ask. If you put location settings on, it will show you nearby deals, which is handy if you don’t know the local area well. The app, available on App Store or Google Play , also features offers for online shopping.

@media(max-width: 64rem){.css-o9j0dn:before{margin-bottom:0.5rem;margin-right:0.625rem;color:#ffffff;width:1.25rem;bottom:-0.2rem;height:1.25rem;content:'_';display:inline-block;position:relative;line-height:1;background-repeat:no-repeat;}.loaded .css-o9j0dn:before{background-image:url(/_assets/design-tokens/goodhousekeeping/static/images/Clover.5c7a1a0.svg);}}@media(min-width: 48rem){.loaded .css-o9j0dn:before{background-image:url(/_assets/design-tokens/goodhousekeeping/static/images/Clover.5c7a1a0.svg);}} Money

10 easy ways to save money at work

Boost your credit score and bag better deals

What benefits can I claim?

Switch off these appliances and save money

How to rent out your spare room

Buy your loved ones gifts that grow in value

Do smart meters save you money?

How to check (and top up) your State Pension

Expert advice on your mortgage

18 tips on finding more money to save

The best loyalty card schemes

Money blog: 27 areas where Aldi wants to open new stores as a 'priority'

Welcome to the Money blog, your place for personal finance and consumer news and advice. Let us know your thoughts on any of the topics we're covering using the comments box below.