We're working on fixing the issue.

If you need to speak to us quote the following code and error:

Code: AKM-CYB-WEB-1

Error: 18.97645e68.1718110069.1f392e91

- Media centre

- Press releases

Free Covid-19 insurance cover for all bookings

Virgin Atlantic provides complimentary COVID-19 global insurance cover for all bookings

- To support customers and provide additional peace of mind, Virgin Atlantic has introduced Virgin Atlantic COVID-19 Cover, which will apply to all existing and new bookings, travelling from 24 August 2020 up until 31 March 2021.

- The insurance policy with Allianz Assistance offers comprehensive cover in the event that a Virgin Atlantic customer or travel companion becomes ill with COVID-19 while on a trip.

- Emergency medical costs, associated expenses such as transport and accommodation and repatriation up to £500,000 are included, as well as costs if a customer is denied boarding or held in quarantine.

Virgin Atlantic customers can book with confidence this year with the introduction of free COVID-19 insurance cover on all new and existing bookings.

The policy, which applies automatically to all flights booked with Virgin Atlantic, is designed to complement existing travel insurance and provide additional peace of mind for upcoming trips, whether customers are already booked or plotting a getaway.

In the event that they or anyone else on their booking becomes ill with COVID-19 while travelling, Virgin Atlantic COVID-19 Cover ensures related costs are covered, no matter how long the trip is or even if they’re visiting another destination on the same overseas trip. The insurance policy is fulfilled by Allianz Assistance and covers emergency medical and associated expenses while abroad totalling £500,000 per customer – the highest value of policy offered by any airline to date, with no excess payment required.

The policy also covers expenses incurred up to £3,000 if a customer is denied boarding, at either departure or in destination, or has to quarantine due to positive or suspected COVID-19 during a trip.

Customers booked to travel from 24 August 2020 up to and including 31 March 2021 will automatically receive the new COVID-19 Cover and Virgin Atlantic Holidays customers will also benefit, where the flights on their holiday booking are with Virgin Atlantic. Providing the customer is travelling on a Virgin Atlantic ticket, if the flight is operated by a partner airline or a Joint Venture carrier - Delta Air Lines or Air France-KLM - the cover will also apply. Tickets can be booked via virginatlantic.com, by phone or through a travel agent, including reward tickets on Virgin Atlantic flights.

Juha Jarvinen, Chief Commercial Officer at Virgin Atlantic said:

“Our priority is always the health and safety of our people and customers and this industry-leading Virgin Atlantic COVID-19 Cover ensures customers can continue to fly safe and fly well with us.

“Following our return to the skies to much-loved destinations like Barbados, we’re planning more services in the autumn, as travel restrictions continue to ease, including London Heathrow to Montego Bay, Antigua, Lagos and Tel Aviv. Whether it’s to visit friends and relatives or take a well-deserved break, we believe this complimentary cover will provide some added reassurance for our customers as they start to plan trips further afield. It applies in parallel to existing travel insurance policies which may now exclude COVID-19, and provides comprehensive cover for coronavirus, recognising the needs of our customers as we restart services.”

Virgin Atlantic COVID-19 Cover joins the airline’s flexible booking policy to give as much choice as possible to customers as they make their future travel plans. Customers booking with the airline have the option to make two date changes to their flights, with rebooking available up until 30 September 2022. These date changes have the associated change fee waived, though potential fare differences may be incurred if the new travel dates are after 30 November 2020.

Key features of the COVID-19 Cover include:

- 24-hour emergency medical assistance

- £500,000 of emergency medical expenses if you are taken ill due to Coronavirus during your journey, including treatment, transport and accommodation costs

- Additional costs should a customer be denied boarding due to suspected or actual COVID-19, or if they are held in quarantine, including accommodation, transport charges, refreshments, booking amendment fees and other travel expenses

- Repatriation home, including private air ambulance where necessary

- No excess payable

- Cover for the whole trip, with no upper limit on the length of customer’s time away

- Cover for all passengers with no restrictions on age, travel class or length of journey

- Terms and conditions apply.

The cover starts from the point of booking and ends when the customer returns home or to a hospital or nursing home in their home country. One-way trips are also included, with the insurance cover valid until the end of the journey, which is defined as 12 hours after the arrival of the customer’s final flight.

For a full breakdown of Virgin Atlantic COVID-19 Cover and more information on the policy visit the Virgin Atlantic website: https://flywith.virginatlantic.com/gb/en/news/coronavirus/free-global-cover-for-COVID-19.html

As part of its multi-layered approach to public health measures, and for customer convenience, peace of mind and confidence, Virgin Atlantic will direct customers towards a list of recommended companies that offer COVID-19 'PCR Antigen' testing, where it’s required to travel. This list will be constantly reviewed by the Medical, Health and Safety teams to ensure the highest standards. Information about the testing requirements for destinations that Virgin Atlantic currently flies to can be found on the website: https://flywith.virginatlantic.com/gb/en/news/coronavirus/travel-restrictions.html

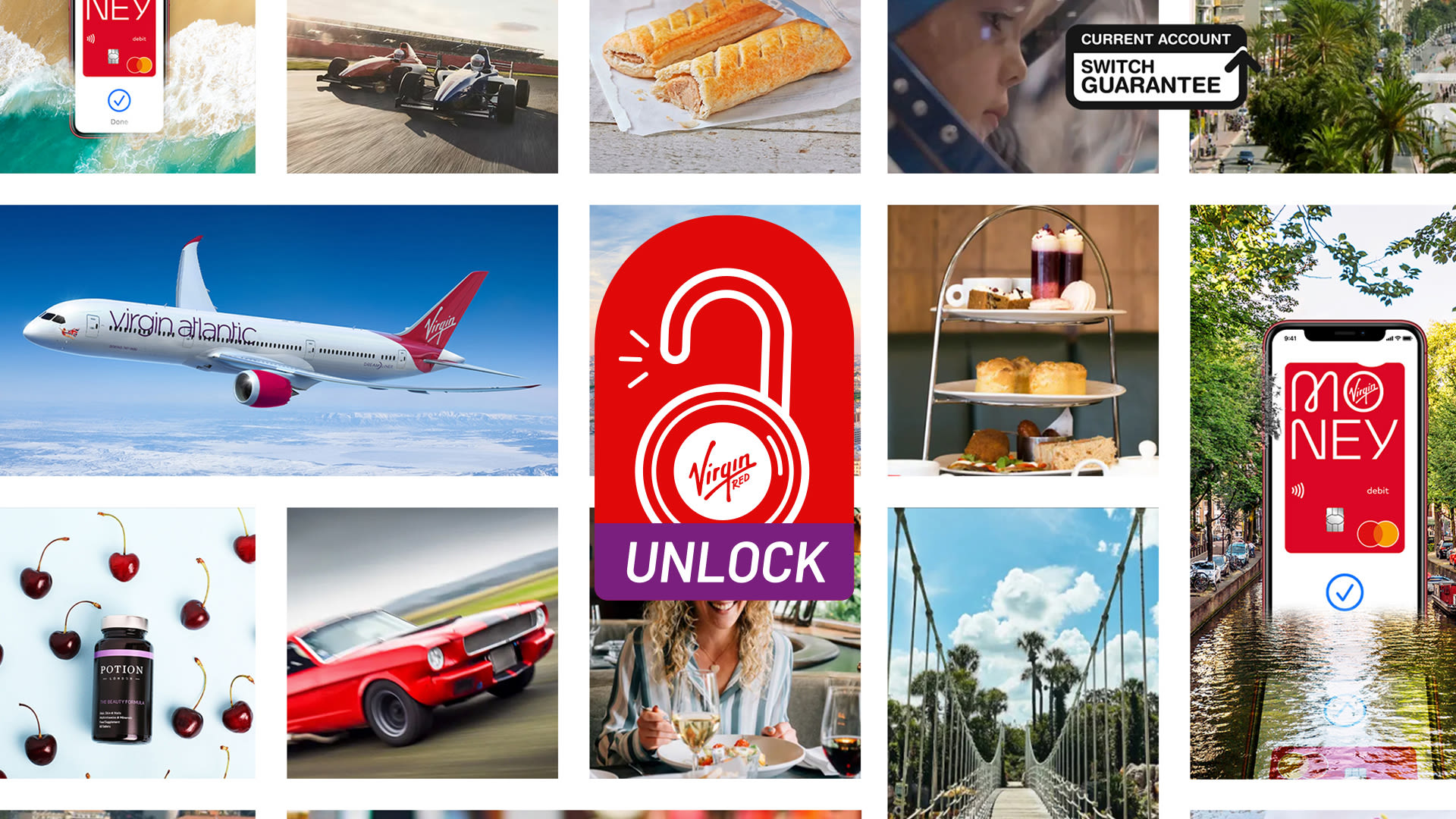

Virgin Money and Virgin Red offer exclusive Travel Insurance rewards for Virgin Red members

We know taking travel insurance out can be one of the least exciting ‘To Dos’ when planning for a trip, but that's all about to change with Virgin Red and Virgin Money . Virgin Red members will be rewarded for taking out travel insurance, so you can explore the world feeling safe and spoiled.

Virgin Money Annual Multi-trip Travel Insurance

If you’ve got a few trips coming up, Virgin Money’s annual multi-trip travel insurance will give you the peace of mind you need to truly relax.

What could be more relaxing than that? 3,500 Virgin Points that's what, from your friends at Virgin Red.

With Virgin Money’s Annual Multi-Trip insurance , you can choose up to 94 days’ worldwide cover per trip, with everything you care about covered – from your gadgets to your health.

Added benefits

Covid cover included - cancellation and medical expenses are covered by Virgin Money, as standard, if you’re diagnosed with Covid-19.*

Gadget cover as standard, plus optional extras - from Enhanced Gadget and Enhanced Covid Cover – to cover for winter sports, car hire excess, and more (fees apply).

On hand to help, 24 hours a day, 365 days a year - help is just a phone call away with Virgin Money’s worldwide medical emergency assistance helpline.

Your policy at your fingertips - looking after your policy is now a breeze, thanks to Virgin Money’s handy new online portal – from downloading docs to making a claim, all in one place.

*Please check your policy wording for full details and any exclusions.

The Virgin Money travel insurance has three levels of cover : Red, Silver and Gold, so you can choose which suits you and your needs best.

Managing your travel insurance is a breeze. Simply register online then unwind knowing you can do anything from updating your personal details, to making a claim, all in one place.

The fun part - spending your points

Virgin Red members are rewarded for everyday spending, and with everything from the biggest brands in retail, travel and entertainment to smaller treats or exciting new start-ups, there are so many different rewards which anyone would enjoy. Members can also use Virgin Points for good by supporting a number of different charities or helping develop technology to remove carbon from the atmosphere.

What will you put your points towards? Your next flight, getaway or holiday? Navigating the world of Virgin Wines? Or another Virgin Red treat, experience or exclusive? Enjoy deciding.

Buy your travel insurance today with Virgin Red and Virgin Money and earn 3,500 Virgin Points.

Terms and conditions

Who can take up this offer?

Virgin Red Members who are 18+ and resident in the UK.

How do you take up this offer?

It’s important that you follow these steps to make sure you are eligible for this offer. If you don’t, you might not get your points... and we don’t want that!

Buy a Virgin Money Annual Multi Trip Policy (the Policy) via the offer in the Virgin Red app or Virgin Red website.

You’ll see the offer listed in the “Earn Points” section of the Virgin Red app and website.

Just click on “Get Points” when you want to go ahead. This will link you to the offer page on the Virgin Money website.

From there, click on ‘Get a quote’ and fill in your policy requirements to receive a quote.

Make sure you choose the Annual Multi-trip Policy. The Policy start date must be within 45 days of buying the Policy.

When you’re happy to go ahead, pay for the Policy. o You will receive a confirmation email from Virgin Money.

You need to hold the Policy for at least 45 days to be eligible for the Offer before points are credited to your Virgin Red account. If you or Virgin Money cancel the Policy before 45 days, you won’t be eligible for points.

This offer can’t be used in conjunction with any other offer. Points are only offered in year one of the policy.

What is the offer?

If you meet the offer conditions, we’ll give you a Virgin Red promo code. You can redeem this code with our friends at Virgin Red to get 3,500 Virgin Points.

We’ll send you an e-mail with your promo code within 28 days of you meeting the offer conditions. We’ll send your code to the e-mail you gave when you bought the Policy. The email will provide instructions on how to redeem the code within the Virgin Red app or website.

Your Virgin Red promo code can be used until 30 April 2023. Make sure to redeem your code before then.

Only one Virgin Red promo code will be generated per eligible Policy.

After you’ve redeemed your Virgin Red promo code, the points are added to your Virgin Red account. There is no specific expiry date for using the points. You’ll be free to use them in line with Virgin Red’s programme terms. You can find the terms here [ http://policies.red.virgin.com/terms ].

We thought we should highlight a few key things from Virgin Red’s terms:

the points don’t have a cash value and they can’t be swapped for cash;

the available offers can change from time to time; and

the points cost for each offer can change too.

Although we’ll be working closely with our friends at Virgin Red on this promotion, we aren't responsible for their terms, their marketing, or any of the offers available through their app. Just contact Virgin Red or the relevant offer provider if you have any questions about these topics.

When can you take up the offer?

The offer will be available on an ongoing basis until we withdraw it. We can withdraw the offer without giving you any advance notice, but we’ll try to give some notice if we can.

The offer is subject to availability. This means we will definitely withdraw it when we’ve used up our stock of Virgin Red promo codes.

You don’t need to worry if we withdraw the offer when you’re part way through meeting the offer conditions. As long as you've bought the Policy before we withdraw the offer, you can still qualify. You’ll just need to continue to meet the rest of the conditions.

What else do you need to know?

You can only benefit from this offer once.

We’ll use your personal information to help us run the offer.

English law applies to the offer.

Standard Virgin Money Travel Insurance Policy conditions apply.

If something goes wrong, we’ll try to fix it. If we can’t because it’s something we can’t control, or it’s not our fault, then we may have to change the offer. This includes suspending the offer or ending it early. We can make such changes without giving you notice. However, we’ll try our best to avoid making changes. And we’ll try to minimise any disappointment to you when we make changes.

Who is the promoter?

We are Clydesdale Bank PLC trading as Virgin Money.

Our company number is SC001111.

Our registered office is 30 St Vincent Place, Glasgow, G1 2HL.

Virgin Red and Virgin Money give new customers 20,000 reasons to switch

Unlock Virgin Red: How to earn Virgin Points with a Virgin Money M Plus Account or Club M Account

Who wants to be a virgin points millionaire.

Where are you flying from?

- London Heathrow

- Manchester International

- Inverness Airport

- Cardiff Airport

- Norwich Airport

- Humberside Airport

- London City Apt

- Belfast International

- Leeds Bradford Airport

- Bristol Airport

- Teesside Airport

Our new direct Virgin Atlantic service commences 22nd October 2023.

Please remember when searching for your holiday to add an additional night, as we operate an overnight service on our outbound flight.

i.e. For a 7 night holiday please search for 8 nights.

Our new direct Virgin Atlantic service commences 30th October 2023.

We will operate from London Heathrow four times a week on Mondays, Tuesdays, Thursdays and Saturdays.

Our seasonal Virgin Atlantic service with up to 4 direct flights, will operate until the 19th May 2024.

Our seasonal direct service will recommence on the 28th October 2024.

Our Virgin Atlantic service operates on Mondays, Wednesdays and Sundays.

Flights include a short touchdown in Barbados.

Our Virgin Atlantic service operates on Tuesdays, Fridays and Saturdays until 29th March 2024. From the 2nd April, this service will reduce to Tuesdays and Saturdays.

Our seasonal service will recommence on the 29th October 2024, with flights operating on Tuesdays, Fridays and Saturdays

Our seasonal Virgin Atlantic service with up to 3 direct flights, will operate until the 11th May 2024. Flights will commence from 23 May 2024 - 24th October 2024 on Thursdays and include a short touchdown.

Our seasonal direct service will recommence on the 29th October 2024.

Daily direct flights from London Gatwick to New York with our partner airline, Delta, operates between 10th April and 26th October 2024.

Our Virgin Atlantic service with direct flights, will operate on Wednesdays and Sundays until the 30th March 2024.

Our direct service will operate on Tuesdays and Thursdays from the 2nd April 2024.

1 room / 2 adults

Please enter all child ages

There must be 1 adult per child under two years of age travelling, please adjust your passenger number

To book online please select a maximum of 9 passengers, to book 10 adults or more please call 0344 557 3978

Please note: Drivers must be over the age of 21 to hire a car unless otherwise specified. Drivers between 21 and 24 years of age may be subject to additional costs.

Holiday insurance tailored to your next adventure

We know it's hard to concentrate on Seizing the Holiday without first having peace of mind.

Whether you are taking the children or grandchildren to Disneyland, tying the knot in Vegas, or relaxing on a Caribbean cruise we've got a policy to cover you. Booking your travel insurance through Virgin Atlantic gives you the reassurance that we have you covered from the start to finish of your holiday.

Get your Travel Insurance Quote today

Single Trip - Travel Insurance

Need travel insurance for your family holiday? Our Single Trip Travel Insurance offers great value cover at an affordable price.

Single Trip - Cruise Insurance

Our specialist cruise policy offers additional benefits including: Cruise connection, Missed port, Cabin confinement, Excursions cover.

Providing peace of mind whilst on holiday:

- COVID-19 - cover for medical expenses and cancellation if you become ill or have to quarantine due to COVID-19

- Up to £15m medical assistance cover in the event of illness or an accident while away

- Up to £5k cancellation cover or if you have to cut your trip short

- Up to £2k in the event of loss, theft or damage to your personal possessions

You may also like...

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best COVID-19 Travel Insurance in June 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Factors we considered when picking travel insurance that covers COVID

An overview of the best travel insurance for covid , top travel insurance for covid options , additional resources for covid-19 travel insurance shoppers.

No matter how well you prepare, travel plans don’t always go as expected. Some travelers buy travel insurance to protect their investment in prepaid travel costs. Amid the ongoing pandemic, exploring travel insurance with COVID-19 coverage is recommended. With the right policy, you can protect yourself if you need to cancel your trip or end it early due to illness. Many insurers offer travel insurance policies with this kind of coverage.

This is the shortlist of the best travel insurance for COVID options:

Berkshire Hathaway Travel Protection .

John Hancock Insurance Agency, Inc.

Seven Corners .

Travelex Insurance Services .

Travel Insured International .

WorldTrips .

We used the following factors to choose insurance providers to highlight in our best travel insurance for COVID list:

Range of coverage: We looked at how many plans each company offered with COVID-19 coverage, plus the range of available plans.

Depth of coverage: We compared the maximum caps for trip cancellation and trip interruption claims between carriers and plans.

Medical benefits: We examined whether plans included emergency medical benefits for COVID-19 reasons and whether plans included medical evacuation and repatriation benefits.

Cost: We determined an average cost for shoppers to benchmark plan prices by looking at the basic coverage costs for plans with COVID-19 benefits across multiple companies.

We looked at quotes from various companies for a six-night trip in May 2023 to Croatia. The traveler was 30 years old, from Texas and planned to spend $1,500 on the trip, including airfare.

On average, the price of each company’s most basic coverage plan with COVID-19 coverage was $47.22. The prices listed below are for the most basic COVID-19 travel insurance coverage. All insurers offer multiple COVID-19 policies with greater coverage coming at a higher cost.

Let's take a closer look at our eight recommendations for travel insurance with COVID coverage:

Berkshire Hathaway Travel Protection

What makes Berkshire Hathaway Travel Protection great:

Several plans allow policyholders to cancel for COVID-19 sickness as part of trip cancellation and trip interruption insurance benefits.

Several plans include COVID-19 medical coverage benefits.

Medical evacuation benefits are included in these plans.

Plans include limited sports and activities coverage and sports equipment loss benefits.

Basic Berkshire Hathaway Travel Protection will run you $50 for an ExactCare Value policy, the company’s most basic COVID-19 travel insurance coverage option.

What makes IMG great:

Many plans include COVID-19 cancellation benefits.

Most of these plans also include COVID-19 medical benefits (the Travel Essentials plan doesn’t include this).

Medical evacuation coverage is available on select plans.

Coverage for adventure travel is available for an extra cost.

IMG is a good option for the budget-minded: Its Travel Essential plans cost more than $10 less than average based on our comparison.

John Hancock Insurance Agency, Inc.

What makes John Hancock Insurance Agency great:

Multiple plans offer COVID-19 cancellation benefits as part of the included trip interruption and trip cancellation coverage.

These plans offer COVID-19 medical benefits.

Medical evacuation coverage is included in all COVID-19 coverage plans.

The John Hancock Insurance Agency, Inc. basic plan (Bronze) costs $56.

Seven Corners

What makes Seven Corners great:

Multiple plans offer COVID-19 cancellation benefits as part of the included trip interruption and trip cancelation coverage.

These plans include COVID-19 medical benefits and evacuation and repatriation benefits.

There is no medical deductible.

Seven Corners’ basic coverage plan (RoundTrip Basic) for our trip to Croatia costs $44.

Travelex Insurance Services

What makes Travelex Insurance Services great:

Multiple plans include Covid-19 sickness coverage, which reimburses prepaid and nonrefundable trip payments if a trip is canceled or interrupted due to a traveler contracting the virus.

These plans also include COVID-19 medical benefits.

Medical evacuation and repatriation benefits are included.

Basic coverage (Travel Basic) from Travelex Insurance Services costs $44 for our sample trip, which is slightly cheaper than average.

Travel Insured International

What makes Travel Insured International great:

Multiple plans cover COVID-19 cancellation benefits as part of the included trip interruption and trip cancelation coverage.

These plans also include COVID-19 medical benefits, including medical evacuation.

Limited sports and activities coverage is included in plans with COVID-19 coverage.

Travel Insured International's basic coverage (Worldwide Trip Protector Edge) begins at $55 — only a few dollars more than the average basic policy price.

What makes Tin Leg great:

A wide range of plans offer COVID-19 cancellation benefits as part of the included trip interruption and trip cancelation coverage.

All of these plans also include COVID-19 medical benefits.

All of these include medical evacuation benefits.

An adventure travel policy is available.

Another plus: Tin Leg’s basic coverage plan (Basic) for our trip to Croatia costs $48.85 — making it right around the average price for the policies we covered.

WorldTrips

What makes WorldTrips great:

Several plans include medical coverage for COVID-19.

Sports and activities and sports equipment loss are included.

Coverage can be extended for up to thirty days, including for medical quarantine purposes.

WorldTrips’ most affordable plan with COVID-19 coverage (Atlas Journey Economy) starts at $44, making it a low-cost option.

Do you want to learn more about travel insurance before you spend money on a policy? Take a look at these resources:

What is travel insurance?

What does travel insurance cover?

The best travel insurance companies

How to find the right travel insurance for you

10 credit cards that provide travel insurance

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

Advertisement

Supported by

What You Need to Know Now About Travel Insurance

A spate of new travel insurance policies have begun covering Covid-19, just as many international destinations begin to require it. Here’s what to look for.

- Share full article

By Elaine Glusac

When the pandemic struck, many travel insurance policies failed to cover Covid-19-related trip interruptions and cancellations, often because they excluded pandemics. But in the intervening months, the travel insurance industry has introduced a spate of new policies covering the disease just as many foreign destinations begin to require them.

“We’ve seen progress in that many plans will now treat Covid like any other unexpected sickness or illness,” said Stan Sandberg, a co-founder of the comparison website Travelinsurance.com . “If you have a trip and travel insurance and came down with Covid-19, which made it impossible to travel, that would fall under cancellation coverage as an unexpected illness that prevents you from traveling.”

Likewise, policies now including Covid-19 would cover holders in the event that a doctor diagnosed them with the virus while traveling under the trip interruption benefit.

Not all travel insurance excluded pandemics when the coronavirus began to spread early this year; Berkshire Hathaway Travel Protection was one exception. But the broader change partially arises from consumer demand, a better understanding of the virus — including mortality rates and hospital costs — and the industry’s eagerness for travel to resume.

“People who are traveling are more conscious of their risks and thinking about protecting themselves and their investment,” said Jeremy Murchland, the president of the travel insurer Seven Corners. The company launched policies that included Covid-19 coverage in June; they now account for more than 80 percent of sales.

But, like all insurance, the devil is in the details when it comes to understanding travel insurance, including what’s covered, destinations where it’s required, and the inevitable caveats, as follows.

How travel insurance covers Covid-19

The new Covid-inclusive insurance generally covers travelers from the day after purchase until their return home. During that period, if you become sick and a doctor determines you cannot travel (because of the virus or another illness), trip cancellation and trip interruption benefits would kick in.

These benefits vary by policy, but a search to insure a $2,000 weeklong trip to Costa Rica in December on Travelinsurance.com turned up a $69.75 Generali Global Assistance Standard policy with Covid-19 benefits that would be triggered if you, your host at your destination, a travel companion or a family member tested positive for the virus.

If this happened before your departure, the policy would cover your prepaid travel expenses. If you or your travel companion contracted Covid-19 during the trip and were diagnosed by a physician, it would reimburse prepaid arrangements, such as lodgings, and cover additional airfare to return home — once a doctor deems it safe to travel — up to $2,500. Should you be required to quarantine and can’t travel, travel delay coverage for lodging, meals and local transportation would pay up to $1,000. The policy also covers medical expenses for up to one year, even after you return home, up to $50,000 — though the policy also states that a holder would have to exhaust their own health insurance benefits before seeking coverage under the travel insurance plan.

Travelers should read these policies carefully to understand the benefits (for example, some rules vary by your state of residence), but brokers like TravelInsurance.com, InsureMyTrip and Squaremouth are making them easier to find through filters, F.A.Q.s and flags.

The new more comprehensive policies don’t necessarily cost more. On a Squaremouth search for insurance for two 40-year-olds on a two-week trip costing $5,000, the site turned up a variety of policies with or without coronavirus exclusions from $130 to $300, with no apparent premium for Covid-19 coverage.

Not every Covid-19-related expense is covered by many of these policies, including tests for the virus that many destinations require before arrival (those may be covered by private insurance).

Many policies include medical evacuation to a nearby facility, but won’t necessarily transport you home. For those concerned about treatment abroad, Medjet , a medical evacuation specialist, now offers Covid-19-related evacuations in the 48 contiguous United States, Canada, Mexico and the Caribbean that will transport you to the hospital of your choice in your home country (trip coverage starts at $99; annual memberships start at $189).

“Covid-19 requires special transport pods to protect the crew and others, which adds logistical issues,” said John Gobbels, the vice president and chief operating officer for Medjet.

In addition to the Medjet plan, travelers would need separate travel insurance with medical benefits to cover treatment costs and trip interruption.

Destination insurance requirements

Travelers aren’t the only ones worried about health. A growing list of countries are mandating medical coverage for Covid-19 as a prerequisite for visiting, often along with other measures like pre-trip virus testing and health screenings for symptoms on arrival.

Many Caribbean islands are among those requiring travel medical insurance, including Turks and Caicos and the Bahamas . St. Maarten requires health insurance coverage and strongly recommends additional travel insurance covering Covid-19.

Farther-flung countries also require policies that cover Covid-19, including French Polynesia and the Maldives .

Some destinations specify the required plan as a way to ensure travelers have the correct coverage and to expedite treatment. Aruba requires visitors to buy its Aruba Visitors Insurance, regardless of any other plans you may have.

“Insurance through a destination typically only covers Covid and infection while you’re there,” said Kasara Barto, a spokeswoman for Squaremouth.com. “If you catch Covid before, they don’t offer cancellation coverage. If you break a leg, the policy may only cover Covid medication. It varies by country.”

Costa Rica also requires insurance that includes an unusual benefit stipulating a policy cover up to $2,000 in expenses for a potential Covid-19 quarantine while in the country.

In response to the new requirement, which Costa Rica announced in October, insurers, including Trawick International , have begun introducing policies that meet the standard.

“It was a pretty quick and nimble reaction,” Mr. Sandberg of TravelInsurance.com said.

Normally, travel insurance varies by factors including the age of the traveler, destination, trip length and cost (most range from 4 to 10 percent of the trip cost). But some destinations are providing it at a flat fee, with most policies spelling out coverage limits and terms for emergency medical services, evacuation and costs associated with quarantines.

Jamaica, which will require insurance, but has not said when the new rule will go into effect, plans to charge $40 for each traveler. The Bahamas will include the insurance in the cost of its Travel Health Visa, an application that requires negative Covid-19 test results, which runs $40 to $60 depending on length of stay (free for children 10 and younger). The Turks and Caicos is offering a policy for $9.80 a day, and Costa Rica ’s policies, if purchased locally, cost roughly $10 a day.

Expect this list of destinations to grow. In January, the Spanish region of Andalusia plans to require travel medical insurance and is working on finding a provider to make it easy for travelers to buy it.

Gaps in travel insurance

Policies that cover Covid-19 as a medical event that may cause trip cancellation or disruption, or those that provide coverage for medical treatment and evacuation still don’t necessarily cover travelers who have a change of heart when they learn they will have to quarantine upon arrival, even if they don’t have the virus. Nor are policies necessarily tied to conditions on the ground, like a spike in infections, State Department travel warnings, a government travel ban or the cessation of flights to and from a destination.

For those events, there’s Cancel For Any Reason, or CFAR, an upgrade to plans that generally only returns 50 to 75 percent of your nonrefundable trip costs.

“Prior to the pandemic, we wouldn’t necessarily recommend CFAR because most of travelers’ concerns were covered by standard plans,” Ms. Barto of Squaremouth.com said. “It’s about 40 percent more expensive and we didn’t want travelers to pay for additional coverage.” Now, she added, there’s been a surge in interest in the upgrade, including in 22 percent of policies sold at the site since mid-March.

Industry experts predict some of these outstanding issues may work their way into policies of the future as they adapt to enduring realities, much as they did after 9/11 in covering travelers in case of terrorist events, which was not the norm before.

The pandemic “was unprecedented, but once it happened, the industry has been pretty quick to react and create coverage, and that’s in the spirit of how this industry is trying to define itself, to be one of those subtle but valuable assets,” Mr. Sandberg said. “Once the world opens back up, we expect travel insurance to be much more top of mind with travelers.”

Follow New York Times Travel on Instagram , Twitter and Facebook . And sign up for our weekly Travel Dispatch newsletter to receive expert tips on traveling smarter and inspiration for your next vacation.

- Let's fly

- Explore hotels

- Travel insurance

- Pride Flight

- Featured sales

- Sign up to V-mail

- Change or cancel

- Upgrade options

- Redeem travel credits

- Disruption information

- Retrieve your Travel Bank details

- Rapid Rebook

- Flights to Sydney

- Flights to Melbourne

- Flights to Brisbane

- Flights to Perth

- Flights to Gold Coast

- Flights to Cairns

- Explore all destinations

- Flights to Bali

- Flights to Fiji

- Flights to Queenstown

- Flights to Tokyo

- Destinations

- Travel Inspiration

- Sydney to Melbourne

- Sydney to Brisbane

- Melbourne to Sydney

- Melbourne to Brisbane

- Brisbane to Sydney

- Adelaide to Melbourne

- Perth to Melbourne

- Sydney to Bali flights

- Melbourne to Bali flights

- Brisbane to Bali flights

- Sydney to Fiji flights

- Melbourne to Fiji flights

- Brisbane to Fiji flights

- Travel agents

- Cargo services

- Airline partners

- Specific needs and assistance

- Flying with kids

- Virgin Pet Travel

- Group travel

- Travelling with airline partners

- Carry-on baggage

- Checked baggage

- Dangerous goods

- Baggage tracking

- Connecting flights

- Airport guides

- Transfer maps

- Cabin classes

- Onboard menu

- In-flight entertainment

- Get connected

- Health onboard

- Travel and entry requirements

- About the program

- Join Virgin Australia Business Flyer

- Partner Offers

- Why choose Virgin Australia

- Enquire now

- Velocity home

- Earning points

- Redeeming Points

- Transferring Points

- Buying Points

- Member benefits

- Transfer credit card points

- Points earning credit cards

- Shop to earn Points

- Shop using Points

- Status membership

- How to use Points for flights

- Flight status

- Travel insurance offers

Offers from our partners

- Car hire offers

- Hotel offers

- Former bookings

Get domestic and overseas cover today and travel knowing you are protected with Cover-More

24/7 emergency assistance, instant quote, easy online claims, earn velocity points.

Silver, Gold and Platinum members earn a 50%, 75% and 100% bonus Points respectively on top of the base Points earned when purchasing your travel insurance through the quote generator.

- Expeditions

- Complimentary Brochures

Plan with Confidence

The Travel Protection Plan, offered by Viking and administered by Trip Mate, a Generali Global Assistance & Insurance Services brand, provides additional peace of mind by covering many unforeseen circumstances that may arise before or during your trip.

Trip Interruption or Cancellation

If your trip is interrupted or cancelled due to a covered emergency, weather issue, or other unforeseeable event, you may be reimbursed.

Accident or Sickness & Medical Repatriation

Emergency medical or dental expenses during your trip may be covered, including costs of circumstances that may arise from any illness, including COVID-19. Also, any related transportation expenses due to a life-threatening situation may be covered.

Baggage & Personal Items

Baggage or personal items—such as passports or visas—that are lost, damaged or stolen during your trip are covered up to the plan limits. Additionally, you may be reimbursed for incurred expenses should your baggage be delayed for 24 hours or more during your trip.

Cancel For Any Reason

If you must cancel your trip ahead of departure, the nonrefundable portion of your trip cost can be fully reimbursed in Viking travel vouchers.

Protect Your Investment Now

To purchase this plan, obtain a quote, or for any other questions, please call Viking at 1-877-668-4546.

The Travel Protection Plan Details

For your convenience, Viking offers a Travel Protection Plan administered by Trip Mate, a Generali Global Assistance & Insurance Services brand. This may help protect your travel investment, your belongings and most importantly, you, from many unforeseen circumstances that may arise before or during your trip, including costs of circumstances that may arise from any illness (including COVID-19*). The Travel Protection Plan includes a non-insurance Cancel For Any Reason Waiver (provided by Viking), Travel Insurance Benefits (underwritten by Generali- U.S. Branch) and Assistance Services (provided by Generali Global Assistance). Payments are for the full Travel Protection Plan, which is made up of the Part A Non-Insurance Cancel For Any Reason Waiver, and Part B Insurance Benefits, and Assistance Services (a separate fee for Assistance Services is included in the Plan Payment). Individuals looking to obtain additional information regarding the features of each travel plan component, please contact Trip Mate at [email protected] . Insurance benefits in the Plan are subject to limitations and exclusions, including an exclusion for pre-existing conditions. Plan benefits, limits and provisions vary by state/jurisdiction and not all coverage is available in all states. To review full plan details online and Important Disclosures, go to: www.tripmate.com/wpGR625V .

*COVID-19 is treated the same as any other sickness. The plan requires a sickness to be “examined and treated by a physician”. We consider all PCR or laboratory tests to have been administered by a physician.

Sign up to receive updates from Viking

Stay current with special offers, news and destination-focused content.

Company Information

- Order a Brochure

- Special Offers

- Sweepstakes

- Travel Advisors

- Media Center

- Investor Relations

- Health & Safety Program

- Privacy Policy

- Cookie Policy

- Manage Cookies

Viking River Cruises

- Mississippi

Viking Ocean Cruises

- Scandinavia

- British Isles & Ireland

- North America

- Caribbean & Central America

- South America

- Mediterranean

- Quiet Season Mediterranean

- Australia & New Zealand

- World Cruises

- Grand Journeys

Viking Expeditions

- Great Lakes

- Longitudinal World Cruises

Protect Your Trip »

Is travel insurance worth it yes, in these 3 scenarios.

These are the scenarios when travel insurance makes most sense.

Is Travel Insurance Worth It?

Getty Images

Travel insurance can be useful, but it's not always necessary.

The key to knowing if you need travel insurance is figuring out your specific risks for any given vacation, then deciding if you can buy coverage that adequately protects you from any financial losses and pitfalls that might occur.

While insurance can be invaluable no matter the traveler and trip, these are the scenarios where it's especially useful:

- You're concerned about flight disruptions: Flight cancellations and delays are commonplace, especially during the holiday and summer travel seasons. Most trip insurance will reimburse you for incidental expenses that occur while you wait for your flight to depart or for your checked luggage to arrive. Examples include meals and hotel stays if your flight is delayed overnight, or clothing and toiletries you have to buy while you wait for your bags to show up at your destination. Limits apply to this coverage, but it can still pay off if you have to use it.

- You need the option to cancel your trip: Do you have a medical condition that might suddenly prevent you from traveling? What about young children who are prone to illness, or the possibility of your beach vacation getting rained out during hurricane season ? These are just some of the instances when cancel for any reason (CFAR) coverage can help. Offered as an add-on to many insurance policies, this coverage lets you cancel your trip for a reason not covered within a typical trip cancellation benefit. If you need to use this coverage, you'll typically get 50% to 80% of your prepaid travel expenses refunded.

- You're traveling internationally: U.S. health insurance policies typically don't cover medical care or emergencies overseas, which is why so many people seek out travel medical insurance . According to Allianz Travel Insurance, the average costs of international medical evacuation can range from $15,000 in Mexico all the way up to $220,000 in Asia, Australia and the Middle East. Fortunately, many travel insurance policies offer up to $500,000 in medical evacuation coverage or potentially more.

The best travel insurance options

If one of the above applies and/or you're still curious about travel insurance, you can find the top-rated policies in a variety of categories below.

Any rates listed are for illustrative purposes only. You should contact the insurance company directly for applicable quotes.

What does travel insurance cover?

You'll quickly notice that each travel insurance policy is different from the next. Most plans offer coverage for trip cancellations and interruptions, lost or delayed baggage, medical emergencies, and other common perils; some let you add optional coverage for a rental car , sporting equipment and more.

To give you an overview of the way different travel insurance policies work, the chart below shows the included benefits in several plans from a travel insurance company called Travelex:

Compare Travelex plans and get a quote .

What does travel insurance not cover?

It's important to note that travel insurance policies cannot possibly cover every unexpected bill you encounter before, during or after a trip. That's because travel insurance is not meant to be used like other types of insurance, including traditional medical coverage you have for routine health care expenses.

According to Allianz Travel Insurance , travel insurance "does not cover losses that arise from expected or reasonably foreseeable events or problems." Here are some of the most common exclusions found in travel insurance policies:

- Civil unrest

- Epidemics (except COVID-19)

- Extreme, high-risk sports

- Government-issued travel bulletins or warnings

- Natural disasters

- Nuclear reaction, radiation or radioactive contamination

- Preexisting conditions (unless specifically covered by your plan)

- Pregnancy-related medical expenses that aren't an emergency (including regular labor and delivery)

- Terrorist events

- Travel to participate or train for a sporting event

Tips on Trips and Expert Picks Newsletter

Travel tips, vacation ideas and more to make your next vacation stellar.

Sign up to receive the latest updates from U.S News & World Report and our trusted partners and sponsors. By clicking submit, you are agreeing to our Terms and Conditions & Privacy Policy .

When should you skip travel insurance?

While the cost of a travel insurance policy can be worth it in the end, there are plenty of travel scenarios where you may not need to purchase a plan. Consider the following situations where buying insurance may not be worth the trouble:

- You're planning a short road trip within the U.S.: If you're planning a short trip within the U.S. where your own health insurance coverage will apply, you may not need trip insurance for medical expenses. The fact that you're not flying also means you don't have to worry about flight cancellations, and that your luggage will likely remain in your possession the entire trip.

- You plan to use credit card travel insurance: There may be instances where credit card travel insurance coverage is sufficient for your plans, although only you can make this decision. For example, the popular Chase Sapphire Reserve card comes with trip cancellation and interruption coverage worth up to $10,000 per person and $20,000 per trip; primary rental car coverage for damage or theft worth up to $75,000; lost luggage reimbursement worth up to $3,000 per passenger; emergency evacuation and transportation coverage worth up to $100,000; and more.

- You bought insurance from your travel provider: There may be instances where the travel insurance coverage from your airline or cruise line is good enough. If you're flying within the U.S. to see a family member and staying in their home for free, for example, you'll likely just need protection against flight cancellations, eligible trip delays, and lost or delayed baggage.

Why Trust U.S. News Travel

Holly Johnson is an award-winning writer who has extensive experience when it comes to researching and buying travel insurance for her own trips to more than 50 countries around the world. Johnson has interviewed top executives from many of the best travel insurance companies and has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family media business.

You might also be interested in:

- The Easiest Way to Renew Your Passport

- Is a Travel Agent Worth It? The Pros & Cons

- TSA Precheck vs. Global Entry

Tags: Travel , Travel Insurance

World's Best Places To Visit

- # 1 South Island, New Zealand

- # 4 Bora Bora

If you make a purchase from our site, we may earn a commission. This does not affect the quality or independence of our editorial content.

You May Also Like

The best places to go for july fourth.

Sharael Kolberg June 10, 2024

The Best Places to Celebrate Juneteenth

Suzanne Mason June 6, 2024

The Best Salem Tours

Lyn Mettler June 6, 2024

The Best Key Largo Snorkeling Tours

Gwen Pratesi June 6, 2024

The Best London Tours

Kim Foley MacKinnon June 5, 2024

Celebrity Ascent Review

Megan duBois June 5, 2024

The Best Graceland Tours

Gwen Pratesi June 5, 2024

Top Things to Do in Orange County, CA

Brittany Chrusciel and Sharael Kolberg June 4, 2024

Fun Things to Do in Arkansas

Ben Luthi and Justine Harrington June 3, 2024

Top Things to Do in Florida

Gwen Pratesi May 31, 2024

IMAGES

COMMENTS

Our Holiday Insurance covers Covid cover as standard. Find out more about our annual and single-trip insurance here. ... **Max trip duration dependent on cover level. Virgin Money Travel Insurance is promoted by CYB Intermediaries Ltd, registered at Jubilee House, Gosforth, NE3 4PL (Company No: 04056283) who is authorised and regulated by the ...

Book single-trip travel insurance with Virgin Money - with Covid cover, gadget cover, 24/7 emergency phone and online assistance. Find out more today. Credit cards, Mortgages, Savings, ISAs, Investments and Insurance - Our quest to make banking better starts here ... Virgin Money Travel Insurance is promoted by CYB Intermediaries Ltd ...

Covid cover included Cancellation and medical expenses are covered by us, as standard, if you're diagnosed with Covid-19.* Find out what we cover. ... Virgin Money Travel Insurance is promoted by CYB Intermediaries Ltd, registered at Jubilee House, Gosforth, NE3 4PL (Company No: 04056283) who is authorised and regulated by the Financial ...

17th March, 2022. Travel insurance policies include option to add enhanced Covid-19 cover. Features Covid-19 pre departure and overseas cover as standard. Fully digital which means policy holders can buy, update and track claims online. As confidence in overseas travel beings to build, Virgin Money has today launched a new range of travel ...

Customers booked to travel from 24 August 2020 until 31 March 2021 will automatically receive the new COVID-19 Cover. Image from Virgin Atlantic The cover is provided by Allianz Assistance and covers emergency medical and associated expenses while abroad totalling £500,000 per customer - the highest value of policy offered by an airline to ...

On the 11 March 2020, the World Health Organisation (WHO) declared coronavirus (COVID-19) a pandemic. As of 11 March 2020, coronavirus is therefore considered a 'foreseen event', which means certain parts of your travel insurance policy may not apply. As an existing Club M Account customer, you may be covered for Coronavirus related travel ...

Travel insurance comparison site Squaremouth (a NerdWallet partner) is one of the very few comparison sites that allows you to filter by policies that offer coronavirus coverage. To find a policy ...

The insurance policy with Allianz Assistance offers comprehensive cover in the event that a Virgin Atlantic customer or travel companion becomes ill with COVID-19 while on a trip. Emergency medical costs, associated expenses such as transport and accommodation and repatriation up to £500,000 are included, as well as costs if a customer is ...

Covid cover included - cancellation and medical expenses are covered by Virgin Money, as standard, if you're diagnosed with Covid-19.* Gadget cover as standard, ... Standard Virgin Money Travel Insurance Policy conditions apply. If something goes wrong, we'll try to fix it. If we can't because it's something we can't control, or it ...

Best Covid Travel Insurance Policies. Travel Insured - Worldwide Trip Protector. WorldTrips - Atlas Journey Premier/Atlas Journey Preferred. Seven Corners - Trip Protection Choice/Trip ...

Cover yourself, your family and any other travel companions with our comprehensive travel insurance policy. Our travel insurance is available exclusively to UK residents with up to £15,000,000 cover for medical expenses and up to £5,000 per person for cancellations. Get insured. If you are a British national travelling to a country where the ...

Fortunately, there are still insurance providers that'll provide coverage in the event you're affected by COVID-19, including: Trip cancellation. Trip delay. Medical care/hospitalization ...

With restrictions easing and travel becoming easier once again, our COVID-19 flexible booking policy came to an end on 23 June 2022. ... you should ensure you have adequate travel insurance for your trip. Flight bookings ... For all flights booked with Virgin Atlantic and package holidays purchased from Virgin Holidays between 16 February 2022 ...

This is not a full travel insurance policy. It is a COVID-19 Group Insurance Policy held by Virgin Atlantic Ltd for the benefit of (and in trust for) Virgin Atlantic passengers, which helps protect while travelling, for various events relating to Coronavirus such as: medical emergencies; being denied boarding; or being placed in quarantine ...

Coronavirus medical and repatriation cover To cover you if you're infected when you're away. Coronavirus cancellation cover You'll need this if you want to be able to claim on insurance for refunds if Covid stops you travelling for any reason. Our ratings will tell you how much Covid cover an insurer has. Scheduled airline failure insurance ...

Almost all travel insurance policies have a "fear of travel" clause. According to AIG, one of the world's largest travel insurance providers, "Trip cancellation for concern or fear of travel ...

Travelex Insurance Services: Best Optional Coverage Add-ons. Allianz Travel Insurance: Best for Multitrip and Annual Plans. World Nomads Travel Insurance: Best for Active Travelers. Generali ...

Our new direct Virgin Atlantic service commences 22nd October 2023. ... tying the knot in Vegas, or relaxing on a Caribbean cruise we've got a policy to cover you. Booking your travel insurance through Virgin Atlantic gives you the reassurance that we have you covered from the start to finish of your holiday. ... COVID-19 - cover for medical ...

This is the shortlist of the best travel insurance for COVID options: Berkshire Hathaway Travel Protection. IMG. John Hancock Insurance Agency, Inc. Seven Corners. Travelex Insurance Services ...

By Elaine Glusac. Nov. 26, 2020. When the pandemic struck, many travel insurance policies failed to cover Covid-19-related trip interruptions and cancellations, often because they excluded ...

On January 21, 2020, the Coronavirus disease 2019 (COVID-19) became a named event, which affects the travel insurance coverage available for new policies purchased. For those purchasing travel insurance AFTER 1/21/2020 (exceptions may apply if traveling to a country with a Travel Health Notice issued by the CDC) benefits included in ...

Get domestic and overseas cover today and travel knowing you are protected with Cover-More. ... 75% and 100% bonus Points respectively on top of the base Points earned when purchasing your travel insurance through the quote generator. ... In the spirit of reconciliation Virgin Australia acknowledges the traditional custodians of country ...

Cons. Medical coverage of $100,000 per person is on the low side compared to top competitors but might be enough for your needs. Missed connection benefits of $500 are low compared to other top ...

It covers an unlimited number of trips per calendar year and includes important coverage types like trip cancellation and trip interruption insurance. It also includes travel delay ($750), baggage ...

Seven Corners' Trip Protection Basic plan: This travel plan offers $100,000 in emergency medical coverage and $250,000 in medical evacuation coverage. It also includes $600 per person in travel ...

This may help protect your travel investment, your belongings and most importantly, you, from many unforeseen circumstances that may arise before or during your trip, including costs of circumstances that may arise from any illness (including COVID-19*). The Travel Protection Plan includes a non-insurance Cancel For Any Reason Waiver (provided ...

Exactly what you'd pay for emergency evacuation would depend on your medical condition, the care required and your location. Durazo says emergency medical transportation to the U.S. from the ...

According to Allianz Travel Insurance, the average costs of international medical evacuation can range from $15,000 in Mexico all the way up to $220,000 in Asia, Australia and the Middle East ...