Trending Stories

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

7 Best Cards To Earn First-Class Travel Without the Price Tag

/authors/kat_tretina_updated.png)

This article was subjected to a comprehensive fact-checking process. Our professional fact-checkers verify article information against primary sources, reputable publishers, and experts in the field.

/images/2019/05/31/first-class-travel-made-easy-with-credit-card.jpeg)

We receive compensation from the products and services mentioned in this story, but the opinions are the author's own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies .

Imagine traveling in first-class luxury, relaxing in a plush seat, and enjoying delectable food and first-rate service. Using a travel credit card and its reward program could make this dream a reality without emptying your bank account. One of our recommended travel credit cards is the Chase Sapphire Preferred ® Card .

You can use your travel credit card to save up the miles or points you earn and redeem them for flights. Even better, you might be able to use your points or miles to make your experience more comfortable and luxurious by upgrading to first-class travel.

Best credit cards to earn first-class travel

Comparison of the best credit cards to earn first-class travel, why first-class travel can be worth the splurge, bottom line, methodology.

While flying first class is an experience worth having, it often comes with a hefty price tag. First-class tickets typically cost hundreds more than seats in the standard cabin.

For example, a flight on American Airlines from Orlando to Philadelphia costs $188 if you opt for basic economy. If you upgrade to first class, that price jumps to a whopping $649. Getting the additional perks and comfort of first class would cost you an additional $461. Keep in mind that’s for a relatively short flight — longer journeys would likely be even more expensive.

Luckily, you don’t have to shell out that much money out of your own pocket to enjoy first-class luxury for less. With a travel card, you can earn valuable rewards to redeem for first-class tickets.

Here are our top picks for some of the best travel credit cards to score first-class fare:

Delta SkyMiles ® Blue American Express Card

Chase sapphire preferred ® card, capital one ventureone rewards credit card, chase sapphire reserve ®, the platinum card ® from american express, capital one venture rewards credit card, ink business preferred ® credit card.

If you frequently fly a specific airline, you may prefer a credit card that enables you to earn points or miles with this airline. For example, frequent Delta Air Lines flyers may enjoy a credit card such as the Delta SkyMiles ® Blue American Express Card .

This credit card helps you earn 2X miles on eligible purchases made directly with Delta and at restaurants worldwide, plus takeout and delivery in the U.S., and 1X miles on all other eligible purchases.

You can also benefit from its welcome offer. Earn 10,000 bonus miles after spending $1,000 in purchases in the first 6 months. And the best part is that you’d only pay a $ 0 annual fee.

If you don’t mind paying an annual fee, you can also explore other Delta SkyMiles credit cards, such as the Delta SkyMiles ® Gold American Express Card and the Delta SkyMiles ® Platinum American Express Card . These two cards charge annual fees:

- Delta SkyMiles® Gold card : $ 0 intro annual fee for the first year, $150 per year thereafter (terms apply)

- Delta SkyMiles® Platinum card : $ 350 (terms apply)

But both cards come with additional rewards and travel benefits, including more generous welcome offers.

Learn how to apply or read more about this card in our Delta SkyMiles ® Blue American Express Card review .

The Chase Sapphire Preferred can help you earn first-class tickets sooner. Not only are your points worth 25% more when redeemed for travel through the Chase Travel℠ portal, you’ll also earn extra points on dining and travel each time you make a purchase on your card in those categories. It also offers flexible redemption methods, which comes in handy for finding first-class seats for less.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

5X points on travel purchased through Chase Travel℠; 3X points on dining, select streaming services, and online groceries; 2X points on all other travel purchases, and 1X points on all other purchases

$50 annual credit on hotel stays purchased through Chase Travel℠

Points bonus equal to 10% of the total purchases you made in the previous year each card anniversary

- No foreign transaction fees

- 1:1 point transfer available with Chase airline and hotel travel partners

- There are no blackout dates — as long as a flight is available in the travel portal, you can book it

- Other perks like primary rental car insurance, trip delay reimbursement, purchase protection, complimentary DoorDash DashPass benefits, and more

Apply now or learn more about this card with our Chase Sapphire Preferred review.

The Capital One VentureOne Rewards Credit Card is a solid choice for someone who wants to earn travel rewards without worrying about a high annual fee.

This credit card helps you earn 1.25 miles per dollar on every purchase, every day and 5 miles per dollar on hotels and rental cars booked through Capital One Travel. Its annual fee is $0.

The Capital One VentureOne also offers a welcome offer. You can earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening.

What makes the Capital One VentureOne further stand out is that it can help you manage a large purchase or an existing credit card balance. This credit card offers new cardholders:

- 0% intro APR on purchases for 15 months, then 19.99% - 29.99% (variable) APR

- 0% intro APR on balance transfers for 15 months, then 19.99% - 29.99% (variable) APR; Balance transfer fee applies

You don’t have to worry about foreign transaction fees with the Capital One VentureOne. And you can redeem the miles you earn from your spending in various ways. This includes transfers to hotel and airline partners or redemptions via the Capital One Travel portal.

Learn more in our Capital One VentureOne Rewards Credit Card review .

If you enjoy high-end travel, the Chase Sapphire Reserve can help you book luxury flights for less. Despite its hefty annual fee, it offers exceptional value and a slew of premium perks. You’ll get significant travel credits worth hundreds of dollars every year. And if you redeem your points for travel through the Chase Travel℠ portal, they’re worth 50% more, helping you score first-class seats much sooner.

- 5X points on flights and 10X points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually; 3X points on other travel and dining & 1X points per dollar on all other purchases

- Receive a $300 annual travel credit as reimbursement for travel purchases charged to your card each year

- Get reimbursed for Global Entry ($100) or TSA PreCheck ($85) application fees

- Complimentary airport lounge access with a Priority Pass Select membership

- Complimentary year of Lyft Pink (a value of $19.99 per month)

- $5 in DoorDash credit each month and a complimentary DoorPass subscription for at least a year when activated by Dec 31, 2024

- Other perks like trip cancellation insurance, primary rental car insurance, lost luggage reimbursement, trip delay reimbursement, free DoorDash DashPass benefits, and more

Apply now or learn more about this card with our Chase Sapphire Reserve review.

For travelers looking to make their experience more luxurious, the Platinum Card from American Express really goes the extra mile. Offering high levels of rewards and travel perks, jet-setters will find its benefits justify its $ 695 annual fee.

- Earn 80,000 Membership Rewards points after spending $8,000 on eligible purchases on your new card in the first 6 months

- 5X points per dollar spent on eligible airfare (on up to $500,000 per calendar year, after that 1X) and eligible hotel purchases, and 1X points per dollar on all other eligible purchases

- Complimentary access to Centurion and Priority Pass Select airport lounges

- Get reimbursed for Global Entry ($100) or TSA PreCheck ($85) application fees (five year plan only)

- Get $200 in Uber Cash every year (terms apply)

- Other perks like secondary car rental insurance, premium roadside assistance, travel accident insurance, baggage insurance, and more

- Note that certain benefits require enrollment

Learn how to apply or read more about this card with our Amex Platinum review.

Voted as “The Best Travel Card” by CNBC in 2018, it’s easy to see why the Capital One Venture Rewards Card is so valuable. You’ll earn a higher rate of return on every purchase you make, helping you achieve first-class status without worrying about spending categories.

- Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within 3 months from account opening

- Earn 2 miles per dollar on every purchase, every day, 5 miles per dollar on hotels, vacation rentals and rental cars booked through Capital One Travel and 5 miles per dollar on Capital One Entertainment purchases through 12/31/25

- Get reimbursed for Global Entry ($100) or TSA PreCheck ($85) application fees once every four years

- Other perks like rental car insurance, travel accident insurance, extended warranty, and more

Learn more about this card with our Capital One Venture Rewards Card review.

If you own a business, traveling for work can be exhausting. Upgrading to first class can make business travel more enjoyable, and the Ink Business Preferred Credit Card can help you earn enough miles to do so quickly. Plus, you can earn impressive rewards in spending categories that commonly rack up business expenses.

- Earn 120,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening

- 3X points on the first $150,000 spent in combined purchases on travel, shipping purchases, Internet, cable and phone services, advertising purchases made with social media sites and search engines each account anniversary year; and 1X points per $1 on all other purchases

- Redeem your points through Chase Travel℠ and they’re worth 25% more

- Get up to $600 in cell phone protection against covered theft or damage

- Other perks like trip cancellation insurance, primary car rental insurance, extended warranty protection, and more

Apply now or learn more about this card with our Ink Business Preferred review.

If comfort is key, it’s hard to beat flying first class. While each airline is different, in general, you can expect amenities like:

- Substantially larger seats with more legroom

- Personal service with a dedicated flight attendant

- Access to power outlets to charge your devices

- Complimentary pillows, blankets, and headphones

- Free premium entertainment like movies and television shows

- Chef-curated meals

- Expedited check-in and security service

- Priority boarding

With these benefits, you’re more likely to relax and enjoy the flight. You’ll arrive at your destination refreshed and relaxed, rather than stressed and hungry. First-class airfare can make the flight an enjoyable part of your vacation instead of a chore you have to endure.

Are first-class flights worth the price?

The value of a first-class flight depends on various factors, such as its actual price, the perks it offers, and your personal preference. First-class flights can offer speedy check-in, fast boarding, more space, improved service, and fewer in-flight fees.

The difference between first class and economy is more apparent on long-haul flights, where first class can provide lie-flat seats and exclusive amenities.

However, first-class flights tend to be more pricey than economy class, especially when booked as roundtrip flights, and the benefits may not justify the cost for everyone. Some travelers may prefer to save money or use other options like redeeming their airline miles or bonus miles for upgrades.

Can a travel credit card help me with first-class flights?

Travel credit cards can help you earn rewards in the form of cash back, points, or miles that you can put toward first-class tickets. In many cases, you can earn these points on things such as takeout and dining purchases, refills at gas stations, and purchases at U.S. supermarkets.

Various travel credit cards may offer welcome bonuses or sign-up bonuses for new card members that can help boost what you earn in the first few months of card membership. Some credit cards may also enable you to transfer points to the loyalty programs of its transfer partners.

You can also use co-branded airline credit cards, which may help you earn an elevated rate for in-flight purchases, get free checked bags, and benefit from elite statuses at frequent flyer programs.

What does first class get you on United?

There are several benefits and perks you can get by flying first class on United. This includes:

- Inflight dining and drinks: You may receive premium snacks, fresh fruit, or a full dinner service with two entree options, depending on how long the journey is. You’d also have a selection of drinks, including soft drinks, juice, tea, freshly brewed coffee, and a variety of beer, wine, and spirits.

First-class travel is an indulgent experience that’s often well worth the splurge (at least once!). To help you enjoy the perks without the expense, use one of the credit cards listed above to earn rewards you can redeem for future trips and vacations.

To choose the best credit cards to earn first-class travel with, we identified cards with travel benefits and compared features like welcome offers, premium travel perks, rewards redemption options, and business traveler benefits. We did not include all possible options.

Great for Flexible Travel Rewards

/images/2024/03/28/chase_sapphire_preferred_032824.png)

FinanceBuzz writers and editors score cards based on a number of objective features as well as our expert editorial assessment. Our partners do not influence how we rate products.

Current Offer

Rewards rate.

- Generous welcome offer valued at $750 when redeemed via Chase Travel

- High rewards on dining and bookings via Chase Travel

- 25% more value when redeeming points for travel through Chase Travel

- Up to $50 in annual statement credits for hotel stays booked through Chase Travel

- Receive valuable travel protections like trip delay reimbursement and primary rental car insurance

- Has a $95 annual fee

- Doesn’t offer airport lounge access or premium travel perks like Global Entry or TSA PreCheck credit

- Doesn't offer bonus points on gas or in-person groceries purchases

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027.

- Member FDIC

Author Details

/authors/kat_tretina_updated.png)

- Customer Service

TD First Class SM Visa ® Signature Credit Card

Travel rewards – Earn triple miles on travel and dining

Compare TD cards >

Read complete terms and conditions for details about APRs, fees, eligible purchases, balance transfers and program details.

Offer details, rates, fees and terms

Bonus miles offer.

Earn up to 25,000 bonus miles within the first 6 billing cycles of account opening, which equals a $250 statement credit towards travel or dining purchases

Bonus miles will be reflected on your credit card statement 6 to 8 weeks after a qualified first purchase and/or 6 to 8 weeks after $3,000 in total net purchases made within the first 6 billing cycles of your credit card account opening date. This offer is non-transferable. This online offer is not available if you open an account in response to a different offer that you may receive from us. This online offer is not available if you open an account in response to a different offer that you may receive from us.

Rewards details

3X First Class miles on travel and dining purchases , including flights, hotels, car rentals, cruises and dining, from fast food to fine dining

1X First Class miles on all other purchases – no categories or gimmicks and earn points that never expire as long as your account is open and in good standing.

Rates and fees

Need more information?

Take a look at our terms and conditions or personal cardmember agreement .

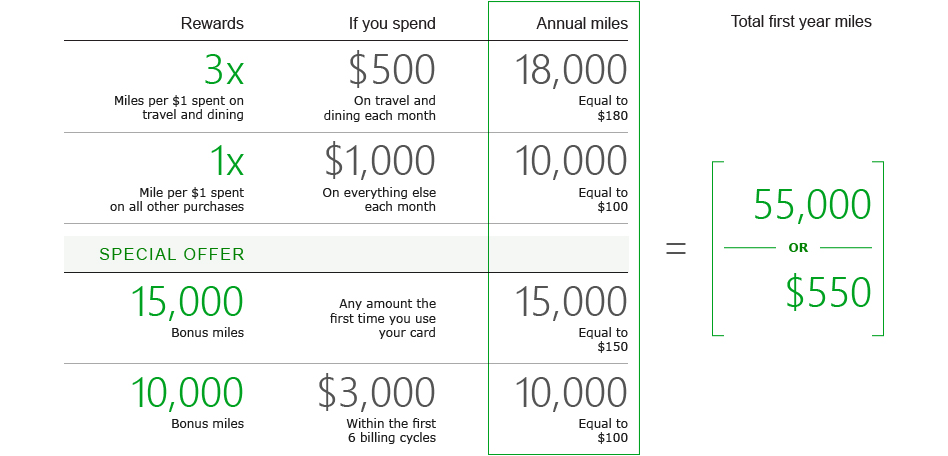

Earn unlimited points with every purchase, and triple the miles on travel

See how many miles you can earn from travel and other purchases.

Redeem your First Class miles for a statement credit toward travel and dining purchases >

To earn and redeem points, your account must be open and in good standing.

Credit Card FAQs

Manage your card, security you can count on.

Don't worry-we're protecting your every move. Our built-in chip technology helps guard you against fraud. Plus, you get the benefits of Visa Zero Liability 2

Managing your account is easy

Get the service you need, when you need it. Log in to your account or talk to a TD Bank representative 24/7 at 1-877-468-3178.

Redeem your rewards

Visit the td first class rewards site >.

- Credit Cards

- TD First Class Travel Visa Infinite Card Review

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

TD First Class Travel® Visa Infinite* Card Review 2024

Updated: Jun 25, 2024, 7:43am

Fact Checked

Frequent travellers will find plenty of value in this card. Considering that it earns a minimum of 2 TD Rewards points on every dollar, it has flexible redemption options, plenty of insurance coverage, a travel credit of $100 when you book travel through Expedia ® for TD and a birthday bonus of up to 10,000 points, it easily earns its spot in your wallet.

- High earn rate for rewards with Expedia.

- Exclusive travel benefits.

- Expensive annual fee.

- Low annual net rewards earnings for average spenders.

Table of Contents

Introduction, quick facts, td first class travel visa infinite card rewards, td first class travel visa infinite card benefits, how the td first class travel visa infinite card stacks up, methodology, is the td first class travel visa infinite card right for you, advertising disclosure.

- Earn up to $700 in value†, including up to 75,000 TD Rewards Points, no Annual Fee for the first year† and additional travel benefits. Conditions Apply. Account must be approved by September 3, 2024.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†.

- Earn 55,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- Earn a Birthday Bonus of 10% of the TD Rewards Points you have earned over the past year, up to a maximum of 10,000 TD Rewards points†.

- Get an annual TD Travel Credit † of $100 when you book at Expedia ® For TD.

- Get an Annual Fee Rebate for the first year†.

- To receive the first-year annual fee rebate for the Primary Cardholder, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by September 4, 2024.

- This offer is not available for residents of Quebec.

- † Terms and conditions apply.

The TD First Class Travel Visa Infinite Card is considered to be one of Canada’s higher end travel credit cards, even though its annual fee makes it quite affordable. With easy earning potential, a flexible rewards program, and a generous insurance package, it’s definitely worth considering if you are a frequent traveller.

The travel perks and benefits aren’t quite as inclusive as other high-end credit cards. The absence of lounge access is a big one to note. Another downside is that the points cannot be converted into other rewards programs. That being said, for its price point, it’s quite competitive and still gives good value.

- Cardholders will earn points for every dollar spent with accelerated rates on groceries, restaurants, recurring bill payments and travel booked through Expedia® For TD.

- Cardholders will benefit from an annual $100 travel credit when they book travel through Expedia® For TD as well as an annual birthday bonus of up to 10,000 TD Rewards Points.

- Cardholders can redeem points for a range of options at any time as long as they have at least 200 TD points available.

- No travel blackouts, no seat restrictions and no expiry for your TD Rewards Points as long as your account is open and in good standing.

Earning Rewards

Earning rewards with the TD First Class Travel Visa Infinite card is easy as you can earn on every purchase you make.

- Earn 8 TD Rewards Points for every $1 you spend when you book travel through Expedia For TD

- Earn 6 TD Rewards Points for every $1 you spend on groceries and restaurants

- Earn 4 TD Rewards Points for every $1 you spend on recurring bill payments

- Earn 2 TD Rewards Points for every $1 you spend on other purchase

- Earn an annual Birthday Bonus of up to 10,000 TD Rewards Points, or 10% of the total number of TD Reward Points earned in the previous 12 months

There is an annual spend cap of $25,000 for each of the accelerated categories. Once you exceed that maximum, you’ll earn 2 TD Rewards Points for every dollar spent.

Here’s an example of how many TD Rewards Points you could get in the first year, including 100,000 TD Rewards Points (20,000 welcome bonus plus 80,000 points when you spend $5,000 within 180 days of account opening):

Redeeming Rewards

Rewards can be redeemed at any point, in increments of 200 points. You can redeem them for options such as travel (you’ll get the best rewards value if you book through Expedia For TD), Amazon purchases, gift cards, cash credits, and education credits. Redeeming points is easy and the multiple rewards options are attractive. However, some other top-tier credit cards allow you to convert points to other programs like airline or hotel partners for more flexibility, which this card is lacking.

Credit card reward perks include:

- Redeem your TD Rewards Points for your next trip at ExpediaForTD.com and get access to exclusive deals

- Link your eligible card to earn 50% more TD Rewards Points and Starbucks Stars

- Redeem your TD Rewards Points towards purchases at Amazon.ca with Amazon Shop with Points.

Rewards Potential

Cardholders will get the best value for their points by booking travel through Expedia For TD. However, if you like to book directly with hotels or airlines to get status points then it’s not the best rewards potential out there, since booking outside of Expedia For TD lowers the value of your points. With Expedia for TD, 200 points are equal to $1 off travel purchases. For travel booked outside of Expedia For TD, you need 250 points for that same dollar value.

That said, based on average Canadian spending, Forbes Advisor estimates this card could earn $127.34 in rewards value per year with Expedia and $111.67 with other travel partners (both calculations factor in the cost of the annual fee).

- Comprehensive travel insurance coverage.

- Discounts on car rentals with Avis and Budget Rent-A-Car.

- Link your card to Starbucks Rewards to earn 50% more TD points and Starbucks Rewards on Starbucks purchases.

More Card Benefits and Features

TD Rewards Program Benefits:

- Go places on points and redeem through Expedia for TD (where your points are worth more) or book through any other travel agency or website and use your points within 90 days of purchase.

- Shop online for merchandise and gift cards through TDRewards.com

- Pay with rewards and pay down your credit card balance with points.

Travel Benefits:

- Annual $100 TD Travel Credit on your first eligible travel credit purchase of $500 or more made with Expedia for TD

- Travel medical insurance, up to $2 million of coverage for the first 21 days (or the first four days if you or your spouse is aged 65 or older)

- Flight/trip delay insurance, up to $500 in coverage if your flight is delayed for over four hours

- Trip cancellation, up to $1,500 per person with a maximum of $5,000 for all insured persons

- Trip interruption, up to $5,000 per person, with a maximum of $25,000 for all insured persons

- Common carrier travel accident insurance, up to $500,000

- Emergency travel assistance services

- Delayed and lost baggage insurance, up to $1,000 per person if your baggage is delayed more than six hours or lost

- Auto rental collision/loss damage insurance, up to 48 consecutive days

- TD’s Credit Card Travel Insurance Verification Tool lets you check your insurance benefits

- Hotel/motel burglary insurance, up to $2,500 of coverage

Additional Benefits and Features:

- TD Payment Plans let you turn purchases of $100 or more into manageable six, 12 or 18 month payment plans

- Save a minimum of 10% off the lowest available base rate with Avis Rent A Car and Budget Rent A Car in Canada and the U.S. and 5% internationally

- Use Apple Pay, Google Pay or Samsung Pay where contactless payments are accepted

Visa Infinite Benefits:

- Complimentary Visa Infinite Concierge 24/7

- Receive seven exclusive benefits when you book your stay through the Visa Infinite Luxury Hotel Collection featuring over 900 hotels

- Visa Infinite Dining Series gives you access to exclusive gourmet events

- Visa Infinite Wine Country Program gives exclusive benefits at over 95 participating wineries in B.C., Ontario and Sonoma Valley, including discounts on wine purchases, complimentary tastings, private vineyard tours and more

- Visa Infinite Entertainment Access provides exclusive access to tickets to curated events

- Visa Infinite Troon Golf provides elevated Troon Rewards Silver Status at over 95 courses and 10% off green fees, merchandise and lessons

- Mobile device insurance, up to $1,000 of coverage in the event of loss, theft, accidental damage or mechanical breakdown

- Chip and PIN technology provides an added level of security

- Purchase security and extended warranty protection within 90 days or purchase, or double the warranty period (up to 12 months) if the item comes with a manufacturer’s warranty

- Visa Secure provides you with increased security and convenience when you shop online

- Instant TD Fraud Alerts whenever there is any suspected suspicious activity

- Set transaction limits, block international purchases or lock your credit card in the TD app

- Pay online with Click to Pay

Optional Benefits:

- Optional TD Credit Card Payment Protection Plan helps you with your payment obligations in the event of a covered job loss, total disability or loss of life

- Optional TD Auto Club Membership that provides 24/7 emergency roadside assistance

Interest Rates

- Regular APR: 20.99%

- Cash Advance APR: 22.99%

- Foreign Transaction Fee: 2.50%

- Annual Fee: $139 (Get an annual fee rebate in the first year; account must be approved by September 3, 2024)

- Any other fees: Additional cardholder $50.00 (To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by September 4, 2024)

TD First Class Travel ® Visa Infinite* Card vs. TD ® Aeroplan ® Visa Infinite* Privilege

While both travel cards, the TD Aeroplan Visa Infinite is a luxury travel card. The annual fee is a hefty $599, but it comes with considerably more perks and benefits. including lounge access and NEXUS card rebates. It also uses Aeroplan rewards rather than TD rewards. The TD Aeroplan Visa Infinite is a strong card, but it’s best for those who travel frequently and can offset the cost of the card with the included benefits.

TD First Class Travel ® Visa Infinite* Card vs. Scotiabank Scene+ Visa Card for Students

Students studying away from home may consider a travel card like the TD First Class Travel Visa Infinite Card to help offset the cost of flights home. However, with the annual fee and rewards earning potential, you might be better off sticking to a $0 annual fee card geared towards student spending. The Scotiabank Scene+ Visa card for students allows you to earn points that can be used for day-to-day expenses like dining out, entertainment and even banking.

TD First Class Travel ® Visa Infinite* Card vs. TD ® Aeroplan ® Visa Platinum* Card

With an annual fee of $89, the TD Aeroplan Visa Platinum is a bit more affordable. The earn rates aren’t as high, but it’s also a different rewards program. While TD Rewards points are best with Expedia, Aeroplan points are best with Air Canada. So your choice between these two cards should depend on who you are most likely to book travel with to get the best value for your points.

When determining a rating for individual credit cards, the Forbes Advisor Canada editorial team factors in an exhaustive list of data points. With the TD First Class Travel ® Visa Infinite*, the scoring model used takes into account factors such as, but not limited to, rewards rates and categories, fees, welcome bonuses and other benefits and features. Keep in mind, what may be best for some people might not be right for you. Conduct informed research before deciding which cards will best help you achieve your financial goals.

The TD First Class Travel ® Visa Infinite* Card is a decent travel card . It’s easy to earn and redeem points and the suite of travel insurance is a huge perk. However, it has the best value for those who like to book their travel via Expedia. If you prefer to book directly with hotels or airlines or via other travel portals, then there are better travel credit cards out there where your rewards will go further.

Related : What is the best Canadian credit card

Frequently Asked Questions (FAQs)

Does the td first class travel visa infinite card have airline lounge access.

No, this card does not include airport lounge access .

Does the TD First Class Travel Visa Infinite Card have foreign exchange fees?

Yes, this credit card charges foreign exchange fees (or FX fees) at a rate of 2.5%. If you’re looking for a credit card without without foreign exchange fees , there are plenty available.

How many TD points do you need for a flight?

You need a minimum of 200 TD points to redeem them for rewards. If you book your flight through Expedia ® For TD the points value is 200 TD points per dollar.

Why should you get a travel rewards credit card?

A travel rewards card helps you earn points on everyday purchases (like groceries) that can be redeemed for travel-related expenses, like flights and hotels. You even earn points on travel-related bookings, earning 8 TD Rewards Points for every $1 you spend when you book travel through Expedia for TD.

How do you earn TD Rewards Points?

You earn points with travel bookings, shopping at a grocery store or eating at a restaurant, on recurring bill payments and everyday purchases.

How do you redeem TD Rewards Points?

You can redeem your TD Rewards Points when you book travel online through Expedia for TD, or any other travel provider. You can redeem your points on Amazon.ca with Amazon Shop with Points or shop for merchandise on TDRewards.com. Finally, you can also redeem TD Rewards Points to pay your credit card account balance on the TD app or EasyWeb.

Our partners are not responsible for anything reported by Forbes Advisor. To the best of our knowledge, everything is accurate at the time of publishing as of the date posted. For full information and details, please visit the advertiser’s website.

Hannah Logan is a Canadian freelancer writer and blogger who specializes in personal finance and travel. You can follow her adventures on her travel blog EatSleepBreatheTravel.com or find her on Instagram @hannahlogan21.

- Best Credit Cards

- Best Travel Credit Cards

- Best Cash Back Credit Cards

- Best No Foreign Transaction Fee Credit Cards

- Best Airport Lounge Access Credit Cards

- Best Aeroplan Credit Cards

- Best Student Credit Cards

- Best Rewards Credit Cards

- Best Mastercards

- Best Credit Cards for Bad Credit

- Best Business Credit Cards

- Most Exclusive Credit Cards In Canada

- Best Prepaid Credit Cards

- Best TD Credit Cards

- Best Low-Interest Credit Cards

- Best Visa Cards

- Best RBC Credit Cards

- Best of Instant Approval Credit Cards

- Best Cash Back Credit Cards With No Annual Fee

- Best Secured Credit Cards in Canada

- American Express Cobalt Review

- KOHO Prepaid Mastercard Review

- EQ Bank Card Review

- Neo Standard Mastercard Review

- TD Aeroplan Visa Infinite Privilege Review

- RBC Avion Visa Infinite Review

- Simplii Financial Cash Back Visa Review

- MBNA Rewards World Elite Mastercard

- Scotiabank Passport Visa Infinite Review

- Neo Secured Credit Card Review

- MBNA True Line Mastercard Review

- TD Aeroplan Visa Platinum Card Review

- TD Cash Back Visa Infinite Review

- BMO CashBack World Elite Mastercard Review

- Platinum Card From American Express Review

- TD Platinum Travel Visa Card Review

- TD® Aeroplan® Visa Infinite* Card Review

- American Express Aeroplan Card Review

- American Express Green Card Review

- Credit Card Interest Calculator

- Credit Card Minimum Payment Calculator

- American Express Cobalt vs. Scotiabank Gold American Express Card

- TD First Class Travel Vs. TD Aeroplan

- What's The Best Day & Time To Book Flights

- Air Canada Aeroplan: The Ultimate Guide

- Guide To American Express Credit Card Levels

- What Credit Cards Does Costco Accept In Canada?

- Is American Express Better Than Visa Or Mastercard?

- How To Get The Apple Card In Canada

- What Happens If You Overpay Your Credit Card?

- How To Redeem Aeroplan Points

- Foreign Transaction Fees: How To Avoid Them

- How To Spot A Credit Card Skimmer

- What Is The Highest Limit Credit Card In Canada?

- Benefits And Perks Of Amex Platinum Card

- How Much Is The Amex Platinum Foreign Transaction Fee?

- Negative Balance On A Credit Card: What To Do?

- Fee Increases Here For Both Platinum Cards From Amex

More from

Rogers red world elite mastercard review 2024, rogers red mastercard review 2024, bmo ascend world elite mastercard review 2024, home trust preferred visa card review 2024, float secured business credit card review 2024: canada’s only secured business credit card, pc financial mastercard review 2024: free groceries for no annual fee.

How to use TD Rewards points to reduce travel costs

by Anne Betts | Jul 3, 2024 | Travel Hacking | 5 comments

Updated July 3, 2024

Is the TD Rewards program worth it? How does the program work? What are the various ways to use TD Rewards points to reduce travel costs ? What qualifies as a travel cost?

After several years of earning and redeeming TD Rewards points for travel, I’ve found the program to be beneficial. Here is my review.

Table of Contents

What are TD Rewards Points?

Td rewards credit cards, td first class travel visa infinite card, what are td rewards worth, (i) expedia for td, (ii) book any way, what qualifies as book any way travel, (i) expedia for td, is the td first class travel visa infinite worth it, what i like, what i don’t like.

TD refers to the Toronto-Dominion Bank. TD’s propriety loyalty program is called TD Rewards. The rewards currency is TD Rewards Points. To improve readability, I’ll refer to the points as ‘TD Rewards.’

TD Rewards can’t be converted to any other loyalty currency, or transferred to another loyalty program. It used to be possible to convert TD Rewards to Aeroplan on a product switch to a TD Aeroplan-branded card at a rate of 4:1. However, since April 2019, this is no longer the case.

Points don’t expire as long as your TD Rewards-earning credit card account is in good standing. If you close your credit card account (and don’t have another TD Rewards-earning credit card), you’ll have 90 days to redeem any points left in the account. But, if you lose access to Expedia For TD, they’ll be redeemable at the lower ‘book any way’ value.

As a general rule, points in any in-house program should be redeemed or transferred to another credit card earning the same rewards currency before cancelling or product switching a card.

How to earn TD Rewards

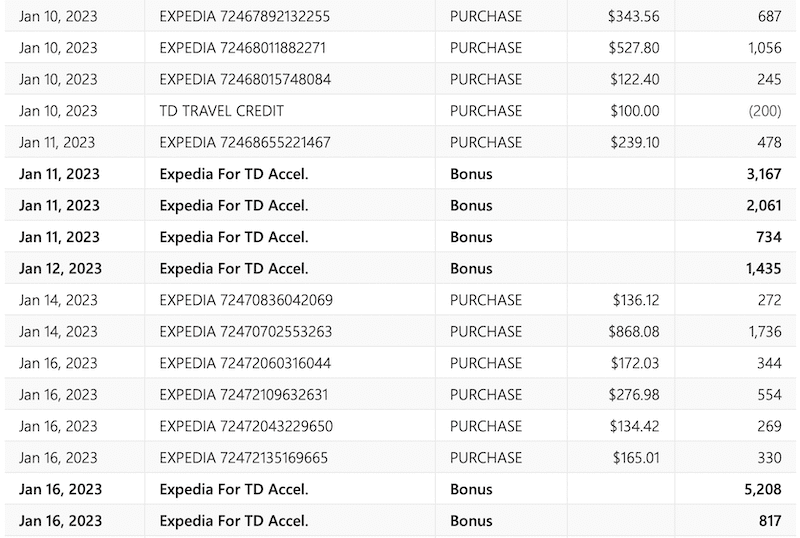

TD Rewards can be earned from a credit card sign-up bonus, through everyday spend on the credit card, and the occasional promotion.

TD offers four credit cards earning TD Rewards:

- TD Platinum Travel Visa Card

- TD Rewards Visa Card

- TD Business Travel Visa Card

TD offers very few points-earning promotions.

The best way to stay abreast of these opportunities is via promotional emails from TD.

For travellers, the best of the three personal credit cards is the First Class Travel Visa Infinite, last overhauled on October 30, 2022.

TD offers promotions on the TD First Class Travel Visa Infinite with elevated sign-up bonuses of up to 135,000 points and an annual fee waiver ($139) in the first year.

According to the terms and conditions, the offers aren’t available to customers who have activated and/or closed a TD First Class Travel Visa Infinite Account in the last 12 months. However, this may or may not be enforced. Also, a product switch from a lower-tier card may be eligible for the full promotional benefits.

The TD First Class Travel Visa Infinite also includes:

- a birthday bonus of 10% of the points earned in the 12 months preceding the primary cardholder’s birthday (up to a maximum of 10,000 points)

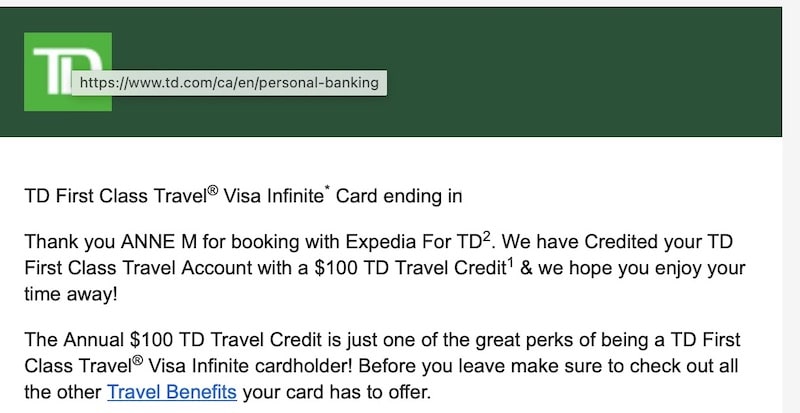

- an annual TD Travel Credit of $100 each calendar year on certain bookings (hotel, motel, lodging, vacation rental, or vacation package) of $500 or more at Expedia for TD in cash, points, or a combination of points and cash.

- a free Uber One membership for 12 months

The earning rate on the TD First Class Travel Visa Infinite is:

- 8 points per dollar for travel booked online or by phone at Expedia for TD

- 6 points per dollar spent on groceries and at restaurants

- 4 points per dollar on regular recurring payments

- 2 points per dollar on all other purchases

There’s a $25,000 cap on spending at the accelerated rates. After that threshold is reached, the earning rate decreases to the base rate of 2 points per dollar.

At first glance, the earning rate on the TD First Class Visa Infinite looks very attractive. That’s because many reward programs can be redeemed at one cent per point (e.g., 10,000 points = $100). With TD Rewards, the best possible redemption rate is 0.5 cents per point (e.g., 10,000 points = $50).

TD’s in-house travel portal is called Expedia For TD, operated by Expedia.

There are two ways to redeem TD Rewards for travel purchases:

- Expedia for TD

- ‘Book Any Way’

Each has a different redemption value.

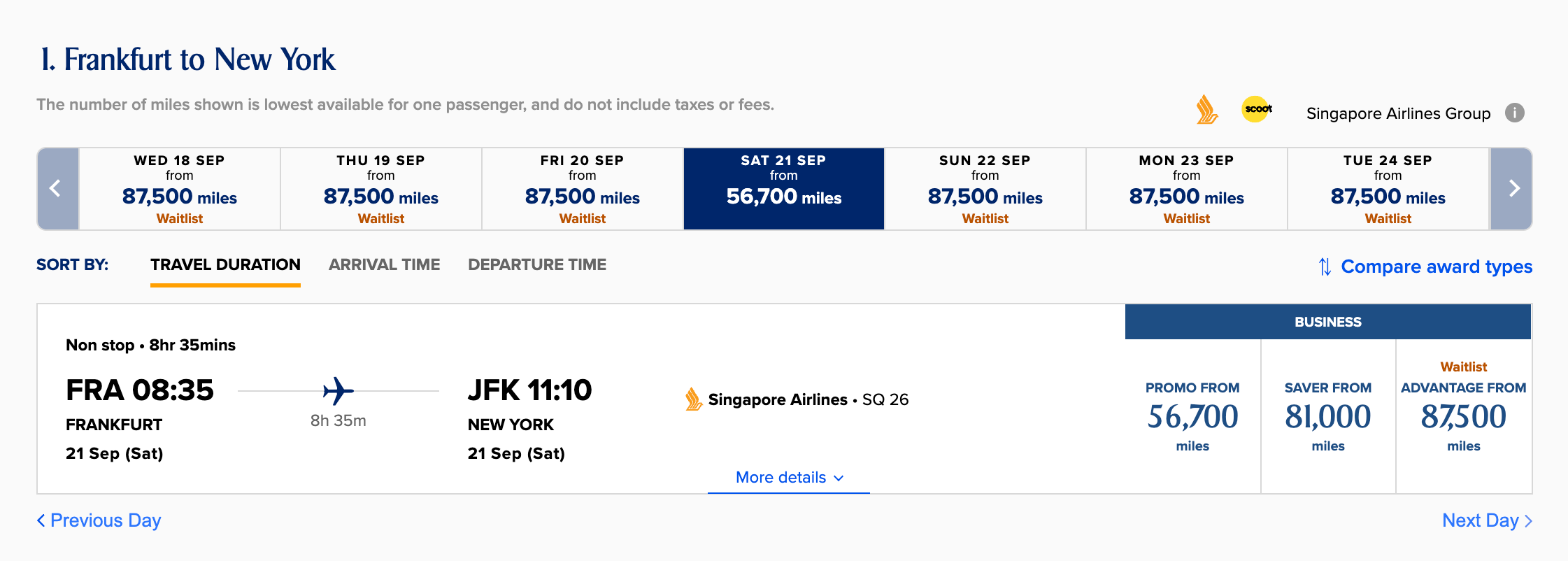

For travel booked through Expedia For TD, points are valued at $0.05 (200 points = $1).

For the most part, Expedia for TD mirrors what’s available on Expedia. However, there are gaps in the inventory. Also, some folks have reported higher prices on Expedia for TD, compared to what’s posted on Expedia.

For what it’s worth, that hasn’t been my experience. For example, a search for a specific hotel in Halifax revealed the best price at Expedia when compared with other booking sites.

The (almost) same price for the same property appeared at Expedia for TD.

‘Book Any Way’ covers travel purchased from travel providers other than Expedia For TD. This allows you to book and redeem points for travel products that don’t appear on Expedia. This includes the option to book last-minute deals or discounted travel at prices that are cheaper than what’s listed at Expedia.

However, TD Rewards are valued at $0.04 (250 = $1) on the first $1,200 of a Book Any Way travel purchase. The value increases to $0.05 (200 = $1) for any amount that is over $1,200 on the same purchase. This is useful for ‘big-ticket’ bookings such as vacation packages or apartment rentals.

Keep in mind that when purchasing from a provider other than Expedia For TD:

- you’re earning x2 TD Rewards Points (instead of x8 at Expedia for TD); and

- you’re redeeming at a lower value of $0.04 (instead of $0.05).

The program has a broad view of what qualifies as travel. Flights, accommodation, cruises, vacation packages (usual stuff) are eligible. Expenses such as theatre tickets, golf fees, resort excursions, restaurant bills, gasoline, taxi fares, and parking may qualify if they’re incurred while travelling.

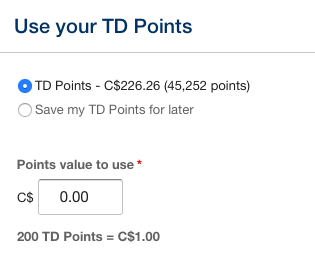

How to redeem TD Rewards for travel

The most convenient way is to book online by signing in to TD Rewards, and entering the Expedia For TD portal to shop for travel.

When you’re ready to make a decision, one click takes you to your chosen travel product.

Another click takes you to the payment page with helpful pre-populated fields showing the name of the cardholder, credit card, TD Rewards account balance, and its monetary value.

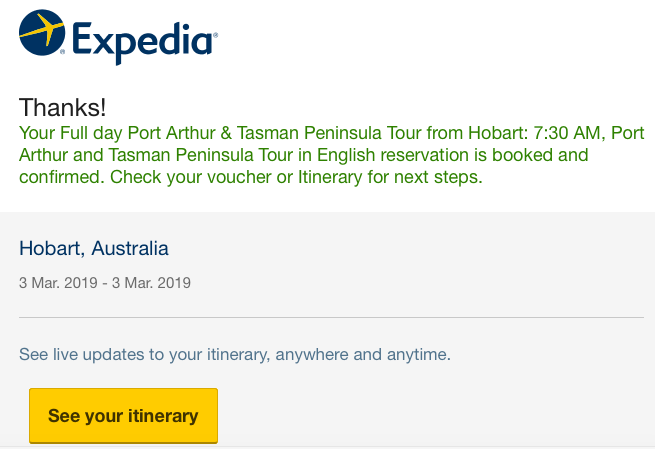

Within moments, an email arrives from Expedia for TD with the booking confirmation and details.

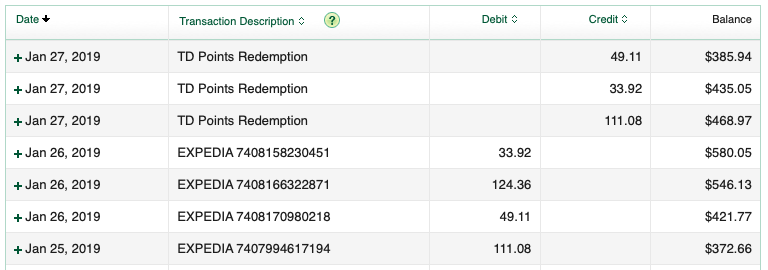

With the “use points” option, the entire travel purchase, including taxes and fees, will be charged to your credit card. But, because you used TD Rewards Points, you’ll receive a credit on your credit card statement within 5 days after the charge, equal to the number of points used.

For the best return, anything appearing at Expedia should be booked online through Expedia For TD and redeemed in this way. Another option is to book by telephone (at Expedia for TD). The points multiplier of x8 for using Expedia For TD will be earned on each booking. Travel purchases and their respective statement credits will appear as separate line items.

- Make a travel-related purchase using the credit card earning TD Rewards.

- Wait until the charge posts to your credit card account.

- Call TD Rewards within 90 days of the transaction date of the purchase, and ask to have points applied.

- The points will be deducted from your points balance available at the time the points are redeemed, not the transaction date of the purchase.

- The amount credited towards the purchase will be equal to the value of the points redeemed. If there are insufficient points available to cover the entire amount, the remaining cost will be posted on the account for payment.

Both redemption routes (Expedia For TD and Book Any Way) allow payment in any combination of points and cash.

Note: Travel usually delivers the best rate of return. However, TD Rewards can be redeemed for merchandise (at an average of 0.23 cents per point), gift cards (0.25), tuition, or paying down a student loan debt (0.4), or as a credit against your credit card account (0.25). These redemption values are shared with thanks to Credit Card Genius for their research and analysis.

If the following applies to you, I say YES :

- You purchase a considerable amount of travel through Expedia (for TD).

- You’re likely to make a single purchase of $500 or more at Expedia for TD to earn the annual travel credit of $100.

- You like the idea of offsetting a variety of travel costs with various rewards programs.

- You’re not loyal to any particular hotel brand and you use a variety of accommodation that’s bookable through Expedia (for TD).

- You’re able to tap into a fee waiver and decent sign-up bonus.

- You have a TD All-Inclusive Banking Package. This requires a minimum daily balance of $5,000 in your account. It entitles you to a $29.95 monthly fee rebate ($22.45 for seniors aged 60 or older). It includes an annual fee rebate of your choice of one of five select TD credit cards. The TD First Class Travel Visa Infinite is one of the cards. The rebate covers the fees for the primary cardholder and one supplementary cardholder.

- You can make use of the travel insurance benefits.

- You use Expedia sparingly. You don’t use it enough to justify paying the annual fee of $139 (beginning in the second year under a -first-year-free promotion).

- Most of your flights are award bookings using frequent flyer miles or points. When you do purchase a revenue ticket, you book flights directly with an airline because of better service in the event of booking irregularities, flight cancellations, and overbooked flights.

- You’re a member of one or more hotel loyalty programs. You book directly with the respective program to earn loyalty points, status credits, and other benefits.

- The other credit cards in your wallet have superior earning power on everyday-spend categories such as groceries, gas, transit, and dining, and/or earn flexible points that are convertible to other reward programs offering better redemption values.

Is the TD Rewards program worth it?

The TD Rewards program shouldn’t be viewed as a frequent flyer program but one where it’s possible to cut trip costs by redeeming points for miscellaneous travel expenses.

For a personal credit card, I believe the best of the bunch is the TD First Class Travel Visa Infinite Card. What did I think of TD Rewards and the TD First Class Travel Visa Infinite Card?

- When used exclusively for travel bookings at Expedia for TD, the TD First Class Travel Visa Infinite Card offers an appealing return of 4%. Otherwise, a mixture of earn rates puts the return somewhere between 1% and 4%.

- For the most part, Expedia has a solid reputation. The company carries some weight in the travel world and could be a useful ally if things don’t go as planned with a small, independent tour operator. However, I’d never use Expedia for expensive long-haul flights. Overbooked flights, delays, cancellations, and other disruptions can put passengers in a zone where neither the airline nor the OTA (Online Travel Agency) will provide assistance.

- I like Expedia For TD’s large inventory of accommodation options, including hostels and apartments, at a variety of price points. I’ve also been impressed by the attractiveness of refundable bookings. For example, the same property at Booking might be refundable up to a month out, whereas at Expedia, it might be refundable up until the day before arrival. This limits reliance on trip cancellation insurance.

- TD’s recent overhaul of the TD First Class Travel Visa Infinite that included a $100 annual travel credit is a welcome benefit. It requires a purchase of $500 or more at Expedia for TD once in a calendar year (that is relatively easy to accomplish when booking accommodation). Triggering the credit requires no intervention on a cardholder’s part as as an email and secure message from TD arrives within 48 hours. This effectively reduces the annual fee of $139 to $39, a compelling reason to keep the card.

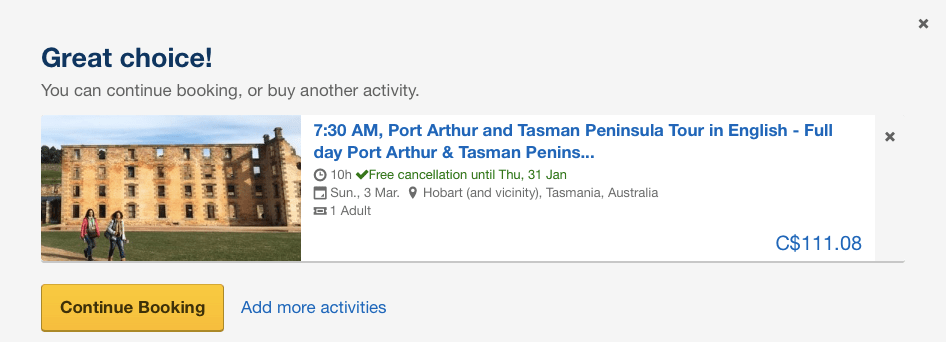

- There’s also the option to book tours and experiences. Other propriety programs (e.g., AMEX Travel) don’t offer a similar range and variety of travel products.

- I love the online system for booking travel at Expedia For TD, and redeeming points against the purchase. It involves inserting a minimal amount of information, and a few clicks to complete the process. Within seconds, the booking confirmation arrives by email.

- Anything appearing at Expedia for TD is bookable online from anywhere in the world. Expedia For TD’s online booking process is convenient, user-friendly, and efficient.

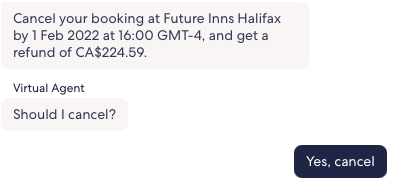

- The same applies to the online process for changing a reservation or using Expedia for TD’s Virtual Assistant to cancel refundable bookings. Sign in, select the booking, hit the cancel button, and receive notification that the refund will be sent within 48 hours.

- The range of travel expenses redeemable as Book any Way travel is impressive.

- With the accelerated earn rate of 6 points per dollar resulting in a 3% return on groceries and dining, I’ve appreciated having the TD First Class Travel Visa Infinite Card in my wallet at restaurants that don’t accept American Express (Cobalt and Scotiabank Gold cards that both earn x5 points on dining).

- TD has a no-fee credit card (TD Rewards Visa Card) that earns TD Rewards. This presents an option to product switch from the TD First Class Travel Visa Infinite (or any other credit card earning TD Rewards) to protect your points and keep a TD Rewards account active.

- TD has a generous approach to product switches that encourage clients to try different credit card products. Some switches provide access to full promotional benefits. In addition, there are cases where clients have been able to hold more than one TD First Class Travel Visa Infinite Card at the same time.

- For credit card cancellations and product switches, TD offers prorated refunds of annual fees.

- The TD All-Inclusive Banking Package presents an option to obtain an annual fee rebate.

- TD’s EasyWeb account management system is efficient and user friendly. After product switching or applying for a new TD credit card, I’ve had the card, with the credit card number, appear in my account within a few hours. On a product switch, the ‘switched-from’ card can be used the following business day to earn points in the ‘switched-to’ card’s rewards program. This is handy to start working on the new card’s Minimum Spend Requirement without having to wait for the new card to arrive by mail.

- There will be others who don’t agree but in my opinion, of the ‘big five,’ TD has the best customer service. For the most part, I’ve found Customer Service Representatives to be helpful, patient, and well informed. Those I’ve dealt with have been more than willing to follow up on requests, listen to, and consider, my interpretation of terms and conditions when it differs from theirs, and seek information from advisors and supervisors.

- To extract maximum value on travel purchases and redemptions, customers need to use Expedia For TD. When purchasing travel from other providers (at an earn rate of 2 points per dollar), and redeeming points using ‘Book any Way’ at the lower redemption value, each point is valued at only 0.8 cents (or 0.8% return).

- At the present time, the program doesn’t have a flight rewards chart where it could be possible, as with other reward programs, for members to extract greater value when redeeming points for flights. For example, the CIBC Rewards (Aventura) Flight Reward Chart offers the potential of a 2.2% return.

- For more information on the CIBC Rewards program, see How to use CIBC Aventura points to reduce travel costs

- Expedia for TD’s Virtual Assistant works well on uncomplicated bookings such as obtaining a refund before the fully refundable date. However, in the case of complications, the Virtual Assistant is hopeless. For example, in Warsaw, the guide on a scooter tour was a no-show on the day of the tour (so it was past the refundable period) and trying to get the Virtual Assistant to retrieve the booking was impossible, despite inserting my answers to each question asked.

- As a rewards currency, TD Rewards has limited value. It’s not convertible to any other program, and it has a fixed maximum value of $0.05 per point.

- While obtaining a fee rebate is an attractive proposition, doing so on a TD Aeroplan-branded credit card might make more sense for Aeroplan account holders. Aeroplan is capable of delivering much greater value than TD’s fixed-value system.

- I’m not fond of having two-tiered redemption values for travel purchases. Other in-house programs such as Scene+ make no distinction between travel booked through the program’s travel portal, and that from another provider. Redemption values are the same.

- For more information on the Scene+ program, see How to use Scene+ points to reduce travel costs

- If a customer has two credit cards earning TD Rewards, it’s possible to merge the points into one account but it must be done by an agent. Unlike other programs such as RBC Avion, it can’t be done online. And disappointingly, fewer than 10,000 TD Rewards cannot be moved from one account to the other.

- The TD First Class Travel Visa Infinite Card doesn’t stand out among its competitors. It’s competing with travel credit cards that offer lounge membership and complimentary passes, companion/buddy passes, NEXUS fee rebates, free checked baggage, concierge services, and no FX (foreign exchange) fees. However, as mentioned earlier, the annual $100 travel credit helps fill a much-needed gap in its attractiveness as a travel credit card.

- The insurance benefits are on par with other premium credit cards. Personally, I’ll never use them. For emergency medical insurance, an annual multi-trip plan from an insurer of my choice is a better fit for my age and travel style. The trip cancellation/interruption doesn’t apply because a covered trip is one where “the full cost has been charged to Your Account and/or using Your TD Points.” Like many other travellers, my trips are funded from a variety of sources using a mixture of miles, points, and cash.

- It’s both a blessing and a curse but I’ve been surprised by the types of charges flagged by TD’s fraud detection program. This results in a rejection of the charge and a freezing of my credit card until it’s sorted.

The fact that TD has hitched its rewards wagon to Expedia makes it an interesting proposition. I’m impressed with Expedia For TD’s online portal for booking and redeeming points for travel (and changing a reservation or cancelling via the Virtual Assistant), and the First Class Travel Visa Infinite’s x8 points multiplier on Expedia for TD bookings. For heavy Expedia users, it’s an attractive addition to a credit card portfolio.

I’ve been impressed by recent promotional offers with annual fee waivers and sign-up bonuses of up to 135,000 points. It demonstrates that TD is interested in attracting new customers. To keep them, TD could be more creative with additional travel benefits. Reinstating the option for cardholders to convert TD Rewards to Aeroplan would be a welcome start.

TD needs to increase the value of Book-any-Way redemptions, and introduce an online system for applying points against those purchases. While the Scene+ coding system for travel purchased from other providers isn’t perfect, their system is capable of presenting the vast majority of travel purchases to users for redeeming points online. TD needs to craft an online redemption system that’s as user-friendly as their booking system.

As a fixed value program, TD Rewards can’t match the value achievable with programs such as Aeroplan, British Airways’ Avios, and other frequent flyer programs. But, with the extensive inventory of travel products bookable at Expedia For TD, and the range of travel expenses redeemable as Book any Way travel, it can certainly occupy a very useful secondary corner of a diversified miles-and-points portfolio.

If you found this post helpful, please share it by choosing one of the social media buttons. Also, what do you think of the TD Rewards program? Please add your thoughts in the comments. Thank you.

Might you be interested in my other miles-and-points posts?

- How to use Scene+ points to reduce travel costs

- How to use CIBC Aventura points to reduce travel costs

- When a no-FOREX-fee credit card isn’t the best travel choice

- Polaris review of United Airlines’ lounge and in-flight experience

- Is the BMO Air Miles World Elite MasterCard a good deal?

- 9 Effective ways of meeting Minimum Spend Requirements

Pin for later?

I’m curious if the prices are jacked a bit through the TD Expedia site. For example, I looked at the Park Lane Hotel in Manhattan. For a five night stay in a 1 Queen Bed City View room, , TD Rewards Expedia site said it would be $2222.97, all taxes, fees all in. Looking at the same room through hotels.com or Trivago, I got the same room, all in price of $1723.72/$1743 respectively. When I apply my current Rewards amount of $836 against the $2222.97, I’m left paying $1386.97, which is only around $336 less, even though I used $836! Is Expedia always more expensive? I looked at more than a few other hotels and they are all much cheaper on hotels.com and Trivago.

Thanks for dropping by. While I never experienced price differences between Expedia and Expedia For TD, some people have reported differences, both in inventory and prices. I’ve just done a search for a five-night stay at the Park Lane Hotel in Manhattan (October 12 to 17) and found the same price at Expedia, Hotels and Booking. I couldn’t access Expedia for TD as I no longer have a TD Rewards credit card. Each of the three sites showed a regular price of $466/$468 and a discounted price of $372 for a total price of $1860. It sounds as though Expedia for TD hasn’t adjusted the regular price yet. What I would do is call Expedia for TD and ask them to match the Expedia price (if that’s what you find for your dates on expedia.ca). Good luck!

Excelent article!

Can you clarify when you got the $100 credit? The “in a calendar year” part confuses me. If I booked accommodations via ExpediaForTD over $500 for the first time this year (March 2023), will I get the $100 travel credit right away? within this year? or Jan 2024?

Trackbacks/Pingbacks

- Why the Best Western loyalty program is good for travellers - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- 25 Tips on earning Aeroplan miles - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- What’s the best use of Scotia Rewards? - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Lounge and flight review of United Airlines’ Polaris experience - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Minimizing Aeroplan taxes, fees and surcharges - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- What is the best credit card with trip cancellation, trip interruption and flight delay insurance for trips on points - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Finding Aeroplan flights: a step-by-step guide - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Is the BMO Air Miles World Elite MasterCard a good deal? - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Is a no-FOREX-fee credit card always the best choice for international travel? - Packing Light Travel - […] Travelling the world on miles and points. Is the TD Rewards program worth it? […]

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search this site

Welcome to Packing Light Travel. I'm Anne, a dedicated carry-on traveller. For information on the site, please see the About page.

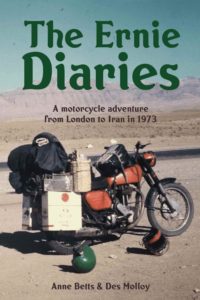

Book: The Ernie Diaries

Packing Light

Join the mailing list for updates, and access to the Resource Library.

You have Successfully Subscribed!

Connect on instagram, if you find this information useful, subscribe to the newsletter and free access to packing lists, checklists, and other tools in packing light travel's resource library..

Your email address will never be shared. Guaranteed.

Pin It on Pinterest

Prince of Travel

Prince of Travel is a full-service travel brand with an emphasis on luxury travel.

Get in-depth information on hotel programs and learn more about Prince Collection’s premier brands and vendors.

Credit Cards

Get the latest news, deals, guides, and travel reviews straight to your inbox with a Prince of Travel newsletter subscription.

Join Our Newsletter

Subscribe to the prince of travel newsletter.

You'll receive priority information about the newest luxury properties worldwide, exclusive reservations and deals through Prince of Travel , and unique destinations across the globe.

By providing your email, you agree to the Prince of Travel Privacy Policy

Thank you for subscribing!

Please check your email to confirm your subscription!

Id ea eiusmod magna cupidatat proident commodo tempor sit incididunt. Fugiat aliquip officia exercitation ad culpa ipsum est.

Points Programs

Hotel programs, best credit cards.

TD First Class Travel® Visa Infinite* Card

Updated on: June 4, 2024

{post.custom_fields.card_benefits_0_b_title}

{post.custom_fields.card_benefits_1_b_title}, {post.custom_fields.card_benefits_2_b_title}, application must be approved by september 3, 2024 to receive this offer, signup bonus:.

20,000 TD Rewards Points upon first purchase† 55,000 TD Rewards Points upon spending $5,000 within 180 days of account opening† Total of up to 75,000 TD Rewards Points†

Interest rates:

20.99% purchase 22.99% cash advance (20.99% in Quebec) 22.99% balance transfer (20.99% in Quebec)

Earning rate:

8 TD Rewards Points† per dollar spent on eligible travel booked through Expedia® for TD† 6 TD Rewards Points† per dollar spent on eligible groceries and restaurant purchases† 4 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account† 2 TD Rewards Points† per dollar spent on all other eligible purchases†

The TD First Class Travel ® Visa Infinite * Card is one of the most popular credit cards that allows you to earn points in the bank's proprietary TD Rewards program. With regular high-volume welcome bonuses, a strong return on travel purchases booked through Expedia, and a competitive insurance package, the TD First Class Travel ® Visa Infinite * Card is a solid choice to incorporate into your TD credit card strategy.

Bonuses & Fees

- 20,000 TD Rewards Points upon first purchase †

- 55,000 TD Rewards Points upon spending $5,000 within 180 days of account opening †

Earning Rewards

- 8 TD Rewards Points † per dollar spent on travel booked through Expedia ® for TD †

- 6 TD Rewards Points † per dollar spent on groceries and restaurants †

- 4 TD Rewards Points † per dollar spent on recurring bills and purchases †

- 2 TD Rewards Points † per dollar spent on all other purchases †

Redeeming Rewards

The best way to redeem TD Rewards Points is by booking travel through Expedia ® for TD, an online travel portal operated in partnership with Expedia ® . You can book flights, hotels, car rentals, vacation packages, and anything else that you would normally be able to book via Expedia ® . You'd apply your TD Rewards Points to the purchase at a rate of 200 points = $1, or 0.5 cents per point. If you'd rather not book through Expedia ® for TD, you can also redeem TD Rewards Points directly against any travel purchase that you purchase with your TD First Class Travel ® Visa Infinite * Card. However, the rate isn't quite as competitive at 250 points = $1, or 0.4 cents per point. Redeeming for statement credits or gift cards is also possible, although the rate is even less appealing at 400 points = $1, or 0.25 cents per point. Generally speaking, you should always strive to redeem your TD Rewards Points for travel through Expedia ® for TD whenever possible, in order to maximize their value. TD Rewards Points never expire as long as you're a cardholder. † If you cancel or switch your card to a different product, you'll have 90 days' time to redeem your TD Rewards Points before they go away. However, you'll lose the ability to book through Expedia ® for TD for 0.5 cents per point, and you'll be limited to redeeming against any travel purchase for only 0.4 cents per point.

Perks & Benefits

TD First Class Travel ® Visa Infinite * cardholders are eligible to earn a $100 credit † on accommodations and vacation packages booked through Expedia ® for TD. † This benefit is available annually to cardholders, and notably does not include flights. However, it certainly helps to offset the $139 annual fee that the card commands, beginning in the second year. Cardholders can also get car rental discounts at Avis and Budget: 10% in Canada or the US, and 5% internationally. †

Insurance Coverage

As one of TD's flagship travel rewards credit cards, the TD First Class Travel ® Visa Infinite * Card offers a strong set of insurance provisions. The card comes with 21 days of travel medical insurance of up to $2,000,000 for travellers aged under 65, and four days of coverage for travellers aged 65+. † There's also trip cancellation and trip interruption insurance of up to $1,500 and $5,000 per person, up to a maximum of $5,000 and $25,000 per trip, respectively. † While flying, cardholders are covered for up to $500 in flight delay insurance and an aggregate amount of $1,000 for lost, stolen, or delayed baggage. † And when making purchases, the card offers extended warranty of up to one additional year, as well as purchase protection that insures you against damage or theft of an item for up to 90 days after your purchase. † Lastly, it also comes with Mobile Device Insurance. By paying for your smartphone, tablet, or smartwatch using your TD First Class Travel Visa Infinite Card, you’ll get coverage of up to $1,000 in the event your mobile device is lost, stolen, or accidentally damaged, for up to 24 months! †

† Terms and conditions apply.

† The Toronto-Dominion Bank (TD) is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete and current information on any TD product, please click the Apply Now button.

Share this post

Copied to clipboard!

Prince of Travel is a non-traditional, full service travel concierge designed exclusively for companies and individuals who require exclusive travel arrangements. We handle the nuances of travel ensuring a seamless and extraordinary journey from start to finish.

Join the Prince Collection newsletter to get weekly updates delivered straight to your inbox.

Book your travel

Let Prince Collection’s Travel Concierge handle your exclusive travel arrangements. Get started by filling out some basic info about your trip.

This browser is not supported. Please use another browser to view this site.

- All Save & Spending

- Best credit cards

- Best rewards cards

- Best travel cards

- Best cash back cards

- Best low interest cards

- Best balance transfer cards

- Newcomers to Canada

- All Investing

- ETF finder tool

- Best crypto

- Couch potato

- Fixed rates

- Variable rates

- Mortgage calculator

- Income property

- Renovations + maintenance

- All Insurance

- All Personal Finance

- Finance basics

- Compound interest calculator

- Household finances

- All Resources + Guides

- Find a Qualified Advisor

- Monthly budget template

- ETF Finder Tool

- Student money

- First-time home buyers

- Guide For New Immigrants

- Best dividend stocks

- Best online brokers

- Where to buy real estate

- Best robo-advisors

- All Columns

- Making sense of the markets

Ask a Planner

- A Rich Life

- Interviews + profiles

- Retired Money

Advertisement

By Winston Sih and Courtney Reilly-Larke on March 31, 2022 Estimated reading time: 6 minutes

TD First Class Travel Visa Infinite Card review

This premium TD card lets travellers redeem flexible rewards through a partnership with Expedia.

With a plethora of travel-focused credit cards on the market, the TD First Class Travel Visa Infinite Card may not be the obvious choice—especially considering how many Aeroplan cards TD currently has on its roster. That said, the TD First Class Travel Visa Infinite Card is worth considering. Why? It boasts a flexible redemption program and a partnership with Expedia. Cardholders get access to Expedia For TD online portal to redeem rewards for flights, hotels and car rentals on expediafortd.com.

Add to that comprehensive insurance coverage and generous earn rates and the TD First Class Travel Visa Infinite Card becomes a solid choice for avid travellers.

TD First Class Visa Infinite Card

Annual fee: $139

- Up to 8 TD Rewards points per $1 on travel

- 6 points per $1 on groceries and restaurants

- 4 points per $1 on recurring bills

- 2 points per $1 on all other purchases

Welcome offer: earn up to $700 in value, including up to 75,000 TD Rewards Points and no Annual Fee for the first year. Conditions Apply. Account must be approved by September 3, 2024.

Card details

The TD First Class Travel Visa Infinite Card

- Three things you need to know about the TD First Class Travel Visa Infinite Card

- How to redeem your TD Rewards

- What are the best ways to benefit from this card?

Are there any drawbacks to the TD First Class Travel Visa Infinite Card?

4 things to know about the td first class travel visa infinite card, 1. the you earn points under the td rewards program.

T he TD points system is easier to understand than the point system for the bank ’ s Aeroplan credit cards. Your Point values stay the same no matter where you ’ re flying, so it ’ s easy to work out how much they ’ re worth. Plus, TD Points can be redeemed on any airline, not just Air Canada or Star Alliance Partners. While Aeroplan Miles are valuable, if you prefer simplicity the TD First Class Travel Visa Infinite Card might be more up your alley.

2. Your points go farther when you book with ExpediaForTD.com

If you already use Expedia to book your travel, this card is a savvy choice. When you book travel online through Expedia For TD, you earn 8 TD points per $1.

3. The card comes with a generous welcome bonus

You can earn up to $700 in value, including up to 75,000 TD Rewards Points and no Annual Fee for the first year. Conditions Apply. Account must be approved by September 3, 2024.. Plus, earn a birthday bonus of up to 10,000 rewards points (conditions apply). You can also receive a $100 TD travel credit when you spend at least $500 at Expedia for TD.

4. You’ll get great travel insurance

The TD First Class Travel Visa Infinite Card comes with up to $2 million of travel medical insurance coverage for the first 21 days of a trip. Trip cancellation, trip interruption, common carrier travel accident insurance, travel assistance services, flight delay insurance, auto rental collision insurance, and delayed and lost baggage insurance round out the card’s benefits. For a premium rewards card, The TD First Class ’ s insurance is fairly standard, however; so, if you ’ re looking for more comprehensive credit card insurance , you could consider a card like the National Bank World Elite Mastercard, * which comes with up to $5 million in out-of-province-of-residence medical/hospital insurance for trips up to 60 days (if you ’ re under 54).

How to redeem your TD Points:

You can redeem your TD Points for travel in two ways. The best—and most valuable—way is through the Expedia For TD online portal, where you can redeem 200 TD points per $1 in travel credit (0.5%) and pay the balance of the cost (if any) using your credit card (you’ll also earn Points on this spend).

Your other redemption choice is the “Book Any Way” option, which lets you book via other travel websites; however, your bookings can cost up to 25% more if you go this route. When using “Book Any Way” you’ll redeem at 250 TD points per $1 (0.4%) applied as a statement credit on your first $1,200 in travel purchases and 200 TD points per $1 (0.5%) for your travel purchases over $1,200. In comparison, with Expedia For TD, you’ll get a better and more consistent return of 0.5% on all your travel spending.

In both cases, the TD First Class Travel Visa Infinite Card allows you to redeem for any seat on any airline. Additionally, you can redeem points for rewards in small increments (minimum 200), so this means you don’t need to build up a large pool of points before you’re able to apply them towards travel.

Finally, through the TD Rewards site, you can shop for items such as a Vitamix blender, a Dyson vacuum or gift cards. However, you won’t get the same value as you would booking travel. For example, a $50 gift card at Best Buy will cost you 20,000 TD points, whereas you can use the same amount of points for $100 in travel on the Expedia For TD portal.

How to optimize the TD First Class Travel Visa Infinite Card

Ultimately, your best bet is to redeem points for travel from ExpediaForTD.com . Generally, prices on the website are similar to those on the main Expedia website, and you’ll be able to redeem at the rate of 200 points per $1. If you redeem points for travel outside of the TD portal, your points can lose up to 25% in value; however this could be a smarter route if you find a really good deal on another travel portal.

If you do find a better hotel or flight deal elsewhere, you have the option to price match, but there are some restrictions: you must have booked within the last 24 hours; your travel plans must be at least 48 hours away; and travel dates, and flight and hotel classes must all be the same to submit a claim.

Does the TD First Class Travel Visa Infinite Card have travel insurance?

With this card you’ll get an extensive suite of travel insurance coverage, for big and small emergencies. For frequent travellers and those who cross the border often, this is a must. The card includes travel medical insurance of up to $2 million of coverage for the first 21 days. (If you or your spouse are over 65 or older, you’re only covered for the first four days of your trip.) You’ll also get up to $1,500 of trip cancellation insurance with this card up to a maximum of $5,000 for all insured persons. For trip interruption insurance, you get $5,000 per insured person, up to $25,000 for all the insured people on the same trip.

You’ll also get common carrier travel accident insurance, emergency travel assistant services and delayed/lost baggage insurance (up to $1,000 per insured person if your baggage is delayed for more than six hours or gets lost ultimately).

There is a minimum personal income requirement of $60,000 or a household income of $100,000. However, this is a common requirement for many cards in the same category.

Other cards offer more incentive to spend in categories like groceries, dining and entertainment. The TD First Class Travel Visa Infinite Card only offers three times the Points earn on travel booked through the Expedia For TD portal (4.5%)—everything else is at the base three TD points per $1 (1.5%) rate. To compare, the Scotiabank Gold American Express has a five-times Points accelerator on restaurants and groceries (5% per dollar).

Finally, the TD First Class Travel Visa Infinite Card doesn’t offer airport lounge access , and you’ll be charged foreign transaction fees . So, if you like to use airport lounges, or you often find yourself shopping in a foreign currency, you may want to consider a card that offers those perks.

Bottom line

TD’s unique partnership with Expedia, accelerated earn rates and incremental points redemption structure make the TD First Class Travel Visa Infinite Card a worthwhile consideration as a travel credit card . However, the biggest boost in earning points you’ll get with this card is by booking with ExpediaForTD.com. If you don’t want to be locked into booking that way, you may want to explore other travel card options.

More on credit cards :

- Canada’s best travel cards 2022

- Canada’s best credit cards for gas