- Aerospace & Defense

- Cruise Ship Market

"Smart Market Solutions to Help Your Business Gain Edge over Competitors"

Cruise Ship Market Share, Growth and COVID-19 Impact Analysis, By Type (Mainstream Cruise Ships, Ocean Cruise Ships, Luxury Cruise Ships, and Others), By Size (Small, Medium, and Large), By Application (Transportation, Leisure, and Others), and Regional Forecast, 2024-2032

Region :Global | Report ID: FBI108152 | Status : Ongoing

- Request PDF Brochure

KEY MARKET INSIGHTS

Key market insights, covid-19 impact, key insights.

- The report analyses a detailed industry overview, including qualitative and quantitative information.

- The report analyses an overview and forecast of the cruise missile market based on various segments.

- The report also analyses comprehensive PEST analysis for all five regions, i.e., North America, Europe, Asia Pacific, Rest of the World, after evaluating economic, social, political, and technological factors affecting the impact of the cargo drones market in these regions.

Regional Analysis

To gain extensive insights into the market, Request for Customization

Key players

- Royal Caribbean Intl.

- Cruise Critic

- Carnival Cruise Line

- Norwegian Cruise Line

- MSC Cruises

- Princess Cruises

- American Cruise Lines

- Celebrity Cruises

- Genting Hong Kong

Cruise Ship Market Segmentation

Recent developments.

- In May 2023, Atlas to Expand to Three Ships in Antarctica, With Atlas Ocean Voyages taking over the World Voyager from sister brand Nicko Cruises, and the company will deploy three ships in Antarctica for the 2023-24 season. The 200-guest ship will start revenue operations for the Mystic brand in November.

- In February 2023, Port of Los Angeles request for proposals on cruise terminal development. The Port is already experiencing a post-COVID cruise industry rebound, with 229 cruise ship calls in 2022, the most since 2008. Such calls are expected to rise to an estimated 250 by 2026 and include larger ships carrying more passengers.

- PUBLISHING STATUS: Ongoing

- BASE YEAR: 2023

- HISTORICAL DATA: 2019-2022

Personalize this Research

- Granular Research on Specified Regions or Segments

- Companies Profiled based on User Requirement

- Broader Insights Pertaining to a Specific Segment or Region

- Breaking Down Competitive Landscape as per Your Requirement

- Other Specific Requirement on Customization

Aerospace & Defense Clients

Client Testimonials

“We are quite happy with the methodology you outlined. We really appreciate the time your team has spent on this project, and the efforts of your team to answer our questions.”

“Thanks a million. The report looks great!”

“Thanks for the excellent report and the insights regarding the lactose market.”

“I liked the report; would it be possible to send me the PPT version as I want to use a few slides in an internal presentation that I am preparing.”

“This report is really well done and we really appreciate it! Again, I may have questions as we dig in deeper. Thanks again for some really good work.”

“Kudos to your team. Thank you very much for your support and agility to answer our questions.”

“We appreciate you and your team taking out time to share the report and data file with us, and we are grateful for the flexibility provided to modify the document as per request. This does help us in our business decision making. We would be pleased to work with you again, and hope to continue our business relationship long into the future.”

“I want to first congratulate you on the great work done on the Medical Platforms project. Thank you so much for all your efforts.”

“Thank you very much. I really appreciate the work your team has done. I feel very comfortable recommending your services to some of the other startups that I’m working with, and will likely establish a good long partnership with you.”

“We received the below report on the U.S. market from you. We were very satisfied with the report.”

“I just finished my first pass-through of the report. Great work! Thank you!”

“Thanks again for the great work on our last partnership. We are ramping up a new project to understand the imaging and imaging service and distribution market in the U.S.”

“We feel positive about the results. Based on the presented results, we will do strategic review of this new information and might commission a detailed study on some of the modules included in the report after end of the year. Overall we are very satisfied and please pass on the praise to the team. Thank you for the co-operation!”

“Thank you very much for the very good report. I have another requirement on cutting tools, paper crafts and decorative items.”

“We are happy with the professionalism of your in-house research team as well as the quality of your research reports. Looking forward to work together on similar projects”

“We appreciate the teamwork and efficiency for such an exhaustive and comprehensive report. The data offered to us was exactly what we were looking for. Thank you!”

“I recommend Fortune Business Insights for their honesty and flexibility. Not only that they were very responsive and dealt with all my questions very quickly but they also responded honestly and flexibly to the detailed requests from us in preparing the research report. We value them as a research company worthy of building long-term relationships.”

“Well done Fortune Business Insights! The report covered all the points and was very detailed. Looking forward to work together in the future”

“It has been a delightful experience working with you guys. Thank you Fortune Business Insights for your efforts and prompt response”

“I had a great experience working with Fortune Business Insights. The report was very accurate and as per my requirements. Very satisfied with the overall report as it has helped me to build strategies for my business”

“This is regarding the recent report I bought from Fortune Business insights. Remarkable job and great efforts by your research team. I would also like to thank the back end team for offering a continuous support and stitching together a report that is so comprehensive and exhaustive”

“Please pass on our sincere thanks to the whole team at Fortune Business Insights. This is a very good piece of work and will be very helpful to us going forward. We know where we will be getting business intelligence from in the future.”

“Thank you for sending the market report and data. It looks quite comprehensive and the data is exactly what I was looking for. I appreciate the timeliness and responsiveness of you and your team.”

Get in Touch with Us

+1 424 253 0390 (US)

+44 2071 939123 (UK)

+91 744 740 1245 (APAC)

[email protected]

- Request Sample

Sharing this report over the email

The global cruise ship market report covered key players such as Royal Caribbean Intl., Cruise Critic, Carnival Cruise Line, & Others.

Read More at:-

Cruise Tourism Market Size & Share Analysis - Growth Trends & Forecast (2024-2029)

The Cruise Tourism Market Report is Segmented by Type (River Cruise, Ocean Cruise, Expedition Cruise, Theme Cruise, Adventure Cruise, and Other Types), by Duration (1- 7 Days, 8 To 14 Days, 15-20 Days, and More Than 21 Days), by Passenger Age (Less Than 12 Years, 13-19 Years, 20-39 Years, 40-59 Years, and Above 60 Years), and by Geography (Asia-Pacific, Europe, North America, South America, and the Middle East). The Report Offers Market Size and Forecasts for the Cruise Tourism Market in Terms of Revenue (USD) for all the Above Segments.

- Cruise Tourism Market Size

Single User License

Team License

Corporate License

Need a report that reflects how COVID-19 has impacted this market and its growth?

Cruise Tourism Market Analysis

The Cruise Tourism Market size is estimated at USD 9.44 billion in 2024, and is expected to reach USD 14.31 billion by 2029, growing at a CAGR of 8.67% during the forecast period (2024-2029).

- The cruise business has transformed tremendously in recent years, becoming the leading travel industry. It is widely regarded as the most popular recreational activity type and is a successful sector globally. Cruise lines offer various itineraries, from tropical getaways to cultural explorations. The industry has grown significantly due to rising disposable income and the desire for unique travel experiences.

- Cruise companies continuously innovate to attract more passengers and offer exciting features like themed cruises, luxury experiences, and onboard entertainment. Cruise ships visit various destinations, including popular tourist spots worldwide. Some destinations have developed specialized cruise terminals to accommodate large cruise ships and handle passenger arrivals efficiently.

- Cruise Tourism Market Trends

Increase in Number of Ocean Cruise Passengers in North America

- The increase in the number of ocean cruise passengers in North America is making waves in the cruise tourism market. More and more people are opting for cruises as their preferred vacation choice.

- The convenience, variety of destinations, and onboard amenities offered by cruise lines are attracting a growing number of travelers, the industry is booming and expanding to meet the demand in North America. Cruise lines are constantly innovating and offering new and exciting experiences to attract passengers.

- From luxurious accommodations to thrilling entertainment options, there's something for everyone. This surge in demand for ocean cruises is contributing to the overall growth of the cruise tourism market.

Increase in Online Sales of Cruises in Asia

- Cruises have been gaining popularity in Asia in recent years. With the convenience and accessibility of online platforms, more and more people in Asia are opting to book their cruises online. This shift in consumer behavior is driving the growth of the cruise tourism market in the region.

- Online travel agencies and cruise line websites are providing a seamless booking experience, allowing travelers to easily compare options, explore different itineraries, and secure their dream cruise with just a few clicks. This trend not only benefits travelers by offering them more choices and flexibility, but it also presents new opportunities for cruise companies to reach a wider audience in the Asian market.

Cruise Tourism Industry Overview

The cruise tourism market is moderately competitive and has several major players. In terms of market share, few of the major players currently dominate the market. The competitive landscape includes an analysis of a few international and local companies that hold market shares and are well-known, including Carnival Corporation & Plc, Royal Caribbean Group, Norwegian Cruise Line Holdings Ltd, MSC Cruises, and Costa Cruises, among others.

Cruise Tourism Market Leaders

Carnival Corporation & Plc

Royal Caribbean Group

Norwegian Cruise Line Holdings Ltd

MSC Cruises

Costa Cruises

*Disclaimer: Major Players sorted in no particular order

Cruise Tourism Market News

- November 2023: TravClan and Resorts World Cruises joined forces in a groundbreaking partnership aimed at revolutionizing cruise tourism in India. Through this collaboration, TravClan embarks on a transformative journey that promises to redefine the landscape of cruise vacations in India, ensuring accessibility and affordability for all.

- October 2023: Traveltek and Cruise Planners formed a strategic alliance, building on their longstanding relationship as Sabre clients. Traveltek is set to empower its agents' cruise technology solution on a national scale, marking a significant step forward in enhancing the cruise booking experience for travelers.

Cruise Tourism Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

4.1 Market Overview

4.2 Market Drivers

4.2.1 Increasing Disposable Income is Driving the Market

4.3 Market Restraints

4.3.1 High Costs is Restraining the Market

4.4 Market Opportunities

4.4.1 Increasing Popularity of Themed Cruises is Creating an Opportunity

4.5 Value Chain / Supply Chain Analysis

4.6 Porter's Five Forces Analysis

4.6.1 Threat of New Entrants

4.6.2 Bargaining Power of Buyers/Consumers

4.6.3 Bargaining Power of Suppliers

4.6.4 Threat of Substitute Products

4.6.5 Intensity of Competitive Rivalry

4.7 Insights on Technological Innovations in the Market

4.8 Impact of Covid-19 on the Market

5. MARKET SEGMENTATION

5.1 By Type

5.1.1 River Cruise

5.1.2 Ocean Cruise

5.1.3 Expedition Cruise

5.1.4 Theme Cruise

5.1.5 Adventure Cruise

5.1.6 Others

5.2 By Duration

5.2.1 1-7Days

5.2.2 8-14 Days

5.2.3 15-20 Days

5.2.4 More than 21 Days

5.3 By Passenger Age

5.3.1 Less than 12 years

5.3.2 13-19 Years

5.3.3 20-39 Years

5.3.4 40-59 Years

5.3.5 Above 60 Years

5.4 Geography

5.4.1 North America

5.4.1.2 Canada

5.4.1.3 Mexico

5.4.1.4 Rest of North America

5.4.2 Europe

5.4.2.1 Germany

5.4.2.3 France

5.4.2.4 Russia

5.4.2.5 Spain

5.4.2.6 Rest of Europe

5.4.3 Asia Pacific

5.4.3.1 India

5.4.3.2 China

5.4.3.3 Japan

5.4.3.4 Rest of Asia Pacific

5.4.4 South America

5.4.4.1 Brazil

5.4.4.2 Argentina

5.4.4.3 Rest of South America

5.4.5 Middle East

5.4.5.1 UAE

5.4.5.2 Saudi Arabia

5.4.5.3 Rest of Middle East

6. COMPETITIVE LANDSCAPE

6.1 Market Concentration

6.2 Company Profiles

6.2.1 Carnival Corporation & Plc

6.2.2 Royal Caribbean Group

6.2.3 Norwegian Cruise Line Holdings Ltd

6.2.4 MSC Cruises

6.2.5 Costa Cruises

6.2.6 Princess Cruises

6.2.7 Celebrity Cruises

6.2.8 Holland America Line

6.2.9 Disney Cruise Line

6.2.10 Cunard Line*

- *List Not Exhaustive

7. MARKET FUTURE TRENDS

8. DISCLAIMER AND ABOUT US

Cruise Tourism Industry Segmentation

Cruise tourism refers to holidays that are entirely or partly based on a cruise ship.

The cruise tourism market is segmented by type which includes a river cruise, ocean cruise, expedition cruise, theme cruise, adventure cruise, and other types, by duration, including 1- 7 days, 8-14 days, 15-20 days, and more than 21 days, by passenger age includes less than 12 Years, 13-19 years, 20-39 years, 40-59 years, and above 60 years, and by geography includes Asia-pacific, Europe, North America, South America, and the Middle East.

The report offers market size and forecasts for the cruise tourism market in terms of revenue (USD) for all the above segments.

Cruise Tourism Market Research FAQs

How big is the cruise tourism market.

The Cruise Tourism Market size is expected to reach USD 9.44 billion in 2024 and grow at a CAGR of 8.67% to reach USD 14.31 billion by 2029.

What is the current Cruise Tourism Market size?

In 2024, the Cruise Tourism Market size is expected to reach USD 9.44 billion.

Who are the key players in Cruise Tourism Market?

Carnival Corporation & Plc, Royal Caribbean Group, Norwegian Cruise Line Holdings Ltd, MSC Cruises and Costa Cruises are the major companies operating in the Cruise Tourism Market.

Which is the fastest growing region in Cruise Tourism Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Cruise Tourism Market?

In 2024, the North America accounts for the largest market share in Cruise Tourism Market.

What years does this Cruise Tourism Market cover, and what was the market size in 2023?

In 2023, the Cruise Tourism Market size was estimated at USD 8.62 billion. The report covers the Cruise Tourism Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Cruise Tourism Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Our Best Selling Reports

- Aircraft Insulation Market

- Aptamers Market

- Cardiovascular Drug Market

- Connected Logistics Services Market

- Endoscopy Devices Market

- Healthcare BPO Market

- IVIG Market

- Renewable Energy Market in Kazakhstan

- Solar Panel Recycling Market

- Therapeutic Drug Monitoring Market

Cruise Tourism Industry Report

Statistics for the 2024 Cruise Tourism market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Cruise Tourism analysis includes a market forecast outlook to for 2024 to (2024to2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.

Cruise Tourism Market Report Snapshots

- Cruise Tourism Market Share

- Cruise Tourism Companies

Please enter a valid email id!

Please enter a valid message!

Cruise Tourism Market Get a free sample of this report

Please enter your name

Business Email

Please enter a valid email

Please enter your phone number

Get this Data in a Free Sample of the Cruise Tourism Market Report

Please enter your requirement

Thank you for choosing us for your research needs! A confirmation has been sent to your email. Rest assured, your report will be delivered to your inbox within the next 72 hours. A member of our dedicated Client Success Team will proactively reach out to guide and assist you. We appreciate your trust and are committed to delivering precise and valuable research insights.

Please be sure to check your spam folder too.

Sorry! Payment Failed. Please check with your bank for further details.

Add Citation APA MLA Chicago

➜ Embed Code X

Get Embed Code

Want to use this image? X

Please copy & paste this embed code onto your site:

Images must be attributed to Mordor Intelligence. Learn more

About The Embed Code X

Mordor Intelligence's images may only be used with attribution back to Mordor Intelligence. Using the Mordor Intelligence's embed code renders the image with an attribution line that satisfies this requirement.

In addition, by using the embed code, you reduce the load on your web server, because the image will be hosted on the same worldwide content delivery network Mordor Intelligence uses instead of your web server.

- Automotive and Transportation

- Marine and Shipping

Cruise Market

Global Cruise Market Size, Share, Trends, Growth, Forecast: By Type: Ocean Cruises, River Cruises; Regional Analysis; Market Dynamics: SWOT Analysis, Porter’s Five Forces Analysis, Key Indicators for Demand, Key Indicators for Price; Competitive Landscape; Key Trends and Developments in the Market; 2024-2032

- Report Summary

- Table of Contents

- Pricing Detail

- Request Sample

Global Cruise Market Outlook

The global cruise market size attained a value of USD 7.89 billion in 2023. The market is further expected to grow at a CAGR of 11.50% between 2024 and 2032, to reach a value of USD 21.02 billion by 2032.

Key Trends in the Market

A cruise refers to a recreational activity in which large or small ships are used to sail around an ocean, sea, or river territory. Cruises also include various entertainment activities such as music, dance, magic, comedy, and theatre, and can be of various durations.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

- Growing enthusiasm to explore new destinations, emergence of women-centred trips, innovations in meals and beverage offerings, gaming, onboard health screenings, and expansion of activities on the ship are some of the key cruise market trends. Increasing number of Gen Z cruisers, owing to the influence of social media and changing preference towards luxurious living, is adding to the market growth.

- The growing use of advanced onboard technologies, such as online check-in, digital boarding pass, cabin key and light switch enabled through smartphones, ocean medallions, and tracking solutions, among others, is a crucial trend in the cruise market. Technologically advanced services are also likely to enhance the customer satisfaction, thereby bolstering the market dynamics.

Global Cruise Market Analysis

Based on type, the market is segmented into ocean cruises and river cruises. The regional markets for cruises are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis. The report gives a detailed analysis of the key players in the global cruise market, covering their competitive landscape and latest developments like mergers, acquisitions, investments and expansion plans.

- Carnival Corporation & plc

- Royal Caribbean Group

- MSC Cruises S.A

- Norwegian Cruise Line Holdings Ltd

- Disney Cruise Line

- Oceania Cruises S. de R.L.

- Regent Seven Seas Cruises, Inc.

- Celestyal Cruises

- Genting Hong Kong Limited

- Holland America Line N.V.

Global Cruise Market Share by Type

The ocean cruises segment, based on type, accounts for a healthy share of the cruise market. This can be attributed to the fact that ocean cruise offers a greater number of routes which expands the range of destinations for cruisers. As oceans are significantly large, ships and vessels of bigger sizes can be used for ocean cruises, increasing the number of activities and facilities supported while reducing costs as more people can be accommodated in a single vessel. Moreover, ocean cruise comes with notable advantages such as visits to notable coastal cities during the cruise and insurance against harsh weather conditions.

Global Cruise Market Share by Region

Based on region, North America occupies a sizable share of the market for cruises, supported by the immense popularity of cruises and a vast network of waterways. The strong foothold of cruise service providers in the United States, coupled with the stable living standards is driving the market. Meanwhile, the European region is likely to be a fast-growing region in the forecast period, owing to the growing popularity of river cruising. In line with this, the increasing inclination of the population towards shore excursions and cruise fares is further fuelling the Europe cruise market.

Competitive Landscape

Carnival Corporation & plc is a leading cruise operator which provides cruise vessels designed to offer fun and entertainment to the customers. It was established in 1972 and is headquartered in Florida, United States.

Royal Caribbean Group is a shipping line company which owns three cruise brands; Royal Caribbean International, Celebrity Cruises, and Silversea Cruises. The company was founded in 1997 and is headquartered in Florida, United States.

MSC Cruises S.A is a family-owned global cruise line which was established in 1989 as a part of Mediterranean Shipping Company. Headquartered in Geneva, Switzerland, this company is one of the largest cruise providers across the world.

Other market players include Norwegian Cruise Line Holdings Ltd, Disney Cruise Line, Oceania Cruises S. de R.L., Regent Seven Seas Cruises, Inc., Celestyal Cruises, Genting Hong Kong Limited, and Holland America Line N.V., among others.

Key Highlights of the Report

Cruise market report snapshots.

Cruise Market Size

Cruise Market Analysis

Cruise Market Share

Cruise Companies

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.

1 Preface 2 Report Coverage – Key Segmentation and Scope 3 Report Description 3.1 Market Definition and Outlook 3.2 Properties and Applications 3.3 Market Analysis 3.4 Key Players 4 Key Assumptions 5 Executive Summary 5.1 Overview 5.2 Key Drivers 5.3 Key Developments 5.4 Competitive Structure 5.5 Key Industrial Trends 6 Market Snapshot 6.1 Global 6.2 Regional 7 Opportunities and Challenges in the Market 8 Global Cruise Market Analysis 8.1 Key Industry Highlights 8.2 Global Cruise Historical Market (2018-2023) 8.3 Global Cruise Market Forecast (2024-2032) 8.4 Global Cruise Market by Type 8.4.1 Ocean Cruises 8.4.1.1 Historical Trend (2018-2023) 8.4.1.2 Forecast Trend (2024-2032) 8.4.2 River Cruises 8.4.2.1 Historical Trend (2018-2023) 8.4.2.2 Forecast Trend (2024-2032) 8.5 Global Cruise Market by Region 8.5.1 North America 8.5.1.1 Historical Trend (2018-2023) 8.5.1.2 Forecast Trend (2024-2032) 8.5.2 Europe 8.5.2.1 Historical Trend (2018-2023) 8.5.2.2 Forecast Trend (2024-2032) 8.5.3 Asia Pacific 8.5.3.1 Historical Trend (2018-2023) 8.5.3.2 Forecast Trend (2024-2032) 8.5.4 Latin America 8.5.4.1 Historical Trend (2018-2023) 8.5.4.2 Forecast Trend (2024-2032) 8.5.5 Middle East and Africa 8.5.5.1 Historical Trend (2018-2023) 8.5.5.2 Forecast Trend (2024-2032) 9 North America Cruise Market Analysis 9.1 United States of America 9.1.1 Historical Trend (2018-2023) 9.1.2 Forecast Trend (2024-2032) 9.2 Canada 9.2.1 Historical Trend (2018-2023) 9.2.2 Forecast Trend (2024-2032) 10 Europe Cruise Market Analysis 10.1 United Kingdom 10.1.1 Historical Trend (2018-2023) 10.1.2 Forecast Trend (2024-2032) 10.2 Germany 10.2.1 Historical Trend (2018-2023) 10.2.2 Forecast Trend (2024-2032) 10.3 France 10.3.1 Historical Trend (2018-2023) 10.3.2 Forecast Trend (2024-2032) 10.4 Italy 10.4.1 Historical Trend (2018-2023) 10.4.2 Forecast Trend (2024-2032) 10.5 Others 11 Asia Pacific Cruise Market Analysis 11.1 China 11.1.1 Historical Trend (2018-2023) 11.1.2 Forecast Trend (2024-2032) 11.2 Japan 11.2.1 Historical Trend (2018-2023) 11.2.2 Forecast Trend (2024-2032) 11.3 India 11.3.1 Historical Trend (2018-2023) 11.3.2 Forecast Trend (2024-2032) 11.4 ASEAN 11.4.1 Historical Trend (2018-2023) 11.4.2 Forecast Trend (2024-2032) 11.5 Australia 11.5.1 Historical Trend (2018-2023) 11.5.2 Forecast Trend (2024-2032) 11.6 Others 12 Latin America Cruise Market Analysis 12.1 Brazil 12.1.1 Historical Trend (2018-2023) 12.1.2 Forecast Trend (2024-2032) 12.2 Argentina 12.2.1 Historical Trend (2018-2023) 12.2.2 Forecast Trend (2024-2032) 12.3 Mexico 12.3.1 Historical Trend (2018-2023) 12.3.2 Forecast Trend (2024-2032) 12.4 Others 13 Middle East and Africa Cruise Market Analysis 13.1 Saudi Arabia 13.1.1 Historical Trend (2018-2023) 13.1.2 Forecast Trend (2024-2032) 13.2 United Arab Emirates 13.2.1 Historical Trend (2018-2023) 13.2.2 Forecast Trend (2024-2032) 13.3 Nigeria 13.3.1 Historical Trend (2018-2023) 13.3.2 Forecast Trend (2024-2032) 13.4 South Africa 13.4.1 Historical Trend (2018-2023) 13.4.2 Forecast Trend (2024-2032) 13.5 Others 14 Market Dynamics 14.1 SWOT Analysis 14.1.1 Strengths 14.1.2 Weaknesses 14.1.3 Opportunities 14.1.4 Threats 14.2 Porter’s Five Forces Analysis 14.2.1 Supplier’s Power 14.2.2 Buyer’s Power 14.2.3 Threat of New Entrants 14.2.4 Degree of Rivalry 14.2.5 Threat of Substitutes 14.3 Key Indicators for Demand 14.4 Key Indicators for Price 15 Competitive Landscape 15.1 Market Structure 15.2 Company Profiles 15.2.1 Carnival Corporation & plc 15.2.1.1 Company Overview 15.2.1.2 Product Portfolio 15.2.1.3 Demographic Reach and Achievements 15.2.1.4 Certifications 15.2.2 Royal Caribbean Group 15.2.2.1 Company Overview 15.2.2.2 Product Portfolio 15.2.2.3 Demographic Reach and Achievements 15.2.2.4 Certifications 15.2.3 MSC Cruises S.A 15.2.3.1 Company Overview 15.2.3.2 Product Portfolio 15.2.3.3 Demographic Reach and Achievements 15.2.3.4 Certifications 15.2.4 Norwegian Cruise Line Holdings Ltd 15.2.4.1 Company Overview 15.2.4.2 Product Portfolio 15.2.4.3 Demographic Reach and Achievements 15.2.4.4 Certifications 15.2.5 Disney Cruise Line 15.2.5.1 Company Overview 15.2.5.2 Product Portfolio 15.2.5.3 Demographic Reach and Achievements 15.2.5.4 Certifications 15.2.6 Oceania Cruises S. de R.L. 15.2.6.1 Company Overview 15.2.6.2 Product Portfolio 15.2.6.3 Demographic Reach and Achievements 15.2.6.4 Certifications 15.2.7 Regent Seven Seas Cruises, Inc. 15.2.7.1 Company Overview 15.2.7.2 Product Portfolio 15.2.7.3 Demographic Reach and Achievements 15.2.7.4 Certifications 15.2.8 Celestyal Cruises 15.2.8.1 Company Overview 15.2.8.2 Product Portfolio 15.2.8.3 Demographic Reach and Achievements 15.2.8.4 Certifications 15.2.9 Genting Hong Kong Limited 15.2.9.1 Company Overview 15.2.9.2 Product Portfolio 15.2.9.3 Demographic Reach and Achievements 15.2.9.4 Certifications 15.2.10 Holland America Line N.V. 15.2.10.1 Company Overview 15.2.10.2 Product Portfolio 15.2.10.3 Demographic Reach and Achievements 15.2.10.4 Certifications 15.2.11 Others 16 Key Trends and Developments in the Market

List of Key Figures and Tables

1. Global Cruise Market: Key Industry Highlights, 2018 and 2032 2. Global Cruise Historical Market: Breakup by Type (USD Million), 2018-2023 3. Global Cruise Market Forecast: Breakup by Type (USD Million), 2024-2032 4. Global Cruise Historical Market: Breakup by Region (USD Million), 2018-2023 5. Global Cruise Market Forecast: Breakup by Region (USD Million), 2024-2032 6. North America Cruise Historical Market: Breakup by Country (USD Million), 2018-2023 7. North America Cruise Market Forecast: Breakup by Country (USD Million), 2024-2032 8. Europe Cruise Historical Market: Breakup by Country (USD Million), 2018-2023 9. Europe Cruise Market Forecast: Breakup by Country (USD Million), 2024-2032 10. Asia Pacific Cruise Historical Market: Breakup by Country (USD Million), 2018-2023 11. Asia Pacific Cruise Market Forecast: Breakup by Country (USD Million), 2024-2032 12. Latin America Cruise Historical Market: Breakup by Country (USD Million), 2018-2023 13. Latin America Cruise Market Forecast: Breakup by Country (USD Million), 2024-2032 14. Middle East and Africa Cruise Historical Market: Breakup by Country (USD Million), 2018-2023 15. Middle East and Africa Cruise Market Forecast: Breakup by Country (USD Million), 2024-2032 16. Global Cruise Market Structure

What was the cruise market value in 2023?

The market reached a value of USD 7.89 billion in 2023.

What is the growth rate of the cruise market?

The market is estimated to grow at a CAGR of 11.50% between 2024 and 2032.

What is the cruise market forecast for 2024-2032?

The market is estimated to witness a healthy growth in the forecast period of 2024-2032 to reach a value of USD 21.02 billion by 2032.

What are the major market drivers?

The increasing affordability and availability of cruises, emergence of women-centred trips, innovations in meals and beverage offerings, onboard health screenings, and expansion of activities on ships are the major drivers of the market.

What are the key trends of the market?

The key trends in the market include the growing enthusiasm to explore new destinations, increasing use of advanced onboard technologies, and rising popularity of cruises on social media.

What are the primary types of cruises in the market?

Ocean cruises and river cruises are the primary types of cruises in the market.

What are the major regions in the market?

North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa are the major regions in the market.

Who are the key market players, according to the cruise market report?

Carnival Corporation & plc, Royal Caribbean Group, MSC Cruises S.A, Norwegian Cruise Line Holdings Ltd, Disney Cruise Line, Oceania Cruises S. de R.L., Regent Seven Seas Cruises, Inc., Celestyal Cruises, Genting Hong Kong Limited, and Holland America Line N.V., among others, are the key players of the cruise market, according to the report.

Purchase Options 10% off

Methodology

Request Customisation

Report Sample

Request Brochure

Ask an Analyst

( USA & Canada ) +1-415-325-5166 [email protected]

( United Kingdom ) +44-702-402-5790 [email protected]

Mini Report

- Selected Sections, One User

- Printing Not Allowed

- Email Delivery in PDF

- Free Limited Customisation

- Post Sales Analyst Support

- 50% Discount on Next Update

Single User License

- All Sections, One User

- One Print Allowed

Five User License

- All Sections, Five Users

- Five Prints Allowed

Corporate License

- All Sections, Unlimited Users

- Unlimited Prints Allowed

- Email Delivery in PDF + Excel

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.

Stay informed with our free industry updates.

We use cookies, just to track visits to our website, we store no personal details. Privacy Policy X

Press Release

Price Forecast

Growth of the Ocean Cruise Line Industry

Worldwide, the ocean cruise industry experienced an annual passenger compound annual growth rate of 5.9% from 1990 to 2024.

While the COVID-19 pandemic brought the ocean passenger cruise industry to a standstill for nearly two years, it also prompted the accelerated retirement of numerous older ships. Simultaneously, new additions to fleets adopted a more modern and environmentally friendly approach. In 2024, passenger numbers are expected to surpass the pre-COVID levels of 2019.

Between 2023 and 2024, a total of 10 new ships, with a combined passenger capacity of 25,450, are set to be added (refer to the tables below). This influx will bring the worldwide ocean cruise passenger capacity to 673,000, spread across 360 ships. These vessels are projected to carry a total of 30.0 million passengers by the end of 2024, representing a 4.2% increase over 2023 and a 9.2% increase over 2019.

Shipbuilding Summary

Sources: Royal Caribbean Cruises, Ltd., Carnival Corporation and plc, NCL Corporation Ltd., Thomson/First Call, Cruise Lines International Association (CLIA) , The Florida-Caribbean Cruise Association (FCCA) , DVB Bank and proprietary Cruise Market Watch Cruise Pulse data.

- Share full article

Advertisement

Supported by

Look at the Stocks Leading the Market Now

Devastated at the height of the pandemic, cruise lines have become top performers.

By Jeff Sommer

Jeff Sommer is the author of Strategies , a weekly column on markets, finance and the economy.

Many top performers in the stock market for the first half of this year were exactly what you would expect, if you’ve been following the news.

Big tech companies were well represented at the front of the pack, led by Nvidia, which makes computer chips that power artificial intelligence programs. It was followed closely by Meta, the Facebook owner, which has been promoting its own A.I. prowess. Tesla, the electric vehicle champion, wasn’t far behind.

But what were cruise ships doing near the very pinnacle of the stock market listings?

At midyear, three of the big cruise companies — Carnival, Royal Caribbean Group and Norwegian Cruise Line Holdings — were among the top 10 stocks in the S&P 500.

Consider that only three years ago, in the first months of the coronavirus pandemic, all cruise lines suspended operations and that in the ensuing months, the shares of publicly traded cruise companies were devastated.

Now, with fears of contagion ebbing and pent-up demand for pleasure trips being unleashed, cruise lines have had a remarkable change of fortune.

Inconsistent Returns

Each of the cruise line stocks had astonishing gains for the first six months of the year, but they are still down significantly from the start of 2020.

Here are their returns, according to FactSet:

Carnival, up 134 percent for the first six months of 2023 but down 63 percent since the start of 2020.

Royal Caribbean Group, up 110 percent in the first half of 2023 but down 22 percent since 2020.

Norwegian Cruise Line, up 78 percent in the first half of 2023 but down 63 percent since 2020.

Returns like these might be puzzling if you were unaware of what happened on the planet in the last three years. But factor in the pandemic and the subsequent economic recovery, and the cruise line stock and bond performance tracks nicely.

It’s part of a larger pattern.

Just as cruise lines have begun to come into their own, a series of companies that prospered during the pandemic are laggards now. Peloton, Zoom and Etsy are trailing in this year’s stock market performance derby. And major pharmaceutical companies, like Moderna and Pfizer, whose shares took off when the firms were providing scarce and desperately needed vaccines against Covid-19, are among the poorest performers in the S&P 500.

The Pandemic

Briefly put, it wasn’t until December 2019 that the first reports of the emergence of a novel coronavirus began to emanate out of China — and in March 2020 that the World Health Organization declared that a pandemic was underway. In January, cruise lines began canceling port calls in China.

In January 2020, the Diamond Princess , a luxury ship owned by Carnival, began an ill-fated journey in Yokohama, Japan. More than 3,700 passengers and crew members were stranded on board for weeks, with little information about the pandemic.

But the virus spread relentlessly, and more than 700 people ultimately tested positive. In those early days of the pandemic, when people lacked natural immunity against the disease, and effective treatment and vaccines were not yet widely available, nine passengers died.

All major cruise lines suspended operations, as passengers canceled their bookings en masse. It became evident that a cruise ship wasn’t an ideal place to be in the middle of a pandemic.

In the stock market, cruise line shares plummeted as 2020 wore on. In that pandemic year, Carnival fell 57 percent, Royal Caribbean 44 percent, and Norwegian 56 percent. The companies had virtually no revenue and mounting debt, and their ability to remain going concerns was in doubt. They survived by taking on enormous debt loads and paying sky-high junk-bond yields, which were needed to attract investors.

The joyful atmosphere needed for a successful vacation at sea seemed unattainable.

An Incipient Recovery

It was only in 2022 that their finances — and share prices — stabilized, and only this year that they have begun to report sufficient earnings and cash flow to show signs of paring down their debt and returning to steady profit-making operations. In a conversation with stock analysts after reporting earnings in late June, Josh Weinstein, the chief executive of Carnival, said the company’s business volume was approaching 2019 levels for the first time since the start of the pandemic and, in some metrics, beginning to exceed it.

According to a transcript of the same session, David Bernstein, the company’s chief financial officer, said Carnival was pouring cash into debt reduction, “driving more than $8 billion in total debt reduction through 2026,” down from a $35 billion peak early in 2023.

These debt payments, combined with increased revenues, should enable the company to “approach investment grade” in its bond ratings in 2026, Mr. Bernstein said. Because of Carnival’s improving financial picture, the yields on the company’s debt have been declining and the price of its bonds, which move in the opposite direction, have risen.

The specifics of each company matter, of course. What the cruise lines have in common is that all have heightened safety procedures aimed at stemming the spread of any future outbreaks on board, commissioned new ships, taken measures to cut costs and embarked on fresh marketing campaigns. Wall Street analysts, including those at JPMorgan Chase, Bank of America and Jefferies, have given them high grades and helped to drive up their share prices.

Perhaps the magic of sea cruises is back. Certainly no one needs a recurrence of the dismal events of 2020.

In prepandemic times, I took a couple of lovely cruises. On one trip, three generations of my extended family were able to see the world together, while participating separately in age-appropriate recreation — on board, in the water and on land. So I’m personally pleased by the beginnings of a sea cruise renaissance, though not ready to sail again quite yet.

As an investor, I see the stock performance of the cruise lines this year less as a question of whether this is an opportune time to buy their shares and more as an affirmation of the ever-present need to diversify. What may seem safe today could easily become hazardous tomorrow.

Harry Markowitz, a Nobel laureate in economics who died last month, transformed modern investing with his teachings about how rigorous diversification can reduce risk. A decade ago, during a volatile stretch in the stock market, he told me that ordinary investors would be better off if they forgot about individual stocks and bought broad low-cost stock and bond index funds instead.

Allocate them in a proportion that makes you comfortable, and then devote yourself to more pleasant pursuits. Mr. Markowitz convinced me. As for pleasant pursuits, go with what delights you.

That could even be a sea cruise, if you find them fun and, at this stage, safe enough for a carefree voyage.

An earlier version of this article misstated when the World Health Organization declared a coronavirus pandemic. It was March 2020, not January 2020.

How we handle corrections

Jeff Sommer writes Strategies , a column on markets, finance and the economy. He also edits business news. Previously, he was a national editor. At Newsday, he was the foreign editor and a correspondent in Asia and Eastern Europe. More about Jeff Sommer

Come Sail Away

Love them or hate them, cruises can provide a unique perspective on travel..

Cruise Ship Surprises: Here are five unexpected features on ships , some of which you hopefully won’t discover on your own.

Icon of the Seas: Our reporter joined thousands of passengers on the inaugural sailing of Royal Caribbean’s Icon of the Seas . The most surprising thing she found? Some actual peace and quiet .

Th ree-Year Cruise, Unraveled: The Life at Sea cruise was supposed to be the ultimate bucket-list experience : 382 port calls over 1,095 days. Here’s why those who signed up are seeking fraud charges instead.

TikTok’s Favorite New ‘Reality Show’: People on social media have turned the unwitting passengers of a nine-month world cruise into “cast members” overnight.

Dipping Their Toes: Younger generations of travelers are venturing onto ships for the first time . Many are saving money.

Cult Cruisers: These devoted cruise fanatics, most of them retirees, have one main goal: to almost never touch dry land .

- Travel, Tourism & Hospitality ›

Leisure Travel

- Worldwide cruise company market share 2022

Worldwide market share of leading cruise companies in 2022

To access all Premium Statistics, you need a paid Statista Account

- Immediate access to all statistics

- Incl. source references

- Download as PDF, XLS, PNG and PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

Definition:

Additional Information:

The main performance indicators of the Cruises market are revenues, average revenue per user (ARPU), users and user penetration rates. Additionally, online and offline sales channel shares display the distribution of online and offline bookings. The ARPU refers to the average revenue one user generates per year while the revenue represents the total booking volume. Revenues are generated through both online and offline sales channels and include exclusively B2C revenues. Users represent the aggregated number of guests. Each user is only counted once per year.

The booking volume includes all booked travels made by users from the selected region, independent of the departure and arrival. The scope includes domestic and outbound travel.

For further information on the data displayed, refer to the info button right next to each box.

Other statistics on the topic Cruise industry worldwide

- Market cap of leading online travel companies worldwide 2023

- Revenue of Booking Holdings worldwide 2007-2023

- Revenue of Expedia Group, Inc. worldwide 2007-2023

Travel, Tourism & Hospitality

- Market size of the tourism sector worldwide 2011-2024

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

Statistics on " Travel companies "

- Online travel market size worldwide 2017-2028

- Key information on the global travel agency industry January 2024

- Leading travel companies worldwide 2022, by sales

- Number of employees at leading travel companies worldwide 2022

- Revenue of leading OTAs worldwide 2019-2023

- Marketing expenses of leading OTAs worldwide 2019-2023

- Marketing/revenue ratio of leading OTAs worldwide 2019-2023

- Airbnb revenue worldwide 2017-2023

- Total revenue of Trip.com Group 2013-2023

- Revenue of Tripadvisor worldwide 2008-2023

- Most popular travel and tourism websites worldwide 2024

- Total visits to travel and tourism website booking.com worldwide 2021-2024

- Total visits to travel and tourism website tripadvisor.com worldwide 2020-2024

- ACSI - U.S. customer satisfaction with online travel websites as of 2024

- Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Number of aggregated downloads of leading online travel agency apps in the U.S. 2023

- Leading travel apps in the U.S. 2022, by market share

- Leading travel apps in Europe 2022, by market share

- U.S. travel agency industry market size 2012-2022

- U.S. tour operator industry market size 2012-2022

- Revenue of TUI AG worldwide 2004-2023

- Leading travel agents ranked by number of outlets in the UK 2024

- Leading ATOL-licensed tour operators in the UK 2024, by passengers licensed

- Turnover of Hays Travel Limited in the UK 2008-2023

- Revenue of Carnival Corporation & plc worldwide 2008-2023

- Revenue of Royal Caribbean Cruises worldwide 1988-2023

- Revenue of Norwegian Cruise Line worldwide 2011-2023

- TUI cruise brand revenue worldwide 2015-2023, by brand

- Percentage change in revenue of leading cruise companies worldwide 2020-2023

Other statistics that may interest you Travel companies

Industry overview

- Premium Statistic Market size of the tourism sector worldwide 2011-2024

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Key information on the global travel agency industry January 2024

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Leading travel companies worldwide 2022, by sales

- Premium Statistic Number of employees at leading travel companies worldwide 2022

Online travel agencies (OTAs)

- Premium Statistic Revenue of leading OTAs worldwide 2019-2023

- Premium Statistic Marketing expenses of leading OTAs worldwide 2019-2023

- Premium Statistic Marketing/revenue ratio of leading OTAs worldwide 2019-2023

- Basic Statistic Revenue of Booking Holdings worldwide 2007-2023

- Premium Statistic Revenue of Expedia Group, Inc. worldwide 2007-2023

- Premium Statistic Airbnb revenue worldwide 2017-2023

- Premium Statistic Total revenue of Trip.com Group 2013-2023

- Premium Statistic Revenue of Tripadvisor worldwide 2008-2023

Travel websites and apps

- Premium Statistic Most popular travel and tourism websites worldwide 2024

- Premium Statistic Total visits to travel and tourism website booking.com worldwide 2021-2024

- Premium Statistic Total visits to travel and tourism website tripadvisor.com worldwide 2020-2024

- Premium Statistic ACSI - U.S. customer satisfaction with online travel websites as of 2024

- Premium Statistic Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps in the U.S. 2023

- Premium Statistic Leading travel apps in the U.S. 2022, by market share

- Premium Statistic Leading travel apps in Europe 2022, by market share

Travel agencies and tour operators

- Premium Statistic U.S. travel agency industry market size 2012-2022

- Premium Statistic U.S. tour operator industry market size 2012-2022

- Premium Statistic Revenue of TUI AG worldwide 2004-2023

- Premium Statistic Leading travel agents ranked by number of outlets in the UK 2024

- Premium Statistic Leading ATOL-licensed tour operators in the UK 2024, by passengers licensed

- Premium Statistic Turnover of Hays Travel Limited in the UK 2008-2023

Cruise companies

- Premium Statistic Worldwide cruise company market share 2022

- Premium Statistic Revenue of Carnival Corporation & plc worldwide 2008-2023

- Premium Statistic Revenue of Royal Caribbean Cruises worldwide 1988-2023

- Premium Statistic Revenue of Norwegian Cruise Line worldwide 2011-2023

- Premium Statistic TUI cruise brand revenue worldwide 2015-2023, by brand

- Premium Statistic Percentage change in revenue of leading cruise companies worldwide 2020-2023

Further related statistics

- Premium Statistic Change in value of travel intermediaries in India 2013-2015

- Premium Statistic Likelihood of U.S. international travel due to COVID-19 as of October 2020

- Premium Statistic COVID-19: excitement over holiday research in the U.S. March-April 2020

- Premium Statistic Likelihood of U.S. travel to Asia due to COVID-19 as of October 2020

- Premium Statistic Change in the retail value of travel in Asia from 2013 to 2015

- Premium Statistic Likelihood of U.S. travel to Europe due to COVID-19 as of October 2020

- Premium Statistic Change in the retail value of travel in the Middle East from 2013 to 2015

- Premium Statistic Change in the retail value of travel in India 2013-2015

- Premium Statistic Change in the retail value of travel in Africa from 2013 to 2015

- Premium Statistic Share of U.S. travelers that canceled travel due to COVID-19 as of March 17, 2020

- Premium Statistic Change in the retail value of travel in the Americas from 2013 to 2015

- Premium Statistic Likelihood of U.S. domestic travel due to COVID-19 as of October 2020

- Premium Statistic Printed circuit board product sales value worldwide 2010-2018

- Premium Statistic Global market value of industrial coatings 2020, by application

- Premium Statistic EBITDA of HunterDouglas 2013-2021

- Premium Statistic Reasons for VC funding gap for POC-owned startups worldwide 2020

- Premium Statistic Market share of power-driven hand tools worldwide by region 2020-2025

Further Content: You might find this interesting as well

- Change in value of travel intermediaries in India 2013-2015

- Likelihood of U.S. international travel due to COVID-19 as of October 2020

- COVID-19: excitement over holiday research in the U.S. March-April 2020

- Likelihood of U.S. travel to Asia due to COVID-19 as of October 2020

- Change in the retail value of travel in Asia from 2013 to 2015

- Likelihood of U.S. travel to Europe due to COVID-19 as of October 2020

- Change in the retail value of travel in the Middle East from 2013 to 2015

- Change in the retail value of travel in India 2013-2015

- Change in the retail value of travel in Africa from 2013 to 2015

- Share of U.S. travelers that canceled travel due to COVID-19 as of March 17, 2020

- Change in the retail value of travel in the Americas from 2013 to 2015

- Likelihood of U.S. domestic travel due to COVID-19 as of October 2020

- Printed circuit board product sales value worldwide 2010-2018

- Global market value of industrial coatings 2020, by application

- EBITDA of HunterDouglas 2013-2021

- Reasons for VC funding gap for POC-owned startups worldwide 2020

- Market share of power-driven hand tools worldwide by region 2020-2025

- Report Store

- AMR in News

- Press Releases

- Request for Consulting

- Our Clients

Cruise Market Size, Share, Competitive Landscape and Trend Analysis Report by Type : Global Opportunity Analysis and Industry Forecast, 2023-2032

CG : Travel & Luxury Travel

Report Code: A02539

Get Sample to Email

Thank You For Your Response !

Our Executive will get back to you soon

A cruise ship is a passenger ship where the trip and ship amenities itself are a part of a luxurious experience. Generally, the length of the cruise ship is 1,187 feet, the tonnage for a passenger cruise is 225,300 tons, and max crew-passenger capacity of almost 8,500. The worlds largest cruise ship is Royal Caribbean Internationals harmony of the seas, which was launched in 2016 that has a gross tonnage of 226,963 and length of about 1,188.1 ft with a passenger capacity of 6,780. Cruising has led to an increase in the tourism industry.

The key factors that drive the growth of the market are the rise in tourism & hospitality industry due to a rise in economy and high disposable income. However, the high costs associated with cruises and clean sailing through strict regulations act as restraints for the market growth. Irrespective of these challenges, the increasing demand for river cruises continues to boost the market growth in future.

The market segmentation is based on type. By type the market is divided into adventure cruises, Christmas cruises, classic cruises, contemporary cruise, family cruises, LGBT cruises, luxury cruises, ultra-luxury cruises, and river cruises. Geographically, it has been analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Prominent players profiled in the report include Hyundai Heavy Industry Co. Ltd, Dsme Co. Ltd, Samsung Heavy Industries Co. Ltd., Meyer Werft Gmbh & Co. Kg, Fincantieri S.P.A., Mitsubishi Heavy Industry. Ltd., Oshima Shipbuilding Co. Ltd., China State Shipbuilding Corporation, MV WERFTEN Wismar GmbH, and Mediterranean Shipping Company S.A.

Key Benefits

- This report provides an extensive analysis of the current & emerging market trends and dynamics in the cruise market report.

- In-depth analysis has been carried out by constructing market estimations for key market segments.

- The report provides a quantitative analysis of the current trends and future estimations, which helps identify prevailing market opportunities.

- Competitive intelligence of the industry helps understand the competitive scenario across geographies.

Cruise Market Report Highlights

Loading Table Of Content...

Enter Valid Email ID

Verification code has been sent to your email ID

By continuing, you agree to Allied Market Research Terms of Use and Privacy Policy

Advantages Of Our Secure Login

Easily Track Orders, Hassel free Access, Downloads

Get Relevent Alerts and Recommendation

Wishlist, Coupons & Manage your Subscription

Have a Referral Code?

Enter Valid Referral Code

An Email Verification Code has been sent to your email address!

Please check your inbox and, if you don't find it there, also look in your junk folder.

Cruise Market

Global Opportunity Analysis and Industry Forecast, 2023-2032

- [email protected]

- +1 718 618 4351 (International)

- +91 78878 22626 (Asia)

More Results

Home ➤ Consumer Goods ➤ Travel ➤ Cruise Market

Global Cruise Market, By Type (Ocean Cruises and River Cruises), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: May 2023

- Report ID: 22103

- Number of Pages: 242

- Table of Contents

- Major Market Players

- Request a Sample

Quick Navigation

Report Overview

Driving factors, restraining factors, growth opportunities, latest trends, by type analysis, key market segments:, covid-19 impact analysis, regional analysis, market share & key players analysis, report scope:.

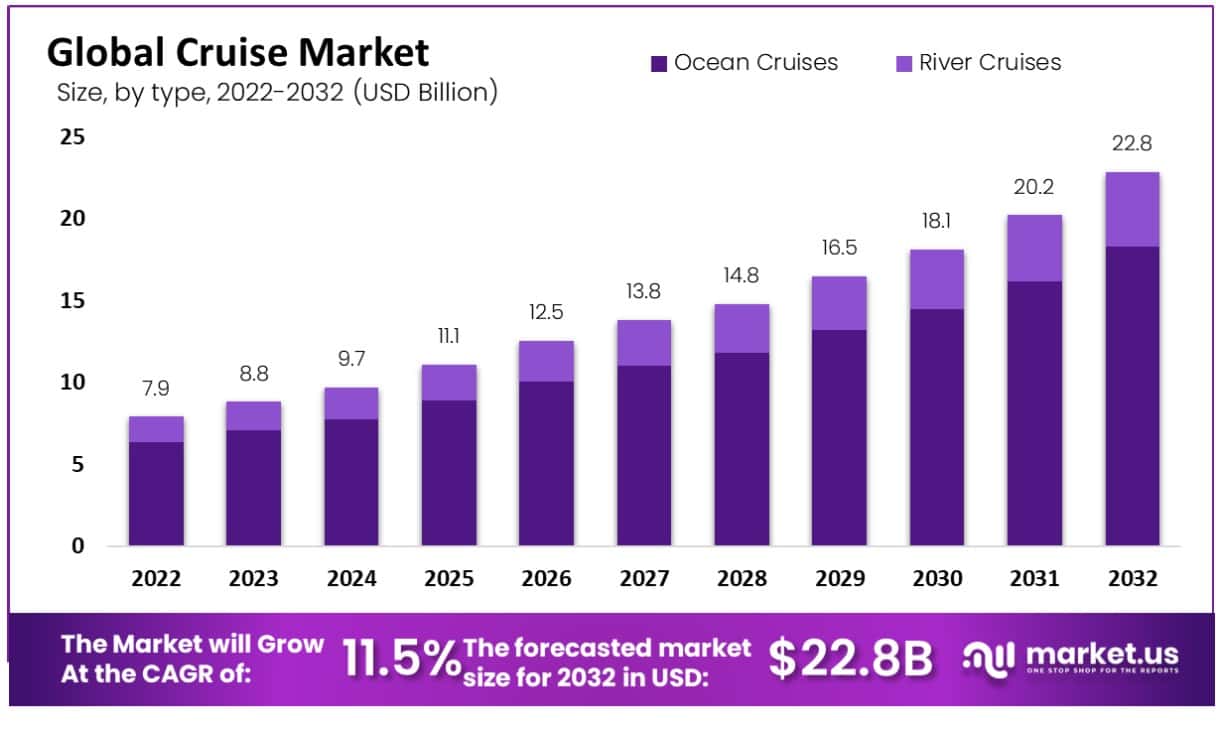

The Global Cruise Market size is expected to be worth around USD 22.8 Billion by 2032 from USD 7.9 Billion in 2022, growing at a CAGR of 11.50% during the forecast period from 2023 to 2032.

A cruise is a multi-day vacation plan that is arranged on a cruise ship large inland while visiting numerous tourist attractions along a planned route. On this kind of trip, the focus is mostly on the ship’s accommodations as well as tourist-attractive locations. The global cruise market is being driven by the expanding hospitality and tourist industries.

Ships are introducing new technologies, a variety of exciting activities, as well as enjoyable themes for travelers, including yoga themes, kid themes, mystery themes, and others. Such innovations are attracting different populations and acquiring massive popularity among the target audience, which is driving the cruise business. The market is expected to increase as a result of the new generation’s increasing preference for leisure travel and adventures with the rising number of people who want to live a luxurious life.

Consumer Demand:

Cruise lines have seen an exponential rise in demand over recent years as more travelers search for unique travel experiences. This has led to growth within the industry, as cruise lines expand their fleets and add new routes to keep up with demand.

Innovation:

Cruise lines are constantly innovating and introducing new features and amenities to attract customers. This includes everything from entertainment options to advanced technology and unique dining experiences.

Expansion of Cruise Line Offerings:

Cruise lines are expanding their services to include niche markets like adventure cruises, river cruises, and small-ship cruising to appeal to different types of travelers.

Natural disasters like hurricanes and earthquakes can disrupt cruise itineraries and impact passenger safety. Geopolitical impacts such as terrorism or political instability also impact cruise demand and itinerary planning. Building and maintaining a cruise ship requires significant capital, which limits market participants, creating limited competition and less price flexibility.

Furthermore, environmental regulations in the industry contribute to higher operational costs which in turn reduce profit margins; cruise lines must invest in cleaner technologies to reduce their environmental footprint, adding to their expenses. Outbreaks of contagious illnesses like COVID-19 can damage the reputation of the cruise industry and sap consumer confidence in sailing.

This could result in decreased demand and revenue for cruise lines. Cruising is typically seasonal, with most travelers opting for cruises during summer holidays. Lower occupancy rates and revenue during off-peak periods impact profitability for cruise companies. Negative media coverage such as reports of passenger injuries or crimes further weakens consumer trust in cruising leading to decreased bookings overall.

Expansion in Emerging Markets

The worldwide cruise market offers several prospects for growth and development, including emerging markets, sustainable tourism, technical improvements, specialized cruises, upselling opportunities, and partnerships and collaborations. Emerging markets such as Asia and South America present major growth prospects for the cruise industry.

These regions boost a growing travel demand, creating an expansive customer base for cruise lines. Furthermore, with growing awareness about the environmental effects of tourism comes an increased interest in sustainable tourism practices; cruise lines that implement sustainable practices and offer eco-friendly itineraries can attract eco-conscious tourists.

Furthermore, advances in technology such as artificial intelligence, virtual reality, and the Internet of Things have the potential to enhance passenger experiences on board while improving operational efficiencies for cruise lines. Specialist cruises, such as wellness cruises, adventure cruises, and culinary cruises can appeal to niche markets and give cruise lines a chance to stand out from competitors.

Cruise lines can generate additional revenue by offering onboard amenities and services like spa treatments, shore excursions, and specialty dining options. Collaborations and partnerships with other travel companies, such as airlines and hotels, can enable cruise lines to extend their reach and offer customers more comprehensive travel experiences.

The global cruise market is expanding in support of luxury experiences, multigenerational travel, wellness and health, sustainability, and the digital revolution. Cruise lines that can anticipate these developments and respond appropriately will likely be successful in the highly competitive cruise market. River cruising has become increasingly popular in recent years, particularly in Europe and Asia.

River cruises offer a more intimate setting with smaller ships and the chance to visit remote destinations. Sustainability has become a top priority for the cruise industry, with many lines adopting eco-friendly practices such as using clean energy sources, reducing single-use plastics, and encouraging responsible tourism.

Cruise lines are investing in technology to enhance their passengers’ experiences, from mobile apps and wearable devices to virtual reality headsets and AI-powered assistants. Wellness and health have become a major priority for the cruise industry, with many lines offering onboard fitness facilities, healthy dining options, and wellness-themed activities.

Cruise lines are catering to this trend by offering family-friendly amenities like onboard water parks and kids’ clubs. Luxurious and experiential cruises have seen a resurgence in the cruise market, with travelers demanding amenities such as private balconies, and exclusive dining venues. Many are seeking authentic cultural encounters; cruise lines have responded by providing shore excursions that showcase local customs, traditions, and cuisine.

The ocean cruises Segment Accounted for the Largest Revenue Share in the Cruise Market

Based on type, the cruise market is segmented into ocean cruises and river cruises. Among these types, the Oceans Cruises segment is the most lucrative in the global cruise market, with a projected total revenue of 80%. The larger market revenue share is attributed to strong players who provide services in the ocean cruises category for transcontinental travel in large numbers. Also, a sizable portion of customers favor ocean cruises over other types of cruises because of the interesting packages, amenities, and entertainment options.

These activities are possible aboard large ocean cruise ships, which offer more room than the others. The global river cruise market is expected to have the fastest growth rate, rising at a CAGR of 13.3%. This growing popularity among vacationers can be attributed to river cruising’s larger size compared to ocean cruises which usually dock along coastal regions. Rivers offer more internal destinations for sightseeing, especially in Europe where some cruise lines offer tours through multiple countries. For instance, Danube River cruises traverse 10 nations within Europe.

Based on Type

- Ocean Cruises

- River Cruises

Based on Applications

- Daily Commute

The COVID-19 pandemic has had a significant impact on the global cruise market, leading to reduced demand, refunds, operational challenges, decreased revenue, shifts in consumer behavior, and regulatory adjustments. The industry will need to navigate these challenges to recover and rebuild passenger confidence in cruising.

Due to the pandemic, cruise lines have seen a reduction in demand for their services, with many potential passengers opting to postpone or cancel their travel plans due to safety fears. Due to travel restrictions and safety worries, many sailings have had to be canceled. Because of these events, significant financial losses have occurred and customers are now demanding refunds.

The pandemic has also presented cruise lines with several operational difficulties, such as implementing new health and safety protocols and managing crew members who have tested positive for COVID-19. The suspension of operations and decreased demand for cruise lines have resulted in significant revenue losses, which may impact their long-term financial viability.

Furthermore, the pandemic has caused changes in consumer behavior such as an increased focus on health and safety that may influence which types of cruises passengers seek and which amenities are offered. The pandemic has led to increased regulatory scrutiny of the cruise industry, with many countries enforcing new health and safety rules that may impact cost and feasibility when operating cruises.

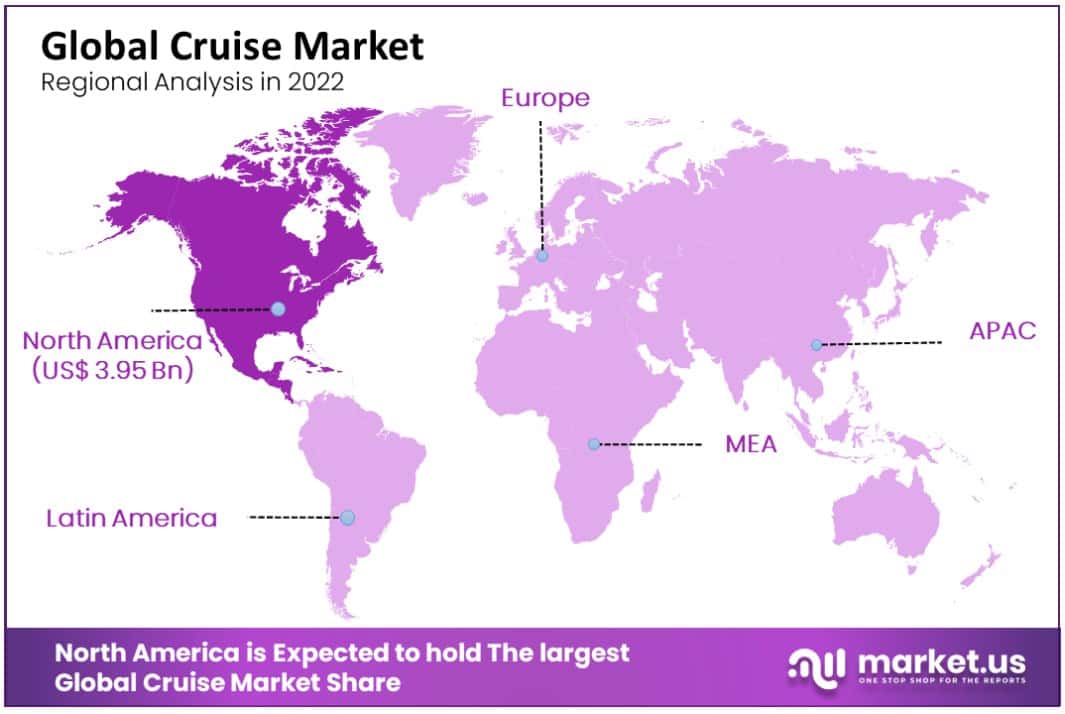

North America Accounted for the Largest Revenue Share in Cruise Market in 2022.

North America dominated the cruise market with the largest revenue share of 50%. Due mainly to its strong presence of international key players and highly developed industry. Higher disposable income levels, consumer spending patterns, and an expanding tourism industry all played their respective roles in driving up market revenue share significantly. The Asia Pacific region is forecast to experience the highest growth rate over the forecast period, with a CAGR of 12.1%.

Recently, cruise industry activity has shifted away from North America and Europe towards Asia Pacific due to government initiatives to develop tourism and increase economic output. For instance, on August 19th, 2020 the Indian government announced the reduction of 70% of berth charges to promote cruise tourism.

Europe ranked second in terms of revenue share in 2021 with over 25% share, expected to achieve an impressive CAGR during the forecast period. The growth is attributed to an uptick in demand for sustainable tourism which in turn makes local communities more appealing to small and medium-sized tour operators, propelling market expansion even further.

Key Regions and Countries

- Switzerland

- Rest of Western Europe

- The Czech Republic

- Rest of Eastern Europe

- South Korea

- Australia & New Zealand

- Philippines

- Rest of APAC

- Rest of Latin America

- Saudi Arabia

- South Africa

- United Arab Emirates

- Rest of MEA

The global market is dominated by a few major players and numerous small local players. The majority of the market share is held by Carnival Corporation & Plc. and Royal Caribbean Group. Key companies are taking new initiatives to expand their clientele.

Examples include multigenerational packages targeting family travel, kids theme cruise vacations for children, mystery theme cruise vacations, etc. Key players in the global cruise industry are also constantly looking for opportunities in underdeveloped regions.

Market Key Players:

Listed below are some of the most prominent cruise industry players.

- Carnival Corporation & Plc

- Royal Caribbean Group

- MSC Cruises S.A.

- Norwegian Cruise Line Holdings Ltd.

- Disney Cruise Line

- Genting Hong Kong Limited

- Fred. Olsen Cruise Lines

- Other Market Players

Recent Developments:

- Many cruise lines began operations in 2021 after being suspended due to the COVID-19 pandemic. Some lines, such as Royal Caribbean and Celebrity Cruises, require all passengers to be fully vaccinated.

- Despite the pandemic, several new ships were launched in 2021. Royal Caribbean’s Odyssey of the Seas, Carnival Cruise Line’s Mardi Gras, and MSC Cruises’ Virtuosa.

Frequently Asked Questions (FAQ)

The Global Cruise Market size was USD 7.9 Billion in 2022, growing at a CAGR of 11.50%.

The Global Cruise Market size is expected to grow at a CAGR of 11.50% during the forecast period from 2023 to 2032.

The Global Cruise Market size is expected to be worth around USD 22.8 Billion by 2032 during the forecast period.

Related Reports

- Space Tourism Market

- Medical Imaging Market

- Micro Tool Market

- Smart Car Market

- Taurine Market

- Wellness Tourism Market

Our Clients

- Report ID 22103

- Published Date May 2023

- ★★★★★ ★★★★★

- location_on 420 Lexington Avenue, Suite 300 New York City, NY 10170, United States

- phone +1 718 618 4351 (International)

- phone +91 78878 22626 (Asia)

- email [email protected]

- How to Order

- Privacy Policy

- Refund Policy

- Frequently Asked Questions

- Terms and Conditions

- All Reports

- All Sectors

- Infographics

- Statistics and Facts

- Search Search Please fill out this field.

Best Value Cruise Line Stocks

Fastest growing cruise line stocks, cruise line stocks with the best performance, advantages of cruise line stocks, risks of cruise line stocks.

- Markets News

- Stocks & Bond News

Top Cruise Line Stocks for 2023

CCL, NCLH, and RCL are top for value, growth, and performance, respectively

:max_bytes(150000):strip_icc():format(webp)/reiff_headshot-5bfc2a60c9e77c00519a70bd.jpg)

Peter Adams/Getty Images

Cruise line companies are seeing a strong rebound after years of COVID-related setbacks, with passenger booking rates up industry-wide. Still, just one stock—Royal Caribbean Group—has outperformed the broader market in the last year.

Royal Caribbean shares are up about 42% in the last year, while the benchmark Russell 1000 Index is up just over 1%. All other cruise industry stocks have lost value in the past year, a sign there could still be room for further recovery.

Below, we look at the top cruise line stocks for 2023 based on best value, fastest growth, and best performance. The Russell 1000 benchmark figure above is as of May 29, while all other data throughout are as of May 23.

These are the cruise line stocks with the lowest 12-month trailing price-to-sales (P/S) ratio . For companies in early stages of development or industries suffering from major shocks, this can be substituted as a rough measure of a business's value. A business with higher sales could eventually produce more profit when it achieves (or returns to) profitability. The price-to-sales ratio shows how much you're paying for the stock for each dollar of sales generated.

Source: YCharts

- Carnival Corp.: Carnival operates the world’s largest fleet of cruise ships. The company also owns travel-related properties such as hotels and vacation destinations. Carnival shares have fallen 16% in the last year while revenues nearly tripled for the first quarter of the year as a result of surging demand post-pandemic.

- Norwegian Cruise Line Holdings Ltd.: Norwegian Cruise Line operates a fleet of passenger cruise ships. In addition, the company offers itineraries and theme cruises. Norwegian's revenue more than tripled for the first three months of the year as it ramped up cruise voyages again following COVID-19.

- Lindblad Expeditions Holdings Inc.: Lindblad Expeditions owns and operates cruise ships and provides expedition cruising and travel services. The company offers both sea-based and land-based expeditions. Lindblad shares have plunged by 22% in the last year, making it among the worst-performing cruise line stocks that we looked at.

These are the cruise line stocks with the highest year-over-year (YOY) sales growth for the most recent quarter. Rising sales can help investors to identify companies that are able to grow revenue organically or through other means and to find growing companies that have not yet reached profitability.

In addition, accounting factors that may not reflect the overall strength of the business can significantly influence earnings per share (EPS) . However, sales growth can also prove to be potentially misleading about the strength of a business—growing sales does not guarantee a company will eventually become profitable.

- Norwegian Cruise Line Holdings Ltd.: See company description above.

- Carnival Corp.: See company description above.

- Royal Caribbean Group: Royal Caribbean Group, formerly known as Royal Caribbean Cruises, operates either directly or through joint ventures a fleet of 64 ships with a total capacity of 150,000 berths. Total revenue almost tripled in the most recent quarter, driven by rebounds in both passenger ticket sales and onboard revenue.

These are the cruise line stocks that had the highest returns or smallest declines in total return over the past 12 months out of the companies we looked at.

- Royal Caribbean Group: See company description above.

Shareholder Perks: A little-known benefit of holding cruise line stocks is that they offer shareholder perks. For instance, investors who hold at least 100 Carnival shares are entitled to a $250 onboard credit for cruises that are 14 days or longer, a $100 credit for cruises between 7 and 13 days, and a $50 credit for sailings of six days or less. Similarly, both Royal Caribbean and Norwegian Cruise Line offer comparable shareholder benefits. To claim these benefits, investors need to provide proof of ownership, such as a shareholder proxy card or a copy of a current brokerage statement.

Pent-Up Demand: Cruise line companies have seen a rebound in demand as customers book cruises they had put on hold during COVID-19. This positions operators in the sector to boost profits as fleets are back at total capacity with reduced COVID requirements. In March 2023, for example, Carnival Cruise Lines said it had reached record future bookings.

High Debt Load: Cruise line companies racked up substantial debt over the past several years to stay afloat during the pandemic. With inflation leading to higher fuel costs and rising interest rates , these elevated debt levels will become increasingly difficult to service, increasing the risk of the companies offering new shares to raise capital , thus diluting the stakes of current shareholders.

Future Pandemics: Cruise Line stocks sank during the pandemic, with the sector facing multiple challenges from bad publicity, no-sail orders, and a sluggish recovery. In the early stages of the health crisis, reports of major outbreaks spreading onboard put downward pressure on the group. Selling accelerated as the Centers for Disease Control and Prevention (CDC) issued and extended no-sail orders. Although forward bookings have bounced back, these challenges remind investors that future pandemics remain a risk for cruise line stocks.

The comments, opinions, and analyses expressed on Investopedia are for informational purposes online. Read our warranty and liability disclaimer for more info.

As of the date this article was written, the author does not own any of the above stocks.

The Maritime Executive. " Cruising’s Rebound Raises Hopes of Normalcy Going Forward ."

YCharts. " Financial Data ."

Carnival Corp. " CARNIVAL CORPORATION & PLC PROVIDES FIRST QUARTER 2023 BUSINESS UPDATE ."

Norwegian Cruise Line Holdings Ltd. " Norwegian Cruise Line Holdings Reports First Quarter 2023 Financial Results ."

Royal Caribbean Cruises Ltd. " Form 10-K for the fiscal year ended December 31, 2022 ." Page 2.

Royal Caribbean Group. " ROYAL CARIBBEAN GROUP REPORTS FIRST QUARTER EARNINGS AND INCREASES FULL YEAR GUIDANCE ON STRONG REVENUE OUTLOOK ."

Cruise Radio. " Overview: Cruise Line Stock Benefits for Shareholders ."

Fox Business. " Carnival Cruise Lines has record future bookings, demand rebounds ."

:max_bytes(150000):strip_icc():format(webp)/RCI_AN_Aerials_Dec2015-338-90b53d8e125249f9ab25e3ff4c6d1e64.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices